Best Debit Cards in Singapore

By irvin yap.

Hey there! I’m exploring the best debit cards in Singapore for 2023. Did you know that the statistic shows that 93.5% of Singaporeans that above 15 age have debit over credit cards? That’s huge, right?

In Singapore, debit cards play a crucial role in the everyday financial lives of residents. They offer a convenient, secure way to make transactions without carrying cash. They are widely accepted for in-store and online purchases, often with benefits like cashback and rewards.

The security of a debit card is the same as a credit card. Debit cards are directly linked to the user’s bank account, allowing immediate access to funds and ensuring spending is limited to available balances, which helps manage budgets more effectively. Unlike credit cards, credit cards may cause you to overspend and create debt.

I will share the best debit card Singapore 2023 according to my research and experiences. With this guidance, you will understand debit cards and find your best debit card Singapore 2023.

Table of Contents

Debit Card is Better Than Credit Card: Key Reasons

When managing finances in Singapore, choosing the best debit card can be smarter than opting for a credit card. Here’s why:

- Spending Within Means: The best debit card Singapore offers ensures you spend the money you already have. This prevents the risk of accruing debt, a common issue with credit cards.

- Better Budget Management: Using a debit card helps in maintaining a budget. You’re more conscious of your balance, leading to more prudent spending decisions.

- No Interest Rates: Unlike credit cards, no interest is charged on debit card purchases. This makes them cost-effective for everyday use.

- Cashback and Rewards: Opting for the best cashback debit card Singapore provides can offer similar rewards to credit cards, like cashback on purchases, without the risk of high interest or overspending.

- Suitability for Students: The best debit card for students in Singapore is tailored to the needs of the younger demographic. It’s a great tool for students to learn financial responsibility without the risk of accumulating debt.

- Travel Benefits: Frequent travellers can benefit from the best travel debit card Singapore boasts. These cards often come with lower foreign transaction fees and other travel-related benefits, making them more suitable than credit cards for international use.

- Wider Acceptance and Convenience: Debit cards are widely accepted locally and globally. They offer the same convenience as credit cards regarding online and in-store purchases.

- Lower Fees and Charges: Debit cards generally come with lower annual fees than credit cards, making them a cost-effective option for many.

Debit cards offer a safer, more budget-friendly alternative to credit cards, especially for those who prefer to avoid debts and manage their finances more effectively.

Read also: Best Credit Cards in Singapore

Compare Best Debit Cards in Singapore

Note: The ranking above are not listed in order

What to Consider When Choosing A Debit Card?

When selecting a debit card in Singapore, several factors are crucial:

- Fees and Charges: Look for cards with low or no annual fees, and consider other charges like ATM withdrawal fees.

- Rewards and Cashback: Some cards, like the best cashback debit card Singapore, offer rewards or cashback on purchases. This can be a great way to earn while you spend.

- Foreign Transaction Fees: For travellers, the best travel debit card Singapore should have low foreign transaction fees. This is important for those who travel frequently or shop online from international retailers.

- ATM Network and Accessibility: Consider the availability and accessibility of ATMs, especially if you travel or withdraw cash frequently.

- Spending Limits: Some debit cards have daily spending limits. Ensure the limit aligns with your spending habits.

- Online and Mobile Banking Features: Look for cards that offer robust online and mobile banking features for convenience.

- Eligibility Criteria: Some cards, like the best debit card for students Singapore, are tailored for specific groups like students and might have special benefits or lower requirements.

- Security Features: Consider the security measures in place, like SMS alerts for transactions and the ability to freeze the card via an app.

- Customer Support: Good customer service is crucial for handling any issues.

- Linked Accounts and Services: Some debit cards are linked to savings or current accounts, which might offer additional benefits or interest.

The best debit card in Singapore depends on individual needs and lifestyle. These factors will help you choose a card that best suits your financial habits and goals.

Popular Debit Cards for Daily Use

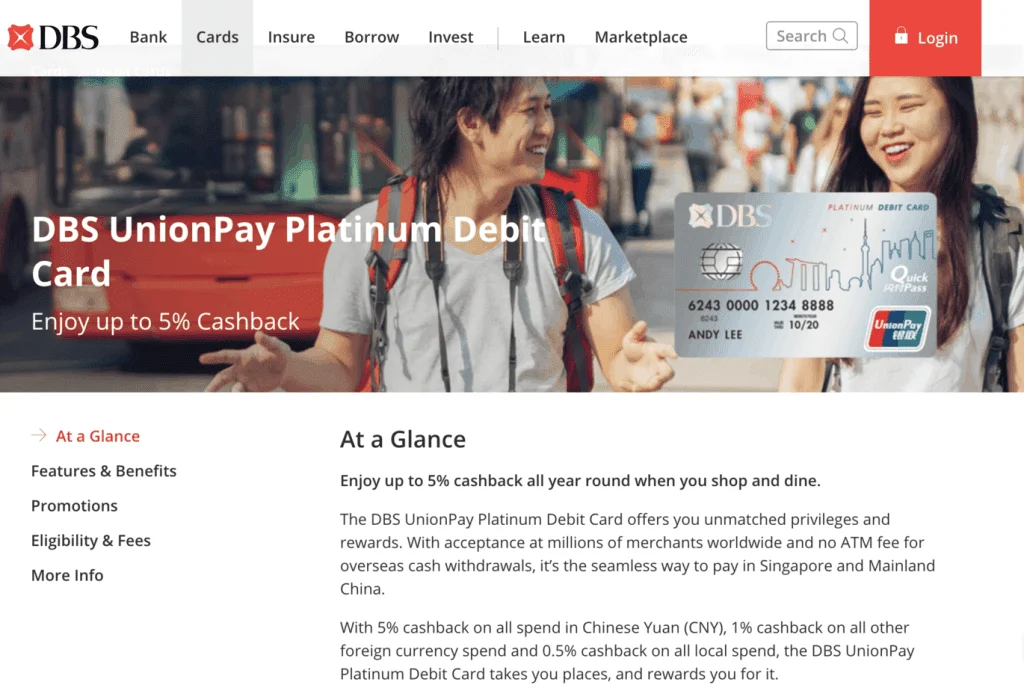

1. DBS Visa Debit Card – Best for Travel

Special Highlight

The DBS Visa Debit Card is particularly valued for its travel-friendly features. It stands out in Singaporean as a robust option for frequent travel abroad. Offering the convenience of multi-currency transactions without additional fees simplifies spending in various countries. This card is a practical choice for globetrotters seeking a seamless financial experience during international adventures.

- Spend in up to 11 foreign currencies without extra fees

- Up to 3% cashback on local contactless transactions

- Widely accepted globally

- Supports Visa payWave for contactless payments

Eligibility

- Must be a DBS/POSB account holder

Additional Benefits

- Enhanced fraud protection

- Access to DBS/POSB’s extensive ATM network

- Compatibility with mobile wallets for digital payments

- Dedicated customer support for international banking queries

This card’s focus on travel-related benefits aligns it closely with the best travel debit card Singapore category, offering a blend of convenience, security, and rewards that cater to the needs of modern travellers.

2. OCBC Yes! Debit Card – Best for Spending and Rewards

The OCBC Yes! Debit Card is a standout option for those who seek rewards on their daily expenditures. It’s particularly known for its cashback and rewards program, making it an attractive choice for savvy spenders who want to maximize their returns on routine purchases. This card is ideal for those who frequent specific merchants and utilize the card’s reward structure effectively.

- Cashback on everyday purchases

- Contactless payments

- Wide merchant acceptance

- Available to OCBC account holders

- Exclusive deals and discounts with partner merchants

- Online banking facilities

- Enhanced security features

The OCBC Yes! Debit Card aligns well with the needs of those looking for a versatile spending tool in Singapore, offering a blend of rewards and convenience.

3. UOB One Debit Card – Best for Cashback

The UOB One Debit Card is highly regarded for its exceptional cashback benefits, making it a top choice for those who prioritize savings while spending. It’s especially beneficial for those with a high transaction frequency, as the card offers attractive cashback rates, making everyday spending more rewarding.

- High cashback rates on various spends

- Contactless payment options

- Wide acceptance both locally and internationally

- Available to UOB account holders

- Discounts and deals with partner merchants

- Access to UOB’s extensive ATM network

- Integration with UOB’s mobile banking app for easy account management

The UOB One Debit Card stands out in the Singapore market as the best cashback debit card Singapore, offering substantial savings through its cashback program on everyday expenses.

4. HSBC Everyday Global Debit Card – Best for Global Use and Travel

The HSBC Everyday Global Debit Card is tailored for those who travel frequently or engage in international transactions. Its multi-currency capabilities stand out, allowing users to transact in various currencies without incurring high conversion fees, making it an ideal choice for globe-trotters and online shoppers buying from international websites.

- Multi-currency transactions without extra fees

- Global acceptance for ease in international spending

- Contactless payments for convenience

- Must be an HSBC account holder

- Competitive exchange rates

- Access to HSBC’s global ATM network

- Security features like fraud protection

The HSBC Everyday Global Debit Card aligns well with the best travel debit card Singapore category, offering various features that cater to international spending needs.

5. Standard Chartered Business Debit Card – Best for Business Transactions and Management

The Standard Chartered Business Debit Card is designed for business owners and professionals. This card stands out for its capacity to simplify business-related financial transactions, offering enhanced control and convenience. It’s an excellent tool for managing company expenses, streamlining accounting processes, and keeping track of business spending.

- Tailored for business transactions

- Enhanced expenditure tracking

- Global acceptance of business travel needs

- Available to Standard Chartered business account holders

- Access to exclusive business-related offers and privileges

- Integration with business banking services for streamlined financial management

The Standard Chartered Business Debit Card is an efficient solution for business professionals in Singapore, offering specialized features that cater to the unique financial needs of businesses.

6. Citibank Debit Mastercard – Best for Global Accessibility

The Citibank Debit Mastercard is renowned for its global acceptance and convenience. This card is particularly beneficial for individuals seeking a seamless spending experience locally and internationally. It stands out for its ease of use in various shopping and travel transactions, making it a reliable choice for those who value accessibility and flexibility in their financial tools.

- Wide acceptance at numerous locations worldwide

- Contactless payment functionality

- Compatibility with various digital wallets

- Available to Citibank account holders

- Access to Citibank’s global ATM network

- Exclusive deals and promotions with partner merchants

This card is a versatile option within the best debit card Singapore landscape, catering to various spending needs and preferences.

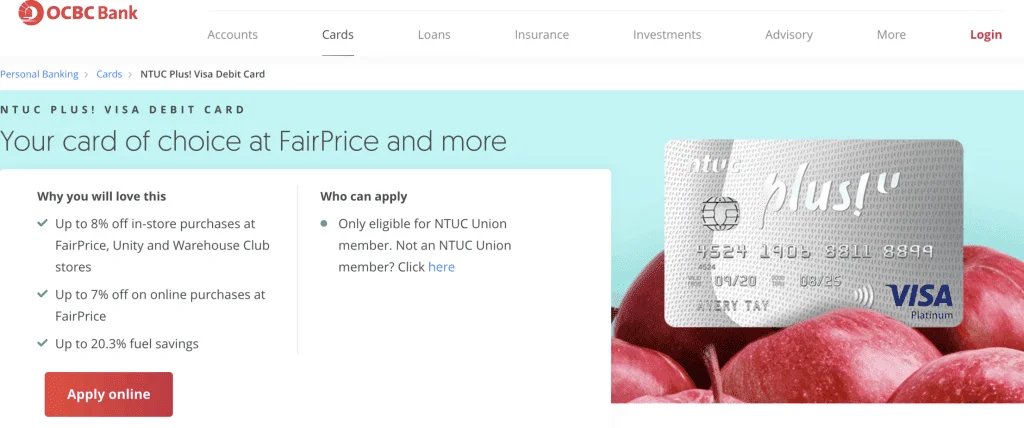

7. NTUC Plus! Visa Debit Card – Best for Shopping and Grocery Discounts

The NTUC Plus! Visa Debit Card is tailored for individuals who frequently shop at NTUC FairPrice stores and affiliated outlets. It offers substantial discounts and savings on everyday grocery purchases, making it an excellent choice for households looking to maximize their budget in daily shopping.

- Discounts at NTUC FairPrice, Unity, and Warehouse Club stores

- Contactless payment technology

- Visa network global acceptance

- NTUC Union membership is required

- Linkage to NTUC membership for more rewards

- Exclusive promotional offers at various retail partners

The NTUC Plus! Visa Debit Card is a practical choice for Singaporeans who prioritize savings on groceries and everyday purchases, fitting well within the best debit card Singapore category for shoppers.

8. Bank of China Great Wall International Debit Card – Best for Travel

The Bank of China Great Wall International Debit Card is an excellent choice for those who frequently travel or transact internationally. This card stands out for its global acceptance and ease of use across different currencies, making it a convenient option for international travellers and shoppers.

- No annual fee

- Multi-currency transaction capabilities

- Global acceptance and usage

- Available to Bank of China account holders

- Access to exclusive global offers and promotions

- Enhanced security features for international use

The Bank of China Great Wall International Debit Card offers essential features for international use, positioning it as a strong contender within the best debit card and travel debit card categories in Singapore.

9. Maybank Platinum Debit Card – Best for Students

The Maybank Platinum Debit Card is particularly favoured for its comprehensive reward program. It is designed for individuals seeking to maximise local spending rewards. This card offers a blend of cashback and reward points on various transactions, making it an attractive choice for those who prioritize earning rewards on their everyday expenditures in Singapore.

- Attractive rewards program

- Cashback on specific categories

- Extensive local merchant network

- Available to Maybank account holders

- Exclusive discounts and deals at partner merchants

- Enhanced security features for safe transactions

The Maybank Platinum Debit Card, with its focus on rewards and local spending, can be categorized as the best debit card for students in Singapore. Its offers of cashback and special rewards help students save their costs and earn some extra benefits to strengthen the experiences of each transaction on their spending.

10. CIMB FastSaver Account Debit Card – Best for Savings and High-Interest Earnings

The CIMB FastSaver Account Debit Card suits individuals who are focused on savings and earning interest. This card is linked to the CIMB FastSaver account, known for its attractive interest rates, making it an excellent choice for those looking to grow their savings effortlessly.

