Oasis Insurance

Traveling to mexico from arizona here’s what you’ll need to insure your trip .

Bring plenty of sunscreen, don’t drink the water (but do partake in the empanadas and street tacos), and take it easy on the tequila … definitely take it easy on the tequila. If you’re traveling from Arizona to Mexico on vacation this year, those are likely three of the most important pieces of advice you’ll get. There is one far less exciting, but way more important thing to remember: Insure your trip.

Why Is Travel Insurance to Mexico Important?

By having a comprehensive auto policy that covers you for collision, liability, and a few extras, you’re safe to roam from sea to shining sea … in America. Once you cross the border into Mexico, however, that plan may not protect you to the extent it does in the United States.

Although you should not let this deter your plans, traveling to Mexico does involve a certain amount of risk. You may find your way to some pretty remote areas where the streets resemble more of a four-wheeling course than any sort of paved roadway, and streetlights are an afterthought in many areas. Other busier locations could have all the congestion of a Los Angeles freeway during the morning commute.

Those non-ideal road conditions can easily lead to an accident. In that case, your Mexico travel insurance will pick up where your existing collision and comprehensive coverage left you at the border.

Also, and this is key: If you’re at fault for a crash that involves personal injury or damage to someone else’s vehicle or property, you could actually be held in Mexico until all damages are rectified unless you have travel insurance.

What Are Some Other Considerations When Traveling from Arizona to Mexico?

The idea of being held against your will in any foreign country is enough reason to get affordable travel insurance, but there are additional unforeseen events to consider as well.

In addition to a policy that covers your driving in Mexico , you should also seek a policy that covers the trip itself. Nobody wants to think about what can go wrong on a vacation. With the right travelers insurance, however, you won’t need to. You can focus on dining, dancing, and sightseeing with the peace of mind that comes with knowing you’re covered.

Lost luggage and last-minute cancellations are unfortunate facts of life. Somehow, once you drop off your bags, they occasionally fall into a black hole and don’t reappear in the baggage claim area at your destination. Even more discouraging is when a family incident, something work-related, or another of life’s challenges causes a last-minute cancellation.

When lost luggage, a trip cancellation, or an accident happens, you’ll be glad you have travelers insurance. It offers extra coverage, including medical expenses, if you get seriously injured during your trip. Nobody likes to think of that happening, but you’re better off understanding your current coverage and taking steps to ensure you are protected than unlucky with nowhere to turn.

Where to Find Mexico Travel Insurance in Arizona

The best travel insurance for your trip to Mexico is only one call or click away. Contact Oasis Insurance at (800) 330-5190 or visit our website for more information.

Related Articles

3 Modern Safety Features to Make Driving in Tucson Safer

Picture it’s 1998, and you’re driving a Toyota Corolla on the I-10 in Tucson, AZ. After a glance over your shoulder and at your passenger [...]

How to Customize Your Auto Insurance in Tucson, AZ

There are many different options for car insurance in Tucson, AZ. You need to have the state’s legal minimum requirement, but you may need to increa[...]

5 Tips for Driving Safely in the Arizona Rain

A lot of folks who aren’t from the area are surprised to learn that it does indeed rain in Arizona. We get more than our fair share of that big,[...]

Get a Quick Quote

Suggested companies

Admiral insurance, switched on insurance.

Oasis Insurance Reviews

In the Travel Insurance Company category

Visit this website

Company activity See all

Write a review

Reviews 4.7.

1,831 total

Most relevant

Almost there ...

Third renewal but ... The price is fine and the cover is fine, but 5 days before travelling I had to update the policy for renewal whilst I am away and underwriting had to be consulted. Oasis were supposed to call me with the answer but they didn't. The answer came in to them from underwriting but I had to chase for the response the day before I travelled. It would have been a 5 star. Rebecca on the phone was good.

Date of experience : 23 April 2024

Reply from Oasis Insurance

Hi David, Thank you for taking the time to leave us a review and for the valuable feedback. Given we're consistently looking to improve our customer experience at Oasis, I'll ensure your review is passed on to the relevant team for feedback. Please accept our apologies for any delay in responding to yourself following underwriting review. Many thanks, Oasis Insurance

Great service and price

Easy to use website and price competitive. I had a few questions about the cover and our medical history and the service was first class.

Date of experience : 21 April 2024

Straight forward forms ,easy to follow

Straight forward forms ,easy to follow, and ending in a fair price to pay for your holiday insurance

Date of experience : 19 April 2024

Very helpful for my travel insurance…

Very helpful for my travel insurance and very reasonable price thank you.

Date of experience : 22 April 2024

Quick and easy

Quick and easy. Othelia was very helpful and efficient in processing our application

Great l price very impressive

Jasmine was great

Jasmine was great. Informative , helpful and friendly. Top marks!

Date of experience : 11 April 2024

The site was easy to use and a…

The site was easy to use and a reasonable quote too and the details were quickly sent to my email address.

Date of experience : 12 April 2024

Well presented unbiased sale without sales pressure

d advised me politely all the salient points of the policy and satisfy myself that had all the cover that I needed. A pleasure to deal with sorry I wrote a little more before the start above I hope you find it

Date of experience : 02 April 2024

No way of upgrading the policy online

No way of upgrading the policy online. You can only buy the preset lowest level and cannot even add extra cover

Hi Jed, Thank you for taking the time to leave us a review and we're sorry to learn of any issues faced. Your policy was purchased via Moneysupermarket, therefore within the price presentation screen there would have been three levels of cover with Oasis Insurance's Silver and Gold tiers shown. Any additional levels of cover such as winter sports would of need to be added when you entered your quote details, however I can see you have already added Excess Waiver to your policy. Unfortunately the customer journey is outside of our control as the website belongs to Moneysupermarket. I will pass your review on to one of our customer service team to see if they can help you any further, while there is also functionality to amend/update your policy within the MyOasis customer self service portal. Once again, we're sorry for any issues faced. Many thanks, Oasis Insurance

Very easy to set up insurance

Very easy to set up insurance, good price also!

Date of experience : 20 April 2024

This company came out the cheapest on comparemarket and best value

Date of experience : 10 April 2024

Good insurer for overseas and all locations

We renewed with Oasis as they were a great insurer when we were travelling. Had a claim in Thailand due to an eye infection which required extensive treatment - money wasy refunded within 4days! Couldn't fault them.

Date of experience : 01 March 2024

An easy decision …

I found the website to be easy to understand and explained well. My medical issue was simple to explain . The policy I decided on was exactly what I needed while staying with family abroad.

Date of experience : 12 March 2024

So simple to use and cheaper than…

So simple to use and cheaper than anyone else.Thankyou.

Date of experience : 16 April 2024

Quick fast and easy and reasonable…

Quick fast and easy and reasonable price . Details send straight away to me in Email.

Date of experience : 08 April 2024

Name of insured?

Insurance cover docs referred to Mrs Roger Ireland, and not Elizabeth Ireland. I applied for and took out this policy to cover my wife, in her name, and am concerned that if I had had to claim, (which I didn't) this discrepancy would have caused difficulties.

Date of experience : 14 March 2024

Hi Roger, Thank you for taking the time to leave us a review. I can see you would have entered all of the details within Compare The Market's website prior to these coming over to us to complete your purchase. Looking at the name on your policy, I can see this as Roger Ireland, with no reference to Elizabeth. I have therefore passed your details over to our customer service team so a member of our team can give you a call to better understand what has happened and ensure all of the information captured is correctly reflected within our system. This will ensure completeness on the policy and no issues moving forward. We can only apologise for any inconvenience caused. Many thanks, Oasis Insurance

Great customer support and very helpful…

Great customer support and very helpful in going thru renewal details, 3rd year with them now and still best price

Date of experience : 27 March 2024

The price and quickness of finding the…

The price and quickness of finding the correct cover for me

Date of experience : 09 April 2024

clear and swift in processing

Oasis Insurance

Oasis is a travel insurance provider. Their policies are underwritten by Great Lakes.

We don't get paid for any links on our site.

We don't currently rate Oasis Insurance in our Customer Experience Ratings.

Travel insurance

Annual multi-trip insurance.

Single trip insurance

Backpacker gold, backpacker silver, backpacker bronze.

Travel insurance add-on: cruise cover

Travel insurance add-on: winter sports

Search Fairer Finance

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

Oasis Travel Insurance Review

Everything you need to know before you buy travel insurance from Oasis!

The experts say:

What oasis customers are saying right now:.

- ✅Competitive price 🤑

- ✅Good level of travel insurance coverage 📝

- ✅Straight forward and easy website 💻

- ✅Helpful and friendly operatives ⭐

- ✅Immediate assistance to resolve issues 🔒

- ❌ Ignored receipts from the pharmacy when making a claim

- 😓 Attempted to get customer to accept a low ball offer without reading policy

- 😠 Incorrect details on policy due to auto correct changing details

Oasis customer reviews summary

Oasis travel insurance provides customers with an easy and straightforward process when purchasing a policy, giving them the peace of mind that they will be supported if something goes wrong. Customers have found the cover to be competitively priced and comprehensive, with helpful staff providing clear explanations of all the options available. From claims relating to skiing injuries to auto-correct mistakes, Oasis have provided prompt refunds and resolutions to customer issues. Overall, customers feel secure in their knowledge that their holidays will be covered by Oasis travel insurance, giving it a score of 9 out of 10.

AllClear Travel Insurance Review

Everything you need to know before you buy travel insurance from AllClear!

Co-op Insurance Services Travel Insurance Review

Everything you need to know before you buy travel insurance from Co-op Insurance Services!

Covered2Go Travel Insurance Review

Everything you need to know before you buy travel insurance from Covered2Go!

Reviewed: 100+ UK travel insurance providers

- Privacy Policy

- Car Insurance Reviews

- Pet Insurance Reviews

- Home Insurance Reviews

Copyright © 2023 TravelInsuranceReview.co.uk

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

7 Best Cheap Travel Insurance Companies in April 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Finding the cheapest travel insurance is often a priority for travelers hoping to protect themselves and their finances while away from home.

But is it better to err on the side of affordable travel insurance or opt for a more comprehensive plan? That depends on your needs .

On average, a comprehensive plan that covers some combination of trip cancellation and interruption costs, medical coverage and baggage protection (and perhaps a number of other things) will cost you 5%-10% of what you paid for the trip, according to NerdWallet partner Squaremouth, a travel insurance marketplace.

That means a comprehensive policy for a trip that costs you $3,000 could run you anywhere between $150 and $300. Factors like the cost and length of your trip, the age of the travelers and how much protection you want can significantly influence what you pay for your plan.

Ultimately, Squaremouth recommends “the least expensive policy that offers the coverage [travelers] need.”

» Learn more: The best travel insurance companies right now

Factors we considered when picking cheap travel insurance plans

We considered a few factors as we looked for the most affordable travel insurance plans.

Price: If your goal is to find cheaper travel insurance, you want the price to be affordable.

Breadth of coverage: The best budget travel insurance is typically going to be a plan that offers a wide range of protections at an affordable cost, ensuring you’re protected with at least some coverage for a wide range of scenarios.

Uniqueness or customizability : While many travel insurance plans have similar protections, some stand out for particular coverage that can be helpful to certain travelers, like those needing to Cancel For Any Reason , those going on a cruise, or travelers with preexisting health conditions. We didn’t spring for the priciest plans with broad, deep coverage; instead, we picked those that meet a sort of budget "sweet spot" when it comes to cost efficiency.

» Learn more: Is travel insurance worth getting?

An overview of the best cheap travel insurance plans

We looked at travel insurance quotes for a hypothetical 10-day trip to Italy in October 2023. The traveler is a 40-year-old man living in North Carolina who spent $2,000 on the trip, including airfare.

Reliable but cheap travel insurance providers

1. axa assistance usa (silver plan: $70).

Why we picked it:

The $500 missed connection benefit is great for cruise and tour participants. It covers additional transportation, accommodations and meal costs when you miss a cruise or tour departure.

Full trip cancellation and interruption coverage, along with up to $25,000 for out-of-pocket medical costs and baggage coverage.

Among the lowest prices we found.

If you’re willing to spend a bit more than AXA's $70 Silver plan, a Gold plan only costs $19 more and gets you deeper coverage amounts and up to $35,000 in collision rental car insurance.

2. Berkshire Hathaway Travel Protection (ExactCare Value plan: $56)

Cheapest plan we found while still offering a wide array of protections.

Includes a preexisting medical condition waiver.

Add-on rental car collision coverage optional for $10 per day. You can pick how many days you want the additional coverage — it’s not all or nothing.

At $56, this plan comes in at less than 3% of the $2,000 trip cost.

3. IMG (iTravelInsured Lite plan: $77)

Treats COVID-19 like any other illness, which is to say, if your claim accepts flu, strep throat or appendicitis as an acceptable, covered condition, the coronavirus is, too.

Covers costs related to trip interruption up to 125%

Higher than normal limits on dental expenses, at $1,000. If your teeth are your Achilles heel (or your biggest fear), this plan might be for you.

The iTravelInsured Lite plan doesn’t offer some of the bells and whistles that other plans do, like rental car coverage , Cancel For Any Reason coverage or waivers for pre-existing conditions. But you’ll have relatively solid across-the-board trip protections.

4. John Hancock (Silver plan: $93 for a mid-tier plan)

Mid-level plan (as opposed to a basic plan) at an affordable price for travelers who want more coverage without paying too much.

Includes an optional Cancel For Any Reason add-on for travelers wanting flexibility. It is a bit pricey, at half the cost of the insurance ($46.50 extra for a $93 plan).

Reimburses up to $1,000 for lost baggage , far more than many basic plans.

Add-on rental car coverage for $9 per day.

At $88, John Hancock’s basic (Bronze) plan isn’t particularly affordable. But for just $4 extra, you can tap into the benefits of a mid-tier plan at still less than 5% of the total trip cost.

5. Nationwide (Essential plan: $76)

Includes a preexisting conditions waiver.

Add-on rental car coverage for $90.

Covers trip interruption at 125% of the trip cost while providing comprehensive emergency medical and baggage coverage.

6. Seven Corners (Basic plan: $75)

On top of standard trip protections, it includes a relatively affordable Cancel For Any Reason option for $31.50 extra.

If you plan to rent expensive sporting equipment, you might consider paying $10 extra to cover lost, damaged, stolen or destroyed gear.

COVID-19 coverage reimburses you for costs incurred if you have to quarantine .

Rental car coverage comes in at an affordable $7 per day.

Seven Corners’ Basic plan stands out because it offers a little bit of everything, appealing to athletic travelers, those who need affordable trip protections, those who want the flexibility to cancel for any reason and those still concerned about getting quarantined due to COVID-19.

7. Travelex Insurance Services (Basic plan: $71)

Straightforward: What you see is what you get. This plan’s coverage has fewer rules and caveats than many.

While not sporting the highest coverage amounts, it offers a solid range of protections to ensure you get at least something back when your travel is disrupted or you have a medical emergency.

Offers add-on rental car coverage for $10 per day.

At $71, the Travelex Basic plan’s cost is just over 3% of the $2,000 trip’s cost.

If you want to get travel insurance at the cheapest possible rate, here’s a trick. Put $0 as your trip cost, Stan Stanberg, co-founder of comparison site Travelinsurance.com said in an email.

“When excluding trip cancellation and trip interruption coverage the cost of a travel insurance plan goes down significantly,” Stanberg said.

That means you won’t get reimbursed if you need to cancel your trip or if it gets interrupted. But you may still have access to the plan’s medical, trip delay , missed connection, baggage and other protections.

You’ll often find comprehensive travel insurance plans cost 5%-10% of your total trip cost, according to Squaremouth. This will often get you full trip cancellation and trip protection, baggage protection, emergency medical coverage and often other benefits.

Typically, the more you pay, the broader and deeper the coverage.

For many plans, you can purchase travel insurance up until you depart. However, to get access to the most protections possible, booking two days to two weeks after making your initial deposit is the best rule of thumb.

That means you won’t get reimbursed if you need to cancel your trip or if it gets interrupted. But you may still have access to the plan’s medical,

, missed connection, baggage and other protections.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

SILVER PLAN

Reasonable Coverage at a Reasonable Price

Travel Insurance | Silver Plan

Why choose the silver plan, accident & health , property , compare travel insurance plans.

Get covered against Trip Delays, Medical Emergencies, Lost Baggage, and more!

How do I purchase the Silver Plan?

- Click here to fill out the travel form with your travel information

- Choose a travel plan and selection of optional add-ons

- Review the policy terms and conditions, including any exclusions or limitations; premiums will depend on the coverage package you selected

- Once your payment has been processed, you will receive a confirmation email with your policy details. Read policy documents and keep them in a safe place for future reference

Also see: Plan Comparison Table | Gold Plan | Platinum Plan

Need help choosing a plan.

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

Travel Insurance

Please note that Oasis Travel are providing a selection of options for your travel insurance, however we are not in a position to sell you a policy directly or manage your policy on your behalf. Other travel insurance options are available and the choice of who you use is entirely yours

Oasis Travel 28-30 Railway Street, Lisburn, BT28 1, United Kingdom

028 9260 4455

OPENING HOURS

Booking Phone Line Open Mon - Fri until 8pm

For the latest travel advice from the Foreign & Commonwealth Office including security and local laws, plus passport and visa information, visit FCO Travel Aware website

Terms and Conditions Privacy Policy Cookie Policy Website by TMS

Changes to VIVA Travel Insurance policies relating to Israel - find out more here...

- Privacy Policy

- Make a claim

Cover your trip

- Single Trip

- Winter Sports

- Medical Conditions

- Sports and Activities

- COVID-19 Testing

- Policy Wording

- Accessibility

Viva Travel Insurance

Enjoy your trip to the full knowing you’re comprehensively covered with Viva’s great value travel insurance.

While we all hope our holidays go without a hitch, our travel insurance has been designed to fully protect you, and your loved ones, should something unexpected happen. With our flexible approach you can choose from a range of cover levels, tailor your benefits and declare any medical conditions.

Wherever your travel plans take you – whether you’re indulging in the local cuisine on a short city break, relaxing on a gorgeous beach on a fly and flop, or you’re off on an action packed backpacking adventure – a Viva Travel Insurance policy will provide real peace of mind!

Find out more about Viva Travel Insurance

Our Travel Cover

Silver cover.

- XS Excess £150

- XS Excess £95

Platinum Cover

- XS Excess £50

Get Started with your Travel Insurance Quote now

The right cover at the right price

Individual Cover

If you’re looking to protect yourself whilst travelling, we can offer you the perfect choice of cover and optional extras, meaning Viva will be with you every step of the way.

Couples Cover

Travelling is extra fun when the experience is shared. Relax and enjoy your break knowing you have complete protection in a policy that covers the both of you.

Family Cover

Protection for your entire family under one policy for real peace of mind. We cover families large and small, including single parents and grandparents travelling with grandkids.

Medical Cover

We will consider any pre-existing medical condition and if we can, we will provide a great value policy that offers complete protection for your health issues.

If you are travelling on your own and just want cover for yourself we can offer you the perfect choice of cover and optional covers.

Travelling is fun when the experience is shared. Relax and enjoy your break knowing you have complete protection in a policy that covers the both of you.

Protection for your entire family under one policy. We cover families large and small, including single parents and grandparents travelling with grand kids.

We consider any pre-existing medical condition and if we can, we will provide a great value policy that includes complete cover for any health issues.

- 24/7 Emergency Helpline

- Cover For Trips Up To 18 Months

- 60+ Sports & Activities Covered

- All Medical Conditions Considered

Why Viva Travel Insurance?

Complete peace of mind, that’s why. The Viva team has been at the forefront of the travel insurance industry for many years and using this knowledge and expertise we’ve built a range of cover that you can be confident provides comprehensive protection at the right price.

We understand that insurance is a promise. In order to keep this promise we have been careful to choose an underwriter with a top security and trust rating to partner with. Our emergency facilities are available to you 24 hours a day, 365 days a year and our team will ensure you receive the very best support and care. Plus, all our policies can be extended to include many pre-existing medical conditions.

- Get more on our app

Trains Moscow to Elektrostal: Times, Prices and Tickets

- Train Times

- Seasonality

- Accommodations

Moscow to Elektrostal by train

The journey from Moscow to Elektrostal by train is 32.44 mi and takes 2 hr 7 min. There are 71 connections per day, with the first departure at 12:15 AM and the last at 11:46 PM. It is possible to travel from Moscow to Elektrostal by train for as little as or as much as . The best price for this journey is .

Get from Moscow to Elektrostal with Virail

Virail's search tool will provide you with the options you need when you want to go from Moscow to Elektrostal. All you need to do is enter the dates of your planned journey, and let us take care of everything else. Our engine does the hard work, searching through thousands of routes offered by our trusted travel partners to show you options for traveling by train, bus, plane, or carpool. You can filter the results to suit your needs. There are a number of filtering options, including price, one-way or round trip, departure or arrival time, duration of journey, or number of connections. Soon you'll find the best choice for your journey. When you're ready, Virail will transfer you to the provider's website to complete the booking. No matter where you're going, get there with Virail.

How can I find the cheapest train tickets to get from Moscow to Elektrostal?

Prices will vary when you travel from Moscow to Elektrostal. On average, though, you'll pay about for a train ticket. You can find train tickets for prices as low as , but it may require some flexibility with your travel plans. If you're looking for a low price, you may need to prepare to spend more time in transit. You can also often find cheaper train tickets at particular times of day, or on certain days of the week. Of course, ticket prices often change during the year, too; expect to pay more in peak season. For the lowest prices, it's usually best to make your reservation in advance. Be careful, though, as many providers do not offer refunds or exchanges on their cheapest train tickets. Unfortunately, no price was found for your trip from Moscow to Elektrostal. Selecting a new departure or arrival city, without dramatically changing your itinerary could help you find price results. Prices will vary when you travel from Moscow to Elektrostal. On average, though, you'll pay about for a train ticket. If you're looking for a low price, you may need to prepare to spend more time in transit. You can also often find cheaper train tickets at particular times of day, or on certain days of the week. Of course, ticket prices often change during the year, too; expect to pay more in peak season. For the lowest prices, it's usually best to make your reservation in advance. Be careful, though, as many providers do not offer refunds or exchanges on their cheapest train tickets.

How long does it take to get from Moscow to Elektrostal by train?

The journey between Moscow and Elektrostal by train is approximately 32.44 mi. It will take you more or less 2 hr 7 min to complete this journey. This average figure does not take into account any delays that might arise on your route in exceptional circumstances. If you are planning to make a connection or operating on a tight schedule, give yourself plenty of time. The distance between Moscow and Elektrostal is around 32.44 mi. Depending on the exact route and provider you travel with, your journey time can vary. On average, this journey will take approximately 2 hr 7 min. However, the fastest routes between Moscow and Elektrostal take 1 hr 3 min. If a fast journey is a priority for you when traveling, look out for express services that may get you there faster. Some flexibility may be necessary when booking. Often, these services only leave at particular times of day - or even on certain days of the week. You may also find a faster journey by taking an indirect route and connecting in another station along the way.

How many journeys from Moscow to Elektrostal are there every day?

On average, there are 71 daily departures from Moscow to Elektrostal. However, there may be more or less on different days. Providers' timetables can change on certain days of the week or public holidays, and many also vary at particular times of year. Some providers change their schedules during the summer season, for example. At very busy times, there may be up to departures each day. The providers that travel along this route include , and each operates according to their own specific schedules. As a traveler, you may prefer a direct journey, or you may not mind making changes and connections. If you have heavy suitcases, a direct journey could be best; otherwise, you might be able to save money and enjoy more flexibility by making a change along the way. Every day, there are an average of 18 departures from Moscow which travel directly to Elektrostal. There are 53 journeys with one change or more. Unfortunately, no connection was found for your trip from Moscow to Elektrostal. Selecting a new departure or arrival city, without dramatically changing your itinerary could help you find connections.

Book in advance and save

If you're looking for the best deal for your trip from Moscow to Elektrostal, booking train tickets in advance is a great way to save money, but keep in mind that advance tickets are usually not available until 3 months before your travel date.

Stay flexible with your travel time and explore off-peak journeys

Planning your trips around off-peak travel times not only means that you'll be able to avoid the crowds, but can also end up saving you money. Being flexible with your schedule and considering alternative routes or times will significantly impact the amount of money you spend on getting from Moscow to Elektrostal.

Always check special offers

Checking on the latest deals can help save a lot of money, making it worth taking the time to browse and compare prices. So make sure you get the best deal on your ticket and take advantage of special fares for children, youth and seniors as well as discounts for groups.

Unlock the potential of slower trains or connecting trains

If you're planning a trip with some flexible time, why not opt for the scenic route? Taking slower trains or connecting trains that make more stops may save you money on your ticket – definitely worth considering if it fits in your schedule.

Best time to book cheap train tickets from Moscow to Elektrostal

The cheapest Moscow - Elektrostal train tickets can be found for as low as $35.01 if you’re lucky, or $54.00 on average. The most expensive ticket can cost as much as $77.49.

Find the best day to travel to Elektrostal by train

When travelling to Elektrostal by train, if you want to avoid crowds you can check how frequently our customers are travelling in the next 30-days using the graph below. On average, the peak hours to travel are between 6:30am and 9am in the morning, or between 4pm and 7pm in the evening. Please keep this in mind when travelling to your point of departure as you may need some extra time to arrive, particularly in big cities!

Moscow to Elektrostal CO2 Emissions by Train

Anything we can improve?

Frequently Asked Questions

Go local from moscow, trending routes, weekend getaways from moscow, international routes from moscow and nearby areas, other destinations from moscow, other popular routes.

Firebird Travel

RUSSIA TRAVEL HOME

Thank you for your enquiry.

RUSSIA TRAVEL PACKAGES A selection of Russian tours to take as they are or adjust to your needs.

THE GOLDEN RING Visit the heart of ancient Russia. What is the Golden Ring?

MOSCOW TOURS What you can see in Moscow.

MOSCOW DAY TRIPS Get out of Moscow and take a relaxing trip to some of these places

ST. PETERSBURG Some of the sights to see in Petersburg

LAKE BAIKAL TOURS Hiking and trekking around the world's deepest lake in the heart of Siberia

RUSSIAN DIGS Come and work in the field on a Russian Archaeological dig. Full training given on site.

TRAVEL TIPS & SERVICES Getting around in Russia

If you do not receive a confirmation email shortly then you have probably incorrectly entered your email.

Number of travelers ">

Special Interests or requests. "> ">

If you experience difficulties please use this link to send Regular Email . All information is treated as confidential

- Your Details

It is important to answer all questions accurately and in full. Failure to do so, may result in your claim being rejected or not being paid in full.

Foreign, Commonwealth & Development Office (FCDO)

Please note, there is no cover for customers who travel against either "all" or "all but essential" travel as directed by the Foreign, Commonwealth & Development Office (FCDO). If you do, your claim may be invalid. You can view the current advice by clicking here .

Your Trip Details

Please take the time to answer all questions honestly and to the best of your knowledge. Any incorrect information provided may invalidate a claim or your policy.

Single Trip Cover for one single trip, up to 183 days in duration.

End date Please enter the last date of your trip. Please note that your policy automatically extends to provide cover if anyone named on the policy is unable to return home due to injury, illness or a public transport delay.

Note: No cover is provided under either a Single Trip or Annual Multi-Trip policy for any trip in, to, or through Afghanistan, Iran, Iraq, Liberia, North Korea, South Sudan, Sudan or Syria.

Annual Multi Trip If you are taking more than one trip a year, an Annual Multi-Trip policy may be more suitable. This covers you for multiple trips within the destination area you have chosen during a 12 month period for up to 31, 45 or 62 days depending on the level of cover you select.

Please note that your policy automatically extends to provide cover if anyone named on the policy is unable to return home due to injury, illness or a public transport delay.

Europe Albania, Andorra, Armenia, Austria, Azerbaijan, Azores, Balearics, Belarus, Belgium, Bosnia Herzegovina, Bulgaria, Canary Islands, Channel Islands, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Faroe Islands, Finland, France, Germany, Gibraltar, Greece (including Greek Islands), Hungary, Iceland, Ireland (Republic), Israel, Italy, Lapland, Latvia, Liechtenstein, Lithuania, Luxembourg, Macedonia, Madeira, Malta, Moldova, Monaco, Montenegro, Morocco, Netherlands, Norway, Poland, Portugal, Romania, Russian Federation, San Marino, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Tunisia, Turkey, Ukraine, United Kingdom and Vatican City.

Worldwide excluding USA, Canada, Mexico and the Caribbean All countries in the world excluding the USA, Canada, Mexico, the islands of the Caribbean and Bermuda.

Worldwide including USA, Canada, Mexico and the Caribbean All countries of the world.

Backpacker If you are taking more than one trip a year, an Annual Multi-Trip policy may be more suitable. This covers you for multiple trips within the destination area you have chosen during a 12 month period for up to 62 days or 92 days depending on the level of cover you select.

Australia/New Zealand Australia and New Zealand.

Destination

Please tell us about all of the countries you are visiting on your travels.

Annual multi trip

A policy covering all your trips in the coming year. Depending on the cover level you select, you could be covered for trips up to 62 days duration.

Albania, Andorra, Armenia, Austria, Azerbaijan, the Azores, Belarus, Belgium, Bosnia Herzegovina, Bulgaria, the Channel Islands, Croatia, Cyprus, the Czech Republic, Denmark, Estonia, the Faroe Islands, Finland (including Lapland), France, Germany, Gibraltar, Greece (including the Greek Islands), Hungary, Iceland, Ireland (Republic), the Isle of Man, Italy, Kosovo, Latvia, Liechtenstein, Lithuania, Luxembourg, Madeira, Malta, Moldova, Monaco, Montenegro, the Netherlands, North Macedonia, Norway, Poland, Portugal, Romania, the Russian Federation, San Marino, Serbia, Slovakia, Slovenia, Spain (including the Balearic Islands and the Canary Islands), Sweden, Switzerland, Turkey, Ukraine, the United Kingdom and the Vatican City.

Worldwide excluding USA, Canada, Mexico and the Caribbean

All countries of the world EXCEPT:

Anguilla, Antigua and Barbuda, Aruba, Bahamas, Barbados, Bermuda, Bonaire, St Eustatius and Saba, Canada, Caribbean Islands, Cayman Islands, Cuba, Curaçao, Dominica, Dominican Republic, Grenada, Guadeloupe, Haiti, Jamaica, Martinique, Mexico, Montserrat, Netherlands Antilles, Puerto Rico, St Barthelemy / St Barts, St Croix, St Kitts and Nevis, St Lucia, St Maarten/St Martin, St Thomas, St Vincent and the Grenadines, Trinidad and Tobago, Turks and Caicos Islands, the United States of America, Virgin Islands (UK), Virgin Islands (US).

Worldwide including USA, Canada, Mexico and the Caribbean

All countries of the world.

Note: No cover is provided for any trip in, to, or through any country where the Foreign, Commonwealth and Development Office advises against all but essential travel. The latest travel advice by country can be found here

A policy covering all your trips in the coming year. Depending on the cover level you select, you could be covered for trips up to 92 days duration.

Albania, Andorra, Armenia, Austria, Azerbaijan, the Azores, Belarus, Belgium, Bosnia Herzegovina, Bulgaria, the Channel Islands, Croatia, Cyprus, the Czech Republic, Denmark, Egypt, Estonia, the Faroe Islands, Finland (including Lapland), France, Germany, Gibraltar, Greece (including the Greek Islands), Hungary, Iceland, Ireland (Republic), the Isle of Man, Israel, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Macedonia, Madeira, Malta, Moldova, Monaco, Montenegro, Morocco, the Netherlands, Norway, Poland, Portugal, Romania, the Russian Federation, San Marino, Serbia, Slovakia, Slovenia, Spain (including the Balearic Islands and the Canary Islands), Sweden, Switzerland, Tunisia, Turkey, Ukraine, the United Kingdom and the Vatican City.

Anguilla, Antigua and Barbuda, Aruba, Bahamas, Barbados, Bermuda, Canada, Cayman Islands, Cuba, Curaçao, Dominica, Dominican Republic, Grenada, Guadeloupe, Guam, Guyana, Haiti, Jamaica, Leeward Islands, Martinique, Mexico, Montserrat, Netherlands Antilles, Puerto Rico, St Helena, St Kitts and Nevis, St Lucia, St Martin, St Pierre and Miquelon, Trinidad and Tobago, Turks and Caicos Islands, the United States of America, United States Minor Outlying Islands, Virgin Islands (UK), Virgin Islands (US).

Note: No cover is provided for any trip in, to, or through Afghanistan, Iran, Iraq, Liberia, North Korea, South Sudan, Sudan or Syria.

Your Trip dates

Important: For Annual multi trip policies you will not be covered for travel cancellation until your policy start date. Please choose today's date if you want cover as soon as possible.

Your Traveller Details

Individual - One person who is 18 years of age or over.

Couple - You and your spouse, including a civil partner or co-habitee

Family - You, your spouse (including civil partner or co-habitee) and up to 5 of your children aged 17 years and under(age at time of purchase). Cover is provided for single parent families and up to 5 of your children aged 17 years and under. In this description, 'children' includes children, step-children, adopted children, foster children and grandchildren.

Group - A group of individuals travelling together, who may not be related. A group can be up to 7 people.

Medical Declarations

A medical condition should be declared if you or anyone to be insured under this policy:

- a. should have sought medical advice?

- b. is under investigation?

- c. is on a waiting list to undergo investigation?

- d. is waiting for test results?

- e. has been given a terminal prognosis?

- Is suffering from a medical condition which he/she knows will require medical treatment during an insured journey?

- Is intending to travel to get medical treatment abroad?

- Has at any time during the last five years been treated for alcohol or drug addiction?

- Is suffering from a psychiatric or psychological condition?

- a. A cardiovascular or heart-related condition such as a heart attack, angina, chest pain or hypertension?

- b. A lung or respiratory-related condition (not including stable, well-controlled asthma if there is no other medical condition)?

- c. Any form of cancer whether in remission or not?

- d. A cerebro-vascular condition such as a stroke or T.I.A. (transient ischaemic attack)?

- e. A renal condition or diabetes?

- a. is being prescribed regular medication?

- b. is receiving treatment of any kind?

- c. is on a waiting list for inpatient hospital treatment?

- d. has required an organ transplant or required dialysis?

You are able to cover certain medical conditions under this policy. Please click on the information button for details of what pre-existing medical conditions you must disclose.

Pre-existing medical conditions should be declared if you or anyone to be insured under this policy would answer “Yes” to the above questions. By answering them, you confirm you have the authority and will provide complete and accurate medical information about everyone to be covered. If you are unsure of any answers please contact the person who you're answering on behalf of. If you don't declare pre-existing medical conditions, it may result in part or all of a claim not being paid.

Do you have any pre-existing medical conditions to declare?

Promotional Code

If you have a discount or promotional code, please enter it here:

Eligibility conditions

By clicking the ' Continue ' button you are confirming that you have read, understand and meet our eligibility conditions.

- You are 18 years of age or over at the date of buying the policy

- You and all persons to be insured must have an address in the United Kingdom, the Channel Islands (excluding Guernsey) or the Isle of Man and have lived there for at least 6 of the last 12 months

- You and all persons to be insured are registered with a GP in the part of the United Kingdom, the Channel Islands (excluding Guernsey) or the Isle of Man where you live.

Why choose Oasis Insurance?

- 24/7 medical emergency helpline

- Winter Sports, Cruise, Wedding, Enhanced Covid-19 Cover available for an additional premium.

- Easy claims process, with no limit on claims.

- Excellent customer service

- Tailor your policy

- There for you in your time of need

Important Information

- Single Trip and Annual Multi Trip Policy Wording

- Single Trip and Annual Multi Trip Insurance Product Information Document (IPID)

- Terms of Business

Email, by Telephone or by Post we're happy to help.

If you have a question about our products or your policy you may find the answer within our FAQs (Frequently Asked Questions) page, a link to which can be found in the panel above.

Open from 9.00am to 5.30pm Monday - Friday.

Call us 0330 041 8147

Email us [email protected]

Our website uses cookies to ensure the website works, remember who you are, personalise content and provide a safer experience. Some of these cookies are essential for the website to function, while others can be switched on or off at any time. You can agree to all cookies by clicking "Accept all."

For more information about the cookies on our website, including switching cookies on or off, please see our Cookie Policy.

- 1800-2121-225

- [email protected]

- Moscow Metro Tour

Activity Details

- moscow tour packages – russian fairy tale tour 6 night / 7 days, activity overview.

- Description

- The Moscow Metro is among the biggest and thickest metro networks in the world.

- This makes it easier for people to travel quickly in Moscow.

- The Moscow Metro is made up of 12 lines and 200 stations, and it is around 333 kilometers long.

Activity Important

- Important to know

- Certified English speaking local guide.

- Hotel/port pickup and drop.

- Tips and personal expenses.

- Instant package confirmation at the time of booking.

- This package does not qualify for any refund policy.

- You will need to present either a paper or an electronic voucher for this activity.

Other activities in Russia

Senate Square Tour

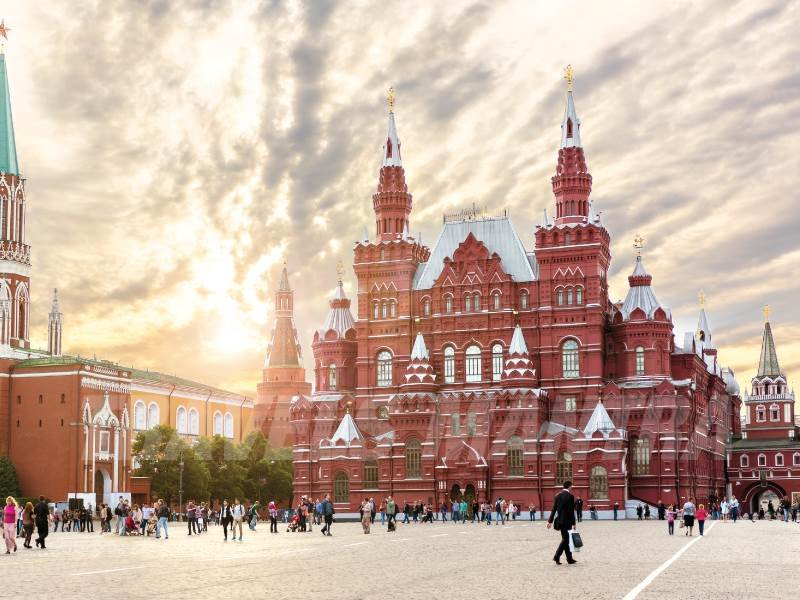

Red Square Tour

Moscow Tour

For tour package: moscow metro tour.

Newsletter Sign Up Sign up and Get Our Amazing Offers

IMAGES

COMMENTS

Oasis Insurance offers 3 different types of travel insurance policies; Single Trip, Annual Multi-Trip and Backpackers. A policy will usually cover the following: Additional optional add-ons include; As with all policies, please check your policy wording for full details on what is and is not covered.

Product: Oasis Travel Insurance - Annual Multi Trip and Single Trip - Silver This Insurance Product Information Document is only intended to provide a summary of the main coverage and exclusions, and is not personalised to your specific individual needs in any way. Complete pre-contractual and contractual information on the product is ...

By reading both positive and negative reviews, I hope you can reach a decision on whether Oasis is the right option for your next trip. To give you a quick idea of the experiences people have had with Oasis Insurance, I've summarised their online reviews in April 2024: Oasis has an average rating of 4.7/5 on TrustPilot.

The best travel insurance for your trip to Mexico is only one call or click away. Contact Oasis Insurance at (800) 330-5190 or visit our website for more information. Get a Quote

About Oasis Insurance. Oasis Insurance is an online travel insurance specialist. We enable customer's the ability to tailor a policy, thus finding the perfect balance between price and the benefits offered. Oasis Insurance leads with values such as honesty and integrity, while having an excellent customer experience not just at the point of ...

Shayla Northcutt. Travel Insurance. Shayla Northcutt is the CEO and founder of Northcutt Travel Agency and a leading world travel expert. Her main expertise includes destination weddings ...

Oasis is a travel insurance provider. Their policies are underwritten by Great Lakes. Let us help you find a reliable bank or insurer. Our ratings let you know which financial companies treat their customers fairly, and which need to try harder. ... Oasis Insurance Backpacker Silver. Cancelling before travel cover limit i: £2,500.00 Medical ...