APAC Travel Retail Market Size & Share Analysis - Growth Trends & Forecasts (2024 - 2029)

Asia-pacific Travel Retail Market Report is Segmented by Product Type (Fashion and Accessories, Jewelry and Watches, Wine & Spirits, Food & Confectionery, Fragrances and Cosmetics, Tobacco, Others (Stationery, Electronics, Etc. ), By Distribution Channel (Airports, Airlines, Ferries, Other(railway Stations, Border, Downtown)) and by Geography (China, Japan, Korea, India, Australia, Southeast Asia, Others). The Report Offers Market Size and Forecasts for the Asia-Pacific Retail Market in Value (USD) for all the Above Segments.

- APAC Travel Retail Market Size

Single User License

Team License

Corporate License

Need a report that reflects how COVID-19 has impacted this market and its growth?

APAC Travel Retail Market Analysis

The Asia-Pacific Travel Retail Market size is estimated at USD 63.15 billion in 2024, and is expected to reach USD 98.11 billion by 2029, growing at a CAGR of 9.21% during the forecast period (2024-2029).

The growing income of the middle-class population increased the development of the travel retail market in Asia Pacific. Asia Pacific is the home of some of the world's most popular countries and a tourist destination. The region's tourism sector is increasing due to the rise in domestic and international travelers. The Asia Pacific region offers attractive duty-free shopping incentives that allow travelers to make tax-free purchases, so these factors attract more travelers to the Asia Pacific region and, therefore, fuel the growth of the travel retail market.

The primary factor that drives the travel retail business in Asia-Pacific is the increasing tourism because foreign investors visit and do tax-free shopping. Many marketers are establishing themselves in Asian marketplaces. One of the largest importers of cosmetics and clothing is in the region, contributing to expanding the Asia-Pacific market. Hence, the region’s travel retail market generates revenue through fashion, accessories, fragrances, cosmetics, wine, and spirits.

Due to the increased adoption of premium lifestyles, the luxury product market in the region is growing. Factors like an increase in disposable income, extensive social media usage, and increased urbanization increase investments in personal luxury goods, which fuels the expansion of the travel retail market in the Asia Pacific region.

- APAC Travel Retail Market Trends

High Revenue Generation From Airport Retailing Drives The Market

The primary factor driving the travel retail market in the Asia-Pacific region is the increasing growth of the tourism sector. Many foreign investors visit countries like Hong Kong and Malaysia for tax-free shopping. The airport became a vital retail channel for brands to promote and create product awareness among customers. Airports are branching out the business to segments like retail, restaurant bars, and cafeterias. 60% of commercial income gained by the airport owners is through airport retail and commercial services, including food and beverage. It contributes to direct investments in Asia-Pacific's aviation infrastructure and increases the development of the Asia-Pacific retail market.

China Dominates The Market

The travel retail industry in China is growing due to the rising demand for tourism, luxury goods, and cosmetics. Apart from this, the industry is getting massive support from the government in Hainan province to boost industry growth. Due to the benefits gained from globalization and steady traffic growth, the travel retail market became attractive in China. To achieve the government's aim of developing a special economic zone or a tourist destination in Hainan, china brought overseas consumption back to its domestic market. Thus, China dominates the travel retail market in the Asia-Pacific region.

APAC Travel Retail Industry Overview

The Asia-Pacific travel retail market is fragmented. The companies are grabbing new contracts and entering into new markets with the help of technological advancements and product innovations. The major brands are opening exclusive stores for unique products. The companies are promoting and selling limited editions to increase their visibility and brand awareness in the market. The major market players are Dufry, DFS Group, China Duty-free Group Co. Ltd, King Power, and Flemingo International.

APAC Travel Retail Market Leaders

Flemingo International

China Duty-free Group Co. Ltd

*Disclaimer: Major Players sorted in no particular order

APAC Travel Retail Market News

- October 2023: DFS Group, the travel retail company, developed an entertainment and shopping complex on the duty-free Hainan Island of China. This development aimed to enhance the tourism market, even during economic downturns.

- July 2023: Lagardère Travel Retail, in partnership with Inflyter, expanded its business by offering an online Duty-Free shopping experience for a broader audience of travelers. This partnership offers customers pre-travel browsing and purchasing to broaden the digital sales channels and create multiple customer touchpoints throughout their journey.

APAC Travel Retail Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions and Study Deliverables

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS AND DYNAMICS

4.1 Market Overview

4.2 Market Drivers

4.2.1 Guaranteed Customer Base In Travel Duty-Free Shops Drives The Market

4.2.2 Exemption From Taxes When Goods Are Taken Out Of The Country Of Purchase Drives The Market

4.3 Market Restraints

4.3.1 Security Concerns Like Heightened Security Measures And Restrictions At Airports And Other Travel Hubs

4.3.2 Market Oppurtunities

4.3.2.1 E-commerce Integration

4.3.2.2 Exclusive Product Launches

4.4 Value Chain / Supply Chain Analysis

4.5 Porters 5 Force Analysis

4.5.1 Threat of New Entrants

4.5.2 Bargaining Power of Buyers/Consumers

4.5.3 Bargaining Power of Suppliers

4.5.4 Threat of Substitute Products

4.5.5 Intensity of Competitive Rivalry

4.6 Insights on Technology Innovation In The Market.

4.7 Impact of Covid 19 On Market

5. MARKET SEGMENTATION

5.1 By Product Type

5.1.1 Fashion and Accessories

5.1.2 Jewellery and Watches

5.1.3 Wine & Spirits

5.1.4 Food & Confectionary

5.1.5 Fragnances and Cosmetics

5.1.6 Tobacco

5.2 By Distribution Channel

5.2.1 Airports

5.2.2 Airlines

5.2.3 Ferries

5.3 By Geography

5.3.1 China

5.3.2 Japan

5.3.3 Korea

5.3.4 India

5.3.5 Australia

5.3.6 Southeast Asia

5.3.7 Rest Of APAC

6. COMPETITIVE LANDSCAPE

6.1 Company Profiles

6.1.1 Dufry

6.1.2 China duty free group co., ltd.

6.1.3 DFS Group

6.1.4 King Power

6.1.5 Heinemann Asia Pacific

6.1.6 Lotte Duty Free

6.1.7 The shilla duty free

6.1.8 Flemingo International

6.1.9 James Richardson Group

6.1.10 The Nuance Group*

- *List Not Exhaustive

7. MARKET FUTURE TRENDS

8. DISCLAIMER AND ABOUT US

APAC Travel Retail Industry Segmentation

Travel retail is sales made in travel environments. It covers duty-free environments of the world, including airports, airlines, cruises, downtown locations, and border shops. Asia-Pacific travel retail market is segmented into product type, distribution channel, and geography. The market is segmented by product type into fashion and accessories, jewelry and watches, wine & spirits, food & confectionery, fragrances and cosmetics, and tobacco. The market is divided by distribution channels into airports, airlines, and ferries. By geography, the market is divided into China, Japan, Korea, India, Australia, Southeast Asia, and the Rest of Asia-Pacific. The report offers market size and forecasts for the Asia Pacific retail market in value (USD) for all the above segments.

APAC Travel Retail Market Research FAQs

How big is the asia-pacific travel retail market.

The Asia-Pacific Travel Retail Market size is expected to reach USD 63.15 billion in 2024 and grow at a CAGR of 9.21% to reach USD 98.11 billion by 2029.

What is the current Asia-Pacific Travel Retail Market size?

In 2024, the Asia-Pacific Travel Retail Market size is expected to reach USD 63.15 billion.

Who are the key players in Asia-Pacific Travel Retail Market?

Dufry, DFS Group, King Power, Flemingo International and China Duty-free Group Co. Ltd are the major companies operating in the Asia-Pacific Travel Retail Market.

Which is the fastest growing region in Asia-Pacific Travel Retail Market?

Asia is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Asia-Pacific Travel Retail Market?

In 2024, the Europe accounts for the largest market share in Asia-Pacific Travel Retail Market.

What years does this Asia-Pacific Travel Retail Market cover, and what was the market size in 2023?

In 2023, the Asia-Pacific Travel Retail Market size was estimated at USD 57.33 billion. The report covers the Asia-Pacific Travel Retail Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Asia-Pacific Travel Retail Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Our Best Selling Reports

- Automated Machine Learning Market

- Bioinformatics Market

- Exosome Market

- High-performance Liquid Chromatography Market

- Identity as a Service Market

- Lithium-Ion Battery Recycling Market

- Media Streaming Market

- Oncology Information Systems Market

- Renewable Energy Market in Portugal

- Rodenticides Market

APAC Travel Retail Industry Report

Statistics for the 2023 APAC Travel Retail market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. APAC Travel Retail analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.

APAC Travel Retail Market Report Snapshots

- APAC Travel Retail Market Share

- APAC Travel Retail Companies

Please enter a valid email id!

Please enter a valid message!

Asia-Pacific Travel Retail Market Get a free sample of this report

Please enter your name

Business Email

Please enter a valid email

Please enter your phone number

Get this Data in a Free Sample of the Asia-Pacific Travel Retail Market Report

Please enter your requirement

Thank you for choosing us for your research needs! A confirmation has been sent to your email. Rest assured, your report will be delivered to your inbox within the next 72 hours. A member of our dedicated Client Success Team will proactively reach out to guide and assist you. We appreciate your trust and are committed to delivering precise and valuable research insights.

Please be sure to check your spam folder too.

Sorry! Payment Failed. Please check with your bank for further details.

Add Citation APA MLA Chicago

➜ Embed Code X

Get Embed Code

Want to use this image? X

Please copy & paste this embed code onto your site:

Images must be attributed to Mordor Intelligence. Learn more

About The Embed Code X

Mordor Intelligence's images may only be used with attribution back to Mordor Intelligence. Using the Mordor Intelligence's embed code renders the image with an attribution line that satisfies this requirement.

In addition, by using the embed code, you reduce the load on your web server, because the image will be hosted on the same worldwide content delivery network Mordor Intelligence uses instead of your web server.

- SOUTH EAST ASIA

- NORTH EAST ASIA

- AUSTRALASIA

What’s the Future for Travel Retail in Asia?

In June, Gary Bowerman analysed the outlook for travel retail across Asia Pacific and beyond, as brands and retailers await the return of the region’s big spending travellers.

The Five Potential Indicators for the Future of Travel Retail commentary was commissioned by Zurich-based DKSH . It forms part of a series of 10 Asia-focused consumer, lifestyle and travel articles I will be producing throughout 2021.

Here’s the introductory section of the article:

“Experiences are more important than possessions.” This has become a mantra of Asia’s tourism industry as it seeks to understand how travel behaviors may evolve post-pandemic.

The underlying precept is that travelers may want to escape to nature, to experience freedom in serene landscapes rather than spend time shopping when travel bans are eventually lifted. Tourists radiating away from urban centers could dampen the much-hoped-for revival of travel retail spending.

Yet, predicting future trends in Asian travel is risky. Having been unable to fly beyond borders for 15 months and counting may mean that caution and safety remain paramount, at least initially. Alternatively, grounded travelers may take to the skies in large numbers as soon as the airport gates are opened.

But when travel does resume, will “revenge spend” travelers stimulate visitor economies once more? And how should businesses prepare? At the same time, has skyrocketing pandemic-era growth in eCommerce altered travel retail forever? If so, what new spending patterns could emerge?

Amid the current uncertainty, here are five factors for travel retail businesses to ponder:

1) Charting Domestic Travel Spending

Things to consider: Shifting consumer aspirations, domestic tourism patterns and purchasing triggers.

2) Watching China’s Hainan Island Experience

Things to consider: Duty-free hypermarkets, bespoke branded launches and huge volume sales.

3) Innovating in Travel Shopping

Things to consider: In-the-moment purchases, downtown duty free and ‘flights to nowhere.’

4) Making Travel Payments Seamless

Things to consider: Diversity of digital payments, e-currencies and gamified promotions.

5) Buying into the Travel Shopping Experience

Things to consider: Travel gift buying, ‘sense of place’ artisanal products and mementos inspired by local culture.

Read the full version of ‘Five Potential Indicators for the Future of Travel Retail’ HERE

Share this:

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car Insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Asia pacific leads the travel retail market due to thriving tourism and growing number of airports.

DUBLIN , Nov. 3, 2023 /PRNewswire/ -- The "Global Travel Retail Market (by Product Type, Sale Channel, & Region): Insights and Forecast with Potential Impact of COVID-19 (2022-2027)" report has been added to ResearchAndMarkets.com's offering.

The global travel retail market is poised for significant growth, with a projected value of US$75.93 billion by 2023, representing a robust compound annual growth rate ( CAGR ) of 17.37% during the forecast period from 2022 to 2027.

Travel retail refers to retail establishments primarily located in travel environments such as airports, train stations, cruise lines, and more. Recent surges in impulse purchases made while waiting for flights or trains at these travel touchpoints, especially airports, have driven the growth of the global travel retail industry. Travel shopping offers several benefits, including convenience, accessibility, a pleasant ambiance, and cost-effectiveness, attracting customers to these establishments.

Travel retail businesses are closely associated with travel environments and typically require customers to provide proof of travel to enter the commercial area, where purchases may be subject to taxes and tariffs. To entice customers, many stores and companies offer duty-free items.

Segment Coverage

By Product Type: The global travel retail market is segmented into seven product types: fragrances & cosmetics, wine & spirits, luxury goods, tobacco, food, confectionery & catering, electronics, and others. The luxury goods segment is expected to exhibit the highest growth during the forecast period. This growth can be attributed to rising disposable incomes, increased exposure to social media, urbanization, and a preference for investments in personal luxury items.

By Sale Channel: The market report categorizes the global travel retail market into four sale channels: airport, border, downtown and hotel shops, railway stations, and cruise liners. The airport segment currently holds the largest share in the travel retail market, driven by the increasing number of travelers and technological advancements at airports.

Geographic Coverage

The global market is divided into five major regions: Asia Pacific , Europe , North America , the Middle East & Africa , and Latin America . North America encompasses the US, Canada , and Mexico , while Europe includes the UK, Germany , France , Spain , and the Rest of Europe .

Additionally, South Korea , China , and the Rest of the Asia Pacific are part of the Asia Pacific region. Asia Pacific dominates the global travel retail market due to the thriving travel and tourism sector, as well as the growth of new international routes in the region. South Korea , in particular, has a flourishing duty-free market, driven by its position as one of the largest in the world and an increasing number of Chinese and Japanese visitors.

Top Impacting Factors

Growth Drivers:

Dominating Gen Z and Millennial Population: Millennials and Gen Z travelers consider travel a necessity and prioritize unique experiences over traditional luxury, driving the demand for travel retail.

Increasing Number of Airports: The growing number of airports and air travelers creates a conducive environment for travel retail businesses.

Increased Personal Luxury Goods Consumption: Rising incomes and exposure to luxury goods on social media platforms contribute to increased spending on personal luxury items.

Increased Traveling Offers: Expanding travel offers, including leisure trips and personalized experiences, boost travel retail sales.

Challenges:

Lack of Availability of Space: Limited space in travel retail stores can pose challenges in merchandising and providing a positive customer experience.

Tedious Air Travel Requirements: Stringent air travel requirements, including security checks and document verification, can deter travelers from shopping at travel retail outlets.

Involvement of Artificial Intelligence: The use of artificial intelligence enhances the travel retail experience and helps retailers tailor offerings to customer preferences.

Digitization of Travel Retail: The digital transformation of travel retail introduces new ways to engage travelers and enhance their shopping experience.

Growing Trend of Robotics in Travel Retail: The integration of robotics in travel retail operations is becoming more prevalent, offering efficiency and convenience.

Technological Advancements: Technological innovations, such as data analytics and personalized marketing, are shaping the future of airport retail.

The COVID-19 Impact

The COVID-19 pandemic had a significant impact on the travel retail market, with reduced footfall, travel restrictions, and economic challenges leading to decreased demand for travel retail products. However, as vaccination efforts progress and mobility at travel touchpoints such as airports and railway stations increases, the post-pandemic market is expected to regain momentum.

Analysis of Key Players

The travel retail market has traditionally been fragmented, with key companies focusing on analyzing consumer buying behavior and offering tailored retail products. Leading players in the market include:

Shilla Duty-Free Shop

LVMH Moet Hennessy Louis Vuitton (DFS Group)

Hotel Shilla Co., Ltd (The Shilla Duty Free)

Lagardere Group

WH Smith PLC

Shinsegae Inc (Shinsegae Duty Free)

Lotte Corporation ( Lotte Duty Free )

Dublin Airport Authority (Aer Rianta International Duty-Free LLC)

Duty Free Americas, Inc.

China International Travel Service Corporation Limited (China Duty Free Group)

Gebr. Heinemann SE & Co. KG

Harding Brothers Retail Ltd (Flemingo International Limited)

Everrich Duty Free Shop

Dubai Duty Free

The King Power International Group

For more information about this report visit https://www.researchandmarkets.com/r/ctynut

About ResearchAndMarkets.com ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Media Contact:

Research and Markets Laura Wood , Senior Manager [email protected]

For E.S.T Office Hours Call +1-917-300-0470 For U.S./CAN Toll Free Call +1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

U.S. Fax: 646-607-1904 Fax (outside U.S.): +353-1-481-1716

Logo: https://mma.prnewswire.com/media/539438/Research_and_Markets_Logo.jpg

View original content: https://www.prnewswire.com/news-releases/asia-pacific-leads-the-travel-retail-market-due-to-thriving-tourism-and-growing-number-of-airports-301977306.html

SOURCE Research and Markets

- Vision & Mission

APTRA’S VISION

We represent all members of the association to strengthen, nurture & protect our industry

APTRA’S MISSION

Supporting members through meaningful research, knowledge share, networking opportunities and advocating our industry when facing regulatory challenges

ABOUT APTRA

Established in 2005, APTRA (The Asia Pacific Travel Retail Association) is a not-for-profit organization serving the interests of multiple stakeholders in the Duty Free & Travel Retail Industry across Asia Pacific, spanning airports, brands, retailers, food & beverage operators, airlines and Travel Retail industry associates.

APTRA enhances regional communication, enriches knowledge and assists members with regulatory negotiations. It also represents members and advocates against legislative changes

that may adversely affect the industry, ensuring members are brought together and represented as one impartial voice.

APTRA also supports members by sharing relevant information, data and research on different aspects of Travel Retail.

Membership is open to all Travel Retail industry stakeholders. Bringing this unique blend of Travel Retail partners together, APTRA encourages participation amongst members to recognize synergies and common needs around knowledge, networking and advocacy.

THE THREE PILLARS OF APTRA

IN PARTNERSHIP WITH

Event sponsorships 2023, may 2023 – aptra networking lunch & aptra exchange.

This website uses cookies

By continuing to browse this website or by clicking “Accept”, you agree to the storing of cookies on your device to enhance your site experience and for analytical purposes. Read more about our cookie policy.

Retail in Asia

How Coty plans to accelerate its travel retail momentum in Asia

Coty’s third-quarter results published last month revealed encouraging momentum in travel retail with revenues surging 30 percent year-on-year and the channel accounting for a healthy 8 percent of group sales.

SEE ALSO: APAC health and beauty industry to expand at 4.7 percent CAGR to 2027

That performance came despite well-documented inventory issues in the key Hainan offshore duty free market which have affected most leading beauty brands.

However, April sales in China generally, and Hainan specifically, increased both versus last year and 2021, auguring well for the balance of 2023.

The much-awaited and accelerating return of Chinese outbound travellers is a further boost, says Coty senior vice president, global travel retail and managing director, China, Guilhem Souche.

Over the past three pandemic-ravaged years Coty, in common with its peers, shifted its strategic focus to other travelling nationalities. Now that Chinese shoppers are returning, it is important to maintain a balance between demographics, he notes.

“Pre-pandemic we were heavily focused on China in Asia Pacific,” Souche comments. “During the pandemic, we had the opportunity to grow other regions and connect with our other consumers in Asia. Today, we’re seeing the first results behind our investments in APAC regions such as Southeast Asia and India.

“While the return of Chinese travellers does mean a revamped focus, we want to keep building the market share, we’ve built in the rest of Asia.

“This is especially true in countries where there has been a boom in fragrances, no slowdown in makeup and skincare is growing exponentially. Our approach is to be multi-regional, as we continue to build equity for our triple-axis brands.

“We’re strong in iconic fragrance brands and very strong in collections like Chloé Atelier des Fleurs which was the number four fragrance brand in China travel retail in 2022, based on Beauty Research data).

Makeup performs well and our skincare portfolio continues to be one of the most exciting growth areas in our business. This is what we want to keep on building.

“We’re very happy to see the progressive return of Chinese shoppers,” Souche continues. “We see a lot of individual travelling from China and are waiting for group travels to pick up again, too.”

The Chinese beauty consumer evolution

The Chinese traveller of today is very different from three years ago and we’re prepared for that. We can see that there has been a huge boom in fragrances, driven by the Chinese. This boom has led to a new sophistication in terms of their fragrance knowledge and expertise. Before, they used to only go for light floral fragrances, but now they know the difference between oud, citrus top notes, oak, etc.

“That’s very good news for Coty because we are among the global leaders in fragrances. So, it’s great to know that the Chinese are coming back with a new love and knowledge for fragrances.

“There is also a huge middle class accessing the luxury world every year in China,” Souche adds. “Young customers who are savvy and sophisticated and that’s very good news. Our customers are very happy to travel. After being unable to these last three years, the Chinese shoppers are very excited to travel again.

“Our job is to help them indulge and give them a great shopping experience in travel retail, an experience which should be just as good as in the mainland.

“While the borders were closed, the China local market and Hainan kept on developing and so we need to match this abroad. We welcome them with memorable experiences, excellent retail design and of course, an impeccable portfolio. We now have a wonderful niche fragrance offering and Asian-focused shades in makeup such as our weatherproof Burberry Beyond Wear [which is known as ‘trench foundation’ in China -Ed]. We’re also going big on skincare and that is something we didn’t have pre-pandemic.”

Multiple pillars

Coty has invested heavily in diversifying its portfolio, boosting the critical skincare sector and broadening established brands such as Gucci and Burberry to include makeup and skincare.

“The biggest innovation this year is that we’ve significantly accelerated our skincare offering. In travel retail, Hainan was the first location where we launched our breakthrough Ligne Princière skincare line, pushing it as a skincare and not sun care brand. This has been well received in the China local market and we’re expanding in South Korea travel retail too.

“On 17 March, we launched TMall, Douyin and four local department stores and boutiques. In Hainan we launched one standalone Lancaster store with Wangfujing Duty Free – boosting our skincare visibility.

“Across the board, our collections are getting wider. Burberry Signature and Chloé Atelier des Fleurs are big parts of our sales. In makeup we’ve added categories we previously didn’t have. We have a lot of opportunities in our offer because we only launched makeup in 2019. So there’s a lot of incremental growth.

“We are expanding our portfolio to cater to all needs. That’s in conjunction with boosting brand awareness, implementing beautiful retail concepts and offering complete experiences which are different from each other.”

A key Coty focus is to develop products specifically focusing on Asian consumers. “The needs of Asian skin and Asian people are very different from the West,” Souche explains.

“They includes shades, textures and formulas that cater to different weather and temperature conditions. In skincare it’s all about routines. Asian consumers have longer skincare routines that incorporate essences and lotions. The successes we have in our fragrance portfolio in Asia differ region per region, which is also very interesting.”

Niche fragrances and the ‘skinification’ of beauty

The so-called ‘skinification’ of beauty is one of the sector’s key trends to emerge from the pandemic as consumers dedicate more attention to the health and wellbeing of their skin. “One of the reasons foundation has been resistant to Covid is that it has skincare ingredients,” Souche comments.

“Adding skincare ingredients to our formulas is something we’ve actively been working on. And I’m not just talking about travel retail and prestige brands, our consumer beauty brands are pushing the boat in skinification too.”

The rise of niche fragrances across Asia Pacific is another trend that Coty’s powerful fragrance portfolio is well-placed to leverage. “If you look at what we’re displaying here [at the Singapore show], you’ll see we have many collections such as Chloé Atelier des Fleurs, Gucci The Alchemist Garden, Burberry Signature and Boss The Collection that highlight the power of our fragrance portfolio.

“People are responding very well to niche fragrances because they enable consumers to differentiate themselves through strong storytelling and quality of the ingredients. This goes hand-in-hand with strong retail expression, particularly in travel retail.”

Fly With Me

Coty has invested heavily in blockbuster multi-brand pop-ups in Asia Pacific, including its recent ‘Fly With Me’ pop-up in Changi Airport and last year’s successful ‘Around The World’ animation at GDF Plaza in Haikou, Hainan province.

The omnichannel animation, which ran from 15 April to 24 May, reinforced themes of travel and discovery from Coty’s signature fragrance brands. It offered a curated scent assortment bolstered by interactive digital and retailtainment elements. A ‘Fly With Me’ airplane served as the centrepiece while a gamepad invited travellers to embark on an olfactive discovery experience by diffusing different scents using a joystick.

A Flight Simulator offered an interactive gaming experience whereby consumers could fly their own plane and aim to attain the best score while a multi-scented tablet allowed shoppers to choose their bespoke perfumes.

Integral to the promotion was a new partnership milestone with Alipay+, the global cross-border mobile payments and marketing solutions app. Thanks to the alliance, Singapore became the first destination outside of China to introduce Alipay Super Brand Day.

“We are developing this animation in other cities too and we can adjust the Sense of Place elements depending on the retailer and location,” Souche says.

“The pop-up attracts travellers because of its many playful elements. It’s a very memorable experience that you can only have in travel retail. On top of that, the animation debuted our partnership with Alipay+.

“We can activate cross-border payments and collaborate with Alipay+ on marketing solutions that reach Chinese travellers throughout their journey. In terms of the activation of this partnership, we need to look at where the Chinese shoppers are travelling. So, we’re rolling out in APAC but potentially it could go global too.”

Coty’s big skincare bets

As noted, Coty has mounted a big push in evolving Lancaster from a sun care brand into a full-fledged skincare proposition. The brand launched the travel retail-exclusive, super-premium range Ligne Princière, which pays homage to Lancaster’s royal roots in the principality of Monaco.

“Lancaster and Ligne Princière are enjoying more and more buzz in China. We’ve also partnered with Lotte Duty Free for some livestreaming sessions to boost awareness for the range in South Korea,” Souche comments.

“When you launch a new range like this, you need to communicate it in a major way. We’ve got great feedback already, but it is a significant investment for us so we’re going to focus on this long term.”

Orveda, Coty’s super-premium skincare brand, is another key focus. The brand revealed its innovative Orveda OmniPotent Concentrate serum and Infiniment Coty Parison 13 May at the Villa Botanica in Grasse, France, a spectacular event which was attended by The Moodie Davitt Report Founder & Chairman Martin Moodie. The brand was co-founded by Coty CEO Sue Y. Nabi and Nicolas Vu in 2014 with the aim of ‘reinventing high-end skincare’.

“Orveda is inspired by Ayurvedaism and was created with Asia in mind,” Souche says. “We’ve launched in November in China and in Hainan. Now, we’re starting to have a good visibility for the brand in other regions and it’s been well received.

SEE ALSO: Exclusive: L’Oréal’s sustainability play in North Asia

“It’s ultra premium so we’re going to take the time that we need to develop it and attract the savviest customers. The fact that it is made with biotechnology with high concentrations of active ingredients is very appealing to customers. The routine is very appealing to Asian consumers and so far it has been welcomed by the travel retail community.”

That welcome has clearly been extended across a powerful and now healthily diverse portfolio that sees Coty gaining rapid traction within an intensely competitive travel retail beauty sector.

(Source: The Moodie Davitt Report )

Messika has announced a new partnership with Bluebell Group for the opening of the jeweller’s first Korea boutique.…

Cartier to mount ‘Trinity 100’ pop-up in Singapore

Samsara Eco secures USD65 million in latest funding round

Interview: Coty’s Guilhem Souche on stepping up the retail experience

Singapore named the costliest city to live in for luxury dwellers

Hongkong Land to pour USD400m into Landmark’s luxury transformation in Central, Hong Kong

Retail Asia website works best with Javascript enabled. Please enable your javascript and reload the page.

- Sections Co-Written / Partner E-commerce Fashion Stores Suppliers Technology

- Events Retail Asia Forum - Manila - October 3, 2024 Retail Asia Summit - November 20, 2024

- Advertising Advertising Digital Events

In Thailand, tourist experiences bring value to retail industry

Tourist-centric retail clicks for Thailand amidst continuous influx of foreign visitors.

THAI tourism is facing a significant boom as “The Land of Smiles” expects this year to reach 36 million international visitors amidst visa-free travel initiatives. This became the cue for the retail industry to adapt and enhance the tourist experience by connecting diverse cultures with a local touch.

At the Retail Asia Forum in Bangkok , Thailand, industry leaders came together to share their perspectives on the emerging trends in tourist-centric retail.

Natee Srirussamee, head of The Mall Group’s Digital Retail, affirmed that foreign tourists have been shifting from ordinary shopping to experiential retail. “Instead of just shopping merchandise and promotion hunting, they are looking for more experience,” he said.

In response, retailers are combining shopping with unique experiences to attract tourists. This includes hosting themed events, and other interactive activities.

Superbee CEO Antoinette Jackson agreed with this sentiment, citing how people who visit Thailand, particularly the younger generation, are more enticed by diverse experiences than material value.

“Many people would come and want to do a workshop to make something themselves. There are also a lot of businesses where you can make your chocolate or Thai tea flurry,” Jackson said.

She also told the forum that with the advent of technology, one crucial aspect that needs to be retained is the “human touch.”

One way Superbee achieves this is through its “Super60 Project,” through which they hire those aged over 60 as sales service assistants to replicate the experience of “speaking to grandparents.”

“They put all their efforts into selling and even remember their customers — a touch that cannot be replaced by a machine or technology,” Jackson added.

Cultural inclusivity

Quoting the Tourism of Thailand (TAT), Srirussamee said the top five tourist nationalities currently visiting Thailand are the Chinese, Malaysians, Russians, Koreans, and Indians. There is also a growth in the number of visitors from emerging markets such as the Middle East.

This demographic spread signifies a diverse range of cultural backgrounds to which businesses are adapting for better tourist-centric outcomes.

“For example, the 1st to 5th of May is a big holiday in China and they love durian so much. That is why we always have our Durian Festival at our gourmet market during that period,” Srirussamee said.

He also noted how services should be inclusive to promote cultural sensitivity. “Let’s say we have more tourists from the Middle East coming in — so prayer rooms and halal foods have to be available,” he said.

KFU Co. Ltd President Ausanee Mahagitsiri Leonio shares the same perspective, noting that foreign tourists are searching for an experience that reminds them of home but with a touch of Thailand’s culture, particularly with food.

“We want to make sure that we offer food similar to home, one that they are familiar with but with something extra that only Thailand would offer,” Leonio told the Thailand forum.

Sharing her experience on the subject, she said: “We have Krispy Kreme foi thong, which is like a local dessert that we put on top of the doughnuts. You can only find that in Thailand because even if we share its formula with other countries, you cannot make foi thong elsewhere,” she said.

Conscious consumerism

There is a growing consumer preference for sustainable and ethically sourced products, and for Jackson, this trend reflects a shift towards conscious consumerism, where customers care about the origins and impact of their purchases.

“At Superbee, our whole mission is about sustainability and education. So a lot of our marketing budget is used on education, not just about how to use our products, but different ways that consumers and also businesses can reduce their carbon footprint and become more sustainable,” Jackson said.

Through this initiative, she shared that the group has reached out to package designers and entrepreneurs, teaching them to create significant environmental and social impact.

For The Mall Group, Srirussamee spoke about their strategy to reduce carbon footprint and promote recycling amongst customers.

“We launched a new programme where for every six, empty bottles put in our vending machine, you get a free Coca-Cola to create awareness and encourage customers to work with us to help the environment,” Srirussamee said.

Leonio mentioned how KFU commits to reducing waste by adopting a similar approach, which is to engage their customers with sustainability practices regarding production.

“We reduce wastage by not discarding imperfect doughnuts. Instead, we donate it to organisations that support the less fortunate. They collect these items from us daily,” Leonio said. “We also manage crumbs or small edible items by contacting groups that provide food for animals to ensure it does not go to waste.”

...there are many ways you can work with us to advertise your company and connect to your customers. Our team can help you dight and create an advertising campaign, in print and digital, on this website and in print magazine.

We can also organize a real life or digital event for you and find thought leader speakers as well as industry leaders, who could be your potential partners, to join the event. We also run some awards programmes which give you an opportunity to be recognized for your achievements during the year and you can join this as a participant or a sponsor.

Let us help you drive your business forward with a good partnership!

Asia-Pacific retailers need AI boost to meet customer expectations

GOPIZZA expands through GS25, targets global market dominance

GS1 2D barcodes enhance retail inventory and traceability

Strategic marketing boosts WCT Malls tenant success

Thought leadership centre.

Asia Pacific businesses face challenges in B2B e-commerce payments

NTT DATA Named a Leader in Everest Group’s Banking & Financial Services Risk & Compliance PEAK Matrix® Assessment 2023 Report

Resource Center

The retail pulse: discoveries from zebra’s 16th annual global shopper study, pandemic accelerated retail experience in southeast asia: digitalisation and retail innovations, accelerating innovation in retail, risk and rewards of buy now, pay later arrangements, self-service: the next level retail evolution, retail asia e-commerce digital conference, print issue.

FMCG Asia Awards

Retail asia forum - manila - october 3, 2024, retail asia summit - november 20, 2024, partner sites.

Moodie Davitt Report

Connect with us

Asia travel retail inventory issues and muted China recovery hit The Estée Lauder Companies in Q1

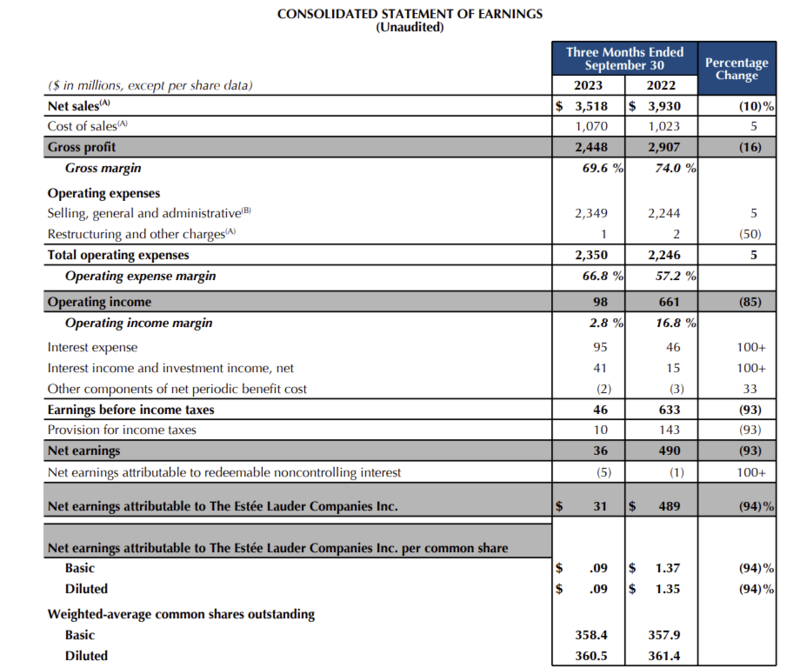

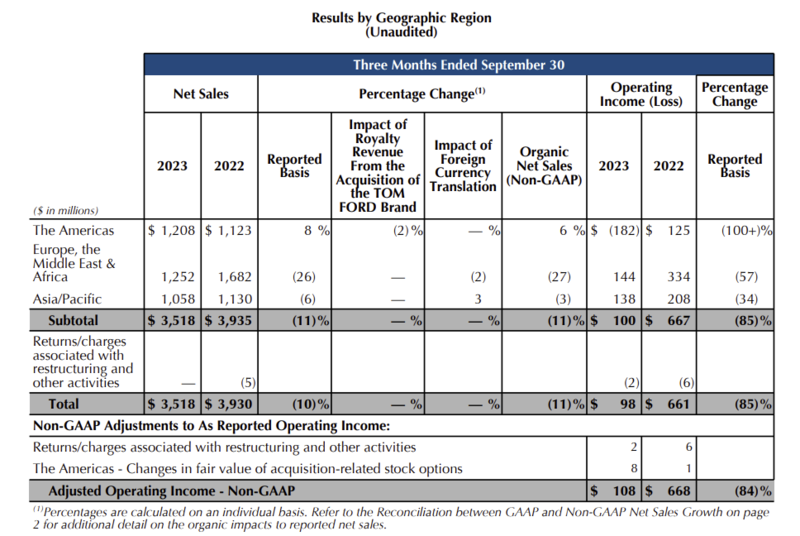

Anticipated pressures in the company’s Asia travel retail business and “incremental headwinds” from a slower-than-expected recovery of prestige beauty in Mainland China drove an -11% year-on-year decline in global organic sales (-10% net sales) at The Estée Lauder Companies (ELC) for its first quarter ended 30 September.

“We delivered our outlook for organic sales and exceeded the expectation for adjusted diluted EPS. Organic sales decreased -11%,” said The Estée Lauder Companies President and Chief Executive Officer Fabrizio Freda during an earnings call. “Our global travel retail business drove the decline, as expected, with organic sales lower by -51% given the combination of trade inventory reduction and a structured market containment.”

The sharp decline in global travel retail net sales was primarily due to the company’s and its retailers’ actions to reset key Asian retailer’s inventory levels [mainly in Hainan and South Korea]. The decrease also reflected changes in government and retailer policies related to “unstructured market activity” [a reference to the crackdown on daigou activity out of the same two key North Asian markets]. These actions and changes led to lower product shipments compared to the prior year, ELC said.

The US beauty powerhouse noted these challenges were partially offset by organic net sales growth in the US and many markets in Asia Pacific, led by Hong Kong SAR and Japan; as well as across nearly all markets in Europe, the Middle East & Africa (led by the UK) and Germany.

The company reported net earnings of US$31 million, down -94% compared with US$489 million in the prior year.

The decrease in operating income primarily reflected the decline in global travel retail net sales, strategic investments in advertising and promotional activities and higher in-store staffing expenses. These factors were partially offset by US$185 million of lower intercompany royalty expense due to the decline in income from the group’s travel retail business

In a statement Freda said, “In the context of a quarter which we anticipated to be challenging, we delivered our organic sales outlook and exceeded expectations for profitability.

“Momentum continued in many developed and emerging markets around the world, where our organic sales grew strongly and we realised prestige beauty share gains. Encouragingly, we returned to growth in the US with fragrance, makeup and skincare all contributing. This performance partially offset the pressures of Asia travel retail and a slower recovery of overall prestige beauty in Mainland China.

“While we had a better-than-expected first quarter, we are lowering our fiscal 2024 outlook given incremental external headwinds, namely from the slower growth in overall prestige beauty in Asia travel retail and in Mainland China, which is currently confirmed in the pre-sale phase of the 11.11 Shopping Festival, and the risks of business disruption in Israel and other parts of the Middle East.

“We are accelerating and expanding our profit recovery plan, to benefit fiscal years 2025 and 2026, to realise our ambitions to rebuild profitability despite the external headwinds’ increased pressure on the business in fiscal 2024.”

Resetting retail inventory in Asia travel retail

Reflecting the challenges in Asia travel retail and Mainland China, ELC confirmed a lowering of its fiscal 2024 expectations for both markets. “Amid this headwind, the Company continues to expect to reset retailer inventory in Asia travel retail by the end of the third quarter of fiscal 2024,” ELC said.

“This, combined with the potential risks of further business disruptions in Israel and other parts of the Middle East as well as currency headwinds, are increasing the pressure on the Company’s fiscal 2024 financial results. With its revised outlook, the Company still anticipates to progressively improve performance in the second half of fiscal 2024.”

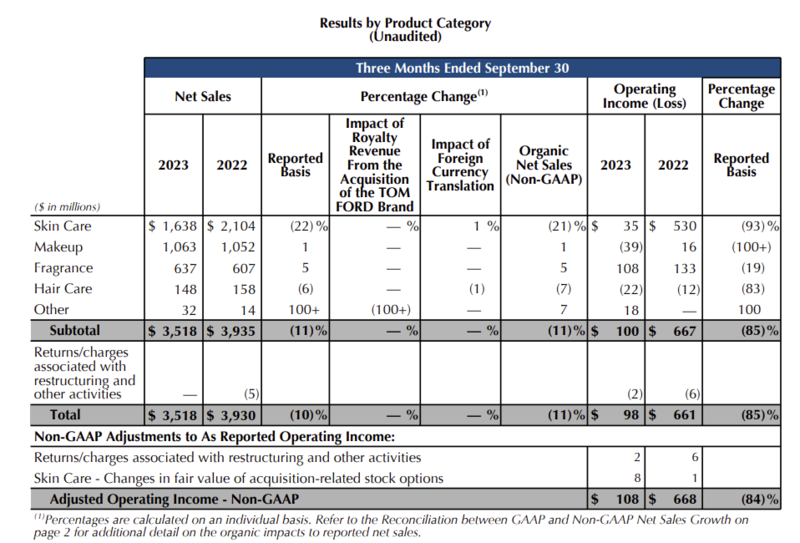

Skincare hard hit by Asia travel and Mainland China challenges

The travel retail and (partly related) Mainland China pressures played themselves out primarily in the key skincare category, where net sales decreased -21% year-on-year, with Estée Lauder and La Mer showing related declines.

Makeup net sales increased +1%, reflecting high-single-digit growth in the Americas and in Asia Pacific, partially offset by a decline in EMEA due to the Asia travel retail pressures (Asia travel retail forms part of EMEA).

Earnings call highlights – travel retail inventory reduction programme underway

During an earnings call, Fabrizio Freda and EVP and Chief Financial Officer Tracey Travis spelled out the Asia travel retail challenges and the road to recovery in the sector.

Freda highlighted one of four strategic imperatives outlined in the group’s August earnings call – i.e. to capture demand from returning individual travellers in Asia travel retail.

“For the first quarter, retail sales in global travel retail were substantially ahead of our organic sales decline, which reflects the execution of our priority to reduce trade inventory in alignment with retailers,” he commented.

“Indeed, we are making solid progress through exciting activation of our heroes, capitalising on innovation and investing in beauty advisers.”

Addressing a question about inventory headwinds, Travis said, “We expect organic sales for our second quarter to decline -8% to -10%. The incremental pressures from impacting sales in our Asia travel retail business and Mainland China are expected to continue to more than offset anticipated growth in other markets globally.

“Our retail trends are ahead of our net trends in Asia travel retail, both still down because we are destocking the trade. And so the expectation is that will be completed by the end of the third quarter.”

She continued: “We’re anniversarying from the second half of last year, where we had the policy changes first in Korea that impacted our third and fourth quarter and then the policy in Hainan, which impacted our fourth quarter. We had, in some parts of our travel retail business, very low shipments given those policy changes. And so we are anniversarying as well some of the initial shocks of that.”

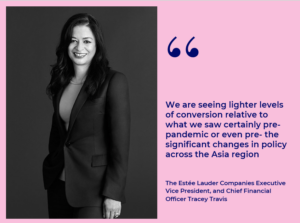

Modest conversion rates

Speaking more broadly on the travel retail sector, Travis commented, “We are seeing travel come back… more slowly than what we anticipated. We are seeing lighter levels of conversion relative to what we saw certainly pre-pandemic or even pre- the significant changes in policy across the Asia region.

“But we are seeing traffic pick up, and we are certainly expecting that conversion will gradually pick up as well in the second half.”

Returning to the issue of inventory, Freda added: “In travel retail, we had a significant stock reduction in this first quarter. And we aim to be in line with the inventory expectation of retailers by the end of March. We have visibility into these numbers.

“We have exactly the understanding with each one of our retailers on where we are today, what are the programmes that we are doing in order to accelerate sales retail of the existing stocks and what are the programmes to replenish and sell in innovation and all what we need to do in these areas.

“And finally, how by the end of March, we aim to have the retail and the net aligned. That’s the programme.”

Shift from travel retail to China local market

Asked about rebuilding former groupwide profit margins in the faced of a reduced travel retail business, Travis noted that much former volume in the channel had shifted to local markets. “I would expect to continue to see growth in the local market as well. So there may be a rebalance as it relates to the consumption for the Chinese consumer in particular as well as perhaps other consumer groups,” she commented.

“So we’re not counting on travel retail to get back to prior levels. If it does, that’s great. But our profit recovery programme, combined with some of the growth plans that we have for our markets and brands going forward, are not relying on… the profit margins that we had previously.”

Commenting on the same theme, Freda added: “I would like to offer a bit of historical perspective on what happened during this COVID period and the volatility that this brought. Our business in Mainland China versus 2019 is more than doubled. Our TR business today globally versus 2019 is by now, with this estimate that we are giving to you now, actually well below.

“But it’s true that during this COVID period, the TR business – also driven by the unstructured phenomenon that we have discussed previously – was actually up. But then by now this has been reabsorbed.”

Normalisation of market structure “positive”

Freda said that the pandemic had transformed an estimated 40% of Chinese beauty consumption being made abroad (much of it in travel retail) in 2019 to a largely China-driven market due to frontier closures.

“Some of it went into travel retail, like the Hainan development and all the other things that happened, which are very good for the long term. And some of it went into the unstructured business, which is actually going down now and is part of the readjustment. And these are positive things for the long term.

“And so the result of all these movements is frankly solid and sustainable for the long term because the result is a solid business in Mainland China, which we are supporting and will continue to support,” Freda continued.

“We have built an R&D centre [in China]. We have created all the abilities to be more locally relevant in the future and to continue to support and invest in this business and invest in this very important market for us in the long term that we believe is core to our future growth algorithm.” ✈

Follow us :

The Moodie Davitt Report Newsletter

Subscribe to our newsletter for critical marketing information delivered to your inbox

Related Articles

The 11th edition of the annual awards highlights the most impactful, innovative and engaging work from airports, airlines, retailers, brands and other players across the global travel ecosystem.

Today’s photo selection features a trio of pop-ups in Block C at cdf Sanya International Duty Free Shopping Complex as well as the cdf Duty Free Shopping Festival Opening Ceremony on 1 July.

The result was boosted by the 1 June 2023 opening at Cologne (Köln) Bonn Airport, Germany, which the Koç Holding-owned company described as a first move towards becoming a global brand.

Estee Lauder projects weak profit on slow recovery in Asia travel retail

Estee Lauder forecast annual sales and profit below estimates on Friday, indicating a slower-than-anticipated rebound in its travel retail business, mainly in Asia, and waning demand in the United States, sending shares down 3 per cent.

Major global companies have taken a cautious stance on their China recovery, as the world’s second-largest economy struggles to revive demand and battles rising youth unemployment rates and a high cost of living.

Analysts note that the drop in consumer demand in China and a slow recovery in Asia travel retail – sales made at airports or travel destinations like Korea and China’s Hainan – could impact luxury companies like Estee, which makes about 30 per cent of its annual revenue from the Asia Pacific region.

“Pressure in Hainan intensified over the course of the fourth quarter,” said CEO Fabrizio Freda, adding that retail sales trends deteriorated and turned “steeply negative” in May and June.

However, Freda said Estee was on track to recovering growth in Asia travel retail and North America, going forward.

The company’s Americas region reported flat net sales, while Asia Pacific reported a 29 per cent increase in the quarter.

European rival LVMH last month also flagged cooling demand in the US, while French cosmetics maker L’Oreal said the Chinese market was not picking up at the speed everyone had hoped for.

Estee’s dour forecast led analysts to raise questions about the continuing uncertainty in Hainan and Mainland China.

“De-stocking and inventory levels in Asian Travel Retail… likely to remain the biggest headwind to growth over the next few quarters,” said Bernstein analyst Callum Elliott.

Estee expects full-year sales to rise between 5 per cent and 7 per cent, compared with an estimated 8.8 per cent increase, according to Refinitiv data.

It sees annual adjusted profit to be between $3.50 and $3.75 per share, compared with an expectation of $4.83.

- Reporting by Granth Vanaik and Ananya Mariam Rajesh in Bengaluru; Editing by Pooja Desai, of Reuters

Recommended By IR

Retail appointments of the week

How will the age of retail media impact store design?

Shein in talks with banks and exchanges about US IPO

Coupang launches luxury beauty shopping service Rocket Luxury

Singapore retailer HoneyWorld sold to New Zealand producer

This is for ir pro members only..

Log in below or subcribe.

By continuing, you agree to Octomedia Terms And Conditions and Privacy Policy .

- Create Account

Signed in as:

We are specialists in creating supply chain solutions to offer maximum efficiency, flexibility, reliability and affordability

WHAT MAKES US SPECIAL?

Ease of doing business.

With over 30 years of experience, we are adept in handling the supply demands of the dynamic and constantly evolving Travel Retail Industry

We offer a flexible and value-added service with complete transparency and no hidden costs

INFRASTRUCTURE

Our own infrastructure and dedicated, forward-thinking team enables us to have complete control over our operations with the ability to deliver an efficient, hassle-free service to our customers

GREEN INITIATIVES

Strategically located in Hong Kong - a world-renowned logistics hub

With our long-standing partnerships with international air & sea freight forwarders we offer preferential shipping rates , terms and reliability

We partner with carriers that champion green initiatives to reduce your carbon footprint

WHAT WE DO BEST

Warehousing and storage.

Receiving, Inspection, and physical verification of Inbound stocks

Secure storage for your inventory and management through our in-house SOP systems

CURATED ORDER PREPARATION

We prepare your individual customer orders according to their unique requirements

DISTRIBUTION

Coordinated order fulfilment through our network of highly experienced and reliable forwarders worldwide

© 2021 Centaur Travel Retail Asia - All Rights Reserved.

- Privacy Policy

- Cookie Policy

You can now book a free appointment to consult with us

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.

Enter the valid email address

Thailand set to end on-arrival duty free at airports

Lagardère nods to Tory Burch’s roots with 1,000sq m boutique at Changi T1

US fashion label Tory Burch has opened a new and exclusive travel retail door in collaboration with Lagardère Travel Retail at...

Penhaligon’s Festival of Flight concept makes European TR debut at Heathrow

British perfumery brand Penhaligon’s has teamed up with Avolta to launch its channel exclusive Festival of Flight concept in European...

Samsonite luggage boutique opens at Zayed International Airport

Samsonite has partnered with Lagardère Travel Retail to launch a store at Zayed International Airport in Abu Dhabi. Centrally...

Kansai Airport T1 spend growth 'up' post-renovation

Japan's Kansai International Airport (KIX) has reported a better-than-expected passenger spending performance since the opening of the...

Manchester Airports Group reports strong results, pax and investment

Manchester Airports Group (MAG), which owns and operates Manchester, London Stansted and East Midlands Airports, has reported a...

Shilla promotes skus and slashes prices as Incheon T2 liquor store goes live

The Shilla Duty Free (Shilla) has activated brand promotions and price discounts twinning with the opening of its flagship liquor store...

Data and disruptive tech reshape commercial opportunity for FAWJ

The inevitable creep of digitalisation is entering the travel retail bloodstream with transformation and innovation defining strategic...

Hillary Clinton to deliver keynote at TFWA World Conference in Cannes

Former US Secretary of State Hillary Clinton will take to the stage for a keynote conversation at this year’s TFWA World Conference,...

WHSmith NA brings Build-A-Bear Workshops to Las Vegas gift stores

Two Build-A-Bear Workshops have opened at WHSmith North America's gift shop locations at The Forum Shops and LINQ Promenade in Las...

TR Confidence Tracker Q2 2024 flash poll now live – take part today!

In Q1 2024, global travel retail (GTR) industry optimism levels rose among respondents to the TR Confidence Tracker flash poll, but has...

US fashion label Tory Burch has opened a new and exclusive travel retail door in collaboration with Lagardère Travel Retail at Singapore Changi...

British perfumery brand Penhaligon’s has teamed up with Avolta to launch its channel exclusive Festival of Flight concept in European travel...

Samsonite has partnered with Lagardère Travel Retail to launch a store at Zayed International Airport in Abu Dhabi. Centrally located within...

Japan's Kansai International Airport (KIX) has reported a better-than-expected passenger spending performance since the opening of the newly...

Latest Product News

Penfolds’ Grange by Nigo debuts in European TR at Copenhagen Airport

Penfolds’ limited edition Grange by Nigo collection has made its European travel retail debut at Copenhagen Airport. Grange by Nigo is born from an...

Silent Pool Gin marks Avolta debut with travel retail exclusive expression

Family-owned spirits company William Grant & Sons, which acquired Silent Pool Gin in 2023, has announced the launch of the Silent Pool Gin Mediterranean...

Absolut Vodka launches limited edition Warhol bottle for GTR-exclusive run

TRBusiness was on location to learn more about Absolut Vodka's latest limited-edition bottle in collaboration with The Andy Warhol Foundation for the Visual...

Manchester Airports Group (MAG), which owns and operates Manchester, London Stansted and East Midlands Airports, has reported a positive set of...

The Shilla Duty Free (Shilla) has activated brand promotions and price discounts twinning with the opening of its flagship liquor store at...

The inevitable creep of digitalisation is entering the travel retail bloodstream with transformation and innovation defining strategic focus...

Former US Secretary of State Hillary Clinton will take to the stage for a keynote conversation at this year’s TFWA World Conference, which is...

Two Build-A-Bear Workshops have opened at WHSmith North America's gift shop locations at The Forum Shops and LINQ Promenade in Las Vegas,...

- Product News

Penfolds’ limited edition Grange by Nigo collection has made its European travel retail debut at Copenhagen Airport. Grange by Nigo is born...

Family-owned spirits company William Grant & Sons, which acquired Silent Pool Gin in 2023, has announced the launch of the Silent Pool Gin...

TRBusiness was on location to learn more about Absolut Vodka's latest limited-edition bottle in collaboration with The Andy Warhol Foundation for...

Estée Lauder unveils skincare retail concept at CDF's Global Beauty Plaza

Estée Lauder has launched its new Skin Longevity Institute retail concept at Global Beauty Plaza in China’s Haitang Bay, Hainan. The...

Lindt & Sprüngli opens first-ever travel retail boutique outside Switzerland

Chocolatier Lindt & Sprüngli has partnered with confectionery distributor and retailer Focus Network Agencies (FNA Group International) and...

MWITR talks big plans for M&M’s & seasonal strategy for gifting moments

Mars Wrigley International Travel Retail (MWITR) utilised its exhibitor platform at the 2024 TFWA Asia Pacific Exhibition & Conference in May...

Quintessential launches Chamère RTD cocktail with Emily in Paris producers

Quintessential Brands has teamed up with Paramount and MTV Entertainment Studios, the producers of the hit Netflix series Emily in Paris, to...

Delhi Duty Free adds Wise Monkey Rum to its duty free assortment

Delhi Duty Free has introduces rum brand Wise Monkey to its assortment of premium rum drinks. Wise Monkey Rum has garnered worldwide recognition...

Bacardi continues travel retail expansion with new spiced rum release

Bacardi Global Travel Retail (Bacardi GTR) has expanded the Bacardi rum range with the launch of the brand’s first aged, premium spiced rum,...

Notions Group using domestic to continue building its travel retail offering

Notions Group, which consists of several trading and manufacturing subsidiaries centred around chocolate products, has a presence in over 15...

Molton Brown shines with Summer Scents sets at UK airports

British fragrance brand Molton Brown is getting travellers at UK airports into the spirit of summer with its seasonal Summer Scents sets featured...

Emma Hardie skincare launches with Aelia Duty Free at London Luton Airport

British skincare brand Emma Hardie is now available at London Luton Airport with Lagardère Travel Retail’s Aelia Duty Free. Travellers can...

Most popular

- Regional News

- Channel News

- Data & Analysis

- Video Channel

- Sustainability

In the Magazine

TRBusiness Magazine is free to access. Read the latest issue now.

In case you missed it...

- women in travel

Expedia Rewards is now One Key™

Elektrostal, visit elektrostal, check elektrostal hotel availability, popular places to visit.

- Electrostal History and Art Museum

You can spend time exploring the galleries in Electrostal History and Art Museum in Elektrostal. Take in the museums while you're in the area.

- Cities near Elektrostal

- Places of interest

- Yuri Gagarin Cosmonaut Training Center

- Central Museum of the Air Forces at Monino

- Peter the Great Military Academy

- Bykovo Manor

- Balashikha Arena

- Malenky Puppet Theater

- Balashikha Museum of History and Local Lore

- Pekhorka Park

- Orekhovo Zuevsky City Exhibition Hall

- Ramenskii History and Art Museum

- Noginsk Museum and Exhibition Center

- Saturn Stadium

Members can access discounts and special features

Elektrostal, visit elektrostal, check elektrostal hotel availability, popular places to visit.

- Electrostal History and Art Museum

You can spend time exploring the galleries in Electrostal History and Art Museum in Elektrostal. Take in the museums while you're in the area.

- Cities near Elektrostal

- Places of interest

- Yuri Gagarin Cosmonaut Training Center

- Central Museum of the Air Forces at Monino

- Peter the Great Military Academy

- History of Russian Scarfs and Shawls Museum

- Bykovo Manor

- Balashikha Arena

- Malenky Puppet Theater

- Fryazino Centre for Culture and Leisure

- Military Technical Museum

- Church of Our Lady of Kazan

- Drama Theatre BOOM

- Balashikha Museum of History and Local Lore

- Pekhorka Park

- Orekhovo Zuevsky City Exhibition Hall

- Borisoglebsky Sports Palace

- Ramenskii History and Art Museum

- Church of Vladimir

- Shirokov House

- Noginsk Museum and Exhibition Center

- Pavlovsky Posad Museum of Art and History

- Saturn Stadium

- Zheleznodorozhny Museum of Local Lore

- Stella Municipal Drama Theater

- Fairy Tale Children's Model Puppet Theater

- Fifth House Gallery

- Likino Dulevo Museum of Local Lore

- Malakhovka Museum of History and Culture

- Art Gallery of The City District

IMAGES

COMMENTS

The Asia-Pacific Travel Retail Market is expected to reach USD 63.15 billion in 2024 and grow at a CAGR of 9.21% to reach USD 98.11 billion by 2029. Dufry, DFS Group, King Power, Flemingo International and China Duty-free Group Co. Ltd are the major companies operating in this market.

Asia Pacific is the undisputed engine of the $78bn* global Travel Retail industry, with over 140,000 people directly employed in Travel Retail, delivering $36.8bn sales in 2018 and 23.3% growth vs 2017*. ... Established in 2005, APTRA (The Asia Pacific Travel Retail Association) is a not-for-profit organization serving the interests of multiple ...

Optimism getting back on track in Q1 yet faith in business performance stalls. Global travel retail optimism levels grew in Q1 2024, with almost 86% of respondents to the TR Confidence Tracker feeling optimistic about the industry, yet faith in business performance stalls quarter-over-quarter (QoQ). The results of the Q1 2024 TR Confidence ...

In June, Gary Bowerman analysed the outlook for travel retail across Asia Pacific and beyond, as brands and retailers await the return of the region's big spending travellers. The Five Potential Indicators for the Future of Travel Retail commentary was commissioned by Zurich-based DKSH.It forms part of a series of 10 Asia-focused consumer, lifestyle and travel articles I will be producing ...

The global travel retail market is poised for significant growth, with a projected value of US$75.93 billion by 2023, representing a robust compound annual growth rate ( CAGR) of 17.37% during the ...

In contrast, medium-haul business travel remains 11 percent down in 2019 and short-haul business travel in APAC down 45 percent on pre-pandemic levels. But the biggest air travel recovery in Asia-Pacific 2022 is being driven by leisure flights. Domestic leisure flights were up a soaring 196 percent in April, compared to the same month in 2019 ...

Each entry to the Travel Retail Awards: Asia Pacific is voted on by thousands of travelling consumers from across the region. TRBusiness and m1nd-set can today (13 March) reveal the winners of the 2024 Travel Retail Awards: Asia Pacific - click below to watch the video ceremony. The special regional edition of the acclaimed consumer-voted ...

The winners of the consumer-voted 2023 Travel Retail Awards Asia Pacific are revealed today (11 April) in a virtual awards ceremony - simply click the video broadcast below to view the results. Organised by TRBusiness and m1nd-set, the Travel Retail Awards are the industry's first and only consumer-voted awards, where each entry has been ...

Established in 2005, APTRA (The Asia Pacific Travel Retail Association) is a not-for-profit organization serving the interests of multiple stakeholders in the Duty Free & Travel Retail Industry across Asia Pacific, spanning airports, brands, retailers, food & beverage operators, airlines and Travel Retail industry associates.

Contributor June 28, 2023. Source: Coty. Coty's third-quarter results published last month revealed encouraging momentum in travel retail with revenues surging 30 percent year-on-year and the channel accounting for a healthy 8 percent of group sales. SEE ALSO: APAC health and beauty industry to expand at 4.7 percent CAGR to 2027.

A new report has shown that the Asia Pacific region will continue to be a major driver of global duty-free and travel-retail sales. According to the study, titled 'Economic Impact Report of Duty Free and Travel Retail in Asia Pacific,' the Asia Pacific travel retail industry generated an estimated US$36.2 billion in 2017 which accounted for 45 per cent of total global duty free and travel ...

These are the first in Greater China to include the brand's VIP lounge concept and premium monogramming service. Stephanie Caite Chadwick. Get the latest from Inside Retail straight to your inbox. Join over 100,000 retailers who rely on our daily news, views and intelligence - it's free. Irene Dong.

With the post-pandemic travel boom ongoing, travel retail is set to surpass $117 billion in global sales by 2030, growing at nearly +10% annually from 2022. To meet rising traffic and enhance ...

The return to organic growth by The Estée Lauder Companies' Asia travel retail business was a key driver for the group's +5% increase in Q1 net sales. Pictured is the company's strong presence at the China International Consumer Products Expo (Hainan Expo) 2024 in Haikou last month.

At the Retail Asia Forum in Bangkok, Thailand, industry leaders came together to share their perspectives on the emerging trends in tourist-centric retail. ... boom as "The Land of Smiles" expects this year to reach 36 million international visitors amidst visa-free travel initiatives. This became the cue for the retail industry to adapt ...

Asia & Pacific Estée Lauder net sales drop 9% in Q2 FY24 amid Asia travel retail struggles. The Q2 FY24 report for The Estée Lauder Companies, which outlines its fiscal performance through Q2 FY24 (six months ended 31 Dec 2023), reveals...

Anticipated pressures in the company's Asia travel retail business and "incremental headwinds" from a slower-than-expected recovery of prestige beauty in Mainland China drove an -11% year-on-year decline in global organic sales (-10% net sales) at The Estée Lauder Companies (ELC) for its first quarter ended 30 September.

Estee Lauder forecast annual sales and profit below estimates on Friday, indicating a slower-than-anticipated rebound in its travel retail business, mainly in Asia, and waning demand in the United States, sending shares down 3 per cent. Major global companies have taken a cautious stance on their China recovery, as the world's second-largest ...

Centaur Travel Retail Asia Ltd. We are specialists in creating supply chain solutions to offer maximum efficiency, flexibility, reliability and affordability.

A mix of the charming, modern, and tried and true. See all. Apelsin Hotel. 43. from $48/night. Apart Hotel Yantar. 2. from $28/night. Elektrostal Hotel.

Patrón Tequila ran a pop-up activation at Miami International Airport throughout April and May, celebrating the brand's role as official... load more product news. TRBusiness is a world leading B2B media and event company, it provides news reporting and unrivalled analytical commentary to the global travel retail industry.

Likino-Dulyovo Tourism: Tripadvisor has 61 reviews of Likino-Dulyovo Hotels, Attractions, and Restaurants making it your best Likino-Dulyovo resource.

Asia; Plan your trip. Hotels in Elektrostal Vacation Rentals in Elektrostal Flights to Elektrostal Car Rentals in Elektrostal Elektrostal Vacation Packages. Elektrostal. Travel Guide. Check-in. Check-out. Guests. Search. Explore map. Visit Elektrostal. Things to do. Check Elektrostal hotel availability.

Travel guide resource for your visit to Elektrostal. Discover the best of Elektrostal so you can plan your trip right. Vacation Packages. Stays. Cars. Flights. Support. All travel. Vacation Packages Stays Cars Flights Cruises Support Things to do. ... Asia; Elektrostal. Travel Guide. Check-in.