- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Student Loans

- Personal Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

25 states with highest tourism revenue in the us.

In this article, we will discuss the 25 states with highest tourism revenue in the US. If you want to skip our discussion on the US tourism industry, you can go directly to the 5 States With Highest Tourism Revenue in the US .

According to the International Trade Administration, overseas tourists contributed $233.5 billion to the US economy in 2019. The travel and tourism industry in the US played a vital role, contributing significantly to the economy by generating $1.9 trillion in economic output and providing 9.5 million American jobs. This contribution accounted for 2.9% of the overall US GDP. Additionally, tourism industry statistics reveal that international travelers spend more in the US than in other countries, accounting for 14.5% of the total global expenditure on international travel. You can read about the 30 Top Tourists Attractions in the USA here.

In 2020, US travel expenditures recorded a 42% decline due to the challenges posed by the COVID-19 pandemic. However, as of April 2022, a recovery has taken place, with US travel spending increasing to $100 billion. This 3% increase surpasses pre-pandemic levels, driven primarily by leisure travel. On the other hand, the scenario for business travel remains complex as the increased use of video conferencing tools has resulted in remote meetings being more convenient in many situations. The historical data from the US Travel Association indicates that US travel spending typically grows by 2% to 4% annually, suggesting that there is still potential for a more substantial rebound in the future.

Major Players Shaping the Tourism Landscape

Several companies can be viewed as key players in the tourism industry. One such company is Airbnb, Inc. (NASDAQ: ABNB ), which aims to offer budget-friendly accommodation options and focuses on travelers who want a more localized experience . Many tourists are interested in "living like a local," a phrase Airbnb, Inc. (NASDAQ:ABNB) employs to attract the audience to their platform. Looking at the US tourism statistics by city in 2022, Airbnb, Inc. (NASDAQ:ABNB) hosts in the US facilitated over 44 million guest arrivals in regions without hotels. This resulted in host earnings of $10.5 billion as well as additional economic activity.

The Walt Disney Company (NYSE: DIS ) stands as another major player in the tourism industry with its theme parks and hotels. A recent study by Oxford Economics revealed that The Walt Disney Company (NYSE:DIS) resulted in a total statewide economic impact of $40.3 billion in Florida during 2022. Furthermore, the company also created 263,000 direct and indirect jobs, contributing to 1 out of every 32 jobs in the state. The Walt Disney Company (NYSE:DIS) also generated a total of $6.6 billion in tax revenue. Moreover, The Walt Disney Company (NYSE:DIS) has engaged 2,500 small businesses based in Florida, contracting them to provide various products and services.

Ranking on Fortune's World's Most Admired Companies List, Booking Holdings Inc. (NASDAQ: BKNG ) is another notable player in the industry. It is the parent company of well-renowned brands, including Priceline.com, Booking.com, and Cheapflights. Based in Connecticut, the company’s network is spread across more than 220 countries. Booking Holdings Inc. (NASDAQ:BKNG) remains the key provider of online travel and related services, offering facilities like flight ticketing, accommodation reservation, rental car booking, and price comparison, among other things. The US travel market size is evident in the remarkable recovery of Booking Holdings Inc. (NASDAQ:BKNG) from the significant downturn during the COVID-19 pandemic. In 2022, the company reported a revenue of $17.1 billion, reflecting an increase of $6 billion from the previous year. Room reservations accounted for 91% of the total bookings made through the company this year. Furthermore, international travel statistics indicate that Booking Holdings Inc. (NASDAQ:BKNG) facilitated the booking of over 60 million rental car days and 20 million flight tickets in the same period.

Here's what RiverPark Advisors said about Booking Holdings Inc. (NASDAQ:BKNG) in its Q3 2023 investor letter:

“Booking Holdings Inc. (NASDAQ:BKNG): BKNG was a top contributor in the quarter following better than expected bookings, revenue and profit margins in the company’s 2Q driven by strong summer travel demand. BKNG reported $40 billion of bookings, $5.5 billion of revenue, and 23% EBITDA margins, which were $1.5 billion, $300m, and two percentage points ahead of expectations, respectively. In addition to strong summer demand, management pointed to continued strength in leisure travel (they raised travel booking guidance for the remainder of the year), building momentum in its alternative accommodation business and improvement in marketing efficiency. Booking is the world’s leader in online travel, operating in 200 countries with brands including Booking.com, priceline.com, agoda.com, Kayak, Rentalcars.com, and OpenTable. The company has been a dominant online travel agency for more than a decade with a high-margin business model that requires limited capital expenditures, typically less than 3% of revenue, producing $6.2 billion of free cash flow for 2022 and $7.2 billion expected for 2024. The company has used its free cash flow for episodic acquisitions as well as to return cash to shareholders. BKNG is well positioned in travel as the largest player in online lodging bookings and the second largest player in alternative accommodations.”

James Kirkikis/Shutterstock.com

Our Methodology

To determine the 25 states with highest tourism revenue in the US, we referred to data provided by the International Trade Administration. The states were shortlisted, taking into account the number of visitors, as a strong correlation exists between heightened visitor numbers and revenue generation. We have ranked the states in ascending order of both the number of visitors and their respective market shares in the US tourism industry.

States With Highest Tourism Revenue in the US

25. indiana.

Market share: 0.7%

Visitation figures 2022: 168,000

Indiana has gained recognition for its association with auto racing, particularly hosting the renowned Indianapolis 500 at the Indianapolis Motor Speedway. Indiana also boasts a cost of living that is 10% below the national average.

24. Wisconsin

Visitation figures 2022: 175,000

Wisconsin is famed for its dairy industry and boasts scenic beauty. Many tourists visit Devil’s Lake, renowned for camping and hiking opportunities. Wisconsin Dells is famous for having one of the largest water parks in America.

23. Connecticut

Market share: 0.9%

Visitation figures 2022: 225,000

Connecticut's major attractions are its museums as well as art galleries, including the Yale University Art Gallery. Connecticut's Beardsley Zoo and Mystic Aquarium also provide a fun experience for many families.

22. Michigan

Market share: 1.1%

Visitation figures 2022: 261,000

Michigan is famous amongst tourists due to its breathtaking landscapes and many outdoor activities, including rafting in the Menominee River. One of the most popular outdoor locations for visitors in Michigan is the Tahquamenon Falls State Park.

Visitation figures 2022: 273,000

Ohio's tourism sector recorded $53 billion in revenue from tourists in 2022. Popular theme parks like Cedar Point and Kings Island and locations like the Hocking Hills, Lake Erie shores, and the Cuyahoga Valley National Park are among the popular attraction points for tourists.

20. Tennessee

Market share: 1.2%

Visitation figures 2022: 292,000

The American Museum of Science and Energy in Oak Ridge, the Parthenon in Nashville, Downtown Knoxville, Andrew Jackson's Hermitage, and the Great Smoky Mountains National Park are some of the major attractions in the state. Visitors contributed $27.5 billion in revenue to Tennessee's tourism industry in 2022.

19. Louisiana

Market share: 1.3%

Visitation figures 2022: 314,000

The rich and diverse culture attracts tourists to Louisiana . The fur-producing region of Avery Island, the Cajun and zydeco music of Southwest Louisiana, and the State Capitol in Baton Rouge are among the popular tourist destinations.

18. Colorado

Visitation figures 2022: 321,000

Visitor spending in Colorado was recorded at $21.9 billion in 2021. The Colorado Springs Garden of the Gods, the Denver Zoo, and the Rocky Mountains are some of the major tourist attractions in the state.

17. Maryland

Market share: 1.4%

Visitation figures 2022: 326,000

Some of the state's attractions are the National Cathedral in Washington, D.C., Baltimore's Inner Harbour, and the National Aquarium.

16. North Carolina

Visitation figures 2022: 340,000

In 2022, North Carolina recorded visitor spending of $28.9 billion. The Blue Ridge Mountains, the Smoky Mountains, and the Outer Banks are some of the state's top tourist destinations.

Market share: 1.7%

Visitation figures 2022: 412,000

In 2021, visitor spending in parks alone in Utah was recorded at $1.6 billion. The vibrant city of Salt Lake City, the state's national parks, and dark sky parks offer visitors exceptional outdoor experiences.

14. Virginia

Market share: 1.8%

Visitation figures 2022: 438,000

The state boasts Colonial Williamsburg, a living history museum that offers an immersive experience into the era of America's founding. Furthermore, nature enthusiasts are drawn to the state's Shenandoah National Park, home to beautiful hiking trails that showcase Virginia's natural beauty.

13. Georgia

Market share: 1.9%

Visitation figures 2022: 465,000

The state's capital, Atlanta, is a famous travel destination with places like the World of Coca-Cola, the Georgia Aquarium, and the Martin Luther King Jr. National Historic Site. Another tourist destination in Georgia is Savannah, which is famous for its beautiful parks and historic neighborhoods.

12. Washington

Market share: 2.0%

Visitation figures 2022: 467,000

Washington has a range of geological features, including the Cascade Mountains, Columbia River, and Coast, which attracts many tourists. The variety of landscapes offers an opportunity for outdoor activities such as camping, wildlife viewing, and winter sports.

11. Pennsylvania

Market share: 2.5%

Visitation figures 2022: 592,000

Pennsylvania has popular tourist destinations, including Philadelphia's Independence Hall and the Liberty Bell. The Pocono Mountains and other natural landmarks are located in the state. Pennsylvania is also famous for Hershey's Theme Park.

10. Arizona

Market share: 2.8%

Visitation figures 2022:663,000

Millions of tourists have been drawn to the state due to its natural features, which include the Grand Canyon, Sedona, Monument Valley, and the Sonoran Desert.

9. Massachusetts

Market share: 3.4%

Visitation figures 2022: 807,000

Massachusetts attracts tourists due to its rich history and cultural sites. It is also known for universities such as Harvard and MIT. Historic downtown Boston has sites like the Freedom Trail. Meanwhile, Faneuil Hall Marketplace provides entertaining shopping and dining experiences for visitors.

8. New Jersey

Market share: 3.6%

Visitation figures 2022: 867,000

New Jersey has many natural features, including beaches and mountains, that make it popular among tourists. The Jersey Shore and Atlantic City are some of the famous destinations. The state also has many historic places, including the Ringwood Manor and Batsto Village. New Jersey has secured the ninth place on our list of 25 states with highest tourism revenue in the US.

Market share: 4.0%

Visitation figures 2022: 953,000

The state is a very popular location for tourists due to its natural beauty. There are many activities for visitors in Hawaii, including hiking, golfing, snorkeling, and surfing. The Hula culture in Hawaii is also a major attraction for tourists as it is a blend of traditional music and choreography.

6. Illinois

Market share: 4.7%

Visitation figures 2022: 1,135,000

Chicago is a famous tourist destination with places like Navy Pier, Millennium Park, and the Art Institute of Chicago. The state's historical sites include Lincoln Home National Historic Site in Springfield.

Click to continue reading and see the 5 States With Highest Tourism Revenue in the US . Suggested articles:

15 States with the Most Expensive Car Insurance in the US

25 Countries With The Highest Deforestation Rates in the World

20 Healthiest States in the US in 2023

Disclosure: None. 25 States With Highest Tourism Revenue in the US is originally published on Insider Monkey.

What state makes the most money from tourism?

By Audrey Wilson | Verified by David Boyd | Published June 29, 2023

Tourism is a thriving industry in the United States that attracts millions of visitors from around the world each year.

It's not hard to see why. Renowned for its diverse landscapes, vibrant cities, cultural attractions, and iconic landmarks, the U.S. offers a wealth of experiences for travelers seeking adventure, entertainment, and cultural enrichment.

But where do those tourist dollars get spent?

From the sun-soaked beaches of California to the bustling streets of New York, these are the states that benefit most from domestic and international tourism.

Coming up next

Key takeaways, pennsylvania.

- California leads the pack in terms of tourism revenue, generating an impressive $139 billion in 2022.

- The top 10 states by tourism revenue showcase a mix of well-known destinations and unexpected contenders. States like Texas and Pennsylvania, not typically associated with tourism, make the list, highlighting the variety of experiences available throughout the United States.

- The United States offers a wide range of tourist destinations that cater to different interests and preferences. Whether you're seeking sun-soaked beaches in Florida, exploring historical sites in Pennsylvania, or marveling at the natural wonders of Arizona's deserts, there is something for every type of traveler.

- Regardless of your passion, be it history, culinary delights, or adrenaline-pumping adventures, the top 10 states by tourism revenue have attractions and activities that cater to your interests.

$139 billion

California takes the lead in tourism revenue, raking in a staggering $139 billion in 2022 .

The state's appeal lies in its diverse range of attractions, from the enchantment of Disneyland and the glitz of Hollywood to the breathtaking beauty of national parks like Yosemite and Joshua Tree. The allure of California extends beyond its iconic landmarks, as its miles of beaches, mountains, and deserts offer something for every traveler. The year-round temperate weather further enhances its draw, making it a sought-after destination throughout the year.

With its unrivaled combination of entertainment, natural wonders, and favorable climate, California continues to captivate visitors from around the world and remains the crown jewel in terms of tourism revenue. Whether seeking family fun, Hollywood glamour, or outdoor adventures, California promises an unforgettable experience that keeps travelers coming back for more.

$101.9 billion

Florida's tourism industry continues to thrive, with an estimated 35 million travelers visiting during the third quarter of 2022 . This marked a notable increase of 6.9% compared to the previous year and an impressive 8% rise when compared to pre-pandemic levels in 2019. In 2021, visitors to Florida contributed $101.9 billion to the state's economy and supported over 1.7 million jobs, emphasizing the significant economic impact of tourism.

While the renowned theme parks in Orlando, including Walt Disney World Resort and Universal Orlando Resort, continue to attract millions of visitors annually, Florida offers much more beyond these iconic attractions. The state's diverse offerings encompass the breathtaking beauty of the Everglades, the idyllic beaches of the Florida Keys, and the opportunity for unforgettable cruises departing from its shores. With a wide range of experiences, from vibrant cities like Miami and Tampa to pristine coastal areas and unique natural wonders, Florida appeals to travelers seeking adventure, relaxation, or family-oriented fun.

Florida's consistent growth in visitor numbers, coupled with its substantial contributions to the state's economy, highlights the enduring appeal of the Sunshine State as a premier tourist destination. With its favorable climate, diverse attractions, and well-developed tourism infrastructure, Florida continues to captivate travelers from around the world, solidifying its position as a prominent player in the global tourism industry.

$90.7 billion

Nevada, the Silver State, experienced a thriving travel and tourism industry with a significant economic impact. In 2022, the industry generated an impressive $90.7 billion impact on Nevada's economy , surpassing pre-pandemic levels. The renowned city of Las Vegas, with its iconic Strip and world-class resorts, continues to be a major draw for visitors worldwide.

The city's vibrant entertainment, casino scene, and diverse culinary offerings create an atmosphere of excitement and allure. However, Nevada's appeal extends beyond Las Vegas, as the state also boasts stunning natural beauty. The proximity to the Grand Canyon and the breathtaking landscapes of Lake Tahoe provide outdoor enthusiasts with opportunities for exploration and recreational activities.

$67.6 billion

The Lone Star State, is not only a significant player in the travel and tourism industry but also a major contributor to job growth and earnings. In 2022, the industry supported a remarkable 10% increase in travel-related jobs, reaching a total of 1.2 million jobs across the state. These jobs encompass various sectors, including hospitality, transportation, and entertainment. Alongside this job growth, earnings in the travel sector soared to $67.6 billion , further highlighting the economic significance of travel and tourism in Texas.

Texas offers a diverse range of attractions, from the captivating Houston Space Center to the historically significant JFK assassination tour in Dallas. Its varied landscape encompasses deserts, beaches, and mountains, while its cities, such as Austin, Dallas, and Houston, offer distinct vibes and a wealth of cultural experiences.

The state's appeal lies in its ability to cater to different interests and preferences. Whether visitors seek adventure in the scenic deserts, relaxation on the beautiful Gulf Coast beaches, or exploration of vibrant urban centers, Texas has something to offer. The economic impact generated by the travel and tourism industry underscores its importance as a key driver of Texas' economy, solidifying the state's position as a noteworthy tourist destination.

$60 billion

The Empire State may not have beaches or theme parks, but its cultural offerings make it a captivating destination. In 2022, the city welcomed a staggering 56.4 million visitors, fueling its economic recovery and supporting around 410,000 jobs in the leisure and hospitality sector. The city's renowned museums, including The Met and MoMA, showcase exceptional art collections, while Broadway enthralls audiences with its world-class theater productions. Iconic landmarks like the Statue of Liberty and Central Park add to the city's allure, making it a must-visit for cultural enthusiasts.

Beyond New York City, the state offers additional cultural gems, such as the historic sites of the Hudson River Valley and the scenic beauty of the Finger Lakes region. The cultural richness of New York attracts millions of visitors worldwide, generating over $40 billion in direct visitor spending and contributing to an estimated $60 billion in total economic impact. With its vibrant atmosphere and cultural treasures, New York promises an unforgettable experience for those seeking art, history, and the unique essence of the city that never sleeps.

$38 billion

Pennsylvania's tourism industry has experienced remarkable growth, with nearly 180 million visitors in 2021, marking an increase of over 28 million visitors compared to previous years. These visitors contributed $38.0 billion in direct spending, supporting hotels, restaurants, retailers, and other businesses across the state. The total economic impact of tourism in Pennsylvania reached $66.3 billion in 2021 , sustaining over 450,000 jobs and generating $4.2 billion in state and local tax revenues.

Pennsylvania's allure as a tourist destination lies in its rich history, diverse attractions, and vibrant cities. From the historic landmarks of Philadelphia, including Independence Hall and the Liberty Bell, to the breathtaking landscapes of the Pocono Mountains and the scenic beauty of Lancaster County, the state offers a wide range of experiences. The vibrant cities of Pittsburgh and Harrisburg add to the appeal, providing cultural and recreational opportunities for visitors.

$34.4 billion

Georgia's tourism industry experienced remarkable success in 2021, attracting nearly 200 million visitors who collectively contributed $34.4 billion in direct visitor spending. This robust influx of visitors generated over $4 billion in state and local tax revenues, fueling the state's economy and supporting vital public services. According to state data, the total economic impact of Georgia's tourism industry reached an impressive $64.5 billion , highlighting its significant role in driving economic growth and prosperity.

The appeal of Georgia as a tourist destination lies in its diverse range of attractions and experiences. The dynamic city of Atlanta stands out as a major draw, offering a blend of rich history, cultural landmarks, and modern amenities. From exploring the historic sites associated with Martin Luther King Jr. to immersing oneself in the vibrant arts scene, Atlanta provides an array of captivating experiences. Georgia's natural beauty also shines through its scenic coastal beaches and picturesque mountain ranges, offering opportunities for outdoor adventures and leisure activities.

$32.2 billion

Illinois boasts a robust tourism industry that significantly contributes to the state's economy. In 2021, direct visitor spending reached $32.2 billion, resulting in a remarkable total economic impact of $59.5 billion. This substantial impact not only fuels economic growth but also supports 388,800 jobs and generates $4.3 billion in state and local tax revenue.

With its diverse range of attractions and activities, Illinois offers something for every visitor. Chicago, the state's vibrant metropolis, stands out as a top destination, attracting tourists with its renowned architecture, cultural institutions like the Art Institute of Chicago, and vibrant arts scene. Historic sites, such as the Abraham Lincoln Presidential Library and Museum in Springfield, provide a glimpse into the state's rich heritage, while nature enthusiasts can explore the scenic beauty of Shawnee National Forest and enjoy outdoor adventures along Lake Michigan's shores.

$53 billion

Ohio's tourism industry reached new heights in 2022, as it recorded a remarkable $53 billion in visitor spending and welcomed a staggering 233 million visitors . This outstanding achievement showcases the state's appeal as a tourist destination and its ability to attract a diverse range of visitors. Furthermore, the industry's growth has had a significant positive impact on Ohio's economy, supporting a substantial workforce of 424,339 seasonal, part-time, and full-time jobs.

Visitors to Ohio are drawn to its wide array of attractions and experiences. The state is home to world-renowned amusement parks, including Cedar Point and Kings Island, which offer thrilling rides and entertainment for all ages. Ohio's vibrant cities, such as Columbus, Cleveland, and Cincinnati, provide cultural richness with their museums, art galleries, and professional sports teams, ensuring there's something for everyone. Additionally, Ohio's natural beauty is showcased through scenic locations like Hocking Hills, the picturesque shores of Lake Erie, and the captivating Cuyahoga Valley National Park.

$23.6 billion

Arizona's tourism industry flourishes as visitors are captivated by its warm weather and remarkable natural beauty, making it the state's top export industry in 2021. The year witnessed an impressive 40.9 million visitors who collectively spent $23.6 billion , driving economic growth and supporting job creation. The industry's significant contribution of $3.4 billion in tax revenue translates to an average tax savings of $738 for every Arizona household and supports a workforce of 167,200 industry jobs.

The state's appeal as a tourist destination lies in its stunning landscapes and diverse attractions. The world-famous Grand Canyon stands as a testament to its natural beauty, attracting millions of visitors annually with its awe-inspiring views. From the picturesque Sedona to the breathtaking Monument Valley and the captivating Sonoran Desert, the state offers ample opportunities for outdoor exploration and adventure. Arizona's vibrant cities, including Phoenix and Tucson, provide cultural experiences, renowned golf courses, and a thriving culinary scene that cater to various interests and preferences.

The Bay State may be small, but it packs a punch with $28.3 billion in tourism revenue in 2019. Boston is the centerpiece, with its rich history and famous landmarks like the Freedom Trail and Fenway Park. Still, Massachusetts also offers picturesque coastal areas like Cape Cod and Martha’s Vineyard and the beautiful Berkshires in the western part of the state.

- Layah Heilpern's net worth

- Ethan Klein's net worth

- Mike Cernovich's net worth

- Richard Cooper's net worth

- Benny Johnson's net worth

- George Janko's net worth

- Matt Walsh's net worth

- Robert F. Kennedy Jr.'s net worth

- Tom Bilyeu's net worth

- Lara Trump's net worth

Advertiser disclosure

At Finty we want to help you make informed financial decisions. We do this by providing a free comparison service as well as product reviews from our editorial staff.

Some of the products and services listed on our website are from partners who compensate us. This may influence which products we compare and the pages they are listed on. Partners have no influence over our editorial staff.

For more information, please read our editorial policy and find out how we make money .

Finty members get

I don't want rewards

I want rewards

Disclaimer: You need to be logged in to claim Finty Rewards. If you proceed without logging in, you will not be able to claim Finty Rewards at a later time. In order for your rewards to be paid, you must submit your claim within 45 days. Please refer to our T&Cs for more information.

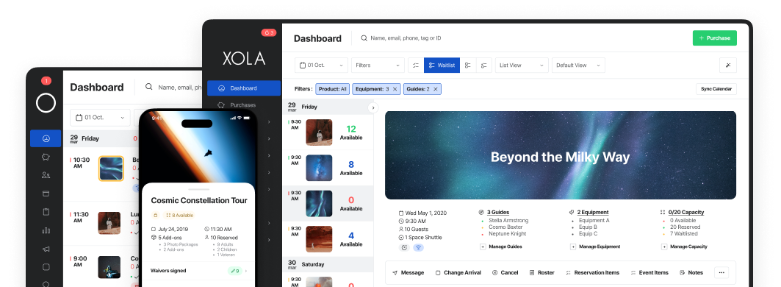

Effortless booking

Maximize online conversions with the most intuitive checkout online.

Expand revenue with our powerful Automated E-commerce tools.

Upgrade your website to industry’s best. Fresh websites. Fresh revenue.

Amplify visibility and expand earnings with integrated OTAs and local partners.

Streamline check-ins, limit risk, and amplify customer data with built-in digital waivers.

Transform data into insights. X-ray reporting gives you customer and business intelligence.

Manage high-volume walk-up customers effortlessly with POS, ticketing, and gated entry.

Automate management of staff schedules, assignments, and staff communications

Control your business precisely the way you want with endless yet easy configurability.

Allocate equipment used in various products. Prevent overbookings and maximize profits.

Grow with Xola in our constantly expanding universe of integrations and apps.

Harness customer data to drive marketing campaigns and generate repeat business.

Transform your guests into passionate brand advocates. Perfect your products & services.

Manage your business with the most powerful mobile suite in the industry.

Perfect the guest experience by giving your staff the industry’s most intuitive software.

Efficiently manage guest flow, minimize wait times, and ensure maximum satisfaction.

Ticketing & Entry

Revolutionize your guest experience: Effortless check-ins, interactive displays, secure payments.

Boost revenue with automated rave reviews, actionable insights, and loyal customer engagement.

Efficient ticketing, digital waivers, and fast check-ins enhance on-site operations and guest satisfaction.

Explore Xola Universe: 80+ apps, limitless integrations, endless growth opportunities.

Simplify check-in and boost your marketing efforts with our integrated automated digital waivers.

With SOC 2 Type II and CCPA compliance Xola exceeds industry security standards and insures your data protection.

Access real-time insights for business growth with our powerful reporting.

Remarkable and hassle-free guest experiences with waitlist and virtual queuing.

Top experiential marketing news sites to stay ahead of the curve

- Xola University

- Business Operations

US tourism top states stats round-up post

The most notable trend is travelers’ desire to spend more time outdoors. They’re helping revive the tourism industry in states like Utah and Arizona, where state and national parks are plentiful. Meanwhile, Florida’s booming theme park industry and accessible beaches are driving an exceptional recovery for the state.

This is good news for tour and attraction operators. The uptick in visitors to your state will translate to more bookings and revenue for your travel business.

If you’re not sure how your state is faring, here are all the U.S. tourism statistics by state that you need to know.

What US states spend the most on tourism?

Historically, Hawaii, Florida, and California were the top three states that spent the most on tourism. Texas, Michigan, and New York were also among the top spenders.

Over the past five years, state tourism funding has increased by 20% across the board. States spend, on average, $22 million on tourism initiatives to attract tourists and generate visitor spending.

Most states took a major step back in tourism spending during the pandemic, but now, they’re jumping back into the marketing game. Twenty-nine states ramped up their tourism budgets during the 2021-2022 fiscal year, including Colorado, Florida, Montana, Nevada, Oregon, Texas, and Washington.

Hawaii and Florida were among the top spenders: In 2022, Hawaii secured a $60 million tourism budget, while Florida had over $80 million to work with, including $30 million in federal stimulus money.

How much of Florida’s economy is tourism-driven?

Nationwide, travel and tourism are major drivers of economic activity. The tourism industry is responsible for 2.9% of the U.S. GDP.

That number is even higher in Florida, where tourism represents 10% of the state’s overall GDP. The industry supports nearly 13% of the state’s jobs.

In 2019, Florida welcomed 131 million out-of-state visitors, 10% of which were international. In total, visitors spent $98.8 billion and helped generate $27.6 billion in federal, state, and local taxes.

The total economic impact amounted to $96.5 billion in 2019.

How much of Hawaii’s economy is tourism-driven?

Hawaii is also heavily reliant on tourism. The travel industry represents about a quarter of the state’s economy.

Over 10 million tourists traveled to Hawaii in 2019, which is over seven times the state’s population. Visitors spent $17.8 billion and contributed over $2 billion in tax revenue.

What are the top 20 US states with the most tourists?

New York, California, and Ohio are among the most popular states in the U.S. In 2021, many states experienced a strong rebound in visitors as domestic travelers started to venture out of their home states.

These were the top-visited states in 2021; numbers are shown for the year 2021 unless otherwise noted.

- 265.5 million visitors (2019)

- $73.6 billion in visitor spending (2019)

- $117.6 billion in economic impact (2019)

- 219 million visitors

- $47 billion in visitor spending

- 213.5 million visitors

- $100 billion in visitor spending

- 211 million visitors (2019)

- $46 billion in visitor spending (2019)

- $4.8 billion in state and local taxes (2019)

- 159.6 million visitors

- $34.4 billion in visitor spending

- $4.2 billion in state and local tax revenues

- 126 million visitors (2019)

- $24.2 billion in domestic and international travel spending in 2021

- $1.9 billion in state and local tax revenue

- 122 million visitors

- $96.5 billion in revenue (2019)

- $27.6 billion in taxes (2019)

- 110 million visitors

- $43 billion in visitor spending (2019)

- $2.5 billion in state tax revenue (2019)

- 102 million visitors

- 20.9 billion in total economic impact

- $1.4 billion in state and local taxes

- 96.6 million visitors

- $37.3 billion in visitor spending

- $4.6 billion in state and local taxes

- 84.2 million visitors

- $21.9 billion in visitor spending

- $1.5 billion in state and local tax revenue

- 72.5 million visitors (2018)

- $83 billion in visitor spending (2019)

- $7.8 billion in state and local taxes (2019)

- 56 million visitors

- $60.6 billion contribution to the economy just in Southern Nevada

- Over $36 billion in visitor spending in Southern Nevada

- 49.3 million total visitor volume

- 13.6 billion in visitor spending

- $1.7 billion in state and local taxes

- 44 million visitors (2019)

- $25.2 billion in visitor spending

- $1.8 billion in state and local taxes

- 45 million visitors

- $28.9 billion in visitor spending

- $2.3 billion in state and local taxes

- 41 million visitors

- $1.1 billion in local, state, and federal taxes

- 40.9 million visitors

- $23.6 billion in visitor spending

- $3.4 billion in tax revenue

- 28.2 million visitors

- Nearly $20 billion in visitor spending

- $1.1 billion in state and local taxes

- 21 million visitors (2019)

- 15.8 million people visited Utah’s parks in 2021

- $1.6 billion in visitor spending at Utah’s parks

Top 10 fastest-growing US states for tourism

Theme parks, casinos, and parks are fueling a strong tourism rebound in these 10 states.

The state is quickly catching up to pre-pandemic visitation numbers and even setting new records. In 2021, Florida welcomed nearly 118 million domestic visitors, the highest level in state history. This was great news for the hotel industry, which is already generating revenue at pre-pandemic levels. The state’s total hotel revenue hit a record in 2021 at $17.3 billion, a 2% increase from 2019.

2. Tennessee

Tennessee’s tourism industry is already setting post-pandemic records. In 2021, visitors spent a record $24 billion traveling through the state. That breaks down to $66 million daily, a 44% increase from the year prior.

3. Virginia

The shift toward outdoor and adventure travel has increased park attendance across the U.S. In Virginia, nearly 8 million people visited the region’s 41 state parks in 2021, a 15% increase from 2019.

4. Arkansas

Similarly, the tourism growth seen in Arkansas is driven by its parks. The state welcomed just over 41 million visitors in 2021, surpassing the 36.3 million that came in 2019. Hot Springs National Park had over 2 million recreational visits in 2021, topping the previous visitation record set in 1970.

Utah’s strong rebound can be attributed to the popularity of the “Might Five,” which is the nickname given to Arches, Bryce Canyon, Canyonlands, Capitol Reef, and Zion National Parks. The five parks welcomed 11.2 million recreation visits in 2021, and all but Bryce Canyon National Park had a record-breaking year.

Wyoming had a big tourism year in 2021. Visitors spent $4 billion, which helped generate $243 million in tax revenue — a 50% increase from 2020. Yellowstone National Park welcomed a record number of visitors (nearly 5 million).

Tourism in Maine has rebounded to pre-pandemic levels. In fact, tourism was up 25% in the first five months of 2022 compared to the same period in 2019. Meanwhile, visitor spending was up 18% in May of this year over May 2019. In 2021, over 15.6 million visitors flocked to the state, an increase of 29% from 2020.

Montana’s state parks welcomed a record-setting number of visitors in 2020. That trend continued into the following year when visitors spent $5.15 billion while traveling through the state, a billion dollars more than they spent in 2019.

In 2021, Arizona outpaced the national rate in terms of visitor spending and overnight stays. The state recovered 87% of its overnight visitation and 92% of its visitor spending rate from pre-pandemic times. Overnight visitors spent $23.6 billion across the state in 2021.

Las Vegas is fueling a strong tourism rebound in Nevada. This past February was the best in history for Vegas, with $1.1 billion of casino winnings recorded. Meanwhile, monthly passenger traffic at Harry Reid International Airport more than doubled in February compared to a year ago.

What are the top 10 least-visited states in the US?

Alaska, Nebraska, and Vermont are among the least visited states in the U.S.

Yet even these states are growing in popularity as domestic travel returns in full force. Visitors flocked to the Alaskan outdoors this summer, boosting demand for hotels and car rentals. Meanwhile, Nebraska’s lodging tax revenue hit an all-time record this year. And as autumn rolls around, Vermont is gearing up to welcome hordes of leaf-peeping tourists .

These are the top 10 least visited states in the U.S. — at least for now:

- Alaska: 2.26 million

- West Virginia: 3.96 million

- Nebraska: 6.5 million

- Wyoming: 8.1 million (Despite being one of the least visited states, record visitation at Yellowstone National Park in 2021 have propelled Wyoming’s tourism industry forward.)

- Delaware: 9.2 million

- Montana: 12.5 million (Montana’s state parks welcomed a record number of visitors in 2020, putting the state’s natural beauty on the map.)

- New Hampshire: 12.8 million

- Vermont: 13 million

- South Dakota: 14.5 million

- Maine: 15.6 million (Despite being one of the least-visited states, tourism was up 25% in the first five months of this year compared to the same period in 2019.)

Whether you run a business in one of the most- or least-visited states in the country, your busy season is about to get a whole lot busier. As tourism continues to rebound in 2022, is your travel company ready to welcome the influx of visitors?

Writer Carla Vianna

Related Articles

How to calculate capacity utilization

Is your attraction operating at its full design capacity potential? Key performance indicators, like your capacity utilization metric can help

7 Skills That All Great Tour Guides Possess

When your business is growing, the thought of hiring, vetting, and managing tour guides can be daunting. In an earlier

How do OTAs work

Most tours and attractions consider Online Travel Agencies (OTAs) a crucial piece of their distribution strategy and a way to

Get the latest news and resources.

For tours and attractions delivered straight to your inbox each week.

Transform your business now.

An official website of the United States government

- Special Topics

Travel and Tourism

Travel and tourism satellite account for 2018-2022.

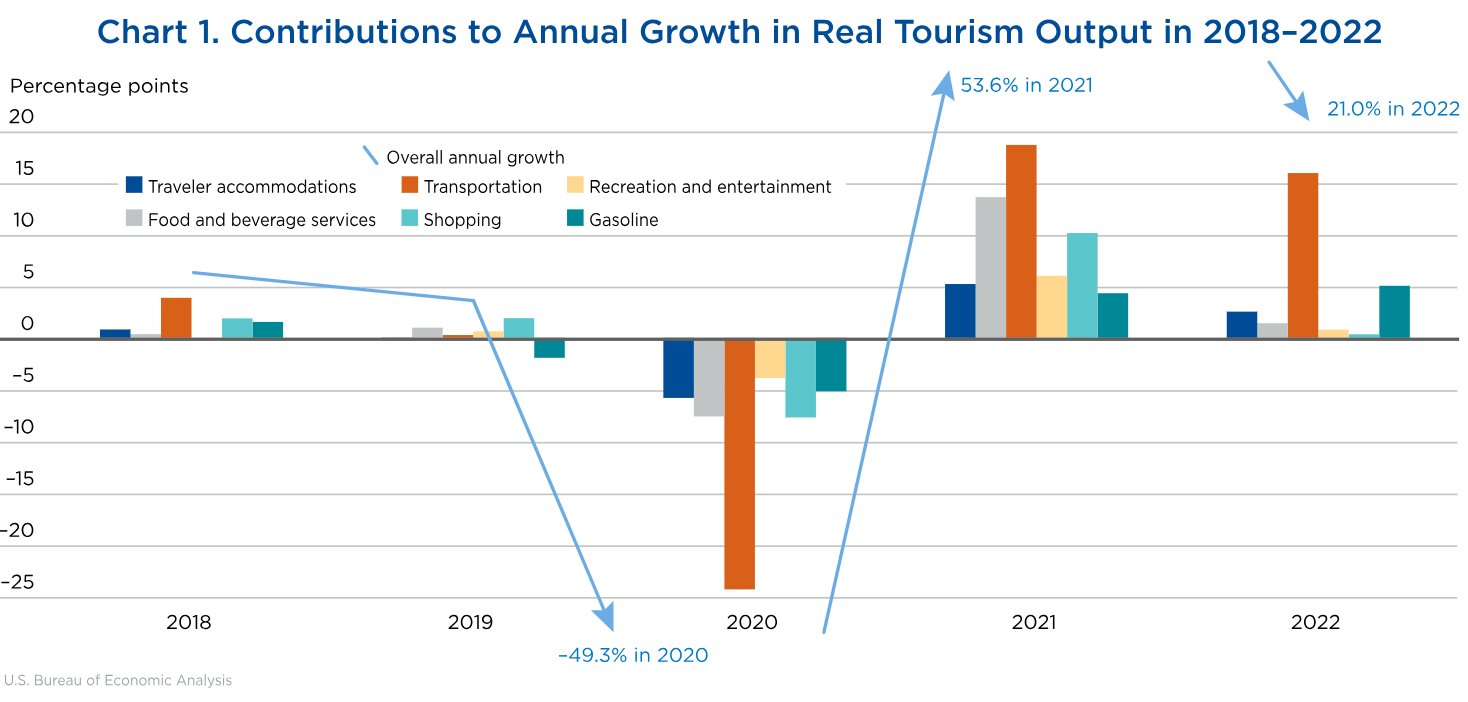

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA’s Travel and Tourism Satellite Account.

Data & Articles

- U.S. Travel and Tourism Satellite Account for 2018–2022 By Hunter Arcand and Paul Kern - Survey of Current Business April 2024

- "U.S. Travel and Tourism Satellite Account for 2015–2019" By Sarah Osborne - Survey of Current Business December 2020

- "U.S. Travel and Tourism Satellite Account for 2015-2017" By Sarah Osborne and Seth Markowitz - Survey of Current Business June 2018

- Tourism Satellite Accounts 1998-2019

- Tourism Satellite Accounts Data A complete set of detailed annual statistics for 2017-2021 is coming soon -->

- Article Collection

Documentation

- Product Guide

Previously Published Estimates

- Data Archive This page provides access to an archive of estimates previously published by the Bureau of Economic Analysis. Please note that this archive is provided for research only. The estimates contained in this archive include revisions to prior estimates and may not reflect the most recent revision for a particular period.

- News Release Archive

What is Travel and Tourism?

Measures how much tourists spend and the prices they pay for lodging, airfare, souvenirs, and other travel-related items. These statistics also provide a snapshot of employment in the travel and tourism industries.

What’s a Satellite Account?

- TTSA Sarah Osborne (301) 278-9459

- News Media Connie O'Connell (301) 278-9003 [email protected]

- Diversity Inclusion

- Advisory Panel

- Our Audience

- Private Tourism Academies

- Tourism Ambassador Training

- Destination Training

- Tourism Keynote Speakers

- Sponsorship

- Business Class Podcast

- Skill & Knowledge

- Product Training

- Our Technology

- Become An Instructor

- Sponsorship Opportunities

- Product Training & Promotion

- Hire Us To Speak

U.S. Travel & Tourism Statistics 2020-2021

The ultimate fact guide to america's tourism industry including outbound, inbound, domestic & business travel figures..

The American tourism industry is thriving, International and domestic travel is currently contribution over $1.1 trillion to the United States GDP every year. When looking at the annual travel split of domestic and international travel, Americans domestically traveling within the country last year made up the lion's share, totaling 2.29 Billion, a 2% increase from the previous year. Following past US tourism trends, the volume of Americans outbound traveling internationally was of course much less, amounting to 79.6 Million, which was a 3.5% increase from the previous year.

Leisure based travel accounts for 73.8% of all tourism in America, leaving 26.2% for business and other reasons. Overall the tourism expenditure accounts for $1,089 Billion a year, and the industry provides a direct source of employment for 5.29 million jobs.

RELATED: 2022 Tourism Trends & Outlook

RELATED: Tourism Experts & Inspiring Speakers For Your Next Meeting

TOP U.S. TOURISM STATISTICS:

US Citizen domestic tourism: Americans take 2.29 Billion domestic trips each year.

US Citizen outbound tourism: Americans take 93.0 Million international outbound trips each year.

International Inbound Tourism: Annually, there are currently 79.6 Million international visitors to the US.

$1,089 Billion: Yearly American tourism expenditure ($932.7b domestic / $156.3b international)

Expenditure sources: $267.7B on food services, $232.2B on lodging, $200.4B on public transport, $166.5B on auto transportation, $112.6B on recreation, $109.6B on retail.

15.7 Million American jobs were supported by travel in 2018.

By 2028, yearly U.S. tourism is estimated to hit the $2.4 trillion mark.

Days/yr. traveled by age group: Gen Z (29 days) , Millennials (35 days) , Gen X (26 days) and Baby Boomers (27 days).

Top 5 inbound countries: Mexico (19.1m), Canada (12.3m), UK (4.9), Japan (3.4), China (2.9)

Top 5 outbound by continent: Europe (17.7m), Caribbean (8.7m), Asia (6.2m), South America (2.1m), Central America (3.2m)

Top US cities visited: New York (9.8m), Miami (5.38m), LA (4.98m), Orlando (4.47m), San Francisco (3.57m), Vegas (3.33m)

Business vs. leisure: U.S. travelers took 466.2 million domestic trips for business (26.2%), and 1,779.7 million for leisure (73.8%)

hbspt.cta._relativeUrls=true;hbspt.cta.load(8602415, 'b0bae044-f1ad-4d53-8aec-bd61f4894c04', {"useNewLoader":"true","region":"na1"});

Quick links: navigate our statistic topics, how many americans travel out of their country a year, how much did americans and tourists spend on travel last year, how much is the travel industry worth to america, which american age groups travel the most, why do americans travel, what are the popular trending activities in america, how do americans book their travel.

Find a Tourism Expert, Keynote Speaker or Travel & Hospitality Trainer

US INBOUND & OUTBOUND TOURISM STATISTICS

US domestic travel increased by +2% YTD in 2019 with Americans taking 2.29 Billion domestic trips.

Domestic leisure travel increased 1.9% in 2019 to 1.9 billion.

80% of all US domestic trips were for leisure travel in 2019.

Domestic business travel in 2019 accounted for 464 million trips.

US Citizen outbound tourism: Americans take 93.0 Million international outbound trips each year. (+6.3% YTD Change)

International Inbound Tourism: Annually, there are currently 79.6 Million international visitors to the US. (+3.5% YTD Change)

Top 5 inbound countries: Mexico (19.1m), Canada (12.3m), UK (4.9), Japan (3.4), China (2.9).

Top 5 outbound by continent: Europe (17.7m), Caribbean (8.7m), Asia (6.2m), South America (2.1m), Central America (3.2m).

Top US cities visited: New York (9.8m), Miami (5.38m), LA (4.98m), Orlando (4.47m), San Francisco (3.57m), Vegas (3.33m).

Each year, 35% of American families plan vacations 50 miles or more from home.

In a Travel Leaders Group survey, 24% of Americans stated they plan to travel to Europe.

22% of American vacations are via road trips.

USA’s top 5 road trip routes: #1 Las Vegas – National Parks, #2 Northern California - Southern Oregon Coast, #3 Northern New England, #4 Blue Ridge Parkway #5 Black Hills.

The lion’s share of the United States tourism is from its own citizen’s domestic travel, with over 2.29 billion Americans taking trips within the country. This saw a +2% year to date increase, which is enormous considering that domestic travel spend was worth $932.7 Billion.

As you can see from the US outbound travel statistics above, the number of Americans traveling out of the country is remarkably low compared to domestic travel. According to Trade.gov, outbound tourism hit 93 Million last year and saw a sizable +6.3% year to date increase, showing more Americans are willing to take an outbound trip and travel out the country.

The outbound travel expenditure of these 93 million people was worth $156.3 Billion to America’s tourism industry, so 6.3% is a very significant outbound tourism statistic! The hottest US outbound destinations were Europe, Caribbean, Asia, South America, and Central America.

The US inbound tourism statistics also paint a fascinating picture of America’s continued tourism industry growth, with visitors flocking from Mexico, Canada, UK, Japan, and China. International visitors totaled 79.6 Million with a 3.5% year to date increase, with the top US vacation destinations being cities such as New York, Miami, LA, Orlando, San Francisco, and Las Vegas.

Sources : Statista , AAA , TravelLeadersGroup , TravelAgentCentral , MMGY

RELATED: Keynote Talks, Custom Training Programs & LIVE Workshops

AMERICAS TOURISM INDUSTRY SPEND STATISTICS

American’s spent around $930 billion USD on domestic travel in 2018.

In 2017 the amount spent on summer vacations was around $101.1 billion USD , up from $89.9 billion in 2016.

$1.1 Trillion / $1,089 Billion: Yearly U.S. travel and tourism expenditure ($932.7b domestic / $156.3b international).

U.S. leisure spend totalled $761.7 billion in 2018 from domestic and international travellers.

U.S. business sped totalled $327 billion in 2018, with $136 Billion from travellers attending conventions or meetings.

Expenditure Sources: $267.7B on food services, $232.2B on lodging, $200.4B on public transport, $166.5B on auto transportation, $112.6B on recreation, $109.6B on retail.

Behind nightlife/dining, travel was voted America’s most popular choice for spending disposable income at 36%.

$101.1 Billion is spent every year in America on summer vacations alone.

The average American spends $6,080 on international trips.

Inbound overseas tourists stay an average of 18 nights and spend $4,200 while in America.

Overseas travellers account for 84% of international tourist spend, despite being half of all international arrivals.

Canadian tourists are the biggest spenders with £22.2 billion in the U.S. every year.

New York brings in $16.1 Billion a year from international visitors.

If you’re wondering how much Americans spend on travel each year, it was huge; International and domestic travelers spent $1.1 Trillion US dollars ($1,089 Billion). Americans spending through domestic travel increased by a massive +5.8% year to date, whereas international tourism spends only saw a 0.3% bump from the previous year. To break this down, this sort of spending would support 8.9M jobs, which in turn would generate $171 Billion in tax and $268 Billion in payroll.

Out of the $1.1 Trillion spending, leisure travelers from both international and domestic spent $762 Billion in 2018, which was a +6.1% increase from the previous year. When looking at business travel spend, it had risen +2.4% to $327 Billion, with 41.5% coming from

What are American tourists spending this $1.1 Trillion on? According to the latest US travel spending statistics, food services such as restaurants, bars, and grocery stores were the most popular spending category at 26.7%. This was followed by 23.1% on lodging, 20.0% on public transport, 16.6% on auto transportation, 11.2% on recreation, and 10.9% on retail.

Furthermore, this $1.1 Trillion spending isn’t the only financial impact of the tourists. When you look at the inputs used to supply or produce the goods travelers desire, and take into account the spend of the employees of travel businesses – there is a considerable multiplier of the financial impact to the US economy, estimated to be a total of $2.5 Trillion.

Sources : US Travel , US Travel 2 , Phocuswright , TravelAgenctCentral , Squaremouth , Statista

RELATED: Engaging & Insightful Speakers

US TRAVEL AND TOURISM INDUSTRY JOB STATISTICS

The travel industry accounts for 7.1% of America’s private employment.

15.7 Million American jobs were supported by travel in 2018.

8.92 Million American travel-related jobs were supported by tourism in 2018 (7.73M domestic / 1.19M international)

$1 Million in travel revenue directly produces eight jobs with the industry.

1 in 10 jobs in the U.S. depend on the travel industry (Excluding farming).

$267.9 Billion in payroll is generated yearly by U.S. travel and tourism ($234.6 Billion domestic / $33.3 Billion international).

$170.9 Billion in tax revenue is generated yearly by U.S. travel and tourism ($147.3 Billion domestic / $23.6 Billion international).

A massive $117.4 billion of the $170.9b in tax revenue was spent on leisure travel, $53.5b on business.

International and domestic business travel generated $327.3 billion in 2018 through direct spending.

In 2018, U.S. residents recorded 463.6M trips for business (38% being events and meetings).

The tourism industry is vital to the US economy, so much so that it accounts for 7.1% of the countries private employment. Overall, 15.7 Million American jobs were supported by the tourism industry last year, making one in eight non-farm jobs dependent on it in some way, direct and indirectly. The trend is on the up, the 15.7 Million American jobs in the travel industry had a +1.3% increase from the previous year.

Jobs, where workers are supplying goods or services directly to visitors, would be classed as ‘direct’ - this supported 8.9 million U.S. travel-specific jobs. The remaining 6.8 Million jobs were classed as indirect, these would include areas whereby workers created goods or services which helped produce the goods or services (sold or used by the 8.9M direct jobs).

The travel industry is known for being extremely labor intensive, its upwards trends have the power to develop new career opportunities much fast than any other niche. If you exclude the farming industry, one in ten jobs would be dependent on the travel industry – as an example, one in five non-farming industry jobs would be created from $1 million sales, but the same value in the travel industry would create one in eight.

Sources : US Travel 1 , US Travel 2

US TRAVEL STATISTICS BY DEMOGRAPHIC

42% of Americans own a passport, up from 27% 10 years ago.

Days a year traveling by age: Millennials ( 35 days ), Gen Z ( 29 days ), Baby Boomers ( 27 days ), and Gen X ( 26 days ).

Millennials : 62% of parents travel with kids under five.

Millennials : 58% prefer traveling with friends, 49% book last-minute vacations.

Millennials : 58% want to solo travel, 26% already have.

Solo Travel Women: Take 3 more trips a year and are the most likely to travel alone.

Solo Travel: 43% take over three trips a year.

Solo Travel: 50% have a college or university diploma/degree.

Family: 4 out of 10 plan a trip with a family each year.

Family: 80% take summertime trips to travel with family.

Family: 42% opt for spring break vacations.

Baby Boomers: Aim to take 4+ leisure vacations a year.

Baby Boomers: 30% opt for a cruise as their vacation choice.

When analyzing the latest US outbound travel statistics by age, it was clear that millennials are the group willing to travel for the most extended period at 35 days a year, while generation X vacationed an average of 26 days.

Millennial Americans that are without children are now less of the typical ‘tourist’ and more of the ‘experience’ generation. Most of their booking habits are focused on exploring cultures, booking retreats, or activities rather than visiting theme parks and tourist trap areas. Their freedom and spontaneity let almost half of them book last-minute vacations, with or without friends as, to them, solo travel means cultural growth and meeting new people.

These travel age statistics also show us that half of the solo travelers take up to 3 more trips a year, have a college or university degree, and American solo travel is more prominent in women. What percentage of Americans own a passport? The myth was only one in ten do which appears in many blogs across the web, but now the Census and State department confirm that over 42% of Americans own a passport.

One travel by age group statistic shows almost one in three baby boomers opt for a cruise as their vacation and aim to take at least 4 trips per year. When it comes to families, the majority go during summer break (80%), and only 4 in 10 plan trips with their family. However, millennial families are far more likely to travel with younger children, at 62%.

Sources : Expedia, Resonanceco, InternetMarketingInc , PRNewswire , SoloTravelWorld , TravelAgentCentral , NYU 1 , NYU 2 , AARP , TripAdvisor

REASONS AMERICANS TRAVEL FACTS & STATISTICS

Business/Leisure: U.S. travellers took 466.2 million domestic trips for business (26.2%), and 1,779.7 million for leisure (73.8%).

Family: 95% prioritized their family to be happy and entertained.

Family: 89% prioritized vacation deals and value.

Family: 85% needed planning around school holidays.

Family: 85% wanted outdoor activities for their family.

Gen Z: 55% travelled to increase their knowledge and experience.

Gen Z: 40% travelled to avoid stress and relax.

Millennials: 43% want to find themselves.

Millennials: 23% want to meet new people.

57% of U.S. travellers would choose a free heritage vacation over alcohol for a year.

56% of global international travellers agree it taught them life skills.

51% want to escape normal life and recharge mentally.

42% take trips to visit friends and family.

35% are travelling to experience local delicacies.

Top bucket list vacations are volunteering trips (39%), food travel adventure (38%), mystery journey (38%), ancestry/heritage trip (36%), and sabbatical (36%).

59% of solo travellers stated the reason they went alone is to see the world without waiting for others.

Why do Americans travel? When looking at the data from several survey sources, it was clear that the gender and age of respondents had little impact on the three most important factors.

RELATED: Find An Inspiring Tourism Speaker For Your Next Event

The most important reasons why Americans travel were:

Being with friends and family

Fun experiences (did index higher in younger generations)

Relaxing and unwinding

In terms of gender-based travel reasons, men indexed higher than women overall for exploring the great outdoors or outdoor activities that fall into that category. Generation Z, Millennials, or general age groups from 18-35 had higher responses around wanting to travel for music events or festivals than people aged 35 and over.

The most important trend we’ve noticed from reviewing multiple studies around American’s desires for travel is that younger generations are factoring in ‘experience tourism,’ this was very common in their responses. Experience tourism can be defined by people wanting to book activities or retreats, meet new people and ‘find themselves’. This is popular among solo travellers, like a cultural trip to Thailand for a detox retreat rather than visiting a traditional tourist attraction like a theme park.

Americans over 35 were keen on finding a vacation where food and drink was priority. Visiting a town or city that had cultural foodie scenes or breweries were very trendy.

Sources : ShortTermRentalz, Wysetc , Trekksoft , TravelNews , USTravel , Booking.com , HospitalityNet , SoloTravelWorld

US TOURISM & TRAVEL ACTIVITY STATISTICS

Top 5 culture activities: #1) 65% visit history/art museums, #2) 59% visit aquariums, #3) 56% visit science museums, #4) 55% visit theme parks, #5) 55% visit zoos

73% of families take their children to a theme park, 34% aim for a world famous one.

Overseas visitors top 5 activities: #1) 54% Shopping, #2) 49% visit historical/cultural sights, #3) 49% Restaurants, #4) 46% Monuments / National Parks, #5) 46% Sightseeing tours.

Trending: 89% increase in sunset cruise excursions trips since last year.

Trending : 64% increase in snorkelling activities since last year.

Trending : 55% increase in sailing trips since last year.

Trending : 49% increase in kayaking and canoeing experiences since last year.

33% of visitors will get spa or beauty treatments while on vacation.

15% of travellers book mindfulness or meditation retreats.

One of the reasons Americans do not travel abroad that much is that there is so much to offer in their own country. There is a wealth of cultural activities such as art galleries, museums that index high on the popular activities list, not to mention the volume of theme parks, zoos, and aquariums across the country.

Families want to book all-inclusive trips where everything is taken care of, and they can focus on shopping or taking their children sightseeing. An overwhelming volume of people wanted to book a cruise in the future, which pairs well with relaxing is one of the most popular reasons for travel data above. Cruises were particularly popular in respondents over the age of 45, as well as self-guided tours, whereas group tours were one of the least popular options for booking.

Even though sporting related activities are trending up, going to a physical sporting event was one of the least popular reasons Americans book travel, with most wanting to support their team… from home.

Sources : MMGY , NYU , StatisticBrain, TripAdvisor , Booking.com

RELATED: Online Destination Training For Agents

US TOURISM BOOKING STATISTICS

65% of hotels are booked on the smartphone the same day as it was researched.

79% of Americans researching trips will eventually book on their smartphone via app or online.

90% of U.S. travellers use apps at their destination to make life easy.

#1 factor in Americans booking travel is price, but reviews and amenities are close runners up.

Americans aged 18-24 classed reviews as the second most crucial factor in the booking.

Overall, travel is most commonly booked between 1 to 3 months in advance.

Men are more likely to last-minute book their trips 2 to 4 weeks out.

Excluding price as the main factor for Americans booking travel, amenities, and reviews were the most popular choices. So when comparing hotels, resorts or cruises of similar price, these are the factors that will sway the booking decision.

Popular amenities people look for when booking hotels are free breakfasts, pool access, fitness centers, and on-site restaurants. Public transportation was the least influential factor for people considering amenities when booking; this increased with ride-share options.

Only 11% of travellers book trips 6 months out; the most standard booking periods were for trips within 1 to 3 months.

Demographics wise, travelers without children would be the target market for last-minute booking, the no strings attached lifestyle leaves their schedules open. This makes them the ideal target for using last-minute deals to sign them up to hotel or travel loyalty programs.

Sources : StatisticBrain, ThinkWithGoogle , Trekksoft

Leave a comment

Related articles, these six tourism trends will rule 2022, tourism academy announces top travel trends for 2023, top 20 tourism keynote topics for inspiring journeys.

United States Tourism Revenues

Tourism revenues in the united states decreased to 20083 usd million in march from 20133 usd million in february of 2024. tourism revenues in the united states averaged 13345.81 usd million from 1999 until 2024, reaching an all time high of 20819.00 usd million in march of 2018 and a record low of 3835.00 usd million in september of 2020. source: office of travel and tourism industries, markets, gdp, labour, prices, money, trade, government, business, consumer, housing, taxes, energy, health, climate.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

U.S. Department of Commerce

- Fact Sheets

Was this page helpful?

Fact sheet: 2022 national travel and tourism strategy, office of public affairs.

The 2022 National Travel and Tourism Strategy was released on June 6, 2022, by U.S. Secretary of Commerce Gina M. Raimondo on behalf of the Tourism Policy Council (TPC). The new strategy focuses the full efforts of the federal government to promote the United States as a premier destination grounded in the breadth and diversity of our communities, and to foster a sector that drives economic growth, creates good jobs, and bolsters conservation and sustainability. Drawing on engagement and capabilities from across the federal government, the strategy aims to support broad-based economic growth in travel and tourism across the United States, its territories, and the District of Columbia.

The federal government will work to implement the strategy under the leadership of the TPC and in partnership with the private sector, aiming toward an ambitious five-year goal of increasing American jobs by attracting and welcoming 90 million international visitors, who we estimate will spend $279 billion, annually by 2027.

The new National Travel and Tourism Strategy supports growth and competitiveness for an industry that, prior to the COVID-19 pandemic, generated $1.9 trillion in economic output and supported 9.5 million American jobs. Also, in 2019, nearly 80 million international travelers visited the United States and contributed nearly $240 billion to the U.S. economy, making the United States the global leader in revenue from international travel and tourism. As the top services export for the United States that year, travel and tourism generated a $53.4 billion trade surplus and supported 1 million jobs in the United States.

The strategy follows a four-point approach:

- Promoting the United States as a Travel Destination Goal : Leverage existing programs and assets to promote the United States to international visitors and broaden marketing efforts to encourage visitation to underserved communities.

- Facilitating Travel to and Within the United States Goal : Reduce barriers to trade in travel services and make it safer and more efficient for visitors to enter and travel within the United States.

- Ensuring Diverse, Inclusive, and Accessible Tourism Experiences Goal : Extend the benefits of travel and tourism by supporting the development of diverse tourism products, focusing on under-served communities and populations. Address the financial and workplace needs of travel and tourism businesses, supporting destination communities as they grow their tourism economies. Deliver world-class experiences and customer service at federal lands and waters that showcase the nation’s assets while protecting them for future generations.

- Fostering Resilient and Sustainable Travel and Tourism Goal : Reduce travel and tourism’s contributions to climate change and build a travel and tourism sector that is resilient to natural disasters, public health threats, and the impacts of climate change. Build a sustainable sector that integrates protecting natural resources, supporting the tourism economy, and ensuring equitable development.

Travel and Tourism Fast Facts

- The travel and tourism industry supported 9.5 million American jobs through $1.9 trillion of economic activity in 2019. In fact, 1 in every 20 jobs in the United States was either directly or indirectly supported by travel and tourism. These jobs can be found in industries like lodging, food services, arts, entertainment, recreation, transportation, and education.

- Travel and tourism was the top services export for the United States in 2019, generating a $53.4 billion trade surplus.

- The travel and tourism industry was one of the U.S. business sectors hardest hit by the COVID-19 pandemic and subsequent health and travel restrictions, with travel exports decreasing nearly 65% from 2019 to 2020.

- The decline in travel and tourism contributed heavily to unemployment; leisure and hospitality lost 8.2 million jobs between February and April 2020 alone, accounting for 37% of the decline in overall nonfarm employment during that time.

- By 2021, the rollout of vaccines and lifting of international and domestic restrictions allowed travel and tourism to begin its recovery. International arrivals to the United States grew to 22.1 million in 2021, up from 19.2 million in 2020. Spending by international visitors also grew, reaching $81.0 billion, or 34 percent of 2019’s total.

More about the Tourism Policy Council and the 2022 National Travel and Tourism Strategy

Created by Congress and chaired by Secretary Raimondo, the Tourism Policy Council (TPC) is the interagency council charged with coordinating national policies and programs relating to travel and tourism. At the direction of Secretary Raimondo, the TPC created a new five-year strategy to focus U.S. government efforts in support of the travel and tourism sector which has been deeply and disproportionately affected by the COVID-19 pandemic.

Read the full strategy here

This website stores cookies on your computer. These cookies are used to collect information about how you interact with our website and allow us to remember you. We use this information in order to improve and customize your browsing experience and for analytics and metrics about our visitors both on this website and other media. To find out more about the cookies we use, see our Cookies Policy .

If you decline, your information won’t be tracked when you visit this website. A single cookie will be used in your browser to remember your preference not to be tracked.

United States Tourism Revenue Growth

- United States Tourism Revenue grew 22.1 % YoY in Mar 2024, compared with an increase of 23.8 % YoY in the previous month

- United States Tourism Revenue Growth rate data is updated monthly, available from Jan 2000 to Mar 2024

- The data reached an all-time high of 161.1 % in Apr 2022 and a record low of -80.5 % in Aug 2020

View United States's Tourism Revenue Growth from Jan 2000 to Mar 2024 in the chart:

What was United States's Tourism Revenue Growth in Mar 2024?

United States Tourism Revenue grew 22.1 % YoY in Mar 2024, compared with an increase of 23.8 % YoY in the previous month See the table below for more data.

Tourism Revenue Growth by Country Comparison

Buy selected data, accurate macro & micro economic data you can trust.

Explore the most complete set of 6.6 million time series covering more than 200 economies, 20 industries and 18 macroeconomic sectors.

United States Key Series

More indicators for united states, request a demo of ceic.

CEIC’s economic databases cover over 200 global markets. Our Platform offers the most reliable macroeconomic data and advanced analytical tools.

Explore our Data

Kentucky tourism continues record-setting pace in 2023 with nearly $14 billion in economic impact

F RANKFORT, Ky. (AP) — Kentucky's tourism industry stayed on its record-setting pace in 2023, generating an economic impact approaching $14 billion while sustaining nearly 100,000 jobs, Gov. Andy Beshear said Thursday.

Travelers visiting the Bluegrass State last year spent $9.7 billion as tourism continued its post-pandemic momentum as a key contributor to Kentucky's growing economy, the Democratic governor said.

“We’re welcoming people to our new Kentucky home, one filled with opportunity and prosperity," Beshear said during his weekly news conference. "Where we want you to come see what we have to offer, and then we want you to move your family here to be a part of it.”

The governor joined tourism leaders at Castle & Key Distillery to celebrate the second straight record-breaking year for tourism in Kentucky. In 2022, the tourism sector bounced back from the COVID-19 pandemic to generate an economic impact of nearly $13 billion and was responsible for 91,668 jobs.

Last year was even better, with the statewide tourism industry producing $13.8 billion in economic impact and the sector sustained 95,222 jobs, Beshear said. The study by Tourism Economics determined that 79.3 million travelers visited Kentucky in 2023, up 4.5% from the prior year, he said.

Kentucky's attractions include horse farms and bourbon distilleries as well as outdoor adventure, history, arts and cultural draws. Kentucky is also home to Mammoth Cave National Park.

Bourbon tourism is flourishing, with attendance surpassing 2.5 million visitors last year along the Kentucky Bourbon Trail and the Kentucky Bourbon Trail Craft Tour, which showcases smaller distilleries. Bourbon tourists tend to spend more and stay longer compared to other attractions, the bourbon industry says.

“With distilleries now in 42 counties, bourbon tourism is resurrecting Main Streets across the commonwealth and pouring much-needed revenue into local coffers. And there’s more to come,” said Eric Gregory, president of the Kentucky Distillers’ Association.

Spirit makers have invested big sums into new or expanded visitor centers to play up the industry’s heritage and allow guests to soak in the sights and smells of bourbon-making.

Communities across Kentucky registered robust tourism numbers last year.

Beshear said tourism generated $4.2 billion of economic impact last year in Jefferson County, which includes Louisville, the state's largest city. In Boone, Campbell and Kenton counties — just south of Cincinnati — the combined economic impact of tourism was $2.1 billion, he said. It was $1.6 billion in Fayette County, home to Lexington, the state's second-largest city. In Warren County, tourism brought in $477 million of economic impact, and in McCracken County it generated $319 million.

State Tourism Commissioner Mike Mangeot thanked tourism officials statewide for their role in the sector's success, along with the thousands of leisure and hospitality industry workers. The tour guides, restaurant workers, hotel desk clerks and others are “the frontline ambassadors,” he said.

Travel & Tourism - United States

- United States

- The Travel & Tourism market is expected to generate a revenue of US$198.70bn in the United States by 2024.

- The market is projected to grow at an annual growth rate (CAGR 2024-2028) of 2.90%, resulting in a market volume of US$222.80bn by 2028.

- The Hotels market is the largest market in the market and is expected to reach a projected market volume of US$110.50bn in 2024.

- By 2028, the number of users in the Hotels market is expected to reach 167.50m users.

- The user penetration rate is projected to increase from 67.5% in 2024 to 69.3% in 2028.

- The average revenue per user (ARPU) is estimated to be US$0.86k.

- By 2028, 72% of the total revenue in the Travel & Tourism market is expected to be generated through online sales.

- In terms of global comparison, United States is projected to generate the highest revenue in the market, with a revenue of US$198.70bn in 2024.

- The United States' Travel & Tourism industry has been greatly impacted by the COVID-19 pandemic, resulting in decreased international travel and a shift towards domestic travel.

Key regions: Malaysia , Europe , Singapore , Vietnam , United States

Definition:

The Travel & Tourism market encompasses a diverse range of accommodation services catering to the needs and preferences of travelers. This dynamic market includes package holidays, hotel accommodations, private vacation rentals, camping experiences, and cruises.

The market consists of five further markets.

- The Cruises market covers multi-day vacation trips on a cruise ship. The Cruises market encompasses exclusively passenger ticket revenues.

- The Vacation Rentals market comprises of private accommodation bookings which includes private holiday homes and houses as well as short-term rental of private rooms or flats.

- The Hotels market includes stays in hotels and professionally run guest houses.

- The Package Holidays market comprises of travel deals that normally contain travel and accommodation sold for one price, although optional further provisions can be included such as catering and tourist services.

- The Camping market includes bookings at camping sites for pitches using tents, campervans, or trailers. These can be associated with big chains or privately managed campsites.

Additional Information: