- Travel Insurance

Bupa Travel Insurance Review

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

Updated: Aug 8, 2023, 1:29pm

Bupa is a well-known name in the Australian insurance scene, and its travel insurance option is no different. With no age limit on policies and unlimited medical cover (including dental), Bupa comprehensive travel insurance is a responsible choice for all types of trips and travellers. Bupa offers three kinds of coverage: comprehensive, essentials and domestic. This review focuses on the comprehensive policy.

- Unlimited medical, hospital and dental cover

- No maximum age limit

- All pre-existing conditions need to be assessed to determine if they will be covered

- Reviews state lengthy waits for claim payments

Table of Contents

About bupa travel insurance, what is covered, who should take out this insurance.

Featured Partners

Fast Cover Travel Insurance

On Fast Cover’s Secure Website

Medical cover

Unlimited, 24/7 Emergency Assistance

Cancellations

Unlimited, (Trip Disruption $50,000)

Key Features

25-Day Cooling Off Period, Australian Based Call Centre, 4.6 Star Product Review Rating

Cover-More Travel Insurance

On Cover-more’s secure website

Unlimited, with a $2000 limit to dental

Yes, amount chosen by customer

Bupa Travel Insurance is underwritten by Allianz Australia Insurance Ltd, and the policy is very similar to the Allianz Comprehensive Travel Insurance offering. The travel insurance policy offered to Australians by Bupa is via Bupa Asia Pacific, a part of the global Bupa Group.

Along with travel insurance, Bupa also offers Australians health insurance, car insurance, home insurance, pet insurance, landlord insurance, valuables insurance, among others.

In relation to its Bupa travel insurance policy, which is analysed in detail below, customers have rated the policy 3.9 stars out of 5 from 138 reviews via Australia’s independent consumer opinion site, ProductReview.

Bupa offers its comprehensive travel insurance policy to all Australians, with no age limits in place for travellers wishing to take out their comprehensive option, although pre-existing medical conditions require assessment before being covered. The lack of an age limit is particularly helpful to senior travellers as well as families, especially considering that dependent children are included in the policy up to the age of 25–provided they are not in full time employment and will be travelling with you 100% of the time.

In terms of financial cover, Bupa covers credit card fraud up to $5,000, while personal liability is covered up to $5 million.

Delays and missed connections are an inevitable risk of travel, which is why Bupa’s travel delay cover includes coverage for missed connections: for delays of more than six hours there is $250 per person allocation and a further $250 for each additional 24-hour period after the initial six hours. The delay cover, however, is limited at $2,000 total for all travellers on the policy, and maximum per person of $500 after the initial six-hour delay.

When taking out your Bupa Travel Insurance policy, travellers can also opt for cancellation cover, with the amount chosen by the customer.

Lost luggage

Bupa’s comprehensive travel insurance policy includes lost luggage cover up to $10,000, however, sub limits apply for certain items. Policyholders do have the option to increase item limits for high value items if required. Check the pds for further details.

The last thing you want to think about on a trip is having to access medical services, but it’s important for Australians heading overseas to ensure this is included on a travel insurance policy for peace of mind.

Bupa covers overseas medical and hospital expenses, so you will not be out of pocket if you need to access medical care while abroad. If you have a pre-existing condition, however, you will need to be assessed by Bupa prior to your trip to determine if they can be covered with the policy.

Is dental cover included in medical?

Yes, Bupa does include dental within its unlimited medical and hospital expenses cover. A lot of insurance providers don’t choose to include dental within medical cover, so it is a benefit of Bupa’s policy.

Does it Cover Me for Covid?

Yes, Bupa’s travel insurance includes covid cover under its medical expenses. In terms of cancellations, these are only covered due to Covid-19 if the trip cancellation is due to a government-enforced border closure or if the policyholder has to complete quarantine due to Covid.

What about Pregnancy?

If you’re pregnant while travelling, you’re going to want to ensure your travel insurance policy covers pregnancy. With Bupa, you are covered until week 24 of your pregnancy, provided that you do not have complications with the pregnancy or a history of complications.

This cover is included under the unlimited medical expenses, however, childbirth is not covered.

What about Sports and Activities?

When taking out Bupa’s travel insurance, there are 38 activities automatically included in your plan. These include golfing, river cruising, gymnastics and more. Certain conditions apply to these automatic inclusions, such as safety provisions and terrain restrictions (or claims made would be void).

In addition to the 38 included activities, policyholders can also add on activity packs to suit their trip type for an additional cost.

These are packs that cover activities designated for ‘adventure’, such as for cave tubing and rock climbing, ‘cruise’ for those going on a multi-day cruising holiday, and a ‘snow’ pack to cover certain winter sports.

Similar to the automatically included activities, certain restrictions apply to the purchase of the additional packs. Failing to meet these requirements could result in your claims being void, which is why it is essential to read your policy’s product disclosure statement.

Customer service

Bupa offers its customers 24/7 emergency assistance with Australian based doctors and nurses, so you can receive trusted medical guidance at any time while on your holiday.

For non-medical enquiries, Bupa has a separate contact telephone number and a call back option for those calling out of hours. Further, Bupa also has a WhatsApp channel which customers can use to get in touch with the Bupa customer service team while travelling.

Bupa has made the process of making claims easier for its customers, by allowing claims to be made online via the myBupa app (available on both iOS and Android, and via web browser).

Thanks to the well-known name and the non-existent age limit when taking out a policy, Bupa’s travel insurance is well suited to a wide variety of Australian families going on holidays together. This is especially true as children up to 25 years of age are included on the policy at no extra charge, pending the meeting of certain conditions. In any case, before you take out this insurance, Forbes Advisor recommends you read the product disclosure statement carefully so you can understand the various sub-limits and exclusions.

Frequently Asked Questions (FAQs)

Is there a discount for bupa travel insurance.

While there is no automatic discount for Bupa travel insurance, pre-existing customers of Bupa (such as those with an active health insurance policy) can get 15% off their premiums.

Does Bupa Travel Insurance cover COVID?

Yes, Bupa Travel Insurance covers COVID-19 as a medical condition under its unlimited medical and hospital cover. It also covers trip cancellations caused by Covid, on the basis that there are government enforced border closures or the traveller is required to quarantine.

How do I make a claim with Bupa Travel Insurance?

Claims can be made via the myBupa app on your mobile or webpage. You can also call the 24/7 Australian-based customer service team to submit a claim over the phone on 1300 992 694.

Sophie Venz is an experienced editor and features reporter, and has previously worked in the small business and start-up reporting space. Previously the Associate Editor of SmartCompany, Sophie has worked closely with finance experts and columnists around Australia and internationally.

- Best Comprehensive Travel Insurance

- Best Seniors Travel Insurance

- Best Cruise Travel Insurance

- Best Domestic Travel Insurance

- Travel Insurance Cost

- Pregnancy Travel Insurance Guide

- Travel Insurance For Bali

- Travel Insurance For Fiji

- Travel Insurance For The USA

- Travel Insurance For Thailand

- Travel Insurance For New Zealand

- Travel Insurance For Japan

- Travel Insurance For Europe

More from

Tick travel insurance top cover review: pros and cons, was discovery travel insurance review: features, pros and cons, fast cover comprehensive travel insurance review: pros and cons, our pick of the best domestic travel insurance for australians, travel insurance for indonesia: everything you need to know, travel insurance for singapore: the complete guide.

