An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

FY 2023 Per Diem Rates for Arizona

Daily lodging rates (excluding taxes) | october 2022 - september 2023.

Cities not appearing below may be located within a county for which rates are listed. To determine the county a destination is located in, visit the Census Geocoder .

Meals & Incidentals (M&IE) rates and breakdown Footnotes

Use this table to find the following information for federal employee travel:

Breakfast, lunch, dinner, incidentals - Separate amounts for meals and incidentals. M&IE Total = Breakfast + Lunch + Dinner + Incidentals. Sometimes meal amounts must be deducted from trip voucher. See More Information

First & last day of travel - amount received on the first and last day of travel and equals 75% of total M&IE.

- I'm interested in:

Primary Destination

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government-related facility (whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and/or counties, even though part(s) of such activities may be located outside the defined per diem locality.

Meals & Incidentals

The separate amounts for breakfast, lunch and dinner listed in the chart are provided should you need to deduct any of those meals from your trip voucher. For example, if your trip includes meals that are already paid for by the government (such as through a registration fee for a conference), you will need to deduct those meals from your voucher. Refer to Section 301-11.18 of the Federal Travel Regulation for specific guidance on deducting these amounts from your per diem reimbursement claims for meals furnished to you by the government. Other organizations may have different rules that apply for their employees; please check with your organization for more assistance.

First & Last Day of Travel

This column lists the amount federal employees receive for the first and last calendar day of travel. The first and last calendar day of travel is calculated at 75 percent.

Additional per diem topics

- Meals & Incidental Expenses breakdown (M&IE)

- State tax exemption forms

- Factors influencing lodging rates

- Per diem highlights

- Fire safe hotels

- Have a per diem question?

- Downloadable per diem files

Need more information?

- Rates for Alaska, Hawaii, U.S. territories and possessions (set by DoD)

- Rates in foreign countries (set by State Dept.)

Related topics

- Travel resources

- E-Gov Travel

- POV mileage reimbursement rates

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

- Financial Services Manual

- 14.00 Travel

14.14 Lodging

Policy information, purpose and summary.

To provide the requirements and guidelines for lodging expenditures for employees, students, Designated Campus Colleagues (DCCs) and vendors while traveling to conduct University business.

Arizona Revised Statues State of Arizona Accounting Manual

This policy applies to all University locations and units, including all University extensions, satellite locations, and off-site campus units, both domestic and international.

Definitions

- Accountable Plan: The University of Arizona reimburses employees under the IRS Accountable Plan in which expenses must have a business purpose, be adequately documented, and submitted within a reasonable period.

- Commercial Lodging: Includes any business enterprise that offers its services to the public and charges an advertised rate, including accommodations offered by online rental services such as Airbnb and VRBO and other offerings.

- Lodging Limit: The maximum lodging expense payment or reimbursement limit established by the State of Arizona, also known as the State’s lodging rate or Rack Rate. Lodging rates are “room” or “rack” rates; other charges that are imposed by the applicable government authority, such as taxes, may be reimbursed in addition to the lodging limit amount.

- Long-Term Travel: A temporary work assignment to a duty post, more than thirty-five (35) miles from the individual’s residence and/or primary duty post for periods greater than thirty (30) days but less than one (1) year. Travel exceeding one (1) year should refer to Policy 9.14 Relocation Policy for Employees .

- Traveler must be on authorized University travel at least 35-miles from their designated duty post to be eligible for reimbursement or direct payment to the vendor. Lodging rates are designated by the State of Arizona Accounting Manual , Topic 50, Section 95, to provide suitable and safe, but not luxurious accommodations and travelers should request the lowest available rate.

- Lodging costs incurred within 35 miles of the traveler’s designated duty post or residence will not be reimbursed unless extenuating circumstances exists which makes it necessary for the traveler to attain lodging. Supporting documentation must include an itemized billing statement from the lodging venue along with an explanation describing the extenuating circumstances. Reimbursement or direct pay to the lodging venue is considered taxable income to the employee and will be reported on the employee’s W-2 form.

- A clear and thorough documented University business purpose is required for all trip related lodging requirements detailing how the University benefited from the expenses incurred.

- Under no circumstances shall lodging, while on personal travel, be charged to or temporarily funded by the University. Only individual business lodging costs will be incurred either via reimbursement or direct payment. The traveler is responsible for additional lodging expenditures while on personal travel.

- University employees who earn vacation hours and include personal time with University business travel must report such personal travel time as vacation time in UAccess Employee.

- Designated lodging may exceed maximum lodging limits and are allowable without additional justification when a copy of the conference brochure showing the designated lodging rate is provided.

- Resort fees, booking fees, health club facility fees and cleaning fees are allowable if such fees are non-discretionary and always charged by the establishment and such charges, when added to the room rate, do not increase the daily lodging charge above the maximum reimbursement rate. Fees increasing the single room rate cost above the lodging limit require justification with a business purpose.

- Payment or reimbursement for lodging costs, exclusive of taxes and other charges that are imposed by the applicable government authority, may not exceed the maximum lodging rate designated by the State of Arizona. Exceeding maximum lodging rates designated by the State of Arizona must be justified with a business purpose detailing why the accommodations were selected.

- Additional lodging expenses for room features, personal items incurred, or the convenience of the traveler that are not for the primary benefit of the University are not reimbursable.

- Cancellation and late fees are discouraged although, reimbursable if fees incurred are the result of a business decision or due to serious unpredictable or unavoidable personal reason, which is at the discretion of department leadership. These costs will not be reimbursed when the fee is incurred for personal purposes or are determined to be avoidable.

- Business-related telephone, internet, and communication charges, including those incurred at a hotel business center, are reimbursable when documented by original receipts or are included in the itemized lodging receipt, and supported by a business purpose.

- Rates for Alaska, Hawaii and the US Territories are located on the Defense Travel Management Office website.

- Rates for international travel lodging and meals are located on the US Department of State Office of Allowances rates website.

- Travel related expenses submitted for reimbursement by vendors, contractors or other non-employees must follow University Travel policy designated by the State of Arizona when conducting state business. Exceptions include when a written agreement or a contract is in place and signed by a University designee with signature authority. Substantiated travel reimbursements with original itemized receipts under the IRS accountable plan are not reported on the IRS Form 1099.

Long Term Travel

- If the employee will be away from their duty post for more than 365 days, this is not considered travel status. Once the traveler knows the duration will be greater than 365 days it becomes a relocation and is not considered University travel and will not be reimbursed within this policy. Refer to Policy 9.14 Relocation Policy for Employees for policy on relocation expenses

- Long term travel status applies to sabbatical leave but is not necessarily restricted to only sabbatical leave.

- Travelers are allowed regular lodging and meal reimbursement rates for the appropriate season, not to exceed seven (7) days, while arranging for long term assignment if arrangements for accommodations were unable to be made prior to traveling.

- Meal reimbursements will be made at the rate of fifty (50%) percent of the full-day amount allowed for the designated location.

- Lodging will be reimbursed at the rate of twenty-five (25%) percent of the amount allowed for the destination. Lodging reimbursement includes all related costs such as electricity, gas, water, and telephone.

- Maximum reimbursable amounts must be determined in advance by the department, on a case-by-case basis.

- Receipts are required for expenditures for which the traveler is requesting reimbursement.

- Sponsored Project Grant and Contract accounts: If the grant or contract provides specific lodging reimbursement rates for foreign or domestic travel, these rates will be honored but must be supported by a copy of the relevant page of the grant or contract.

Lodging rates are based on the location, where the traveler will be during the rest period of their trip, documented on a travel itinerary. Steps to identify the allowable lodging reimbursement rate are as follows: Domestic:

- Travel prior to 1/8/2024 is required to use the lodging rates published by the State of Arizona Accounting Manual dated 10/1/2022. Travel on or after 1/8/2024 will be required to use the State of Arizona Accounting Manual lodging reimbursement rate table (begins at page 6).

- Locate the state, city or county and review the lodging column for the room rate maximum limit to make reservations.

- If the specific city is not listed, use the rate applicable to the county in which the lodging occurs.

- If neither city nor county is listed, use the default rate listed at the beginning of the table.

International:

- If traveling to Alaska and Hawaii, use Defense Travel Management Office rates.

- If city is not listed for locations outside the continental US, use the “Other” rate provided.

- Purchasing : Contracting with a hotel

- PCard : 6.3 Hotel enhancement

- Prepaid Travel : Prepaying for Hotel Expenses

- Supporting documentation must include citizenship of the traveler(s) to ensure requirements for payment(s) to and on behalf of a foreign visitor are followed.

- When travelers share lodging while on University business and each traveler pays their portion, each traveler should obtain a separate receipt from the hotel when submitting for reimbursement. When the establishment is unable to provide separate receipts, one traveler should submit the original receipt, marked with “Shared Lodging” and indicate the costs incurred by the traveler on the receipt. The second traveler should submit a copy of the same receipt marked “Shared Lodging” indicating their costs incurred for reimbursement. Documentation must include the names of all travelers sharing the room. Shared lodging with multiple travelers on University business may be reimbursed per person, not to exceed the actual costs incurred, subject to lodging reimbursement limits. Reimbursements must include full details of what occurred and a breakdown of expenses for auditing purposes. Example #1: Two travelers shared a room, and one traveler identified as the primary person and paid for lodging in full. The primary traveler submits the full billing statement and is reimbursed the full amount. When the room rate exceeds the single room rate lodging limit, write “shared lodging” on the billing statement. Supporting documentation must include the Travel Authorization number, name, and affiliation of both travelers. If the billing statement does not reflect the travelers name that is being reimbursed, please provide proof of payment. Example #2 : Two travelers (or multiple travelers) shared a room and each paid a portion of the expense. When the room rate exceeds the single room rate, write “shared lodging” on the billing statement and include a breakdown indicating each traveler’s portion. Make copies of the billing statement for each traveler’s reimbursement. Supporting documentation must include the Travel Authorization number, names, and affiliation of all travelers.

- Upon return from travel, prepare a Travel Expense Report following post-trip instructions . Submit documentation accordingly to seek reimbursement and include business purpose and justification for expenditures outside of University policy.

- When University employees make their own lodging arrangements or can control the site of the conference, training sessions, or agency meetings, the conference designated hotel ruling may not apply. If established lodging reimbursement maximums will be exceeded when the site is controlled by the University, a request for exception should be documented within the expenditure. The exception request should explain why it is impractical to use commercial establishments where the rates are within prescribed allowances.

- Lodging upgrades exceeding lodging rates unless supported with a business purpose.

- Movies, alcoholic beverages, water, juice, and snacks available in the room.

- Valet parking for the convenience of the traveler.

- Internet, Wi-Fi, or hot spot unless supported with a business purpose.

- Health club charges, unless medically required by traveler’s physician.

- Room Service (Meal Reimbursement rates will be reimbursed).

- Tips to baggage porters, maids, and service personnel, as these are inclusive of meal and incidental reimbursements.

