U.S. Department of State

Diplomacy in action.

The Bureau of Public Affairs of the Department of State offers a subscription service that permits individuals to receive notices when Foreign Travel Per Diem rates are updated.

The Chapter 925 Per Diem Supplement to the Standardized Regulations (Government Civilians, Foreign Areas) lists all foreign areas alphabetically. Where a country or island is listed it is intended to include all territory within the boundaries of that country or island including any off-shore islands in the same general vicinity. It will not include territories or possessions located elsewhere even though considered an integral part of the parent country or island. In such cases, no cost data pertinent to such territories and possessions were used in determining the established rates. When a political subdivision smaller than a country is named, such as states, provinces, departments, cities, towns, villages, etc., it will include the corporate limits of such political subdivision or the limits of territory within the normal boundary thereof if it is not incorporated. Any further clarification of the area covered by a specific listing is contained in associated footnotes which can be viewed by selecting Foreign Per Diems By Location.

If you have questions regarding the per diem rates, please contact the Office of Allowances.

Office of Allowances Bureau of Administration U.S. Department of State Washington, DC 20522-0104 Telephone: (202) 663-1121 E-mail: [email protected]

All travelers are advised to request information on hotel discounts for U.S. Government employees when arranging for hotel reservations. They should also seek information on the possible avoidance of taxes or their refund upon return to the United States or their post of assignment.

Separate amounts are established for lodging and meals plus incidental travel expenses (M&IE). The maximum lodging amount is intended to substantially cover the cost of lodging at adequate, suitable and moderately-priced facilities. The M&IE portion is intended to substantially cover the cost of meals and incidental travel expenses such as laundry and dry cleaning. The maximum per diem rates for foreign countries are based on costs reported in the Hotel and Restaurant Survey (Form DS-2026) submitted by U.S. government posts in foreign areas. This report includes prices for hotel rooms and meals at facilities representative of moderately priced and suitable hotels and restaurants most frequently used by typical Federal travelers. The lodging portion of the allowance is based on average reported costs for a single room, including any mandatory service charges and taxes. The meal portion is based on the costs of an average breakfast, lunch, and dinner at facilities typically used by employees at that location, including taxes, service charges, and customary tips. The M&IE rate is based on these meal costs plus an additional amount, equal to 10% of the combined lodging and meal costs, to cover incidental travel expenses.

In order for the Department of State to maintain appropriate travel per diem rates in foreign areas, employees of the Federal Government who believe that the per diem rate authorized for a particular area is inappropriate for expenses normally encountered while on temporary duty are encouraged to notify their respective agency travel officials. Those agencies that receive complaints about a per diem rate for a locality where there is frequent travel may submit a request to the Department of State for review. This request should include cost data on lodging and meals using Form DS-2026. This information must be submitted in accordance with instructions in section 074 of the Department of State Standardized Regulations (DSSR).

Tax and accounting regions

- Asia Pacific

- Europe, Middle East, and Africa

- Latin America

- North America

- News & media

- Risk management

- thomsonreuters.com

- More Thomson Reuters sites

Join our community

Sign up for industry-leading insights, updates, and all things AI @ Thomson Reuters.

Webcast and events

Browse all our upcoming and on-demand webcasts and virtual events hosted by leading tax, audit, and accounting experts.

Related posts

When Do COVID-19-Related Extended HIPAA Special Enrollment Periods End?

ACA Preventive Health Services Mandate to Remain in Effect During Braidwood Appeal

CMS Issues Guidance on Elimination of MHPAEA Opt-Out Elections by Self-Insured Non-Federal Governmental Health Plans

More answers.

Software depreciation: Exploring tax implications and deductions

How to master the tax provision process

What accountants need to know about Form 1042 filing requirements

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

IRS updates business travel per-diem rates

- Individual Income Taxation

The IRS issued its annual update Friday of special per-diem rates for substantiating ordinary and necessary business expenses incurred while traveling away from home ( Notice 2021-52 ).

The new rates are in effect from Oct. 1, 2021, to Sept. 30, 2022. Specifically, they are the special per-diem rates, including the transportation industry meal and incidental expenses rates; the rate for the incidental-expenses-only deduction; and the rates and list of high-cost localities for purposes of the high-low substantiation method.

The updated rates are effective for per-diem allowances paid to any employee on or after Oct. 1, 2021, for travel away from home on or after that date, and supersede the rates in Notice 2020-71, which provided the rates for Oct. 1, 2020, through Sept. 30, 2021.

Rev. Proc. 2019-48 provided general rules for using a federal per-diem rate to substantiate the amount of ordinary and necessary expenses for lodging, meals, and incidental costs paid or incurred for business-related travel away from home.

High-low substantiation method

For purposes of the high-low substantiation method, the per-diem rates are $296 for travel to any high-cost locality and $202 for travel to any other locality within the continental United States (CONUS), both slightly higher than last year.

The amount of these rates that is treated as paid for meals for purposes of Sec. 274(n) is $74 for travel to a high-cost locality and $64 for travel to any other locality within CONUS, both also slightly higher than last year.

The notice contains a list of the localities that are high-cost localities (localities that have a federal per-diem rate of $249 or more, $4 higher than last year) for all or part of the calendar year.

Incidental expenses

Since 2012, incidental expenses have included only fees and tips given to porters, baggage carriers, hotel staff, and staff on ships. The per-diem rate for the incidental-expenses-only deduction remains unchanged at $5 per day for any locality of travel.

Transportation industry

The special meals and incidental expenses rates for taxpayers in the transportation industry are $69 for any locality of travel within CONUS and $74 for any locality of travel outside CONUS, both $3 more than last year.

— Paul Bonner ( [email protected] ) is a JofA senior editor.

Where to find April’s flipbook issue

The Journal of Accountancy is now completely digital.

SPONSORED REPORT

Manage the talent, hand off the HR headaches

Recruiting. Onboarding. Payroll administration. Compliance. Benefits management. These are just a few of the HR functions accounting firms must provide to stay competitive in the talent game.

FEATURED ARTICLE

2023 tax software survey

CPAs assess how their return preparation products performed.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

Travel resources

Per diem look-up, 1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

City Pair airfares

Visit City Pair Program to learn about its competitive, federally-negotiated airline rates for 7,500+ domestic and international cities, equating to over 13,000 city pairs.

- Search for contract fares

Note: All fares are listed one-way and are valid in either direction. Disclaimer - taxes and fees may apply to the final price

Taxes and fees may apply to the final price

Your agency’s authorized travel management system will show the final price, excluding baggage fees. Commercial baggage fees can be found on the Airline information page.

Domestic fares include all existing Federal, State, and local taxes, as well as airport maintenance fees and other administrative fees. Domestic fares do not include fees such as passenger facility charges, segment fees, and passenger security service fees.

International

International fares do not include taxes and fees, but include fuel surcharge fees.

Note for international fares: City codes, such as Washington (WAS), are used for international routes.

Federal travelers should use their authorized travel management system when booking airfare.

- E-Gov Travel Service for civilian agencies.

- Defense Travel System for the Department of Defense.

If these services are not fully implemented, travelers should use these links:

- Travel Management Center for civilian agencies.

- Defense Travel Management Office for the Department of Defense.

GSA lodging programs

Shop for lodging at competitive, often below-market hotel rates negotiated by the federal government.

FedRooms provides federal travelers on official business with FTR compliant hotel rooms for transient and extended stays (up to 29 days). The program uses FEMA and ADA-compliant rooms with flexible booking terms at or below per diem rates. Federal employees should make reservations, including FedRooms reservations, via their travel management service.

Visit GSALodging for more details on FedRooms and for additional programs offering meeting space, long term lodging, and emergency lodging.

Privately owned vehicle (POV) mileage reimbursement rates

GSA has adjusted all POV mileage reimbursement rates effective January 1, 2024.

* Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs).

For calculating the mileage difference between airports, please visit the U.S. Department of Transportation's Inter-Airport Distance website.

Plan a trip

Research and prepare for government travel.

Per diem, meals & incidental expenses (M&IE) Passenger transportation (airfare rates, POV rates, etc.) Lodging Conferences/meetings Travel charge card State tax exemption

Services for government agencies

Programs providing commercial travel services.

Travel Category Schedule (Schedule L) E-Gov Travel Service (ETS) Emergency Lodging Services (ELS) Employee relocation

Travel reporting

Federal Travel Regulation Table of contents Chapter 300—General Chapter 301—Temporary Duty (TDY) Travel allowances Chapter 302 - Relocation allowances

Supply Chain Management

Meals & incidental expenses.

Refer to the information below on UC Davis policies for meal reimbursement and incidentals.

Meals & Incidentals (M&IE) must be ordinary and necessary to accomplish the official business purpose of the trip.

- See Foreign travel section for information about daily maximum allowances .

- Meal reimbursement may only be claimed for the amount of actual expenses incurred (not to exceed $79 per day).

- There must be an overnight stay to claim meal reimbursement.

- Alcohol is not permitted when charging the expense to a State or General Fund source.

- Meals should be purchased using the UC Davis Travel card, whenever possible.

- All tips for meals are included in the same daily limit.

- Any non-group travel expense paid on behalf of another traveler is subject to exception approval before reimbursement can be issued.

- Exception approval is requested by answering the question, "Expenses for other travelers or spouse/partner?" on the AggieExpense report header.

- Travelers who appear to be treating the daily meal limit as a per diem, by claiming the full amount or another fixed amount on a repeated basis without additional justification, will be required to provide supporting receipts for future meal claims, in accordance with BFB G-28 .

Incidentals

- Incidentals include tips and gratuity given to baggage carriers or train porters.

- Incidentals do not include purchasing of personal items, such as toothbrushes or soap.

- Incidentals do not include tips for housekeeping, which should be categorized as a lodging expense.

- The daily limit for meals and incidentals is $79 (effective September 9, 2022).

- Receipts are not required for incidentals.

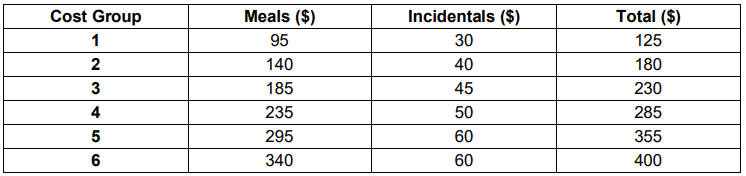

ATO Reasonable Travel Allowances

‘Reasonable’ allowances received in accordance with ATO’s reasonable travel allowances schedules are not required to be declared as income, and can be excluded from the expense substantiation requirements.

Per diem rate schedules of amounts considered reasonable are set out in Tax Determinations published by the Tax Office annually.

Tax Ruling TR 2004/6 describes the substantiation exception for expenses which are in line with the prescribed reasonable allowance amounts.

2021, 2022, 2023 and 2024 rates and for prior years are set out below.

The annual determinations set out updated ATO reasonable allowances for each financial year for:

- overtime meal expenses – for food and drink when working overtime

- domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work

- overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

On this page:

2017- 18-Addendum

More information

Substantiation rules

Substantiation in practice

Alternative: Business travel expense claims

Distinguishing Travelling, Living Away and Accounting for Fringe Benefits

See also: Super for long-distance drivers – ATO

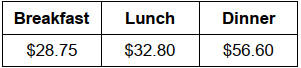

Allowances for 2023-24

The full document in PDF format: 2023-24 Determination TD TD 2023/3 (pdf).

The 2023-24 reasonable amount for overtime meal expenses is $35.65.

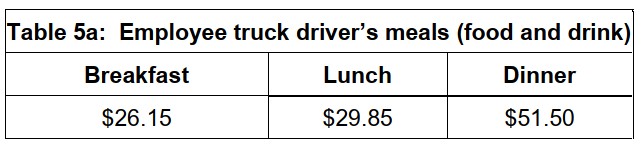

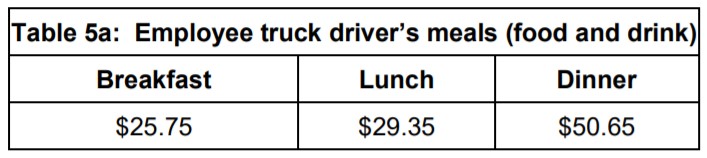

Reasonable amounts given for meals for employee truck drivers (domestic travel) are as follows:

- breakfast $28.75

- lunch $32.80

- dinner $56.60

For full details including domestic and overseas allowances in accordance with salary levels, refer to the full determination document:

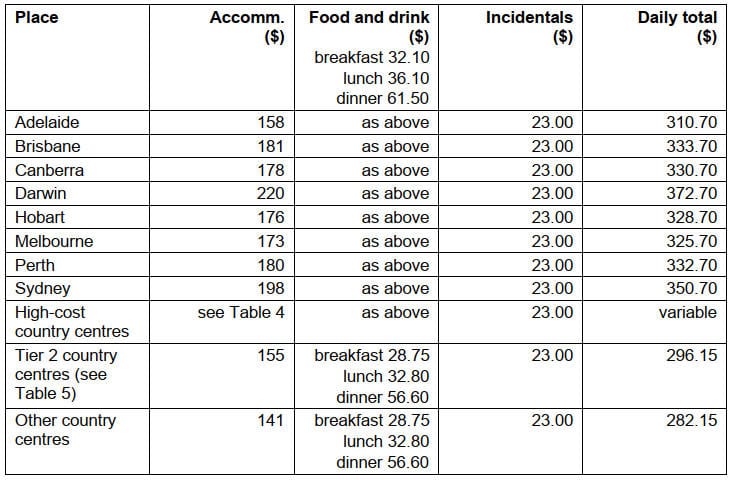

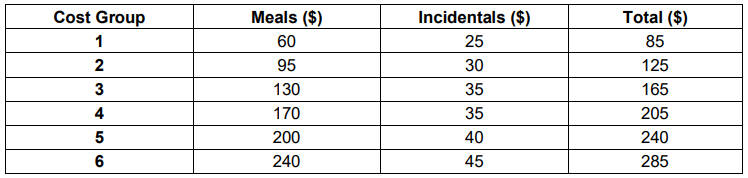

2023-24 Domestic Travel

Table 1:Salary $138,790 or less

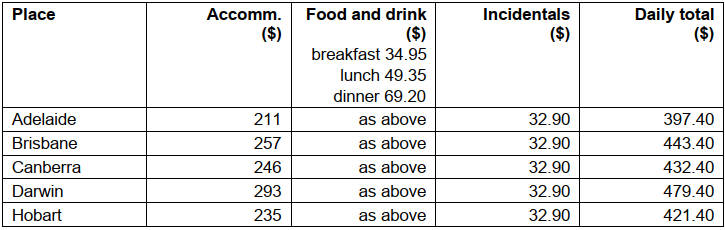

Table 2: Salary $138,791 to $247,020

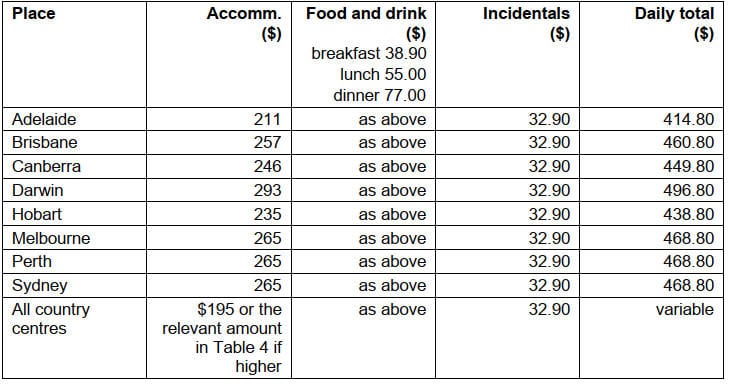

Table 3: Salary $247,021 or more

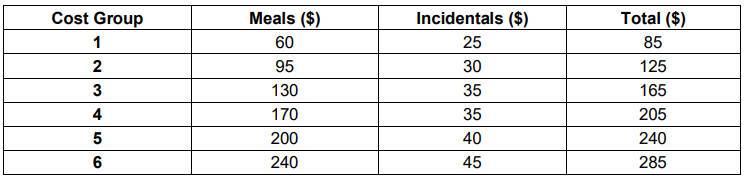

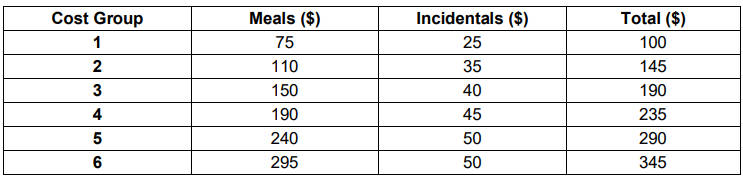

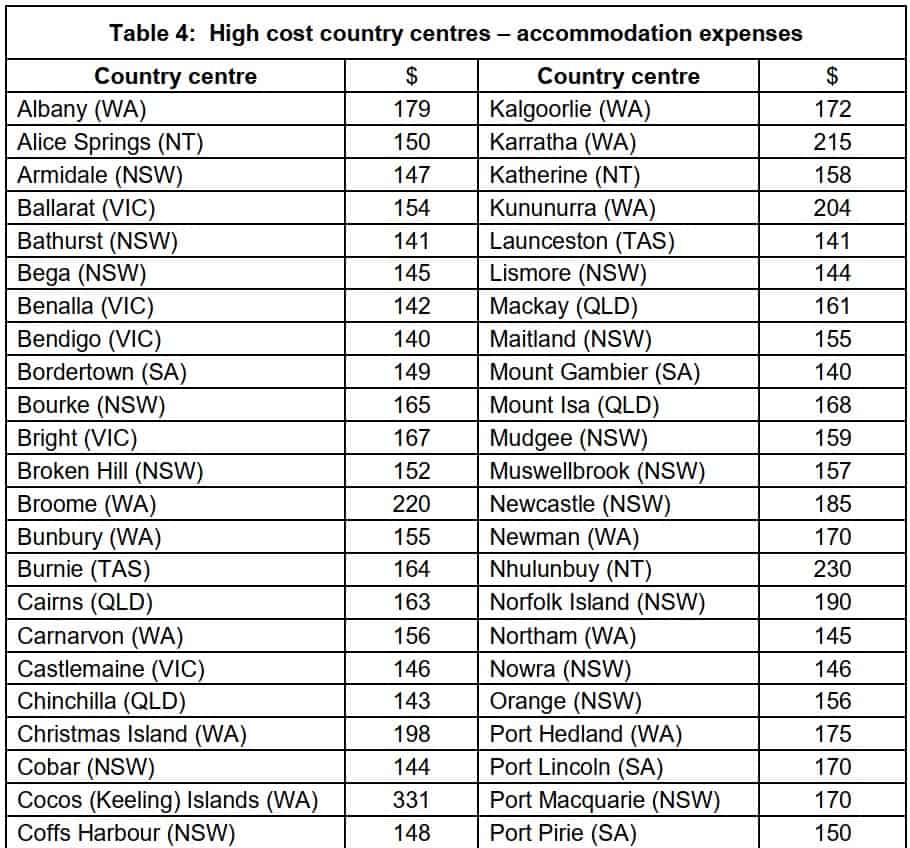

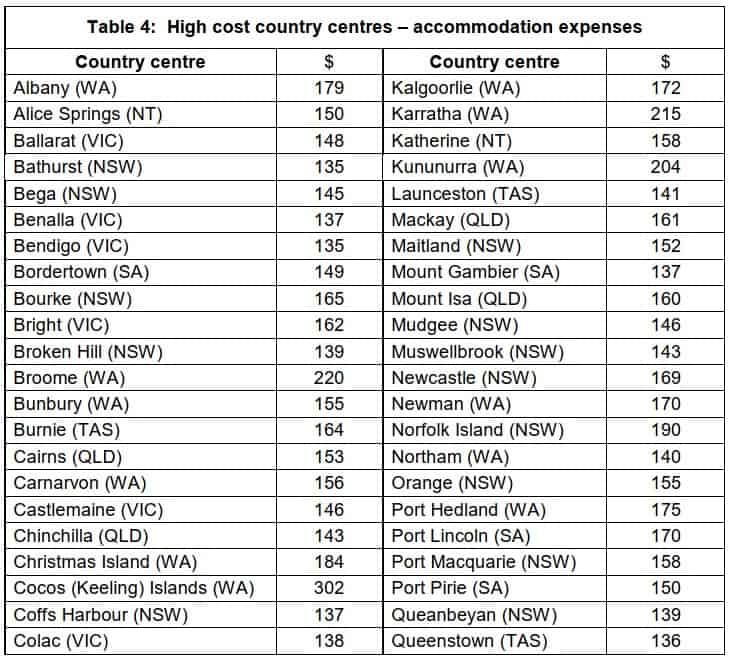

Table 4: High cost country centres accommodation expenses

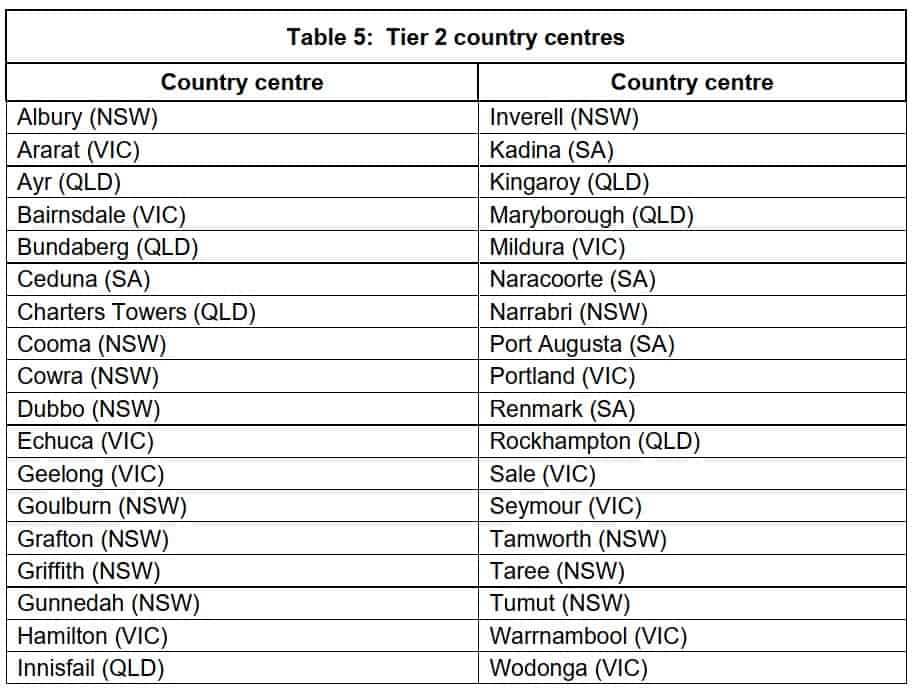

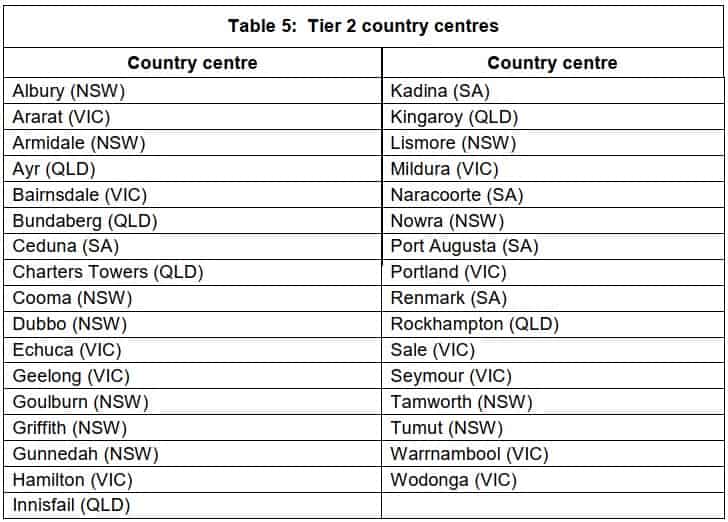

Table 5: Tier 2 country centres

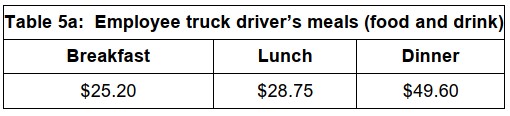

Table 5a: Employee truck driver’s meals (food and drink)

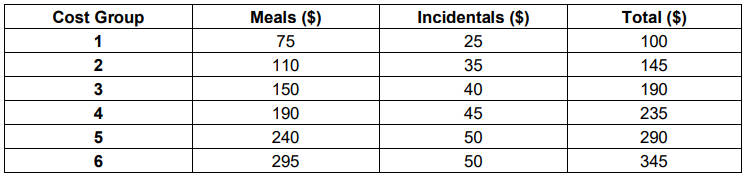

2023-24 Overseas Travel

Table 6: Salary $138,790 or less

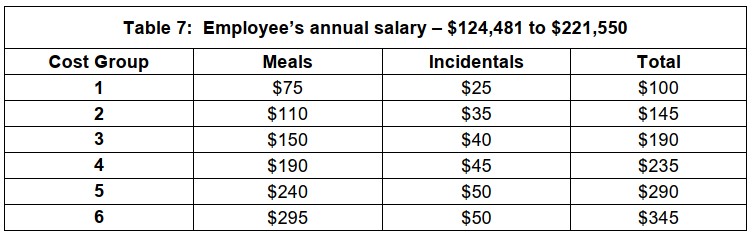

Table 7: Salary $138,791 to $247,020

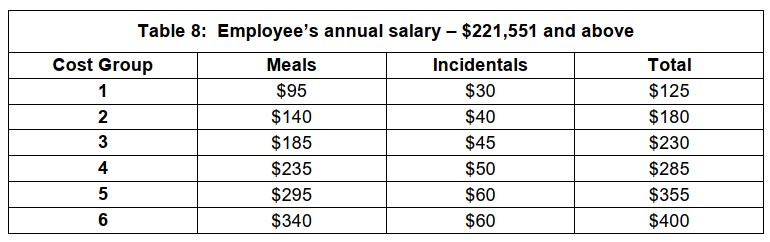

Table 8: Salary $247,021 or more

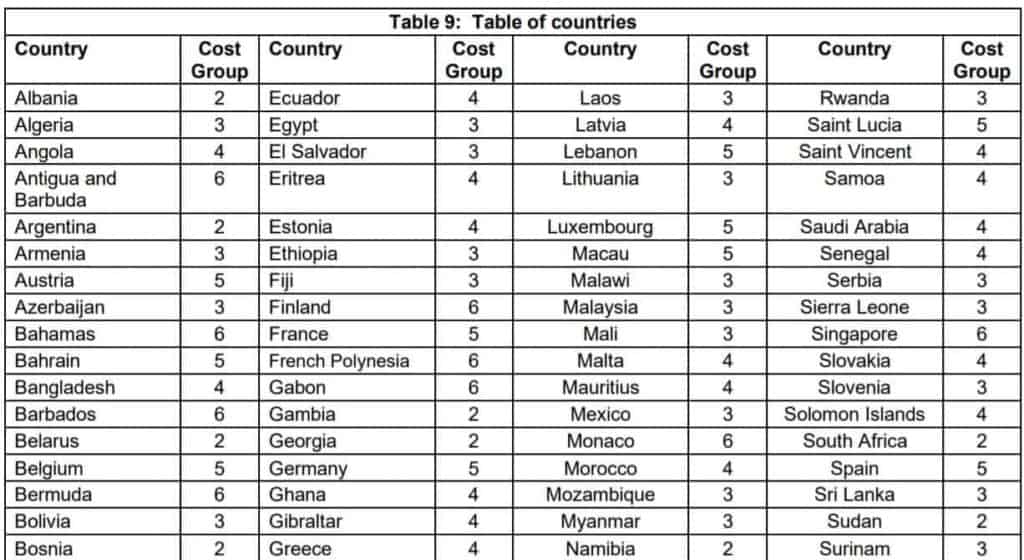

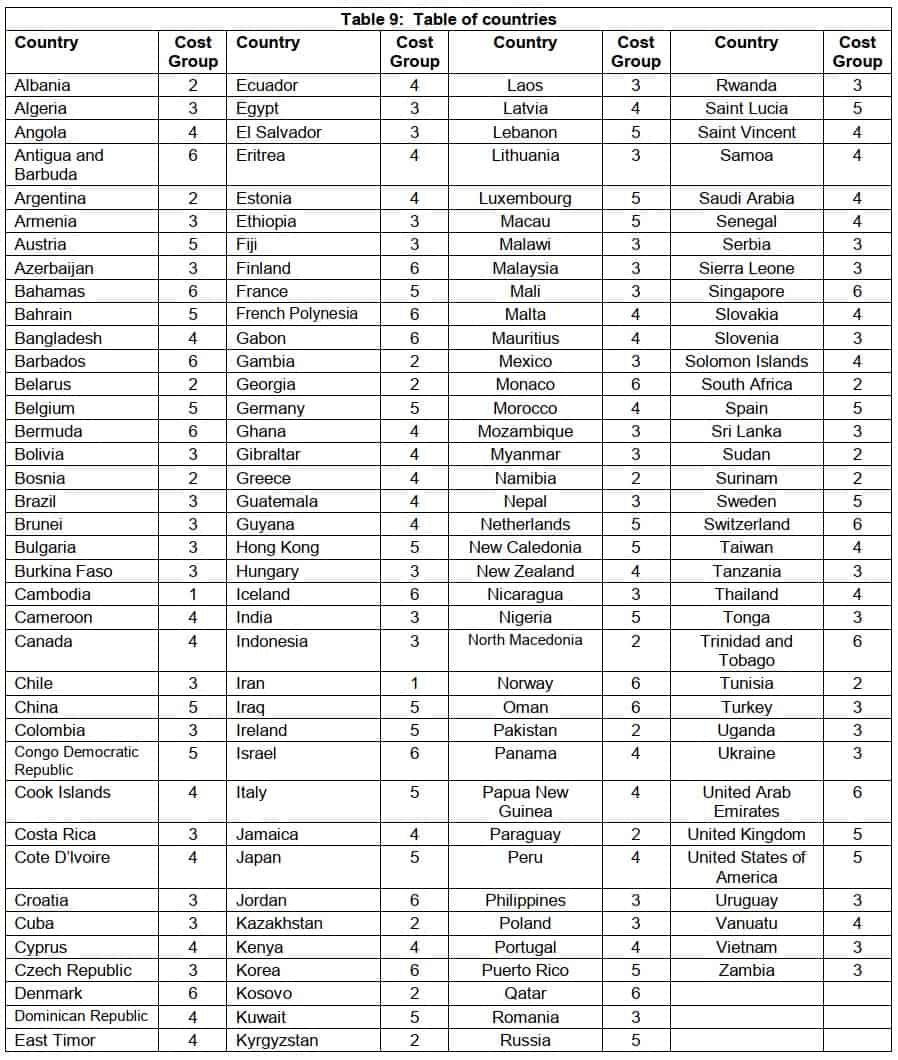

Table 9: Table of countries

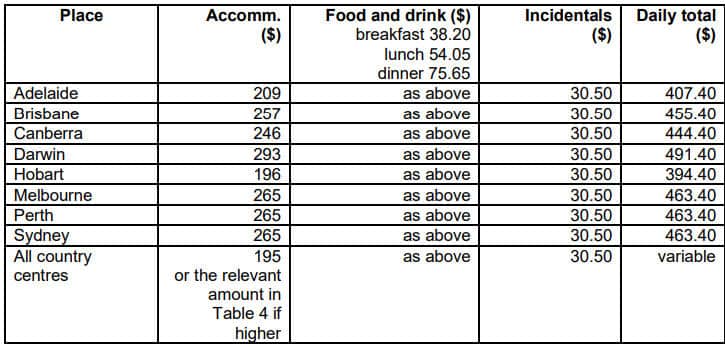

Table 1:Reasonable amounts for domestic travel expenses – employee’s annual salary $138,790 or less

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $138,791 to $247,020

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $247,021 or more

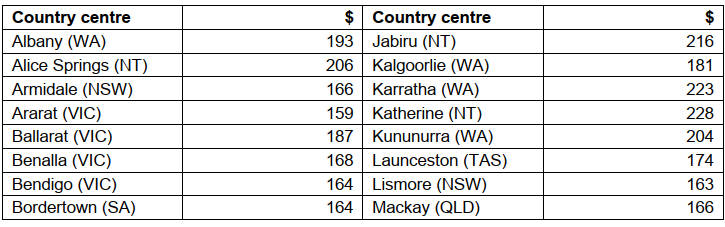

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

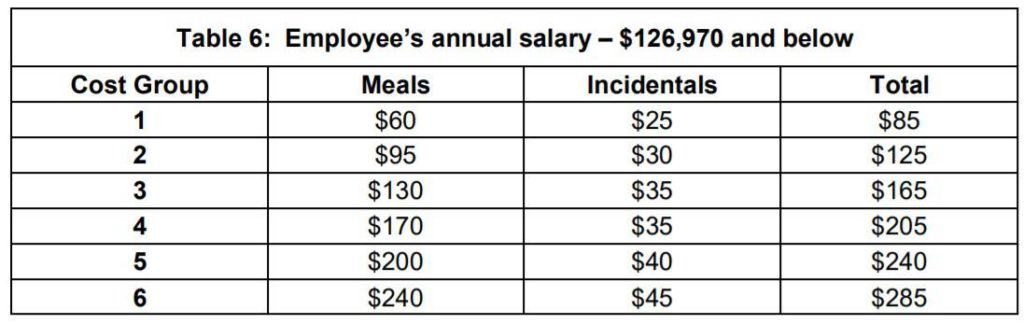

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,790 or less

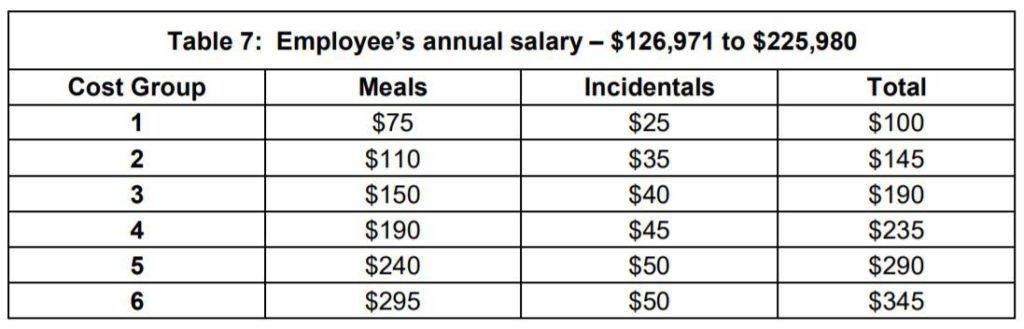

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,791 to $247,020

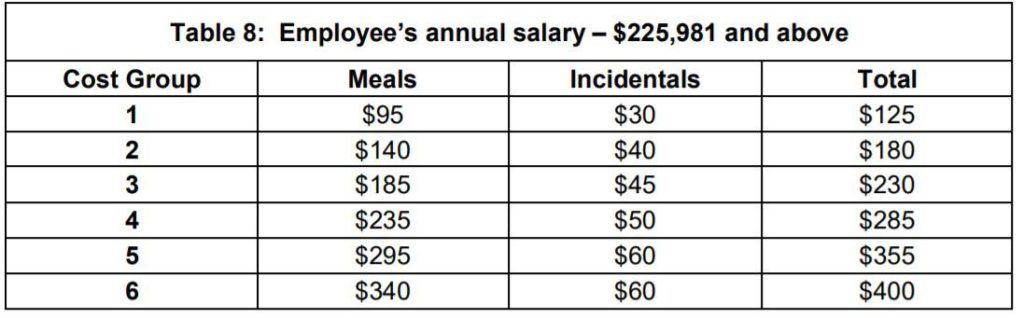

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $247,021 or more

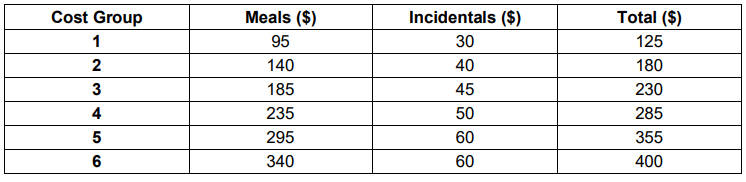

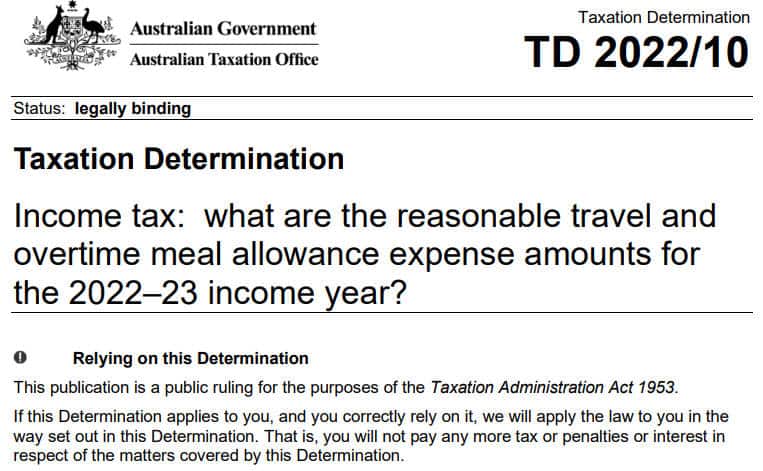

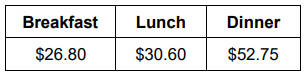

Allowances for 2022-23

The full document in PDF format: 2022-23 Determination TD 2022/10 (pdf).

The 2022-23 reasonable amount for overtime meal expenses is $33.25.

Reasonable amounts given for meals for employee truck drivers are as follows:

- breakfast $26.80

- lunch $30.60

- dinner $52.75

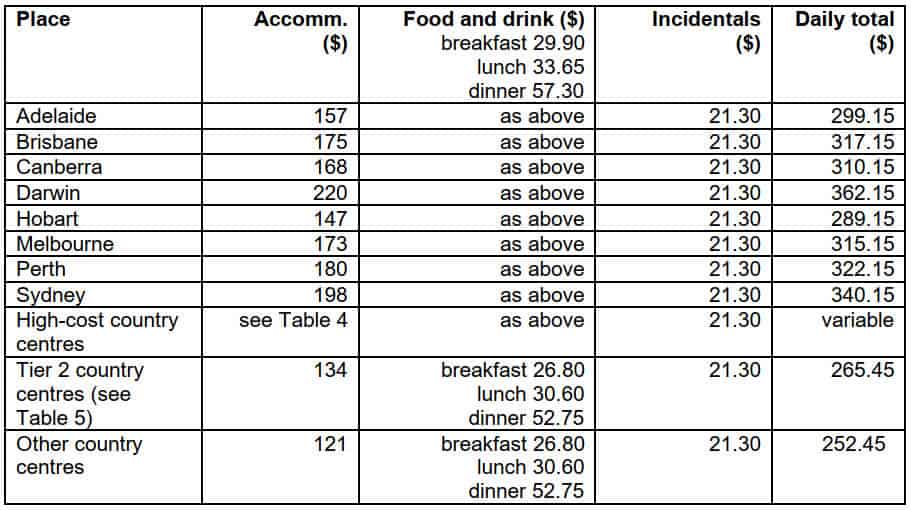

2022-23 Domestic Travel

Table 1: Salary $133,450 and below

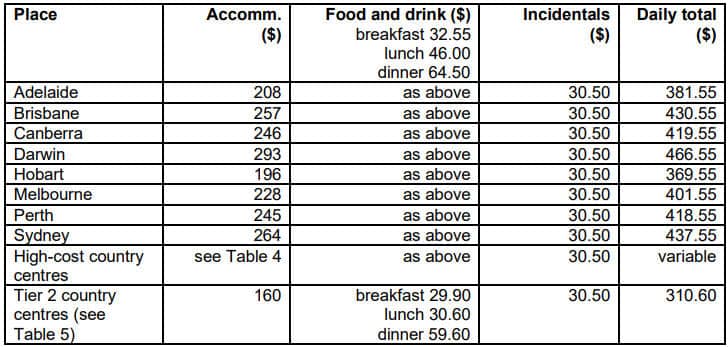

Table 2: Salary $133,451 to $237,520

Table 3: Salary $237,521 and above

2022-23 Overseas Travel

Table 6: Salary $133,450 and below

Table 7: Salary – $133,451 to $237,520

Table 8: Salary – $237,521 and above

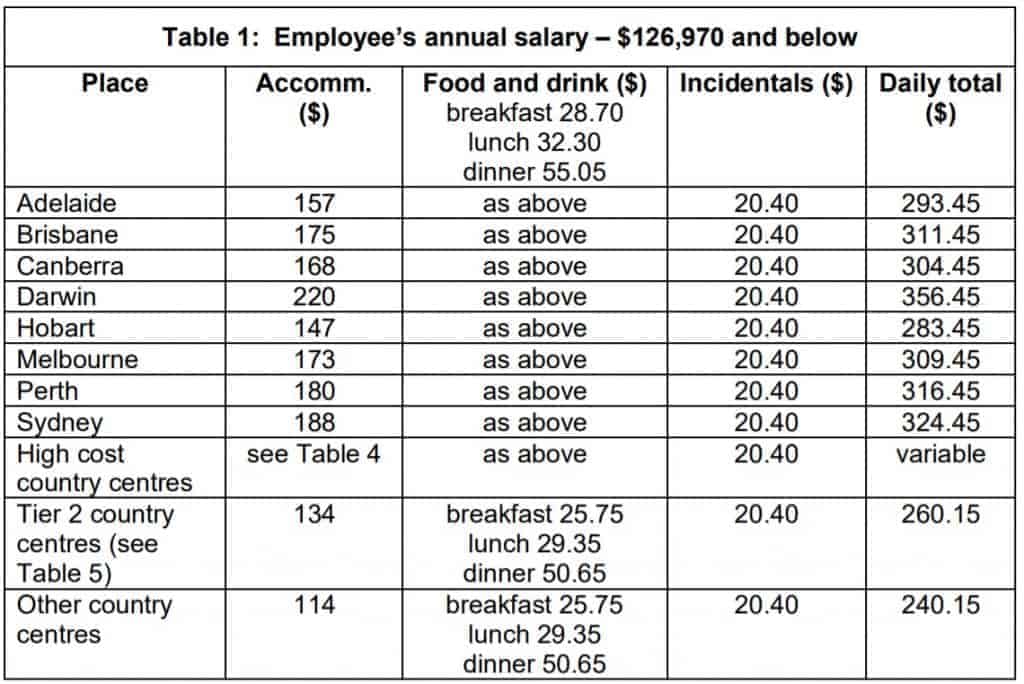

Table 1: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,450 and below

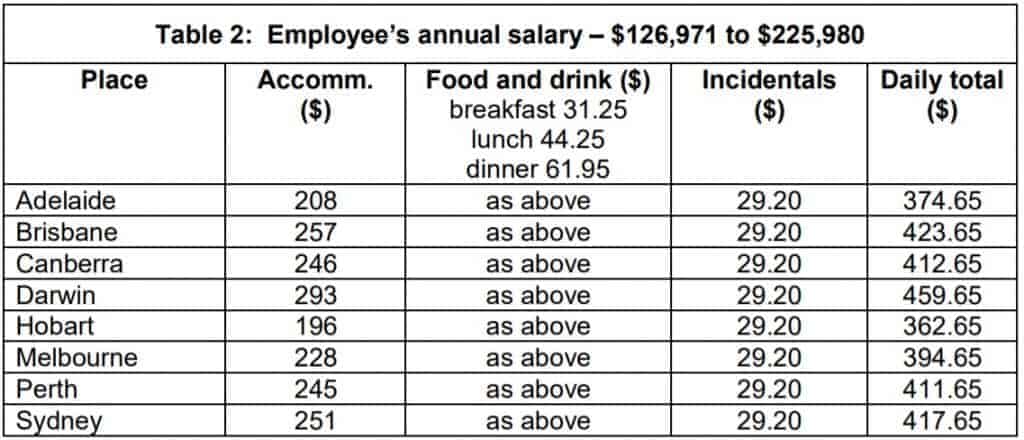

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,451 to $237,520

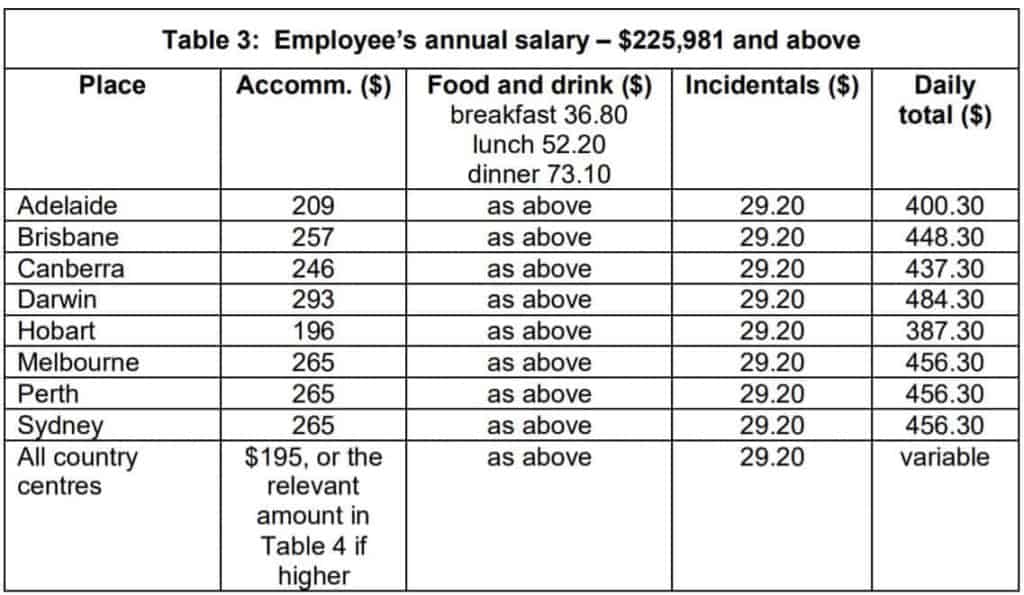

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $237,521 and above

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,450 and below

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,451 to $237,520

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $237,521 and above

Allowances for 2021-22

The full document in PDF format: 2021-22 Determination TD 2021/6 (pdf).

The document displayed with links to each sections is set out below.

For the 2021-22 income year the reasonable amount for overtime meal expenses is $32.50

2021-22 Domestic Travel

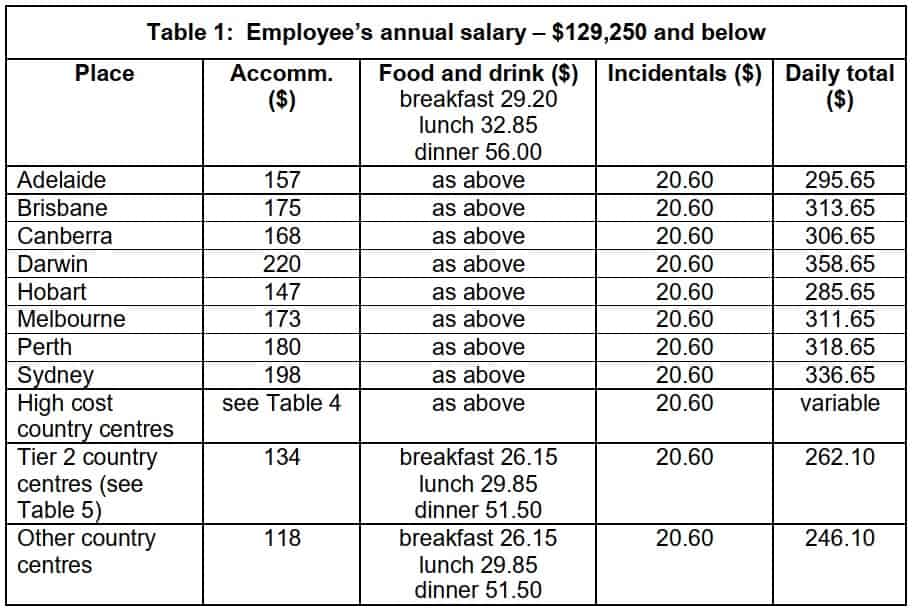

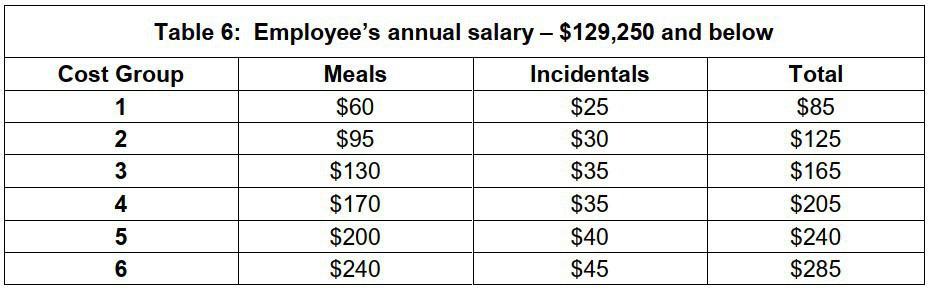

Table 1: Salary $129,250 and below

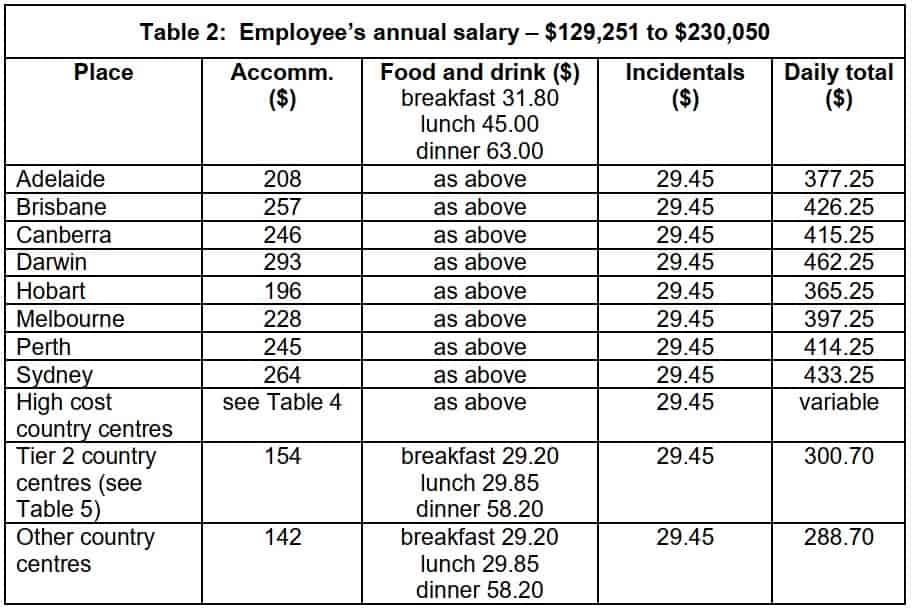

Table 2: Salary $129,251 to $230,050

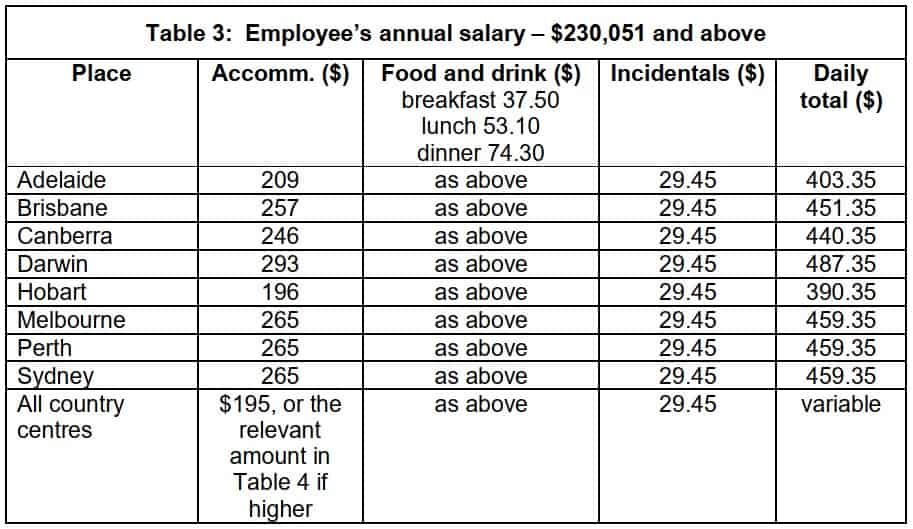

Table 3: Salary $230,051 and above

2021-22 Overseas Travel

Table 6: Salary $129,250 and below

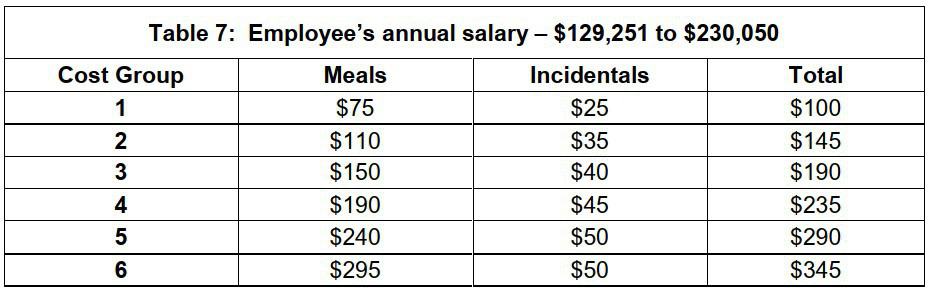

Table 7: Salary – $129,251 to $230,050

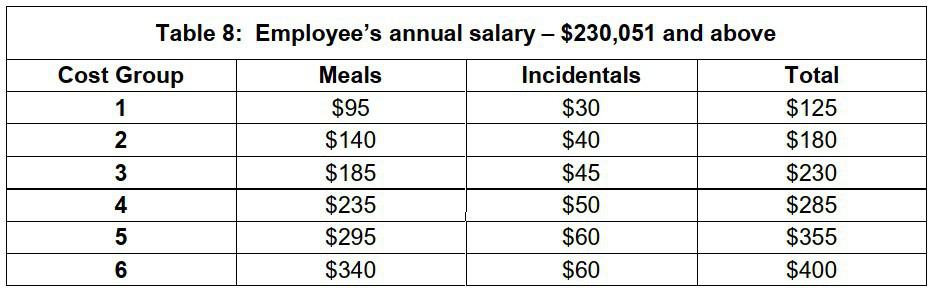

Table 8: Salary – $230,051 and above

2021-22 Domestic Table 1: Employee’s annual salary – $129,250 and below

2021-22 Domestic Table 2: Employee’s annual salary – $129,251 to $230,050

2021-22 Domestic Table 3: Employee’s annual salary – $230,051 and above

2021-22 Domestic Table 4: High cost country centres – accommodation expenses

2021-22 Domestic Table 5: Tier 2 country centres

2021-22 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2021-22 Overseas Table 6: Employee’s annual salary – $129,250 and below

2021-22 Overseas Table 7: Employee’s annual salary – $129,251 to $230,050

2021-22 Overseas Table 8: Employee’s annual salary – $230,051 and above

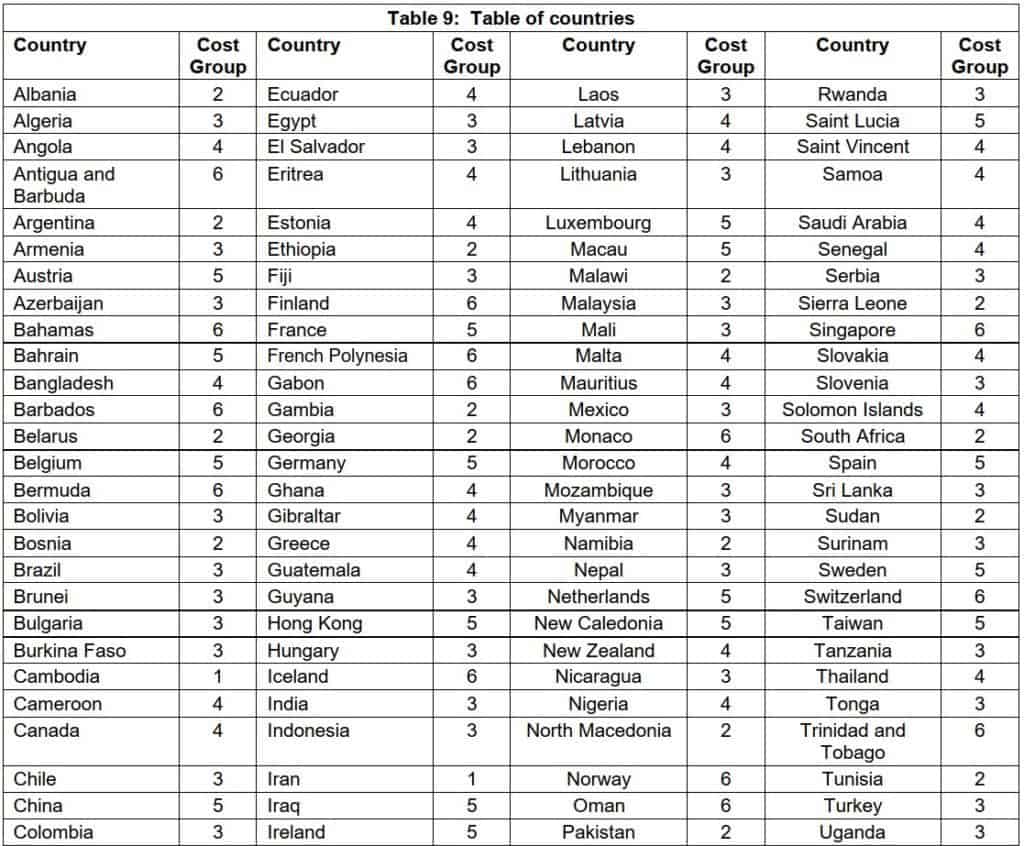

2021-22 Overseas Table 9: Table of countries

Allowances for 2020-21

Download full document in PDF format: 2020-21 Determination TD 2020/5 (pdf).

The document displayed with links to each section is set out below.

For the 2020-21 income year the reasonable amount for overtime meal expenses is $31.95 .

2020-21 Domestic Travel

Table 1: Salary $126,970 and below

Table 2: Salary $126,971 to $225,980

Table 3: Salary $225,981 and above

2020-21 Overseas Travel

Table 6: Salary $126,970 and below

Table 7: Salary – $126,971 to $225,980

Table 8: Salary – $225,981 and above

2020-21 Domestic Travel 2020-21 Domestic Table 1: Employee’s annual salary – $126,970 and below

2020-21 Domestic Table 2: Employee’s annual salary – $126,971 to $225,980

2020-21 Domestic Table 3: Employee’s annual salary – $225,981 and above

2020-21 Domestic Table 4: High cost country centres – accommodation expenses

2020-21 Domestic Table 5: Tier 2 country centres

2020-21 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2020-21 Overseas Travel 2020-21 Overseas Table 6: Employee’s annual salary – $126,970 and below

2020-21 Overseas Table 7: Employee’s annual salary – $126,971 to $225,980

2020-21 Overseas Table 8: Employee’s annual salary – $225,981 and above

2020-21 Overseas Table 9: Table of countries

Allowances for 2019-20

The determination in sections:

Domestic Travel

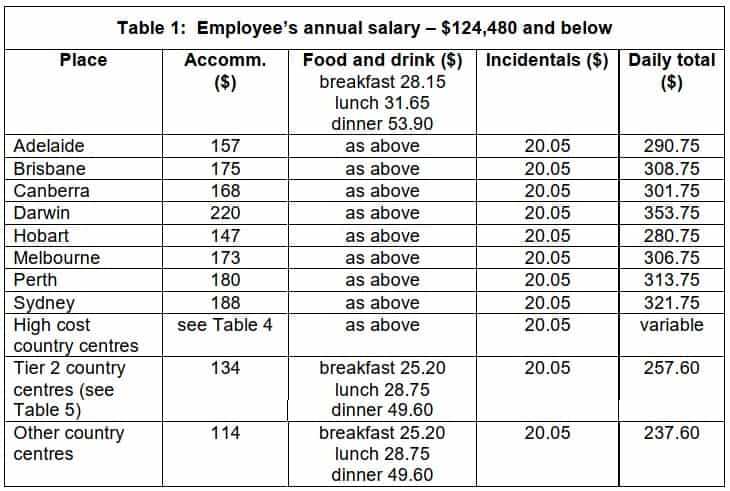

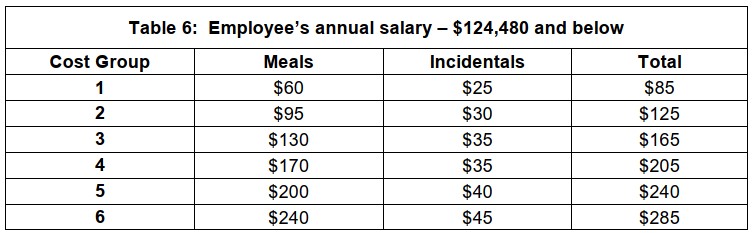

Table 1: Employee’s annual salary – $124,480 and below

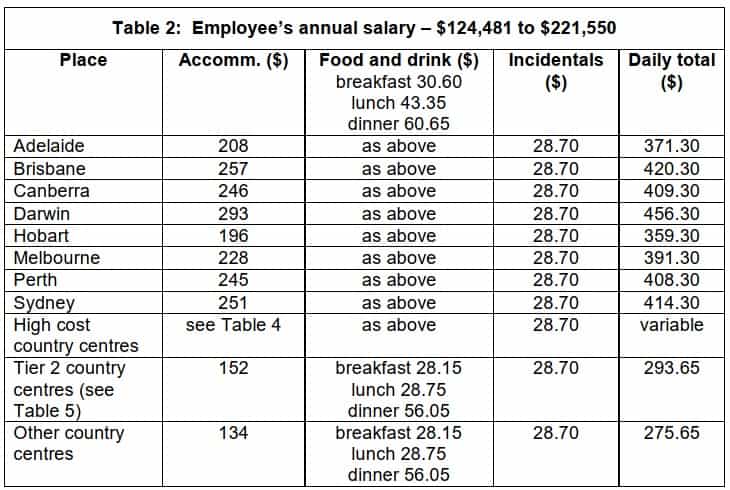

Table 2: Employee’s annual salary – $124,481 to $221,550

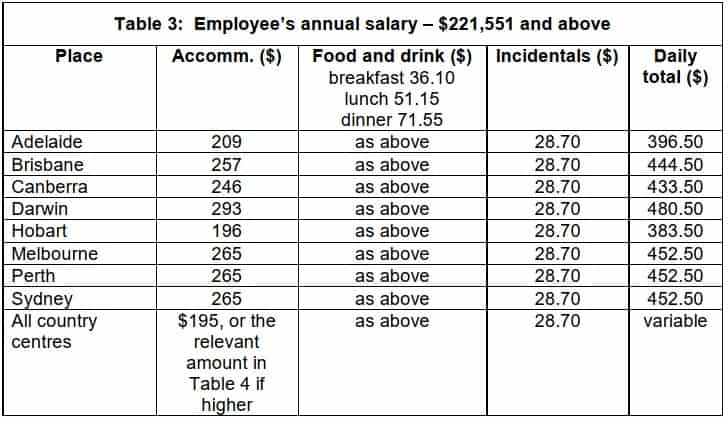

Table 3: Employee’s annual salary – $221,551 and above

Table 4: High cost country centres – accommodation expenses

Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel

Table 6: Employee’s annual salary – $124,480 and below

Table 7: Employee’s annual salary – $124,481 to $221,550

Table 8: Employee’s annual salary – $221,551 and above

For the 2019-20 income year the reasonable amount for overtime meal expenses is $31.25.

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2019 for the 2019-20 income year are contained in Tax Determination TD 2019/11 (issued 3 July 2019).

Download the PDF or view online here .

Domestic Travel Table 1: Employee’s annual salary – $124,480 and below

Domestic Travel Table 2: Employee’s annual salary – $124,481 to $221,550

Domestic Travel Table 3: Employee’s annual salary – $221,551 and above

Domestic Travel Table 4: High cost country centres – accommodation expenses

Domestic Travel Table 5: Tier 2 country centres

Domestic Travel Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel Table 6: Employee’s annual salary – $124,480 and below

Overseas Travel Table 7: Employee’s annual salary – $124,481 to $221,550

Overseas Travel Table 8: Employee’s annual salary – $221,551 and above

Overseas Travel Table 9: Table of countries

Substantiation and Compliance

Taxation Ruling TR 2004/6 explains the the way in which the expenses can be claimed within the substantiation rules, including the requirement to obtain written evidence and exemptions to that requirement.

Allowances which are ‘reasonable’ , i.e. comply with the Reasonable Allowance determination amounts and with TR 2004/6 are not required to be declared as income and are excluded from the expense substantiation requirements.

These substantiation rules only apply to employees. Non-employees must fully substantiate their travel expense claims. Expenses for non-working accompanying spouses are excluded.

Key points :

To be claimable as a tax deduction, and to be excluded from the expense substantiation requirements, travel and overtime meal allowances must:

- be for work-related purposes; and

- be supported by payments connected to the relevant expense

- for travel allowance expenses, the employee must sleep away from home

- if the amount claimed is more than the ‘reasonable’ amount set out in the Tax Determination, then the whole claim must be substantiated

- employees can be required to verify the facts relied upon to claim a tax deduction and/or the exclusion from the substantiation requirements

- an allowance conforming to the guidelines doesn’t need to be declared as income or claimed in the employee’s tax return, unless it has been itemised on the statement of earnings. Amounts of genuine reasonable allowances provided to employees(excludng overseas accommodation) are not required to be subjected to tax withholdings or itemised on an employee’s statement of earnings.

- claims which don’t match the amount of the allowance need to be declared.

The Tax Office has issued guidance on their position.

[11 August 2021] Taxation Ruling TR 2021/4 reviews the tax treatment of accommodation and food and drink expenses, and provides 14 examples which distinguish non-deductible living expenses from deductible travelling on work expenses. FBT implications for the ‘otherwise deductible’ rule and travel and LAFHA allowances are also considered.

[11 August 2021] Practical Compliance Guideline PCG 2021/3 (which finalises draft PCG 2021/D1 ) provides the ATO’s compliance approach to determining if allowances or benefits provided to an employee are travelling on work, or living at a location.

For FBT purposes an employee is deemed to be travelling on work if they are away for no more than 21 consecutive days, and fewer than 90 days in the same work location in a FBT year.

See also: Travel between home and work and LAFHA Living Away From Home

The issue of annual determination TD 2017/19 for the 2017-18 year marked a tightening of the Tax Office’s interpretation of the necessary conditions for the relief of allowances from the substantiation rules, which would otherwise require full documentary evidence (e.g. receipts) and travel records. (900-50(1))

For a full discussion of the issues, this article from Bantacs is recommended: Reasonable Allowance Concessions Effectively Abolished By The ATO .

Prior to 2017-18

In summary: Prior to 2017-18 the Tax Office rulings stated the general position that provided a travel allowance was ‘reasonable’ (i.e. followed the ATO-determined amounts) then substantiation with written evidence was not required. “In appropriate cases”, however employees may have been required to show how their claim was calculated and that the expense was actually incurred.

What changed

The relevant wording was changed in the 2017-18 determination to now require that more specific additional evidence be available if requested. This additional evidence is not prescribed in the tax rules, but represents a higher administrative standard being applied by the Tax Office.

The required evidence includes being able to show:

- you spent the money on work duties (e.g. away from home overnight for work)

- how the claim was worked out (e.g. diary record)

- you spent the money yourself (e.g. credit card statement, banking records)

- you were not reimbursed (e.g. letter from employer)

Other requirements highlighted by the Bantacs article include:

- a representative sample of receipts may be required to show that a reasonable allowance (or part of it) has actually been spent (TD 2017/19 para 20)

- hostels or caravan parks are not considered eligible for the accommodation component of a reasonable allowance because they are not the right kind of “commercial establishment”, examples of which are hotels, motels and serviced apartments (para 14)

- reasonable amounts for meals can only be for meals within the specific hours of travel (not days), and can only be for breakfast, lunch or dinner (para 15), and therefore could exclude, for example, meals taken during a period of night work.

Tip : The reasonable amount for incidentals still applies in full to each day of travel covered by the allowance, without the need to apportion for any part day travel on the first and last day. (para 16).

Alternative: business travel expense claims

With the burden of proof on ‘reasonable allowance’ claims potentially quite high, an alternative is to opt for a travel expense claim made out under the general substantiation rules for employees, or under the general rules for deductibility for businesses.

The kind of business travel expenses referred to here could include:

Airfares Accommodation Meals Car hire Incidentals (e.g. taxi fares)

The Tax Office has an article describing how to meet the requirements for claiming travel expenses as a tax deduction. See: Claiming a tax deduction for business travel expenses

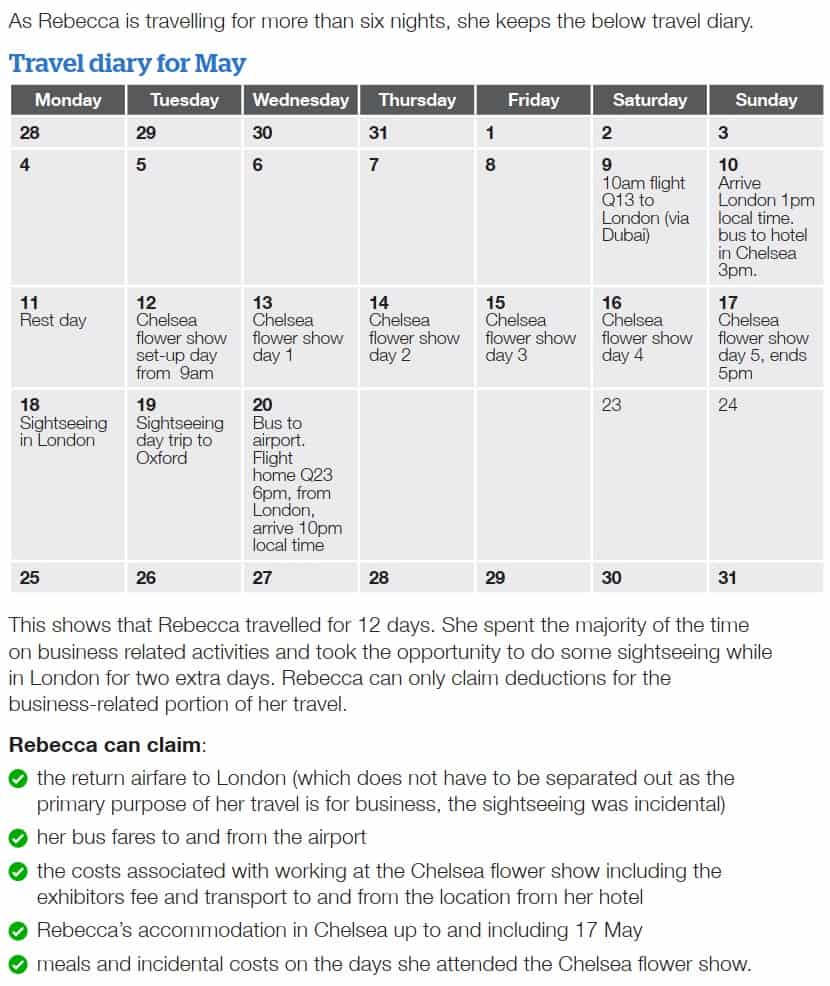

Travel diary

A travel diary is required by sole traders and partners for overnight expenses and recommended for everyone else (including companies and trusts).

It is important to exclude any private portion of travelling expense which is non-deductible, or if paid on behalf of an employee gives rise to an FBT liability.

For example the expenses of a non-business associate (e.g. spouse), the cost of private activities such as sight-seeing, and accommodation and associated expenses for the non-business portion of a trip.

Airfares to and from a business travel destination would not need to be apportioned if the private element of the trip such as sightseeing was only incidental to the main purpose and time spent.

This is an example of a travel diary for Rebecca who owns a business as a sole trader landscape gardener. (courtesy of ATO Tax Time Fact Sheet )

Allowances for 2018-19

For the 2018-19 income year the reasonable amount for overtime meal allowance expenses is $30.60 .

The meal-by-meal amounts for employee long distance truck drivers are $24.70, $28.15 and $48.60 per day for breakfast, lunch and dinner respectively.

This determination includes ATO reasonable allowances for

(a) overtime meal expenses – for food and drink when working overtime (b) domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work (particular reasonable amounts are given for employee truck drivers, office holders covered by the Remuneration Tribunal and Federal Members of Parliament) (c) overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

Allowances for 2017-18

An addendum was issued modifying paragraphs 23 to 30 of determination TD 2017/19 setting out the new reasonable amounts, and consolidated into TD 2017/19 as linked above. For reference purposes, the first-released version of TD 2017/19 issued 3 July 2017 is linked here .

2017-18 Addendum: ATO reinstates the meal-by-meal approach for truck drivers’ travel expense claims

On 27 October 2017 the ATO announced the reinstatement of the meal-by-meal approach for truck drivers who claim domestic travel expenses for meals. The following new reasonable amounts have now been included in an updated version of the current ruling (see on page 7):

For the 2017-18 income year the reasonable amount for overtime meal allowance expenses is $30.05 .

This determination contains ATO reasonable allowances for:

- overtime meals

- domestic travel

- employee truck drivers

- overseas travel

- $24.25 for breakfast

- $27.65 for lunch

- $47.70 for dinner

The amount for each meal is separate and can’t be combined into a single daily amount or moved from one meal to another.

See: ATO media release

Allowances for 2016-17

For the 2016-17 income year the reasonable amount for overtime meal allowance expenses is $29.40 .

Allowances for 2015-16

Download the PDF or view online here . For the 2015-16 income year the reasonable amount for overtime meal allowance expenses is $ 28.80 .

Allowances for 2014-15

Allowances for 2013-14

The reasonable travel and overtime meal allowance expense amounts for the 2013-14 income year are contained in Tax Determination TD 2013/16 . For the 2013-14 income year the reasonable amount for overtime meal allowance expenses is $ 27.70 .

Allowances for 2012-13

The reasonable travel and overtime meal allowance expense amounts for the 2012-13 income year are contained in Tax Determination TD 2012/17 . For the 2012-13 income year the reasonable amount for overtime meal allowance expenses is $27.10

Allowances for 2011-12

The reasonable travel and overtime meal allowance expense amounts for the 2011-12 income year are contained in Tax Determination TD 2011/017 . For the 2011-12 income year the reasonable amount for overtime meal allowance expenses is $26.45

This page was last modified 2023-06-28

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

Per diem allowances for business travel

International per diem rates, hmrc per diem rates for international corporate travel.

?)

See how to save your company time and money on business travel

Gsa per diem rates for international corporate travel.

- Meals: breakfast, lunch, and dinner in the location city.

- Incidental expenses: expenses such as dry cleaning or taxi services.

?)

Find out your per diem allowance for your upcoming U.S. trip

Are international per diem allowances taxed differently, wrapping up.

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Travelperk Sustainability Policy

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Thoughts from TravelPerk

- Careers Hiring

- User Reviews

- Integrations

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

assignment_turned_in Policy

Travel meals.

The university pays directly or reimburses individuals for expenses that are necessary and appropriate to conduct university business. Key considerations and associated processes are found in Business and Travel Expense Policies Fundamentals . The university outlines its core responsibility, guiding principles and IRS regulations with regard to Business and Travel Expense policy in Administrative Guide Memo 5.4.2 .

General Policy

A travel meal is defined as an ordinary and necessary meal that occurs while traveling on university business. The primary purpose for reimbursing a travel meal is to defray the cost of meal expenses when traveling outside of one’s local area, which is defined as more than 50 miles one way from home or Stanford, whichever is greater. Unlike a business meal , no additional justification is needed for a travel meal as long as the meal occurs within the business travel period, because it is covered by the business purpose of that trip. The cost of the travel meal must still be deemed reasonable under university policy, as such, the university has established maximums for travel meal reimbursement.

Travel Companions

In general, the expenses of a spouse, family member or other person accompanying the business traveler are not reimbursable. Such expenses are only allowed if the accompanying person has a position with the university and is traveling to make a significant contribution in furtherance of university business. Exceptions to this policy are rare and must be approved in advance of travel by the Provost.

Travel Period

A travel period may begin one day ahead of a business event (for example, arriving on Sunday for a conference that begins on Monday). The business travel period may include weekends, holidays, and other necessary standby days if they fall between business travel days. If a traveler chooses to arrive early or to stay longer for non-business reasons, the university does not pay for expenses incurred during those additional days. Exceptions include when travel is at a lower total cost if the traveler stays over a weekend or holiday, with department approval, or when traveling more than eight time zones, The traveler must document the reason for this extra expense in order to support the non-business-day payment.

Travel Meals for 30 Days or Longer

Long term travel is defined as when a travel period is 30 days or longer. In these instances, the traveler is required to use the per diem reimbursement method, and the per diem rate is reduced to 55 percent for the trip. The assumption is that when staying 30 days or longer, a traveler can plan for or prepare less expensive meals.

The reduced rate will not be calculated by the Expense Requests System so the expense report preparer should calculate the reduced rates (0.55 x listed rate) and enter the adjusted amount in the Expense Requests System via the Adjusted Per Diem expense type in transaction lines.

To learn about lodging policies for travel periods of 30 days or longer, please visit the Lodging Policy page .

Group Travel Meals

A group travel meal is when a group of Stanford employees, affiliates or colleagues who are travelling together or attending the same conference share an ordinary and necessary meal. In this example, the meal must be classified as a travel meal, unless it meets the additional requirements of a business meal with a clearly documented business purpose.

Group travel meals should adhere to the per person travel meal limits, which are significantly lower than business meal maximums. The meal would be expensed by one participant and the travel meal cost would be deducted from each of the attendees' expense report. The Deducting Provided Meals section on this page provides reasonable guidance for individual meals.

It is best practice to have the individual with the highest level of financial approval pay for the group meal and submit the reimbursement so that the expense request can be reviewed by an approver who was not a meal attendee.

In the Expense Requests System, include the names of employees that participated in the group travel meal. The attendee list can be entered by listing them directly in the transaction or by attaching the list as a supporting document.

Roles and Responsibilities

It is the responsibility of the individual incurring the travel meal and those involved in the preparation and approval of the reimbursement request or financial transaction to exercise good stewardship of university funds and to adhere to university policies. The individual incurring the expense and the appropriate administrator must ensure that all costs are in compliance with university travel and business expense policies prior to purchasing. These roles and responsibilities are outlined in Reimbursements & Expense Requests .

Choosing a Payment or Reimbursement Method

To reduce administrative burden, the Stanford Travel Card (TCard) is the preferred payment method for travel costs unless the traveler will choose the per diem reimbursement method. Alternatively, personal funds may be used and a request for reimbursement can be submitted after the trip. When the per diem reimbursement method is available and selected by the traveler, the TCard should not be used for those costs (i.e., meals that will be reimbursed to the traveler at the per diem rate).

The same policies and guidelines must be followed regardless of payment or reimbursement method.

When personal funds are used, there are different reimbursement options available depending on who is traveling and the funding source:

- Stanford travelers may select between per diem or actual reimbursement up to the daily maximum. The method selected must be used for the entire trip. If the funding source of the trip is a sponsored award, Stanford travelers must use the per diem option for travel meals.

- University affiliates must choose actual reimbursement up to the daily maximum. Any individual without a SUNet ID should indicate their affiliation in the business purpose.

- Non-Stanford travelers and visitors are required by the IRS accountable plan rules to be reimbursed for actual travel expenditures up to the daily maximum, regardless of the funding source. For more information on visitor travel payment and reimbursement methods, visit Business and Travel Expense Policies .

Per Diem Method vs. Daily Maximum

Stanford uses per diem rates recommended by the U.S. government to take advantage of governmental cost studies and to ensure general equity with grant and contract requirements. The use of the per diem method is required when travel meals will be charged to a sponsored award . See complete guidance on using the per diem reimbursement method in Business and Travel Expense Policies .

When Stanford travelers are traveling on non-sponsored funds, they may also consider the daily maximum method, described below. This method allows Stanford travelers who are using non-sponsored funds to be reimbursed for their actual expenses up to a defined maximum.

Daily Maximum Method

The daily maximum method allows Stanford travelers who are traveling on non-sponsored funds to be reimbursed for their actual expenses up to $90 a day for domestic trips, and $140 for international trips. Stanford travelers are not required to attach receipts in the Expense Requests System unless there is an individual expense of $75 or more, although schools and units may require all receipts to be attached at their local discretion.

Non-Stanford travelers (visitors) must always be reimbursed for actual expenses up to the daily maximum regardless of funding source, as they are not eligible for per diem reimbursement. For more information on visitor travel payment and reimbursement methods, visit Business and Travel Expense Policies .

Policy Details:

- The maximums below include the actual cost per person for food, tax, tip and alcohol (excludes room rental and non-food costs). The total cost for the meal, including all fees, taxes and tips, should not exceed the daily per person maximum.

- For guidance on tips, visit the Business and Travel Expense Policies page .

- Individual schools and units may choose to set lower limits and may require all receipts to be submitted.

The travel meal daily maximums do not include Living Wage (Cost of Living) fees. These fees are automatically added to dining bills by some restaurants to compensate for high labor costs, ongoing labor shortages and increasing food costs. They may be listed on a receipt as Wellness fees, Dining-in fees, or Health care fees.

Deducting Provided Meals

When a meal is provided as part of a conference, included in a hotel rate, transportation fare, or is part of an event or meeting where another party pays for the cost, a deduction must be made from the applicable reimbursement method. This includes when a business meal occurs while traveling.

Deducting from Per Diem Method

When reporting travel meal per diem expenses in the Expense Requests System, checkboxes are available to deduct a provided meal. The system will automatically deduct the portion of the applicable per diem rate. The deductible amount varies based on the rate for the applicable city and may be found at the GSA website.

Deducting from Daily Maximum Method

When reporting expenses with the travel meals daily maximum option, it's reasonable to use the following amounts to deduct the provided meal from the daily maximum.

Expense Reporting & Reimbursement Submit a Support Request

© Stanford University , Stanford , California 94305 .

IMAGES

VIDEO

COMMENTS

Office of Allowances Bureau of Administration U.S. Department of State Washington, DC 20522-0104 Telephone: (202) 663-1121 E-mail: [email protected]. ... The M&IE portion is intended to substantially cover the cost of meals and incidental travel expenses such as laundry and dry cleaning. The maximum per diem rates for foreign countries are ...

Amount of standard meal allowance. The standard meal allowance is the federal M&IE rate. For travel in 2023, the rate for most small localities in the United States is $59 per day. Most major cities and many other localities in the United States are designated as high-cost areas, qualifying for higher standard meal allowances..

Per diem rates. Rates are set by fiscal year, effective Oct. 1 each year. Find current rates in the continental United States, or CONUS rates, by searching below with city and state or ZIP code, or by clicking on the map, or use the new per diem tool to calculate trip allowances.

M&IE breakdowns. The meals and incidental expense (M&IE) breakdowns in the tables below are provided should federal travelers need to deduct meals furnished by the government or included in a registration fee from their M&IE allowance consistent with Federal Travel Regulation 301-11.18.Meals provided by a common carrier or a complimentary meal provided by a hotel/motel do not affect per diem ().

Do I receive a meal reimbursement for day travel away from my regular duty station? According to the Federal Travel Regulation (FTR), travelers are entitled to 75% of the prescribed meals and incidental expenses for one day travel away from your official station if it is longer than 12 hours. Please see FTR 301-11.101.

Beginning October 1, 2021, the high-low per diem rate that can be used for lodging, meals, and incidental expenses increases to $296 (from $292) for travel to high-cost locations and increases to $202 (from $198) for travel to other locations. The high-low M&IE rates increase to $74 (from $71) for travel to high-cost locations and to $64 (from ...

Instead of keeping records of your meal expenses and deducting the actual cost, you can generally use a standard meal allowance, which varies depending on where you travel. The deduction for business meals is generally limited to 50% of the unreimbursed cost. If you're self-employed, you can deduct travel expenses on Schedule C (Form 1040 ...

Beginning October 1, 2022, the high-low per diem rate that can be used for lodging, meals, and incidental expenses increases to $297 (from $296) for travel to high-cost locations and increases to $204 (from $202) for travel to other locations. The high-low M&IE rates remain at $74 for travel to high-cost locations and $64 for travel to other ...

This annual notice provides the 2022-2023 special per diem rates for taxpayers to. use in substantiating the amount of ordinary and necessary business expenses incurred. while traveling away from home, specifically (1) the special transportation industry meal. and incidental expenses (M&IE) rates, (2) the rate for the incidental expenses only.

The standard meal allowance is based on what federal workers are allowed to charge for meals while traveling and is, therefore, relatively modest. The amount is revised each year. ... And international business travel has some special rules. (Talk to a tax pro to learn more.) Costs for business-related transportation at your destination—for ...

• overseas travel expenses - for food and drink, and incidentals when travelling overseas for work. 2. This Determination should be read together with Taxation Ruling TR 2004/6 Income tax: substantiation exception for reasonable travel and overtime meal allowance expenses, which explains the substantiation exception and the way in which these

The updated rates are effective for per-diem allowances paid to any employee on or after Oct. 1, 2021, for travel away from home on or after that date, and supersede the rates in Notice 2020-71, which provided the rates for Oct. 1, 2020, through Sept. 30, 2021.

For instance, Los Angeles has a meal allowance of $74 per day, which is divided into breakfast ($17), lunch ($18), and dinner ($34), along with a tip allowance of $5. This is higher than the meal allowance for a city with a lower cost of living, such as Richmond, where the average allowance is $59.

Per diem rates look-up Allowances for lodging, meal and incidental costs while on official government travel. ... federally-negotiated airline rates for 7,500+ domestic and international cities, equating to over 13,000 city pairs. ... Chapter 301—Temporary Duty (TDY) Travel allowances Chapter 302 - Relocation allowances. Print Page Email Page.

Look up per diem rates by location or download annual rates for all locations. GSA sets per diem rates for the contiguous 48 States and the District of Columbia. Rates are updated annually at the start of the fiscal year (or as necessary). View recent changes. DoS sets the per diem rates for foreign locations. Rates are updated at the beginning ...

Per diem is an allowance paid to your employees for lodging, meals, and incidental expenses incurred when travelling. This allowance is in lieu of paying their actual travel expenses. Return to top 2. What is the federal per diem rate for my area? Publication 1542, Per Diem Rates provides the rates for all continental U.S. areas. Return to top 3.

Meals. Meal reimbursement for Travel under 30 days within the lower 48 states is limited to $79 per day (effective September 9, 2022). See Foreign travel section for information about daily maximum allowances.; Meal reimbursement may only be claimed for the amount of actual expenses incurred (not to exceed $79 per day).; There must be an overnight stay to claim meal reimbursement.

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2014 for the 2014-15 income year are contained in Tax Determination TD 2014/19. For the 2014-15 income year the reasonable amount for overtime meal allowance expenses is $28.20. Allowances for 2013-14 .

International travel involves different per diem rates. Here's our comprehensive list of international per diem rates from HMRC and the GSA. ... meals, and any incidental expenses that could occur when traveling on business to a specific country. When traveling internationally, the option to apply for a bespoke per diem allowance is still ...

Definition. A travel meal is defined as an ordinary and necessary meal that occurs while traveling on university business. The primary purpose for reimbursing a travel meal is to defray the cost of meal expenses when traveling outside of one's local area, which is defined as more than 50 miles one way from home or Stanford, whichever is greater.

24. Where an employee is paid a meal allowance and IPEA also funds meals taken in the hotel(s) of stay on the official travel itinerary or a meal is provided as part of an official function, e.g. a working lunch or official dinner, a component of the allowance will be recovered by IPEA. International travel equipment allowance . 25.