Sign On to Online Banking or select another service

- Mortgage Application Status Tracker

- PNC Benefit Plus HSA

- PNCI International

DO NOT check this box if you are using a public computer. User IDs potentially containing sensitive information will not be saved.

Get our mobile banking app:

- Virtual Wallet®

Credit Cards

- Online & Mobile Banking

- ATM Banking

- Student Banking

- Military Banking

- PNC WorkPlace Banking®

- PNC Choice Banking

- PNC HomeHQ®

- Mortgage Purchase & Refinance

- Home Equity Lines of Credit

- Construction and Lot Loans

- Personal Loans & Lines of Credit

- Student Loans

- Student Loan Refinancing

- Explore Options in the Lending Portal

INVESTING & MANAGING WEALTH

- PNC Investments

- PNC Private Bank

Explore Topics

- Managing Wealth

- Small Business

- The Great Timing Debate: When to Claim Your Social Security Benefit

- Kids Flown the Coop? 10 Not-So-Obvious Money Tips for Empty Nesters

- Do You Know the Most Common Types of Cybercrime?

- 5 Questions to Consider as You Plan Your Retirement Income Strategy

How Mobile Banking Can Help You Save Time and Money

When it comes to getting your banking questions answered, using your mobile banking app can help you save time and even allow you to avoid fees.

Stay Informed on News and Issues Impacting PNC Customers

Visit Update Center

Security & Privacy

- Report Fraud

- Report Phishing Attempt

- Privacy Policy

- Visit Security & Privacy Center

- Home Equity

Frequently Asked Questions

- Lending Hardship Service & Support

- Visit Customer Service Center

How Can We Help You

- Call 1-888-PNC-Bank

- @PNCBank_Help

- Locate a Branch or ATM

- Schedule an Appointment

get a clear picture of where you are today and plan for the future you want

Experience Financial Wellness

Checking & Savings. Together.

Spend, save and grow your money with Virtual Wallet®.

Earn Unlimited 2% Cash Back on Purchases

With the new Cash Unlimited® Visa Signature® Credit Card.

Introducing Low Cash Mode®

Everyone can have a low cash moment. We're here to help when you do.

When you open and use a new, qualifying business checking account.

- Corporate & Institutional

- Español false xf false

- Customer Service

Welcome to PNC! How can we help you today?

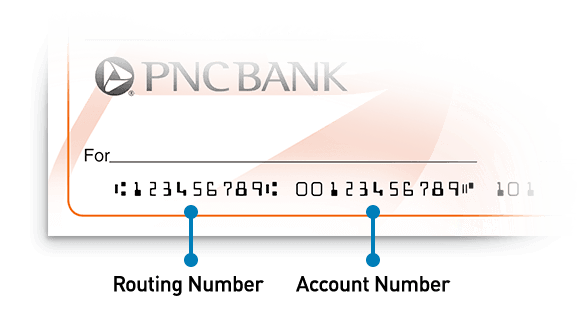

Start here you may find answers to your questions and concerns in our frequently asked questions., important account information for existing checking customers, where can i find my full account and routing numbers.

Routing numbers are nine digit numbers that can also be referred to as banking routing numbers, routing transit numbers, RTNs, and ABA numbers. This code identifies your financial institution and it can differ depending on where you opened your account and the type of transaction you make.

There's a number of ways you can find your Account and Routing numbers:

PNC Mobile App

For all Deposit Accounts (Checking and Savings)

- Sign in to the Mobile app.

- Select your account, then select Account and Routing Numbers .

- Verify your identity by entering a one-time passcode to view your full account number and routing number.

Online Banking

For Deposit Accounts (Checking and Savings)

- For Virtual Wallet accounts , go to Account Activity , change the selected Virtual Wallet account from the dropdown if needed, and select Go to the Account and Routing Number link.

- For all other checking and savings accounts, select the Show Account & Routing Number link.

- Verify your identity by entering a one-time passcode and follow the instructions for viewing your full account number and routing number.

On Your Paper Checks:

Your Account number and Bank (ABA) Routing number can be found at the bottom of your checks:

If you don’t have your checkbook handy, don’t worry. If you have recently written a check that has posted to your account you can:

- Sign on to Online Banking.

- Select your account.

- Within the Posted Transactions section of the Account Activity page, locate a recently posted check and click on the blue hyperlink under the Description column.

- View an image of the check to obtain the routing and account number.

Incoming Wire Transfers

Incoming wire transfers have a different routing number than the one displayed on your account. To set up an incoming wire transfer, you’ll need to provide your account number and the following PNC Bank Routing Number: 043000096 .

What should I do if I can't access my account, or forgot my Online Banking Password or User ID?

To reset your Password or User ID, click on "Forgot Your User ID or Password?" located in the Online Banking Sign On block on pnc.com. This link will walk you through the steps necessary to reset your Password or User ID.

How do I change the address, phone number, or email address on my account?

It's easy to change the address you have on file with pnc for your accounts:.

1. In Online Banking, Click on the Customer Service tab and then select the "Customer Profile" option at the top. You'll see your personal information.

2. To update your mailing address:

- Click "edit" next to the Customer Address section.

- Place a check next to the account(s) that you would like to change.

- Type in your new address and click the "next" button.

- Confirm that the new address is correct and click the "submit modifications" button.

3. To update your phone number:

- Click “edit” next to the Telephone Numbers section.

- Delete the digits in either the Primary and Secondary fields.

- Click the “Next” button.

4. To update your email address:

- Click “edit” next to the Email Addresses section.

- Type in your new email address.

- Confirm your new email address by reentering it.

- Click the “Submit Modifications” button.

For a non-U.S. address or phone number change , use Message PNC in the PNC Mobile app or Online Banking. For an address change, include your new physical, international address or a military box address and contact number.

For Business Accounts: To ensure your protection and security, please change your address by visiting your local PNC branch.

When will my deposit be available?

Your deposit is typically available on the first business day after your deposit is received. Your funds may be delayed, however, depending on the type of deposit and the amount of that deposit.

See when funds deposited to your Consumer Accounts will be available:

In some situations, you may be notified that your funds may not be available for up to 5 business days after you make your deposit.

For more information on the circumstances under which a delay may occur, refer to the applicable Funds Availability Document:

Consumer Accounts

PNC Bank Consumer Funds Availability Policy

Business Accounts

Funds Availability Policy for Business Accounts

How do I order checks?

It’s easy to order checks with online banking:.

- Sign in to Online Banking

- Click on the Customer Service Tab

- In the Manage Accounts section, click on Order Checks & Supplies.

- Click on the “Checks/Supplies” link under the Order column next to the account for which you want to order checks.

Sign up for Automatic Check Reorder so you don’t have to remember about reordering checks.

Automatic Check Reorder is a free service offered by PNC that notifies you when 70% of your checks are gone. At that time, you can make changes to your check style or address. Your new checks will be mailed to you automatically

Not sure if you’re already enrolled in Automatic Check Reorder?

- In the Manage Accounts section, click on "Order Checks & Supplies".

You will see a list of your open accounts. Look in the Automatic Check Reorder column and it will state “Enabled” for the accounts that are enrolled.

Why did I receive an Overdraft Item or Returned Item (NSF) Fee?

You were charged a fee because your account was overdrawn..

There were not enough funds in your account to pay for all of the transactions that were posted to your account. Fees may be charged for each Overdraft Item (OD) or Returned Item (NSF).

If you sign on to Online Banking, you can view the transactions that led to your overdraft by clicking on the Overdraft Item Fee or Returned Item (NSF) Fee.

PNC customers with a Virtual Wallet Spend account and all other consumer checking/savings account types: You won’t be charged a Returned Item fee (also known as Non-Sufficient Funds or NSF) for an item that is returned unpaid. You may see a maximum of one Overdraft fee per business day. If there are additional overdrafts on the same business day, those items will be paid or returned with no additional fees.

PNC customers with business checking/savings account types: You may see a maximum of four Overdraft or Returned Item (NSF) fees per business day.

Please refer to the appropriate Consumer and Business Schedule of Services and Fees for additional information.

How do I place a stop payment on a check or pre-authorized payment?

A "stop payment" allows you to stop payment on a check, range of checks or pre-authorized payment (excluding cashier's checks, money orders or other cash equivalent items)., to place a stop payment:.

- Sign On to PNC Online Banking.

- Click the "Customer Service" tab.

- Select "Stop Payment" from the Account Services section.

- Select the type of stop that you would like to place.

- The screens that follow will walk you through the remaining steps to place the stop payment.

All Stop Payment requests on a pre-authorized payment must be received by PNC at least three (3) business days before the payment is scheduled to be made. Once placed, Stop Payment orders remain effective for six (6) months from the date authorized. You can place another stop payment order for an additional six months when the expiration date arrives.

Stop Payment requests on checks are not effective if, either before or within 24 hours from the time when the stop payment was requested, PNC Bank cashes the check or has become otherwise legally obligated for its payment. PNC Bank will assume no responsibility if any information provided is incorrect or incomplete and would cause the check or pre-authorized payment or transfer order to be paid (i.e., incorrect check number, date, account number, or invalid amount).

Please note that additional fees may apply. For more information, refer to the applicable schedule of service charges and fees:

What do i need to access the automated telephone banking service.

Our toll-free Customer Service number will get you fast, easy and secure account information from our automated banking system - there's no waiting and it's available anytime, whenever you need it. Use it to check balances, hear account activity, transfer funds and much more.

To access the Automated Telephone Banking Service, you will need the following:

- Your User ID you associated with your account, as well as

- Your Telephone PIN Number you registered with your account (in many cases, this is the same as your PNC Debit Card PIN).

Once you enter the information required to access your account, just follow the instructions given to you through the automated system

How do I set up alerts for my account?

Setting up alerts is easy once you're logged into online banking..

- From your Alerts tab, access the Add/Edit Alerts Page.

- The Add/Edit Alerts Page provides a list of all the alerts eligible for each account.

- From there, you can select the Alerts that you want and how you want to receive them.

The following types of Alerts are available:

- Deposit Account Alerts

- Credit Card Alerts (provide balance & payment information)

- Debit/Credit Card Transaction Alerts

- Security Alerts

- Service Alerts

You can receive alerts via email, text message, and/or push notifications. To update delivery preferences, visit the Delivery Options page from the Alerts tab.

There is a transaction on my account that is incorrect or that I do not recognize or did not authorize. How can I dispute it?

There are two separate process to dispute debit card and credit card transactions. Please refer to your applicable account agreement for more detailed information on how to file a dispute, including the timeframe in which you must file a dispute for a debit card or credit card transaction.

You may dispute most debit or credit card transactions via your Online Banking by going to the Customer Service Tab.

To dispute a debit card transaction:

- Select "Dispute a Transaction” from the Account Services section.

- Select the account associated with the transaction you want to file a dispute on, and confirm your address.

- Click "Next."

- Select the transaction you wish to dispute from the transaction list.

- The steps that follow will walk you through how to place the dispute. If you have any other questions or concerns, please contact us.

To dispute a credit card transaction, notify us in writing at PNC Bank, P.O. Box 3429, Pittsburgh, PA 15230. Include your name and account number, the dollar amount of the error, and a description of what you believe is wrong and why you believe it is a mistake. You may also call us at 1-800-282-7541.

To dispute a credit card transaction through Online Banking:

- Select "Dispute a Transaction” link under “Credit Card”.

- Select the account associated with the dispute, and confirm your address.

- The steps that follow will walk you through how to place the dispute. If you have any other questions or concerns please contact us.

If you have a question regarding a fee, finance charge, payment or other question not related to purchase dispute, please contact Credit Card Customer Service at 1-800-282-7541.

To dispute a PNC Online Bill Pay transaction , first review the details of the transaction in the Payment Activity page on the Pay Bills tab in Online Banking. If you have a question about this payment or would like to dispute it, call us at 1-800-762-2035 .

To dispute a Personal Check or Pre-authorized Payment , please contact us at 1-888-762-2265 or visit your local branch.

Other than calling the Customer Care Center for help, what alternative option do I have?

If you have banking questions, we encourage you to take advantage of this helpful resource:

Connect with our Customer Care Center using Message PNC , now available in both Online Banking and the PNC Mobile app [1] . Connect on your time and reply when convenient. You can even switch between devices during a conversation. To begin a conversation in Online Banking, click the “Message PNC” link at the top of the right-hand navigation column. In the PNC Mobile app, tap “Help.”

Important account information for PNC Bank Visa® Reward Card Customers

Effective october 8, 2021, bbva bank visa reward card service was transferred to pnc bank..

As of June 14, 2021, the Reward Card sales were discontinued.

- All cards issued prior to this date will be serviced by PNC Bank.

- To learn more about your card, check your balance, or to review the updated terms and conditions please click the link below or call 866-791-6841 . By clicking the link below you will be leaving PNC Bank.

Click Here to access your Reward Card Account now serviced by PNC Bank

What do I do if my card is lost or stolen?

If you think your card is temporarily lost, you can lock your card using PNC Easy Lock when signed into Online Banking or the PNC Mobile App.

If you think someone has used your card without your permission, call PNC immediately at 1-800-558-8472 . Business Credit Card customers can call 1-800-474-2101 .

You can report your card as lost or stolen either through the PNC Mobile App, Online Banking, by calling PNC, or by visiting a local PNC branch .

To report your card as Lost or Stolen in the PNC Mobile App:

- Log in to the PNC Mobile App.

- Tap the menu icon (three lines), then tap Cards .

- Tap Card Actions .

- Tap Report a Card Lost or Stolen and begin filing your report.

To report your card as Lost or Stolen in Online Banking:

- Log in to PNC Online Banking.

- Click the Customer Service tab.

- In the Credit Card Accounts section, select Report Lost or Stolen Card .

- Select the appropriate account to begin filing the report.

How do I request a replacement card if my card is damaged or no longer working?

The easiest way to request a replacement card is either through PNC’s Mobile App or Online Banking.

To request a replacement card in the PNC Mobile App:

- Tap Request a Replacement Card and begin your request.

To request a replacement card in Online Banking:

- Within the Credit Card Accounts section, select Request Replacement Card .

- Select the appropriate account to being your request.

You can also request a replacement card by calling PNC at 1-800-558-8472 . Business Credit Card customers can call 1-800-474-2101 .

How do I make a payment on my credit card?

*Your use of the Voice Banking service, with the entry of your PIN, is your authorization for PNC Bank to initiate a payment via an ACH debit or other electronic entry to the designated account. Your payment cannot be canceled after you have submitted it.

How do I dispute a credit card charge?

If you suspect a charge on your account to be fraudulent, please call PNC immediately at 1-800-558-8472 . Business Credit Card customers can call 1-800-474-2101 .

If you have concerns about an authorized merchant charge on your credit card account, you can dispute the charge either through Online Banking (steps provided below) or by calling PNC.

Note: Please consider contacting the merchant before disputing a merchant charge. Reaching out to the merchant can often result in a quicker resolution and greater clarity into the nature of the transaction.

To dispute an authorized merchant transaction in Online Banking:

- Within the Credit Card Accounts section, select Dispute a Credit Card Transaction .