- Expenses incurred to conduct personal business or for the personal preference or convenience of the traveler.

Frequently Asked Questions

- When the conference hotel lodging rate exceeds the reimbursement limit, how should this be handled? The State of Arizona lodging limits allow for an exception for designated lodging locations to reduce ground transportation costs when attendees at a conference have no control over the venue. Travelers will be reimbursed actual costs when the conference brochure or website is provided classifying the hotel as the conference hotel. Accommodations at an alternate hotel in the immediate vicinity of the conference hotel are also considered designated lodging; when no vacancies exist at the conference location and details are provided in the supporting documentation.

- How do I determine the lodging rate for the commercial establishment? Traveler should read and understand expenditures to be incurred on behalf of the University when booking reservations. When additional fees increase the lodging costs, the traveler assumes responsibility for these expenses unless there is a compelling business purpose.

- What are the receipt requirements for lodging costs? Lodging costs are determined by the address on the billing statement, invoice, or receipt and should include the traveler’s name, lodging establishment name and address, check-in and check-out dates, and itemized expenses to include room charges, applicable taxes, and fees. Proof of payment should also be provided if paid by the traveler directly.

- Why does the employee have to sign or approve a reimbursement? University policy requires employees to authorize reimbursement of expenses and certify the reimbursement is a bona fide University expenditure that has not been reimbursed by another entity, or paid with University PCard, or other funds.

- When personal travel is combined with business travel, how should this be handled? When personal travel is combined with business travel, the traveler should make lodging arrangements directly and provide a personal credit card to secure the room and charges. When submitting for reimbursement, the University will reimburse the most economical room rate available at the same hotel, within the allowable State of Arizona lodging limits.

- My significant other made my business travel lodging reservation using their credit card, and the lodging receipt is in their name. Can I be reimbursed? University best practice is to reimburse the individual who incurred the expense when possible. However, the significant other can provide a signed statement or email indicating the University can reimburse the traveler. Supporting documentation must include the signed statement or email from the individual that incurred the cost.

Related Information

9.10 Requisitions/Reimbursements 9.18 Small Dollar/Direct Purchase Procedures 9.16 Payments to Nonresident Alien 14.12 Accountable Plan 14.16 Preparing a Travel Expense Report 14.17 Cancellations and Corrections Business Purpose Guide Purchasing Policies Manual Purchasing Card Policies Manual 6.3 Hotel Enhancement Contracting with Hotels Risk Management

* Please note that sections titled Procedures, Frequently Asked Questions, Related Information, and Revision History are provided solely for the convenience of users and are not part of the official University policy.

See the latest guidance from Financial Services on the University Financial Action Plan.

Business Travel Guide

This guide serves as an overview of travel policies and procedures.

In This Guide:

Things to know, funding university travel, allowable expenses, unallowable expenses, requesting reimbursement.

The Travel Authorization process will be changing on May 13, 2024. Updated learning resources, web content, and other details will be available closer to launch date.

Coordinate all travel with your department business unit.

Travel Status : A person is in Travel Status whenever any travel takes you more than 35 miles away from your duty post. ?

Travel Authorization : Travel Authorization is required prior to travel when the Travel Status definition is met for each Employee, Student, and Designated Campus Colleagues (DCC) traveling on behalf of the University of Arizona, regardless of any expenses charged to the University.

International Travel : Registry is required prior to travel for all international travel including U.S. Territories. Registry must be in an affirmed status to ensure traveler's safety and eligibility for expense reimbursement. See International Travel for more information. Additional information may be found in International Travel Safety and Compliance Policy .

IRS (Internal Revenue Service) Accountable Plan : All reimbursement requests must comply with the University Accountable Plan to qualify as non-taxable income. Specifically:

- Original, itemized receipts

- Reimbursements must be submitted to your department business office within 60 days of the end of the trip and to Financial Services within 90 days of the end date of travel.

- Refer to Financial Services Manual Policy 14.12 Accountable Plan

Recommended options to pay for business travel :

- Department PCard : Hotel/lodging (with Hotel Enhancement ), airfare (with Travel Enhancement ), conference registrations

- Requisition : Travel agencies

- Single Use Account Credit Card : Prepayment for hotel/lodging, airline tickets, and conference registrations to avoid out of pocket expenses

- Travel Advance : A minimum of $250 may be issued by direct deposit up to 7 days prior to travel and must be repaid or settled within 10 days after the trip ends.

Tipping : Tipping is limited to the 20% industry standard.

- Lodging rates are established by the state of Arizona.

- Travel must be a minimum of 35 miles from duty post to qualify for lodging reimbursement unless there is a University business purpose.

- Reimbursement for non-designated lodging is based upon the least expensive single room rate plus tax. Room rates exceeding the State lodging rate(s) will require a University business purpose.

- When personal travel is included, lodging will only be reimbursed based on the lease expensive single room under Unallowable Expenses rate plus tax.

- Resort fees required as part of the lodging are reimbursable.

- Reimbursement for lodging that is specifically designated by a conference or meeting is based upon rate established for that conference or meeting. Designated lodging rates are reimbursed at actual costs which may be higher than the State rate. Additional costs for room upgrades at designated lodging are unallowable.

Meal and Incidental Reimbursements (M&IE) :

- Meal reimbursement rates are established by the state of Arizona and are determined by lodging address.

- M&IE is not allowable for meals provided during transit, by the lodging establishment, or by the meeting/conference organizer.

- Discretionary incidental expenses included in the M&IE rate are dry cleaning, laundry, tips for personal services (such as concierge, bellhop, housekeeper, and doorman), curbside baggage check-in, newspapers and magazines, etc.

- Room service is allowable, but must be deducted from the lodging folio and include the meal reimbursement rate for reimbursement.

Transportation :

- Transportation reimbursement is based upon the cost of the most direct and/or economical means available.

- Mileage is reimbursable at the current state rate of 65.5 cents for privately owned vehicles.

- Mileage to/from the airport is reimbursed at 65.5 cents and is calculated from campus during business hours and with map applications (MapQuest, Google Maps, etc.) from the traveler's residence after hours, on holidays or weekends.

- EITHER mileage OR gas is reimbursable, not both.

- Car rentals are reimbursed based on the most economical compact car rate. See University vehicle rental vendors .

- Collision Damage Waiver (CDW) and Loss Damage Waiver (LDW) insurance are not allowable or reimbursable without a University business purpose. Utilizing existing UA rental company contracts, which include full insurance, is strongly encouraged.

- Airline and other transportation tickets are reimbursed at the economical rate based on the most direct route to the business destination.

- Public/mass transit (bus, subway, etc.) do not require receipts when a set rate is established for transportation.

- Baggage fee for first checked bag is allowable. Fees for additional checked baggage are not reimbursable without a University business purpose.

- Airport parking will be reimbursed for the most economical daily/weekly rate for reasonable parking expenses incurred by the traveler. Recommended State of Arizona airport parking facilities: see Policy 14.15 Transportation , policy section, paragraph 9.

Personal Travel : Expenses incurred as a result of extending a business trip for personal time or costs associated with the personal travel. Please note that the PCard may not be used when personal travel is included in the trip .

Family Members : Expenses incurred by a family member unless there is a University business purpose in which the University benefited from the expense.

Insurance :

- Personal accident insurance

- Personal medical insurance unless recommended or advised in advance by the Risk Management International Travel Insurance Program

- Travel insurance unless there is a University business purpose (ex: international flights)

- Collision Damage Waiver (CDW) insurance and excess liability insurance must be declined, unless the traveler is on foreign travel status

Alcohol : Alcohol is not permitted with University funds.

Other Personal Expenses :

- Personal phone calls, movies, or snacks from a hotel

- Grooming – hair dressers, barbers, masseurs, manicurists, lavatory attendants, etc.

- Toiletries – deodorants, toothpaste, soap, toothbrushes, combs, etc.

- Health club, spa, gym, swimming pool fees, green fees, etc.

- Passport fees

- Airline and other travel clubs or TSA Pre-check

- Traffic citations or parking tickets

- Child care, babysitting, pet sitting, and kennel charges

- Specialty seating assignments or other special accommodations (upgrades) on common carriers unless a medical or physical necessity

Please be sure to include the following with your reimbursement request :

- Travel Expense Report (signed or routed for approval in UAccess Financials): Refer to the Travel Expense Report Guide for further assistance

- Digital itemized receipts

- Conference documentation to support designated lodging and allowable meal reimbursements

Including personal time on your trip? Include two economy class flight comparisons that show the cost of round-trip airfare from your duty post to the business destination that correspond to business dates of trip. Reimbursement will be based on the lower of the two costs.

Prefer to drive? Include two economy class flight comparisons, as your reimbursement will be the lower of the cost between driving and flying.

Taking a driving detour for personal reasons? Include an internet-based map of the most economical direct route from your duty post to the business destination, as your reimbursement will be limited to the most direct route.

Using an airline credit from previously canceled flight? Include all receipts associated with any canceled flights to show proof of payment.

Need Additional Help?

Contact the Travel team at 520-621-9097 or [email protected] .

More information: See all Travel Services

Traveler resources

Find the latest travel guidance on the travel guidance webpage ..

All domestic and international trips with an overnight stay or airfare are processed in My ASU TRIP with a request submitted before travel and an expense report submitted within 30 days after a trip ends.

Accounts payable processes trips without an overnight stay, airfare and ASU travel card transactions on the mileage — parking reimbursement form .

Travelers are responsible for the review and compliance with:

- ASU Policy .

- Authorized Driver Program .

- Carbon Project — price on carbon for air travel.

- Funding source and department requirements.

- Receipt requirements: Receipts are required for any expense greater than $50 not placed on the ASU travel card. Itemized receipts are required for any expense — regardless of amount or payment method — for airfare, car rental, lodging, or business meal. Additional receipts may be required by your department or funding source. My ASU TRIP accepts the following file formats for receipt images: .html, .jpg, .jpeg, .pdf, .png, .tif and .tiff.

- Traveling with mobile devices .

Travelers to international destinations should also review the international travel webpage .

Additional resources:

- My ASU TRIP Travel Manual — comprehensive printable document.

- My ASU TRIP Quick Reference Guide .

- Supplemental travel information form — used by faculty and staff to provide additional information to expedite international travel approval.

Daily allowances used by ASU are loaded into MY ASU TRIP and based on the following per diem rates:

- Alaska, Hawaii, U.S. Territories .

- International .

My ASU TRIP — Getting started

Faculty and staff

- Update your My ASU TRIP Profile .

- Activate e-receipts .

- Add a delegate .

- Apply for an ASU Travel Card to be used in conjunction with My ASU TRIP.

- Book travel after your submitted trip request is approved.

- You may have an active profile if you are an active GA, RA or TA. If able to log in to My ASU TRIP, your profile is active. If not, work with the department funding your trip and complete the manual profile form .

- Book your travel after your submitted trip request is approved.

Trip requests

Trips require an approved request before traveling and travel booking. Expense reports are filed when the trip is complete and created from the approved request.

The request:

- Authorizes travel card use for trip expenses.

- Documents needed for travel approvals.

- Provides a trip expense and itinerary estimate.

- Provides data for traveler location for risk assessment.

High-risk destinations

- Additional departmental and risk management approvals are needed. Sufficient details should be included in the request for assessment. Allow time for these additional approvals.

Personal time

- Do not include any expenses associated with personal time included on your trip. Costs associated with the personal portion of the trip are not reimbursable.

Zero-dollar trips

- Trips with no cost to the university and no reimbursement to the traveler Zero-dollar trips . A request is submitted to document your travel for insurance purposes and helps the university locate you in an emergency. The request is closed or inactivated when the trip is complete.

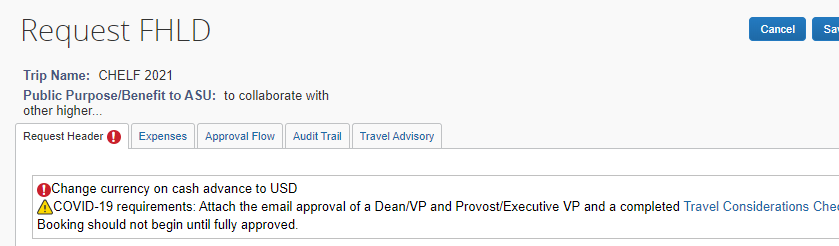

These exceptions may occur as you build your request:

To begin a trip request, log in to My ASU TRIP and click request > new request.

- Create the trip request header .

- Estimate expenses .

- Allocate between funding sources, if needed.

- Attach documents as needed.

- Submit the request .

If needed, Copy a request .

Book travel

Airfare must be booked through My ASU TRIP or with Anthony Travel. Car rentals, hotel and trains should be booked though My ASU TRIP unless there is a business reason not to do so.

- Airfare can be purchased with your ASU travel card, the university-wide airfare card on file with Anthony Travel, a P-Card, or with personal funds. Personal funds are reimbursed when the trip is complete and the expense report is filed. American Airlines and Southwest Airlines are preferred airlines and discounts are preloaded into My ASU TRIP.

- To receive conference hotel rates , book directly with the hotel and not through My ASU TRIP. Email your booking prior to travel.

- Review — Risk Management guidelines.

- A traveler must be an authorized driver before driving any vehicle.

For assistance with bookings and to use airline credits email Anthony Travel or call 480-739-9145 or 1-844-682-5052.

My ASU TRIP step-by-step instructions:

- Book airfare .

- Reserve hotels .

- Reserve rental vehicle .

Expense reports

- Are created from approved trip requests.

- Are documents of public record and scrutiny.

- Completed within 30 days of the trip end date.

- Document actual trip expenses and itineraries.

- Generate traveler reimbursement.

These exceptions may occur as you build your request

Read the exception for directions to clear them. Contact your department or My ASU TRIP for additional assistance.

Complete an Expense Report .

Complete a Non-Travel Expense Report — process travel card charges unrelated to ASU travel.

Complete a Modification Expense Report — when a previously approved expense report needs adjustment.

General Information

Travel Service Center

PO Box 875912 Tempe, Arizona 85287-5912

Select Section

Hundreds of Arizona schools made breakfast and lunch free for all students. What to know

A growing number of schools across Arizona are offering free meals to all students, and school leaders say the change has helped families who don't qualify for free meals but still struggle to afford the costs.

More than 260 schools across the state this spring made breakfast and lunch free for all students through a federal reimbursement program called the Community Eligibility Provision, according to the Arizona Department of Education.

The decisions came as a $6.75 million pandemic relief fund investment from the Arizona Department of Education that made meals free for students who qualify for reduced-price meals is set to expire at the end of this school year.

Created in 2010 and administered through the Food and Nutrition Service of the U.S. Department of Agriculture, the program allows high-need schools to serve free breakfast and lunch to all students without requiring applications from families. To qualify, a certain percentage of a school or district's students must be deemed eligible through their participation in another federal assistance program, including SNAP or TANF.

In Arizona, the list was expanded this school year to include Medicaid , paving the way for more schools to become eligible for the program.

Twenty-one Arizona school districts made meals free for all students this spring through CEP after the program allowed a mid-year election. Other districts, including Mesa Public Schools, increased the number of schools that provide free meals to all kids. Many charter schools joined the program as well.

The program lasts for four years before schools must reapply.

Free school meals for all students have made a "tremendous difference," according to Lupita Hightower, the superintendent of Tolleson Elementary School District, which joined the program in 2022. Paying meal fees "gets very difficult for families," especially in a household of four or five, she said.

Nora Ulloa, the superintendent of the Fowler Elementary School District, which made meals free for all kids in March, said the change has improved the district's relationship with parents and increased the number of school meals being served.

A majority of the district's students qualify for free or reduced meals. But if a family doesn't qualify for free meals and can't afford the price, "that adds up," Ulloa said. "You never know what families are contending with." To qualify for free school meals , a family of four must have an annual household income of at or below $39,000. Four-person households between $39,000 and $55,500 qualify for reduced-price meals and can't be charged more than 30 cents for breakfast and 40 cents for lunch.

"It got to the point where it felt like we were making kids uncomfortable by repeatedly reminding them that they had a bill outstanding, and it’s really not the kid’s fault," Ulloa said. The majority of the district's parents are "doing the best they can," she added.

Some school employees would pay for the meals of kids who had outstanding balances, she said, and teachers and cafeteria employees would be the ones "stuck in the middle" asking parents to pay.

