You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

It appears that JavaScript is either disabled or not supported by your web browser. JavaScript must be enabled to experience the American Express website and to log in to your account.

Redemption of American Express ® Travelers Cheques

Travelers Cheques have been a timeless addition to the world traveler’s carry-on for over 130 years. While new Travelers Cheques are no longer issued, your Cheques remain backed by American Express and have no expiration date.

REDEEM WITH AMEX ANYTIME

NO EXPIRATION DATE

24/7 CUSTOMER SERVICE

BACKED BY AMERICAN EXPRESS

HOW TO REDEEM

Travelers Cheques can no longer be purchased but can be redeemed in several convenient ways. Here’s how:

REDEEM WITH AMERICAN EXPRESS TRAVEL RELATED SERVICES COMPANY, INC.

REDEEM ONLINE

Quickly and securely redeem your Travelers Cheques online .

Call American Express Customer Service at 1-800-221-7282 or find additional contact numbers based on your location to redeem over the phone.

DEPOSIT WITH YOUR BANK

Confirm whether your bank allows account holders to deposit Travelers Cheques. Fees may apply.

EXCHANGE FOR LOCAL CURRENCY

Travelers Cheques can be exchanged worldwide. Find exchange locations . Fees may apply.

TRAVELERS CHEQUES EXCHANGE LOCATOR

Find the nearest exchange location.

Service Center

Have more questions?

Here are some common scenarios and what to do.

UNDERSTANDING TRAVELERS CHEQUES

Keep your Cheques secure until you’re ready to redeem.

Protect yourself in case of loss or theft by signing on the upper signature line.

Record the serial numbers and keep them in a safe place when you travel.

Keep your Cheques tucked away and hidden like you would cash.

When the time comes, sign your Cheque on the lower signature line in sight of the person accepting it.

Find documents you may need in case of claiming inherited Cheques, lost or stolen Cheques, and more.

DOCUMENTATION

Additional documents may be required based on the claim type. Typical documents include:

- Valid Photo ID (Passport, Driver's License or Government Issued ID)

- Copy of the Voided Travelers Cheque(s)

- Refund Details

UPLOAD DOCUMENTS

Once you have gathered the required documents and filled out any required documents and forms, upload here. Clear images will help expedite processing.

UNABLE TO UPLOAD?

If you’re unable to upload your completed documents, you can send hard copies directly to American Express .

INHERITED CHEQUES

How to redeem your inherited Travelers Cheques if the original owner is deceased or incapacitated.

1. OPEN A CLAIM

Call American Express Customer Service at 1-800-221-7282 or find additional contact numbers based on your location to begin a claim over the phone.

2. IDENTIFY & LOCATE REQUIRED DOCUMENTS

List of required documents and forms can be found here . You’ll need these to submit your claim.

3. UPLOAD REQUIRED DOCUMENTS

Be sure to upload clear images for faster processing.

4. IF YOU’RE UNABLE TO UPLOAD

As an alternative to submitting online, you can also mail hard copies of your documents to American Express .

*Travelers Cheque Encashment service is provided by American Express Travel Related Services Company, Inc.

Can I buy Travelers Cheques?

Travelers Cheques are no longer issued and so cannot be purchased.

Where can I redeem my Travelers Cheques?

There are thousands of foreign exchange partners in countries around the world where you can exchange your American Express Travelers Cheques for local currency. You can find places to redeem your Travelers Cheques using " Find Exchange Locations ". It may also be possible to redeem your Travelers Cheques directly for goods and services. Check first, though, with the merchant. American Express does not approve the use of its products, or any services related to its products, in the following territories: Crimea, Donetsk, and Luhansk Regions of Ukraine, Cuba, Iran, North Korea, Syria, Russia and Belarus.

Can I redeem my Travelers Cheques directly with American Express?

Yes, you can redeem your Travelers Cheques directly with American Express Travel Related Services Company, Inc. online . Alternatively, you can call American Express Customer Service at 1-800-221-7282 to register a redemption claim. You can find additional contact numbers based on your location. We may have to contact you with questions regarding your claim or to request additional information.

How do I redeem my Travelers Cheques?

You can redeem your Travelers Cheques directly with American Express Travel Related Services Company, Inc. Please refer the “How to Redeem” section above. Alternatively, simply present the Cheque at an eligible foreign exchange partner or merchant location. Make sure the acceptor watches while you countersign the Cheque on the lower signature line. Photo identification may be required. We strongly recommend you retain and carry your original Cheque purchase receipt with you when you travel. Commission charges may apply and can vary by country or exchange partner. Exchange limits may apply due to local regulations and exchange policies.

What happens if I sign my Travelers Cheques in the wrong place, or if my signatures don't match?

Acceptance of Travelers Cheques is based on the acceptor watching the customer sign the Cheque on the lower signature line, and then comparing that signature with the original signature on the upper signature line. The acceptor must observe the customer signing the Cheque. If the signatures are a reasonable match, the Cheque should be accepted. Photo identification may be required at the discretion of the acceptor. As always, if the acceptor is unsure, they should call an American Express Travelers Cheque Customer Service Center .

Is there a fee to cash Travelers Cheques?

Commission charges may apply and can vary by country and/or exchange partner. Before you travel, we recommend that you find the most convenient Travelers Cheque exchange locations using the Find Exchange Locations .

What happens if my Cheques are lost or stolen?

Lost or stolen Travelers Cheques may be refunded.* Please call Customer Service at 1-800-221-7282 or find the additional contact numbers for your current location. Have your recorder serial numbers on hand when you call.

* Terms & Conditions and restrictions apply. Identification and proof of purchase required.

How are Gift Cheques cashed?

When cashing a Gift Cheque, the recipient should fill out the "pay to the order of" line and countersign the Gift Cheque in the lower corner with the acceptor watching. If you encounter diffiulties in cashing a Gift Cheque in the United States, please encourage the merchant to call American Express for instructions at 1-800-221-7282 . If you are located outside of the U.S., you can find additional contact numbers to provide the merchant based on your location.

Can I redeem my Gift Cheques directly with American Express?

Yes, you can redeem your Gift Cheques directly with American Express Travel Related Services Company, Inc. online . Alternatively, you can call American Express Customer Service at 1-800-221-7282 to register a redemption claim. You can find additional contact numbers based on your location. We may have to contact you with questions regarding your claim or to request additional information. You can also find places to redeem your Gift Cheques using Find Exchange Locations . There also may be restrictions on the currency and method of redemption and the value of Gift Cheques that can be redeemed.

Still Need Help?

Call American Express Customer Service 24/7 at 1-800-221-7282 or find additional contact numbers based on your location.

American Express stopped issuing Travelers Cheques, so they’re no longer available for purchase. Support is available by phone and the American Express website for customers to redeem valid Travelers Cheques. Travelers Cheques remain backed by American Express and have no expiration date.

Your guide to Amex's travel insurance coverage

Update : Some offers mentioned below are no longer available. View the current offers here .