- Select the account associated with the charge in question and provide information regarding the dispute. Please be prepared to include as much detail as possible about the nature of your transaction.

- Click Send .

How do I activate my credit card?

- Tap the menu icon (three lines), and then tap Cards .

- Tap Activate This Card.

- Tap Begin Activation .

- Log in to Online Banking.

- Navigate to the Account Activity page for your credit card account.

- Click on the Activate Card link.

What do I do if my card has or is about to expire?

Credit cards expire at the end of the month indicated by the expiration date on your credit card. PNC will automatically send you your replacement card approximately 2 weeks in advance of expiration. If you have not received your new credit card before your current credit card expires, please contact PNC at 1-800-558-8472 . Business Credit Card customers can call 1-800-474-2101 . You may not receive a new credit card if your account is not in good standing or is inactive.

How do I request a balance transfer to my PNC credit card?

A balance transfer, as it pertains to your account, is a transaction where all or part of a balance existing with a non-PNC financial institution is transferred to your PNC credit card account. For example, you may want to move a balance from a credit card that has a higher interest rate to your PNC credit card account to take advantage of a lower or introductory interest rate and save money.

Existing PNC credit card customers can transfer a balance to their PNC credit card either through the PNC Mobile App, Online Banking, by calling PNC, or by visiting a local PNC branch . Follow the instructions below to view your eligibility for a balance transfer and to begin transferring a balance. If you decide to transfer a balance, please be prepared to present the account number for the other lender, payment mailing address, and amount to be transferred.

Note: A one-time balance transfer fee is charged for every balance transfer that is processed. The fee is a percentage of the amount transferred or a fixed minimum amount, whichever is greater.

Transfer a balance in the PNC Mobile App:

- Tap Transfer a Balance and begin your transfer.

Transfer a balance in Online Banking:

- Within the Credit Card Accounts section, select Balance Transfer Center .

- Select your offer and begin entering information to initiate the balance transfer.

You can also call PNC at 1-800-558-8472 to inquire about transferring a balance. Business Credit Card customers can call 1-800-474-2101 .

How do I request a credit line increase?

Existing PNC credit card customers can request a credit line increase using the PNC Mobile App or Online Banking.

Request a credit line increase in the PNC Mobile App:

- Tap Manage Credit Limit and begin making your request.

Request a credit line increase in Online Banking:

- Within the Credit Card Accounts section, select Request Credit Limit Change .

- Begin making your request.

You can also request a credit limit increase by visiting a local PNC branch or calling PNC at 1-800-558-8472 .

How can I enroll in paperless statements?

To go paperless and sign up for online-only statements, visit paperless.pnc.com/creditcard or log in to Online Banking and follow the steps below.

To enroll in paperless statements via Online Banking:

- Within the Manage Accounts section, select Activate Online Statements .

- Click Edit under Statement Type to turn off paper statements.

Can I use my card(s) internationally?

You can use your card(s) when traveling internationally. However, before you do, we recommend you notify us before you leave to have a travel notice placed on your account(s).

There are three ways to place a travel notification:

Sign on to Online Banking:

- Navigate to the Debit/ATM Card Services, Credit Card Account Activity, or Customer Service page, and

- Click on the Notify Us of Travel link

Sign into the PNC Mobile Banking app:

- Tap the menu icon (three lines), then tap Cards .

- Tap Card Actions in the bottom of the Cards screen.

- Tap Set a Travel Notification .

Call the phone number found on the back of your card

Be prepared to provide the date(s) you will be traveling, as well as your destination(s).

Note: when using your card(s) internationally, foreign transaction fees may apply.

Assistance while you are traveling

For assistance while traveling internationally: Debit cardholders: call us collect [2] at 412-803-7711 Credit cardholders: call us collect [2] at 412-803-7787

For assistance while traveling within the U.S.: Debit cardholders: call us toll-free at 1-888-762-2265

Credit cardholders: call us toll-free using the following numbers: PNC Premier Traveler Visa Signature credit card: 1-877-588-3602 PNC Premier Traveler Reserve Visa Signature credit card: 1-877-631-8996

All other credit cards: 1-800-282-7541

Business Cards: 1-800-474-2101

View Details of Service Charges and Fees:

Frozen or locked credit - what if i want to apply but my credit is frozen or locked, or my application was declined due to frozen or locked credit.

Before you apply, you’ll need to unfreeze or unlock your credit report with Experian, so we can access your credit bureau information and make a decision on your application.

Follow these steps:

- Visit Experian's Website to see how you can unfreeze or unlock your credit online, by phone, or in writing.

- Unfreeze or unlock your credit report.

- Come back to PNC.com to apply.

How do I enroll in and earn PNC points?

Enrollment for points is automatic. If your account is not enrolled please call the number on the back of your credit card.

How do I establish or modify my credit card cash advance PIN?

To establish, modify, or reset your credit card cash advance PIN:

- Please call 1-855-893-0460 and have your credit card available.

- Remember - Cash advances, including ATM withdrawals, are subject to the cash advance APR and cash advance fee that apply to your account.

Please refer to your credit card agreement for details.

How do I file a claim for a damaged or stolen cell phone?

To learn more about this benefit or to file a claim, go to

www.cardbenefitservices.com

or call 1-866-894-8569 . If you are outside the U.S., you can call collect at 1-303-967-1096 . Certain terms, conditions, and exclusions apply.

For coverage to apply, you must charge your eligible cellular wireless bill to your covered PNC Bank credit card. Please refer to your Guide to Benefits for further details.

I only have a business credit card. Where do I sign on to view my business credit card information?

To view your business credit card(s) online you can either view your account through PNC Online Banking or through Account View.

Why do I have two account numbers for my business credit card account?

When a business credit card is opened, a control account number is established for the business.

The control account is designed to link together all cards issued to authorized users of the company and provide a number where all card transactions are billed. While there is no card issued for the control account, each card issued to authorized users of the company will have its own number.

What are my options if I'm experiencing financial circumstances that are making it hard to make my payment?

Unexpected events may impact your ability to make your monthly payments..

One of the first steps to getting back on track is understanding the range of options available. Let us explore what assistance may be available to you, whether you are experiencing short-term or long-term circumstances. Communicating with us may help your situation.

For hardships, please use our Lending Hardship Service & Support

Home Lending

Can i pay online, yes, we offer options for making your mortgage payment online; simply, go to pnc online banking ..

In Online Banking, select Make a Payment on your account activity screen or go to Transfer Funds and choose Make an Internal Transfer or Loan Payment.

How do I sign up for the Automated Payments Program?

To sign up for our free Automated Payments Program and have your loan payments automatically deducted from your checking or savings account, including accounts at other banks, download the Automated Payment Authorization form.

Automated Payment Authorization Form (Mortgage and Home Equity) – Complete, sign and return this form via mail, fax, or to a branch using the instructions provided on the form.

If you would prefer to have the Automated Payment Authorization form emailed to you so that you may complete and submit the form electronically, please contract our Customer Care Center at 1-888-762-2265 .

Automated Payment set up may take up to ten (10) business days from the date we receive your completed authorization form to process your request. Please continue to make your payments until you receive a confirmation letter with the date that your automated payments will begin.

What is the Bi-Weekly Automated Payment Program?

The PNC Mortgage Bi-Weekly Automated Payment Program automatically withdraws ½ of your mortgage payment directly from your accounts every 2 weeks.

By enrolling in the program you will be making 13 monthly payments per year – instead of 12. This “extra” payment will automatically be applied to your principal balance, paying off your loan faster and reducing the total interest you will pay on your mortgage. The funds from your first ½ payment each month will be held in a non-interest bearing account, and will be applied once a full monthly payment is received.

To learn more about our Bi-Weekly Automated Payment Program, access the Bi-Weekly Automated Payment Authorization form for more details, including FAQs and how to sign up.

Why did my payment change?

An increase or decrease in your payment may be a result of an increase or decrease in your property taxes and/or insurance premiums and may result in an escrow shortage or surplus. An increase or decrease in your taxes may be due to a property reassessment, a change in the tax rate, a change in an exemption or a special assessment.

Will you accept less than the total amount due?

Rather than making a partial payment, please call 1-800-523-8654 to speak to a Customer Service Representative about your options. We may have a program available to you that permits a period of forbearance.

My loan payment is automatically deducted from my account each month. If my monthly payment amount has changed, do I need to do anything to adjust the automated payment to deduct the new amount?

If your payment is automatically deducted from your checking or savings account each month, and you have enrolled in PNC's Automated Payment Program, or PNC's Bi-Weekly Automated Payment Program, the new payment amount will be deducted from your account. There is nothing that you need to do.

If you scheduled your monthly payment to be paid using your bank's online bill payment system, you will need to modify the monthly payment amount with your bank.

If my payment is due on the 1st and I have a 15-day grace period, when would a late charge be assessed?

PNC has different grace periods, but the majority of loans are assessed a late charge on the night of the 16th. Late fees vary in accordance with the mortgage note.

Why did I receive a bill from my taxing authority when PNC Mortgage is supposed to pay the bill for me?

More than likely, this bill is an assessment or supplemental bill. Some taxing authorities will send this type of bill because an additional amount is due that was not assessed at the beginning of the current tax cycle. You may wish to contact your local taxing authority for clarification.

What should I do if I receive a tax bill?

If you have an escrow account for taxes and the regular property tax bill is for the current taxes due, we will obtain the tax bills from the tax collector. You may retain the bill for your records.

If the tax bill is for delinquent taxes due, please call us via 1-800-822-5626 .

Please note, for customers in the states of PA, CA, VA, MD, NJ, ID, IA, ME, and CT: Supplemental, interim and/or special/additional assessment tax is not escrowed. You are responsible for paying these bills. In addition, if you do not have a tax escrow account, you will need to pay the bill prior to the due date.

Please write your loan number on the bill and mail to our Tax Department.

The mailing address is:

PA Customers: Tax Department-0046586 PO Box 9220 Coppell, TX 75019

NON-PA Customers: PNC Financial Services PO Box 9042 Coppell, TX 75019

If there is a shortage in my escrow account, what should I do?

You may pay the shortage from your escrow analysis statement through our online banking, by calling our customer care team, or visiting your local branch. Upon receipt of the escrow payment shortage, we will adjust your payment to reflect the lower payment amount. If you choose not to pay the shortage, the shortage will be divided by 12 and spread over the next 12 months payments, interest free. In either case, your mortgage payment will be adjusted to reflect the new amount.

Can PNC Mortgage provide me with information concerning why there were changes in my tax payments, special assessments, or insurance premiums?

PNC can assist you with information pertaining to your mortgage. However, we do not have access to information regarding why your taxes, insurance or special assessments have changed. Please contact your local tax office or your insurance agent for further assistance.

How can I delete PMI?

Single family dwelling mortgage loans secured by a primary residence and closed after July 29, 1999 are covered under the Homeowner’s Protection Act of 1998 (HOPA). The Act gives customers the right to request PMI deletion once the Loan to Value (LTV) ratio reaches 80%. This will automatically take effect once it’s scheduled to reach 78%. If you feel your loan qualifies for PMI deletion, please send a written request to the PNC Bank ISAOA ATIMA address listed below so your request can be reviewed accordingly. PMI deletion requires a good pay history: no payment may be 30 or more days late in the past 12 months, and no payment may be more than 60 or more days late in the past 24 months. You may be responsible for the costs of an appraisal.

PNC Bank Attention: PMI Department B6-YM13-01-5 PO Box 8736 Dayton, OH 45401-8736

How do I find information about servicemember benefits I may be eligible for?

The Servicemembers Civil Relief Act (SCRA) provides financial relief and protections to eligible servicemembers and their dependents. PNC is grateful for your service and we would like to help you understand your benefits and protections under SCRA as well as other similar benefits that PNC may be able to provide to you.

To find out more, please contact us at:

- Phone: 844-PNC-SCRA ( 844-762-7272 )

- Email: [email protected]

- Fax: 855-568-4532

PNC Bank Servicemembers Operations Center, BR-YB58-01-U PO Box 5570 Cleveland, OH 44101-0570

My loan was recently transferred to PNC Mortgage from my previous lender. How do I submit my monthly payment?

For your convenience, PNC offers a variety of methods for submitting your monthly mortgage payments. Visit our Payment Options page to learn more about your payment options.

Is my loan eligible for a Principal Reduction Modification?

To find out if your loan is eligible, call us at 1-800-822-5626 and ask for our Special Loans Department. Please note, your loan must be at least 6 months old to be considered for a Modification.

Do I have to carry Flood Insurance?

If your property lies within a FEMA defined Special Flood Hazard Area ( SFHA),and in a community participating in the National Flood Insurance Program (NFIP) Flood Zone "A" or "V", federal law requires you to maintain and provide proof of flood insurance coverage. If there are any changes in your flood zone, PNC Mortgage will notify you by mail.

Other Loans

Where can i find my payoff information, you can review your payoff information for your loan through online banking. once you have signed onto online banking:.

- Select your loan account from the “My Accounts Summary” page.

- You will be sent to your Account Activity page.

- From your Account Activity page, you should find information regarding your loan payoff. There are some circumstances where payoff information will not be displayed. For those types of accounts, you will be directed to call us at 1-888-762-2265 .

I see an unfamiliar charge on my statement, how can I get more information?

If you see an unfamiliar charge on your statement or within Online Banking, please call us at 1-888-762-2265 .

My line of credit draw period will be expiring soon, what are the terms of my repayment?

You can find the terms of your repayment in your original note listed under the repayment terms section. If you have additional questions, please contact us at 1-888-762-2265 . For information about refinancing, please contact us at 1-877-487-3420.

What are the different ways I can make a payment on my loan?

You can make a payment on your loan several different ways:.

- The Transfer Funds tab, or

- Online Bill Pay through the Pay Bills tab.

- You can make a payment over the phone.

- You can mail a check or money order, or

- You can have it automatically withdrawn using our Automated Payment Program and payments will be withdrawn from your designated checking or savings account.

How do I enroll in the Automated Payment Program?

You can enroll in our automated payment program by downloading the automated payment authorization form provided through online banking, by calling us at 1-888-762-2265 , or by visiting your local branch., to enroll through online banking:.

- Select your loan that needs to be set up with an Automated Payment Program from the “My Accounts Summary” page.

- Navigate to the “Maintenance” tab on the right side of the page and click on it.

- Click Download form link under Automated Payment Authorization .

- Print, complete, and sign the form. Return the form to us by mail, fax, or to a branch following the instructions provided on the form.

Automated payment set up may take up to ten (10) business days from the date we receive your completed authorization form to process your request. Please continue to make your payments until you receive a confirmation letter with the date that your automated payments will begin.

My automated payment is due to draw from my checking or savings account, and I will not have the funds available. Is there a way to stop the automated payment?

You can request to suspend or cancel your automated payment as long as your contact us at least three (3) business days before your next payment due date. Please call us at 1-888-PNC-BANK (1-888-762-2265) or visit the nearest PNC Branch.

Suspending your automated payment is a temporary option which will allow you to stop your automated payment for one month. You are still responsible for making your payment on time to avoid late fees. When you suspend your automated payment, you must make your monthly payment manually to keep your account current and allow automated payments to resume the next month.

If you chose to cancel your automated payment service, you will be responsible for making on-time payments once the automated payment has been removed from your account. Any applicable interest rate discount for automated payments will be lost, which means that your monthly payment may increase since additional interest would be charged.

Where can I find my full account number?

Look on the detachable portion of your statement or coupon that you would return with a payment by mail. Your account number will be displayed there.

Am I able to view or print my 1098 online?

Your IRS 1098 Form for any interest paid the prior year is postmarked and mailed to you by January 31st. It is not available to view online. Should you require a copy, please call 1-888-762-2265 or visit a branch after February 10th to request a copy from the prior year.

Important Legal Disclosures & Information

PNC does not charge a fee for the Mobile Banking service. However, a supported mobile device is needed to use Mobile Banking. Also, your wireless carrier may charge you for data usage. Check with your wireless carrier for details regarding your specific wireless plan and any data usage charges that may apply. PNC products, services and prices are subject to change.

Check with your phone service provider for specific international calling instructions, rates and charges that may apply. Collect calling availability varies by country and may require a local operator.

The $5 annual fee for every Heart Design Visa ® Debit Card is donated to the American Red Cross. The American Red Cross name is a registered trademark owned by the American National Red Cross and is used with its permission.

The Contactless Indicator mark, consisting of four graduating arcs, and the Contactless Symbol are trademarks owned by and used with permission of EMVCo, LLC.

Bank deposit products and services provided by PNC Bank, National Association. Member FDIC .

Virtual Wallet is a registered mark of The PNC Financial Services Group, Inc.

Visa is a registered trademark of Visa International Service Association and used under license.

PNC is a registered mark of The PNC Financial Services Group, Inc.

Read a summary of privacy rights for California residents which outlines the types of information we collect, and how and why we use that information.

- SMALL BUSINESS

- CORPORATE & INSTITUTIONAL

- Accessible Banking

- Locate ATM/Branch

- Mobile Apps Directory

- Diversity & Inclusion

- Corporate Responsibility

- Terms & Conditions

- Cookie Preferences

- Do Not Sell or Share My Personal Information

The PNC Financial Services Group, Inc. All rights reserved.

The World’s Best Bank Accounts for International Travelers and Nomads

Updated: Feb 12, 2024 • by Thomas K. Running

Did you know that every time you swipe your card in a foreign country, your bank is charging you exorbitant fees and giving you a terrible exchange rate? Yet, you can save thousands every year by choosing the right bank.

If you travel abroad for a week or two per year, 3–5% in various foreign transaction fees and bad exchange rates for international card use is not really a big problem. But as a frequent traveler or digital nomad spending most of your time abroad, these fees add up quickly. In fact, you might be donating hundreds or even thousands of dollars yearly to your bank. I’m sure you could think of a better way to spend that money.

Table of Contents ↺ Nomad friendly banks available globally Wise Nomad friendly banks in Europe N26 Tomorrow Bunq Monzo Revolut Nomad friendly banks in North America Charles Schwab Bank Nomad friendly banks in Oceania HSBC Everyday Global Account Citibank ING Orange Everyday Other nomad friendly banks? Transferring money between banks

But what if I told you that there are banks out there that charge no monthly fees, 0% foreign transaction fees, 0% currency exchange markup, 0% ATM withdrawal fees and even refund fees imposed by ATM owners worldwide? Sounds like some sort of black magic right? Well, it’s not. I spent countless hours finding the best banks for nomads in North America, Europe, and Oceania, so you don’t have to. Read on to learn more about these incredible banks and how you can open an account with them today.

Update: In this article you’ll find personal bank accounts. If you’re a freelancer or business owner, don’t miss my article on the best business bank accounts you can open remotely . 🕴

Nomad friendly banks available globally

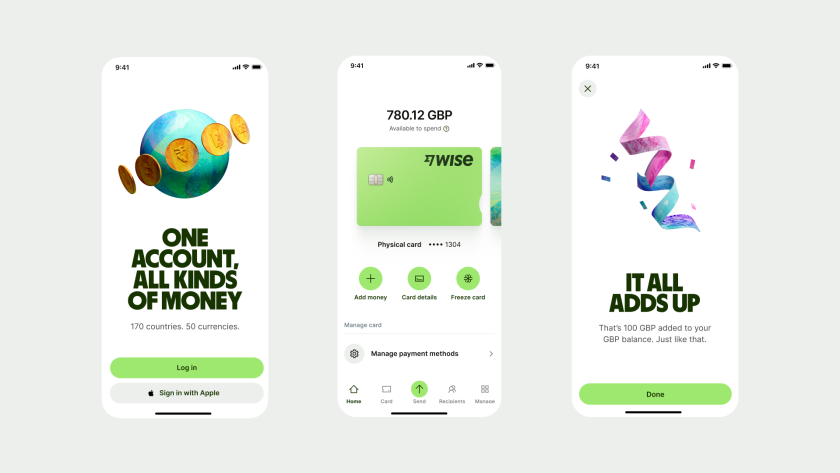

Wise, formerly Transferwise, is one of the biggest names in global fintech and international banking. Wise allows you to hold money in over 50 different currencies, and is probably the banking product that comes closest to offering a truly global service, earning it this special mention.

There are only about a dozen countries or so where you cannot use Wise at all (e.g. for cheap international money transfers), and only a few more where you cannot get their free borderless multi-currency accounts.

In many countries, you also get access to the Wise debit card which comes with some of the most competitively low fees for international spending.

Personally, the feature I like the most with Wise is that they provide you with local banking details in a range of countries (e.g. in Europe, US, Australia, Singapore and many more) making it easy to receive payments from clients or friends located all across the world without any extra charges or delays.

Another thing I especially like about Wise is that they have always been completely transparent about the low fees they do charge, including how much go to cover their direct costs as well as how much goes to improve their product. Unlike competitors who initially launched with too-good-to-be-true pricing which soon thereafter gets jacked up (classic bait-and-switch), Wise has tirelessly worked on improving their cost structure leading to even lower fees over time.

Wise at a glance

Things to note, nomad friendly banks in europe, n26 (eur — eu/eea: 🇩🇪🇦🇹🇪🇸🇮🇹🇮🇪🇸🇰🇬🇷🇫🇷🇧🇪🇪🇪🇫🇮🇱🇻🇱🇹🇱🇺🇳🇱🇵🇹🇸🇮🇳🇴🇸🇪🇩🇰🇮🇸🇵🇱🇱🇮).

My favorite bank in Europe is definitely N26 . By now it’s one of the most mature of the user-friendly and innovative challenger or neo-banks that have revolutionized the European banking market in the last few years.

Having started out in Germany, N26’s EUR account is now available in most of Europe. Since late 2018, N26’s EUR accounts are also available to residents of Norway, Sweden, Denmark, Poland, Iceland, and Liechtenstein.

But don’t worry if you’re not currently in Europe, dear nomad friends. One of the best things about N26 is that you can open an account from anywhere in about 5 minutes . You just need your smartphone, an internet connection, and your ID.

(If you’re unsure about the process, just read my article on how to open an N26 account remotely )

You’ll still need a delivery address in Europe (specifically in Austria, Belgium, Denmark, Estonia , Finland, France, Germany, Greece, Iceland, Ireland, Italy, Liechtenstein, Luxembourg, the Netherlands, Norway, Poland, Portugal , Slovakia, Slovenia, Spain, Sweden, or Switzerland). If you’re not currently in any of those countries, don’t worry. As a global-minded citizen, I’m sure you can make some European friends that will allow to you use their address as a C/O address to open the account. You can easily change the address after receiving the card.

N26 is now offering a few different plans, but the free Standard plan is probably still the best bet for most—unless you can take advantage of the excellent travel insurance included with the paid plans. That’s the case if you’re mostly based in a European country and often make trips abroad of up to three months at a time.

N26 You (€9.90/mo) and N26 Metal accounts (€16.90/mo) give you medical, trip cancellation, luggage, winter sports, and even car sharing, e-scooter, and e-bikes hires covered for damages. N26 Metal plan also adds car rental insurance and phone insurance (up to €2,000 for theft and damage).

If you don’t need the travel insurance, but want a free physical card and like to use subaccounts for better budgeting and saving—their Smart plan (€4.90/mo) could be best for you.

N26 at a glance

* They add a low 1.7% exchange fee for ATM withdrawals only in non-EUR currencies for the Standard and the Smart plan. That’s still much lower than the competition (typically 2-5% on all foreign spend, including point-of-sale).

Tomorrow (EUR — EU/EEA: 🇩🇪🇦🇹🇮🇹🇪🇸)

Tomorrow is a German banking product focusing on sustainability, so a perfect option for nomads and other travelers who are concerned about their environmental footprint .

Although they are currently only available in Germany, Austria, Italy, and Spain, they make it easy to send, receive and withdraw money all around the world. For every 5 euros that you pay with your Tomorrow Visa card, they will restore one “wheelbarrow” full of healthy habitat.

With any money that you deposit, they will only use it to invest in renewable and sustainable products or resources.

They have three plans all at a monthly fee:

Now – at €3/month, with withdrawals costing €2 (but no additional fees on foreign exchange).

Change - at €7/month, with 5 free monthly withdrawals, optional shared account and no additional foreign exchange fees.

Zero – €15/month, a wooden card with unlimited withdrawals and no additional foreign exchange fees.

From 1st March 2024, the prices for the plans will be €4, €8 and €17, respectively.

Tomorrow at a glance

Dutch bank Bunq is a mobile only bank that offers both personal accounts and business accounts .

They offer many features with their personal accounts, including the option to have a shared account with a partner, an IBAN in either Germany, Netherlands, Spain, France or Ireland (or multiple IBANs in their more premium plans), and the possibility for a Maestro Card (particularly useful in Central Europe and the Netherlands).

While they do have a free version, it is quite limited and doesn’t come with a debit card, so the best option would be €2.99 a month for their “Easy Bank” plan.

To add 22 different currencies and investment features, you can upgrade to “Easy Money” for €8.99 per month, or €17.99 a month for “Easy Green”, which allows you to offset your CO2 emissions, similar to Tomorrow .

Bunq at a glance

Monzo (gbp — uk 🇬🇧).

This fast-growing challenger bank is the closest thing to N26 in the UK. You get a free current account and debit card, a user-friendly app which makes it easy to stay on top of your spending, and just a few, low fees.

A Monzo Plus account costing £5/month adds credit score tracker and fee-free withdrawals abroad up to a certain limit—among other features. Monzo Premium costing £15/month also includes travel insurance, phone insurance, and discounted access to airport lounges.

The account is easily opened through their mobile app (including ID verification), and the debit card can be sent to any UK address.

Monzo at a glance

This is a competitor to Wise that many people have probably already heard about. They got quite famous in nomad circles in the middle of 2010s when they launched with free unlimited currency conversion, free international money transfers, and free instant top-ups from debit and credit cards.

But these perks are no more.

Now you can only exchange up to £1,000 per month for free, all international transfers are paid, even on the Premium and Metal plans, and only non-commercial cards issued in the EU can be used for free top-ups.

While Revolut was initially available worldwide, they had to scale back to just the EU/EEA, though they have now added back support for a handful non-European countries, though usually with limited services.

The thing you’ll notice as you start using Revolut is that pretty much all their features has one or several asterisks attached to them, such as:

- Free currency conversion (including international card spend) not being available for all currencies, nor on the weekends, nor for large amounts.

- Or that their travel insurance you get with their Premium account which advertises cover for your whole family only really includes your kids (under 18), not your spouse.

- Or that the 1% cashback on all your non-EU purchases for those splurging for the Metal plan is capped at what you pay for the plan—so it’s essentially just a discount, not a cashback.

That said, while they are no longer a clear winner on price, their app is probably the most feature-packed of all the big fintechs, including budgeting features, microsavings, investments, etc.

Revolut may also add value if you are a freelancer, sole trader, contractor, and self-employed in some other way, as they now have a Revolut Pro. This is essentially the same as Revolut Business, but can be accessed through their personal account app instead, to make things easier for solo business owners.

Revolut at a glance

Honorable mentions.

- Monese (GBP & EUR — UK 🇬🇧): Free to use globally, but with certain limits. Affordable upgrade in case you’re a big international spender or need more than €/£200 in monthly ATM withdrawals. The EU customers can have EUR (Belgium) and RON accounts, and the UK customers can open these plus GBP accounts.

- DKB (EUR — Germany 🇩🇪): Similar fee structure to N26, but I personally found their support to be quite hard to work with as a non-German speaker (insisting that you email them in German, not English for example, else refusing to respond). Could be a good option for Germans still.

Wise (formerly TransferWise) —the global, multi-currency account 🌍🚀 This isn’t your run-of-the-mill bank account. It’s worthy of a special mention because it’s a fantastic product for those of us that earn and spend in several currencies. You’ll get local bank details in the United Kingdom 🇬🇧 (GBP), the Eurozone 🇪🇺 (Belgium or Germany—EUR), the United States 🇺🇸 (USD), Australia 🇦🇺 (AUD), New Zealand 🇳🇿 (NZD), Canada 🇨🇦 (CAD), Hungary 🇭🇺 (HUF), Romania 🇷🇴 (RON), Singapore 🇸🇬 (SGD), and Turkey 🇹🇷 (TRY), which makes it easy to get paid from all over the world. Pair that with a free debit card that can be used worldwide with very low fees, and the fact that it’s available to residents of most countries, and you have yourself a winner. They offer both personal and business accounts . Open Wise account

Nomad friendly banks in North America

Charles schwab bank (usd — united states 🇺🇸).

By far my favorite bank for nomads in the US, and perhaps even in the world. Pretty much anything is free, from all card usage globally to unlimited free checks (if you still use those). They even refund you unlimited amounts of ATM fees imposed by ATM owners worldwide.

The only thing that leaves me wanting a bit more is their online banking solution and mobile apps. They have improved a lot in since I first started recommending Schwab, but I will still only characterize them as OK. Then again, most US banks suck in this area.

Like most US banks it also requires you to be a US resident. But as long as you keep a US address on file, they assume you are living there. If you don’t have a US address while traveling or living abroad, your account might be subject to closure. A mail scanning and forwarding service that offer street addresses (not P.O. boxes) can take care of this for a low monthly fee.

Charles Schwab at a glance

* You will be charged Visa’s official rate , which is pretty darn close to the mid-market rate.

Capital One 360 (USD — United States 🇺🇸): Quite similar benefits compared with Charles Schwab, but does not refund your ATM fees.

STACK (CAD — Canada 🇨🇦) : While not technically a bank, this prepaid Mastercard is the only Canadian option with no FX fees, no ATM fees, and no monthly fees. Highly recommended for Canadians who travel abroad!

Do you know any nomad friendly banks in Canada? Let me know , so I can add them here!

Nomad friendly banks in Oceania

Hsbc everyday global account (aud + 9 more — australia 🇦🇺).

Launched in the spring of 2018, the HSBC Everyday Global Account is the first Australian multi-currency travel card and bank account without foreign transaction fees or “criminal” exchange rates.

Australian residents can apply to open an account online. Non-residents can try to apply through a branch, but you may not be accepted.

HSBC Global at a glance

Ing orange everyday (aud-australia 🇦🇺).

Another recent contender in Australia, ING now refunds ATM fees (charged by the ATM owner) worldwide with their Orange Everyday account , as long as you meet the following two conditions:

- Receive at least $1,000 in your account every month

- Make at least 5 card purchases per month

The downside is that if you don’t meet the requirements, you don’t only miss out on the refunds, but you’re also charged a $5 international ATM fee, plus a 3% foreign transaction fee for both purchases and withdrawals.

Highlights 🌟

- No monthly/yearly costs

- No set-up cost

- No ATM fees worldwide*

- No foreign transaction fees*

- No currency exchange markup**

* Only if you meet the $1,000 deposit + 5 card transaction requirement in the preceding month. ** You will be charged Visa’s official rate , which is pretty darn close to the mid-market rate.

Special thanks to Chloe R for the tip!

Open ING Orange Everyday account

- Wise (formerly TransferWise Borderless) (NZD, AUD, EUR, GBP, USD + dozens more—Australia 🇦🇺 & New Zealand 🇳🇿): As previously mentioned , this is a fantastic product that give you local bank details in 10 countries (including Australia and New Zealand), and let you hold several dozens more currencies. You can convert between currencies at some of the best rates in the market, and you get a free debit card that makes spending around the world a breeze.

- Air NZ OneSmart (NZD, AUD, SGD, HKD, JPY, GBP, EUR, CAD, USD—New Zealand 🇳🇿): This innovative prepaid card offer 3 free international ATM withdrawals per calendar month, and can hold a variety of different currencies. If you are in a country with one of the supported currencies, this card can be a good option. If you need to use the card for transactions in unsupported currencies, there is a 2.5% fee. There is now also a $1 monthly fee.

Other nomad friendly banks?

I have included all the nomad friendly banks I came across in my research, but if I missed a bank in your country please let me know , so I can update the article!

If you’re not able to open accounts with any of the banks listed in this article, check if there’s a bank in the Global ATM Alliance in your country. These banks usually waive any fees when you use your card in a partner bank’s ATM. Note that they often still charge foreign transaction fees of up to 3%.

Another alternative can be using a bank with a significant global presence, such as HSBC bank , and as much as possible use their ATMs abroad. Yet, tracking down the few ATMs you can use fee-free in a particular city can be quite impractical.

Transferring money between banks

If you successfully open one of the bank accounts that I’ve listed above, you might wonder how you can fund your account if your current account is in a different country. Usually, the fastest and easiest way is to use Wise (formerly TransferWise) and is what I would recommend in most cases. Even if your bank supports international transfers, you’ll most likely get a terrible exchange rate, plus loads of fees—especially if the transfer goes via the SWIFT network.

I hope this article was helpful! If you have any questions, please post them in the comments below. If you know of any other nomad-friendly banks, please send me a tip ! 🙌

Get free access to our community & exclusive content.

Don't worry, I won't spam you. You'll select your newsletter preference in the next step. Privacy policy .

Read this next

How to open an n26 bank account—from anywhere, the best business bank accounts to open from anywhere, my top resources for nomads, travelers, & expats, portugal golden visa guide: pros & cons in 2024, the world's best travel insurance for long-term travelers, the ultimate retirement savings guide for expats & nomads.

Get answers to all of your questions in the Nomad Gate community!

Join the most active community for DNs, PTs, online business owners, freelancers, expats and travelers.

Join for free

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

5 Best Banks for International Travel

Ruth Sarreal is a content management specialist covering consumer banking topics at NerdWallet. She has over a decade of experience writing and editing for consumer websites. She previously edited content on personal finance topics at GOBankingRates. Her work has been featured by Nasdaq, MSN, TheStreet and Yahoo Finance.

Yuliya Goldshteyn is a former banking editor at NerdWallet. She previously worked as an editor, a writer and a research analyst in industries ranging from health care to market research. She earned a bachelor's degree in history from the University of California, Berkeley and a master's degree in social sciences from the University of Chicago, with a focus on Soviet cultural history. She is based in Portland, Oregon.

Spencer Tierney is a consumer banking writer at NerdWallet. He has covered personal finance since 2013, with a focus on certificates of deposit and other banking-related topics. His work has been featured by The Washington Post, USA Today, The Associated Press and the Los Angeles Times, among others. He is based in Oakland, California.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Using the right bank can save you money when traveling abroad. When researching the best banks for international travel, features we considered included:

Low wire transfer charges.

Decent currency conversion rates.

International ATM fee reimbursement.

Foreign currency delivery to your home.

Here are our favorite banks for international travel.

Charles Schwab Bank: Best for using ATMs.

Capital One 360: Best on foreign transaction fees.

HSBC Bank: Best for expats with high balances.

Citibank: Best for wiring money.

Revolut: Best for nonbank multicurrency account.

Why you can trust NerdWallet: Our writers and editors follow strict editorial guidelines to make sure our coverage is fair and accurate, so you can choose the financial accounts that work best for you. See our criteria for evaluating banks and credit unions .

Best Banks for International Travel

Our pick for

Schwab Bank

Why We Like It

Schwab Bank customers who use the Investor Checking Account get fees refunded from any ATM in the world. That kind of perk is usually only available for premium checking accounts at other banks.

Plus, the bank doesn't charge foreign transaction fees.

Pros: - Refunds on all ATM fees worldwide. - No foreign transaction fees. - Account earns interest. - No minimum balance requirement and no monthly fee. - Free travel and emergency assistance services, including emergency messaging, medical and legal referrals, emergency translation and lost luggage location.

Cons: - Checking account must be linked to a Schwab One brokerage account (but the account doesn’t have a minimum balance requirement).

Foreign transaction fees

Capital One

Though it’s not the only bank that doesn’t ding you for international purchases, Capital One 360 is a NerdWallet favorite because its fees are low across the board.

Capital One 360 doesn’t charge a foreign transaction fee for using your debit card outside the U.S. or for any transactions made in a foreign currency. If you want to use cash, the bank won’t charge you a fee for taking money out at an ATM (but it also won’t refund you if the ATM owner charges you a fee).

In comparison, many banks charge special fees when you make purchases abroad, or even if you buy something online from a retailer based outside the U.S.

Pros: - No foreign transaction fees. - No ATM fees. - No monthly maintenance fees.

Cons: - No refunds for fees charged by ATM owner.

Expats with high balances

In the U.S., HSBC only offers premium accounts that require a high balance to open. But for those who can swing the balance, this bank can be handy while living abroad. A few features make this bank handy for expats or frequent globetrotters: The bank doesn’t charge foreign transaction fees on debit card purchases; it lets depositors monitor and move money between HSBC accounts in multiple countries; and if you lose your wallet while traveling, you can access up to $10,000 in emergency cash.

Pros: - Can access up to $10,000 in emergency cash in U.S. dollars or local currency if you lose your wallet while traveling. - No foreign transaction fee on debit card purchases. - Account holders can receive international wire transfers for free.

Cons: - In the U.S., HSBC only offers premium accounts with high minimum balance requirements. - Outgoing international wire transfers may come with a fee if the receiving account is not also an HSBC Premier account holder. - Mobile apps are poorly rated.

Wiring money

Citibank, N.A.

While many banks offer customers a way to send remittances directly without going through a third-party wire transfer service, few do it as elegantly as Citibank, which offers free international transfers to other Citi accounts through the Citibank Global Transfers service.

Plus, if you need cash while you’re abroad, Citibank offers free withdrawals at its ATMs in more than 20 countries. And if you often find yourself in a hurry before a trip with too much to do, the bank will deliver foreign currency by the next business day to a Citibank branch, your home or office.

Pros: - Foreign currency delivery before a trip. - Free international transfers to other Citi accounts. - Citibank ATMs available in more than 20 countries.

Cons: - Non-premium accounts are subject to out-of-network ATM fees from the ATM owner. - If you need to wire money internationally to someone who doesn’t have a Citibank account, the fee could be as high as $35.

Nonbank multicurrency account

The Revolut account lets you hold and send money in more than 28 currencies and uses a real-time exchange rate. Exchanges done in the app, exchanges for a transfer and exchanges for a payment use the same rates. One catch is that Revolut will charge an exchange fee for transactions on the weekends.

Pros: - Can withdraw up to $400, $800 or $1,200 fee-free per month at out-of-network ATMs, depending on your plan. - Can hold and send money in more than 28 currencies. - Account earns interest.

Cons: - Foreign currency exchanges made on the weekends incur a fee. - Premium accounts have a monthly fee of about $10-$17, which can’t be waived.

More top choices for best banks for international travel

BECU: No foreign transaction fee ( read full review ).

Axos Bank: ATM foreign currency conversion fee reimbursements with World Checking account ( read full review ).

Navy Federal Credit Union: Branches in just under 10 foreign countries ( read full review ).

Varo: No foreign transaction fee ( read full review ).

Wise (formerly TransferWise): Multicurrency account with a debit card that doesn’t charge foreign transaction fees ( read full review ).

More strategies to keep banking costs down while traveling

Using money abroad can incur costs, but switching banks isn’t your only way to avoid them. Here’s a breakdown of different approaches and accounts to consider:

When spending money abroad:

Try a multicurrency account : Spend and hold different currencies in one account. This option is usually best if you live or work outside the U.S. for extended periods. Two mainstream providers are the financial tech firms Wise and Revolut .

Find a credit card with no foreign transaction fees : For everyday purchases when you can use physical cards or mobile wallets, a travel-friendly credit card can be useful.

When dealing with cash abroad:

Use a debit card with no foreign transaction or ATM fees : This is especially good for cash withdrawals, especially in countries where cash is heavily used. Generally, these debit cards, and the checking accounts they’re connected to, don’t have foreign transaction fees either.

Take advantage of currency exchange services from your bank : For cash you’ll bring on your next trip, see if your bank or credit union has this service since it’s cheaper than using kiosks at the airport.

When sending money abroad:

Consider nonbank money transfers : If you're sending a wire overseas while still in the U.S., companies such as Wise and OFX offer stand-alone transfers internationally that have competitive rates and low to no fees.

When managing wealth abroad:

Look into private banking : Private banking offers a personalized experience for high-net-worth individuals, which can include overseas considerations.

Open an offshore bank account : If you need help managing international business or investments, or if you'll be traveling long term, consider the merits of an offshore bank account.

Last updated on November 15, 2023

Methodology

We took a close look at over 90 financial institutions and financial service providers, including the largest U.S. banks based on assets, internet search traffic and other factors; the nation’s largest credit unions, based on assets and membership; and other notable and/or emerging players in the industry. We rated them on criteria including annual percentage yields, minimum balances, fees, digital experience and more.

Financial institutions and providers surveyed are: Affirm , All America Bank , Alliant Credit Union , Ally Bank , Amalgamated Bank , America First Credit Union , American Express National Bank , Andrews Federal Credit Union , Associated Bank , Axos Bank , Bank of America , Bank5 Connect , Bank7 , Barclays , Bask Bank , Bethpage Federal Credit Union , BMO , BMO Alto , Boeing Employees Credit Union , Bread Savings , BrioDirect , Capital One , Carver Federal Savings Bank , Charles Schwab Bank , Chase , Chime , CIBC U.S. , CIT Bank , Citibank , Citizens , Citizens Bank , City First Bank , Climate First Bank , Commerce Bank , Community First Credit Union of Florida , ConnectOne Bank , Connexus Credit Union , Consumers Credit Union , Current , Delta Community Credit Union , Discover Bank , E*TRADE , EverBank (formerly TIAA Bank) , Fifth Third Bank , First Foundation , First National Bank , First Tech Federal Credit Union , Flagstar Bank , FNBO Direct , Global Credit Union , GO2bank , Golden 1 Credit Union , Greenwood , Hope Credit Union , Huntington Bank , Industrial Bank , Ivy Bank , KeyBank , Lake Michigan Credit Union , LendingClub Bank , Liberty Bank , Live Oak Bank , M&T Bank , Marcus by Goldman Sachs , Navy Federal Credit Union , NBKC , One , OneUnited Bank , Pentagon Federal Credit Union , PNC , Popular Direct , Quontic Bank , Regions Bank , Revolut , Salem Five Direct , Sallie Mae Bank , Santander Bank , SchoolsFirst Federal Credit Union , Security Service Federal Credit Union , Securityplus Federal Credit Union , Self-Help Credit Union , Service Credit Union , SoFi , State Employees’ Credit Union of North Carolina , Suncoast Credit Union , Synchrony Bank , TAB Bank , TD Bank , Truist Bank , U.S. Bank , UFB Direct , Upgrade , USAA Bank , Varo , Vio Bank , Wells Fargo and Zynlo Bank .

How we rate banks and credit unions

To recap our selections...

NerdWallet's Best Banks for International Travel

- Schwab Bank : Best for Using ATMs

- Capital One : Best for Foreign transaction fees

- HSBC : Best for Expats with high balances

- Citibank, N.A. : Best for Wiring money

- Revolut : Best for Nonbank multicurrency account

Frequently asked questions

Banks that don’t make it expensive for you to use your debit card when you’re out of the country are best for international travelers.

Here are NerdWallet’s picks for best banks for international travel :

Some banks offer international bank accounts that U.S. citizens can open. International bank accounts generally require a high minimum balance.

Some banks allow you to make purchases and perform other transactions in other countries without charging a fee. Banks that don’t charge foreign transaction fees include Capital One 360, Discover Bank, HSBC Bank and Schwab Bank.

IMAGES

VIDEO

COMMENTS

Exchange currency, send money overseas, receive money from foreign countries and learn the exchange rate for debit cards — all from PNC Bank.

We asked Buxton and two other PNC experts, senior line of business risk specialist Beverly Bauer and physical intelligence team security lead Eric Gumbert, for their advice and tips to help travelers stay safe and enjoy …

The good news is that PNC offers several cards that are accepted worldwide, making it easy to access your funds while traveling. However, there are some important things …

You can use your card(s) when traveling internationally. However, before you do, we recommend you notify us before you leave to have a travel notice placed on your account(s). There are three ways to place a travel notification: Sign on …

You can notify PNC Bank of your travel plans by calling customer service, logging in to your online banking account, using the PNC Bank mobile app, or sending a letter to the bank. PNC …

If you travel abroad for a week or two per year, 3–5% in various foreign transaction fees and bad exchange rates for international card use is not really a big problem. But as a frequent traveler or digital nomad spending …

To let PNC know you’re traveling, you can call 1-800-762-2265, log in to your online account, or use the PNC mobile app. When you let PNC know you’re traveling, you should provide your …

The best banks for international travel make it easy to access and manage your money from anywhere in the world. And they do so without charging you an arm and a leg in extra fees.

NerdWallet's Best Banks for International Travel. Schwab Bank: Best for Using ATMs; Capital One: Best for Foreign transaction fees; HSBC: Best for Expats with high balances