JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

Private client group.

Policyholders in the U.S. can make online payments.

Workers’ Compensation (AIG Go WC)

Access workers’ compensation claims information, including FAQs, payments, prescription data, doctor information, and more.

Report a Claim

Report Aerospace, Commercial Auto, General Liability, Property, and Workers’ Compensation claims.

Dental, Group Life, and AD&D Claims

Employers and employees can access claim forms, claim reports, and information on claim status.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

myAIG Client Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Brokers & Agents

Myaig portal for north america.

Generate loss runs, download policy documents, access applications and tools, and more.

myAIG Portal for Multinational

U.s. producer appointment and licensing.

Submit requests to become an AIG appointed brokerage/agent, expand or terminate your current AIG appointment.

Risk Managers

Log in to pay bills, manage policies, view documents, company news, materials & more.

- INDIVIDUALS

- BROKERS & AGENTS

- RISK MANAGERS

AIG Travel Guard

Get a quote in less than two minutes and travel with more peace of mind.

Travel Guard Plans

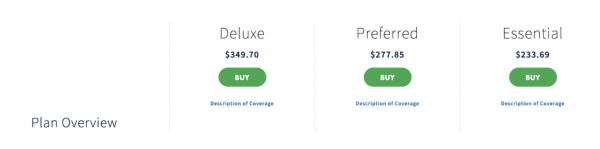

Compare coverage levels and pricing on our most popular plans with our product comparison tool—and find a Travel Guard plan that’s right for you.

Deluxe Plan

Our top-of-the-line, comprehensive travel coverage that sets the standard.

Preferred Plan

A comprehensive travel plan with superb coverage and service from start to finish.

Essential Plan

Savvy coverage for the budget-minded traveler.

Pack N' Go Plan

Immediate coverage for unplanned trips and adventures

Annual Travel Insurance Plan

Year-round coverage for your travel investments.

Millions of travelers each year trust AIG's Travel Guard to cover their vacations

Travel insurance plans provide coverage for certain costs and losses associated with traveling. Travel Guard ® helps you navigate canceled flights, lost bags, sudden health emergencies, and much more—almost anywhere in the world. Whether you’re planning a two-day getaway, a cruise, an adventure vacation, or a month-long international holiday, our plans help cover travelers and their trip inverstments.

Education Center

Sort through common questions about travel insurance

Traveler Resources

Safety information and travel tips for travelers

Preparing travelers wherever their journey takes them

AIG Travel CEO Jeff Rutledge shares how the underlying risks of travel have changed and what AIG is doing to help companies and individuals manage risks.

Coverage available to residents of U.S. states and the District of Columbia only. These plans provide insurance coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of each policy with your existing life, health, home, and automobile insurance policies, as well as any other coverage which you may already have or is available to you, including through other insurers, as a member of an organization, or through your credit card program(s). If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc .(Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP.

This is only a brief description of the coverage(s) available. The policy will contain reductions, limitations, exclusions and termination provisions. Insurance underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., a Pennsylvania insurance company, with its principal place of business at 1271 Ave of the Americas, Floor 41, New York, NY, 10020-1304. It is currently authorized to transact business in all states and the District of Columbia. NAIC No. 19445. Coverage may not be available in all states.

Related Content

COVID-19 Updates

Corporate Accident & Health Insurance

Insurance for Individuals and Families

DO NOT SELL OR SHARE MY PERSONAL INFORMATION

The California Consumer privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A "sale" is the exchange of personal information for payment or other valuable consideration and includes certain advertising and anatytics practices. "Sharing" means the disclosure of personal information for behavioral advertising purposes, where the informatirm used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to accessour website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we used to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Notice .

Thank you. We have received your request to opt out of the sale/sharing of personal information.

More information about our privacy practices.

- | Terms of Use

- | Privacy Notice

- | Legal Notice

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

- Contact AIG

We've got your back.

Security, Travel and other assistance services provided by your employer's Lifeline Plus policy.

Lifeline Plus, Group Personal Accident & Business Travel + Crisis Insurance

Lifeline plus protects a business’s people after serious work related injuries & against a host of travel emergencies while they’re away on business..

The global cover and services we provide, designed to keep employees informed and as safe as possible, continue to get wider and stronger in order to meet evolving risks.

Introducing Lifeline Plus

Watch this short video for an introduction to the cover, assistance and tools Lifeline Plus provides.

Who is it for?

UK businesses of all sizes in all sectors.

See our Risk Appetite

Product Details

Evolving client protection.

- Travel Assistance app : quick-call help button, geo-fenced check-in tool, claim notification, GPS enabled medical provider finder, medical translation and drug brand equivalency tools, country and city reports, security alerts and online training modules

- MyLifeline assistance website

- HR resource hub

- Virtual assistance card

- Virtual Medical Care with GP Consultation and Expert Case Management

- Crisis consultants to help handle negative media coverage

See below for a summary of the insurance protection and range of services that Lifeline Plus has to offer.

Lifeline Plus GPA & Travel

Serious injury and accident help.

