Get Daily Travel Tips & Deals!

By proceeding, you agree to our Privacy Policy and Terms of Use .

The 12 Best Budgeting Apps for Travelers

Ashley Rossi

Ashley Rossi is always ready for her next trip. Follow her on Twitter and Instagram for travel tips, destination ideas, and off the beaten path spots.

After interning at SmarterTravel, Ashley joined the team full time in 2015. She's lived on three continents, but still never knows where her next adventure will take her. She's always searching for upcoming destination hotspots, secluded retreats, and hidden gems to share with the world.

Ashley's stories have been featured online on USA Today, Business Insider, TripAdvisor, Huffington Post, Jetsetter, and Yahoo! Travel, as well as other publications.

The Handy Item I Always Pack : "A reusable filtered water bottle—it saves you money, keeps you hydrated, and eliminates waste—win-win."

Ultimate Bucket List Experience : "A week in a bamboo beach hut on India's Andaman Islands."

Travel Motto : "Travel light, often, and in good company."

Aisle, Window, or Middle Seat : "Window—best view in the house."

Travel Smarter! Sign up for our free newsletter.

While you’re stuck daydreaming about your next bucket-list vacation, why don’t you get a hold of your finances and make it a reality by first budgeting out your travel expenses? Whether it’s a road trip or international vacation that you’re planning, easily forgettable items like parking fees can add up. That’s why you should use a travel-specific budgeting app to help streamline your costs on your next trip. Here are 12 budget apps to help you plan your expenses.

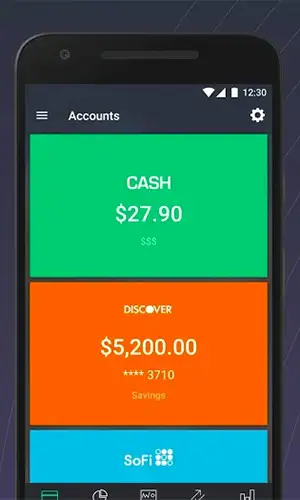

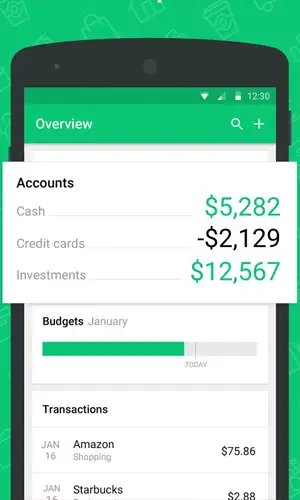

PocketGuard

Link all of your financial accounts and cards to this app, and it will automatically update and categorize your spending in real time. It then tells you what spending money you have with the “in my pocket” feature. It also automatically builds you a spending budget based on income, bills, and the goals you set. It even finds ways to lower some of your monthly bills for you … sign us up.

Download: iOS | Google Play

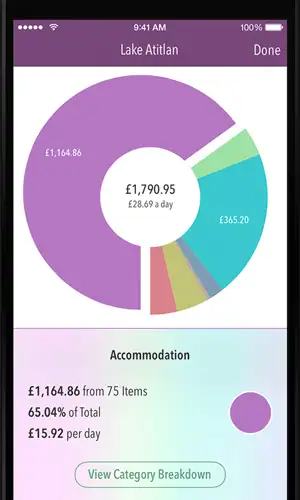

Tripcoin lets you enter in your expenses per day and even works offline. It then processes your spending to give you a spending summary of your trip, which you can export for other uses. This lets you see how much you’re spending on each category of your trip, broken down by day, so you can monitor your vacation expenses in real time.

Download: iOS

9 Sneaky Travel Costs You Might Forget to Budget For

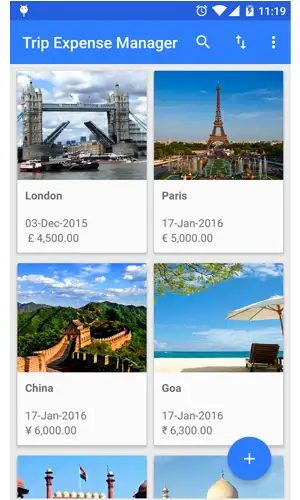

Trip Expense Manager

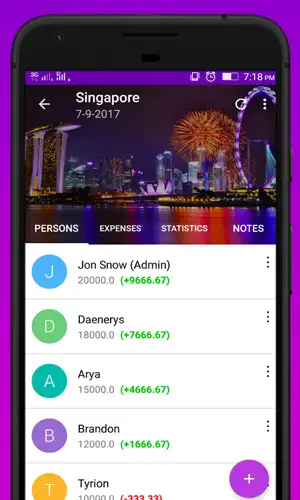

The Trip Expense Manager app is ideal for large traveling groups that need help planning and monitoring travel expenses. For each trip you take, you can add Google users, a list of places to go, and expenses, and even mark who paid which bill.

Download: Google Play

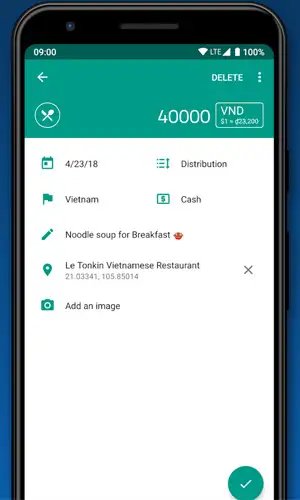

TravelSpend

I love TravelSpend for its easy-to-use features and simple design. How it works: You add expenses as they happen (the app works offline and even converts foreign currencies) and the app tracks your spending by total and by day. You can even follow your spending on a map throughout your vacation.

Wally connects to your current financial accounts and tracks your spending so you can get a handle on your cash flow and spending by category. Wally is useful because unlike some of the other budgeting apps, it lets you use private groups for managing trip spending or other budgets. You can even add reminders, notes, lists, documents, and comments.

Users love TripMate for its simplicity and easy-to-use features, plus it’s all free. This travel expense tracker app lets you create a trip and then add and remove users as needed. You can add expenses, receive a personalized summary, and even get hotel, and other booking-related information.

Trail Wallet

If you’re looking for a travel-specific budget tool and expense tracker, this is your best bet. Input your expenses into Trail Wallet and the app will split them up based on category so you can get a closer look at your spending. Note that only the first 25 items you enter are free.

11 Budget Travel Lies You Should Stop Believing Right Now

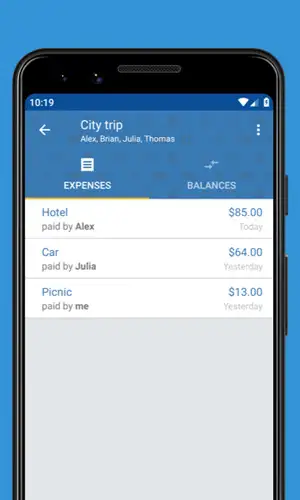

This travel expense app makes splitting costs a breeze. Simply invite your travel partners to the trip you’ve created on the app, and each person can enter in his or her expenses. Once the trip is over (and all expenses have been entered) you can see who owes whom what amount.

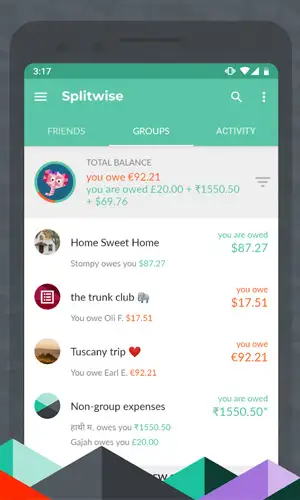

Splitwise is another useful cost-tracking platform that easily lets you split group expenses while traveling. You can split by percentage or shares, and it’s even available in offline mode. It’s great for international trips, too, as the app is available in seven languages and over 100 currencies. Plus, it’s integrated with Venmo and PayPal for easy payback.

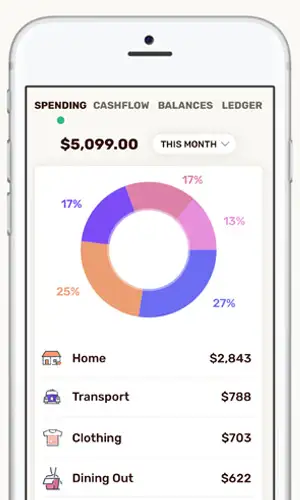

Mint is so much more than just a travel expense app—it connects with all of your bank accounts to give you an overall summary of your cash flow. You can then easily create a budget for different categories, like saving for a vacation.

30 Essential Non-Travel Apps for Travelers

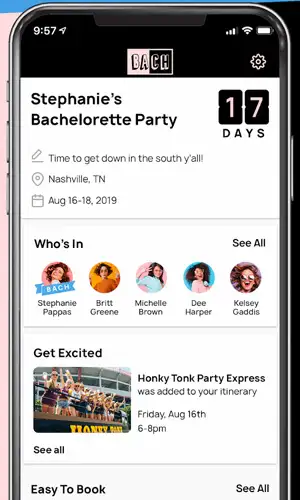

For those who have been involved in the planning of a bachelor or bachelorette party, you know the trials and tribulations that come with splitting large group expenses. This app was created specifically for those organizing large group trips and includes building an itinerary, polls, and chat features as well as ways to track payments and bar tabs within your group.

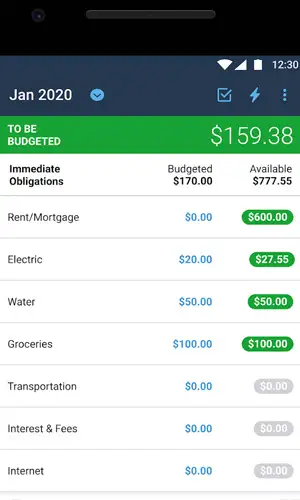

YNAB (You Need a Budget) is a popular software used for budgeting. While it’s slightly pricey ($84 annually), the positive reviews are endless. On the app version, you can set savings goals and itemize your vaca expenses. There is a free 34-day trial to get you started.

More from SmarterTravel:

- Single Travel: Essential Tips for Planning a Solo Trip

- 5 Ways to Stay Sane When Planning a Trip with Friends

- The 7 Best Trip Planner Apps for Travelers

Ashley Rossi is always ready for her next trip. Follow her on Twitter and Instagram for travel tips, destination ideas, and off the beaten path spots.

We hand-pick everything we recommend and select items through testing and reviews. Some products are sent to us free of charge with no incentive to offer a favorable review. We offer our unbiased opinions and do not accept compensation to review products. All items are in stock and prices are accurate at the time of publication. If you buy something through our links, we may earn a commission.

Top Fares From

Don't see a fare you like? View all flight deals from your city.

Today's top travel deals.

Brought to you by ShermansTravel

Oslo to Bergen: 6-Night Norway Fjords...

Luxe, 7-Night Caribbean & Mexico Cruise...

Regent Seven Seas Cruises

Shop and Save with Country Inns...

Patricia Magaña

Trending on SmarterTravel

NerdWallet: Manage Your Money 4+

Track credit, budget & finance.

- #68 in Finance

- 4.8 • 111.2K Ratings

Screenshots

Description.

Track your budget, finances and credit - all in one place and all for free. Get the insights you need to make the most of your money. View all your financial accounts on one screen for easy, holistic monitoring. Then zoom in on the details of your cash flow, expenses, credit score and net worth. Plus, get Nerd-approved tips to help you manage your finances and work toward your goals. Here’s how our FREE personal finance tracking app works: KNOW YOUR CASH FLOW - Track spending across multiple cards - Keep track of your budget with our 50/30/20 breakdown - Get detailed spending insights - Track your bills, expenses and more - Discover ways to cut back or save - Compare spending month-to-month - See your top spending categories for easier budgeting KEEP UP WITH YOUR NET WORTH - See how your income, debts, investments, and home value all add up - Follow the history of your net worth - Zoom into the details of your net worth and track individual accounts over time MONITOR & BUILD YOUR CREDIT - Access your credit score and credit report any time - Get score change notifications - Understand the factors that affect your score - Learn ways to keep building – whether it’s increasing your credit utilization or paying your bills earlier, and more SMART MOVES FOR YOUR MONEY - Quickly find and compare more rewarding credit cards, better loan rates, and higher-earning bank accounts - Join NerdWallet+ so you can earn rewards worth up to $350 for making smart financial decisions - like paying your credit card on time.

Version 11.25.0

New Nerdy Updates: - Your bills are more accurate now! - If you’re a NerdUp user, you’ll see more prominent data on your card usage.

Ratings and Reviews

111.2K Ratings

The truth for me at least.

I was working hard as hell at a fast food restaurant for about 2 years when I met a guy who taught me about credit. He recommended this app, I quickly download it and started my journey on building my credit. I use to think “why have credit? why worry about credit?, why would I put myself at risk of owing money to a bank or personal lender, I have heard so many bad things.” But the guy I met explained to me vividly how to go about building and maintaining my credit to insure that “in the worst case scenario you’ll be taken care of, but only if you use credit for credit not to splurge. Don’t use it as a means to obtain cash you don’t have at hand. Use it as a means that ensures that as you progress in life, even if things turn sour you’ll be okay but only if you maintain you’re credibility. This app will help you, I’m certain.” This helped me out a lot, I watched my credit go from 552 to 688 in a matter of 8 months of being responsible and paying back what was owed and maintaining current or new credit accounts. I give NerdWallet a 1,000,000 star rating.

Developer Response ,

Thank you so much for your rating and review, and especially for sharing your inspiring story! It's always great to hear about successes like yours. Keep up the good work, and please let us know if you have any suggestions or ideas for us. You can share any time at [email protected], we're always listening!

Worst thing ever!

I tried to get into the website to see my information… no problem as soon as I tried to run the maze requires to cancel my account after 4 years, I came off the site to try again later. Then SUDDENLY the (phone saved) password suddenly does not work. GUESS WHAT, they have no service by phone… you can only contact them on the site that I can no longer get on!!! If this was a legitimate business they would not ask other members to help you out! What a crock!!! I still can’t get in, I will have to go to the bank and turn it over to fraud and have it stopped at that end! I do have an account with Self. And they are amazing, when I determined I was no longer in need of these services, they ANSWERED the phone immediately and put a check in my account by midnight that night of what I had saved with them and the posted closing of that account was midnight of the night we spoke. Nerd Wallet may have better advertising but a terrible way to run a business. Trying to save you all from this kind of aggravation . Try it out for a month or two then try to cancel THERE IS THE TRUE TEST! Then quickly go to your bank and ask them to close the account for you.. Get the SELF. App and move on.. to those of you from Nerd Wallet reading this please don’t state your usual answer.. we’re sorry you were not happy… well you have time to answer these posts but not your own web site… justify that!

Thanks for sharing your experience, Judye. While we currently streamline support via email, we hear you. We’ve noted that you’d like to see phone support as well. It looks like you were able to connect with a member of our support team to regain access to your account. We truly value you as a NerdWallet member, so please don’t hesitate to respond to the email you’ve received if you need further assistance.

Doesn’t give up to date information.

This app started out good and quickly deteriorated. I put in all my cards and bank accounts. It gave fairly accurate information for about a month. Although one credit card continuously needed to be re linked. After a few months although the accounts showed an average of 10 hours since last update they were weeks and sometimes months behind. Then one day for no reason my bank account was not updating although it showed all the balances it’s balance was never changing for weeks. Trying to get help I emailed them. No response. Went online for help and suggested in linking and relinking the account which I did. It updated the balance but I lost all history. The transactions were all still there I could see them but the cash flow looked like I had a zero bank balance for 5 months. I emailed again and guess what? No response. They can’t do what they say. They spend a lot of money on advertising that should go into support. Get a phone support system unless of course what I suspect is true. You can’t fix the problems with the app. Apparently they are just trying to sell access to your credit reports. Thanks but I want an accurate financial tracking system and this ain’t it. Too bad I had high hopes.

App Privacy

The developer, NerdWallet , indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy .

Data Linked to You

The following data may be collected and linked to your identity:

- Contact Info

- Identifiers

Data Not Linked to You

The following data may be collected but it is not linked to your identity:

- User Content

- Diagnostics

Privacy practices may vary, for example, based on the features you use or your age. Learn More

Information

- Developer Website

- App Support

- Privacy Policy

More By This Developer

Nerds x NerdWallet

You Might Also Like

Monarch: Budget & Track Money

PocketGuard・Money&Bill Tracker

Copilot: Track & Budget Money

Quicken Simplifi—Budget Better

Debt Payoff Planner & Tracker

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Airlines + Airports

- Points + Miles

This New Tool Will Show You Exactly How to Maximize All Your Unused Travel Rewards

Get ready to go further on points.

:max_bytes(150000):strip_icc():format(webp)/Stacey-Leasca-2000-631fabdcfe624115bea0ce8e25fdec96.jpg)

Odds are you have your fair share of credit card and airline points sitting around in the back of your digital closet, even if you're just a mildly active traveler. However, Nerdwallet is here to help you dust those bad boys off and get on your way for less.

The financial advice wizards at Nerdwallet unveiled a tool to help travelers make the most of their unused points by showing you which partners will accept which points, and which ones will take you the furthest.

"We built a tool that allows you to input the points/miles that you have and where you want to go, and we'll give you our recommendations based on our nerdy research of which partner airline likely offers the best value for your points," reps for the company wrote in a blog post .

To use the tool, simply click on each place you currently hold points (think: United, Delta, Chase, Capital One, etc). Then, click on where you want to go. In a snap, the system tells you where you should use your miles, be it on the credit card or airline's own hub, or transfer them to a partner.

For example, I checked off that I currently hold American Express Membership Rewards and want to travel to Europe. According to Nerdwallet, my best bet would be to transfer my points to one of two airline mileage programs: Virgin Atlantic Flying Club or ANA.

"Transferring AmEx Membership Rewards to the Virgin Atlantic Flying Club is a great option for flying to Europe from the U.S., as awards cost as few as 10,000 points each way to fly between the northeastern part of the U.S. to the U.K. in economy or 17,500 points in premium class," Nerdwallet said. "Just watch out, as Virgin points bookings may also incur a cash fee that can be high. You can also use your Flying Club points to book partner awards with Flying Blue (Air France/KLM) and Delta, which opens up more opportunities from airports across the U.S."

As for ANA, it notes that the program "offers one of the cheapest business class awards to Europe. You can pay 55,000 miles round-trip for economy. Or, upgrade to business class for just 88,000 miles round-trip. You can fly on United, Lufthansa, or any other Star Alliance partner once you have your points in ANA's Mileage Club. Even better, you can book a free stopover."

Want to see your best options? Check out the Nerdwallet tool here .

Related Articles

30 essential travel apps every traveler needs before their next trip

When it comes to planning and taking a vacation, travelers rely on their phones now more than ever.

Travel apps are a source of inspiration and are extremely useful for booking and managing logistics — even making restaurant reservations or finding a great fitness class wherever in the world you're flying next.

From apps that help with everything from day-of hotel bookings and last-minute flight changes to those that serve as guidebooks and foreign-language dictionaries, travel is infinitely easier thanks to technology.

Apps can help you navigate a new city, make currency conversions, pack a perfect suitcase and even provide on-the-ground local expertise. Whatever you need when you hit the road, there's an app for that.

We've rounded up the most-loved apps here at TPG. Some may be obvious, and others more obscure, but either way, get ready to download.

Best apps for researching and booking trips

In addition to the apps for the airlines you fly most frequently and your favorite hotel brands, these apps can help you save money on flights and accommodations.

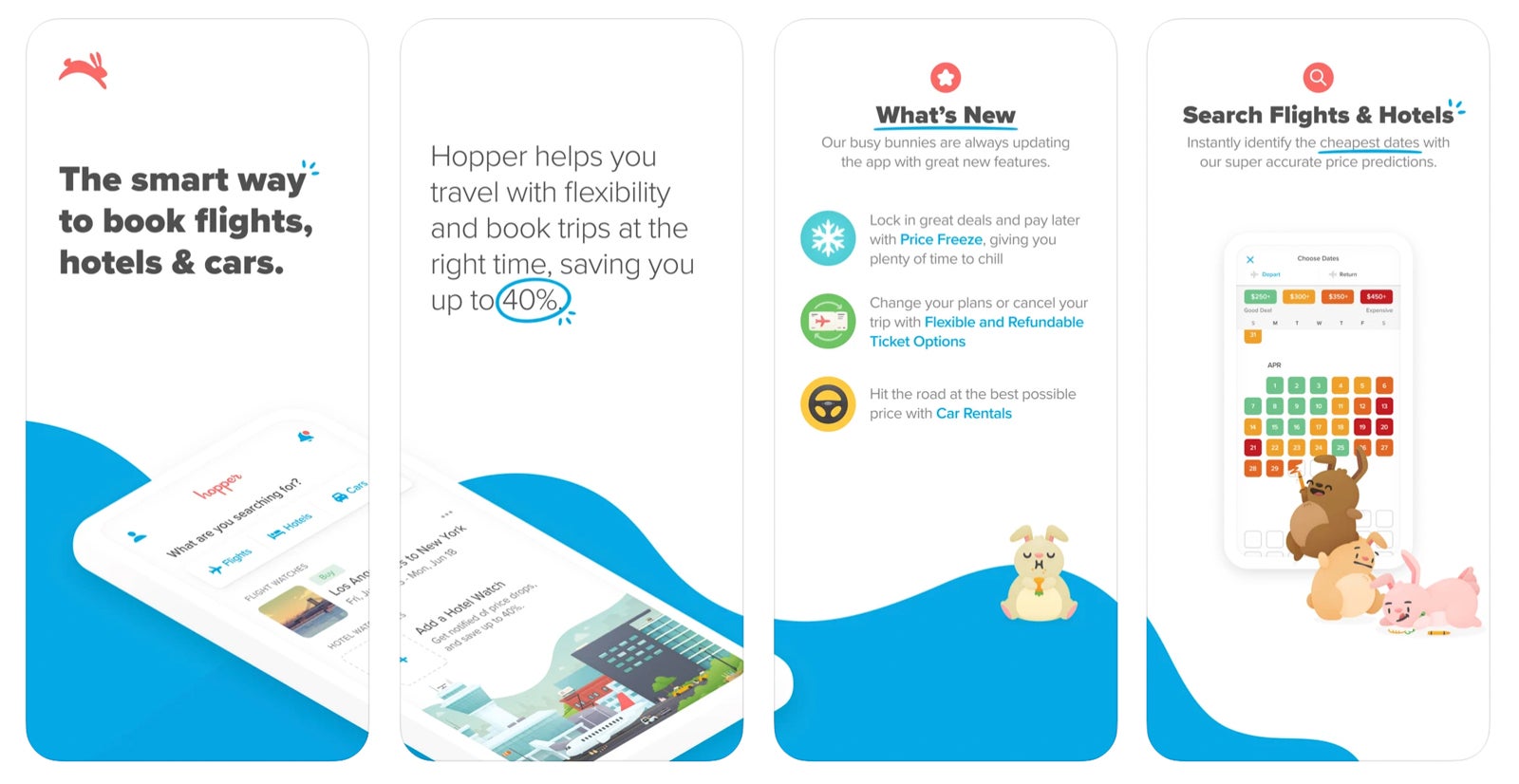

Hopper has changed in recent years from just offering a price prediction tool for flights to being a true online travel agency. The app helps travelers find the cheapest flights, hotels and rental cars.

Of course, Hopper also still offers its signature price prediction technology to help you plan out when to book, as well as travel protection options and a price freeze to help you lock in the lowest possible price on hotels and flights.

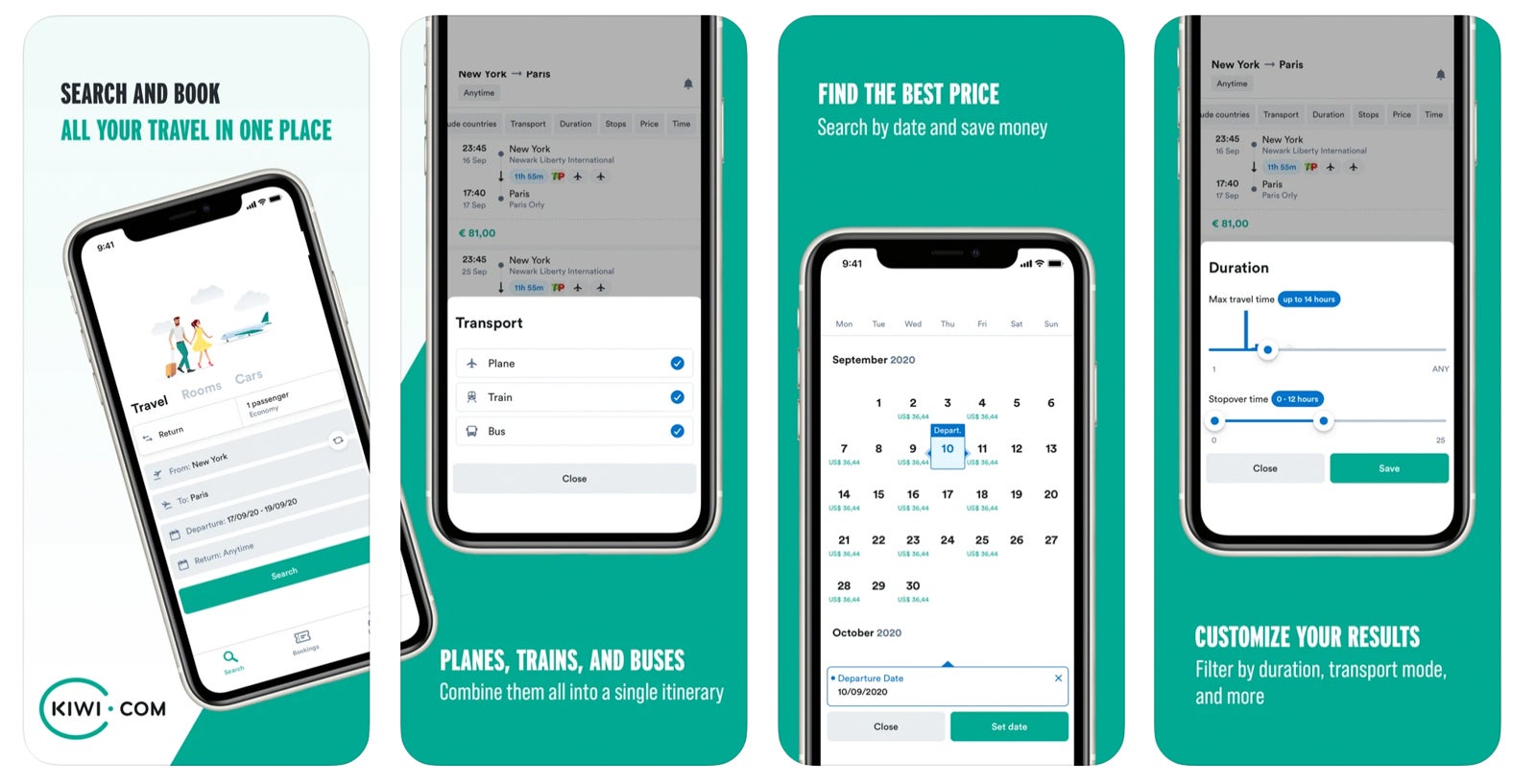

Kiwi is used mainly to book flights, but it also helps you book hotels (using its partnership with Booking.com) and car rentals (using its partnership with RentalCars.com).

Some of the app's most interesting features include the "Deals" section, which pulls in discounted flights, and the "Travel hacks" section, which includes options for hidden city ticketing, throwaway ticketing (making one-way flights more affordable) and free price alerts.

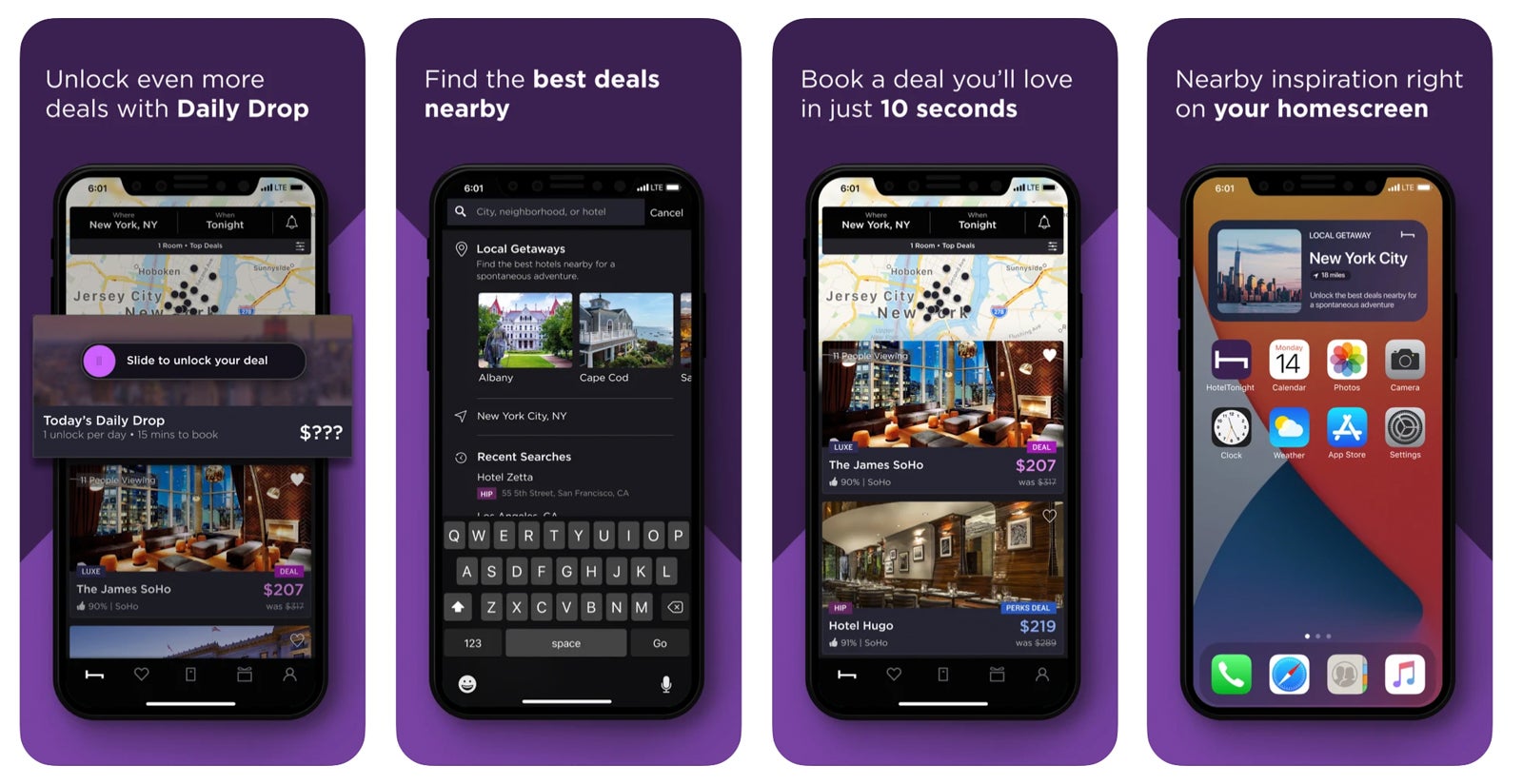

Hotel Tonight

A dream for last-minute travelers, Hotel Tonight ( now owned by Airbnb ) lets you book stays for the same evening up to a few months in advance in thousands of cities worldwide. Available hotel rooms are categorized into sections like basic, luxe, hip, charming and solid, so you can select what works for your vibe. Take advantage of the daily drop feature, where you swipe to find a personalized deal with a special price only valid for 15 minutes after unlocked.

At TPG, we love a good loyalty program, and HT Perks, the app's nine-level reward program, is extensive. Not unlike a video game, you "level up" by reaching specific spending thresholds on the app, and you'll gain access to perks like discounts, VIP customer support and credits. Also, your levels never expire, so you can only continue to move up.

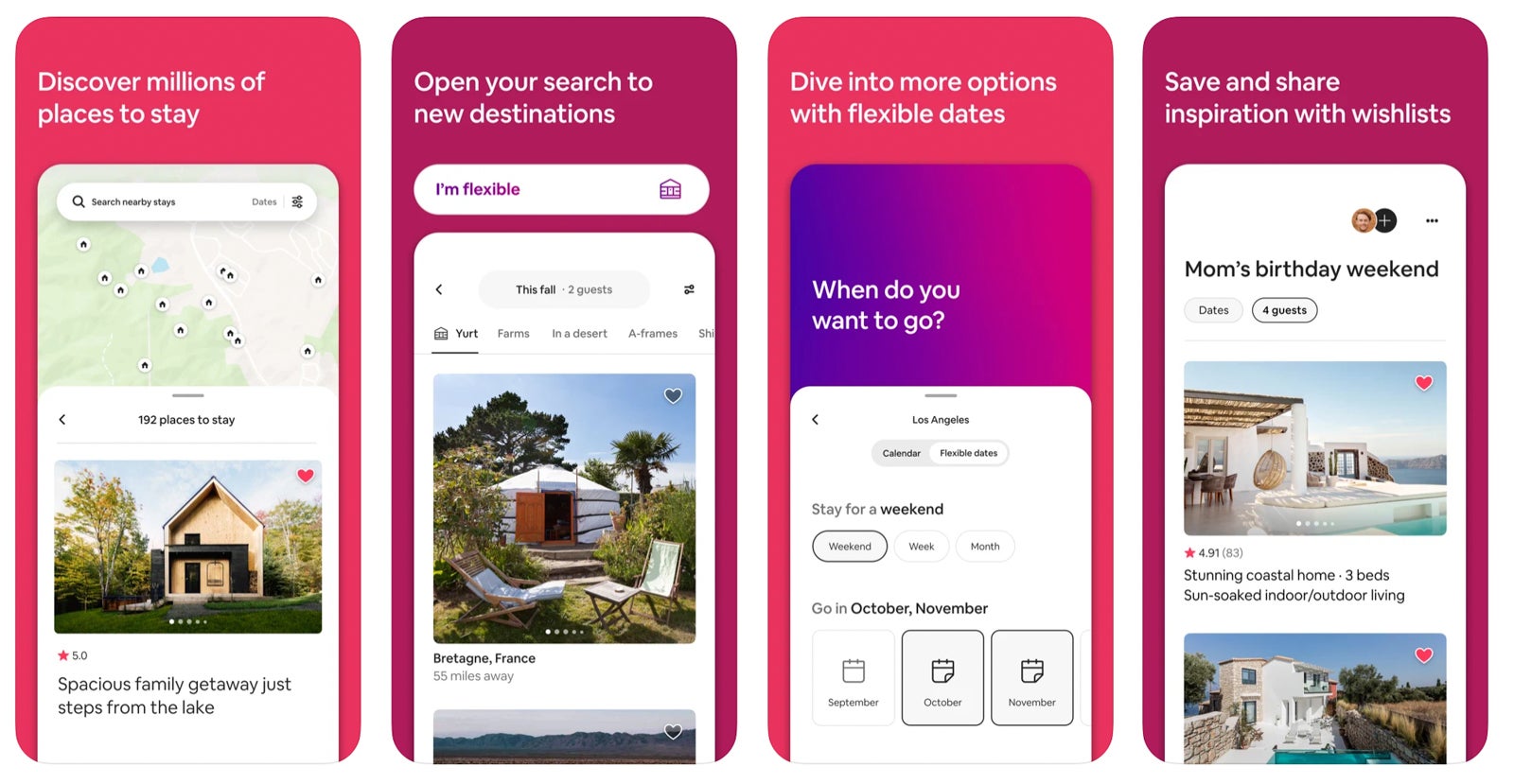

To book home rentals instead of hotels, use the Airbnb app. After entering your destination and dates, you can filter results based on the home type, price, requisite amenities and more. If you find something you like, you can book directly through the app.

The app is ideal for managing your trips while on the road — you can access all your bookings under the "Trips" tab, where you can view your reservation (and the address or directions), contact the host or change your reservation. Once you have a booking, you can also explore and book local experiences in your destination, such as wine tastings, kayak tours, hikes, shows and concerts.

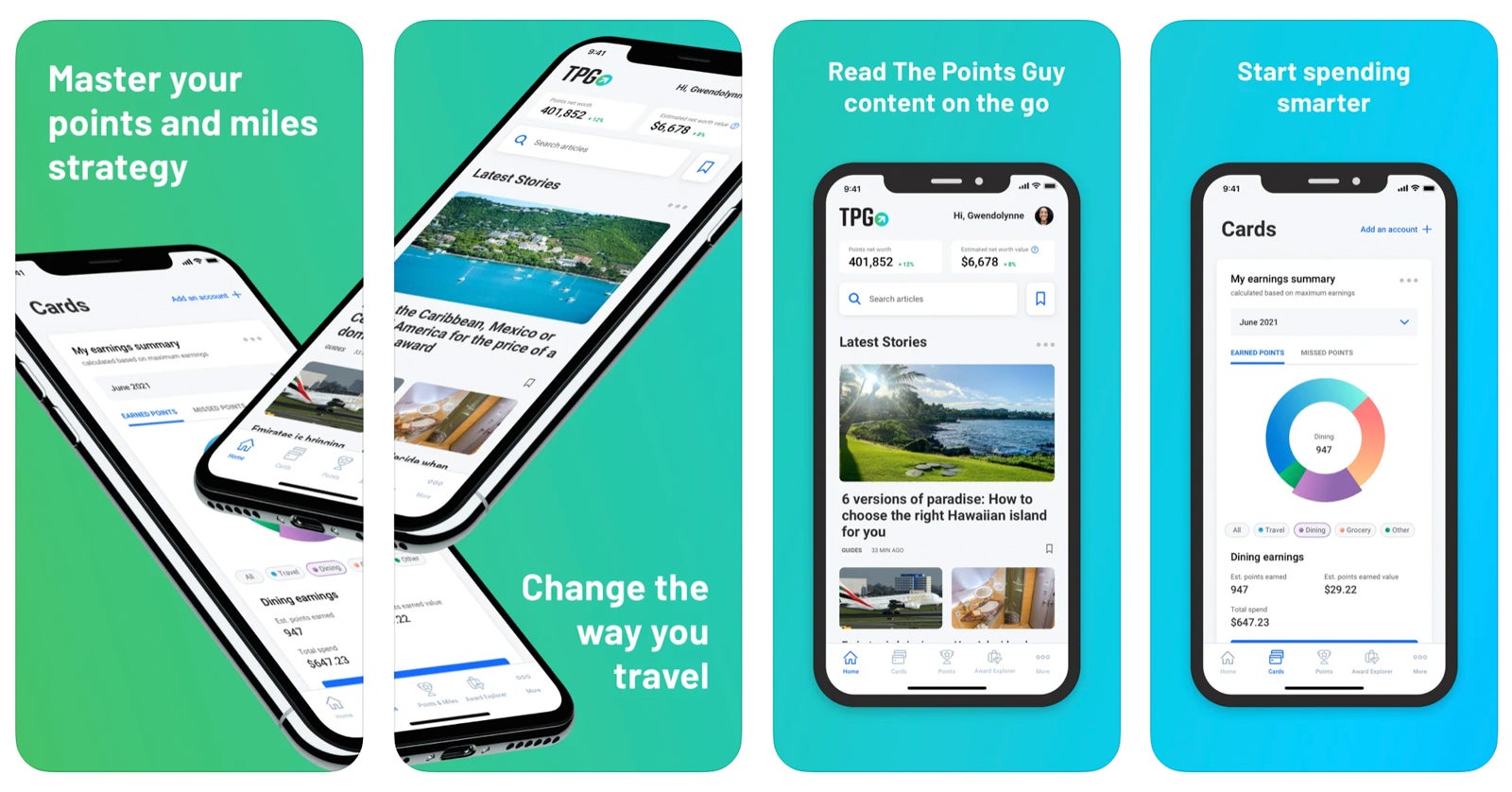

We can't talk about travel apps without mentioning the TPG App. Use it to track your credit card, airline and hotel points balances; earn points and miles efficiently through using the right credit card ; and research how many points or miles you'll need to book your dream getaway. You can even curate your own news feed so you see the news and advice that matters most to you first.

The TPG App is available for download on iOS . Android users can join the waitlist here .

Related: The TPG App has arrived — here's why you should download it now

Best apps for organizing a trip

From keeping all your documents in order to perfectly packing your suitcase without forgetting a thing, these are the best apps for organizing travel plans.

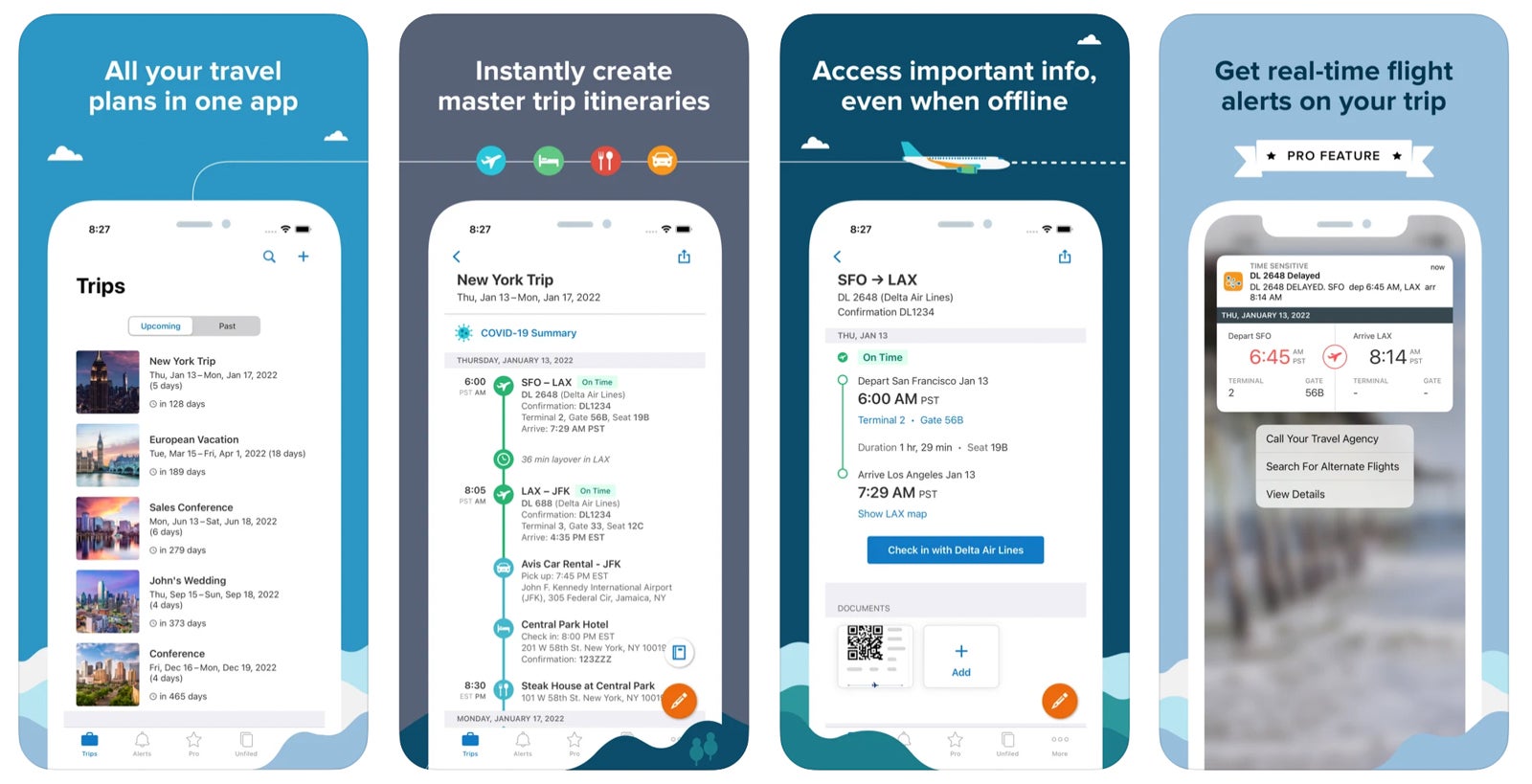

TripIt declutters your itineraries and documents by keeping them organized in one place. You can set your reservations to automatically send to TripIt, which lets you view travel confirmations, flight itineraries, tickets, hotel and Airbnb booking information, rental car reservations, ferry tickets and driving directions without ever leaving the app.

TripIt also makes it simple to share your trip plans with whoever picks you up from the airport or train station or anyone else who may need to coordinate with you. TripIt Pro subscriptions cost $49 per year and include extras like real-time flight alerts, security wait times, baggage claim information and updates on your loyalty reward programs.

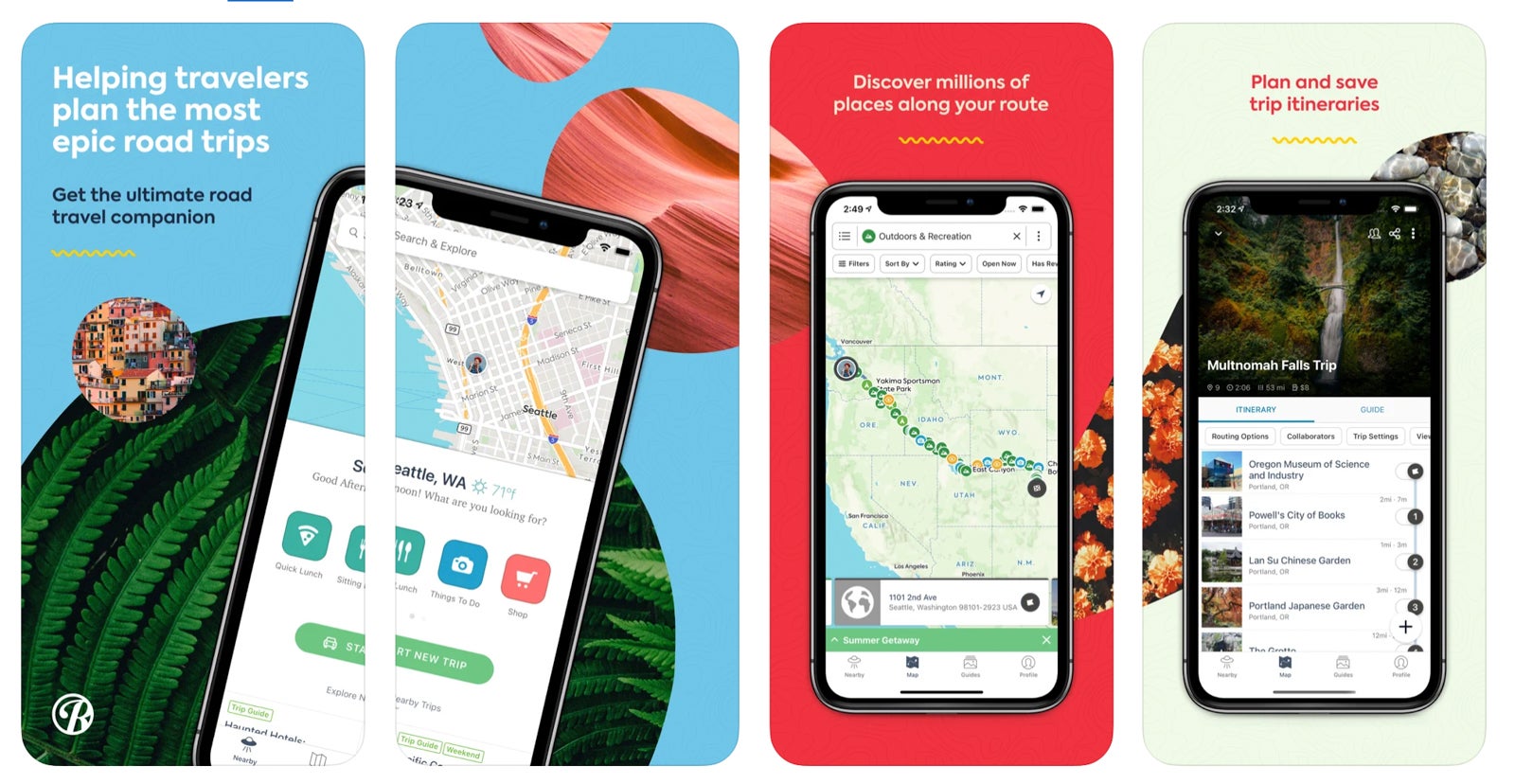

Roadtrippers

Perfect for organizing that epic road trip you've always wanted to take, Roadtrippers plans out your driving route and lets you book hotels and activities along the way. The app is especially useful for finding interesting and off-the-beaten-path roadside attractions, cool restaurants and can't-miss landmarks you can bookmark.

A Roadtrippers Premium membership includes offline maps, live traffic information, overnight RV parking and more for $59.99 per year. For those looking to only venture on a few road trips per year, the app also offers a Pro ($49.99 per year) and Basic ($35.99 per year) membership.

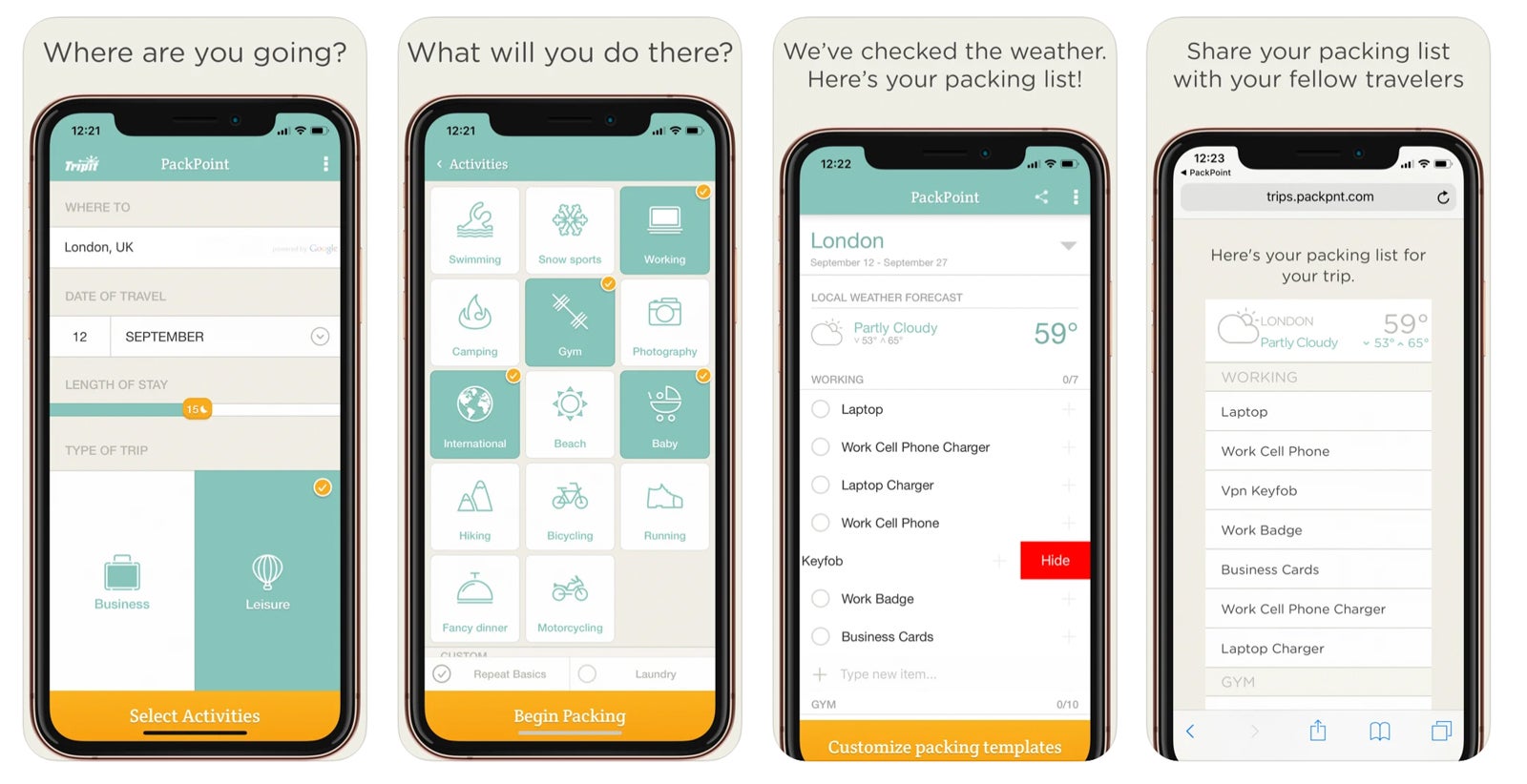

PackPoint takes all the stress out of packing . The app shows you what to bring based on the length of your trip, the weather in your destination and any activities you're planning along the way. If you have access to laundry facilities at your destination, PackPoint even allows you to account for washing your clothes and wearing them multiple times.

Just download and install the app, type in the city you're visiting and plug in your travel details. So, stop waiting until the day before your trip — or the hours before you have to leave for the airport — and start packing now.

Best apps for navigating the airport and flights

Track flights, navigate airports and find airport lounges with these apps.

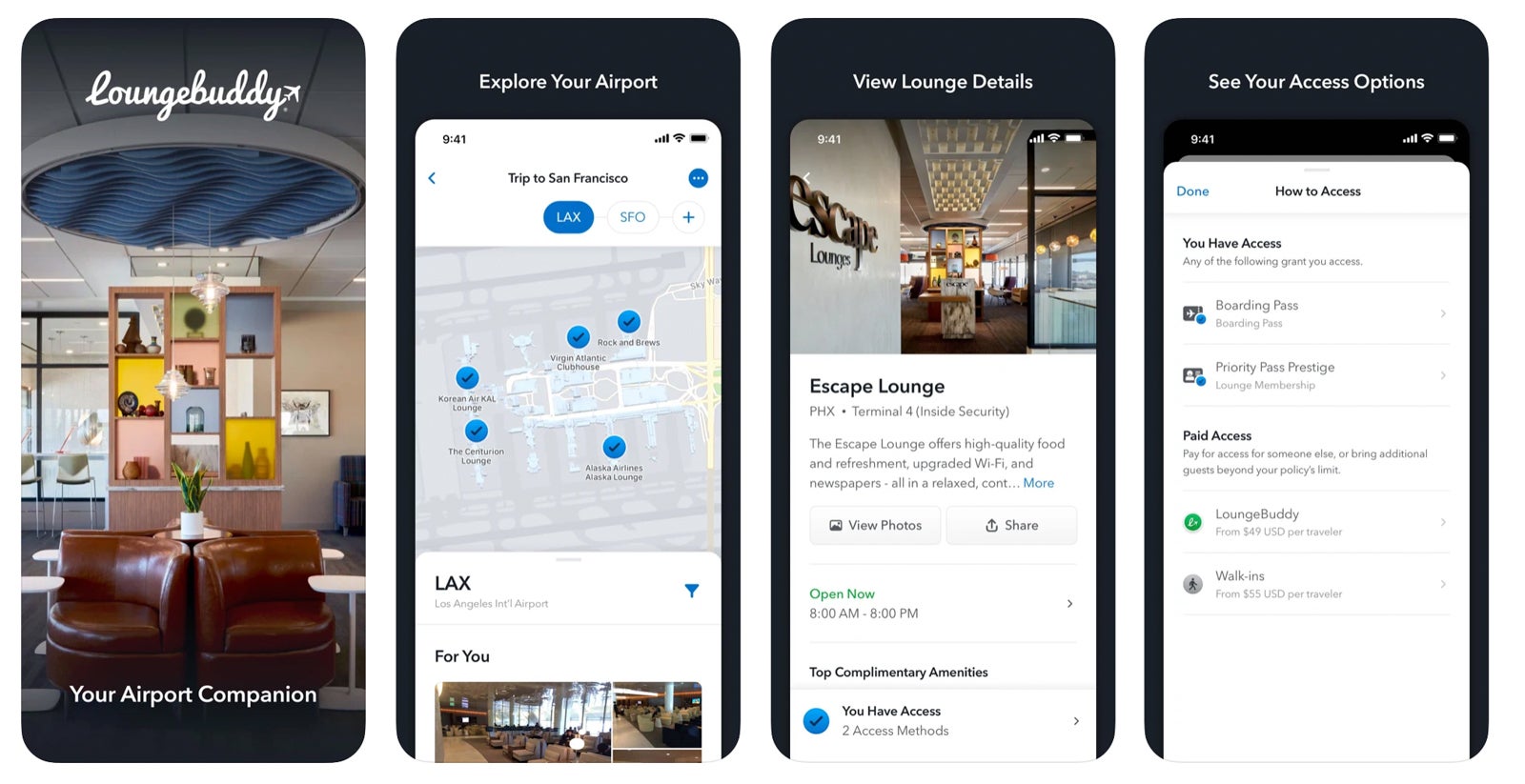

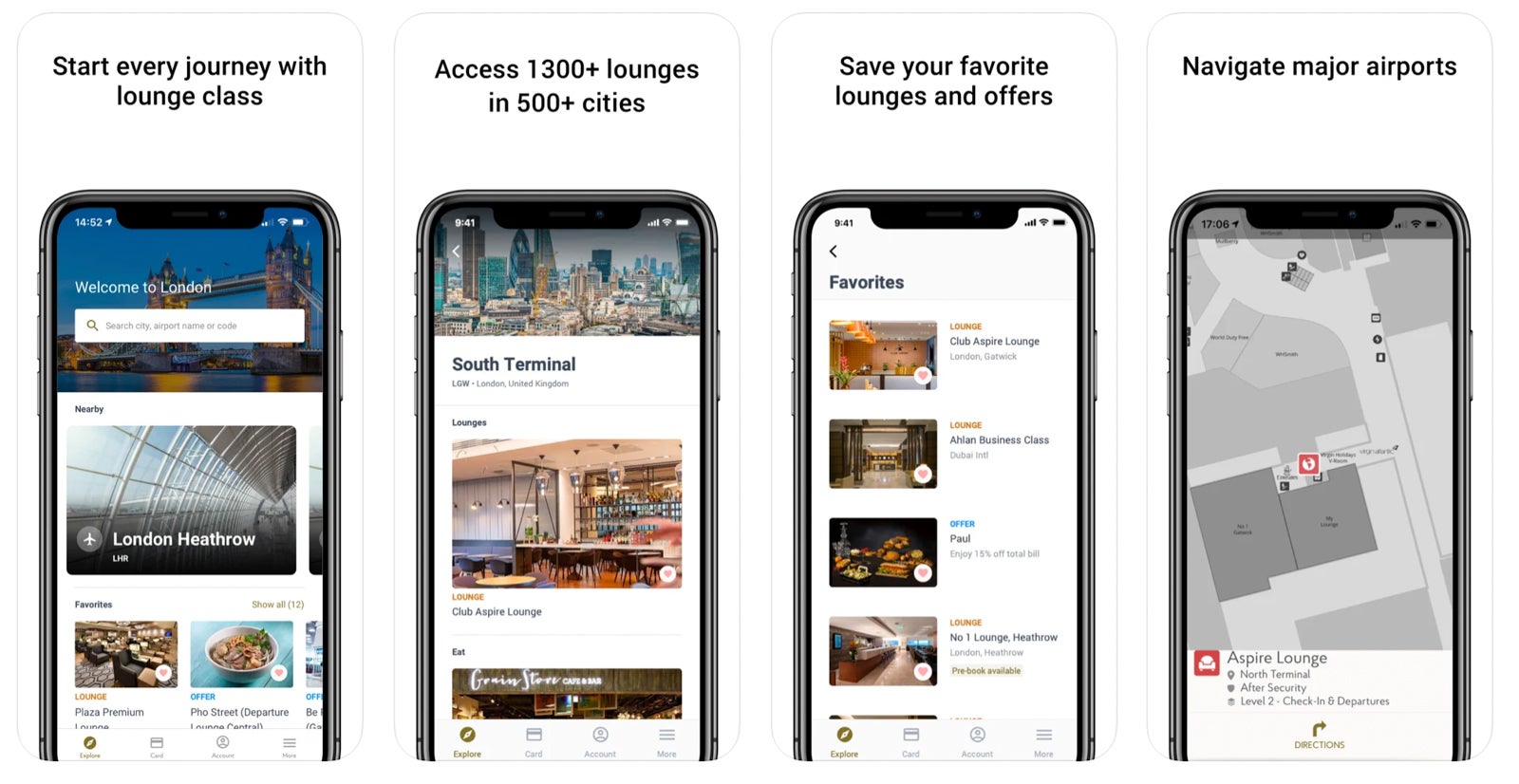

LoungeBuddy

LoungeBuddy offers access to premium airport lounges around the world, regardless of the airline or class you're flying. When you create a trip in the app and type in the credit cards you currently hold, it will tell you which lounges you have access to based on the airports you'll be transiting through and how to purchase access if you don't already have it.

You can purchase access on the day you're traveling or up to two months in advance if you're the plan-ahead type. If you prefer to search by lounge or lounge program, the app will tell you exactly what is needed to use them.

Priority Pass

Priority Pass offers access to more than 1,300 lounges worldwide and provides meal vouchers at select airport restaurants across the world for an annual fee starting at $99.

Several cards, including The Platinum Card® from American Express , the Capital One Venture X Rewards Credit Card and the Chase Sapphire Reserve , offer Priority Pass memberships for all cardholders (enrollment required). Otherwise, you'll have to pay an annual fee to be a member and, depending on your membership tier, a fee to enter each lounge on top of the annual fee.

To use the Priority Pass app, enter the name or code of the airport you're in, and Priority Pass will pull up the lounges or restaurants that you have access to, including photos, hours, amenities and specific location information. For more information on the Priority Pass Program and how to gain lounge access, click here . Enrollment is required for select benefits.

Related: The best credit cards for Priority Pass lounge access

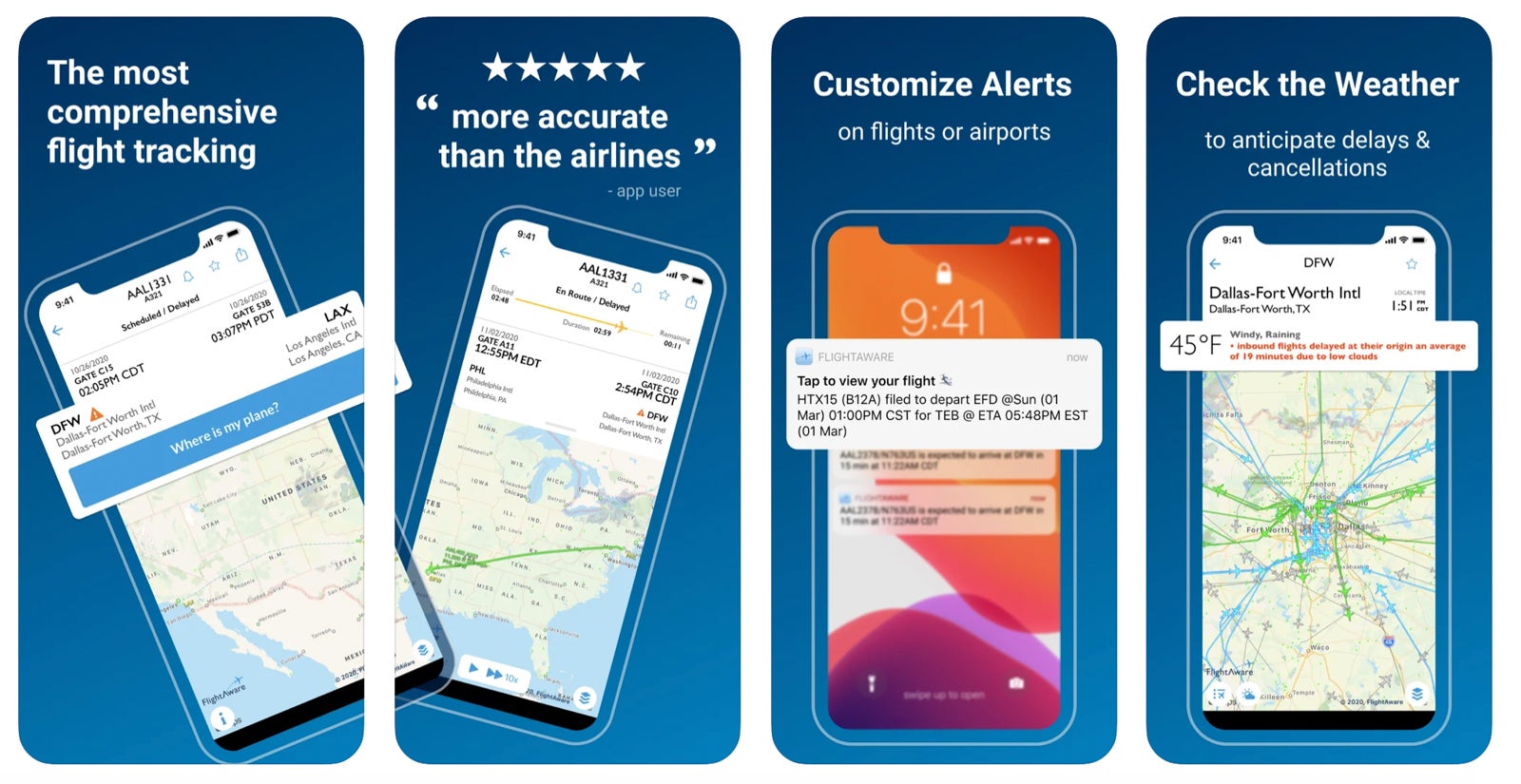

FlightAware

The FlightAware app allows you to track flights online, see a live map of a flight and check on delays, cancellations and gate changes. This app is especially helpful if you have a tight connection or want to track your flight.

It's also useful when picking up friends and family at the airport, as you can track their flight and see updated landing times or delays. AvGeeks will enjoy digging into flight statistics, flight maps and community aviation discussions on the app.

Best apps to use during your flight

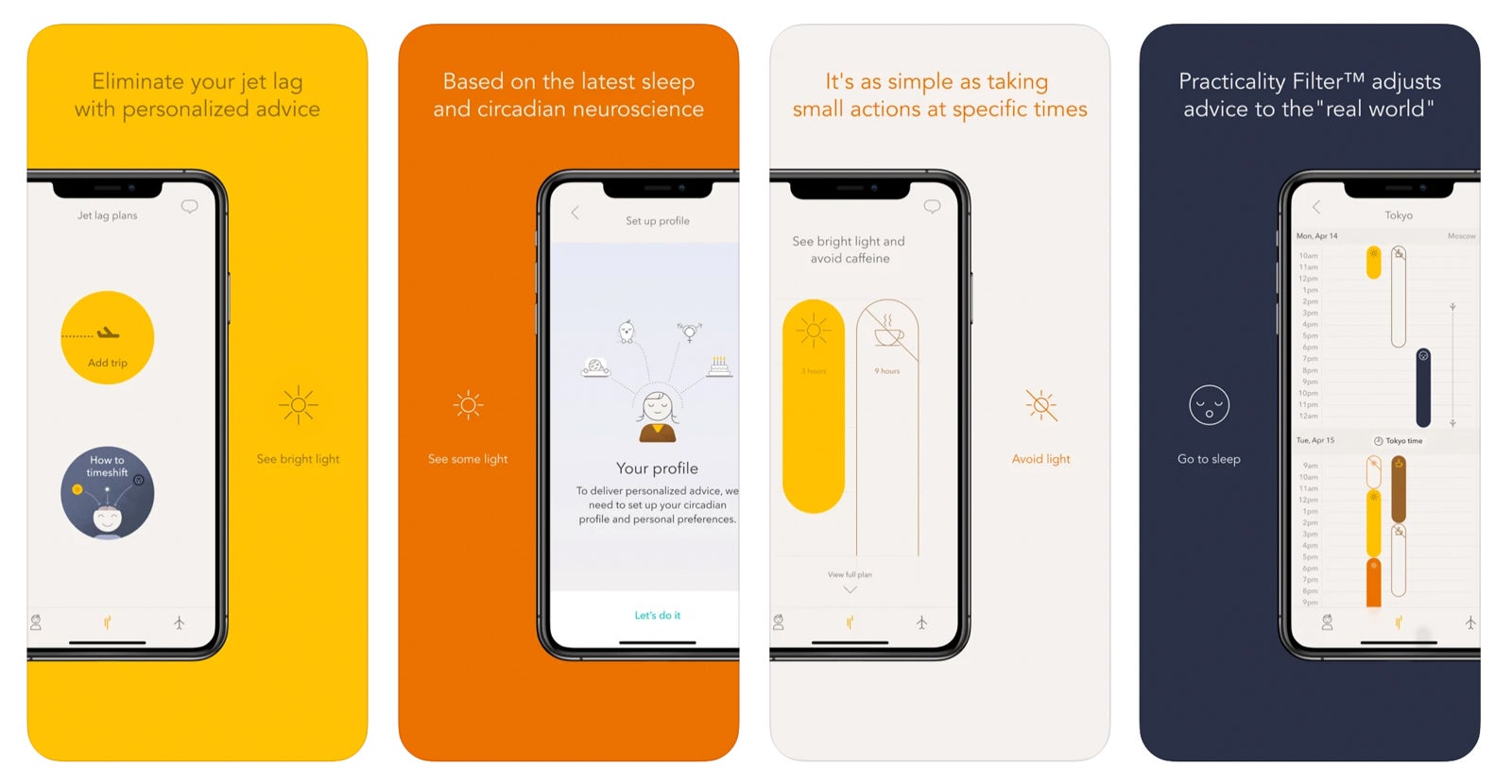

Timeshifter.

What better way to cure jet lag than with an app? Timeshifter actually helps you avoid jet lag long before your flight takes off and also offers inflight and post-flight suggestions. The app relies on neuroscience research about sleep and circadian rhythms to provide personalized recommendations, taking into consideration your age, gender and normal sleep patterns — as well as specifics about your trip and travel plans. Timeshifter maps out when you should avoid or seek light, take a nap or try to stay awake. It even tells you if you should consider supplementing with melatonin or caffeine.

Your first jet lag plan is free, then $9.99 per plan, or you can enjoy unlimited plans for a year for $24.99.

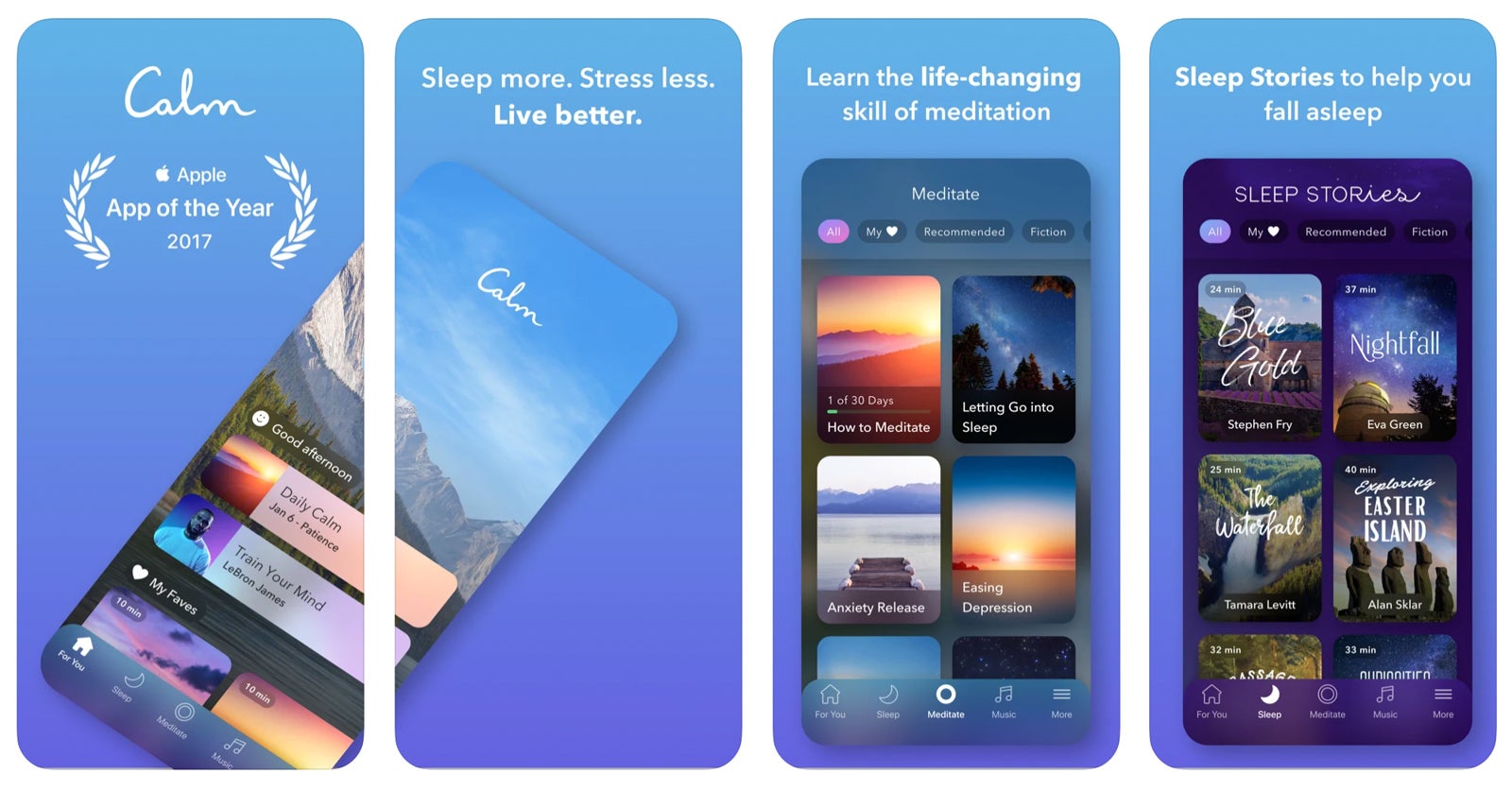

Flying can cause anxiety — or provide a welcome relief from constant contact with our digital devices. Either way, use travel as an opportunity to relax, meditate or listen to soothing sounds that will lull you to sleep or a deep, relaxed state. Or, perhaps, you'll simply find it helps pass the time during a long flight.

Calm offers meditations on topics such as self-awareness, calming anxiety, breathing, lowering stress levels and happiness, among others. The app also has music options for focusing, relaxing and sleeping, as well as stories for adults and content for kids.

A limited selection of meditations and music is available for free (which you can download to use when you're offline or in flight). The premium version of the app costs $14.99 per month or $69.99 annually.

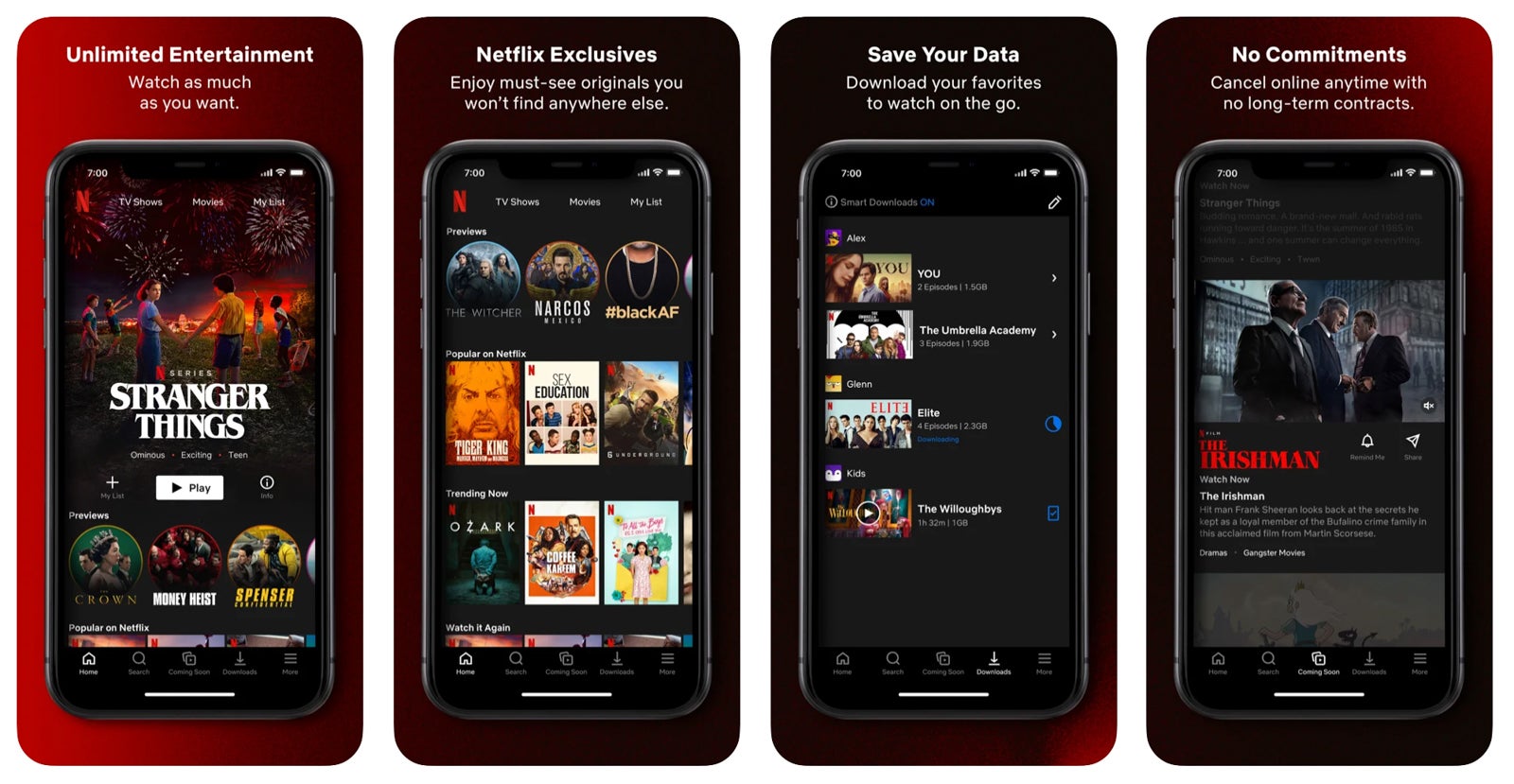

OK, so Netflix isn't really a travel app, but it can be a lifesaver during a long flight on an aircraft without seatback inflight entertainment or at the airport during an unexpected flight delay or boring layover. If you have a Netflix account, the app allows you to download your favorite shows onto your device to watch offline.

Just make sure to download your shows while connected to Wi-Fi before flying and check them again preflight to make sure they haven't expired (you can usually renew any expired downloads, but you must be connected to Wi-Fi or data to do so). Monthly prices vary depending on the plan.

Another app that's not really a travel app, Spotify can still be incredibly useful during tedious travel moments — just pop in those noise-canceling headphones and listen to your favorite music, meditations, podcasts and more.

The app's Premium plans (prices vary) allow you to download all your content offline on your phone, so you'll have it during long flights or when you don't have data or Wi-Fi access. Whether you want to take a morning jog in Bali to your favorite tunes or pass the time with a podcast on the metro in Barcelona, Spotify has it all.

Best apps to use in your destination

From exchanging money and sightseeing to communicating and knowing all the local tips and tricks, you don't want to land in a foreign city for the first time without these key apps.

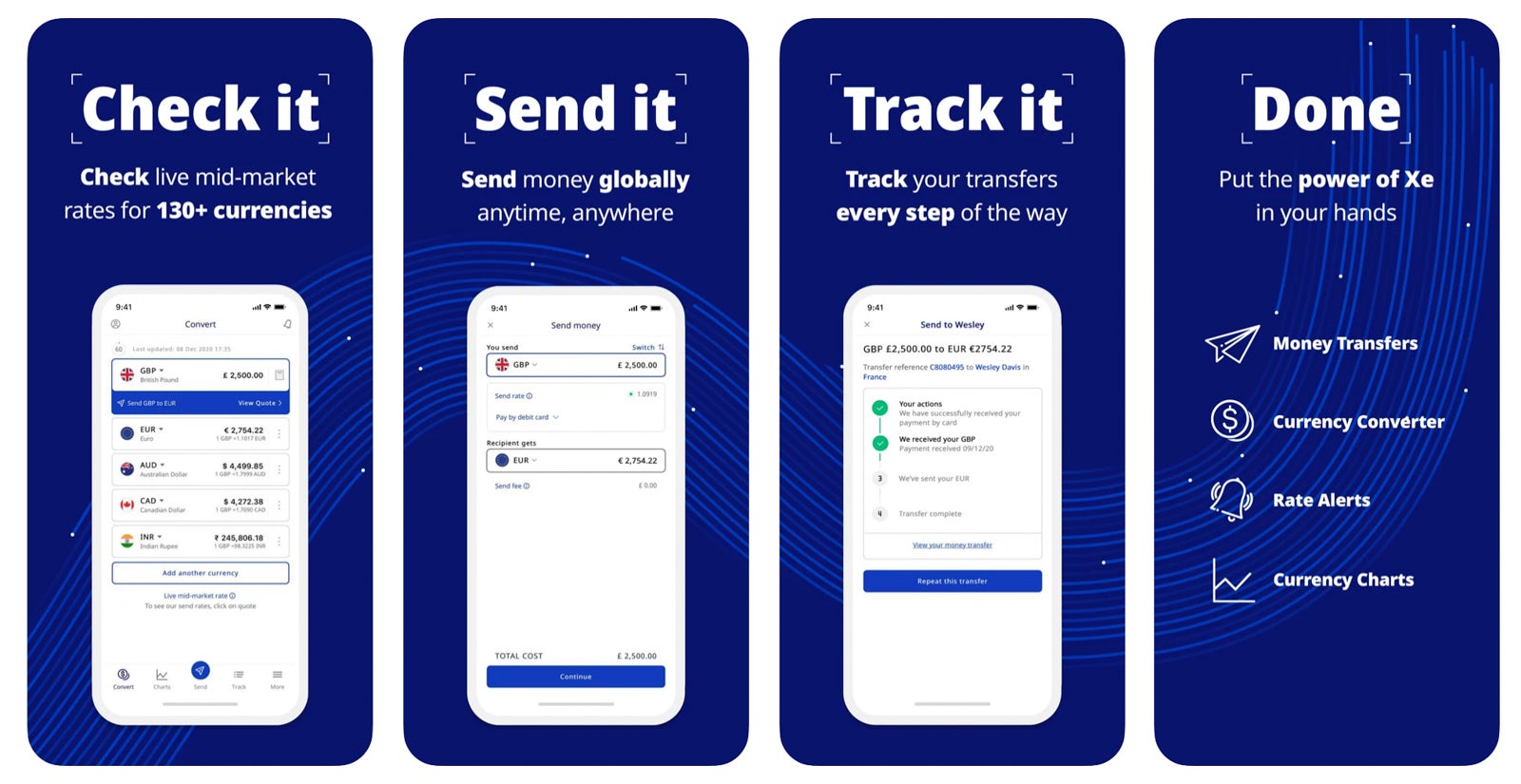

XE Currency Converter

The XE Currency Converter app quickly provides live, up-to-the-minute currency rates, then allows you to store and view them even when you're offline. You'll never need to wonder if you're really getting a good deal in another country if you have this app.

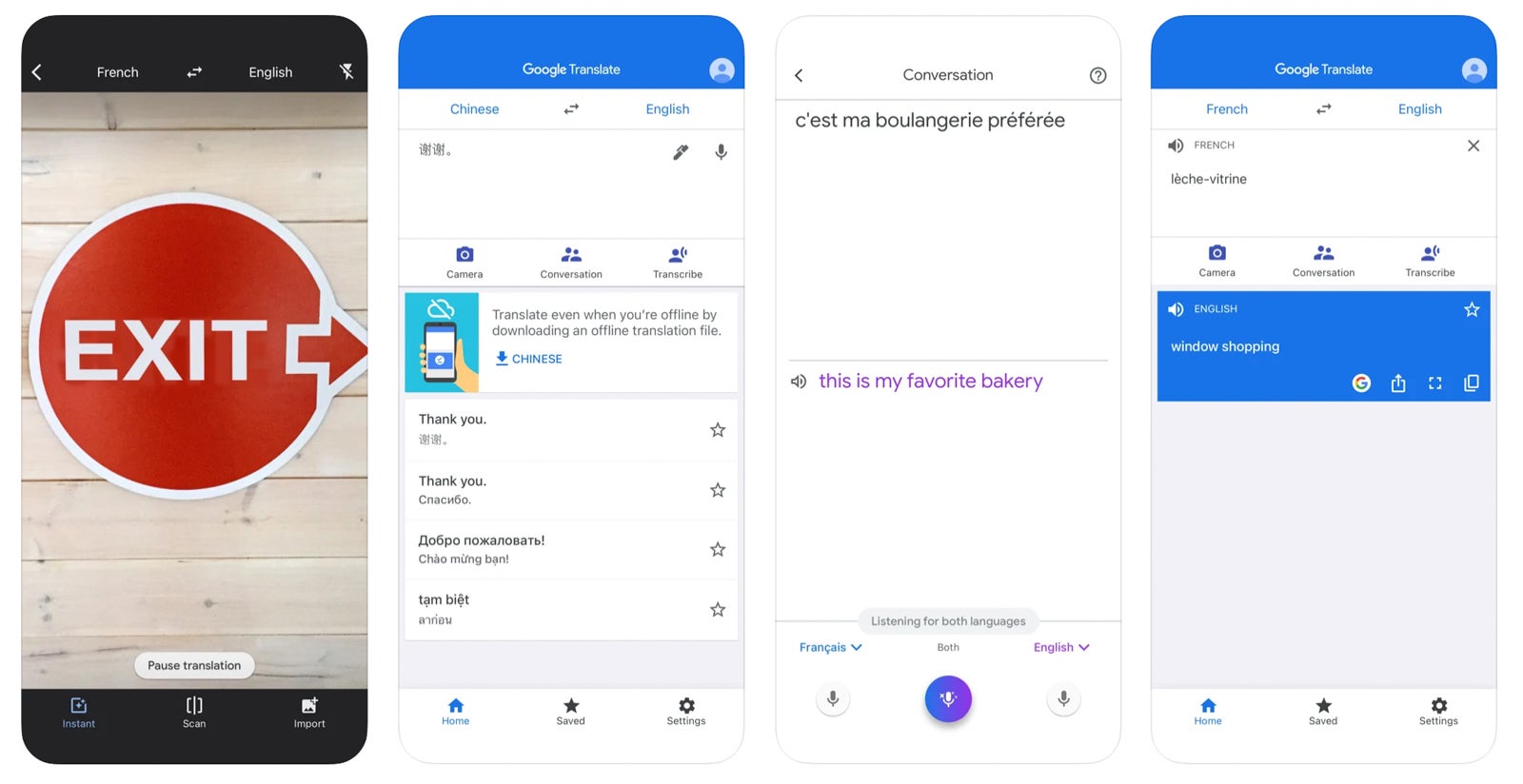

Google Translate

Google Translate is a translation app that allows you to do it all — translate into more than 100 languages by typing, access 59 languages offline, translate via photo, translate bilingual conversations and even use the handwriting tool to translate.

The app is simple to use, too, with icons at the top you can click on to draw, take a photo, speak or type.

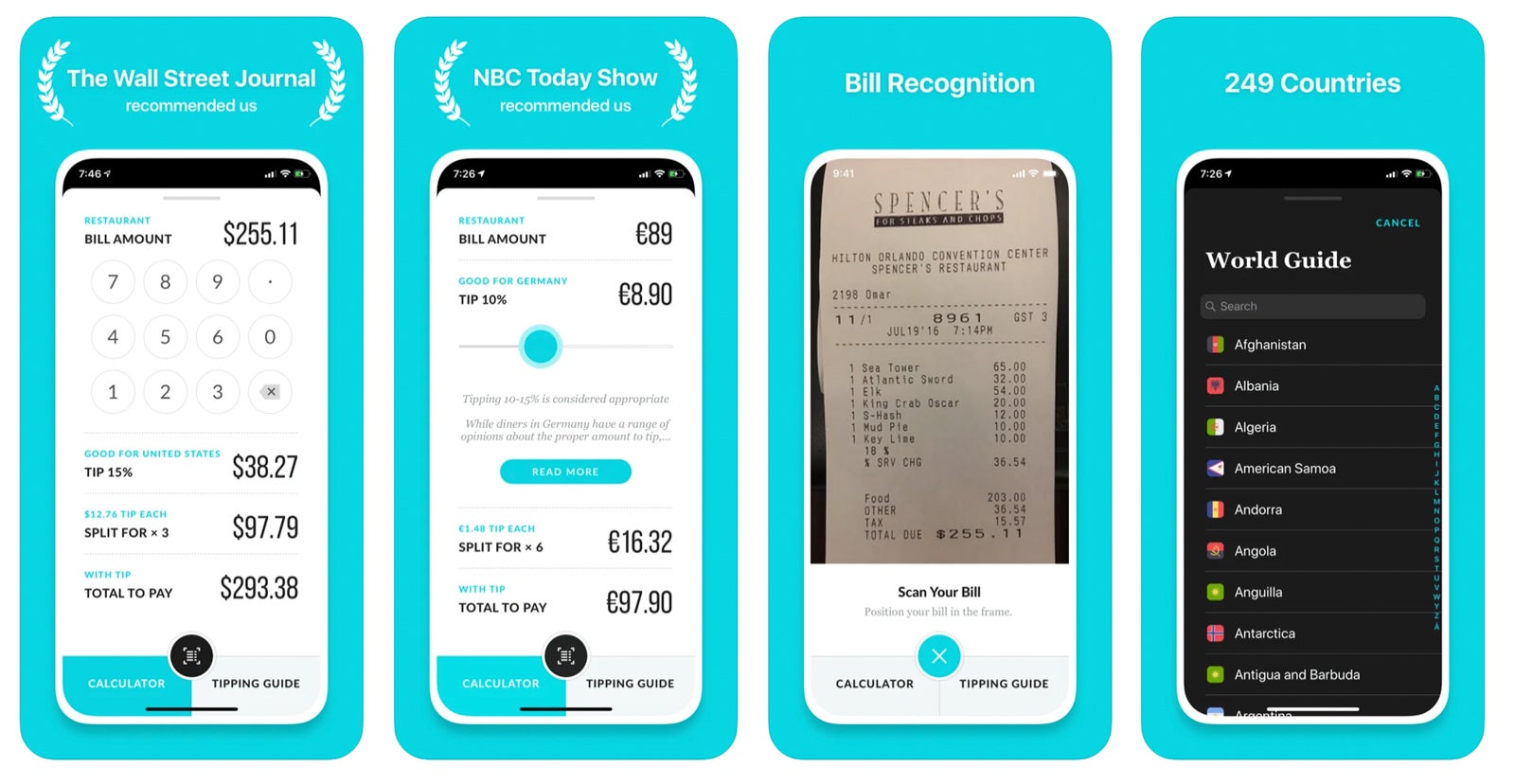

Not quite sure how much to tip when traveling internationally? GlobeTips will advise you on how to tip appropriately in more than 200 countries. It also offers a tip calculator for easy math. Globe also has apps for currency conversion, unit conversion and more that may be useful for travelers.

Related: The ultimate guide to tipping while traveling

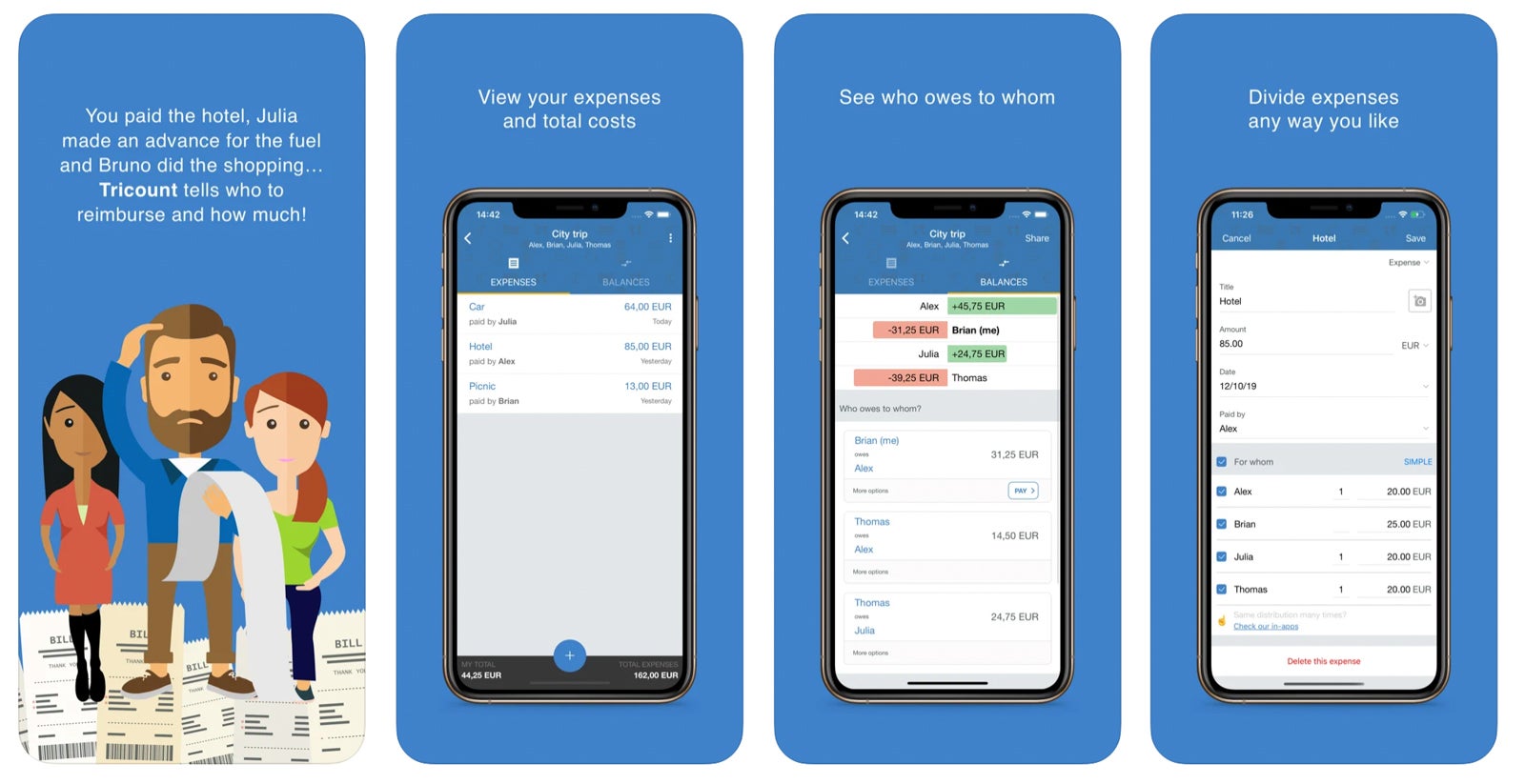

For travelers globe-trotting with friends and family members or simply splitting the cost between groups, Tricount calculates shared costs and splits bills so you don't have to think twice about who owes what. Just enter your trip and currency and invite your travel mates to join your trip.

Each time someone pays for something, you enter the amount in Tricount, and the app splits everything up. You can also snap and store photos of receipts in the app. At the end of your trip, it will show the balances of who owes who what, making it easy to settle up.

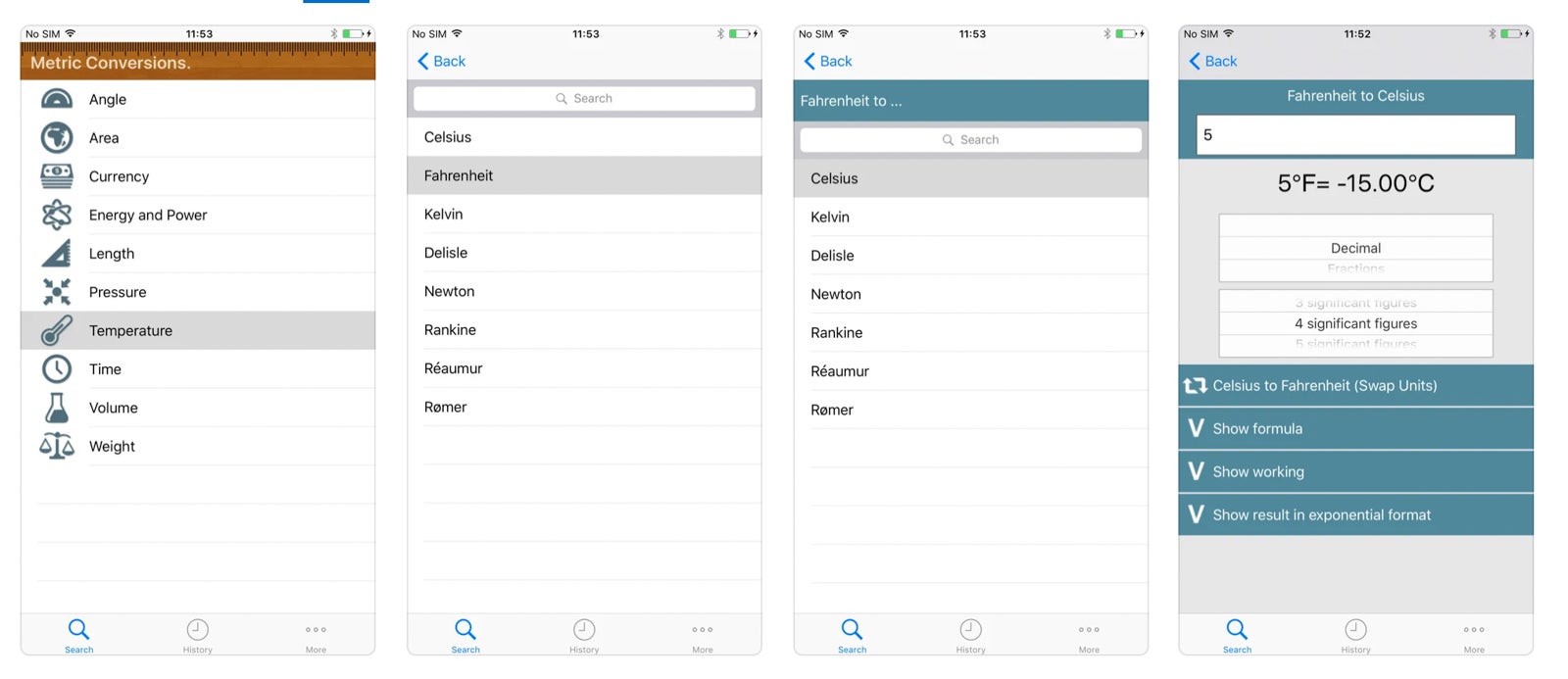

Metric Conversions

Never be baffled by Celsius temperatures or suitcase weight in kilograms again with the Metric Conversions app . Whether you're measuring flour to cook at your Airbnb, figuring out distances for your Europe road trip or deciding whether to take a sweatshirt with you during your walking tour of the Great Wall of China, this app has you covered with easy conversions in volume, weight, temperature, area and more.

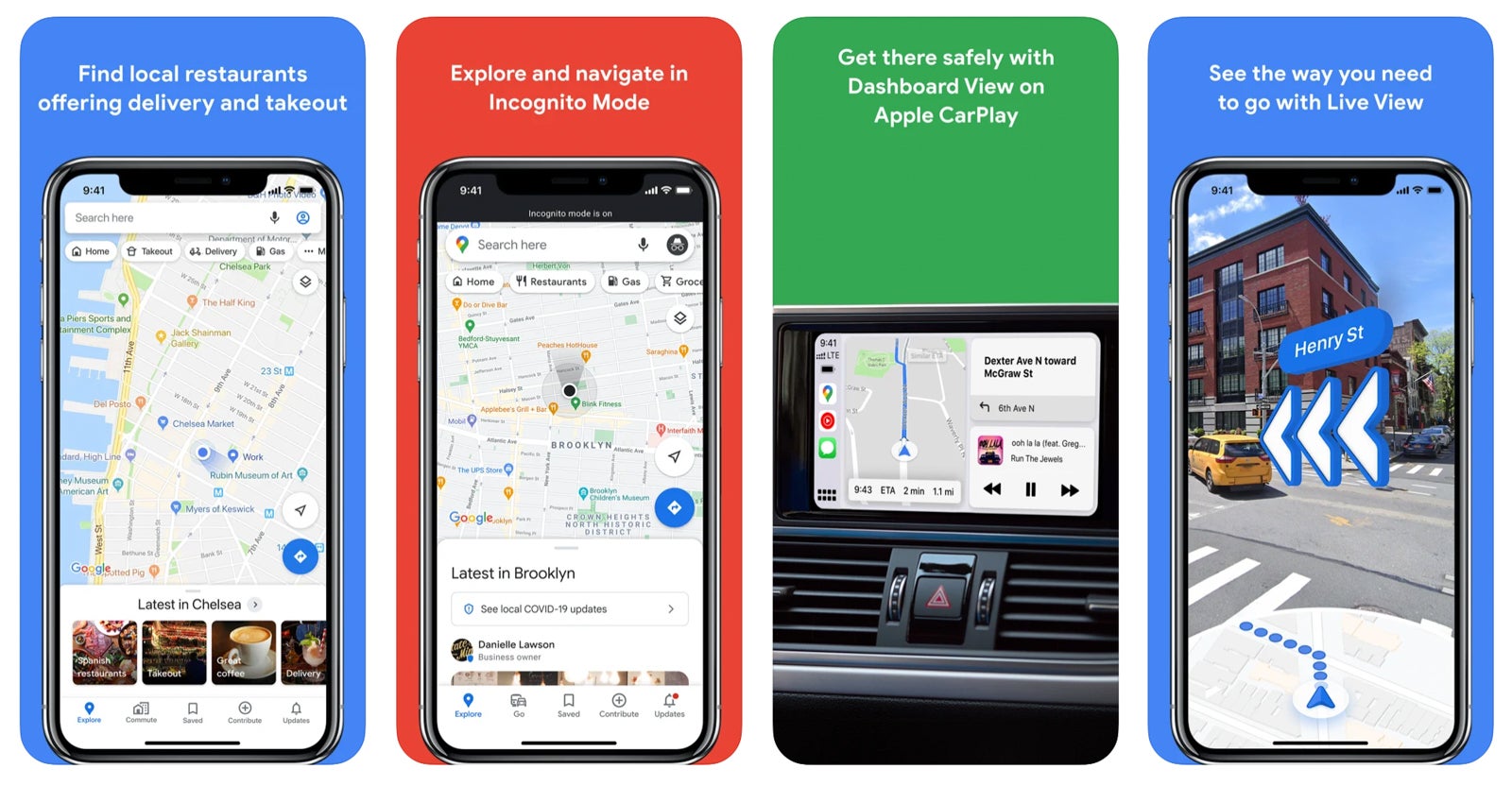

Google Maps

Google Maps is essential when visiting a new city (or even for getting around your hometown). You can map locations, get directions (walking, driving, public transportation, ride-hailing services and beyond) and see how crowded your subway will be in select cities .

You can make restaurant reservations, save your favorite spots and read and write reviews of attractions, eateries, shops and more. Make sure to download specific city or area maps ahead of time for offline access if you know you'll be without internet at your destination. For obvious reasons, the app works best when your GPS is turned on.

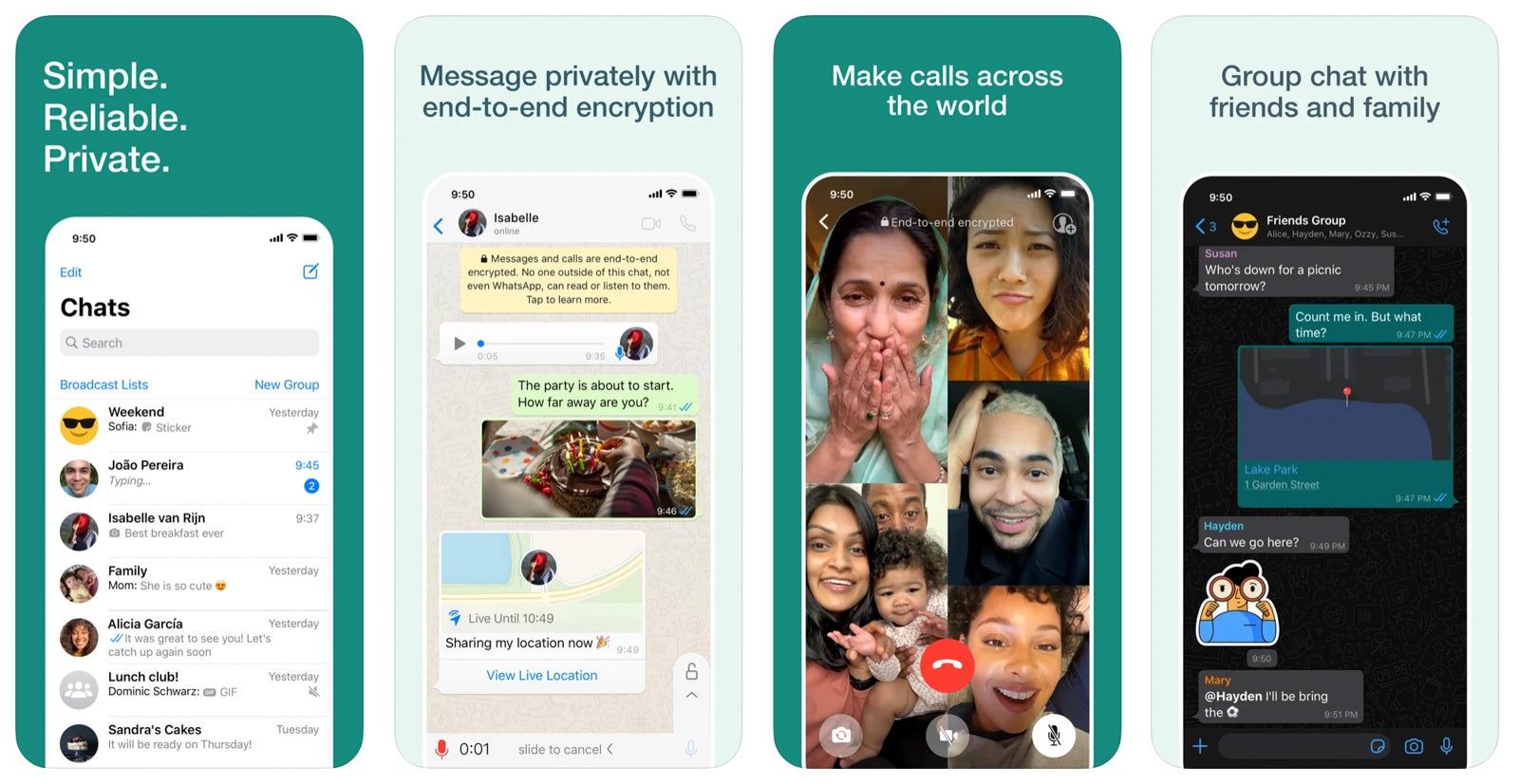

WhatsApp is a handy messaging service for travelers abroad as it uses an internet connection to avoid SMS fees.

It works like most other messaging apps: You start by creating an account, then add your friends and family members to contact and voila! You're able to call, video chat and send messages, images, voice memos, gifs and files just as you would in, say, iMessage (but with Android users too). You can also download WhatsApp on your Windows or Mac computer.

Best apps for planning activities

Traveling is about more than just getting from point A to point B. If you're looking for activities to add to your itinerary, check out these apps.

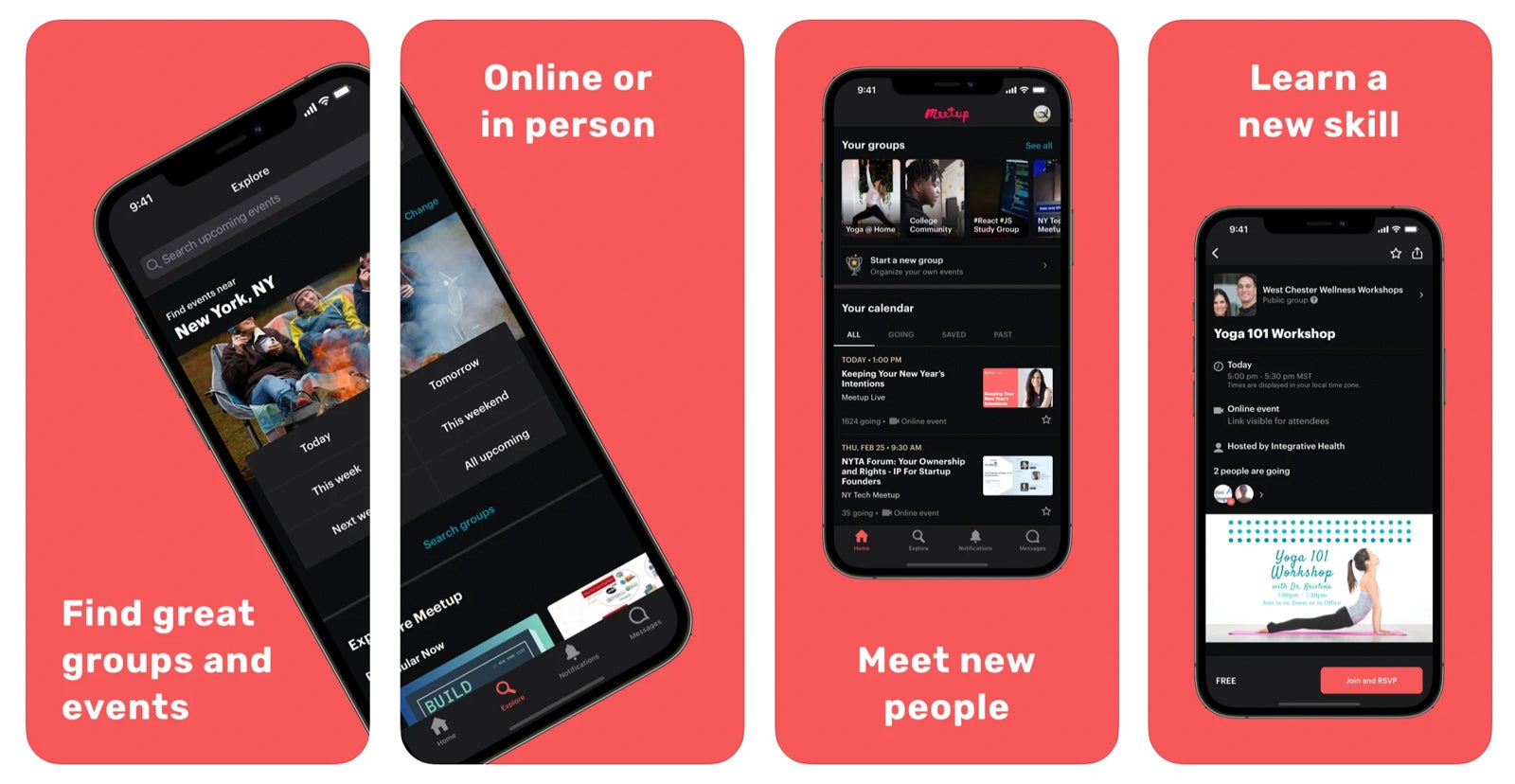

Meetup is an app designed for interacting with locals and other travelers who have mutual interests or shared hobbies. Whether you're traveling or at home, take what you love and do more of it with Meetup.

The app shows you groups that are formed around particular interests in your city, including yoga, photography, cooking, wine tasting, hiking, cinema and other activities. You can join groups to get updates on particular events you may want to participate in. The app can even help with networking, as there are many groups dedicated to business and technology. You might even be able to join a coworking group. Travelers with kids can participate in family-friendly meetups, and it's a great way for solo travelers to make friends and connect with others.

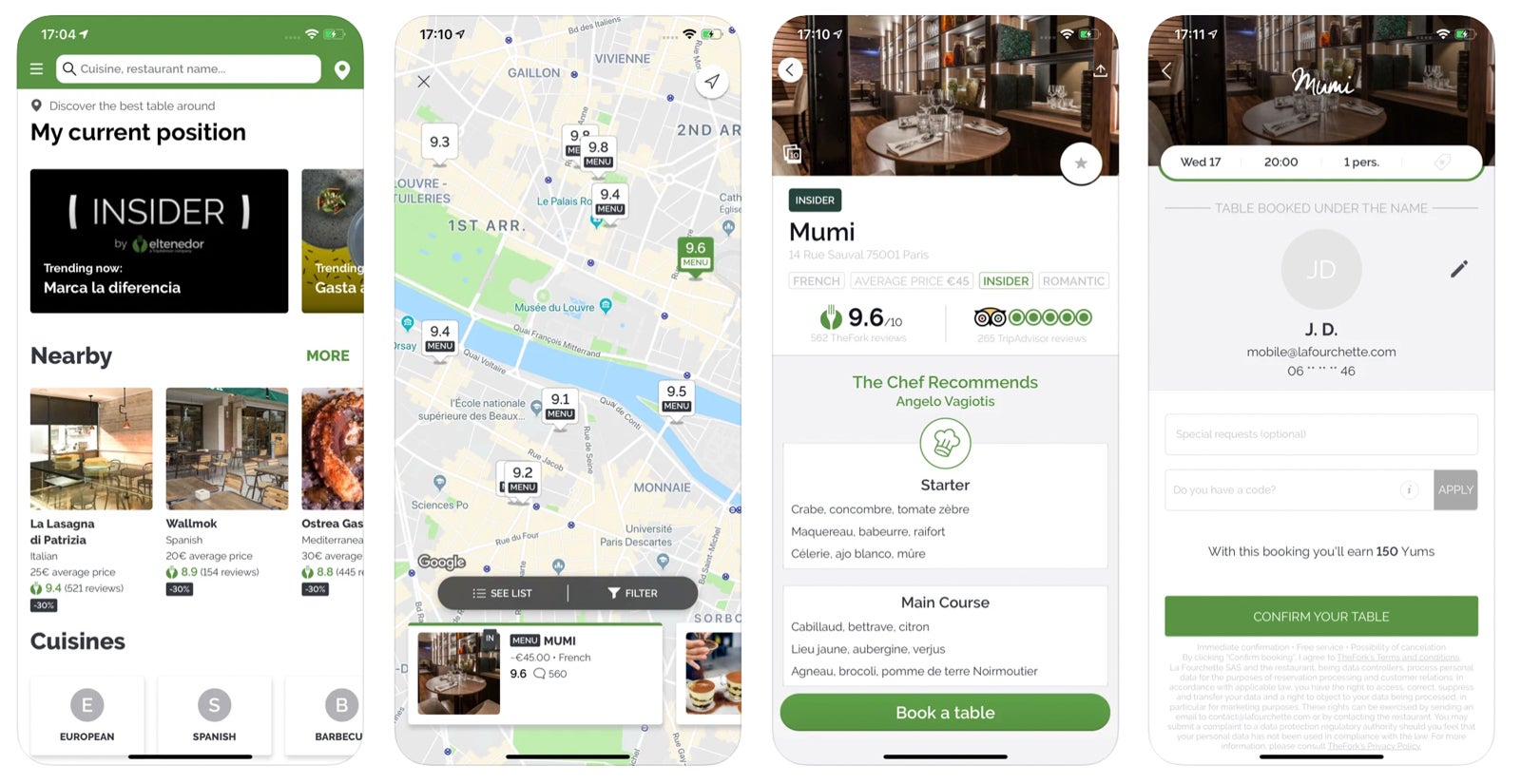

TheFork is one of the most useful resources for making restaurant reservations in Europe. Similar to OpenTable or Resy, the app lets you browse different restaurants by category and make reservations. TheFork features more than 60,000 restaurants in cities like London, Madrid and Geneva, as well as spots outside of Europe like Sydney, Australia.

The biggest perk is that many restaurant reservations come with discounts — in some cases, you can get up to 50% off your meal just by reserving a table through TheFork. Since we here at TPG are always down for earning rewards, make sure to monitor your YUMS — TheFork's reward system. You'll earn YUMS with each reservation, and when you hit 1,000, you receive a discount on your bill. Foodie travelers should also consider downloading these apps , too.

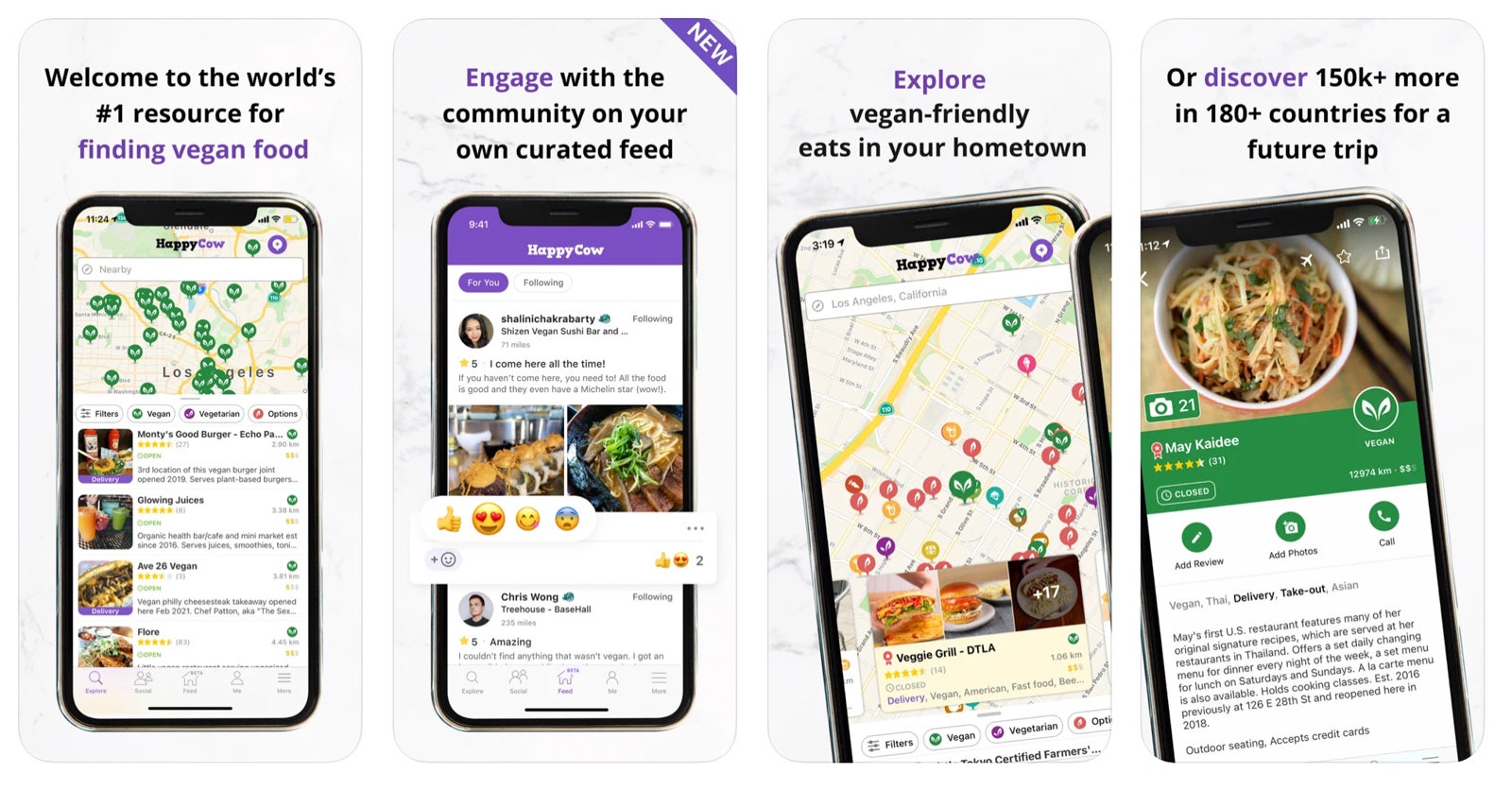

Happy Cow helps vegan and vegetarian eaters locate more than 180,000 restaurants, coffee shops, bakeries, farmers markets and grocery stores in over 180 countries around the world. The app allows you to filter by not only vegan and vegetarian but also gluten-free and cuisine types. You can also read reviews and get recipes on the app as well.

The app does cost $3.99, but it's a one-time expense.

TripAdvisor

Besides reading reviews of restaurants, hotels and attractions, you can book almost anything on TripAdvisor, from vacation rentals and restaurant reservations to tours and tickets.

The app has grown to include almost all things travel, allowing you to search by destination or interest (like the outdoors, food and drink, family or by the water, for example), which can give you inspiration for a trip or help you get your activities, meals and accommodations organized before traveling or on the fly.

With over 400,000 curated trails, AllTrails can help you find the hike or walk perfect for you and your group. It's not just mountain trails — AllTrails offers city walks, too, like easy meanders through the Marais district in Paris or peaceful strolls through Bangkok's Lumpini Park in Thailand.

See photos, updated weather predictions and key information about each route and connect with other travelers through reviews and forums. Access to AllTrails+ is $35.99 per year, which offers perks like offline maps and wrong turn alerts.

Best apps for staying safe

Use these apps to stay safe when traveling.

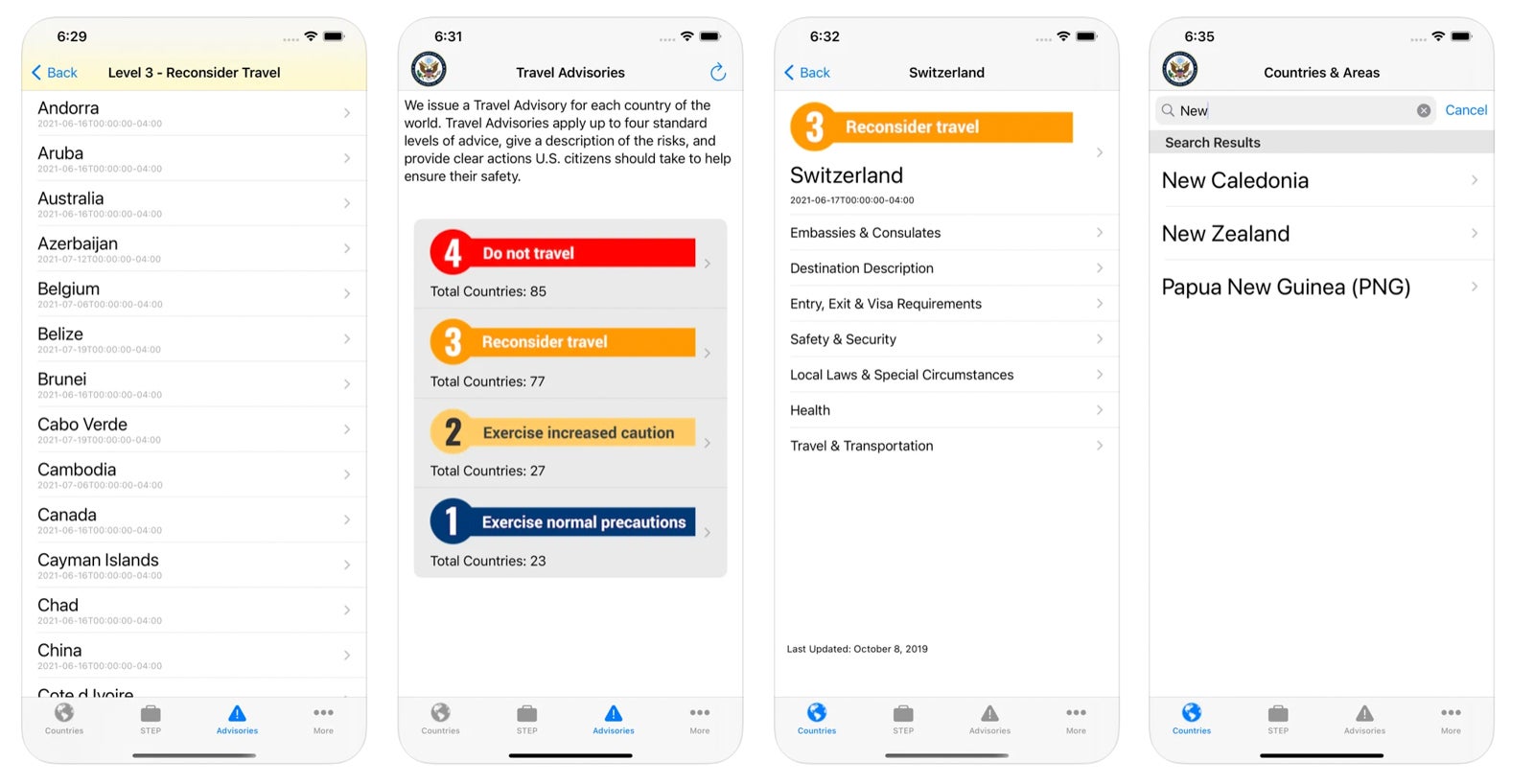

Smart Traveler

Smart Traveler is a free service that offers tips and information specifically for U.S. travelers. You can see what visas and vaccines you'll need before traveling and where to find help if you need it during your trip.

Register your trip on the app, which gives your information to local embassies and consulates in your destination. If there's any kind of disaster or tragedy, the local embassy can contact you to see if you need help.

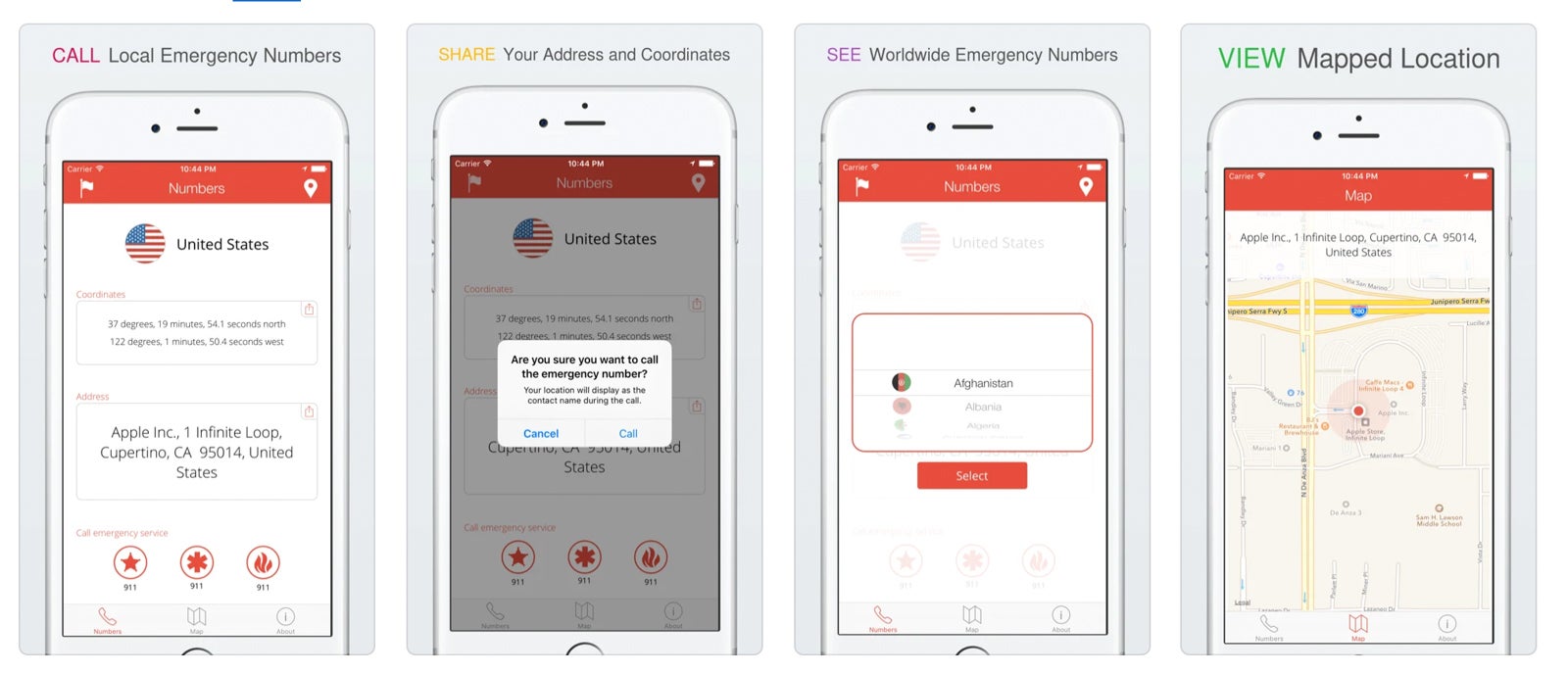

TripWhistle

Another app dedicated to keeping you safe, TripWhistle maps your location and allows you to easily text or send your GPS coordinates or location. It also provides emergency numbers for firefighters, medical personnel and police in nearly 200 countries. After all, 911 is only for U.S.-based emergencies: Each country has its own specific emergency number.

Yes, Uber (or any local ride-hailing service app) is convenient, but it may also keep you safe. Using this app when traveling means you'll never get stuck wandering around in an unfamiliar area late at night or have to deal with unscrupulous taxi drivers trying to scam you. Uber also has in-app safety features such as an emergency assistance button which will allow you to call local emergency services right in the app.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

2024 State of Consumer Credit Report

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

From credit cards to mortgages, credit is a cornerstone of many people’s personal finances. It can open the door to long-term life goals, such as homeownership, but can also serve as an emergency source of funding when times are tough.

In the past 12 months, many Americans have used credit cards or buy now, pay later (BNPL) services to pay for the things they need. In some cases, they relied on credit because they didn’t have the money to pay for these necessities outright, according to a new NerdWallet survey conducted online by The Harris Poll. And while the survey of more than 2,000 adults found that 33% of Americans feel better about their ability to manage their debt now compared with 12 months ago, many anticipate having to lean on credit to pay for necessities in the coming year.

“How we use credit says a lot about our overall household financial health,” says NerdWallet credit cards expert Sara Rathner. “At one end of the spectrum, someone could be paying off their credit card balances each month and racking up rewards points to use on a vacation. At the other is someone signing up to buy now and pay later on their weekly groceries. Access to credit is useful in both of these scenarios, though the costs and benefits of these types of credit can vary dramatically.”

Key Findings

Traditional and new credit types used by many in the past year. In the past 12 months, credit cards were among the most commonly used type of credit that we asked about in the survey, but 25% of Americans used buy now, pay later (BNPL), and 10% used a cash advance app.

Many Americans use credit cards for necessities such as groceries or bills. Though one-third (33%) of Americans used a credit card to pay for necessities in the past 12 months to accumulate rewards or cash back, 16% used cards for necessities during this period because they didn’t have the money to pay for these expenses outright. Further, 12% anticipate using their credit card for such expenses in the coming 12 months because they won’t have the money to cover them outright.

Some Americans carry a credit card balance from month to month, potentially due to a common misconception. More than one-quarter (27%) of Americans generally carry a balance on at least one credit card from month to month, according to the survey. But just 40% of Americans recognize leaving a balance on your card is not better for your credit score than paying it off.

Americans will continue to use BNPL for “needs” in coming year. During the past 12 months, 8% of Americans had to use BNPL to pay for necessities, and 8% anticipate having to use the service for those things in the coming 12 months.

Many Americans pay late fees as delinquent accounts are on the rise. Well over one-third (37%) of Americans have been charged a late fee in the past 12 months, according to the survey. And in the first quarter of 2024, 3.6% of total debt balances moved into delinquency, according to the New York Federal Reserve.

Use of credit

Over the past year, Americans have taken out billions of dollars in debt across personal loans, credit cards, mortgages, auto loans and other forms of credit. Use of credit is ubiquitous. Just 19% of Americans say they didn’t use any of the eight credit types we detailed in our survey within the past 12 months.

In addition to traditional loans and credit cards, many made use of more innovative credit types: One-fourth (25%) of Americans used buy now, pay later services, and 10% used a cash advance app within the past 12 months, for example.

With this credit use, overall debt balances have climbed to $17.7 trillion in the first quarter of 2024, according to the New York Fed. But prices and wages have risen recently, too. Adjusting these current debt balances for inflation, or the true buying power, indicates despite the massive total, the growth in debt may not be as alarming as it initially appears, at 0.5% over the past year.

High interest rates could also be contributing to higher debt levels. The Federal Reserve began increasing rates to tamp down inflation in March 2022, and credit types across the economy — from credit cards to mortgages — have been impacted. These rising rates make debt more expensive, and some borrowers are sensitive to these changes: Roughly one-tenth (11%) of Americans say they postponed or opted against taking out new credit they otherwise would in the past 12 months due to high interest rates, according to the survey.

Credit use tip: If you’re purchasing the same things with credit that you were before prices went up, you’re using more credit now because those same goods and services cost more. Staying cognizant of your overall credit usage can help ensure you’re not taking on an unreasonable amount of debt, even in light of recent inflation. A good rule of thumb is to keep debt payments under 36% of your income; a debt-to-income calculator can help you track this.

For rewards or out of necessity: Using credit cards for “needs”

People use credit for various reasons. When it comes to credit cards, some people maximize their credit use to reap points and rewards, using their cards for everything they can, including necessities. But that’s not the only reason people use their cards for “needs.”

One-third (33%) of Americans used a credit card to pay for necessities in the past 12 months in order to accumulate rewards points or cash back, according to the survey. But 16% of Americans used a credit card for necessities during that time because they didn’t have the money to pay for those costs outright. Further, 12% anticipate having to use cards for necessities in the coming 12 months because they won’t have the money to cover the costs outright.

No matter the use, most credit cards charge interest on balances, and paying off those balances entirely may be difficult in times where cardholders are turning to their cards for things like groceries and bills. More than one-quarter (27%) of Americans generally carry a balance on at least one credit card from month to month, according to the survey.

Credit use tip: Carrying a credit card balance from month to month is likely doing you no favors. It certainly doesn’t help your credit scores, despite the common misconception that it does — just 40% of Americans know leaving a small balance on your card is not better for your score than paying it off, according to the survey. And leaving a balance comes at a literal cost in the form of interest.

“If you’re accustomed to carrying a credit card balance, getting those balances to zero can feel like a tall order,” Rathner says. “There are several debt payoff strategies that may be right for you. Making the minimum required payment each month can lock you in debt for years, so try to pay more than the minimum whenever you can. A balance transfer credit card or debt consolidation loan can reduce how much you’re paying in interest. If you’re in over your head, however, you may want to consider debt relief options , such as working with a debt management nonprofit.”

BNPL most common among younger generations and parents

Buy now, pay later services are relative newcomers to the credit scene, and their popularity is unmistakable. These services allow people to enter payment agreements at the point of sale, generally without the credit requirements of a credit card or traditional loan, and most often without interest.

One-fourth (25%) of Americans used BNPL in the past 12 months, according to the survey, with younger generations and parents among the groups more likely to make use of the service. Well over one-third (37%) of parents of minor children have used BNPL in the past 12 months, compared with 20% of nonparents of minors. And 40% of Gen Z (ages 18-27) and 36% of millennials (ages 28-43) have used BNPL during that time, compared with just 20% of Gen X (ages 44-59) and 12% of baby boomers (ages 60-78).

In the past 12 months, 8% of Americans had to use BNPL to pay for necessities. Unlike credit cards, which may offer cash back or rewards, buy now, pay later services tend not to come with such benefits.

If using BNPL for necessities is a sign of financial hardship, many Americans don’t see that hardship subsiding. An equal share (8%) anticipate having to use BNPL for necessities in the coming 12 months, according to the survey.

“Because buy now, pay later services don’t require a credit check, the barrier to entry is low,” Rathner says. “This convenience can work against you, however, if you’re taking on more debt than you can realistically pay off.”

Credit tip: If you rely on BNPL because your credit prevents you from getting a traditional credit card, you could consider getting a secured card. Because these cards require that you put down a refundable security deposit upfront, which becomes your credit limit, they can be easier to get and prevent you from amassing unmanageable debt. However, if you’re struggling to cover the costs of necessities, the required deposit makes this a goal to work toward, perhaps seeding the card after a windfall such as a tax refund or gift. Ultimately, secured cards can help build credit, which can assist you in eventually gaining access to traditional cards, including those that offer rewards and cash back.

Delinquencies on the rise

Whether you’re using credit to achieve financial goals or handle financial emergencies and hardship, the ability to make payments on that debt is crucial to long-term stability. Well over one-third (37%) of Americans have been charged a late fee in the past 12 months, and they’ve been charged these penalties on everything from credit cards (21% of Americans) to utility bills (10%) and rent (8%).

Parents of minor children are more likely (61%) to have paid a late fee over the past 12 months than nonparents of minors (28%). And younger generations are more likely to have paid such fees: 58% of Gen Z, and 57% of millennials, compared with just 32% of Gen X and 13% of baby boomers.

Indeed, the share of newly delinquent accounts has climbed across most debt types in the past few years, according to data from the New York Fed. About 3.9% of total debt balances moved into delinquency in the first quarter of this year, down from the prepandemic rate of 4.7%, but up considerably from the most recent low: 1.9% in the third quarter of 2021.

Despite rising debt and relatively common late fees, 33% of Americans feel better about their ability to manage their debt now than they did 12 months ago, compared with 19% who feel worse.

Credit tip: When it becomes apparent you’ll be late on a debt payment, reach out to your creditor sooner rather than later. Depending on the circumstances of your hardship, it may be willing to adjust your payment due date or even place your loan on a forbearance plan. Being proactive could buy you some time and keep your account out of delinquency.

Feeling optimistic: Access to credit

Being approved for credit, whether it’s a mortgage or a credit card, can open doors to economic mobility. The ability to access credit can depend on factors including the applicant’s credit history and income, but also banks’ willingness to lend .

In the past 12 months, 11% of Americans were denied a new credit card, 8% were denied a personal loan, 4% were denied an auto loan and 3% were denied a mortgage, according to the survey.

But some may anticipate those tides changing. Three in 10 (30%) of Americans feel better about their ability to qualify for credit now versus 12 months ago. That's compared with 19% who feel worse.

Those feeling better may be onto something: According to newly released data from the Federal Reserve, a smaller share of banks are tightening their lending standards across credit cards, auto loans and other loan types.

In another sign of potential optimism, 33% of Americans who were denied a personal loan in the past 12 months plan on taking one out in the next 12 months, and 24% of Americans denied a credit card during the past 12 months plan on taking out a new card in the coming year. This intention after a denial could indicate applicants feel better about their chances of approval.

Credit tip: While at least some of the decision to approve credit rests with a bank’s willingness to loan, much of it lies with your creditworthiness. You can help ensure your application has a better chance of success by practicing good credit hygiene. Making debt payments on time, using as little of your credit limit as possible and being thoughtful about how often you apply for credit can help strengthen your credit application.

This survey was conducted online within the United States by The Harris Poll on behalf of NerdWallet from April 2-4, 2024, among 2,061 U.S. adults ages 18 and older. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within +/- 2.5 percentage points using a 95% confidence level. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact [email protected] .

NerdWallet disclaims, expressly and impliedly, all warranties of any kind, including those of merchantability and fitness for a particular purpose or whether the article’s information is accurate, reliable or free of errors. Use or reliance on this information is at your own risk, and its completeness and accuracy are not guaranteed. The contents in this article should not be relied upon or associated with the future performance of NerdWallet or any of its affiliates or subsidiaries. Statements that are not historical facts are forward-looking statements that involve risks and uncertainties as indicated by words such as “believes,” “expects,” “estimates,” “may,” “will,” “should” or “anticipates” or similar expressions. These forward-looking statements may materially differ from NerdWallet’s presentation of information to analysts and its actual operational and financial results.

On a similar note...

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

This site aims to serve as a helpful guide for our users to learn and compare different buying options. We are part of an affiliate sales network and may receive a commission by clicking on the offers below at no cost to you. This compensation may impact how and where links appear on this site. MoneyRanger.com does not include all financial companies or all available financial offers.

10 Best NerdWallet Alternatives in 2024

Last Updated on: Feb 11, 2024

NerdWallet has quickly leapt into the top echelon of personal finance websites in the United States. Launched in 2009 by founder and CEO Tim Chen, the site has become a juggernaut in the very competitive personal finance space, surpassing older and more established players like BankRate. According to Inc. Magazine, the company is worth a staggering $500 million , and that number is probably off by today’s frothy valuation standards. Not too shabby for a blog that got its start in the midst of the 2009 recession with $800 in initial capital. That kind of success is sure to attract a myriad of competitors, which begs us to ask the question: Who are the top NerdWallet competitors? In this article, we review the 10 best alternatives to NerdWallet in 2024.

What We'll Cover

The 10 Best NerdWallet Alternatives and Competitors

Who owns bankrate.com, the balance, who owns thebalance.com, who owns smartasset.com, the points guy, who owns thepointsguy.com , valuepenguin, who owns valuepenguin.com, the penny hoarder, who owns thepennyhoarder.com, who owns wallethub.com, money under 30, who owns moneyunder30.com, who owns everquote.com, surfky finance, final thoughts.

Below, we’ve reviewed 10 personal finance websites that are alternatives to NerdWallet. These sites are all reputable sources of information that help consumers make more informed decisions about their money. They provide articles with important information, interviews with industry leaders, free financial tools, workshops and how-to guides on different topics ranging from insurance to mortgages.

Headquartered in Palm Beach Gardens, Florida, Bankrate is one of Nerdwallet’s most powerful competitors. Originally founded as a print publication in 1976, it wasn’t until 20 years later that the company launched its website bankrate.com in 1996. Bankrate’s vision of helping you “Maximize Your Money” has led them to provide a plethora of helpful financial information and tools for readers, including more than 200 personal finance calculators. Bankrate’s content gives readers a comprehensive overview of important financial topics, including home equity loans, mortgages, banking, and personal loans. The company has been a prime target for private equity investors and has gone public, and subsequently been taken private, twice. Today, the company employs more than 500 people and is being led by its current CEO Scott Kim.

Red Ventures, an American media holding company, owns Bankrate, which it acquired in 2017 for $1.24 billion. Bankrate was founded in 1976 by Robert Heady.

Sources: SimilarWeb, Bankrate, Wikipedia

The Balance was founded in 2016 and specializes in broader topics affecting the U.S. economy, as well as more personal finance topics, such as banking, loans, and credit cards. Much of The Balance’s content came from the now defunct About.com, and it eventually became a standalone publication in 2016. Based in New York City, The Balance has a team of more than 50 financial experts that write content to help consumers with all of their financial endeavors. According to SimilarWeb, The Balance receives an average of 13.51 million visits a month. Readers can access over 9,000 articles, including over 2,000 financial product reviews. In addition to The Balance, consumers can also visit The Balance Careers and The Balance Small Business for more specialized content. The Vice President and General Manager of The Balance is Lauren Silbert.

The Balance is part of the IAC-owned company Dotdash. Investopedia, Lifewire, ThoughtCo, and TripSavvy are also part of the Dotdash publishing family. According to TechCrunch, Dotdash increased its revenue by 44% in 2019 to $131 million. The current CEO of Dotdash is Neil Vogel.

Sources: SimilarWeb, Investopedia, The Balance

Headquartered in New York City, SmartAsset is one of the newer alternatives to NerdWallet. The site specializes in helping people find financial advisors, retirement information, and investing. SmartAsset self-identifies as a “financial technology company” that provides users free tools to help them make sound financial decisions. The company is heavily backed by venture money with a total 19 investors according to their Crunchbase profile. SmartAsset has most notably received attention for its successful fundraising. In 2018, SmartAsset raised $28 million in a Series C funding round. It has raised a total of $51.4 million in six funding rounds. SmartAsset tends to focus more on the investment side of things, helping its readers find a financial advisor and selling the RIA leads to financial institutions. According to SimilarWeb, SmartAsset has an average of 11.31 million monthly visits, which puts it in fifth place on SimilarWeb’s list of financial planning and management websites. Like two other sites on this list (EverQuote and ThePennyHoarder) SmartAsset uses native ads advertorials to promote their brand. Trying to take a page from the EverQuote playbook they sometimes try to create controversial ads to increase engagement on their creatives. One ad in particular that I personally saw involved a picture of two of their employees with the company's logo on the background and the letters E and T seemed to have been cut on purpose from their name SmartAsset. I couldn't make this stuff up. It was a Taboola native advertorial.

SmartAsset was founded in 2012 by Michael Carvin and Philip Camilleri. The current CEO is Michael Carvin.

Sources: SimilarWeb, Business Wire

Brian Kelley started The Points Guy because of his expertise on maximizing credit card rewards and airline miles to travel. Because of this, The Points Guy is different from other NerdWallet competitors. The Points Guy focuses its content on how you can optimize credit card and airline rewards to travel cost-effectively. For example, users can read about the best airline credit cards, recent travel deals, a beginner’s guide to points and miles, and more. Additionally, The Points Guy is also a great resource for reviews on flights, hotels, travel gear, and more. According to Entrepreneur, Capital One is one of The Points Guy’s major partners. SimilarWeb reports that The Points Guy receives an average of 7.65 million monthly visits, making it no. 11 on SimilarWeb’s list of top travel and tourism websites.

From 2010 to 2012, founder Brian Kelley owned ThePointsGuy.com. In 2012, Brian Kelley sold majority ownership to Bankrate for an undisclosed amount of money. Subsequently, Red Ventures acquired Bankrate.

Sources: SimilarWeb, The New York Times

Now 8 years old, ValuePenguin is an alternative to NerdWallet that focuses on presenting valuable data and comparison tools so that consumers can make smart financial choices. On ValuePenguin, consumers have the option to compare various types of insurance and credit cards. According to ValuePenguin, the website reached a total of 16 million users in 2018. A lot of the personal finance sites on our list are private and don't reveal their internal numbers. However, in 2019 ValuePenguin was acquired by publicly traded LendingTree (Nasdaq:TREE). LendingTree revealed that in for the first nine months of 2018, ValuePenguin had $12.5 million dollars in revenue and $9 million en EBITDA. Pretty impressive margins !

In 2013, three veteran financial analysts—Jon Wu, Ting Pen, and Brian Quinn—started ValuePenguin to equip readers with valuable research and data. In 2019, LendingTree acquired ValuePenguin for $105 million.

Sources: SimilarWeb, Lending, Tree, Inc.

Kyle Taylor founded The Penny Hoarder in 2010 in St. Petersburg, Florida. According to The Collegiate Entrepreneurs’ Organization, Taylor started The Penny Hoarder to discuss how he was effectively managing money while paying off $50,000 worth of student loans and credit card debt.The Penny Hoarder offers coverage of an expansive selection of financial topics, including home buying and credit scores, but it’s primary focus tends to be on making and saving money. Readers can also learn from The Penny Hoarder Academy, which offers guides and tips on common financial topics like budgeting, credit cards, and job hunting. ThePennyHoarder employs a traffic strategy that is similar to that of companies; such as EverQuote, which is namely, blasting the entire web with sensationalist native ads. The strategy seems to be working as the website has 17 million readers, 6.9 million Facebook fans, and 1.2 million email subscribers.

In 2021, Sykes Enterprises acquired The Penny Hoarder for $102.5 million.

Sources: SimilarWeb, Tampa Bay Times

In 2012, founder and CEO Odysseas Papadimitriou launched WalletHub, a Washington, D.C.-based personal finance website that helps consumers improve their “WalletFitness” with helpful tools about credit and money management. Before WalletHub, Papadimitriou previously started CardHub, which offered credit card comparison tools. In 2016, those tools were integrated into WalletHub. Today, one of WalletHub’s main objectives is to provide consumers with personalized and data-backed tips on how they can improve their credit. Additionally, Wallethub strives to improve people’s financial literacy. According to SimilarWeb, WalletHub receives an average of 6.11 million users a month.

WalletHub is owned by Evolution Finance, Inc.

Sources: SimilarWeb, Wallethub

An independent site, Money Under 30 directs its personal finance advice specifically toward young adults. In addition to producing informative articles, Money Under 30 also allows readers to use free personal finance tools, including a monthly budget spreadsheet and a home affordability calculator. One feature that makes Money Under 30 stand out from other NerdWallet competitors is its podcast series. Money Under 30’s podcast series, MU30-In-Person, regularly features some of the financial industry’s biggest names and experts. These conversations give listeners an insightful look into the minds of industry leaders. Some of the most recent guests include the CEO of Gabi, Hanno Fichtner, and the Chief Insurance Officer of Bestow, Jackie Morales.

In 2006, David Weliver founded Money Under 30. According to Money Under 30, Weliver began the website after successfully paying off $80,000 worth of debt over the course of three years.

Sources: SimilarWeb, Money Under 30

You've probably seen their ads everywhere on display and native platforms. For those of you who sometimes can't tell the difference between advertorials and real articles; you've probably clicked on one of their ads curious to read about how two young asian geniuses are disrupting the insurance industry . Funny, misleading, or not; EverQuote has found a way to serve more than 5,000 insurance companies and agencies and build a base of 5 million monthly active users. They focus on providing insurance comparison services and some editorial content for their audience. The company is based in Cambridge, MA and it's publicly traded on the Nasdaq (Nasdaq:EVER). EverQuote is growing very rapidly. They reported revenues of $126 million in 2017, $163 million in 2018, and $248 million in 2019. For 2020 They expect to do over $300 million in revenue. So those two asian geniuses are doing something right afterall.

EverQuote is a public company with a market capitalization of $1.1 Billion. It was founded by Seth Birnbaum and Tomas Revesz

Sources: SimilarWeb, Money Crashers

Just as TV contributors can’t go on TV without plugging their own book, we couldn’t write an article about the best NerdWallet alternatives without talking about our own site. Part of the Bidwise Media family, Surfky.com reports on personal finance topics like insurance , credit cards, mortgages , and small businesses. The site sole focus isn't finance though. Surfky Magazine covers various areas that appeal to all consumers, including lifestyle, and education . We're not like SmartAss et , or any of the companies above for that matter, we have our own identity and are thrilled to bring a unique perspective to the industry.

Financial management sites are a quick and easy way to find the answers to your biggest financial questions, and NerdWallet is one of the most prominent resources. NerdWallet has set a pretty high bar as the ultimate insurtech giant and a resource for guiding their audience through the challenges of personal finance. To learn from experts and gain insightful information that will shape your financial future, check out one of these 10 NerdWallet alternatives.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

Comments 0 comments

Related Posts

CNBC Pro Benefits Explained vs Motley Fool: 9 Things to Know

How Online Accountants Facilitate Seamless Money Management

How to Dissolve an LLC: Online & In-Person Step-by-Step

](https://www.moneyranger.com/assets/images/1f8287f7b8db5a23d09ee1d0fa27b6d8.png)

Top Places to Buy Business Checks Online [Best & Cheapest](2023)

Disclaimer : The information used and statements of fact made are not guarantees, warranties or representations as to their completeness or accuracy. Use or reliance on this information is at your own risk and does not constitute information associated with the present or future performance of NerdWallet or any of its affiliates or subsidiaries. NerdWallet disclaims, expressly and impliedly, all warranties of any kind, including those of merchantability and fitness for a particular purpose or whether the information is accurate or reliable or free of errors. Statements that are not historical facts are forward-looking statements that involve risks and uncertainties as indicated by words such as “believes,” “expects,” “estimates,” “may,” “will,” “should” or “anticipates” or similar expressions. These forward-looking statements may materially differ from NerdWallet’s presentation of information to analysts and its actual operational and financial results.

Lauren Nash [email protected]

Release Summary

How to use credit cards to save money on gas

- Published: Jun. 02, 2024, 11:22 a.m.

- NerdWallet | special to cleveland.com

If you’re paying full price at the gas pump these days, you might be missing a way to fuel your household savings. That’s because many rewards credit cards offer bonus points when you use them at the gas station.

Used right, those rewards are like a discount on every gallon you buy. Few consumers would turn down these savings when the average price of a gallon of gas as of May 2024 was $3.61, according to AAA.

It’s fairly common now to get triple points — 3 points per dollar spent — for using a rewards card to pay for gas. Notably, some of the best cards for fill ups don’t feature the names of big oil companies or their service station brands. Instead, you’ll likely save the most with general rewards credit cards or cards associated with warehouse clubs and credit unions.

As you shop around for a card that will shrink your gas budget, keep these tips in mind.

Use 3% as a benchmark

The most lucrative cards for gas offer the equivalent of 3% or more in rewards. Better still, many cards with high rewards rates don’t charge an annual fee, so you’ll pay nothing to earn rewards that can be redeemed for cash back, gift cards, travel and more.

Credit score matters

More often than not, rewards rates of 3x and above are found in cards that require at least good credit , or a FICO score of at least 670, to qualify. If you have a low credit score, expect your credit card options to be limited. Nonetheless, there are a few cards for people with bad, limited or no credit that earn rewards, albeit modest ones.

Mind the caps

Some cards — especially those with 5% rates and no annual fee — limit how much gas spending will earn bonus rewards. For example, you might get 4% on gas purchases up to $7,000 in annual spending. After hitting the cap, gas purchases earn just 1% until the new year. Before applying for a card for gas purchases, check the rewards cap, if any, and decide if it’s generous enough to accommodate your spending.

Beware of ‘cents off’ rewards

Instead of a percentage of cash back or points per dollar spent, some cards — especially gas station-branded cards — give you a specific discount, such as 6 cents off per gallon. But when gas costs $3 per gallon, that 6 cents off is a mundane 2% discount. Plus, gas station cards typically earn rewards that can only be spent at that particular merchant.

Rewards at the gas station vs. pump

Many cards that offer outsized rewards on gas spending also reward purchases inside the service station such as snacks and wiper fluid. But some cards limit rewards to gas spending paid at the pump, and some gas cards earn elevated rewards only on in-store purchases, not fill ups.

Rewards credit cards have terms and conditions that govern their rewards programs; read through them to see what purchases earn rewards and if that list aligns with your expectations.

Warehouse cards have pros and cons

Warehouse clubs like Sam’s and Costco can be great places to get cheaper gas, savings that are compounded when combined with the stores’ co-branded credit cards that offer high rewards rates on gas. However, these same cards only earn those desirable cash-back rates up to a certain annual cap, and the reward redemption process can be cumbersome.

Remember, too, that you must be a member of those warehouse clubs, which means paying an annual membership fee.

Stack rewards with card-linked offers

Many rewards cards offer digital coupons in the form of card-linked offers through the issuer’s app. You “clip” the coupon by adding it to your card, and once you make a qualifying purchase, you’ll receive your savings, often in the form of a statement credit. It’s common to find card-linked offers for gas purchases, so before your next fill up, skim through your card’s digital coupon list for a station near you. You’ll save with the card-linked offer and earn rewards from that fresh tank, if your card earns rewards on gas.

Look beyond gas rewards

As you shop for a good gas credit card, consider whether the card offers rewards in other categories that align with your spending habits. That way, your gas credit card card transforms into an everyday card that you can use to pay for things like groceries, take out and streaming.

Plus, you might not spend as much on gas as you think. In 2023, U.S. households spent an average of $2,635 per year on gasoline, according to the Bureau of Labor Statistics. Even with a 3% rewards card, that’s $79.05 cash back per year, or about $6.50 per month.

More From NerdWallet

- At Risk of Missing a Credit Card Payment? Act Now to Lessen Impact

- Your 2024 Credit Card Checklist for Summer Travel

- Here’s How Active Military Can Snag Special Credit Card Benefits

Gregory Karp writes for NerdWallet. Email: [email protected] . Twitter: @spendingsmart.

Jae Bratton writes for NerdWallet. Email: [email protected] .

The article How to Use Credit Cards to Save Money on Gas originally appeared on NerdWallet.

If you purchase a product or register for an account through a link on our site, we may receive compensation. By using this site, you consent to our User Agreement and agree that your clicks, interactions, and personal information may be collected, recorded, and/or stored by us and social media and other third-party partners in accordance with our Privacy Policy.

Watch CBS News

Here's why summer travel vacations will cost more this year

By Megan Cerullo

Edited By Anne Marie Lee

Updated on: May 23, 2024 / 8:08 PM EDT / CBS News

Summer vacations, a big-ticket purchase for most Americans, will be even costlier this year despite airfares, rental car costs and other travel-related expenses dropping. The reason? Elevated prices on things like checked bags , restaurants and recreational experiences.

While hotel prices are down 4%, airfares down 6% and rental car costs have dipped 10%, according to a NerdWallet survey, vacationing this summer will cost 15% more than it did before the pandemic. That's because airline extras like seat selection fees, as well as dining out and entertainment costs, are making a bigger dent on Americans' wallets.

"Inflation is no joke. Americans are feeling the impact," said CBS News senior transportation correspondent Kris Van Cleave. "What they're going to find when that bill comes, it's going to look a lot like it did last year, but there are some real pain points," he added.

One of those pain points is airline baggage fees . "That could be $5 and then multiply that times two for your roundtrip, multiply that by four for your family of four, and you're seeing that the cost of travel does feel like it's going up even if individual prices are going down," Sally French, who tracks vacation inflation for NerdWallet, told CBS News.

Vacation activity costs, such as visiting amusement parks or other sites, have risen 3.4% since 2019, according to NerdWallet.

As far as eating out goes, restaurant dining is up nearly 30% compared with 2019. That could amount to a significant expense for vacationers, many of whom don't include food in their budget. "A lot of people won't budget restaurant prices when they're making that initial vacation plan," French said. "They're budgeting out the price of their hotel and airfare."

Indeed airfares can appear artificially low when only the base fare is advertised which doesn't take into account the cost of extras like choosing a seat.

Ways to save on summer travel

Despite inflation and concerns about the state of the economy weighing on Americans' psyches and wallets, roughly 70% still say they will take a trip this summer.

Van Cleave offers these tips for consumers looking to cut costs when taking trips.

- It always pays to travel at off-peak times, when airfares tend to be cheaper. Over Memorial Day Weekend , for example, Saturday is a slower travel day compared with Thursday and Friday, which folks look to so they can get a head start on their long weekends.

- Being flexible on where you travel can also help your wallet. Avoiding particularly popular or congested areas can lead to significant savings. "If you just want a beach, you maybe go to a less popular, less in-demand destination," Van Cleave suggests. "You get the sun, you get the sand, you get the surf and maybe you get a smaller bill."

- Lastly, spend your travel rewards and credit card points as you accumulate them, as opposed to stockpiling them for some point in the future, when they may be worth less. "Use them as you get them to cut travel costs. The only guarantee with those points is they become less valuable as time goes on," Van Cleave said.

Megan Cerullo is a New York-based reporter for CBS MoneyWatch covering small business, workplace, health care, consumer spending and personal finance topics. She regularly appears on CBS News 24/7 to discuss her reporting.

More from CBS News

Why you should open a 1-year CD this June

How to get the cheapest student loan for fall 2024

These 4 costs are negotiable when buying a home, experts say

U.S. prices cooled in April, key inflation gauge shows

Money Talk: Is it wise to have all your accounts under one roof?

- Show more sharing options

- Copy Link URL Copied!

Dear Liz: I’m setting up accounts post-divorce, while learning personal finance on the fly. Is it “safe” or advisable to have all of my larger accounts — IRAs, 401(k), cash management — with the same institution, or should I spread them around? I have smaller checking and savings accounts with a good credit union.

Answer: Using a single investment firm is certainly convenient, and most people will be just fine having all their accounts in one place.

The Securities Investor Protection Corp. covers accounts up to $500,000, including up to $250,000 in cash. This insurance protects you if the brokerage fails and your cash or securities go missing.

Customers with multiple accounts often get more coverage. For example, IRAs and Roth IRAs would each get up to $500,000 in coverage, as do individual and joint brokerage accounts. A person with all four types of accounts would have $2 million in coverage. Accounts for corporations, trusts, estate executors and guardians of minors also get separate coverage. For more details, see SIPC’s brochure, “How SIPC Protects You.”

Your 401(k) has its own protections. Assets in 401(k)s are placed into trust accounts, separate from the investment firms that administer the plans and the employers that sponsor them. The money can’t be touched by creditors of either one.

A $100 fee to close a brokerage account? Really?

Dear Liz: My brokerage recently sent an updated fee list. They now are charging $100 to close an account. That seems an incredibly high fee should I choose to move my investments somewhere else. The fine print says the fee will not apply to anyone who holds at least $5 million in qualifying assets. Well that certainly isn’t me. So they’re hitting those who have the least with a ridiculously high fee when it comes time to end the account. Is this typical across the investment industry?

Answer: Unfortunately, yes, but the usual fee is closer to $75.

Many brokerages have lowered their fees in recent years, with many eliminating commissions. But the account closure fee has stuck around, probably because most people don’t think about the costs of shutting down an account after they’ve opened one.

Caught between Social Security’s two retirement ages

Dear Liz: I’ve received multiple conflicting answers from Social Security and hope you can clarify. My husband waited to collect until he was 70 and unfortunately passed away soon afterward. I am 66 and was instructed to apply for survivor benefits because I would be eligible to collect his enhanced benefit at age 66 plus two months. I received an “approval of application” letter in January 2024 and was expecting payment on March 20, but nothing! I went on the SSA.gov website and saw my status was “ineligible due to being employed or still working.” I’m an independent human resources consultant. I finally got through to Social Security on the phone and was told I wouldn’t be able to collect his benefits (which would be higher than mine due to his age and earnings) until I was at full retirement age, 66 plus six months. Is this true?

Answer: Yes. You just got squeezed between two different types of full retirement age.