Suggested companies

Breeze esim.

Breeze Reviews

In the Disability Insurance Company category

Visit this website

Company activity See all

Write a review

Reviews 4.8.

Most relevant

Highly Recommended

As a solo practitioner, Sophie took the time to listen to my needs and then offered me several products without sales pressure. I ended up going with Breeze because their products offered me the best options at the best price. Everything was clear, quick, and easy.

Date of experience : 15 March 2024

Quick, easy and helpful!

Having such a quick, easy process to get myself the coverage I needed was SO much less stress than I thought! The Breeze team was fast to help answer any questions I had with my policy, and I loved being able to modify my plan to suit my needs. I've already recommended Breeze to friends in need of personal coverage!

Date of experience : 13 March 2024

I highly recommend using the Breeze to help you decide on the best insurance/disability plans!

I highly recommend using the Breeze to help navigate any of your insurance and disability needs. The Breeze team were quick to answer my questions and address my concerns regarding the right policy to choose based on my current needs. Their texting feature made it easy to have my questions answered promptly and they were responsive and helpful! Their easy to use quote calculator on the website is what sold me to reach out!

Date of experience : 12 February 2024

Great staff, easy experience

Everyone I spoke with at Breeze was friendly, quick to reply, and guided me through the process. This is the easiest experience I have had purchasing insurance

Date of experience : 27 February 2024

Great experience

It was a great experience and easy way to register without any complicated. the employees was helpful and professional. I wish you a good luck.

Date of experience : 25 February 2024

Fantastic Experience

We had a fantastic experience with Breeze. I would give it a 5 out of 5. Everyone we spoke with and worked with was on top of everything. They did a phenomenal job in communication. And we are very pleased with the rates they found for us. We appreciate how timely they were with everything too.

Date of experience : 09 February 2024

Very pleased with my Breeze Experience

Breeze helped me figure out the right "level" of disability insurance to get. When looking through the system, I THOUGHT I knew what I needed, but after receiving my policy, I had additional questions. I called and spoke with Shay, who was extremely thorough and helpful answering questions about every aspect of the insurance - which really helped me to determine the right policy for me. After that conversation, I was happy to spend $20 more per month than I originally thought, and now I feel more comfortable with the investment I'm making. Additionally, Maria and Riza also were very communicative when my policy came back from Underwriting. I'm very pleased with my interaction with everyone.

Date of experience : 17 January 2024

Excellent Customer Service

I just got a disability insurance plan with Breeze. Everyone at Breeze has been very helpful and quick to respond. It was easy to ask questions and get signed up because of the excellent communication. I have been very happy with my experience so far.

Date of experience : 01 February 2024

Sophia was great

Sophia was great! She gave me all the information I needed and some about short and long term disability plans. It was very helpful and I felt able to make the best decision for what I needed based on the phone call. Thanks

Date of experience : 20 February 2024

Simple and straightforward

I appreciated that it was a simple, straightforward process. The tools to understand monthly payment vs overall coverage were helpful in making the decision that was best for me. I received a response about my application status quickly.

Date of experience : 31 January 2024

The experience was above and beyond…

The experience was above and beyond amazing! I came across Breeze by accident and went on a wim and decided to apply for coverage, little did I know about y'all and ended up getting cheaper coverage than I thought. Navigating the website was very easy and not complex at all. Thank you for your amazing website and help getting me covered! Sincerely Janelle Cruz

Date of experience : 04 November 2023

Don’t Waste Your Time

Got denied coverage after spending two hours on an application because I was diagnosed with anxiety nearly ten years ago (which I no longer struggle with that much). Otherwise in perfectly good health. I’m in my 30s, don’t smoke, perfect weight, never been in an accident, never had any other health conditions. Total scam.

Date of experience : 22 June 2023

Simply the best!

A friend told me about Breeze and how easy it was to sign up. Once i checked the website out i was blown away!! It was so simple, fast approval and affordable pricing. They are doing everything right and I will definitely tell my friends and family about them.

Date of experience : 16 January 2024

One of the only companies to provide a FMLA Family Care Rider to Short Term Disability

It was really easy to apply for short term disability with Breeze. I chose this company because they have a unique family care rider, which can provide some compensation if you need to take maternity leave or leave to take care of your family, are covered under FMLA but your employer won't provide any compensation. I have not had to file a claim, but I'm hoping that process is just as simple.

Date of experience : 17 February 2023

Easy Process with Real Humans

This was a very easy process and every time I had to contact Breeze or Assurity via phone or email, I was met with prompt responses and never had a long hold time on the phone. Everyone I talked to was very helpful and it felt like connecting with a real human, not a robot.

Date of experience : 16 October 2023

Very professional and hospitable.

Very professional and hospitable.. Each rep would acknowledge me and explain if there was any hold up in the process as my application was being reviewed and confirmed. They moved fast and efficient. From the 1st person to the last "CEO"👍🏼 excellent service . That's rare to have quality customers service like that these days. Thanks Breeze team!

Date of experience : 04 May 2022

I’ve decided to try Breeze for my…long term disability policy

I’ve decided to try Breeze for my insurance needs. Couldn’t be more satisfied. Rates are great. Customer service is top notch. Recommend for anyone out there looking for an easy online process and customer support. Able to receive text messages with quick response has been a plus. 5 star company

Date of experience : 17 March 2022

Just what I was looking for!

The process from start to finish was smooth and easy. Everyone was extremely nice and professional. I would definitely recommend to anyone including family and friends.

Date of experience : 21 January 2024

Easy to use

Compared to other online options for disability insurance, Breeze was the easiest to get rates and sign up for. It was very easy to fill out the application and I received a response within a few days. Communication on the phone for follow-ups was easy and quick, too.

Date of experience : 27 October 2023

Easy and knowledgeable

Easy and knowledgeable! Due to a co-worker becoming pregnant at my work - I learned we do not have short term insurance included in my office and immediately set out to find a plan. My husband and I have one son and I work full time / he owns his own business. If something ever happened to me we would be in a financial pinch as most of our income is from me. They helped me pick a plan that is perfect for my (hopefully) growing family, help me get covered and answered all my questions as I read through the fine print of the policy. I'm very happy with what is covered and the plan. I feel like I'm in good hands! 10/10 would recommend.

Date of experience : 25 October 2023

Breeze review

For most, disability insurance is just something that you anticipate is included through your employer and you don’t think much about unless you actually know you need it.

But, if you are self-employed or make a lot of money, it might make a ton of sense to have disability insurance.

It takes less than 20 minutes to get a free quote online, and there’s no obligation. Below I’ll break down Breeze completely, so you can determine if it’s right for you or not.

What is Breeze?

Breeze is an insurance company that was founded in 2019 that offers disability insurance, and they operate entirely online. They named the company Breeze because going their application process is supposed to be a breeze (more on this below).

According to their site, “Breeze is the first insurtech company to modernize disability insurance – an old, confusing product that desperately needed it.”

Breeze works with a company called Assurity Life Insurance, which has been around since 1890 and has close to $18 billion already written in life insurance alone.

How does Breeze work?

Breeze claims their process for getting a quote is a breeze – so let’s find out if that’s true.

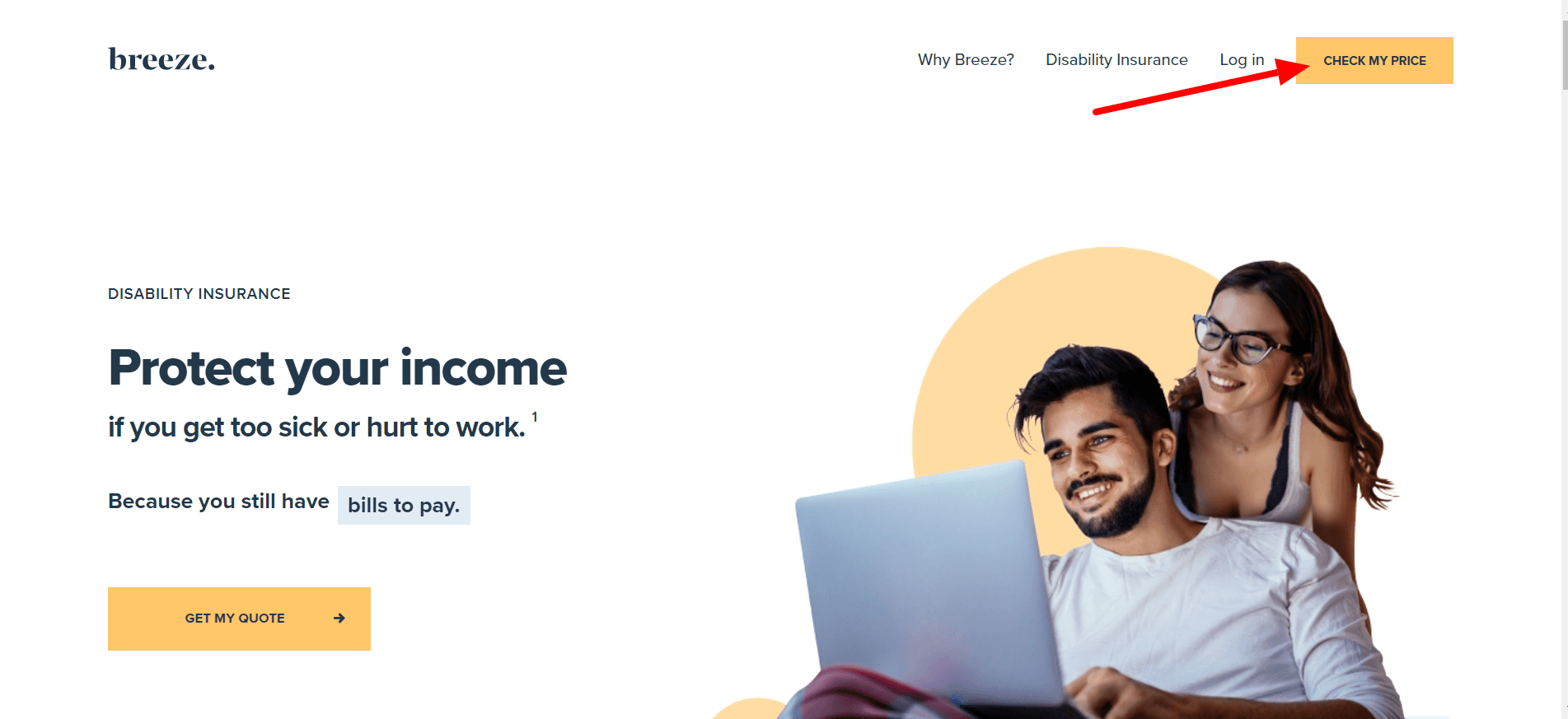

From their homepage, you’ll click “Check My Price” in the upper right corner.

The first step is basic – I need to enter my birthdate and gender.

Note that if you’re female, they’ll ask if you want maternity leave coverage, too.

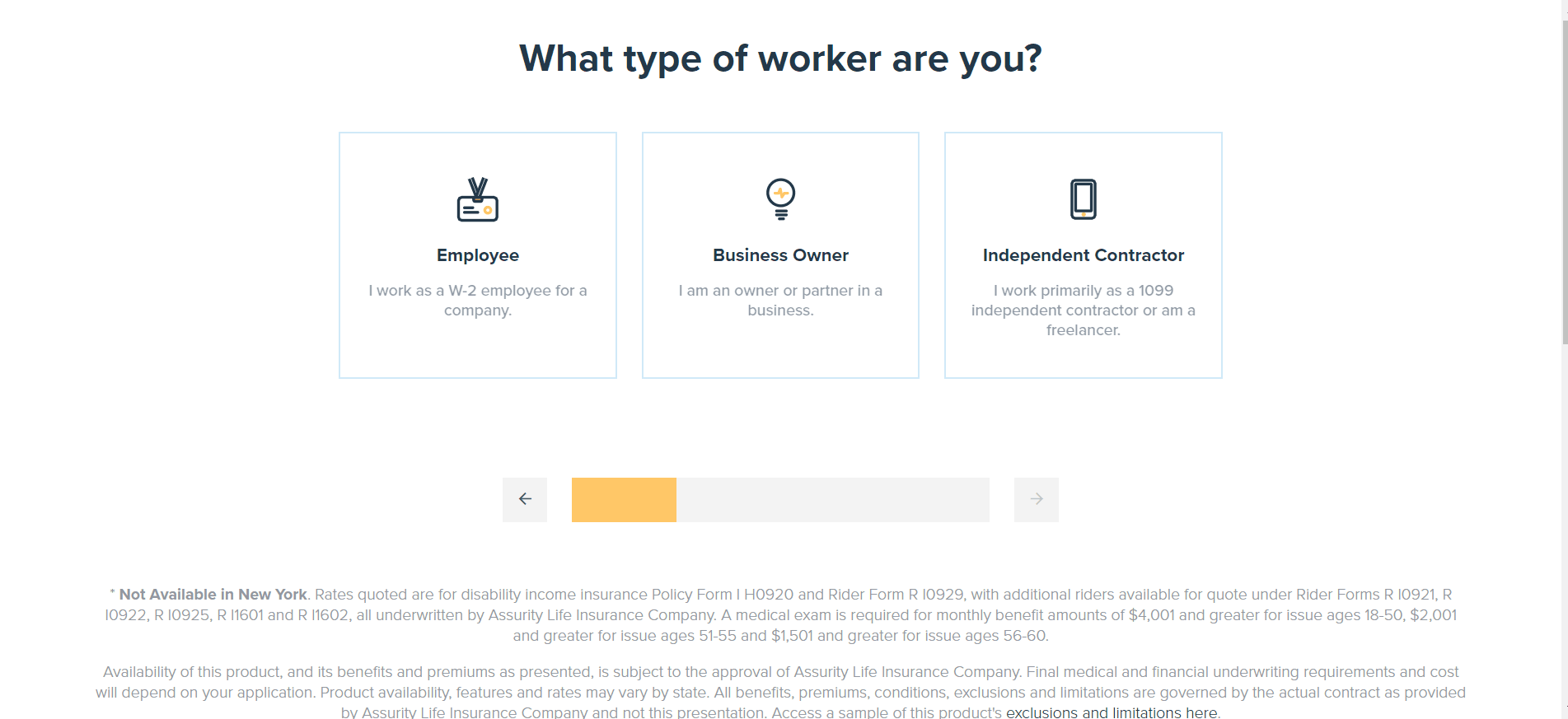

Next, I need to tell Breeze what kind of worker I am. For the sake of this example, I’ll say I am a small business owner.

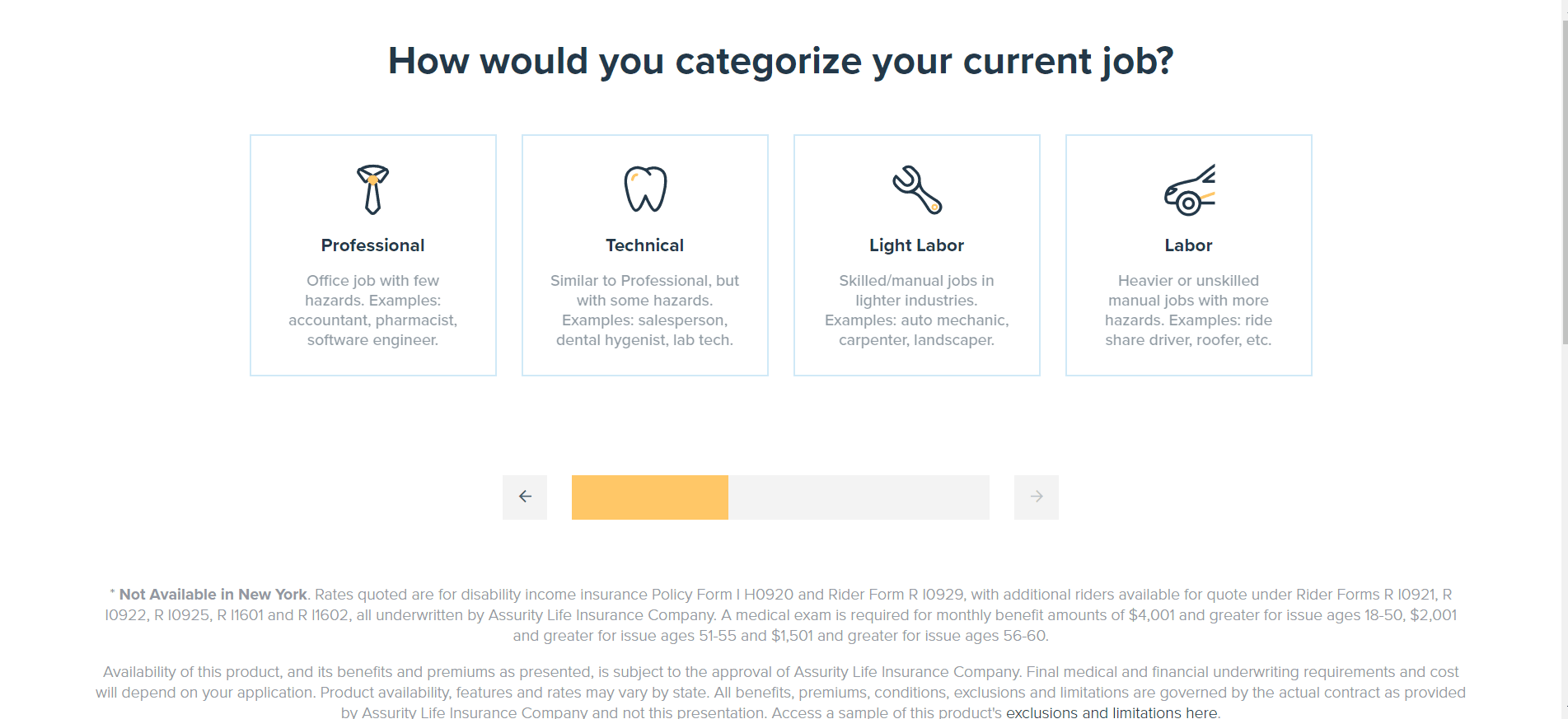

Then, I need to categorize the work I do and say if I work at least 30 hours a week or not.

If I say yes to working 30+ hours, I need to specify my income (otherwise it goes to the next step). Then, I enter my zip code and n eed to say whether or not I use nicotine.

N ext, I have to say what scenario best describes me. For this demo, I am going to select “Protect My Future”.

Breeze then asks if I want quotes for life insurance, too (I am going to say no).

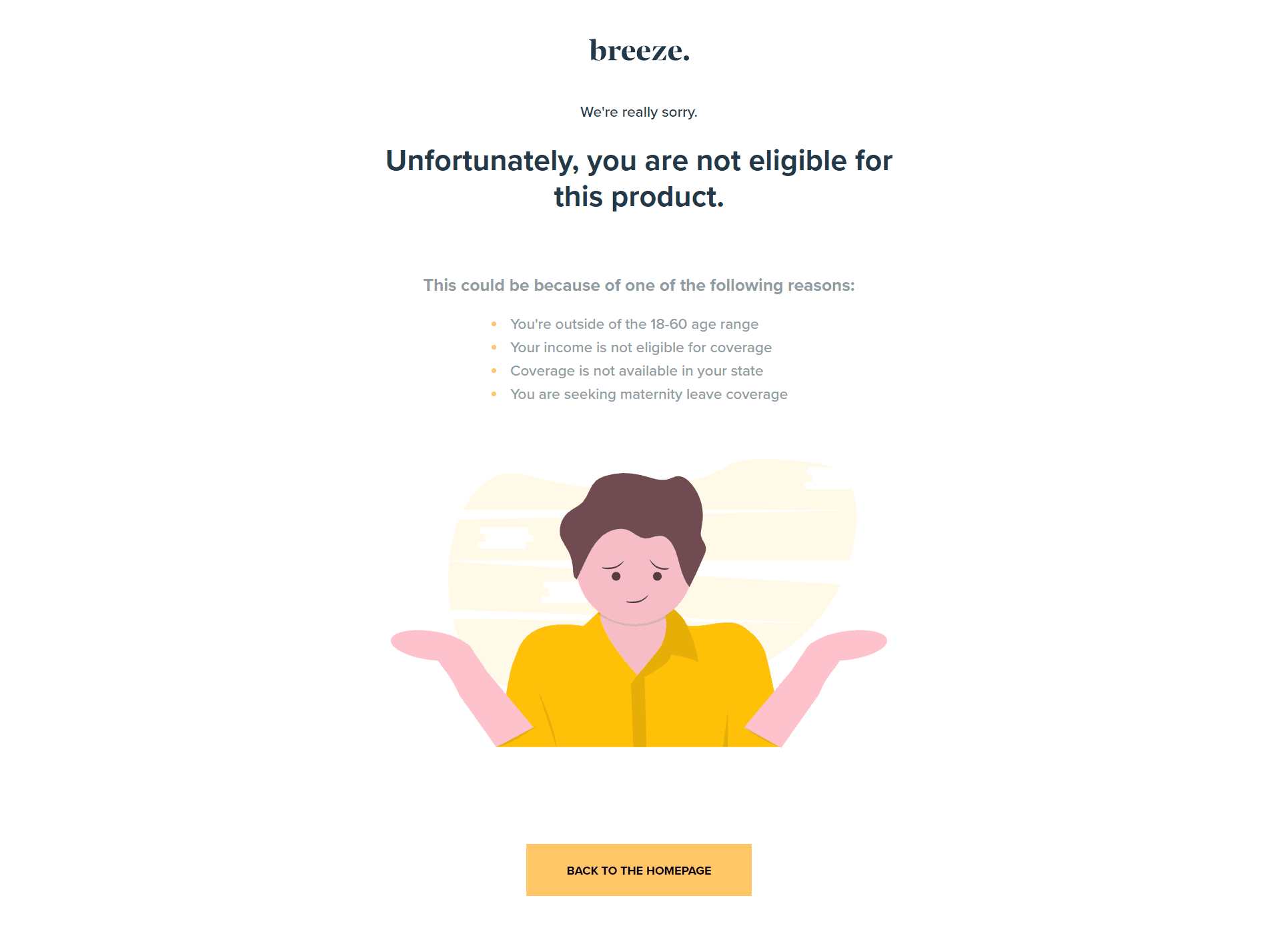

And after all that, I was told I wasn’t eligible for coverage, but they didn’t specify why.

Now, assuming you do qualify, this is where Breeze would display your options for disability coverage. I have to say, although I don’t qualify, the process of getting a quote was incredibly fast and simple.

Pricing for Breeze

For most, disability insurance is just something that you anticipate is included through your employer and you don’t think much about unless you actually know you need it. But, if you are self-employed or make a lot of money, it might make a ton of sense to have disability insurance.

Because Breeze is an insurance agency, their pricing is going to depend on the person applying for the insurance. And since it’s disability insurance, this can vary greatly. Meaning, some people are a much higher risk than others based on many factors, so their pricing will be higher.

Honestly, the best thing you can do is take 15-20 minutes to complete the simple online application process with Breeze. This way, you’ll know if you can protect your income against disability with a policy that is tailored specifically to you.

Breeze features

Quick application process.

Breeze has its name for a reason. The application takes very little time, and once you have a quote, you can enact the policy in as little as 15 minutes.

For most of us who have very little time to worry about things like disability insurance, this is a huge value add.

Automated underwriting

The online application process is not only quick, but it’s completely streamlined. Breeze has set up a system, through algorithms and their questionnaire, to enable automated underwriting of policy online. If you qualify for automated underwriting, this means you don’t need to wait for a human to review your file – it just works.

Affordable pricing

Breeze focuses on providing affordable disability insurance. Because they operate entirely online, their overhead is low and they can offer far more affordable prices.

Flexible policies

One of the things that set Breeze apart is the flexibility it has within its policies. They issue policies to anyone between the ages of 18 and 60 years old with benefits ranging from $500 to as much as $20,000.

In addition, they have multiple options for waiting periods (how long you have to wait before your benefits kick in) of 30, 60, 90, 180, and 365 days.

Finally, unlike many insurers, Breeze has guaranteed renewability until ages 65 or 67.

Numerous built-in features

All Breeze policies have a number of built-in features, including things like partial disability, presumptive disability, home modification, organ donor benefits, survivor benefits, and vocational rehab. This just enhances your disability insurance policy even more.

Additional riders

On top of great pricing, flexible terms, and built-in features, Breeze includes several critical riders into their policies, including non-cancelable feature, catastrophic disability benefit, critical illness benefit, and automatic benefit increase.

Free resources

Since disability insurance is a bit obscure, Breeze also offers a resource center that not only has FAQs but a bevy of in-depth guides to better understand this type of insurance.

Some of their better guides I enjoyed were their guides on no exam disability insurance , workers’ compensation insurance , and short term disability insurance .

Who is Breeze for?

Breeze is primarily for people who need disability insurance. Most importantly, I would say people who don’t already get disability insurance through their employer are the ones who will benefit most from Breeze. This will typically include people who are self-employed or are gig-workers.

In addition, I would recommend people who are at a higher risk of disability take a look at Breeze. Even if your employer is giving you benefits, if the odds of you becoming disabled are a lot higher (i.e., you’re close to retirement), it might be worth checking into Breeze.

Who shouldn’t use Breeze?

If you already get disability insurance through your employer and you’re younger and generally healthy, there’s really no need to sign up for disability insurance. What you get through your employer should definitely suffice.

The problem is, finding disability insurance specifically can be a hassle. Before Breeze, I honestly wouldn’t have even known where to begin looking. But thankfully Breeze offers disability insurance online – and they make their process super simple.

Pros & cons

- Underwritten by a highly-regarded provider — Breeze has all of its policies underwritten by Assurity Life Insurance, who has been around since the 1800s. So you’re not dealing with a company that’s inexperienced.

- Great coverage — Aside from the perks, the coverage is excellent and will replace at least a portion of your income if you’re hurt or too sick and can’t go to work.

- Lots of flexibility — Breeze has not only a lot of options but plenty of perks within its coverage, including additional riders. They give you multiple options for quotes so you can choose what fits you best and what’s most affordable for what you need.

- Fast quotes — You can get an accurate quote in less than a minute on the Breeze website. So you can literally get your application submitted in about 15 minutes, instead of dealing with a mess of paperwork and waiting weeks.

- They only sell disability insurance — This may be a good thing since they specialize, but I would prefer a company that can take care of multiple insurance-related needs. At one point I was asked if I wanted life insurance, but my understanding is that it’d be offered by their underwriter.

- A brand new company — While their underwriter has been around forever, Breeze itself is only less than a year old.

The competition

Breeze vs policygenius.

Policygenius is a little different than Breeze in that it’s a full-scale insurance broker that offers a plethora of different insurance types. Bear in mind, though, that they don’t actually underwrite the policies, they work with other insurance providers to do that.

So while you can get all of your insurance through Policygenius , they don’t underwrite it – so you’ll have policies with multiple companies if you want multiple types of insurance.

Now that I’ve cleared that up, Policygenius is a pretty great platform to use if you need more than just disability insurance, but their policies for disability are great too. They work with a bunch of different insurance companies (as opposed to Breeze who uses one) to get you the best possible rate.

But with that being said, Breeze’s niche is that they only focus on disability insurance – so they have a more well-rounded system.

» MORE: Read our full Policygenius Review

My experience using Breeze

As you saw above, the information I entered wasn’t qualified for a disability insurance plan. It took me all of five minutes to enter that information, so the process really was a breeze. The next screen would have shown my options, however, if I did qualify.

The one thing that annoyed me was the fact that they didn’t stop me during the process when something I input didn’t qualify (i.e., income, age, location) and they also didn’t tell me why I didn’t qualify at the end.

It was just a picture of someone doing the international gesture for “oh well” and a link back to their homepage. Not very user friendly in my opinion.

That said, I do like what Breeze is doing – they’ve basically cornered the disability insurance market in a positive way and are positioning themselves as experts in this one particular type of insurance.

If I were going to get disability insurance, I would use Breeze since they focus on one product. I get nervous when my insurer offers me a bunch of different types of insurance because it makes me feel as if they aren’t specialists in any one of them. That’s just my two cents though.

Overall, Breeze makes a lot of sense if you need disability insurance. Yes, they’re a new company, but they’re underwritten by a company that has been around for a very long time – so that brings some assurance.

I didn’t like how I was “rejected” without any type of understanding as to why, but if you do go through the five minutes it takes to get a quote and you qualify, the process is amazingly simple from that point forward.

Your money deserves more than a soundbyte.

Get straightforward advice on managing money well.

Most financial content is either an echo chamber for the "Already Rich" or a torrent of dubious advice designed only to profit its creators. For nearly 20 years, we've been on a mission to help our readers acheive their financial goals with no judgement, no jargon, and no get-rich-quick BS. Join us today.

We hate spam as much as you do. We generally send out no more than 2-3 emails per month featuring our latest articles and, when warranted, commentary on recent financial news. You can unsubscribe at any time.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Best travel insurance companies of April 2024

Amy Fontinelle

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 3:40 a.m. UTC April 1, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

WorldTrips is the best travel insurance company of 2024, based on our analysis of cost and coverage options. Use this rating to compare top travel insurance plans and find the best match for your next trip.

Best travel insurance companies of 2024

- WorldTrips: Best travel insurance .

- Travel Insured: Best for emergency evacuation .

- TravelSafe: Best for missed connections .

- Aegis: Best for traveling with a pet .

- Travelex: Best for traveling with kids .

- AIG: Best for add-on coverage options .

- Nationwide: Best for cruise itinerary changes .

Why trust our travel insurance experts

Our travel insurance experts evaluate hundreds of insurance products and analyzes thousands of data points to help you find the best product for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Travel insurance quotes comparison

Top-rated travel insurance companies , best travel insurance.

Top-scoring plans

Medical limit per person, medical evacuation limit per person, what you should know.

Two WorldTrips plans top our rating of the best travel insurance: Atlas Journey Preferred and Atlas Journey Premier.

The Preferred plan is more affordable and provides $100,000 per person in emergency medical benefits as secondary coverage, with an optional upgrade to primary coverage. Atlas Journey Preferred is also the best travel insurance for cruises .

For a little extra, you can buy the Premier plan, which gives you $150,000 in travel medical insurance with primary coverage. This is a good option if health insurance for international travel is a priority.

Pros and cons

- Atlas Journey Preferred is the cheapest of the 5-star travel insurance plans.

- Atlas Journey Premier has $150,000 in primary medical coverage.

- Both plans have top-notch $1 million per person in medical evacuation coverage.

- Each plan includes travel inconvenience coverage of $750 per person.

- 12 optional upgrades, including destination wedding and rental car damage and theft.

- No non-medical evacuation coverage.

Best for emergency evacuation

Travel insured.

Top-scoring plan

Travel Insured Worldwide Trip Protector travel insurance offers $1 million in emergency evacuation coverage per person and $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits. If you’re looking for the best travel insurance for international travel, consider the Worldwide Trip Protector plan.

- Only plan in our rating that offers $150,000 in non-medical evacuation coverage.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person only available for cruises and tours.

Best for missed connections

If you’re worried that missed connections could disrupt your trip, it’s worth considering TravelSafe. Some travel insurance companies only provide missed connection coverage for cruises and tours, but TravelSafe doesn’t impose that restriction.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of the top-scoring travel insurance plans.

- No “interruption for any reason” coverage available.

- Weak baggage delay coverage of $250 per person after 12 hours.

Best for traveling with a pet

Go Ready Choice by Aegis has the most affordable travel insurance of the top-scoring companies in our rating. It offers basic coverage limits with optional add-ons, such as a Pet Bundle that includes pet medical, pet kennel and pet return benefits.

- Cheapest of the top-scoring travel insurance plans.

- Optional pet bundle adds pet medical expense and pet return benefits.

- Low emergency medical and evacuation limits.

- Low missed connection benefit of $500 per person for cruises and tours only.

- Low baggage and personal items loss benefit of $500 per person.

Best for traveling with kids

If you’re traveling with children age 17 or younger, you’ll appreciate not having to pay extra for their coverage when you buy a Travel Select plan from Travelex Insurance Services.

- Free coverage for children 17 and under on the same policy.

- Robust travel delay coverage of $2,000 per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Low emergency medical coverage of $50,000 per person.

- Non-medical evacuation is not included.

- Low baggage delay coverage of $200 requires a 12-hour delay.

Best for add-on coverage options

Travel Guard Preferred from AIG allows you to customize your policy with a host of optional upgrades. These include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings.

There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million. This is a good option if you’re looking for foreign travel health insurance.

- Bundle upgrades allow you to customize your travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Best for cruise itinerary changes

Evacuation limit per person

Nationwide’s Cruise Choice plan has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion. It also has a missed connections benefit of $1,500 per person after only a 3-hour delay, when you’re taking a cruise or tour. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

- Benefits for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Missed connection coverage of $1,500 per person for tours and cruises, after a 3-hour delay.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” upgrade available.

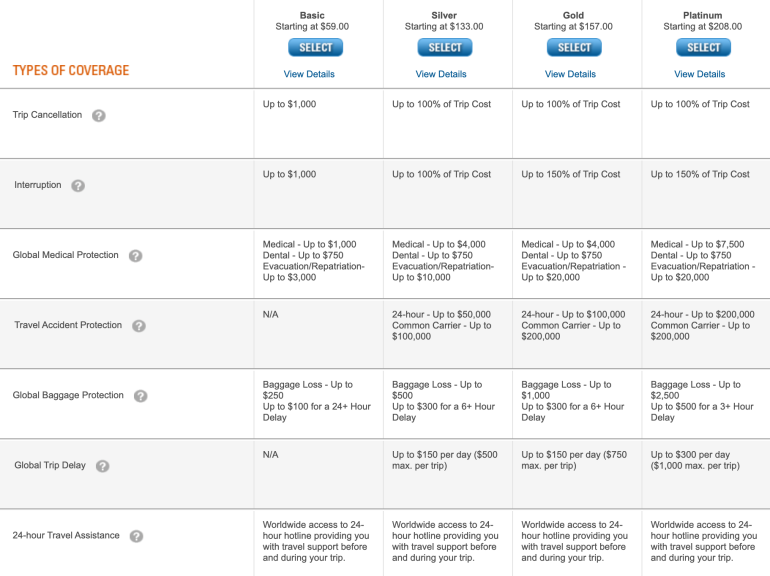

Compare the best travel insurance companies of 2024

Methodology

Our travel insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance of 2024. For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- Cost: 40 points. We scored the average cost of each travel insurance policy for a variety of trips and traveler profiles.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

What does travel insurance cover?

Travel insurance covers your prepaid, nonrefundable trip costs — as well as extra money you may need to spend due to unforeseen circumstances and emergencies — both before and during your trip.

Travel insurance coverage varies by plan, but in general travel insurance covers costs associated with these problems:

- Bankruptcy of a travel company, such as your airline or tour operator.

- Dangerous weather conditions .

- Delayed and lost luggage.

- Illness or death in your family that requires you to stay home or cut your trip short.

- Illness that needs medical attention.

- Injury requiring medical evacuation.

- Jury duty.

- Travel delays and missed connections.

- Theft of your personal belongings while traveling.

- Unexpected job loss.

A comprehensive travel insurance plan bundles several types of travel insurance coverage, each with its own limits. To ensure you have adequate financial protection for your trip, your travel insurance policy should include the following travel insurance coverages.

Trip cancellation insurance

As soon as you buy a travel insurance plan that includes trip cancellation insurance , you’re covered if you need to call off your trip because of a reason listed in your policy. These reasons generally include unexpected illness, injury or death of you, a family member or a travel companion, severe weather, jury duty and your travel supplier going out of business.

If you cancel your trip for a covered reason, you can expect to be reimbursed for 100% of your prepaid, nonrefundable travel expenses.

For even greater flexibility, some travel insurance plans offer a “ cancel for any reason ” (CFAR) upgrade. This optional coverage allows you to pull the plug on your trip for any reason at all, as long as you do so at least 48 hours before your scheduled departure.

Adding CFAR coverage will increase the cost of your plan and it’s important to note that this coverage typically only reimburses 50% or 75% of your expenses, depending on the policy.

Travel delay insurance

Once your trip is underway, inconvenient delays can be expensive. Travel delay insurance reimburses you for unexpected expenses you incur after a certain waiting period, such as five hours. If your travel is delayed longer than that time because of a reason in your policy, such as severe weather, your benefits can cover needs like airport meals, transportation and even overnight accommodation.

This coverage usually has daily limits as well as a maximum limit. For example, a travel insurance plan may provide trip delay coverage of up to $150 per day with a $2,000 maximum.

Trip interruption insurance

If you need to end your trip early — again, for a reason listed in your policy — trip interruption insurance comes into play.

Say a close family member back home is involved in an accident and you need to rush back to be by their side. Trip interruption benefits can reimburse you for any prepaid, nonrefundable payments you’ll lose by leaving early. It can also pay for a last-minute one-way ticket home.

Travel medical insurance

Emergency medical benefits are especially important if you need international health insurance for travel outside of the country. Your domestic health insurance may provide limited coverage once you leave the U.S.

The best senior travel insurance provides ample travel medical coverage because Medicare does not cover health care outside of the U.S., except in very limited circumstances.

The best travel medical insurance pays for ambulance service, doctor visits, hospital stays, X-rays, lab work and prescription medication you may require while traveling.

Many travel insurance plans cover medical treatment for COVID-19, but not all do. The best COVID travel insurance has generous emergency medical and emergency medical evacuation benefits.

When comparing plans to find the best medical travel insurance for international trips, check to see if the coverage is primary. If the travel medical insurance coverage is secondary, you will need to file a claim with your health insurance before you can file a travel insurance claim.

Emergency medical evacuation

If you’re traveling to a remote area, or planning excursions such as boating to an island, emergency medical evacuation coverage is a good idea. This coverage pays to transport you to the nearest adequate medical facility if you are injured or sick while traveling.

Depending on your location and medical condition, emergency transportation could cost tens of thousands of dollars. Our top-scoring travel insurance plans all offer coverage of $1 million.

Baggage delay coverage

If you arrive safely at your destination but your bags do not, this coverage can help. After a certain waiting period, such as six or 12 hours, this coverage will reimburse you for necessities you may need while waiting for your bags to arrive. Be sure to save your receipts and look at your coverage limit, as some caps are low, like $200.

Baggage loss and personal effects coverage

Baggage insurance can reimburse you if your bag never arrives, or if your personal belongings are stolen during your travels. Coverage limits apply here, as well as exclusions for certain items such as electronics. If you’ll be traveling with your laptop or other valuables, read your policy carefully to make sure they’re covered.

What travel insurance doesn't cover

Travel insurance policies often exclude or limit “foreseeable” losses. Typical travel insurance exclusions include:

- Accidents or injuries caused by drinking or drug use.

- Canceling your trip because you changed your mind.

- Ending your trip early because you changed your mind.

- Losses caused by intentional self harm, including suicide.

- Losses due to war, civil disorder or riots.

- Medical tourism.

- Medical treatment for pre-existing conditions.

- Mental health care.

- Natural disasters that begin before you buy travel insurance.

- Non-medical evacuation.

- Normal pregnancy.

- Medical treatment related to high-risk activities.

- Routine medical care, such as physicals or dental care.

- Search and rescue.

Most travel insurance companies offer a free look period when you buy a policy. Take this time — which might be anywhere from 10 to 21 days — to carefully review the plan’s coverages and exclusions, and request a full refund if it doesn’t meet your needs.

“For trip cancellation coverage, travel insurance plans will only cover you for very specific covered reasons listed in a plan’s description of coverage,” said Stan Sandberg, co-founder and CEO of TravelInsurance.com. “If an event is not listed as a covered reason, it won’t be covered unless the consumer opts for a ‘cancel for any reason’ policy.”

“Cancel for any reason travel insurance” upgrade

For the greatest flexibility to cancel, consider adding “cancel for any reason” (CFAR) coverage to your travel insurance plan. This will increase the cost of your policy, but will typically reimburse you for 75% of your trip expenses if you decide to cancel your trip.

A CFAR upgrade also usually has a number of requirements, such as buying it within seven to 14 days of making your first trip payment and insuring the full amount of your travel costs. But, it will give you the freedom to cancel your trip for any reason, as long as you do so at least two days before your scheduled departure.

Adding CFAR coverage typically increases the cost of your travel insurance plan by 50%.

Make sure you’re covered: Best COVID travel insurance

How much travel insurance should I buy?

Travel insurance companies typically offer several plans with varying maximum limits. The higher the coverage limits, the more you’ll pay for travel insurance.

Squaremouth recommends the following coverage limits for international travel:

- Emergency medical coverage: At least $50,000.

- Medical evacuation coverage: At least $100,000.

If you’re going on a cruise, or to a remote location, Squaremouth recommends:

- Emergency medical coverage: At least $100,000.

- Medical evacuation coverage: At least $250,000.

When evaluating travel insurance plans, our team of insurance analysts considered the best medical travel insurance to be policies with at least $250,000 in emergency medical coverage and at least $500,000 in medical evacuation coverage.

What is the best travel insurance?

The best travel insurance for international travel is sold by WorldTrips , according to our analysis. Two WorldTrips plans — Atlas Journey Preferred and Atlas Journey Premier — top our rating of the best travel insurance. But the best travel insurance for you depends on the trip you are planning and the coverage areas that are most important to you.

Make sure you’re covered: WorldTrips travel insurance review

Best travel insurance for cruises

The best cruise travel insurance is WorldTrips Atlas Journey Preferred. This plan offers solid travel insurance for cruises for a low rate.

Best travel insurance for COVID

The best COVID travel insurance is the Trip Protection Basic plan sold by Seven Corners . It is a relatively low cost travel insurance plan with optional “cancel for any reason” coverage that reimburses up to 75% of your prepaid, nonrefundable trip expenses.

Best travel insurance for “cancel for any reason”

The best cancel for any reason (CFAR) travel insurance is Seven Corners Trip Protection Basic. Adding CFAR coverage to a RoundTrip Basic plan only increases the cost by about 40%, which is lower than other plans we analyzed. For the extra cost, you get coverage of 75% of your prepaid, nonrefundable trip expenses, as long as you cancel at least 48 hours before your scheduled departure.

Best travel insurance for seniors

The best senior travel insurance is the Gold plan sold by Tin Leg . It is an affordable plan with travel medical primary coverage of $500,000 and a pre-existing conditions waiver if you insure the full amount of your trip within 14 days of your first trip deposit.

How much is travel insurance?

The average travel insurance cost is 5% to 6% of your trip costs.

How much you pay for travel insurance will depend on how expensive your trip is, how many benefits the insurance provides and the age of the covered travelers.

Here are average costs per trip by travel insurance plan, based on our analysis of rates.

Travel insurance cost examples

Average travel insurance costs are based on rates for seven trips with a variety of traveler ages, trip costs and destinations. Travel insurance plans have different levels of included benefits, which can account for price differences.

What affects travel insurance costs?

How much you pay for travel insurance will depend on:

- The cost of your trip.

- Your destination.

- The length of your trip.

- The ages of travelers being insured.

- Your state of residence.

- The travel insurance policy you choose.

- The total coverage amounts in your policy.

- Any travel insurance add-ons you select.

How travel insurance works

“Typically, travelers are expected to pay their expenses out of pocket, and then file a claim for reimbursement,” said Clark. “However, there are medical situations in which a provider may be required to pre-authorize payment to make sure the policyholder receives the treatment they need.”

According to Clark, “Providers can pre-authorize payment for medical care and emergency evacuations. With that said, every circumstance is unique, and providers will handle each situation on a case-by-case basis.”

How to get travel insurance

To buy travel insurance, you’ll need to submit an online application with information about yourself and your trip, such as your name, age, permanent address, destination, travel dates and total trip cost per person. Since the application is simple, you can easily get quotes from multiple companies on your own.

Even easier, you can get multiple quotes by submitting a single application online through a travel insurance comparison site like Squaremouth.

How to choose which travel insurance is best for you

When shopping for travel insurance, consider the coverages that are most important to you. For example:

- Travel medical insurance. If you need travel health insurance for international travel, you’ll want a high limit for medical expenses, such as doctor and hospital bills, ambulance, X-rays and medicine. The best travel insurance for seniors includes ample travel medical insurance because Medicare generally does not pay for health care outside of the U.S.

- Emergency medical evacuation. If you’re planning a trip to a remote destination, make sure your travel insurance plan has high limits for emergency evacuation. Squaremouth suggests $50,000 to $100,000 of medical evacuation coverage for most trips but recommends $250,000 for travel to remote locations.

You’ll also want to consider common exclusions , such as:

- Adventure sports. Many travel insurance plans exclude coverage for risky activities such as skiing and scuba diving. Read the fine print of a policy to see what is excluded, or look for a travel insurance company that specializes in covering adventure sports trips, such as World Nomads.

- Named storms. If a hurricane is named before you buy travel insurance, it’s too late to buy coverage and cancel your trip because of the storm.

- Normal pregnancy. Normal pregnancy typically isn’t covered by travel insurance. If you get pregnant after you buy travel insurance, you may be covered for pregnancy-related reasons, but you’ll need to provide medical proof that pregnancy started after your purchased travel insurance.

- Pre-existing medical conditions. If you have dealt with a health issue — even allergies or asthma — look closely at this common exclusion. Travel insurance plans typically have look-back periods, which could be 60, 90 or 180 days before you bought the policy. If you had symptoms during that time, your claim could be denied if your condition flares up while you’re traveling. If you’re shopping for the best travel insurance for pre-existing conditions, look for plans that offer a pre-existing medical condition waiver. You’ll be eligible for this waiver if you meet specific terms, such as buying travel insurance within days of making your first trip deposit and insuring the full value of your trip.

When to buy travel insurance

The best time to buy travel insurance is immediately after making your first nonrefundable travel payment, whether it’s for a plane ticket, hotel stay, cruise or excursion. Like other types of insurance, your policy needs to be in place before something goes wrong. It won’t cost you any extra to buy travel insurance far in advance of your trip, and it will cover a longer period of time.

“Purchasing a travel insurance policy at the time of making an initial trip payment offers travelers the most peace of mind,” said James Clark, spokesperson for Squaremouth.

“Knowing they are protected if unforeseen events such as medical emergencies, inclement weather, natural disasters and other trip disruptions occur allows travelers to approach their trip with less worry and more confidence.”

You’d have a hard time buying travel insurance before booking anything because you’d have nothing to insure, Clark said. “With that said, travelers are able to purchase a policy and make modifications, such as updating travel dates or adding expenses to the insurance policy, as they continue to make their travel arrangements.”

You can buy travel insurance up to the day before you leave on your trip, but waiting may cost you the opportunity to qualify for a pre-existing condition waiver or to buy a “cancel for any reason” upgrade.

Where to buy travel insurance

You can buy a travel insurance plan:

- Online. Visit a travel insurance company’s website to buy a policy directly or use a comparison website like Squaremouth to see your options and compare plans. You may also be able to purchase travel insurance online through an airline, cruise, hotel, rental car company or other provider you book a ticket with.

- In person. A travel agent or insurance agent may be able to assist you in buying travel insurance.

Using a travel insurance marketplace that will give you quotes for multiple policies is a great way to compare coverage options and pricing to find the best policy for your trip. Buying a policy directly from a travel provider is convenient and might be fine, but it might not meet your needs.

“If a traveler is heading to the Caribbean with the intention of going scuba diving, it’s unlikely that the policy offered by the airline would cover that activity,” Clark said. “Shopping around for insurance opens the door to other policy providers that may offer a policy that checks all of a traveler’s boxes.”

In addition, while flight insurance , which may be offered through a partnership with a travel insurance provider like AIG or Allianz, may cover travel delays and cancellations, it might not protect you if you get sick during your trip, Clark said. “We highly recommend travelers read the policy’s fine print before making a purchase so they know what’s covered,” he added.

Top 10 travel destinations

Americans are changing the way they travel and this includes buying travel insurance when they might have skipped it in the past.

Here are the top destinations travel insurance customers are traveling to — and how much they’re spending on these trips — according to Feb. 2024 data from Squaremouth.

Source: Squaremouth. Based on travel insurance purchased from Jan. 14 to Feb. 13, 2024.

Travel insurance trends in 2024

Here are some key travel insurance trends in 2024:

- As spending on trips continues to rise , so will the price of travel insurance policies.

- People are planning trips further in advance and purchasing 2024 travel insurance earlier, making them eligible for perks like cancel for any reason (CFAR) coverage and a pre-existing conditions exclusion waiver.

- Emergency evacuation, medical coverage and trip interruption remain top concerns for travelers, increasing the search for comprehensive travel insurance plans with more robust coverage — even if it costs more.

“As Americans continue to spend more on vacations, they have more to lose if they need to cancel or return home early. A travel insurance policy is an efficient and cost-effective way to protect that financial investment for trips in 2024,” said InsureMyTrip senior vice president Suzanne Morrow.

Best travel insurance FAQs

WorldTrips has the best trip insurance, according to our analysis. Two of its plans — Atlas Journey Preferred and Atlas Journey Premier — get 5 stars in our rating.

The best travel insurance policy for you will depend on what type of coverage you need. With so many different policies and carriers, the policy that was best for your friend’s trip to California might not be ideal for your trip to Japan. If you’re looking for the best travel insurance for international travel, you may be willing to pay more for higher coverage levels.

Your U.S. health insurance may provide little or no coverage in foreign countries. Check with your health insurance company to see if you have any global benefits and ask how they work. If your health care does extend across the border, the benefits it provides abroad may not be the same benefits it provides domestically.

Medicare usually won’t pay for health care outside of the United States and its territories, so older travelers planning an international trip should look into the best senior travel insurance with robust medical benefits.

The best time to buy travel insurance is immediately after booking your trip and making a nonrefundable payment — in other words, as soon as you’re at risk of losing money. This way, you’ll know the total cost that you need to insure and you’ll have the longest window to take advantage of your policy’s benefits if something goes wrong.

You can’t wait until something goes wrong and then buy travel insurance to get reimbursed for your loss. Travel insurance only covers unexpected losses.

Travel insurance companies can decline to cover travel to certain countries. For example, you may find that some trip insurance companies don’t offer coverage to countries with a Level 4: Do Not Travel advisory from the U.S. State Department.

Travel insurance policies also frequently exclude certain risks that you’re more likely to encounter in Level 4 or Level 3 countries. For example, your policy may not cover losses related to declared or undeclared wars or acts of war or losses related to known or foreseeable conditions or events.

Some credit cards , such as the Chase Sapphire Preferred® Card , offer benefits such as trip cancellation and interruption insurance, baggage delay insurance and trip delay reimbursement when you use your card to pay for your trip.

Ask your credit card issuer for your card’s benefits guide to see what coverage you may have. Keep in mind that it may not cover all the risks you want to protect against, such as the cost of international health care or emergency medical evacuation .

Business travel insurance makes sense if you are self-employed and paying for your own travel expenses, or if you are traveling internationally and want medical coverage abroad.

You might also consider buying travel insurance for a business trip if your company won’t cover extra expenses if your flight is delayed or you need to head home early.

Cruise travel insurance can help protect you financially if you need emergency medical care in a remote location, or if a delayed flight causes you to miss embarkation and you need to pay extra to catch up to your cruise.

Experts caution that travel insurance you buy through a cruise line may not be as comprehensive as plans you can buy directly from travel insurance companies.

Some travel insurance plans cover rental cars as an optional upgrade, for an additional cost. The 5-star rated travel insurance companies in our rating offer these optional rental car benefits:

- Travel Insured International — Rental car damage and theft coverage of $50,000.

- WorldTrips — Rental car damage and theft coverage of $50,000 with a $250 deductible.

Travel insurance typically only covers a single trip, although your insured trip can have multiple destinations.

If you’re looking to insure several trips in the same year, annual travel insurance may be a good option for you.

Editor’s Note: This article contains updated information from previously published stories:

- Spirit Airlines scrubs 60% of its Wednesday flights, says cancellations will drop ‘in the days to come.’

- ‘Just a parade of incompetency’: Spirit Airlines passengers with ‘nightmare’ stories want more than apology, $50 vouchers

- ‘This is not our proudest moment’: Spirit Airlines CEO says more flight cancellations expected this weekend

- Hurricane Irma: Flight cancellations top 12,500; even more expected

- Is an annual travel insurance policy right for you?

- How 2020 and COVID-19 changed travel forever – and what that means for you

- COVID-19 or delta variant have you ready to scrap your trip? Here’s how to cancel like a pro

- Sunday: Snow is over, but flight cancellations top 12,000

- After nearly 13,000 Harvey cancellations, Irma is new threat to airline flights

- What’s the difference between travel insurance and trip ‘protection’?

- How to choose the right travel insurance for your next vacation

- Travel insurance can save the day

- Angry passengers brawl after Spirit cancels flights

- What to do when travel insurance doesn’t work

- How lockdowns, quarantines and COVID-19 testing will change summer travel in 2021

- Travelers will pay and worry more on summer vacation this year. But they won’t cancel

- How to find a hotel with COVID testing and quarantine facilities wherever you travel

- Yearning to travel in 2022? First, figure out your budget – then pick a destination

- Pro tips for surviving a long flight during a pandemic: Get the right mask, bring a pillow

- Want to steer clear of contracting COVID-19 on your next vacation? Follow these guidelines

- Post-pandemic travel: Is it OK to ask another passenger’s vaccine status or request they mask up?

- These days, forgetting these important travel items could cost you thousands of dollars

- International travel hacks: When to book flights and hotels, how to deal with COVID-19 rules

- Traveling post-coronavirus: How do you book your next trip when so much remains uncertain?

- The COVID-19 guide to holiday travel – and the case for why you shouldn’t go this year

- Should you travel during the holidays? Americans struggle with their decision

- ‘There’s still pent-up demand’: What you should know about fall travel

- Planning for life after coronavirus: When will we know it’s safe to travel again?

- ‘Busiest camping season’: Travelers choose outdoor recreation close to home amid COVID-19 pandemic

- Considering a camping trip this summer? Tips to make sure your gear is good to go

- RVing for the first time? 8 tips for newbies I wish I’d known during my first trip

- Five myths about travel agents

- Should I buy travel insurance?

- Is travel insurance stacked against you?

- Five myths about travel insurance and terrorism

- These eight things could get your travel insurance claims rejected

- There’s a good chance that your credit card already gives you some kind of travel insurance coverage

- How to avoid a hotel cancellation penalty

- Change fees and travel insurance continue to rise

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Amy Fontinelle has more than 15 years of experience helping people make informed decisions about their money, whether they’re refinancing a mortgage, buying insurance or choosing a credit card. As a freelance writer trained in journalism and specializing in personal finance, Amy digs into the details to explain the products and strategies that can help (or hurt) people seeking greater financial security and wealth. Her work has been published by Forbes Advisor, Capital One, MassMutual, Investopedia and many other outlets.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

Travel Insurance Jennifer Simonson

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travel Insurance Mandy Sleight

Travelex travel insurance review 2024

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Outlook for travel insurance in 2024

Survey: Nearly 85% of Americans avoid family over the holidays

Travel Insurance Kara McGinley

AIG travel insurance review 2024

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

9 Best Travel Insurance Companies of March 2024

According to our analysis of more than 50 travel insurance companies and hundreds of different travel insurance plans, the best travel insurance company is Travelex Insurance Services. In our best travel insurance ratings, we take into account traveler reviews, credit ratings and industry awards. The best travel insurance companies offer robust coverage and excellent customer service, and many offer customizable add-ons.

Travelex Insurance Services »

Allianz Travel Insurance »

HTH Travel Insurance »

Tin Leg »

AIG Travel Guard »

Nationwide Insurance »

Seven Corners »

Generali Global Assistance »

Berkshire hathaway travel protection ».

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance Companies.

Table of Contents

- Travelex Insurance Services

- Allianz Travel Insurance

Travel insurance can help you protect the financial investment you made in your vacation when unexpected issues arise. Find the best travel insurance for the type of trip(s) you're taking and the coverages that matter most to you – from interruptions and misplaced belongings to illness and injury.

- Travelex Insurance Services: Best Overall

- Allianz Travel Insurance: Best for Trip Interruptions

- HTH Travel Insurance: Best for Groups

- Tin Leg: Best Cost

- AIG Travel Guard: Best for Families

- Nationwide Insurance: Best for Last-Minute Travel Insurance

- Seven Corners: Best for 24/7 Support When Traveling

- Generali Global Assistance: Best for Medical Emergencies

- Berkshire Hathaway Travel Protection: Best for Specialized Coverage

Customizable upgrades are available, including car rental coverage, additional medical insurance and adventure sports coverage

Medical and trip cancellation maximum are not as high as some other companies

- 100% of the insured trip cost for trip cancellation; 150% for trip interruption

- Up to $1,000 in coverage for lost, damaged or stolen bags and personal items; $200 for luggage delays

- $750 in missed connection coverage

- $50,000 in emergency medical and dental coverage

- Up to $500,000 in emergency medical evacuation and repatriation coverage

SEE FULL REVIEW »

Annual and multitrip policies are available

Distinguishing between the company's 10 travel insurance plans can be challenging

- Up to $200,000 in trip cancellation coverage; $300,000 in trip interruption coverage

- $2,000 for lost, damaged or stolen luggage and personal effects; $600 for bag delays

- Up to $1,600 for travel delays

- Emergency medical coverage of up to $75,000

- Epidemic coverage

Generous coverage at the mid- and high-tier levels, and great group discounts

Preexisting conditions coverage is only available at mid- and high-tier plans

- 100% trip cancellation coverage (up to $50,000); 200% trip interruption coverage

- Up to $2,000 in coverage for baggage and personal effects; $400 in baggage delay coverage

- Up to $2,000 in coverage for trip delays; $1,000 for missed connections

- $500,000 in coverage per person for sickness and accidents

Variety of plans to choose from, including two budget-friendly policies and several more premium options

More limited coverage for baggage issues than other companies

- 100% trip cancellation protection; 150% trip interruption

- $500 per person for lost, stolen or damaged baggage and personal items

- Up to $2,000 per person in travel delay coverage ($150 per day); $100 per person for missed connections

- $100,000 per person in emergency medical coverage, including issues related to COVID-19

Travel insurance policy coverage is tailored to your specific trip

Information about policy coverage inclusions is not readily available without first obtaining a quote

- Trip cancellation coverage for up to 100% of your trip's cost; trip interruption coverage for up to 150% of the trip cost

- Up to $2,500 in coverage for lost, stolen or damaged baggage; $500 related to luggage delays

- Up to $1,000 in missed connection and trip delay coverage

- $100,000 in emergency medical coverage

Variety of plans to choose from and coverage available up to a day before you leave on your trip

Limited trip cancellation coverage even at the highest tier

- Trip cancellation coverage up to $30,000; trip interruption coverage worth up to 200% of the trip cost (maximum of $60,000)

- $2,000 for lost, damaged or stolen baggage; $600 for baggage delays

- Up to $2,000 for trip delays; missed connection and itinerary change coverage of $500 each

- $150,000 for emergency medical and dental issues

Customer service available 24/7 via text, Whatsapp, email and phone

Cancel for any reason coverage costs extra

- 100% trip cancellation coverage (up to between $30,000 and $100,000 depending on your state of residence); interruption coverage for up to 150% of the trip cost

- Lost, stolen or damaged baggage coverage up to $2,500; up to $600 for luggage delays

- Trip delay and missed connection coverage worth up to $1,500

- Emergency medical coverage worth up to between $250,000 and $500,000 (depending on where you live)

Generous emergency medical and emergency evacuation coverage

Coverage for those with preexisting conditions is only available on the Premium plan

- 100% reimbursement for trip cancellation; 175% reimbursement for trip interruption

- $2,000 in coverage for loss of baggage per person

- $1,000 per person in travel delay and missed connection coverage

- $250,000 in medical and dental coverage per person

In addition to single-trip plans, company offers specific road trip, adventure travel, flight and cruise insurance coverage

Coverage for missed connections or accidental death and dismemberment is not part of the most basic plan

- Trip cancellation coverage worth up to 100% of the trip cost; interruption coverage worth up to 150% of the trip cost

- $500 in coverage for lost, stolen or damaged bags and personal items; bag delay coverage worth $200

- Trip delay coverage worth up to $1,000; missed connection coverage worth up to $100

- Medical coverage worth up to $50,000

To help you better understand the costs associated with travel insurance, we requested quotes for a weeklong June 2024 trip to Spain for a solo traveler, a couple and a family. These rates should help you get a rough estimate for about how much you can expect to spend on travel insurance. For additional details on specific coverage from each travel insurance plan and to input your trip information for a quote, see our comparison table below.

Travel Insurance Types: Which One Is Right for You?

There are several types of travel insurance you'll want to evaluate before choosing the policy that's right for you. A few of the most popular types of travel insurance include:

COVID travel insurance Select insurance plans offer some or a combination of the following COVID-19-related protections: coverage for rapid or PCR testing; accommodations if you're required to quarantine during your trip if you test positive for coronavirus; health care; and trip cancellations due to you or a family member testing positive for COVID-19. Read more about the best COVID-19 travel insurance options .

Cancel for any reason insurance Cancel for any reason travel insurance works exactly how it sounds. This type of travel insurance lets you cancel your trip for any reason you want – even if your reason is that you simply decide you no longer want to go. Cancel for any reason travel insurance is typically an add-on you can purchase to go along with other types of travel insurance. For that reason, you will pay more to have this kind of coverage added to your policy.

Also note that this type of coverage typically only reimburses 50% to 80% of your nonrefundable prepaid travel expenses. You'll want to make sure you know exactly how much reimbursement you could qualify for before you invest in this type of policy. Compare the best cancel for any reason travel insurance options here .

International travel insurance Travel insurance is especially useful when traveling internationally, as it can provide medical coverage for emergencies (in some cases for COVID-19) when you're far from home. Depending which international travel insurance plan you choose, this type of travel insurance can also cover lost or delayed luggage, rental cars, travel interruptions or cancellations, and more.

Cheap travel insurance If you want travel insurance but don't want to spend a lot of money, there are plenty of cheap travel insurance options that will offer at least some protections (and peace of mind). These are typically called a company's basic or standard plan; many travel insurance companies even allow you to customize your coverage, spending as little or as much as you want. Explore your options for the cheapest travel insurance here .

Trip cancellation, interruption and delay insurance Trip cancellation coverage can help you get reimbursement for prepaid travel expenses, such as your airfare and cruise fare, if your trip is ultimately canceled for a covered reason. Trip interruption insurance, on the other hand, kicks in to reimburse you if your trip is derailed after it starts. For instance, if you arrived at your destination and became gravely ill, it would cover the cost if you had to cut your trip short.

Trip delay insurance can help you qualify for reimbursement of any unexpected expenses you incur (think: lodging, transportation and food) in the event your trip is delayed for reasons beyond your control, such as your flight being canceled and rebooked for the next day. You will want to save your receipts to substantiate your claim if you have this coverage.

Lost, damaged, delayed or stolen bags or personal belongings Coverage for lost or stolen bags can come in handy if your checked luggage is lost by your airline or your luggage is delayed so long that you have to buy clothing and toiletries for your trip. This type of coverage can kick in to cover the cost to replace lost or stolen items you brought on your trip. It can also provide coverage for the baggage itself. It's even possible that your travel insurance policy will pay for your flight home if damages are caused to your residence and your belongings while you're away, forcing you to return home immediately.

Travel medical insurance If you find yourself sick or injured while you are on vacation, emergency medical coverage can pay for your medical expenses. With that in mind, however, you will need to find out whether the travel medical insurance you buy is primary or secondary. Where a primary policy can be used right away to cover medical bills incurred while you travel, secondary coverage only provides reimbursement after you have exhausted other medical policies you have.

You will also need to know how the travel medical coverage you purchase deals with any preexisting conditions you have, including whether you will have any coverage for preexisting conditions at all. Read more about the best travel medical insurance plans .

Evacuation insurance Imagine you break your leg while on the side of a mountain in some far-flung land without quality health care. Not only would you need travel medical insurance coverage in that case, but you would also need coverage for the exorbitant expense involved in getting you off the side of a mountain and flying you home where you can receive appropriate medical care.

Evacuation coverage can come in handy if you need it, but you will want to make sure any coverage you buy comes with incredibly high limits. According to Squaremouth, an emergency evacuation can easily cost $25,000 in North America and up to $50,000 in Europe, so the site typically suggests customers buy policies with $50,000 to $100,000 in emergency evacuation coverage.

Cruise insurance Travel delays; missed connections, tours or excursions; and cruise ship disablement (when a ship encounters a mechanical issue and is unable to continue on in the journey) are just a few examples why cruise insurance can be a useful protection if you've booked a cruise vacation. Learn more about the top cruise insurance plans here .

Credit card travel insurance It is not uncommon to find credit cards that include trip cancellation and interruption coverage , trip delay insurance, lost or delayed baggage coverage, travel accident insurance, and more. Cards that offer this coverage include popular options like the Chase Sapphire Reserve credit card , the Chase Sapphire Preferred credit card and The Platinum Card from American Express .

Note that owning a credit card with travel insurance protection is not enough for your coverage to count: To take advantage of credit card travel insurance, you must pay for prepaid travel expenses like your airfare, hotel stay or cruise with that specific credit card. Also, note that credit cards with travel insurance have their own list of exclusions to watch out for. Many also require cardholders to pay an annual fee.

Frequently Asked Questions

The best time to buy travel insurance is normally within a few weeks of booking your trip since you may qualify for lower pricing if you book early. Keep in mind, some travel insurance providers allow you to purchase plans until the day before you depart.

Many times, you are given the option to purchase travel insurance when you book your airfare, accommodations or vacation package. Travel insurance and travel protection are frequently offered as add-ons for your trip, meaning you can pay for your vacation and some level of travel insurance at the same time.

However, many people choose to wait to buy travel insurance until after their entire vacation is booked and paid for. This helps travelers tally up all the underlying costs associated with a trip, and then choose their travel insurance provider and the level of coverage they want.

Figuring out where to buy travel insurance may be confusing but you can easily research and purchase travel insurance online these days. Some consumers prefer to shop around with a specific provider, such as Allianz or Travelex, but you can also shop and compare policies with a travel insurance platform. Popular options include: