Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

Great deal: Buy travel insurance, get free Accor Plus Explorer membership, bonus MR points or miles

Buy an AMEX My Travel Insurance plan and enjoy an Accor Plus Explorer membership, Samsonite bag or eCapitaVouchers, plus extra referral awards.

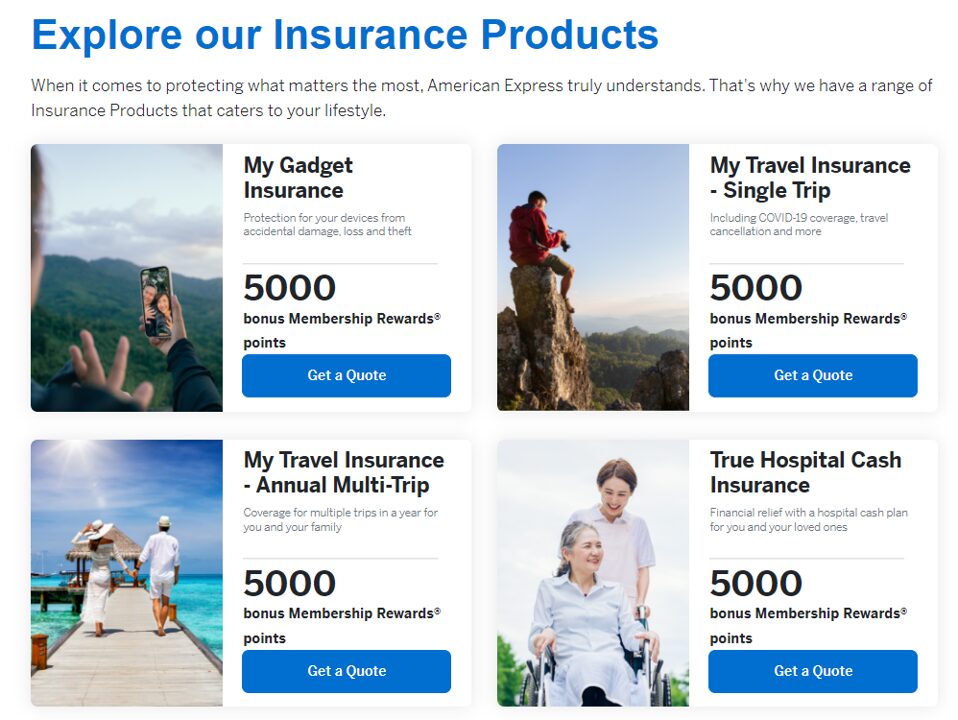

If you’re in the market for a travel insurance plan, American Express has launched an offer for its My Travel Insurance plan that’s well worth considering.

From now till 30 June 2024, customers can enjoy an Accor Plus Explorer membership (which comes with up to 50% off dining and one free hotel night) or a Samsonite luggage & S$50 eCapitaVoucher when they purchase an annual policy, or S$30-50 eCapitaVouchers for a single-trip policy.

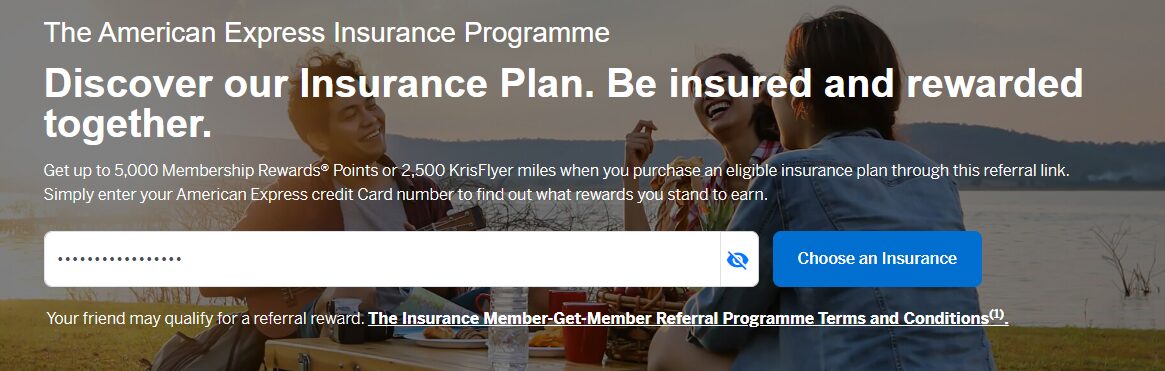

You can also enjoy an extra 5,000 MR points , 2,500 KrisFlyer miles o r S$15 eCapitaVoucher when you make the purchase via my referral link, on top of the public gifts.

AMEX My Travel Insurance offer

From 2 April to 30 June 2024 , customers who purchase a My Travel Insurance policy can enjoy the following gifts:

You’ll receive one gift per plan purchased , so for example, someone who buys 2x single-trip Superior plans will get 2x S$50 eCV.

On top of this, American Express cardholders who purchase their plans (whether single-trip or annual) via my referral link will enjoy extra gifts.

For applications till 17 April 2024

5,000 MR points are worth 3,125 KrisFlyer miles (2,777 KrisFlyer miles if you have the Platinum Reserve or Credit Card), and you can convert them to hotel or other airline points if you wish, so I’d recommend going for that offer if you have one of the Platinum cards.

For applications from 18 April 2024

All applicants will receive a S$15 eCapitaVoucher as a referral bonus, regardless of which AMEX card they hold.

Which plan to buy?

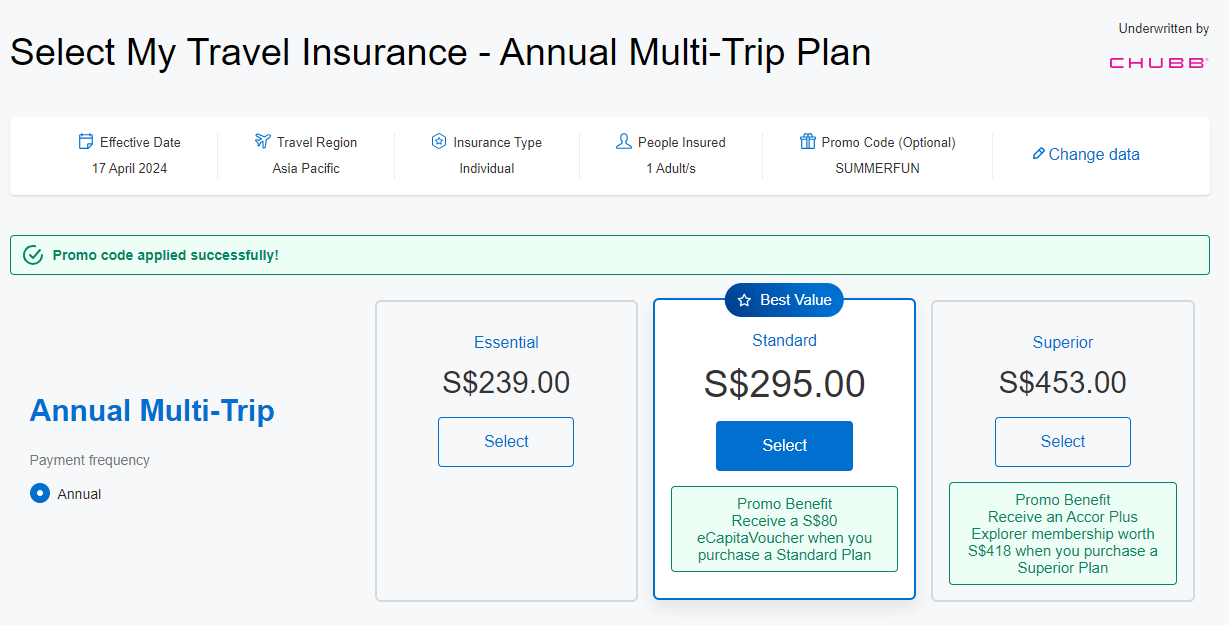

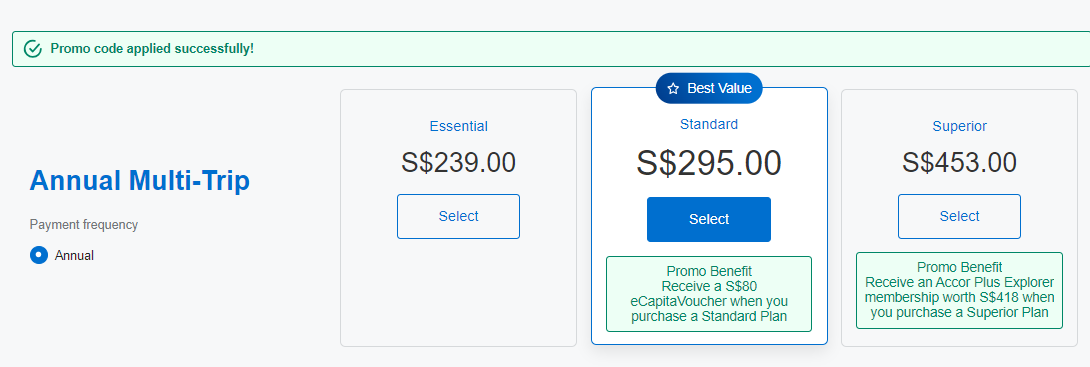

If you ask me, the sweet spot here is the Accor Plus Explorer membership offered for APAC plans. Here’s a quote for an annual Asia Pacific plan for one adult, which costs S$453.

The Accor Plus membership retails for S$418 (though there’s several sales a year where you can buy it for slightly less), so it’s like topping up a little to enjoy an annual travel insurance plan too.

The My Travel Insurance Superior plan offers up to S$500,000 coverage for accidental death and permanent disablement, up to S$2 million for overseas medical expenses or personal liability, S$20,000 for travel cancellation or curtailment, S$1,000 of rental car excess, as well as COVID-19 protection.

Miles chasers will be pleased to know that the plan also offers up to S$20,000 coverage for the loss of frequent flyer points, in the event your inability to travel leads to them being forfeited (e.g. if you book a KrisFlyer Spontaneous Escapes award, which cannot be refunded, or if you’ve booked a hotel with points and are inside the cancellation window).

Terms & Conditions

Below you’ll find links to the factsheet, policy wording, FAQs and T&Cs for this offer.

- My Travel Insurance Factsheet

- My Travel Insurance Policy Wording

- My Travel Insurance FAQs

- My Travel Insurance Promotion

The Accor Plus membership, Samsonite luggage and eCapitaVouchers will be fulfilled within eight weeks of purchasing the plan.

The bonus MR points, KrisFlyer miles or eCapitaVouchers from the MGM programme will take up to 12 weeks for fulfillment.

How to purchase a plan

When you click on my referral link, you’ll be prompted to enter your AMEX card number. This will confirm which reward you qualify for.

After that, you’ll be able to select the plan you wish to purchase- My Travel Insurance Annual Multi Trip in this case. Click on that and proceed as per usual.

The promo code field will be automatically populated with SUMMERFUN , and you’ll see that the regular gifts still apply, just as if you were going via the public website.

Do you earn miles or points on your purchase?

While American Express no longer awards points for insurance payments in general, there’s an exception carved out for “payments made for insurance products purchased through American Express authorised channel”.

My assumption would be that My Travel Insurance purchases qualify, and if that’s the case you’ll be able to earn your usual general spending rate, on top of the 5,000 MR points or 2,500 KrisFlyer miles bonus for referrals.

What’s the benefits of Accor Plus?

Accor Plus is a dining and lifestyle membership that offers members discounts on hotel stays and restaurants across Asia Pacific.

Standard Accor Plus benefits include:

- 10% off best available public rate

- Up to 50% off member exclusive room rates with with Red Hot Room offers

- 25% off dining: 1 member only

- 50% off dining: 1 member and 1 guest

- 33% off dining: 1 member and 2 guests

- 25% off dining: 1 member and 3 guests

- 15% off drinks bill in Asia

- Member exclusive More Escapes stay packages

- Early access to global Accor hotel sales

- Members’ exclusive experiences

- 20 status nights each year

Some examples of participating Accor Plus restaurants in Singapore include Prego, Mikuni and Asian Market Café at the Fairmont, SKAI, The Stamford Brasserie, CLOVE, at Swissotel and The Cliff and Kwee Zeen at the Sofitel Sentosa Resort.

Don’t forget that your dining benefits apply overseas too- even on breakfast. You’ll often find that it makes more sense to book a non-breakfast rate and then purchase breakfast at 50% off at the hotel itself.

Stay Plus certificates are offered to Explorer (1 certificate) and Explorer Plus (2 certificates) members Each Stay Plus certificate can be used for a one-night stay at participating hotels across Asia Pacific. Obviously, you’ll want to save this for a high-end chain like Sofitel or Mondrian, and steer clear of the cheaper ones.

Do note that Stay Plus nights are subject to blackout dates, and you may not always be able to get the hotel you want.

I’ve written a comprehensive guide to using your Stay Plus benefit, which can be found below.

How does the Accor Stay Plus free hotel night benefit work?

American Express is now offering an Accor Plus membership, Samsonite luggage or eCapitaVouchers to customers who purchase a My Travel Insurance plan, with the best gifts reserved for annual policies.

On top of this, you can enjoy 5,000 bonus MR points, 2,500 KrisFlyer miles or a S$15 eCapitaVoucher if you’re an AMEX cardholder.

With both COVID-19 and loss of miles and points covered under this policy, it’s a deal well worth considering if you’re in the market for an annual travel insurance plan.

- american express

- travel insurance

Similar Articles

Ocbc rewards card offering 12 mpd at watsons, krisflyer uob credit card extends 25,000 miles sign-up offer, 20 comments.

What happens if i already have another Accor plus membership from Vantage?

Give it to a family member. By right you can only have one membership at a time

Does this apply to payment with HighFlyer card?

you can buy with highflyer if you want, but there’s no referral bonus in that case. just the accor plus/luggage.

If spouse and I buy Worldwide annual plan, can 1 person take Accor gift, 1 person take something else? Meaningless to have 2 Accor membership in the household

Can use Amex True Cashback card to buy and get KF points?

A very honest friend who did got it from Chubb found it difficult to make a claim. When there is such nice embellishments, I wonder what is covered and not covered in the fine print. Sheep hair only grow on a sheep. Will give it a miss.

Claim what?

It was for an overseas accident with all the medical certificates and the cost was maybe USD 75. After many questions and rounds, they refused to pay. We have better experiences with AIA, AIG and Income. No questions just pay for a small amount. The impression we got was that they are just making it difficult. As what I said before, if they have a lot of goodies…I will be more careful with the fine print. The key to me is still the coverage and support to choose the insurer.

This is a good point. Some travel insurers make your life hell when you want to make a genuine claim. So far, I am good experience for FWD as well as Aviva (for injury and visiting TCM) claims.

seems apply single trip also make sense, you can get 50$ ecapita voucher. Is this only valid for one time or i can apply multiple times (have multiple trips this year)

you receive one gift per policy purchased

For Sup card members, will they also get the gift and free miles?

Aka the main card buy 1 policy and the sup card buy another policy?

would like to know this as well!

My Chubb experience:

A Jetstar flight of mine was 10 hours late, the airline provided a letter saying it was “late for operational reasons”, I went ahead and claimed.

Chubb: “Please provide the actual reason, we cannot accept operational reasons”

Jetstar: “Nope, that’s the best we can do”

Is there any point to this if you already get travel insurance with the Amex Charge card?

Has anyone received the complimentary Accor Plus yet?

Is Amex True Cashback card excluded from this promotion? I tried using the referral link but got this message “Unfortunately your Card is not eligible for an insurance referral”

not eligible. you will need an MR points or KrisFlyer miles earning card to enjoy the referral bonus

Noted, thanks for the clarification

CREDIT CARD SIGN UP BONUSES

Featured Deals

© Copyright 2024 The Milelion All Rights Reserved | Web Design by Enchant.sg

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Gold Card

Full List of Travel Insurance Benefits for the Amex Gold Card [2024]

Christine Krzyszton

Senior Finance Contributor

316 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Jessica Merritt

Editor & Content Contributor

101 Published Articles 523 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Senior Editor & Content Contributor

120 Published Articles 726 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

![amex travel insurance promotion Full List of Travel Insurance Benefits for the Amex Gold Card [2024]](https://upgradedpoints.com/wp-content/uploads/2022/09/Amex-Gold-Upgraded-Points-LLC-19-Large.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Amex gold card — snapshot, amex gold card — travel insurance benefits, travel benefits, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The American Express ® Gold Card is known for being a go-to card for everyday purchases at restaurants and at U.S. supermarkets. The card also doubles as a travel rewards card offering elevated earnings on select flight purchases and a nice selection of flexible travel redemption options.

The card is far less known for its travel insurance benefits. Today, we’re turning the spotlight on some of the useful travel insurance benefits that come with the card and talking about how these benefits can add value to the cardholder.

First, let’s look at the overall earning and redemption features of the Amex Gold card, then jump right into the list of travel insurance benefits you can expect to find on the card.

This is the best card for food lovers who dine out at restaurants (worldwide), order take-out and want big rewards at U.S. supermarkets!

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

The American Express ® Gold Card is a game-changer.

With this card, you can earn 4x Membership Rewards points at restaurants and you’ll also earn 4x Membership Rewards points at U.S. supermarkets on up to $25,000 per calendar year in purchases, then 1x.

There isn’t another card on the market that offers a 1-2 punch like this. Of course, there are several other benefits of the Gold Card as well, including extra monthly dining rewards and more.

- 4x points per dollar at restaurants, plus takeout and delivery in the U.S.

- 4x points per dollar at U.S. supermarkets, up to $25,000 per calendar year in purchases; and 1x thereafter

- 3x points per dollar on flights purchased directly from airlines or at AmexTravel.com

- $250 annual fee (see rates and fees )

- No lounge access

- Earn 60,000 Membership Rewards ® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards ® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards ® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards ® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express ® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

Hot Tip: Check to see if you’re eligible for a welcome bonus offer of up to 90,000 points with the Amex Gold card. The current public offer is 60,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

Why We Like the Card Overall

We like that you can jumpstart your earnings with a generous welcome bonus after meeting minimum spending requirements in the first 6 months after card approval.

The Amex Gold card also strikes a nice balance between functioning as an everyday spending card and offering accelerated earnings on flights. It also offers flexible travel redemption options.

You’ll earn 4x Membership Rewards points at restaurants worldwide and at U.S. supermarkets (on up to $25,000 in purchases each year). Plus, you’ll receive 3x earnings on flights purchased directly with the airline and via AmexTravel.com .

With monthly statement credits for select purchases, it’s easy to find enough value to offset the annual fee.

When it’s time to use your rewards, you’ll have options such as redeeming points for flights via AmexTravel.com or transferring your points to the American Express transfer partners for even more potential value.

While the Amex Gold card doesn’t come with a long list of comprehensive travel benefits, you’ll find these core travel insurance benefits useful for saving money and for access to assistance should something go wrong during your journey.

Car Rental Loss and Damage Insurance

Having car rental insurance can save you money and provide a level of peace of mind when renting a vehicle . The Amex Gold card comes with secondary car rental insurance that would require you to first file a claim with any other applicable insurance before card coverage kicks in.

Secondary coverage can still be valuable coverage, but there is another car rental coverage option included on the card that is a much better choice.

Premium Protection

The option to purchase Premium Protection car rental insurance on the Amex Gold card is a game changer.

You’ll pay one low price of $12.25 to $24.95 for the entire period, up to 42 total days, for primary theft and damage coverage. The actual rate will depend on your state of residence and the level of coverage chosen. Note that this is not a per-day rate like the car rental agencies charge.

Just enroll in the coverage via your online card account, then whenever you charge your rental car to your card, you’ll have the coverage automatically. You are not charged prior to renting a car.

There is no deductible. Accidental death/dismemberment coverage is included. Liability coverage, uninsured/under-insured motorist coverage, or disability coverage is not included.

Cardholders and authorized listed drivers are covered.

Applicable coverages for both secondary and Premium Protection include rental car damage, theft, and loss of use.

Coverage is not available when renting vehicles in Australia, Ireland, Israel, Italy, Jamaica, and New Zealand.

There are several additional exclusions, including the theft of an unlocked vehicle, illegal activity, intoxication of the driver, and war. Access the Guide to Benefits for a complete list of exclusions, terms, and conditions.

Filing a Claim

You can file a claim online or call 800-338-1670. You must file the claim within 30 days of the event and submit the required claim form within an additional 15 days. You’ll then have 60 days to submit the required documentation.

Bottom Line: The Amex Gold card comes with secondary car rental insurance with the option to purchase primary Premium Protection for one low rate that covers the entire rental period.

Trip Delay Insurance

To be eligible for trip delay insurance, you must pay for your entire trip with your Amex Gold card, associated rewards, or a combination of the 2. Using airline vouchers, certificates, or discounts, such as those associated with your frequent flyer account, in combination with your card, are also acceptable. Eligible travelers include family members, travel companions, and a spouse or domestic partner.

Trip delay insurance reimburses an eligible traveler for incidental expenses incurred after a 12-hour or greater trip delay. Eligible expenses can include lodging, meals, toiletries, medication, and necessary personal items.

Eligible Losses and Coverage Limits

The following types of losses are eligible covered losses :

- Inclement weather preventing a traveler from beginning a trip or continuing on a trip

- Terrorism or hijacking

- A common carrier’s equipment failure (documented)

- Lost/stolen travel documents, such as passports

You could receive up to $300 per trip with a limit of 2 claims per card, per 12-month period. Coverage is secondary to any other applicable coverage including reimbursement by the airline.

Loss exclusions include prepaid expenses, losses that were known to the public or the traveler prior to the trip, and intentional acts by the covered traveler. Access the card’s Guide to Benefits for more details on loss exclusions under trip delay coverage.

You’ll have 60 days from the date of the loss to file a claim. You can do so by calling 844-933-0648 or the number on the back of your card to be directed to the claims department.

You’ll then have 180 days to submit the required documentation, which can include a statement from the common carrier validating the delay, receipts, your card statement showing the trip charge, and other requested supporting information.

Bottom Line: The Amex Gold card comes with trip delay insurance that provides up to $300 per trip for eligible expenses incurred after a 12-hour or greater delay due to a covered loss.

Baggage Insurance Plan

To be eligible for baggage insurance, pay for your common carrier ticket entirely with your Amex Gold card and/or associated rewards. Trips paid for, in full or in part, with non-American Express rewards such as airline loyalty programs are not eligible.

You, your spouse or domestic partner, children under 23, and certain dependent handicapped children are covered for baggage insurance as long as the trip is paid for in full with your card and/or associated rewards.

Lost, damaged, or stolen baggage is covered, except in the event of war, government confiscation, or acts arising out of customer actions, for the following coverage limits.

High-risk items such as jewelry, gold, silver, platinum, electronics, furs, and sporting equipment, are limited to $250 per item maximum, per trip.

Certain items are not covered under baggage insurance — here is a condensed list of those items:

- Credit cards, cash, securities, or money equivalents (such as money orders or gift cards)

- Travel documents, tickets, passports, or visas

- Plants, animals, or food

- Glasses, contact lenses, hearing aids, prosthetic devices, and prescription or non-prescription drugs

- Property shipped prior to departure

You’ll have 30 days from the date of the loss to file a claim. To file a claim, you can go online or call 800-228-6855 within the U.S. To call from outside of the U.S., call 303-273-6498 collect.

You’ll then have 60 days to submit supporting documentation including a list of items lost, receipts, a statement showing the trip was purchased with the card or associated rewards, and common carrier reports.

Please note that we have abbreviated coverage descriptions and all terms and conditions are not spelled out in their entirety. You’ll want to access the benefits guide for full information.

Bottom Line: You and certain family members are covered for baggage insurance of up to $1,250 per person when traveling with a common carrier. You’ll need to pay for your entire trip with your card or rewards associated with your card for coverage to be valid.

Travel Accident Insurance

Travel accident insurance that comes with the Amex Gold card pays a benefit in the unlikely event of accidental death or dismemberment of the primary card member, additional card member, spouse or domestic partner, or children under the age of 23.

The trip must be paid for with the Amex Gold card and/or associated Membership Rewards points (Pay With Points).

The coverage pays a benefit for death or severe injury suffered as a result of riding in, boarding, exiting from, or being struck by a common carrier.

The benefit paid is based on a table provided and can be up to $100,000.

While not travel insurance specifically, these additional benefits can provide assistance when planning a trip or if an unexpected event should disrupt your trip.

Emergency Travel Assistance

The Amex Global Assist Hotline provides important 24/7 assistance when traveling more than 100 miles from home. Receive help finding medical, legal, and translation referrals as well as assistance securing emergency transportation.

In addition, you could receive help securing a replacement passport or finding missing luggage.

You can reach the Global Assist Hotline at 800-333-2639. Outside the U.S., call 715-343-7977.

Actual services provided by third parties that incur costs are the responsibility of the cardholder.

Services are also not available in areas such as Cuba, Iran, Syria, North Korea, or the Crimea region.

No Foreign Transaction Fees

You’ll want to include the Amex Gold card during your next trip, as the card does not charge foreign transaction fees ( rates & fees ).

Additional Travel Benefits

Receive help planning your trip with Insider Fares via AmexTravel.com, upgrade your flights with points , American Express Travel Insurance , onsite benefits at The Hotel Collection , Amex Offers , and more.

While the Amex Gold card comes with several valuable travel insurance benefits, you would not select the card for this specific reason. The card shines when it comes to earning on select everyday purchases, for purchasing airline tickets, and its flexible travel redemption options. Those should be key reasons for selecting the card.

The fact that there are travel insurance benefits that come complimentary with the card is just one more reason to consider the card.

If having premium travel insurance benefits is a priority for you, you might consider the Chase Sapphire Preferred ® Card , The Platinum Card ® from American Express , the Chase Sapphire Reserve ® , or the Capital One Venture X Rewards Credit Card , all of which offer some of the best travel insurance benefits.

You can read about more credit cards with travel insurance in our article on this specific topic.

For the car rental collision damage coverage benefit of the American Express Gold Card, car rental loss and damage insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car rental loss or damage coverage is offered through American Express Travel Related Services Company, Inc. For the trip delay insurance benefit of the American Express Gold Card, up to $300 per covered trip that is delayed for more than 12 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company. For the baggage insurance plan benefit of the American Express Gold Card, baggage insurance plan coverage can be in effect for eligible persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier (e.g. plane, train, ship, or bus) when the entire fare for a common carrier vehicle ticket for the trip (one-way or round-trip) is charged to an eligible account. Coverage can be provided for up to $1,250 for carry-on baggage and up to $500 for checked baggage, in excess of coverage provided by the common carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. For the global assist hotline benefit of the American Express Gold Card, you can rely on the Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Third-party service costs may be your responsibility. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Card members may be responsible for the costs charged by third-party service providers.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of the American Express ® Gold Card, click here . For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Does the amex gold card have travel insurance benefits.

While the list of travel insurance benefits on the Amex Gold card is not extensive, you will find coverage such as secondary car rental insurance, the option to purchase Premium Protection car rental insurance, trip delay, baggage insurance, a Global Assist Hotline, and travel accident insurance.

Does the Amex Gold card have trip interruption or trip cancellation insurance?

No. The Amex Gold card does not offer trip interruption or trip cancellation insurance. The card does come with trip delay insurance.

Does the Amex Gold card charge foreign transaction fees?

No. You will not be charged foreign transaction fees when using the Amex Gold card for foreign purchases ( rates & fees) .

Does the Amex Gold card cover lost luggage?

Yes, the Amex Gold card can cover lost, stolen, or damaged luggage. The coverage is secondary to any coverage or reimbursement received by the airline or other applicable insurance.

Does the Amex Gold card have good car rental insurance?

The Amex Gold card comes with secondary car rental insurance, which means that you must first file a claim with any other applicable insurance before card coverage kicks in. You will have the option, however, to purchase Premium Protection for one low rate that covers the entire rental period, up to 42 days.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

Discover the exact steps we use to get into 1,400+ airport lounges worldwide, for free (even if you’re flying economy!) .

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![amex travel insurance promotion Amex Gold Card vs. Amex Rose Gold Card [Are They Different?]](https://upgradedpoints.com/wp-content/uploads/2022/08/Amex-Gold-vs-Amex-Rose-Gold-Upgraded-Points-LLC.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

AMEX Travel Insurance Singapore Review: Platinum Card, KrisFlyer Card (2022)

If you’re an American Express credit card user, not only are you a relatively rare breed, but you might also already have used the famous free Amex travel insurance. (Technically, Amex travel insurance is actually Chubb travel insurance.)

So, why is Amex providing travel insurance? Well, these days, you don’t even have to approach an insurance company to buy a plan. You can get it instead from the nearest bank or credit card company. It’s like getting toys from HMV or a bicycle from Carrefour.

Back to AMEX’s travel insurance. It was previously known as American Express My VoyageGuard. That’s quite a mouthful, so it’s a good thing they’ve since decided to adopt a much simpler name—AMEX My Travel Insurance.

Buying travel insurance through your credit card company sounds extremely convenient, but what’s really in that plan, and is it adequate for your needs? Let’s have a look.

- AMEX Travel Insurance: Summary

- AMEX Chubb Travel Insurance Coverage

- AMEX Travel Insurance Covid-19

- AMEX Platinum Travel Insurance

- AMEX KrisFlyer Travel Insurance

- AMEX Travel Insurance: Extreme Sports

- AMEX Travel Insurance Promotion

- AMEX Travel Insurance Claim Review

- Should I buy AMEX Travel Insurance?

1. AMEX Travel Insurance Summary

AMEX My Travel Insurance comes in two iterations:

- AMEX My Travel Insurance Annual Multi-Trip – Gives you coverage for an entire year regardless of the number of trips you make, for up to 90 days per trip.

- AMEX My Travel Insurance Single Trip – Gives you coverage for one single trip of up to 90 days.

Furthermore, each plans has three tiers:

Note that these travel insurance plans are paid. If you are getting the travel insurance for free through your credit card, your insurance plan will come with less benefits than the paid version. We’ll talk about that later.

2. AMEX Chubb Travel Insurance Coverage

Here’s a quick summary of the three tiers of My Travel Insurance that can be purchased through AMEX.

Compared to DBS’s travel insurance (also by Chubb), AMEX’s is relatively generous thanks to its high coverage amounts for medical expenses.

It’s not as generous as Citibank’s in terms of coverage amounts, though. What’s more, while DBS offers coverage for outdoor adventure activities, Citibank does not.

3. AMEX Travel Insurance Covid-19 Coverage

AMEX’s travel insurance automatically includes Covid-19 cover. Here’s a summary of Covid-19 benefits and coverage:

In comparison, DBS’s travel insurance offers Covid-19 coverage but Citibank’s travel insurance does not.

4. AMEX Platinum Travel Insurance

If you book your originating and return trip using the AMEX Platinum Card, you will automatically be covered by free travel insurance, as well as your spouse and dependant children travelling with you.

Here’s what the free plan gets you:

The Platinum Card’s free travel insurance coverage is not too bad compared to DBS’s complimentary travel insurance, which only gives you up to $150 for travel delays and $500 for trip cancellation.

Meanwhile, Citibank’s only gives you $500 for trip cancellation and $40,000 for medical expenses.

5. AMEX KrisFlyer Travel Insurance

The blue AMEX KrisFlyer Credit Card also entitles you to free travel insurance when you charge you return trip to the card.

Here’s what you get:

As you can see, the Platinum Card’s complimentary travel insurance is shockingly bare bones, with coverage extending only to travel inconveniences and personal accident.

There’s no mention of overseas medical expense coverage.

This plan underperforms woefully compared to DBS and Citibank’s complimentary travel insurance.

6. AMEX Travel Insurance: Extreme Sports & Outdoor Adventure

When it comes to AMEX’s paid My Travel Insurance plans, extreme sports are not expressly excluded so long as you are not taking part in training in any speed contest or racing (other than on foot), or any professional competition or sports.

So, don’t try to be clever and enter drag races or something. Other than that, other sporting activities are not excluded, so you should be covered for expenses arising from them.

AMEX’s free travel insurance plans are completely silent on the subject of recreational or leisure activities.

In the absence of any exclusions, that means that you should be receiving coverage for expenses incurred while doing any sporting or leisure activities like scuba diving,

7. AMEX Travel Insurance Promotion

Use the promo code TRAVELNOW and get a discount on your AMEX travel insurance policies purchased online.

American Express Singapore Airlines KrisFlyer Ascend Credit Card

[LUCKY DRAW | Trip.com Coupon Flash Deal] Get S$80 Trip.com Coupon from MoneySmart and earn up to 3 chances to win a 3 Day 2 Night stay at Capella Ubud, Bali (worth up to USD4,000) or a Samsonite Choca Spinner 68/25 Luggage (worth S$700) when you apply, pay the annual fee and spend a min. of S$1,000 within 1 month from card approval ! T&Cs apply . [American Express Welcome Offer | 1 to 23 July 2024] Pay the card's annual fee and spend a min. of S$1,000 within the first month of card approval:

- New American Express cardholder can get S$300 eCapitaVouchers AND up to 17,000 KrisFlyer miles (enough to redeem a Return Trip to Bali*)

- Existing cardholders can get up to 24,000 KrisFlyer Miles . T&Cs apply .

Key Features

1.2 KrisFlyer miles = S$1 for all eligible card spend

2 KrisFlyer miles = S$1 in foreign currency spent overseas in June & December with no cap

2 KrisFlyer miles = S$1 for eligible purchases made on singaporeair.com, SingaporeAir mobile app and KrisShop with no cap

3.2 KrisFlyer miles = S$1 for eligible Grab Singapore transactions, capped at S$200 per month

Complimentary one night stay at particpating Hilton properties and 4 complimentary access each year to any participating SATS Premier Lounge in Singapore and Plaza Premium Lounge around the world.

Receive 5,000 KrisFlyer miles upon first spend on card, applicable for first-time American Express Singapore Airlines Credit Card applicants only

Spend S$15,000 or more on eligible purchases on singaporeair.com within the qualifying period to be rewarded with a Double KrisFlyer Miles Accrual Voucher

Spend S$15,000 or more on eligible purchases on singaporeair.com within first 12 months of Card approval and get an accelerated upgrade to KrisFlyer Elite Gold Membership

Up to S$1 million Travel Inconvenience & Travel Accident Benefits

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

8. AMEX Travel Insurance Claim Review

This is all hearsay on the internet, but there have been some complaints of people getting their travel insurance claims denied because the insurer was very stringent about technicalities. Not saying that will happen to you, but tread with caution

Chubb Travel Insurance Emergency hotline: Call the Chubb Assistance emergency hotline at +65 6836 2922

AMEX Travel Insurance hotline : 6299 0922 (9am to 5pm, Mondays to Fridays)

Online claims: Submit claims and supporting documents online through Chubb’s online portal . Alternatively, download the claims form PDF and email with documents to [email protected] .

AMEX Travel Insurance Claim Settlement Time : You’ll get an acknowledgement within 3 days.

Even though you buy this travel insurance from American Express channels, every aspect of the after-sales support is taken care of by Chubb Insurance.

Chubb has a very good international reputation for its emergency assistance, which is reassuring if your idea of a good time is trying to cheat death.

9. Should I buy AMEX Travel Insurance?

If you have the Amex Platinum Card, you can get okay complimentary travel insurance coverage by booking your trip on the card. However, the blue Amex KrisFlyer Credit Card’s free travel insurance coverage leaves much to be desired, so we would suggest not relying on this plan unless you like living life on the edge.

The paid AMEX My Travel Insurance plans, however, are actually decent and quite reasonably priced compared to competitors like DBS or Citibank.

Still shopping for travel insurance? Compare the best travel insurance in Singapore here.

Related Articles

Travel Insurance Singapore Guide (2024): Must-Knows for Choosing the Best Travel Insurance

Airline Travel Insurance – What does SIA, Scoot, Jetstar travel insurance cover?

Best Travel Insurance Plans in Singapore [content outdated due to Covid]

Best Credit Cards With Complimentary Travel Insurance Coverage (2024)

Several credit cards offer complimentary travel insurance. That is, on the condition that you charge your full flight fares to them. Which of them have the best travel insurance coverage and complement your everyday lifestyle? We analyse it in further detail below.

Citi PremierMiles Card Travel Insurance

Citi PremierMiles Card

[FLASH DEAL | FASTER GIFT FULFILMENT] Get UPSIZED CASH REWARDS of up to S$530* or 5,100 SmartPoints + S$80 Trip.com Coupon , in as fast as 5 weeks from meeting the S$500 spend criteria! T&Cs apply . Use 5,100 SmartPoints to fully redeem a product from our Rewards Store. If the product costs more, redeem with your points and top up the rest by purchasing additional SmartPoints e.g. get an Apple 10.9-inch iPad Wi‑Fi 64GB (10th Generation) at only S$104 on top of your earned SmartPoints.

AMEX Credit Card Travel Insurance

American Express Singapore Airlines KrisFlyer Credit Card

[LUCKY DRAW | Trip.com Coupon Flash Deal] Get S$80 Trip.com Coupon from MoneySmart and stand a chance to win a 3 Day 2 Night stay at Capella Ubud, Bali (worth up to USD4,000) or a Samsonite Choca Spinner 68/25 Luggage (worth S$700) when you apply and spend a min. of S$1,000 within 1 month from card approval ! T&Cs apply . [American Express Welcome Offer | 1 to 23 July 2024] New American Express cardholder can get up to 17,000 KrisFlyer miles (enough to redeem a Return Trip to Bali*)when you spend a min. of S$1,000 within the first month of card approval. T&Cs apply .

American Express Singapore Airlines KrisFlyer Ascend Credit Card

[LUCKY DRAW | Trip.com Coupon Flash Deal] Get S$80 Trip.com Coupon from MoneySmart and earn up to 3 chances to win a 3 Day 2 Night stay at Capella Ubud, Bali (worth up to USD4,000) or a Samsonite Choca Spinner 68/25 Luggage (worth S$700) when you apply, pay the annual fee and spend a min. of S$1,000 within 1 month from card approval ! T&Cs apply . [American Express Welcome Offer | 1 to 23 July 2024] Pay the card's annual fee and spend a min. of S$1,000 within the first month of card approval:

- New American Express cardholder can get S$300 eCapitaVouchers AND up to 17,000 KrisFlyer miles (enough to redeem a Return Trip to Bali*)

- Existing cardholders can get up to 24,000 KrisFlyer Miles . T&Cs apply .

CIMB Visa Signature Travel Insurance

CIMB Visa Signature

CIMB Visa Infinite

Dbs altitude travel insurance.

DBS Altitude Visa Signature Card

AA.png)

DBS Vantage Visa Infinite Card

Uob prvi miles travel insurance.

UOB PRVI VISA Miles Card

[LUCKY DRAW] Stand a chance to win 54,000 Air Miles (worth a Round-Trip to Tokyo for 1) OR an Apple 11-inch iPad Pro WiFi, 256GB (worth S$1,499) OR an Apple Watch Series 9 GPS, 41mm (worth S$604.50) when you apply and meet the relevant spend criteria. T&Cs apply . PLUS g et up to 50,000 miles from UOB when you spend a min. of S$1,000 on your new UOB PRVI credit card for 2 consecutive months from your card approval date, payable first-year annual fee and SMS registration required. T&Cs apply .

UOB PRVI MASTERCARD Miles Card

UOB PRVI Miles American Express Card

Dcs cashback card travel insurance.

.jpeg)

DCS CASHBACK Card

Ocbc 365 travel insurance.

OCBC 365 Credit Card

[LUCKY DRAW] Stand a chance to win A Pair of Cat 1 Tickets to Jay Chou Carnival World Tour 2024 - Singapore (worth S$796) when you apply & submit the MoneySmart Claim Form (without the Unique Redemption Code first*) by 4 Sept 2024 ! No min spend required! [MONEYSMART EXCLUSIVE GIFT] Earn 1,890 SmartPoints or S$200 Cash via PayNow when you apply and spend a min. of S$500 in qualifying spends within 30 days from card approval date. T&Cs apply . Use 1,890 SmartPoints to fully redeem a product from our Rewards Store. If the product costs more, redeem with your points and top up the rest by purchasing additional SmartPoints e.g. get an Apple 10.2 inch iPad Wi-Fi (9th Generation) 64GB at only S$315 on top of your earned SmartPoints.

Exclusive: Most Popular Credit Cards in Singapore

MoneySmart has helped over 3 million users find the best credit cards in the market. Curious to know what people searched for? Find out in this members-only report and get insights on which card you can apply for next! Plus, try out our personality quiz to find which card matches your taste!

Frequent Asked Questions

Do you get travel insurance with your credit card, does travel insurance cover me if i cancel my flight, does my credit card's complimentary travel insurance cover discounted flights, related links.

Best Credit Cards for Grab Rides in Singapore

Best Credit Cards with 1-for-1 Buffet Promotions in Singapore

Best Credit Cards for Overseas Spending

What’s covered by credit card travel accident and emergency evacuation insurance?

MSN has partnered with The Points Guy for our coverage of credit card products. MSN and The Points Guy may receive a commission from card issuers.

Editor’s note: This post has been updated with new information and offers.

Many perks available from your credit cards are well-known and well-utilized. However, benefits such as trip cancellation insurance , delayed baggage insurance , lost baggage insurance , and trip delay protection can quite literally save the day and justify paying an annual fee.

Today, we’ll explain a couple of lesser-known benefits that you hopefully won’t have to use but, if needed, can protect you from extreme financial hardship and ensure your family and loved ones are provided for if something happens to you. You can easily find the coverage and terms of any protection your credit card offers by doing a quick web search for the card’s updated benefits guide.

Travel accident insurance

Often called common carrier insurance , this is a policy that pays in case of death, losing eyesight or losing a limb(s) while on a plane, train, ship or bus licensed to carry passengers and available to the public. A few cards also have travel accident insurance that offers protection for the entire duration of a trip (up to 31 days long) but pays out less than the common carrier insurance policies. To be eligible, you typically have to pay for the entire fare with the credit card.

Different credit cards have different payment tables for how much your beneficiary would receive in case of death, losing one limb, losing two limbs, losing sight in one eye or becoming legally blind. Coverage is also typically extended to authorized users on the account, spouses, domestic partners, and dependent children of the cardholder on trips paid for with the card.

By default, the beneficiaries in order of precedence are spouse, then children, then estate. You can submit a letter to the card issuer to establish another beneficiary.

Emergency evacuation insurance

In the past, when traveling to remote destinations like the Maldives and Fiji, I bought third-party emergency medical evacuation insurance , not realizing the cards I already had would have covered me. There are a few crucial aspects of emergency evacuation insurance offered by credit cards that you need to understand and follow so you don’t compound your medical situation with the stress of financial hardship:

- Everything must be approved and coordinated through a benefits administrator. This is who you or your companions should call when things first start looking like you’ll need assistance. Nothing that you decide to pay for on your own will be reimbursed.

- Evacuation does not mean repatriation. You won’t be evacuated back to the U.S. if you’re far overseas. Most policies state you’ll be moved to the nearest medical facility capable of proper care.

- Preexisting conditions may lead to your request for evacuation at the credit card provider’s expense being denied. Read your credit card’s full terms and benefits guide to see which exclude these conditions and the credit card’s definition of a pre-existing condition.

- The coverage is only for the cost of evacuation and medical care during transportation. You still need medical insurance to pay the doctors and staff who provide you care once you’re back on the ground.

- Some cards have country exclusions, so don’t expect to head into Syria or Afghanistan and rely on your credit card benefits administrator to get you to a hospital.

To get all the relevant information, make sure you download and read the entire section of the benefits guide pertaining to these coverages. Here are a few cards offering travel accident and/or emergency evacuation insurance.

Related: The best credit cards with travel insurance

The Platinum Card® from American Express

The Amex Platinum card removed travel accident insurance in 2020. However, the card still offers one of the most generous emergency evacuation insurance of any card. There’s no cost cap and benefits are extended to immediate family and children under 23 (or under 26 if enrolled full-time in school). Best of all, you don’t even have to use the card to pay for the trip.

You must be on a trip less than 90 days in length and at least 100 miles away from your residence. A Premium Global Assist (PGA) administrator must coordinate everything to not incur any cost. The benefit will also pay economy airfare for a minor under 16 to be returned home if left unattended, pay for an escort to accompany that minor if required to get them home, and get a family member to the place of treatment if hospitalization of more than 10 consecutive days is expected.*