- High-interest rates when linked to FastSaver account

- Wide ATM network access

- No minimum spending requirements

- Must hold a CIMB FastSaver account

- Online banking convenience

- No annual fees

- Easy fund transfers and bill payments

This card is a solid option within the best debit card Singapore category, especially for those prioritizing savings and interest accrual on their deposits.

Debit Cards with the Best Rewards

In Singapore’s dynamic financial scene, finding a debit card with the best rewards can significantly enhance your spending. Certain cards stand out for their unique reward structures among many options.

1. UOB One Debit Card

The UOB One Debit Card is noteworthy for its lucrative cashback offers, making it a top contender for Singapore’s best cashback debit card. It caters to a broad range of spending habits, offering substantial cashback on daily expenses. This makes it particularly appealing to those prioritising savings on everyday purchases.

2. CIMB FastSaver Account Debit Card

Furthermore, the CIMB FastSaver Account Debit Card is an excellent choice for those looking to earn rewards through savings. This card is linked to the CIMB FastSaver account, which offers attractive interest rates. It’s an ideal option for individuals focused on growing their savings while enjoying the convenience of a debit card.

Debit Cards for Online Shopping

1. NTUC Plus! Visa Debit Card

In the realm of online shopping in Singapore, selecting the right debit card is crucial for maximizing benefits and convenience. The NTUC Plus! Visa Debit Card is a noteworthy option, especially for those who frequently shop online for groceries and household items.

This card offers exclusive discounts at NTUC FairPrice, Unity, and Warehouse Club stores, making it an excellent choice for budget-conscious shoppers. Its cashback features and rewards program, coupled with the convenience of online shopping, position it well within the best debit card Singapore category.

For those looking to combine everyday grocery shopping with the benefits of online purchasing, the NTUC Plus! Visa Debit Card presents an attractive package of rewards and savings.

Debit Cards for Travellers

1. HSBC Everyday Global Debit Card

For travellers in Singapore, choosing a debit card that caters to their specific needs while on the move is essential. The HSBC Everyday Global Debit Card stands out in this regard. It is specifically designed for globetrotters, offering the flexibility of multi-currency transactions without additional fees.

This feature is particularly valuable for those who travel across different countries, as it eliminates the hassle of currency conversion charges. Additionally, globally, the card’s wide acceptance ensures that travellers can use it conveniently, no matter where they are.

With its traveller-friendly features, the HSBC Everyday Global Debit Card aligns perfectly with the best travel debit card Singapore cluster, making it an ideal choice for Singaporeans who are frequent travellers.

Debit Cards for Students and Young Adults

1. Maybank Platinum Debit Card

In Singapore, students and young adults have specific financial needs, and choosing the right debit card can make a significant difference. The Maybank Platinum Debit Card is an excellent choice in this segment.

Tailored to suit the lifestyles of younger individuals, it offers a mix of rewards and practicality. This card provides a rewards program that accumulates points for every spend, which can be redeemed for various rewards. Its wide acceptance and security features make it a reliable option for daily use and online purchases.

Particularly for students beginning to manage their finances independently, the Maybank Platinum Debit Card stands as a strong contender within the best debit card for students in the Singapore category, offering benefits that align with their unique spending habits and financial learning curve.

Premium Debit Cards

1. Citibank Debit Mastercard

Singapore’s financial landscape offers a range of premium debit cards, each designed to cater to the upscale market segment. The Citibank Debit Mastercard exemplifies this category, providing users with premium features.

This card offers global acceptance, Ideal for individuals seeking a blend of luxury and functionality, making it perfect for international travel and online shopping.

Its enhanced security features, exclusive deals, and promotions stand out, aligning with the best travel debit card Singapore cluster. This card caters to those who desire a high-end banking experience coupled with the convenience and safety of a debit card.

How to Apply for a Debit Card

Step 1: determine your needs.

Before choosing a debit card, assess your financial habits and needs. Consider whether you’re seeking cashback, travel perks, or student-friendly features.

Are you a frequent shopper, traveller, or student managing a tight budget? Identifying your primary spending patterns and what you value most in a debit card – rewards, low fees, or specific benefits – is essential.

This understanding will guide your choice, ensuring your card aligns with your lifestyle and financial goals.

Step 2: Research Options

Once you’ve identified your needs, research various debit cards available in Singapore. Explore their features, benefits, and fees. Look for cards that offer rewards and benefits that match your lifestyle, such as the best cashback debit card in Singapore for shoppers or the best travel debit card Singapore for frequent travellers.

Consider factors like annual fees, rewards programs, and user reviews. Comparing these features across different banks and their offerings will help you find a card that meets your requirements and offers the best value for your spending habits.

Step 3: Check Eligibility

After narrowing down your choices, check the eligibility criteria for the debit cards you’re interested in. Each card has specific requirements set by the issuing bank.

These often include age restrictions, minimum income levels, or, in the case of student cards, proof of enrollment in an educational institution. Some cards also require you to have an existing account with the bank.

Ensuring you meet these prerequisites is vital before proceeding with your application, as it saves time and increases the likelihood of your application being approved.

Step 4: Gather Necessary Documents

For a smooth application process, gather all necessary documents beforehand. You’ll need a valid identification document like a National Registration Identity Card (NRIC) or passport.

Additional documents such as an Employment Pass or Student Pass might be required if you’re a foreigner. Proof of address, often a utility bill or bank statement, is usually needed.

For income verification, recent payslips or bank statements are standard. Students should have their student ID or proof of enrollment ready. These documents will expedite the application process for your chosen debit card.

Step 5: Apply Online or In-Person

Once you have all your documents, apply for the online or in-person debit card. Online applications can be done on the bank’s website, offering convenience and speed.

For in-person applications, visit your chosen bank’s nearest branch. This option can be beneficial if you prefer face-to-face assistance or have specific questions.

Both methods require completing an application form and submitting the necessary documents. Choose the method that best suits your comfort and convenience.

Step 6: Await Approval

After submitting your application, the next step is to wait for approval. The processing time can vary depending on the bank and the completeness of your application.

Banks typically review the provided information to ensure eligibility and compliance with their criteria. During this period, you might be contacted for additional information or clarification.

Approval times can range from a few days to a couple of weeks. Patience is key during this phase, as the bank carries out necessary checks to approve your debit card application.

Step 7: Activate the Card

Once your application is approved and you receive your debit card, the next step is activation. This is a crucial security measure. Activation can be done through various methods, such as calling a designated phone number, using an ATM, or through the bank’s online banking platform.

Follow the instructions provided with your card. Activation verifies your identity and enables the card to be used. Ensure you complete this step before attempting transactions with your new debit card.

Step 8: Set Up Online Banking

After activating your debit card, set up online banking to manage your account efficiently. This can usually be done through the bank’s website or mobile app.

You must create a username and password and provide additional verification details. Online banking allows you to check balances, view transactions, transfer funds, and pay bills conveniently.

Applying for a debit card in Singapore is a systematic process that starts with understanding your financial needs and preferences. It involves thorough research of available options, checking eligibility criteria, and preparing necessary documentation.

The application process, whether online or in-person, is followed by a waiting period for approval. Once the card is received, activation and online banking are essential final steps. The right debit card can significantly streamline your financial transactions, offering convenience, security, and benefits tailored to your lifestyle.

Frequently Asked Questions

Which singapore debit card has no foreign transaction fee.

The HSBC Everyday Global Debit Card is known for having no foreign transaction fees, making it ideal for international use.

Are there any debit cards in Singapore that offer rewards or cashback?

Yes, the UOB One Debit Card and OCBC FRANK Debit Card are popular for offering rewards and cashback on various transactions.

What should I look for in a debit card if I travel frequently?

Look for cards with low or no foreign transaction fees, wide global acceptance, and travel-related benefits. For example, the HSBC Everyday Global Debit Card offers multi-currency transactions without extra fees.

Can I use my Singapore debit card overseas, and what are the associated fees?

Yes, you can use Singapore debit cards overseas, but be aware of foreign transaction fees and currency conversion charges, which vary by card and bank.

Is there a minimum age requirement to apply for a debit card in Singapore?

Yes, the typical minimum age requirement is 16 years, but it can vary depending on the bank’s policies.

Financial Disclaimer:

The information provided herein is for general informational purposes only. It is not intended as financial, legal, or professional advice. While efforts have been made to ensure accuracy and up-to-dateness, the content may not reflect current legal or regulatory standards or developments. Individual circumstances vary, and users should seek personalized advice from qualified professionals if necessary. The author or publisher of this content does not accept responsibility for any losses or damages arising from the use, reliance on, or actions taken based on the information contained in this material.

Irvin Yap is a skilled writer focused on personal finance and insurance in Singapore. Known for simplifying complex topics, his...

Editorial note: We may not cover every product in this category. For more information, see our Editorial guidelines .

The 5 best travel money cards for singapore in 2024.

Singapore is a vibrant place to visit with amazing nightlife, delicious food and a gateway to the rest of the world, it has a lot to offer visiting Australians.

In Singapore you are likely to pay for accommodation, food, transport and entertainment as well as withdraw cash from ATMs with your card.

We have looked at a number of best travel card for overseas in 2024 and have summarised their best points.

Best 6 Travel Money Cards for Singapore in 2024:

- Wise Travel Card - for the best exchange rates

- Revolut Travel Card for low fees

- Travelex Money Card - best all rounder

- HSBC Global Everyday Debit Card for ATM cash withdrawals

- Bankwest Breeze Platinum Credit Card for lowest interest rate

- ING One Low Rate Credit Card with no annual fee

Wise Travel Card - Best Exchange Rates

- 40+ currencies available

- Best exchange rates globally

- One of the lowest conversion fee on the market

- No international transaction fees

- No annual or monthly fees

- Extremely low costs to send money overseas

Wise Travel Card

- Cross currency conversion fees are between 0.24–3.69%. AUD to USD, EUR or GBP was 0.42%, which is one of the lowest on the market

- Free cash withdrawals up to $350 every 30 days. However after that, Wise Card charge a fixed fee of $1.50 per transaction + 1.75%

- Daily ATM withdrawal is $2,700

- Issue up to 3 virtual cards for temporary usage

- It takes between 7 to 14 business days to receive your card

- Can be used wherever MasterCard is accepted

The Wise Travel Card is an excellent choice for people traveling to Singapore, offering a multitude of benefits tailored to international visitors. One of the key advantages is access to over 40 currencies at the interbank exchange rate, widely acknowledged as the most cost-effective globally. This is particularly useful for travelers coming to Singapore, as they can exchange their home currency for Singapore Dollars (SGD) at very competitive rates. However if you use ATMs frequently this is not the card to use due to the fees. Finally Wise Travel Card lets you transfer money to an overseas bank account with extremely low fees and the best exchange rate.

Revolut - Best Exchange Rates

- 30+ currencies available

- One of the best exchange rates globally

- No annual or monthly fees for standard membership

- No initial card fee

- Instant access to a range of cryptocurrencies

Read our Revolut Card Review

Revolut Travel Card

- No fee ATM withdrawals up to A$350, or 5 ATM withdrawals, whichever comes first, per rolling 30 day period and 2% of withdrawal amount (minimum charge of A$1.50) after that

- Exchanging currency on the weekend can incur a 1% mark-up fee

- Fees on international money transfers were introduced in April 2021.

- Can be used wherever Visa is accepted

The Revolut Travel Card is a decent option for those who travel a lot as it offers over 30 currencies at a great exchange rate, which is the cheapest rate globally. However if you exchange currency on the weekend you can incur a one-percent mark-up fee. In addition they have introduced fees for international transfers. Finally if you use ATMs frequently this is not the card to use due to the fees.

Travelex Money Card - Best All Rounder

Best features.

- Unlimited free ATM withdrawals

- 24/7 Emergency Assistance

- Initial and replacement card are free

- Lock in up to 10 currencies

Read our Travelex Review

Travelex Money Card

- Minimum load of $100 and maximum load of $100,000

- Can be used wherever Mastercard is accepted

- Fees include a $10 closure fee, $5 for an additional card and $4 inactivity monthly fee.

- While Travelex don't charge ATM fees, some ATM operators may charge their own fees.

- Currencies that can be loaded are AU$, US$, EU€, GB£, NZ$, TH฿, CA$, HK$, JP¥, SG$

- If your card is lost or stolen you can access cash in your account through Moneygram or Western Union agents, with no charge

- Boingo hotspots offer free wifi and you can look at their number of free hotspots per country on this map

The Travelex Money Card is a good all-rounder no matter if you are heading to the bustling streets of Hong Kong or visiting the serene Lantau Island.

You can use it to take money out of the ATM, for merchant purchases like restaurants and even for online shopping in foreign currency. While the exchange rates aren't as good as Wise or Revolut for travelling , the support network if the card is lost or stolen is very good. This service can be extremely useful when journeying across the cosmopolitan city of Hong Kong.

HSBC Everyday Global Travel Card - Best Travel Card by Bank

- Great exchange rate offered for Singapore dollars (SGD)

- No ATM fees at HSBC tellers

- No initial card, closure, account keeping or monthly fees

- No cross currency conversion fees

HSBC Everyday Global Travel Card

- 10 Currencies can be loaded are SGD, AUD, USD, EUR, GBP, CAD, JPY, NZD, HKD and CNY (currency restrictions on CNY)

- No maximum balance for any currency

- Very competitive exchange rates on all currencies when you have currencies already loaded on your card

- ATMs within Australia need to be HSBC and overseas they need to display a VISA or VISA Plus logo, not be be charged fees

- Earn 2% cash back when you tap and pay with payWave, Apple Pay or Google Pay for purchases under $100.

- Daily maximum ATM withdrawal is $2,000

- Fraud protection covered by Visa Zero Liability

The HSBC Everyday Global Travel Card offers a great exchange rate for Singapore dollars, ATMs, so you can withdraw cash without the hefty overseas ATM fees.

In addition it does not charge an ‘international transaction fee’ so you can spend in Singapore and online in Australia and not pay an additional 3%.

Finally, on top of the excellent currency exchange rate, there is no maximum balance on currencies held and a 2% cash back incentive when you tap and pay under $100.

Bankwest Breeze Platinum Credit Card - Lowest Interest Rate

- Lowest interest rate at 9.90%

- No international transaction fees on purchases

- Up to 55 days interest free on purchases

- Low annual fee

- Complimentary international travel insurance

Bankwest Breeze Platinum Credit Card

- Free annual fee first year, then $69 annual fee

- Free international travel insurance that includes the basics but does not cover cancellation costs, pre existing conditions and travellers over 80

- $6,000 minimum credit card

- 0% p.a. on purchases and balance transfers for the first 15 months, then reverts to 9.90%

- 21.99% interest rate on purchases and cash advances

- Cash advance fee of the higher of $4 or 2% of cash advance

The Bankwest Breeze Platinum is a great no frills credit card that offers ‘no foreign transaction fees’ and the lowest interest rate on the market, at 9.90%. These two factors alone will save you hundreds of dollars when travelling throughout Singapore.

In addition it has a low annual fee and complimentary international travel insurance. Finally for its price point it is a great value credit card that will be accepted most places in Singapore.

ING One Low Rate Credit Card - No Annual Fee

- No annual fee

- Up to 45 days interest free on purchases

- Lowest cash advance interest rate of 11.99%

- Use instalment plans to pay off your purchases over time at a lower interest rate

ING One Low Rate Credit Card

- 11.99% interest rate on purchases

- Make payments from your mobile with pay with Apple Pay and Google Pay

- International ATM fee and Foreign currency conversion fee are waived when you deposit $1,000 into your Orange Everyday each month, and make 5+ card purchases that are settled. Otherwise they are the higher of 3% or at least $3

- Put repayments on auto payment each month to pay the minimum balance or full amount

The ING One Low Rate credit card is a great option to take to Singapore as it charges no annual fee and offers a low interest rate for purchases and cash advances of 11.99%. The cash advance interest rate is very low and about 50% less than most of its competitors who charge around 22% on cash advances.

Furthermore the ING One Low Rate credit card has no international transaction fees, so you can save money on your travels and when you buy goods from overseas. It's a handy backup card to have in your wallet when travelling through Singapore.

Learn more about the best credit, debit and prepaid cards for travel

Best Credit Card for Overseas Travel

International Prepaid Cards

Overseas Debit Card

The best travel card for Singapore is the Wise Multi Currency card for tap or swipe large transactions like accommodation and restaurants. Wise offers the best exchange rate for Singapore dollars globally and charges no international transaction fees.

HSBC Global and Citibank Plus cards are the best for ATM withdrawals and great exchange rates for Singapore dollars. Both these cards charge no international transaction fee and can be used within Australia without penalties.

The best credit cards for Singapore are the BankWest Platinum Breeze and ING One Low Rate as they have the lowest interest rates on the market with and charge no international transaction fees.

Yes, you should bring cash to Singapore and buy Singapore dollars before you travel to Singapore. It is one of the best ways to take money to Singapore. Having Singapore dollars on hand when you arrive at the airport will make your life a lot easier. The airport is also the most expensive place to exchange currency, so you will save a lot of money as well. Even though Singapore is card friendly, having cash on hand will always be handy for small purchases, tipping and paying for transport.

HSBC and Citibank have the best travel money cards for Singapore. Both have lots of ATMs within Singapore, both offer fantastic exchange rates for the Singapore dollar and both offer ‘no international transaction fees’.

A travel money card is more secure than cash because you need your pin to authorise transactions, if you lose cash you are unlikely to have it returned. If your travel money card is stolen, then you can report it lost or stolen online quickly. It is also less bulky to carry 2 or 3 cards than lots of cash.

The best prepaid cards for Singapore are Wise , HSBC and Citibank which offer the most competitive cards in the market. Other older style prepaid cards like Australia Post, Cash Passport, Travel Money Oz and Travelex have lots of charges like load, unload, inactivity, ATM withdrawals and initial card fees.

You can place money on your travel money card online and paying by direct debit from your bank account will cost you the least. Log in to your bank account, transfer your funds into the travel money card and the money should be there within 24 hours.

As a general rule, working out how much money to take to Singapore depends on where you go and your type of travel. If you travel on a budget to Singapore it can cost from $70 a day. If you travel in the middle range throughout Singapore it can cost from $150 per day. Finally if you travel with luxury throughout Singapore it can cost anywhere from $300 per day.

You can only use Singapore dollars in Singapore, you can not use Australian dollars or US dollars . The currency in Singapore is the Singapore dollar. There are 4 commonly used bank notes with different colours, they are $2, $5, $10, $50, $500 and $1,000. There are 5 coins, they are 5c, 10c, 20c, 50c and $1.

More Travel Card Guides

Learn more about the best travel money cards for your holiday destination.

ASIC regulated

Like all reputable money exchanges, we are registered with AUSTRAC and regulated by the Australian Securities and Investment Commission (ASIC).

S Money complies with the relevant laws pertaining to privacy, anti-money laundering and counter-terrorism finance. This means you are required to provide I.D. when you place an order. It also means the order must be paid for by the same person ordering the currency and you must show your identification again when receiving your order.

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

6 Best Travel Cards for Singapore

Getting an international travel card before you travel to Singapore can make it cheaper and more convenient when you spend in Singapore Dollar. You'll be able to easily top up your card in USD before you leave the US, to convert seamlessly to SGD for secure and flexible spending and withdrawals.

This guide walks through our picks of the best travel cards available for anyone from the US heading to Singapore, like Wise or Revolut. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

6 best travel money cards for Singapore:

Let's kick off our roundup of the best travel cards for Singapore with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from the US:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to Singapore.

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in Singapore. Wise accounts can hold 40+ currencies, so you can top up in USD easily from your bank or using your card. Whenever you travel, to Singapore or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

In either case you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in SGD, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in SGD when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- 9 USD delivery fee for your first card

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 14 - 21 days to arrive

How to apply for a Wise card

Here’s how to apply for a Wise account and order a Wise travel card in the US:

Open the Wise app or desktop site

Select Register and confirm you want to open a personal account

Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

Tap the Cards tab to order your card

Pay the one time 9 USD fee, confirm your mailing address, and your card will be on the way, and should arrive in 14 - 21 days

Revolut travel card

Choose a Revolut account, from the Standard plan which has no monthly fee, to higher tier options which have monthly charges but unlock extra features and benefits. All accounts come with a smart Revolut card you can use in Singapore, with some no fee ATM withdrawals and currency conversion monthly, depending on the plan you pick. Use your Revolut account to hold and exchange 25+ currencies, and get extras like account options for under 18s, budgeting tools and more.

Revolut features

Revolut travel card pros and cons.

- Pick the Revolut account plan that suits your spending needs

- Hold and exchange 25+ currencies, and spend in 150 countries

- Accounts come with different card types, depending on which you select

- All accounts have some no fee currency exchange and some no fee ATM withdrawals monthly

- Some account tiers have travel perks like complimentary or discounted lounge access

- You need to upgrade to an account with a monthly fee to get all account features

- Delivery fees may apply for your travel card

- Fair usage limits apply once you exhaust your currency conversion and ATM no fee allowances

- Out of hours currency conversion has additional fees

How to apply for a Revolut card

Set up your Revolut account before you leave the US and order your travel card. Here’s how:

Download and open the Revolut app

Register by adding your personal and contact information

Follow the prompts to confirm your address and order your card

Pay any required delivery fee - costs depend on your account type

Chime travel card

Use your Chime account and card to spend in Singapore with no foreign transaction fee. You’ll just need to load a balance in USD and then the money is converted to SGD instantly with the Visa rate whenever you spend or make a withdrawal. There’s a fee to make an ATM withdrawal out of network, which sits at 2.5 USD, but there are very few other costs to worry about. Plus you can get lots of extra services from Chime if you need them, such as ways to save.