American Express premium credit cards offer some of the best perks in the credit card space. While lounge access and travel credits are typically the highlights of these cards, some of the lesser-known benefits, such as trip delay reimbursement and trip cancellation and interruption insurance, are becoming hot topics as the coronavirus pandemic continues to impact the travel industry.

Want more credit card news and advice from TPG? Sign up for our daily newsletter!

As a result, many TPG readers have sent in questions about Amex's travel insurance protections. As travel restrictions change, policies and best practices will likely change as well. But this guide will walk you through which Amex credit cards have these benefits, what's currently covered and how you can file a successful claim.

Related: Best credit cards for trip cancellation and interruption insurance

Amex cards offering trip delay, cancellation or interruption insurance

Here is an overview of the Amex cards that offer trip delay reimbursement, trip cancellation/interruption insurance or both:

The information for the Hilton Aspire Amex card and American Express Corporate Platinum Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: The best credit cards with travel insurance

What is covered by trip cancellation and interruption insurance?

You can find the full terms and conditions of what is generally covered on your respective card in your Guide to Benefits, which can be found through your online account. I'll use the Delta SkyMiles® Reserve as an example.

Here is a rundown of the "covered losses" provided by Amex's trip cancellation and interruption insurance:

- Accidental bodily injury or loss of life or sickness of either the eligible traveler, traveling companion or a family member of the eligible traveler or traveling companion

- Inclement weather, which prevents a reasonable and prudent person from traveling or continuing on a covered trip

- The eligible traveler or his or her spouse's change in military orders

- Terrorist action or hijacking

- Call to jury duty or subpoena by the courts, either of which cannot be postponed or waived

- The eligible traveler or traveling companion's dwelling made uninhabitable

- Quarantine imposed by a physician for health reasons

Related: Book carefully if you have multiple Amex cards that offer travel protections

Amex also provides an extensive list of things that are not covered by trip cancellation/interruption insurance:

- Pre-existing conditions

- The eligible traveler's suicide, attempted suicide or intentionally self-inflicted injury

- A declared or undeclared war

- Mental or emotional disorders, unless hospitalized

- The eligible traveler's participation in a sporting activity for which he or she receives a salary or prize money

- The eligible traveler's being intoxicated at the time of an accident. Intoxication is defined by the laws of the jurisdiction where such accident occurs

- The eligible traveler being under the influence of any narcotic or other controlled substance at the time of an accident, unless the narcotic or other controlled substance is taken and used as prescribed by a Physician

- The eligible traveler's commission or attempted commission of any illegal or criminal act, including but not limited to any felony

- The eligible traveler parachuting from an aircraft

- The eligible traveler engaging or participating in a motorized vehicular race or speed contest

- Dental treatment except as a result of accidental bodily injury to sound, natural teeth

- Any non-emergency treatment or surgery, routine physical examinations

- Hearing aids, eyeglasses or contact lenses

- One-way travel that does not have a return destination

- A counterfeit scheduled airline or train ticket; or a scheduled airline or train ticket which is charged to a fraudulently issued or fraudulently used eligible card.

- Any occurrence while the eligible traveler is incarcerated

- Loss due to intentional acts by the eligible traveler

- Financial insolvency of a travel agency, tour operator or travel supplier

- Any expenses that are not authorized and reimbursable by the eligible traveler's employer if the eligible traveler makes the purchases with a commercial card

If you do find yourself canceling or cutting a covered trip short, here are the basic guidelines provided by Amex on what types of expenses are covered for trip cancellation/interruption:

"If a Covered Loss causes an Eligible Traveler's Trip Interruption, we will reimburse you for the nonrefundable amount paid to a Travel Supplier with your Eligible Card for the following: 1. The forfeited, non-refundable, pre-paid land, air and sea transportation arrangements that were missed; and 2. Additional transportation expenses that the Eligible Traveler incurs less any available refunds, not to exceed the cost of an economy-class air ticket by the most direct route for the Eligible Traveler to rejoin his or her places of origin.

If a Covered Loss causes an Eligible Traveler to temporarily postpone transportation by Common Carrier for a Covered Trip and a new departure date is set, we will reimburse you for the following: 1. The additional expenses incurred to purchase tickets for the new departure (not to exceed the difference between the original fare and the economy fare for the rescheduled Covered Trip by the most direct route); and 2. The unused, non-refundable land, air, and sea arrangements paid to a Travel Supplier with your Eligible Card."

What is covered by trip delay insurance?

Trip delay coverage provides reimbursement for reasonable additional expenses incurred when your trip is delayed due to a covered hazard for more than six hours.

Coverage is limited to $500 per trip and cardmembers are only eligible for two claims each 12 consecutive month period.

Amex outlines what is not covered, which includes the following:

- Covered losses that are made public or known to the eligible traveler prior to the departure for the covered trip

- An eligible traveler's expenses paid prior to the covered trip

Filing a claim

When you have a delay or trip cancellation/interruption that you think qualifies for coverage, you can file a claim by calling Amex at 1-844-933-0648 within 60 days of the covered loss.

Trip delay reimbursement requires the following documentation:

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss

- Receipts - Acceptable documentation includes the following:

- A statement from the common carrier that the covered trip was delayed

- Charge receipt

- Copies of common carrier ticket(s)

- Receipts for travel expenses

Trip cancellation/interruption insurance requires slightly different documentation.

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss. Acceptable documentation includes:

- Court subpoenas, orders to report for active duty, physician orders, etc.

- Copies of your common carrier tickets and travel supplier receipt

- Your eligible card billing statement showing the charges for the covered trip

- Copy of travel supplier's cancelation policy

After Amex receives notice of your claim, instructions will be sent on how to send the proof. Typically, you have up to 180 days to file a claim after a delay or cancellation.

Proof of flight delay or cancellation

One of the documents required to file for trip delay reimbursement is a verification form that outlines the reason for the delay or cancellation by the carrier. You can typically get this at the airport when the delay or cancellation is announced, but keep in mind that it may require a supervisor. Each U.S. major airline also has a process for requesting this information after the fact.

Here is an overview of the process that major U.S. airlines require for you to receive a delay or cancellation verification form:

Amex cards that offer car rental insurance

Unfortunately, no American Express credit cards offer primary car rental coverage, although most offer secondary coverage. You can see the entire list of cards that offer secondary car rental protection on the American Express website . However, all American Express credit cards offer an optional "Premium Car Rental Protection policy" that can be added to rentals made using the card for a small fee.

Read our guide on when to use American Express' Premium Car Rental Protection for more details on this coverage option.

You can add Premium Car Rental Protection to any American Express card . TPG has a guide of the best American Express cards , but here are some of the best cards in terms of the return you could receive when renting a car. Note, the estimated return rate for these cards is based on TPG's latest valuations:

- Hilton Honors American Express Aspire Card: $450 annual fee (see rates and fees); 4.2% return on car rentals booked directly from car rental companies; no foreign transaction fees (see rates and fees)

- The Blue Business® Plus Credit Card from American Express: $0 annual fee (see rates and fees); 4% return on general spending on the first $50,000 in purchases per calendar year and 1x thereafter; 2.7% foreign transaction fee (see rates and fees)

- The Amex EveryDay® Preferred Credit Card from American Express: $95 annual fee; 3% return on general spending in billing cycles where you make 30+ purchases; 2.7% foreign transaction fee

The information for the Amex EveryDay Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer baggage insurance

If you're a frequent traveler, you've likely run into this situation at some point (it's the worst). Over the years, airlines have been working on improving the baggage system by introducing live bag tracking. Regardless, it's still a smart idea to have some protections in place, like baggage insurance.

Related: Everything you need to know about Amex's baggage insurance plan

This is why you need to pay attention to the benefits each of your travel rewards cards offers. Nearly all of Amex's premium rewards cards offer baggage insurance. You can check out the full list of cards and details on American Express's website.

The types of losses it covers: You're covered for losses resulting from damaged, stolen or lost baggage, including both carry-on and checked bags.

When you're covered: To be eligible for coverage, you have to travel on a common carrier, which Amex defines as any air, land or water vehicle (other than a personal or rental vehicle) that is licensed to carry passengers for hire and available to the public. Your rental car, as well as taxis and ride-share services such as Uber and Lyft, would be excluded from this protection.

To receive coverage, you also need to pay for the entire fare with an eligible American Express card or by using Membership Rewards points to book tickets through Amex Travel . Trips booked with miles from other sources — even the cobranded Delta SkyMiles cards from Amex — are excluded. Your trip also isn't covered if you used a combination of miles and dollars unless the miles came from a Membership Rewards transfer. This is a welcome change. A few years ago, a TPG staffer found out the hard way that Amex's policy didn't cover frequent flyer mile awards.

Who's covered: This policy covers both primary and additional cardholders, as well as cardmembers' spouses or domestic partners and any dependent children under 23 years old. In addition, travelers must be permanent residents of one of the 50 states, Washington, D.C., Puerto Rico and the U.S. Virgin Islands.

How much it covers: Most American Express credit cards will cover replacement costs for checked bags and their contents up to $500 per person, although so-called "high-risk items" are only covered for a maximum of $250. These items include jewelry, sporting equipment, photographic or electronic equipment, computers and audio/visual equipment. Carry-on bags are covered for up to $1,250, which is good to know since your belongings could be stolen from the overhead bins.

You'll enjoy additional coverage if you use The Platinum Card from American Express, The Business Platinum Card from American Express, the Platinum Card from American Express Exclusively for Mercedes-Benz and Morgan Stanley-branded Platinum Card (but not the Delta SkyMiles® Platinum American Express Card).

The information for the Amex Platinum Mercedes-Benz and Morgan Stanley Platinum card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer medical assistance

One of the lesser known benefits of some of Amex's most premium cards is its Premium Global Assistance. This benefit can quite literally be a lifesaver if you or an immediate family member run into any unexpected issues or accident on your trip. For example, this service can help you arrange emergency medical referrals.

All Amex cards have access to Amex's Global Assist Hotline, but the Premium Global Assist Hotline and higher level of coverage are reserved exclusively for the Amex's premium cards:

- The Platinum Card from American Express

- The Business Platinum Card from American Express

- American Express Corporate Platinum Card

- Hilton Honors Aspire Card from American Express

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Marriott Bonvoy Brilliant® American Express® Card

- American Express Centurion Card

- American Express Business Centurion Card

The information for the Amex Centurion and Amex Business Centurion cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Having a card with trip insurance can save you hundreds of dollars when unexpected hiccups happen in your travel plans. Still, it can be confusing to know what is covered and the right documentation you need to file a claim.

Nothing is worse than getting through an entire claims process only to be denied or have to start over because you don't have the required documentation for the insurance provider. Before you start filing a claim, make sure you have the documents listed above. Keep in mind that a provider may ask for additional documentation related to the incident, so you may have to collect receipts and other forms to help your case.

If you're starting to travel again, it's also a good idea to consider booking refundable travel . Some airlines and hotels even waive cancelation fees and/or change fees for certain fares, which can make last-minute adjustments in the case of emergencies.

Additional reporting by Stella Shon and Madison Blancaflor.

For rates and fees of the Amex Platinum card, please click here. For rates and fees of the Amex Gold card, please click here. For rates and fees of the Amex Business Gold card, please click here. For rates and fees of the Amex Green card, please click here. For rates and fees of the Hilton Aspire card, please click here. For rates and fees of the Amex Blue Business Plus card, click here. For rates and fees of the Marriott Bonvoy Brilliant card, click here. For rates and fees of the Delta SkyMiles Reserve card, please click here. For rates and fees of the Delta SkyMiles Reserve Business card, please click here. For rates and fees of the Delta SkyMiles Platinum card, please click here. For rates and fees of the Amex Business Platinum card, click here.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

The Guide to American Express Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

American Express travel insurance vs. coverage provided by AmEx cards

Complimentary travel insurance provided by amex cards.

Trip cancellation and interruption insurance

Trip delay insurance

Car rental loss and damage insurance

Baggage insurance

Premium global assist.

Global Assist Hotline

Standalone American Express travel insurance plans

Should you use the complimentary benefits or purchase a policy, amex travel insurance recapped.

You can get AmEx travel insurance via your card or as a standalone policy.

AmEx cards typically include coverage for trip delays, interruptions, cancellations, baggage and car rentals.

Coverage tends to be secondary.

Policies vary by card.

American Express has two different types of travel insurance offerings: standalone travel insurance plans that customers can purchase and travel insurance that is included as a complimentary benefit on certain cards.

So if you’re thinking about getting travel insurance before a trip, get familiar with American Express travel insurance benefits that are included on your credit cards. Knowing what protections you already have will prevent you from spending money on a separate policy with benefits that overlap.

A standalone travel insurance policy from American Express may offer more robust coverage, but depending on your needs, the travel insurance perks provided by your AmEx card may be sufficient.

If you primarily want specific coverage for cancellations, delays or rental cars and baggage, it’s likely your card will be enough.

If, however, you’re mainly concerned with emergency health coverage while traveling , you’re better off with a separate medical insurance policy because the benefits provided by credit cards are limited in those areas. You can purchase this from American Express directly or shop around other travel insurance companies .

» Learn more: How to find the best travel insurance

There are six travel insurance benefits offered on many American Express cards:

Trip cancellation and interruption insurance .

Trip delay insurance .

Car rental loss and damage insurance .

Baggage insurance plans .

Premium Global Assist Hotline .

Global Assist Hotline .

Here's a closer look at each.

Trip cancellation will protect you if you need to cancel your trip for a covered reason (more below), and you will be reimbursed for any nonrefundable amounts paid to a travel supplier with your AmEx card. Bookings made with Membership Reward Points are also eligible for reimbursement. Travel suppliers are generally defined as airlines, tour operators, cruise companies or other common carriers.

Trip interruption coverage applies if you experience a covered loss on your way to the point of departure or after departure. AmEx will reimburse you if you miss your flight or incur additional transportation expenses due to the interruption. American Express considers the following to be covered reasons:

Accidental injuries.

Illness (must have proof from doctor).

Inclement weather.

Change in military orders.

Terrorist acts.

Non-postponable jury duty or subpoena by a court.

An event occurring that makes the traveler’s home uninhabitable.

Quarantine imposed by a doctor for medical reasons.

There are many reasons that are specifically called out as not covered (e.g., preexisting conditions, war, self-harm, fraud and more), so we recommend checking the terms of your coverage carefully.

If you want a higher level of coverage for trip cancellation, consider purchasing Cancel For Any Reason (CFAR) travel insurance . CFAR is an optional upgrade available on some standalone travel insurance plans. This supplementary benefit allows you to cancel a trip for any reason and get a partial refund of your nonrefundable deposit.

Alternately, if you want what essentially amounts to CFAR insurance on your flights specifically, purchase your fares through the AmEx Travel portal and tack on Trip Cancel Guard for an extra fee. Trip Cancel Guard guarantees you an up to 75% refund on nonrefundable airfare costs when you cancel at least two days before departure, regardless of why. This isn't as comprehensive as other CFAR policies, but it can add some peace of mind for people who want the cash back (as opposed to a travel credit) for flights they may not take.

AmEx cards with trip cancellation, interruption coverage

The following American Express credit cards offer trip cancellation and trip interruption coverage:

on American Express' website

Additional AmEx cards that offer trip cancellation and interruption coverage include:

The Business Platinum Card® from American Express .

Centurion® Card from American Express.

Business Centurion® Card from American Express.

The Corporate Centurion® Card from American Express.

The Platinum Card® from American Express for Ameriprise Financial.

The American Express Platinum Card® for Schwab.

The Platinum Card® from American Express for Goldman Sachs.

The Platinum Card® from American Express for Morgan Stanley.

Corporate Platinum Card®.

Delta SkyMiles® Reserve Business American Express Card .

Terms apply.

Covered amount

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Coverage is secondary and applies after your primary policy provides reimbursement. Claims must be filed within 60 days. To start a claim, call 844-933-0648.

This benefit will reimburse you for reasonable, additional expenses incurred if a trip is delayed by a certain number of hours. Examples of eligible expenses include meals, lodging, toiletries, medication and other charges that are deemed appropriate by American Express. It makes sense to use your judgment in terms of what will get approved based on your policy's fine print.

Acceptable delays include those that are caused by weather, terrorist actions, carrier equipment failure, or lost/stolen passports or travel documents. There are also plenty of exclusions, such as intentional acts by the traveler.

AmEx cards with trip delay insurance

The reimbursable amount depends on which card you hold.

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Up to $300 per Covered Trip that is delayed for more than 12 hours; and 2 claims per Eligible Card per 12 consecutive month period.

As expected, the more premium travel credit cards offer higher compensation for shorter delays. Trip delay insurance is offered on the following American Express credit cards:

When you decline the collision damage waiver offered by the car rental agency, you will be covered if the car is damaged or stolen through your AmEx Travel Insurance. Depending on the card you have, the coverage is $50,000 or $75,000.

» Learn more: How AmEx car rental insurance works

In addition, the cards offering car rental damage and theft insurance up to of $75,000 also provide secondary benefits:

Accidental death or dismemberment coverage.

Accidental injury coverage.

Car rental personal property coverage.

To qualify, you must decline the personal accident coverage and personal effects insurance provided by your car rental company.

The entire rental must be charged on the American Express credit card to receive coverage for car rental loss and damage. And keep in mind that you do still need liability insurance when making your rental car reservation (you may have this through your personal auto insurance policy), as these credit card-provided coverage options don't include personal liability.

AmEx cards with car rental coverage

American Express lists over 50 different cards on its site that come with one of the two forms of car rental insurance. Cards that link to the Tier 1 policies are the $50,000-coverage cards, and Tier 2 policies are the $75,000 cards.

Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

Car Rental Loss and Damage Insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

The amount reimbursed is calculated as whichever is lowest:

The cost to repair the rental car.

The wholesale book value (minus salvage and depreciation).

The invoice purchase price (minus salvage and depreciation).

Here are some key exclusions to be aware of with this coverage:

These policies don't cover theft or damage that was caused by a driver’s illegal operation of the car, operation under the influence of drugs/alcohol or damage caused by any acts of war.

Policies don't cover drivers not named as "authorized drivers" on your rental agreement.

The benefit only covers car rentals up to 30 consecutive days.

Not all cars are included in the policy. Certain trucks, vans, limousines, motorcycles and campers are excluded from coverage.

Insurance protection doesn't apply in Australia, Italy, New Zealand and any country subject to U.S. sanctions .

You can file a claim online or call toll-free in the U.S. at 800-338-1670. From overseas, call collect 216-617-2500. Your claim must be filed within 30 days of the loss. Additionally, some benefits vary by state, so check the policy for your specific card.

» Learn more: The guide to AmEx Platinum’s rental car insurance

As an American Express cardholder, you are eligible to receive compensation if your luggage is lost or stolen. This benefit is in addition to what you may receive from the carrier. However, the AmEx policy is secondary, which means that it kicks in after the carrier provides any compensation for losses.

AmEx provides this insurance to "covered persons," who are defined as:

The cardmember.

Their spouse or domestic partner.

Their dependent children who are under 23 years old (there are age exceptions for handicap children).

Some business travelers (Tier 2 coverage only).

To qualify, all covered individuals need to be traveling on the same reservation and must be residents of the U.S., Puerto Rico or the U.S. Virgin Islands.

AmEx cards with baggage insurance

Naturally, the higher-end cards offer more protection — but even the basic cards have decent coverage. The compensation limits per person are as follows (note that the maximum payout per covered person for lost luggage is $3,000 on all of these cards).

Below are the limits for cardholders of the The Platinum Card® from American Express , The Business Platinum Card® from American Express , The American Express Platinum Card® for Schwab, The Platinum Card® from American Express for Goldman Sachs, The Platinum Card® from American Express for Morgan Stanley, Hilton Honors American Express Aspire Card , Marriott Bonvoy Brilliant™ American Express® Card, Centurion® Card from American Express and Business Centurion® Card from American Express:

Baggage in-transit to/from common carrier: $3,000.

Carry-on baggage: $3,000.

Checked luggage: $2,000.

Combined maximum: $3,000.

High-end items: $1,000.

Disclosure: Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

And here are the coverage limits for cardholders of the American Express® Gold Card , American Express® Business Gold Card , American Express® Green Card , Business Green Rewards Card from American Express , Hilton Honors American Express Surpass® Card , Marriott Bonvoy™ American Express® Card, Marriott Bonvoy Business® American Express® Card , Delta SkyMiles® Reserve American Express Card , Delta SkyMiles® Reserve Business American Express Card , Delta SkyMiles® Platinum American Express Card , Delta SkyMiles® Platinum Business American Express Card , Delta SkyMiles® Gold American Express Card and Delta SkyMiles® Gold Business American Express Card , The Hilton Honors American Express Business Card :

Baggage in-transit to/from common carrier: $1,250.

Carry-on baggage: $1,250.

Checked luggage: $500.

High-end items: $250.

Disclosure: Baggage Insurance Plan coverage can be in effect for Eligible Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier (e.g. plane, train, ship, or bus) when the entire fare for a Common Carrier Vehicle ticket for the trip (one-way or round-trip) is charged to an eligible Account. Coverage can be provided for up to $1,250 for carry-on Baggage and up to $500 for checked Baggage, in excess of coverage provided by the Common Carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all Covered Persons per Covered Trip.

AmEx also offers limited reimbursement for high-end items (coverage varies by card), such as:

Sports equipment.

Photography or electronic equipment.

Computers and audiovisual equipment.

Wearable technology.

Furs (including items made mostly of fur and those trimmed/lined with fur).

Items made fully or partially of gold, silver or platinum.

Claims must be filed within 30 days of your baggage loss. To file a claim, call 800-645-9700 from the U.S. or collect to 303-273-6498 if overseas. You can also file a claim online.

» Learn more: Compare travel insurance options: airline or credit card?

This benefit helps with events like replacing a lost passport, missing luggage assistance, emergency legal and medical referrals, and in some instances, emergency medical transportation assistance.

The service can also help you figure out important travel-related details like customs information, currency information, travel warnings, tourist office locations, foreign exchange rates, vaccine recommendations for the country you’re visiting, passport/visa requirements and weather forecasts.

AmEx cards with Premium Global Assist

Premium Global Assistance is offered on the following American Express credit cards:

The Platinum Card® from American Express .

Delta SkyMiles® Reserve American Express Card .

Hilton Honors American Express Aspire Card .

Marriott Bonvoy Brilliant™ American Express® Card.

Services provided by Premium Global Assist Hotline

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, the Premium Global Assist Hotline may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility.

The hotline isn’t so much a concierge as a service that provides logistical assistance, which can include the following:

General travel advice

Emergency translation if you need an interpreter to help with legal or medical documents (cost isn't covered).

Lost item search if your belongings are lost while traveling.

Missing luggage assistance if an airline loses your luggage. The hotline will contact your airline on a daily basis on your behalf to help locate your bags.

Passport/credit card assistance if your credit card or passport is lost or stolen.

Urgent message relay if you need to contact a family member and/or friend in the event of an emergency.

Medical assistance

Emergency medical transportation assistance if the cardmember or another covered family member traveling on the same itinerary gets sick or injured and needs medical treatment (there are many conditions for this coverage; review your policy’s fine print).

Physician referral if you need a doctor or dentist (cardmember is responsible for costs).

Repatriation of remains in the event of death.

Financial assistance

Emergency wire service to get help obtaining cash (fees will be reimbursed).

Emergency hotel check in/out if your card has been lost or stolen.

Legal assistance

Bail bond assistance if you need access to an agency that accepts AmEx (cardmember is responsible for paying bail bond fees).

Embassy and consulate referral if you need help finding or accessing local embassies.

English-speaking lawyer referral if you’re traveling and need a list of available attorneys (cardmember is responsible for any legal fees).

To use this benefit, call the Premium Global Assist Hotline toll-free at 800-345-AMEX (2639). You can also call collect at 715-343-7979.

The main difference between the Global Assist Hotline and the Premium version is that some of the services that are fully covered by Premium Global Assist aren't covered in the more basic version (cited examples include emergency medical transportation assistance and repatriation of mortal remains).

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Third-party service costs may be your responsibility.

AmEx cards with Global Assist Hotline access

The Global Assist Hotline is available to holders of the following cards:

American Express® Gold Card .

American Express® Business Gold Card .

American Express® Green Card .

Business Green Rewards Card from American Express .

Delta SkyMiles® Platinum American Express Card .

Delta SkyMiles® Platinum Business American Express Card .

Delta SkyMiles® Gold American Express Card .

Delta SkyMiles® Gold Business American Express Card .

Delta SkyMiles® Blue American Express Card .

Hilton Honors American Express Surpass® Card .

Hilton Honors American Express Card .

The Hilton Honors American Express Business Card .

Marriott Bonvoy™ American Express® Card.

Marriott Bonvoy Business® American Express® Card .

The Amex EveryDay® Preferred Credit Card from American Express .

Amex EveryDay® Credit Card .

Blue Cash Preferred® Card from American Express .

The American Express Blue Business Cash™ Card .

The Blue Business® Plus Credit Card from American Express .

You can call the Global Assist Hotline toll-free at 800-333-AMEX (2639), or collect at 715-343-7977.

If you don’t have any of the credit cards above and are thinking about purchasing a policy from American Express or just simply want to price compare to see if you get better perks by purchasing a policy, you can go to the AmEx travel insurance website and input your trip plans to build a quote. You’ll need to provide your departure and return date, state of residence, age of traveler, number of travelers covered by the policy and the trip cost per traveler. Then, you can select the option of choosing a package or building your own.

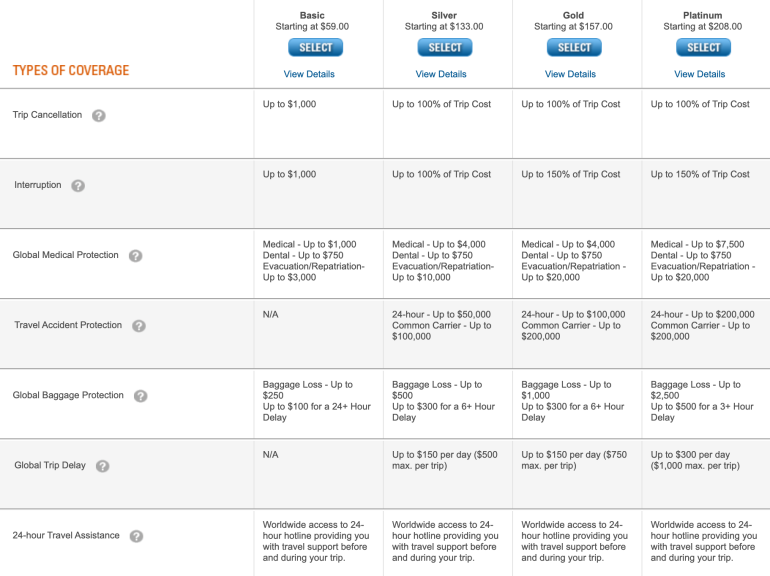

To see which plans are available, we input a sample $3,000, one-week trip by a 35-year-old from South Dakota. Our search result yielded four different plans ranging from $59 for a Basic plan to $208 for a Platinum plan.

Global medical protection (not included on AmEx cards)

Medical protection includes coverage for emergency healthcare and dental costs as well as medical evacuation and repatriation of remains . The limits increase as the plans become more expensive. Although AmEx cards offer an array of travel insurance benefits, medical coverage isn't included. So if medical protection benefits are important to you, a standalone travel insurance policy is what you’ll want to look for.

Travel accident protection (not included on AmEx cards)

Another benefit not included with AmEx cards is travel accident protection. This benefit provides coverage in case of death or dismemberment while traveling . Although this is a topic no one wants to think about, it's good to be familiar with this coverage. While travel accident protection isn’t offered on the Basic plan, all of the higher plans offer it.

Standalone policy benefits that are also included on AmEx cards

These elements of coverage are offered on the AmEx cards mentioned, although in some, the limits may be higher or lower.

Trip cancellation

The Basic plan only covers a trip up to $1,000, however, all the other plans cover 100% of the trip cost. To compare this with the perks included as a benefit on the cards, all AmEx cards that include trip cancellation coverage provide up to $10,000 per covered trip.

Keep in mind that, all the cards included have annual fees and the card with the lowest fee is the Hilton Honors American Express Aspire Card , with a $550 annual fee.

Trip interruption

Trip interruption coverage ranges from $1,000 on a Basic plan to 150% of trip cost on the Gold and Platinum plans. The trip interruption benefit offered by the AmEx cards is included on all the same cards that offer trip cancellation insurance, with the trip interruption limit capped at $10,000 per covered trip.

Global baggage protection

If your luggage is lost or stolen this benefit will provide monetary compensation to reimburse you for your lost items. AmEx cards offer baggage coverage as a complimentary benefit, with the higher-end cards naturally providing higher limits. Interestingly, the cards with the lower annual fees (i.e. Hilton Honors American Express Surpass® Card , annual fee $150 ) have a high limit as well, offering a total combined limit for lost luggage of $3,000, which is higher than the coverage offered by the standalone Platinum plan.

Global trip delay

If your trip is delayed, you’re eligible for reimbursement of any necessary expenses incurred up to a specific limit. The Basic plan doesn’t offer this benefit, but all the other plans do, with the Platinum plan providing up to $300 per day (maximum of $1,000 per trip). This coverage is also included on the higher-end AmEx cards.

AmEx cards offer key travel insurance benefits: trip cancellation and interruption insurance, trip delay insurance, car rental loss and damage insurance, baggage insurance, Premium Global Assist Hotline (or Global Assist Hotline). However, they don't offer any sort of emergency medical coverage. This is pretty typical of travel credit cards, as the travel insurance perks they offer don't provide coverage for emergency health care costs.

If you’re looking for emergency medical coverage, you’ll need to purchase a separate policy, such as the standalone one offered by American Express. The other limits provided in the American Express travel insurance policy are comparable to what you get on the AmEx cards, so it makes sense to shop around to make sure that the benefits you’re paying for are sufficient for your needs.

» Learn more: What to know about American Express Platinum travel insurance

Yes, if you have one of the cards listed above. If you have a credit card that isn’t listed in this guide or the card is no longer available by American Express, call the number on the back of your card for more information. Generally, AmEx offers a number of travel insurance benefits on its credit cards that shouldn't be overlooked.

Yes, but it depends on which card you have. To qualify for reimbursement, the trip cancellation must be for a covered reason. Refer to the section "Trip Cancellation and Interruption Insurance" for a list of cards and explanations of covered reasons.

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a separate travel insurance policy . If you only need emergency medical coverage , there are policies that provide that as well.

Call the number on the back of your card to ask for guidance. Some benefits may require authorization from American Express before coverage kicks in, so make sure you follow all the correct steps for reimbursement.

Refer to the AmEx credit card policy for the specific benefit because it will include instructions for submitting a claim. If you cannot find the policy, you should call the customer service number on the back of your American Express card for more assistance.

Yes. American Express offers travel insurance as a benefit of some of its cards, but it also sells standalone coverage that you can purchase out-of-pocket. The latter tends to be more comprehensive and customizable to your needs.

No, you do not get automatic travel insurance with American Express. It is available as a benefit on certain cards. Refer to your terms and conditions to learn if you are covered.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as repatriation of remains or medical evacuation coverage .

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a

separate travel insurance policy

. If you only need

emergency medical coverage

, there are policies that provide that as well.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as

repatriation of remains or medical evacuation coverage

American Express travel insurance offers a wide array of benefits, especially on its premium cards. Knowing what benefits are available to you is important in the event of unforeseen circumstances. Determine whether an individual policy is a better fit for your risk tolerance than coverage that is included on an eligible card, then go from there.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Underwritten by AMEX Assurance Company.

Baggage insurance plans

Please visit americanexpress.com/benefit sguide for more details.

Premium Global Assist Hotline

If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

Card Members are responsible for the costs charged by third-party service providers.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Claudia Looi

Touring the Top 10 Moscow Metro Stations

By Claudia Looi 2 Comments

Komsomolskaya metro station looks like a museum. It has vaulted ceilings and baroque decor.

Hidden underground, in the heart of Moscow, are historical and architectural treasures of Russia. These are Soviet-era creations – the metro stations of Moscow.

Our guide Maria introduced these elaborate metro stations as “the palaces for the people.” Built between 1937 and 1955, each station holds its own history and stories. Stalin had the idea of building beautiful underground spaces that the masses could enjoy. They would look like museums, art centers, concert halls, palaces and churches. Each would have a different theme. None would be alike.

The two-hour private tour was with a former Intourist tour guide named Maria. Maria lived in Moscow all her life and through the communist era of 60s to 90s. She has been a tour guide for more than 30 years. Being in her 60s, she moved rather quickly for her age. We traveled and crammed with Maria and other Muscovites on the metro to visit 10 different metro stations.

Arrow showing the direction of metro line 1 and 2

Moscow subways are very clean

To Maria, every street, metro and building told a story. I couldn’t keep up with her stories. I don’t remember most of what she said because I was just thrilled being in Moscow. Added to that, she spilled out so many Russian words and names, which to one who can’t read Cyrillic, sounded so foreign and could be easily forgotten.

The metro tour was the first part of our all day tour of Moscow with Maria. Here are the stations we visited:

1. Komsomolskaya Metro Station is the most beautiful of them all. Painted yellow and decorated with chandeliers, gold leaves and semi precious stones, the station looks like a stately museum. And possibly decorated like a palace. I saw Komsomolskaya first, before the rest of the stations upon arrival in Moscow by train from St. Petersburg.

2. Revolution Square Metro Station (Ploshchad Revolyutsii) has marble arches and 72 bronze sculptures designed by Alexey Dushkin. The marble arches are flanked by the bronze sculptures. If you look closely you will see passersby touching the bronze dog's nose. Legend has it that good luck comes to those who touch the dog's nose.

Touch the dog's nose for good luck. At the Revolution Square station

Revolution Square Metro Station

3. Arbatskaya Metro Station served as a shelter during the Soviet-era. It is one of the largest and the deepest metro stations in Moscow.

Arbatskaya Metro Station

4. Biblioteka Imeni Lenina Metro Station was built in 1935 and named after the Russian State Library. It is located near the library and has a big mosaic portrait of Lenin and yellow ceramic tiles on the track walls.

Lenin's portrait at the Biblioteka Imeni Lenina Metro Station

5. Kievskaya Metro Station was one of the first to be completed in Moscow. Named after the capital city of Ukraine by Kiev-born, Nikita Khruschev, Stalin's successor.

Kievskaya Metro Station

6. Novoslobodskaya Metro Station was built in 1952. It has 32 stained glass murals with brass borders.

Novoslobodskaya metro station

7. Kurskaya Metro Station was one of the first few to be built in Moscow in 1938. It has ceiling panels and artwork showing Soviet leadership, Soviet lifestyle and political power. It has a dome with patriotic slogans decorated with red stars representing the Soviet's World War II Hall of Fame. Kurskaya Metro Station is a must-visit station in Moscow.

Ceiling panel and artworks at Kurskaya Metro Station

8. Mayakovskaya Metro Station built in 1938. It was named after Russian poet Vladmir Mayakovsky. This is one of the most beautiful metro stations in the world with 34 mosaics painted by Alexander Deyneka.

Mayakovskaya station

One of the over 30 ceiling mosaics in Mayakovskaya metro station

9. Belorusskaya Metro Station is named after the people of Belarus. In the picture below, there are statues of 3 members of the Partisan Resistance in Belarus during World War II. The statues were sculpted by Sergei Orlov, S. Rabinovich and I. Slonim.

10. Teatralnaya Metro Station (Theatre Metro Station) is located near the Bolshoi Theatre.

Teatralnaya Metro Station decorated with porcelain figures .

Taking the metro's escalator at the end of the tour with Maria the tour guide.

Have you visited the Moscow Metro? Leave your comment below.

January 15, 2017 at 8:17 am

An excellent read! Thanks for much for sharing the Russian metro system with us. We're heading to Moscow in April and exploring the metro stations were on our list and after reading your post, I'm even more excited to go visit them. Thanks again 🙂

December 6, 2017 at 10:45 pm

Hi, do you remember which tour company you contacted for this tour?

Leave a Reply Cancel reply

You must be logged in to post a comment.

Please go to the Instagram Feed settings page to create a feed.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

American Express Travel Insurance Coverage Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3093 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1170 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Why Purchase Travel Insurance

Travel insurance and the covid-19 virus, package policy options, custom select coverage options, pricing by age, cancellations and changes, to other travel insurance companies, to credit card travel insurance, travelinsurance.com, insuremytrip, squaremouth, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

We frequently discuss the travel insurance coverages that are offered complimentary on most credit cards . We do so because these benefits, especially the long list of travel insurance coverages on premium cards, can save you money, offer peace of mind during your travels, and provide help if something goes wrong.

These complimentary coverages are useful and can offer more than adequate coverage for most trips. However, if you’re investing in an expensive trip or 1 that involves multiple travel providers, purchasing a comprehensive travel insurance policy is a prudent move. You’d also want a travel insurance policy if your trip has a complicated itinerary or if you’re anxious about the possibility of having to cancel any portion of the journey.

Additionally, it’s imperative that if you’re worried about having medical coverage while traveling, you’d want to purchase a travel insurance policy that provides medical coverage.

Fortunately, travel insurance is widely available, reasonably affordable, and simple to secure. There are several reputable travel insurance companies , highly-rated by financial rating organizations such as AM Best , that offer nearly endless options from which to choose.

American Express Travel Insurance , underwritten by AMEX Assurance Company, is one of those highly-respected, highly-rated, established companies offering comprehensive travel insurance solutions.

Join us while we check out the types of policies the company offers, any limitations of which to be aware, and additional options for protecting your next trip appropriately.

Travel insurance can help you avoid losing the investment you made when booking your trip, reimburse you for covered expenses should your trip be disrupted due to a covered event, or pay for emergency medical services.

Policies are designed to cover disruption due to the reasons listed in the policy you purchased. These reasons consist of events that are unforeseen and unexpected.

Here are a few situations where travel insurance could cover your loss:

- You or a covered family member become ill and you must cancel your trip. Trip insurance can cover prepaid non-reimbursable expenses.

- You are injured in an accident during your trip and need to be evacuated to a hospital by air ambulance.

- You become ill during your trip and must return home versus continuing on your journey.

- Your flight is delayed or canceled and you must stay at a hotel and incur expenses for lodging and incidentals.

Whether you should purchase travel insurance or not is a personal decision. If losing your trip investment or having to pay for extra expenses if the trip is disrupted makes you uncomfortable or would present a financial burden, then you should purchase a comprehensive travel insurance policy.

If worrying about having to cancel your trip or having it disrupted during your journey is an issue, purchasing a travel insurance policy will definitely deliver some peace of mind, both prior to and during your trip.

For more tips on buying travel insurance in general, you’ll find valuable information in our guide to buying the best travel insurance .

Bottom Line: The longer, more expensive, and more complicated your trip, the greater the need for a comprehensive travel insurance policy.

When you purchase travel insurance and your trip is canceled, you expect to have coverage. However, not all cancellations are covered — only those specifically listed in your policy.

Once COVID-19 was declared a pandemic, it became a known event and therefore is not covered on travel insurance policies. While it’s reasonable to want to cancel your trip due to fear of COVID-19, canceling a trip due to the fear of any illness is not a covered reason on any travel insurance policy.

There is also no coverage for canceling a trip due to a U.S. State Department announcement warning of COVID-19 in a particular area.

In order to have coverage for voluntary trip cancellations, you would need to purchase “Cancel for Any Reason Insurance” (CFAR) . CFAR is not a stand-alone insurance policy — it is an add-on coverage you select when you purchase a travel insurance policy or coverage you may be able to add to a travel insurance policy after purchase, within an initially specified timeframe.

CFAR insurance is expensive, does not cover the entire cost of your trip, and not all companies sell the coverage, including American Express Travel Insurance.

Additionally, there is a small window of time when you are able to purchase the coverage, including during your initial purchase or up to 10 to 21 days after the purchase, depending on the company.

While American Express Travel Insurance does not cover trip cancellation due to fear of contracting COVID-19, there may be coverage in certain circumstances. For example, if you become sick with the virus and have to cancel your trip as a result, you may have coverage under trip cancellation insurance.

Additionally, if you become ill with the virus during your travels, you may have coverage under Travel Medical Protection. Terms and conditions apply.

Bottom Line: Travel insurance does not cover canceled trips due to fear of getting COVID-19 or a government declaration that a specific destination is unsafe. Cancel for Any Reason Insurance must be purchased to cover these voluntary cancellations.

American Express Travel Insurance Options

American Express offers you 2 options when it comes to purchasing travel insurance. You can select a package policy that includes several types of coverages in 1 plan or you can build your own travel insurance plan and select just the coverages that are important to you.

Coverage is worldwide except for where it would violate U.S. trade or economic sanctions. All permanent U.S. residents are eligible to purchase travel insurance with American Express.

American Express Travel Insurance offers 4 levels of travel insurance package policy plans — a Basic Plan, Silver Plan, Gold Plan, and Platinum Plan. Each has its own levels of coverage and associated premium cost.

Let’s take a look at the package policy offerings and pricing. We chose a week-long trip for a 40-year old that cost $3,000. Prices ranged from $59 to $208 to cover the entire trip.

With package policies, you can expect to find the following coverages. The limits of coverage differ based on the policy plan you select.

- Trip Cancellation/Interruption — Receive reimbursement for prepaid non-refundable expenses due to cancellation for covered reasons and additional costs if your trip is disrupted, also for covered reasons.

- Global Medical Protection — Receive worldwide emergency medical and dental coverage for the first 60 days of your trip and access to emergency evacuation/repatriation services.

- Travel Accident Protection — Receive coverage for accidental death/dismemberment from the time you leave on your trip until the time you arrive home.

- Global Baggage Protection — Coverage varies from $250 to $2,500 for lost luggage depending on the level selected. Baggage delay coverage starts from 3- to over 24-hour delays, depending on the policy plan selected.

- Global Trip Delay — Receive up to $300 per day, $1,000 per trip, depending on the level of coverage selected. Coverage is valid for delayed/canceled flights or involuntary-denied boarding.

- 24-Hour Travel Assistance — Have global access to planning and emergency assistance before and during your trip.

Bottom Line: American Express Travel Insurance offers 4 different levels of package policies, each comprising a collection of coverages most travelers look for. The plan you select and the level of coverage limits chosen determine the amount of the premium cost.

If some of the coverages in the package plan are not important to you, you can select only the coverage(s) you want and pay accordingly. Perhaps, for example, you have a need for just medical coverage while traveling abroad. You have the option to select just that coverage.

This example shows the levels of coverage available and the associated premium costs. The Gold Plan selected offers up to $100,000 in emergency medical, up to $750 in emergency dental, and up to $100,000 in emergency evacuation/repatriation. The price of this plan would be $32 for the entire trip.

Bottom Line: Having the option to select only the coverages you want allows you to save money by not paying for coverages you don’t need. This is a key benefit of purchasing travel insurance through American Express Travel Insurance. Few travel insurance companies offer the option to purchase stand-alone travel medical coverage.

Additional Information — American Express Travel Insurance

Like most travel insurance companies, American Express Travel Insurance prices its products within age brackets. The price for coverage is the same for everyone in that specific age bracket.

Based on dozens of quotes obtained, pricing brackets were determined to be as follows:

- Age 17 to 40

- Age 41 to 65

- Age 66 to 70

- Age 70 to 80

- Age 81 or over

Knowing this upfront can help you determine if you’re at the beginning of the highest price bracket or the end. For example, if you are 40 years old, you’re going to pay less than a 41-year-old in the next pricing bracket but the same as a 17-year-old.

If you’re a senior and want to learn more about purchasing travel insurance in your 60s, 70s, and beyond , the tips in our article will help guide you in the right direction.

Bottom Line: Knowing a travel insurance company’s age pricing brackets can help you determine which company offers you the best value for your money.

Here is some information you should know about cancellations and changes to an American Express Travel Insurance policy.

- You can change or modify your policy prior to your trip.

- You can request a full refund within 14 days after receiving your policy documents. Some restrictions vary by state.

- If you have purchased American Express Travel Insurance and your trip was canceled due to COVID-19, you may qualify for a policy refund . Contact AMEX Assurance Company for details at [email protected]. Terms apply.

- Once your trip is completed, you cannot request a refund.

Hot Tip: Due to the overall decrease in travel, many travel insurance companies now allow you to cancel your travel insurance and receive a full refund or extend your policy without extra charges.

How Does American Express Travel Insurance Compare

When comparing other package policies to American Express Travel Insurance, the company’s premiums came up higher overall for this specific trip and traveler (1-week trip, 40-year-old, total value $3,000).

The first policy above with Assistance USA for $77, for example, has coverages similar to the Silver Amex plan which has a premium of $133. The coverage on the $102 Assistance USA plan above compares more with the Amex Gold plan at $157.

Prices will vary considerably based on the types of coverages selected, age, and limits of each coverage. We used policy comparison websites and found similar but not identical policies. With so many different coverage options, it’s difficult to compare apples to apples.

This is a very limited comparison — your results will be different based on your specific details. The most important factors to consider are that you’re purchasing from a highly-rated company, the coverages are a match for your needs, and the premium is one with which you’re comfortable paying.

The travel insurance coverages that comes complimentary on your credit card can serve to provide coverage for some trips. For example, if you book a domestic round-trip flight, a hotel, and a rental car, you may have sufficient coverages on your credit card to cover that trip.

Credit card travel insurance coverage, however, is not a replacement for a comprehensive travel insurance policy , for these reasons:

- Most credit card travel insurance coverage is secondary and in excess of other coverage you might have. You’ll normally be working with 2 (or more) entities to get your claim resolved.

- Credit card travel insurance is administered by a third party, not by the issuing financial institution, thus making the claims process potentially redundant and complicated.

- You generally won’t find medical coverage on a credit card. The Platinum Card ® from American Express and the Chase Sapphire Reserve ® offer emergency medical evacuation and there is a small medical benefit on the Chase Sapphire Reserve card.

- Coverage limits are set on credit card travel insurance. Travel insurance policies can offer higher limit options.

- Credit card travel insurances have requirements such as purchasing the trip with the associated credit card.

- Additional coverages can be added to travel insurance policies such as CFAR insurance, a preexisting conditions waiver, and other benefits not available with credit cards.

Bottom Line: While the travel insurance coverages that come with credit cards may be sufficient to cover a simple trip where there is no large investment at stake, these coverages are by no means a replacement for a comprehensive travel insurance policy.

The Value of Travel Insurance Comparison Sites

Because travel insurance is widely available and quite competitive, you may find drastic differences in the price you’ll pay between companies and policy offerings. Selecting a company is not difficult as there are dozens of reputable, highly financially-rated, established companies, but comparing policies is essential for getting the best value for your money.

One way to easily compare pricing and coverages is to utilize a travel insurance comparison site to narrow down the appropriate options for your situation.

Here are some of the most popular, easy-to-use comparison sites that only feature highly financially-rated travel insurance companies.

- Coverage is available instantly

- The comparison tool is easy to use

- The company has a “best price guarantee”

- Calls are handled by licensed agents

- The website contains educational information for understanding travel insurance coverages and policies

- Features nearly 2 dozen companies

- Compare 90 different policies from over 20 different companies

- Customer service receives high accolades

- Over 86,000 reviews

Bottom Line: Utilizing a travel insurance comparison website can help you quickly narrow your choices to policies that fit your needs and your budget.

There is no doubt that American Express is a financially-stable, established, and well-respected travel insurance company.

One of the company’s strengths is that it offers the consumer the ability to purchase needed coverages separately , such as medical insurance for an international trip. The premiums for such coverage are also very competitively priced. This could be a huge plus if you are not interested in duplicating credit card travel insurance coverages or in having just secondary or excess coverage.

One downside, especially in today’s environment, is that American Express Travel Insurance does not sell CFAR insurance. If this is important to you, you should attempt to find the coverage elsewhere by using comparison sites.

Another downside that may or may not be important is that American Express Travel Insurance does not sell annual or multi-trip policies. You must purchase a new policy for each individual trip.

Also, like several other travel insurance companies, high-risk adventurous activities may not be covered with American Express Travel Insurance. You might look to a company specializing in insuring these activities such as World Nomads .

If you want to make sure you’re purchasing from an established company and have specific coverages you’re more interested in than others, American Express Travel Insurance is a solid decision . For package travel insurance policies, you might be able to realize modest savings by shopping around, but you won’t go wrong with the company selection of choosing American Express Travel Insurance.