EaseMyTrip is one of the leading travel organisations in India, aiming to offer exclusive travel services to diverse explorers.

Today, the company has a dedicated in-house technology and a customer support team that is focused on developing a secure, advanced, and scalable technology infrastructure and software to enable a quick response time and ensure efficient services.

EaseMyTrip also joined the elite club of India’s first-ever 100 unicorns and remained India’s only company delivering consistent profits among all listed new-age tech businesses. Now, EaseMyTrip is strategically expanding its international presence and diversifying its offerings beyond air travel to include hotels and holidays. Additionally, we are banking on a franchise model to improve service accessibility for offline customers. Currently, overseeing a network of 13 franchise stores nationwide. *In terms of air ticket bookings, based on the Crisil Report-Assessment of the OTA Industry in India, February 2021.

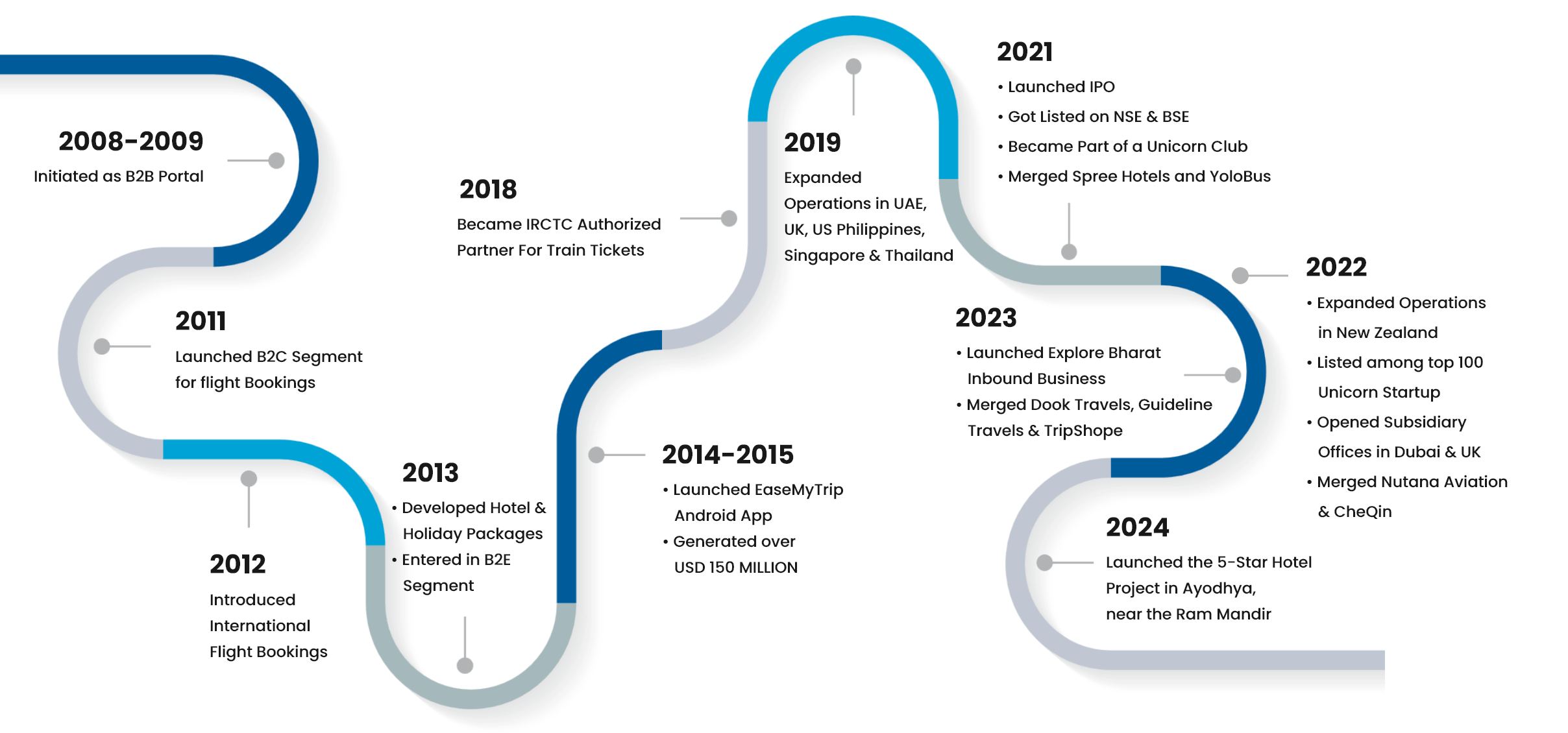

Established in 2008, EaseMyTrip.com is India’s second-largest* online travel platform. Founded by brothers Nishant, Rikant, and Prashant, the company's inception stemmed from their earlier venture, Duke Travel, with a vision to streamline operations and minimize capital requirements.

Operating initially from a small space, we overcame challenges through determination and familial support, evolving into a resilient entity ensuring financial stability. Transitioning to a customer-facing model in 2011, we adopted a 'no convenience fee' policy, attracting a loyal customer base with transparent pricing and exceptional service.

With exponential growth, EaseMyTrip became the second-largest travel portal in India, boasting 1.5 crore users. Bootstrapped until its successful IPO in March 2021, the company consistently delivers impressive financial results.

Supported by a robust infrastructure and strategic acquisitions, including Spree Hospitality, Eco Hotels and Resorts, Dook Travels, CheQin, Guideline Travels, TripShope, YOLO Bus, Nutana Aviation, and ETrav, EaseMyTrip expands its presence across Indian cities and international markets.

- Best Online Travel Agency – Veta 2024

- Online Travel Agent of the Year - SATTE Awards 2024

- Game changer award – India Travel Awards, North, 2023

- Bootstrapped Entrepreneur of the Year – HURUN India 2022

- Best Travel Portal of the Year – Entrepreneur India 2022

At EaseMyTrip, we feature a comprehensive mosaic of exceptional travel products and services that are specially designed to offer personalise customer experience at its best.

We’re one of the leading Online Travel Agencies in India that believes in implementing a customer-centric approach to nurture relations with travellers across the globe

Meet our inspiring leaders of the EaseMyTrip family that nurtured our company with their unparalleled passion, sheer dedication and years of valuable expertise. Their unwavering commitment towards excellence empowers us to offer best travel experiences to our users.

- International

Philippines

New Zealand

Nishant Pitti

Mr. Nishant Pitti, CEO & Co-Founder of EaseMyTrip, is the visionary architect of the company's enduring success. He embarked on his entrepreneurial journey at the age

of 18, demonstrating remarkable foresight and determination. With a strategic mindset and extensive industry network, he steers EaseMyTrip to prominence, achieving unicorn status in the competitive travel industry. Under Mr. Nishant's leadership, EaseMyTrip made history with its IPO launch in March 2021, becoming the first online travel company listed on stock exchanges. His accolades include and not limited to Fortune India's 40 under 40. Beyond entrepreneurship, Mr. Nishant's commitment to industry development is evident through his role as honorary secretary for the Travel Agents Federation of India. With unwavering dedication, Nishant Pitti continues to shape the future of travel, leaving an indelible mark on the industry.

Rikant Pittie

Mr Rikant Pittie, Co-Founder of EaseMyTrip, combines business acumen with technological expertise.Starting at 16, he laid the groundwork for EaseMyTrip's success.

Today, he leads the second-largest online travel platform in India. Mr Rikant’s visionary leadership has propelled EaseMyTrip into unicorn status with a market capitalization of USD 1.3 billion. His accolades include features in Fortune India's 40 under 40 and the 'Entrepreneur of the Year in Service Business (Travel)' award from Entrepreneur India. Beyond business, Mr Rikant serves as Vice Chairman of the CII Delhi State Council, shaping the industry's future. His thorough understanding of every aspect of the travel business, as well as its connection with e-commerce, has made this organization a household name among India's discerning travellers. Rikant was the owner and operator of Duke Travel Agency while still in college. With a passion for innovation, he continues to drive EaseMyTrip to new heights in travel and technology.

Prashant Pitti

Mr. Prashant Pitti, Co-founder of EaseMyTrip, led the company to the remarkable feat of bootstrapping its way to IPO success, positioning it among the select

few in the global tech landscape. He has also played a pivotal role in steering the company's course to become a unicorn through his passion for the industry. His prior venture, a social app with a user base exceeding 63 million worldwide, underscores his entrepreneurial prowess. With a distinguished background at Capital One and HSBC Bank in the United States, complemented by an undergraduate degree from IIT Madras, Mr. Prashant's journey epitomizes a fusion of financial excellence and business acumen.

Vinod Kumar Tripathi

Mr. Vinod Kumar Tripathi is an Independent Director of our Company and has been with us for years. He holds a bachelor's degree and a master's degree in political

science from the University of Allahabad. He has more than 40 years of experience in the taxation, finance, administration, textiles and wind turbine etc sectors. He previously worked as the Commissioner of Income Tax, where his last posting was at Mumbai. He was Managing Director at National Textiles Corporation (Maharashtra South and Gujarat) and was President and group director at Reliance Capital Limited He also worked as Auditor with the office of the Comptroller and Auditor General of India. He taught Political Science at Ewing Christian College Allahabad. He has a keen interest in sports and social activities and he is a poet too and has been awarded prestigious Sahitya Academy award, by Maharashtra Urdu Sahitya Academy, Government of Maharashtra and Urdu. His third poetry book is in the press at the moment. Academy, Government of Uttar Pradesh.

Satya Prakash

Mr. Satya is an Independent Director of our Company. He holds a bachelor's degree in science from the University of Allahabad and a master's degree in

science from IIT, Delhi. He passed the civil services examination in 1976. He has approximately 39 years of experience in the railways sector. He previously worked as an Indian Railway Traffic Service Officer, and has been previously associated in various capacities with the Ministry of Railways, Government of India, including serving as a member of the Railway Claims Tribunal, Mumbai bench, as a trustee of the Mumbai Port Trust, Ministry of Shipping, Government of India, and as a permanent invitee on the board of directors of Western Coalfieds Limited. He has also been awarded the Premchand Award by the Ministry of Railways, Government of India in 1993.

Justice Usha Mehra (Retired)

Ms. Usha Mehra is an Independent Director of our Company. She holds a bachelor's degree in law from the Panjab University and has been a member of

the Bar Council of Delhi since 1962. She has over [37] years of experience in the legal sector. She has also been working in the field of commercial and arbitration law and is currently serving on the panel of Indian Council of Arbitration. Justice Usha Mehra (Retired) is a former member of the Law Commission of India. Previously, she has, presided as an Additional District and Session Judge at Delhi and as the Registrar of High Court of Delhi, before being appointed as a judge of the Delhi High Court.

- Celebrating Festivities

- Sports And Tournaments

- Holidays Trips

- CSR Activities

- [email protected]

- 011 - 43131313, 43030303

- www.EaseMyTrip.com

- Trending Stocks

- Heritage Foods INE978A01027, HERITGFOOD, 519552

- Vodafone Idea INE669E01016, IDEA, 532822

- Suzlon Energy INE040H01021, SUZLON, 532667

- One 97 Paytm INE982J01020, PAYTM, 543396

- Aadhar Housing INE883F01010, AADHARHFC, 544176

- Mutual Funds

- Commodities

- Futures & Options

- Cryptocurrency

- My Portfolio

- My Watchlist

- FREE Credit Score ₹100 Cash Reward

- My Messages

- Price Alerts

- Chat with Us

- Download App

Follow us on:

- Global Markets

- Indian Indices

- Economic Calendar

- Technical Trends

- Big Shark Portfolios

- Stock Scanner

- Auri ferous Aqua Farma , 519363

- INSTANT LOANS UPTO ₹ 5 Lakhs

- Zero Ads Get Premium Content Daily Stock Calls Stock Insights Daily Newsletters Stock Forecasts Technical Indicators Go Pro @₹99

- Top Stories Technical Trends

- Financial Times Opinion

- Learn GuruSpeak

- Webinar Interview Series

- Business In The Week Ahead Research

- Technical Analysis Personal Finance

- My Subscription My Offers

- Loans

- Home FII & DII Activity

- Earnings Webinar

- Web Stories

- Tax Calculator

- Silver Rate

- Storyboard18

- Home Tech/Startups

- Auto Research

- Opinion Politics

- Home Loans

- Home Performance Tracker

- Top ranked funds My Portfolio

- Top performing Categories Forum

- MF Simplified

- Home Gold Rate

- Trade like Experts

- Pharma Industry Conclave Unlocking opportunities in Metal and Mining

- REA Advanced Technical Charts

- International

- Go pro @₹99

- Elections 2024

- T20 WC 2024

- Personal Finance

- Moneycontrol /

- Share/Stock Price /

- Travel Services

Samco Stock Rating

Easy Trip Planners Ltd.

As on 10 Jun, 2024 | 03:59

* BSE Market Depth (10 Jun 2024)

As on 10 Jun, 2024 | 04:01

- Top 5 Trending Stocks

- #KnowBeforeYouInvest

Forecast

Stock with medium financial performance with average price momentum and val

The Estimates data displayed by Moneycontrol is not a recommendation to buy or sell any securities. Estimates data is a third party aggregated data provided by S&P Global Market Intelligence LLC for informational purposes only. The Company advises the users to check with duly registered and qualified advisors before taking any investment decision. The Company does not guarantee the accuracy, adequacy or completeness of any information/data and is not responsible for any errors or omissions or for the results obtained from the use of such information/data. The Company or anyone involved with the Company will not accept any liability for loss or damage as a result of reliance on the Estimates data. The Company does not subscribe or endorse any of the services and/or content offered by such third party.

Hits/Misses

- MC Insights

- MC Technicals

- Price & Volume

- Corp Action

- Shareholding

Note: High PE if PE ≥ 80 percentile, Low PE if PE ≤ 30 percentile and Average PE if 30 < PE < 80 percentile (calculations based on 3 years data)

Note: High P/B if P/B ≥ 80 percentile, Low P/B if P/B ≤ 30 percentile and Average P/B if 30 < P/B < 80 percentile (calculations based on 5 years data)

- Advanced Chart

*Delayed by 20 seconds.

Share Price Forecast

Earnings forecast, consensus recommendations.

- Underperform

Get detailed analysis with Moneycontrol Stock Insights.

- 22.41% away from 52 week high

- Market Cap - Below industry Median

- Promoters holding remains unchanged at 64.30% in Mar 2024 qtr

- Management Interviews

- --> Investor Presentation

- Earnings Transcripts

- Credit Rating

- Resignation

Pivot levels

Note : Support and Resistance level for the day, calculated based on price range of the previous trading day.

Note : Support and Resistance level for the week, calculated based on price range of the previous trading week.

Note : Support and Resistance level for the month, calculated based on price range of the previous trading month.

- Very Bullish

- Very Bearish

Decreasing ROE

Companies that are decreasing efficiency in utilisation of shareholders funds, rising profits, falling margins, companies that have grown their net profits but decreased net profit margins over the past 12 months, dii buying fii buying, list of companies in which diis and fiis have increased their holdings in last quarter.

- ROE<ROE 1 yr Back

- ROE<ROE 3 yr Avg

- Market Capitalization >250

- NetProfit>NetProfit1YrBack AND

- NPM<NPM1YrBack AND

- NetProfit1YrBack>0 AND

- MarketCap>250

- FIIHolding >FIIHolding1QtrBack AND

- DIIHolding >DIIHolding1QtrBack AND

- MarketCap >250

Companies in which FIIs have increased holding QoQ

10x profit growth explosion, companies whose net profit have grown 10 times in 5 years, 5x premium to book value, companies trading at more than 5 times their book values.

- FIIHolding>FIIHolding1QtrBack AND

- MarketCap>500

- Market Capitalization >500 AND

- Profit growth 5Years >59 AND

- Profit growth >0

- Price to book value > 5 AND

- Book value >0 AND

- Market Capitalization >500

Sales Pioneers

3 yr sales cagr of 25% or higher, rising book value, book value of these companies rising over last 3 years.

- Sales3yrCAGR>25 AND

- SalesGrowth>25 AND

- BookValue>BookValue1YrBack AND

- BookValue1YrBack>BookValue3YrsBack AND

Price to Book Value Above Industry

Companies with price to book value above industry, premium to peers, companies trading at premium pe valuation as compared to their industry peers.

- Price to book value >Industry PBV AND

- Price to Earning >Industry PE AND

Profit Pioneers

Companies that are consistently generating 25% or higher profit growth for last 3 years, falling quarterly profits, companies that have shown a fall in qoq profits as per their latest results.

- NetProfit3yrCAGR>25 AND

- NetProfitGrowth>25 AND

- QuarterlyNetProfit<NetProfit1QtrBack AND

Increasing Institutional Interest

Companies in which diis and fiis have increased their holding in the latest quarter.

- DIIHolding>DIIHolding1QtrBack AND

Price and Volume

Easy trip consolidated march 2024 net sales at rs 164.04 crore, up 40.69% y-o-y.

Travel bookings for Maldives opened due to a technical glitch: EaseMyTrip co-founder May 28 2024 01:13 PM

EaseMy Trip Q4 FY24 u2013 not an easy trip anymore May 27 2024 11:37 AM

Easy Trip Standalone March 2024 Net Sales at Rs 130.01 crore, up 16.63% Y-o-Y May 27 2024 10:47 AM

Stock Radar: Aurobindo, Adani Ports, RVNL, NTPC, Torrent Pharma, Divis Labs, Glenmark in focus on Monday May 28 2024 12:44 AM

Community Sentiments

Data not available.

What's your call on today?

Read 5 investor views

Thank you for your vote

You are already voted!

suresh_visu1987

going forward all stocks below 250 will have the tick size 0.01 paise. View more

Posted by : suresh_visu1987

Repost this message

going forward all stocks below 250 will have the tick size 0.01 paise.

yes. is it a glitch or will it be like this only.. View more | 2

Posted by : DRSUM1

yes. is it a glitch or will it be like this only..

today in both nse and bse the tick size .01 did any one noticed. View more | 2

today in both nse and bse the tick size .01 did any one noticed.

- Broker Research

ICICIdirect.com

- Company analysis giving insights of fundamentals, earnings, relative valuations, risk, price momentum and inside trading.

- Thomson Reuters proprietary rating of stock on scale of 1 to 10

- Industry ranking and detailed sector analysis of recent happening in sector

- Analyst rating like Buy/Sell/Hold with Earnings estimates with 1 year price target

WILSON HOLDINGS PRIVATE LIMITED

Nishant pitti.

*Transaction of a minimum quantity of 500,000 shares or a minimum value of Rs 5 crore.

HRTI PRIVATE LIMITED

Minerva ventures fund.

*A bulk deal is a trade where total quantity of shares bought or sold is more than 0.5% of the equity shares of a company listed on the exchange.

Insider Transaction Summary

Rikant pittie, nishant pitti.

*Disclosures under SEBI Prohibition of Insider Trading Regulations, 2015

Rikant Pittie & PACs Disposal

Nishant pitti & pacs disposal, nishant pitti disposal, prashant pitti acquisition, prashant pitti & pacs acquisition.

*Disclosures under SEBI SAST (Substantial Acquisition of Shares and Takeovers) Regulations, 2011

Corporate Action

- Announcements

- Board Meetings

Easy Trip Planners Limited

Easy trip planners - announcement under regulation 30 (lodr)-press release / media release.

- Consolidated

- Income Statement

- Balance Sheet

- Debt to Equity

- Half Yearly

- Nine Months

Detailed Financials

- Profit & Loss

- Quarterly Results

- Half Yearly Results

- Nine Months Results

- Yearly Results

- Capital Structure

- Mutual Funds holding remains unchanged at 0.06% in Mar 2024 qtr

- Number of MF schemes remains unchanged at 8 in Mar 2024 qtr

- FII/FPI have increased holdings from 2.18% to 2.78% in Mar 2024 qtr.

About the Company

Company overview, registered office.

223, FIE Patparganj Industrial Area, ,East Delhi,,

011-43131313

http://www.easemytrip.com

Selenium Tower B, Plot No. 31-32,,Gachibowli, Financial District, Nanakramguda,Seri

Hyderabad 500032

040-67161500, 67162222, 33211000

040-23420814, 23001153

http://www.kfintech.com

Designation

Chairman & CEO

Executive Director

Independent Director

Included In

INE07O001026

Your feedback matters! Tell us what we got right and what we didn’t? Click here>

- Know Before You Invest

- Shareholding Pattern

- Deals & Insider

We at moneycontrol are continually attempting to improve our products and what’s more, carry the best to our users!

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500

Which stock to buy and why? Make an informed investment decision with advanced AI-based features like SWOT analysis, investment checklist, technical ratings and know how fairly the company is valued.

An analysis of stocks based on price performance, financials, the Piotroski score and shareholding. Find out how a company stacks up against peers and within the sector.

Read research reports, investor presentations, listen to earnings call and get recommendations from the best minds to maximise your gains.

Is the company as good as it looks? Track FII, DII and MF trends. Keep a tab on promoter holdings along with pledge details. Get all the information on mutual fund schemes and the names of institutions which invested in a company.

Advanced charts with more than 100 technical indicators, tools and studies will give you the edge, making it easier to negotiate the market and its swings.

Who is raising the stake and who is exiting? Stay updated with the latest block and bulk deals to gauge big investor mood and also keep an eye on what Insiders are doing.

- Share Price & Valuation Forecast

- MC Essentials

- Sharpest Opinions & Actionable Insights

- Exclusive Webinars

- Research & Expert Technical Analysis

You got 30 Day’s Trial of

- Ad-Free Experience

- Actionable Insights

- MC Research

You are already a Moneycontrol Pro user.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

Easy Trip Q2 net profit jumps 66% to ₹47 crore, revenue rises 31%

Easy trip q2 results: on a sequential basis, the net profit and revenue also surged 81% and 14%, respectively, from ₹26 crore and ₹124 crore in the preceding quarter..

IMAGES

VIDEO

COMMENTS

Established in 2008, EaseMyTrip.com is India’s second-largest* online travel platform. Founded by brothers Nishant, Rikant, and Prashant, the company's inception stemmed from their earlier venture, Duke Travel, with a vision to streamline operations and minimize capital requirements.

Easy Trip Share Price: Find the latest news on Easy Trip Stock Price. Get all the information on Easy Trip with historic price charts for NSE / BSE.

Get the latest Easy Trip Planners Ltd (EASEMYTRIP) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment...

EasyTrip Ltd is one of the leading OTA in Bangladesh. You can fly to your desired destinations with affordable rates.

Easy Trip Planners Ltd., the Indian travel search engine that postponed its initial public offering from last year to finally make its stock market debut earlier this month, couldn’t have timed...

Travel agency company Easy Trip Planners on Wednesday announced a 66% year-on-year (YoY) jump in consolidated net profit at ₹ 47 crore for the second quarter ended September 2023 (Q2FY24). The same was ₹ 28 crore in the year-ago quarter.