Asia Travel Insurance: how to choose the best coverage

Travel insurance for asia.

Asia, the largest and most populous continent on Earth, is a kaleidoscope of cultures, landscapes, and experiences. From the bustling streets of Tokyo to the serene backwaters of Kerala, Asia is a melting pot of ancient traditions, modern marvels, and natural wonders.

While Asia offers incredible experiences, it also presents unique challenges for travelers. As you embark on your journey through this diverse continent, it's essential to arm yourself with the right tools for a worry-free experience. Here's everything you need to know about travel insurance for Asia so you can enjoy your adventures with confidence.

Discover our travel insurance for Asia

China Travel Insurance | India Travel Insurance | Japan Travel Insurance | Malaysia Travel Insurance | Singapore Travel Insurance | Thailand Travel Insurance | Vietnam Travel Insurance

- What should your Travel insurance cover for a trip to Asia?

How Does Travel Insurance for Asia Work?

- Do I need Travel Insurance for Asia?

How Much Does Travel Insurance Cost for Asia?

Our suggested axa travel protection plan, what types of medical coverage does axa travel protection plans offer, are there any covid-19 restrictions for travelers to asia.

- Traveling with pre-existing Medical Conditions?

What should your travel insurance cover for a trip to Asia?

At a minimum, your travel insurance should cover trip cancellation, trip interruption and emergency medical expenses. When it comes to international travel, the US Department of State outlines key components that should be included in your travel insurance coverage.

AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is making sure your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

In just a few seconds, you can get a free quote and purchase the best travel insurance for Asia.

GET YOUR FREE QUOTE

You're enjoying a relaxing vacation in Bali when a natural disaster, such as a volcanic eruption or earthquake, occurs, prompting local authorities to evacuate the area. With travel insurance, you can receive assistance for trip interruption and emergency evacuation and repatriation, helping you navigate the situation and arrange alternative travel plans or return home safely.

No matter how dire the situation becomes, AXA is there to help you create a strategic plan of action. Here’s how travelers can benefit from an AXA Travel Protection Plan:

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation : In non-medical crises (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Baggage Benefits:

- Luggage Delay: If the airline delays your checked baggage, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Post-Departure Travel Benefits

- Trip Interruption: In case of an unexpected event, you could be eligible for reimbursement for the unused portion of your trip.

- Missed Connection: If you miss a connecting flight due to delays or cancellations, this coverage may help with expenses like rebooking fees and accommodations.

Additional Optional Travel Benefits

- Rental Car (Collision Damage Waiver) : Exclusive to Gold & Platinum plan policy holders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policy holders; this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days : Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days : Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

Do I Need Travel Insurance for Asia?

While travel insurance is not strictly required for visiting Asia, it is strongly recommended due to the unique experiences and challenges the continent presents. Asia is vast and diverse, with varying levels of healthcare standards, transportation infrastructure, and environmental conditions across different countries.

Here are several reasons why we recommend travel insurance for vacations to Asia:

1. Emergency Medical Expenses: Asia's diverse landscapes and cultural attractions often involve adventurous activities such as trekking, exploring remote regions, or trying local cuisine. In the event of an unexpected illness or injury during these activities, having coverage for emergency medical expenses allows travelers to access quality healthcare without worrying about expensive medical bills.

2. Lost Baggage: Airlines sometimes mishandle baggage, and the last thing you want is to be without your essentials in an unfamiliar place. Travel insurance offers to cover the cost of replacing necessary items, allowing you to continue on.

3. Emergency Evacuation & Repatriation: Asia is prone to natural disasters such as earthquakes, typhoons, and tsunamis, especially in regions like Southeast Asia and the Pacific Islands. In case of a serious medical emergency or natural disaster, having provisions for emergency evacuation or repatriation allows travelers to be safely transported to the nearest appropriate medical facility or evacuated from the affected area to receive necessary medical care.

In general, travel insurance costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

Total Trip cost: The total amount of non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

Age: Like any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.

With AXA Travel Protection, travelers to the Asia will be offered three tiers of insurance: Silver, Gold and Platinum . Each provide varying levels of coverage to cater to individual's preferences and travel needs.

AXA presents travelers with three travel plans – the Silver Plan , Gold Plan , and Platinum Plan , each offering different levels of coverage to suit individual needs. Given that The Caribbean hospitals often do not accept U.S. health insurance or Medicare, we genuinely recommend travelers to consider purchasing any of these plans, particularly for the crucial coverage they offer for emergency accident and sickness medical expenses.

The Platinum Plan is your go-to choice if you're looking for extra coverage for The Caribbean’s experience. "Cancel for Any Reason" offers greater flexibility for those unexpected twists in your travel plans and the "Rental Car (Collision Damage Waiver)" offers assistance when you're out exploring The Caribbean's stunning landscapes in a rental car.

Loss Skier Days and Loss Golf Days, exclusive to Platinum plan policyholders, offer reimbursement for pre-paid ski tickets or golf arrangements that cannot be used due to specified closures in Asia. Whether facing slope closures in destinations like Japan's Hokkaido or golf course shutdowns in countries like South Korea or Thailand, these benefits allow a smoother travel experience in Asia.

AXA covers three types of medical expenses:

Emergency medical

Emergency evacuation & repatriation

Non-medical emergency evacuation & repatriation

Emergency medical: This coverage includes unexpected incidents like broken bones, burns, sudden illnesses, and allergic reactions.

Emergency evacuation and repatriation: Can cover your immediate transportation home in the event of an accidental injury or illness.

Non-medical emergency evacuation and repatriation: Offers assistance for evacuating from a destination swiftly in situations not related to health issues. Examples include natural disasters or civil unrest.

Although many Asian countries have eased Covid-19 entry requirements, mainland China, Myanmar, and Iran continue to maintain them. Moreover, certain nations that have relaxed their measures, like the Philippines, still mandate travelers to submit a health declaration form upon arrival. Therefore, thorough research into the entry requirements of your destination country is crucial.

Traveling with preexisting Medical Conditions?

Traveling with preexisting medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip. Our Gold Plan , and Platinum Plans offer coverage for preexisting medical conditions. The Platinum plan, in particular, is our highest-offered choice for travelers who want our highest coverage limits and optional add-ons,

What does this mean for you? If you've got a medical condition that's been hanging around, you can qualify for coverage under our Gold and Platinum plan with a preexisting medical condition , so long as it’s within 14 days of placing your initial trip deposit and in our 60 day look back period. We're here to make sure you travel with ease, no matter your health situation.

1.Can you buy travel insurance after booking a flight?

You can buy travel insurance even after your flight is booked.

2.When should I buy Travel Insurance to Asia?

It's advisable to purchase travel insurance for your trip as soon as you have made your initial trip deposit (prepaid and non-refundable trip costs.) AXA Travel Protection offers coverage as soon as you purchase your protection plan. We can give coverage against unforeseen events before you leave for your trip. Additionally, our policies offer coverage for preexisting medical conditions and Cancel for Any Reason if you purchase your protection within 14-days of making your initial trip deposit.

3.Do Americans need travel insurance in Asia?

No, travel insurance is not mandated for Americans visiting Asia. However, it is strongly recommended due to the unique challenges and diverse environments found across the continent.

4.What is needed to visit Asia from the USA?

US citizens visiting Asia typically need a valid passport, may require a visa depending on the destination, and should check specific health requirements such as vaccinations and COVID-19 tests. It's important to have a detailed travel itinerary, including flight and accommodation bookings, and consider purchasing travel insurance for medical emergencies and trip protection.

5.What happens if a tourist gets sick in Asia?

If you become sick in Asia, travelers with AXA Travel Protection can contact the AXA Assistance hotline 855-327-1442 Contact information is typically provided within the insurance documentation. Please ensure to read through your policy details and information.

Disclaimer: It is important to note that Destination articles are for editorial purposes only and are not intended to replace the advice of a qualified professional. Specifics of travel coverage for your destination will depend on the plan selected, the date of purchase, and the state of residency. Customers are advised to carefully review the terms and conditions of their policy. Contact AXA Travel Insurance if you have any questions. AXA Assistance USA, Inc.© 2023 All Rights Reserved.

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

- Privacy Policy

Travelers Plans How to Travelers Plans in The World

Travel insurance southeast asia.

Introduction

Southeast Asia is a popular destination for travelers around the world. With its vibrant culture, beautiful beaches, and affordable prices, it’s no wonder that the region is a favorite among backpackers and luxury travelers alike. However, traveling to Southeast Asia can also come with a certain level of risk. From illnesses to natural disasters, it’s important to be prepared for any unforeseen circumstances. That’s where travel insurance comes in.

What is Travel Insurance?

Travel insurance is a type of insurance that provides coverage for unexpected expenses that may occur during your travels. This can include medical emergencies, trip cancellations, lost or stolen luggage, and more. Travel insurance can give you peace of mind knowing that you’ll be protected in case something goes wrong on your trip.

Why You Need Travel Insurance in Southeast Asia

While Southeast Asia is generally a safe place to travel, there are certain risks that come with exploring the region. Here are some reasons why you should consider getting travel insurance for your trip:

Types of Travel Insurance

There are several types of travel insurance policies available, depending on your needs:

Medical Coverage

Medical coverage provides coverage for medical emergencies, such as illnesses or injuries. This type of travel insurance is particularly important if you’re traveling to a country with a high risk of diseases, such as malaria or dengue fever.

Trip Cancellation Coverage

Trip cancellation coverage provides reimbursement for prepaid, non-refundable expenses, such as flights and hotels, in case your trip is cancelled or interrupted due to unforeseen circumstances, such as a natural disaster or political unrest.

Baggage Coverage

Baggage coverage provides reimbursement for lost or stolen luggage, as well as any personal items that may have been lost or damaged during your trip.

How to Choose the Right Travel Insurance Policy

When choosing a travel insurance policy for your trip to Southeast Asia, there are several factors to consider:

Coverage Limits

Make sure that the policy you choose provides adequate coverage for your needs. For example, if you’re planning on participating in adventure activities, such as scuba diving or rock climbing, make sure your policy covers these activities.

Deductibles

The deductible is the amount you’ll need to pay out of pocket before the insurance coverage kicks in. Make sure that the deductible is affordable for you.

Read the policy carefully to understand what is not covered. For example, some policies may not cover pre-existing medical conditions or certain adventure activities.

Travel insurance is an important investment for any trip, particularly when traveling to Southeast Asia. It can provide peace of mind knowing that you’ll be covered in case of any unforeseen circumstances. When choosing a policy, make sure to read the fine print and choose one that provides adequate coverage for your needs.

1. Is travel insurance mandatory for Southeast Asia?

No, travel insurance is not mandatory for traveling to Southeast Asia. However, it is highly recommended to protect yourself in case of any unforeseen circumstances.

2. How much does travel insurance for Southeast Asia cost?

The cost of travel insurance depends on several factors, such as the length of your trip, your age, and the level of coverage you choose. On average, a basic travel insurance policy can cost around $50-$100 for a two-week trip to Southeast Asia.

3. Can I purchase travel insurance after I’ve already started my trip?

No, you cannot purchase travel insurance after you’ve already started your trip. It’s important to purchase travel insurance before your trip begins to ensure that you’re covered from the start.

4. Does travel insurance cover adventure activities in Southeast Asia?

It depends on the policy. Some policies may exclude coverage for certain adventure activities, such as scuba diving or rock climbing. Make sure to read the policy carefully and choose one that covers the activities you plan on participating in.

5. What should I do if I need to make a claim with my travel insurance?

If you need to make a claim with your travel insurance, contact the insurance company as soon as possible. They will provide instructions on how to submit a claim and what documentation is required.

- Global travel destinations

- South East Asia

South East Asia travel insurance

Compare and buy travel insurance, best travel insurance for covid-19 coverage.

Healthcare has evolved as the most vital aspect in the present situation of Covid-19 pandemic where having an effective coverage for coronavirus is essential for all international travelers. At American Visitor Insurance, we aim to provide travelers with the most suitable Covid travel insurance plan to ease the financial risks of international travel with insurance comparison tool .

Based on the traveler’s requirement and with information of the traveler like travelers age, duration of travel, the maximum coverage required, deductible and the need of coverage our comparison function will show the available travel insurance plans. The search can be then tapered down to the most specific plans as per your requirements with the coverage for Covid illness which are competitive and affordable plans.

Travel health insurance Southeast Asia, Southeast Asia Travel Insurance

US Expatriates Insurance

Group Travel Insurance

Older travelers Insurance

USA Visitors Insurance

Popular south east asian travel destinations.

Travel insurance for Brunei

Travel insurance for Cambodia

Travel insurance for Indonesia

Travel insurance for Laos

Travel insurance for Malaysia

Travel insurance for Myanmar

Travel insurance for Philippines

Travel insurance for Singapore

Travel insurance for Thailand

Travel insurance for Timor-Leste

Travel insurance for Vietnam

Popular us citizens travel destinations, us citizen travel to philippines, us citizen travel to singapore, us citizen travel to thailand, us citizen travel to vietnam, get insurance quotes for us citizens to asia.

Review and compare the best visitor insurance plans.

Travel insurance for visiting Southeast Asia

Select the type of travel health insurance for visiting southeast asia ..., travel insurance with quarantine coverage, travel insurance for quarantine coverage.

- Travel insurance for US Citizens and US Residents traveling outside USA

- Provides minimum coverage of $3,000 for potential or extended quarantine lodging expenses due to Covid19.

- Provides guaranteed travel insurance for Covid19 for medical expenses of at least USD $50,000.

- Covid-19 is covered as any other sickness

- Safe Travels Voyager plan's trip delay benefit can be upgraded.

- The base benefit is $3,000 (which is $250 per day). Traveler’s can choose $4000 ($300 per day) or $7000 ($500 per day).

- Travel insurance for American citizens and US Residents traveling outside USA

- Provides minimum coverage of $2,000 for potential or extended quarantine lodging expenses due to Covid19.

- Covid-19 is covered as any other sickness.

- Covid Quarantine Benefit: Coverage for accommodations due to a covered Trip Delay $2,000/$150 per person per day (6 hours or more) is included in the basic coverage.

- Optional Quarantine Benefit Upgrade at additional price Trip Delay Max Upgrade - including Accommodations (6 Hours or more) $4000 ($300/day) or $7000 ($500 per day)

- Travel insurance for Non US Citizens and Non US Residents traveling outside their home country

- Travel insurance for US Citizens and US Residents

- Provides minimum coverage of $1,000 for potential or extended quarantine lodging expenses due to Covid19.

- Covid19 medical expenses are covered and treated the same as any other sickness

- Offers coverage of $50,000 for emergency medical expenses

- Offers comprehensive trip cancellation coverage

- Travel medical insurance coverage outside USA

- Atlas insurance offers $50 per day for each day that travelers are quarantined abroad for a maximum of 10 days.

- Coverage must be bought for a minimum of 30 days. Proof of quarantine mandated by physician needed.

- Quarantine must be due to you testing positive for COVID-19/SARS-CoV2.

- Travel insurance for US Citizens and US Residents traveling outside US

- Trip cancellation up to $50,000

- Trip interruption up to 200% of trip cost

- $500,000 medical for sickness and injury/$1,000,000 medical transportation

- Include $2000 in travel delay benefits for quarantine/lodging.

Covid Quarantine insurance for US citizens

Despite the removal of the Covid-19 restrictions both in the US and around the globe, it is prudent for US citizens to purchase international travel insurance which will make the whole trip worry free and provide good protection for any medical or travel related expenses in case of unexpected situations.

US travelers can either buy US Covid quarantine coverage trip insurance (includes coverage for cost of the trip), or Covid quarantine travel health insurance (insures only the health of the traveler and is cheaper than trip insurance).

Travel medical insurance to emergency medical expenses

Best travel insurance, best international travel insurance for us citizens.

- Travel medical insurance for US Citizens and US Residents traveling outside USA

- Available up to 180 days

- Offers emergency sickness coverage up to $500,000

- Covid-19 covered as any other sickness

- Coverage for travelers traveling outside their home country whose destination excludes the U.S. and its territories.

- Deductible options from $0 to $2,500

- Policy Maximum from $50,000 to $2,000,000

- Renewable upto 24 continuous months

- Covers COVID-19/SARS-CoV-2 as any other Illness or Injury.

- Patriot Platinum Insurance is best suited for travelers expecting first-class medical coverage; vacationing families; individuals up to $8 million.

- Deductible options from $0 to $25,000

- Policy Maximum from $1,000,000 to $8,000,000

- USA travel medical insurance coverage outside USA for US citizens

- Available up to 365 days

- Offers maximum coverage up to $2,000,000

- Offers insurance coverage for Covid expenses

- US travel health insurance for US citizens outside USA

- Available from 5 days to 364 days

- Offers maximum coverage up to $5,000,000

- Travel Medical Choice insurance offers coverage for expenses related to COVID-19

- Short term fixed benefit cheap travel insurance USA for US citizens outside USA

- Plan maximum options available up to $130,000 for medical expenses

- Offers coverage outside the US

- Deductible options from $0 to $1,000

- Policy Maximum from $50,000 to $150,000

- Offers emergency medical evacuation coverage up to $500,000

- Offers coverage for travelling outside your home country

- It includes coverage for Covid-19 is covered as any other illness under the medical expense maximum.

- Testing for Covid-19 will only be covered if deemed medically necessary by a physician. The antibody test and prescreening test are not covered, as they are not medically necessary. Maximum age for plan eligibility is 64.

Expatriate heath insurance for living outside home country

Best expat insurance, best expatriate insurance, expat insurance plans.

- Ideal for US expatriates and for those global citizens living and working outside their home country.

- Xplorer Premier Insurance provides unlimited annual and lifetime medical maximum.

- It covers pre-existing conditions with creditable coverage

Trip cancellation insurance for trip investment expenses

Best trip cancellation insurance, best trip protection insurance, best trip cancellation insurance.

- Trip Cancellation: Up to 100% of insured trip cost

- US Residents on domestic and worldwide trips

- Travel SE Covid Quarantine Benefit : Travel SE plan offers Coverage for accommodations due to a covered Trip Delay $2,000/$125 per person per day is included in the basic coverage.

- Travel LX Covid Quarantine Benefit : Travel LX plan offers Coverage for accommodations due to a covered Trip Delay $2,500/$250 per person per day is included in the basic coverage.

- Inexpensive coverage for trip cancellation & interruption

- Travel Lite Covid Quarantine Benefit : Travel Lite plan offers Coverage for accommodations due to a covered Trip Delay $500/$125 per person per day is included in the basic coverage.

- Trip Cancellation: Up to 100% of Trip Cost Insured

- Up to 100% of Trip Cost Insured

- It covers Trip Cancellation coverage from $150 to $10,000.

- Trip Cancellation: Trip Cost: Up to a Maximum of $30,000.

- Maximum Trip Length 90 Days

- Offered by Trawick International and is highly rated.

- You can add a "Cancel for Any Reason" waiver onto the plan.

- It can cover trips up to 90 days long.

- Cancellation of policy must be purchased within 10 days of the initial trip deposit date.

- Trip Cancellation: Basic - $15,000 Max

- Trip Cancellation: Plus - $100,000 Max

- Trip Cancellation: Elite - $100,000 Max

- Trip Cancellation: 100% of trip cost up to $30,000

- Provides coverage for U.S. residents travelling outside their home country

- Trip Cancellation: 100% of trip cost up to $100,000

Trip cancellation insurance for Cancel for any reason

Cancel for any reason trip cancellation insurance, cancel for any reason plans.

- Cancel For Any Reason: 75% of non-refundable trip cost

- Trip Cancellation: Tour cost to a maximum of $100,000

- Cancel for Any Reason: Up to 75% of trip cost insured

- Trip Cancellation: Up to 100% of Trip Cost

- Cancel for Any Reason: 75% of non-refundable trip cost

- Trip Cancellation: Up to a Maximum of $50,000. ($30,000 for travellers above 80 years)

- Cancellation for Any Reason: 75% of the Insured Trip Cost within 21 days of trip deposit - some restrictions apply. Not available in NY or WA.

US seniors traveler insurance, Medicare supplement international travel insurance

Usa senior citizen travel insurance, us seniors travel insurance, travel insurance for older us travelers.

- The GlobeHopper Senior plan is available either as the GlobeHopper Single-Trip plan for single trips with coverage from 5 days to 365 days

- The GlobeHopper Multi-trip plan which covers a period of 12 months with a maximum of 30 days for each overseas trip

- It is an affordable international travel health insurance for US citizens.

- It offers coverage for medical and evacuation expenses for short trips.

- It is available up to 12 months

- It is an renewable long term international travel health insurance for US citizens.

- It offers coverage for medical and evacuation expenses.

- It is available up to 12 months.

Annual travel insurance, Yearly travel insurance

Best annual travel insurance, best yearly travel insurance, annual travel plans.

- Patriot Multi Trip is designed by IMG to cover travelers taking multiple trips in a year.

- Covers non US Citizens travelling multiple times annually outside their home country

- Trekker Essential Insurance offers maximum coverage of $50,000 for sickness and accidents.

- Available for both US and Non US citizens up to 75 years

- Maximum trip length is 30 or 45 days per trip

- Available for US residents only up to age 81 years

- Maximum trip length is 30 days per trip

- Voyager Annual (offered by USI Travel Insure) covers US citizens in and out of the US at least 100 miles away from home.

- It does not cover trip cancellation but can be used for 90 days at a time within a year and is great for frequent travelers.

- Take an unlimited number of Covered Trips during the 364 day Policy period

- Covers domestic and international trips - up to 90 days each

- Offers two plan levels namely Silver and Gold offer options for different needs and budgets

- Provides coverage for Emergency Accident and Sickness, Emergency Medical Evacuation, Baggage & Personal Effects, Baggage Delay, and Accidental Death and Dismemberment.

- The Gold plan includes additional benefits like Trip Interruption and Political Natural Disaster Evacuation

Review and compare the best Annual insurance.

Types of US travel insurance

Single trip travel insurance.

Compare and Buy Best US Single trip travel Insurance for travel within the US and overseas

Single Trip vs MultiTrip Travel Insurance

Compare Single trip vs multi trip insurance plans offered by US insurers.

South East Asia healthcare for tourists - FAQ's

Does south east asia travel insurance cover covid19 illness.

There are some USA Covid travel insurance plans available for travel to South east Asian countries that cover covid19 as a new illness. International travelers can compare best Covid travel insurance plans and buy it online. These US covid travel insurance plans are available for visitors to the US, US citizens and US residents traveling abroad as well as non US travelers traveling outside their home country.

What is the best health insurance for visitors to USA? What is the best travel insurance for USA? What is the best visitor insurance USA?

There are different factors for buying best health insurance for USA visitors. Visitors should compare fixed benefits and comprehensive visitor insurance plans. Foreign visitors to USA travel insurance customers should understand the concepts of deductibles and co-insurance and Pre-existing conditions travel health insurance. A prudent and well informed traveler will make the correct choice while buying tourist insurance in USA for his or her unique needs.

Why is travel insurance for USA so expensive?

There is no denying that travel insurance to USA is unfortunately very expensive. The main reason for this is simply because the cost of healthcare in the USA is very expensive and the travel insurance USA costs are directly related to the healthcare costs.

One more factor for some USA travel insurance plans to be very expensive is that there are specially designed travel insurance for USA plans available for older travelers, with higher medical coverage as well as some plans with coverage for pre-existing ailments.

How to buy travel insurance? How to find the best international travel health insurance ?

There are many international travel health insurance plans for coverage both in the USA as well as around the world offered by US insurance providers. Given the several travel insurance international options, it can be confusing to find the best health insurance for international travel for your needs. What is very useful in making this decision is to compare travel insurance USA of different companies.

The travel insurance comparison allows travelers compare prices as well as coverage benefits in an objective manner. The traveler can change relevant factors like the medical maximum coverage required, the international traveler insurance deductible, any international travel health insurance plans with coverage for pre-existing ailments, travel insurance international coverage for Covid19 ...

The global travel insurance comparison also allows travelers to buy the best travel insurance based on ones needs by completing an online application and paying using a credt card. One completing the purchase the travel insurance plan is emailed to the customer.

Trip insurance vs Travel health coverage vs Global medical insurance

Confused whether to buy trip, travel or global health insurance? Understand the differences!

International travel Insurance for Southeast Asia residents

Select the best health insurance for visitors to usa..., covid travel health insurance for usa, coronavirus health insurance for foreigners in usa.

Most countries have opened their borders now for international tourism. Unfortunately, even years after the pandemic started in China, Covid is again making a comeback with new immune-evasive variants.

The Covid situation is made even more complicated with influenza and the respiratory syncytial virus (RSV) which is also spreading across the globe. Though there is a risk with the new variants, authorities have relaxed their strict controls thanks to improved vaccination coverage.

However, while Covid appears to be less virulent and no longer as dangerous thanks to a large percentage of the population having vaccinations and booster shots, Covid

Budget travel insurance with covid19 coverage for visiting USA

Trawick international travel insurance.

Trawick International offers visitor medical insurance for coronavirus with their Safe Travels USA Insurance . The Safe Travels USA Comprehensive plan is ideal for travelers with pre-existing medical conditions even for travelers older than 70 years. You can compare Safe Travels USA Covid19 travel insurance plans and buy it online to get coverage as early as the following day. After buying the Trawick travel insurance, travelers can download a visa letter which indicates that Safe travels USA visitors insurance covers covid19 illness.

- Safe Travels USA

- Compare and Buy Safe Travels USA insurance

- Safe Travels USA comprehensive

- Compare and Buy Safe Travels USA cost saver insurance

- Safe Travels Elite

- Compare and Buy Safe Travels Elite insurance

Seven Corners visitors medical insurance

International medical group (img) coronavirus insurance.

International Medical Group (IMG) travel insurance offers coronavirus insurance for USA. IMG's Patriot America Plus , Patriot Platinum insurance , Visitors Protect insurance and Visitors Care insurance plans cover COVID-19 like any other illness. The Patriot America Plus Insurance and Patriot America Platinum insurance include COVID coverage up to the policy maximum.

- Patriot America Plus insurance

- Compare and Buy Patriot America Plus insurance

- Visitors Protect insurance

- Compare and Buy Visitors Protect insurance

- Visitors Care insurance

- Compare and Buy Visitors Care insurance

- Patriot America Platinum insurance

- Compare and Buy Patriot America Platinum insurance

INF travel insurance

INF travel insurance offers coverage for coronavirus as any other new sickness. It is available for Non-US citizens or residents travelling to the US. INF Premier and INF Elite plans covers pre-existing complications from COVID-19.

- INF Premier insurance

- Compare and Buy INF Premier insurance

- INF Elite insurance

- Compare and Buy INF Elite insurance

- INF Elite 90 insurance

- Compare and Buy INF Elite 90 insurance

- INF Elite Plus insurance

- Compare and Buy INF Elite Plus insurance

- INF Traveler USA 90 insurance

- Compare and Buy INF Traveler USA 90 insurance

- INF Standard insurance

- Compare and Buy INF Standard insurance

- INF Traveler USA insurance

- Compare and Buy INF Traveler USA insurance

Global Underwriters US visitor insurance

Diplomat America visitors insurance by Global Underwriters offers coverage for covid-19 as a new sickness. It is available for Non-US citizens or residents travelling to the US. Diplomat Long term Covid19 medical insurance must be bought for a minimum of 3 months and has a plan maximum options of $500,000 and $1,000,000 for medical expenses. You can compare Diplomat insurance for visitors to USA.

- Diplomat America

- Compare and Buy Diplomat America insurance

- Diplomat LongTerm

- Compare and Buy Diplomat LongTerm insurance

WorldTrips insurance

Atlas travel insurance coverage will cover eligible medical expenses resulting from COVID-19/SARS-CoV-2.

- Atlas America

- Compare and Buy Atlas America insurance

- Atlas Premium

- Compare and Buy Atlas Premium insurance

- Atlas Essential

- Compare and Buy Atlas Essential insurance

- Atlas Multitrip

- Compare and Buy Atlas Multitrip insurance

Travel Insurance Services travel insurance

- If you are traveling to the US : Visit USA coronavirus insurance offers coverage for COVID-19 as a covered medical expense.

- Compare and Buy Visit USA insurance

Best health insurance for visitors to USA, Best travel insurance for USA

- Patriot America Plus Covid insurance offers coverage for coronavirus illness.

- Covers acute onset of pre-existing conditions till maximum limit (up to 70 years).

- Available for US citizens visiting USA

- Visitors Protect Covid insurance offers coverage for coronavirus illness.

- This plan covers pre existing conditions for age 69 and below up to $25,000 and for ages 70 and above it covers up to $20,000 with deductible up to $1,500.

- Atlas America Covid insurance offers coverage for coronavirus illness.

- Covers acute onset of pre-existing conditions till maximum limit (up to 79 years).

- Diplomat America Covid insurance offers coverage for coronavirus sickness

- Covers acute onset of pre-existing conditions up to policy maximum for age up to 69 years.

- It offers coverage for visitors up to 89 years.

- Covers Covid insurance offers coverage for coronavirus sickness

- Covers treatment of acute onset of pre-existing conditions (up to 79 years)

- INF Elite Covid19 insurance offers coverage for coronavirus.

- Treats Coronavirus/covid19 as a new sickness & covered by the plan

- Best comprehensive plan that covers all pre-existing conditions up to 99 years.

- Comprehensive plan with full pre existing condition coverage which is unique.

- Covers 90% of eligible medical expenses.

- There is a minimum purchase of 90 days required to buy this plan

- Covers Preventive & maintenance care and coverage for full body physicals.

- Coverage for TDAP, Flu, etc Vaccines

- INF Traveler USA 90 covers 90% of elgibile medical expenses

- Minimum purchase of 30 days is required for this plan.

- This is a comprehensive plan too but does not cover pre existing condition

- INF Traveler USA Covid insurance offers coverage for coronavirus illness.

- This plan is available for Non-US Citizens. Anyone visiting USA, Canada and Mexico can enroll in this plan.

- Optional pre-existing conditions rider offers coverage for Stroke or Myocardial Infarction (heart attack) for travelers of any age.

- Plan can be renewed up to 2 year.

- It offers coverage for acute onset of pre-existing conditions up to 70 years.

- Plan can be renewed up to 364 days.

- Safe Travels Elite Covid insurance covers coronavirus illness.

- Covers acute onset of pre-existing conditions up to 89 years.

- This plan is not available to any individual who has been residing within the United States for more than 365 days prior to their Effective Date

- INF Premier Covid insurance covers coronavirus illness.

- Covers all pre-existing conditions, this means doctors, appointments, blood tests & labs, specialist care, urgent care visits, & hospital stays are all covered for pre-existing conditions.

- Renewable up to 364 days

- INF Standard Covid insurance covers Coronavirus illness.

- This is a fixed plan and is available for both US and Non US citizens visiting the US.

Best travel insurance for pre-existing conditions, Best Visitors insurance with pre-existing conditions coverage

- Covers acute onset of pre-existing conditions up to chosen maximum limit (aged up to 70 years).

- The plan is available for individuals traveling outside their country of residence and traveling to the US, Mexico, or Canada.

- Covers acute onset of pre-existing conditions up to chosen maximum limit (aged up to 79 years).

- Covers Acute Onset of a Pre-Existing Condition: Up to 69 years the limit is up to the Medical Maximum purchased per Period of Coverage. For any coverage related to cardiac disease, coverage is limited to $25,000 up to age 69 years, with a $25,000 Maximum Lifetime Limit for Emergency Medical Evacuation. Any repeat recurrence within the same policy period will no longer be considered Acute Onset of a Pre-Existing Condition and will not be eligible for additional coverage.

- Covers Up to $1,000 for sudden, unexpected recurrence of a Pre-existing Condition

- Safe travel USA Covid insurance offers coverage for coronavirus.

- Covers unexpected recurrence of a pre-existing medical conditions up to $1000

- Eligible for foreign residents visiting USA and worldwide

- Covers expenses for treatment of acute onset of pre-existing conditions

- For the acute onset of pre-existing condition coverage with cardiac condition and/or stroke for age range of 14 days to 69 years, $50k coverage is available and for age range of 70 to 79 years, $5k coverage is available .

- For the acute onset of pre-existing condition coverage other than cardiac condition and/or stroke for age range of 14 days to 69 years, $75k coverage is available and for age range of 70 to 79 years, $7,500 coverage is available .

- The policy maximum for this comprehensive insurance starts from $50,000 and provides up to $1,000,000. For people above age 80 years, they get a policy maximum of $10,000

- Acute onset of pre-existing conditions are covered up to $25k for age under 69 years and a coverage of $2,500 for age of 70-79.

- This is a comprehensive plan with excellent coverage.

- Elite plan with policy maximum $150,000 covers pre-existing condition coverage up to $25,000 maximum with deductible $1,500 for age 0 to 69 years.

- Policy maximum $75,000 covers pre-existing condition coverage up to $20,000 maximum with deductible $1,500 for age 70 to 99 years.

- This plan need to be purchased for a minimum of 3 months.

- This is a comprehensive plan with full pre existing condition coverage which is unique.

- Pre-existing complications from covid-19 covered

- Elite 90 plan with policy maximum $150,000 covers pre-existing condition coverage up to $25,000 maximum with deductible $1,500 for age 0 to 69 years $1,500 for age 0 to 69 years.

- Covers accident & sickness while traveling to USA, Canada, and Mexico and covers 90% of eligible medical expenses

- Elite Plus plan with policy maximum $150,000 covers pre-existing condition coverage up to $25,000 maximum with deductible $1,500 for age 0 to 69 years $1,500 for age 0 to 69 years.

- Policy maximum $75,000 covers pre-existing condition coverage up to $20,000 maximum with deductible $1,500 for age 70 to 99 years. Coverage for TDAP, Flu, etc Vaccines.

- Visit USA Insurance is an excellent medical insurance for tourists and holiday travelers, parents of students studying in the United States, new immigrants and visiting scholars in the USA.

- Visit USA offers 3 plans to satify your requirements and budget.

Senior Citizen travel insurance for above 60 years

- The best travel health insurance for 60 year old travelling to the US is Atlas America .

- With the best travel insurance plans for people under 70 years, you get covered up to policy maximum for acute onset of pre-existing conditions for people up to age 79.

- Atlas Premium is another version of this plan with higher coverage available for some of the benefits as compared to Atlas America.

- You can compare Atlas Travel insurance plans .

- Travel Medical Basic offers acute onset of pre-existing conditions up to $25k for age under 69 years and a coverage of $2,500 for age of 70-79.

- Patriot America Plus Plan offer coverage upto choosen plan maximum for travelers under 70 years. This is a comprehensive plan from IMG and is is similar to the Patriot America with the unique difference in the benefit that covers acute onset of pre existing conditions up to the age of 70

- Visitors Protect plan offer maximum limits from $50,000 to $250,000.

- Covers medical evacuation, emergency reunion, repatriation of remains, Accidental Death & Dismemberment, etc.

- Patriot Platinum Plan covers acute onset of pre existing condition up to the age of 70 for up to $1,000,000. $25,000 maximum limit for medical evacuation.

- This is a comprehensive plan and is the plan with excellent coverage.

- This plan covers all pre existing conditions including blood tess, doctor appointments, specialist care...for US and NON US citizens coming to the US, which is unheard of, when it comes to visitor insurance plans.

- This plan provides a maximum of $25,000 for pre existing conditions up to age 69 subjected to a deductible of $1,500.

- Pre-Existing complications from Covid-19 covered.

- This is a comprehensive plan with full pre existing condition coverage which is unique. This includes doctor appointments, blood tests and lab, specialist care, urgent care visits and hospital stays are covered for pre existing condition

- Covid-19 medically necessary testing & treatment covered 100% as any other new sickness with no cost sharing.

- Covers 90% of elgibile medical expenses

- This plan covers eligible accident & sickness (excluding pre-existing conditions) while traveling to USA, Canada, and Mexico

- Minimum purchase of 30 days is required for this plan

- This is a comprehensive plan too but does not cover pre existing condition.

- This is another comprehensive plan from INF.

- This plan differs from the other INF comprehensive plans where it does not cover pre existing conditions.

Older traveler medical insurance for above 70 years

- Safe Travels USA Comprehensive is a very popular option for coverage of acute onset of pre-existing condition for people above 70.

- Seniors travel insurance plan provides a coverage of $25,000 for acute onset of pre- existing condition.

- Atlas America plans from WorldTrips have upgraded their benefits for acute onset of pre-existing conditions up to age 80.

- There is also a higher policy maximum option available for people above 70 up to the age of 79.

- Atlas Premium plans from WorldTrips have upgraded their benefits for acute onset of pre-existing conditions up to age 80.

- The highest maximum that can be purchased for a comprehensive plan is Patriot Platinum which offers pre-existing condition coverage up to $2,500 for any condition.

- In the $50,000 range there are many fixed benefit and comprehensive plan options available

- Travelers must be at least 14 days old and under 99 years to be covered by this plan.

- Offers coverage from 90 days to 12 months.

- This plan covers pre existing conditions for ages 70 and above it covers up to $20,000 with deductible up to $1,500.

- Travel Medical Choice Travelers must be at least 14 days old and under 99 years to be covered by this plan.

- You may buy coverage for yourself, your legal spouse, domestic partner, or civil partner, your unmarried children under the age of 19, and your traveling companions.

- Visitors Care which offer limited coverage of $2,500. Visitors care insurance offers coverage for acute onset of pre-existing conditions with sublimits up to chosen plan maximum.

- INF Elite plan This plan provides a maximum of $20,000 for people over 70 up to the age of 99 for coverage of pre existing conditions.

- This plan is definitely the most suitable for people with pre existing condition as it is the full pre existing coverage plan.

- INF Elite 90 plan This plan provides a maximum of $20,000 for people over 70 up to the age of 99 for coverage of pre existing conditions.

- Pre-existing complications from covid-19 covered.

- Coverage for TDAP, Flu, etc Vaccines.

- INF Elite Plus plan This plan provides a maximum of $20,000 for people over 70 up to the age of 99 for coverage of pre existing conditions.

- INF Traveler USA 90 This plan provides a policy maximum of $75,000 for people over 70 up to the age of 99.

- This plan does not cover pre existing conditions including acute onset of pre existing conditions.

- Covers 90% of elgibile medical expenses and minimum purchase of 30 days is required for this plan.

- INF Traveler USA plan This plan provides a policy maximum of $75,000 for people over 70 up to the age of 99.

Senior Citizen travel insurance for above 80 years

- The Safe Travels USA Comprehensive is also very useful for this age group as it provides a policy maximum of $50,000 and provides coverage for acute onset of pre-existing conditions for $25,000 and $15,000 for heart related pre-existing condition.

- Non-US citizens and Non-US residents traveling outside their home country but not to the United States. This includes emergency medical evacuation, repatriation and security evacuation benefits.

- It is ideal for foreign residents visiting USA and then other countries worldwide. Travelers on transit visa in US can also purchase this plan.

- This Policy provides coverage to non-US citizens who reside outside the USA and are traveling outside of their Home Country to visit solely the United States, or to visit a combination of the United States and other countries worldwide.

- This Policy is not available to green card holders in the USA. This Policy is not available to anyone age 90 or above.

- Available for individuals traveling outside their country of residence and traveling to the US, Mexico, or Canada.

- It is available for travelers of ages 14 days to 99 years.

- This plan is available for people traveling to the USA and are not US Citizens, US Residents or Greencard Holders.

- It is available for travelers of ages 70 to 89 years

- INF Traveler USA plan plan provides a policy maximum of $75,000 for people over 70 up to the age of 99.

- This fixed plan from INF provides full pre existing condition coverage which includes doctor appointments, blood tests, specialty care, urgent care visits and hospital stays.

- For age 70 to 99 years for policy maximum $100,000 covers pre-existing condition maximum of $15,000/$25,000 with deductible $1,000/$5,000.

Visitor visa health insurance USA

USA B1 visa health Insurance, B1 visa travel insurance for tourists.

B2 visa health insurance for tourists, B2 visa tourist insurance for USA.

F2 visa medical insurance for F1 visa dependents, F2 visa health insurance.

F1 visa student health insurance, International student insurance in USA.

J1 visa insurance for exchange scholars, J1 visa medical insurance.

Health insurance for green card holders, Green card health insurance.

Fiancée health insurance, K1 visa health insurance for fiancé on K1 visa.

H1B visa health insurance, Travel health insurance for H1B visa holders.

Travel insurance for tourists in USA, tourist insurance USA.

H4 visa health insurance, Health insurance H4 visa holders.

New US Immigrant health insurance

The Trump administration had introduced rules making it mandatory for prospective new US immigrants to show proof of adequate US health insurance while applying for the immigrant visa. The aim of this mandatory US health insurance for immigrants is to reduce the burden on the US hospitals, the overall US health care system and finally on US tax payers by uninsured new immigrants.

At American Visitor insurance we offer immigrant health insurance plans which work well for prospective new US immigrants. After buying this immigrant medical insurance, customers will immediately receive the health insurance policy document by email. Customers can use this immigrant insurance document as proof of US health insurance while applying for the Immigrant visa. Given this rule as well as the very high cost of healthcare in the US, it is strongly recommended to buy medical insurance for new US immigrants.

New US immigrant insurance blogs

Us immigrant health insurance plans.

Compare popular US immigrant plans suitable for immigrants regardless whether permanently in the US or traveling out or waiting for Green Cards

Difference between visitors and immigrant Insurance

Find out the difference between US visitors insurance and new immigrant insurance. Compare and buy the best immigrant insurance for USA!

US Health insurance mandatory for new US immigrants

The US government has made it compulsory for new immigrants coming to the US to have proper US immigrant health insurance coverage.

Travel tips for international travelers

Travel tips for international travelers – Safety, Comfort and Wellness.

Travel medical insurance Southeast Asia, Travel insurance Southeast Asia from USA links

Travel Insurance for Southeast Asia FAQ

Southeast Asia Travel Insurance Blog

Travel Insurance to Southeast Asia Forum

Travel Insurance Claims in Southeast Asia

Us medical insurance for visitors to global destinations, us health insurance for travelers to usa.

- International travel insurance for USA

- US citizens residing outside US and visiting the US.

- USA Green Card holders travel insurance who travel overseas often

- New US immigrant insurance

- International USA travel health insurance for tourists visiting the USA

- Annual travel insurance for US business travelers

- Expatriate health insurance for expats working and living in the United States

- US non-immigrant work visa health insurance for H1B visa holders and H4 visa holders

- US international student health insurance for foreign students in USA (F1 visa / F2 visa holders)

- J visa insurance for US Exchange scholars and their dependents (J1 visa insurance and J2 visa insurance)

- Snowbird travel insurance for USA travelers from Canada and the UK (for warmer USA weather during winter)

US health insurance for tourists to Canada

- International travel insurance for Canada

- International travel insurance for tourists visiting Canada

- Annual travel insurance for US corporate travelers

- US international student health insurance

- Expatriate travel health insurance Expat insurance for US and other expatriates in Canada

US health insurance for travelers to Europe

- International travel insurance for Europe

- Schengen visa travel insurance as required by Schengen consulates

- Travel insurance coverage to insure trip expenses

- Long stay visa travel health insurance for Europe

- Expat insurance for US and other international expatriates in Europe

US health insurance for tourists to the Caribbean

- Travel insurance - Caribbean , Asia , Australia , Africa and South America

- International travel insurance for US tourists and vacationers

- US international student health insurance for US students abroad

- Annual travel insurance for business and corporate travelers

- US Expatriate insurance for expatriates living and working outside their home country

Find the best US visitor insurance coverage - Blogs and Articles

Affordable travel insurance online.

Fixed benefit or scheduled benefit plans are the most affordable international travel insurance plans.

Best international travel insurance

International travel insurance plans covering pre-existing conditions which many older travelers look for.

Compare US travel insurance online

Compare quotes online for best travel insurance online, Fixed vs comprehensive travel insurance USA.

Advantages of buying travel insurance online

Compare and buy the best travel medical insurance plans online.

Buy cheap travel insurance

There are many cheap international insurance plans also known as visitor insurance plans.

How does travel insurance work?

Coinsurance & Deductible - How visitor travel insurance works.

Best International travel insurance Cost

Travel insurance - pre-existing conditions coverage, international travel insurance resources, us visitors insurance providers.

You can find reliable US insurance providers like International Medical Group(IMG), Seven Corners, WorldTrips, Global Underwriters, Travel Insure, GeoBlue, HTH Worldwide and INF insurance.

More tourist medical insurance usa categories

Compare Visitors insurance USA

USA New immigrant Insurance

US visa health insurance

Senior Citizen travel insurance

Pre-existing visitors insurance

J1 Visa health insurance

International student Insurance

Green Card medical insurance

International Medical Insurance

Cruises Travel Insurance

- Call: (877)-340-7910

The best travel insurance for Southeast Asia: 5% discount

- Sofía Pozuelo

- UPDATED: 02/03/2019

A few years ago, I left home to travel through Southeast Asia for 4 months. If you are visiting this part of the world, whether it is 4 months or a week, you need to have travel insurance for Southeast Asia. Purchasing travel insurance is one of the most important steps when planning a trip on your own, since there is always a possibility of running into issues or falling ill, whether it be something that affects your health or your pockets due to transport delays, loss of luggage, etc.

On my previous trips to Asia, I only had to use travel insurance on one occasion. However, in those 4 months traveling around Southeast Asia, I had to use it a couple of times. The first time I had to use travel insurance was in Bali. I got a bacteria from contaminated water, food or who knows what. The second time I had to make an insurance claim was in Myanmar, due to food poisoning.

The chances of something, similar to what happened to me, happening to you is quite high if you spend several months traveling in Southeast Asia. It is also very possible that nothing will happen to you, that's what we should all want. Other common problems that you may run into in Southeast Asia are motorcycle accidents, infections, flight cancellations and delays, etc.

I don't want to scare you! If you are careful and luck is on your side, nothing will happen to you. But sometimes these things are out of our control, for this reason it is so important to purchase travel insurance for Southeast Asia. It is important to purchase a policy for any trip in which you do not have medical coverage, but in this article we are going to focus on Southeast Asia.

Table of contents

1. s afety in southeast asia.

Traveling to Southeast Asia is generally very safe. However, you should always follow basic precautionary safety measures.

If you are going to drive, be very careful as driving in Southeast Asia is very different. Very few drivers follow traffic laws. If you are going to ride a motorcycle, wear a helmet. You’ll see many foreigners and locals not wearing a helmet, please, put it on.

Lookout for scams, something quite common. I recommend reading on the internet about scams in the country you are going to visit. My advice is that if someone comes to offer you a service, always say no. If you want something, you will find it at licensed places.

Always keep an eye on your belongings. There have been cases of theft and robberies in Southeast Asia. A very common form of theft is locals driving by you and snatching valuable items such as cellphones, cameras, purses, etc. Thus it is very important to always keep valuables stored safely. At night, be sure to lock you home’s doors. If you are going to stay at a hostel, always leave valuables in a locker.

In your embassy’s website you can view a country’s safety details.

Necessary vaccines for Southeast Asia

If you are planning on visiting Southeast Asia and you’ve visited a country where yellow fever is very prevalent that year, it is necessary to bring the yellow fever vaccination certificate. You can view which countries are classified as “areas of risk” for yellow fever by clicking on this link . This disease isn’t present in Southeast Asia.

Other than the requirement mentioned above, there aren’t any mandatory vaccines to travel to Southeast Asia. The CDC does recommend a Hepatitis A and Typhoid vaccines. Refer to a health professionals if you have questions or concerns about vaccination prior to traveling.

Certain countries in Southeast Asia are classified as “a risk” of contracting malaria. To prevent malaria, it is important to use bug spray. Preventive medication for malaria can also be taken. Even so, the risk of contracting malaria does not disappear completely.

2. Is having travel insurance mandatory to travel to Southeast Asia?

No, purchasing travel insurance for Southeast Asia is not mandatory. However, just because something isn’t mandatory doesn’t mean it’s not highly recommended or necessary. We all have health insurance in our home country, it is equally as important being covered abroad as well. Purchasing travel insurance is an investment in your health and safety, two things that we should not spare any expense on.

As I mentioned prior, you never know what can happen to you. It is better to be safe than sorry. The same way you can have an accident walking around your neighborhood, you can have it during your trip. The difference is that abroad we are much more helpless and vulnerable and, uninsured if you don’t purchase travel insurance. If you have need medical attention and you do not have travel insurance, you will have to bear all the costs. Hopefully the figure on the bill won’t be too high. But if something more serious happens to you, it will have at least 3 figures, although it can perfectly have 4 or even 5, if something very serious happens to you.

Traveling to Southeast Asia with travel insurance is not mandatory, but it is highly recommended. And trust me, the best thing about purchasing travel insurance for Southeast Asia is, not having to use it, I say this from experience.

3. Best travel insurance for Southeast Asia?

I hope that by now you understand why you need travel insurance for Southeast Asia. Well, now you are probably wondering: “which travel insurance should I purchase?”.

After having traveled to Asia with different travel insurances and based on my experience, I always recommend the best and most comprehensive travel insurance. I am talking about the Heymondo travel insurance . I’ve traveled for 4 months in Southeast Asia and my experience with this company have all been great.

Apart from having great experiences with this company, I think it is the best travel insurance for Southeast Asia after to other companies on the market. Heymondo offers the best value-for-money.

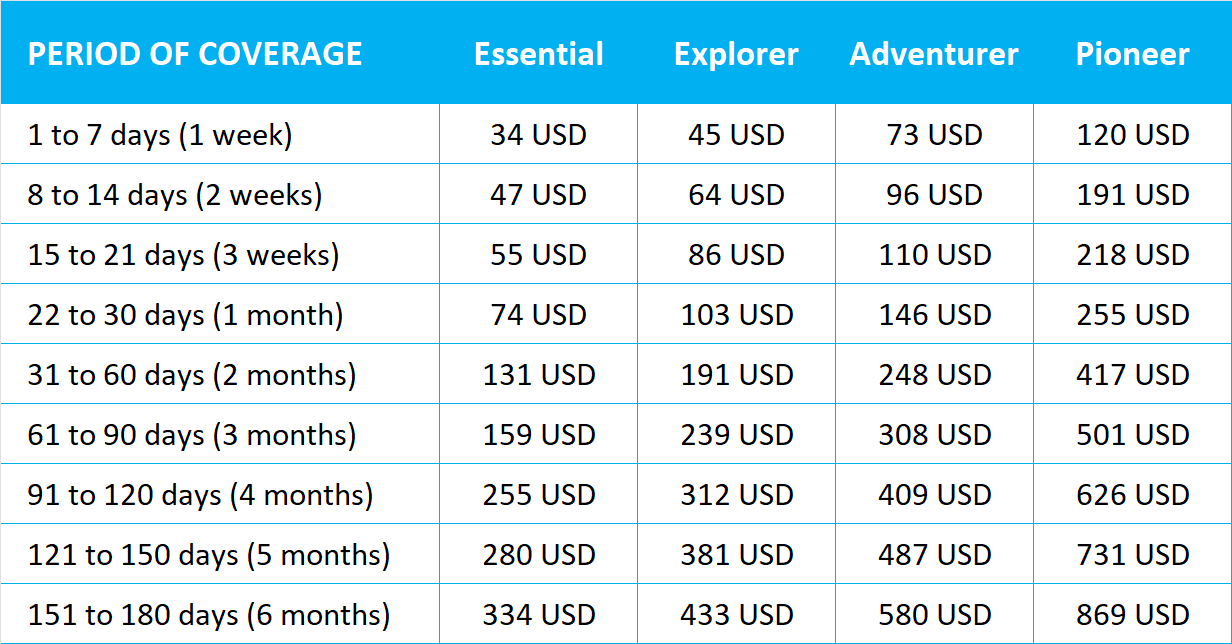

In order to compare these travel insurance policies, I got a quote from each travel insurance for a 2-week trip to the Asia . I have compared the most affordable travel insurance policy for each company. This is the result:

As you can see in the table above, Heymondo travel insurance is the second most affordable travel insurance; however, Heymondo offers the best value-for-money. The most affordable travel insurance is Safety Wings but it has a $250 deductible. Heymondo offers a more comprehensive coverage without a deductible. In addition, despite being the second cheapest travel insurance , it has equal or better coverage than other insurances.

Another reason why I recommend Heymondo travel insurance is because you do not have to pay anything out of pocket. If something happens to you and you use your travel insurance policy, you will not have to pay anything in advance since the insurance pays directly to the health center. Later I’ll explain how it works.

Lastly, something that makes Heymondo stand out from the rest is that it has 24-hour medical-care chat via WhatsApp. If something that is not serious happens to you, you can talk to a doctor (they also have pediatricians in case you are traveling with children) by Whatsapp through a number that they provide you. It’s great if you suddenly have any symptoms and want to make an appointment.

In addition, it has an app where you can call the insurance company, which means you won’t have to make a standard call, which can cause problems and costs money.

4. How much does travel insurance for Southeast Asia cost?

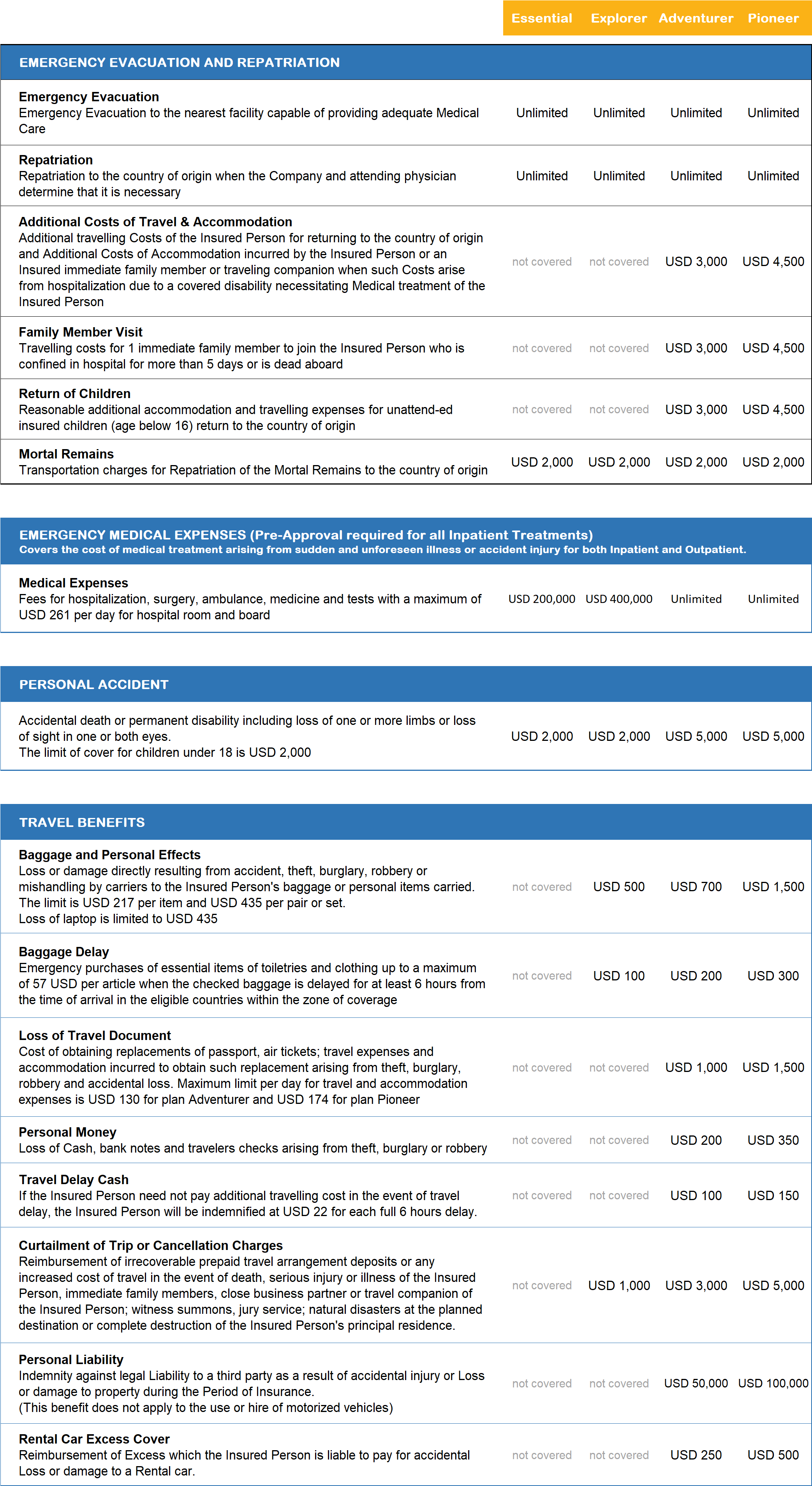

Heymondo travel insurance offers 3 types of policies: Heymondo Top and Heymondo Premium and Heymondo Medical. Each type of insurance has a different cost and coverage.

These would be the prices and coverage of a 2-week travel insurance for Southeast Asia from Heymondo .

– Heymondo Top: $76.63 (emergency medical coverage: $250,000 USD) – Heymondo Premium: $97.96 (emergency medical coverage: $500,000 USD) – Heymondo Medical: $73.57 (emergency medical coverage: $500,000 USD)

If you are looking for an affordable travel insurance policy, I recommend purchasing “Heymondo Top” insurance, as it is the most affordable plan relative to the coverage.

If you are going to engage in adventure sports or want coverage for your tech equipment, you can add this coverage to both Heymondo Top and Premium; however, if you are going on a cruise, you must purchase Heymondo Premium insurance policy as it’s the only policy that offer such add-on.

Heymondo travel insurance discounts

For being a reader of this blog, you can take advantage of a 5% discount on your next Heymondo travel insurance policy. Click on this link and a new window will pop up with the discount applied.

5. Purchasing a Heymondo travel insurance for Southeast Asia

Click on this link and a new window will pop up with a 5% discount applied. Once you arrive at the Heymondo website, follow the steps below.

1. Click on “Start Quote. The first step is to choose the type of travel insurance you need: insurance for a single trip or a multiple-trip travel insurance. If you are traveling for less than 3 months in Southeast Asia, click on “single trip” and then on the green arrow.

2. You’ll be taken to a new window where you’ll be prompted to insert your country of residence and your destination.

4. Insert the number of travelers you wish to purchase coverage and your email address. Then click on the green arrow.

5. You’ll be taken to a window displaying all 3 types of Heymondo travel insurance policies and their rates. You can scroll down and open the tabs to review the different coverage options. Choose the plan that suit you and click “buy”. The following page will ask for personal and payment information, fill every space, accept the terms and conditions and click on “confirm purchase”

How to file a claim if somethings happens to you in Southeast Asia?

If you are traveling through Southeast Asia and you need medical attentions, start by contacting Heymondo travel insurance as soon as possible. You’ll be able to find the companies phone number in the confirmation email that will be sent after your purchase.

Have your policy number in hand while talking to a customer service representative. They’ll ask you to tell them what has happened to you and your exact location. You’ll be referred to the closest health facility. Once you get to the hospital, you won’t be asked for payment because the insurance company takes care of payment and paperwork. It’s important to have a copy of your passport in case the hospital requests identification. You can have a picture of your passport on your phone as well.

My experience with Heymondo travel insurance

As I mentioned before, during my 4-month trip through Southeast Asia, I used Heymondo travel insurance on 2 separate occasions.

The first time was in Bali. I had bad diarrhea several days in a row. I called the insurance, told them what was wrong and they sent me to a clinic very close to my hotel. When I arrived, they asked me for a copy of my passport and took care of me right away. The clinic looked very clean and modern, and the workers spoke very good English.

I had to take a stool test (sorry the information haha). That same night they sent me the results. I had bacteria… I went back to the doctor to pick up my meds which I had to take for 10 days to get better. Oh, and all this without paying a dime.

I always recommend calling the insurance company before going to a health center if your condition isn’t serious. In this way, you will not have to pay any money up front and also the insurance will always send you to a quality health center.

The second time I had to use my Heymondo travel insurance for Southeast Asia was in Myanmar. This time I had food poisoning. For several reasons, I went directly to a hospital that was next to my hotel. They sent me several medications and it was gone the next day. This time, I had to send several documents to the insurance to get my money back.

Don’t forget to purchase your travel insurance for Southeast Asia with a 5% discount through this link .

I hope that this post about the best travel insurance for Southeast Asia has been very useful when planning your trip. If you have any questions, leave a comment down below or contact me by email. Until next time, travelers!

- PLAN A TRIP STEP BY STEP

↠ Book free tours and guided visits on Civitatis or GetYourGuide . I always use these platforms to check what organized activities there are at my destination.

↠ To pay with card in foreign currency or withdraw money from ATMs, I always use this card (there are free and paid plans). It works the best!

↠ Traveling with travel insurance to a destination where you don’t have healthcare coverage is a must. Get your insurance 5% cheaper with this link .

↠ If you want to have cellphone data at your destination from the moment you land and don’t want to waste time, there is nothing like this eSIM . Use the code “comeamaviaja” for a 5% discount.

↠ Check out Booking’s offers , a platform I always use, as I always find very good options thanks to its search engine with filters.

↠ For destinations where I need to rent a car, I always check Discover Cars and Auto Europe search engines. I recommend them!

↠ If you still need to buy flights for your trip, there is no better search engine than Skyscanner (although I always recommend booking the flight on the company’s website).

RELATED POSTS

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Asia travel insurance: how to choose the best coverage

Travel insurance for asia.

Asia is known for its incredible diversity and is home to more than half the world’s population. From culture and history to religion to terrain, the world’s largest continent boasts unparalleled variety in every aspect, making it a popular destination for millions of tourists annually. Whether you’re looking to spend weeks in the mountains surrounded by nature, wish to experience living in a secluded village, or enjoy the best of city life, Asia has it all. This region's fantastic variety of food works like the cherry on top. While this region welcomes people from all across the world, there are specific requirements that tourists have to fulfill to visit and explore it.

Discover our travel insurance for Asia.

India Travel Insurance | Japan Travel Insurance | Thailand Travel Insurance | Vietnam Travel Insurance

Do You Need Travel Insurance for Asia?

It depends on the country you’re traveling to. Considering there are 48 countries in Asia, no single rule applies across the region. Some Asian countries require all foreign tourists to carry travel insurance, while some only require tourists from specific countries to have travel insurance, allowing others to visit without it. Moreover, the coverage requirement for each country that mandates travel insurance may also vary. Several countries that previously allowed international travelers to visit and explore their lands without insurance have made it necessary post-COVID.

Which Asian Countries Require Travel Insurance?

To facilitate your travel planning for Asia, here’s the list of countries that require tourists to carry insurance:

Countries with Fluid Insurance Coverage Rules for Travelers

Indonesia made it mandatory for all international travelers to carry travel insurance with COVID-19 coverage when it opened up for tourists post-pandemic. However, it is no longer a legal requirement. You have to show your COVID-19 vaccination proof.

Philippines

Philippine laws require unvaccinated tourists to get travel insurance with COVID-19 treatment coverage for a minimum of USD 35,000 from a reputable insurance company. The policy should remain valid for their entire duration of stay. However, fully vaccinated travelers are exempted from this condition and can travel to the Philippines without insurance. The term ‘fully vaccinated’ here refers to two standard doses and a booster for adults over 18 years and two classic shots for tourists aged 17 and under.

Russia requires all tourists who require a visa to enter the country to get travel insurance. It’s part of the visa requirements. However, tourists from countries with visa-free access to Russia can travel without insurance. American citizens (as anyone can guess) belong to the first category, which means they need travel insurance for Russia.

You’re only required to have travel health insurance for visiting Thailand when your next destination requires you to take a COVID-19 test before leaving Thailand.

Travel insurance is necessary for obtaining a Turkey visa. So, everyone needing a visa to travel to Turkey must buy a travel insurance policy. There is no minimum amount limit for coverage; however, it should be for the entire trip duration.

Asian Countries That Require All Tourists to Carry Travel Insurance

- Israel – travel medical insurance with COVID-19 coverage

- Jordan – travel medical insurance

- Nepal – travel medical insurance with emergency assistance and medical repatriation coverage if tested positive for COVID-19

- Oman – travel– travel medical insurance

- Saudi Arabia – travel medical insurance with full coverage for COVID-19 treatment.

- Singapore – travel insurance with COVID-19 treatment and hospitalization coverage for a minimum of USD30,000.

- Sri Lanka – requires COVID insurance, regardless of travelers’ vaccination status.

- UAE – The insurance must cover international healthcare for the entire trip duration.

- Vietnam – Travel or medical insurance with COVID-19 treatment coverage for a minimum of USD 10,000.

- Laos – travel medical insurance with a minimum coverage of USD 50,000

- Iran – requires all foreign visitors to carry travel insurance

- Qatar – All international tourists must have travel insurance

Apart from these, no other Asian country mandates travel insurance.

Travel Insurance is Always Encouraged

Though you are legally allowed to visit most Asian countries without travel insurance, it is still highly encouraged to carry one for several reasons. Traveling is never 100% risk-free. No matter how well-planned your trip is or how safe and secure the country or city you’re visiting is, there is always a chance that things might go wrong. You may fall sick, have an accident, miss a flight, or become a victim of crime. Insurance can come in handy in such unfortunate situations and save you from getting into any financial trouble in a foreign country.

Why Choose AXA Travel Insurance for Asia?

AXA is consistently ranked as the most reliable insurance company for a decade. There are several reasons why travelers trust us with their travel insurance plans. Here are some of the major ones:

We Offer the Most Flexible Travel Coverage