- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

What You Need to Know About Chase’s Trip Delay Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

1. What does Chase trip delay insurance cover?

2. which chase cards include trip delay insurance, 3. who is covered, 4. how to file a claim for trip delay reimbursement, 5. is this different than trip cancellation/interruption insurance, the bottom line.

A delayed trip can cause headaches, especially if it means missing a connecting flight to your next destination. When a delay happens, having the right credit card can make all the difference in keeping your trip moving along as smoothly as possible.

Chase offers trip delay reimbursement coverage with some of its top travel credit card options. Having this benefit means you could be reimbursed for out-of-pocket expenses if your trip gets held up. Here's what you need to know.

Chase trip delay insurance offers reimbursement for expenses you pay if your trip is delayed, including meals, lodging, toiletries and medication.

You can use this coverage if:

Your trip is delayed for more than 12 hours or requires an overnight stay (with two exceptions; see below).

The trip is away from your city of residence and is less than 365 days in length.

You purchased the fare for your trip with an eligible Chase card or rewards earned with an eligible Chase card.

Chase trip delay insurance covers you up to $500 per ticket, per trip. You're covered for delayed flights, as well as other types of travel that are classified as a “common carrier.” For example, you could still be reimbursed for delays if you booked travel by bus, cruise ship or train (but not taxi or commuter rail/bus).

Note that these benefits kick in after you've exhausted any other trip delay reimbursement benefits you might have through your frequent flyer program or third-party travel insurance coverage.

» Learn more: How to find the best travel insurance

The good news is there are several Chase cards that come with built-in trip delay reimbursement.

on Chase's website

You're also covered if you have any of these cards:

United℠ Business Card .

United Club℠ Infinite Card .

Marriott Bonvoy Bold® Credit Card .

Again, most of these cards specify that a delay last 12 hours or more or require you to stay overnight before your reimbursement coverage kicks in. The exception is the Chase Sapphire Reserve® , which only requires a six-hour or more delay to use your coverage.

» Learn more: Chase Sapphire Reserve review: A first-class premium travel card

As the cardholder, you're covered — but your coverage can also extend to the people traveling with you. Chase will cover your spouse or partner and any dependent children under the age of 26. The same $500 reimbursement limit per ticket, per trip applies to everyone on your booking.

» Learn more: The majority of Americans plan to travel in 2022

Filing a claim means first making sure you have eligible expenses. If you're traveling under a known hazard alert, such as a hurricane warning, then Chase may deny your claim. And prepaid expenses are never covered by trip delay reimbursement.

