- United States

- United Kingdom

In this guide

Restrictions

Your reviews, ask a question, australia post travel platinum mastercard review.

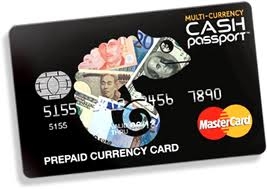

Spend in 11 currencies, lock in exchange rates and boost your travel budget with a promotional cashback offer.

What currencies can I load on the Australia Post Travel Platinum Mastercard?

- Great British pounds

- New Zealand dollars

- Canadian dollars

- Japanese yen

- Hong Kong dollars

- Singapore dollars

- United Arab Emirates dirham

- Australian dollars

If you make a purchase in a currency that isn't supported on the card, the Mastercard rate ("FX Rate") plus a margin of 0% of the transaction value will be applied.

Features of the Australia Post Travel Platinum Mastercard card

As well as the 10 supported international currencies and locked in exchange rates, here are some of the extra features you can expect from this travel card:

- Complimentary lounge passes. If your flight is delayed, you can wait for your next flight in comfort with two complimentary access passes to LoungeKey lounges or restaurants.

- Free global Wi-Fi. When you load your Cash Passport with a minimum AUD$100 or foreign currency equivalent, you will be eligible to register for a 3 month membership of free global Wi-Fi provided by Boingo Wi-Fi. After starting a new 3 month membership, you can be eligible for another 3 month membership after your active one expires if you make another eligible reload during this period.

- Domestic: 2.95% of withdrawn amount

- International: $3.50 AUD (Or equivalent in foreign currency)

- Manage your account. You can easily manage your account on the go via 'My Account', which you can use to top up your account and view your transactions.

- 24/7 global customer service. If your card is lost or stolen, you can also make use of 24/7 customer support who can help you with a card replacement or emergency cash. Call 1800 098 231 from within Australia or +44 207 649 9404 internationally for assistance.

How to load and reload funds on your card

You can top up your card balance online, via bank transfer or in-store:

- Debit card. You can use your debit card to load money on your account and you should be able to access the funds immediately.

- Bank transfer. If you load your card via bank transfer, it will take up to one or two business days for the funds to appear in your account.

- BPAY. You can load funds via BPAY, but a 1% reload fee applies. It will take up to two business days for your funds to appear in your account if you load via BPAY.

- Australia Post. You can also load funds on your card in-store at an Australia Post office.

You can load a minimum of $100 on the card and a maximum of $100,000 p.a.

How to order an Australia Post Travel Platinum Mastercard card

You can order your Australia Post Travel Platinum Mastercard card online or in-store at Australia Post. You just need to provide your full name, contact number and email.

The Australia Post Cash Passport could be a good multi-currency travel card option if you want a prepaid card that locks in exchange rates. With complimentary Wi-Fi and airport lounge options, it also has plenty of platinum features that could come in handy on your next trip. As there are a bunch of prepaid travel cards available on the market, make sure to compare your options before choosing the right card for you.

- Australia Post Travel Platinum Mastercard Product Disclosure Statement PDF

- Australia Post Travel Platinum Mastercard TMD

To ask a question simply log in via your email or create an account .

AAAAFinder Finder

Hi there, looking for more information? Ask us a question.

Error label

You are about to post a question on finder.com.au :

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our 1. Terms Of Service and 6. Finder Group Privacy & Cookies Policy .

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

February 08, 2020

Is there an age limit for this card? Can I get this for my 12-year-old? Thanks.

February 09, 2020

Thank you for contacting Finder .

To apply for the Australia Post Cash Passport Platinum Mastercard, the applicant must be at least 16 years old. For the application, your son/ daughter must provide his/ her full name, a valid contact number and email. A valid ID such as passport or Driver’s License is required to verify the applicant’s identity.

Your 12-year-old son/ daughter may not be able to apply now due to the age requirements.

I hope this helps.

Cheers, Ash

November 20, 2018

Trying to find out how much money I have on my pre paid currency card australian post? How do I do this as it keeps saying my email address and password is wrong?

John Basanes Finder

November 21, 2018

Thank you for leaving a question.

If you need to check your account details or change the password linked to the email that you have with the account, you may click on “Forgot Password” located at the right side of the screen. Confirm your details and an email with the link to reset your password will be sent to you. Hope this helps!

Cheers, Reggie

The Finder team is dedicated to helping you start making better financial decisions right now. See full profile

- Debit cards

- Wise Travel Money Card Review

- Revolut travel account review

- South Korea

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

Power up your money know-how

Join the 35K+ subscribers who receive our weekly Moneyzone newsletter, showcasing the latest rate movements, exclusive deals, money-saving hacks, and expert insights from Mozo.

Zero spam. Unsubscribe anytime.

By submitting your information you agree to the terms and conditions and privacy policy

Thanks for signing up

You will receive a welcome email shortly, australia post load & go travel card retired: here’s what you need to know.

If you’ve been using an Australia Post Load & Go travel card for a while now, this is news you’ll need to hear: Australia Post has announced it is replacing its Load & Go card with a multi-currency Travel Platinum Mastercard .

As of 12 April 2019, customers can no longer renew their Load & Go cards once they expire. So make sure to keep an eye on your card’s expiry date, which is 3 years from its date of production (you’ll find the exact date printed on the front of your card and at the back of its packaging), and get your hands on a new travel card in time for your upcoming trip abroad.

So what should I do with existing balance on my Load & Go travel card?

There are a few ways you can use up your Load & Go card balance before it expires:

- Spend it! A transaction fee of 9c applies for each purchase you take, capped at $0.99 per month.

- Withdraw it from an ATM. But bear in mind that you'll have to take out at least $20 at any one time, and you’ll be charged a foreign currency equivalent of $2 AUD every time you enquire about your balance or withdraw cash.

- Cash it out, by applying for a money order online. This may take up to 45 business days to process.

But what if my Load & Go card has already expired?

Once your card has expired, you’ll no longer be able to use it for purchases or at ATMs. But worry not - if you’ve still got money on the card, you can cash it out by calling 1300 665 054.

What Australia Post travel card can I use now?

Looking for another travel card to use on your adventure overseas? Introducing Australia Post’s Travel Platinum Mastercard, which can load up to 11 currencies: Australian Dollars, US Dollars, Euros, British Pounds, New Zealand Dollars, Thai Baht, Canadian Dollars, Hong Kong Dollars, Japanese Yen, Singapore Dollars and United Arab Emirates Dirham.

The Travel Platinum Mastercard suits travellers looking to splurge on their holiday, as it allows you to have anywhere between $100 and $100,000 on your card (daily limits apply). And with each $100 upload, you’ll be eligible to register for a 3-month membership for free Wi-Fi around the world, provided by Boingo Wi-Fi.

Unlike credit and debit cards where you’ll never know what exchange rate you’ll be charged until after your purchase, the Travel Platinum Mastercard lets you lock in your exchange rates, so you’ll know exactly where your hard-earned holiday money is going. But keep in mind this benefit only applies for the initial load and not subsequent reloads.

And for those hoping to send some cash over to a family member overseas, you can transfer money from one Travel Platinum Mastercard card to another in an instant.

What if you lose your card or have it stolen while travelling abroad? No worries - you can call up Australia Post’s 24/7 global emergency assistance line, and a new card will be sent to you without any additional charges.

How Australia Post’s new Travel Platinum Mastercard compares with Load & Go

While the Travel Platinum Mastercard packs a punch in extra value and freebies, there are some fees to keep an eye on, so it may not suit travellers on a shoestring budget.

If you’ve caught the travel bug, it’s time to get your travel card today and wave goodbye to the hassle of visiting your bank or a specialist money exchanger to swap Aussie dollars for foreign currency. Take a look at our prepaid travel cards comparison table to find the card that suits you.

Prepaid travel cards - rates updated daily

Revolut account, today's rates, purchase fee, overseas atm withdrawal.

30+ currencies

Read our Mozo Review to learn more about the Revolut Account

The Travelex Money Card can be used wherever Mastercard is accepted online or in-store at millions of outlets around the world. $0 Eftpos and ATM fees, $0 currency conversion and online shopping fees. Better rates available on amounts over AUD$2,000.

AUD, USD, NZD, EUR, GBP, SGD, HKD, JPY, CAD, THB

Read our Mozo Review to learn more about the Money Card

Platinum Prepaid Currency Mastercard

Get Free Global Wi-Fi when you travel with Cash Passport. The Platinum card has many beneficial attributes, including free global WiFi.

AUD, USD, NZD, EUR, GBP, SGD, HKD, JPY, CAD, THB, AED

Read our Mozo Review to learn more about the Platinum Prepaid Currency Mastercard

Travel Platinum Mastercard

Read our Mozo Review to learn more about the Travel Platinum Mastercard

Currency Pass

USD, AUD, NZD, EUR, GBP, SGD, HKD, JPY, CAD, THB

Read our Mozo Review to learn more about the Currency Pass

Mozo provides general product information. We don't consider your personal objectives, financial situation or needs and we aren't recommending any specific product to you. You should make your own decision after reading the PDS or offer documentation, or seeking independent advice.

While we pride ourselves on covering a wide range of products, we don't cover every product in the market. If you decide to apply for a product through our website, you will be dealing directly with the provider of that product and not with Mozo.

Who we are and how we get paid

Our goal at Mozo is to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. As a marketplace business, we do earn money from advertising and this page features products with Go To Site links and/or other paid links where the provider pays us a fee if you go to their site from ours, or you take out a product with them. You do not pay any extra for using our service.

We are proud of the tools and information we provide and unlike some other comparison sites, we also include the option to search all the products in our database, regardless of whether we have a commercial relationship with the providers of those products or not.

'Sponsored', 'Hot deal' and 'Featured Product' labels denote products where the provider has paid to advertise more prominently.

'Mozo sort order' refers to the initial sort order and is not intended in any way to imply that particular products are better than others. You can easily change the sort order of the products displayed on the page.

Important information on terms, conditions and sub-limits

Terms, conditions, exclusions, limits and sub-limits may apply to any of the insurance products shown on the Mozo website. These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website. Please refer to the relevant Product Disclosure Statement and the Target Market Determination on the provider's website for further information before making any decisions about an insurance product.

- Credit cards

- Personal Finance

What Is A Travel Money Card?

How does a travel money card work?

How many currencies can you load at once, other features to compare, how to get a travel money card, when is a travel money card worth it, alternative options.

A travel money card, also called a prepaid travel card, is a type of card that can hold foreign currencies. It’s intended for overseas travel, and you can use one to withdraw foreign cash from ATMs and to make purchases in a local currency.

Think of a travel money card as a debit card that uses local currency. Before you use a travel money card, you’ll preload a set amount of a specific international currency onto the card at the day’s exchange rate. For example, if you’re travelling to Italy and France for two weeks, you’d load Euros (€) onto the card and use it instead of your regular debit or credit card during your trip.

You can continue reloading money onto the card via an app or website as you spend your funds. So, if you blow through your Euros in Rome, you can top off your card’s balance before arriving in Paris.

Understanding the value of your exchange

The value you exchange currency for will depend on when you load your funds. Rates change from day to day, but you’ll lock in the rate used at the time you exchange currency. So, you’ll know the exact worth of the foreign currency in Australian dollars every time you use your preloaded card.

On the one hand, a locked-in rate protects you from volatile currencies with fluctuating values. However, if the rate drops, you could be stuck with devalued foreign funds. So, while you can’t predict the future, try to coordinate the load when the exchange rate is most valuable — even if that means waiting a few days.

The number of foreign currencies available will depend on the company providing the card, but you’ll generally find a wide variety of options. Even if dozens of currencies are available, there are typically limits to the number someone can load onto a travel money card. These limits vary by card, but these cards generally only allow for about a dozen currencies at once.

For example, here are common travel money cards and the number of currencies they can support simultaneously:

- Australia Post Travel Platinum Mastercard: up to 11 currencies

- Cash Passport Platinum Mastercard (issued by Heritage Bank): load up to 11 currencies

- CommBank Travel Money Card: up to 13 currencies

- Qantas Travel Money Card: up to 10 currencies

- Travelex Money Card: up to 10 currencies

- Travel Money Oz Currency Pass Travel Money Card: up to 10 currencies

- Westpac Worldwide Wallet: up to 10 currencies.

The number of currencies available and the ability to load multiple currencies onto one card have obvious advantages: it helps you save on fees and makes it easier to manage your money while travelling overseas .

However, there are other key features to compare when choosing a travel money card.

Another thing to look for is reduced or waived fees for loading or reloading funds, account keeping, account closing and emergency card replacements.

Be sure to check for any potential fees when accessing leftover foreign funds you didn’t use on your trip, as there may be an unloading fee or an extra charge to withdraw funds and close your account. For example, Travelex charges a $4 monthly inactivity fee when the card hasn’t been used for more than 12 months.

Top-up options

How easy it is to use a financial product is typically important, but simplicity and convenience may feel more essential when you’re on holiday. In that case, options to quickly load or reload funds and notifications when your balance is low can be very helpful. Some cards may allow you to top up your balance immediately and with little cost. With others, you may have to wait a few days and pay a small fee.

Top-up methods also vary. For example, you can use BPAY with certain cards, but not all. Some cards may require you to use a specific app or portal. If convenience and flexible top-up options are important to you, compare options accordingly.

Perks and benefits

Travel perks, such as airport lounge access or the ability to earn rewards, are also great features to look for. Digital wallet compatibility, allowing you to use a virtual version of your card, can also be helpful.

Security and customer service

Security features are also important. Look for a card with a PIN to use at ATMs and the ability to lock the card instantly if lost or stolen.

And, since you’re travelling overseas, 24/7 customer support is essential to ensure you have access to help when you need it.

To get a travel money card , you can go through your bank, an airline, a foreign exchange retailer or a payment merchant.

Prepaid travel card eligibility is comparable to the requirements for a debit card. For example, CommBank requests that cardholders are at least age 14, are registered with NetBank, and provide a valid email and residential address.

You can apply directly on the provider’s website once you choose your favourite prepaid travel money card. Make sure to submit your application at least a few weeks before your trip in case of delays.

» MORE: How old do you have to get a credit card?

Activating the card

Once you receive the card:

- download the provider’s app and familiarise yourself with how it works

- register your account

- activate the card

- convert your money to the chosen currency. You might want to start with a smaller amount for the first part of your trip and reload while overseas or make one big transfer.

While overseas, you’ll likely alternate between paying in local cash and pulling out your travel card. Your goal is to find the best travel card that allows you to pay for items with minimal fees and maximum protections flexibly.

Possible advantages

- Provides access to multiple currencies. Most options allow you to convert Australian dollars into several different currencies simultaneously. That means you can have secure access to a handful of foreign funds during your next multi-country adventure.

- Saves on ATM fees. Credit card holders won’t usually be charged the standard 3% foreign transaction fee or pay extra for in-network ATM withdrawals, loading, and topping up their cards. However, these are just generalisations — each credit card company or bank will have its own fee structure.

- Exchange rates are locked. You’ll pay for the local currency using the exchange rate available when you load funds, which locks in the rate. Having dependable value for your funds goes a long way for peace of mind, especially when travelling.

- Fewer risks when lost. Losing a prepaid card while travelling is undoubtedly a hassle. However, a lost or stolen credit card can mean more risks, like thieves potentially accessing your personal banking details and account funds. Since a lost travel money card is unlikely to result in identity theft and fraud , some travellers find it a safer choice while abroad.

- Helps with budgeting. Trying to keep to preloaded funds may help you stick to a budget while on vacation. Plus, you see the value of money in the local currency, which can help you manage your finances while travelling.

- May come with rewards and perks. Some travel money cards earn frequent flyer points or come with other special travel perks, like overseas customer service. For example, the Qantas Travel Money Card earns Qantas points, and the Westpac Worldwide Wallet prepaid travel money card offers airport lounge access to the cardholder and one companion access when a flight is delayed.

Potential risks

- There are delays when reloading. If you need to top up your balance, you may need to wait up to a few days before funds are available to use.

- Other fees. Some travel money cards may levy typical credit card fees for reloading funds, emergency card replacement, account maintenance, closures, inactivity and more. For example, Travelex and the Australia Post Travel Platinum Mastercard charge a $10 account closing fee.

- Limited acceptance. Travel money cards are less common than other payment options, so you may need help using one for all purchases. So, it’s always a good idea to carry emergency cash.

- Typically lack rewards or major perks. Travel money cards may come with some, but these extras are usually less robust than the offerings on rewards credit cards .

The right travel money card supports a stress-free trip, but you don’t have to use one when travelling overseas — your bank card or credit card could also be a suitable option.

If you’re deciding between a travel money card and a travel credit card , it’s important to understand the differences in how they work.

- Travel money cards are preloaded with foreign currencies, while travel credit cards spend borrowed money. Travel money cards are generally easier to obtain as they don’t require good credit or income thresholds. With a travel money card, you can withdraw funds from an ATM without incurring interest or cash advance fees .

- Travel credit cards don’t usually hold foreign currency but offer perks such as international buyer protections, free insurance , airport lounge access and frequent flyer travel points .

Be sure to consider other important features — such as security, reduced fees and travel perks — to decide if a travel money card is worth it for you.

Frequently asked questions about travel money cards

The available currencies will depend on the card, but you’ll generally find the following options:

- United States Dollars (USD)

- Europe Euros (EUR)

- Great British Pounds (GBP)

- Japanese Yen (JPY)

- New Zealand Dollars (NZD)

- Hong Kong Dollars (HKD)

- Canadian Dollars (CAD)

- Singapore Dollars (SGD)

- Thai Baht (THB)

- Vietnamese Dong (VND)

- Chinese Renminbi (CNY)

- Emirati Dirham (AED).

Most Australian banks — including Westpac, CommBank, ANZ and NAB — have some sort of travel product, whether that’s a travel money card, a travel-friendly debit card or a travel credit card. However, ANZ and NAB no longer offer prepaid travel money cards.

About the Author

Amanda Smith is a freelance reporter, journalist, and cultural commentator. She covers culture + society, travel, LGBTQ+, human interest, and business. Amanda has written stories about planning for retirement for…

DIVE EVEN DEEPER

How Do I Pay With My Phone?

Instead of carrying your wallet around and pulling it out at check-out, you can just tap your phone, which is always on you, to pay for most things now.

What Is a Travel Credit Card?

Using a travel rewards credit card can help you get your next flight on a discount, hotel upgrades, or even cover the full cost of a trip.

What Is a Frequent Flyer Program Credit Card?

Frequent flyer credit cards earn points or miles that can upgrade your travel and help you score free flights.

How To Lock, Block Or Freeze Your Credit Card

A card lock is essentially an on-off switch that allows you to temporarily freeze or block your credit card and most debit cards.

- Vacation Rentals

- Restaurants

- Things to do

- Things to Do

- Travel Stories

- Rental Cars

- Add a Place

- Travel Forum

- Travelers' Choice

- Help Center

Australia Post Load and Go Card - Travel Gadgets and Gear Forum

- Tripadvisor Forums

- Travel Gadgets and Gear Forums

Australia Post Load and Go Card

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Vacation Rentals

- Travel Gadgets and Gear forum

Now i know a lot of people don't like this card but it is too late , my money is already on there. Well some of it. I was just checking all is in order as i travel in two weeks and i spotted this notice:

Important notice - change to PDS for Load&Go Reloadable Visa Prepaid Card

Changes to the maximum ATM withdrawal limits, effective from 1 November 2013:

a maximum weekly ATM withdrawal limit of $250 (subject to the available balance and individual ATM operator limits) will apply to the Australia Post Load&Go Reloadable Visa Prepaid Card; and

the maximum daily ATM withdrawal limit of $500 will be removed.

Am i reading this correctly?

What the hell does that mean?!?! Holy crap...

Looks to me like it is lucky I only put accommodation money on this card otherwise $250 a week would be lucky to cover tips and coffee.

I went to the website because I couldn't believe your post! LOL

Definitely not a card to use for travel...

I would have been more annoyed if i hadn't seen the notice because it doesn't jump out at you. I will have to make sure i use the funds up on card transactions.

hello bakermob,

this might be a little late butfrom what you have written:

"Changes to the maximum ATM withdrawal limits, effective from 1 November 2013:

a maximum weekly ATM withdrawal limit of $250 (subject to the available balance and individual ATM operator limits) will apply to the Australia Post Load&Go Reloadable Visa Prepaid Card; and the maximum daily ATM withdrawal limit of $500 will be removed."

But i just got my card after reading the terms and conditions (white sheet) that comes with the card and it says that the MAX. DAILY withdrawal limit is $2500 AUD but is subject to individual ATM operators.

Maybe it has changed since last year but thats what it has stated in the pack.

I used the load and go to pay for the hotel and put my "cash" onto a City Bank Plus card that has no fees (atm fees apply) and a better exchange rate than most cards. It does not "lock in" dollars so is subject to drop in Aus$ value and exchanges at the rate on the day.

Hope your terms and conditions are correct. $250 per week makes no sense.

If you are about head off on a trip - enjoy.

Load and Go is not good value because of the poor exchange rate offered.

The Citibank Plus card is good for obtaining cash, and ATM fees can be avoided in most countries by using an ATM affiliated with Citibank (as listed on the Citibank web site).

For larger purchases, the 28 Degrees Mastercard has no fees for overseas purchases (in person or over the Internet).

Both Citibank Plus and 28 Degrees give the official inter-bank exchange rate, which immediately makes them around 4% better than any pre-loaded travel card.

Would like some advise please.

I see that the Citibank Plus is a great way to go with no fees. It's what I intended to use for my 6 weeks in USA next month. Due to the constant decline of the AUD/USD I'm wondering if I'm playing with fire and should take the lower conversion rate with a prepaid travel card to lock in the rate? I'm worried it's going to continue going down between now and when I get back- they predict it reaching 65c by the end of the year.

Thoughts and opinions? In this specific circumstance is it a safer bet?

Thanks all!

You'd have to look at fees and see if the better rate + fees over 6 months comes out better than the citibank plus card with no fees

Edit: reply posted twice, sorry

- understanding global roaming and getting a good service Apr 17, 2024

- Has anyone used Roamflux for eSim? Apr 17, 2024

- How to cook my beer and milk Apr 17, 2024

- Has anyone used Holafly eSIM card Apr 15, 2024

- Currency Conversion App for Android Apr 14, 2024

- Do wifi/WhatsApp messages count as texts for eSIMS? Apr 13, 2024

- Selfie Photos on phone Apr 12, 2024

- Tracfone in Europe Apr 10, 2024

- Taking a 55L backpack as a carry-on Apr 10, 2024

- Taking a 55L backpack as a carry-on Apr 09, 2024

- Prepaid physical SIM for USA from India Apr 09, 2024

- Is Tumi worth the price ? Apr 06, 2024

- Offline maps Apr 06, 2024

- Alternative to TripIt Apr 05, 2024

- What about Power Converters and Adapters?

- "Staying in touch" while travelling?

- Luggage? So many questions!

- More Questions about Luggage

- Packing Tips?

- Mobile / cell phone questions?

- Bring an unlocked phone or buy a Prepaid phone in USA / Canada?

- Digital camera? Photo storage media?

- Tips regarding internet use when traveling?

- Take a lap-top or net-book?

- What is a good tablet / e-reader to choose for travel?

- What apps are good for tablets?

- The Wish List; & Top Ten (10), or less, Gadgets and/or Gear?

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Australia Post Multi-currency Cash Passport Travel Card Review

Learn about the Australia Post Multi-currency Cash Passport in this review to help you decide whether this is the card for you.

- Multi-currency Mastercard

- Withdraw local currency at over 2 million Mastercard ATMs worldwide

- Load up to 10 currencies

- Lock in exchange rate

- No transaction fee for purchases or withdrawals

- 24/7 Global Emergency Assistance

Pros and cons of using Auspost Multi-currency Cash Passport

- Back-up card with your primary card

- Free replacement card

- No age limit

- Manage your account online

- Can’t change your PIN

- Reload funds can take 2 days

- Not all currencies are available all the time

- $10 cancellation fee

Benefits of the Auspost Multi-currency Cash Passport

- Chip and PIN

- Free back-up card provided

Convenience

- Easy way to manage, spend and save on multiple currencies

- No bank account required

- No international ATM fee

- No retail transaction fee

- Lock in exchange rate by loading funds to foreign currencies and avoid fluctuations

Manage Your Money

- Reload and manage your funds easily online

- Ability to reallocate your funds easily online

- Redeem your unused funds easily on your return

Currencies and Countries

Currencies supported.

- Australian dollars (AUD)

- US dollars (USD)

- Great British pounds (GBP)

- New Zealand dollars (NZD)

- Hong Kong dollars (HKD)

- Canadian dollars (CAD)

- Singapore dollars (SGD)

- Thai baht (THB)

- Japanese yen (JPY)

Load Amounts

- Minimum Load $100

- Maximum Load $100,000 p.a.

Transaction Limits

- ATM Withdrawal Limit (24 hours) : AUD 3,000 (or currency equivalent)

- POS Transaction Limit (24 hours): AUD 15,000

All prices are in AUD

Jason does wildlife photography as a hobby. For the next 4 weeks, Jason will be traveling various countries in Asia to photograph zoos and animals in the wild to create his portfolio. When Jason found out that the Australia Post Multi-currency card held all the currencies he would need, and more for future trips, Jason enquired about getting one in his nearest Post Office. He found that there was no international ATM, or transaction fee so he could save more of his AUD w when spending in a supported foreign currency. He could also reallocate his funds to a different currency quickly and easily online if needed. Jason loaded his AUD before his trip into the currencies he needed, and locked in the exchange rate. Jason is now photographing and documenting the rehabilitation of elephants in Thailand.

Online Tools

Save time and let our online tools crunch the numbers for you.

Currency converter

Burning to know what the exchange rate is? Check today’s exchange rate on any amount.

View tool ⟶

Travel money comparison tool

Heading overseas? Find the best rates for exchanging currency online or find a store near you.

Knowledge centre

Learn the ins and outs of currency

Money transfer comparison tool

Finding the best deal can be nightmare. We bring together all your options by highlighting the fees and rates.

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

The 6 Best Travel Money Cards for Australia 2024

Heading to Australia to kick back on the world famous beaches, soak in the city atmosphere, or explore the open road? Or maybe you’re off for a working holiday, or as a longer term move to live, work, retire or study. In any case, picking up a travel debit, prepaid or credit card can help you manage your money across currencies, and cut the overall costs.

Different travel money cards have their own benefits and drawbacks. Join us as we look through your key travel money card options, and introduce a couple of our favourites from each category so you can see if any suit your preferences and needs.

Wise - our pick for travel debit card for Australia

Wise accounts can hold and exchange 40+ currencies, and you can get a linked Wise card for a one time delivery fee. Top up your account in GBP and switch to AUD before you travel. All currency conversion uses the mid-market exchange rate, with low fees from 0.41%. Here are some of the pros and cons of the Wise travel money debit card, to help you decide if it’s right for you.

Hold and exchange 40+ currencies , including GBP-AUD

No fee to spend any currency you hold, low conversion fees from 0.41%

Mid market exchange rate on all currency conversion

Some fee free ATM withdrawals every month

No ongoing fees and no interest to pay

7 GBP delivery fee

No option to earn points or rewards

Click here to read a full Wise review

What is a travel money card?

A travel money card can help you cut costs whenever you spend in foreign currencies. Travel money cards can be debit or credit cards, but they all offer some international features and benefits such as options to hold a balance in multiple currencies, low or no foreign transaction fees, or cash back or rewards for spending and withdrawals overseas.

Once you’ve picked the travel money card that suits your needs you’ll be able to use it as easily as any other payment card, for in person and online shopping and cash withdrawals. Some cards also offer virtual card options for mobile payments.

What are different types of travel cards?

Travel cards can fall under the following categories. We’ll walk through the features and benefits of each in a moment, so you can see which might work best for your specific needs:

Travel debit cards

Travel prepaid cards

Travel credit cards

Quick summary: Best travel cards for Australia

The right travel card for you might depend on how long you’re spending in Australia and what you’ll be up to while you’re there. To help you weigh up some different options, we’ve included reviews of 2 of our favourite travel money cards from each category to help you choose. Here’s what we’ll be looking at:

Wise travel debit card : Hold 40+ currencies including AUD, with no ongoing fees, and spend with the mid-market exchange rate with no foreign transaction fee and low conversion costs from 0.43%

Revolut travel debit card : Hold 25+ currencies including AUD, in one of 4 different plan types, including some with no monthly fee, and some which comes with ongoing costs but which unlock more benefits and no fee transactions

Post Office travel money card : Hold AUD and 21 other currencies, with no fee to spend a currency you hold - 3% fee applies if you don’t have the currency required in your account

Monese travel money card : Hold a balance in GBP, then spend in AUD with no fees, up to your plan’s limit. Different plans on offer, including Simple which has no ongoing fees to pay

Barclays Rewards Visa travel credit card: Spend with the Visa exchange rate, and earn 0.25% cash back, with no foreign transaction fee and no cash advance fee. Interest and penalties can apply

Halifax Clarity Mastercard travel credit card: No foreign transaction fee, no annual fee, and no cash advance fee if you withdraw money at an ATM. Variable interest and penalties can apply

Travel money cards for Australia compared

Here’s a brief comparison of all the cards we’ve picked out - in a moment we’ll also look at each card in more detail.

When you’re figuring out which travel card suits you it’s worth thinking a bit about how you’ll use your card and account in Australia. If you’re there for work or need to send and receive AUD payments, a card with options to hold and receive Australian dollars - like the Wise card - can be handy.

If you’re looking for a card you can use on this trip and then in future for other holiday destinations make sure you pick one with no ongoing costs so you don’t run up a bill even when you’re not using your card. Finally, travel credit cards might suit you if you need to spread your costs over a few months - but bear in mind that fees and interest can apply in this case, pushing up the price in the end.

Travel Debit Cards for Australia

Travel debit cards can be ordered online from specialist providers, and will usually be linked to a digital multi-currency account. Different card accounts have their own features, but you can usually add money in GBP and then convert to AUD in the provider’s app, or just let the card manage the conversion for you at the point of payment. It’s worth knowing that some travel debit cards come with accounts with a broad suite of AUD functionality, including getting local bank details to get paid in AUD by local transfer. This can be a handy feature if you’re working in Australia, or visiting family and friends who may need to send you money in dollars.

Travel debit card option 1: Wise

There’s no fee to open a personal Wise account , but you’ll pay a one time card order fee of 7 GBP. After that there’s no minimum balance and no monthly charge. Wise accounts can support 40+ currencies for holding and exchange, with low fees from 0.43% when you convert currencies, and transparent ATM fees when you exhaust the monthly free transactions available with your account. Accounts come with local bank details for AUD so you can get paid easily.

No fee to open a personal Wise account, no minimum balance requirement

7 GBP one time fee to get your Wise card

2 withdrawals, to 200 GBP value per month for free, then 0.5 GBP + 1.75%

Hold 40+ currencies, convert between them with the mid-market rate

Get local account details to receive GBP, NZD, EUR, USD and a selection of other major currencies conveniently

Travel debit card option 2: Revolut

Revolut has a selection of different account tiers for personal customers in the UK, including Standard plans with no monthly fee, to the top end Ultra plan which has a 45 GBP/month fee and comes with loads of perks including a fancy platinum plated card. You can hold around 25 currencies, and convert currencies with the mid-market rate to your plan’s allowance. The higher account tiers also come with extras like various different forms of complimentary insurance, discounts, cash back opportunities and travel benefits.

No monthly fee for a Standard Revolut account, or upgrade to one of 4 different account plans which have monthly fees running from 3.99 GBP/month to 45 GBP/month

All accounts have some no fee weekday currency conversion with fair usage fees after that which are 1% for Standard plan holders

Standard plan holders can withdraw 200 GBP overseas per month for free

Hold around 25 currencies

Pros and cons of using debit travel cards in Australia

How much does a travel debit card cost.

Different travel debit card services set their own fees, which can include transaction fees, and monthly costs, depending on the card you pick. Generally, though, because travel debit cards are flexible and allow you to hold a foreign currency balance, you can avoid foreign transaction fees which keeps the overall costs of spending internationally down.

The good news is that you can select the provider and card that works best for you easily. Wise has a one time fee to get your card, but then no monthly charges or minimum balance requirements. Revolut customers in the UK can choose from different account plans, including one with no ongoing charges, or several different account options with a monthly fee in exchange for extra perks and benefits.

How to choose the best travel debit card for Australia?

There’s no single best travel debit card for Australia. Ultimately the decision will come down to personal preferences and spending habits, so you’ll need to compare a few to see which suits your spending and withdrawal needs best.

If you’re only in Australia for a short time and you’re unsure about travel debit cards you could always order a card with no ongoing costs like the Wise card or the Standard Revolut card, to try out whether or not a travel debit card suits you.

Is there a spending limit with a travel debit card in Australia?

You’ll probably find there’s a spending limit for your travel debit card. However, this limit can vary quite significantly, depending on the provider you pick. You can also usually adjust your spending limits for security in the provider’s app which means you can set the limit you’re comfortable with.

For the providers mentioned above, Revolut UK travel debit card holders have some spending caps based on merchant and transaction type. This applies to things like sending money to others, buying travellers cheques or money orders, and betting. Wise caps monthly card spending at 30,000 GBP but you can also move your limit lower if you’d like to, for security reasons.

ATM withdrawals

ATM withdrawals with a travel debit card are also likely to be subject to limits. Revolut applies a 3,000 GBP limit based on any given 24 hour period. Wise ATM withdrawal limits are 4,000 GBP per month. Both providers allow you to make some no fee ATM withdrawals monthly, but the exact amount you can withdraw will depend on your account type.

Prepaid Travel Cards for Australia

Prepaid travel cards are somewhat similar to travel debit cards but may not have quite the same functionality. You’ll usually still get your prepaid travel card from a non-bank provider like the Post Office or Monese and you can still usually manage your application and account remotely with just your phone if you want to. Prepaid cards can also offer multi-currency balance options, but one key difference is that the range of currencies covered may not be as broad as the range offered by travel debit cards. Let’s look at these options in more detail.

Prepaid travel card option 1: Post Office Travel Money Card

You can order a Post Office Travel Money Card online or pick one up in person at a branch as long as you have a valid ID on you. You’ll be able to top up and hold in 22 currencies, although bear in mind a fee applies if you add money in GBP. There’s no fee to add foreign currencies. The exchange rate used when you top up or convert may include a markup, but once you hold a currency balance in your account you can spend it with no further charges.

AUD and 21 other currencies are supported for holding and exchange

No fee to spend a currency you hold on your card

3% cross border fee if you spend in an unsupported currency

80 THB ATM withdrawal fee

Manage your account and card from the Post Office travel money app

Prepaid travel card option 2: Monese Travel Money Card

Monese offers several different account plans which come with linked cards you can use while overseas. Depending on the plan you pick you’ll get some free international spending and some free ATM withdrawals. Simple account plans have no monthly fees, but are more limited in terms of no-fee transactions compared to the other account tiers. While Monese does offer foreign currency account plans, these are not available in AUD.

- Pick the account plan that suits your needs, including a Simple plan with no monthly costs and some plans which do have a fee to pay every month

- Accounts offered in GBP, EUR and RON

- Simple account plan holders can spend up to 2,000 GBP a month in foreign currencies with no fees - other account plans have unlimited overseas spending with no extra fees

- All accounts have some fee free ATM withdrawals every month, with variable limits based on account plan

- Virtual cards available

Pros and cons of using prepaid travel cards in Australia

How much does a prepaid card cost.

Prepaid travel cards can have some fees, even if it’s free to get your card in the first place - which makes it essential to read the account terms and conditions carefully before you sign up. Among other things, look out for monthly maintenance fees, currency conversion charges, top up costs, and any account dormant fees that may apply. Weighing up a few different prepaid travel cards is the only way to decide which is the best value for your particular needs.

How to choose the best travel prepaid card for Australia?

The best prepaid travel card for Australia depends on your spending patterns. The Post Office Travel Money Card has the advantage that you can convert your money to AUD and see your budget instantly. However if you don’t do this, you might end up paying a 3% fee. Monese has different plan types, so has the flexibility to allow you to pick the one you want - but you can’t hold an AUD balance.

Prepaid travel card spending limit

The Post Office travel card lets you top up to 5,000 GBP at a time, with the maximum balance at any given time set at 10,000 GBP, or 30,000 GBP annually. Monese accounts may have different limits based on the tier you pick - usually set at a maximum holding balance at any time of 40,000 GBP. You may be limited to spending up to 7,000 GBP a day, depending on your account type.

With the Post Office card, you can make up to 17,000 THB maximum daily withdrawals and each withdrawal costs 80 THB. Monese accounts may have a maximum ATM withdrawal of 300 GBP a day, depending on the specific account you pick, so it’s worth reading the fee schedule carefully to understand the details.

Travel credit cards for Australia

If you’re going to be spending with a credit card in Australia anyway it could be worthwhile applying for a specific travel credit card before you go. These cards have been optimised for travel and can offer perks like no foreign transaction fee or more rewards and cash back for overseas spending.

If you pick a card with no annual fee, that can mean that using a travel credit card instead of your regular credit card when you’re away costs you less as you’ll dodge foreign transaction fees while still benefiting from network exchange rates. Bear in mind though that while credit cards can be safe and convenient, interest and penalty costs mean that they’re often more expensive than a debit or prepaid card.

Travel credit card option 1: Barclaycard Rewards Visa

The Barclaycard Rewards Visa credit card is a good, straightforward option for UK customers looking for a credit card which does not have foreign transaction fees, and which doesn’t have an annual fee. As with any credit card, some costs can apply including interest fees if you don’t clear your bill monthly, but you’ll be able to earn 0.25% cash back on all your card spending at home and abroad.

No annual fee, with 0.25% cash back on card spending

Currency exchange uses the network rate and no foreign transaction fee

No ATM withdrawal fee - but interest can still apply

28.9% representative APR, with penalty fees for late payments

Secure spending with extra protection on some purchases

Travel credit card option 2: Halifax Clarity Mastercard

The Halifax Clarity Mastercard has a variable interest rate which is based on your creditworthiness, but doesn’t use different rates for different transaction types as some cards do. There’s no foreign transaction fee when you spend or withdraw in foreign currencies, but bear in mind that an ATM operator might charge a fee, and interest accrues instantly for cash advance transactions.

No foreign transaction fee when spending or making a cash withdrawal overseas

Interest applies instantly when making cash withdrawals

Same interest rate applies on all purchase categories

Variable APR based on your credit score - you’ll need to check your eligibility online to see the APR you’d be offered

Spending is covered by the Consumer Credit act which means extra protections for purchases from 100 GBP to 30,000 GBP in value

Pros and cons of using credit cards for Australia

How much does a travel credit card cost.

As with any credit card, you may find that you run into fees when you use a travel credit card. While the travel credit cards highlighted above have no annual charge, and no foreign transaction fee, interest applies if you don’t pay your bill in full every month. If you’re late making a payment, penalties can also apply. Consider carefully if using a credit card is right for you to avoid running up unexpected or unmanageable bills.

How to choose the best travel credit card for Australia?

The best travel credit card for Australia depends on your preferences and situation. Because there’s an eligibility screening process with credit cards, you may find you can’t get approved for some cards if you don’t have an established and strong credit history. It’s generally worth looking for a card with no annual fee, and the lowest available interest rate, just in case you can’t always repay your bill monthly.

Travel credit card spending limit

Your travel credit card spending limit will be set by the card provider, and will depend on your credit score. You’ll be shown details of your spending limit when you’re approved for a travel credit card.

The cards we’ve looked at earlier don’t charge a cash advance fee, but this is a common cost when using a credit card at an ATM, so worth looking out for when you select any credit card. It’s also worth noting that it’s very common for ATM withdrawals to start accruing interest instantly, so you’ll end up needing to repay some charges whenever you use your credit card in an ATM.

How much money do I need in Australia?

There’s so much to do in Australia it’s pretty much impossible to suggest a one size fits all budget for your trip. How much you need to spend will depend entirely on what you’re planning on doing, how long you’ll stay and your personal preferences. The good news is that there are plenty of options out there so you should be able to find a budget and itinerary that suits you with a bit of research and planning. Here’s a quick look at some common costs in Australia:

Conclusion: Which travel money card is best for Australia?

You’re not going to end up short of fun things to do in Australia. But lots of activities means you’ll need to figure out the best way to pay for things while you’re there, to avoid unnecessary costs and make your money go further.

Using one or more travel card options can help you manage your travel budget flexibly, and may also mean lower overall costs. However, the right card and account for you will depend on your preferences and whether you need extras like ways to get paid in AUD by others.

Consider a Wise travel debit card if you need ways to pay and get paid in AUD, with the mid-market rate and low fees. Or as an alternative, check out a Monese travel prepaid card for free currency conversion to your specific plan limit, or a travel credit card like the Barclays Rewards Visa for cash back opportunities and ways to spread your costs over several months if you need to.

No matter what type of travel card suits you best, there’s going to be an option for you - use this guide to research and get ready to enjoy that trip of a lifetime to Australia.

FAQ - Best travel cards for Australia

Can you withdraw cash with a credit card in australia.

Yes. You can use your credit card to make an ATM withdrawal at any ATM in Australia where your card network is accepted. However, bear in mind you’ll pay interest instantly when you use a credit card in an ATM. Choosing to withdraw with a low cost travel debit card from Wise or Revolut may bring down your overall fees.

Can I use a debit card in Australia?

Yes. Debit cards are widely supported in Australia, and can be used in many places, although you may struggle at some small independent merchants or at markets. That said, having multiple ways to pay is reassuring, making carrying both a prepaid or travel debit card and some Australian dollars in cash a smart plan.

Are prepaid cards safe?

Yes. Prepaid cards are not linked to your normal UK bank account which means that they’re safe to use. Even if you were unlucky and someone stole your card while you’re in Australia, they would not be able to access your main account - and you could freeze your prepaid card in the app easily if you needed to.

What is the best way to pay in Australia?

Paying for things with a specialist travel debit, prepaid or credit card in Australia is most convenient. However, having a few options for payment is a good plan, just in case your preferred payment method can’t be used for some reason. Consider getting a travel card from a provider like Wise or Revolut, which has some no fee ATM withdrawals so you can also conveniently get cash as a back up, and for when card payments aren’t offered.

Enter the first 6 and last 4 digits of the number found on the front of your card.

Please Wait...

Can't remember your password?

- Click ' Forgot Password '

- Confirm your account details

- An email with a link to reset your password will be sent to you

Please check your email

Need an account? Activate your card

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386837) arranges for the issue of the Australia Post Travel Platinum Mastercard® (“Travel Mastercard") in conjunction with the issuer, EML Payment Solutions Limited ('EML') ABN 30 131 436 532 , AFSL 404131 . Australian Postal Corporation (ABN 28 864 970 579, AR No. 338646), the card distributor, acts as an Authorised Representative of Australia Post Services Pty Ltd (ABN 67 002 599 340, AFSL 457551). You should consider the Travel Mastercard Product Disclosure Statement and Financial Services Guide before deciding to acquire the product. The Target Market Determination for this product can be found here auspost.com.au/travelcard . Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

^Pay no foreign transaction fees on purchases when travelling, when you load your Australia Post Travel Platinum Mastercard with USD or EUR currencies supported by the product, and transact in that same currency.

Before you make a decision to acquire the card, please check auspost.com.au for the latest currencies supported. Lock in your rates means the exchange rate is locked in for the initial load only. The exchange rates for subsequent reloads will be set at the prevailing exchange rate at the time of the transaction. Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386837) arranges for the issue of the Australia Post Travel Platinum Mastercard in conjunction with the issuer, EML Payment Solutions Limited ('EML') ABN 30 131 436 532 , AFSL 404131. Australian Postal Corporation (ABN 28 864 970 579, AR No. 338646), the card distributor, acts as an Authorised Representative of Australia Post Services Pty Ltd (ABN 67 002 599 340, AFSL 457551). You should consider the Australia Post Travel Platinum Mastercard Product Disclosure Statement and Financial Services Guide before deciding to acquire the product. These can be found together with the Target Market Determination for this product at auspost.com.au . Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Terms, conditions and fees apply. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386837) arranges for the issue of the Australia Post Travel Platinum Mastercard in conjunction with the issuer, EML Payment Solutions Limited ('EML') ABN 30 131 436 532 , AFSL 404131. Australian Postal Corporation (ABN 28 864 970 579, AR No. 338646), the card distributor, acts as an Authorised Representative of Australia Post Services Pty Ltd (ABN 67 002 599 340, AFSL 457551). You should consider the Australia Post Travel Platinum Mastercard Product Disclosure Statement and Financial Services Guide before deciding to acquire the product. The Target Market Determination for this product can be found here.

Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Terms, conditions and fees apply. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Best Travel Card for Australians

By Will Ellis

When you spend money abroad, the fees can quickly make the trip more expensive, especially when using your regular debit card and bank account. T

here are usually foreign currency fees and additional fees when you withdraw money and the exchange rates, too. Using a travel card can reduce the cost of fees when you use one for spending money outside of Australia.

There are three types of travel cards: prepaid travel money cards, travel reward credit cards, and travel debit cards. In this article, you’ll learn all about travel cards, and we’ll introduce you to the best ones on the market.

Table of Contents:

- What Is a Travel Card

- Travel Cards: Pros and Cons

- 1. Travelex Money Card

- 2. Australia Post Travel Platinum Mastercard

- 3. Qantas Money Travel Money Card

- 4. Wise Travel Money Card

- 5. Revolut Travel Money Card

- 6. HSBC Everyday Global Account Debit Card

- 7. Bankwest Breeze Platinum Credit Card

- 8. ING Orange One Low Rate Credit Card

- 9. 28 Degrees Platinum Mastercard

- The Verdict

What Is a Travel Card? 💳️

A travel card is a card that is specifically to be used when someone is planning to travel outside of their home country. Travel cards allow you to spend money abroad with lower fees than expected with your everyday bank account . Most travel card providers will tell you about the currency conversion fee, interest rates and other fees before you make a transaction so you know exactly how you could spend abroad on fees.

You can use different types of travel cards; each will depend on your spending needs and financial situation. Before diving into the best travel cards on the market, we’ve provided a list of all three types of travel cards.

There are three types of travel cards:

- Prepaid travel card: A prepaid travel card is a card you load money onto. You can use a prepaid card wherever Mastercard is accepted. You can use it like your everyday debit card, but it helps you shop safely and stick to a budget, as you can’t spend more than the balance allows. You can load more than one foreign currency onto the card, so it’s perfect for travelling overseas. You simply need to bank transfer money across to the prepaid debit card.

- Travel debit card: A travel debit card is part of a travel bank account, usually known as a multi-currency account; you can use it just like your everyday bank account, but it’s for travelling. If planning a long trip, you may benefit from opening a travel bank account.

- Travel credit card: Travel credit cards are similar to credit cards you can apply from your main bank provider. However, they usually offer better currency conversion fees and reward you with travel points or perks for using the credit card and repaying the balance on time. Travel credit cards typically require a good or excellent credit score.

Travel Cards: Pros and Cons ➡️

You may be unsure if a travel card is the right option, so we’ve compiled a list of all the pros and cons of using one for travelling overseas.

- Cheaper foreign transaction fees: Travel cards typically have lower foreign currency conversion fees. Plus, you won’t be charged as much as you were if you used your everyday bank account.

- Easy access: You can apply for and access your travel money card online. Most prepaid cards allow you to reload money onto the card via an app on your phone.

- Hold multiple currencies: When you have a travel debit card, you will get a multi-current account, which allows you to hold multiple currencies on one account. You can use this bank account for spending abroad; currency conversion fees are usually the lowest with these types of accounts. Prepaid travel cards also allow you to hold and use multiple currencies on one card.

- Earn reward points: When you use a travel credit card, you can earn reward points when you use the credit card for spending. You can use the points for travel perks, discounts, cheaper flights, and lounge access.

- Helps to budget: With a prepaid card, you can only use the balance as there is no credit option. So, if you’re trying to stay on a budget, it’s easier when there is no temptation of an overdraft or credit balance.

- Locked-in exchange rates: Most prepaid cards have a locked-in exchange rate, so you don’t have to worry about fluctuation of exchange rates when transferring money into a different currency. Some companies may use a live exchange rate; always check with the provider about fees before you use your card abroad.

- Use just like a debit card: A prepaid debit card allows you to spend and pay for things like your regular debit card. If you choose a prepaid debit card, it will be attached to a bank account that works like your everyday account.

- Backup card: Most prepaid card providers will send you a backup card if you lose or damage the first one. They will send you two cards together, so keep one separate from the other for safekeeping so you don’t lose them both together.

- Currency conversion: When you use a travel card overseas, especially a travel debit card, the provider will automatically transfer funds into the currency you’re paying with.

- Potential reload delay: Sometimes, there can be a delay in reloading prepaid cards. To prevent potential delays, try to transfer all the money you need before you travel so you don’t have to worry about it whilst you’re away.

- Travel money card fees: A travel money card has its own fees, such as account fees, reload fees, and inactivity fees. Some travel credit cards have monthly fees.

- ATM fees: Depending on the country you visit, there may be overseas ATM withdrawal fees and which ATM operators are used. Some ATMs charge fees when you withdraw cash, so you should look out for that.

Best Travel Cards: Reviews 🔎️

As there are three types of travel credit cards, we’ve provided a list of the top three of each type so you can pick which card suits your needs the best.

1. Travelex Money Card: Award-Winning Prepaid Travel Card

- Exchange rates: Locked-in exchange rates that vary between foreign currencies

- Currency conversion fees: None

- Loading money fee: Free online AUD load and top-ups

- ATM fees: There are no ATM fees outside of Australia

With the Travelex Money Card, you can load up to 15 currencies onto the card, including AUD, GBP, EUR, UDS, NZD, CAV, TJB, SGB, JPY and HKD. There are no fees for cash withdrawals overseas. However, you may be charged for withdrawals in Australia using this card. The prepaid card is accepted at millions of locations worldwide; look out for the Mastercard logo, and you can use your prepaid card at that location.

There is currently an offer online that offers free online AUS load funds and top-ups. If you apply for a prepaid card in-store, there will be a 1.1% fee of 1% of the transaction amount for adding AUD. However, if you load a foreign currency, the top-ups are free. If your prepaid card is inactive for over 12 months, there will be AU$4 monthly inactivity fees.

The minimum top-up amount is AU$50, and the maximum you can load on initial purchase is AU$5,000 so if you want to add a large sum of money to the card, you will have to do it once you’ve applied for the card and already have funds on it. The maximum balance during any 12 months is AU$75,000.

Benefits of this prepaid card include free Wi-Fi worldwide; you can reduce your data usage without worrying about roaming fees with on-the-go internet access using free Boingo Wi-Fi. If your card is lost or stolen, Travelex offers 24/7 global assistance to help replace the card or provide emergency cash so you’re not stuck without money when travelling. You can also add an optional additional emergency card at checkout.

2. Australia Post Travel Platinum Mastercard: A Low Fee Prepaid Travel Card

- Exchange rates: The exchange rate will vary between each foreign currency

- International transaction fees: None

- Loading money fee: Free for bank transfer, but there is a 1.1% for instore and 1% for BPAY

- ATM fees: $3.50 for international cash withdrawals and 2.95% for domestic cash withdrawals

The Australia Post Travel Platinum Mastercard is a prepaid card that allows you to load with 11 different foreign currencies and easily switch between currencies as you travel. There are fixed exchange rates, but they may vary depending on the currency you’re converting. You can manage and load your prepaid card on the go by accessing your ‘My account’ on the website or using the Australia Post Travel Platinum Mastercard app.

There is no direct link to your bank account, and your prepaid card is Mastercard’s Zero liability protection against fraudulent and unauthorised transactions; you can travel and spend safely without worrying about compromised data or funds.

Benefits include three months of access to millions of Wi-Fi hotspots worldwide when you reload $100 onto your card. You can reload money onto your prepaid card at any Australia Post Branch or online in the app.

3. Qantas Money Travel Money Card: Earn Reward Points With a Prepaid Travel Money Card

- Exchange rates: Locked in

- Currency Conversion fees: 0%

- Loading money fee: Fee-free load options; otherwise, a 0.5% debit card instant load fee

- ATM fees: $1.95

To make the most of a prepaid card, you can earn Qantas points with the Qantas Travel Money Card. You can load up to 10 foreign currencies, lock in exchange rates before you travel, and transfer between currencies.

Using the prepaid card, you earn 1.5 Qantas Points for every AU$1 spent in a foreign currency. You’ll earn 1 Qantas Points for every AU$4 spent in Australian dollars. You can earn double points when you spend with Qantas Frequent Flyer program partners using Qantas Travel Money. If you load over AU$1,500 equivalent of foreign currency by 20 November, you can earn up to 10,000 bonus points. For shopping discounts, you can use your Qantas Points for cheaper travel at select airlines or popular retailers.

If you lose your card or it’s stolen, you can temporarily lock it and access emergency funds while travelling. You’ll also have access to the 24/7 Mastercard Global Support team, who can help you if you have any issues or are seeking help while travelling. You will also receive fraud protection against unauthorised transactions.

4. Wise Travel Money Card: Travel Debit Card and Multi-Currency Account

- Exchange rates: Competitive exchange rate

- Currency conversion fees: From 0.43%, fees vary by currency

- Loading money fee: $2

- ATM fees: 2 free ATM withdrawals per month up to AU$350

With the Wise card and multi-currency account, you can spend and withdraw money in over 40 currencies at a live exchange rate. You can transfer money between banks, use the wise debit card overseas, receive and add money to your account and hold different currencies in one account. It’s free to register for a Wise account.

The wise card works just like your regular debit card, but it’s designed to help make spending money abroad cheaper. The card costs $10, but you also get a free digital card that you can use on your smartphone to spend online, in-store and overseas safely with Apple Pay and Google Pay.

So, while waiting for your debit card to be delivered, you can start spending using your virtual card. There are no markups, monthly or hidden fees; you can spend overseas with the real exchange rate. You’ll know how much each transaction will cost upfront.

The application process is simple; you can create an account and order a card within five minutes. So, if you’re travelling soon, you still have time to order a wise travel debit card. With the account and card, you can manage your finances from the Wise app. On the app, you can freeze and unfreeze your card whenever you want, generate digital cards and get notifications for all your transitions to keep in control of your spending.

5. Revolut Travel Money Card: Low Fee Travel Debit Card

- Exchange rates: Competitive rates

- Loading money fee: No loading fee

- ATM fees: Fee-free for withdrawals up to $350 every 30 days

There are over 30 currencies available with the Revolut Travel Money Card, that you can spend in over 150 currencies. You can spend overseas with one of the best exchange rates globally. With this travel debit card, there are no fees. You simply pay the exchange rate and for any additional cash withdrawals above the free amount with the standard free plan. You can transfer money across borders at low rates, and the transactions are quick to complete no matter where in the world you are.

You can choose the colour of your Revolut travel debit card and even personalise it. With a Revolut account and card, you can create one-use virtual cards to help make shopping online more secure. Additionally, if you want to control your spending whilst travelling, you can set up spending limits and freeze your card immediately if you lose it.

Revolut offers paid plans, but they’re optional. If you want to invest in cryptocurrency and save more globally, you can apply for the Premium account for $9.99 monthly. Additionally, if you want all available benefits, plus earning cashback and getting a metal card, you can pay A$24.99 monthly for the Metal plan. Whatever your budget, you can still benefit from the Revolut debit travel card.

6. HSBC Everyday Global Account Debit Card: Banking for Home and Overseas

- Exchange rates: Competitive real-time exchange rates

- Loading money fee: None

- ATM fees: None for ATMs with a VISA or VISA plus logo

If you’re looking for a bank account that you can use at home and on your travels, the HSBC Everyday Global Account allows you to do fee-free everyday banking across 10 currencies. You don’t need to pay a monthly HSBC ATM or transaction fees. You can switch between 10 currencies seamlessly with the HSBC Mobile Banking App; available currencies are EUR, GBP, AUD, USD HKD, CAD, JPY, NZD, SGD, and CNY (with some restrictions with CNY).

If you’re sending money overseas, there are no HSBC fees for you to worry about. You don’t have to worry about ATM fees either. When you’re in Australia, you can get free cash withdrawals from HSBC ATMs, and when you’re overseas, you have to look out for ATMs with the VISA logo.

You can earn up to 2% cashback for contactless payments under $100, so you can earn money just by using your travel debit card to make purchases when you’re home in Australia. You can use your card with Visa payWave, Apple Pay, and Google Pay.

7. Bankwest Breeze Platinum Credit Card: Complimentary Travel Insurance

- Annual fees: No annual fee for the first year, then $69 yearly

- Interest rates: 12.99% after the introductory period

- Foreign transaction fees: None

- Minimum credit limit: $6,000

If you’re looking for a travel credit card with low-interest rates, consider Bankwest’s Breeze Platinum credit card. You can spend interest-free for the first 55 interest-free days on purchases if the balance is repaid in full and on time, then you’ll only have to pay 12.99%. When using your credit card overseas, there are no foreign transaction fees, so you can spend knowing there won’t be additional fees to pay. You can use the credit card anywhere that accepts Mastercard.

There is no annual fee for the first year; after the first year, there is a $69 annual fee. A perk of the Breeze Platinum card is complimentary overseas travel insurance, interstate flight inconvenience insurance and 90-day purchase security insurance. Additionally, new customers will benefit from a 2% balance transfer fee.

To be eligible for this credit card, you must be a permanent Australian resident over 18 with a regular income of over $15,000.

8. ING Orange One Low Rate Credit Card: No Annual Fee Travel Credit Card

- Annual fees: No annual fee

- Interest rates: 11.99% variable

- Foreign transaction fees: No international transaction fees

- Minimum credit limit: $1,000