- Death benefits

- Loss of limbs

- Loss of eyes, speech and hearing

- Permanent disability

- Temporary disability

- Cosmetic reconstruction

- Recovery support

- Role retraining

- Lifesaver benefit

Have a Safe Trip

- 24/7 travel assistance

- Concierge service

- Pre-crisis consultancy

- Security and safety advisories, global risk analysis

- 24/7 travel and security alerts

- Flight, hotel and rental vehicle re-bookings

- Cash transfer assistance

- Telephone interpretation assistance

- Message relay to family, friends or business associates

- Embassy or consulate referral

- Security awareness training

- Country reports and city guides

- Translation tools and resources

If You Run Into Trouble

- Medical and emergency travel expenses, rescue and assistance

- Legal liabilities and expenses

- Money, baggage, personal property

- Cancellation, curtailment, disruption, replacement and delay of travel

- Vehicle rental

- Kidnap, extortion and detention

- Political and natural disaster evacuation

- Crisis consultancy

- Inpatient hospital admission and monitoring

- In and outpatient case management

- Outpatient expense guarantee and payment

- Compassionate visit and family travel assistance

- Dispatch of medication and equipment

- Emergency return travel arrangements

- Lost baggage search/stolen luggage replacement assistance

- Lost passport/travel documents assistance

What's Inside Lifeline Plus

Our brochure will help you understand the cover and services included in a Lifeline Plus policy.

Why choose Lifeline Plus from AIG?

Serious injury & accident claims.

Our claims teams handle thousands of injury payments a year – for everything from temporary to life changing conditions. We’ll confirm cover and settlement as quickly as possible. Once confirmed, we will start to make payments within 24 hours by either bank transfer or cheque to help the business’s people back on the road to recovery as soon as we can.

Have a safe trip

Our global assistance company, AIG Travel, provides a wealth of services to help keep travelling employees comfortable, informed and safe wherever they’re going. Whether that’s concierge services, help in locating lost luggage or travel security training in preparation for an upcoming trip - we’re on hand 24/7 to help.

If you run into trouble

Your people are in safe hands even if their trip takes a turn for the worst. Whether that’s support on the ground, medical help or evacuation to get out quickly, we provide the essential expertise and crisis response capabilities (see our Crisis Plus extension upgrade). And our concierge claims service aims to pay baggage and money claims in under 15 minutes over the phone.

"We've got your back" tools

We’re always looking to improve. Our Travel Assistance app now includes a check-in feature to notify selected contacts that they’ve arrived safely plus a claim notification tool. Our Virtual Medical Care service provides employees (and their immediate families) with GP Consultations and Expert Case Management should they need it. We can even help clients protect their reputation in the event of a crisis or bad publicity.

Travel Assistance App

Employees can access many of our travel, security and assistance services directly on their mobile phones, via the AIG Travel Assistance App. To download the app onto an iPhone or Android device, visit the App store or Google play . Employees will need their Lifeline Plus policy number to register.

HR Manager Hub

We’ve introduced a dedicated website designed to support HR Managers at organisations with an AIG Lifeline Plus policy.

HR Managers will find documents that will help them to inform their people about the tools, resources and benefits available to them under Lifeline Plus. Ranging from pre-written staff emails through to app download guides, we’ve assembled helpful templates that will assist in bringing the policy to life for staff.

www.aig.co.uk/LifelinePlusResourceHub

Claims Excellence

Help when it matters most

Related Documents

Get lifeline plus documents, how can we help, risk appetite & claims, support for hr & benefits managers.

AIG Travel Insurance: The Complete Guide

Everything you need to know before you buy AIG Travel insurance plans

:max_bytes(150000):strip_icc():format(webp)/joecortez_headshot-56a97f185f9b58b7d0fbf9ac.jpg)

For decades, AIG Travel , part of American International Group, Inc., has provided travel insurance options for many travelers. Marketed under Travel Guard, the company offers travel insurance solutions and travel-related services, including medical and security services, marketed to both leisure and business travelers around the globe.

If you have purchased a trip insurance plan in the past, it may have been provided by AIG Travel without you even knowing it: the company also creates custom policies for several smaller insurance brokers, airlines and even travel groups. Is AIG Travel the right company for your trip?

About AIG Travel

AIG Travel is a member of American International Group, Inc., a global insurance company that provides everything ranging from property casualty insurance, life insurance, retirement products, and other financial services. Travel Guard is the marketing name that AIG Travel uses to advertise its portfolio of products.

Today, the company is headquartered in Stevens Point, Wisc., and serves travelers in 80 countries and jurisdictions through eight wholly-owned global service centers in key regions, including Houston, Texas; Stevens Point, Wisc.; Kuala Lumpur, Malaysia; Mexico City, Mexico; Sofia, Bulgaria; Okinawa, Japan; Shoreham, England; and Guangzhou, China.

How Is AIG Travel Rated?

AIG Travel policies are underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., another subsidiary of AIG. As of June 2018, the policy writer has an A.M. Best A rating, putting them in the “Excellent” credit category with a stable outlook.

For customer service, AIG Travel is highly rated on three major travel insurance marketplaces online. With more than 400 reviews, AIG Travel has a five-star rating from TravelInsurance.com , with a 98 percent recommendation rate. Customers of InsureMyTrip.com give the company 4.56 stars (out of five). Although Squaremouth.com no longer offers AIG Travel policies anymore, previous customers gave the company 4.46 stars (out of five), with less than one percent negative reviews.

What Travel Insurance Does AIG Travel Offer?

AIG Travel offers four plans for consumers, based on their needs and travel plans: Basic, Silver, Gold, and Platinum. Although the Basic plan is not available direct through AIG Travel, it can be purchased through marketplaces like TravelInsurance.com. All travel insurance plans include travel medical assistance, worldwide travel assistance, LiveTravel® Emergency Assistance, and personal security assistance, but only take effect when travelers are at least 100 miles away from home.

Please note: All schedules of benefits are subject to change. For the most up-to-date coverage information, contact AIG Travel.

- Travel Guard Basic: Travel Guard Basic is the lowest level of coverage available through AIG Travel Guard, with the smallest benefits for trip cancellation , trip interruption , and trip delay. The basic plan offers 100 percent coverage of trip cancellation or trip interruption events (up to $100,000), but has very low coverage ceilings for return airfare due to trip interruption ($500 maximum), trip delay (maximum of $100 per day, up to $500), baggage loss ($500 before a $50 deductible) and baggage delay ($100 maximum). The basic plan includes an optional rental car damage policy for an additional price but does not include options for a pre-existing medical condition exclusion waiver or accidental death and dismemberment. Read the schedule of benefits here.

- Travel Guard Silver : Travel Guard Silver is the lowest level of coverage available directly through AIG Travel Guard. Described as “savvy coverage that helps give you peace of mind on a budget,” Travel Guard Silver offers more generous benefits for baggage delay and baggage loss ($750; $50 deductible) and accident sickness medical expenses ($15,000; $50 deductible). This plan also offers optional coverage for pre-existing medical condition exclusion waivers, trip cancellation or interruption due to financial default and additional flight coverage. Typically, travelers who elect to purchase Travel Guard Silver over Travel Guard basic can expect to pay around 2.5% more. Read the schedule of benefits here.

- Travel Guard Gold : The most popular plan offered by AIG Travel Guard, Travel Guard Gold balances insurance costs with benefits. The Gold plan offers more money for trip interruption (150 percent, up to $150,000 maximum), return airfare due to trip interruption (the greater of $750 or 150 percent of the trip cost) and trip delay coverage ($150 per day maximum, up to $750 total). This plan also introduces several additional benefits, including baggage and travel document loss (up to $1,000), baggage delay ($300) and missed connection coverage (up to $250). When purchasing within 15 days of the initial trip payment, travelers may also be covered for pre-existing condition waivers, trip cancellation or interruption due to financial default and primary coverage for accident sickness medical expenses. Optional coverage levels include Cancel for Any Reason insurance (up to 50 percent of insured trip costs), car rental collision coverage and upgrades for medical expense and emergency evacuation coverage. Before any optional coverage, expect to pay 20 percent more for Travel Guard Gold compared to Travel Guard Silver. Read the schedule of benefits here.

- Travel Guard Platinum : Travel Guard Platinum is the highest level of coverage offered by AIG Travel Guard, with the biggest benefit levels. In addition to trip cancellation and trip interruption benefits, travelers can receive up to $1,000 for return air travel due to trip interruption, trip delay benefits of up to $200 per day ($1,000 maximum) and up to $500 in missed connection benefits. Like Travel Guard Gold, travelers who purchase their policy within 15 days of their initial trip payment may also receive the pre-existing medical condition exclusion waiver, trip cancellation or interruption coverage due to financial default, primary accident sickness medical expense coverage and primary baggage and personal effects coverage. Optional policy add-ons include Cancel for Any Reason (up to 50 percent of insured trip costs), car rental collision coverage, and medical coverage upgrades. Because Travel Guard Platinum is the highest level of coverage available, it is also the most expensive: travelers should expect to pay between 50 and 60 percent more than Travel Guard Gold before any additional add-on coverage. Read the schedule of benefits here.

What Won't AIG Travel Cover?

While AIG Travel offers plans to cover many common travel issues, they will not necessarily cover everything. Excluded situations include:

- Self-inflicted injuries: If you are in crisis while traveling, there are ways to get help anywhere around the world. Note that mental health care may not be covered by your travel insurance plan .

- Pregnancy or childbirth: In many situations, pregnancy or childbirth are not covered under AIG Travel plans.

- Dangerous activities: Planning on mountaineering, going motor racing, or participating in a professional-level athletic event? All of these situations are not covered under AIG Travel plans.

- Baggage loss for items seized by governments or customs officials: Before you return home, be sure to understand what may (or may not) be allowed in your home country. If you believe your items were stolen by customs or Transportation Security Administration officials , there is a separate protocol for reporting those losses.

- Baggage loss for eyeglasses, sunglasses, or hearing aids: Loss or replacement of prescription vision wear is not covered by AIG Travel.

This is just an abbreviated list of situations that may not be covered under AIG Travel trip insurance plans. For a full list, refer to the schedule of benefits of each plan, which are linked in the above content.

How Do I File a Claim With AIG Travel?

Travelers who purchased an AIG Travel plan in the United States can start their claims online . After starting an account online, travelers can file claims for the most common situations, including trip cancellation, baggage loss, and trip delay. Policyholders can also find documentation requirements online , as well as receive updates online. Those who have questions about their policies or claims can call AIG Travel direct at +1-866-478-8222.

The online claims tool is only available for American travelers who purchased their travel insurance plans in the United States. All other travelers should contact AIG Travel directly via their provided telephone number to start the claims process.

Who Is AIG Travel Best For?

At the Basic and Silver levels, AIG Travel is a very basic-level travel insurance plan that may cover those who do not already have trip coverage through a credit card or otherwise have access to a trip insurance plan. Before considering either of these AIG Travel plans, be sure to check that you don't already have coverage through the credit card used to pay for your trip.

If you are planning a major international trip, or are going on a big trip aboard a cruise line, AIG Travel Gold and Platinum may offer better coverage than a credit card. With large benefit levels and coverage already built in for pre-existing conditions when purchased within the first 15 days of an initial travel payment, Gold and Platinum can be a better bet for those who are spending money on a big vacation and want to make sure their trip runs smoothly.

Travelex Insurance: The Complete Guide

The 8 Best Luggage Sets of 2024, Tested and Reviewed

Nationwide Travel Insurance: The Complete Guide

Flight Insurance That Protects Against Delays and Cancellations

The Best Credit Cards for Travel Insurance

The 14 Best Backpack Brands of 2024

Does Travel Insurance Cover Earthquakes?

Dealing With Lost, Damaged, or Stolen Luggage While Flying

Loss of Use Car Rental Insurance

Should You Buy Collision Damage Waiver Insurance for Your Rental Car?

How to Get Your Miles Back After Canceling an Award Flight

How to Get Free Breakfast at Hotels

Best Car Rental Companies of 2024

Etihad Gives All Passengers Free COVID-19 Insurance

8 Air Travel Rights You Didn’t Know You Have

Delta Is Reducing Access to Its Sky Clubs—and Frequent Flyers Aren't Happy

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Longstay & Backpacker

Travelling Against FCDO Advice:

Longstay & Backpacker cannot cover you when travelling to destinations that the FCDO (previously known as the FCO) have advised against. However, we can still help – learn more, generate quotes and arrange cover, here .

PROVIDING ESSENTIAL COVER FOR THOSE TAKING EXTENDED TRIPS ABROAD

- Standard provides essential cover for cancellation, curtailment, personal possessions, emergency medical expenses, personal liability and personal accident.

- Longstay provides higher limits and additional cover for gadgets*, departure delay, missed departure, possessions delayed in transit, personal money & loss of travel documents and legal advice & expenses.

- Longstay Plus provides the same benefits as Longstay with enhanced cover limits.

Already Travelled

If you require insurance having already embarked upon your travels, please see our Worldwide Global Travel Insurance .

02392 419 011

Key features.

- Trips covered up to 18 months

Longstay & Backpacker provide cover for single trip travel for periods from 1 month up to a maximum duration of 18 months.

- Return home at no extra charge!

For those wishing to break their trip midway, Longstay & Backpacker allows you to return home, say, at Christmas or Easter, for up to two trips, each up to a maximum 21 days per trip during the policy period. Cover is suspended during the period at home.

- ‘Stop-over’ cover

Longstay & Backpacker automatically provides for ‘stop-overs’ of up to 7 days maximum in a higher rated area e.g. travelling to New Zealand via the USA.

- ‘Excess Waiver’ Option

The standard excess can be reduced to ‘nil’ by paying an additional premium of £15 per person (£30 for Family cover).

Read more on our Key Features page.

*Gadget cover includes: handheld consumer electronic devices such as mobile phones, tablets, iPads, kindles, satnavs, cameras, lenses, camcorders, smart watches, smart glasses, head mounted displays, hand held games consoles, portable DVD players, headphones, wireless speakers, MP3 players, iPods and laptop computers (laptops are not covered for accidental loss), purchased as new or, in the case of refurbished items, not purchased directly from the manufacturer or network provider in the UK; that is no more than 48 months old at the start date of the trip.

If we can’t offer you the travel insurance cover you want, or your premium is higher than you expected because you have serious medical conditions, you may be able to get help by accessing the MoneyHelper travel insurance directory or by calling 0800 138 7777 (Open Monday to Friday, 8am to 6pm).

ToolBox Login

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

A travel assistance website for Lifeline Plus policyholders with resources that help prepare for a trip and offer support while abroad.

Virtual Medical Care

Round-the-clock access to GPs for consultations and an expert case management service for complex medical cases and second opinions. (A complimentary service included with specific AIG policies).

A travel assistance website for Lifeline Plus policyholders with resources that help prepare for a trip and offer support while abroad

Round-the-clock access to GPs for consultations and an expert case management service for complex medical cases and second opinions.(A complimentary service included with specific AIG policies).

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Health and Safety eLearning

Our safety, cyber and workplace skills eLearning platform for Employers’ Liability policyholders helps drive down their total cost of risk.

Trade business online with AIG. AIG eXtra is a full-cycle e-trade platform that allows brokers to quote and bind SME business with AIG.

myAIG Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

Risk Managers

Our safety, cyber and workplace skills eLearning platform for Employers’ Liability policyholders helps drive down their total cost of risk.

Log in to access our supporting tools and services, plus portals for brokers and risk managers.

- INDIVIDUALS

- RISK MANAGERS

For Brokers: Appetite & Channels to Market

AIG provides brokers with exceptional tools and resources for their success.

How AIG Empowers Brokers

At AIG, we see brokers as key partners. To help them communicate the unique benefits of our products and services to our mutual clients, we offer tools and resources that empower them to build winning relationships across every sector.

From e-trade capabilities to ongoing learning, brokers gain insights that help them position solutions to their greatest benefit for the people and businesses they’re designed to protect.

Quick Links

- Risk Appetite: Winning with AIG

- e-Trade: AIG eXtra & Acturis

- AIG Academy on Demand

Explore Our Products

AIG is committed to working with our brokers to deliver industry-leading solutions. Discover how our products and services can address a wide array of client risk needs.

Accident & Health / Travel

AIG Accident & Health insurance products are built to meet the ever-evolving needs of our clients, from small domestic organisations to multinational corporations.

AIG’s innovative Aerospace Insurance minimises risk and maximises safety for Airline & Deductible, Manufacturers & Airports and General Aviation clients.

From Employers’, Public and Products Liability, to Environmental, Product Recall and Commercial Motor insurance, we apply expansive UK and global Casualty expertise to our products.

Credit Insurance

AIG’s Credit Lines (Trade Credit, Trade Finance, and Political Risk) help Corporates (medium and large companies) from a wide variety of industry sectors and Financial Institutions navigate the complexities of local and global business practices by offering non-payment credit insurance solutions.

Crisis Solution

In the face of evolving global security threats, AIG’s Crisis Solutions support businesses and individuals with insurance and risk consultancy expertise.

AIG’s outstanding cyber experience and global footprint enables us to issue policies in countries throughout the world to protect businesses against cyber-attacks, ransomware and other related risks, while also helping clients pinpoint and understand their vulnerabilities.

Construction

AIG provides robust property damage cover for buildings and infrastructure projects and major oil, gas, power, pharmaceutical and heavy industry processing plants.

Drawing on our deep industry expertise, our products are crafted to provide flexible solutions to address our: Renewable, Chemical & Pharmaceutical, Power & Utilities, Mining, Upstream, Oil, Gas and Petrochemical client’s complex needs.

Environmental

We protect businesses against growing risks related to heightened levels of public awareness and developing environmental regulations, with an unmatched global pollution incident response team.

Financial Institutions

AIG offers a range of solutions to the management liability exposures of clients within the financial sector, including global banks, hedge funds, venture capital firms, investment management companies and more.

Financial Lines

AIG is a world leader in D&O insurance, and we regularly update our cover to ensure directors and officers are protected against new and emerging risks.

AIG Marine Insurance provides extensive protection for portside operations and for goods in transit around the world, with bespoke programmes that cater to the specialised needs of maritime operations.

Mergers & Acquisitions

Our bespoke M&A insurance products are specifically designed to solve commercial risks arising from M&A transactions.

Multinational Solutions

With nearly a century of experience servicing multinational businesses, AIG has vast global knowledge of local markets, practices, regulatory and tax considerations, exposures and cover requirements.

Package & Combined

Policies that combine a range of essential covers to provide businesses with affordable, comprehensive cover.

AIG provides Property insurance for companies of all shapes and sizes, including some of the world’s largest and most complex organisations, underpinned by risk engineering expertise and local market knowledge.

Related Content

Winning with AIG

Portfolio Solutions

AIG Travel Guard Insurance | Money

W e’ve reviewed Travel Guard from AIG as part of our exploration of the best travel insurance companies of 2023. This review will cover the pros, cons and features of AIG Travel Guard to help you decide if it’s the best travel insurance provider for you.

Best for Add-Ons

AIG travel insurance stands out for its wide variety of add-on options. Travel Guard offers a security bundle, pet bundle, sports bundle and many other add-ons to customize your travel insurance.

AIG Travel Guard Travel Insurance Pros and Cons

AIG Travel Guard is one of many insurance providers that support international travelers while they’re abroad. It isn’t your only option, so let’s take a look at how the company’s policies compare to competitive offerings. Here’s an overview of what you can expect from a Travel Guard travel insurance policy.

- Up to $1 million in evacuation coverage

- Plenty of add-on options

- Optional waiver for pre-existing conditions

- CFAR upgrade doesn't cover the entire trip

- Premiums can get expensive

Pros explained

AIG Travel Guard insurance is highly rated across review platforms. This might be the right insurance company for you if you’re looking for a policy with high coverage for medical evacuations, a range of add-ons and waivers for pre-existing conditions.

$1 million medical evacuation coverage

One of the main reasons people buy travel insurance is to pay for an emergency medical evacuation. If you get sick or injured while abroad, you may need to be evacuated for your safety.

With Travel Guard Deluxe from AIG, you get up to $1 million in coverage for medical evacuations. Travel Guard Preferred offers $500,000 for evacuations, and Travel Guard Essential offers $150,000. That coverage goes toward flights and other costs to get you to a safe location where you can receive high-quality medical care.

Offers a variety of special add-on coverages

AIG Travel Guard Insurance offers a wide variety of add-on coverage options. These riders can be added to your plan to customize your trip. These include:

- Medical bundle: This supplies extra coverage for medical costs and the option to choose your hospital.

- Wedding bundle: This allows you to cancel your trip if a destination wedding is canceled.

- Pet bundle: This provides a daily benefit for the costs of traveling with a dog or cat, plus coverage for veterinary bills.

- Inconvenience bundle: This covers certain problems that don’t end your trip, such as credit card cancellations, closed attractions and trip delays.

- Adventure sports bundle: This removes coverage exclusions for injuries caused by extreme sports such as scuba diving, skydiving and rock climbing.

- Baggage bundle: This gives increased coverage for baggage loss and delays.

Pre-existing medical conditions waiver available for purchase

If you have a pre-existing condition that could lead to medical costs during your trip, Travel Guard offers waivers to extend coverage for those expenses. The waiver must be bought before your trip. It might be worthwhile for travelers with chronic conditions, immune system deficiencies, and other conditions that can make traveling especially dangerous.

Cons explained

AIG travel insurance isn’t right for everyone. Before you buy a Travel Guard plan, you should be aware that you can’t get a full reimbursement when you cancel for any reason and that your premium might be more expensive than other options.

Cancel for Any Reason upgrade only covers 50% of trip costs

Cancel for any reason (CFAR) policies are common with travel insurance companies. This add-on allows you to be reimbursed no matter why you cancel your trip.

A standard travel insurance plan only offers reimbursements for a prescribed list of eligible reasons for canceling. These include medical or weather-related emergencies and the death of a close family member or traveling companion. But with CFAR, you can cancel under any circumstances and still receive coverage — as long as you do so 48 hours before departure.

Unfortunately, AIG Travel Guard with CFAR only offers a 50% reimbursement of your prepaid travel expenses. Other companies offer a higher reimbursement percentage, so consider whether you want more comprehensive protection before signing up for this insurance.

Expensive premiums

AIG Travel Guard is not the cheapest travel insurance company out there. Your exact premium depends on several factors, including your destination, plan type, add-ons and age. But based on our sample quotes, AIG travel insurance plans are slightly more expensive, on average, than other insurers’ plans.

AIG Travel Guard Travel Insurance Plans

Like shopping for the best travel credit cards , choosing the best travel insurance plan takes time and research. The best plan will save you money and give you peace of mind, while the wrong plan could be an unnecessary expense. That’s why looking for insurance companies offering multiple policy options is best.

AIG Travel Guard offers three main plans plus two bonus plans for international travel insurance. Let’s break those options down in detail.

Travel Guard Essential is a very basic travel plan offered by AIG. This budget-friendly plan comes with standard coverage for trip cancellations, interruptions and delays. Medical coverage goes up to $15,000 plus $500 for dental costs and $200 for lost or damaged baggage.

The Essential plan is best for a tourist or short-term traveler who is willing to sacrifice comprehensive coverage for a lower insurance premium. The plan can be beefed up with any of AIG’s add-on bundles.

Travel Guard Preferred is a mid-priced option for someone who wants more coverage. This policy comes with medical coverage of up to $50,000 and evacuation coverage of up to $500,000. Damaged, lost or stolen baggage is covered up to $1,000.

Travel Guard Deluxe, the most expensive plan offered by AIG, comes with a wide range of benefits and includes security evacuation, missed-connection coverage, trip-saver coverage and more. This plan offers up to $1 million for a medical evacuation.

Travel Guard Deluxe is a good choice for someone traveling to rural or dangerous areas. It covers almost any emergency and even includes robust coverage for your beneficiaries in case of a fatal accident.

AIG’s Pack N’ Go plan is designed for travelers who buy their insurance at the last minute. There is no cancellation coverage, but this plan offers up to $25,000 in medical coverage plus $500 for lost or damaged baggage. Buying travel insurance at the last minute is not recommended, but this is a helpful option if you plan a trip quickly.

You can purchase an annual travel insurance plan through AIG. An annual plan is ideal for someone who travels frequently, especially to dangerous areas. With Travel Guard’s annual plan, you’ll get:

- Trip delay coverage: $150 per day, up to $1,500

- Trip interruption coverage: up to $2,500

- Lost baggage coverage: up to $2,500

- Baggage delay coverage: up to $1,000

- Medical expenses coverage: up to $500,000 (dental coverage up to $500)

- Accidental death coverage: up to $50,000

- Emergency evacuations and repatriation of remains: up to $500,000

These benefits apply to multiple trips within the same year. You can renew your coverage annually or cancel at the end of a payment period. Purchasing an annual plan is usually less costly than insuring two trips individually.

AIG Travel Guard Travel Insurance Pricing

AIG travel insurance is comprehensive but on the higher end of the price spectrum. Premiums for Travel Guard Essential and Premium are on par with industry standards. Travel Guard Deluxe is slightly more expensive because of the added coverage that comes with it.

For example, our quote for a month-long vacation in Europe for two people costing around $5,000 came to around $300 with Travel Guard Premium and $560 with Travel Guard Deluxe. Add-on bundles will add a flat rate to that price. Our quotes for the same trip came out to around $150–$300 with other travel insurance companies.

Of course, that’s just an estimation. Your exact premium will vary depending on your travel dates, destination, age, number of people in your party and other factors. AIG family travel insurance goes up in price for each family member added.

Talk to an AIG Travel Guard representative to get a personalized quote for your travel insurance. You can also request a quick quote online for a basic estimate.

AIG Travel Guard Travel Insurance Financial Stability

AIG Travel Guard is an established insurance provider and a publicly traded company. It has an A rating from AM Best, which reflects a high degree of financial strength and stability. AIG also has a rating of A2 from Moody’s and an A+ from Standard and Poor’s. Because Travel Guard is a product of AIG, you should expect this insurer to remain stable in the future.

AIG Travel Guard Travel Insurance Accessibility

Here’s how AIG Travel Guard compares with other top insurers in terms of accessibility.

Availability

AIG travel insurance offers coverage on six continents. You can search for your destination country on AIG’s website to ensure coverage is available, but remember that not all coverage is available in all destinations.

When it comes to buying travel insurance, AIG is only available to residents of the U.S.

Contact information

You can call AIG’s travel insurance phone number any time to get more information about your policy or request help. Both of these numbers have 24/7 availability:

- U.S. toll-free, 1-855-203-5962

- U.S. and international collect, 1-715-345-0505

If you need to file an AIG travel insurance claim, you can connect with a customer service agent online or over the phone. You can also reach AIG by mail at:

Travel Guard

3300 Business Park Drive

Stevens Point, WI 54482

User experience

While it does offer a travel-assistance app, this insurer isn’t as up-to-date with modern technology as other options. Its Travel Assistance app has 2-star ratings on both Google Play and the App Store and is difficult to navigate. The website is also slightly confusing and has several pages stating the same information. On top of that, AIG travel insurance claims must be filed directly with an agent.

However, getting a quote on the AIG website is easy. It takes less than a minute, and you don’t need to provide your name or any contact information.

AIG Travel Guard Travel Insurance Customer Satisfaction

AIG Travel Guard receives a high rate of customer complaints. It’s rated 1.01/5 stars with the Better Business Bureau. Some reviewers report a lack of helpful customer service and problems getting their AIG travel insurance refund for a canceled trip.

Keep in mind that these complaints are fairly standard in the travel insurance industry. Your individual experience will vary depending on your plan and other details.

AIG Travel Guard Travel Insurance FAQ

What does aig travel guard travel insurance not cover.

- Pre-existing conditions (without an optional waiver)

- Traveling against your doctor's advice

- Traveling against warnings about war or other dangerous conditions

- Trip cancellation due to concerns over a COVID-19 outbreak at home or in your destination country. You may be eligible for cancellation coverage if you have a confirmed diagnosis of COVID-19 before your departure.

What is the AIG Travel Guard claims process like?

Is aig travel guard travel insurance worth it, how we evaluated aig travel guard travel insurance.

We evaluated AIG Travel Guard for this review based on several factors, including:

- Range of plan options

- Accessibility

- Customer reviews and complaints

- Claims filing process

- The extent of coverage for the cost

Summary of Money’s AIG Travel Guard Travel Insurance Review

AIG Travel Guard stands out for its variety of add-ons. Its optional bundles allow you to customize your plan to meet your travel needs. While the Deluxe plan is a little more expensive than other options, Travel Guard could be the right choice for you if you value flexibility and extensive coverage.

Whichever insurance policy you choose, be sure to plan ahead and buy your insurance far in advance. Keep an eye out for other ways to save on your trip, including the best travel rewards credit cards and travel booking sites .

© Copyright 2023 Money Group, LLC . All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer .

IMAGES

VIDEO

COMMENTS

MyLifeline. A travel assistance website for Lifeline Plus policyholders with resources that help prepare for a trip and offer support while abroad. Login. Virtual Medical Care. Round-the-clock access to GPs for consultations and an expert case management service for complex medical cases and second opinions.(A complimentary service included ...

Individuals, families and companies of all sizes in the UK trust AIG for our exceptional service and multinational expertise. We offer partnership with transparency at every step of the insurance process - with an expert claims team located across the world, so each client gets the help they need when and where they need it.

If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc . (Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP. This is only a brief description of ...

Club M Travel Insurance. Brought to you by AIG (American International Group UK Ltd) Making a claim. To make a claim online, visit the AIG portal. Go to the AIG portal. Alternatively, to make a travel insurance claim call AIG on: 01273 740 982. The claims department is open Monday to Friday between 9am and 5pm. Medical Emergency Helpline.

Is not less than 8 characters Must have at least 1 alphabet and at least 1 number(0-9) Must not contain part of username Must not contain First name Must not contain Last name Must not use last password Have at least one special character (!,@,#,$,%,&,^,*) Contain at least one Upper case and one lower case Account will be locked after 6 unsuccessful attempts Account will be automatically ...

Wherever you're going on holiday you'll need to remember to pack your travel insurance. Unity Travel is underwritten by AIG and administered by Just Insurance Agents Limited. Contact Us. 0800 015 1215. Monday - Friday Thursday 9-6, Friday 9-530, Saturday 9-1, Sunday closed. My Account. Get A Quote. Log in to your account. Email Address ...

Group personal accident and travel insurance that contains a wide range of cover, is simple to buy and delivers the promised benefits effectively. ... AIG eXtra is a full-cycle e-trade platform that allows brokers to quote and bind SME business with AIG. Login. myAIG Portal for Multinational. Track the status of controlled master programs, view ...

myAIG is a secure online portal that allows you to access and manage your AIG insurance products and services. You can view your policy details, make payments, file ...

The cost of travel insurance is based, in most cases, on the value of the trip and the age of the traveler. Typically, the cost is five to seven percent of the trip cost. You can get a free quote for your personalized travel insurance plan or call our representatives at 800-826-5248.

Insurance is provided by AIG, and Azur provides brokers and clients with the exceptional service they are accustomed to. For more information, please visit www.azuruw.com , or contact: General Enquiries : 0203 319 8888

Lifeline Plus: Group personal accident and travel insurance that contains a wide range of cover, is simple to buy and delivers the promised benefits effectively. JavaScript has been disabled on this browser.

Typically, travelers who elect to purchase Travel Guard Silver over Travel Guard basic can expect to pay around 2.5% more. Read the schedule of benefits here. Travel Guard Gold: The most popular plan offered by AIG Travel Guard, Travel Guard Gold balances insurance costs with benefits. The Gold plan offers more money for trip interruption (150 ...

Lifeline Plus. If you need emergency assistance, call +44 (0)1273 552 922. Making an insurance claim should be straight forward and stress free - here are some simple steps to follow when making a claim:

AIG Travel's global service centers respond to emergency medical, travel and security needs 24/7/365, and are located in key regions around the globe. Flight delays, unpredictable weather, lost or stolen luggage and other travel hassles are an unfortunate reality of travel today. We provide dedicated, around-the-clock travel counselors who ...

American International Group, Inc. (AIG) is a leading global insurance organization. AIG member companies offer insurance solutions that help businesses and individuals in approximately 70 countries and jurisdictions protect their assets and manage risks. AIG common stock is listed on the New York Stock Exchange.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan. Like the Preferred, you'll get 100% coverage for trip cancellation and 150% of the cost of your insured trip ...

AIG eXtra is a full-cycle e-trade platform that allows brokers to quote and bind SME business with AIG. Login. myAIG Portal for Multinational. ... At AIG UK, it's our priority to resolve claims as quickly as possible whilst providing the support our customers need to get back on their feet. ... Head of Personal Insurance Claims, UK (including ...

Both of these numbers have 24/7 availability: U.S. toll-free, 1-855-203-5962. U.S. and international collect, 1-715-345-0505. If you need to file an AIG travel insurance claim, you can connect with a customer service agent online or over the phone. You can also reach AIG by mail at: Travel Guard.

Cons. The Travel Guard Deluxe plan has generous coverage but a high average cost compared to other top-rated policies. Medical expense coverage of $100,000 is on the low side, but might be ...

Welcome to Advisor Connect (formerly Agentlink). Log into our new user-friendly travel insurance plan booking platform. This enhanced platform has a full suite of tools designed to help our travel advisors and other Travel Guard partners quote and offer travel insurance plans to clients.

Employers/Employees - Employee Benefits. Now that ellipse has joined the AIG Life family, as an employer or employee, you can log in to our new dedicated employee benefits secure area to manage/amend details as required. Employer/Employee login. Welcome to our award-winning critical illness cover. Every client is different, so we've designed ...

Longstay & Backpacker is a specially designed travel insurance policy for people who take extended trips abroad of up to 18 months, such as a gap year or round the world trip. Standard. provides essential cover for cancellation, curtailment, personal possessions, emergency medical expenses, personal liability and personal accident.

ToolBox Login Enter your user ID (email address) and password to access restricted content in the ToolBox. If you haven't registered previously, please contact your sales representative or call 1.866.729.5215 to request access. ... The purchase of travel insurance is not required in order to purchase any other product or service from the Travel ...

Claims at AIG UK. If you need to report a claim, you'll have a global team of AIG claims experts with you at every step throughout the process. ... AIG Multinational Insurance Fundamentals. ... AIG eXtra is a full-cycle e-trade platform that allows brokers to quote and bind SME business with AIG. Login. myAIG Portal for Multinational. Track the ...

W e've reviewed Travel Guard from AIG as part of our exploration of the best travel insurance companies of 2023. This review will cover the pros, cons and features of AIG Travel Guard to help ...