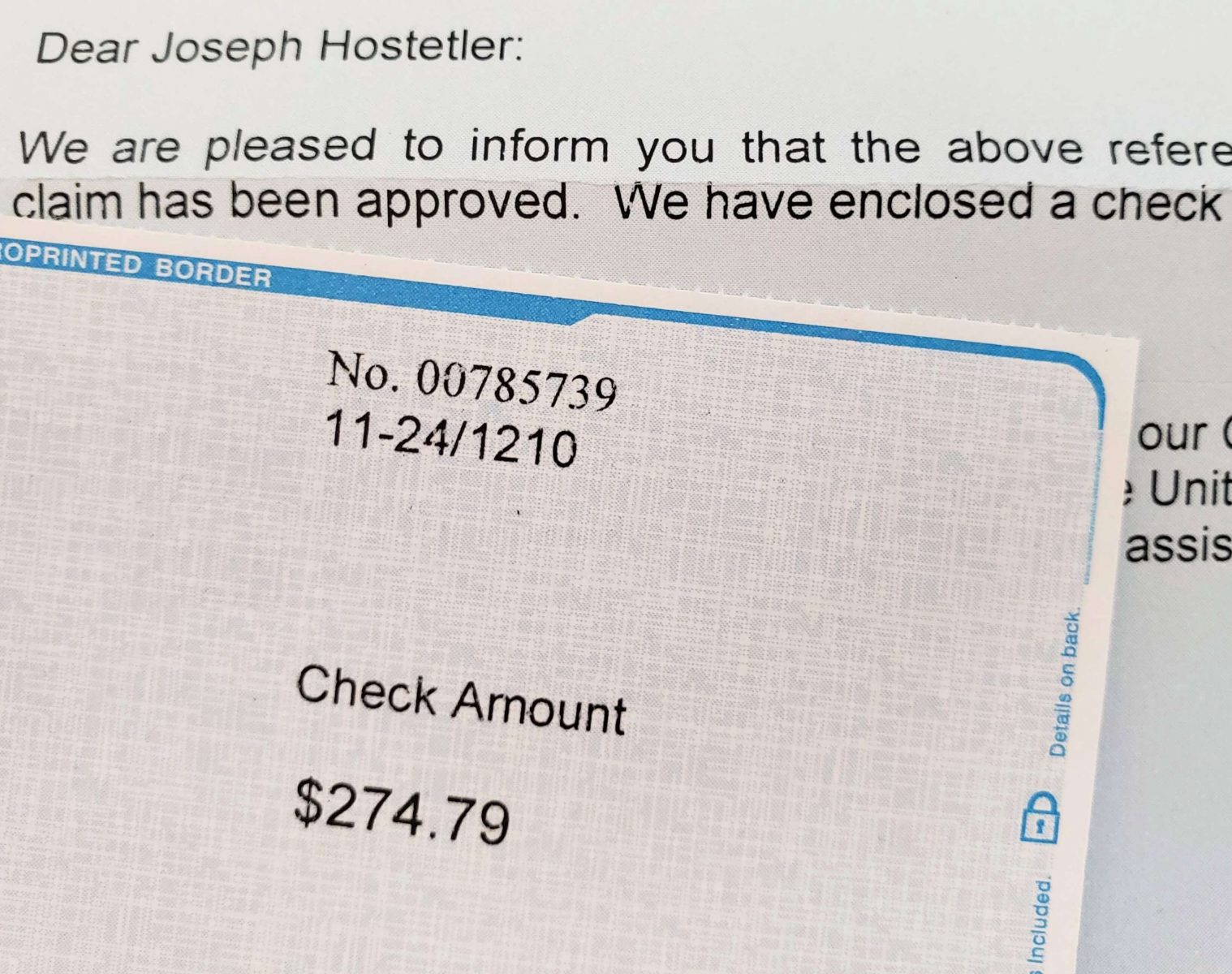

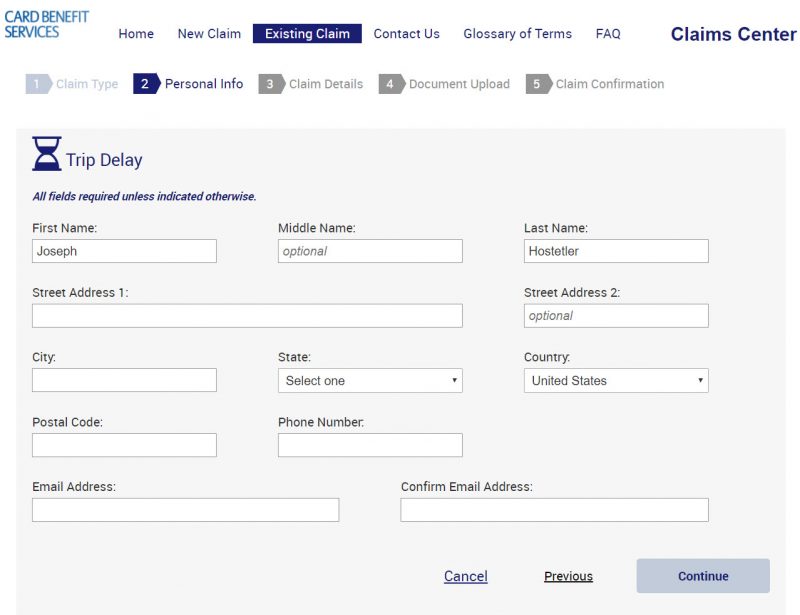

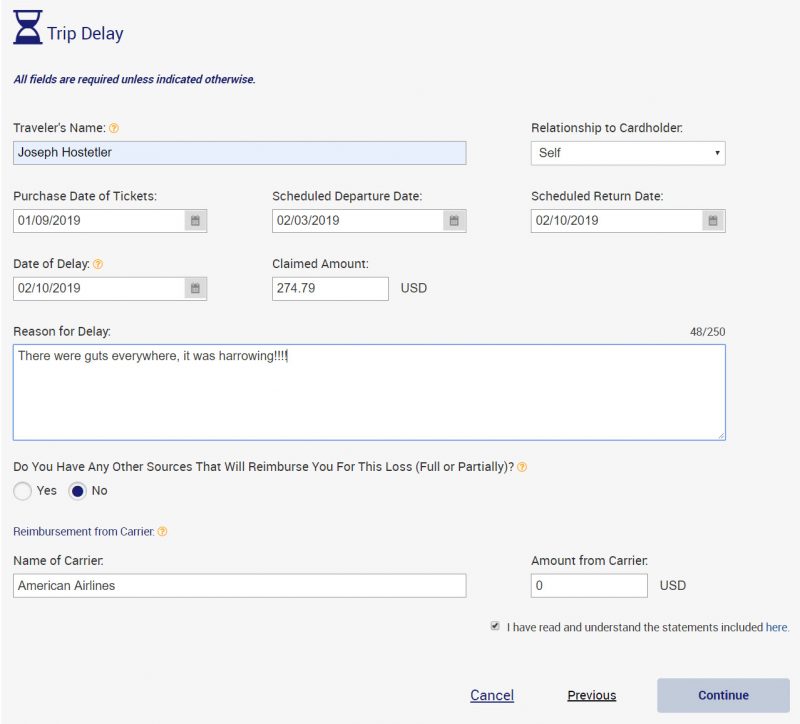

As the cardholder, you must notify a Chase Benefit Administrator within 60 days following the date of the delay to file a claim. You'll be sent a claim form that you'll need to fill out detailing the circumstances of the delay and your expenses. You have up to within 100 days of the date of the delay to return this form, along with copies of receipts or other supporting documentation.

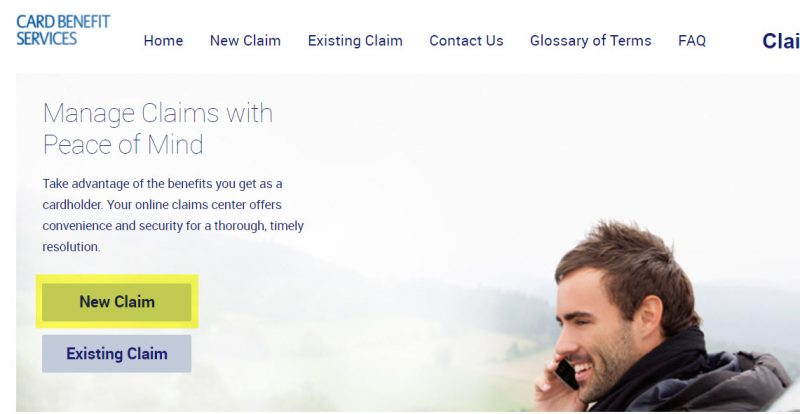

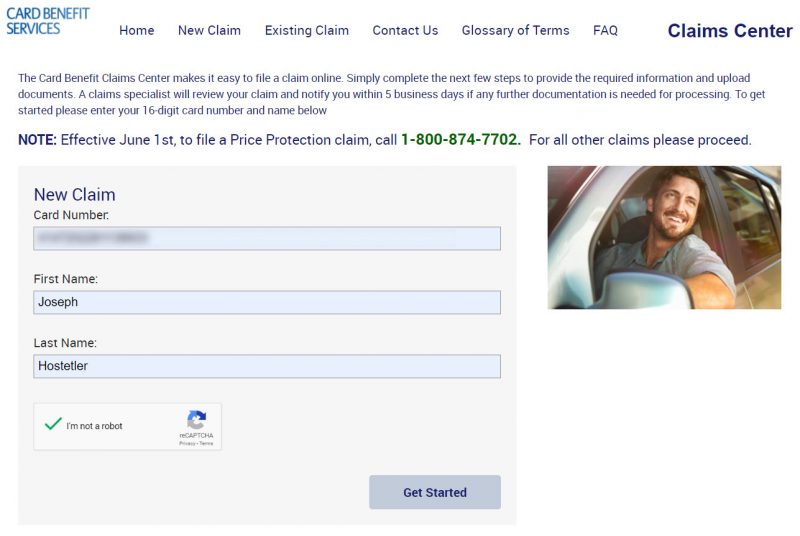

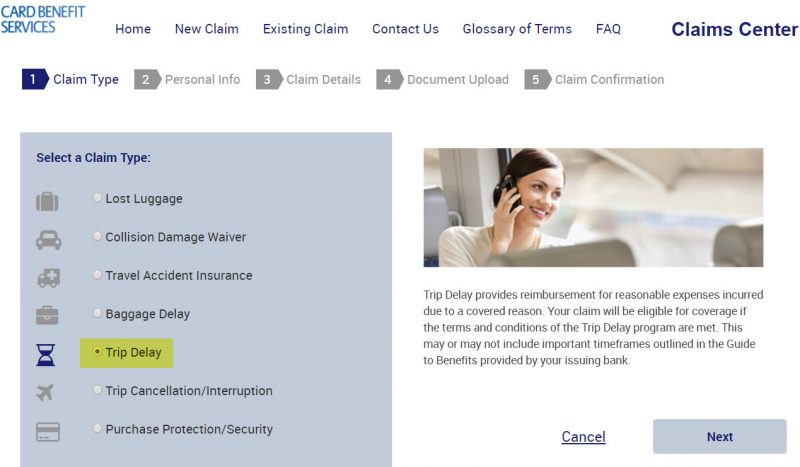

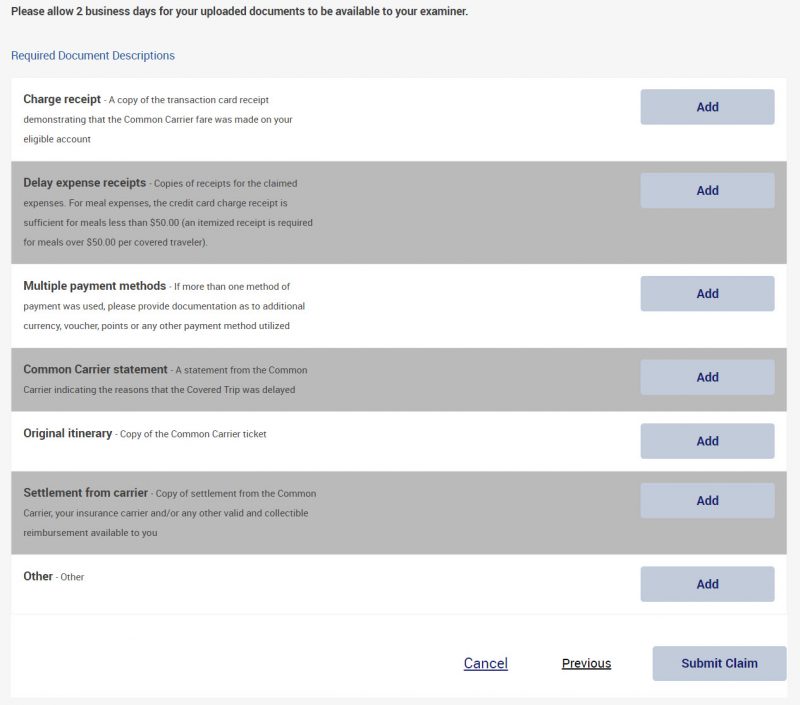

The good news is all of this can be done online through a third-party company called Card Benefit Services . Once you've filled out the form and uploaded your documents, a representative will review your claim. If asked for any additional documents or if you have questions, you can email them to [email protected] .

Required documents for submitting a trip delay claim include:

Copy of monthly billing statement.

Copy of both the original and updated travel itineraries showing the date and time of both flights and the total amount charged.

Copy of the statement from the common carrier to verify the reason the flight was delayed.

Here is how to verify your flight delay, broken down by airline.

Chase trip delay insurance is different than cancellation/interruption insurance.

Trip delay coverage applies to instances when your trip still happens, just on a different timeline than you were originally anticipating.

Trip cancellation or interruption insurance, conversely, provides reimbursement for covered travel expenses when you have to cancel a trip entirely or end it early.

Some Chase credit cards have both trip delay and trip cancellation/interruption coverage, while others only have one or the other. For instance, the Chase Sapphire Preferred® Card offers both, whereas the Marriott Bonvoy Boundless® Credit Card only offers delay coverage. The World of Hyatt Credit Card and the IHG One Rewards Premier Credit Card , meanwhile, only have trip cancellation/interruption coverage.

» Learn more: The guide to Chase trip cancellation insurance

Ideally, you always arrive on time when traveling, but when a delay happens, having a Chase credit card could save the day. If you're not a Chase cardmember yet, consider applying for a card to take advantage of trip delay reimbursement when you need it.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Chase Sapphire Preferred Card

Full List of Travel Insurance Benefits for the Chase Sapphire Preferred Card [2024]

Christine Krzyszton

Senior Finance Contributor

307 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Jessica Merritt

Editor & Content Contributor

86 Published Articles 487 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Senior Editor & Content Contributor

92 Published Articles 675 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

![chase sapphire preferred travel delay insurance Full List of Travel Insurance Benefits for the Chase Sapphire Preferred Card [2024]](https://upgradedpoints.com/wp-content/uploads/2019/07/Chase-Sapphire-Preferred-Upgraded-Points-LLC-07-Large.jpg?auto=webp&disable=upscale&width=1200)

Chase Sapphire Preferred Card Overview

Auto rental collision damage waiver, trip cancellation and trip interruption insurance, trip delay reimbursement, lost luggage, roadside dispatch, travel accident insurance, travel and emergency assistance, no foreign transaction fees, filing a claim, other credit cards, travel insurance policies, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The Chase Sapphire Preferred ® Card is a solid choice for your first travel rewards credit card. The card’s strengths include its ability to earn valuable Chase Ultimate Rewards Points on every purchase, the variety of redemption options it offers, and even its shopping benefits.

In addition to the key benefits of strong earning power and travel redemption flexibility, the Chase Sapphire Preferred card has your back with travel insurance coverage that offers peace of mind and potential savings during your journey.

If you travel frequently, chances are you’ve used a travel insurance coverage or benefit and realize the value of having this protection. It’s reasonable to expect that a travel rewards card you use to pay for your travel will have associated trip benefits. Unfortunately, credit card issuers have recently cut back on both travel and shopping benefits.

While some other cards are cutting back, the Chase Sapphire Preferred card offers prominent travel insurance coverage and benefits. Whether you currently have the card or are considering it, you’re sure to find this information useful when comparing travel rewards cards.

To put the Chase Sapphire Preferred card ‘s coverage into context, it’s important to have a little background. Below, you’ll find important card information like any welcome bonus and annual fee.

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s over $900 when you redeem through Chase Travel SM .

- Enjoy benefits such as 5x on travel purchased through Chase Travel SM , 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel SM . For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Chase Ultimate Rewards

Car Rental Loss and Damage Insurance

The Chase Sapphire Preferred card shines at providing car rental insurance coverage when compared to other travel rewards cards.

Unlike most travel rewards cards, the coverage you receive with the Chase Sapphire Preferred card is primary car insurance coverage compared to secondary, which means you do not have to file an insurance claim with your own auto insurance company first for coverage to be valid.

To activate the coverage on your card, simply reserve and pay for your rental car with the Chase Sapphire Preferred card , then decline the rental car agency’s collision damage waiver coverage.

The cardholder and any additional drivers you list on the rental agreement are covered.

Coverage You Can Expect:

- Damage to or theft of the rental car

- Loss of use charges imposed by the rental car company while the vehicle is being repaired

- Reasonable and customary towing charges

Conditions:

- Coverage is valid in most countries

- The rental period must not exceed or intend to exceed 31 consecutive days

- Coverage is primary

Exclusions:

- Exceptionally expensive, exotic, and antique vehicles are not covered

- Also excluded are open cargo bed vehicles, trucks, and recreational vehicles

- Motorcycles, mopeds, and motorbikes

- All limousines and vans that transport more than 9 people

- Losses due to off-road use of the rental vehicle

- Liability insurance coverage is not included

Bottom Line: According to the Insurance Information Institute , a car rental agency’s collision damage waiver coverage can cost $9 to $19 per day, even more depending on where you’re renting the vehicle. Having primary rental car insurance with the Chase Sapphire Preferred card could save you hundreds of dollars on a multi-week car rental.

In addition to car rental insurance, one of the most valuable benefits to have on your travel rewards credit card is coverage when there’s a disruption during your travels.

Pay for your trip in full or in part with your Chase Sapphire Preferred card or Chase Ultimate Rewards points and receive up to $10,000 if a covered loss prevents you (or other covered persons) from traveling. The maximum benefit for each occurrence is $20,000 and $40,000 maximum per 12-month period.

Expenses covered include any non-refundable, prepaid transportation arrangements that were missed plus change fees.

The definition of who is covered for trip cancellation and trip interruption coverage is broad. The cardholder, spouse or domestic partner, and immediate family are eligible for coverage. Immediate family includes adopted or step-children, legal guardians/wards, siblings or siblings-in-law, parents or parents-in-law, grandparents, grandchildren, aunts, uncles, and nieces or nephews.

The trip cannot exceed 60 days in duration and the destination must be more than 1 mile from home for coverage to be valid.

Covered events include:

- Accidental injury, loss of life, or illness experienced by the cardholder, immediate family, or traveling companion

- Severe weather

- Change of military orders

- Terrorist events or hijackings

- Jury duty or subpoena that cannot be postponed or waived

- Finding that your residence has become uninhabitable

- You have been quarantined

Hot Tip: If you pay for your immediate family’s trip with your Chase Sapphire Preferred card or Ultimate Rewards points , they are eligible for trip interruption and trip cancellation insurance coverage, even if you are not traveling with them. For more card options that come with trip cancellation insurance, check out our full guide to the best credit cards for trip cancellation and interruption insurance .

If your trip is significantly delayed, you may be stranded overnight and need to purchase necessities or incur other unexpected expenses such as lodging and additional meals.

Trip delay reimbursement pays up to $500 per ticket for covered expenses that are not paid for by the common carrier. The delay must be overnight or greater than 12 hours in duration.

Baggage Insurance

When traveling on a common carrier, if your baggage is delayed more than 6 hours, you could receive up to $100 reimbursement per day , for up to 5 days, for incidentals purchased.

You can expect to be reimbursed for essential items such as:

- Cell phone charging cable (1)

If your luggage is lost or damaged, lost luggage coverage will pay to repair or replace the luggage plus the cost of personal items lost, up to $3,000 per person, per trip.

