Visa Traveler

Exploring the world one country at a time

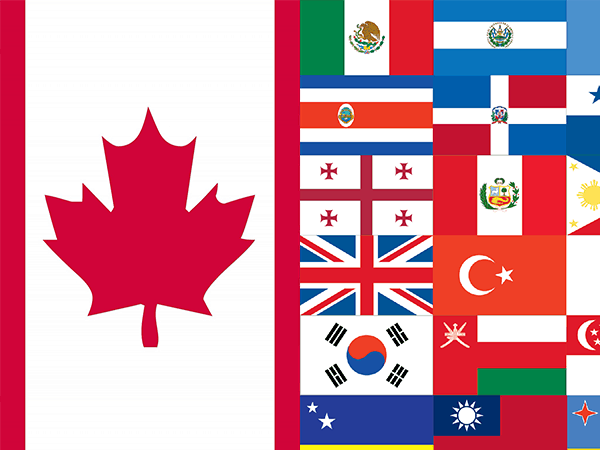

35 VISA-FREE Countries for Canadian PR Holders [2024 Edition]

Updated: February 11, 2024 Leave a Comment

As a Canadian PR card holder, you can enjoy VISA-FREE travel to certain countries. As of 2024, there are 35 VISA-FREE countries for Canadian PR holders. This includes Mexico, countries in the Caribbean, Central America, Europe and Asia.

In this article, you will learn which countries Canadian permanent residents can travel to without visa along with the duration of stay and entry requirements for those countries.

So without further due, let’s get started.

Table of Contents

What are the visa-free countries for canadian pr holders in 2024.

The VISA-FREE countries for Canadian PR holders in 2024 are:

- Anguilla (British Territory) (90 days)

- Antigua and Barbuda (30 days)

- Armenia (VOA for 21 or 120 days, select nationalities only)

- Aruba (30 days)

- Bahamas (30 days)

- Belize (30 days)

- Bermuda (British Territory) (30 days)

- Bonaire (Dutch Territory) (90 days)

- Cayman Islands (British Territory) (30 days)

- Costa Rica (30 days)

- Curaçao (90 days)

- Dominican Republic (90 days)

- El Salvador (90 days)

- Georgia (90 days)

- Guatemala (90 days)

- Honduras (90 days)

- Japan (eVisa, 90 days)

- Jordan (eVisa, 90 days)

- Mexico (180 days or less)

- Moldova (90 days)

- Montenegro (30 days)

- Morocco (eVisa, 90 days)

- Nicaragua (VOA, 30 days)

- Oman (VOA for 30 days, select nationalities only)

- Panama (30 days)

- Peru (180 days)

- Philippines (14 days, India only)

- Qatar (eVisa, 30 days)

- Singapore (96 hours TWOV, India and China only)

- Sint Maarten (30 days)

- South Korea (30 days while transiting, select nationalities only)

- Taiwan (eTA, 14 days, select nationalities only)

- Thailand (eVisa, 60 days)

- Turks and Caicos (British Territory) (90 days)

- United Kingdom (24-hour entry while transiting)

How many countries you can visit with Canadian PR?

In 2024, you can visit 35 countries with a Canadian PR without requiring a separate visa. Your Canadian permanent resident card must be valid and should be accompanied by a valid passport from your country. Here are the requirements in short.

- Must hold a valid Canada Permanent Resident card

- Must hold a valid passport from your country of nationality

- Must be from an eligible nationality and must follow entry requirements

Let’s look into each of these 35 Canadian PR VISA-FREE countries in detail.

North America

- Eligible nationalities: All nationalities

- Entry granted: Varies depending on the itinerary

- Entry rule: Canada PR card must be valid for the entire stay in Mexico

- Official source: National Institute of Migration in Mexico

Central America

- Entry granted: 30 days

- Official source: Consulate of Belize in Alberta, Canada

03. Costa Rica

- Entry rule: Canada PR cards must be valid for at least 3 months from the day of arrival

- Official source: Embassy of Costa Rica in Ottawa, Canada

04. El Salvador

- Burkina Faso

- Central African Republic

- Côte d’Ivoire

- Equatorial Guinea

- Guinea-Bissau

- Papua New Guinea

- Philippines

- Turkmenistan

- Entry granted: 90 days total in the entire CA-4 zone (Guatemala, Honduras, El Salvador and Nicaragua)

- If entering by air, a fee of 12 USD will be charged for a tourist card

- If you have already entered Guatemala or Honduras, you can enter El Salvador from Guatemala or Honduras by land without any additional visa requirements as per CA-4 Border Control Agreement

- Official source: IATA Travel Centre

05. Guatemala

- Côte d´Ivoire

- Dominican Republic

- Entry rule: If you have already entered Honduras or El Salvador, you can enter Guatemala from Honduras or El Salvador by land without any additional visa requirements as per CA-4 Border Control Agreement.

- Official source: Embassy of Guatemala in Ottawa, Canada

06. Honduras

- Cote d’Ivoire

- South Sudan

- Entry rule: If you have already entered Guatemala or El Salvador, you can enter Honduras from Guatemala or El Salvador by land without any additional visa requirements as per CA-4 Border Control Agreement.

07. Nicaragua

- Afghanistan

- Bosnia and Herzegovina

- Congo, Dem Rep of

- Congo, Rep of

- Sierra Leone

- Timor-Leste

- Visa is NOT EXEMPT, but are eligible to obtain Visa ON ARRIVAL

- VOA fee is 50 USD, payable in USD, valid for 30 days, single-entry only

- Besides VOA fee, there is a 10 USD tourist card fee, a 2 USD land border migration fee (for land border only) and 1 USD municipality tax (for land border only) (payable in USD only)

- Canada PR must be valid for at least 6 months from the day of arrival

- Must show proof of economic solvency for a minimum of 500 USD

- Official source: Consulate of Panama in Toronto, Canada

RELATED: 53 countries you can travel VISA-FREE with a US visa in 2024

09. Anguilla (British Territory)

- Entry granted: 90 days

- Official Source: Anguilla Tourist Board, entry requirements

10. Antigua and Barbuda

- VOA fee is 100 USD, valid for 30 days, single-entry only

- Official source: Department of Immigration, Antigua and Barbuda

- Official source: Netherlands Worldwide

12. Bahamas

- If traveling directly from Canada, the Canada PR card must be valid for at least 3 months from the day of arrival

- If not traveling directly from Canada, the Canada PR card must be valid for at least 6 months from the day of arrival

- Official source: Bahamas Ministry of Tourism

13. Bermuda (British Territory)

- Canada PR card must be valid for a minimum of 45 days beyond the date of departure from Bermuda

- Passport must be valid for a minimum of 45 days beyond the date of departure from Bermuda

- Official source: Government of Bermuda

14. Bonaire (Dutch Territory)

15. cayman islands (british territory).

- Entry rule: On arrival, you must present a return ticket back to Canada (not to a third country)

- Official source: Cayman Islands Customs and Border Controls

16. Curaçao

- E ntry granted: 90 days

17. Dominican Republic

- Entry rule: If arriving by land or sea, must purchase a Tourist Card on arrival for 20 USD. If arriving by air, the tourist card is included in the airfare.

- Official source: Ministry of Tourism of Dominican Republic

18. Sint Maarten

19. turks and caicos (british territory).

- Official source: Ministry of Border Control of Turks and Caicos

RELATED: 43 countries you can travel VISA-FREE with UK visa in 2024

South America

- Entry granted: 180 days

- Entry rule: Canada PR must be valid for at least 6 months from the day of arrival

- Official source: Ministry of Foreign Affairs of Peru

21. Armenia

- Marshall Islands

- Saint Kitts and Nevis

- Saint Lucia

- Saudi Arabia

- Solomon Islands

- Trinidad and Tobago

- Entry granted: 21 or 120 days

- Visa is NOT EXEMPT but are eligible to obtain Visa ON ARRIVAL

- VOA fee is 3,000 AMD, valid for 21 days, single-entry (OR) 15,000 AMD, valid for 120 days, single-entry

- Official source: Ministry of Foreign Affairs of Armenia

22. Georgia

- Canada PR must be valid on the day of arrival in Georgia

- Total duration of consecutive stays must not exceed 90 days in any 180-day period

- Official source: Ministry of Foreign Affairs of Georgia

23. Moldova

- São Tomé and Príncipe

- South Africa

- Entry rule: Canada PR must be valid for the intended period of stay

- Official source: Ministry of Foreign Affairs of the Republic of Moldova

24. Montenegro

- Official source: Government of Montenegro

25. United Kingdom

- Entry granted: 24 hours only (Transit Without Visa)

- Visa is NOT EXEMPT, but are eligible to request a 24-hour entry at London (LHR) or Manchester (MAN) airports

- You must be traveling to or from Canada

- Must arrive and depart by air

- Must hold the boarding pass for the onward flight

- Onward flight must be within 24 hours (on the same day or the next day before midnight)

- Granting the 24-hour entry is at the sole discretion of the immigration officer

- Official source: GOV.UK

RELATED: 53 countries you can travel VISA-FREE with Schengen visa in 2024

Middle East

- Congo, Dem. Rep. Of

- Guinea Bissau

- Visa is NOT EXEMPT but are eligible to apply for Jordan E-Visa

- Official source: Jordan E-Visa

- El Salvador

- Entry granted: 10 or 30 days

- Visa is NOT EXEMPT, but are eligible to obtain Oman 26M or 26N Tourist Visa online

- 26M eVIsa fee is 20 OMR, valid for 30 days, single-entry only

- 26N eVIsa fee is 5 OMR, valid for 10 days, single-entry only

- Official source: Sultanate of Oman, Royal Oman Police

- Visa is NOT EXEMPT, but are eligible to apply for A3 Visa online on the Hayya portal

- A3 Visa fee is QAR 100, valid for 30 days, single-entry only

- Must provide hotel booking for the entire stay reserved through the Discover Qatar website

- Canada PR must be valid on the day of the A3 Visa application

29. Morocco

- Visa is NOT EXEMPT, but are eligible to apply for Morocco e-Visa online

- E-Visa fee is 770 MAD, valid for 180 days, single-entry only

- Canada PR permit must be valid for at least 90 days from the day of arrival

- Official source: Morocco E-Visa Portal

- Visa is NOT EXEMPT, but are eligible for Japan eVisa

- eVisa fee is JPY 3,000, valid for 90 days, single-entry

- Must submit proof of residence to prove that you reside in Canada

- Must show the visa issuance confirmation via the eVisa website on your phone at the immigration (Prints and PDFs are not accepted)

- Must enter Japan by flight only

- Official source: Ministry of Foreign Affairs of Japan

31. Philippines

- Eligible nationalities: India passport holders only

- Entry granted: 14 days, extendable for another 7 days

- Canada PR must be valid for the entire duration of the stay

- Passport must be valid for at least 6 months beyond the date of departure

- Official source: Embassy of the Philippines in India

32. Singapore

- Entry granted: 96 hours (4 days)

- Visa is NOT EXEMPT but are eligible to obtain Visa Free Transit Facility (VFTF) upon arrival

- Must be traveling to or from the country of passport. Example: Must be traveling to a third country from India via Singapore or traveling to India from a third country via Singapore. An example itinerary would be India-Singapore-Bali or Bali-Singapore-India.

- Both arriving and departing flights in Singapore must be on the same itinerary

- Canada PR must be valid for at least 1 month at the time of arrival

- Official source: Singapore Immigration & Checkpoints Authority

33. South Korea

- Eligible nationalities: All nationalities (except these 23 nationalities – Afghanistan, Bangladesh, Cameron, Cuba, Egypt, Gambia, Ghana, Iran, Iraq, Kosovo, Kyrgyzstan, Myanmar, Nepal, Nigeria, Pakistan, Palestine, Senegal, Somalia, Sri Lanka, Sudan, Syria, Uzbekistan and Yemen)

- Entry rule: Must be traveling to/from Canada through South Korea

- Official source: South Korea Embassy in Washington DC, USA

- Entry granted: 14 days

- Visa is NOT EXEMPT but are eligible to apply for ROC Travel Authorization Certificate

- ROC Travel Authorization Certificate is free of charge, valid for 90 days, multiple-entry

- If using an EXPIRED Canada PR card, the PR card must have expired within the last 10 years

- Official source: Bureau of Consular Affairs of Republic of China (Taiwan)

35. Thailand

- Entry granted: 60 days, extendable for another 30 days

- Visa is NOT EXEMPT, but are eligible to apply for Thailand e-Visa online

- E-Visa fee is 40 USD, valid for 90 days or 180 days, single or multiple-entry

- Official source: Thai E-Visa Portal

RELATED: 18 countries you can visit VISA-FREE with an Australian visa or PR in 2024

Can you use a Canadian visa to travel to these countries?

Yes, you can also use a valid Canadian visa to travel to these countries. However, the eligibility and entry requirements vary depending on what Canadian visa you hold. Refer to my article on VISA-FREE countries for Canada visa for more details.

There you go, folks! 35 countries and territories that a Canadian PR holder can visit in 2024. Though most of them are Visa-Free, some countries require you to obtain VOA at the airport or apply for an eVisa before your travel.

Change history: For those who are interested, here are the changes to this list.

WRITTEN BY THIRUMAL MOTATI

Thirumal Motati is an expert in tourist visa matters. He has been traveling the world on tourist visas for more than a decade. With his expertise, he has obtained several tourist visas, including the most strenuous ones such as the US, UK, Canada, and Schengen, some of which were granted multiple times. He has also set foot inside US consulates on numerous occasions. Mr. Motati has uncovered the secrets to successful visa applications. His guidance has enabled countless individuals to obtain their visas and fulfill their travel dreams. His statements have been mentioned in publications like Yahoo, BBC, The Hindu, and Travel Zoo.

PLAN YOUR TRAVEL WITH VISA TRAVELER

I highly recommend using these websites to plan your trip. I use these websites myself to apply for my visas, book my flights and hotels and purchase my travel insurance.

01. Apply for your visa

Get a verifiable flight itinerary for your visa application from DummyTicket247 . DummyTicket247 is a flight search engine to search and book flight itineraries for visas instantly. These flight itineraries are guaranteed to be valid for 2 weeks and work for all visa applications.

02. Book your fight

Find the cheapest flight tickets using Skyscanner . Skyscanner includes all budget airlines and you are guaranteed to find the cheapest flight to your destination.

03. Book your hotel

Book your hotel from Booking.com . Booking.com has pretty much every hotel, hostel and guesthouse from every destination.

04. Get your onward ticket

If traveling on a one-way ticket, use BestOnwardTicket to get proof of onward ticket for just $12, valid for 48 hours.

05. Purchase your insurance

Purchase travel medical insurance for your trip from SafetyWing . Insurance from SafetyWing covers COVID-19 and also comes with a visa letter which you can use for your visas.

Need more? Check out my travel resources page for the best websites to plan your trip.

LEGAL DISCLAIMER We are not affiliated with immigration, embassies or governments of any country. The content in this article is for educational and general informational purposes only, and shall not be understood or construed as, visa, immigration or legal advice. Your use of information provided in this article is solely at your own risk and you expressly agree not to rely upon any information contained in this article as a substitute for professional visa or immigration advice. Under no circumstance shall be held liable or responsible for any errors or omissions in this article or for any damage you may suffer in respect to any actions taken or not taken based on any or all of the information in this article. Please refer to our full disclaimer for further information.

AFFILIATE DISCLOSURE This post may contain affiliate links, which means we may receive a commission, at no extra cost to you, if you make a purchase through a link. Please refer to our full disclosure for further information.

RELATED POSTS

Leave a Reply Cancel reply

READ BEFORE LEAVING A COMMENT: (1) Use the Search Form to see if your questions have already been answered in an existing article. (2) Ask your questions on Visa Traveler Facebook Group for quick response from us and other experienced visa travelers. (3) We cannot respond to questions on student visas, work visas or immigration. Our advice is purely for travelers needing tourist visas. (4) Due to overwhelming amount of questions, comments and messages we receive, please allow us 24-48 hours to respond to your query.

- Cookie Policy

- Copyright Notice

- Privacy Policy

- Terms of Use

- Flight Itinerary

- Hotel Reservation

- Travel Insurance

- Onward Ticket

- Testimonials

Search this site

Language selection

- Français fr

What type of insurance do I need for International Experience Canada?

For International Experience Canada , you must have health insurance for the entire time you are in Canada. The health insurance must cover

- medical care;

- hospitalization; and

- repatriation.

We recommend you buy this insurance only after you receive your port of entry (POE) letter. We can’t recommend specific insurance companies or plans, but you can search online for something that meets your needs.

You may be refused entry if you don’t have insurance. If your insurance policy is valid for less time than your expected stay in Canada, you may be issued a work permit that expires at the same time as your insurance.

Did you find what you were looking for?

If not, tell us why:

You will not receive a reply. Telephone numbers and email addresses will be removed. Maximum 300 characters

Thank you for your feedback

Answers others found useful

- Can I come to Canada before I receive my POE Letter?

- Can I change employers if I have an International Experience Canada work permit?

- Can I extend my International Experience Canada work permit?

- Can I stay in Canada as a tourist after my work permit expires?

How to video

Form and guide

- Application to work in Canada

Glossary term

- Work permit

CoverMe ® travel insurance for visitors to Canada

On this page.

Instruction: Change of selection promptly shifts the focus to a matching heading further down, on the same page.

Help cover emergency medical expenses while visiting Canada

Canada has lots to offer, including free health care but only for its residents. When you or your loved ones visit Canada, emergency medical expenses could leave you burdened with hefty bills. With Manulife CoverMe Travel Insurance for Visitors to Canada, you can get help covering unexpected medical expenses such as prescription drugs, dental, hospital, and healthcare practitioner services, so you don’t end up paying out-of-pocket.

Travel plans for Visitors to Canada

All plans meet the requirement of super visa for parents and grandparents.

This plan helps protect you from emergency medical expenses, so you can focus on experiencing Canada.

- Covers up to the limit you select up to CAD $200K

- No medical questionnaires required

- No coverage for pre-existing medical conditions

- No age limit

Get help with covering the cost for medical emergencies in Canada —even with some pre-existing medical conditions.

- Coverage for pre-existing medical conditions that did not exist within 180 days prior to the effective date 1

- Includes dental, and accident death and dismemberment coverage

- Apply up to age 85

Our most comprehensive plan to help you from emergency medical costs, even if you have a stable pre-existing medical condition.

- Coverage for pre-existing medical conditions that have been stable 2 for at least 180 days

- Includes dental, and accident death and dismemberment benefits

Download a detailed comparison chart for visitors to Canada (opens PDF)

Why Manulife

Our Visitors to Canada travel plans are comprehensive and flexible – all have the following benefits:

- Access to Manulife’s Travel Assistance 24/7 – 365 days a year

- Receive a full refund if your plans change or get cancelled before the effective date

- Side trips are covered when you travel to another destination from Canada 3

Ready to buy?

You can get a quote and purchase Manulife travel insurance online through Manulife CoverMe.

Visitors to Canada travel insurance is highly recommended to prevent you from paying out-of-pocket for expensive health care services in case of a health emergency. Purchasing visitors to Canada travel insurance is mandatory if you are applying for super visa for parents and grandparents.

It is best to purchase visitor to Canada insurance before your arrival. This is because if you purchase the insurance after you arrive, there is a waiting period. A waiting period is an amount of time that you need to wait after purchase or after your arrival in Canada before you’re covered.

Need assistance?

Want to talk through your options.

Have questions and want to speak to a licensed insurance advisor? We can help with that!

Submit a travel claim

Visit our dedicated travel portal to start a claim. First-time on the site? Simply register, activate your account, and sign in.

Explore other travel insurance products

Travel insurance for travelling canadians.

Explore out-of-province or country with less worry with coverage for emergency medical, flight cancellations and delays, and more.

Travel Insurance for Students

Get help with medical expenses when studying away from home – either in Canada or abroad.

1 No coverage is provided for pre-existing medical conditions that existed within 180 days prior to the effective date. For example, if your travel date and policy effective date is June 30 th , then any pre-existing medical conditions that existed between January 1 st and June 30 th are not covered.

2 A pre-existing medical condition is considered stable when all of the following statements are true:

- There has not been any new treatment prescribed or recommended, or change(s) to existing treatment (including a stoppage in treatment), and

- There has not been any change in medication, or any recommendation or starting of a new prescription drug, and

- The medical condition has not become worse, and

- There has not been any new, more frequent or more severe symptoms, and

- There has been no hospitalization or referral to a specialist, and

- There have not been any tests, investigation or treatment recommended, but not yet complete, nor any outstanding test results, and

- There is no planned or pending treatment.

3 A side trip is any trip taken to other countries from Canada (starts and ends in Canada) during the duration of your policy. Side trips do not cover your country of origin. Side trips must not exceed the lesser of 30 days/policy or 49% of the total number of coverage days in your policy.

- Skip to main content

- Skip to site information

Language selection

Help us to improve our website. Take our survey !

Trip interruption and travel health insurance

If you plan to travel outside Canada—even for a day in the United States—you should buy trip interruption and travel health insurance before you leave.

On this page

Where you can get trip interruption and travel health insurance, why you should buy travel health insurance, choose the best insurance based on your needs, if you need to make a claim, if you live or work outside canada, if you need help while outside canada.

You can buy trip interruption and travel health insurance directly with an insurance company or through:

- a travel agent

- an insurance broker

- an employer’s insurance provider

- a credit card company

If you encounter a medical emergency while abroad, you should know the following:

- Your medical bills may not be paid by your personal Canadian health insurance

- Your provincial or territorial health plan may cover none, or only a small part, of the costs of your medical care abroad including a medical evacuation, if needed. It will never pay your bills up front

- Hospitals and clinics in other countries can be very expensive and may require immediate cash payment

- In some countries, hospitals and clinics will not treat you if you don’t have enough insurance or money to pay your bills

- The Government of Canada will not pay your medical bills

What your travel health insurance should cover

No matter where you’re travelling, your travel health insurance policy should always cover 3 things:

1. Medical evacuation

Make sure your policy covers medical evacuation to Canada or to the nearest place with medical care. The policy should also cover the costs of a medical escort to travel with you to your destination.

2. Pre-existing medical conditions

Ask the insurance provider to explain the definition of and the limitations and restrictions on any pre-existing conditions and tests and treatments you may have had:

- Make sure you get a written agreement that your insurance covers your pre-existing medical condition, otherwise you could find your claim “null and void” under a pre-existing condition clause.

- no changes to your medical condition

- no new medical conditions, symptoms or medications during the stability period before your trip.

- a compassion clause saying that an inaccurate statement may not invalidate the entire policy

- a change-of-health clause.

3. Repatriation in case of death

Make sure that your plan includes everything to help your loved ones if you die outside Canada as the result of an accident or a sudden and unexpected illness.

Your insurance should cover:

- the preparation and return of your remains

- local cremation or burial outside Canada

- additional expenses if someone needs to travel to identify your body

Learn more about what to do if a Canadian dies outside Canada.

Why you should buy trip interruption insurance

Trip interruption insurance is different from medical travel insurance. Trip interruption insurance provides coverage for situations that lead you to have to cancel a part of your trip once you’ve departed. It will reimburse the unused portion of your trip if you must return early, due to an unforeseen incident.

It’s also different from trip cancellation coverage, which applies only when you cancel your trip before it starts.

