Please update your browser.

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

Update your browser

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

Credit Cards

Checking Accounts

Savings Accounts

Chase.for Business

Commercial Banking

- ATM & branch

Chase Ultimate Rewards redeem points

Please turn on javascript in your browser.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Chase Ultimate Rewards ®

Use your points to fuel your passions.

Not earning rewards? Apply for a Chase credit card with Ultimate Rewards today.

Explore the possibilities

Earn bonus points on select purchases and redeem for travel, gift cards, cash back and more.

Pay with Points

Use your points to pay for all or part of your eligible Amazon.com orders or when you check out with PayPal.

Apple ® Ultimate Rewards Store

Use your points to pay for all or part of your Apple purchases.

Shop over 175 of your favorite gift card brands.

Pay Yourself Back

Choose to receive a statement credit on one or more of your eligible purchases.

Chase Dining℠

Redeem your points for takeout, reservations or exclusive culinary experiences.

Plan your next getaway, and use your points to help pay for it.

Earn Bonus Points

Earn 1-15 bonus points per $1 spent at 450+ stores with Shop through Chase ® .

Turn your rewards into a statement credit or a direct deposit into most U.S. checking and savings accounts.

Experiences

Use your card and points to attend exclusive events curated around your passions with select cards.

Transfer to Travel Partners

Transfer your points to any of our airline and hotel partners at full 1:1 value with select cards.

Enjoy value, flexibility and choice

Here are just some of the perks you could get with Chase Ultimate Rewards.

Ready to get away?

Remember to book your travel through Chase. You'll get competitive prices plus the flexibility to use your points, your card or both.

Pay with points

Instantly redeem your points to pay for all or part of your eligible orders at Amazon.com or when you check out with PayPal.

Find something delicious

Visit Chase Dining℠ to redeem points for takeout, access exclusive reservations and book culinary experiences.

Si tienes alguna pregunta, por favor, llama al número de teléfono que está al reverso de tu tarjeta.

Chase Survey

Your feedback is important to us. Will you take a few moments to answer some quick questions?

You're now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Combine Chase Points in Your Household

Dan Miller is a freelance writer and founder of PointsWithACrew.com, a site that helps families travel for free or cheap. He travels with his wife and six kids. His work has been featured by Business Insider, CreditCards.com and The Points Guy.

Jeanette Margle leads the home loans content team at NerdWallet, where she has worked since 2019. Previously, she led NerdWallet's travel rewards content team and spent three years editing for Upgraded Points while self-employed as an editor and writing coach.

Jeanette earned bachelor's degrees in journalism and Plan II Honors from the University of Texas at Austin and has a Master of Education from the University of Houston. A lifelong Texan, Jeanette grew up in a small town in the Hill Country and lives in the Houston area with her husband and daughters.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Why combine Chase points in your household?

How to transfer chase ultimate rewards® between cards, how to merge chase points with a family member, if you want to combine chase points with a household member.

Chase Ultimate Rewards® is one of the most popular rewards programs out there. Chase offers multiple credit cards that earn points and many ways to redeem them.

If you have more than one Chase credit card or if there is more than one Chase cardmember in your household, you may be able to transfer points between cards. This makes it possible to use your combined pool of points to book the trip you actually want to take — and that might not have otherwise been possible if you both had points to your name, but none sufficient to actually book what you need.

By combining points strategically in your household (particularly if one household member has a Chase Sapphire card), you may actually get more rewards or unlock more ways to redeem them. Here’s how:

Transfer points to get up to 50% more value with certain cards

The value of Chase Ultimate Rewards® points varies depending on which card the points are attached to and how you redeem them.

on Chase's website

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

Point value in Chase travel portal: 1.5 cents apiece.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Point value in Chase travel portal: 1.25 cents apiece.

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠.

On the following cards, the points are worth just 1 cent each when redeemed through Chase's travel portal.

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening.

Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening.

Don’t get confused when Chase describes perks on the Chase Freedom Flex® , Chase Freedom Unlimited® or other cards as “cash back.” That cash back comes to you first in the form of points, which you can redeem for credit card statements that erase a portion of your credit card balance. For example, the 20,000 Chase Ultimate Rewards® points you get as a welcome bonus with the Chase Freedom Unlimited® card are redeemable for $200 cash back. That comes out to 1 cent cash back per point.

All of these cards (even the cash-back cards), pay you in Chase Ultimate Rewards® points, but they don’t all give you the same value when you redeem them. As shown above, a point earned through Chase Freedom Unlimited® is worth 1 cent, while a point earned with a Chase Sapphire Reserve® and redeemed in Chase's travel portal gets you 1.5 cents in value. That’s where transfers can pay off.

If you have a Chase Sapphire Reserve® card and you want to use your points for travel, you can transfer points from a lower level Chase card to your Chase Sapphire Reserve® card then redeem them for flights, hotels, car rentals and more at a value of 1.5 cents each, increasing their value by half.

Similarly, you can transfer points to a Chase Sapphire Preferred® Card then redeem them for travel at a value of 1.25 cents each.

» Learn More: How to redeem Chase Ultimate Rewards® points

Transfer points to get more redemption options

Chase Sapphire Reserve® , Chase Sapphire Preferred® Card and Ink Business Preferred® Credit Card let you convert your points at a 1:1 ratio into the currency of more than a dozen different travel partners including United Airlines, Southwest, Air France, Marriott, Hyatt and IHG. Other Chase cards don’t.

By transferring your points from a cash-back Chase card to one of these three premium cards, you can move those points into an airline frequent flyer account or hotel loyalty account, combining them with an existing stash of miles or points to book your next vacation sooner.

Transfer points before closing a credit card

When you close a credit card account, you risk losing the points it has earned. But if you have another Chase card, you can preserve those points by transferring them.

» Learn More: Will I lose my points if I cancel my credit card?

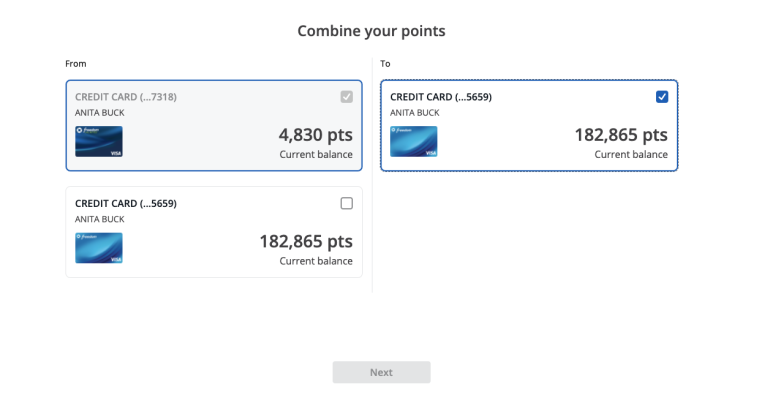

The process of transferring Chase Ultimate Rewards® between cards is easy. Simply log in to your account and go to the Chase Ultimate Rewards® section. Select the card that you want to transfer points from and choose “Combine Points" from the left-hand navigation.

Select which card you want to move points from and to. Doing so will take you to a screen asking how many points to transfer. Enter the number of points you want to move, and that’s it — the transfer is instant.

You’re allowed to combine Chase points within a household, but the process is less convenient than transferring between personal cards. To add a household member to your own account, you must call the customer service number on the back of your Chase credit card. From there, a Chase representative can help you add your household member’s Chase-branded card to your own account (so you'll need their account information, including name and credit card number, handy).

This small roadblock is just a one-time thing. Once your household member's account is linked via phone, it remains linked for future digital self-serve combine points redemptions.

But for families playing in what some might call two-player mode , merging points with a family member is a brilliant move. For example, one spouse with a Chase Sapphire Preferred® Card card and one with a Chase Sapphire Reserve® might each earn points through their own spending. When they want to take a trip together, moving all the points into the account means all the points are worth 1.5 cents each when booked for travel through Chase.

Want to receive points from your household member instead of sending them? Have the other cardmember log in to their account and follow the steps above to add you as their transfer partner.

The ability to transfer Chase Ultimate Rewards® makes this currency especially valuable. Because points tied to different Chase credit cards are worth different amounts, it’s usually a good idea to combine your points into the account with the highest value. After all, two wallets are better than one , and earning with your family members can really boost your points game.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel℠, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Chase Travel®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

How to redeem Chase Ultimate Rewards points for maximum value

You can never have too many Chase Ultimate Rewards points .

This transferable points currency gives you access to some of the best hotel and airline transfer partners in the business, as well as the easy-to-use Chase Travel℠ portal , which allows you to cover a wide variety of different costs for your trip, including car rentals, hotels, flights, tours and activities, as well as some everyday expenses.

Despite increasing competition from American Express Membership Rewards , Citi ThankYou Rewards and Capital One miles , Chase Ultimate Rewards maintains its place as one of the most valuable points currencies on the planet. Plus, the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve® offer welcome bonuses of 60,000 points after you spend $4,000 on purchases in the first three months of account opening.

If you are new to redeeming Chase Ultimate Rewards points, this stress-free beginner guide will show you how to easily redeem points.

However, if you're ready to get serious about traveling more for less, here's everything you need to know about Chase transfer partners and the best ways to redeem your Chase Ultimate Rewards points.

How much are Ultimate Rewards points worth?

TPG values Ultimate Rewards points at 2.05 cents each, which is what you should aim for when redeeming them. The actual value you get from these points depends on how you redeem them.

How can I redeem Chase Ultimate Rewards?

If you redeem your points for cash back or statement credits at the lower-value end, each point is typically worth 1 cent.

A midvalue redemption option is to use your Chase points for virtually any kind of travel booking: Flights, hotels, cruises, tours and rental cars via Chase Travel. If you have the Chase Sapphire Preferred , your points are worth a fixed rate of 1.25 cents each. Meanwhile, cardholders of the Chase Sapphire Reserve get a higher valuation of 1.5 cents per point. This is an excellent redemption option for folks who don't want to deal with complicated award program rules.

If you want to maximize your Ultimate Rewards points, the most valuable option is often to transfer your points to one of 14 airline or hotel partners. From there, you can use them for premium travel bookings, such as premium cabin flights and luxury hotels.

What are the most valuable ways to redeem Chase points?

We've mentioned that transferring your Chase points to a travel partner is often your best bet if you want to get the most value out of your points. Here are some of the best ways to redeem Ultimate Rewards with airline and hotel transfer partners.

Air France-KLM Flying Blue

While Flying Blue prices its awards dynamically, the program has now standardized saver-level pricing for all one-way flights between the U.S. and Europe as follows, regardless of origin or destination, meaning you can connect at no extra cost:

- 20,000 miles in economy

- 35,000 miles in premium economy

- 50,000 miles in business class

Remember that these rates are only for the lowest saver-level seats, which are limited. Booking business class from anywhere in the U.S. to anywhere in Europe for 50,000 Flying Blue miles is a fantastic deal, so jump on this if you find this price on dates that work for you.

Additionally, you could spend a few days in Paris or Amsterdam using the free Flying Blue stopover program . This is a great way to visit another city without paying additional miles or cash. To book Flying Blue stopovers, you'll need to call Flying Blue at 800-375-8723.

Southwest Airlines Rapid Rewards

TPG values Southwest Rapid Rewards points at 1.35 cents each, which is a lot less than the 2.05 cents per-point value of Ultimate Rewards. So, transferring to Southwest isn't a great way to use your Chase Ultimate Rewards points.

However, there are a couple of scenarios where transferring points to a friendly carrier with no change or baggage fees makes sense. First, for inexpensive fares of $100 or less, Rapid Reward points can be worth as much as 1.7 cents per point, which beats the value you get when booking through the portal. Second, if you have a Southwest Companion Pass and are really getting two flights for the price of one award, then your points become worth as much as 3.4 cents per point for inexpensive fares.

Remember, too, that Southwest flights booked with Rapid Rewards points include free changes and cancellations , which gives you a ton of flexibility if the award rate drops after booking.

Singapore Airlines KrisFlyer

Singapore Airlines has several benefits as a potential airline transfer destination for your Ultimate Rewards. First, Singapore is one of the best airlines in the sky, with tremendous service and luxurious onboard products and experiences. The carrier's premium-class products are typically only available through the KrisFlyer program , not with its Star Alliance partners.

Second, Singapore's KrisFlyer program offers fantastic value, with reasonable award charts, low fuel surcharges, routing rules that allow stopovers and the ability to combine multiple partners in one award.

Finally, the online award booking tool is intuitive and easy to use — though be aware that transfers typically are not instantaneous.

Here are some of our favorite KrisFlyer redemptions when using Chase Ultimate Rewards:

- Fly from the mainland U.S. to Hawaii in economy class on United Airlines for 19,500 miles each way

- Fly Singapore Airlines from the U.S. to Europe from 25,000 miles (note: this may be discounted further thanks to KrisFlyer's monthly Spontaneous Escapes offers )

- Fly the world's longest flight in business class from New York to Singapore for 111,500 miles each way

- Fly first class from Los Angeles to Japan or South Korea from 120,500 miles each way

Related: It doesn't get much better than this: Singapore Airlines' A380 in business class from Frankfurt to New York

Iberia Plus

Spain's national carrier remains a mystery to many Chase cardholders despite the significant value Iberia Plus can offer U.S.-based flyers. The carrier offers cheap economy, premium economy and business-class transatlantic flights on its own metal.

Transatlantic business class is priced based on a distanced-based award formula. One-way flights from Miami to Madrid on off-peak dates start at just 21,250 Avios in economy and 42,500 Avios in business class, for instance. There can be less than $100 in surcharges, depending on the class of service you book.

However, prices get even more attractive for shorter routes (based on distance in miles). For example, off-peak flights from Boston to Madrid require only 17,000 Avios in economy, 25,500 in premium economy and 34,000 Avios in business each way, one of the best sweet spots of any airline program.

Related: A review of Iberia's new business-class suite on the A350-900 from Madrid to Mexico City

Virgin Atlantic Flying Club

There are multiple ways to use Virgin Atlantic's loyalty program to unlock value. Thanks to its own distance-based formula, you can redeem points to fly Delta domestic itineraries here in the U.S. starting at 7,500 points per segment, potentially saving you thousands of points compared to the number of miles Delta is asking for the same flight.

Delta One flights to Europe (excluding the United Kingdom) are a flat 50,000 points for nonstop itineraries — though availability tends to be very scant. Instead, consider booking Air France flights in business class. On off-peak dates, flights from the U.S. to most of Europe are just 48,500 points.

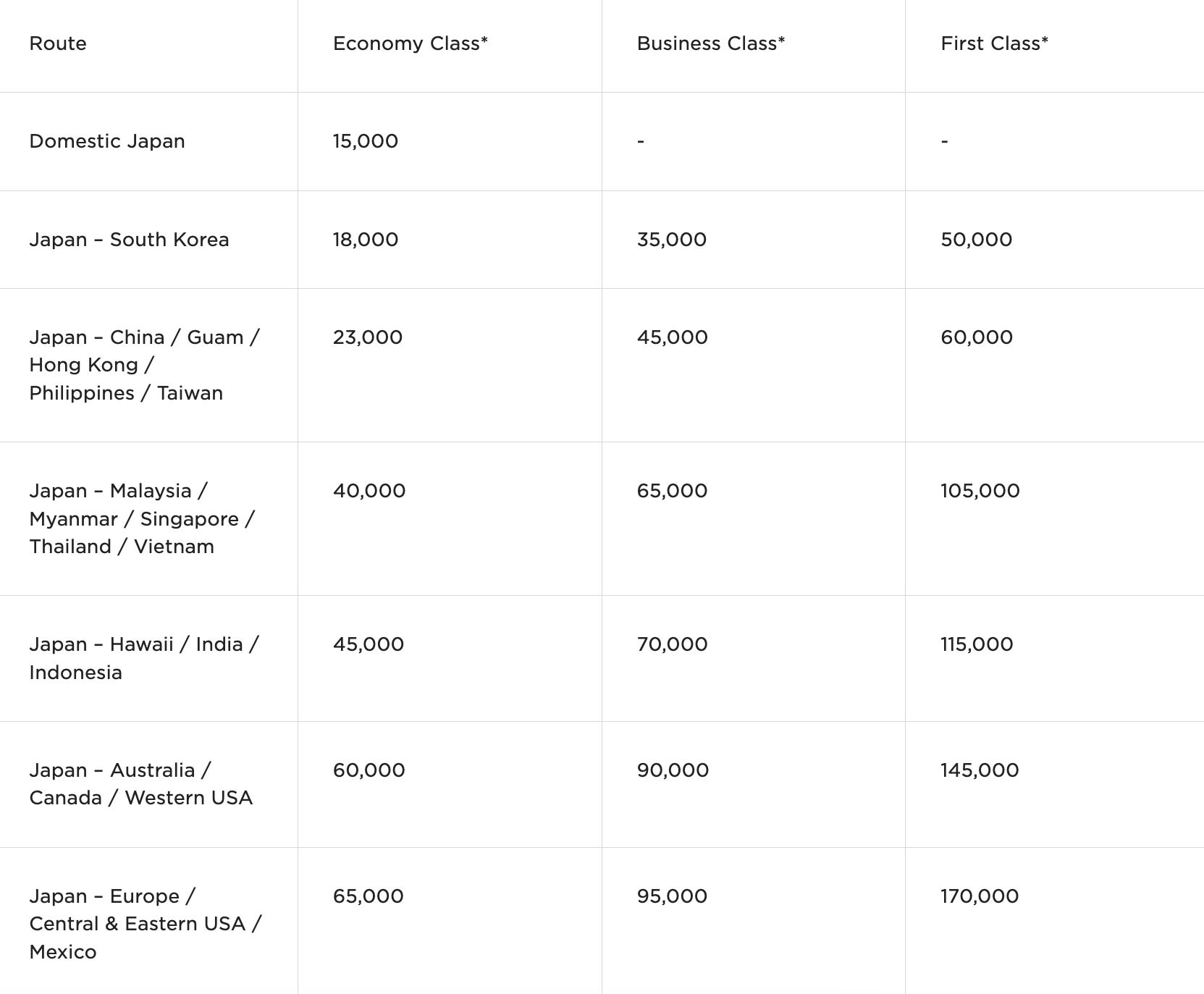

Other partners like All Nippon Airways have award charts so attractive they almost seem like a mistake. You can use just 90,000 Virgin points to fly ANA business class round trip from the West Coast to Japan and 95,000 miles from the central and eastern U.S. to Japan — or one-way for half these prices.

Here is Flying Club's award chart for ANA-operated flights:

Virgin Atlantic also offers attractive fares on flights between the U.S. and the U.K., though taxes on the return flight are quite high. A one-way economy-class flight from the East Coast is just 10,000 points.

Related: How 5,000 credit card points saved me over $650 on a flight to London

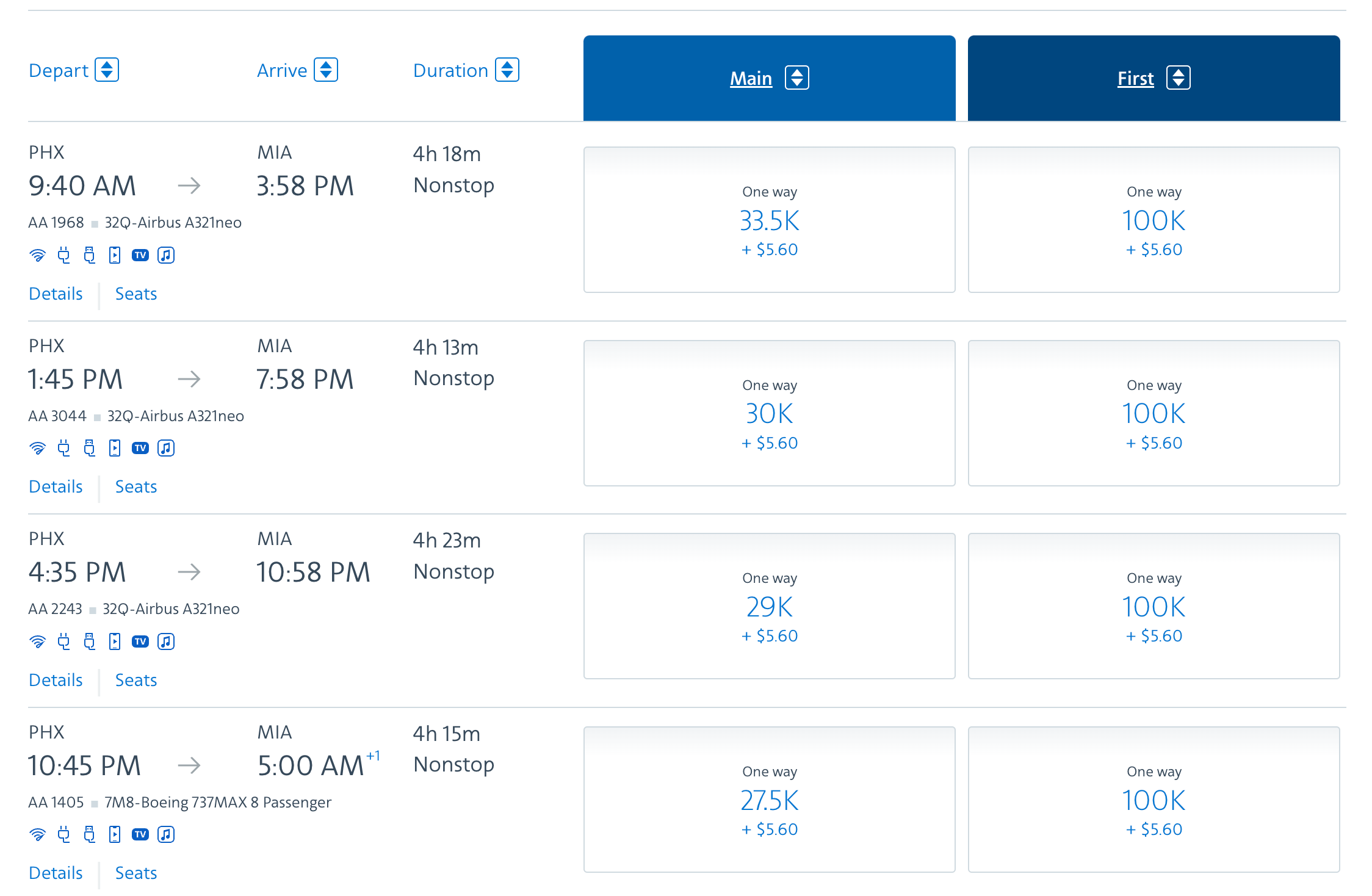

British Airways Executive Club

If you need a short-haul, nonstop flight on a Oneworld partner like American Airlines or Alaska Airlines, British Airways Avios can reward you with tremendous savings.

Short-haul flights start at 8,250 Avios for U.S. economy flights up to 650 miles in length, 11,000 Avios for flights 651 to 1,151 miles in length and 14,500 Avios for flights up to 2,000 miles in length. The latter would cover a flight from Phoenix Sky Harbor International Airport (PHX) to Miami International Airport (MIA).

This can be considerably cheaper than what American Airlines charges its American AAdvantage members for the same flights.

British Airways also lowered the cost of Qatar Airways awards when the Doha-based carrier adopted Avios as its own loyalty currency , giving another great option for transferring your Chase points for a valuable award ticket.

Related: British Airways Executive Club: Guide to Avios, elite status and transfer partners

World of Hyatt

One of the best ways to use Ultimate Rewards points is to transfer them to World of Hyatt for low- or high-category properties. Hyatt points are generally worth more than Marriott Bonvoy and IHG points, so Hyatt is often your best hotel transfer partner within Chase Ultimate Rewards.

World of Hyatt also offers an extremely reasonable award chart, with prices ranging from 3,500 to 45,000 points.

If you're looking at standard award nights, the program has value across the spectrum of properties. Category 1 to 5 properties , in particular, can offer some fantastic awards. Examples include the Grand Hyatt Washington (17,000 to 23,000 points), the Grand Hyatt Athens (9,000 to 15,000 points) and the Park Hyatt Mendoza (12,000 to 18,000 points).

Several Category 1 properties sell for over $100 a night (excluding taxes), so redeeming just 3,500 points for these off-peak dates is usually a good decision. An example is the Hyatt Place Tucson-Central, which is bookable for just 3,500 to 6,500 Hyatt points per night.

Higher-tier hotels also have substantial value. For example, redeeming 35,000 to 45,000 points per night at the ski-out Park Hyatt Beaver Creek or 25,000 to 35,000 points per night at the Park Hyatt St. Kitts or the Park Hyatt Maldives Hadahaa can make sense since rooms at these luxury properties routinely sell for over $1,000 a night.

Best cards to earn Chase Ultimate Rewards points

There are many ways to earn Ultimate Rewards points with Chase credit cards. Here is a summary of the best options:

- Chase Sapphire Preferred Card : Best for overall mid-tier cards

- Chase Sapphire Reserve : Best for frequent travelers, dining and travel insurance

- Ink Business Preferred® Credit Card : Best for business travelers

- Ink Business Cash® Credit Card : Best for office supplies and technology services

- Ink Business Unlimited® Credit Card : Best for no-annual-fee business card

- Chase Freedom Flex® : Best for earning 5% cash back (or 5 points per dollar) up to a quarterly maximum; activation required

- Chase Freedom Unlimited® : Best for simple rewards

The first three cards earn fully transferable Ultimate Rewards points, while the remaining four are technically billed as cash-back credit cards .

However, if you have an Ultimate Rewards-earning card, you can convert your Chase cash-back rewards to Ultimate Rewards points. For this reason, having more than one Chase card in the family can make sense to maximize your earning and redeeming potential.

Check out TPG's guide to transferring Chase points between accounts for complete details.

Bottom line

The above strategies sample the many redemptions available through the Ultimate Rewards program. If you have the Chase Sapphire Reserve , the Chase Sapphire Preferred Card or the Ink Business Preferred Credit Card , booking through the Chase Travel portal at a rate of 1.25 to 1.5 cents per point will be a solid baseline redemption for many travelers.

However, to really get maximum value, look to utilize Chase transfer partners to book flights and hotel rooms that might otherwise be beyond your means.

IMAGES

VIDEO

COMMENTS

Chase transfer partners include 3 hotel loyalty programs and 11 airline programs. Here's how to increase per point value when you transfer points from Chase.

Chase credit cards that allow you to transfer to travel partners. Sapphire Reserve ®, Sapphire Preferred ® and Ink Business Preferred ® are the cards that offer Chase cardmembers the ability to transfer points to travel partners. Some of those partners also offer bonuses for transferred points.

How do I transfer Chase points to partners? You can easily transfer Chase points online. First, log in to your Chase account and navigate to the Ultimate Rewards portal. Under the Travel drop-down, select "Transfer to Travel Partners" to access the main transfer page.

Transfer your points to any of our airline and hotel partners at full 1:1 value with select cards. Use your points to pay for all or part of your eligible Amazon.com orders or when you check out with PayPal. Use your points to pay for all or part of your Apple purchases. Shop over 175 of your favorite gift card brands.

Transfer points to get up to 50% more value with certain cards. The value of Chase Ultimate Rewards® points varies depending on which card the points are attached to and how you redeem...

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

Download the free TPG app! In fact, it's among the most customer-friendly transferable points programs along these lines. By combining Ultimate Rewards points in a single account, you can effectively add up to 50% in value to some of your cards.

If you want to maximize your Ultimate Rewards points, the most valuable option is often to transfer your points to one of 14 airline or hotel partners. From there, you can use them for premium travel bookings, such as premium cabin flights and luxury hotels. What are the most valuable ways to redeem Chase points? BEN SMITHSON/THE POINTS GUY.