- About GeoBlue

- Why GeoBlue?

GeoBlue Solutions:

For Individuals

For Employers

For Academic Institutions

- For Members

- For Brokers

- For Providers

- Privacy Policy

- Terms & Conditions

- Blue Cross Blue Shield Global

- Bupa Global

Pushing the Boundaries: Health Insurance Considerations in the New World of Work-From-Anywhere

Celebrating 25 years of supporting the globally mobile, global telemd tm a simple way for our members to get remote access to care, anywhere in the world., geoblue. trusted provider of health insurance coverage and technology-smart solutions that help world travelers stay safe and healthy wherever they roam., when your company is globally mobile, geoblue solutions keep world-class healthcare at hand., geoblue provides the healthcare protection you need to make the world your classroom., when you travel, work or live outside the u.s., geoblue keeps you connected to world-class care., geoblue has an elite network of doctors from almost every specialty ready to meet with members in over 180 countries. allow us to introduce a few.

1 2 3 4 5 6 7 8

GeoBlue has been awarded full URAC Health Utilization Management (HUM) accreditation URAC accredited Read more »

Beware of check fraud scams beware of check fraud scams read more », do you have what it takes to be a world leader do you have read more », telehealth service available to members telehealth service read more », selecting the right international health insurance coverage is easy with geoblue..

Even when you travel alone, we're there for you every step of the way. Learn More

We'll care for your employees as if they were our own. Learn More

Students and staff abroad will feel right at home with us by their side. Learn More

More than 25 years as a leader in international healthcare.

We provide peace of mind for the globally mobile through sample a robust physician and hospital network, innovative digital tools and world-class member service. Learn more about GeoBlue

Offering world-class solutions for the globally mobile.

We offer a wide range of compliant health insurance solutions to meet the unique needs of employees, students or travelers, giving them confidence that they can access quality care wherever and whenever they need it through best-in-class networks, an integrated service experience and industry-leading digital tools. Learn more about what makes GeoBlue different

STRONGEST GLOBAL NETWORKS

EXCEPTIONAL SERVICE

WORLD-CLASS HEALTHCARE

Life is too hectic. See how GeoBlue is further simplifying access to healthcare for members.

- Car Finance

- Hire Purchase

- Novated Leasing

- Bad Credit Car Loans

- Car Loan Refinance

- Business Car Loans

- Australian Car Statistics

- Car Loan Repayments Calculator

- Compare Car Loans

- Average Car Loan Interest Rates

- How Much Can I Borrow?

- How to Get a Car Loan?

- Caravan Loans

- Motorbike Loans

- Jet Ski Loans

- Camper Trailer Loans

- Loans for Harley-Davidson

- Boat Loan Calculator

- Caravan Buying Checklist

- How to Choose a Motorbike?

- Top Tips to Choose a Right Boat

- Equipment Finance

- Chattel Mortgage

- Truck Finance

- Aircraft Finance

- Technology Finance

- Agriculture Finance

- Plant & Machinery Finance

- Operating Lease

- Unsecured Personal Loans

- Low-interest Personal Loans

- Debt Consolidation Loans

- Travel Loans

- Wedding Loans

- Bad Credit Loans

- Compare Personal Loans

- Personal Loan Calculator

- Personal Loans Eligibility

- Unsecured Business Loans

- Small Business Loans

- Invoice Financing

- Business Overdrafts

- Cashflow Lending

- Small Business Start-up Loans

- Compare Business Loans

- Business Loan Interest Rates

- First Home Buyers

- Buy Next Home

- Investment Home Loans

- Home Loan Refinance

- Bad Credit Home Loans

- Self Employed

- Construction Home Loans

- Compare Home Loans

- How to Choose a Home Loan?

- Home Loan Repayments Calculator

- Borrowing Power Calculator

- Balance Transfer

- Frequent Flyer

- No Annual Fee

- Master Card vs Visa Card

- Maximise Credit Reward Points

- Perks of Using a Credit Card

- Manage Your Debt with a Balance Transfer Card

- Small Personal Loan

- Quick Cash Loan

- Rental Bond Loan

- Car Repair Loan

- Furniture Loan

- Emergency Loan

- Rent Arrears Loan

- Bank Accounts

- Savings Accounts

- Term Deposits

- Business Bank Accounts

- Debit Cards

- Kids Savings Accounts

- Margin Loans

- Travel Money Cards

- Best International Money Transfers

- Send Money to India

- Send Money to USA

- Send Money to New Zealand

- Send Money to UK

- Send Money to Canada

- Superannuation

- Compare Super Funds

- Cryptocurrency

- Share Trading

- Forex Trading

- CFD Trading

- Comprehensive Car Insurance

- Third Party Fire and Theft Car Insurance

- Third Party Property Damage Car Insurance

- CTP Insurance

- Classic Car Insurance

- Car Insurance for Young Drivers

- Seniors Car Insurance

- How Do I Compare Car Insurance?

- How Much is Car Insurance?

- Types of Car Insurance in Australia

- Market Value Vs Agreed Value

- Car Insurance with Choice of Repairer

- Landlord Insurance

- Building Insurance

- Flood Insurance

- Contents Insurance

- Best Home Insurance

- Cheapest Home Insurance

- Professional Indemnity Insurance

- Public Liability Insurance

- Product Liability Insurance

- Domestic Travel Insurance

- Cruise Travel Insurance

- Single Trip Travel Insurance

- Seniors Travel Insurance

- Best Travel Insurance

- Cheap Travel Insurance

- Travel Insurance for Pre-Existing Conditions

- What Does Travel Insurance Cover?

- Why Do I Need Travel Insurance?

- Travel Insurance COVID-19

- Seniors Funeral Insurance

- Hospital Cover

- Extras Only Cover

- Singles Cover

- Couples Cover

- Family Health Insurance Cover

- Overseas Visitors Health Insurance Cover

- Health Insurance for Seniors

- Cheap Health Insurance

- Income Protection

- Personal Accident Insurance

- Trauma Insurance

- TPD Insurance

- Funeral Insurance

- Seniors Pet Insurance

- Cheap Pet Insurance

- Best Pet Insurance

- Electricity Plans

- Compare Electricity Plans

- Compare Gas Plans

- Solar Electricity Plans

- Green Energy Plans

- ADSL Broadband Plans

- Mobile Broadband

- Home Wireless Broadband Plans

- Internet Providers

- Best Broadband Deals

- Prepaid Plans

- iPhone Plans

- Unlimited Data Plans

- SIM-Only Plans

- Unlimited Data for Mobile Phones

- Travel Insurance for Mobile Phone

- Customer Reviews

Home > Travel Insurance > Bupa Travel Insurance Review

Bupa Travel Insurance Review

Learn more about Bupa’s travel insurance policies to find out about their coverage and fees and compare them with other insurers today.

Fact checked

One of the world’s leading providers of insurance, Bupa offers its almost 40 million global customers protection for their health, home, and travel arrangements. In Australia, the company has about 4.7 million customers and is underwritten by CGU Insurance.

Savvy can help you compare Bupa's plans with those of other insurers in the market so you can find the best travel insurance for your next trip. You'll be able to compare everything from benefit caps to deductibles to coverage details.

Find out more about their services here before getting a quote with us today.

*Please note that Savvy does not represent Bupa for its travel insurance products.

More about Bupa travel insurance

What travel insurance policies does bupa offer.

Bupa offers four travel insurance policies, which include:

- Overseas Comprehensive: this comprehensive travel insurance policy covers you for overseas medical expenses, urgent dental work, loss of luggage and personal liability. You’re also insured against unexpectedly needing to cancel your global holiday, as long as your reason for doing so is among those covered.

- Overseas Essentials: this streamlined policy provides you with coverage for the basics including overseas dental and hospital treatment, personal liability, cancellation, and personal liability. The key difference with this policy compared to the comprehensive option is the claim limits are considerably lower.

- Domestic: Bupa offers a domestic travel insurance policy which provides you with cover for your luggage and personal items, trip delays or unexpected delays and personal liability. You may also be covered for the excess on a rental car. This domestic travel insurance is also open to seniors.

- Annual Multi-Trip Insurance: this multi-trip policy is tailored to those taking several holidays across the year. Bupa allows you to take an unlimited number of journeys over 12 months, but they individually can’t exceed 45 days. The benefits are the same as the comprehensive or domestic travel insurance policies.

However, no matter if you’re taking a holiday to the UK or just touring Australia, it’s a good idea to compare with Savvy so you can find the best travel insurance for your holiday.

What optional extras are available through Bupa?

Bupa, like many other travel insurance companies, provides optional extras for both international and domestic getaways. These include:

- Skiing and snowboarding: taking a European holiday to carve up the slopes? Bupa requires you to take out extra coverage for an additional premium so you’re covered for a range of winter sports , including skiing, snowboarding, tobogganing or tubing. This add-on covers you for emergency assistance, damage to your equipment and costs of hiring equipment.

- Adventure: deep sea fishing, caving, quad bike riding, outdoor rock climbing and motorcycles/mopeds are all covered under this extra coverage, which is available to anyone under the age of 75.

- Cruises: if you’re booked to take an international or domestic cruise, you’ll need to purchase additional coverage if you’re going with Bupa. This cover protects you from medical costs onboard the ship, ship-to-shore evacuation, cabin confinement and cancellations.

- Valuables: this optional extra allows you to increase the cover limit or expensive items you’re going to take on holiday with you. These can include cameras, camera equipment, jewellery, camping equipment or sunglasses.

What exclusions should I be aware of when buying travel insurance through Bupa?

It’s important to remember that even the most comprehensive policy draws a line at coverage in some unforeseen circumstances. As such, Bupa has a range of exclusions, including:

- Flying on a privately-chartered plane

- Taking part in a competitive sport

- Treatment for an unapproved pre-existing medical condition

- Elective surgeries

- Accidents caused by intentionally putting yourself at risk

- Knowingly travelling to a dangerous location

- Any incident that occurs while you’re driving solo

- Travelling against medical advice

If you’ve found a policy that catches your eye, make sure you review the Product Disclosure Statement (PDS) before you set your decision in stone.

What we think of Bupa travel insurance

What we like, flexible cancellation limits.

As is the case with some big-name insurers, you’re able to set your own cancellation limit on your travel insurance policy.

Discounts for health insurance members

By entering your Bupa membership number when you purchase a travel insurance policy, you can receive a 15% discount.

24/7 support

You can rest easy knowing that Bupa is available around the clock, seven days a week, should you ever find yourself in a bind when travelling abroad.

What we don't like

Pay extra for cruise cover.

Whether you’re cruising in Australian waters or setting sail around the UK, you will need to pay extra for cruise cover. Many big-name insurers offer this coverage automatically.

Modest travel delay coverage

Bupa offers a coverage limit of about $2,000 if your mode of transport is delayed. However, these limits are lower than some of their competitors.

Tough pre-existing condition requirements

Bupa's travel insurance plans automatically cover specific forms of diabetes and asthma. Still, if you have a more serious illness, like a heart problem, you need to see a doctor and get a medical assessment to be covered.

Types of travel insurance

International.

International travel insurance can offer cover for a range of events, including medical expenses, lost luggage or items, cancellation fees and more when you're overseas and a long way from home.

If you're journeying within Australia, domestic policies are designed to offer many of the same protections as international travel insurance (with the exception of medical expenses).

Single trip

The most standard and common type of travel insurance, this policy can cover you for one trip starting and ending in Australia (and is available for both international and domestic travel).

Annual multi-trip

As the name suggests, this type of travel insurance covers multiple trips over a 12-month period. Depending on your insurer, you may be able to take an unlimited number of trips up to 90 days each.

You don't have to have a return ticket booked to take out cover while you're overseas. One-way travel insurance enables you to access cover without a set end date, such as if you're moving temporarily.

You may need to take out specialist coverage if you're setting sail on a cruise. Fortunately, cruise insurance can cover emergency evacuation, cabin confinement and more.

Just because you're older doesn't mean travel insurance isn't still important. If you qualify for cover, seniors' travel insurance can offer greater peace of mind for included events while you're travelling.

Adding winter sports or ski cover to your policy can add protection against damage to your equipment, piste closure due to bad weather and activities such as back-country skiing, heliskiing and more.

Adventure sports

Looking to enjoy some adventure sports on holiday? An adventure sports pack can grant you cover for a range of activities, such as hiking, scuba diving and motorcycle or scooter riding.

Jetsetting with the whole clan in tow? Some insurers offer family travel insurance, which enables you to include yourself, your partner and your dependent children under one policy to help you save.

If you're travelling interstate or overseas with your partner (or simply another friend or family member), you may be able to access a discount by taking out a joint or duo travel insurance policy.

Why compare travel insurance with Savvy?

Reputable insurance partners, fast and convenient online process.

You can complete the quote, comparison and purchase process online through Savvy quickly and easily.

Competitive quote costs

Regardless of the type of insurance you’re looking for, we can help you compare between competitive quotes.

Frequently asked questions about Bupa travel insurance

Yes – depending on the policy you choose, Bupa may allow you to get a full or partial refund if your travel plans are derailed because of a positive COVID-19 diagnosis , resulting in having to quarantine or accruing overseas medical expenses. In some cases, you may be covered if your travel plans are impacted by government-enforced border closures.

If something goes wrong while you’re on holiday, you can make a claim 24/7 through Bupa’s website. This involves completing an online claim form and providing ample detail about the incident and evidence through medical or police reports and receipts. Once you’ve filed your claim, Bupa’s website states it can take up to ten days for claims to be processed. They also advise that you must submit a claim within 30 days of the incident you’re claiming.

The cost of travel insurance premiums vary from one person to the next based on several factors, including:

- Your date of birth

- Your chosen destination

- The level of coverage you buy

- Any optional extras you need

- Pre-existing medical conditions you need to disclose

- The policy excess you choose

- The type of insurer and insurance policy you buy

You may take many trips within a year with yearly multi-trip travel insurance (often up to 60 travel days per trip), but you can only take one trip out and back with a single-trip policy. A one-way travel insurance coverage covers you for the duration of your trip, up to a year, but only if you are taking a single flight without a return date set in stone. Coverage may often be extended for another year.

More travel insurance reviews

CHI Travel Insurance Review

Learn more about CHI’s travel insurance to find out about their coverage and fees and compare them with other insurers …

RACT Travel Insurance Review

Read Savvy’s review of RACT’s travel insurance offers to find out about their overseas coverage and fees and compare them …

CFMEU Travel Insurance Review

Learn more about CFMEU’s travel insurance policies to find out about their coverage and fees and compare them with other …

Real Insurance Travel Insurance Review

Learn more about Real Insurance’s travel policies to find out about their coverage and fees and compare them with other …

Australian Unity Travel Insurance Review

Learn more about Australian Unity’s travel insurance policies to find out about their coverage and fees and compare them with …

COTA Travel Insurance Review

Learn more about COTA’s travel insurance policies to find out about their coverage and fees and compare them with other …

Helpful travel insurance guides

Travel Insurance for Heart Conditions

Looking for travel insurance that covers heart conditions? Compare with Savvy to help you get the cover you need today....

Best Travel Insurance for Cruises

If you’re chasing travel insurance for your next cruise, compare with Savvy and get the best policy today. Compare Travel...

Best Multi-Trip Travel Insurance Australia

Compare your multi-trip travel insurance options with Savvy to help you find the best. Compare Travel Insurance Quotes in 30...

Travel Insurance for Expats

Are you an Australian expatriate chasing travel insurance back home? Compare with Savvy and find the best policy. Compare Travel...

Cheap Travel Insurance For Seniors

Compare travel insurance for seniors with Savvy to help you find the cheapest. Compare Travel Insurance Quotes in 30 Seconds...

Best Travel Insurance for Seniors

Make the most of your next holiday. Compare with Savvy and find the best seniors travel insurance today. Compare Travel...

What is a Travel Insurance Excess?

Find out what a travel insurance excess is and how you should compare them here. Compare Travel Insurance Quotes in...

Benefits of Travel Insurance

Understand more about the benefits of travel insurance by comparing your options with Savvy. Compare Travel Insurance Quotes in 30...

What is Travel Insurance?

Compare with Savvy and find out more about what travel insurance is today. Compare Travel Insurance Quotes in 30 Seconds...

Optional Cover Travel Insurance

Explore the many optional extras travel insurance offers by comparing with Savvy. Compare Travel Insurance Quotes in 30 Seconds Get...

Explore your travel insurance options for your next destination

Travel Insurance for New Zealand

Travel Insurance for Abu Dhabi

Travel Insurance for Italy

Travel Insurance for Bangladesh

Travel Insurance for Sri Lanka

Travel Insurance for Taiwan

Travel Insurance for Costa Rica

Travel Insurance for Thailand

Travel Insurance for Egypt

Travel Insurance for Fiji

Travel Insurance for Singapore

Travel Insurance for Oman

Travel Insurance for the Himalayas

Travel Insurance for Malta

Travel Insurance for Hungary

Travel Insurance for the UK

Travel Insurance for Hong Kong

Travel Insurance for India

Travel Insurance for Nepal

Travel Insurance for Dublin

Travel Insurance for Bangkok

Travel Insurance for Lebanon

Travel Insurance for Ireland

Travel Insurance for Kenya

Travel Insurance for America

Travel Insurance for the Philippines

Travel Insurance for Amsterdam

Travel Insurance for the Middle East

Travel Insurance for Las Vegas

Travel Insurance for Ghana

- Giving Back

- Partner with us

- Privacy Policy

- Terms of Use

- Credit Guide

- How We Handle Complaints

- Scam and Fraud Warning

- Comparison Rate Warning

1300 974 066

Sign up to our newsletter.

Quantum Savvy Pty Ltd (ABN 78 660 493 194) trades as Savvy and operates as an Authorised Credit Representative 541339 of Australian Credit Licence 414426 (AFAS Group Pty Ltd, ABN 12 134 138 686). We are one of Australia’s leading financial comparison sites and have been helping Australians make savvy decisions when it comes to their money for over a decade.

We’re partnered with lenders, insurers and other financial institutions who compensate us for business initiated through our website. We earn a commission each time a customer chooses or buys a product advertised on our site, which you can find out more about here , as well as in our credit guide for asset finance. It’s also crucial to read the terms and conditions, Product Disclosure Statement (PDS) or credit guide of our partners before signing up for your chosen product. However, the compensation we receive doesn’t impact the content written and published on our website, as our writing team exercises full editorial independence.

For more information about us and how we conduct our business, you can read our privacy policy and terms of use .

© Copyright 2024 Quantum Savvy Pty Ltd T/as Savvy. All Rights Reserved.

Thanks for your enquiry!

Our consultant will get in touch with you shortly to discuss your finance options.

We'd love to chat, how can we help?

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance for Visiting the U.S.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Travel insurance basics

Best visitors insurance policies, for the lowest price: trawick international, for customizing options: worldtrips, for pre-existing conditions: worldtrips, for highest medical coverage limit: img, other options to consider, the bottom line.

Since health care can be expensive in the U.S., it’s important that visitors have insurance coverage, aka visitors insurance or travel medical insurance, in case something happens that requires medical attention mid-trip.

Whether you have coverage for travel in the U.S. depends on your health care plan in your home country. But if you don't, you'll need to buy a policy from a third-party insurance provider. Several companies sell this kind of visitor insurance, and each company and policy is a bit different. Let’s look at which is best for you.

First, a few basics about visitor insurance. Two kinds are available: travel medical insurance and trip insurance.

Travel medical insurance covers medical expenses that you may incur while traveling internationally, like a visit to the doctor, a trip to the hospital and medical evacuation and repatriation.

Trip insurance usually covers limited medical expenses like emergency care and can compensate you if your trip is delayed, you need to leave the trip early or you have to cancel the trip. It is designed to help you protect the investment you’re making as you prepare to travel.

Standard trip insurance might not cover a visit to the doctor unless it is an emergency.

It’s important to make sure any pre-existing conditions are covered if the visitor has any. Some policies exclude them.

» Learn more: How to find the best travel insurance

With so many kinds of visitors insurance policies, which is the best?

To make comparisons, we got quotes from several companies using Squaremouth , a website to search for different types of travel insurance in one place.

The parameters we set are for a 49-year-old citizen and resident of Spain traveling to the U.S. on May 1-31, 2024.

The quotes don't include cancellation coverage; these examples are for medical coverage only. To get a quote, the hypothetical deposit for the trip was paid on Feb. 15.

Since we’re looking for a policy that will cover medical care for visitors, there are several medical filters to select: emergency medical ($100,000 or more), medical evacuation ($100,000 or more) and coverage for pre-existing medical conditions.

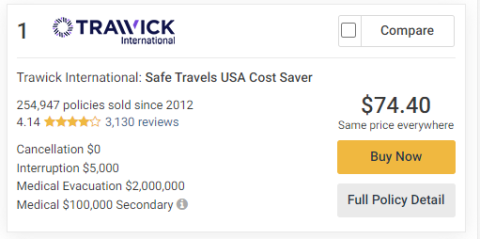

The search came up with nine results ranging in price from $74.40 to $179.18.

The policy with the lowest cost was the Trawick International 's Safe Travels USA Cost Saver at $74.40.

Trawick policies use the FirstHealth PPO network.

The policy as quoted has a $250 deductible and includes $100,000 in emergency medical, $2 million in medical evacuation and $5,000 in interruption coverage. It has limited coverage for pre-existing conditions.

It is possible to change the deductible to as little as $0 or raise it to $5,000.

The same company has another policy, the Trawick International Safe Travels USA Comprehensive policy, that is better at covering pre-existing conditions and costs a little more — $89.59.

The general coverage is the same as the less expensive policy, and the Safe Travels USA Comprehensive option adds coverage for acute onset of a pre-existing condition. it is possible to change the deductible amount to $0 or go up to $5,000.

» Learn more: The best travel credit cards right now

Some policies are sold as is, while others allow some flexibility depending on what is important to you.

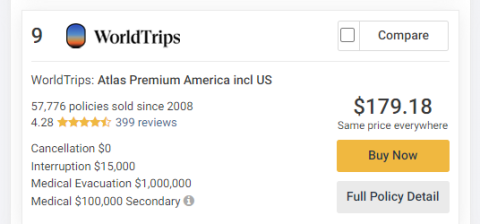

The WorldTrips Atlas Premium America policy for $179.18 allows a lot of customization.

It was also the most expensive of the nine policies Squaremouth suggested.

It’s possible to customize the emergency medical coverage and pre-existing condition coverage and medical deductible. The policy also includes $15,000 in trip interruption coverage, the highest of any of the nine policies available.

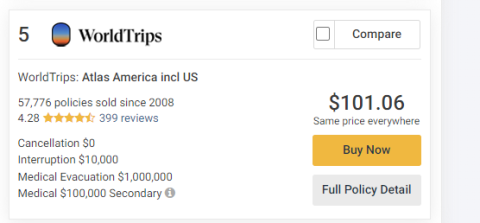

If the traveler has a pre-existing condition, policies from WorldTrips Atlas America are your best bet. The WorldTrips Atlas America policy in our comparison costs $101.06.

The policy as quoted covers $100,000 in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence of a pre-existing condition.

The deductible is also available for customization from $0 to $5,000.

The PPO network for Atlas America Insurance is United Healthcare.

The WorldTrips Atlas Premium America policy mentioned above is also good for pre-existing condition coverage.

While eight of the nine policies had $100,000 in secondary medical coverage, one had a limit of $2 million.

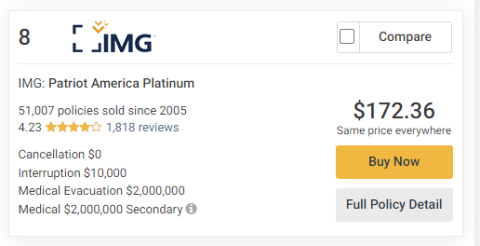

The IMG Patriot America Platinum policy has a premium of $172.36 along with a high medical evacuation limit of $2 million and interruption coverage of $10,000.

If $2 million in medical coverage is not enough, it’s possible to increase that amount to an $8 million policy limit.

It’s not possible to change the level of coverage for preexisting conditions from the high $1 million limit in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence.

It is possible to change the deductible from $0 all the way up to $25,000.

Our comparison also included policies from two additional companies, Seven Corners and Global Underwriters .

Seven Corners had two policies come up in the results, the Seven Corners Travel Medical Basic for $98.27 and the Seven Corners Travel Medical Choice policy for $136.71. Both of the Seven Corners policies include coverage for hurricane and weather, and the less expensive policy covers acts of terrorism.

Having insurance to cover unexpected medical expenses for anyone visiting the U.S. can be a smart money move.

An illness or accident could cause financial problems for visitors because of potentially having to pay for full health care costs. When planning your travel, be sure to check your current health insurance to find out if it will cover you in the U.S.

For a monthlong stay in the U.S., the lowest-priced visitors insurance policy was around $75 (Trawick International Safe Travels USA Cost Saver) and the highest was about $180 (WorldTrips Atlas Premium America). That’s about $2.42 or $5.81 a day, depending on the policy.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Why Travel Insurance?

Got Questions? Ask us!

Quick buttons, insurance plans, free quotation, email [email protected].

WhatsApp +65 9175 6942

Phone Number +65 6551 2861

404 Not found

Get your Travel Insurance today

By clicking Get Started, you authorize Niva Bupa to call/SMS on your registered mobile number and also consent to override your existing registry in DNCR. Further, you agree to get quote and policy details on WhatsApp.

Trip Cancellation

Coverage for financial loss incurred due to cancellation of trip before its onset

Emergency in-patient Medical treatment

Covered up to sum snsured

Destination Specific Plans

Separate plans for Asia Pacific region, Europe, USA & Canada and worldwide

Hospital daily cash allowance

Up to $50/day

Download Resources

Travelassure brochure.

Download the brochure to understand TravelAssure better

TravelAssure Policy Wordings

Find out all you need to know about the plan here

TravelAssure Claim Form

Download the form to make a hassle-free claim

TravelAssure Application Form

Download the form to avail the services of any of our network hospitals

What is Travel Insurance?

Travel insurance is a type of insurance that is custom-made for people going on domestic and international travels. It addresses the various risks that one may face during travels, including hospitalisation, medical expenses, loss of luggage or documents, cancellation or disruption of flights, and various other costs. Travel insurance covers you from the date of departure till your arrival back at the place of origin. For frequent fliers, a travel plan that remains effective for a certain period is more suitable as it covers multiple travels during the policy period.

How to Buy Travel Insurance Plan?

You can buy a travel insurance policy online or by visiting the insurer’s office. While applying online, you need to fill in the basic details like dates of travel, traveler details, coverage required, etc. Then you receive the quote, based on which you can select the travel insurance policy that suits your requirement. There are different types of travel plans customized for different travel needs. These include corporate, single, family, senior citizen, or student travel plans. You can purchase a travel plan that suits you the best. You can also buy travel insurance plans from insurance brokers and agents. However, ensure that they are licensed by the Insurance Regulatory and Development Authority of India. It is worth noting that you may be eligible for discounts if you buy a travel insurance plan online directly from the insurer.

When to Buy Travel Insurance?

If you plan to embark on multiple trips, you should buy a travel plan in advance to cover all the upcoming trips. Even in the case of a single trip, buying a travel plan in advance is advisable. Typically, it could be on the date of booking the tickets or a few days after that. You can also buy travel plans at the last minute. But you may miss out on crucial coverages. For instance, travel insurance offers cancellation coverage. But you will miss out on the same if the cancellation happens before the policy start date. In other words, buy your travel insurance well in advance to avail all benefits.

Why Buy Travel Insurance Policy?

Some of the common reasons that make a travel insurance important are:

- People are more prone to medical problems in a foreign land, be it within India or overseas, due to changes in food habits and environmental reasons.

- Travel insurance helps tackle such circumstances with ease.It protects in case of baggage losses at airports and theft or travel scams in many tourist destinations.

- Travel insurance protects the policyholder in the event of flight delay or cancellation. It protects you in the event of natural calamities, man-made disasters, flight hijacking, etc. Student travelers can also opt for study interruption coverage in their travel plans.

- Travel insurance may cover fatalities and repatriation of mortal remains.

- Travel insurance is a mandatory requirement in more than 30 countries. It is a prerequisite for visa processing while travelling to these countries.

Who Should Buy a Travel Insurance Plan?

While it is mandatory to have travel insurance before visiting certain countries, people travelling to any country, in general, should buy a travel insurance plan. Along with, it is advisable for the following travelers to buy a travel insurance plan: Individual travelers and families Senior citizens - because of their higher medical susceptibility Corporate travelers can cover their travel risks while travelling on behalf of their organization Students can buy student-specific travel plans with longer validity People travelling in groups can insist on the purchase of travel insurance by their tour organizer Domestic travelers can buy travel plans designed to cover travel risks within the country

Advantages/Benefits of Niva Bupa's Travel Insurance Policy

Some of the reasons why you should choose Niva Bupa's Travel Insurance Policy are:

- Coverage: Extensive coverage including in-patient hospitalisation, OPD treatment, trip cancellation, loss or delay of luggage, medical evacuation, loss of passport, missing a connecting flight, etc.

- Pre-existing Diseases: Up to 100% coverage of pre-existing diseases under the emergency in-patient medical cover for students traveling abroad for education on a student visa.

- Medical Check: No requirement for pre-policy medical check-ups.

- Claims: You can enjoy a hassle-free claim process.

- COVID-19: Coverage for hospitalisation due to COVID-19 provided up to the sum assured.

- Sum Assured: Total coverage of up to USD 250,000

Get the most value from TravelAssure

Extension of the Policy Period for a Single Trip Policy

In order to extend the policy, policyholders can apply for an extension by contacting Niva Bupa’s customer care center or online by paying their premium and submitting all the required documents. This must be done before the policy expires. Once our team has verified the information, they will grant permission for an extension. Customers can also extend the geographical coverage of their policy by paying an extra premium.

Contact Details for extending coverage

Niva Bupa Health Insurance Contact No: 1860-500-8888; Fax No.: 011-30902010 Customer Service Portal - Insta Assist (https://rules.nivabupa.com/customer-service/)

Types of Travel Insurance Plans in India

There are various types of travel insurance plans offered by insurers in India:

- Basic Travel Policy: These plans cover basic travel risks that most insurers provide. The premium amount is comparatively low due to the limited coverage.

- Comprehensive Travel Policy: Comprehensive plans offer a host of optional covers, like medical expenses or repatriation of mortal remains, many insurers may not provide. etc. Notably, Niva Bupa Travel Insurance offers over 40 travel-related covers, including the ones mentioned above.

- Single Trip: One-time travelers can buy this policy before or after booking their tickets. This policy remains applicable for the duration of that trip.

- Multi-trip: If the policy buyer has several trips planned for the year, they can opt for a multi-trip policy that offers coverage for a specific period instead of the trip duration. Frequent fliers opt for this plan to avoid buying plans repeatedly.

- Student: Students can buy a travel plan that offers coverage for the study duration. Covers like sponsor protection and study interruption can be opted for to make the plan more student-friendly.

- Policy buyers can opt for a single, family, group, or any other plan as per their requirements.

Eligibility Criteria for Travel Insurance

The various eligibility criteria for Niva Bupa Health Insurance's TravelAssure plan include:

- Adults should be between the age of 18 and 70

- Dependent children can be up to the age of 25

- Travelers must possess and furnish mandatory documents like copies of passport, visa, income proof, and other relevant papers

Considerations Before Buying Travel Insurance Policy

Some of the factors that you need to consider before buying a travel insurance policy are:

- Duration: If you are planning to travel again, it is advisable to opt for a long duration multi-trip travel insurance plan. If your single trip is for a longer duration, the premium will be higher, so plan your trip accordingly.

- Nature of the Trip: Choose the plan as per the nature of your trip. Someone planning to do sky diving would have different optional covers compared to someone travelling to attend business meetings.

- Sum Assured: Estimate your travel risk and finalize your sum assured accordingly. The higher the sum assured, the higher will be the premium.

- Optional Covers: Go through the list of covers available and select judiciously. Selecting unnecessary covers will only escalate the premium.

- Exclusions: There may be specified circumstances or conditions where the travel insurance is not applicable. Always familiarize yourself with the exclusions before buying the travel plan.

COVID-19 Coverage

Due to the global scale of the COVID-19 pandemic, most leading insurance companies offer COVID-19 specific coverages in their travel plans. Niva Bupa TravelAssure provides COVID-19 hospitalisation coverage up to the sum assured. Accordingly, if you are infected or test positive for COVID-19 during your overseas stay, the travel insurance plan will bear the cost of your treatment and hospitalisation. In almost all countries, a COVID-19 infection leads to the applicability of strict isolation rules and gets addressed as per their SOP when detected. Therefore, adequate COVID-19 coverage can be handy in times of need.

Frequently Asked Questions

Does travelassure plan provide coverage against covid 19, is there any tax benfit that one can avail while purchasing travel insurance, is a medical check-up necessary before buying this policy, is it mandatory to buy travel insurance for visa, how to extend international travel insurance policy, can you buy travel insurance after booking your trip, can i buy insurance if i am going on a work permit abroad, can i file a claim after getting back to india, what are the age criteria for which you issue a travel insurance policy online in india, how to file for a claim for international travel insurance, how to claim travel insurance, when, where, and how to choose travel insurance plan, how to calculate travel insurance premium, how to compare travel insurance premium, countries where travel insurance is necessary/mandatory.

Insurance Plans

- Health Insurance Plans

- Individual Health Insurance Plans

- Family Health Insurance Plans

- Critical Illness Insurance Plans

- Personal Accident Insurance Plans

- Mediclaim Policy

- Travel Insurance

- Best Health Insurance for Senior Citizens

- Niva Bupa Store Locator

- Empower Health Plan

- SurroGuard Health Plan

- Oocyte Guard Health Plan

About Niva Bupa

- Unclaimed Amount

- Media Center

- Public Disclosures

- Investor Relations

- Our Management

- Board of Directors

- Supplier Code Of Conduct

Tools for You

- BIMA BHAROSA

- Channel Payment

- Customer Grievance Redressal

- Insure Care

- Auto Renewal

- Do Not Disturb Registry

- Download Center

- Balasore Train Accident

- ABHA Health ID

- IRDA Consumer Education

- Stewardship Policy

- Underwriting Philosophy

- Website Terms & Conditions

- Privacy Policy & Disclaimers

- Insurance Ombudsman

- Products Updated & Withdrawn List

- Installment Premium Product List

- List of Products Offered

- Whistleblower Policy

- Infosec Incident Reporting

- Service Provider

- Health Link Portal

- IRDAI Call Centre Feedback Survey

- Individuals

- (591) 334 24264

- Log in to MY Bupa Opens a new window

- Facility Finder

- Dominican Republic

- Trinidad and Tobago

- Who we are?

- Second medical opinion

- International

Selecciona el país

- Islas Vírgenes Británicas

- República Dominicana

- Trinidad y Tobago

- Latinoamérica

- Latin America

TRAVEL INSURANCE BUPA GLOBAL TRAVEL

- Privacy policy

- Terms of use

- Accessibility

- Financial Statements (516 kb)

Bupa Global 2024

Bupa México 2024

- +852 2114 2840

- Individuals

- Emergency Evacuation

- Alternative Therapy

- Newborn Child Insurance

- Deductibles and excesses

- Waiting Periods

- Definitions

- Coverage Areas

- Whole of Life

- Seven Corners

- Specialty Countries

- United Arab Emirates

- Global Travel Insurance Plans

IHI-Bupa Travel Insurance

Introduction.

Cooper Claridge-Ware is able to provide high quality international travel insurance coverage from leading insurance company IHI-Bupa in the form of the company’s Worldwide Travel Options plan.

IHI-Bupa Travel Insurance Protection

This travel insurance policy is designed specifically for the modern traveller, and is able to provide high levels of flexibility and ease-of-use. Including a bespoke mobile application in the form of the MyCard App directly from the Insurance Company, and offering a 24/7/365 claims hotline, policyholders with an IHI-Bupa Worldwide Travel Options policy are assured of receiving the assistance they need, when they need it.

With worldwide coverage, extensive medical and health insurance protection, and the option to add a range of non-medical umbrella coverage benefits, the high quality travel insurance plan from IHI-Bupa is one of the best short term trip insurance plans currently available on the international market.

Comprehensive Medical Protection

The Worldwide Travel Options plan starts with comprehensive medical insurance at the core of the policy’s coverage offering. You are able to purchase the basic medical coverage as either a standalone policy, or add one of the other non-medical protection modules to this portion of the plan.

Unlimited Medical Protection – No Limits on the coverage you receive

Inpatient treatment coverage, outpatient treatment coverage, emergency evacuation and repatriation protection, mugging and assault medical insurance, repatriation of mortal remains in the event of death, no deductibles or excesses, non-medical coverage option.

When you purchase your short term health insurance protection with the Worldwide Travel Options plan you will also be given the ability to add a range of umbrella coverage benefits to the plan through the optional Non-Medical Coverage selection. In order to obtain the Non-Medical coverage available through this plan policyholder’s must first have purchased the Basic Cover for health insurance.

Personal Accident Insurance – coverage for death or disability

Loss of baggage insurance, baggage delay cover, passport and cash theft insurance, personal liability insurance, travel delay protection, missed flight connection protection, security and legal assistance coverage, trip cancellation protection.

The final option available under the Worldwide Travel Options policy from IHI-Bupa is in the form of a Trip Cancellation coverage benefit.

Available in addition to the Basic Coverage Medical Protection, the Trip Cancellation option will cover you against the cost of a cancelled journey (providing reimbursement for non-refundable deposits and the like) in the event that you are unable to travel due to acute illness, injury, or death.

In order to obtain the Trip Cancellation option you must first purchase the Basic Cover option. However, you are able to receive coverage for the Trip Cancellation benefit without purchasing the Worldwide Travel Options Non-Medical Coverage option.

Further reading

IHI-Bupa Worldwide Travel Option plans will have their premiums calculated based on two main factors. These are:

- The Age of the Policyholder

- The total duration of the intended trip

Free Quotes and More Travel Insurance Help

If you would like additional assistance in finding the correct travel insurance policy for your needs, please Contact Us Today ! Our expert Global Insurance Brokers can help answer all your travel insurance questions and can provide hand crafted quotations if you are unsure about buying your coverage directly through this website.

We have received your enquiry, it may take us 1-2 working days to respond to your enquiry. In case of urgent assistance please call our office at (+852) 2114 2840 during business hours.

- United States

- United Kingdom

Bupa travel insurance discounts and coupon codes

In this guide

Interested in other travel insurance discounts?

What policies are available from bupa, pros and cons of travel insurance from bupa, how do i apply for bupa travel insurance, how do i make a claim with bupa travel insurance.

Destinations

Bupa is one of the most trusted names in Australia when it comes to health insurance and now Bupa can take care of you both at home and abroad.

Better still, Bupa members can get 15% off their Bupa Travel Insurance premiums with the Bupa members only travel insurance discount.

Compare the cost of travel insurance using the promo codes below and get a better deal.

Were you looking for a discount code?

Oops! There aren't any Bupa Travel Insurance Discount Codes available on Finder right now. If you would like find out more about Bupa Travel Insurance check out the Bupa page or see our other travel insurance deals below.

Save 10% on InsureandGo policies with Finder

Get 10% off Freely travel insurance policies

Protect your next trip with Qantas Travel Insurance

Get 12% off Kogan travel insurance policies

Get 8% off your Travel Protect policy

Get 10% off on Tick travel insurance policies

ahm and Medibank members get 10% off travel insurance

Earn Velocity Points with Cover-More

Get 8% off your Wise and Silent policy

15% off travel insurance for Medibank Private members

This plan provides the minimum cover for your journey if you’re travelling to the United States, Canada or Japan. You benefit from:

- Unlimited medical expenses overseas

- Dental expenses

- Unlimited cover for cancelled or rescheduled travel

- Resuming overseas travel

- Cover for luggage and travel documents

- Accidental death and disability

- Personal liability

- Rental car excess waiver

This plan provides minimum cover for journeys to the UK, Europe, South America, Russia, Africa, India and the Middle East. You are covered for:

- Unlimited cancelled or rescheduled travel

- Luggage and travel documents

This plan provides minimum cover for travels to Asia, including Bali, and covers the following:

- Medical and dental expenses overseas

- Cancelled or rescheduled travel

This option covers travel to New Zealand, the South Pacific Islands and Norfolk Island. You are covered for:

Suited to local travel, this plan does not provide medical or dental cover. Under the Australian plan, you are covered for:

- Unlimited expenses for cancelled or rescheduled travel

- Minor travel delays

- Underwritten by CGU Insurance Limited

- Five policies available

- Quotes available online or by phone

- 24/7 emergency assistance hotline

- Resume an interrupted trip

- Extend policy if necessary

- Frequent travellers can apply for multi-trip cover

- International insurance available if you work overseas

- Some pre-existing medical conditions excluded

- Temporary visitors and non-residents not eligible for cover

- No cover after the 24th week of pregnancy

Here’s how to apply for one of Bupa’s travel insurance policies.

- Compare policy options. Choose the plan that provides the best cover for your holiday at the best rate.

- Get a quote. You can apply for a quote online or by phone.

- Read the fine print. Different policies offer different levels of cover, so make sure that you understand the product disclosure statement (PDS) before agreeing to purchase a policy.

- Look out for optional extras. If you need additional cover for specific items or equipment, check to see whether extra cover is available to upgrade your policy.

If you have to file a claim from your policy, here’s how to get the process started.

- Get in touch. Contact CGU as soon as possible. The sooner you get in touch the more likely you are to get your claim paid.

- Provide documentation. Depending on the nature of your incident, you will be asked to provide supporting documentation including police and medical reports, statements from transport providers, receipts, proof of ownership, tickets and valuations.

- Cooperate. Be honest when providing information about the incident. A case manager will be assigned to your claim and will keep you updated on its progress. You will be informed about any excess payable when you file the claim.

Here are a few frequently asked questions about Bupa’s travel insurance policies.

When should I buy travel insurance?

The best time to purchase your policy is immediately after you confirm your travel booking. This means you will be insured if you have to cancel your plans.

How is my premium calculated?

Determining factors include the duration of your trip, the policy you choose and whether it’s a single or doubles plan, as well any additional cover options.

Can I use my Medicare card overseas?

No, your Medicare card does not cover you for overseas medical expenses. However, countries part of the Reciprocal Health Care Agreement (RHCA) allow Australians access to that country's healthcare system.

Are pre-existing conditions covered by these policies?

Some pre-existing medical conditions are automatically covered. Otherwise, you’ll have to pay an additional premium to have your condition covered under the policy terms. Travellers aged 70 years and older are not covered for medical or medical-related losses.

Can I cancel my Bupa policy if I’m not happy with it?

You have a 21-day cooling-off period during which you can cancel your policy. You will receive a full refund if you haven’t yet left on your trip or filed a claim.

Who is Bupa underwritten by?

Bupa’s travel insurance is underwritten by CGU Insurance Ltd.

Compare other travel insurance coupons on offer

Jessica Prasida

Jessica Prasida is a travel insurance expert for Finder. She lives and breathes travel, having worked as a travel agent and branch manager at STA Travel for over 4 years, then writing about travel insurance with Finder for another 5 years. Jess has a Bachelor of Business from the University of Technology, Sydney and a Tier 1 General Insurance qualification.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

- Health table of contents

Travel Insurance

Our goal is to give you peace of mind by offering you, your family and/or your employees coverage at any time or wherever you travel , as well as high quality service, access to adequate treatment and a safe return to your home for you, your family or your employees whenever this is needed.

- WORLDWIDE INDIVIDUAL

- WORLDWIDE CORPORATE

Choose between Annual Travel , which covers all trips of up to one month per trip, or Single Trip , which covers a trip of up to a maximum of 12 months.

With Worldwide Travel Options we offer a solution that lets you personalize your travel insurance policy , giving you flexibility and total peace of mind.

YOU WILL HAVE ACCESS TO:

- 24/7 in-house emergency service

- In-house doctors and nurses

- Guarantee of payment to hospitals

- Assistance in arranging medical evacuations

- Pre-authorization

- Medical advice in-house

- Counselling on treatment

- Medical referrals to most appropiate place of treatment

- Claiming Online

- Free myCard app for iPhone, iPad and Android

SOME UNIQUE ADVANTAGES:

- Worldwide coverage (except in your country of residence)

- Free choice of hospitals and doctors

- No deductible or co-payment on Basic Cover

- Most dangerous sports and occupations covered

- Risk and war zone cover

- Optional coverage for baggage, liability and trip cancellation

- All nationalities covered

- Global risk and security monitor

- Easy to extend online even after start of trip

- 5% online discount here

The premium is based on the total number of travel days per year, which guarantees that you only pay for the days on which insured individuals are actually abroad .

A minimum number of 200 travel days a year for all employees together is required.

Keep in mind that if you need to add more travel days during a coverage period of your insurance, it is easy to buy additional travel days.

- Cover for business and leisure trips

- Cover for business partners, co-travelling family members etc.

- Online travel days administration

- Privacy Policy and Personal Data Transfer to U.S. Consent

- Terms of use

- Accessibility

- Disclaimers

IMAGES

VIDEO

COMMENTS

Plus, Bupa Health Insurance members get 15% # off. Get a quote chevron_right. Our team of in-house doctors, nurses and case managers are available to help you 24/7. ... Bupa Travel Insurance is distributed by Bupa HI Pty Ltd (Bupa) (ABN 81 000 057 590, AR 354269), an authorised representative of Open Insurance Pty Ltd, ABN 23 166 949 444, AFSL ...

Medical cover. Unlimited, 24/7 Emergency Assistance. Cancellations. Unlimited, (Trip Disruption $50,000) Key Features. 25-Day Cooling Off Period, Australian Based Call Centre, 4.6 Star Product ...

Providing information about Bupa Global's Health Insurance Abroad plans . Skip navigation Bupa Global . Your partner in health. Bupa Global . Your partner in health ... This offer will only be available where a quote is provided between 1 October 2023 and 12 May 2024 (inclusive), AND the BG Policy starts on or before 12 May 2024. ...

Bupa's COVID-19 coverage is limited in comparison with brands such as Fast Cover and Southern Cross Travel Insurance. Its cover limit of $10,000 for theft or damage to luggage and personal ...

For a personalised quote call +44 (0) 3301 737 698. For Bupa services in the UK such as dental care practices and care homes. visit bupa.co.uk. Our health insurance plans provide you with a global network of medical practitioners, giving you access to specialists all over the world. Get a quote now.

Trusted provider of health insurance coverage and technology-smart solutions. that help world travelers stay safe and healthy wherever they roam. solutions keep world-class healthcare at hand. to make the world your classroom. keeps you connected to world-class care. GeoBlue has an elite network of doctors from almost every specialty ready to ...

As the nation's original travel insurance comparison site, InsureMyTrip has over 20 years of experience connecting travelers like you with the best policy for your trip. Our simple quote process helps you choose the right coverage by comparing top plans from trusted providers. And if you need help, our licensed insurance agents can assist you ...

Domestic: Bupa offers a domestic travel insurance policy which provides you with cover for your luggage and personal items, trip delays or unexpected delays and personal liability. You may also be covered for the excess on a rental car. This domestic travel insurance is also open to seniors. Annual Multi-Trip Insurance: this multi-trip policy ...

Get Quotes Now. Travel plans are significantly cheaper than annual or short-term policies, but they are also generally less broad in their coverage. ... IHI-Bupa Travel Insurance Plan Benefits Table. Benefit: Coverage Limit (USD) Maximum cover per person per trip: Unlimited: Hospitalization: 100%: Outpatient treatment by a doctor/specialist: 100%:

For a monthlong stay in the U.S., the lowest-priced visitors insurance policy was around $75 (Trawick International Safe Travels USA Cost Saver) and the highest was about $180 (WorldTrips Atlas ...

Travel insurance is crucial to safeguard one against unexpected circumstances. It provides you with assurance and some protection against such circumstances which may happen before, during and even after a vacation or overseas trip. Unexpected circumstances such as: Cancellation of trip due to serious illness, accidental injury, medical bills ...

Of delay cover, however, is limited at $2,000 total for all travel on the policy, and limit per person of $500 following the initial six-hour delay. A Guide to Family Travel Insurance | Niva Bupa. When taking out your Bupa Travel Insurance policy, travellers can also opt for cancellation cover, with the amount chosen by the customer. Lost luggage

1. We'll call you to help make sure you get the cover that best meets your needs. 2. We'll send you a quote. If you're happy with it, let us know and we'll set up your policy. 3. We'll send you a welcome pack and insurance card. You can call one of your advisers to discuss your application now.

Compare and Buy travel insurance policy for your needs. Get a quote today! ... Niva Bupa Travel Insurance offers over 40 travel-related covers, including the ones mentioned above. Single Trip: One-time travelers can buy this policy before or after booking their tickets. This policy remains applicable for the duration of that trip.

TRAVEL INSURANCE. BUPA GLOBAL TRAVEL. Who we are? ¿Busca un seguro de viaje con cobertura mundial? Bupa Worldwide Travel le ofrece cobertura tanto si es un viaje simple como si requiere una protección anual.

This travel insurance policy is designed specifically for the modern traveller, and is able to provide high levels of flexibility and ease-of-use. Including a bespoke mobile application in the form of the MyCard Appdirectly from the Insurance Company, and offering a 24/7/365 claims hotline, policyholders with an IHI-Bupa Worldwide Travel ...

Bupa Global partners with GeoBlue to offer worldwide expatriate medical coverage to buyers in the USA. To find out more, please call toll free inside the U.S. 855-481-6647; outside the U.S. + 1-610-254-5850.

Bupa travel insurance discounts and coupon codes. Bupa is one of the most trusted names in Australia when it comes to health insurance and now Bupa can take care of you both at home and abroad ...

Fitness and wellbeing is available to all Bupa UK health insurance and trust members over 16 years old. Over 1,500 fitness classes from yoga to HIIT workouts. Follow exercise plans designed for all levels. Guided meditations to help with breathing, sitting, walking and stretching. Access articles and videos filled with proactive wellbeing advice.