Research your needs. Verify the terms, conditions, limitations, exclusions and requirements of your insurance policy before you leave Canada.

When assessing a travel health insurance plan, you should ask a lot of questions:

- Plans with 100% coverage are more expensive but may save you money in the long run

- Does the plan offer continuous coverage for the length of your stay outside Canada and after your return?

- Does the plan exclude or limit coverage for certain regions or countries you may visit?

- Travel health insurance rarely covers routine health checkups, non-emergency care or cosmetic surgery.

- It may not cover mental health disorders.

- Does the plan cover drug or alcohol-related incidents?

- Does the plan exclude coverage for activities such as mountaineering, skiing, scuba diving or extreme sports?

- Does it offer coverage that is renewable from abroad and for the maximum period of stay?

- Does the company have an in-house, worldwide, 24-hour/7-day emergency contact number in English and/or translation services for health care providers in your destination country?

- Does it pay for hospitalization for illness or injury and related medical costs at your destination?

- Does it pay your bills or provide cash advances up front, so you don’t have to pay them?

If you’re driving, make sure you have driver and vehicle coverage in case you have an accident.

If you’re flying, make sure you get insurance for trip interruption, lost luggage and document replacement. You may also want to consider trip cancellation insurance.

Meet the terms of your policy

It’s your responsibility to know and understand the terms of your insurance policy. Read the fine print and ask for help if you need it.

The information you provide must be accurate and complete. If you have any questions, contact the insurance company. Ask them to send you a written explanation.

Carry your insurance information with you and leave a copy with a friend or relative at home.

Get a detailed report and invoice from your doctor or hospital before leaving the country where you received medical treatment. Trying to get the proper paperwork from thousands of kilometres away can be frustrating.

Always submit the original receipts for medical services or prescriptions you received abroad. Keep a copy of the documents for your files.

Effects of travel advisories on travel insurance policies

Many travel insurance policies will not cover you if you travel to regions where the Government of Canada has issued a travel advisory to “avoid all non-essential travel” or “avoid all travel.”

The Government of Canada is not responsible for travel insurance policies nor how Travel Advice and Advisories may affect travel insurance policies. The Government of Canada does not issue its Travel Advice and Advisories for the purpose of travel insurance coverage or refunds.

Canada’s Travel Advice and Advisories provide information and recommendations about safety and security conditions in destinations around the world to help you make informed decisions.

We issue travel advisories when the security or health situation in a country or region may pose a significant threat to the personal safety and security of Canadians travelling or living there.

As new information becomes available, we review the level of risk. A travel advisory for a destination may be issued, upgraded, downgraded or removed.

Before you book your trip and buy insurance, check the details of any insurance policy you’re considering and the travel advice and advisories for your destination.

Travel insurance is not intended to be used when you are living outside Canada for an extended period, or permanently.

If you live abroad or you’re planning to, consider your insurance needs. Local laws may require that you have medical insurance, and you may have to include proof of medical insurance with your visa application.

If you study outside Canada

If you study or plan to study outside Canada, contact your educational institution or program administrator for advice on the insurance coverage you need.

The Government of Canada is limited in the help it can provide you when you are outside Canada.

See the services available at our consular offices outside Canada.

Our travel advice and advisories provide recommendations about safety and security conditions outside Canada to help you make informed decisions. The decision to travel is yours and you’re responsible for your personal safety abroad.

Whether you are planning a vacation or living outside Canada, sign up for the free Registration of Canadians Abroad service so that we can notify you in case of an emergency outside Canada.

For help with emergencies outside Canada, contact the:

- nearest Canadian office abroad

- Emergency Watch and Response Centre in Ottawa

Related links

- Say yes to travel insurance

- Bon voyage, but…

- Well on your way

- A guide to travel health insurance (Canadian Life and Health Insurance Association)

- Guide to travel health insurance (International Association for Medical Assistance to Travellers)

- Tips for healthy travel

Life Insurance

Mortgage Protection

Critical Illness

Group Benefits

Term life insurance pays out a tax free lumpsum when you pass away.

Life Insurance that never expires

A permanent life insurance purchased for a minor child, by a parent or grandparent

Life Insurance without any blood work or medical checkups

- What is life insurance?

- Types of life insurance

- Term versus whole life insurance

- Single versus joint coverage

- The biggest life insurance companies

- How much does life insurance cost?

- How much life insurance do I need?

- Should I renew my policy?

- Best term life insurance

- Best whole life insurance

Term life insurance that pays off your outstanding mortgage debt and more should you pass away unexpectedly

- What is mortgage insurance?

- Mortgage Insurance vs life insurance

- How to save money on mortgage insurance

- Do you need life insurance for a mortgage?

- Why is mortgage insurance so expensive?

- Best mortgage insurance

Coverage that provides a lump sum payment to help while you recover from a major illness or health problem

- What is critical illness insurance?

- Critical illness insurance versus riders

- When to buy critical illness insurance

- What is covered under critical illness insurance?

- Is critical illness insurance worth it?

- What is a pre-existing condition?

- What is return of premium?

- What is a rider?

- Best critical illness insurance

Coverage that provides a monthly benefit to help with everyday expenses when you can no longer work due to injury or illness

- What is disability insurance?

- Disability insurance versus disability riders

- Long-term disability options in Canada

- How long do I need disability insurance?

- Do I need disability insurance if I’m covered through work?

- Do I need disability insurance if I have critical illness insurance?

- What is an Attending Physician Statement (APS)?

- Best disability insurance

Emergency medical coverage for Canadians leaving the country and visitors to Canada.

- Guide to travel insurance

- Guide to super visa insurance

- Travel Insurance and COVID-19

- Guide to snowbird travel insurance

- What is visitors to Canada insurance?

- Should you use your credit card’s travel insurance?

- Do students need travel insurance?

- Travel medical versus interruption insurance

- Best Visitors to Canada travel insurance

Medical coverage for Canadians for conditions / treatments that are not covered by Provincial healthcare

- What is personal health insurance?

- Health insurance for the self-employed

- Health insurance for students

- Health insurance for seniors

- Does health insurance cover vision care?

- Does health insurance cover dental work?

- How to file a health insurance claim?

- How to access a virtual doctor?

- The best health & dental insurance in Canada

Coverage that aids in your hiring and retention efforts and enhances employee well-being

- The Ultimate Guide to Employee Benefits in Canada

- Understanding how group health insurance works

- Types of group health benefits plans in Canada

- Is critical illness insurance part of an employee benefits plan?

- Do employee benefits cover mental health?

- Does an employee benefit plan include group accident insurance?

Compare Canada’s Best Travel Insurance

Trusted by Canadians

100% of customers recommend us

Was looking for a life insurance policy and the search was exhausting by conventional means, until I found PolicyAdvisor. My representative was excellent, and explained all my options and preferred quotes. Life Insurance…

If you’re looking for best rate and an advisor, I would highly recommend PolicyAdvisor. They are expert in finding the best insurance provider. They are reliable and give unbiased advise. I’m glad I came across Policy…

I was able to derive a personalized quote within a minute. From there on it was as smooth as taking a walk in the park. I did not have to wait in long lines, could chart my progress, and had full control of my application.

I'd previously reached out to one of the big insurance companies directly but found them so unresponsive and uninterested. I'm glad we found PolicyAdvisor. They made comparing options easy so we found something that worked…

They are the Gold Standard of Client Experience. The whole process was simple, hassle-free, uber transparent and all of this at no cost. Our advisor’s knowledge and attitude reeled us in from the first call. We felt as if…

Very knowledgeable and helpful in determining the best plans for my son and I and he took the stress out of the process. Fully explained all of the options available to me, and answered all of my questions. I know that I…

First I was skeptical about high reviews but anyways PolicyAdvisor. I could see that they are trying to give best details they have and guide us to choose policy rather than selling it. Rarely I type in reviews. I can say…

Thank you for the excellent customer service. You’ve been very supportive in all our questions. After the video call, he didn’t really push to sell. We appreciate your time, and support in giving us updates and follow-ups…

My advisor genuinely cared about making sure I was comfortable and informed throughout the process, and patiently answered my many questions. He also always followed up to make sure I was up to date on my application…

Answer all our questions in a timely manner, and the process was much more simple than I was expecting. We had our life insurance sorted and approved within a few days. I really like that they did the comparisons of…

The country’s leading travel insurance broker

Canadians are choosing PolicyAdvisor to help them with all their travel insurance needs. Whether vacationing abroad or visiting Canada temporarily, our advisors can help you find the right coverage.

Travelling Canadians

Cover unexpected medical expenses when you travel abroad

Visitors to Canada

Comprehensive emergency medical coverage for a visit to Canada

Super Visa Insurance

Coverage that fits the requirements for those applying for a Canadian super visa

Cover your time away as you escape from Canada's winter

International Students

Coverage for international students attending school in Canada or Canadians studying abroad

Foreign Workers

Coverage for those working in Canada before they are eligible for provincial health plans

Awarded Best Life & Health Advisor of the year

By Insurance Business Canada

What is travel insurance?

There are two main types of travel insurance: travel medical insurance and trip cancellation/interruption insurance .

Travel medical insurance can help to cover the cost of medical care if you become sick or injured while travelling. It can also help to cover the cost of travel if you need to be transported to a hospital in another country. This is the most common type of travel insurance.

Trip cancellation/interruption insurance can help to reimburse you for the cost of your trip if you have to cancel due to an unforeseen circumstance, such as illness or bad weather, or other situations that may delay or cancel your trip (lost baggage, transportation delays, etc).

If you are planning a trip from your home in Canada, or planning on travelling to Canada, it is important to ensure you have travel insurance before you depart. This will help to protect you from unexpected costs if something goes wrong on your trip and give you peace of mind such accidents or delays will not be a financial burden.

Learn more about travel insurance

Call 1-888-601-9980 to speak to our licensed advisors right away, or book some time with them.

Who needs travel insurance?

There is a wide array of insurance needs for both those visiting Canada, and travelling away from it. They include:

Inbound travellers

- Visiting Canada from another country

- Super visa applicants

- International students studying in Canada

- Foreign workers or work permit holders working in Canada

- Amateur athletes competing in Canada

Outbound travellers

- Snowbirds (seniors vacationing away from Canada for the winter)

- Canadians vacationing abroad

What are the different types of travel insurance available in Canada?

Depending on where you call home, and the reason and length of your travel, there are several different kinds of travel insurance available.

Residents of Canada need travel insurance for trips abroad. While you public healthcare or group health insurance covers medical emergencies at home, an accident or medical emergency while you are out of country can be very costly.

Those visiting Canada from outside the country also need travel medical insurance. While Canada does have a robust public healthcare system, these services do not extend to non-residents of the country. If you are ill or injured during your trip to Canada, you will be responsible for the costs of doctor's visits, emergency care, prescription, and more.

Super visa insurance

Parents and grandparents or Canadian citizens and permanent residents are eligible for a special Canadian visa called the super visa. This visa allows them to enjoy an extended stay in Canada for as long as 2 years. A mandatory stipulation of super visa approval is holding a medical insurance policy to cover and illnesses or accidents that can occur during this trip. Super visa insurance is a widely available insurance policy that caters to the specific needs and requirements for super visa eligibility.

Snowbirds are retired Canadians who spend the winter season abroad to avoid Canada’s colder months. As a snowbird, it’s important to make sure you have the right travel insurance in place before you head south for the winter, as you will not qualify for public health insurance at your destination.

International students often need emergency health insurance wherever they choose to complete their studies. This includes both Canadians studying abroad and students completing their education in Canada. Emergency travel medical insurance ensures one can focus on their studies knowing they won’t have to deal with an unforeseen medical bill.

Foreign workers visiting Canada for temporary or permanent employment will not have immediate access to public health care. Travel medical insurance will cover you if you get sick or injured while working in Canada.

25 Companies, 20,000 Options, 1 Way to Compare and Save

Who offers the best travel insurance in Canada?

At PolicyAdvisor, we partner with the country’s best travel insurance providers to present you with the most choice and best option for your insurance needs. Whether you are vacationing abroad, visiting Canada for an extended trip, or sponsoring a super visa application for a loved one, we’re here to help guide you to best provider.

Some of our partners include:

- Tugo (iA Financial Group)

- Group Medical Services (GMS)

- 21st Century Travel Insurance Limited

- Destination Canada

Get instant quotes from Canada’s top travel insurance companies

Why should you buy travel insurance?

Whether for a vacation abroad or a visit to Canada, travel medical and health insurance is very important.

For Canadian travelling abroad

- Canadian public health care or your provincial health insurance plan may not cover medical expenses while you are outside Canada

- Your work or group benefits health plan may not cover, or only cover a portion, of the costs of your medical bills abroad

- Foreign medical facilities are generally expensive and often require immediate payment

- Some hospitals and clinics in foreign countries will refuse treatment if you do not have enough insurance coverage or funds to pay for your treatment

For those visiting Canada

- You are not covered under any of Canada's public healthcare plans

- Treatment for medical emergencies and prescriptions may require cash payments

- Your home country's public health care offering generally does not cover trips abroad

- Travel medical insurance can cover a broad range of potential situations, including emergency room visits, transportation back to your home country, and prescription drug and dental costs

Frequently asked questions

How much does travel insurance cost?

The cost of travel insurance is determined by many variable factors including the type of insurance you purchase, your age, the duration of the trip, and the amount of coverage you are getting. A rule of thumb is travel insurance should typically cost 5% of your trip. Of course, these costs can increase for extended stays like super visa insurance , insurance for snowbirds, and insurance for students or foreign workers.

Can't I just use credit card travel insurance?

While knowing there is a built-in insurance component to your credit card provides great peace of mind, it sometimes falls short of comprehensive travel coverage. Insurance from credit cards usually has a cap on the amount of coverage it provides and is not intended to cover you for medical emergencies that may occur on an extended trip. Moreover, credit card travel insurance is also limited in that its coverage typically only extends to those parts of your trip you paid for using that credit card.

An independently purchased travel insurance policy ensures you are covered for your entire trip and whatever may happen during its duration.

Does travel insurance cover pre existing conditions?

Most travel medical insurance policies do not cover a pre-existing medical condition by default.

In some cases, if you have shown no symptoms or diagnosis of a pre-existing medical condition for 180 days prior to the effective date of the policy and have not had treatment for the condition during that time, it will not be considered a pre-existing condition during your coverage period.

As well, some conditions may get excluded from your travel medical insurance coverage during the underwriting process. A pre-existing condition exclusion could include a heart condition, kidney condition, form of dementia,

Lastly, some providers offer policies that will cover pre-existing conditions, though the premium will be higher to compensate for the added risk.

Can you get a refund for travel insurance?

You can typically get a refund for a travel insurance policy as long as you cancel the coverage before the departure date of your trip.

Is travel insurance mandatory?

Most travel insurance is not mandatory, though encouraged as foreign medical expenses can add up quickly. Without travel medical insurance you are personally responsible for any medical expenses you incur during your time away from your home country.

Some travel insurance policies are mandatory. For instance, super visa insurance is mandatory for super visa applicants to get approved for their policy, and an in-force policy is compulsory for the duration of your stay in Canada using the super visa.

Does provincial healthcare cover you when travelling abroad?

No, a public healthcare plan from your province or territory does not cover medical emergencies that happen outside of Canada. Much like how Canada’s public healthcare does not cover those who do not reside in Canada, the healthcare in countries outside of Canada has no reciprocal agreement to treat travelers. Canadians are expected to pay out of pocket for any health or medical procedures they need when outside of Canada.

Thus, it is important to have an in-force travel medical insurance policy when travelling outside of Canada and your home province.

Can I get travel insurance after I have left Canada?

Yes, it is possible to get some coverage, though there will most likely be exclusions on your policy. Many providers in Canada or abroad will offer you emergency medical travel insurance if you have already left Canada but wish to purchase coverage.

However, the policy generally will not be active until 48 hours after you purchase the coverage. This waiting period is designed to prevent someone from acquiring a policy after they have been injured or hospitalized with an illness.

Should I buy an individual policy for each trip I have planned or an annual travel policy?

If you travel abroad often (more than twice per year) it may be worthwhile to purchase an annual travel policy. Many providers offer annual options for their travel medical insurance policies, which can save you money on premiums and eliminate the need to arrange separate insurance policies for each trip you take or each leg of a multi-trip journey. Many Canadians travel during winters to warmer climates ( snowbirds ), it is advisable to buy multi-trip / annual travel insurance for such needs. Speak with our advisors to see if an annual travel insurance policy makes sense for your plans.

Can a Canadian Permanent Resident Travel to USA? Your Guide.

As a Canadian permanent resident, you may wonder if you can travel to the USA. The good news is that Canadian permanent residents are generally allowed to enter the United States for tourism, business, or other purposes. However, there are specific entry and exit requirements that you need to be aware of before planning your trip. Let’s explore the details.

Key Takeaways:

- Canadian permanent residents can travel to the USA for tourism, business, or other purposes.

- There are specific entry and exit requirements that need to be met.

- Visa requirements depend on the country of citizenship for Canadian permanent residents.

- The Department of Homeland Security and Customs and Border Protection have authority over entry into the USA.

- Consult the U.S. Embassy and Consulate websites for up-to-date information on traveling to the USA.

Risk Level and Safety and Security in the USA

When traveling to the United States, it is essential to consider the risk level, safety, and security measures in place. While most of the country is safe for travelers, it’s necessary to be aware of specific areas that may pose higher risks.

Risk Level in the United States

Along the border with Mexico, in states like Arizona, California, New Mexico, and Texas, criminal incidents related to drug trafficking may occur more frequently.

Travelers should exercise increased caution in these areas and use officially recognized border crossings when crossing the U.S.-Mexico border by car. It’s important to stay vigilant and follow local law enforcement guidance.

There may be instances of petty crime, such as pickpocketing, in urban centers and tourist locations. Travelers should be mindful of their belongings and take necessary precautions to protect their valuables.

Entry and Exit Requirements for Canadian Permanent Residents

As a Canadian permanent resident planning to travel to the United States, you must familiarize yourself with the entry and exit requirements. These requirements ensure a smooth and hassle-free travel experience. Here are the key details you need to know:

- Traveling by Air: When traveling by air, you must present a valid passport for the duration of your stay or a valid NEXUS card at self-serve kiosks. This applies to both entry and exit from the United States.

- Traveling by Land or Water: If you’re entering the United States by land or water, you may need a valid passport, a Trusted Traveler Program card, an enhanced driver’s license (EDL), or other approved travel documents. It’s essential to check the specific requirements based on your travel purpose and the duration of your stay.

In addition to these requirements, it’s always recommended to carry your Canadian permanent resident card or other proof of your status as a Canadian permanent resident when traveling to the United States.

Remember, having the necessary documentation and meeting the entry and exit requirements is essential for hassle-free travel as a Canadian permanent resident.

Visa Requirements for Canadian Permanent Residents

The visa requirements for Canadian permanent residents vary depending on their country of citizenship.

If you are a citizen of a country eligible for the Visa Waiver Program, you may be able to visit the U.S. for up to 90 days without a visa. However, if you are not eligible for the Visa Waiver Program or your stay in the U.S. exceeds 90 days, you must apply for a nonimmigrant visa.

The Visa Waiver Program lets people from certain countries visit the U.S. for tourism or business without a visa. To qualify, you need a valid e-passport and approval through ESTA.

This program provides convenience for Canadian permanent residents who meet the requirements and plan to visit the U.S. temporarily.

However, you must apply for a nonimmigrant visa if you are not eligible for the Visa Waiver Program or plan to stay in the U.S. for longer than 90 days.

The reason for your trip determines the visa you require, be it for work, study, or joining a family member. Review the criteria and application procedures for the particular nonimmigrant visa category that suits your situation.

Disclaimer: The table info is just a general guide. Visa rules can change, so check the exact requirements for your country and the reason for traveling.

Permanent Residents of Canada and the Visa Waiver Program

As a permanent resident of Canada, you may be eligible for the Visa Waiver Program (VWP) when traveling to the United States. The VWP allows individuals from participating countries to visit the U.S. for business or pleasure for up to 90 days without needing a visa.

To qualify for the VWP, you must be a citizen of a participating country, possess a valid e-Passport, and have obtained ESTA approval. This streamlined process makes it easier for Canadian permanent residents to travel to the United States.

When getting ready for your trip, bring evidence of your Permanent Resident Status in Canada for your return. This could be your permanent resident card or travel document.

Also, have all the essential travel documents, including your passport and any extra paperwork that U.S. Customs and Border Protection officers might ask for.

While the VWP allows for visa-free travel, it’s essential to remember that it has certain limitations. The 90-day period is not extendable, and you must leave the United States before your authorized stay ends.

If you plan to stay in the U.S. for longer than the allowed 90 days or for purposes other than those permitted under the VWP, you must apply for a nonimmigrant visa before your trip.

Participating Countries in the Visa Waiver Program

Visa Requirements for Canadian Permanent Residents from Specific Countries

If you’re a permanent resident of Canada originally from India, you need to request a U.S. Visitor Visa. This visa lets you travel to the United States for different reasons, such as tourism, business, medical treatment, or participating in conferences and workshops. Review the visa requirements based on your citizenship to ensure a hassle-free entry into the United States.

The U.S. Department of State’s official website provides comprehensive information on visa requirements and the application process, making it easier to understand the specific steps you need to take.

Remember to allow ample time for visa processing, as it can take several weeks or months, depending on your situation.

Table: Visa Requirements for Canadian Permanent Residents from Specific Countries

It’s important to note that visa requirements may change over time, so it’s always a good idea to check for any updates or changes before planning your trip.

To find out what you need for a visa, contact the U.S. embassy or consulate where you live. They’ll give you the most current info.

Additional Resources for Canadian Visitors to the United States

Here are some additional resources Canadian visitors can utilize to ensure a smooth and hassle-free trip to the United States.

U.S. Embassy and Consulate Websites in Canada

The U.S. Embassy and Consulate websites in Canada are excellent sources of information for Canadian visitors. These websites offer detailed guidance on visa requirements, entry procedures, and travel advisories.

You can also find contact information for the embassy or consulate nearest your location, allowing you to reach out for any specific queries or concerns.

U.S. Customs and Border Protection (CBP) Website

The U.S. CBP website provides comprehensive information on admissions, entry requirements, and restrictions.

This resource can help you understand the processes of entering the United States, including the required documents, customs procedures, and guidelines for bringing restricted items.

Canadian Government Travel Advisories

It’s always wise to stay informed about travel advisories issued by the Canadian government. These advisories provide essential updates on safety and security measures in various countries, including the United States.

Department of Homeland Security and Customs and Border Protection

Before traveling to the United States as a permanent resident of Canada, it’s essential to familiarize yourself with the Department of Homeland Security (DHS) and Customs and Border Protection (CBP). These organizations are crucial for safeguarding the security and safety of the United States at its borders and entry points.

The DHS is responsible for preventing terrorism, securing borders, enforcing immigration laws, safeguarding cyberspace, and managing disaster response efforts.

CBP, a branch within the DHS, focuses explicitly on regulating and facilitating international trade, collecting import duties, and enforcing U.S. regulations regarding immigration, customs, and agriculture.

As a Canadian permanent resident, you will come into contact with CBP officials when entering the United States at a port of entry.

These officials have the authority to permit or deny admission into the country, so it’s crucial to understand and comply with their requirements and procedures. Be prepared to present your valid passport, visa (if applicable), and other necessary travel documents, as requested by CBP.

In conclusion, as a Canadian permanent resident, your dream of traveling to the United States can become a reality. By understanding and complying with the entry and exit requirements and visa regulations (if applicable) and following the necessary procedures, you can have a smooth and enjoyable trip to the USA.

It is crucial to stay well-informed and prepared by keeping up-to-date with the latest travel information and resources. Consult Canada’s U.S. Embassy and Consulate websites for specific and up-to-date information on traveling to the United States.

Review the Department of Homeland Security and Customs and Border Protection (CBP) websites for essential details that may affect your entry into the country.

Remember, whether you’re going for business or pleasure, a successful journey to the USA as a Canadian permanent resident is within reach. Safe travels!

Can Canadian permanent residents travel to the USA?

Yes, Canadian permanent residents are generally allowed to enter the United States for tourism, business, or other purposes.

Is it safe to travel to the USA?

While the majority of the country is safe for travelers, there are some areas along the border with Mexico where criminal incidents related to drug trafficking are more common. It’s essential to remain vigilant and cautious of petty crime in urban centers and tourist locations.

What documents do Canadian permanent residents need to enter the USA?

When traveling by air, you must present a valid passport for your stay or a valid NEXUS card at self-serve kiosks. If you’re entering by land or water, you may need a valid passport, a Trusted Traveler Program card, an enhanced driver’s license (EDL), or other approved travel documents.

Do Canadian permanent residents need a visa to enter the USA?

It depends on your country of citizenship. If you are a citizen of a country eligible for the Visa Waiver Program, you may visit the U.S. for up to 90 days without a visa. If you are not eligible for the Visa Waiver Program or plan to visit the U.S. for over 90 days, you may need to apply for a nonimmigrant visa.

Are permanent residents of Canada eligible for the Visa Waiver Program?

Yes, permanent residents of Canada may be eligible for the Visa Waiver Program if they are citizens of a participating country, possess a valid e-Passport, and have obtained ESTA approval.

What are the visa requirements for Canadian permanent residents from specific countries?

The visa rules can differ based on your citizenship. For instance, if you’re a permanent resident of Canada originally from India, you’ll need to seek a U.S. Visitor Visa. Reviewing the visa requirements that apply specifically to your country of citizenship is crucial.

Are there additional resources available for Canadian visitors to the USA?

Yes, additional resources are available, including information on entering the country, business travel, visa exemptions, and more. It’s recommended to consult Canada’s U.S. Embassy and Consulate websites for specific and up-to-date information on traveling to the United States.

What are the entry requirements for citizens of Bermuda?

Citizens of Bermuda generally do not require a nonimmigrant visa for stays up to 180 days. However, there are specific travel purposes where a nonimmigrant visa is required. It’s crucial to review the visa requirements that apply to your trip, considering the purpose of your travel and how long you plan to stay.

What is the role of the Department of Homeland Security and Customs and Border Protection?

The Department of Homeland Security and Customs and Border Protection (CBP) officials have the authority to permit or deny admission to the United States at the port of entry. Reviewing the CBP website for information on admissions, entry requirements, and other vital details that may affect your entry into the United States is essential.

Similar Posts

Why Canada Post May Delay Your Delivery

Since its founding more than a century ago, Canada Post has experienced a slew of obstacles that have shaken its operations and forced a change of course. The motivation for the transformation sprang from a desire to grow toward financial independence and stability. While any postal service’s goal is to provide timely delivery to its…

Is It Legal to Have an Owl as a Pet in Canada? Unbelievable Laws

Is it Possible to Own an Owl as a Pet in Canada? Recently, various wild creatures, such as wolves, owls, and tigers, have been becoming more popular to own as pets. This may be due to their portrayal in films and television programs like Harry Potter and Game of Thrones. Nevertheless, keeping these animals as…

How Much to Tip Your Hairdresser: Canadian Tipping Customs

When you go to a hair salon, you must worry about how much to tip your hairstylist. Tipping customs vary from country to country, and regional differences can exist even within countries. In this blog post, we will discuss tipping customs in Canada. We will give you some tips on how much to tip your…

Can a British Citizen Live in Canada: A Guide

It’s no secret that Canadians love their British neighbors. After all, the United Kingdom is one of our closest allies—and they make some pretty great television shows and movies! So it’s no surprise that many Brits want to move to Canada. But can a British citizen live in Canada? What is the process? Let’s break…

Medical Conditions That Qualify for Disability in Canada: A Comprehensive Guide

Medical conditions can significantly impact an individual’s ability to work and earn a living. In Canada, individuals unable to work due to a medical condition can access disability benefits. Disability benefits in Canada aim to offer financial assistance and uphold the independence and well-being of individuals who cannot work due to disabilities. Eligibility for these…

Does Aliexpress Ship to Canada?

Shopping online from Aliexpress Canada is an experience like no other. You have got access to multiple carefully-selected and high-quality products at unbeatable prices. Aliexpress Canada ships to customers in different countries. Your Aliexpress order will get delivered to your Canadian home within three to seven days. What is Aliexpress Canada? Aliexpress Canada is an…

- Find a Branch

- Call 1-800-769-2511

Travelling within Canada - Travel Insurance for RBC Clients 1

Why travel across the ocean when there are so many breathtaking vistas right in your own backyard? If you’re going outside your home province or territory, your provincial health insurance won’t cover you for any non-medical travel situations or certain emergency medical expenses (such as an air ambulance back to your home province). Our travel insurance can help fill the gap.

Popular Choice:

Travel within canada package, get a quote.

You are covered for:

- Unlimited eligible emergency medical expenses 2

- Travel expenses to get you home after a medical emergency or other trip interruption

- Last-minute cancellation or trip interruptions due to family/work emergencies, unexpected health issues or other unforeseen events

- Non-refundable portions of unused, prepaid flights if an illness, injury or other unexpected event forces you to cancel your flight, cut your trip short or delay your return home

- Baggage delays and lost or stolen luggage or personal items

- Flight and travel accidents

- 24-hour worldwide emergency medical assistance

Make sure you have the right travel insurance—get an online quote or call the Enrollment Centre.

Have an RBC Royal Bank credit card with travel coverage?

If you’re using an RBC Royal Bank credit card to pay for your trip in full, see if your card provides enough coverage for your trip.

See If My Card Covers Me

View Legal Disclaimers Hide Legal Disclaimers

- Forums New posts Search Forums

- Members Registered members Current visitors Recent Activity

- Free Assessment

Health Insurance for PR (Express Entry)

- Thread starter science and art

- Start date Apr 13, 2018

science and art

Hello all, Just a little question: I have PR (from express entry) and will fly to Canada in 3-4 months for the first time. Do I need to have a health insurance before landing. Some people say that a private health ins. would be essential as the procedure of the canadian health system to cover you would take about 3 months. Therefore, a 3 month private insurance is required. Otherwise, I would pay a lot, if need to see a doctor. Does anyone know about it? Shall I have a private insurance covering the fisrt 3 months? Thanks all in advance

strikeharsh

Hero member.

Every province has different policies. I strongly suggest that you google each province’s health card policy and decide what to do. Or you can hire an immigration consultant.

> Do I need to have a health insurance before landing. Some people say that a private health ins. would be essential as the procedure of the canadian health system to cover you would take about 3 months. Therefore, a 3 month private insurance is required. Otherwise, I would pay a lot, if need to see a doctor. Almost every province has a 3 months waiting period. If I recall the exception was Alberta where it starts after arrival. Research your province's health insurance. > Shall I have a private insurance covering the fisrt 3 months? It depends on how risk averse you are. Many private insurances cover the emergencies only. Not having insurance means you pay out of pocket anything. Just seeing a doctor for basic stuff won't break the bank, but anything requiring emergency treatment at hospitals easily runs into 5 figures...

strikeharsh said: Every province has different policies. I strongly suggest that you google each province’s health card policy and decide what to do. Or you can hire an immigration consultant. Click to expand...

science and art said: Hello all, Just a little question: I have PR (from express entry) and will fly to Canada in 3-4 months for the first time. Do I need to have a health insurance before landing. Some people say that a private health ins. would be essential as the procedure of the canadian health system to cover you would take about 3 months. Therefore, a 3 month private insurance is required. Otherwise, I would pay a lot, if need to see a doctor. Does anyone know about it? Shall I have a private insurance covering the fisrt 3 months? Thanks all in advance Click to expand...

Maverick28 said: An immigration consultant for insurance, really? Click to expand...

Star Member

Kirchenbomb

strikeharsh said: Sure why not. If you are stuck, confusing like hell, don’t know next move. Why not hire professional to help you get out of swamp? Click to expand...

- Global travel destinations

- Canadian travel insurance to USA

US travel insurance for Canadians, Travel insurance Canada to US

Popular travel insurance for usa from canada, canadian citizens visiting the us.

Given that nearly 90% of Canada's population lives within 100 miles of the US border, it is really no surprise that Canadians are the top source of tourists to the United States. In 2018 alone, the US had over 21 million overnight trips from Canada with almost half of these arrivals by air and the other half by crossing the land border.

The US has a very varied topography and shares land borders with Canada to the North and Mexico to the south. Canada's population has a relatively large number of baby boomers and this older generation prefers traveling nearby to the US. Many Canadian baby boomers spend a lot of time and money escaping the cold during Canada's long winters. Also known as Canadian Snowbirds, they are attracted to the southern warmer states of the US, mainly Florida , Arizona and Texas .

Travel health insurance for Canadian visitors to USA

Canadians travel across the southern border to the US on a regular basis. The reasons for travel can vary, be it for warmer weather for the snowbirds, or simply a short vacation, or travel for work, business and corporate meetings. Whatever the reason for travel, it is important to buy proper health insurance with adequate coverage in the United States. The " Canadian government authorities advise Canadians to buy travel insurance " while traveling overseas from Canada. Given the high cost of healthcare in the US , it is not worth the risk of being uninsured while visiting the United States. Know more »

Health Care in the US

Naturally, the first thing one thinks about when planning a trip is not how much a trip in that country’s ER will cost you. However, we do suggest you consider the high costs of health care in the US and arrange to have yourself and your loved ones covered in case something does happen.

Emergency room expenses and hospital stays are extremely expensive and regularly impoverish under-uninsured and uninsured people in the US. It is not a great state of affairs, but at the moment, this is a reality.

The cost of a routine physician's visit is significantly higher in the U.S., where it might be $176. An echocardiogram can cost around $1,000 in Massachusetts and around $3000 in New Jersey depending on the provider. The cost of common ailments like Diabetes Mellitus with Hyperglycemia admitted to an emergency room would cost around $2,500 -$5000. Stroke resulting in ICU for about 10 days would cost $120,000, Heart attack treatment with medical bills for ambulance, hospital emergency room, ICU, EKG and MRI heart scans and continuing care from cardiologists would cost about $20,000, the average treatment cost of acute kidney failure in the USA was over $22,000.

While there are several reasons for high healthcare costs, the fact remains that one cannot afford to be uninsured while visiting the US. In US hospitals the cost for any treatment is much lower if you have insurance and the hospital is part of the PPO network when compared to getting the same treatment without any insurance. This is beyond the actual insurance coverage itself, so simply having visitors insurance reduces the bill substantially. This high price without insurance is unimaginable for visitors to pay out of their pocket. It is important for Canadians to realize the importance of health insurance while visiting the US.

You must be very careful and bring any prescription medication as well as a prescription or copy of such so that you can show that you have good reason to have medications with you. There are lower cost “Urgent Care” centers that can be used for sudden, non-life threatening situations that will be cheaper and quicker than trying to visit a hospital emergency room. They can assess the situation and often treat the situation quickly and efficiently. They also are open beyond “normal” doctor hours (why do these things seem to always happen on Sunday afternoons?) which can be helpful to be aware of.

Here at American Visitor Insurance, we have many travel insurance for Canadians travelling to USA from reputable US insurance companies who help travelers from Canada receive the care they need!Let us help you find the right medical travel insurance for Canadians visiting the United States.

USA - General Information

Popular travel destinations in the usa.

US States for tourists. Beaches, National Parks and more !

US Cities renowned for their Glitz, Glamor, Museums and more !

US Territories

U.S Virgin Islands

American Samoa

Puerto Rico

Popular tourist destinations in the united states.

Mount Rushmore

Mount Rushmore depicts the faces of four former American presidents, each of which is carved and blasted from the side of a rock face.

Niagara Falls

The water from Lake Erie flows into Lake Ontario over these massive waterfalls along the US and Canadian border.

Statue of Liberty

The Statue of Liberty is America's most familiar icon. It is the largest statue in the world with 152 ft in the New York city Harbor.

Yellowstone National Park

It is home to a huge ancient volcano which has resulted in a dramatic landscape and awesome natural phenomena. It is also home to some amazing wildlife.

Annual Multi-trip travel insurance for Canadians to USA

There are many Canadians who travel to the US and elsewhere outside Canada regularly. These travelers can be businessmen or corporate travelers or those who live close to the US border and travel overseas often.

While there are many top rated travel health insurance plans for multiple trips worldwide, the Patriot Annual Multi trip insurance is an ideal plan for Canadian travelers. Travellers must have domestic health insurance policy while being covered under this plan. Every trip duration can be limited to either 30 days or 45 days with a medical coverage maximum of $1 million. Travelers up to the age of 76 years can buy this plan. The plan is renewable up to 3 years and also offers coverage for pre-existing conditions.

Best Seniors travel insurance with Pre-existing Conditions Coverage

Pre-existing condition is a medical ailment that existed before the travel insurance became effective. Another term that we come across more frequently in insurance policies is "Acute onset of pre-existing condition". Acute onset of pre-existing condition is a sudden relapse of the pre-existing condition without advance warning which requires medical attention within 24 hours.

Travelers with pre-existing conditions always find it hard to buy travel health insurance. Some of the common conditions that are considered as pre-existing conditions are asthma, food & drug allergies, environmental allergies, heart related issues, high blood pressure, kidney disease, cancer, and diabetes. Typically all insurance providers have their terms and conditions for the pre-existing condition coverage provided. Most do not cover anything related to a pre-existing condition. Travelers can buy a travel insurance policy without a medical check, however chronic illnesses like cancer, parkinson's disease, Amnesia...which cannot be cured are not covered by the travel health insurance policies. With the pre-existing condition there is a "look back" period of 60-180 days to determine the claim. Most of the Insurance providers consider the age of the individual as a factor for providing this benefit. Most of the policies do not provide coverage for pre-existing conditions at the age of 70 and more.

Some US insurance providers offer senior citizen travel insurance for pre-existing conditions above the age of 80 with fixed or limited coverage. The Safe Travels USA, Safe Travels USA Cost Saver, and Safe Travels USA Comprehensive all offer $1000 coverage for pre-existing conditions without limitation to chronic illness. If travelers have a medical condition they are concerned about, it is very important for them to buy a policy that includes the illnesses in the coverage and to be aware of the terms of pre-existing condition coverage.

Travel insurance for acute onset of pre-existing conditions

Travel insurance for Asthma

Travel insurance for Arthritis

Travel insurance for Diabetes

Travel insurance for Heart Ailment

Travel insurance for Cholesterol

Travel insurance for Blood Pressure

How does travel insurance for pre-existing conditions work?

The travel health insurance plans which cover pre-existing conditions have clear definitions of what is a pre-existing condition, the look back period for pre-existing condition, whether the travel insurance coverage is limited to acute onset of pre-existing conditions, and if it provides full coverage for pre-existing conditions the coverage limit within the policy for pre-existing conditons. Any travel health insurance coverage for pre-existing conditions will depend on all these.