Chime features

Chime travel card pros and cons.

- No Chime foreign transaction fees

- No ongoing charges for your account

- Lots of extra products and services if you need them

- Easy ways to manage your money online and in app

- Virtual cards available

- You'll need to inform Chime you're traveling to use your card abroad

- Low ATM limits

- Cards take 7 - 10 days to arrive by mail

How to apply for a Chime card

Here’s how to apply for a Chime account and order a travel card in the US:

Visit the Chime website or download the app

Click Get started and add your personal details

Add a balance

Your card will be delivered in the mail and you can use your virtual card instantly

Monzo travel card

Monzo cards can be ordered easily in the US and used for spending in Singapore and globally. Monzo accounts are designed for holding USD only - but you can spend in SGD and pretty much any other currency easily, with no foreign transaction fee. Your funds are just converted using the network exchange rate whenever you pay or make a withdrawal.

Monzo doesn’t usually apply ATM fees, but it’s worth knowing that the operator of the specific ATM you pick may have their own costs you’ll need to check out.

Monzo features

Monzo travel card pros and cons.

- Good selection of services available

- No foreign transaction fee to pay

- No Monzo ATM fee to pay

- Manage your card from your phone conveniently

- Deposits are FDIC protected

- You can't hold a foreign currency balance

- ATM operators might apply their own fees

How to apply for a Monzo card

Here’s how to apply for a Monzo account and order a travel card in the US:

Visit the Monzo website or download the app

Click Get Sign up and add your personal details

Check and confirm your mailing address and your card will be delivered in the mail

Netspend travel card

Netspend has a selection of prepaid debit cards you can use for spending securely in Singapore. While these cards don’t usually let you hold a balance in SGD, they’re popular with travelers as they’re not linked to your regular checking account. That increases security overseas - plus, Netspend offers virtual cards you can use to hide your physical card details from retailers if you want to.

The options with Netspend vary a lot depending on the card you pick. Usually you can top up digitally or in cash in USD and then spend overseas with a fixed foreign transaction fee applying every time you spend in a foreign currency. You’ll be able to view the terms and conditions of your specific card - including the fees - online, by entering the code you’ll find when your card is sent to you.

Netspend features

Netspend travel card pros and cons.

- Large selection of different card options depending on your needs

- Some cards have no overseas ATM fees

- Prepaid card which is secure to use overseas

- Manage your account in app

- Change from one card plan to another if you need to

- You may pay a monthly fee for your card

- Some cards have foreign transaction fees for all overseas use, which can be around 4%

- Selection of fees apply depending on the card you pick

How to apply for a Netspend card

Here’s how to apply for a Netspend account and order a travel card in the US:

Visit the Netspend website

Click Apply now

Complete the details, following the onscreen prompts

Get verified

Your card will arrive by mail - add a balance and activate it to get started

PayPal travel card

PayPal has a debit card you can link to your PayPal balance account, to spend in Singapore as well as locally, in person and online. One advantage of PayPal is that there are lots of easy ways to add money in USD - but bear in mind that when you spend in SGD you’ll likely pay a foreign transaction fee of 2.5%. ATM fees apply when you make out of network withdrawals, too, which can push up the costs depending on how you use your card.

PayPal travel cards aren’t connected to your checking account which makes them a handy and secure way to spend, particularly if you already have a PayPal balance account.

PayPal features

Paypal travel card pros and cons.

- Globally accepted card

- Easy ways to top up your PayPal balance including cash and check

- Popular and reliable provider

- Use your card for spending online easily as well

- 2.5 USD fee for out of network ATM withdrawals

- 2.5% fee when you spend in a foreign currency

- Other charges may apply depending on how you fund and use your account

How to apply for a PayPal card

Here’s how to apply for a PayPal account and order a travel card in the US:

Visit the PayPal website or download the app

Click Get Sign up or log into your existing account

Add your personal details to create an account, or tap Request a card if you already have a PayPal account

Follow the prompts to order your card

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your United States Dollar everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to Singapore or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app or on the web.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to Singapore. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday USD account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for Singapore

We've picked out 6 great travel cards available in the US - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for Singapore include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in SGD can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences.

What makes a good travel card for Singapore

The best travel debit card for Singapore really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it’s the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you’re paying when you spend in SGD.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It’s also important to look into the security features of any travel card you might pick for Singapore. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

For Singapore in particular, choosing a card which offers contactless payments and which is compatible with mobile wallets like Apple Pay could be a good plan. Card payments are extremely popular in Singapore - so having a card which lets you tap and pay easily can speed things up and make it more convenient during your trip.

Ways to pay in Singapore

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In Singapore card payments are common in most situations. You’ll be able to make Chip and PIN or contactless payments or use your favourite mobile wallet like Apple Pay to tap and pay on the go. It’s still worth having a little cash on you just in case - and for the odd situations where cash is more convenient, such as when tipping or buying a small item in a market.

Which countries use SGD?

You’ll find that SGD can only be used in Singapore. If you don’t travel to Singapore frequently it’s worth thinking carefully about how much to exchange so you’re not left with extra foreign currency after your trip. Or pick a travel card from a provider like Wise or Revolut which lets you leave your money in USD and convert at the point of payment with no penalty.

What should you be aware of when travelling to Singapore

You’re sure to have a great time in Singapore - but whenever you’re travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you’re been to Singapore before it’s worth looking up the most recent entry requirements so you don’t have any hassle on the border

2. Plan your currency exchange and payment methods - you can change USD to SGD before you travel to Singapore if you’d like to, but as card payments are common, and ATMs widely available, you can actually leave it until you arrive to get everything sorted as long as you have a travel money card. Top up your travel money card in USD and either exchange to SGD in advance or at the point of payment, and make ATM withdrawals whenever you need cash. Bear in mind that currency exchange at the airport will be expensive - so hold on until you reach Singapore to make an ATM withdrawal in SGD if you can.

3. Get clued up on any health or safety concerns - get travel insurance before you leave the US so you have peace of mind. It’s also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don’t offer fair prices or adequate services.

Conclusion - Best travel cards for Singapore

Ultimately the best travel card for your trip to Singapore will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

How does a Singapore Dollar card work?

Getting a Singapore Dollar card can make managing your money easier when you travel to Singapore.

Your Singapore Dollar card will be linked to a digital account you can manage from your phone, so you'll always be able to see your balance, get transaction notifications and manage your card no matter where you are. Just add money to your account in pounds, and - depending on your preferences and the specific card you pick - you can either convert your balance to Singapore Dollar instantly, or just let the card do the conversion when you spend or make a withdrawal.

If your card gives you the option to hold a Singapore Dollar balance, there's not normally any extra fee to spend the Singapore Dollar you have in your account when you're in Singapore.

Can I withdraw Singapore Dollar currency with my card in Singapore?

With some cards, you'll be able to add money to your card in United States Dollar, and then convert to Singapore Dollar instantly online or in your card's app.

Once you have a balance in Singapore Dollar you can spend with your card with no extra fees - just tap and pay as you would at home. You'll also be able to make cash withdrawals whenever you need to, with no extra conversion fee to pay. Your card - or the ATM operator - may charge a withdrawal fee, but this can still be a cheap, secure and convenient option for getting cash when you need it.

With other cards, you can't hold a balance in Singapore Dollar on your card - but you can leave your money in United States Dollar and let the card convert your money for you when you spend and withdraw.

Some fees may apply here - including currency conversion or foreign transaction charges - so do compare a few different cards before you sign up, to make sure you're picking the one which best suits your specific spending needs.

Bear in mind though, that not all cards support all currencies - and the range of currencies available with any given card can change from time to time. If your card doesn't let you hold a balance in Singapore Dollar you might find that fees apply when you spend in Singapore, so it's well worth double checking your card's terms and conditions - and comparing the options available from other providers - before you travel, just in case.

Why should I get a Singapore Dollar card?

Getting a Singapore Dollar card means you can spend like a local when you're in Singapore. You'll be able to check your Singapore Dollar balance at a glance, add and convert money on the move, and use your card for secure spending and withdrawals whenever you need to. Best of all, Singapore Dollar cards from popular providers often offer good exchange rates and low, transparent fees, which can mean your money goes further when you're on a trip abroad.

FAQ - best travel cards for Singapore

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards - like the Wise and Revolut card options - have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise, Revolut and Monzo.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others like Wise and Revolut, let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in Singapore.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their USD / SGD rate to calculate how much Singapore Dollar you would receive when exchanging / spending $4,000 USD. The card provider offering the most SGD is displayed at the top, the next highest below that, and so on.

The rates were collected at 09:36:26 GMT on 25 May 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

Travel money guide: Singapore

Compare how you can take your money and spend singapore dollars in the garden city..

In this guide

Travel card, debit card or credit card?

These are your options for spending money in singapore, buying singapore dollars in the us, singaporean currency, atms in singapore, how many dollars do i need to bring to singapore.

Travel money type

Compare more cards

Top picks of 2024

This cosmopolitan island city-state is the most financially stable and prosperous in the region. Before you embark on your adventure to tour the lush gardens, shopping malls and street food stalls, stash a travel credit card in your wallet to pay for your travels. The card waives any foreign transaction fees and lets you earn miles with your purchases.

Most locals use Singapore dollars or credit cards to pay for goods and services. Since Singapore has one of the lowest rates of crime in the world — yes, no jaywalking or littering while you’re there — you shouldn’t feel threatened carrying cash. To your advantage, getting cash from bank-owned ATMs means no operator fees.

Our picks for traveling to Singapore

40+ currencies supported

- 4.85% APY on USD balances

- $0 monthly fees

- Up to $100 free ATMs withdrawals worldwide

- Hold and convert 40+ currencies

Up to $300 cash bonus

- 0.50% APY on checking balance

- Up to 4.60% APY on savings

- $0 account or overdraft fees

- Get a $300 bonus with direct deposits of $5,000 or more

Free ATM transactions

- $50 waivable monthly fee

- 0% foreign transaction fee

- Securely move money domestically and globally

- 5 monthly out-of-network ATM reimbursements

- Free international HSBC ATM transactions

Major card brands are widely accepted in Singapore, but some merchants will charge a surcharge . ATMs in Singapore will accept the major brands Visa, Mastercard and American Express. As for travel money cards, most of them support SGD but may not be the most secure option because they don’t have your name on the card.

Using a credit card

Almost everyone in Singapore uses credit cards, so find yourself a travel credit card that waives foreign transaction fees, like the Capital One VentureOne Rewards Credit Card (Terms apply, see rates & fees ). Carrying a credit card gives you the added benefit of travel insurance and discounts, depending on your provider. For added savings, take advantage of the interest-free period by paying your balance in full each month.

Cards that offer travel perks and waive fees often charge an annual fee, so make sure the fee is worth it before you bring it along on your travels. If you’re ever in a jam, credit cards offer cash advances, though we don’t recommend it. You’ll pay high fees, and interest rates apply the moment you get your money.

- Tip: It’s worth researching credit cards that offer travel benefit and rewards for things you’ll buy anyways like flights and hotel stays.

- Widely accepted, especially Visa and Mastercard

- Find a card with no annual fees, foreign exchange fees

- Exchanges at the best possible interchange rate

- Credit cards usually charge currency conversion fee

- Cash withdrawals using your credit card are considered cash advances which will incur a costly fee and high rate

Using a debit card

A debit card to use while you’re overseas could be a good travel money choice to take to Singapore. You’ll have access to cash each time you come across an ATM without carrying lots of cash on you. Because you’re spending your own money, you avoid interest charges. Find a bank that waives or reimburses those international ATM fees, such as the Betterment Checking .

- Tip: Singapore bank ATMs do not charge an ATM operator fee.

- Singapore bank ATMs do not charge an ATM operator fee

- ATMs are located all over the city-state. Every bank or shopping center has its own

- Better for managing your budget

- Most debit cards will charge a currency conversion and ATM withdrawal fee

- No access to cash advance

Using a prepaid travel card

Travel cards can lock in conversion rates once you load USD. Use it for purchases without worrying about rates each time you spend — debit and credit cards often charge 3% for each transaction.

Where you save in the conversion rates, you may pay in fees. You’ll pay fees each time you load the card, ATM withdrawals and sometimes even an inactivity fee.

Compare these cards by looking at fees for international ATM withdrawals, initial loading and reloading, and inactivity.

- Tip: Prepaid travel cards are dual card accounts, meaning you’ll receive an additional card.

- Can be preloaded with foreign currency and canceled at any time

- Most travel cards support SGD

- Comes with lots of fees for loading and reloading, inactivity and ATM withdrawals

- Exchange rates are lower than credit cards and debit cards

Paying with cash in Singapore

You’ll need cash if you want to shop in the market areas of Haji Lane, Sim Lim and Burgis. Otherwise, you’ll find that you can use your card for the majority of purchases in Singapore.

- Accepted anywhere

- Take as much as $30,000 into Singapore without declaring it.

- More difficult to manage expenses

- Risk of theft

Using traveler’s checks

Security is the main advantage of using traveler’s checks, as each check has a unique serial number and can only be cashed with a photo ID. They’ve been replaced by less expensive debit, travel and credit cards. You can cash them at the Changi Airport and major money exchanges in Singapore, but you’ll pay a high commission and get a less favorable rate than using plastic.

- Tip: Traveler’s checks are good for locking in a good exchange rate. So if you watch the forex market, get them while the getting’s good.

Getting a refund if you’re the victim of a fraudulent transaction

- Accepted at most banks

- Fees for purchasing and cashing

- Hard to find merchants that accept them

The exchange rate

Visa and Mastercard apply a foreign exchange rate for over-the-counter purchases and ATM withdrawals. This rate is a touch above the midmarket rate and is better than what you’ll get at exchange offices and banks.

Refreshing in: 60s | Fri, Jun 21, 06:09PM GMT

It’s better to wait until you arrive in Singapore and make an ATM withdrawal or at an exchange office rather than get money exchanged in the US. The rates will be better. You can bring up to $14,000 into the country without making a customs declaration.

You can always send your money to Singapore ahead of time with a money transfer service and have it waiting to be picked up when you arrive.

The main banks in Singapore are:

- Developmental Bank of Singapore

- Post Office Savings Bank

- United Overseas Bank

- Standard Chartered Bank

- State Bank of India

- Barclays Bank

- Bank of China

You can find ATMs in Singapore inside banks or near shopping areas like malls and grocery stores. ATMs should accept Visa, Mastercard, American Express and Discover, though you’ll want to look for your card’s logo on the ATM before inserting your card.

Keep in mind that you might see Visa’s Plus and Mastercard’s Maestro or Cirrus symbols. To avoid hefty foreign currency exchange and ATM fees, go with a Betterment Checking debit card in hand, which automatically reimburses these fees.

You’ll find that Singapore is more expensive than other countries in Southeast Asia but less expensive than cities in the US and Europe. Hostels and inexpensive hotels are easy to find, and you can find tasty Asian cuisine to fit any budget.

For a backpacker’s budget, you can plan for less than $60 per day. Midrange to luxury travelers can expect to spend between $100 to $300 a day. All prices are in US dollars.

Prices are approximate and based on summer seasonality and are subject to change.

Case study: Shirley's experience

Case study: Shirley in Singapore

Shirley spent two weeks in Singapore and told finder.com about what she thinks the best travel money options are.

What are your money travel tips for Singapore?

- Be sure to notify all your credit cards and banks about your travel abroad. Credit cards want to safeguard against fraud, so they will freeze your account if any unusual spending occurs.

- Singaporean restaurants don’t include service charges, so remember to account for these when paying for goods and services.

- She says the exchange rates were better in Singapore than in the US, so she waited to exchange money until she arrived. She says the more you change, the better the rate.

Kyle Morgan

Kyle Morgan is SEO manager at Forbes Advisor and a former editor and content strategist at Finder. He has written for the USA Today network and Relix magazine, among other publications. He holds a BA in journalism and media from Rutgers University. See full profile

More guides on Finder

How to pay, how much to bring and travel money suggestions for your trip to USA.

How to pay, how much to bring and travel money suggestions for your trip to South Africa.

How to pay, how much to bring and travel money suggestions for your trip to Sri Lanka.

How to pay, how much to bring and travel money suggestions for your trip to Mexico.

How to pay, how much to bring and travel money suggestions for your trip to Portugal.

How to pay, how much to bring and travel money suggestions for your trip to Hungary.

How to pay, how much to bring and travel money suggestions for your trip to Ecuador.

How to pay, how much to bring and travel money suggestions for your trip to Fiji.

How to pay, how much to bring and travel money suggestions for your trip to Japan.

How to pay, how much to bring and travel money suggestions for your trip to South America.

Ask a Question

Click here to cancel reply.

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Digital Multi-Currency Accounts & Cards For Travel Spending: BigPay vs Instarem Amaze vs Revolut vs Wise (Formerly TransferWise) vs YouTrip

Singaporeans are always looking for ways to save cash—especially when travelling. This is where the digital multi-currency accounts come in.

The world of digital multi-currency accounts is constantly changing. Instarem’s Amaze card used to be lauded for its lucrative 1% cashback on top of your linked credit card , but it’s since replaced this with a loyalty points-based system. At the same time, it’s also slapped on some top-up fees for certain top-up methods. Meanwhile, YouTrip has finally added Google Pay compatibility —you can now add your YouTrip card to your Google Wallet and make seamless and secure payments.

So, with all these changes, how do we know which is the best? Here’s the lowdown on offerings from YouTrip, Instarem, BigPay, Revolut, and Wise (formerly TransferWise). Let’s review and compare them to see which is the best digital multi-currency account.

BigPay vs Instarem Amaze vs Revolut vs Wise (Formerly TransferWise) vs YouTrip: Which is the best multi-currency account?

Swipe left to see the full table.

Best all-round digital multi-currency card: Instarem Amaze Card

The Instarem Amaze Card’s winning factor is the fact that you can earn Instarem rewards on top of your own credit or debit card cashback or rewards. All you have to do is link your credit or debit card (up to 5 cards) to your Amaze card or top up your Amaze wallet and spend away. This alone introduces a very enticing incentive for people to use the Instarem Amaze card while still spending on their existing cards.

How does the cashback work for the Instarem Amaze card?

The Amaze card used to give you 1% cashback, but has now switched to a loyalty points system with InstaPoints . When spending overseas on your Amaze card, you earn up to 1 InstaPoint for every 1 SGD-equivalent in foreign currency . There’s a minimum spend of 10 SGD (the equivalent in foreign currency) per transaction for you to earn InstaPoints on that transaction.

You’ll notice we said up to 1 InstaPoint. I dug through the Amaze Card T&Cs and found out that how many InstaPoints you earn depends on your payment method. Per SGD1 spent in foreign currency on your Amaze Card, you’ll earn

- 0.5 InstaPoints if your Amaze Card is linked to a credit or debit card.

- 1 InstaPoint if you’re topping up your Amaze Wallet on your Amaze Card.

Their website doesn’t spell out this distinction, it just says “T&Cs apply”. Sneaky, but we’re sneakier.

There’s also a cap of 500 InstaPoints you can earn per foreign currency transaction, and InstaPoints expire after 12 months . Do note that there are also certain categories excluded from Amaze Rewards , including healthcare, utilities, education, tolls, and postal services.

To redeem InstaPoints as cashback, do so directly on your Instarem App. Every 2,000 InstaPoints gets you SGD 20 cashback.

Pros—What we like about the Instarem Amaze Card:

- 1% cashback per quarter on top of your credit or debit card rewards.

- Googly Pay compatibility: Android users can add their Amaze card on Google Pay.

- No foreign currency conversion fees

- No annual, processing, or application fees

- The Instarem app automatically categorises your transactions into categories like “Food and Dining” and “Travel”. These days, we need all the help we can get staying organised.

- Since you can link up to 5 cards, the app also combines your cards into 1 and lets you track your spending across all of them regardless of the credit card provider.

Cons—What we don’t like about the Instarem Amaze Card:

- You can only link your Amaze Card to a Mastercard credit/debit card or to Google Pay . For other card associations like Visa or Amex, you have to top up your Amaze Wallet instead—which doesn’t let you earn rewards on the card you use for top-ups .

- At the same time, you only earn 1 InstaPoint per 1 SGD spend in foreign currency if you use the Amaze Wallet. If you link a card or use Google Pay, you earn half of that—0.5 InstaPoints per 1 SGD instead.

- You’ll incur a 1.5% fee when topping up your wallet using Visa cards. Top-ups using Mastercard and PayNow are free.

- Instarem charges you a fee of 2% (minimum S$0.50) for SGD transactions involving GrabPay, prepaid cards and other e-wallet top-ups. This applies to both using your Amaze card with your linked bank card as well as to Amaze wallet transactions. The saving grace is that this doesn’t apply to foreign currency transactions .

- However, to note, there’s a $100 cap on the cashback and a minimum spend requirement of $500per quarter.

- We found the linking service a bit wonky . Users have reported random declines or duplicate charges , including myself. To elaborate, I made a skincare haul on Guardian Singapore, had my S$238 charge reversed, and then recharged again.