Since making the change, Fowler Elementary has seen an increase in the number of school meals being served. "It's just a non-issue now," Ulloa said. And the parent relationship is "a lot more positive," she said.

Tempe Elementary School District made meals free for all students across 22 schools in February — formerly, they had only been available at eight schools.

Before the change, the district didn't turn students away from meals for having outstanding bills. But district families have a total of $263,000 in meal debt, according to spokesperson Gabi Dunton.

Now, more students are opting to eat the lunch offered by the school. "It eliminates that stigma that this program is only for students" who can't afford it, said Janay Watts, the district's nutrition services director. And it eliminates barriers for families who couldn't afford the meal prices, she said.

Between February and April, the number of lunches served per day rose from roughly 6,800 to around 7,200 to 7,300, Watts said. "And it's growing every day," she said.

For Pendergast Elementary School District, the change has freed up time for school leaders who no longer have to process applications for free and reduced-price meals, according to Jamie Triolo, the district's director of food services.

Participation in school meals has been linked to improved attendance, behavior and academic achievement, according to Crystal FitzSimons, the child nutrition programs and policy director at the Food Research and Action Center.

"By making school meals more accessible, more kids are going to benefit from those," FitzSimons said.

Meals served through federal programs must meet certain nutrition requirements, and according to the Centers for Disease Control and Prevention, students who participate in school meals consume more whole grains, milk, fruits and vegetables during mealtimes than nonparticipants.

"When kids aren't eating, they're crabby," said Ulloa, the Fowler superintendent. "They're not learning."

A growing trend nationwide

Before the COVID-19 pandemic, about one in three schools across the country were offering free meals to all kids, according to FitzSimons. Then, when the pandemic hit in 2020, nearly all schools began offering universal free meals through a temporary waiver passed by Congress. "It was really a trial run for nationwide healthy school meals for all," FitzSimons said, calling it a "huge success."

That waiver expired in 2022, and when schools returned to normal meal operations for the 2022-23 school year, the program grew from around 33,000 schools to over 40,000 nationwide.

In Arizona, more than 500 schools participated in the program during the 2022-23 school year, according to a report from the Food Research and Action Center. Some districts, including the Phoenix Union High School District, offer free meals to all kids through other federal programs.

Still, other school districts across the Valley are raising meal prices for next school year, including the Littleton elementary school district.

Even as CEP participation expands, not all schools that are eligible find it financially viable, FitzSimons said. The number of meals reimbursed at the federal free rate is determined by the percentage of eligible students, and the remaining meals are reimbursed at a much lower rate.

"The places where we really are expecting to see the big upticks are from districts who are committed to putting additional funding into supporting the program," FitzSimons said. Some states subsidize the difference for schools.

Others have gone further in investing in free school meals: eight states, including California and New Mexico, have passed laws making breakfast and lunch free for all students regardless of household income.

Reach the reporter at [email protected].

Arizona to get $55 million to provide humanitarian aid to migrants at the border

Nonprofits and local governments in Arizona will receive more than $54 million to continue providing humanitarian assistance to migrants released at the state's border with Mexico, the federal government announced Friday.

The funding is part of the Shelter and Services Program, which is jointly administered by U.S. Customs and Border Protection and the Federal Emergency Management Agency. Congress replenished the program in March, when they allocated $650 million as part of a supplemental funding package passed to avoid a government shutdown.

FEMA will award the grants to local communities in two separate rounds. The first round announced on Friday totaled about $300 million. The second round will be awarded in a new competitive process by the end of September, according to the U.S. Department of Homeland Security.

The four states along the U.S.-Mexico border are slated to get more than half of the funding from the first round. Texas will receive $62.4 million, Arizona will receive $54.6 million, California will receive $45.2 million, and New Mexico will receive $4.1 million.

The rest of the funding will go to communities in the interior of the country, which have also been struggling to accommodate and assist large numbers of migrants and asylum seekers arriving to their cities. Some of the biggest recipients in the interior include New York City, which will get $38.9 million, and Atlanta, which will get $10.1 million.

Nonprofits and local governments in Arizona faced a March 31 financial cliff that threatened to upend a system they developed to prevent having the border officials release migrants into the streets of border communities in southern Arizona.

Pima County, which is the fiscal agency that distributes funding to nonprofits and local governments in southern Arizona, will receive $21.8 million of the funds allocated to the state. The county ran out of funds to provide humanitarian assistance to migrants on March 31, but said this funding announcement will cover retroactive costs for expenses incurred over the past two weeks.

"The size of this award is an acknowledgment by the Biden Administration of the benefit that our coalition provides to the country and the people of Arizona, Pima County, and Tucson. Easing suffering, facilitating travel, and protecting the health and welfare of our border-county communities is a win for everyone," Adelita Grijalva, the chair of the Pima County Board of Supervisors, said in a written statement.

"This funding gives us the breathing room to work towards a better solution that, at the very least, will relieve local governments of the burden of mitigating the effects of federal border control and immigration policy," she added.

In addition to Pima County, other local governments and nonprofits in Arizona will receive large awards in this latest round of funding. Maricopa County will get $11.6 million, World Hunger Ecumenical Arizona Task Force in Maricopa County will also receive $11.6 million, while World Hunger Ecumenical Arizona Task Force in Yuma County will receive $9.5 million.

The funding allocated for Fiscal Year 2024 is less than the $780 million set aside for local governments and nonprofits providing humanitarian assistance in 2023. That year, FEMA awarded a bulk of the funding to communities in the interior of the country.

Arizona lawmakers pressed FEMA and Customs and Border Protection to prioritize border communities when determining how to distribute the money, and to get it communities quickly.

Arizona's independent Sen. Kyrsten Sinema and Democratic Sen. Mark Kelly released a joint statement praising Friday's announcement. The two senators led efforts to secure federal funding since large-scale migrant releases began in Arizona in 2018.

"Arizona’s local governments and nonprofits are on the frontlines doing the vital work that keeps asylum seekers and communities safe, and this funding will help them continue operations and support our border communities,” Kelly said.

“Today’s funds will help Arizona border nonprofits keep their doors open - preventing street releases and providing humane treatment of migrants seeking asylum,” Sinema added.

Arizona's Democratic delegation in the House also welcomed Friday's announcement, touting changes they advocated for such as acceptable error rates in data reporting for A-numbers, which prevented nonprofits and local governments from expensing all eligible costs for reimbursement.

"This funding couldn’t come soon enough," Rep. Greg Stanton, D-Ariz., said. "I’ve visited local aid groups along the border, and they’re near a breaking point — over-stretching their budgets to help care for migrant families and prevent street releases."

Another notable change removes caps on non-congregate shelter like hotels or transportation, which nonprofits argued made it harder to respond to changing flows on the ground and limited their flexibility to respond to those changes.

“The funds announced today are needed to help our border communities manage the crisis at the border, and I won’t stop pushing the administration to prioritize Arizona,” Rep. Ruben Gallego, D-Ariz., said.

Rep. Raúl Grijalva, who represents nearly all of Arizona's communities along the border with Mexico, said that while the funding was welcomed, it was not a permanent fix to a federal issue.

"It’s clear that the only path forward to address these issues long-term is real immigration reform to fix our broken system beginning with humane solutions, increased legal pathways, dealing with root causes, and providing more resources and personnel at the border instead of Republicans’ detrimental funding cuts and failed enforcement-only policies," Grijalva said.

In the past year, the number of migrants crossing through the Arizona border increased dramatically, resulting in the state once again becoming the busiest crossing corridor along the southern U.S. border with Mexico. The number of apprehensions in Arizona has been dropping week over week, though they typically rise during the summer months.

The increase has continued to strain the capacity of border and immigration holding facilities in Arizona. As a result, Customs and Border Protection has been coordinating with nonprofits and local governments to drop off migrants at designated sites after they've been legally processed and cleared for release into the country under parole.

In Arizona, CBP has been releasing migrants in Yuma, Tucson, Nogales and Douglas. State and local governments coordinate with nonprofits like Catholic Community Services of Southern Arizona, the Regional Center for Border Health and the International Rescue Committee to transport migrants from small communities to larger cities like Tucson and Phoenix.

The humanitarian assistance includes housing, food, medical screenings, and transportation. The majority of migrants released will not stay in Arizona, and instead have relatives and sponsor buy plane or bus tickets to go elsewhere in the United States.

This system has drawn scrutiny, especially from Republican lawmakers who argue that the federal government is allowing migrants to evade U.S. immigration laws, and have called for an end to the release of migrants at the border.

Nonprofits and local governments contend that they are preventing further chaos at the border and are responding to an issue that is ultimately the federal government's responsibility.

Have any news tips or story ideas about immigration in the Southwest? Reach the reporter at [email protected] , or follow him on X (formerly Twitter): @RafaelCarranza .

IMAGES

COMMENTS

State of Arizona Travel Claim Form: 01-08-2024 : GAO-503EZ Instructions. State of Arizona Travel Claim Instructions: 01-01-2008 : GAO-503HRIS. State of Arizona Travel Claim HRIS Continuation Form -Intended for Travel Entry Personnel Only: 04-01-2021 : GAO-509. State of Arizona Out of State Travel Approval Request: 09-29-2022

State of Arizona Accounting Manual Topic 50 Travel Issued 01/09/23 Section 95 Maximum Mileage, Lodging, Meal, Parking and Incidental Expense Reimbursement Rates ... rates that comply with State reimbursement limits. Quick Park Quick Shuttle • 6448 and 6550 South Tucson Blvd., Tucson, AZ (520) 2949000, 24/7 Service. -

State of Arizona Accounting Manual Topic 50 Travel Issued 01/08/24 Section 95 Maximum Mileage, Lodging, Meal, Parking and Incidental Expense Reimbursement Rates Page 5 of 30. When travel involves an entire day, the full day meal reimbursement may be used without allocation between breakfast, lunch and dinner. When a meal is provided,

The State of Arizona has updated the State of Arizona Accounting Manual, effective Monday, January 9, 2023, to include the following: Mileage reimbursement rate has increased to 62.5 cents per mile. Single day travel with no overnight stay increased to $15. Extended day travel with no overnight stay increased to $27.

Rates are set by fiscal year, effective Oct. 1 each year. Find current rates in the continental United States, or CONUS rates, by searching below with city and state or ZIP code, or by clicking on the map, or use the new per diem tool to calculate trip allowances.

The State of Arizona has updated the State of Arizona Accounting Manual, effective Monday, Jan. 9, 2023, to include the following: Mileage reimbursement rate has increased to 62.5 cents per mile. Single-day travel with no overnight stay increased to $15. Extended-day travel with no overnight stay increased to $27.

5. Travel is conducted and reimbursed in accordance with State Travel Policy, regardless of the funding source that pays for the travel and is limited to the State rates published in SAAM 5095, Maximum Mileage, Lodging, Meal, Parking and Incidental Expense Reimbursement Rates. 6.

Mileage reimbursement rates Reimbursement rates for the use of your own vehicle while on official government travel. ... FY 2023 Per Diem Rates for Arizona. Change fiscal year: 2024. 2023. 2022. or. ... (set by State Dept.) Federal travel regulations; Related topics. Travel resources; E-Gov Travel;

Payroll Services will process the Travel Reimbursement Request. 2.4 CLAIMING TRAVEL IN-STATE VS. OUT OF STATE . An employee traveling within 100 miles of the Arizona border will be treated as In-State. For out-of-state locations treated as In-State, use the rates appropriate to the locations. For example, if lodging

The State of Arizona travel policy and rates have been updated and are published in the State of Arizona Accounting Manual (SAAM) 5095, Maximum Mileage, Lodging, Meal, Parking, and Incidental Expense Reimbursement Rates, located on the GAO's webpage at https://gao.az.gov/. The effective date of the rate increases is January 9, 2023, any costs ...

Maximum Mileage, Lodging, Meal, Parking and Incidental Expense Reimbursement Rates: 09-27-2021 : 95. Maximum Mileage, Lodging, Meal, Parking and Incidental Expense Reimbursement Rates: 10-01-2022 : 95 : Maximum Mileage, Lodging, Meal, Parking and Incidental Expense Reimbursement Rates 01-09-2023 : 95

Single day meal reimbursement prior to 01/09/2023 = $12.00. Traveler qualifies for an extended day meal reimbursement limit of $27, if in travel status twelve (12) or more consecutive hours. Extended day meal reimbursement prior to 01/09/2023 = $19.00. Single and extended day meal reimbursements limits apply regardless of destination and time ...

A.R.S. §§ 38-621 - 38-627 Reimbursement of Expenses State of Arizona Accounting Manual (SAAM) Topic 50, Travel State of Arizona Accounting Manual (SAAM) Topic 50, Section 26 Incidentals and ... Expenses incurred beyond the state approved rate for approved travel expenses, shall not be reimbursed to the traveler without an exception

Travel prior to 1/8/2024 is required to use the lodging rates published by the State of Arizona Accounting Manual dated 10/1/2022. Travel on or after 1/8/2024 will be required to use the State of Arizona Accounting Manual lodging reimbursement rate table (begins at page 6).

Accounts Payable has published a new Travel Expense Report form based on the updated State of Arizona Accounting Manual mileage rates. ... State of Arizona Accounting Manual (SAAM) Reimbursement Rates. Thu, 01/19/2023 - 2:32 pm. The State of Arizona has updated the State of Arizona Accounting Manual, effective Monday, January 9, 2023 ...

a. Travel expenses will be processed according to the State of Arizona Accounting Manual (SAAM) Policy. b. Submit a Vendor Travel Reimbursement form for all travel expenses. Include map print out with to and from location Mail all ORIGINAL reimbursement forms and itemized receipts for lodging and meals c. Must not exceed ADE reimbursement rates ...

Lodging rates are established by the state of Arizona. Travel must be a minimum of 35 miles from duty post to qualify for lodging reimbursement unless there is a University business purpose. Reimbursement for non-designated lodging is based upon the least expensive single room rate plus tax.

A traveler must be an authorized driver before driving any vehicle. For assistance with bookings and to use airline credits email or call 480-739-9145 or 1-844-682-5052. My ASU TRIP step-by-step instructions: Book airfare. Reserve hotels.

State of Arizona Accounting Manual Topic 50 Travel Issued 01/02/19 Section 95 Maximum Mileage, Lodging, Meal, Parking and Incidental Expense Reimbursement Rates Page 3 of 29 Quick Park Quick Shuttle • 6448 and 6550 South Tucson Blvd., Tucson, AZ (520) 294-9000, 24/7 Service. • 6840 and 6920 South Tucson Blvd., Tucson, AZ (520) 294-9000, 24/7 Service.

The Joint Legislative Budget Committee has approved an increase to certain travel reimbursements. The mileage reimbursement rate has increased from 34.5 cents to 37.5 per mile and the in-state lodging rate increased from $55 to $60 per night effective on Dec. 16, 2004.

Fiscal 2024 Travel Reimbursement Rates Employees. In-State or Out-of-State Meals and Lodging: Refer to the U.S. General Services ... For locations not listed (city or county), the daily rates are: Lodging in state/out of state: up to $107. Meals in state/out of state: up to $59. In-State or Out-of-State Non-Overnight Meals: Not to exceed $36 daily:

State of Arizona Accounting Manual Topic 50 Travel Issued 09/27/21 Section 95 Maximum Mileage, Lodging, Meal, Parking and Incidental Expense Reimbursement Rates Page 5 of 30 When travel involves an entire day, the full day meal reimbursement may be used without allocation between breakfast, lunch and dinner. When a meal is provided,

7.3.2. Must be consistent with and complement State Travel Policy. 7.3.3. May be more restrictive, but not more liberal, than State Travel Policy. 7.3.4. Must be applied equitably to all agency personnel. 7.3.5. Must not deprive or attempt to deprive employees of any benefits, reimbursements or compensation to which they might otherwise be ...

To qualify for free school meals, a family of four must have an annual household income of at or below $39,000. Four-person households between $39,000 and $55,500 qualify for reduced-price meals ...

Travelers are reminded that, though the Federal site lists these as per diem amounts, State rates represent reimbursement limits for actual expenditures. For the convenience of Arizona travelers, a spreadsheet entitled AZ Travel Rates will also be posted on the Travel Section of the GAO Website until SAAM 5095 can be updated.

The four states along the U.S.-Mexico border are slated to get more than half of the funding from the first round. Texas will receive $62.4 million, Arizona will receive $54.6 million, California ...