Travel Insurance. Stay worry-free at sea.

There’s nothing like a cruise to feed the soul and broaden the mind. And nothing like the unexpected to put a dampener on your plans.

With over 30 years’ experience in travel insurance, covering more than 3.8 million journeys every year, cover-more is the perfect travel (and cruising) companion. cover-more helps you explore the world with confidence by ensuring you are covered for general medical expenses overseas, existing medical conditions, hospitalisation and medical evacuations~., if something goes wrong, you want expert help fast so you can keep travelling., travel insurance for all your cruising needs, budget plan.

- Our most affordable insurance especially for cruises

- On-trip cover if you’re diagnosed with COVID-19*

- Up to $5 million of emergency overseas medical expenses~*

- Missed cruise departure cover

- Amendment or cancellation costs*

Comprehensive Plan

- On-trip cover if you’re diagnosed with COVID-19 (including cabin confinement)*

- Up to $10 million of overseas emergency medical expenses~*

- Missed cruise departure, port and connections cover*

- Up to $8,000 luggage cover⬩

- Amendment or cancellation costs^

- Existing medical conditions cover available.

(To ensure your Existing Medical Condition is covered, read page 21 of the PDS )

Premium Plan

- Pre-trip cover if you’re diagnosed with COVID-19#*

- $Unlimited overseas emergency medical expenses~*

- Up to $15,000 luggage cover⬩

- Amendment or cancellation costs^*

~Cover will not exceed 12 months from onset of the illness, condition or injury. To ensure your Existing Medical Condition is covered, read page 21 of the PDS . ^Cover chosen applies per policy. Read page 14 of the PDS for more information. *Sub-limits apply. Read the PDS for more information. #If you bought the policy within the 21 days before your scheduled trip departure date, we will only cover the travel costs that you paid for in the 48 hour period before buying your policy and after buying this policy. ⬩ Sub-limits and item limits apply. You may wish to increase these items limits, read the PDS for more information.

Doing more than relaxing?

If you plan on participating in sports such as scuba diving or parasailing, a premium may apply..

Special Note For New Caledonia

Guests traveling on a South Pacific cruise that calls on New Caledonia must hold a valid international travel insurance policy and present printed proof of this travel insurance at time of check-in. Guests may also be requested to present it during the cruise. Any guest who is unable to provide proof of holding suitable travel insurance will be denied boarding.

Frequently Asked Questions

Not all domestic cruise ships have access to a Medicare accessible doctor on board. If you need to see a GP while on a domestic cruise, the cost won’t be covered by Medicare in these cases and – you may have to pay for it yourself in full.

At Cover-More, we can provide cover for these expenses when you tell us you are travelling on a cruise for two or more nights (except for river cruises within Australia). An additional premium will need to be paid and cruise cover benefits will then be available on your policy.

When generating a Cover-More travel insurance quote – the first step in buying our cover – you will be asked if you are travelling on a cruise for two or more nights (except for river cruises in Australia). An additional premium will be applied to your policy and the cruise cover benefits will be available once the premium is paid and the Certificate of Insurance issued.

To buy cover for a domestic cruise in Australia, select “Domestic Cruise” as the destination in the quote box, and answer the cruise question when prompted. To buy cover for an international cruise, select the country or region or “Anywhere in the World” as your destination, and answer the cruise question when prompted. Before protecting your trip with our Cover-More cruise insurance benefits, please read the PDS to ensure our product is right for you.

No. For cruise cover to apply, your travel insurance policy must include our Cruise Cover and must be purchased before you leave home. This also includes before you catch any flights or transportation required to get to your departing port.

Our Cruise Cover benefit includes cover for onboard emergency medical and dental expenses and ship-to-shore medical expenses incurred by travellers on multi-night cruises. If you fall ill with COVID-19 while on board a cruise, we can help you financially and provide emergency assistance support if required.

For more information on what is and isn’t covered regarding COVID-19 while you’re on a multi-night cruise, please read the PDS . For Cover-More’s COVID-19 FAQs you can read here .

If for some reason you change your mind about your insurance purchase, Cover-More policies give you peace of mind by offering a ‘cooling off period’ of 21 days. During this time, you can obtain a full refund if you haven’t made a claim and your departure date has not passed. If you need to cancel your policy, please phone 1300 72 88 22

Your claim will be managed by Cover-More. You can make a claim online or call Cover-More, 8am-5pm Mon – Fri and 9am-4pm Sat (Sydney/Melbourne time)

Within Australia: Call Cover-More on 1300 467 951

From overseas: Call Cover-More on +612 8907 5060 (call charges may apply)

For more information, please see the Department of Foreign Affairs website at smartraveller.gov.au.

Disclosure: Carnival Cruise Line has a referral arrangement with Cover-More and may receive a fee or commission if you choose to purchase an insurance product from Cover-More. Limits, sub-limits, conditions and exclusions apply. Insurance administered by Cover-More Insurance Services Pty Ltd (ABN 95 003 114 145, AFSL 241713) on behalf of the product issuer, Zurich Australian Insurance Limited [ABN 13 000 296 640, AFSL 232507). Any advice is general advice only. Please consider your financial situation, needs and objectives and read the Combined FSG/PDS before deciding to buy this insurance. For information on the Target Market and Target Market Determination for these products, contact Cover-More on 1300 77 88 22

With over 30 years’ experience in travel insurance, covering more than 3.8 million journeys every year, Cover-More is the perfect travel (and cruising) companion.

Travel Insurance

An illness, an accident or an unexpected situation can arise before or during any type of vacation. Such an event might cause you to cut short your cruise or cause your trip to be canceled altogether. Unfortunately, most cruise lines impose penalties for canceling a cruise, up to and including loss of the entire cruise price.

Because a cruise is a significant investment, most cruise lines offer some form of insurance to protect their passengers from financial loss in the event of an emergency. Details and prices vary from cruise line to cruise line, as do coverage limits and exclusions.

If you decide to purchase insurance, you will have two options, to go with the cruise line's plan or to use our independent insurance provider, Generali Global Assistance. Use the summaries below to compare policies and prices.

Generali can provide insurance coverage to all customers, regardless of their country of citizenship, except residents of the province of Quebec, Canada.

For more information or a complete copy of a policy, ask your Vacations To Go cruise counselor.

Independent Insurance Coverage

Generali Global Assistance

Cruise Line Coverage

Cruise travel insurance: What it covers and why you need it

What does cruise travel insurance cover? And does it pay to buy cruise travel insurance?

The answer is not always clear-cut, as we'll discuss in this guide. But consider this: It's not always smooth seas when it comes to cruising. Even the best-laid plans for a cruise vacation can sometimes be thrown off course by an unexpected event.

You might need to cancel a cruise in advance due to the sudden onset of an illness, such as COVID-19 or the flu. Or, maybe you fall ill during the cruise and need emergency medical attention. Maybe your flight to your ship gets canceled, and you miss the vessel's departure. Or your ship is late arriving in port at the end of a voyage, and you miss your flight home.

In all of these situations, you might benefit from having cruise travel insurance — keyword "might."

Cruise insurance policies vary widely, and not every policy covers every type of mishap. That's why it always pays to read the fine print in a travel insurance policy before you purchase it to know what you're getting in advance.

It's also why you should read this introduction to everything you need to know about cruise insurance. It has many details, but the next time something unexpected happens on your cruise vacation, you'll be glad to be educated and covered by a comprehensive travel insurance policy.

What does travel insurance cover when you cruise?

The typical cruise insurance policy covers a wide range of circumstances that can go wrong in conjunction with a vacation at sea — both before and during the sailing.

For starters, policies often will reimburse you for the cost of canceling a cruise due to a last-minute crisis. They will also often cover costs related to an interruption of a cruise (maybe your ship breaks down, requiring you to fly home mid-voyage ). These two elements are known as trip-cancellation and trip-interruption insurance, and they are bundled into a typical travel insurance policy.

Some policies will also cover out-of-pocket costs related to a flight delay or cancellation that results in you missing your cruise departure (for instance, the cost of catching up to the ship at its next port). Expenses related to baggage delays and loss are often covered as well.

But perhaps most importantly, many travel insurance policies will cover medical expenses you incur while on a cruise. Some will even cover the cost of evacuating from a foreign destination if you are in the midst of a medical crisis.

Travel insurance giant Allianz Global Assistance reports that 53% of all cruise-related "billing reasons" for claims are because of illness for the insured person, while 14% are for an injury. Another 8% are for the illness of a family member, 4% for the death of a family member and 4% for the illness of a traveling companion, among other reasons.

Those percentages include illness and accidents that happen to cruisers just before a trip, making travel impossible. But, in many cases, such claims result from illness and injuries that occur during voyages.

"People often take risks during vacation that they might not take back home, whether riding a jet ski, zipping around on a motorized scooter in a city they don't know well or hiking unfamiliar terrain," James Page, senior vice president and chief administration officer of AIG Travel, told TPG .

Some policies also cover the financial default of a travel provider. In such cases, if your cruise line goes out of business before you sail, you could get all — or at least some — of your money back.

Cruise travel insurance policies don't cover everything. For instance, standard travel insurers generally will not reimburse you for the cost of a cruise you cancel due to worries about an outbreak of an illness. That's true even if a U.S. government agency such as the U.S. Centers for Disease Control and Prevention issues a recommendation that you don't cruise due to an illness outbreak, as it did during the COVID-19 pandemic .

If you want the ultimate flexibility to cancel for such a reason or any other, you'll want to look into a more expensive cancel for any reason travel insurance upgrade.

Related: Avoiding outbreaks isn't covered by most travel insurance policies

Where to find a cruise travel insurance policy

You can buy a travel insurance policy directly from your cruise line when booking your trip or through your travel agent (if you're using one, which often is a good idea when booking a cruise). You also can go directly to a third-party travel insurance provider or a travel-insurance aggregator site, such as InsureMyTrip or TravelInsurance . Your credit card might even give you some travel protections.

Here's what you need to know about each type of cruise travel insurance.

Third-party insurance companies

Third-party insurance companies that specialize in writing travel insurance include AIG Travel, Allianz Travel Insurance, Travelex Insurance and American Express Travel Insurance.

One reason to use a travel agent or a travel aggregator: They can help you find a policy that offers added coverage specific to cruising.

Related: The Points Guy's guide to the best travel insurance companies

"Many plans now offer benefits that will specifically appeal to cruise travelers, such as missed connection, missed port-of-call and cruise disablement coverage," Stan Sandberg, cofounder of TravelInsurance.com, said.

Missed connection coverage reimburses cruisers for a set dollar amount if they need to rebook travel to catch up with their cruise at the next port. Missed port-of-call coverage pays a benefit if the cruise ship misses a scheduled port of call due to weather, a natural disaster or a mechanical breakdown.

Cruise disablement coverage pays a benefit if the traveler is confined on a ship for more than five hours without power, food, water or restrooms.

As noted, policies vary widely. It's a good idea to compare plans and make sure the one you buy has the elements that are most important to you. One size doesn't fit all.

Credit cards with travel benefits

Some premium credit cards offer valuable travel protections comparable to what you might get from a standard travel insurance plan. For example, the travel insurance provided when you pay for travel with select cards can reimburse you for expenses if your baggage is damaged, you're stranded overnight due to a flight delay or cancellation, or you have to return home to handle a family medical emergency.

The Chase Sapphire Reserve card, for example, offers trip delay reimbursement, trip cancellation and interruption insurance, emergency medical coverage and even medical evacuation coverage , among other benefits. And yes, cruise lines are considered common carriers just like airlines.

If you're planning to rely on a card like the Chase Sapphire Reserve or The Platinum Card® from American Express * (among others) for travel insurance, just be sure to recheck your card's benefits and limits carefully against regular travel insurance. You must pay for at least part — and sometimes all — of the trip with that credit card to take advantage of its protections.

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

Related: The best credit cards for booking cruises

Find out if your credit card protection includes travel accident insurance or covers preexisting medical conditions, and figure out when it will pay you back. Other questions to ask: What are the coverage limits? Will you have to pay for a foreign hospital bill upfront and then seek reimbursement later?

Cruise lines

Cruise lines often ask consumers booking a cruise to buy the line's own protection at the time of purchase. If specifics about the coverage are lacking, always ask the line for details in advance, review coverage perks and limits; then, compare those to one or two independent travel insurance policies or your credit card's insurance benefits.

Related: A beginners guide to picking a cruise line

Cruise line travel insurance policies sometimes have quirks. Many cruise companies will only offer a travel voucher or credit for future use in the event of a covered cancellation, not an outright refund.

Also, financial default may not be a covered event in a cruise line-sold policy, but it's typically covered with plans from third-party travel insurance companies.

Cruise line policies also can be more restrictive.

"Cruise line insurance seems to have become better and has more widespread coverage than in the past, but it typically won't cover air or pre- and post-travel [arrangements] unless those elements are purchased through [the line]," said Debra Kerper, a Cruise Planners travel adviser from Carrollton, Texas, who books travel and sells private insurance. "This is when private insurance coverage becomes so very important."

How much does cruise insurance cost?

Expect to pay anywhere from 4% to 8% of your total prepaid, nonrefundable trip expenses for a travel insurance policy. That's a wide range, we know, but it reflects the wide range of products out there.

You'll also find some basic plans that cost even less than 4% of your trip expenses, while some super-premium plans that cover just about any conceivable issue can cost as much as 12% of your trip expenses.

Related: What's included in your cruise fare?

All reputable insurance companies will offer a "free-look period" during which you can receive a 100% refund on your premium. This allows you to review the policy you've selected and return it for any reason within the period allotted — usually for a small administration fee of less than $10.

Under normal circumstances, you don't need to purchase a so-called "cancel for any reason" add-on to your cruise travel insurance policy unless you really need the flexibility. The upgrades are significantly more expensive.

You can receive a quote and purchase a policy online in minutes with any credit card. Although you may think travel insurance should code as "travel" when paid on a credit card and thus be eligible for bonus points on certain cards, that isn't always the case. Your points earnings will depend on the individual underwriter's merchant code. When in doubt, expect the purchase to fall under the insurance category for earnings.

Should I buy travel insurance for a cruise?

Whether you buy travel insurance is a personal decision that will depend on many factors. Would you be willing to absorb the loss of canceling a cruise on short notice due to an illness or accident? Could you afford an evacuation flight from a far-off port if you suddenly became seriously ill? Only you can answer those sorts of questions.

Here are some things to consider as you make that decision.

You might not be covered by regular medical insurance while cruising

If you're a U.S. citizen traveling internationally (which will be the case for most cruises), you may find that most private medical insurance plans in the U.S. won't cover you.

Additionally, Original Medicare only covers people traveling outside U.S. borders in limited circumstances.

While certain Medicare Supplement Plans do have some foreign emergency medical benefits, not all do. Be sure to talk to your Medical Supplemental Plan provider to see if you're covered, what's covered, what the limits are and how the bill is paid.

Also note that, in some countries (particularly those in Central and South America), travelers may not be discharged from a hospital until their bill is paid in full.

Related: Trip wrecked: 7 ways to prepare for any kind of travel disaster

Plus, if you have a medical incident overseas, you could find yourself stuck in a shared hospital room without air conditioning or a private bathroom. The level of care may not be what you expect.

"For people traveling internationally, it's crucial to know beforehand where to go for any treatment … and how they're going to pay for that treatment," Page said.

Getting evacuated for a medical condition is expensive

Most airlines won't accept seriously ill passengers, those carrying bulky medical equipment or those requiring a full medical team.

Even a low-cost weekend getaway on a cruise to the Bahamas out of Miami can turn costly if you suffer a serious accident or illness requiring medical treatment or an emergency medical evacuation.

Related: Do cruise ships have doctors, nurses, medical centers or hospitals?

Being flown back to the U.S. from a far-flung overseas location in a private, medically equipped aircraft, with a professional medical team on board, can run between $70,000 and $180,000, according to Mike Hallman, president and CEO of Medjet, a medical transport membership company.

"Domestic transports, which we cover as well, can cost upwards of $30,000," Hallman said.

Without proof of medical evacuation coverage, foreign providers will also want that money upfront. Hallman said that regular travel insurance will typically get you to an acceptable overseas hospital and even to a higher-level care facility if "medically necessary." Alternatively, medical evacuation coverage means you can fly home to your own hospital, doctors and family — without claim forms, cost caps on transports or surprise bills.

The tandem approach — buying both travel insurance and a separate medevac transport membership — is a good option, Hallman said.

"We always recommend travel insurance, as it covers trip interruption, which is important, as well as medical coverage for the hospital and treatment costs," he said. "We pick up where they leave off."

You can't predict the weather

Cruising is a great way to explore multiple destinations in one trip. But it's good to remember that unexpected delays, interruptions or cancellations due to weather can happen during cruises, particularly during hurricane seasons in places such as the Caribbean and Asia (where hurricanes are called typhoons).

During a typical hurricane season (June 1 to Nov. 30), Allianz pays about 6,000 claims from customers whose travel plans in the Caribbean, Gulf of Mexico and southeastern U.S. are affected by the storms, according to a spokesperson for Allianz Global Assistance USA.

If you're hoping to insure against a storm-related disaster, it's good to buy travel insurance as early as possible. Once a storm or hurricane is named, it's too late to buy travel insurance to cover it.

Of course, cruise lines will move ships away from a weather threat. When the port lineup is adjusted or the cruise shortened, the company will offer the guest an onboard credit, onboard gift or future cruise credit rather than any refund. It depends on the circumstances of that specific voyage. You won't be able to make a claim on your cruise travel insurance policy just for a minor itinerary change .

Related: Everything you need to know about cruising during hurricane season

Costs can mount quickly when things go wrong

Even if the cruise line does provide a full or partial refund or cruise credit for an itinerary change or some other interruption, travelers could have to swallow the cost of other travel elements not purchased through the line. That could include nonrefundable flights , prepaid resort or hotel nights, nonrefundable tour fees and more.

Travel insurance can cover those, plus help with flight delays or cancellations, baggage loss or theft.

If a winter storm causes you to miss your flight to where the ship is boarding , "travel insurance could help you get to the next port to join the cruise, so you don't miss your entire trip," Page said.

In fact, 13% of "billing reasons" for claims to Allianz are for common carrier delays (such as a flight delay), while weather and natural disaster-related claims account for about 3%.

The government probably won't bail you out

While cruise ships have medical facilities, they're usually not equipped to treat serious illnesses. If you experience a serious medical problem on a vessel, you may have to get off the ship in a foreign port to seek treatment at a hospital. In such a case, if you don't have medical evacuation insurance, you may then find yourself stranded in that port awaiting a medical evacuation.

Don't expect Uncle Sam to step in and help foot the bill.

The U.S. Department of State's Bureau of Consular Affairs clearly states the importance of buying travel insurance.

"The U.S. government does not provide medical insurance for U.S. citizens overseas," the bureau says on the website. "We do not pay medical bills. You should purchase insurance before you travel."

You may need more assistance than you think

If you're injured or become severely ill during a cruise, especially in a foreign country, it may be difficult to access help without the assistance of trained professionals that comes with many insurance plans.

Many travel insurance companies provide around-the-clock assistance with locating overseas clinics and pharmacies, getting to a doctor or hospital, refilling lost or depleted prescriptions, assisting with up-front payments to hospitals, and arranging flight changes so you can get home.

Travel insurance companies also can arrange for an air ambulance, a nurse escort, oxygen and a lie-flat seat on a flight home if your medical condition warrants it.

You want to be careful if you have preexisting conditions

When you cruise, it's important to be fully covered, which means having comprehensive medical coverage that includes any preexisting conditions. Otherwise, if you head into a doctor's office overseas, have any tests completed, or visit an urgent care center or emergency room, you might not be covered.

Here, timing is extremely important. Cruisers seeking coverage of preexisting conditions, as well as cancel for any reason insurance, generally must book within seven to 21 days of the first payment they make for a trip. The timing varies by insurer.

Bottom line

Cruise insurance isn't for every traveler — or even for every sailing. It's not inexpensive. However, it can bring a lot of peace of mind if you're about to head out to sea. Do your homework, compare plans and always assess the risks.

Planning a cruise? Start with these stories:

- The 5 most desirable cabin locations on any cruise ship

- The 8 worst cabin locations on any cruise ship

- A quick guide to the most popular cruise lines

- 21 tips and tricks that will make your cruise go smoothly

- Top ways cruisers waste money

- 12 best cruises for people who never want to grow up

- The ultimate guide to what to pack for a cruise

Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

P&O Cruises Travel Insurance - 2024 Review

P&o cruises travel insurance.

- Insurance Not Provided to US Citizens – Travelers Can Shop The Open Marketplace

- Insurance Suggestions Not Offered

Sharing is caring!

P&o cruises - background.

P&O Cruises is the oldest cruise line in the world, having operated the world's first passenger cruise ship in 1837. P&O began life as " The Peninsular Steam Navigation Company ", but in 1840 the word “ Oriental " was added to reflect the company's expanding services eastwards beyond the Iberian Peninsula to Egypt and the Orient.

P&O Cruises – Carnival Corporation

P&O Cruises was demerged from the P&O Group (which operates container and channel ferry services) in 2000 and became a subsidiary of P&O Princess Cruises. Just three years later, in 2003, P&O Princess Cruises merged with Carnival Cruises to form the current company.

P&O Cruises – The Passenger Experience

P&O strives to give its passenger a memorable and stress-free holiday. From the moment you drive into either the Ocean Cruise Terminal or the original Mayflower Cruise Terminal in Southampton, your cases and car are whipped away by smiling, cheerful staff. The entire P&O ethos centers on the passenger experience, and it is something P&O is very good at. However, before you arrive in Southampton to take your cruise, you need to have booked the cruise itself and your cruise travel insurance.

P&O Cruises Website

The P&O Cruises website is extremely easy to navigate. Simply select a destination, months to travel, cruise duration and ship. The system will eliminate any dates that are unavailable for that destination which makes selection easy.

Once you have the trip details selected, the system will show you the pricing per travelers. However, you’ll need to call P&O to book the cruise – you cannot book online.

P&O Cruises does not sell their own insurance. They have partnered with Holiday Extras to provide travel insurance to their Non-US guests. Once you go to the Holiday Extras website and put in general information on your trip, you’re presented with several options for insurance (again in British pounds):

When you select one of the three available options, you then answer a series of questions about pre-existing conditions. Finally, you arrive at the declaration page (see below) prior to paying for the insurance. It’s here that the insurance spells out that it is only available to UK residents, and you must have a UK General Practitioner and the trip must start and end in the UK.

To be eligible for cover under this Policy, you confirm and agree that:

- You are a resident and must have an address in the United Kingdom, the Channel Islands or the Isle of Man and lived here for at least 6 months in the last 12 months.

- You are 18 years of age or older at the date of buying this policy.

- You are registered with a General Practitioner in the United Kingdom, the Channel Islands or the Isle of Man.

- Your trip must start and end in the UK and not have already started your trip.

Since US residents cannot purchase travel insurance from Holiday Extras, we’ll need to look elsewhere for travel insurance.

Let’s book a cruise on P&O and then shop for insurance on the open marketplace.

Our Cruise – Northern Europe

Our sample couple, both aged 62, chose a 8-night cruise from April 1 – April 8 to several northern European countries. The cruise starts in Southampton and travels through Germany, Netherlands, and Belgium before returning to Southampton.

Total cost for both travelers after converting to US dollars is $1413.94.

Alternatives to Holiday Extras Travel Insurance

As US residents, we’ll have to find alternate insurance. We used the same trip information to create a quote at CruiseInsurance101 and our system provided 25 results for a variety of plans and insurers.

CruiseInsurance101 consistently recommends carrying at least $100k Medical Insurance, $250k Medical Evacuation, and a Pre-Existing Medical Condition Waiver when traveling outside the US.

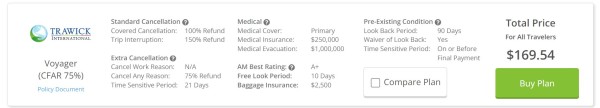

For this trip, the Trawick Voyager plan is the least expensive policy that meets the recommended coverage amounts, at a total of $99.74 for both travelers combined. It provides $250,000 of medical coverage and $1 million of medical evacuation coverage. Pre-existing medical conditions will be waived if the policy is purchased on or before the final trip payment date.

Next, we looked for the least expensive Cancel For Any Reason (CFAR) plan that meets our minimum recommended coverage, which is the Trawick Voyager (CFAR 75%) for $169.64. This is the same plan as the standard Trawick Voyager but includes the added benefit of allowing you to cancel your trip for any reason not otherwise covered by the policy and receive a 75% reimbursement of your trip cost.

Price and Value

CruiseInsurance101 recommends carrying at least $100k in Medical Insurance when traveling outside the country. Both Trawick Voyager policies provide $250k in medical coverage, so you can feel assured you will have sufficient medical coverage should you need it.

We recommend at least $250k of Medical Evacuation coverage when traveling to Europe. For trips farther afield, we recommend at least $500k of Medical Evacuation coverage. The Trawick Voyager provides $1 million of Medical Evacuation coverage so you’ll be well covered in a medical emergency that requires evacuation to a hospital and back to the US.

If needed, CruiseInsurance101 also recommends getting a policy that provides a waiver for Pre-Existing Medical Conditions. The Trawick Voyager policies provides coverage for Pre-Existing Conditions, if purchased on or before the final trip payment date.

Next, we’ll discuss other important benefits in travel insurance.

Trip Cancellation

Sometimes unexpected events interfere with your travel plans, forcing you to cancel your trip. Trip Cancellation reimburses you for your pre-paid and non-refundable trip costs if you must cancel your trip for a covered reason.

Most plans available from CruiseInsurance101 cover cancellation for:

- Unforeseen illness, accidental injury, or death (traveler, traveling companion, family member, or host)

- Inclement weather, strike, or mechanical delay of a common carrier

- Financial default of a common carrier

- Traffic accident en route to the destination

- Hijacking, quarantine, jury duty, subpoena

- Fire, flood, burglary, or natural disaster

- Documented theft of passport or visas

- Mandatory evacuation

- Called to military duty or revocation of leave

- Involuntary job termination or lay off

Hopefully, none of these things happen, and you can leave for your vacation without a hitch.

Cancel For Any Reason (CFAR)

Cancel For Any Reason policies provide peace of mind against any uncertainty about traveling. This coverage helps you recover 50% - 75% (depending on policy) of your trip cost if you must cancel your travel plans for any reason not covered by the policy. Without it, you would lose all your pre-paid and non-refundable trip costs for a non-covered cancellation.

Suppose your main concern for cancellation is uncertainty about Covid rates at your destination. You may worry that you shouldn’t travel on your scheduled trip if your destination country sees a large spike in Covid rates. Even if your doctor advises against traveling, Trip Cancellation does not cover cancellation due to fear of traveling because of Covid concerns.

Travel insurance with a Cancel For Any Reason benefit is the only option. CruiseInsurance101 offers a variety of Cancel For Any Reason options for residents in most states.

There are some rules to keep in mind when purchasing a Cancel For Any Reason plan:

- You must insure 100% of your pre-paid and non-refundable trip costs

- You must purchase the policy within the Time Sensitive Period (10-21 days of the date you placed your initial payment or deposit towards the trip) and insure subsequent payments

- You must cancel your trip no later than 48 hours prior to departure

The Trawick Voyager (CFAR 75%) will reimburse 75% of your trip cost should you cancel for a reason not listed in the policy.

Trip Interruption

While Trip Cancellation covers you before you depart, Trip Interruption covers you once you leave for your trip. It reimburses you for the unused portion of your trip costs and the cost to catch up to your trip, if you’re able, or return home early.

Trip Interruptions covers circumstances like Trip Cancellation. For example, suppose you fall and break your leg during one of your excursions. You certainly will not be able to continue the rest of your vacation.

Once the local hospital takes care of you, the physician will likely recommend you return home to recover. Trip Interruption reimburses you for the portion of the trip you did not use and covers the cost to travel home early

Travel insurance also covers if your Trip Interruption is temporary and resolves before the end of your trip, such as for a quarantine due to Covid or similar. You can claim the unused portion of the journey while hospitalized or quarantined and the transportation costs to rejoin the trip.

Trip Interruption reimbursement ranges between 100-150% of the insured trip cost. Any amount above 100% helps cover transportation expenses. In this case, the Trawick Voyager policy provides a 150% benefit.

Pre-Existing Medical Conditions

Travel insurance does not pay benefits for Pre-Existing Conditions . It’s a standard, industry-wide exclusion. However, many policies offer a waiver that adds coverage for Pre-Existing Conditions back into the policy. These policies typically must be purchased within 14-21 days (depending on policy) of the date you place your initial payment or deposit towards the trip. This timeframe is called the Time Sensitive Period.

The Trawick Voyager will provide coverage for Pre-Existing Conditions if the policy is purchased on or before the final trip payment date. Several other terms must also be met:

- you are medically able to travel at the time the coverage is purchased; and - you insure 100% of your prepaid Trip costs that are subject to cancellation penalties or restrictions.

Medical Insurance If Sick or Injured Traveling

Travel Medical Insurance pays for medical treatment if you are injured or ill during your planned vacation. Even healthy people can be victims of an accident that requires costly care. A broken leg, a car accident, or even severe food poisoning can land you in the hospital.

If you plan overseas travel, it’s important to keep in mind most health insurance plans do not pay for medical treatment outside of the US. Even if your health insurance does provide some coverage while you travel, it may restrict the nature of care and provider.

Also, Medicare does not pay for treatment outside the US. While some Medicare supplements cover up to $50k for treatment, it is a lifetime limit and for emergencies only. In addition, you must pay a deductible and 20% copay.

In addition, you can’t count on universal health care in foreign countries to pay for your treatment. Citizens pay taxes for this privilege. If you are not a citizen of that country, you will pay full price for treatment at a private hospital, which can cost $3,000-$4,000 per day.

Consequently, we recommend that you travel with at least $100k Emergency Medical Insurance while traveling abroad .

Trawick Voyager provides $250k for Medical Insurance.

Emergency Medical Evacuation Brings You Home

Emergency Medical Evacuation pays for transportation to a medical facility capable of treating your condition. Typically, Emergency Medical Evacuation is uncomplicated, like a ground ambulance to the nearest hospital. However, Emergency Medical Evacuation can include a costly airlift by medical personnel. If, after your condition is stabilized, it’s determined you need further treatment, Emergency Medical Evacuation transports you to a hospital near your home so you can recover. When traveling outside the US, CruiseInsurance101 always recommends a policy that includes at least $250k of Emergency Medical Evacuation . This ensures you have enough financial protection, especially in a critical situation.

The Trawick Voyager exceeds this recommendation and provide $1 million of Medical Evacuation coverage.

When shopping for travel insurance, it’s important to make sure the policy has sufficient Medical and Medical Evacuation benefits for overseas expeditions and includes coverage for Pre-Existing Conditions. Though we cannot get P&O’s recommended insurance in the United States, we were able to find excellent policies at competitive prices through CruiseInsurance101 . As such, we always recommend comparison shopping to find the best value for your money.

Will I Get a Better Deal Going Directly Through the Insurer?

No. Many don’t realize that they won’t find the same travel insurance plans available at a better price directly from the insurer. Travel insurance rates are state-regulated, and no one can change those rates.

Travelers can find the best plan to fit their travel needs by using a comparison site like CruiseInsurance101 to shop their options and find the appropriate coverage.

Next time you cruise, run a comparison quote with us and see how much money you can save on a similar or better policy. You can even run a sample quote before you book your cruise.

Questions? We would love to hear from you. Please stop by and chat with us, send an email , or give us a call at +1(786) 751-2984 .

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

monica munoz

Excellent customer service

Spoke to Melanie. Excellent customer service, she was very thorough, answered all my questions, and was very nice.

A number of policies to choose from

A number of policies to choose from. Fast response. Reasonable price.

Perfect plan to fit a seniors budget

Perfect plan to fit a seniors budget, with adequate coverage,with great customer service.

P&O Insurance

P&O Cruises strongly recommends all passengers to purchase travel insurance for their cruise. Details about the Go Plan from Generali Global Assistance are below.

Troubles such as illness, injury of a family member, adverse weather causing delayed flights or lost luggage can occur when you least expect them and may affect your vacation. Travel insurance can help protect your vacation investment and provides added comfort so you can enjoy your trip. If you decide to purchase travel insurance, you have the option of using our preferred partner, Generali Global Assistance. The Go plan featured here can protect you before, during and after your trip with important insurance coverage, 24-hour emergency assistance and concierge services.

Plan Details

Some of the covered reasons for trip cancellation and trip interruption include:

- Covered sickness, injury or death of you, a family member or traveling companion

- Common carrier delays resulting from inclement weather, mechanical breakdown or unannounced strikes

- Financial insolvency of a travel supplier

- Your primary residence or accommodations at your destination are made uninhabitable by fire, flood, volcano, earthquake, hurricane or other natural disaster

- Mandatory hurricane evacuations

- Being called into emergency military duty for a natural disaster

- A documented theft of passports or visas

- Your involuntary termination of employment or layoff after you've been working with the same employer for at least one year

- A terrorist act which occurs in your departure city or in a city to which you are scheduled to travel while on your trip, and which occurs within 30 days of your scheduled departure date

The table below provides the coverage and benefit limits of the Go plan.

The Go plan also includes 24-hour emergency assistance services and concierge services from Generali’s designated provider.

24-Hour Emergency Assistance Services These services offer on-the-spot and immediate assistance for unexpected problems that can arise during your trip. The hotline operates 24/7 for help while traveling.

Concierge Services Get pre-trip assistance scheduling golf tee times, making restaurant, airline and rental car reservations or obtaining tickets for performances and special events.

All benefits and services are described on a general basis. For complete details on policy exclusions and benefits, contact Generali Global Assistance for a sample Description of Coverage or Policy.

For trips over $10,000 per person or longer than 31 days in length, please contact your Vacations To Go travel counselor for a price.

Other Details

Purchase Rule This plan must be purchased the same day the first trip payment is made. In addition, the traveler must be medically able to travel at the time the policy is purchased.

10-Day Free Look Generali offers a 10-day free look for the Go plan. In the 10 days after you purchase your plan, you have the ability to cancel your coverage and receive a full refund of the plan cost as long as you haven't left for your trip or filed a claim.

Policy Confirmations You will receive a Description of Coverage (or Policy for residents of certain states) which describes the benefits and limitations in detail. If you do not receive your documents within 10 days or 24 hours for email, call Generali Global Assistance at 800-994-3765. Note : Insurance coverage is provided to all travelers listed on the policy, who must be residents of the United States or purchase this insurance from a company that is based in the United States.

Travel insurance plans are administered by Customized Services Administrators, Inc., CA Lic. No. 821931, located in San Diego, CA and doing business as Generali Global Assistance and Insurance Services. Plans are available to residents of the U.S. but may not be available in all jurisdictions. Benefits and services are described on a general basis; certain conditions and exclusions apply. Travel Retailers are not authorized to answer technical questions about the benefits, exclusions, and conditions of this insurance and cannot evaluate the adequacy of your existing insurance. This plan provides insurance coverage for your trip that applies only during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of this policy with your existing life, health, home and automobile policies. The purchase of this plan is not required in order to purchase any other travel product or service offered to you by your travel retailers. If you have any questions about your current coverage, call your insurer, insurance agent or broker. This notice provides general information on Generali's products and services only. The information contained herein is not part of an insurance policy and may not be used to modify any insurance policy that might be issued. In the event the actual policy forms are inconsistent with any information provided herein, the language of the policy forms shall govern. Travel insurance plans are underwritten by: Generali U.S. Branch, New York, NY; NAIC # 11231. Generali US Branch operates under the following names: Generali Assicurazioni Generali S.P.A. (U.S. Branch) in California, Assicurazioni Generali – U.S. Branch in Colorado, Generali U.S. Branch DBA The General Insurance Company of Trieste & Venice in Oregon, and The General Insurance Company of Trieste and Venice – U.S. Branch in Virginia. Generali US Branch is admitted or licensed to do business in all states and the District of Columbia.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Cruise Insurance: Why You Need It + 4 Best Options for 2024

Seven Corners »

Travelex Insurance Services »

AXA Assistance USA »

Berkshire hathaway travel protection ».

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Cruise Insurance Plans.

Table of Contents

- Seven Corners

- Travelex Insurance Services

Cruise vacations come with the same considerations as any other trip, including the potential for trip cancellations, trip interruptions, unforeseen medical expenses and even a need for emergency medical evacuation. Add in the potential for unruly weather during hurricane season , and it's easy to see why cruise insurance plans are so popular and recommended.

Read on to find out which cruise travel insurance plans U.S. News recommends and how they can protect the investment you made in a cruise when something goes wrong.

Frequently Asked Questions:

All cruise insurance plans are unique, and some have different coverages than others. However, most travel insurance plans for cruises cover the following:

- Trip delays, interruptions and cancellations: This kind of coverage is essential any time of the year, but especially during hurricane season when storms can impact your travel plans.

- Protection for medical emergencies: This type of coverage can help pay for unexpected medical bills if you're injured on board the ship or hurt during a shore excursion. You can also choose a cruise insurance plan that covers emergency medical evacuation from the ship or to the nearest hospital.

- Coverage for lost or delayed baggage: Coverage for baggage is important for cruises just like any other trip. This type of insurance can pay for essential items you need to buy if your bags are lost or stolen and don't make it on the ship.

With each of these protections, a coverage limit is listed with your plan. This means you may get reimbursed for your losses or prepaid travel expenses up to this limit, but only when a covered reason applies to your claim.

One of the main reasons to buy cruise insurance is for medical emergencies. Note that, once you're on a cruise ship or visiting a destination outside the United States, your own U.S. health insurance plan will not apply. The same truth applies if you have government health coverage like Medicare.

You can purchase cruise insurance through your cruise line, but these plans are often very basic with low limits for medical expenses and other coverages. For example, cruise line travel insurance policies often come with just $25,000 in coverage for emergency medical expenses and up to $50,000 in coverage for emergency medical evacuation, which may not be enough.

Fortunately, you can buy cruise insurance from any travel insurance provider when planning this type of trip. By buying coverage from an independent travel insurance provider instead of your cruise line, you get to select the exact coverages and limits you need for the best protection possible.

- Seven Corners: Best Overall

- Travelex Insurance Services: Best for Families

- AXA Assistance USA: Best for Medical Emergencies

- Berkshire Hathaway Travel Protection: Best Cost

Plan is cruise-specific

Get coverage for missed cruise connections and tours

Medical expense coverage is secondary if you opt for lower-tier Basic plan

- Up to 150% in reimbursement for trip interruption

- Up to $250 per person, per day in trip delay coverage ($2,000 maximum)

- Up to $250 per day in missed tour or cruise connection coverage ($1,500 maximum)

- Primary emergency medical expense coverage worth up to $500,000

- Medical evacuation and repatriation of remains coverage worth up to $1 million

- Political and security evacuation coverage worth up to $20,000

- Up to $2,500 in protection for baggage and personal effects (limit per item of $250)

- Up to $100 per day ($500 maximum) in coverage for baggage delays of six hours or more

Travel Select plan offers coverage with pricing for kids included

Customize your plan with additional medical coverage, adventure sports coverage and more

Only $1,000 in coverage for baggage and personal effects

$200 maximum coverage for baggage delays

- Trip cancellation coverage worth up to 100% of total trip cost (maximum $50,000)

- Trip interruption coverage worth up to 150% of trip cost (maximum $75,000)

- $2,000 in trip delay coverage for a delay of at least five hours ($250 per day)

- $750 in coverage for missed connections (delay of at least three hours required)

- Emergency medical expense coverage worth up to $50,000 (dental emergency sublimit of $500 included)

- Emergency medical evacuation coverage worth up to $500,000

- $1,000 in protection for baggage and personal effects

- Up to $200 in coverage for baggage delays (at least 12-hour delay required)

- Travel assistance services

Provides comprehensive coverage for all aspects of cruising

High policy limits for medical expenses and emergency evacuation

Does not offer cruise-specific travel insurance

- Trip cancellation coverage up to 100%

- Trip interruption protection up to 150%

- $1,250 in travel delay coverage ($300 per day)

- $1,500 in protection for missed connections

- Emergency accident and sickness coverage up to $250,000

- Emergency medical evacuation coverage up to $1 million

- Nonmedical emergency evacuation coverage up to $100,000

- $50,000 in accidental death and dismemberment coverage

- Baggage and personal item coverage up to $3,000

- Baggage delay coverage worth up to $600

Comes with enhanced medical and luggage benefits, protections for cruise ship disablement, and more

Cruise delay coverage kicks in after five hours

Baggage delay coverage is only for $200 and doesn't kick in for 24 hours

No option to purchase CFAR coverage

- Up to $75,000 in protection for emergency medical care

- Emergency evacuation and repatriation of remains coverage worth up to $750,000

- Cruise cancellation coverage for 100% of trip cost up to $25,000 per person

- Cruise interruption coverage for 150% of trip cost up to $37,500 per person

- Cruise delay coverage worth up to $1,000 ($200 per day for delays of five hours or more)

- Missed connection coverage worth up to $500 (for delay of three hours or more)

- Cruise ship disablement coverage worth up to $500

- Up to $1,500 in coverage for baggage and personal effects

Why Trust U.S. News Travel

Holly Johnson is a professional travel writer who has covered international travel, travel insurance and cruises for more than a decade. Johnson has researched and compared all the top travel insurance options for her own family for trips to more than 50 countries, some of which have included cruises all over the world. Johnson lives in Indiana with her two children and her husband, Greg – a travel agent who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

9 Best Travel Insurance Companies of April 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

How Much Does a Cruise Cost in 2024?

Gwen Pratesi

Use this guide to learn more about cruise pricing and how to figure out the total cost of a cruise.

Cruise Packing List: 56 Essentials Chosen by Experts

Gwen Pratesi and Amanda Norcross

This cruise packing list includes all of the essentials – plus items you didn't know you needed.

The 12 Best All-Inclusive Cruises for 2024

When most of the extra costs are paid before you sail, you can truly enjoy your cruise.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Welcome to P&O Cruises. This website presents a main menu on the left hand side from where you can browse our cruises, and a toolbar menu at the top page with search, live chat, support, and profile settings.

- Skip to side menu (Press enter)

- Skip to toolbar menu (Press enter)

- Skip to content (Press enter)

- Plan a Cruise Trip

- Know Before You Go

Travel Insurance

There’s nothing like a cruise to feed the soul and broaden the mind. And nothing like the unexpected to put a dampener on your plans.

With nearly thirty years of experience and more than 2.2 million journeys every year, Cover-More knows what travellers need. That’s why P&O Cruises recommends Cover-More Travel Insurance.

Ensure you are covered for general medical expenses overseas, existing medical conditions, hospitalisation and medical evacuations.

If you plan on participating in sports such as scuba diving or parasailing, ensure your policy covers these activities.

International travel insurance is recommended on Australian coastal cruises, as your cruise is outside the scope of the New Zealand Health system.

If your cruise includes a call to New Caledonia, please note the New Caledonia government requires that all guests hold comprehensive international travel insurance. Guests will be required to bring printed proof of travel insurance and this will be checked at embarkation. Guests may also be requested to present it during the cruise. Any guest who is unable to provide proof of travel insurance will be denied boarding.

Be aware when organising your insurance that uninsured travellers (or their families) are held personally liable for cancellation, medical and associated costs incurred at any time whether before the cruise, on board or overseas. Hospitalisation costs on board or outside of the country and medical evacuation costs are very expensive and are not covered by Medicare or private health insurance. Daily hospital bills can cost as much as AUD 5,000 per day. All consultations, treatments and medications are charged at private rates.

If something goes wrong, you want expert help fast so you can keep travelling.

For more information, please see the Ministry of Foreign Affairs and Trade website at safetravel.govt.nz .

For more information about this travel insurance product, contact us on 0800 550 125.

Disclosure: P&O Cruises Australia has a referral arrangement with Cover-More and may receive a fee or commission if you choose to purchase an insurance product from Cover-More.

Limits, sub-limits, conditions and exclusions apply. Insurance administered by Cover-More (NZ) Ltd, underwritten and issued by Zurich Australian Insurance Limited (ZAIL) incorporated in Australia, ABN 13 000 296 640, trading as Zurich New Zealand. Consider the Policy Brochure and wording therein before deciding to buy this product. For further information see Zurich New Zealand’s financial strength rating.

As Australian Medicare, New Zealand ACC and private health insurance won’t cover you for medical costs onboard, all cruises (even domestic cruises) require international travel insurance.

- UK Cruisers

Travel Insurance cruise cover.

By majortom10 , March 5, 2021 in UK Cruisers

Recommended Posts

Anyone have the above account and use it for travel insurance was just wondered if it is OK as thinking of opening account. £13 a month for worldwide travel insurance is excellent value for money and wondered if anyone has paid extra for the optional cruise upgrade and what extra they charge for medical conditions that anyone has.

Link to comment

Share on other sites.

cruisenewbie1976

9 minutes ago, majortom10 said: Anyone have the above account and use it for travel insurance was just wondered if it is OK as thinking of opening account. £13 a month for worldwide travel insurance is excellent value for money and wondered if anyone has paid extra for the optional cruise upgrade and what extra they charge for medical conditions that anyone has.

We've got the flex plus account insurance and have found them to be OK. Only had to claim once and although I had to submit various bits of evidence, they did pay out. I'm on medication for high blood pressure and I think I have to pay about £30 extra per year for that to be covered. We've never paid for any of the extras such as cruise cover as you're covered for the main stuff with a standard policy.

I know nothing about their travel insurance, but I have just transferred an ISA because of very low interest. What I do know is that some very good savings account rates have been available for certain accounts that can only be opened if you have one of their current accounts. I am pretty sure it is that account, so perhaps other benefits.

I chose not to open one as we did not want to use it as main account and my income was not high enough to make it possible as an extra from what I recollect. Perhaps worth searching that sort of thing as I am not sure what the ins and outs were when I looked into the current account a couple of years ago.

You do need to pay extra for cruises out side Europe, sorry can't remember how much.

23 minutes ago, Cathygh said: You do need to pay extra for cruises out side Europe, sorry can't remember how much.

We've had this account for a few years and consider it great value. I don't think you have to pay extra for worldwide travel - we have used it for longer cruises of 83 days and 60 days - both outside of Europe and we have only had to pay extra for the length of the cruise.

Luckily we don't have any health problems to declare so can't comment on how much extra that would be nor have we had to make a claim (hope that's not tempting fate!). My sister i law took out missed port insurance with them last year the day before they set off on the world cruise, the amount she paid was miniscule compared to what the insurance had to pay out due to them not being able to dock after the Covid nightmare began. If you ring them for advice they are really friendly and helpful! Something else I never think about, but it is perhaps more relevant now, you will be covered on weekends away or short breaks in this country too.

Don't forget you also get breakdown cover in the UK and Europe - that even covered our motorhome when we had one.

35 minutes ago, Waju said: We've had this account for a few years and consider it great value. I don't think you have to pay extra for worldwide travel - we have used it for longer cruises of 83 days and 60 days - both outside of Europe and we have only had to pay extra for the length of the cruise. Luckily we don't have any health problems to declare so can't comment on how much extra that would be nor have we had to make a claim (hope that's not tempting fate!). My sister i law took out missed port insurance with them last year the day before they set off on the world cruise, the amount she paid was miniscule compared to what the insurance had to pay out due to them not being able to dock after the Covid nightmare began. If you ring them for advice they are really friendly and helpful! Something else I never think about, but it is perhaps more relevant now, you will be covered on weekends away or short breaks in this country too. Don't forget you also get breakdown cover in the UK and Europe - that even covered our motorhome when we had one.

Agree - we've never paid any extra for this insurance to cruise outside Europe. Unless you want the added extras.

1 hour ago, Cathygh said: You do need to pay extra for cruises out side Europe, sorry can't remember how much.

According to Nationwide website FlexPlus includes worldwide travel cover, the optional upgrade is if you want extra cover i.e. missed ports or cabin confinement etc.

Holiday130256

12 hours ago, majortom10 said: Anyone have the above account and use it for travel insurance was just wondered if it is OK as thinking of opening account. £13 a month for worldwide travel insurance is excellent value for money and wondered if anyone has paid extra for the optional cruise upgrade and what extra they charge for medical conditions that anyone has.

We opened the account before our World Cruise last year. It is excellent value, paid a little extra for 100 days cover, £30k cancellation cover for the full cost of the cruise and a couple of declared minor medical issues. Just before we left paid for missed ports cover. Think from memory the extras cost about £400.

You also get included with the account mobile phone insurance and car and caravan recovery insurance Europe wide.

On our return home the insurer paid up for the ports we missed, they only required a note from P and O Confirming that the stops were not made. As we missed all of the ports after Australia and a couple prior to that it was a tidy sum.

11 hours ago, majortom10 said: According to Nationwide website FlexPlus includes worldwide travel cover, the optional upgrade is if you want extra cover i.e. missed ports or cabin confinement etc.

I have now been informed by He Who Knows it All that we don't have the flex plus account, just a Flex Account and the insurance cover is different. 🙄

Interesting. Has anyone over 70 paid for the age extension and how much is it ? I am 75.

Just checked, it is £65.

I think it may be helpful if a few more people could let the rest of us know how good the insurance is at settling claims. That will be the true test.

2 hours ago, Cathygh said: I have now been informed by He Who Knows it All that we don't have the flex plus account, just a Flex Account and the insurance cover is different. 🙄

there is no travel insurance cover now with Flex account.

1 hour ago, majortom10 said: there is no travel insurance cover now with Flex account.

It's closed to new applicants but we are still covered

Splice the mainbrace

2 hours ago, pete14 said: I think it may be helpful if a few more people could let the rest of us know how good the insurance is at settling claims. That will be the true test.

I made a claim last March / April when we had to curtail our land tour of Vietnam due to Covid restrictions coming into place. I got a letter from the travel company confirming how many days we had left of the tour when we had to fly home and they worked out how much the reimbursement should be (cost per day x number of days left).

I completed the online claim form and attached the letter, got a phone a week or so later where I confirmed what I had put in the claim. I was expecting problems or them trying to wriggle out of it with some technicality but it was agreed during that phone call of a few minutes. The monies were paid a week or so later. So no issues with them for this only claim I have made with them.

I was told that the insurance does cover cruises. I take stains so I informed them and they covered me at no extra charge for heart / circulatory issues, they classed it as a 1 medication issue which they cover for no additional charge. I don't know what types of medication or conditions fall into this category though.

3 hours ago, pete14 said: I think it may be helpful if a few more people could let the rest of us know how good the insurance is at settling claims. That will be the true test.

Friends had 3 claims in 4 years - all for Caribbean fly/cruise holidays. Two cancellations were the result of developing last minute infections, the third a broken leg. All were paid promptly, no quibbles - and no increase in premiums.

Thanks for the info, I have been searching for Insurance that would cover a world cruise, and every quote was hellishly expensive, and only covered cancellation up to £5k !!! Had a call with the Nationwide Insurance people today who were super helpful and explained if you opened a joint account the insurance policy covers both people even if they don’t live together, so any add ons for age, cruise add on, and long trip extension etc, are per policy and not per person, also for £150 they would insure the world cruise trip up to the amount paid. I am now in the process of opening a flex plus account 😀

56 minutes ago, JessM66 said: Thanks for the info, I have been searching for Insurance that would cover a world cruise, and every quote was hellishly expensive, and only covered cancellation up to £5k !!! Had a call with the Nationwide Insurance people today who were super helpful and explained if you opened a joint account the insurance policy covers both people even if they don’t live together, so any add ons for age, cruise add on, and long trip extension etc, are per policy and not per person, also for £150 they would insure the world cruise trip up to the amount paid. I am now in the process of opening a flex plus account 😀

What number did you ring if you dont mind me asking as I would like to know cost of extra upgrade for cruise cover and what extra we might have to pay for medical conditions.

We have the barclays travel pack plus for £12.50 per month which also includes full RAC with at home call out. I think that is very good value. I had breast cancer in 2013 I wasn't covered for the 1st 2 years but after that I was and no increase in cost.

scarlet ohara

We’ve had Flex plus for several years, primarily for the annual worldwide travel insurance, although it also gives us breakdown and recovery for our cars, and mobile phone insurance for the £13 per month. I have had to pay extra for medical cover which has gone up over the last few years. I have asthma, (on 2 inhalers) high blood pressure (well controlled on one tablet) and a dodgy heart valve under annual review. Last year the upgrade cost about £250 for both of us. (Hubby has no medical issues, we are both early 60’s) We had 2 x 3week land holidays (Peru and Japan) and had to pay small ( £15) upgrades for the cost when over £5k each. We’ve also had a couple of cruises each year- Med and Caribbean- and European/USA city breaks. It’s been excellent value. Have only had to claim once - last year on a cruise in Jan 2020 I had a mishap and had to go to hospital for a CT scan. The total bill was around £400, including the P&O medical centre costs. It was reimbursed within a week of phoning on our return without even having to send in the receipts - probably because it was a relatively low claim. We returned from holiday in Vietnam on 11March last year, just before lockdown and our renewal was waiting for us. I renewed the next day and soon realised that we wouldn’t be going very far. I think I contacted NW in June/July to ask for a refund of my additional health premium which was promptly processed. I think they no longer cover Covid for new bookings (from approx 18 March) I hope they reinstate cover for Covid and would consider them again so have kept the Flex plus policy meantime. I think the service from NW was excellent when I needed to claim (and also from P&O too)

I was confused by the covid terms which not only does not cover you if you travel when gov travel advises against travel (quite understandable) but it says if you book when covid advice is in place. Surely if gov advice changes to OK to travel then it doesn't matter what the conditions were when you booked. Someone on here many months ago assured me that they had phoned them and the booking date restriction does not apply when travel advice changes to being OK, but the NW wording looks quite clear to me.

0800 051 0154

13 hours ago, majortom10 said: What number did you ring if you dont mind me asking as I would like to know cost of extra upgrade for cruise cover and what extra we might have to pay for medical conditions.

Hi I called 0800 051 0154, they were very helpful

terrierjohn

43 minutes ago, Splice the mainbrace said: I was confused by the covid terms which not only does not cover you if you travel when gov travel advises against travel (quite understandable) but it says if you book when covid advice is in place. Surely if gov advice changes to OK to travel then it doesn't matter what the conditions were when you booked. Someone on here many months ago assured me that they had phoned them and the booking date restriction does not apply when travel advice changes to being OK, but the NW wording looks quite clear to me.

This has been discussed before and my own broker dismissed it, but several insurance companies do still seem to be using this phraseology. If you get any information on it from NW, please share it with us.

59 minutes ago, Splice the mainbrace said: I was confused by the covid terms which not only does not cover you if you travel when gov travel advises against travel (quite understandable) but it says if you book when covid advice is in place. Surely if gov advice changes to OK to travel then it doesn't matter what the conditions were when you booked. Someone on here many months ago assured me that they had phoned them and the booking date restriction does not apply when travel advice changes to being OK, but the NW wording looks quite clear to me.

Does that though mean if you have need to claim for cancellation before the FCO advice changes, you would not be covered from loss of payments so far.

I am thinking someone booked could become seriously ill or possibly even pass away before advice changes, so the holiday could effectively be cancelled for all parties and normally loss could reclaimed from insurance.

The travelling against FO advice is a bit concerning, I have booked a world cruise for 2023, but it was booked when the FO advice was not to travel. The Nationwide insurance says it’s the later of when you booked, or when you took out insurance. I will have to take the trip extension add on to cover for the 120 day trip, which I will do nearer the time, as it’s too far in advance to cover me for the 2023 trip, so presumably so long as at the point I pay for the trip extension there is no FO travel restrictions in place I should be covered? Flipping hope so anyway!

Please sign in to comment

You will be able to leave a comment after signing in

- Welcome to Cruise Critic

- ANNOUNCEMENT: Set Sail Beyond the Ordinary with Oceania Cruises

- ANNOUNCEMENT: The Widest View in the Whole Wide World

- New Cruisers

- Cruise Lines “A – O”

- Cruise Lines “P – Z”

- River Cruising

- Cruise Critic News & Features

- Digital Photography & Cruise Technology

- Special Interest Cruising

- Cruise Discussion Topics

- UK Cruising

- Australia & New Zealand Cruisers

- Canadian Cruisers

- North American Homeports

- Ports of Call

- Cruise Conversations

Announcements

- New to Cruise Critic? Join our Community!

Write Your Own Amazing Review !

Click this gorgeous photo by member SUPERstar777 to share your review!

Features & News

LauraS · Started 21 hours ago

LauraS · Started Monday at 09:50 PM

LauraS · Started Monday at 05:37 PM

LauraS · Started Monday at 04:09 PM

LauraS · Started Monday at 06:02 AM

- Existing user? Sign in OR Create an Account

- Find Your Roll Call

- Meet & Mingle

- Community Help Center

- All Activity

- Member Photo Albums

- Meet & Mingle Photos

- Favorite Cruise Memories

- Cruise Food Photos

- Cruise Ship Photos

- Ports of Call Photos

- Towel Animal Photos

- Amazing, Funny & Totally Awesome Cruise Photos

- Write a Review

- Live Cruise Reports

- Member Cruise Reviews

- Create New...

You are using an outdated browser. Please upgrade your browser to improve your experience.

Welcome to P&O Cruises. This website presents a main menu on the left hand side from where you can browse our cruises, and a toolbar menu at the top page with search, live chat, support, and profile settings.

- Skip to side menu (Press enter)

- Skip to toolbar menu (Press enter)

- Skip to content (Press enter)

- Plan a Cruise Trip

- Know Before You Go

- Book with Confidence

Covid-19 Assurance Policy

Our Covid-19 Assurance Policy applies to cruises departing on or before 31 March 2023.

The following applies to all applicable cruise departures until further notice and is subject to change based on relevant local health requirements.

Prior to Boarding

Please note that effective for all P&O Cruises departures on or after 29th August 2023, any guest who is unable to board due to testing positive to COVID-19 will be subject to our cancellation & refund policy.

Guests with valid travel insurance should submit a claim with their insurance provider.

During your cruise

Any guest who tests positive to COVID-19 during their cruise and is required to isolate onboard, will be eligible to receive a Future Cruise Credit for the number of days in isolation. Any guest who must isolate during their cruise, will be entitled to a Future Cruise Credit for the days spent in isolation. The Future Cruise Credit will be the value of the cruise fare paid for the number of cruise days missed less government taxes, fees and port expenses, and will be subject to our standard terms and conditions for Future Cruise Credits.

Visit our Healthy Cruising pageand FAQs, for more information.

- P&O Cruises ( UK )

Travel insurance

By jules57 , June 19, 2023 in P&O Cruises ( UK )

Recommended Posts

I see P&O state they require proof of insurance including Covid. I have insurance via my bank account which does appear to include Covid cover. I haven't been issued with a policy schedule as such and the policy wording forms part of a very large document which includes all account benefits. I have downloaded a copy and taken a screenshot of the page referencing the inclusion of Covid cover. Will that be sufficient? Do they physically check to see if you have a policy?

Link to comment

Share on other sites.

9 minutes ago, jules57 said: Do they physically check to see if you have a policy?

Never had one checked yet - but that is not to say that it will not happen.

.png.469882c3dcf717e25087cffe94dce586.png)

22 minutes ago, jules57 said: I see P&O state they require proof of insurance including Covid. I have insurance via my bank account which does appear to include Covid cover. I haven't been issued with a policy schedule as such and the policy wording forms part of a very large document which includes all account benefits. I have downloaded a copy and taken a screenshot of the page referencing the inclusion of Covid cover. Will that be sufficient? Do they physically check to see if you have a policy?

I was in the same position as you a month ago.

I asked my TA about P&O checking insurance docs at Southampton. They said that P&O had not made any changes regarding to the customer having to provide proof but they do not check everyone now, but they could always conduct a spot check. They probably said that to cover themselves, they also suggested that I took a screenshot that said that all their polices covered covid.