U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best COVID-19 Travel Insurance Options

Travelex Insurance Services »

Allianz Travel Insurance »

World Nomads Travel Insurance »

Generali Global Assistance »

IMG Travel Insurance »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best COVID Travel Insurance Options.

Table of Contents

- Rating Details

- Travelex Insurance Services

- Allianz Travel Insurance

Even though COVID-19 is no longer considered a global emergency, concerns around illness-related costs remain for many travelers. If you're looking for travel insurance that covers COVID – as well as other potential disruptions like flight delays and lost luggage – these are your best options.

- Travelex Insurance Services: Best Optional Coverage Add-ons

- Allianz Travel Insurance: Best for Multitrip and Annual Plans

- World Nomads Travel Insurance: Best for Active Travelers

- Generali Global Assistance: Best for Comprehensive Travel Insurance

- IMG Travel Insurance: Best for Travel Medical Insurance

Best COVID Travel Insurance Options in Detail

Plans include coverage for COVID-19

Optional CFAR coverage is available with Travel Select plan

Some coverages require an upgrade, including rental car collision, accidental death and dismemberment, and more

Not all add-ons are available with every plan

Allianz offers some travel insurance plans that come with an epidemic coverage endorsement

Single-trip, multitrip and annual plans available

COVID-19 benefits don't apply to every plan

Low coverage limits with some plans (e.g., only $10,000 in emergency medical coverage with OneTrip Basic plan)

24-hour travel assistance services included

More than 200 sports and activities covered in every plan

Low trip cancellation benefits ($2,500 maximum) with Standard plan

No CFAR option is offered

Free 10-day trial period

Some coverage limits may be insufficient

Rental car damage coverage only included in top-tier Premium plan

Offers travel medical insurance, international travel health insurance and general travel insurance plans

Some plans include robust coverage for testing and quarantine due to COVID-19

Not all plans from IMG offer coverage for COVID-19

Cancel for any reason coverage not available with every plan

Frequently Asked Questions

When comparing COVID-19 travel insurance options, you'll want to make sure you fully understand the coverages included in each plan. For example, you should know the policy inclusions and limits for COVID-related claims, including coverage for testing, treatments, trip cancellation or COVID-related interruptions that can occur. Meanwhile, you should understand how your coverage will work if you contract some other illness while away from home.

Also ensure your travel insurance coverage will kick in for other mishaps that occur, and that limits are sufficient for your needs. If you're planning a trip to a remote area in a country like Costa Rica or Peru , you'll want to have emergency evacuation and transportation coverage with generous limits that can pay for emergency transportation to a hospital if you need treatment.

You can also invest in a travel insurance policy that offers cancel for any reason coverage. This type of travel insurance plan lets you cancel and get a percentage of your prepaid travel expenses back for any reason, even if you just decide you're better off staying home.

It depends on your private health insurance provider and/or travel insurance policy. As of May 11, 2023, private health insurers are no longer required to cover the cost of COVID-19 testing. Out-of-pocket costs for COVID-19 test kits at local drugstores and on Amazon are relatively affordable, however.

As you search for plans that will provide sufficient coverage for your next trip, you'll find travel insurance that covers COVID-19 quarantine both inside and outside the United States. However, you'll typically need to have your condition certified by a physician in order for this coverage to apply. Also make sure your travel insurance plan includes coverage for travel claims related to COVID-19 in the first place.

Many travel insurance plans do cover trip cancellation as a result of COVID-19, although the terms vary widely. You typically need to be certified by a physician in order to prove your condition. Disinclination to travel because of COVID-19 – such as fear of exposure to illness – will generally not be covered. This means you will actually have to test positive for coronavirus for benefits to apply; simply not wanting to travel is not a sufficient reason to make a claim.

If you want more flexibility in your COVID-19 travel insurance, ensuring you have a cancel for any reason policy may be your best bet, but be sure to check with your chosen travel insurance provider to assess your options.

Why Trust U.S. News Travel

Holly Johnson is an award-winning writer who has been covering travel insurance and travel for more than a decade. She has researched the best travel insurance options for her own trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. Over the years, Johnson has successfully filed several travel insurance claims for trip delays and trip cancellations. Johnson also works alongside her travel agent partner, Greg, who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

5 Best Travel Insurance Plans for Seniors (Medical & More)

Holly Johnson

Discover coverage options for peace of mind while traveling.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

9 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Is There Travel Insurance That Covers COVID Quarantine?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

We get it — traveling these days can be an uncomfortable experience. In the ever-changing world of COVID-19 variants, border restrictions and PCR tests, learning how to stay protected is important.

Travel insurance can insure you against a variety of complications during travel, including trip delay, trip cancellation and medical issues. But not all policies are the same, and coverage can vary not only across providers, but across policies themselves.

Let’s take a look at travel insurance that covers COVID-19 quarantine, plus the best COVID-19 travel insurance.

What does travel insurance usually cover?

Travel insurance can provide peace of mind on vacation, especially when things go awry. There are varying types and levels of coverage for travel insurance, though these are common inclusions for travel insurance policies:

Trip cancellation insurance.

Trip interruption insurance.

Trip delay insurance.

24-hour hotline assistance.

Emergency medical insurance.

Primary/secondary medical insurance.

Lost or delayed baggage insurance.

Rental car insurance.

There's a lot of variety when it comes to travel insurance and the types of incidents it’ll cover. The cost of your premium will vary according to the plan you select.

Cancel for Any Reason insurance allows you to cancel your trip and recoup your costs, no matter why you’ve chosen to cancel.

Before buying travel insurance, check to see if any of your credit cards offer trip insurance . Some travel credit cards offer this insurance free of charge when you use your card to pay.

The Chase Sapphire Preferred® Card , for example, provides primary rental car insurance when you charge the car to your card.

The Platinum Card® from American Express , meanwhile, will cover trip cancellation, trip delay and lost luggage insurance. Terms apply.

There are no credit cards whose benefits include medical insurance. You’ll want to read the terms carefully to be sure that any travel insurance you purchase covers instances of COVID-19.

» Learn more: Will my travel insurance cover coronavirus?

Finding insurance that covers COVID quarantine

In the beginning of the pandemic, many insurance policies covered losses related to COVID-19, including trip cancellation and medical issues.

Since then, some providers have chosen to exclude coverage for coronavirus-related issues. So you’ll need to search specifically for an insurance policy that covers COVID-19.

Fortunately, there are still insurance providers that’ll provide coverage in the event you’re affected by COVID-19, including:

Trip cancellation.

Trip delay.

Medical care/hospitalization.

Quarantine.

Several countries — like Thailand — actually require that you purchase this insurance before traveling.

If you already have an insurance provider in mind, take a look at their coverage options — and any available add-ons — to see if COVID-19 quarantines are covered.

» Learn more: The best travel insurance companies

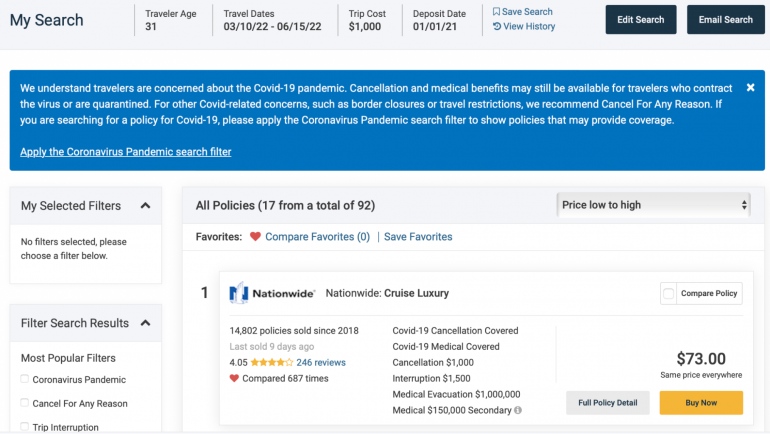

If you aren’t already committed to an insurance company, sites such as SquareMouth, a NerdWallet partner, will allow you to search for and compare policy coverage from multiple companies at once.