You must report the loss to the common carrier first as the Lost Luggage benefit is in excess of any payments you receive from that carrier.

If you’re stranded on the side of the road, lock your keys out of your car, or your car fails to start, you’ll find Roadside Dispatch a welcomed benefit. The coverage provides 24/7 roadside assistance that is just one call away.

Services You Can Expect:

- Changing your flat tire when you have an inflated spare

- Delivery of up to 5 gallons of fuel

- Jump starting

- Lockout service

- Standard towing up to 5 miles

- Standard winching

Service extras such as towing beyond 5 miles, the cost of a replacement key, or the cost of the actual fuel being delivered, are additional charges and the responsibility of the cardholder. However, you won’t pay more than the pre-determined flat rate fee of $69.95 for the initial service call, as it is set in advance.

It’s painful to think about something serious happening during your travels, but there are benefits available in case you’re faced with such a tragic event.

The Chase Sapphire Preferred card is one of a few cards to offer travel accident insurance . The cardholder and immediate family members are covered even if the cardholder is not traveling with the immediate family. The ticket must be paid for in full or partially with your Chase Sapphire Preferred card or Ultimate Rewards points.

Chase’s travel accident insurance is divided into 2 coverages:

- Common Carrier Travel Accident Benefit — Covers you while you are a passenger on any common carrier or at the airport, terminal, or station immediately before or after your trip.

- 24-Hour Travel Accident Benefit — Provides coverage as soon as you embark on your trip, during your qualifying trip, and until you return for accidental death, dismemberment, and loss of speech, sight, and hearing.

Coverage on the Common Carrier benefit is limited to up to $500,000 and $100,000 maximum on the 24-hour travel accident benefit. Only 1 benefit can apply per trip.

You’re just one call away from assistance or referral help anytime you need it 24/7. Calling the toll-free number when in the U.S. or the collect-call phone number on the back of your card when traveling out of the country is the fastest way to receive assistance.

In addition to you (the cardholder), your spouse or domestic partner and dependent children under 22 can also use the service.

Referral assistance is complimentary, but the cardholder is responsible for the actual goods or services provided .

- Emergency Message Service — Record and relay emergency messages to travelers

- Medical Referrals — Referral to an English-speaking medical practitioner to monitor your progress and serve as a patient liaison

- Legal Referrals — Referral to an English-speaking attorney, U.S. Consulate or embassy, and assistance with bail bond arrangements

- Emergency Transportation — Help with making arrangements for emergency transport to the nearest medical facility

- Emergency Ticket Replacement — Assistance replacing a lost ticket with your carrier

- Lost Luggage — Provides assistance filing a lost luggage claim or help with replacement items

- Translation Services — Assistance with local language translation services

- Prescription and Valuable Documents Replacement — Assistance getting prescriptions filled at a local pharmacy or locating and transporting valuable documents

- Pre-trip Assistance — Includes help finding an ATM, assistance with visas, health precautions, and other pre-trip information

You don’t want to be hit with 3% fees when using your card during international travels. The Chase Sapphire Preferred card doesn’t charge foreign transaction fees, which is thankfully true of many cards nowadays.

If you spent $4,000 abroad on a family vacation, the savings would equal $120.

It’s prudent to think about the claim process even before you embark on your journey . Should you need to make a trip interruption, trip delay, or trip cancellation claim, the process will be much easier if you have gathered the information and documentation you need during the event versus after the fact.

Contact the plan administrator as soon as possible during or after the disruption for guidance and to file a claim. You may be expected to provide any of the following when submitting a claim for a trip interruption, trip cancellation, or trip delay :

- A completed and signed claim form

- Credit card statement with the last 4 digits of the card or receipts showing you paid for the trip with an eligible card or points

- A copy of your transportation ticket and itinerary

- Medical documents or a death certificate for health-related claims

- A statement from the carrier stating why the trip was interrupted, canceled, or delayed

- Receipts for purchases and food expense receipts over $50

- Copy of the carrier, tour company, or travel supplier’s cancellation or refund policy

- Any additional documentation requested by the benefit administrator

The documentation needed is not requested by Chase, but by the third-party claim administrator, therefore Chase statements validating your trip purchase are necessary. Knowing this upfront allows you to store your trip receipts in advance for easy access should you need them.

Hot Tip: Prior to your trip, contact the benefits administrator for clarification of trip coverage and to inquire about any special destination information you should know. You can also be proactive by reviewing the claim process before your trip to learn about any required documentation that would be needed in case of an event.

How Coverage Compares

Travel protection and insurance vary greatly by the credit card issuer and can change periodically. In general, here’s what you can expect in the way of travel protections by major issuers:

Chase issues credit cards including the Chase Sapphire Preferred card, Chase Sapphire Reserve ® , and Ink Business Preferred ® Credit Card offer the comprehensive collection of trip protections reviewed in this article. The Chase Sapphire Reserve card additionally offers emergency medical evacuation, $2,500 in emergency medical and dental coverage, and a shorter delay for trip delay coverage.

American Express

American Express offers secondary car rental insurance versus primary coverage, accident insurance, premium roadside assistance, a Global Assist Hotline, and baggage insurance. There is also emergency medical evacuation coverage that comes with The Platinum Card ® from American Express . The issuer does not offer trip interruption, cancellation, or delay coverage .

Capital One

You’ll find secondary car rental insurance, roadside dispatch, accident insurance, lost and delayed baggage, and emergency travel assistance on some Capital One cards.

Bank of America

Bank of America travel rewards cards generally do not offer trip protection or major travel benefits.

Hot Tip: For more details, check out our guide to the best credit cards for travel insurance .

Travel protections, benefits, and insurance that come complimentary on credit cards are not designed to take the place of a comprehensive travel insurance policy.

A comprehensive travel insurance policy allows you to select the type of coverage you need and the coverage limits that match your level of risk, whether you’re protecting a significant financial outlay or the potential physical risks associated with the trip. You can also purchase a travel insurance policy that can cover one specific trip or many trips over a specific time period.

With that said, by taking a few minutes to read through the trip protections offered on the Chase Sapphire Preferred card, you may find enough coverage to satisfy your trip protection requirements for your next trip. As always, you should review the card benefit coverages carefully before you travel and purchase any needed travel insurance to fill in any gaps.

Bottom Line: The Chase Sapphire Preferred card offers a high level of travel protection and insurance compared to other travel rewards credit cards. This level of coverage may be more than sufficient for your trip.

Having travel insurance brings with it the peace of mind to enjoy your journey without worry of any significant financial expense should something go wrong.

To avoid a false sense of security, however, you’ll want to call the benefits administrator (using the number on the back of your card) to ensure you have the coverage you need.

For example, you may assume you have coverage for emergency evacuation on that mountain trek, but the Chase Sapphire Preferred card does not carry this coverage. If the protection is important to you, you’ll want to be aware (and purchase separate coverage) before you embark on your journey.

Additionally, you may want to confirm that the country in which you’re renting is one that is covered under Chase’s car rental collision damage waiver, although most are.

While the Chase Sapphire Preferred card offers some of the best travel protection and insurance benefits of any travel rewards card, these benefits are not a substitute for comprehensive travel insurance.

If you’re spending thousands on a vacation for an entire family, booking an expensive cruise, or planning a trip with several forms of transportation involved, you may want to make sure that card-provided benefits provide protection at a level with which you’re comfortable.

If not, you should purchase a comprehensive travel insurance policy.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

The information regarding the Capital One Venture Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Is the chase sapphire preferred card worth it.

Yes. The Chase Sapphire Preferred card offers the best travel insurance protection of any major credit card, but that is just one of the strong benefits of having the card.

First, the annual fee is lower than other travel rewards cards that offer similar benefits. Additionally, you’ll earn valuable Ultimate Rewards points which can be redeemed for 25% more value when used for travel.

You can also transfer points to airline and hotel partners, receive a statement credit, or purchase gift cards.

Finally, you’ll find shopping benefits such as purchase protection and extended warranty for eligible purchased items.

Does the Chase Sapphire Preferred card have travel insurance?

The Chase Sapphire Preferred card has a long list of travel protections and insurance . You’ll find the all-important primary car rental insurance, trip interruption, trip cancellation, and trip delay insurance, which can be difficult to find on other travel rewards cards.

In addition, the card offers travel accident insurance, lost and delayed baggage coverage, roadside assistance, and travel and emergency assistance.

Does the Chase Sapphire Preferred card have lounge access?

The Chase Sapphire Preferred card does not come with a complimentary lounge access benefit.

However, the Chase Sapphire Reserve card offers complimentary Priority Pass Select membership which affords the cardholder access to over 1,300 worldwide lounge properties.

If the Chase Sapphire Preferred card better than the Chase Sapphire Reserve card?

Both cards offer a comprehensive collection of travel protections and benefits.

However, the Chase Sapphire Reserve card is a premium travel rewards card that comes with premium travel rewards benefits including complimentary worldwide lounge access, travel statement credits, elevated earnings on travel and dining, and 50% more value when redeeming Ultimate Rewards points for travel.

The Chase Sapphire Reserve card also comes with a much higher annual fee than the Chase Sapphire Preferred card.

A good strategy, if you’re just starting out, is to start with the Chase Sapphire Preferred card with its lower annual fee.

If you then want more travel benefits, are comfortable paying a higher annual fee, and can utilize the travel benefits that come with the Chase Sapphire Reserve card, it can be your subsequent move.

Does the Chase Sapphire Preferred card cover the Global Entry fee?

No. The Chase Sapphire Preferred card does not offer reimbursement for the Global Entry application or renewal fee.

Do the Chase travel benefits cover my trip if I use Ultimate Rewards points to pay?

Yes. You can purchase your trip in part or in full with your Chase Sapphire Preferred card, Ultimate Rewards points, or a combination of the two, and trip protections and benefits will still apply.

Be sure to check the benefits guide for details.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![chase sapphire preferred travel delay insurance Chase Sapphire Preferred Card – Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2020/09/sapphire-preferred.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

/static-assets/statics-12566/images/financebuzz.png)

Trending Stories

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

15 Legit Ways to Make Extra Cash

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

6 Smart Strategies to Save Money on Car Insurance

Chase sapphire travel insurance: what it covers and how to use it.

/authors/christy_rakoczy_updated.png)

This article was subjected to a comprehensive fact-checking process. Our professional fact-checkers verify article information against primary sources, reputable publishers, and experts in the field.

/images/2020/04/06/woman-travel-airport-smiling.jpg)

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies .

Whether you're traveling domestically or abroad, going on a trip is an exciting way to see the world. But it can also be expensive, and the last thing you want is to end up losing your money if something goes wrong with your planned vacation.

The good news is, if you pay for your trip with your Chase Sapphire Preferred ® Card or Chase Sapphire Reserve ® , you should have coverage if your trip is cancelled or delayed or if you experience certain other losses along the way.

There are details you need to be aware of to take advantage of Chase Sapphire travel insurance, though, so it's important to read the fine print to make certain you're able to use this important cardholder benefit if something goes wrong. This complete guide to Chase Sapphire insurance will help you understand what you need to know.

What is travel insurance?

Quick look: chase sapphire travel insurance.

- Chase Sapphire Preferred travel insurance

- Chase Sapphire Reserve travel insurance

How to file a claim with Chase

Faqs about chase sapphire travel insurance, bottom line on chase travel insurance.

Travel insurance broadly refers to insurance that provides reimbursement when you suffer losses in conjunction with a trip. But lots of different things could go wrong when you’re traveling, so there are different kinds of insurance that cover different major and minor calamities. Although you can buy travel insurance through an agency or insurance company, many travel credit cards come with different types of travel insurance as an included benefit.

Some of the different types of travel insurance you may want when traveling include:

- Travel delay insurance : This covers you when your common carrier (cruise line, airline, tour operator, etc.) is delayed and you get stuck somewhere for a long time or you have to stay somewhere unexpected overnight.

- Trip cancellation insurance: If your trip is cancelled for a covered reason, such as severe weather, this insurance provides you reimbursement for non-refundable expenses.

- Baggage delay insurance: If your bags are delayed for a long time, this insurance covers costs you'll incur for essential purchases such as clean clothing and toiletries.

- Lost luggage insurance: If your baggage never shows up at all, you can get reimbursed for your lost luggage and the stuff inside it.

- Car rental insurance: Car rental insurance can cover you if your rental vehicle is lost, stolen, or damaged

- Roadside assistance: If you get stuck on the road, roadside assistance can come to your rescue and provide a tow, tire change, or other help.

- Travel accident insurance: If you get into an accident or die while on a trip, travel accident insurance can provide a payout to you or your loved ones.

Chase offers some of these insurance benefits, but there are differences in coverage when you compare the Sapphire Preferred vs. the Sapphire Reserve . This could impact which card you use to make a travel-related purchase or which card you apply for to begin with.

The table below shows some of the details about the travel insurance benefits on the Chase Sapphire Preferred and the Chase Sapphire Reserve cards.

Each of these different kinds of coverage come with limitations, restrictions, and qualifications that are important to be aware of if you're relying on the protections Chase is offering. Let's look at each type of coverage on each card in a little more detail.

Chase Sapphire Preferred ® Card travel insurance

While the benefits of the Chase Sapphire Preferred cover a number of different aspects, the travel benefits are a big draw for most cardholders. Here's what you need to know about using your travel insurance benefits available on the Chase Sapphire Preferred card.

Trip delay reimbursement

This provides coverage for the cardholder, the cardholder's spouse or domestic partner, and the cardholder's dependent children ages 22 and under when the trip is paid for with the Chase card. This coverage applies if your trip is delayed more than 12 hours or an overnight stay is required due to a delay.

Coverage is limited to one delay per covered trip and delays are covered only if they are caused by a common carrier and are in a city away from the cardholder's home. The maximum of $500 in benefits can be spent on reasonable expenses for meals, lodging, toiletries, medication, and other personal items. To be considered for reimbursement, the cardmember must notify Chase within 60 days of the delay.

Trip cancellation insurance

Cancellation insurance covers the cardholder and immediate family members if a trip is interrupted on the way to the point of departure or after you've left. It also provides coverage if a trip has to be postponed for a covered reason and fees are incurred due to rescheduling.

Covered losses include severe weather; terrorist actions; jury duty; court subpoenas; or accidental bodily injury, death, or sickness of the cardholder, immediate family, or a traveling companion. The cardholder doesn't need to be traveling with family for them to be covered, but the trip must be paid for by the Chase card.

The benefit is limited to $10,000 per covered trip and $20,000 per occurrence and benefits paid can't exceed $40,000 over 12 months. So if a family of five goes on a $30,000 trip, the maximum coverage is still $20,000 even though each individual family member would theoretically be entitled to $10,000 in reimbursement.

The coverage is secondary to other travel insurance or reimbursement from others, so if your cruise line or travel insurance policy offers any reimbursement, you have to go through them first.

Baggage delay insurance

The cardholder, spouse or domestic partner, and immediate family members are covered if a common carrier delays luggage for six or more hours. This coverage provides up to $100 per day for a maximum of five days to pay for essentials such as clothes, toiletries, and one cell phone charging cable.

This insurance is secondary to other reimbursement or travel insurance coverage, so claims have to be made with those other providers first. To get reimbursement from Chase, you have to file your claim within 20 days of the delay.

Lost luggage insurance

Checked and carry-on baggage are both covered, along with personal property in your suitcases or bags. The cardholder and immediate family members are covered, even if the cardholder isn't traveling with the family members.

The insurance provides up to $3,000 per insured person on each covered trip; however, coverage for jewelry, watches, and electronics is limited to $500 per person and there's no coverage for loss of money or travelers checks or for losses resulting from a war.

Claims have to be made within 20 days of the occurrence and the loss must have been reported to the carrier in a timely manner. Coverage is secondary, which means you have to try to get reimbursed by any other primary travel insurance or by the occupancy provider (hotel, etc.) or common carrier first.

Car rental insurance

The Chase cardholder and additional drivers on the rental agreement are covered by this policy, which provides reimbursement for collision or theft for rental vehicles in the U.S. and abroad. Coverage is secondary in your own country when renting for personal reasons, so you have to make a claim on your other auto insurance first. This isn't required if you're renting abroad.

You're covered for up to the actual value of the rental car, but won't be covered if you're renting the car for more than 31 consecutive days. Chase also excludes expensive, exotic, and antique automobiles as well as trucks, recreational vehicles, and large vans.

Travel accident insurance

If you pay with your Chase card, you're covered for $500,000 in benefits for loss of life if you have an accident while on a common carrier. You'll also get a payout for dismemberment or a loss of speech, sight, and hearing. The amount you get will depend on your injuries. If you have an accident at any other time, your maximum coverage is $100,000 for loss of life and you get partial compensation for dismemberment up to $100,000, depending on what injuries you sustained.

The cardholder and immediate family members are covered even if the cardholder isn't traveling with them as long as the cardholder files a written claim within 20 days of the incident. But if multiple eligible people are hurt, coverage can't exceed twice the applicable benefit amount ($500,000 or $100,000) and the total amount will be divided up among the eligible injured people.

Emotional distress is not covered, nor are injuries or deaths sustained in the commission of illegal acts or when car racing, parachute jumping, or participating in sports activities where potential prizes are at stake.

Bottom line on Chase Sapphire Preferred travel insurance

The Chase Sapphire Preferred provides similar travel insurance benefits to the Sapphire Reserve, which we’ll discuss in detail next. But with the Sapphire Preferred, your trip delay insurance doesn't kick in until 12 hours have passed instead of six with the Reserve and your travel accident insurance offers $500,000 in coverage instead of $1 million. You also won't get roadside assistance, though you can use roadside dispatch if you pay for it.

On the plus side, the Chase Sapphire Preferred card comes with a much lower annual fee ($95) than the Sapphire Reserve ($550). The Sapphire Preferred card also offers plenty of other travel-related benefits, including 5X points on travel purchased through Chase Travel℠, 2X bonus points on other travel purchases, and a 25% points bonus when you redeem your rewards for travel through the Chase Travel℠ portal .

Overall, the Chase Sapphire Preferred is a great choice for frequent jetsetters who want to be protected in case of a problem on their trip.

Chase Sapphire Reserve ® travel insurance

The benefits of the Chase Sapphire Reserve are plentiful, and there’s no shortage of travel-related perks with this card. Here's what you need to know about using the travel insurance benefits you're provided with as a Chase Sapphire Reserve cardholder.

When your common carrier delays your trip for six or more hours or a delay requires an overnight stay, you'll get up to $500 in coverage per purchased ticket. Cardholders, their spouses or domestic partners, and dependent children under age 22 are all covered.

However, coverage is limited to one covered hazard per trip, and you won't be covered for prepaid expenses or for covered hazard delays you knew about before departing. You have just 60 days to provide notice after a covered delay and you'll be reimbursed for reasonable additional expenses only.

This coverage kicks in if you can't go on your trip before it starts due to a covered loss. The cardholder and immediate family are covered even if the cardholder doesn't go along on the trip with family.

The maximum payout is $10,000 for each covered trip and $20,000 for each covered incident, with an aggregate maximum payout of $40,000 over a 12-month period. This means if a three-person family goes on a trip that costs $10,000 each, they would be entitled to a maximum payment of $20,000 if the trip is cancelled for all of them for a covered reason, even though they'd be out $10,000 that wasn't reimbursed.

Claims have to be made within 20 days after the occurrence that causes the trip cancellation, and there must have been a covered reason for cancelling such as severe weather; jury duty or a subpoena that can't be postponed; or accidental injury or death of the cardmember, an immediate family member, or a traveling companion. Coverage is secondary to other travel insurance or reimbursement from the common carrier or occupancy provider.

The cardholder, spouse or domestic partner, and immediate family members get up to $100 per day in coverage when a common carrier delays a bag for more than six hours. This $100 can be used to purchase one cell phone charging cable, clothing, toiletries, and other essential personal care items.

The cardholder has to file a claim within 20 days of the loss and reimbursement from Chase comes only after exhausting other travel insurance or seeking funds from the common carrier.

The cardholder and immediate family can be reimbursed up to $3,000 per person per trip for checked bags or carry-ons that are lost by a common carrier. Claims have to be made on other travel insurance policies or with the carrier first, though, and coverage is limited to $500 per person per covered trip for jewelry, watches, and electronics.

The cardholder has to report the loss right away to the common carrier and to Chase within 20 days and no coverage is provided for travelers checks, money or security, or losses resulting from war.

This provides reimbursement for up to $75,000 in losses for the cardholder and additional drivers if a rental vehicle is in an accident or stolen. The reservation for the car rental can't exceed 31 consecutive days, and expensive or antique vehicles are excluded.

The insurance coverage is primary, so there's no need to file a claim with other insurance first, but the entire rental transaction has to be completed with Chase and you have to decline the rental company’s auto rental collision damage waiver or loss damage waiver.

Roadside assistance

The cardholder and anyone driving a vehicle the cardholder owns or leases is eligible for roadside assistance 24/7. Coverage includes battery charges, flat tire changes, fuel delivery, help if you're locked out, and towing.

You're covered for a maximum of $50 per service event and get a maximum of four service events annually. If you're in an off-road area or in a place not regularly traveled, you won't be covered.

The cardholder and immediate family members get up to $1 million in coverage for accidents on a common carrier and $100,000 in coverage for other types of accidents on a trip. The $1 million is reserved for loss of life but a partial payout is available for dismemberment, loss of speech, loss of sight, or loss of hearing. The specific amount you'll receive depends on the nature of your injuries.

Chase doesn't provide payments for emotional trauma; dismemberment or death during a war; if you're hurt or killed during an illegal act or while on an aircraft not certified by or registered with the government; or if you get hurt racing cars, parachute jumping, or participating in competitive sports.

Bottom line on Chase Sapphire Reserve travel insurance

If you want coverage for shorter trip delays, need roadside assistance or want more travel accident insurance coverage, the Chase Sapphire Reserve is the ideal card for you.

The Sapphire Reserve also has a $550 annual fee, though. While you’ll earn 5X points on flights and 10X points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually; 3X points on other travel and dining & 1X points per dollar on all other purchases, and you’ll also enjoy a 50% redemption bonus when you redeem your Chase Ultimate Rewards through the Chase travel portal, you'll want to make sure other cardholder perks — such as a $300 annual travel credit and statement credit for TSA PreCheck or Global Entry application fees — make this card worth your while.

If you’re a regular traveler wanting to take advantage of the travel insurance protections this card offers, then the Chase Sapphire Reserve might be the best travel credit card to have in your wallet.

If you believe you have a valid claim under Chase's travel insurance, call 800-356-8955 to request a claim form. You can also submit a claim online at eclaimsonline.com .

To file your claim:

- Start by selecting the type of claim you wish to file

- Provide your personal details including your contact information

- Input details about your claim, including the type of loss you endured and the amount of financial damage you're seeking reimbursement for

- Be prepared to upload documentation such as receipts from expenses incurred; a statement from your common carrier detailing your delay or its refund or cancellation policy; a copy of your original tickets or receipts; and, if necessary, proof you filed a claim for reimbursement from your common carrier, auto insurer, or travel insurer

- Confirm the details and submit your claim

Chase may contact you to request that you provide additional details or documentation to support your claim.

Does Chase Sapphire cover missed flights?

Chase provides reimbursement for its list of covered losses only. Although you could potentially get some airfare costs covered if your airline delays your flight long enough that you miss your connection, you won't be covered by Chase if you simply get to the airport late and miss your flight.

Does Chase Sapphire travel insurance cover jury duty?

According to Chase, jury duty is a covered reason for cancelling your trip. So, your trip cancellation or trip interruption insurance provided by Chase should protect you from losses in the event that you are called to jury duty.

Does Chase travel insurance cover my immediate family members?

Chase travel insurance covers the cardholder as well as immediate family members such as spouses and dependent children, even if the cardholder isn't traveling with them.

What happens to my Chase Ultimate Rewards when I cancel a trip?

When you book travel through the Chase Travel℠ portal, it's just like booking through a travel agent. Your ability to cancel and get your travel rewards refunded depends on the policies of the hotel or airline you book with. But if you cancel for a reason covered by Chase, then your trip cancellation insurance will kick in and your Ultimate Rewards points will be refunded.

If you are a frequent traveler, both the Chase Sapphire Preferred and Chase Sapphire Reserve offer you important protections, whether you're renting a car or taking a train, bus, cruise, or plane. You’ll also have some protections even if you can't go on your trip at all because it's cancelled or delayed.

Although the travel insurance benefits differ slightly on each card, both can earn you valuable travel rewards, charge you no foreign transaction fees, and provide travel protections for many of the losses you're likely to encounter when you’re off adventuring. You just need to make sure to read the fine print and have one of these valuable rewards credit cards in your wallet.

Great for Flexible Travel Rewards

Chase sapphire preferred ® card.

/images/2024/03/28/chase_sapphire_preferred_032824.png)

FinanceBuzz writers and editors score cards based on a number of objective features as well as our expert editorial assessment. Our partners do not influence how we rate products.

Current Offer

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

Rewards Rate

5X points on travel purchased through Chase Travel℠; 3X points on dining, select streaming services, and online groceries; 2X points on all other travel purchases, and 1X points on all other purchases

- 5X points on travel purchased through Chase Travel℠

- 25% more value when redeeming rewards for travel through Chase Travel℠

- 10% anniversary point bonus each year

- $50 annual credit on hotel stays booked through Chase Travel℠

- Premium travel protection benefits

- Has annual fee

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Author Details

/authors/christy_rakoczy_updated.png)

- Credit Cards

- Best Credit Cards

- Side Hustles

- Savings Accounts

- Pay Off Debt

- Travel Credit Cards

Want to learn how to make an extra $200?

Get proven ways to earn extra cash from your phone, computer, & more with Extra.

You will receive emails from FinanceBuzz.com. Unsubscribe at any time. Privacy Policy

- Vetted side hustles

- Exclusive offers to save money daily

- Expert tips to help manage and escape debt

Hurry, check your email!

The Extra newsletter by FinanceBuzz helps you build your net worth.

Don't see the email? Let us know.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Chase Sapphire Preferred Travel Insurance (2024 Guide)

This page includes information about the Chase Sapphire Preferred credit card and its benefits. The information featured in this guide was collected by the MarketWatch Guides team and has not been provided or reviewed by the card issuer.

Alex is a MarketWatch Guides team writer that covers automotive and personal finance topics. She’s worked as a content writer for over a dozen car dealerships across the U.S. and as a contributor to several major auto news websites.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

If you have a Chase Sapphire Preferred credit card, you can access a wide variety of travel insurance benefits when you book a trip using the card. Chase travel insurance can reimburse certain expenses in less-than-ideal travel scenarios involving trip cancellations, trip interruptions, lost baggage and more.

Learn more about the coverage offered by the Chase Sapphire Preferred credit card so you can decide whether its benefits can cover your travel needs — or if you need a separate travel insurance policy for your vacation.

Our Thoughts on Chase Sapphire Preferred Travel Insurance

Chase offers travel insurance through the Sapphire Preferred credit card if you use the card to purchase trip expenses such as cruise bookings, airline tickets, hotel accommodations and more. The company’s travel insurance offering includes coverage for trip cancellations, interruptions and delays, accidents and more.

But while Chase has competitive luggage loss limits when compared with the top travel insurance providers, the Sapphire Preferred Preferred card doesn’t offer emergency medical and evacuation coverage like some other travel cards. And although Chase provides free travel insurance benefits with the Sapphire Preferred card, there is a $95 annual fee.

If you’re a Chase Sapphire Preferred credit card holder, we encourage you to compare its coverage with plans offered by competitors. This can help ensure you have travel protection that fits your vacation and your unique needs as a traveler.

How To Qualify to Use Chase Sapphire Preferred Travel Insurance

Qualifying for Chase Sapphire Travel Insurance is a relatively simple process based on our experience. If you do not have a credit card already, you will need to visit Chase’s website to fill out an application. You’ll need to provide personal information such as your name, date of birth, mother’s maiden name, home address, contact information, Social Security number, individual tax ID number, employment status and annual income. Chase states that if you have a high credit score, you can likely apply for any card of your choice — so prepare for the company to consider your credit score when applying for this card.

Available travel insurance when you book using your Chase Sapphire Preferred card includes protection for rental car damage, cruise line reservations and airfare, to name a few. Benefits also apply to the cardholder and their immediate family during their travels. Note that if you have a Chase Sapphire Reserve card, you can also qualify for travel protection benefits. However, the benefits differ between the two cards, which we will address further in this article.

How Does Chase Sapphire Preferred Travel Insurance Work?

Chase Sapphire Preferred travel insurance coverage offers several protections at no extra cost to cardholders who book trips using their credit card. Benefits include trip cancellation and interruption insurance, baggage delay insurance and trip delay reimbursement. Chase Sapphire Preferred cardholders also receive travel and emergency assistance services if they need legal and medical referrals.

Chase notes that unaffiliated insurance companies underwrite the travel benefits, and these companies are solely responsible for the administration and claims of cardholders. Those so-called benefit administrators may enforce specific time limits and documentation requirements that apply to the claims process. Chase should provide cardholders with this information when they first open their account.

Coverage Benefits of Chase Sapphire Preferred Travel Insurance

Chase provides extensive travel insurance benefits through its Sapphire Preferred credit card, including protections you’d find with a traditional travel insurance policy . See the table below for a detailed breakdown of the Chase Sapphire Preferred travel insurance benefits and associated coverage limits.

* Information about benefits provided by the Chase Sapphire Preferred credit card was collected by the MarketWatch Guides team and has not been provided or reviewed by the card issuer.

Trip Cancellation

If you must cancel your trip for a reason covered under your policy, trip cancellation insurance can reimburse prepaid, non-refundable travel expenses. This often covers expenses such as lost airline tickets, cruise bookings, prepaid tours and hotel reservations.

Chase Sapphire Preferred travel insurance covers trip cancellations due to traveler sickness, severe weather and other situations, with reimbursement up to $10,000 per person and $20,000 per trip for prepaid, non-refundable expenses.

Trip Interruption

If you must cut your vacation short and return home, trip interruption insurance can provide a refund for unused, prepaid and non-refundable travel expenses.Much like trip cancellation insurance, coverage also applies to situations such as the injury, illness, or death of a family member or traveler.

Chase covers Chase Sapphire Preferred travelers up to $10,000 per person and $20,000 per trip for prepaid, non-refundable expenses.

Trip Delay Insurance

Trip delay coverage applies to travel delays caused by planes, buses, trains and other types of transport to your destination. Benefits for a covered trip will vary depending on the travel insurance plan but can extend to hotel rooms, meals and other necessities incurred if you must wait to resume your trip. Delay coverage does not extend to missing a flight due to poor planning or time management on behalf of the traveler.

Chase will reimburse up to $500 per common carrier travel ticket purchased using your Chase Sapphire Preferred card if you experience a delay of more than 12 hours or require an overnight stay.

Baggage Delay or Loss

Baggage coverage can pay for your travel bags if they become lost, stolen, delayed or damaged during your trip. Coverage is usually capped at a certain amount per bag, with some travel insurance plans offering higher limits than others. If you intend on bringing expensive or valuable items in your baggage, you might consider a policy with a high maximum coverage amount for lost luggage reimbursement or delays.

Chase provides Sapphire Preferred cardholders $100 per day for up to five days if they experience baggage delays with a common carrier such as an airline. If your carry-on or checked bags get lost, stolen or damaged, you could receive a reimbursement of up to $3,000 per person to cover your personal effects.

Auto Rental Collision Damage Waiver

Car rental collision damage coverage is not a standard offering from travel insurance companies. This waiver provides Chase Sapphire Preferred cardholders with reimbursement up to the actual cash value of a rental car, minus certain high-value and exotic car models.

To qualify for this waiver, you will need to decline the rental car insurance provided by the rental company and charge the entire cost of your rental to your Sapphire Preferred card. This waiver covers both theft and collision damage.

Travel Accident Insurance

Travel accident insurance through Chase provides accidental death and dismemberment (AD&D) coverage when you pay for your air, bus, train or cruise transportation using your card. Coverage includes up to $500,000 in accident protection.

Emergency Travel Medical Coverage

Travel medical coverage helps cover medical bills if you fall ill or get injured during your vacation. It does not cover routine medical services — only sudden illnesses or injuries considered emergencies or that require treatment by a healthcare provider. Some emergency medical benefits also include emergency dental coverage.

While many travel insurance providers offer this type of coverage, Chase Sapphire Preferred cardholders do not have access to these protections with the card’s benefits. You can, however, find this coverage with the Sapphire Reserve card.

If you’re looking for comprehensive travel medical insurance, we recommend International Medical Group (IMG), as the company offers coverage up to $8,000,000. IMG plans average $217 per trip.

Emergency Evacuation and Transportation

Emergency evacuation and transportation insurance can provide peace of mind if you need transportation to a hospital or medical facility while traveling. For example, if you fall ill or become injured in a remote location and require transportation or evacuation to a medical facility equipped to care for your needs. Chase doesn’t provide this coverage for Sapphire Preferred cardholders and their immediate family members.

Chase Sapphire Preferred vs. Chase Sapphire Reserve Travel Insurance

The Chase Sapphire Preferred card is not the only credit card Chase offers with travel insurance benefits. Chase’s Sapphire Reserve card also provides benefits for cardholders who book their trips with their credit card. See the table below for a comprehensive breakdown of what each Chase credit card offers in travel insurance benefits.

* Information about benefits provided by the Chase Sapphire Preferred and the Chase Sapphire Reserve credit cards were collected by the MarketWatch Guides team and have not been provided or reviewed by the card issuer.

How To File a Travel Insurance Claim with Chase

Filing a travel insurance claim with Chase will vary based on your credit card and the type of coverage you’re filing a claim for. But the typical process follows these steps:

Generally, the first step is to contact the appropriate number listed in your credit card’s benefits guide. You can also file a claim online through eclaimsline.com if you prefer a fully digital experience.

Chase will likely ask you to prepare documentation that proves your losses to support your claim. These documents may include receipts for prepaid expenses, proof of lost, damaged or stolen items, or proof of travel delays from your airline or other transportation carriers.

Once you’ve submitted your claim, you then wait for approval and reimbursement, which may vary in time. Note that Chase enforces specific time limits in addition to documentation requirements for claims filing, so submitting your claim as soon as possible is recommended.

Should You Get a Chase Sapphire Preferred Card For Travel Insurance?

Signing up for a Chase Sapphire Preferred card strictly for its travel insurance benefits is a personal decision. However, getting a credit card for travel insurance is not your only option — you may also opt for a policy with a standard carrier such as Travelex . Chase’s coverage limits are not as high as limits from some other providers offering comprehensive travel insurance policies. Taking on an additional expense in the form of the Sapphire Preferred card’s $95 annual fee may also not be worth it if you don’t plan on using the card for anything other than infrequent travel.

If you’re looking for coverage for emergency medical expenses, evacuations and more, you may consider a plan from some of the other dedicated travel insurance companies. Chase does not specialize in travel insurance and lacks unique protections such as cancel for any reason (CFAR) and extreme sports coverage that other travel insurance companies may provide.

If you already have the Chase Sapphire Preferred card and feel satisfied with its travel insurance coverage limits, you can take advantage of these benefits by booking your trip using the card. Regardless, we recommend considering your travel needs and budget before choosing travel insurance coverage.

Chase Sapphire Travel Insurance: Frequently Asked Questions

Does chase travel insurance cover family members.

Yes, Chase travel insurance through its Sapphire Preferred and Sapphire Reserve cards covers the cardholder and immediate family members traveling with them.

What reasons for trip cancellation does Chase cover?

Covered cancellations related to trip cancellation insurance vary by travel insurance provider. Chase states that covered cancellations for trips purchased with Sapphire Preferred and Sapphire Reserve cards include sickness, severe weather and other situations. Check your card benefits guide for more information on specific scenarios.

Do I need travel insurance if I have a credit card?

If you have a credit card with a company such as Chase, Citi or Capital One, your card may come with travel insurance benefits if you use the card to purchase your trip components. If you’re unsure whether your credit card comes with these perks, check with your card issuer.

What other benefits come with the Chase Sapphire card?

The Chase Sapphire card comes with more than just travel rewards. It also includes benefits such as the ChaseUltimate Rewards program, which adds points for qualifying purchases that cardholders can redeem toward future travel expenses. In addition, new card members can receive 60,000 bonus points after spending $4,000 in the first three months of card ownership.

Methodology: Our System for Rating Travel Insurance Companies

Our team researched and reviewed dozens of travel insurance providers and created a scoring system to judge each company based on coverage, quality and service. We also collected sample quotes from each company, both over the phone and on the Internet, to better understand the customer experience. Here are the factors we take into consideration when rating providers:

- A 30-year-old couple taking a $5,000 vacation to Mexico

- A family of four taking an $8,000 vacation to Mexico

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom

- A 30-year-old couple taking a $7,000 trip to the United Kingdom

- A 19-year-old taking a $2,000 trip to France

- A 27-year-old couple taking a $1,200 trip to Greece

- A 51-year-old couple taking a $2,000 trip to Spain

- Plan availability (10%): We look for insurers offering a variety of travel insurance plans and the ability to customize a policy with coverage upgrades. Providers that offer six or more plans will earn top marks in this category.

- Coverage details (29%): We review the standard coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage will earn full points, with a focus on baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons such as accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that will reimburse customers after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

AM Best Disclaimer

More Chase Bank Resources

- Chase Bank Review

- Chase Auto Loan Review

- Chase Bank CD Rates

- Chase Savings Account Rates

- Chase Banking Promotions and Bonuses

If you have questions about this page, please reach out to our editors at [email protected] .

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards