No spam. We promise.

Indonesia Travel & Tourism Economic Impact Report

Discover the direct and total economic contribution that the Travel & Tourism sector brings to Indonesia in this comprehensive report.

Create an account for free or login to download

This report is FREE for you as a WTTC member

Over the next few weeks we will be releasing the newest Economic Impact Research reports for a wide range of economies and regions. If the report you're interested in is not yet available, sign up to be notified via the form on this page .

Report details

This latest report reveals the importance of Travel & Tourism to Indonesia in granular detail across many metrics. The report’s features include:

- Absolute and relative contributions of Travel & Tourism to GDP and employment, international and domestic spending

- Data on leisure and business spending, capital investment, government spending and outbound spending

- Tables ranking Indonesia against other competing destinations and benchmarked against the world and regional average across various metrics

- Charts comparing data across every year from 2014 to 2024

- Detailed data tables for the years 2018-2023 plus forecasts for 2024 and the decade to 2034

Sponsored by

Research support partners.

Non-Members

Other reports you may like.

World Economic Impact Report

Discover the direct and total economic contribution that the Travel & Tourism sector brings to the World economy in this comprehensive report.

Sudan Travel & Tourism Economic Impact Report

Discover the direct and total economic contribution that the Travel & Tourism sector brings to Sudan in this comprehensive report.

New Zealand Travel & Tourism Economic Impact Report

Discover the direct and total economic contribution that the Travel & Tourism sector brings to New Zealand in this comprehensive report.

Licence or Product Purchase Required

You have reached the limit of premium articles you can view for free.

Already have an account? Login here

Get expert, on-the-ground insights into the latest business and economic trends in more than 30 high-growth global markets. Produced by a dedicated team of in-country analysts, our research provides the in-depth business intelligence you need to evaluate, enter and excel in these exciting markets.

View licence options

Suitable for

- Executives and entrepreneurs

- Bankers and hedge fund managers

- Journalists and communications professionals

- Consultants and advisors of all kinds

- Academics and students

- Government and policy-research delegations

- Diplomats and expatriates

This article also features in The Report: Indonesia 2019 . Read more about this report and view purchase options in our online store.

Improved tourism infrastructure supports growing numbers of visitors to Indonesia

Indonesia | Tourism

Boasting the world’s largest tropical coastline and renowned cultural heritage sites across more than 17,000 islands, Indonesia is becoming a leading tourism destination in South-east Asia. Strong gains have been noted internationally, with the World Economic Forum (WEF) declaring Indonesia as the region’s fourth-most competitive destination after Singapore, Malaysia and Thailand in its most recent “Travel and Tourism Competitiveness Report” for 2017. Globally, Indonesia ranked 42nd out of 136 economies, an increase of eight spots over 2016.

Tourist arrivals have recorded gradual growth in recent years – with 14m and 15.8m in 2017 and 2018, respectively, according the Ministry of Tourism (MoT) – but a string of natural disasters and other challenges have impacted the achievement of certain targets. “The 2018 objective was to attract some 17m visitors, but this goal was not met, partly due to the recent natural disasters in Bali and Lombok and travel warnings,” Abdulbar Mansoer, president director of the Indonesia Tourism Development Corporation, told OBG. “Once the right infrastructure is in place, human capital development then has to be the top priority. Tourism is very labour intensive, and creates a vast range of both direct and indirect jobs.”

Oversight & Policy

Tourism policy is formulated and implemented by the MoT, which has been headed by Arief Yahya since President Joko Widodo was first elected to office in 2014. Kick-starting the tourism sector has been one of the top priorities of the Widodo administration, and industry development is expected to remain a priority regardless of the outcome of the 2019 general elections.

In 2015 the authorities unveiled Rencana Strategis Kementerian Pariwisata 2015-19 (Strategic Plan of the Ministry of Tourism), which sought to attract 20m foreign visitors and have tourism account for 8% of GDP by 2019. The plan is supported by a $300m loan granted by the World Bank in May 2018 for the Indonesia Tourism Development Project, which aims to ensure roads and basic services are present in all tourist areas. According to the “Travel & Tourism Economic Impact 2018 Indonesia” report, published by the World Travel & Tourism Council (WTTC), tourism directly contributed $19.4bn in 2017, or 1.9% of GDP, with this forecast to increase by 5.2% in 2018. Total contribution to GDP, including wider effects from the supply chain, investment and income generation, was estimated at 5.8% in 2017.

One area of concern for the government is the over-reliance on Bali to attract increased international arrivals, with fears that the island destination is nearing saturation. To address this, the 10 New Balis strategy was rolled out in 2016, which identified 10 non-traditional destinations to draw visitors into new areas of the country. Part of this effort involved significantly increasing the national budget for tourism development through promotions that include television advertisements and international roadshows. The results have been favourable, and tourism is now the country’s fourth-largest source of foreign exchange after oil and gas, coal and palm oil.

The push to develop the tourism sector is demonstrated by state spending. According to the WEF, Indonesia spent 9% of its national budget on travel and tourism in 2017, with the sector representing 6% of exports. The government is also investing in training and skills development for young people planning to work in the sector.

Infrastructure

As part of the 10 New Balis programme, focus has been placed on infrastructure development. Unlike its regional peers Thailand and Vietnam, which are contiguous landmasses, Indonesia is an archipelago that spans four time zones, sometimes making travel between different islands difficult and expensive. Some 70% of Indonesian territory consists of remote islands, many of which are either home to small populations or are entirely unpopulated, and have little to no infrastructure. Ferries to these islands are often unreliable and uncomfortable, and domestic flights to isolated locations like West Timor can be more expensive than international ones. Visitors to these destinations are often confronted with poor roads and unreliable electricity, especially in provinces in Indonesia’s east.

In the past Indonesia managed this challenge by promoting the tourist destination of Bali, an island with good connectivity to its main source markets of China and Australia. Now, even with the government’s diversification efforts, 42% of international arrivals visited Bali in 2018, as it remains Indonesia’s most popular tourism destination.

New Locations

The destinations selected under the 10 New Balis plan are Lake Toba in North Sumatra; Tanjung Kelayang on the island of Belitung; Tanjung Lesung in Banten; Kepulauan Seribu (Thousand Islands) off the coast of Jakarta; the Borobudur temple – the world’s largest Buddhist temple – in Central Java; Mount Bromo in East Java; Mandalika on Lombok; Labuan Bajo in East Nusa Tenggara; Morotai Island in North Maluku; and Wakatobi in Southeast Sulawesi.

To support these offerings, the authorities have embarked on an airport expansion drive. Boosting the number of international visitors can be a first step towards additional infrastructure investment: with more visitors comes the need for better roads and facilities. This generates jobs and focuses policymakers’ attention on areas that may have fallen outside the government’s priorities. Even within Bali, efforts are in place to divert tourists north, which is less visited than the southern hub of Kuta.

The small, provincial Silangit Airport in North Sumatra was upgraded and expanded in 2017, which resulted in it gaining international status. Additional planned works should see a second runway extension and terminal expansion project. More visitors from China are beginning to travel to North Sumatra after marketing roadshows began in 2016. Belitung Island also saw its small airport upgraded to international status in 2017. The island now caters to the lucrative Singaporean market, which is just a 90-minute flight away. Overall, Indonesia has 11 international airports spread across the archipelago.

Furthermore, Indonesia enjoys a number of inherent advantages over regional peers. Its equatorial climate means temperatures are generally milder than in Thailand and Vietnam, and rains are predictable and steady. It is also more cost effective to holiday in Indonesia than in Thailand or Malaysia, in part because the value of the rupiah has declined considerably in recent years, from about Rp8000:$1 in 2012 to approximately Rp15,000:$1 in January 2019.

Source Markets

Despite falling short of the government target of 15m international tourists in 2017, the number of such arrivals grew from 11.5m in 2016 to 14m that year, and then to 15.8m in 2018. The MoT has been running the Wonderful Indonesia promotional campaign since 2011, targeting both emerging and developed markets around the world to reach arrival goals. Although Malaysia was the largest source market in 2018, accounting for 2.5m arrivals, the number of Chinese tourists is growing at a steady rate, from 1.05m in 2014 to 1.25m in 2015, 1.56m in 2016, 2.09m in 2017 and 2.14m in 2018.

There is potential for the number of Chinese tourist arrivals to grow, as less than 10% of Chinese citizens currently own passports (see regional analysis). In 2015 Indonesia dropped its visa requirement for Chinese citizens and embarked on promotional roadshows in the world’s most populous country. However, while over 2.1m Chinese visitors arrived in Indonesia in 2018, this fell short of the 2.6m targeted by the MoT. Nonetheless, Chinese tourists are fast embracing Indonesia as one of their top global destinations, increasingly opting for the archipelago over other regional tourism hotspots such as Thailand.

At the same time, the growth in Chinese arrivals brings additional challenges for regulators. These groups are increasingly arriving on so-called zero-dollar packages – ultra-cheap holidays where organisers shepherd tourists to designated souvenir stores, hotels and attractions. The businesses are often Chinese-owned, with prices denominated in yuan, resulting in little benefit to the local economy. Thailand faced the same issue, and in 2016 the Thai authorities banned zero-dollar tours.

The Wonderful Indonesia campaign also has India in its sights, viewing the country as a major future force of outbound tourism. A drive to promote Indonesia as a halal tourism destination to Islamic travellers is under way as well. As the country with the world’s largest Muslim population, Indonesia is aggressively marketing itself in Middle East and North African countries. The authorities have set an ambitious target of welcoming 5m halal tourists in 2019, an increase of 42% over 2018. Halal tourism is considered a lucrative segment because it taps the high spending power of visitors from the Arabian Gulf.

Domestic Tourism

While international tourism is the government’s main focus, domestic travel is also growing strongly under the five-year plan. To supplement the Wonderful Indonesia campaign, in 2017 the MoT announced the Pesona Indonesia initiative, which encourages Indonesians to travel their country. Some 264m domestic trips were made in 2016, and 200m between January and August 2017, driven by better domestic air service, improved infrastructure and a weaker rupiah that discouraged locals from travelling abroad. According to the WTTC, domestic spending increased from $17.6bn in 2016 to $20.5bn in 2017. “The sector will continue to rely on domestic tourists for a stable supply of visitors, but it has to be the right mix with foreign tourists who usually stay longer and spend more,” Mansoer told OBG.

Another government priority in the sector is to generate jobs for the millions of young Indonesians entering the labour market. In this regard the five-year plan aimed to see the sector employ 13m people by 2019. Tourism directly supported 4.6m jobs in 2017, or 3.7% of the workforce, with the WTTC forecasting the industry will directly employ 6.3m people by 2028. When jobs indirectly supported by travel and tourism were assessed, the WTTC estimated the number of employed at 12.5m in 2018, rising to 17m, or 11.4% of the workforce, by 2028.

Sourcing human resources is difficult outside of Bali, thus officials are expanding efforts to train staff for the hospitality industry elsewhere. “Human capital challenges are prevalent in the hospitality sector behind the dynamic in the market driven by continuous technology adoption by wider population,” Kevin Sandjaja, CEO of travel booking platform PegiPegi, told OBG. “Better leadership is required and Indonesia needs more people with a strong background in hospitality to drive growth in the market.”

Investment & Hotels

The tourism industry is also set to benefit from the government’s deregulation drive aimed at increasing foreign investment. The country’s previously protectionist foreign ownership laws were loosened in 2016 to encourage investors from abroad to build up hotel and restaurant offerings, among other businesses, in a move that has attracted a lot of international attention. The government has also made strides in easing its cumbersome employment laws, reducing bureaucratic hurdles to construction and simplifying taxation.

The 2017 tourism report by the WEF noted significant improvements in Indonesia’s international openness, ranking it 17th out of 136 countries, up 38 spots over the previous year. Jakarta has been refining its image and boosting its offerings of luxury hotels, driven to some extent by its hosting duties for the 2018 Asian Games. According to real estate consultancy Colliers, Jakarta was expected to have added some 2065 hotel rooms in 2018, including 804 three-star hotel rooms, 375 four-star rooms and 885 five-star rooms. Occupancy rates vary across the archipelago, but figures for Jakarta sat at around 65% in 2018. That year in the capital alone, eight new five-star hotels were either under construction or planned for completion by 2020. The mid-range market will also see a large number of projects come on-line by 2020. Some 16 hotels in Jakarta classified as either three or four stars were under construction or in the advanced stages of planning in end 2018.

Positive Moves

The capital city is still primarily a business travel destination, but more global promotion is expected to attract a wider variety of tourists to Jakarta. Central Jakarta is developing itself into a street-food destination that may one day rival Bangkok, and the city’s up-scale bars and nightlife counter the image of religious conservatism sometimes associated with it. Jakarta also aims to tackle its notorious traffic congestion with a more efficient public transport system, along with moves to reduce chronic air pollution. “Kuala Lumpur is a lot smaller than Jakarta but attracts more international visitors,” Bram Hendrata, managing director of Ismaya Group, a lifestyle and hospitality company, told OBG. “The meetings and events segment continues to offer great potential for Jakarta, and may help put the city on the map as a regional tourist destination.”

However, perhaps Indonesia’s most noticeable achievement in improving tourists’ experiences is its success in reducing wait times at the arrivals terminal of Jakarta’s Soekarno-Hatta International Airport through removing visa requirements. In 2016 the government eliminated the visa fee for tourists from 169 countries, cutting down the associated paperwork and processing time. This move saw the WEF rank Indonesia second globally in terms of visa policy in 2017. The reduced wait times are facilitating the increased number of arrivals resulting from a large-scale expansion of the airport.

Terminal 3, valued at $341m, was completed in August 2016 and serves as the new domestic flight terminal for the national carrier, Garuda Indonesia, creating more space for international flights. In 2017 the airport catered to the country’s international arrivals through expanded facilities, which include approximately 70,000 sq metres of multi-use commercial space and two hotels.

Indonesia is making progress in the meetings, incentives, conferences and exhibitions (MICE) segment, and in October 2018 it hosted the annual IMF and World Bank meeting in Bali. The event was attended by delegates from around the world, along with a following of press and observers.

“Bali has established itself as a MICE hub because events have been part of the local tourism industry for quite some time,” Riyanti Handayani, president director of Nusa Dua Indonesia, the Bali Convention Centre, told OBG in 2018. “Most events in Bali are corporate, and 2017 saw 96 events with more than 100,000 attendees.” Jakarta, for its part, hosted the Asian Games in 2018, as well as numerous other corporate and political events.

“The government has been working diligently to promote large projects and events, such as the Asian Games,” Aldo Susanto, director of business development at Nayati, a foodservice equipment manufacturer, told OBG. “Efforts like these are not only making Indonesia a rising hub for the MICE segment in the ASEAN region, but are also providing more opportunities for local businesses to expand.”

Even with determined efforts to boost tourism growth, significant challenges remain for Indonesia. In 2018 social media was buzzing with videos of divers swimming in Bali and Java amid plastic rubbish; indeed, Kuta beach in Bali is often afflicted by city run-off, and its shores are frequently clogged with plastic bags and other refuse. In 2016 the World Bank identified Indonesia as the world’s second-largest plastic polluter behind China.

The authorities are mulling strategies to tackle this problem, including needed clean-up programmes in key destinations. Deforestation is another concern, which was noted by the WEF report. It is hoped that steadily growing eco-tourism will contribute to incentivising the protection of the country’s rain forests and further improve its treatment of wastewater.

In addition to pollution and deforestation, Indonesia was afflicted by natural and man-made disasters in 2018, including in places earmarked under the 10 New Balis project. For example, a ferry crossing Lake Toba sank in June, taking the lives of an estimated 167 people. The incident shone a harsh light on Indonesia’s safety standards, as the ferry was licensed to carry a maximum of 60 passengers. Not long afterwards, in August, an earthquake in Lombok measuring about 6.9 on the Richter scale resulted in the evacuation of tourists from the island.

Moreover, the Tanjung Lesung beach town and special economic zone – a major beneficiary of the 10 New Balis initiative – was heavily damaged in December 2018. The eruption of the Anak Krakatau volcano caused a landslide and tsunami that hit the area without warning, killing over 100 people. Although Indonesia had developed early-warning systems after the 2004 tsunami that killed hundreds of thousands of people regionally, experts found that budget cuts led the systems to fall into disrepair, leaving locals unaware of the impending disasters in 2018. That year also saw an airline tragedy in October, when the country’s budget carrier Lion Air crashed shortly after take-off in Jakarta, killing all 189 passengers. At the time of writing, investigators looking into the accident suspected a software design fault.

Despite falling short of some targets, Indonesia has made impressive strides in terms of increasing visitor arrivals and broadening its appeal away from Bali. A combination of streamlined administration and liberalised rules on visas and foreign investment have helped to develop tourism into a dependable revenue stream.

Dulling these achievements, however, were a string of natural disasters and accidents that occurred throughout 2018, which indicates that Indonesia must improve its public safety standards and enforce strict environmental protection rules.

Nevertheless, as the general elections take place in April 2019, tourism is all but assured to retain its status as a top development priority for the country.

Request Reuse or Reprint of Article

Read More from OBG

In Indonesia

Report: Examining Indonesia's path to responsible paint production With Indonesia's National Medium-Term Development Plan (RPJPN) 2025-45 underscoring the role of manufacturing for economic growth, the paint and coatings segment has a role to play in sustainable economic development. From eco-friendly formulations to strategic risk management, the sector continues to navigate towards responsible production.This report explores the industry's commitment to environmental and social responsibility, balancing economic growth with eco-friendly products and …

Khalid Jasim Al Midfa, Chairman, Sharjah Commerce and Tourism Development Authority (SCTDA) In this Global Platform video, Oxford Business Group speaks with Khalid Jasim Al Midfa, Chairman, Sharjah Commerce and Tourism Development Authority (SCTDA) about Sharjah’s strategies for fostering tourism growth by striking a balance between cultural appreciation and sustainability. In 2022 tourism constituted over 9% of the UAE's GDP and contributed around 10% to non-oil GDP in the emirate of Sharjah, which is positioning itself as a family and environmentally friendly destination. Sharjah, …

Ghana underscores its pivotal role as a regional and international trade partner Oxford Business Group has launched The Report: Ghana 2024. This latest edition offers a detailed analysis of the country’s economic trajectory, focusing on fiscal consolidation and structural reforms. It examines the nation's progress in managing expenditure and debt, alongside the impact of IMF programmes and strategic reforms aimed at enhancing revenue mobilisation. Despite challenges such as financial sector stress and the upcoming elections, Ghana remains optimistic…

Register for free Economic News Updates on Asia

“high-level discussions are under way to identify how we can restructure funding for health care services”, related content.

Featured Sectors in Indonesia

- Asia Agriculture

- Asia Banking

- Asia Construction

- Asia Cybersecurity

- Asia Digital Economy

- Asia Economy

- Asia Education

- Asia Energy

- Asia Environment

- Asia Financial Services

- Asia Health

- Asia Industry

- Asia Insurance

- Asia Legal Framework

- Asia Logistics

- Asia Media & Advertising

- Asia Real Estate

- Asia Retail

- Asia Safety and Security

- Asia Saftey and ecurity

- Asia Tourism

- Asia Transport

Featured Countries in Tourism

- Indonesia Tourism

- Malaysia Tourism

- Myanmar Tourism

- Papua New Guinea Tourism

Popular Sectors in Indonesia

- Indonesia Construction

- Indonesia Energy

- Indonesia Industry

- Indonesia Transport

Popular Countries in Tourism

- The Philippines Tourism

- Thailand Tourism

- Oman Tourism

Featured Reports in Indonesia

Recent Reports in Indonesia

- The Report: Indonesia 2020

- The Report: Indonesia 2019

- The Report: Indonesia 2018

- The Report: Indonesia 2017

- The Report: Indonesia 2015

- The Report: Indonesia 2014

Privacy Overview

- Previous Article

- Next Article

Indonesian tourism profile a year after the COVID-19 pandemic

- Article contents

- Figures & tables

- Supplementary Data

- Peer Review

- Reprints and Permissions

- Cite Icon Cite

- Search Site

Nensi Fitria Deli , Risnanta Wildan Sambodo , Thosan Girisona Suganda , Setia Pramana; Indonesian tourism profile a year after the COVID-19 pandemic. AIP Conf. Proc. 22 December 2022; 2662 (1): 020039. https://doi.org/10.1063/5.0108167

Download citation file:

- Ris (Zotero)

- Reference Manager

Tourism is one of the most important sectors in Indonesia. However, since the COVID-19 pandemic, tourism industries has declined significantly. Restrictions on mobility and activities in public places affect the tourism sector. One of them can be seen from the hotel room occupancy rate (ROR). ROR in Indonesia experienced a significant decline in mid-2020, since the spread of COVID-19 was confirmed in Indonesia. Until the end of 2020, Indonesia’s ROR seems to have increased, but still cannot fully recover as before the pandemic. It’s been a year since the first COVID-19 case in Indonesia. Various policies have been implemented by the central and regional governments in dealing with this pandemic. To find out how much ROR has improved in 2021, this paper discusses the analysis of national and provinces level ROR in January 2020-June 2021 from BPS survey and big data. These two data are compared to see how well the ROR generated by big data represents the official ROR from the BPS survey. The result from big data analysis show that majority of provinces have not experienced significant ROR improvements in 2021. The result is in line with ROR from the BPS survey, as well as the demand pattern shown from the google trends data.

Sign in via your Institution

Citing articles via, publish with us - request a quote.

Sign up for alerts

- Online ISSN 1551-7616

- Print ISSN 0094-243X

- For Researchers

- For Librarians

- For Advertisers

- Our Publishing Partners

- Physics Today

- Conference Proceedings

- Special Topics

pubs.aip.org

- Privacy Policy

- Terms of Use

Connect with AIP Publishing

This feature is available to subscribers only.

Sign In or Create an Account

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser.

Table of Contents

Indonesia tourism report.

Total tourist arrivals to Indonesia are projected to fully recover to pre-pandemic (2019) levels in 2024, with arrivals continuing to expand over the medium term (2024-2028). Asia-Pacific markets will be the country's largest source markets for arrivals with increasing flight networks and preference for short-to-mid haul travel supporting travel to Indonesia.

Providing expert analysis, independent forecasts and competitive intelligence on the tourism industry.

Report includes: Industry View, Industry SWOT Analysis, Industry Forecasts, Economic Forecasts, Company Profiles and Global, Regional and Country Industry Overviews.

Why you should buy this report

- Benefit from the latest market opportunities

- Understand the threats to your operations and investments and protect your company against future risks

- Gain insight on emerging trends that could support, strengthen or disrupt your activities in the market

- Get a full view of the competitive landscape to assess your market position

The Indonesia Tourism Report has been researched at source and features BMI’s independent assessment and forecasts for tourist expenditure; government expenditure on tourism; passenger arrivals and departures by mode of transport, reason for travel, origin and destination; and the accommodation market.

BMI’s Indonesia Tourism Report provides industry professionals and strategists, corporate analysts, associations, government departments and regulatory bodies with independent forecasts and competitive intelligence on the countries tourism industry.

Key Benefits

- Benchmark BMI’s independent tourism industry forecasts to test other views - a key input for successful budgetary and planning in the tourism market

- Target business opportunities and risks in the tourism sector through our reviews of latest industry trends, regulatory changes and major deals, projects and investments

- Assess the activities, strategy and market position of your competitors, partners and clients via our Company Profiles (inc. KPIs and latest activity)

Request Summary

Thank you for your summary request. You will receive an email shortly.

Find the report that's right for you

- Fitch Solutions

CreditSights

Fitch learning, fitch ratings research & data, sustainable fitch.

- BMI Platform

- BMI Geoquant

- Fitch Connect

Robust Tourist Arrivals Growth Projected For Indonesia, But Overtourism Is A Risk

Tourism / Asia / Wed 17 Jul, 2024

Key View: We project arrivals to Indonesia to fully recover to pre-pandemic (2019) levels in 2024. Over the medium term (2024-2028), arrivals to Indonesia will continue expanding, with growth driven by the Asia Pacific region. Looser entry requirements, as well as increasing departures from key arrivals source markets will underpin growth. Overtourism amid increasing arrivals will, however, pose challenges to infrastructure, environmental quality, and cost of living for local residents.

In 2024, we project that arrivals to Indonesia will reach 16.3mn, increasing from 11.7mn in 2023, and growing by 39.3% y-o-y. The 2024 arrivals will mark a full recovery as they rise above the pre-pandemic level in 2019, when arrivals reached 16.1mn. Our projections are based on latest high frequency data by Statistics Indonesia which recorded arrivals to Indonesia between January-May 2024 at 5.2mn. On February 5 2024, the Indonesian Tourism and Creative Economy Ministry announced it has increased its tourism target for 2024 from 14.3mn arrivals to about 17mn. The target revision was informed by a higher arrivals turnout in 2023 which was higher than the Ministry's target of 7.4mn arrivals for the same year.

Arrivals Over The Medium Term Projected To Exceed Historic Levels

Indonesia - total arrivals (2014-2028).

Over the medium term (2024-2028), we predict arrivals to Indonesia will grow at an annual average rate of 13.9%, to reach 21.7mn by 2028. Arrivals growth will be driven by traditional major source markets for arrivals which include Malaysia, Singapore and Australia, as well as emerging key source markets with strong departures outlooks such as Mainland China and India.

Malaysia will outperform as the largest source market for arrivals to Indonesia in 2024, with a projected 3.0mn (or 18.4% of total arrivals). China will rank fourth largest in 2024 after Singapore (second place) and Australia (third place), with a projected 1.2mn arrivals (7.5% of total arrivals), while India will rank fifth with a projected 662,930 arrivals (4.1% of total arrivals). By 2028, we predict that Malaysia will retain its position as the largest key source market for arrivals to Indonesia, with Malaysia arrivals increasing to 3.8mn (17.8% of total arrivals). China will improve its ranking, overtaking Singapore and Australia to become Indonesia's second largest arrivals source market, with a forecast 2.6mn arrivals (11.8% of total arrivals). Arrivals from India will increase to 890,760 (4.1% of total arrivals), retaining its ranking as Indonesia's fifth largest arrivals source market after Singapore (third place) and Australia (fourth place) in 2028.

Malaysia To Stand Out As Largest Arrivals Source Market, With China's Position Strengthening

Indonesia - arrivals by market, top 5 (2024, 2028).

In October 2024, the Indonesian tourism ministry aims to finalise a visa exemption policy for 20 major arrivals source markets including China, India, Germany, the US and the UAE. This follows the Tourism and Creative Economy Minister Sandiago Uno's announcement on June 27 2024 and is part of a wider strategy to increase arrivals to the market.

Despite an increase in arrivals, unprecedented tourist arrivals levels will pose a downside risk to the cost of living for local residents, as well as the quality of natural environments exposed to tourism activities such as coral reefs in Bali and the Gili Islands. Mass tourism will also weigh heavily on infrastructure and public services such as sanitation and transport. In order to combat mass tourism, particularly in popular destinations, Indonesia has begun implementing strategies which include a focus on environmental preservation and the introduction of a tourist tax.

This commentary is published by BMI, a Fitch Solutions company, and is not a comment on Fitch Ratings Credit Ratings. Any comments or data included in the report are solely derived from BMI and independent sources. Fitch Ratings analysts do not share data or information with BMI. Copyright © 2023 Fitch Solutions Group Limited. All rights reserved. 30 North Colonnade, London E14 5GN, UK.

Thank you. Your download link will be emailed to you shortly.

Please complete to access all articles on fitchsolutions.com.

Thank you for registering. To read the article please click on the link we have sent to your email address.

Get to know the business behind the products. Meet some of our key people and explore our credentials.

Fitch Group Named Top Forecaster in FocusEconomics Analyst Forecast Awards

BMI Launches ESG Country Service to Measure Risk in 140 Markets

Bmi appoints lyndsey anderson as head of content.

- Early Talent

Know what you need but not sure where to find it? Discover how we can meet your requirements.

- Countries & Regions

- Industries & Sectors

- Companies or Entities

- Issues, Deals & Transactions

Explore knowledge that cuts through the noise, with award-winning data, research, and tools.

- Country Risk

- Industry Research

- Operational Risk

- Fitch Ratings Data & Research

- Fitch Credit Ratings Data

- Fitch Ratings Credit Research

- Fitch Ratings ESG Relevance Scores Data

- Fundamental Data & Analytics

- Bank Scorecard

- Basel III - SCRA Data

- CDS Implied Credit Scores

- Financial Implied Credit Scores

- Fitch Connect News

- Fundamental Data

- Leveraged Finance Intelligence

- Covenant Review

- LevFin Insights

- PacerMonitor

- CreditSights

- Risk Products

Browse over 2,000 research reports at the Fitch Solutions Store .

- Country Risk Reports

- North America

- Latin America

- Middle East

- Industry Reports

- Special Reports

- Browse All Reports

Know what you need but can't find it?

BMI has a 40- year track record of supporting investors, risk managers and strategists. We help them identify opportunities and quantify risks in markets where reliable information is hard to find and difficult to interpret. This includes in-depth insight and data, and high frequency geopolitical risk indicators.

CreditSights enables credit market participants to manage financial risk better with independent credit research, global market insights, covenant analysis, and news, distilling market noise into actionable investment ideas.

dv01 provides true transparency in lending markets, and valuable intelligence on every consumer loan in the structured finance world, through a leading data intelligence platform.

Fitch Learning develops the future leaders of the financial services industry and drives collective business performance. We do this by utilizing a best-in-class technology platform and blended learning solutions that maintain the personal element of development.

We help credit, risk, and investment professionals make better-informed decisions and meet regulatory requirements, within and beyond the rated universe. We do this by providing differentiated perspectives and in-depth expertise through Fitch Credit Ratings, Fitch Ratings Credit Research, Fundamental Financial Data, and innovative datasets, all backed by transparent methodologies, accessible analysts, and workflow-enhancing analytical tools.

Sustainable Fitch delivers human-powered sustainability Ratings, Scores & Opinions, as well as Data & Research to serve the needs of fixed income investors. Our specialists uniquely deconstruct the complex issues of E, S, and G globally.

ESG Relevance Scores Data

Access ESG Scores on more than 10,000 entities and transactions, and over 140,000 ESG data points to support your credit risk assessments.

Get to know the company behind the products, our values and our history. Meet some of our key people and explore our credentials.

- Work with Us

Explore our latest views on risks and opportunities by industry, region or topic.

Aggressive Discounts Reveal Mainland China's Luxury Retail Quandary

Recovering Tourism And Wages Will Drive Sri Lanka's Growth

Kenya’s Proposed Capital Requirements To Support Financial Stability

A Trump Encore: Assessing The Impact On The US Dollar

US Election Chartbook (June 2024)

Europe Mining Insight (May 2024)

- Global Elections 2024

- BMI Key Themes 2024

- Russia-Ukraine Crisis

- Agribusiness

- Consumer & Retail

- Consumer Electronics

- Food & Drink

- Information Technology

- Infrastructure

- Medical Devices

- Oil & Gas

- Pharmaceuticals

- Telecommunications

- More Industries

Learn more about the BMI products and services that empower you to make critical business decisions with confidence.

- Politics & GeoQuant

- Reports Store

PwC Indonesia Firm Profile

Indonesia's Carbon Pricing

Global Annual Review 2023

Power in Indonesia

Indonesia Electric Vehicle Consumer Survey 2023

Perspectives from the Global Entertainment & Media Outlook 2024–2028

PwC Indonesia Mergers and Acquisition Update 2023

PwC's Global NextGen Survey 2024

PwC’s Global Risk Survey 2023

Indonesia Economic Update

Global Entertainment and Media Outlook 2024 - 2028

Loading Results

No Match Found

Is now the right time to invest in Indonesian tourism? Strategy to prepare Indonesia's tourism sector

Jakarta, 12 November 2021 - The COVID-19 pandemic is the biggest challenge faced by Indonesian tourism business owners and operators. The number of foreign tourists entering the country in 2020 was only about 25% of the number of tourists in 2019. The decline in hotel occupancy in Indonesia in 2020 also sharply decreased in bookings from domestic and international guests, where in January-February, occupancy was still at 49.17% and 49.22%, respectively. However, in March it became 32.24%, and worsened when entering the month of April, which was 12.67%. The existence of large-scale social restrictions and the closure of access in and out of Indonesia, caused a decrease in government revenue in the tourism sector by Rp20.7 billion.

However, along with the continued decline in daily COVID-19 confirmed cases and with the vaccination programme in all provinces in Indonesia, optimism for business recovery has begun to grow.

As stated by Sandiaga Uno, Minister of Tourism and Creative Economy at the PwC Indonesia webinar - Is now the right time to invest in Indonesian tourism? - said, “We are entering the new era of tourism in Indonesia, where the tourism business map is also influenced by changes in market demand and tastes such as sustainable tourism. We have started offering more personalised, customised and localised tourism, focusing more on the quality over quantity. To reach that stage, we must improve the quality of human resources, business resilience, and continue to promote local products in those areas.”

The Government's various efforts in dealing with the COVID-19 pandemic and encouraging national economic growth have begun to show results. However, further joint efforts between the public and private sector are needed to speed up the revival of the tourism industry. Having said this, now may be a good time to invest in the industry in order to ride the wave of the recovery.

Julian Smith, ESG, Government & Infrastructure Advisor of PwC Indonesia said, “There is more the Government can do, such as coordinating the efforts of airports, airlines, hotels and public agencies to offer a smooth and safe experience to people wanting to book a holiday in Indonesia, and to communicate this to the overseas market, building on the recent success of the vaccination and public safety (PPKM) measures.”

Irfan Setiaputra, President & CEO of PT Garuda Indonesia (Persero) Tbk , commented “In order to achieve tourism sustainability, the acceleration of the tourism sectors must be supported with measurable efforts in handling the pandemic. As an entity engaged in the transportation industry where the business fundamental is mobilisation, we certainly believe that sustained efforts in pandemic handling and focus on restoring the tourism industry are crucial aspects in ensuring the readiness of national tourism ecosystem revival – with solid end-to-end collaboration amongst all industry players. In the end, we’ve seen good measures in handling the pandemic will have a multiplier effect in all economic sectors including tourism, which relies on community mobility to recover.”

As stated by Jean Hélière, Chairman of the Bali Hotels Associations , “It’s been a very difficult time for all of us indeed but we are very optimistic about the new measures to reopen the tourism sector. We have seen an increasing request for MICE (Meetings, Incentives, Conferences and Exhibitions) especially from the local market. Also, there are more and more international tourists visiting Bali, which shows their confidence in our security and safety measures. In terms of sustainability, Bali has been ahead of other hotels in Indonesia, we have a plastic free policy, and we now put more focus on water assessment/distribution. At the same time, efforts have been made to raise awareness on food sustainability to support local suppliers.”

Budi Tirtawisata, CEO of Panorama Group emphasised by saying, “From my point of view, the tourism industry is showing signs of recovery. Many local restrictions in Indonesia have started to ease slowly and market confidence has increased along with the success of the vaccination programme. Many countries have reopened their borders. So, we expect the tourism industry will start to recover in mid 2022 with cautious steps while we continue to educate the market on health and safety measures.”

Nathalia Wilson, South East Asia and Korea Development Director of IHG Hotels & Resorts , explains on the asset, “Tourism is one of the economic drivers to focus in Indonesia because of its significant foreign exchange revenue and employment contribution. We have seen a growing number of domestic new investors from family businesses, companies or high net-worth individuals acquiring hotels as legacy assets or diversification. Furthermore, the change of stakeholders in the market comes from the consolidation of government hotel assets under BUMN and strategic partnership being formed by local operators and regional capital. Investment in tourism is a long term strategy and for Indonesia to increase its competitiveness, infrastructure development is critical to tourism growth. Indonesia has such a diverse tourism environment to offer investors and a large, productive population which is fundamental as demand generators. Although I think this is the right time to invest in the tourism sector, some of the key issues such as the availability of equity options, debt financing, and managing valuation/price expectation gaps still need to be addressed.”

Hendri Hendrawan, Infrastructure and Tourism Director of PwC Indonesia , closed by saying “The tourism industry needs to take into consideration the following aspects if they want to invest now in Indonesian tourism such as diversification, improving resilience by right-sizing, capitalising on recent consumer trends, and moving towards sustainable tourism. Sustainability in the tourism sector is becoming more important because more investors have requirements related to ESG (Environment, Social, and Governance) so the industry needs to invest in sustainability-related aspects. The tourism industry can also explore potential revenue from the carbon off-set scheme as an additional source of income”.

About PwC Indonesia

PwC Indonesia comprises KAP Tanudiredja, Wibisana, Rintis & Rekan, PT PricewaterhouseCoopers Indonesia Advisory, PT Prima Wahana Caraka, PT PricewaterhouseCoopers Consulting Indonesia, and Melli Darsa & Co., Advocates & Legal Consultants, each of which is a separate legal entity, and all of which together constitute the Indonesian member firm of the PwC global network, which is collectively referred to as PwC Indonesia.

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 156 countries with over 295,000 people who are committed to delivering quality in assurance, advisory, and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com .

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

© 2021 PwC. All rights reserved.

External Communications, PwC Indonesia

Tel: +62 21 509 92901

© 2018 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Privacy statement

- Legal disclaimer

- Cookies Information

- About site provider

International tourism, number of departures - Indonesia

Selected Countries and Economies

All countries and economies.

- Privacy Notice

- Access to Information

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here.

Travel and tourism in Indonesia

Statistics report on the travel and tourism industry in Indonesia

This report presents information about the inbound travel and tourism industry in Indonesia. It provides key figures in international tourism, as well as key economic figures for the tourism industry.

Download your Report

Table of contents.

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Premium Statistic International tourist arrivals worldwide 2019-2022, by subregion

- Basic Statistic Travel and tourism contribution share to GDP in Indonesia 2019-2021

- Basic Statistic Travel and tourism contribution to GDP in Indonesia 2019-2021

- Premium Forecast Absolute economic contribution of tourism in Indonesia 2014-2029

Inbound tourism

- Premium Statistic Number of international visitor arrivals Indonesia 2014-2023

- Premium Statistic Number of international visitor arrivals from Asia Pacific to Indonesia 2014-2023

- Premium Statistic Number of international visitor arrivals Indonesia 2023, by mode of transport

- Premium Statistic Number of foreign visitor arrivals in Indonesia 2023, by port of entry

- Premium Statistic Monthly international air passengers at Soekarno-Hatta airport Indonesia 2019-2024

- Premium Statistic Average length of stay of inbound visitors to Indonesia 2012-2021

Domestic tourism

- Premium Statistic Number of domestic trips Indonesia 2013-2022

- Premium Statistic Number of domestic trips made in Indonesia 2021, by mode of transport

- Premium Statistic Breakdown of domestic trips in Indonesia 2021, by purpose

- Premium Statistic Monthly domestic air passengers at Soekarno-Hatta airport Indonesia 2019-2024

- Premium Statistic Number of domestic guests in star hotels Indonesia 2014-2023

- Premium Statistic Average length of stay in hotels by domestic travelers in Indonesia 2012-2021

- Premium Statistic Common concerns about traveling Indonesia 2023

Economic impact

- Premium Statistic Average daily expenditure of inbound visitors to Indonesia 2012-2021

- Premium Statistic Inbound tourism expenditure value Indonesia 2013-2022

- Premium Statistic Value of international tourism receipts Indonesia 2011-2020

- Premium Statistic Number of employees in tourism industry Indonesia 2011-2020

Accommodations, hotels, and bookings

- Premium Statistic Number of accommodation establishments for visitors Indonesia 2013-2022

- Premium Statistic Number of hotels and similar establishments Indonesia 2012-2021

- Premium Statistic Total number of hotels by star ratings Indonesia 2023

- Premium Statistic Number of employees in accommodation services for visitors Indonesia 2011-2020

- Premium Statistic Occupancy rate in classified hotels in Indonesia 2013-2023

- Premium Statistic Leading online travel agencies used in Indonesia 2023

- Premium Statistic Preferred accommodation booking methods for year-end holiday Indonesia 2022

Impact of COVID-19 on tourism

- Premium Statistic Quarterly change in international tourism receipts COVID-19 in Indonesia 2022

- Premium Statistic Monthly number of international visitor arrivals Indonesia 2020-2023

- Premium Statistic International tourism receipts during the COVID-19 pandemic in Indonesia Q4 2022

- Premium Statistic Monthly change in international tourist arrivals due to COVID-19 Indonesia 2020-2022

If this report contains a copyright violation , please let us know. Note that you will leave this page when you click the link.

Recommended and recent reports

Recommended statistics.

- Basic Statistic Domestic tourism spending in France 2019-2034

- Basic Statistic Domestic tourism spending in Germany 2019-2034

- Basic Statistic Domestic tourism spending in Europe 2019-2034

- Premium Statistic Domestic tourism spending in the Netherlands 2019-2034

- Basic Statistic Domestic tourism spending in Belgium 2019-2034

Statista report shop

We provide information on industries, companies, consumers, trends, countries, and politics, covering the latest and most important issues in a condensed format.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Get instant access to all reports & Premium Statistics

- Download reports & statistics for further analysis

- Share the exported formats inside your company

- Indonesia ›

Indonesia Tourism Statistics 2023 - All You Need To Know

by GoWithGuide travel specialist: CHLOE Miki

There is the glamour of a bustling city and the magnificence of sprawling nature both in land and in sea, hiding Indonesia’s colorful heritage. Beating Japan and the Philippines , the country of Indonesia ranks first in the world for the largest coastline coverage at 54.72 thousand kilometers. Within these coastlines are miles upon miles of beautiful beaches incomparable with the rest of the world.

You would be surprised at how much more the country has to offer aside from its gorgeous beaches. Indonesia is also abundantly rich in biodiversity, historical architecture, and culture. If that is not the full package, then what is?

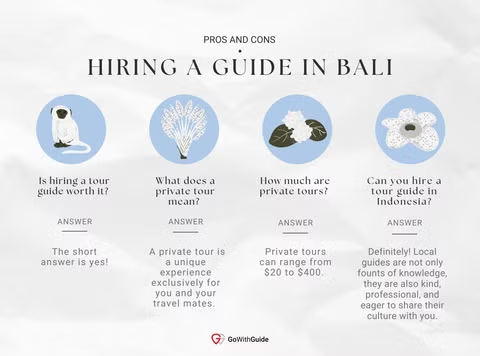

Southeast Asia is definitely a different type of travel to experience. If it is your first time in the region, we suggest booking a private guided tour to ease your worries. GoWithGuide only hires professional local guides who are trained and ready to answer any of your queries.

Before embarking on your equatorial exploits, read up on all you need to know before visiting incredible Indonesia.

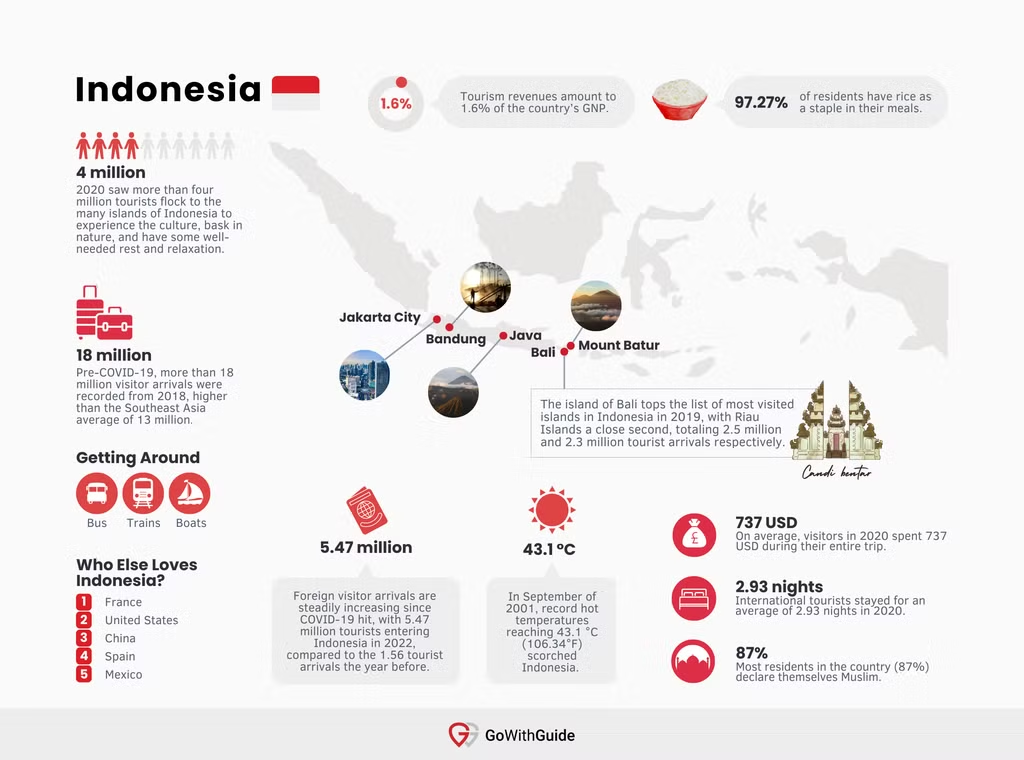

Indonesia’s Top 10 Tourism Statistics

Home to 17% of the entire world’s biodiversity and more than 273 million people , it is no wonder Indonesia tops the list of travelers wanting to experience the world. The archipelago awaits, with 18,110 islands ready to be explored.

- 4 million - 2020 saw more than four million tourists flock to the many islands of Indonesia to experience the culture, bask in nature, and have some well-needed rest and relaxation.

- 18 million - Pre-COVID-19, more than 18 million visitor arrivals were recorded from 2018, higher than the Southeast Asia average of 13 million.

- 1.6% - Tourism revenues amount to 1.6% of the country’s GNP.

- 5.47 million - Foreign visitor arrivals are steadily increasing since COVID-19 hit, with 5.47 million tourists entering Indonesia in 2022, compared to the 1.56 tourist arrivals the year before.

- 737 USD - On average, visitors in 2020 spent 737 USD during their entire trip.

- 2.93 nights - International tourists stayed for an average of 2.93 nights in 2020.

- 43.1 °C - In September 2001, record hot temperatures reaching 43.1 °C (106.34°F) scorched Indonesia.

- Bali - The island of Bali tops the list of most visited islands in Indonesia in 2019, with Riau Islands a close second, totaling 2.5 million and 2.3 million tourist arrivals respectively.

- 97.27% - 97.27% of residents have rice as a staple in their meals.

- 87% - Most residents in the country (87%) declare themselves Muslim.

Who Else Loves Indonesia?

An interesting mix of countries tops the list of international tourism arrivals in 2019, with European, North and South American, and Asian countries making an appearance.

- France - Tourists from France were the largest contingent of inbound visitors, with more than 200,000 tourists visiting Indonesia.

- United States

Life in Indonesia

Indonesia has something for every type of traveler. For the foodies, food tours introducing you to the authentic tastes of satay, pece lele (catfish), and nasi liwet (Javanese rice) will leave you hungry for more. If you love adventure , exploring the country’s many mountains and seas will strengthen your wanderlust.

For the art aficionados , a trek through Indonesia’s traditional sites and attractions will take you back in time.

Top 5 Must See Indonesia Attractions

Jakarta City

Downtown, Jakarta blends Islamic culture and high class residential modernities like antipodes. Jakarta is the capital that keeps on giving, with extraordinary attractions such as the National Museum containing more than 140,000 collections of history and prehistory, the biggest mosque in the country in the form of Istiqlal Mosque, as well as China Town.

Mount Batur

Meeting up at Toya Bungka Village hours before sunrise, everything is still, and the sky is dim. A local briefs you about Mount Batur , sharing a bit of its history and what to expect. He expects to give a more detailed account of the mountain on the hike to those eager to learn more. Reaching the crater, you are greeted with a lovely view, some delicious smelling breakfast, and whispers of a hot spring bath on the way down.

There is so much to do on the island of Bali , you could easily spend weeks without getting bored. Find yourself in Ubud , where UNESCO-listed rice terraces reign and the grand Tegenungan Waterfall and Sacred Monkey Forest Sanctuary can be enjoyed. Otherwise, lounge at Padang-Padang Beach before watching the entrancing Uluwatu Kecak Dance. In order to get the most of your visit, speak with our local guides to get the most accurate and up-to-date advice as to how to plan your days.

Lying in between Sumatra and Bali is the island of Java , volcanic, historical, and undeniably beautiful. Hear the Buddhist stories to attain Nirvana at Borobudur Temple. Once spiritually refreshed, wake up your senses in the active crater at Kawah Ijen.

Ever seen those markets in boats? Yes, you can find them in Bandung , specifically in the Floating Market Lembang. To get the best deals, book a private tour with a local guide so as not to get the “tourist price” of items and food. For the children, take them to the Great Asia Africa, a theme park with replica villages from the region, as well as a mini zoo.

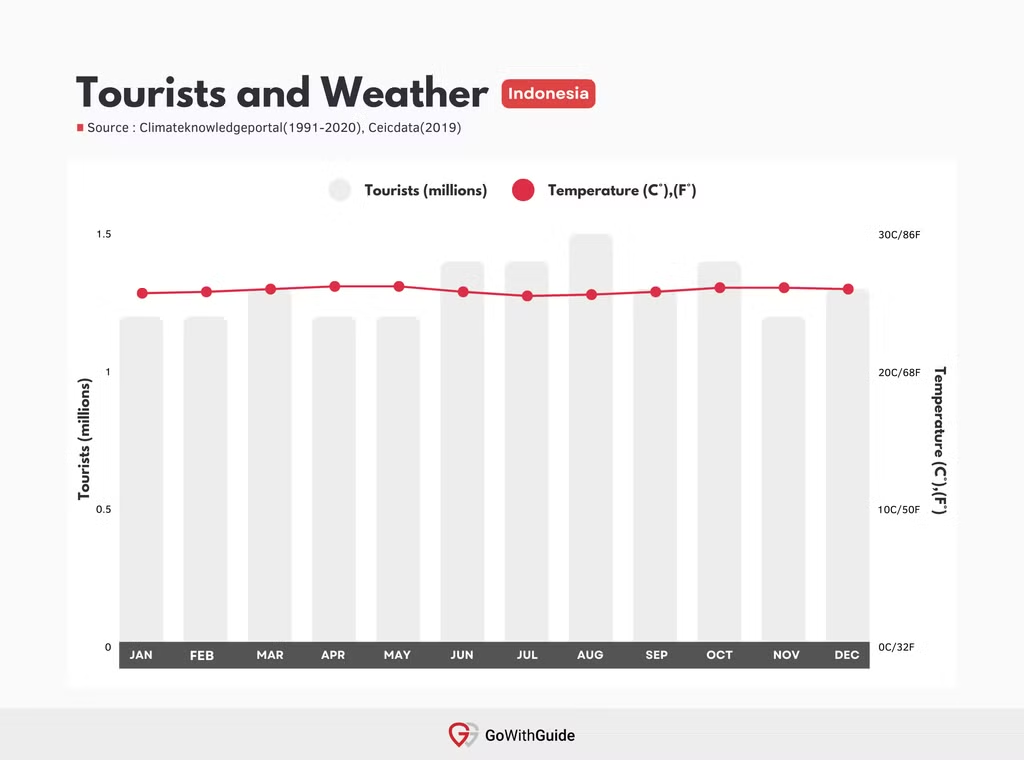

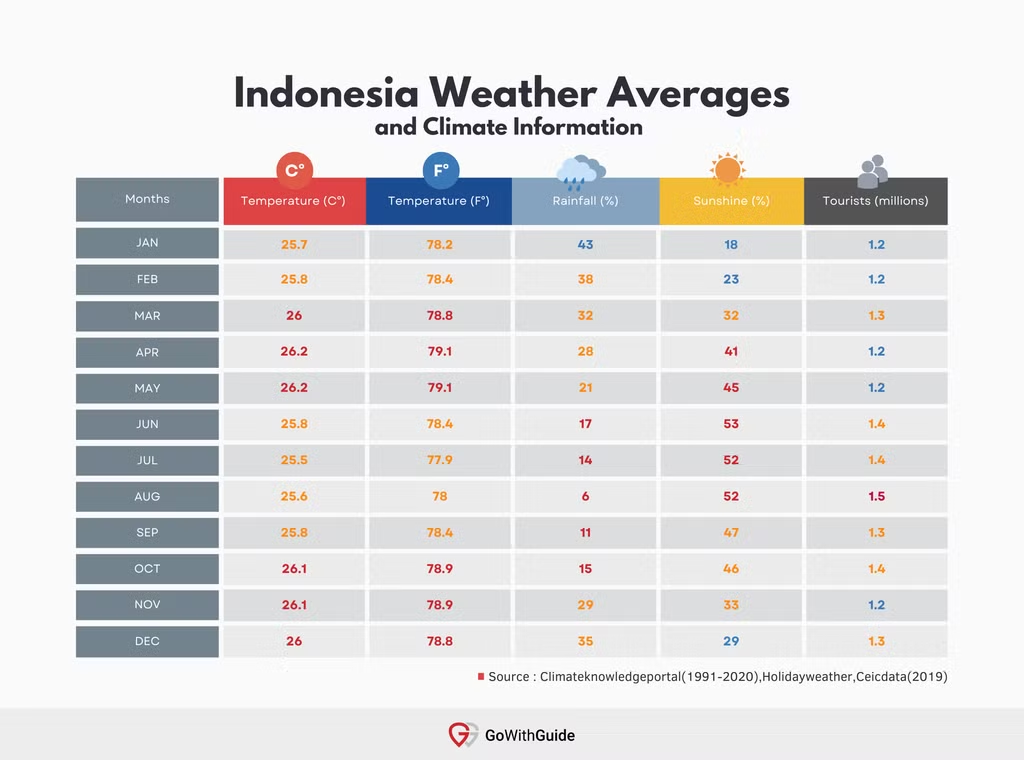

Best Time to Visit Indonesia

If you are in search of calm seas and blue skies, then Indonesia is best visited during its dry season from May to October. Although rain showers may occur during this time, these storms are definitely less frequent than in the wet season from November to April.

With highs of 31°C (87.8°F) and lows of 21°C (69.8°F), the country’s weather follows many of the other equatorial regions nearby. If you are looking for clear skies and inviting temperature, then July and August are the best months for you.

How to Get Around Indonesia

Buses - This is the main way both locals and tourists get around, specifically in minibuses called angkots , short for angkutan kota, or public transportation.

Trains - More comfortable than buses, trains are your next best bet for transportation. Like most countries, the lines are mostly in central areas. Depending on where you would like to go, there may or may not be a train line available. Check the official train website for more information.

Boats - Boats and ferries will get you to the islands in but an hour or two. Make sure you book your tickets well in advance to ensure seats on your desired travel date.

Safety in Indonesia

Indonesia was ranked 14 out of 43 Asian countries in the list of Safety Index Rankings in 2021. The country is a relatively safe country to visit, but just like in any country, make sure you are aware of your surroundings. Pickpockets may abound, and taxi and ATM-related scams may occur.

In order to make the most of your tropical adventure safely, hire a private guide to whizz you through all the most interesting attractions. Having a local with you will not only assimilate you to the culture, but they can also recommend off-the-beaten path alternatives, as well as suggest the best times to visit certain attractions.

Dos & Don'ts In Indonesia

Indonesia has everything you need for a perfect summer vacation. This equatorial jewel will not only leave you refreshed, but even revitalized after spending some time in the country’s spiritual nature.

For your next holiday destination, take your pick of one of the amazing islands dotted around Indonesia. Make sure to book your private tours with our local guides in advance to ensure we can provide the best service on your desired travel dates. Be the first to share these statistics and important information with friends and family. They will definitely add Indonesia to their bucket lists!

Written by CHLOE Miki

GoWithGuide’s writers are passionate travel specialists sharing unique tips and essential information for global explorers.

Popular indonesia tour guides.

Hi ! I love to meet new friends, specially from other countries. I will be very happy to company you guys to show arround Jakarta. I'll show you a Lot of GREAT FOODS in Jakarta, Cafe , Bar , Lounge, anything ! Lets have fun !

Hi My Name is Komarudin, i am 47 years old. I live in bekasi, not far from Jakarta, to be your travel guide is an honour to me. Cause this is my dream job. Since I was a child,I love to hang out, travelling anywhere my heart urges me to go. I love freedom and i love to interact with new friend. If you are alone, and you want to travel and cruise the night all around Jakarta, i am sure i am the best tour guide for you. I can be your trusted friend to explore every Corners of Jakarta.

As a legal & certified tour guide in Bali, I'm dedicated to unveiling the island's unique culture and awe-inspiring natural beauty. With years of experience and a deep passion for exploration, I specialize in creating personalized itineraries tailored to your budget and interests. Let me uncover Bali's hidden treasures and craft unforgettable memories for your journey.

Plan your trip to indonesia.

Chat with a local tour guide who can help organize your trip.

Related Blogs

Hiring A Guide In Indonesia - Pros & Cons

Indonesia is a country so full of wonder, culture, and adventure, that everyone should take time to visit at least once. home to more than 17% of the whole world’s biodiversity, ranked as the country with the largest coastline worldwide, and equipped with....

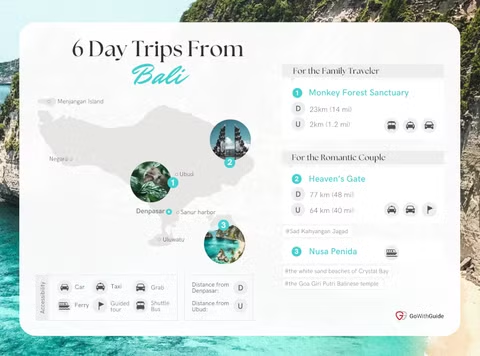

6 Day Trips From Bali

Bali, Indonesia

For some, Bali is a home; for many, it is a dream; and for the lucky few, it is their next vacation getaway. Blessed with crystal clear waters, cloudless days, and colorful food, the island of Bali in Indonesia is a place every nature lover and beach goer...

How to Watch Sumo Wrestlers Training in Tokyo

Tokyo, Japan

I think we can agree that sumo or sumo wrestling is different from the usual sports/attraction, and it’d be very interesting to watch it and experience the culture of sumo wrestling whilst in Japan. But, you might not know where, when, and how much does i...

Follow us on social media

IMAGES

VIDEO

COMMENTS

Prior to 2020, tourism in Indonesia was experiencing steady growth, spurred by increasing numbers of foreign visitors. However, the outbreak of the COVID-19 pandemic in 2020 showed how precarious ...

The Ministry of Tourism and Creative Economy introduced InDOnesia CARE, a symbol of support for Indonesia's strong effort in implementing the cleanliness, health, safety, and environment protocols across the tourism industry as mandatory precautions. All to assure travelers that InDOnesia CARE for your safety, health, hygiene and comfort.

Indonesia encompasses more than 17,000 islands, spread out over thousands of kilometres between the Indian and Pacific oceans. With the world's largest tropical coastline, Indonesia has become a leading tourism destination in South-east Asia; the country's cultural and natural diversity also offer significant untapped potential. Although the country has seen expansion in tourism in recent

The tourism sector is a significant part of Indonesia's economy. In 2019, tourism directly accounted for 5.0% of the country's GDP. The impacts of COVID-19 saw tourism GDP fall by 56% in 2020 to just 2.2% of the total economy. Prior to 2020, tourism in Indonesia had been steadily growing, fuelled by an influx of international visitors.

The 2022 Domestic Tourism Statistics Publication is an annual routine publication prepared and presented by BPS-Statistics Indonesia. This publication containing the profile of domestic visitors, the purpose of trip, the accommodation used, the trip duration, and the average of expenditure related to trips made by residents within the territory of Indonesia.

This latest report reveals the importance of Travel & Tourism to Indonesia in granular detail across many metrics. The report's features include: Absolute and relative contributions of Travel & Tourism to GDP and employment, international and domestic spending. Data on leisure and business spending, capital investment, government spending and ...

In the third quarter of 2023, domestic tourist trips in Indonesia reached 192.52 million trips. This number increased by 13.36 percent compared to the third quarter of 2022 (year-on-year). Throughout the third quarter, the highest number of domestic trips occurred in July 2023, which reached 73.69 million trips.

In 2023, the Travel & Tourism sector contributed 9.1% to the global GDP; an increase of 23.2% from 2022 and only 4.1% below the 2019 level. In 2023, there were 27 million new jobs, representing a 9.1% increase compared to 2022, and only 1.4% below the 2019 level. Domestic visitor spending rose by 18.1% in 2023, surpassing the 2019 level.

International tourism, number of arrivals - Indonesia from The World Bank: Data. Free and open access to global development data. Data. This page in: ... World Tourism Organization, Yearbook of Tourism Statistics, Compendium of Tourism Statistics and data files. ... REPORT FRAUD OR CORRUPTION.

Domestic Tourism Statistics 2020. July 21, 2023. Domestic Tourism Statistics 2022. June 29, 2023. Outbound Tourism Statistics 2022 ... BPS-Statistics Indonesia. Badan Pusat Statistik (BPS - Statistics Indonesia) Jl. Dr. Sutomo 6-8. Jakarta 10710 Indonesia. Telp (62-21) 3841195. 3842508. 3810291. Faks (62-21) 3857046. Mailbox : [email protected] ...

Boasting the world's largest tropical coastline and renowned cultural heritage sites, Indonesia is becoming a leading tourism destination in South-east Asia. Strong gains have been noted internationally, with the World Economic Forum declaring Indonesia the region's fourth-most-competitive destination after Singapore, Malaysia and Thailand in its most recent "Travel and Tourism ...

The 2017 tourism report by the WEF noted significant improvements in Indonesia's international openness, ranking it 17th out of 136 countries, up 38 spots over the previous year. Jakarta has been refining its image and boosting its offerings of luxury hotels, driven to some extent by its hosting duties for the 2018 Asian Games.

Tourism is one of the most important sectors in Indonesia. However, since the COVID-19 pandemic, tourism industries has declined significantly. Restrictions on mobility and activities in public places affect the tourism sector. One of them can be seen from the hotel room occupancy rate (ROR).

Tourism in Indonesia is an important component of the Indonesian economy as well as a significant source of its foreign exchange revenues. ... The report states that Indonesia scores well on visa policy (#3) and international openness (#16), as well as on natural (#17) and cultural resources (#24).

Indonesia Tourism Report. Total tourist arrivals to Indonesia are projected to fully recover to pre-pandemic (2019) levels in 2024, with arrivals continuing to expand over the medium term (2024-2028). Asia-Pacific markets will be the country's largest source markets for arrivals with increasing flight networks and preference for short-to-mid ...

Over the medium term (2024-2028), we predict arrivals to Indonesia will grow at an annual average rate of 13.9%, to reach 21.7mn by 2028. Arrivals growth will be driven by traditional major source markets for arrivals which include Malaysia, Singapore and Australia, as well as emerging key source markets with strong departures outlooks such as Mainland China and India.

report no: pad2756 international ank for re onstru tion and development project appraisal documentpublic disclosure authorized on a proposed loan in the amount of us$300 million to the republic of indonesia for a integrated infrastructure development for national tourism strategic areas (indonesia tourism development project) may 8, 2018

The World Travel & Tourism Council (WTTC) 2024 Economic Impact Research (EIR) projects a record breaking year for Indonesia's Travel & Tourism sector in 2024, with jobs in the sector set to ...

Growth of Tourism in Indonesia April 2024. Share. Release Date : June 3, 2024: File Size : 3.07 MB: Abstract. In April 2024, international visitor arrivals in Indonesia were 1.07 million. International visitors increased by 2.41 percent compared with March 2024 (month-to-month) and 23.23 percent compared with April 2023 (year on year ...

Jakarta, 12 November 2021 - The COVID-19 pandemic is the biggest challenge faced by Indonesian tourism business owners and operators. The number of foreign tourists entering the country in 2020 was only about 25% of the number of tourists in 2019. The decline in hotel occupancy in Indonesia in 2020 also sharply decreased in bookings from domestic and international guests, where in January ...

Welcome to VITO Online Report Ministry of Tourism and Creative Economy of the Republic of Indonesia

International tourism, number of departures - Indonesia. World Tourism Organization, Yearbook of Tourism Statistics, Compendium of Tourism Statistics and data files. License : CC BY-4.0. LineBarMap. Also Show Share Details. Label. 2000 - 2020.

Basic Statistic. Travel and tourism contribution to GDP in Indonesia 2019-2021. Premium Forecast. Absolute economic contribution of tourism in Indonesia 2014-2029. Inbound tourism. Premium ...

An interesting mix of countries tops the list of international tourism arrivals in 2019, with European, North and South American, and Asian countries making an appearance. France - Tourists from France were the largest contingent of inbound visitors, with more than 200,000 tourists visiting Indonesia. United States China; Spain; Mexico Life in ...

Indonesia's Ministry of State-Owned Enterprises (SOEs) has entered into a significant agreement with Eagle Hills a United Arab Emirates (UAE)-based property developer, to boost the country's tourism sectors and infrastructure. The Memorandum of Understanding (MoU), signed on July 18, 2024, outlines plans for investments of up to $3 billion in Indonesia's tourism ecosystem.

BPS-Statistics Indonesia. Badan Pusat Statistik (BPS - Statistics Indonesia) Jl. Dr. Sutomo 6-8. Jakarta 10710 Indonesia. Telp (62-21) 3841195. 3842508. 3810291. Faks (62-21) 3857046. Mailbox : [email protected]. Tourism - covers statistics regarding visitor activity (such as arrivals/departures, overnight stays, expenditures, purpose of the ...

Uno made his fortune with investment firm Saratoga Capital, before becoming deputy governor of Jakarta in 2017. He was appointed tourism minister in 2020.