- Buy Now Pay Later

- Personal Credit Cards

- Personal Loans

- Kiwisaver - Coming Soon

- Savings Accounts

- Term Deposits

- House Insurance

- Contents Insurance

- Car Insurance

- Travel Insurance

- Money Transfers

- Business Credit Cards

- Business Loans

- Business Overdrafts

- Mobile Phone Plans

- Personal Finance

Recent Posts

Compare Rewards Credit Cards

Credit card providers look after their customers with loyalty programs offering many different types of rewards. Check out the cards below to see which one will benefit you the most.

Kiwibank Air New Zealand Airpoints Platinum Visa

Interest rate purchases, balance transfer.

1.99% p.a. for 6 months

Annual Account Fee

$90 every 6mos

Interest Free Days

Up to 44 days

Earn 1 Airpoints dollar for every $115 spend | 1 status points for every $200 eligible purchase

Built-in Travel Insurace

$15 per card every six months.

1.85% of the New Zealand dollar amount once converted.

Two complimentary single entry Lounge eVouchers each year when you spend $30,000

The American Express Platinum Card

AMEX Card Members can now redeem points with Qatar, Hawaiian, KrisFlyer, and Emirates airlines.

Earn 2 points for every $1 spent | Up to $300 Dining Credit a year | Complimentary access to airport lounges

Enjoy a Welcome Offer of 100,000 bonus Membership Rewards points, valued at $750, with American Express Travel. T&C's apply.

Built-in Travel Insurance

2.50% of converted amount

Redeem 1 Avios, KrisFlyer, or Skyward Mile for every 3 points, and 1 Hawaiian Mile for every 2 points. Access 1,400 lounges globally, incl. Centurion Lounge & Escape Lounges, with The AMEX Global Lounge Collection in Sydney & Melbourne, Australia.

SBS Pink Ribbon Visa

Up to 55 days

Earn $1 for every $150 spent

2% of transaction value

With every successfully opened account, a $20 donation will be contributed to the Breast Cancer Foundation NZ, and every card usage will further contribute 5 cents.

The American Express Gold Rewards Card

Earn 2 points for every $1 spent | Up to 2X $100 Dining Credits a year | Get free travel insurance for both domestic and international trips

Welcome Offer: Get $200 back. Apply online, be approved and spend $1,500 in the first 3 months. T&Cs apply. New Card Members only

Redeem 1 Avios, KrisFlyer, or Skyward Mile for every 3 points; 1 Hawaiian Mile for every 2 points. Use Gold Rewards Card for free travel insurance, including Medical Emergency Expenses, Travel Cancellation, and Baggage, Money & Documents. T&C's apply.

Westpac hotpoints Platinum MasterCard

$35 every 6mos

Earn 1.5 hotpoints for every $1 spent on your card up to (and including) $7,000 then 1 hotpoint for every $1 spent on your card each month.

Extended Warranty Insurance up to 12 months | 90 days Purchase Protection

Up to 35 days

$25 per year

1.95% of transaction amount

ANZ Cashback Visa Platinum

$1 cash back for every $120 spent on eligible purchases

1.3% of the NZ $ amount

Apple Pay & Google Pay

ASB Visa Rewards

0% for 6 months

$20 every 6mos

True Rewards: $150 = TR$1 or AA Smartfuel: $75 = 1c off per/L

$13 Joint account fee (per person, every 6mos) $6 Additional Card (per card, every 6mos)

For overseas transactions made using your ASB Visa card Offshore Service Margins of 2.10% of the New Zealand dollar amount of the transaction are charged.

Apple Pay , Google Pay, Fitbit Pay & Garmin Pay

BNZ Advantage Visa Classic

Earn Flybuys or BNZ Rewards | Earn 1 Flybuys for every $40 spend | Earn 1 BNZ point for every $1 spend

$6 half-yearly

2.25% of the NZ dollar value on every foreign currency transaction.

Westpac hotpoints World MasterCard

$142.50 every 6mos

Earn 2 hotpoints for every $1 spent on your card up to (and including) $15,000 then 1 hotpoint for every $1 spent on your card each month.

Priority pass lounge | Extended Warranty Insurance up to 12 months | 90 days Purchase Protection

Up to 120 days

Your first joint or additional card is free. Supplementary cards are $100 per year ($50 every 6 months)

Six-monthly account fee of $142.50 waived if you spend $50,000 or more between your fee charges.

ASB Visa Platinum Rewards

$40 every 6mos

True Rewards: $100 = TR$1 or AA Smartfuel: $50 = 1c off per/L

$27.50 Joint account fee (per person, every 6 months) $15 Additional Card (per card, every 6 months)

Understanding Rewards Credit Cards

A rewards credit card is a financial tool provided by banks, credit unions, or lenders, allowing you to accumulate points for every dollar spent. These points can be redeemed for a variety of rewards, including goods, merchandise, gift cards, and event tickets. It’s crucial to comprehend the workings of these cards, taking into account associated annual fees and potential benefits, to make an informed decision.

The functionality of rewards programs is quite straightforward. When you use a rewards credit card for a purchase, you earn points. The number of points is determined by the type of transaction and the terms of your card. These accumulated points can then be exchanged for a range of rewards. Some cards even offer additional points for specific spending categories or provide bonus points when you initially use the card.

Choosing Your Ideal Rewards Credit Card

When comparing rewards credit cards, be sure to check out the features we’ve listed below to find a card that’s right for you.

Nature of Rewards

Understand the specific rewards provided by the card, including gift cards, merchandise, household items, entertainment options, or cashback. Align these offerings with your preferences and needs.

Annual Fee

Evaluate the associated annual fee. Some cards may present a no-annual fee offer for the initial year, potentially bringing cost savings. At first glance, some rewards cards might seem as though they have a relatively high annual fee. Keep in mind that the reward point earn rate may be better on these cards — so it’s up to you to decide if the value you receive in rewards outweighs the annual fee.

Scrutinise the earn rate, which indicates the number of points accumulated for each dollar spent. A higher earn rate can amplify the card’s overall value. For example, one card may earn you one point for each dollar spent, whereas another type of card might earn you two points for each dollar spent. If you’re looking for a significant volume of reward points, a higher earn rate might be for you.

Redemption Constraints

Stay aware of blackout periods, limits on items in the rewards store, or expiry dates for accumulated points, as these factors can influence the flexibility of your rewards.

Cost Factor

Take into account not only the annual fee but also the interest rates for purchases. Rewards credit cards often carry higher interest rates than other types of cards. This may be handled through careful repayment management to prevent accumulating debt.

Pros and Cons of Rewards Credit Cards

- Versatile Reward Options: Rewards credit cards offer a diverse range of redemption choices, from travel and merchandise to cashback and gift cards. This flexibility allows cardholders to tailor their rewards to their preferences.

- Introductory Offers: Many rewards credit cards provide enticing sign-up bonuses or introductory offers, allowing users to accumulate a significant number of points or enjoy perks during the initial months of card ownership.

- Additional Perks: Beyond rewards, these cards often come with supplementary benefits such as travel insurance, purchase protection, and exclusive access to events.

- Points Accumulation: Regular spending on the card translates into points accumulation, providing a tangible return on everyday purchases. Some cards even offer bonus points for specific categories like dining, groceries, or travel.

- High Annual Fees: A common drawback is the relatively high annual fees associated with rewards credit cards. Cardholders need to weigh these fees against the value of the rewards earned to ensure cost-effectiveness.

- Interest Rates: Rewards credit cards typically have higher interest rates for outstanding balances. If users carry a balance from month to month, the accrued interest can offset the value of earned rewards. Careful repayment management can help relieve the interest accumulation.

- Complexity in Redemption: Navigating through the redemption process can sometimes be complex, with varying point values for different rewards. Some users may find it challenging to maximise the value of their accumulated points. However, the online platforms and customer care teams are there to guide you through the process.

- Potential for Overspending: The allure of earning rewards might tempt users to overspend. Without careful budgeting and discipline, the cost of interest on outstanding balances could outweigh the value of rewards.

Are Rewards Credit Cards Worth It?

For financially diligent individuals managing repayments responsibly, rewards credit cards have the potential to offer substantial value in the way of rewards. However, it’s crucial to choose a card that aligns with your preferences and spending patterns to maximise benefits.

Ready to Dive Into the World of Rewards Credit Cards?

If you’re ready to explore and compare rewards credit cards, we’re here to help! Browse through a range of providers and initiate your application effortlessly.

Your Rewards Credit Card Checklist

As you embark on the journey of selecting a rewards credit card, utilise this checklist to make an informed decision:

Points Earning Structure: Evaluate the card’s points earning structure, including the earn rate for points and any limitations or caps on points accumulation. Redemption Flexibility: Assess the flexibility of the card’s redemption options, ensuring they align with your preferences and lifestyle. Be vigilant about blackout periods or limitations on redemption. Cost Analysis: Conduct a thorough cost analysis, calculating the total annual fees against the potential value of rewards. Understand the purchase interest rates and their impact on overall costs, especially if you anticipate carrying a balance. Introductory Offers: Explore any sign-up bonuses or introductory offers, considering their immediate value and the duration of these introductory perks. Additional Benefits: Take a look at the card’s additional benefits, such as travel insurance, purchase protection, and concierge services. Evaluate their relevance to your specific needs. Point Expiry and Conditions: Familiarise yourself with the card’s policies regarding point expiry and any conditions associated with the redemption process. Check for any restrictions on transferring points between programs if flexibility in point usage is crucial for you.

Rewards credit cards are designed to transform daily expenses into actual rewards. Begin your comparison process online today, explore various providers, and find a rewards credit card that aligns seamlessly with your lifestyle.

Priceless® Specials

Explore the world with mastercard's offers curated specially for you.

Compare credit cards

Compare credit cards from New Zealand's leading banks and find the right card for your lifestyle. Earn rewards points, get cashback, save money with a balance transfer, and more.

By Yvonne Taylor | Verified by David Boyd | Updated 5 Jan 2024

Comparing credit cards

American Express Gold Rewards Credit Card

Balance transfer, purchase rate.

22.95% p.a. ongoing

$200.00 p.a. ongoing

- Get $200 back when you apply online, be approved, and spend $1,500 in the first 3 months. Terms and Conditions apply. New Card Members only.

- Up to 2 x $100 credits annually to spend at the Local Dining Collection featuring some of New Zealand’s top restaurants.

- Earn 2 Membership Rewards points per $1 spent on eligible purchases.

- Includes complimentary travel insurance.

- $200 cashback when you apply online, get approved, and spend $1,500 in the first 3 months. New Card Members only.

- Receive up to $200 credits for the Local Dining Collection of New Zealand’s top restaurants.

- Earn 2 Membership Rewards Points per $1 spent.

- The card is made from metal instead of plastic.

- Some non-chain retailers may not accept American Express cards.

- 2.50% currency conversion fee, which is higher than some competing credit cards.

American Express Airpoints Platinum Credit Card

$195.00 p.a. ongoing

- Earn 300 bonus Airpoints Dollars for spending $1,500 within the first 3 months.

- $195 p.a. annual fee.

- Earn rewards fast at 1 Airpoints Dollar per $59 spent.

- American Express Lounge and VIP lounges and discounted rates on Koru club lounge membership.

- Complimentary domestic and international travel insurance and smartphone insurance for screen repairs.

- Sign up bonus of 300 Airpoints Dollars for spending $1,500 within the first 3 months.

- Earn 1 Airpoints Dollar for each $59 spent.

- American Express Lounge and VIP lounge access with discounted Koru club lounge membership.

- Complimentary domestic and international travel insurance.

- Smartphone insurance for the repair of a damaged front screen.

- The ongoing $195 annual fee.

- This card does not have an interest-free balance transfer feature.

- Some non-chain retailers may not accept American Express credit cards.

American Express Platinum Card

0% p.a. ongoing

$1,250.00 p.a. ongoing

- Get 100,000 Bonus Membership Rewards Points when you apply online, are approved, and spend $1,500 within the first 3 months.

- Up to $300 Dining Credit a year at the best NZ restaurants. Enjoy a $150 cash back when you spend $150 or more in one transaction at a participating restaurant. Valid twice a year.

- Receive up to $200 travel credit each year through American Express Travel.

- Transfer your Membership Rewards Points to a choice of airline and hotel rewards programs.

- Up to $500 cover towards smartphone front screen repair.

- Signup bonus of 100,000 Membership Rewards Points.

- Big spending gets you big travel-related perks at 2 Membership Rewards Points per $1 spent.

- Domestic and international travel insurance cover.

- Other perks and benefits, including elite hotel status, dining credit, and more.

- Access to the 24 / 7 concierge services.

- VIP lounge access at airports in the Amex Global Lounge Collection.

- Add up to 4 additional cards for free.

- The annual fee is on the high side, at $1,250 p.a.

- Some non-chain retailers do not accept American Express cards.

- The American Express Platinum Card is a charge card, so balances must be paid in full monthly.

American Express Airpoints Credit Card

6 months at 0% p.a. 6 months at 0% p.a., then 22.95% p.a. ongoing.">

$0.00 p.a. ongoing

- Get 50 bonus Airpoints Dollars when you apply online are approved and spend $750 on your new Card within the first 3 months. New Card Members only.

- Take advantage of 0% p.a. on purchases for the first 6 months.

- No annual card fee.

- No annual fee for life while earning rewards.

- Sign up bonus of 50 Airpoints Dollars.

- Earn 1 Airpoints Dollar per $100 spent.

- Interest-free on purchases for 6 months.

- Up to 4 additional cardholders for free.

- No complimentary insurance cover.

- High ongoing interest rate on purchases.

- No balance transfer offer at the moment.

ANZ Low Rate Visa Credit Card

24 months at 1.99% p.a. 24 months at 1.99% p.a. with a $0.00 fee, then 12.9% p.a.">

12.9% p.a. ongoing

- 1.99% p.a. on balances transferred for 24 months, with no balance transfer fee.

- Low ongoing variable purchase interest rate of 12.90% p.a.

- $0 annual fee and $0 p.a. additional cardholder fee.

- Pay 1.99% p.a. for the first two years on balances transferred.

- Low ongoing interest rates.

- Up to 55 interest-free days on purchases.

- No annual fee for life.

- Free additional cardholders.

- No rewards program.

- No insurance.

ANZ Cashback Visa Platinum Credit Card

19.95% p.a. ongoing

$80.00 p.a. ongoing

- Earn $1 cashback for every $120 spent on eligible purchases.

- Earn unlimited cashback rewards.

- Up to 55 days interest-free on retail purchases.

- No cap on how much cashback can be earned.

- Low foreign transaction fee.

- The annual fee is $80 p.a.

- Ongoing interest rates are around average for a rewards credit card.

- No balance transfer offer.

ANZ Cashback Visa Credit Card

$40.00 p.a. ongoing

- Earn $1 cashback for every $150 spent on eligible purchases.

- $40 p.a. annual fee.

- Up to 55 days interest-free on purchases when you pay your account in full each month.

- Low annual fee.

- Get up to 55 interest-free days on purchases.

- No ongoing sign-up promo on this card.

ANZ Airpoints Visa Platinum Credit Card

$150.00 p.a. ongoing

- Earn 1 Airpoints Dollar for every $110 spent on eligible purchases.

- Earn 50% bonus Status Points on top of the Status Points you earn on eligible flights with Air New Zealand.

- $150 p.a. annual fee (with $75 charged every six months).

- Comes with complimentary overseas travel insurance.

- Earn Airpoints Dollars per dollar spent.

- No cap on what you can earn.

- Get an advance if you need more for a redemption.

- Earn bonus Status Points on eligible flights.

- Complimentary international travel insurance.

- Access to the Visa Concierge.

- $150 p.a. annual fee.

- Average ongoing interest rates.

ANZ Airpoints Visa Credit Card

$65.00 p.a. ongoing

- Earn 1 Airpoints Dollar for every $170 you spend on eligible purchases.

- Earn unlimited Airpoints Dollars that never expire.

- $65 p.a. annual fee.

- Up to 44 days interest-free on purchases.

- Earn Airpoints Dollars with no cap.

- Low ongoing annual fee.

- Cheap to add additional cardholders.

- No travel insurance policy.

- No lounge access.

- No concierge service.

Q Mastercard

26.69% p.a. ongoing

$0.00 for 1st year $0.00 for 1st year, then $50.00 p.a. ongoing.">

- Enjoy 90 days interest-free on purchases with no minimum spend.

- Use anywhere Mastercard is accepted, in-store and online.

- Exclusive cardholder days when Q Mastercard cardholders can enjoy exclusive deals and extended finance promotions.

- Enjoy 3 months of 0% p.a. interest on all purchases.

- No annual fee for the first year.

- Annual fee in later years are spread out over two equal instalments.

- No minimum spend required.

- A relatively high purchase interest rate of 26.69% p.a.

- Long term advances come with a $55 establishment fee at the first use.

- Long term finance purchases have a fee of $35.

Customise and filter

Leave blank to leave out of filtering

Using credit cards is a globally accepted method of making purchases using money borrowed from a lender (usually a bank). Unlike a one-off loan, a credit card offers you a fixed amount of money (i.e. a credit limit) that you can borrow for a brief period and use every month for expenses. You can physically use your credit card to pay for the expenses you have incurred by swiping across a payment terminal (or simply holding it close to the reader in case of a contactless card). You can also use your credit card for online purchases by providing your card details. But it's highly recommended that you only provide your card details to reputable websites and trustworthy online vendors.

In either case, your credit card issuer actually pays the shop/vendor on your behalf, and you then owe money to the card issuer. How you repay your credit has a lot of impact on how much this arrangement is costing you. It also helps you build your credit history (either good or bad), which affects your chances of being approved for a loan, mortgage, or another credit card. It's unsecured debt since you are not borrowing against collateral, and there isn't a guarantor that can take the fall if you are unable to pay off your debt.

Cost of using a credit card

There are several things you need to understand about the costs of using credit cards in New Zealand, but let's start with the simplest scenario.

When you compare credit cards, one of the features you will commonly see listed is 'interest-free days'. While the term seems self-explanatory, it's often misunderstood. Most credit cards come with either 44 or 55 interest-free days.

Let's say you choose a credit card with 44 interest-free days. If you make a purchase using your credit card on the first day of your billing cycle, you will have 44 days interest-free on that purchase. If you pay off your debt within this time, you will not pay any interest charges. But understand that these 44 days didn't start from the day you made the purchase . They started with your billing cycle . If you buy something ten days in your billing cycle, you will have only the remaining 34 days in your 44-day interest-free cycle, in which to pay off your debt interest-free.

So if you use credit cards to make purchases and pay off your debt completely within your interest-free period, it costs you nothing to use your credit card. Well, apart from an annual account fee (or simply annual fee), which for a basic card is usually $20 to $30 a year.

Tip: Some banks offer credit cards with no annual fees to pay.

But life is rarely that simple. What happens when you cannot pay off your credit within the interest-free period? First of all, you will lose your interest-free days for the next billing cycle, at least until your previous debt is paid off. Secondly, you will start accumulating debt according to your card's purchase interest rate (calculated daily based on the per annum rate). Also called the Annual Percentage Rate (APR), it's the interest that you are charged for purchases you made using your credit card until you pay off your carried-over debt completely.

Meanwhile, you will have to make regular minimum payments on your credit card, to ensure that you are only charged the purchase rate interest, and not incurring additional late payment penalties and interest. But if you just pay the minimum payment due (typically a small percentage of your outstanding balance), you will keep accumulating interest on your outstanding debt.

Interest calculation and minimum payments

While the rate is expressed as a percentage per annum, it's calculated on a daily basis. If your credit card's purchase rate is 20% p.a., the daily interest you will accumulate (once your interest-free period has expired) is 0.055% (20% divided by 365 days). If you have an outstanding debt of $2000, you will accumulate $1.10 daily, up until the end of your monthly billing cycle. Your interest amount in the following month will be calculated based on the debt remaining after the minimum payment has been deducted.

Assuming you have a 2.5% minimum monthly payment, you will need to pay $50 when your credit card bill arrives. That amount will be subtracted from your outstanding balance. So $2,000 now becomes $1,950. But you have also accumulated interest at a rate of 0.055% per day for the number of days in the billing cycle (e.g. 30 days)

So: 0.055% x $2,000 x 30 = $33, which will be added to the balance, making it $1,983.

As you can see, the cycle will continue, especially if you keep putting off repaying your debt completely and just pay the minimum amount. Every month the minimum repayment will be subtracted from the outstanding balance, but new accumulated interest will be added. It increases your chances of getting caught in a long-term debt trap, and you can end up paying way more than the principal amount you borrowed if you don't pay off your outstanding credit in sizeable chunks.

Order of payments

If you have accumulated different kinds of credit debt on a single card, your repayment can get a little more complicated. For example, if you have both outstanding purchase debt and cash advance debt (charged at a higher interest rate), the latter will be paid off first when you make a payment towards your outstanding balance.

Purchases and cash advances

The most common use of a credit card is to pay for goods or services, which is why its default interest rate is dubbed the purchase rate. Another frequent use of a credit card is to take out a cash advance. Cash advances are typically charged at a higher interest rate, and don't qualify for interest-free days. Just like a personal loan , you will start incurring interest from the moment you take out a cash advance, and it will keep accumulating until you pay it off completely. Credit cards are expensive when they aren't paid off in time. But they are even more expensive when used for cash.

Balance transfers

Another common way to use a credit card is to make a balance transfer . That is, if you transfer your outstanding debt from one card to another with a promotional balance transfer offer, you may be able to pay zero or low interest for an introductory period. It's not available on every credit card and may have some other more stringent requirements.

When considering a balance transfer option, compare credit cards for all the terms and interest rates. Also, consider your ability to pay off your outstanding balance before the revert interest rate kicks in.

International spending

While Visa, Mastercard, and American Express cards issued in New Zealand can be used internationally, it's a good idea to look into your card's terms and conditions, and the additional charges incurred for international use. Two typical fees associated with international use are currency conversion assessment and foreign currency margin. The extra cost is typically 1.80-4.5% added to your original purchase amount after conversion to NZD.

Credit card features

While credit cards serve a common purpose, there are a few different types of credit cards available in New Zealand. The right credit card type depends upon your spending habits and your overall financial goals. There are a few features you can compare in different credit cards to help you decide which one suits your needs best.

- Credit limit: While it's always advisable to stay well within your credit limit, a higher credit limit may sometimes be needed, especially if you are a heavy spender. However, a higher credit limit might be an issue when you are applying for a mortgage because banks in New Zealand calculate your ability to repay your mortgage based on your available credit limit, and not on how much credit you actually use per month.

- Low interest: Low interest cards are best suited to people who use their cards frequently but rarely pay them off in full, i.e., they mostly make the minimum repayment with an occasional overpayment, but they typically always carry a revolving balance. In cases such as these, the lower the interest rate the better, since it keeps the debt more manageable.

- Low fee: In a lot of cases, low-interest cards inherently have a low-fee or no-fee feature. In New Zealand, the ASB VISA Light is an example of a no-fee and low interest rate credit card.

- Balance transfer: A good balance transfer credit card would ideally have a decent zero-interest period, and low interest rates afterward, compared to the card you currently have. Even if you stick with the bad habit of making minimum payments for several consecutive months, transferring your debt to a card with better terms/rates can save you hundreds, or even thousands of dollars.

- Interest-free: Permanently interest-free or 0% interest credit cards don't exist. A few credit cards come with an interest-free period (typically for the first six months), but that's rare for a new card. This feature is usually only available on balance transfers.

- Rewards, benefits and cashback: To stay ahead of the competition, and to provide incentives other than low interest rates, many banks offer very lucrative rewards and incentives. When you are making a comparison between different credit cards, be sure to consider the rewards that each card is offering. These rewards can be Airpoints dollars , in-store discounts, luxury rewards (like high-end smartphones), online purchase discounts, and cashback per dollar spent . Apart from providing good points of comparison, sometimes credit card rewards and benefits can be a very financially savvy decision when choosing one card over another.

Credit card alternatives

Despite all the added benefits, credit cards have the inherent risk of incurring and increasing your debt obligation, especially if you can't or don't pay off your debt in full on the due date. However, if used wisely, and while exercising strict financial discipline, credit cards can be efficient tools for managing your finances.

- Cash: The simplest alternative to credit cards is good old cash, but it's becoming less and less a norm as we enter into an era of cashless transactions. According to an estimate, only about seven percent of people in New Zealand use cash in most of their transactions.

- Debit card: The second, most viable and most used option is a debit card, where you pay for your expenses using your own money. It's smart, efficient, doesn't incur debt and additional expenses, and the best part is that it forces you to stay within your means. With credit cards, you can get into a bad habit of buying things that you don't need, knowing that you don't need to pay for them for a while. Even people that are careful with their spending can get a little carried away with a credit card.

- Q Card: While not a true alternative to a credit card, Q Card is also very common in New Zealand. It combines the features of a store card and a credit card, but unlike the latter, you can defer paying off your Q Card for up to three months without incurring any interest or additional penalties. That is, if you keep up with the minimum payment. Thousands of vendors in the country accept Q Card payments, and some even offer additional incentives for using Q Cards.

- Buy now pay later services: One of the most popular credit card alternatives, especially with millennials, are the buy now pay later services. Afterpay, Laybuy, Zip, and Oxipay all operate in New Zealand. These services allow you to spread the cost of a purchase over a fixed term. Unlike a credit card, you know it will be paid off in a fixed amount of time and typically with no interest charged. However, there are serious concerns that these services facilitate impulse spending, which is particularly problematic given that they can be funded with a credit card.

- Personal loans: Depending on what you want to use the funds for, a personal loan may be a better option. Personal loans provide the funds you need, but since they do not operate like a credit card, you are less likely to get further into debt. They can be used to fund many things like holidays, home renovation work, wedding expenses, buying a car , and much more. They are also popularly used to consolidate multiple debts into one loan .

Cards, including both credit and debit cards, are by far the most common mode of payment in New Zealand. And by adopting some good credit card practices, you can enjoy the added benefits of using credit, without accumulating interest payments and debt.

Learn about credit cards

Answers to common questions about applying for and using a credit card.

Pros & cons

Can i use a credit card to pay for another credit card.

No, you can't do this. You'll normally need to make your repayments by transferring funds from a bank account (using online banking, phone banking, an ATM, a mobile app or an automated repayment system). But some banks may give you the option of making repayments in cash (over the counter in a branch), or even by using the antiquated cheque-in-the-mail method.

Who can apply for a credit card?

There are a few things that banks/lenders look into when they issue a credit card – starting with your age and citizenship. Most banks offer credit cards to citizens and permanent residents (some will exclude Resident Visa holders) who are over 18 years of age.

Each bank might have its own requirements for issuing a credit card. Generally, you have to produce proof of income, which will tell the bank that you are earning enough to stay ahead of your debt. Other requirements may include a decent credit score. In New Zealand, there isn't a national minimum threshold for a credit score, but generally a score of 500 or above is considered good enough for a basic credit card. Individual banks may have different minimum score requirements, especially when it comes to their premium credit cards.

Based on these requirements, any working adult with a decent credit history may be eligible for most credit cards offered in New Zealand. For students, the options are relatively limited. They can either look for the typical low-fee, and low-interest credit card (if their student bank account allows it), or choose a tertiary student package which sometimes includes a credit card with the credit limit capped at $1,000 or $2,000 at most.

How is interest calculated?

Interest rates on credit cards are calculated on a daily basis. Your interest rate is divided by 365, then applied to your outstanding debt. But if you qualify for interest-free days because you have no debt carried over from the previous month, you won't pay any interest on purchases in the current month.

If you do have carried-over debt, interest accumulates daily on purchases, starting from the transaction date of each purchase, and is added to your balance at the end of your billing cycle.

For cash advances there are no interest-free days, ever. Interest starts accumulating from the day the advance is taken until it is fully repaid.

Is it better to not have a credit card at all?

No. If you are financially disciplined and used to living within your means, then having a credit card and using it efficiently is a good thing. It helps you build a good credit score and makes you eligible for better financial products, loans, and lines of credit.You may also save money by using Airpoints, or reward points, or any complimentary benefits attached to the card.

Can I get a credit card with no credit history or a low credit score?

If you are a student, you may be eligible for a tertiary bank account that includes a credit card. For migrants who have recently arrived in New Zealand, applying for a credit card will require them to provide details about their residency status, residential address, employment, and in some cases, additional financial information. It might make them eligible for basic credit cards with low credit limits, but that would be enough to establish a credit history.

For locals with a bad credit score, the first thing to do is start fixing your credit report. If you're earning enough to qualify for a credit card, then you need to take care of any outstanding debt and liens you have on your name. Until you pay them off, applying for new credit cards only to get rejected will push your credit score down even more. Another option is a prepaid card, where you load your own money onto the card so that you can access the convenience of paying with a card – but it's not actually a credit card.

How should I make payments against my outstanding debt?

On your credit card statement you will usually see two amounts – the full balance that you can pay off to avoid paying any interest in the following month, or a minimum payment. While repaying the minimum each month prevents you from suffering late or no-payment penalties, it is not an effective way to stay ahead of your credit card debt.

You can pay any amount between your minimum payment and your total outstanding credit. Even if you can't pay it off fully, try paying as much as you can. The faster you pay off your balance, the less interest you will accumulate. Ideally, pay off all your balance every month, which means you'll never pay any interest.

Annual fee (or Annual account fee)

The annual fee is a fixed amount charged for keeping a credit card on a half-yearly or yearly basis.

Additional card fee

An additional charge applies to joint accounts and additional cardholders, and it's due annually.

Airpoints Dollars

Based on a predetermined ratio, certain credit cards earn Airpoints . These points can be redeemed for flights with Air New Zealand and its partners.

Credit card holders can transfer their outstanding balance from one card to another, typically for better interest rates or even zero interest, for long periods.

Balance transfer fee

A fee charged as a percentage of the balance being transferred.

Billing cycle

The time which elapses between the start and end of the card's billing period. It can start on any day of the month (usually the day on which your account was first approved) and ends around 30 days later (depending on the number of days in the calendar month). A grace period of around 14 or 25 days (depending on whether 44 or 55 interest-free days are allowed) is then added to the billing cycle end date in order to arrive at the payment due date.

Cash advance

A cash advance occurs when you use a credit card to withdraw cash. The maximum amount you can take out as cash is a sum less than your remaining credit limit. Some other transactions that are considered cash advances are gambling transactions, credit card cheques, purchasing prepaid/gift cards, or purchasing foreign currency. The interest rate is also usually higher for cash advances.

Cash advance fee

In addition to interest, a fee is charged for every cash advance transaction.

Complimentary travel insurance

Some credit cards offer built-in travel insurance for up to 40 days. Policies vary, but many cover medical expenses, property loss, loss of deposit and cancellations, among a few other things.

Credit limit

The maximum dollar limit of your credit card for making purchases. Once you've reached that limit you need to repay some of the balance before you can use your card again for purchases.

Credit score

A numerical score based on your credit history, including the use of credit, repayment frequency, promptness, and any debts in default. Typically, the range is from 0 to 1000 (it can vary depending upon the bureau), but most credit scores start from 300. A higher credit score helps you qualify for better credit cards, personal loans and mortgages.

Dynamic Currency Conversion

A process in which the amount of an overseas credit card transaction made in person is converted by a merchant or ATM to the currency of the payment card's country of issue. It allows you to see how much you've spent in NZD and lock in the exchange rate, but the exchange used may disadvantage the cardholder.

Interest-free days

The number of days a credit card holder has to pay back the bank before any interest is charged on the balance. The number of days is calculated cyclically, and not according to the day of the transaction or purchase. No interest-free days apply to cash advances.

Interest rate

The interest percentage applied to your outstanding balance if you don't fully repay it at every billing cycle. Stated as an annual percentage (APR), but calculated on a daily basis. Different rates may apply to purchases and cash advances on the same card.

Late payment fee

A fee charged if minimum payments aren't made on time.

Minimum payment

The minimum amount you can repay per month. Typically a small percentage of your outstanding balance (e.g. 2% or 3%) or a minimum dollar amount, whichever is higher. Making the minimum payment doesn't prevent interest accumulating on the outstanding balance.

Over-limit fee

For transactions that exceed the credit limit, an over-limit penalty fee is levied upon the cardholder, typically a fixed amount.

Revert interest rate

The interest rate which is applied to any unpaid balance after the expiry of a 0% or low-interest introductory offer. The revert rate can be either the card’s ongoing interest rate on carried-over purchases balances, or its cash advance interest rate.

Benefits and incentives you can earn by using a particular credit card, for example Airpoints or cashback.

Buy on your own schedule

With a credit card, you don't have to wait till payday to buy the things you want or need.

Instills bad spending habits

Frequently using the money you don't have can encourage and facilitate some bad spending habits and nudge you towards expenses that you can't really afford.

Improve your credit score

Responsible credit card usage is one of the easiest ways to improve your credit score.

Earn rewards

You can claim several rewards and incentives, such as merchandise, vouchers, cash discounts and Airpoints &c, by using credit cards.

Complimentary insurance and other benefits

The more expensive cards usually have valuable complimentary benefits attached. These may include, for example, travel insurance, purchase protection insurance, a price protection program, extended warranty, and extra privileges or discounts when staying at hotels.

Better personal loan alternative

If you only need a small amount (a few thousand dollars), which you can pay back within your interest-free period, using a credit card instead of taking out a personal loan is much more cost-effective and comes with easier repayment terms. You will pay no interest at all on the money you borrow using a credit card, if you can pay it back within the interest-free period.

Encourages bad spending habits

Frequently using money you don't have can encourage bad spending habits if you are not financially disciplined, nudging you towards expenses that you can't really afford.

An expensive way to spend money

If you don't pay off your credit card within the interest-free period, whatever you buy using your card will cost you more with the added interest cost.

Constant debt cycle

If you use your credit card for every financial transaction, and then pay off the credit card with your monthly income, you can get trapped in a constant debt cycle if you face an unexpected expense or your monthly income is discontinued for any reason (such as layoff or business failure). Try to keep your credit card spending well within your income level.

Annual and other additional fees

The annual fee is an added expense of using a credit card, along with other fees, penalties, and surcharges you may incur by using your credit card for payments.

Stay well within your credit limit

Maxing out your credit card will make it harder for you to pay off your outstanding balance, and it will also negatively impact your credit score. Ideally, you should stay within 30% of your total credit limit.

Pay off your balance

Kiwis are among some of the most avid credit card users in the world. With such frequent use, you may forget that you are essentially borrowing money by using a credit card to pay for stuff. Unless you pay that money back on time (i.e., pay off your total debt on or before the payment due date) you will incur interest. The interest cost will typically be greater than the money you have saved in rewards and benefits by using the credit card in the first place.

Don't apply for too many cards

If you can't keep track of them all, or can't pay them off promptly, don't apply for too many credit cards. Having multiple credit cards can help your credit history and your credit score if you can manage them well. But if you can't, more credit cards mean more debt traps. Even for financially disciplined people, it's prudent to keep between three and five active cards at most. And since every application for credit will appear on your report, you can also damage your credit score by applying for cards too frequently.

Choose a credit card based on your spending habits and everyday needs

Many cards that offer amazing rewards and benefits also come with higher annual fees and interest rates, which can make it difficult to pay them off if you make too many expensive purchases while chasing the rewards.

Don't take out a cash advance

Cash advance interest is usually charged at a higher rate, and it's calculated from the day you withdraw the cash – there are no interest-free days.

Don't buy what you can't afford

If you can't pay for it now (with the money you have in the bank), it's unlikely that you will be able to afford it at the time of paying your credit card bill.

Strategically use balance transfer cards

Take advantage of banks competing with each other for business, run your numbers, and if a balance transfer deal can significantly reduce your interest burden, take it. But be sure that you aim to pay off your outstanding debt as soon as possible.

Be sure to check your credit history

Monitoring your credit history will help you keep track of your credit score as well as your purchase patterns.

Efficiently use your interest-free period

Make all major purchases at the start of the billing cycle (i.e. at the beginning of your interest-free period) if you possibly can. This will give you the maximum amount of time in which to pay off your full balance and not incur any interest on your purchases.

Keep track of your spending

Use your credit card statements to have a better idea of your spending habits. By adjusting your shopping habits and schedule, and your repayment routine, you can ensure that you aren't paying anything extra on your credit card purchases.

Use your credit efficiently

If you can afford multiple cards, make sure they all confer to your spending pattern and lifestyle. If you are a frequent traveller, use reward cards that can help you accumulate Airpoints. If you have accumulated a lot of debt, a balance transfer card with a generously long interest-free period can make repayment easier. With multiple credit cards, make sure to maximise the benefits you can get by using the appropriate card in each situation. However, be sure to run the numbers to check out that the cost of holding on to multiple cards does not outweigh the benefits they provide. You can't get everything in one card, but sometimes making peace with the rewards you have with a single card is better than having multiple cards and not be able to keep track of them all.

Know your credit card terms before travelling abroad

Using your card overseas can trigger some unexpected expenses, like a poor foreign currency exchange rate, foreign transaction fees and Dynamic Currency Conversion. Make sure you are familiar with your credit card terms, exchange rates, and limitations on overseas use. If your card offers travel insurance, you should know what's included in the insurance, whether it will be applicable for your trip, and whom you should contact if you need to make a claim.

Keep credit card safety tips in mind

Whether you are using your credit card for online purchases or buying something from your favourite shop, never get complacent about credit card security. For online purchases, only provide your details to a trustworthy website. If unsure, search for the store online to see if there are any reviews about fraud or scams. Similarly, if you hand over your card to someone else, watch them like a hawk. Skimming is a common practice used to steal your credit card info if you aren't vigilant. Cover your hand when you are entering your card PIN (no matter how silly it looks).

Advertiser disclosure

At Finty we want to help you make informed financial decisions. We do this by providing a free comparison service as well as product reviews from our editorial staff.

Some of the products and services listed on our website are from partners who compensate us. This may influence which products we compare and the pages they are listed on. Partners have no influence over our editorial staff.

For more information, please read our editorial policy and find out how we make money .

Finty members get

I don't want rewards

I want rewards

Disclaimer: You need to be logged in to claim Finty Rewards. If you proceed without logging in, you will not be able to claim Finty Rewards at a later time. In order for your rewards to be paid, you must submit your claim within 45 days. Please refer to our T&Cs for more information.

- Credit Cards

NZ’s Best Credit Cards

Posted by Bruce Pitchers March 27, 2024

Bank of the Year | Credit Cards

Congratulations to TSB, the winner of Canstar’s award for Bank of the Year | Credit Cards .

Each year, Canstar’s expert research team evaluates all the major credit cards on the market. This year, 34 cards from 10 different providers were rated using an exacting methodology. The awards and ratings are split into three main categories:

- Low Rate Cards

- Reward Cards : $12,000 | $24,000 | $60,000 | $120,000 Annual Spend

- Flight Reward Cards : $12,000 | $24,000 | $60,000 | $120,000 Annual Spend

When rating the performance of the cards, our research team judges them for features including:

- Fees/interest rates

- Premium features

- Number of interest-free days

- Reward/loyalty programs

- Standard features

- No frills benefits

The results are then condensed into a consumer-friendly five-star concept. Top-rating cards in each category are rewarded our top 5-Star awards for Outstanding Value. And the overall best credit card provider earns our prestigious Bank of the Year | Credit Cards Award .

TSB: Bank of the Year | Credit Cards

For the second straight year, the winner of Canstar’s Bank of the Year | Credit Cards Award is the TSB .

Once again our research shows that TSB leads the way in low-rate and rewards cards, plus it was the stand-out performer in our consumer satisfaction survey of over 2500 credit card users.

TSB is the only provider offering a card with a purchase rate below 10%, and its Platinum rewards card offers a market-leading cashback offering of $1 cashback for every $70 spent on eligible purchases:

TSB’s Award Winning Credit Cards

TSB offers two great credit card options:

- TSB Low Rate Mastercard

- Mobile phone protection (T&Cs apply)

- Up to 55 days interest free

Fees and charges:

- $20 annual fee

- Additional card: $5 p.a.

- Purchase & cash advance interest rate: 9.95% pa

- TSB Platinum Mastercard

- $1 cashback for every $70 spent on eligible purchases

- Domestic & overseas travel insurance (Exclusions, T&Cs apply)

- $90 annual fee

- Purchase interest rate: 20.95% p.a.

- Cash advance interest rate: 22.95% p.a.

Compare Rewards Credit Cards

Compare Credit Cards with Canstar

If you are looking for a new credit card, then let Canstar be your guide. Perhaps you want one with a low interest rate, or low fees, or want to swap your rewards card from points to cash. Our free credit card comparison tool compares all the major cards in the market and awards the best our prestigious Star Ratings.

The comparison table below displays some of the low rate credit cards currently available on Canstar’s database for Kiwis looking to spend around $2000 per month (some may have links to providers’ websites). The products are sorted by our latest Star Rating (highest to lowest), followed by provider name (alphabetical). Use Canstar’s credit card comparison selector to view a wider range of credit cards. Canstar may earn a fee for referrals.

Compare Credit Cards with Canstar here!

Canstar’s 5-Star Winning Credit Cards

Our 5-Star winning credit cards deliver true value, whether you’re looking for a card with a low rate of interest, or one that offers great rewards, whatever your annual credit card spend.

Outstanding Value Low Rate Credit Card

Credit cards from three banks earned our 5-Star Outstanding Value Rating for their low-rate cards:

- ANZ Low Rate Visa

- Westpac Fee Free Mastercard

Outstanding Value Rewards Credit Card

The following rewards credit cards earned 5-Star Outstanding Value Ratings across different annual spends:

Rewards $12,000 Annual Spend

Rewards $24,000 annual spend.

- BNZ Advantage Visa Platinum – Flybuys Option

Rewards $60,000 Annual Spend

Rewards $120,000 annual spend.

- Westpac Hotpoints World Mastercard

Outstanding Value Flight Rewards Credit Card

The following flight rewards credit cards earned 5-Star Outstanding Value Ratings across different annual spends. And, as you can see, it’s Amex that dominates:

Flight Rewards $12,000 Annual Spend

- American Express Airpoints Card

Flight Rewards $24,000 Annual Spend

- American Express Airpoints Platinum Card

Flight Rewards $60,000 Annual Spend

Flight rewards $120,000 annual spend.

- Westpac Airpoints World Mastercard

For more information on this year’s award, and to compare different credit cards for free with Canstar’s comparison tool, just click on the button below.

Check out our 2024 Credit Card Awards here!

About the author of this page

This report was written by Canstar’s Editor, Bruce Pitchers. Bruce has three decades’ experience as a journalist and has worked for major media companies in the UK and Australasia, including ACP, Bauer Media Group, Fairfax, Pacific Magazines, News Corp and TVNZ. Prior to Canstar, he worked as a freelancer, including for The Australian Financial Review , the NZ Financial Markets Authority, and for real estate companies on both sides of the Tasman.

Enjoy reading this article?

Sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article

Compare credit cards, nz's best rewards & airpoints credit cards.

Best Balance Transfer Credit Cards

What Type of Credit Card Should I Get?

- Canstar is an information provider and in giving you product information Canstar is not making a recommendation or giving an opinion in relation to acquiring or disposing of a particular credit product or loan. If you decided to apply for a credit product or loan, you will deal directly with a credit provider, and not with Canstar. Rates and product information should be confirmed with the relevant credit provider. For more information, read the product disclosure statement (PDS) and Canstar’s terms of use and liability disclaimer .

- This is provided for information purposes only. It is general in nature and has not taken into account your particular financial situation or goals so is not a personalised service. Consider whether this information is right for you. It is recommended that you consult a financial adviser before making any financial decision.

Quick Links

RewardExpert.com is an independent website that is supported by advertising. RewardExpert.com may be compensated by credit card issuers whose offers appear on the site. Because we are paid by our advertising partners it may impact placement of products on the site, including the order in which they appear. Not all available credit card issuers or card offers are included on the site.

- Credit Cards

- Comparisons

The Best Credit Cards to Get to Australia and New Zealand With Miles

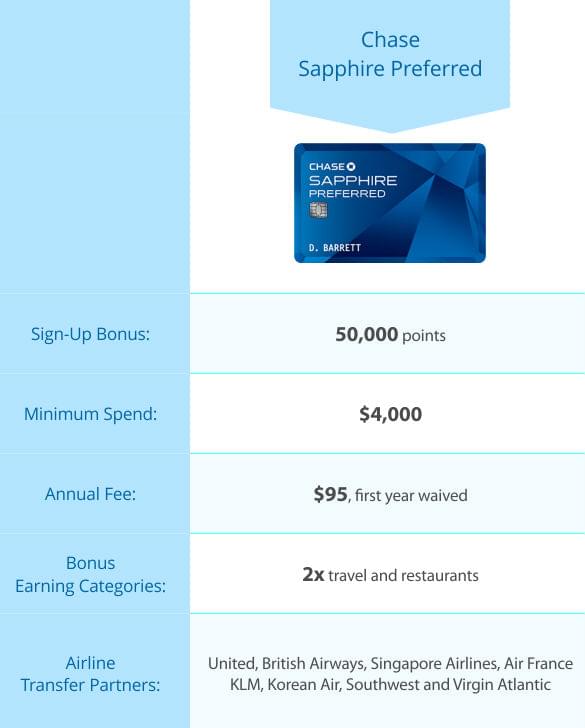

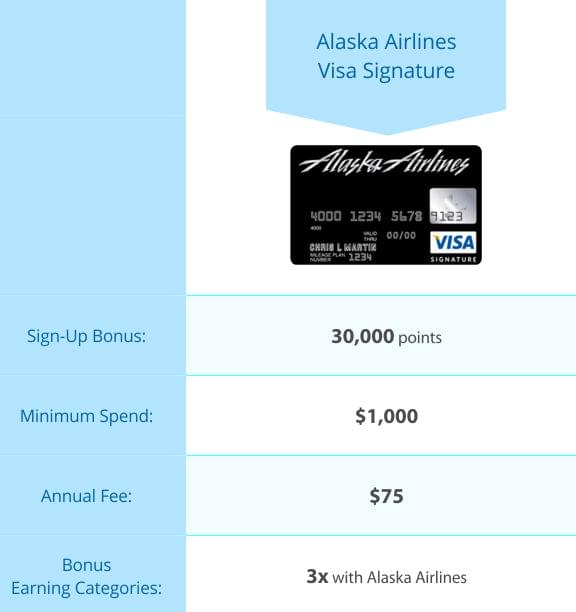

Planning a trip Down Under? A flight from the U.S. can be expensive, so it’s worth saving your miles and getting your ticket for nearly free. It can take as little as 15 months to earn an award ticket to New Zealand, and as little as 18 months to Australia if you channel $1,500 a month through a recommended credit card.

We looked at redemption rates for round-trip economy flights from major U.S. hubs on both coasts to Australia and New Zealand to determine which frequent flyer programs offered the best deals. Then we figured out which travel rewards credit cards could earn miles for those programs the fastest. Here’s what we found.

The Best Redemptions to Australia and New Zealand

JAL Mileage Bank , United MileagePlus , ANA Mileage Club , American Airlines AAdvantage and Alaska Airlines Mileage Plan topped the list for best redemptions from either coast to Australia.

Round-trip award ticket prices from the U.S. to Australia.

With the exception of Alaska Airlines, the mileage rates are the same for flights from the East Coast to New Zealand. Alaska doesn’t partner with anyone that flies that route, but for 90,000 miles you can get a ticket through Air Canada’s frequent flyer program, Aeroplan .

You’ll pay slightly less through JAL Mileage Bank and Alaska Airlines Mileage Plan if you fly from the West Coast to New Zealand. Those tickets cost 55,000 miles and 80,000 miles, respectively.

Round-trip award ticket prices from the U.S. to New Zealand.

To calculate the amount of time it takes to earn an award flight, we estimated spending $1,500 a month on a rewards credit card. Obviously this could vary depending on how much you spend. It will take less time if you spend more, and longer if you spend less.

The figure also assumes that each dollar spent will earn only one mile or point. Many rewards credit cards offer bonus earning categories which give you extra miles or points per dollar spent on qualifying purchases. This could also cut down the time it takes to earn a flight.

It’s important to note that every airline charges taxes and fees, and they can vary widely. Some carriers, such as British Airways and Iberia, add excessive fuel surcharges to long-haul flights. They’ve been omitted from this list because of those costs, which can be over $800 for this route.

The Best Cards

With its outstanding 75,000-point sign-up bonus, the Starwood Preferred Guest American Express card is probably your best bet for earning an award flight to Australia or New Zealand. That’s true for two reasons: You’ll get a 5,000-point bonus for every 20,000 points that are transferred to a frequent flyer program and you can transfer your points to over 30 different airlines. In other words, it’s an extremely flexible card that rewards you for using points with airline partners.

With the SPG Amex card, you can transfer points to four of the six recommended frequent flyer programs: JAL, ANA, American and Alaska. That gives you a lot of redemption options to find the best flight to fit your schedule.

SPG also transfers to United, but at a rate of two points to one MileagePlus mile it’s not a good use of your points.

Unfortunately, you’ll only earn bonus points at Starwood properties. All other purchases earn one point per dollar.

As most travel hackers will tell you, Sapphire is a great all-around travel credit card. It would’ve made the top spot with its 50,000-point sign-up bonus and double earning categories, but the Ultimate Rewards program transfers to only one frequent flyer program on our list, United so this card takes second place because it is not as flexible.

If you plan to book through United MileagePlus and fly on United, Air New Zealand or Air Canada, this is the card to get. And if you spend a fair amount of money on travel and eating out, which earn double points, you can cut down the 21 months it would take to earn an award flight.

The American Express Premier Rewards Gold card is also a great credit card with generous bonus earning categories and a lot of redemption options. You can transfer points to 17 frequent flyer programs through American Express Membership Rewards . Two of those programs made our list, ANA Mileage Club and Air Canada Aeroplan.

This card is the best option if you want to minimize the cash cost of your award flight since ANA has the lowest fees on tickets to Australia. You’ll pay only $30, compared to $110 for the next cheapest program.

Two co-branded airline cards round out the best five cards to get for award flights to Australia and New Zealand. Both the and Alaska Airlines Visa Signature cards come with slightly higher sign-up bonuses than either the SPG card or the Amex Premier Rewards Gold card.

These cards didn’t rank higher because they offer no flexibility when it comes to redeeming miles. They’re tied to only one frequent flyer program. If you can’t find the flight you want, you’ll either have to hang on to those miles for a different trip or change your travel dates and hope for the best.

Both of the airline cards give you a free checked bag and priority boarding, plus bonus earning for purchases made with the carrier. The Alaska card comes with an annual companion fare, which allows a family member or friend to fly with you on a domestic round-trip flight on Alaska for only $99. That’s an excellent perk that can be worth hundreds of dollars.

Which Card Should You Get?

The SPG Amex card is great because of its flexibility. You’ll have a lot of redemption options for award flights to Australia and New Zealand, making it easier to find award seats on the dates you want.

The Sapphire Preferred and Amex Premier Rewards Gold card also offer some flexibility since you can transfer your points to several different frequent flyer programs. While many of those programs don’t offer the best redemptions to Australia and New Zealand, some of them do. And you’ll have plenty of options for using points in the future if you decide to keep the cards after your trip. These cards also have great bonus earning categories, which will boost your points balance faster.

If you already have all three of those cards, but you still want a decent sign-up bonus to reach your goal fast, consider either the Alaska Airlines Visa Signature or . Both are solid co-branded airline cards associated with frequent flyer programs that can get you to Australia and New Zealand with a minimum number of miles.

Editorial Disclosure: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

UGC Disclosure: The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Best Choices

The 10 Best Credit Card NZ

When it comes to managing our finances, few tools have revolutionized the way we handle money like credit cards. In the bustling financial landscape of New Zealand, finding the best credit card can make a significant difference in our daily lives. From earning rewarding perks to enjoying financial flexibility, the right credit card can open doors to a world of possibilities.

In this blog post, we’ll dive into the realm of credit cards in New Zealand to help you uncover the top choices tailored to your needs. Whether you’re a frequent traveler seeking travel rewards, a savvy shopper looking for cashback benefits, or a responsible spender aiming to build credit, we’ve got you covered. Join us as we explore the best credit card options in NZ, unravel the unique benefits they offer, and guide you towards a financially empowered future.

YOU MIGHT ALSO LIKE:

- Best Online Dating Sites in NZ

- How Can You Make Real Money Online NZ

Table of Contents

Best Balance Transfer Credit Card

1. co-operative bank’s credit card.

Co-operative Bank’s credit card presents an appealing long-term low interest rate with an annual fee of $20. The deal entails an enticing 0% interest rate for the initial 6 months, which later adjusts to 12.95%. The annual fee amounts to $20, paid in $10 increments every six months. There is no balance transfer fee, and the monthly payments must exceed the minimum requirement, which is either 3% of the outstanding balance or $10, whichever is higher.

To make use of this credit card, certain factors must be considered. Firstly, you cannot transfer a balance from another The Co-operative Bank card. Additionally, the credit limit must be at least $1,000, and the balance transfer amount cannot exceed 80% of the credit limit, with a minimum of $100 for balance transfers. After the 0% interest period ends, any remaining transferred debt will incur a 12.95% interest until it is fully paid off.

Furthermore, it is essential not to use the card for cash withdrawals or new purchases, as the interest rate for these transactions stands at 12.95%. While you can only perform one balance transfer from another card, it is possible to consolidate balances from multiple cards into a single transfer.

2. Westpac Fee Free Mastercard

Westpac Fee Free Mastercard presents a plethora of benefits without any burdensome charges. With no annual fees, no foreign transaction fees for overseas purchases, and a highly favorable low-interest rate of 12.90% per annum, it’s a compelling choice for financially savvy individuals.

Here’s a summary of the deal’s key features: Firstly, there are no annual fees, providing cardholders with the freedom to enjoy its perks without worrying about extra costs. Secondly, the absence of overseas foreign exchange fees ensures that travelers can make purchases abroad without incurring additional expenses. Thirdly, the credit card offers a competitive interest rate of 12.90% per year, which is considerably lower than many other options in the market.

Moreover, this card presents an attractive balance transfer offer, with a fixed rate of 5.95% for the entire duration of the balance. This enables users to consolidate their debts and manage them more effectively. However, it’s essential to note that monthly payments must exceed the minimum requirement, which is either 2% of the outstanding balance or a minimum of $5, whichever is higher. Responsible credit management will ensure that cardholders can fully benefit from this exceptional offering.

3. ASB Visa Light

ASB Visa Light is presenting a compelling 0% balance transfer opportunity, allowing you to clear your outstanding balance and enhance your financial practices. The deal offers an interest-free period lasting six months, during which you can diligently work towards paying off your debt without incurring any interest charges. However, it’s crucial to take timely action and initiate the balance transfer within the initial 30 days to secure this advantageous 0% interest period. It’s important to note that balance transfers from other ASB cards are not permitted.

The terms of this deal are quite attractive. For the first six months, the interest rate remains at a favorable 0% per annum, offering significant financial relief. Beyond this grace period, the interest charge will rise to 13.50% per annum, necessitating careful financial planning to avoid high interest costs. Additionally, there is no annual fee associated with this offer, which is another appealing aspect.

Moreover, ASB is providing a window of opportunity for interest-free purchases over $1,000 for six months. This means that if you need to make sizeable purchases, you can take advantage of this interest-free period to manage your expenses efficiently.

4. ANZ Low Rate Visa

ANZ Low Rate Visa presents an appealing offer for those seeking to manage short-term debt through a balance transfer, and the first-year annual fee is waived. To make the most of this opportunity, the balance must be settled within 24 months, or else a 9.95%* interest rate will apply to any remaining balance.

The deal entails an initial interest rate of 1.99% for a duration of 24 months, after which it reverts to 12.90%*. During the first year, there is no annual fee, but subsequently, an annual fee of $35 will be charged ($17.50 every six months).

When initiating the balance transfer, no additional fee is imposed. However, it is crucial to effectuate the transfer within the first 30 days to avail of the 0% interest period. Note that transferring a balance from another ANZ card is not permitted.

Once the 0% interest period concludes, any remaining transferred debt will be subjected to a 9.95% interest rate until it is completely paid off. It’s important to avoid using this card for cash withdrawals or purchases, as new purchases will also incur a 9.95% interest rate.

Best Travel Benefits Credit Card

5. american express airpoints platinum.

American Express Airpoints Platinum comes with a $195 annual fee but offers a plethora of valuable features. Cardholders can explore the detailed review of this credit card to learn more about its benefits. One of the significant advantages is the ability to use Airpoints Dollars for various purposes such as gifts, food and beverages, shopping at Mitre 10 and other hardware stores, flights, and numerous other options. Additionally, new applicants can enjoy a sign-up bonus of 300 Airpoints Dollars after being approved and spending $1,500 on the card within the first three months, effectively covering the membership fee for at least the initial year.

This credit card stands out with its high earning rate of Airpoints Dollars, approximately 1.70 for every NZ$100 spent, making it an attractive choice for those looking to grow their Airpoints balance each month. Moreover, cardholders benefit from a range of useful insurance perks, including coverage for rental cars and international travel, which could potentially save them hundreds of dollars. Notably, the American Express card is widely accepted across New Zealand, including all major supermarkets and retailers.

The card’s additional perks include mobile phone screen insurance for those who purchased their phone with the American Express card, as well as a notable discount on the Koru Club membership. In conclusion, the American Express Airpoints Platinum is deemed as one of the top credit card choices available, appealing to a wide range of households in New Zealand.

6. Kiwibank Air NZ Airpoints Platinum Visa

Kiwibank Air New Zealand Airpoints Platinum Visa card being discussed here is widely accepted and offers certain benefits, but it comes with a significant annual fee and a lower Airpoints earning rate compared to the AMEX Airpoints Platinum card. While the AMEX card earns 1 Airpoints Dollar for every $59 spent, this Visa card only earns 1 Airpoints Dollar for every $115 spent. This discrepancy makes it a high-fee platinum-level option, which might not be the best choice for those looking to maximize their Airpoints rewards.

The card’s deal includes an interest rate of 20.95% p.a. and an annual fee of $180. To maintain the account in good standing, monthly payments must exceed the greater of either 5% of the balance owing or $10. Additionally, using this credit card to pay for travel expenses provides complimentary overseas travel insurance, which can be beneficial for frequent travelers.

Another feature of this card is the Status Points it offers. For every $200 spent, the cardholder earns 1 status point, which aids in reaching different tier levels such as Silver, Gold, and Gold Elite. If a total of $45,000 is spent within a year, the cardholder will earn 225 Status Points. While this is half the number required to reach the Silver tier, it’s essential to note that 50% of the status points needed for tier progression must be earned on Air New Zealand, Star Alliance, or other Qualifying flights.

Best Rewards & Cashback Credit Cards

7. american express gold rewards card.

American Express Gold Rewards Card is a one-of-a-kind credit and rewards card in New Zealand, offering a delightful fusion of dining benefits and enticing rewards. Applicants can choose between a stylish pink or gold metal card during the application process.

With this card, dining enthusiasts are in for a treat. Each year, cardholders receive a $200 free statement credit when they dine at selected restaurants affiliated with American Express across the country. By spending over $100 on a single bill, $100 will be credited back to their statement. This dining credit is available twice a year, resetting every six months.

The rewards program is equally impressive, with cardholders earning 2 Membership Reward Points for every $1 spent. For those who spend approximately $25,000 annually, a generous reward of 50,000 Membership Reward Points awaits. These points can be converted into 333 Airpoints Dollars, $375 of travel credit (which can be booked through American Express Travel), or roughly $250 credit toward card expenses (equivalent to 52,000 Membership Reward Points).

It’s important to note that the American Express Gold Rewards Card comes with an interest rate of 19.95% per annum. However, customers enjoy a comfortable interest-free period of 55 days. An annual fee of $200 is billed yearly.

8. SBS Visa

SBS Visa is a unique credit card that stands out for being the only one offering cashback to its users. With this card, you have the opportunity to receive a cashback of 67 cents for every $100 spent, providing a little financial benefit with your purchases. However, it’s important to consider some essential aspects of this card before applying.

One key factor to keep in mind is the relatively high-interest rate of 18.50% per annum. If you struggle to pay off your monthly balance in full, this higher-than-average interest rate could potentially lead to significant costs in interest charges, making it less favorable for those who may carry a balance from month to month.

Nevertheless, the card does come with a few attractive features. It provides a reasonable interest-free period of 55 days, allowing you to make purchases without incurring interest as long as you clear your balance within that period. Additionally, you can earn cashback rewards of $1 for every $150 spent on the card, which can add up over time.

It’s important to manage your credit card responsibly and make monthly payments above the minimum amount required, which is either 5% of the closing balance or $10, whichever is greater. This helps you avoid falling into a cycle of debt and maintain a healthy financial standing.

9. TSB Platinum Mastercard

TSB Platinum Mastercard , a top-tier credit card tailored to cater to your premium needs. This exclusive card provides cardholders with exceptional benefits, making it an attractive choice for savvy consumers.

With the TSB Platinum Mastercard, you can earn $1 cashback for every $70 spent, translating to an impressive 1.42 cents back for every dollar spent. This generous rewards program ensures that you can get a little something back with every purchase you make.

In terms of interest rates, the card offers a competitive 20.95% per annum rate. However, with the added advantage of 55 interest-free days, you have the flexibility to manage your payments effectively without incurring any interest during this grace period.

The perks don’t stop there. Alongside the cashback rewards, the TSB Platinum Mastercard provides several valuable features. Cardholders can take advantage of travel insurance and purchase protection, safeguarding your purchases and ensuring peace of mind during your trips. Additionally, a standout benefit is the Mobile Phone Protection feature, which offers insurance coverage against accidental damage or theft when you pay your monthly mobile phone bill using the card.

To maintain your card’s benefits, it is essential to make monthly payments that exceed the minimum requirement, which is either 5% of the closing balance or $10—whichever is greater.

10. ASB VISA Rewards

ASB VISA Rewards , a credit card program that offers an array of enticing benefits for Kiwis looking to make the most of their spending. While some may find the allure of extravagant rewards like Samsung phones appealing, the truth is that earning such rewards requires an impractical amount of spending – $300,000, to be exact. Instead, the focus should be on the more attainable yet equally rewarding options.

With ASB VISA Rewards, Kiwis can earn 1 “True Rewards Dollar” for every $150 spent or even better, 1 for every $75 spent at Mobil stations. These True Rewards Dollars accumulate quickly, and for every $150 spent, you earn $1 in rewards value, equivalent to a 67 cents return for every $100 spent. It’s worth noting that these rewards can’t be used to directly offset your credit card bill but can be redeemed at various partner stores, opening up a world of enticing possibilities.

This credit card comes with a competitive interest rate of 20.95% p.a. and an annual fee of $40, billed conveniently at $20 every six months. To make the most of the rewards, monthly payments must exceed the minimum threshold, which is either 3% of the balance or $10, whichever amount is higher.

FAQ’s

What is a credit card, and how does it work in nz.

A credit card is a financial tool that allows you to borrow money from a bank or financial institution for purchases. In NZ, you can use it for online and in-store transactions, paying bills, and withdrawing cash, with the balance payable monthly.

What are the benefits of having a Credit Card in NZ?

Credit cards offer various benefits in NZ, including convenience, reward points, purchase protection, and the ability to build a credit history for future financial opportunities.

How can I apply for a Credit Card in NZ?

To apply for a credit card in NZ, visit the website of the bank or institution of your choice and fill out the online application form, providing necessary personal and financial details.

What factors influence credit card approval in NZ?

Credit card approval in NZ is influenced by factors like credit score, income, employment status, existing debts, and credit history.

What is a credit score, and why is it important for obtaining a Credit Card in NZ?