You’ll be asked to provide a variety of information, such as your destination, dates of travel, age, and whether you’d like to be reimbursed for cancellations.

SquareMouth’s search also includes the ability to filter search results so you’ll only see policies with COVID-19 protections.

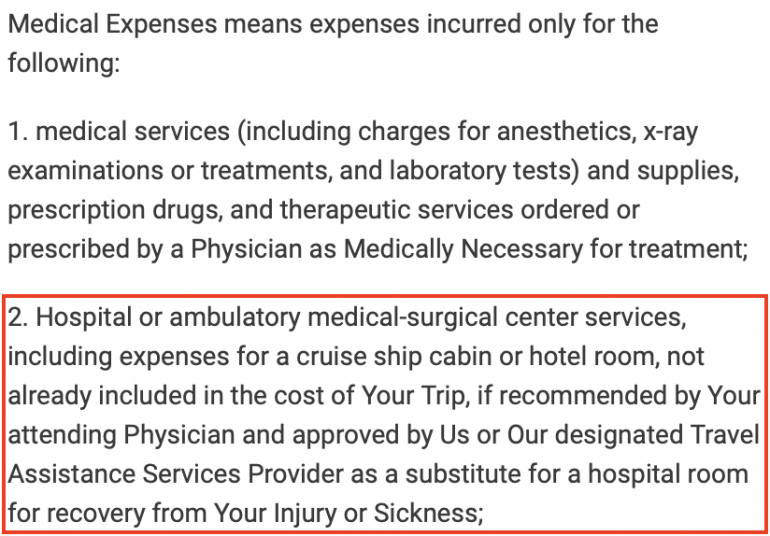

Once you’ve found a provider whose policy includes COVID-19 coverage, you’ll want to make certain that quarantine will also be reimbursed. Reading the policy in full will tell you; it can look something like this:

» Learn more: What to know before buying travel insurance

How much will COVID quarantine travel insurance cost?

The price of travel insurance is going to depend on many factors, including the length of your trip, your age, your destination and your coverage limits.

As you’d expect, the more comprehensive your coverage and the higher your limits, the more expensive your policy will be. The same is true if you’re heading out of the country for an extended period of time.

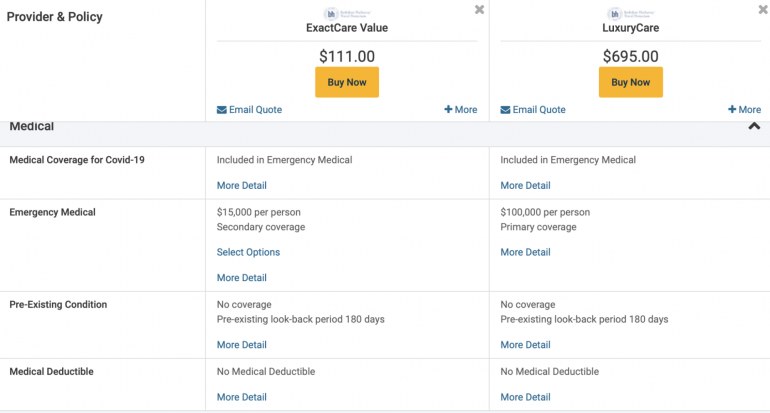

When comparing insurance policies, you’ll want to think about coverage limits as well as whether the insurance will provide primary or secondary coverage. Compare these factors against other policies to see which policy is the right fit for you.

Here’s a comparison between two different policies. Although neither of these requires a deductible, one of these is secondary (it pays out after other insurance) and caps out at $15,000 per person in emergency medical expenses.

The other is primary (it pays out before other insurance policies) and covers up to $100,000 per person in emergency medical expenses:

While $15,000 may seem like a lot of money, remember that this total includes all doctor visits, tests and medications — in addition to the cost of your quarantine stay.

If you’re staying somewhere expensive, those costs can quickly add up.

Although some communities, such as New York City, may provide cost-free isolation accommodation, others will leave you to fend for yourself.

Even if staying in a moderately priced hotel, five to 10 days (or more) of isolation can quickly run into the thousands of dollars. You’ll want to be sure your insurance policy can cover this.

» Learn more: Does travel insurance cover COVID-19?

Final thoughts on travel insurance that covers COVID quarantine

Although the world is still trying to grapple with the COVID-19 pandemic, you may be looking to get out and travel again. Being protected in the event something happens can give you peace of mind when away from home.

This is especially true when it comes to mandatory COVID-19 quarantine, when costs can easily pile up. Acquiring travel insurance with COVID-19 quarantine protection can save you — and your wallet — in case of an emergency.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

How do you choose travel insurance that covers COVID-19?

Oct 26, 2021 • 5 min read

COVID-19 has made it more important to check the health coverage on your travel insurance © Maskot/Getty Images

After 18 months of pandemic-related travel restrictions, you may be itching to act on your pent-up wanderlust—but the situation and the rules are still continuously evolving. So before you go anywhere, it’s best to have a travel insurance plan that protects the investment you’ve made in a long-awaited trip.

A robust travel insurance plan will reimburse pre-paid trip costs and non-refundable deposits if you have to cancel or interrupt your trip, encounter trip delays, experience baggage loss or require medical expense and medical evacuation. Your policy will also reimburse “covered reasons” in your plan, such as death, illness or injury, serious family emergencies, unplanned jury duty, military deployment, acts of terrorism, or your travel supplier going out of business.

But COVID-19 has added an additional checklist to your usual insurance needs—it’s now important to check to ensure your travel insurance plan includes coverage for COVID-19 medical expenses, and losses related to illness. Your policy should also cover quarantine costs if you need to self-isolate after testing positive for the virus.

What do I look for in COVID-19 insurance coverage?

When you’re shopping for a travel insurance plan that covers COVID-19, you need to do your research and read the fine print of your plan.

Look for a travel insurance product that will protect your non-refundable, prepaid expenses if you have to cancel your trip due to illness caused by COVID-19. Your policy should also cover emergency medical treatment and emergency medical transportation. With regard to COVID-19 coverage, be sure your policy covers medical care, medicine, hospitalization and quarantine expenses.

“The type of coverage you should look for depends on you, your needs, travel dates, and the type of trip you’re taking,” says Sasha Gainullin, CEO of battleface , a travel insurance carrier. He says some travel insurance companies have now excluded COVID-19 coverage because it has been labeled a “known/foreseeable event”, while others may exclude pandemics altogether.

“It’s important to search for plans that include medical and quarantine expenses as well—this will be critical in the event you become ill and need to receive treatment while traveling,” continues Gainullin.

One additional tip is to confirm there are no exclusions based on the destinations you’re traveling to—this can happen with countries under government-issued travel warnings, Gainullin says.

“If a traveler feels uncertain, I recommend speaking with the travel insurance company directly. They can review the policy details with you, answer all of your questions, and confirm all of your required coverage options are included,” he adds.

Is getting coverage dependent on vaccination?

While it’s a good idea to be fully vaccinated before traveling, vaccination is not required to purchase a travel insurance policy, says Daniel Durazo, spokesperson with Allianz Partners USA.

What are the medical costs that are covered by travel insurance?

Travel insurance can cover the cost of both medical treatment and emergency medical transportation. A US health insurance plan, as well as Medicare, generally will not cover overseas medical expenses, so it’s best to check with your personal health insurance provider if any global coverage is available.

“While losing the cost of a trip due to an unexpected cancellation would be painful, paying for expensive emergency medical treatment or emergency medical transportation can be financially devastating,” Durazo says.

Under a travel insurance plan, medical costs could range doctor visits, pharmacy expenses, imaging costs and covering a hospital stay if required. Other expenses that can be covered are transportation to medical care and medicine.

Read more: Will my health insurance cover getting COVID-19 while traveling in the US—or abroad?

What about covering an unexpected quarantine due to COVID-19?

Many international destinations are now requiring that visitors purchase travel insurance coverage for an unexpected quarantine. Allianz Travel Insurance has added coverage to many of its products that includes reimbursement for quarantine-related accommodations if you or a traveling companion is individually-ordered to quarantine while on their trip, says Durazo.

This coverage typically covers the cost of additional food, lodging and transportation while quarantined. In addition, trip interruption and travel delay benefits on certain Allianz plans also provide coverage if you or your travel companion is denied boarding by your travel carrier due to suspicion of illness.

The benefits for quarantine coverage vary from carrier to carrier. For example, on select Trawick International plans, they offer $2,000 in quarantine benefits and for an additional charge, and you can increase it up to $7,000.

What about pre-flight COVID-19 testing?

Your plan may provide coverage for flights if you are turned away at a border for not passing a health inspection. Foster says Trawick’s travel insurance plans that cover COVID-19 would cover the expenses if you could not pass your pre-health inspection. Also, the plan would cover the costs of the failure of your PCR test to return to the United States, such as having to quarantine abroad.

It’s important to note that the actual cost of the PCR test is not covered by your policy, just the loss associated with the negative test.

Read more: PCR tests for travel: everything you need to know

Some destinations require COVID-specific insurance coverage—how do I comply with those restrictions?

Before any international travel, you should check the country where you are headed to make sure you comply with insurance coverage requirements. Countries like Spain, Turks and Caicos and Thailand are among the nations that mandate COVID-19 insurance coverage.

“You first must check the countries’ specific COVID regulations for entry into the country. Some countries require travelers to provide proof of travel insurance that covers COVID-19 related expenses purchased from a third party,” explains Foster. Providing proof coverage is key; so travelers need to ensure they receive documentation from their insurance provider that their policy covers COVID-19 related expenses to show customs officials, she says.

Should you arrive in a country that requires proof of insurance to cover COVID-19 medical expenses and quarantine costs, and you don’t hold a policy, you will not be granted entry.

For more information on COVID-19 and travel, check out Lonely Planet's Health Hub .

You may also like: What happens if I'm denied entry to a country on arrival? What is a vaccine passport and do I need one to travel? What is the IATA Travel Pass and do I need it to travel?

Explore related stories

Destination Practicalities

Mar 28, 2023 • 3 min read

Here’s all you need to know about getting a traveler visa to visit China now that “zero COVID” has come and gone.

Sep 12, 2022 • 4 min read

Mar 31, 2024 • 7 min read

Mar 30, 2024 • 4 min read

Mar 31, 2024 • 6 min read

Mar 31, 2024 • 10 min read

Mar 30, 2024 • 6 min read

Mar 30, 2024 • 11 min read

- United States

- United Kingdom

Bupa travel insurance review

There are 5 policies to choose from with bupa travel insurance, along with a heap of add-ons including adventure activities, snow sports and wide-ranging cruise cover..

In this guide

Compare your travel insurance quotes

What does bupa travel insurance include, bupa travel insurance features – an overview, comprehensive policy features, optional add-ons, more reasons to consider bupa, frequently asked questions.

Destinations

Our Verdict

- Enjoy the flexibility to pick between a wide range of policies and set your own trip cancellation limit

- If you're involved in an emergency while you're overseas, you can enjoy peace of mind you can contact Allianz Global Assistance for help at any time – 7 days a week.

- Bupa health insurance members can score a 15% discount on their travel insurance.

- Bupa's COVID-19 coverage is limited in comparison with brands such as Fast Cover and Southern Cross Travel Insurance.

- Its cover limit of $10,000 for theft or damage to luggage and personal belongings is decent, but some competitors offer $15,000.

Review by our insurance editor James Martin

Use a comma or space to separate ages. Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

Bupa travel insurance is underwritten by Allianz. Bupa offers quality travel insurance that can bring peace of mind that you can make the most of your trip, while knowing you'll receive financial support if things do go wrong.

All policies come with a basic excess . In most cases, you'll pay this when making a claim. You have the option to vary this excess – by committing to a higher sum, you could reduce the cost of your insurance. Keep in mind that an additional $500 excess applies to Bupa's Adventure Pack and Snow Pack.

With Bupa, you can choose between a single, couple and family policy. This provider offers a cooling-off period of 14 days – you can cancel your policy within 2 weeks for a full refund.

- Overseas emergency assistance – unlimited

- Overseas medical expenses – unlimited

- Accidental death – up to $25,000 (or $50,000 with a family plan)

- Permanent disability – up to $25,000 (or $50,000 with a family plan)

- Trip cancellation costs – chosen by you

- Additional expenses – up to $50,000 (or $100,000 with a family plan)

- Travel delay expenses – up to $2,000 (or $4,000 with a family plan)

- Personal liability – up to $5 million

- Luggage, personal effects and valuables – up to $10,000 (or $20,000 with a family plan)

- Alternative transport costs – up to $5,000 (or $10,000 with a family plan)

- Travel documents, bank cards and traveller's cheques – up to $5,000 (or $10,000 with a family plan)

- Rental Vehicle Excess – up to $6,000

- Luggage & personal effects delay expenses – up to $500 (or $1,000 with a family plan)

- Theft of cash – up to $250 (or $500 with a family plan)

Additionally, Bupa offers multi-trip cover, a domestic policy and an entry-level Essentials plan. Finally, you can opt for a non-medical plan – a basic policy that's good if you want some insurance but without cover for a pre-existing condition .

- Adventure Pack . Available to those under the age of 75, this optional cover includes insurance for activities including abseiling, deep sea fishing, caving, quad bike riding, outdoor rock climbing and motorcycles/mopeds.

- Cruise Pack . Get cover while you cruise overseas and in Australian waters. In addition to features such as unlimited medical cover and unlimited evacuation cover, you can claim up to $1,000 if you need to cancel (for an unforeseen reason) any pre-booked tours.

- Snow pack . Available to those under 75, the Snow Pack comes with a range of snow sports activities including skiing and snowboarding. Overseas emergency assistance is capped at $100,000.

- Travelling when you know you are unfit or against medical advice

- Going to a country where a 'Do not travel' alert has been issued by the Australian government

- Breaking the law

- Being under the influence of alcohol or ilicit drugs

- Death, illness or injury from an existing condition (unless it's specifically covered by your policy)

- Any consequential loss or loss of enjoyment

- A loss caused by or in connection with a criminal or dishonest act

- Failure to take precautions after a public warning of strike, riot, civil commotion or natural disaster

- Driving a rental vehicle in an illegal or dangerous manner.

Be sure to read Bupa's PDS for a full list of exclusions. Learn more about travel exclusions here .

- Range of options. Bupa offers high-quality cover with a wide range of options to meet your travel needs. But you may also opt for lower-priced cover that will come with fewer and/or lower benefit limits.

- 24/7 assistance. If the unexpected happens while you’re travelling overseas, emergency help is available 24 hours a day. If you have any difficulties while you are travelling, you can contact the Emergency Assistance Hotline and you will be able to speak with one of Bupa's trained staff. You can call Bupa on +61 7 3305 7497 (overseas) or 1800 119 412 (within Australia).

- Discounts for existing members. Bupa health insurance members can receive up to a 15% discount on their travel insurance premiums.

Am I covered for pre-existing conditions?

You can get cover for some pre-existing illnesses. However, according to Bupa's policy wording, you'd need to have "disclosed the condition to Allianz Global Assistance and they have agreed in writing to include cover under your policy for the condition".

Be aware, you won't be able to get cover for pre-existing conditions under Bupa's Essentials or Non-Medical Plans.

Is there a cooling-off period?

Yes. If you change your mind about a policy, Bupa offers a 14-day cooling off period, in which time you can cancel your insurance and get a full refund, so long as you haven’t begun your travels or made a claim. If you wish to cancel or change your policy outside of this period, you can apply to Bupa online or over the phone.

How long do I have to make a claim?

If you wish to make a claim, you typically must phone Bupa within 30 days of completing or cancelling your journey.

- Bupa Domestic, Comprehensive International and Essentials International Travel Insurance information page

- Bupa Domestic, Comprehensive International and Essentials International Travel Insurance information PDF

- Bupa Domestic, Comprehensive International and Essentials International Travel Insurance TMD

James Martin

James Martin was the insurance editor at Finder. He has written on a range of insurance and finance topics for over 7 years. James often shares his insurance expertise as a media spokesperson and has appeared on Prime 7 News, WIN News, Insurance News, 7NEWS and The Guardian. He holds a Tier 1 General Insurance (General Advice) certification and a Tier 1 Generic Knowledge certification, both of which meet the requirements of ASIC Regulatory Guide 146 (RG146).

More guides on Finder

Bupa is an international healthcare services provider that also offers insurance to cover car, home, life and travel.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

4 Responses

I have benign irregular heart beat. cardiologist letter says fit for travel. Which cover can I buy that covers this? John

Thanks for your inquiry.

There are brands that offer travel insurance to people with heart conditions . You can compare the costs and get more details about the cover by clicking on the “Get Quote” button. It is also best to contact your chosen insurer if you want to discuss more the level of cover.

Before applying, please ensure that you read through the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

Hope this helps.

Cheers, May

Do you cover missed flights due to illness? and providing you a medical certificate for proof?

Hi Michelle,

Thanks for your question. finder.com.au is a comparison service and not an insurer. Bupa Travel Insurance do provide cover for cancellation and yes you will need to be able to provide them with substantiating evidence that a claimable event did happen.

I hope this was helpful, Richard

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

How COVID-19 Travel Insurance Works

From weekend getaways to extended vacations, specialized covid-19 travel insurance can provide security if the virus affects your travel plans..

)

3+ years writing about auto, home, and life insurance

7+ years in personal finance and technology

Amy specializes in insurance and technology writing and has a talent for transforming complex topics into easy-to-understand stories.

Read Editorial Guidelines

Featured in

)

Licensed auto and home insurance agent

4+ years in content creation and marketing

As Insurify’s home and pet insurance editor, Danny also specializes in auto insurance. His goal is to help consumers navigate the complex world of insurance buying.

Updated September 18, 2023

Reading time: 4 minutes

)

Table of contents

- Pandemic insurance

- What’s covered

- Is it worth it?

- Secure a policy

Travel lets you see new places, meet new people, and experience different cultures. But the lurking shadow of COVID-19 can make traveling uncertain. Almost half of canceled trips in 2020 were due to the virus, according to the U.S. Travel Insurance Association (UStiA). [1]

Travel insurance can help if something goes wrong before or during your trip, but not all policies cover COVID-19 issues. Let’s explore how COVID-19 travel insurance works and how it might — or might not — shield you on your next journey.

How pandemic travel insurance works

Most travel insurance policies include protections for trip cancellations, delays, or other trip interruption coverage. However, many policies don’t cover disruptions due to pandemics. [2] That’s where COVID travel insurance comes into play.

COVID travel insurance is a specialized policy that can refund your money if the virus throws a wrench into your plans. It typically has three coverage levels: coverage for a trip delay, canceling for any reason, and medical care if you get sick.

Travel delay coverage

Illness, injury, jury duty, and other circumstances beyond your control can delay your travel plans. Travel delay insurance covers flight issues, bad weather, sudden breakdowns, and unexpected illnesses or injuries that happen before reaching your destination. It can pay you back for non-refundable expenses and cover extra costs, too — like food, hotel rooms, or cab rides.

Cancel for any reason

Travel insurance policies typically have strict rules, but a cancel-for-any-reason (CFAR) option offers more leeway, allowing you to cancel for reasons not covered in the original policy.

But with CFAR benefits, you might only get a partial refund amount. Reimbursements usually range from 50% to 75% of the total price. [2]

Medical coverage for COVID-19

If your health insurance is only valid in a specific area and doesn’t cover international travel, travel insurance with medical expenses coverage can fill the gap.

If medical insurance is included in your trip policy, it can help pay for medical attention and treatment costs if you, a family member, or another traveling companion becomes ill from COVID-19 before or during your trip.

Will travel insurance cover you if you need to quarantine?

Some travel protection plans cover quarantine or self-isolation due to COVID-19 concerns. It can reimburse you for lost prepaid expenses and cover additional lodging and meal costs. However, it depends on your policy and the conditions leading to the cancellation, delay, or disruption.

Protection often hinges on two factors:

Not all travel insurance plans include a pandemic as a covered reason. If COVID-19 was a significant public concern when you purchased the policy, insurers may not provide coverage because it’s a “foreseeable” threat. But some plans let you add COVID-19 coverage as an endorsement.

Even if you set out to buy COVID-19 travel insurance, it may not be available for your plan or location. Review your benefits and endorsement options to look for “pandemic” or “epidemic-related” language to see if COVID-19 is a covered event.

Is travel insurance worth it?

The Centers for Disease Control and Prevention (CDC) declared the COVID-19 public health emergency over in May 2023, but there’s still a risk of infection, according to the World Health Organization (WHO). [3] [4]

Your credit card’s travel protections are worth considering, but you may not want to rely on that alone. Credit cards often limit travel coverage, and most companies don’t include trip cancellation coverage. [5]

Travel delay benefits can fill the gap — especially benefits with COVID-19 coverage. Compare the policy cost against the potential loss if you have to cancel or delay your trip to determine if it’s worth it. The up-front payment for travel insurance is typically a fraction of what you might spend out of pocket if plans go south.

The CDC reports that medical bills in the first six months of a COVID-19 diagnosis average nearly $8,400. [6] Factor in non-refundable trip costs, accommodation charges, and other miscellaneous expenses, and the expenses can skyrocket.

How to find the best travel insurance

If you’re concerned about the pandemic and the potential effects on your travels, here are some tips to help you secure a policy with the best travel insurance plan:

Research coverage and services

Compare multiple companies and policies and read reviews to see others’ experiences.

Check for pandemic coverage

Not all policies cover travel disruptions from COVID-19. Review your coverage to make sure it specifically addresses pandemic reasons.

Buy medical coverage

Travel policies don’t automatically include medical emergencies. Consider adding medical travel insurance, and ask about emergency assistance coverage and medical evacuation in case of a natural disaster.

Consider a cancel-for-any-reason insurance policy

CFAR policies can be beneficial, especially with unpredictable pandemic-related concerns and travel restrictions.

Understand refund policies

Read the fine print and policy information to verify how the insurer handles refunds. Some policies might offer partial refunds.

COVID travel insurance FAQs

The COVID-19 virus has made travel plans tricky. Whether you’re planning a weekend getaway or a month-long vacation, here’s what you need to know about COVID-19 travel insurance.

Will travel insurance cover COVID cancellations?

It depends. Standard travel insurance policies don’t cover COVID-19 or other pandemic-related reasons, but some travel insurance companies offer specialty COVID-19 coverage against the virus’ potential interference. If you cancel your trip due to the virus, a COVID travel insurance policy may provide refunds or reimbursements for your expenses.

Do you get your travel insurance premium refunded if you cancel your trip?

Travel insurance offers varying refund policies depending on the travel insurance company, but it doesn’t refund your premium. Instead, coverage can reimburse you for prepaid trip costs, meals, hotel rooms, or cab rides because of the interruption.

Will travel insurance cover quarantine outside the U.S.?

It’s possible. Travel insurance policies may cover quarantine or self-isolation expenses outside the United States due to COVID-19 concerns. However, coverage depends on your specific policy and the circumstances leading to the quarantine. It’s crucial to review the specific details and look for “pandemic” or “epidemic-related” language to ensure coverage.

How does COVID travel insurance differ from regular travel insurance?

Regular travel insurance often covers typical trip cancellations, interruptions, or delays. However, many don’t address pandemic-related disruptions. COVID travel insurance provides specialized coverage for travel hiccups related to the virus, ensuring you’re shielded financially if COVID-19 affects your journey.

Related articles

- Tesla Battery Replacement Cost

- What to Know About Illinois Emissions Testing

- How Much Will Insurance Pay for My Totaled Car? (Full Guide)

- Can You Legally Drive with an Expired License?

- What Is the Difference Between a Real ID and a Driver’s License?

- How Many Cars Can You Have in Your Name?

- How to Get Auto Insurance on the Weekend

Popular articles

- Car Insurance for First Responders

- Cheapest Car Insurance for Drivers Under 25

- Car Insurance Calculator: Estimate Your Monthly Costs

- Can You Add Someone Who Doesn’t Live with You to Your Car Insurance?

- New Jersey Dollar-a-Day Insurance (SAIP Plans)

- How to Participate in the teenSMART Driver Program

- Rideshare Insurance in California

- US Travel Insurance Association . " Consumers Spend $1.72B on Travel Protection in 2020, According to New UStiA Study ." Accessed September 13, 2023

- National Association of Insurance Commissioners . " Travel Insurance ." Accessed September 13, 2023

- Centers for Disease Control and Prevention . " End of the Federal COVID-19 Public Health Emergency (PHE) Declaration ." Accessed September 13, 2023

- World Health Organization . " Coronavirus disease (COVID-19) pandemic ." Accessed September 13, 2023

- US Travel Insurance Association . " Will Your Credit Card Protect Your Travels? ." Accessed September 13, 2023

- Centers for Disease Control and Prevention . " Direct Medical Costs Associated With Post–COVID-19 Conditions Among Privately Insured Children and Adults ." Accessed September 13, 2023

)

Amy is a personal finance and technology writer. With a background in the legal field and a bachelor's degree from Ferris State University, she has a talent for transforming complex topics into content that’s easy to understand. Connect with Amy on LinkedIn .

Latest Articles

)

Cheapest Car Insurance for Drivers Under 25 (2024)

Finding cheap car insurance for drivers under 25 can be tough, but there are plenty of affordable options if you know where to look.

)

Cheapest Car Insurance for Teens (2024)

Teens are notoriously expensive to insure. Check out the cheapest car insurance companies for teenagers to find a better deal.

)

Best Car Insurance with a $500 Deductible (2024)

Nationwide has the cheapest full-coverage car insurance with a $500 deductible, at $273 per month. Your deductible is what you pay when you file a claim.

)

Cheapest Car Insurance Companies for High-Risk Drivers (2024)

High-risk drivers face challenges with car insurance rates, but options are available. Research the best coverage for high-risk drivers.

)

6 Best Pay-as-You-Go Car Insurance Companies (2024)

Pay-as-you-go car insurance has a different payment model than traditional insurance. See which companies have the best pay-as-you-go coverage.

)

State Farm Car Insurance Review: Costs and Ratings (2024)

State Farm costs an average of $175 for full-coverage car insurance. See State Farm’s car insurance customer reviews, ratings, discounts, and quotes.

Advertisement

Supported by

Omicron and Travel: So, Now Do I Need Trip Insurance?

In light of the new variant, is extra protection warranted for things like flight and lodging cancellations and quarantine hotels? It depends. Here’s what you need to know.

- Share full article

By Elaine Glusac

While the pandemic has depressed travel, it may have encouraged travel insurance, say those in the industry.

“The biggest question we get from customers is: ‘What happens if I get Covid during travel and what if I have to quarantine?’” said Jeremy Murchland, the president of Seven Corners , a travel insurance management company. “Covid has created a much broader awareness of travel insurance.”

But will it help you in light of the new Omicron variant, which has already led to new travel restrictions and requirements? In the early days of the pandemic, travel insurance largely failed to protect travelers who wanted or needed to cancel as the world shut down. The following are answers to common questions about travel insurance now.

Does travel insurance cover Covid-19, including the new Omicron variant?

For the most part, yes, travel insurance policies now treat Covid-19 in all its variants — including Omicron — like any other medical emergency.

“Consumers should know that most travel insurance plans with medical benefits now treat Covid like any other illness that you could contract while traveling or that could prohibit you from going on your trip,” said Carol Mueller, a vice president of Berkshire Hathaway Travel Protection . “If you become ill before your trip, you’ll need a doctor’s note confirming your illness and that you are unable to travel in order to be eligible for benefits. The benefits are the same regardless of whether you contract Omicron, another variant of Covid or any illness for that matter.”

Buyers should read the policies carefully and look out for those that exclude pandemics, Covid-19 and its variants. To make a claim, you must have had travel insurance before becoming ill.

“We always say, you can’t buy auto insurance after you’ve already had an accident,” said Meghan Walch, the product manager of InsureMyTrip , an insurance sales site. “It is designed for unforeseen issues. You have to purchase it before an event.”

I am traveling internationally. If borders close because of Omicron, am I covered through travel insurance?

No, most policies do not cover you if your foreign destination closes its borders to visitors, as Israel did recently. With a few exceptions, that also goes for a government-issued travel warning to a destination, which is generally not a covered reason to make a claim.

Given the added uncertainties of Omicron, should I consider a ‘Cancel for Any Reason’ policy?

Cancel for Any Reason, or C.F.A.R., provisions would allow you to claim some of your nonrefundable costs if you decide not to go on a trip for any reason, including border closures or fear of contracting Covid. The rub is that this form of insurance — in addition to being more expensive — must generally be purchased within a few weeks of booking the trip and will only return 50 to 75 percent of nonrefundable trip costs.

“Most travel insurance policies do not cover you for wanting to cancel out of fear of Covid. We say this 10 times a week,” said Sarah Groen, the owner of the agency Bell and Bly Travel . She counsels clients to consider their worst fears — illness, for example, or quarantine — in troubleshooting travel insurance. “We’ve become like therapists,” she said.

What about quarantine and medical expenses?

Make sure the policy you choose covers these. In the case of medical coverage, check with your regular health insurer; many policies will not cover you abroad, which is an additional reason to consider coverage if you are traveling internationally.

“What travel insurance can do is cover additional hotel stays if you are able to self-quarantine and additional airfare when you’re able to come home,” said Megan Moncrief, the chief marketing officer for Squaremouth , a travel insurance sales site. She added that most policies will extend to seven days past your originally scheduled return date, effectively covering only about seven days in case of quarantine.

Do some destinations require travel insurance?

Yes, primarily to cover medical care or quarantine accommodations in the event that a traveler tests positive for Covid-19. For example, Singapore requires medical insurance with a minimum coverage of 30,000 Singapore dollars, or about $22,000. Fiji requires travel insurance to cover potential treatment for Covid-19, and makes it available from about $30. Some destinations, such as Anguilla , recommend rather than require travel insurance. InsureMyTrip.com has a page devoted to countries that require travel insurance.

It bears thinking about what it would take to get home for treatment should you contract Covid-19 abroad. Thailand, for example, requires travelers to have medical insurance with the minimum coverage of $50,000. “Evacuation out of Thailand would be higher,” said Sasha Gainullin, the chief executive of Battleface , a travel insurance start-up that unbundles benefits. In the case of a Thailand trip, he advised taking medical coverage up to $100,000 for treatment locally and $500,000 for medical evacuation and repatriation.

Do I need insurance if I have bookings with flexible cancellation policies?

Probably not, if you have hotel reservations that allow free cancellation 24 to 48 hours in advance. The same with flights; if your flight is changeable and will provide a voucher or refund in case of cancellation, you’re covered.

I have rented a house with restrictive cancellation penalties. Can I insure against those?

Yes. Vacation home rentals from Airbnb and the like can be treated just like other accommodations that do not offer refunds. In this case, you would want to get a policy in the amount you would forfeit if you had to cancel for a covered reason like illness. Again, fear of travel is not a covered reason; for that, you would need C.F.A.R.

Elaine Glusac is the Frugal Traveler columnist. Follow her on Instagram: @eglusac .

Follow New York Times Travel on Instagram , Twitter and Facebook . And sign up for our weekly Travel Dispatch newsletter to receive expert tips on traveling smarter and inspiration for your next vacation.

An earlier version of this article misstated the timeframe within which it is recommended that Cancel for Any Reason travel insurance be purchased. It is generally within about two to three weeks of booking the trip, not one or two days.

How we handle corrections

- Type 2 Diabetes

- Heart Disease

- Digestive Health

- Multiple Sclerosis

- COVID-19 Vaccines

- Occupational Therapy

- Healthy Aging

- Health Insurance

- Public Health

- Patient Rights

- Caregivers & Loved Ones

- End of Life Concerns

- Health News

- Thyroid Test Analyzer

- Doctor Discussion Guides

- Hemoglobin A1c Test Analyzer

- Lipid Test Analyzer

- Complete Blood Count (CBC) Analyzer

- What to Buy

- Editorial Process

- Meet Our Medical Expert Board

Traveling This Summer? Here’s Why You Need COVID Travel Insurance

Gabriella Clare Marino/Unsplash

Key Takeaways

- Some travel insurance will cover COVID-19 infection and quarantine. However, the fear of contracting COVID is not covered under most plans. In that case, “Cancel for Any Reason” coverage may offer protection.

- Many countries now require travel insurance. Depending on where you go, you may need to purchase a nationally administered plan.

- If you’re planning a trip, know that these requirements are changing frequently. Always read the fine print on any coverage you’re considering. Before you depart, double-check your plan to make sure that it’s complying with the requirements of the country you’re traveling to.

Jonathan Tucker didn’t intend to contract COVID-19 in Ireland in early April.

Tucker, who plays djembe and sings with the pirate band The Musical Blades, was touring the Emerald Isle as part of a guided tour featuring the musical group.

After seeing many of the sights, he and roughly 20 of the 65 tour participants came down with COVID and had to stay behind to quarantine.

While quarantining in an Irish hotel room isn’t ideal, Tucker told Verywell that he was prepared for the possibility.

“We got travel insurance, although it wasn’t exclusively for COVID,” said Tucker. “We also made sure we saved enough for double the trip expenses just in the event that this happened. Otherwise, it would be irresponsible.”

Tucker chose a plan through Allianz that reimbursed his expenses, including accommodations while traveling.

Since Ireland’s quarantine time is counted from the first sign of COVID symptoms , without that coverage, Tucker would have been on the hook for an additional seven days of accommodations.

What Is Travel Insurance?

Travel insurance has been around far longer than COVID, but the pandemic has made it much more attractive to travelers.

Typical plans cover trip delays, lost baggage, or medical care if a traveler has to visit a healthcare facility abroad. Most domestic healthcare plans don’t offer coverage.

Some plans, like Tucker’s, work for solo travelers or couples traveling together—even if only one person tests positive for COVID.

Travel Insurance for COVID

While there are options for travelers trying to prepare for the possibility that COVID could derail their plans, it hasn't always been that way.

Damian Tysdal, the founder of CoverTrip , told Verywell that epidemics were historically excluded from travel insurance.

Tysdal has written about travel insurance trends on his blog since 2006. He told Verywell that he’s seen plans change throughout the pandemic.

“COVID coverage with travel insurance has been evolving since the beginning of the pandemic,” said Tysdal. “Some companies outright excluded any losses resulting from an epidemic. Others covered it, but only if you purchased insurance before it became a ‘known event’—after which it could not be insured.”

According to Tysdal, most companies covered COVID as if it were any other illness—they paid for medical care, or if you were diagnosed before your trip, they covered trip cancellation.

However, consumers need to read plans carefully and look for loopholes such as exclusions for epidemics.

Is COVID Fear Covered?

Tysdal said that one thing that most plans don’t cover is the fear of contracting COVID, even if case rates justify that fear.

“The main problem came down to people wanting to cancel out of fear of getting COVID. That is not covered,” said Tysdal.

According to Tysdal, an exception would be a plan with “Cancel for Any Reason” coverage, which is “an optional upgrade that extends your list of covered reasons for cancellation. In that case, you could cancel out of fear.”

What Will Travel Insurance Cover?

Joe Cronin, MBA , president of International Citizens Insurance, told Verywell that travel insurance plan coverage varies, particularly when it comes to COVID-related expenses.

For example, some plans will only cover the costs of medical treatment, while others will pay for the cost of quarantining (as in Tucker’s case).

For quarantine coverage, plans might pay a set amount of money for meals, transportation, and lodging.

Read the Fine Print

Cronin said that travelers need to know that self-administered COVID tests are not always enough to trigger plan coverage.

“In most cases, a physician must diagnose you with COVID to receive coverage,” said Cronin. “If you discover you have COVID through a self-administered test, you may have to go to a doctor to get the diagnosis confirmed for the coverage to take effect.”

Cronin explained that “some policies will only cover quarantine if you can show that a government authority or doctor mandated it and that it was because you tested positive or are symptomatic.”

To make sure you’re complying with the policy you’ve purchased, Cronin said it’s crucial that you read the fine print.

Some traditional travel insurance plans changed to accommodate COVID, but there are others that are specifically geared toward it. For example, CAP and Covac Global both offer programs that are optimized for COVID coverage.

Do I Need Travel Insurance?

Travel insurance used to be an optional expense, but Cronin said that many countries now require it for entry.

As borders open to summer travelers, some countries are starting to require travelers to purchase the insurance coverage that’s offered by their national governments.

As of February 2022, Belize requires all visitors to purchase mandatory international health insurance through their tourism portal and covers medical treatment in the country.

Other countries only require travel insurance if you’re unvaccinated.

For example, Singapore requires unvaccinated travelers to carry travel insurance with a minimum of S$30,000 coverage (about US$22,000). Vaccinated travelers are encouraged, but not required, to have insurance.

Know Requirements—and Check for Changes

Cronin said that the requirements for travel insurance change rapidly, so it can be hard to keep up.

“Some countries have said they are implementing a travel insurance requirement only to remove it at the last second,” said Cronin. “Other countries have officially removed their travel insurance requirement—but border control agents are still asking for your travel insurance plan on entry. It is important to check the requirements of the country you are going to.”

As of April 2022, the United States has no travel insurance requirement for entry. Still, White House representatives have stated that there is no intention of lifting the testing requirement for reentry into the U.S.

As that testing remains, more Americans could wind up stranded abroad with COVID—whether they are symptomatic or not. Travel insurance could be the only thing standing between them and a very expensive quarantine.

What This Means For You

Travel insurance used to be a precaution that many travelers considered an unnecessary expense. Now, it might be necessary for entry into a country you plan to visit.

If you choose to purchase travel insurance, read the fine print carefully. Make sure that you know what’s covered—and what’s not—when it comes to COVID medical care and quarantine support.

The information in this article is current as of the date listed, which means newer information may be available when you read this. For the most recent updates on COVID-19, visit our coronavirus news page .

By Rachel Murphy Rachel Murphy is a Kansas City, MO, journalist with more than 10 years of experience.

Does travel insurance cover pandemics?

More than a quarter of the population of the U.S. has received at least one COVID-19 vaccination as of this week, and all those shots in arms seem to be directly correlating to a surge in travel.

In fact, the number of passengers in U.S. airports reached their highest numbers in more than a year last week according to the Transportation Security Administration ( TSA ). Whether you're vaccinated or not, concerns about new strains of the coronavirus are high, so it's not surprising to hear that inquiries about travel insurance have also hit their highest level since the pandemic began, according to InsureMyTrip .

However, "there is a big misconception about what travel insurance does — and doesn't — cover," said Meghan Walch, pandemic travel insurance expert for InsureMyTrip . In the company's latest poll of travel insurance agents, the vast majority of questions (a whopping 97%) from would-be travelers are regarding how travel insurance may or may not cover COVID-19 related travel concerns.

So, does your travel insurance cover a pandemic? Here's everything you need to know.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter .

Why travel insurance usually doesn't cover epidemics and pandemics

In general terms, regular travel insurance policies cover the "unknowns" — for example, an accident you couldn't have anticipated in advance, such as falling while you were hiking and breaking your leg — and not losses caused directly or indirectly by known or foreseeable events (in this case, an epidemic complete with government travel advisories).

Similar to a weather event , once something becomes "known" it may not be a covered reason for cancellation if a traveler purchases insurance after that date.

In other words, if you purchased travel after the World Health Organization (WHO) declared COVID-19 a pandemic, you've entered "known" territory, the same as deciding to fly into the eye of a hurricane.

Related: Avoiding outbreaks isn't covered by most travel insurance

What travel insurance normally covers

"Essentially, travel insurance covers unexpected events during your travels and pre-departure starting the effective date of your policy," said Christina Tunnah, general manager of the Americas of travel insurance company World Nomads.

According to Tunnah, regular travel insurance breaks down into three main categories:

- The protection of your pocketbook (investment in flights, delays, interruption, cancellation)

- The protection of yourself (emergency medical and evacuation)

- The protection of your belongings ( delayed and lost bags , theft)

Many credit cards also offer travel protection. Covered situations, maximum coverage amounts and eligible expenses vary across the cards that offer this benefit. Covered situations typically include accidental bodily injury; loss of life or sickness; severe weather; terrorist action or hijacking and jury duty or a court subpoena that can't be postponed or waived.

Related: The best credit cards with complimentary travel protection

Are some insurers covering COVID-19?

Not all the news on the COVID-19 insurance front is negative. According to Walch, many traditional travel insurance policies will cover your COVID-19 related travel concerns if you meet regular guidelines.

Examples of COVID-19 coverage in traditional plans include:

- If you must visit a doctor or hospital during a trip due to a COVID-19 illness

- If you get sick with COVID-19 and must cancel a trip

- If a physician orders you to quarantine before a trip

- If you lost a job during the coronavirus pandemic by no fault of your own

In addition, some plans are now offering higher travel delay limits in order to help with additional accommodation expenses due to a covered quarantine, adds Walch.

And, there are also some individual insurers that are simply covering COVID-19 outright. For example, World Nomads' plans cover the diagnosis of COVID-19 the same as any other illness with benefits that could include emergency medical care, emergency medical evacuation, trip delay and trip interruption coverage if you contract COVID-19 while traveling.

How to find a plan that covers COVID-19

First of all, you should look in the exclusion section to see if pandemics or epidemics are mentioned. If so, you'll need to shop around for a different policy, said Tunnah.

Even though travel insurance companies may offer COVID-19 sickness coverage, they typically don't offer benefits for every circumstance.

"Every policy is different, so you'll want to get a good grasp of a plan's coverage before you purchase it," Tunnah explained. Some of the questions you should ask yourself are: Does the plan cover emergency medical and evacuation expenses if I contract COVID-19? What are covered reasons for cancellation? What if my trip is delayed or interrupted because of a COVID-19 event?

If you're getting confused from reading the legal jargon of a policy, you can contact the customer service department of your travel insurance company, Tunnah advised. Representatives should be able to provide plain English explanations of coverage and help you identify a plan that meets your specific trip needs.

To see multiple options in one place, InsureMyTrip has a COVID-19 coverage tool that allows you to compare different policies.

Here's what you should be looking for according to the company:

- Trip cancellation coverage: While traditional trip cancellation does not allow a traveler to cancel a trip due to COVID-19 fears, it may cover a traveler in the event they get sick from COVID-19 and must cancel a trip.

- Trip interruption coverage: In the event a traveler gets sick from COVID-19 and the trip is interrupted, this coverage may apply.

- Cancel for any reason coverage : If eligible, this protection allows travelers the option to cancel a trip due to concerns over COVID-19, whereas traditional trip cancellation coverage does not (see below for more details).

Cancel for any reason insurance could be your best option

Cancel for any reason, also known as CFAR in the insurance industry, is an add-on to certain traditional trip insurance policies.

While travel insurance policies can offer a range of inclusions (think: medical evacuation, trip cancellation due to foreign or domestic terrorism or rental car damage) not every eventuality is included in all insurance policies. For example, some trip insurance plans cover employment layoffs while others do not. Some policies may have robust emergency medical coverage while competitors don't. That's why it's so important for you to select a plan that meets your specific needs for each trip.

One commonality among insurance policies? A long lists of exclusions. That's where a CFAR policy comes into play.

" InsureMyTrip strongly recommends travelers strongly consider a CFAR upgrade," said Walch. This upgrade offers the most trip cancellation flexibility and is the only option available to cover "fear of travel" (traditional travel insurance does not offer cancellation coverage for "fear of travel," whether related to COVID-19 or not).

If eligibility requirements are met, reimbursement is typically up to 70% of the pre-paid, nonrefundable trip cost. "Just be aware that this add-on will increase the cost of the plan," Walch advised.

Some countries are requiring mandatory insurance for entry

Even in pre-pandemic times, many countries required travelers to have personal medical insurance to visit (although you weren't necessarily required to provide proof). Now, with pandemic concerns, some countries are instituting mandatory COVID-19 insurance for entry.

The Bahamas is one example. Travel health insurance is required for all incoming visitors and the cost for the mandatory insurance is included in the price of the Travel Health Visa all tourists are required to apply for before entry. Aruba is another example where COVID-19 insurance is purchased onsite at arrival and mandatory for entry.

Note that these insurance coverage policies just are for medical coverage, so travelers will still need additional coverage to cover non-health-related expenses such as travel delays or lost baggage.

Bottom line

If you're planning on traveling during a pandemic, don't assume that your usual travel insurance will cover you. Be sure to compare different insurance policies. and strongly consider Cancel For Any Reason insurance if you want to make sure your trip costs are covered.

- Join CHOICE

Does travel insurance cover COVID-19 or other pandemics?

What you're covered for when travelling during an epidemic or pandemic like covid-19..

Fact-checked

Checked for accuracy by our qualified fact-checkers and verifiers. Find out more about fact-checking at CHOICE .

Australians are back on the international travel bandwagon, but many of us still have bad memories of travel plans that went south due to the COVID-19 pandemic.

With those hard-learned lessons behind us, you'll want to ask the tough questions of your travel insurance policy for any future trips. Will travel insurance cover COVID-19 medical expenses or cancellation due to related government travel bans or isolation requirements? And will travel insurance policies cover future pandemics or epidemics?

On this page:

Can you get travel insurance to cover COVID-19?

Which travel insurers cover covid-19, domestic travel insurance for covid-19, does travel insurance cover covid-19 on a cruise, can you get a refund on travel insurance, your travel insurer declined your covid-19 claim. now what, does travel insurance cover pandemics or epidemics (other than covid-19).

Many travel insurance policies will provide limited cover if you or your travelling companion get COVID-19.

Cover will likely be limited to medical, and sometimes quarantine and cancellation costs if you contract COVID-19. Some policies may cover you for expenses if you can't travel because you're a close contact.

Travel insurance is unlikely to cover you for cancellation due to government travel bans.

Many of the most popular travel insurers in Australia, like Cover-More, Allianz, Tick and Travel Insurance Direct, provide cover for COVID-19. The table below shows which international travel insurance policies cover COVID-19 medical and cancellation costs if you're diagnosed with COVID-19 while overseas.

You may have to pay an optional extra fee for COVID-19 cover. Check the insurer's product disclosure statement (PDS) for more details.

- 'Variable' means multiple cover options are available and you can select the level of cover you require (for an additional fee).

- Cancellation may not cover you if you're deemed a close contact but haven't tested positive yourself.

* No cancellation prior to departure; $5000 if you contract COVID-19 on your trip.

Does travel insurance cover medical expenses for COVID-19?

Policies that cover medical expenses for COVID-19 will pay for emergency medical and hospital, and medically assisted repatriation to Australia, if deemed necessary. Most policies that cover COVID-19 provide unlimited cover for medical expenses.

Does travel insurance cover cancellation due to COVID-19?

Some policies will cover cancellation and amendment expenses if you get COVID-19 before you leave or while you're overseas. These policies may also cover you for cancellation and amendment expenses if you're deemed a close contact of someone who tests positive to COVID-19, but this isn't always the case. The cover amount can be limited to as little as a couple thousand dollars, so check with your travel insurer specifically to find out what they'll cover because it can be tricky.

Below are some of the typical exclusions for cancellation cover.

- Cooling-off periods for COVID-19 cancellation cover are usually 72 hours.

- Cover-More and other policies underwritten by Zurich, such as Flight Centre, AHM and Medibank, place restrictions on COVID-19 cancellation cover if you bought the policy within 21 days of your departure date. Check your PDS for details.

- Most (but not all) policies that cover COVID-19 cancellations will provide limited cancellation cover if a non-travelling relative residing in Australia has contracted COVID-19.

- These policies may also cover cancellation and amendment costs if you're designated a close contact of someone with COVID-19 and are required to self-isolate while on your trip.

- Travel insurance is unlikely to cover cancellation costs if you're unable to travel due to general travel restrictions, like lockdowns at home or at your destination, or government travel alerts due to COVID-19.

Does travel insurance cover additional expenses and quarantine costs for COVID-19?

If you contract COVID-19 while on your overseas trip, some policies will provide limited cover for additional accommodation and meal costs under specific circumstances, such as:

- if you're denied boarding scheduled public transport because you have tested positive to COVID-19

- if you have to go to hospital or self-isolate with COVID-19.

If you're ordered into quarantine while overseas because you've contracted COVID-19, some policies will cover your quarantine expenses. However, if you're ordered into quarantine as a close contact, without having contracted COVID-19, very few policies will cover your expenses in this scenario.

There are several insurers selling domestic travel insurance, but not all insurers will cover COVID-19. Domestic travel insurance doesn't cover medical expenses, because that's covered by Medicare or your private health insurance. So you'll just need COVID-19 cover for cancellation or additional expenses if you're travelling around Australia.

Read the travel insurance PDS to check whether you're covered for cancellation if you, or someone you're travelling with, catches COVID-19. Travel insurance is unlikely to cover you for government travel bans.

Travel insurance for an Aussie holiday may be worth considering if you're:

- spending a lot of money on your trip

- carrying expensive equipment, such as custom-made surfboards

- hiring a car, as some travel insurance can cover the damage excess .

Travel insurance policies that offer cruise cover will often (but not always) cover medical costs if you contract COVID-19. Some of these policies will also cover you if you need to cancel your trip due to COVID-19, or if a non-travelling relative in Australia has contracted COVID-19.

If you're going on a cruise, you'll usually have to pay an extra fee to add cruise cover to your travel insurance, or buy a separate cruise-specific policy. Cover for COVID-19 is restricted, so check your PDS for details.

Travel insurance policies have a 14-day cooling-off period (or longer). If you change your mind in this period, you can cancel your policy and get your money back from the insurer.

AFCA (the Australian Financial Complaints Authority) considers a credit or refund of your premium a fair outcome where:

- you got a refund or credit from all of your travel providers, so there's nothing left to claim on your travel insurance

- your travel insurance policy has a COVID-19-related exclusion that prevents you from claiming on the policy.

Ask your travel insurer what they can do for you.

Partial policy refunds

From the moment you buy a travel insurance policy, cover kicks in for cancellation due to unforeseen events. So if your insurer offers you a refund, they may calculate a partial refund to take into account the cover that you've already received with your policy.

AFCA considers proportionate refunds for the remaining unused period fair, but your insurer should outline how they calculate it.

Visit AFCA's website for more information on what they deem fair treatment from insurers when it comes to COVID-19 claims.

Read your travel insurance PDS. In the first instance, it's up to you as the policyholder to establish that you have a valid claim under the policy terms and conditions. That generally means handing in lots of documentation.

Then it's up to the insurer to decide if your claim is valid and that there are no policy exclusions that should be applied.

If you disagree with the insurer's decision regarding your claim, raise a complaint via their internal dispute resolution service.

If you don't get a satisfactory result from the insurer's internal dispute resolution, escalate your complaint to AFCA , which is the external ombudsman for the insurance industry.

The chance of experiencing a pandemic similar to COVID-19 in a lifetime is estimated to be 38%. Many travel insurance policies now cover COVID-19 to some extent, but not as many policies will cover future pandemics or epidemics other than COVID-19.

There are several policies that cover COVID-19 for medical expenses, but not other pandemics, and very few policies now cover cancellation expenses for pandemics that aren't COVID-19.

An epidemic is an outbreak of disease that happens in a wide geographic location and affects a lot of people.

A pandemic is an epidemic that has spread throughout a whole country or across continents.

Which travel insurers will cover pandemics or epidemics (other than COVID-19)?

Insurers such as Allianz, Travel Insurance Direct and Cover-More cover pandemics or epidemics for medical costs, but Travel Insurance Direct and Cover-More exclude cover for cancellation costs incurred due to a pandemic that isn't COVID-19.