- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Citi Credit Card Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Do Citi cards have travel insurance?

Car rental insurance, costco anywhere visa® card by citi travel insurance benefits, citi® / aadvantage® executive world elite mastercard® travel insurance coverage, does citibank offer travel insurance.

Citi credit cards provide a host of benefits, including some generous points and miles earning opportunities (depending on the card you have).

But, when it comes to travel insurance, let’s just say it’s not necessarily Citi cards' strong suit.

Still, there are Citibank travel insurance benefits you should know about to ensure you use the right card when paying for your next trip. Here are the primary benefits associated with Citi card travel insurance.

Only two Citi cards have travel insurance, and each one has a different set of benefits: The Costco Anywhere Visa® Card by Citi and the Citi® / AAdvantage® Executive World Elite Mastercard® .

on Citibank's application

Both cards provide rental car insurance.

The Costco Anywhere Visa® Card by Citi also offers roadside assistance, worldwide travel accident insurance and a 24/7 concierge for travel and emergency assistance. The Citi® / AAdvantage® Executive World Elite Mastercard® , on the other hand, offers baggage protection, trip cancellation/interruption insurance and trip delay protections.

» Learn more: Best Citi credit cards right now

If you use either of the two Citi credit cards listed above to pay for a car rental, Citi travel insurance will protect any damages to a rental car up to $50,000.

This amount will cover the cost of repairs or the cash value of the car, whichever is lower. It applies anywhere you rent a car — there are no geographic limitations — as long as the rental period is no longer than 31 days. Citibank travel insurance covers accidental damage, theft, vandalism or a natural disaster, and any necessary towing costs.

Citi's rental car insurance is secondary when renting a car within the U.S., but if you're renting outside of the country, it switches to primary coverage.

With secondary insurance, you need to rely on any other insurance coverage you have before Citi’s car rental insurance kicks in. Primary insurance, alternatively, will be the first line of coverage you have.

Coverage wouldn't apply if you rent the car to someone else or operate a rental car as a rideshare vehicle. It also only covers the car, not any personal injuries that might result from an accident.

There are several types of vehicles that are excluded from coverage. These include:

Trucks, pickup trucks, trailers, full-size vans on a truck chassis or recreational vehicles like campers and off-road vehicles.

Motorcycles or motorized bikes.

Commercial vehicles or cargo vans.

Any vehicle with fewer than four wheels.

Antique vehicles older than 20 years or that have not been made in the past decade.

Limousines.

Sport-utility trucks or open, flat-bed trucks.

Any vehicle that retails for over $50,000.

» Learn more: Rental car insurance explained

Roadside assistance

When driving in the U.S., roadside assistance is available for Costco Anywhere Visa® Card by Citi cardholders by calling 866-918-4670.

Roadside assistance is valuable in the event of an accident, loss of fuel or other vehicle malfunction. Keep in mind that you would still have to pay for the assistance (like a tow truck, for example), but this benefit makes it easy to reach someone with one phone call.

Citi card provides access to similar assistance as a membership program like AAA . The difference is that AAA’s annual fee covers roadside assistance fees while Citi's coverage doesn't; it solely provides access to someone who can help you for a reduced rate.

Several credit cards provide some type of roadside assistance and are worth considering before paying the annual fee for AAA.

Worldwide travel accident insurance

The Costco Anywhere Visa® Card by Citi includes accident insurance, which covers the cardholder or family members if they are injured or killed when traveling on a common carrier (any vehicle that is licensed to carry passengers like a bus, plane, cruise ship or train).

You will need to have used the Citi card to cover the entire cost of the travel on that common carrier for the benefit to apply. The maximum coverage is $250,000.

» Learn more: How does travel insurance work?

Travel and emergency assistance

The Costco Anywhere Visa® Card by Citi card provides access to a 24/7 concierge to help you with a disruption to your trip. This can include medical assistance, referrals to a doctor or legal help. It can also help if you need to adjust travel plans.

Just remember, you’ll be responsible for paying for any services used, but the call is toll-free.

Baggage protection

Only available for the Citi® / AAdvantage® Executive World Elite Mastercard® , this luggage protection provides coverage if your checked bag is stolen, lost or damaged.

The insurance covers as much as $3,000 per person ($2,000 for New York residents), but only kicks in if you use the card or American AAdvantage miles to pay for the trip.

» Learn more: The guide to baggage insurance

Trip cancellation and interruption insurance

If a covered traveler has a medical emergency or dies, the Citi® / AAdvantage® Executive World Elite Mastercard® coverage can provide reimbursement for up to $5,000 in eligible nonrefundable expenses.

You would need to use the card or American AAdvantage miles to pay for the trip.

Trip delay protection

Another benefit that’s reserved only for the Citi® / AAdvantage® Executive World Elite Mastercard® is trip delay protection . This coverage kicks in if your trip is delayed by at least six hours, and offers reimbursement for expenses incurred during the delay, up to $500 per trip.

This would include reasonable purchases like hotel stays, rental cars and meals.

» Learn more: The best travel credit cards right now

Citibank travel insurance is available, but limited. It is only offered on two cards and isn't as comprehensive as other credit cards with travel insurance .

Both cards include rental car coverage, but beyond this, each has its own set of benefits. Depending on which one you hold, it may include coverage like trip delay protection or roadside assistance.

People hold Citi cards for many reasons, including the ability to earn transferable Citi ThankYou Points . But, the travel insurance benefits are somewhat limited. If you have a Citi card, review the travel insurance perks before you take off to understand your coverage.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Citi Thankyou Premier Card

23 Valuable Benefits of the Citi Premier Card [For Travelers]

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3093 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

![citi premier mastercard travel insurance 23 Valuable Benefits of the Citi Premier Card [For Travelers]](https://upgradedpoints.com/wp-content/uploads/2022/09/Citi-Premier-Upgraded-Points-LLC-05-Large.jpg?auto=webp&disable=upscale&width=1200)

1. A Generous Welcome Bonus

2. earn on travel purchases, 3. earn when dining out, 4. earn on gas, 5. earn on supermarket purchases, 6. earn on every purchase, 7. no limit on the number of thankyou points you can earn, 8. add an authorized user to earn even more, 9. share points between accounts, 10. transfer points to airline loyalty programs, 11. redeem for travel via the citi thankyou travel portal, 12. transfer to sears shop your way, 13. redeem for gift cards, 14. redeem for cash-back or shopping, 15. make a charitable donation, 16. citi concierge, 17. citi entertainment℠, 18. luxury hotel and resorts benefits, 19. world elite air program, 20. priceless mastercard golf experiences, 21. no foreign transaction fees, 22. purchase protection, 23. extended warranty, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Perhaps you’ve been thinking of applying for a travel rewards credit card but you’re not quite ready to pay the higher annual fee that can come with premium travel rewards cards.

Although premium travel rewards cards offer a lot of luxury travel perks and other benefits that can negate all or most of the annual fee, there’s still that large fee that has to be paid every year.

If you’re a frequent traveler and want an alternative to a premium travel rewards card, you might consider the Citi Premier ® Card. If most of your spending is on travel, gas, entertainment, and dining, you’re going to find elevated earnings that will make it easy to accumulate rewards quickly. Your points will also be easy to redeem with several flexible options, including travel.

That’s not the end of the benefits that come with the Citi Premier card; however, as there are so many other reasons to consider the card, so here’s a long list of all the benefits of the Citi Premier card.

Lots of Ways to Earn ThankYou Rewards Points

The Citi Premier card is perfect for the traveler as bonus earning categories include common travel purchases. Rewards are also valuable as they are earned in the form of ThankYou Points , which have several flexible redemption options.

Earn a welcome bonus worth hundreds of dollars after meeting minimum spending requirements within the first 3 months after card approval.

Citi Premier ® Card

Frequent flyers will enjoy 3x ThankYou Points at restaurants, gas stations, supermarkets, air travel, and hotels.

The Citi Premier ® Card is an excellent option for anyone looking for an all-around travel rewards credit card. The card helps you earn points fast with great 3x bonus categories such as restaurants, supermarkets, gas stations, airfare, and hotels. Plus, it offers access to airline and hotel transfer partners, doesn’t charge foreign transaction fees, and has a reasonable annual fee!

- 3x points at restaurants, supermarkets, gas stations, airfare, and hotel purchases

- Access to Citi transfer partners

- Annual hotel credit

- No foreign transaction fees

- $95 annual fee

- Earn 60,000 bonus ThankYou ® Points after you spend $4,000 in purchases within the first 3 months of account opening. Plus, for a limited time, earn a total of 10 ThankYou ® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024.

- Earn 3 Points per $1 spent at Gas Stations, Air Travel and Other Hotels

- Earn 3 Points per $1 spent at Restaurants and Supermarkets

- Earn 1 Point per $1 spent on all other purchases

- Annual Hotel Savings Benefit

- 60,000 ThankYou ® Points are redeemable for $600 in gift cards redeemable for $600 in gift cards or travel rewards at thankyou.com

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

Financial Snapshot

- APR: 21.24% - 29.24% Variable

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Citi ThankYou Rewards

- Benefits of the Citi Premier

- Authorized User Benefits of the Citi Premier

- Chase Sapphire Preferred Card vs. Citi Premier Card [Detailed Comparison]

- Best Citi Credit Cards

- Best Credit Card Sign Up Bonuses

- Best Travel Credit Cards

- Best Credit Cards for Groceries and Supermarkets

- Best Virtual Credit Cards

Points will add up quickly as you earn 3 ThankYou Points per dollar spent on airfare and hotels.

Whether it’s a late-night hamburger, a high-end dining experience, or lunch at an outdoor café, you’ll be earning 3 points for every dollar you spend on dining.

Do a lot of commuting? Use your Citi Premier card at gas stations and earn 3 points per dollar spent .

If you’re like most people, supermarket purchases make up a significant amount of your yearly expenses. So put those purchases on your Citi Premier card and earn 3 points per dollar spent .

Every purchase you make with your Citi Premier card earns at least 1 ThankYou Point per dollar spent .

Unlike some travel rewards cards that limit the amount of spending that earns elevated rewards in bonus categories, the Citi Premier has no such limit.

Bottom Line: Frequent travelers will find the Citi Premier card a good match as every travel purchase, including gas stations, earns 3 ThankYou Points per dollar spent and 2 ThankYou Points per dollar spent on dining and entertainment.

Share the Benefits with Others

There is no cost to add an authorized user to your Citi Premier card and their purchases earn ThankYou Points.

There are no fees to transfer ThankYou Points between accounts. Up to 100,000 points can be shared and 100,000 points received in a calendar year. Points expire 90 days after points are received.

Redeeming Your ThankYou Point Rewards

One reason ThankYou Points are so valuable is because of their flexibility. They can be transferred to airline loyalty programs, used to purchase travel, redeemed for merchandise, gift cards, or even cash-back.

Transferring points to airline frequent flyer programs can result in great value for your ThankYou Points. Simply log in to your online Citi Premier account, click on Rewards and Benefits, then “more ways to redeem”. ThankYou Points transfer at the rate of 1 point to 1 mile.

Check out some of the best ideas for redeeming your ThankYou Points by transferring to airline partners.

Your ThankYou Points can be worth 25% more when redeemed for flights through the ThankYou Rewards portal and 1 cent when redeemed towards travel.

Transferring your ThankYou Points to Sears Shop Your Way points is a decent option that gives you more than 1 cent in value for your ThankYou Points. A ThankYou Point is worth 12 Shop Your Way points. Since a Shop Your Way point is worth 1/10 of a cent, 1 ThankYou Point will equal 1.2 cents worth of Shop Your Way points.

Generally, your ThankYou Points are worth 1 cent per point when redeeming for gift cards, but occasionally there are specials where the value is greater. With the 1 center per point, that means 2,500 ThankYou Points will earn you $25 to one of the many retail partners. For a list of Citi’s current gift card merchants, visit the ThankYou Rewards portal.

While redeeming your points for cash-back or merchandise is not the best value for your points, at least it’s an option if you need to do it. You’ll receive less than 1 cent per point in value and in many cases just 1/2 cent per point. As of May 2019, there’s a few retailers that were available:

Redeem your ThankYou Points for a charitable donation to the American Red Cross or Smile Train for a value of 1 cent per point.

Bottom Line: While the value you receive for your ThankYou Points may vary, the flexibility to select the best redemption for your situation has tremendous value.

Recreation and Entertainment Benefits

With the Citi Premier card, you’ll have access to an expert 24/7 with the Citi ® Concierge dedicated phone line. Get help with travel, shopping, entertainment, and dining out. The concierge staff can help with concert tickets, dinner reservations, or planning out that dream vacation with a simple phone call.

Receive special access to events, exclusive invitations, dining perks, ticket pre-sale privileges, preferred pricing, and more.

World Elite Mastercard Benefits

Some of the benefits covered below are actually World Elite Mastercard benefits that come complimentary with the Citi Premier card. The list of World Elite Mastercard benefits is lengthy, but here are some of the most notable:

Receive upgraded rooms, hotel amenities, credits to use during your stay, late checkout, complimentary breakfast, and more at over 2,000 luxury properties worldwide .

Receive up to 25% discount on premium flights with several airlines .

Receive special access to courses, even private courses, worldwide and be treated like a member. Enjoy select tee times, use of member facilities, discounted pricing, and more.

You’ll find information on these and additional World Elite Mastercard benefits here plus you’ll want to check out the best Mastercards for points and rewards .

Travel Protections and Benefits

Take your card along when you travel as foreign purchases will not incur foreign transaction fees.

Shopping Protections and Benefits

Simply purchase an eligible item with your Citi Premier card and if the item should be damaged or stolen within 90 days of the purchase or delivery date, you could receive up to $10,000 per incident. There is a maximum limit of $50,000 per calendar year.

Why items seem to break down just after the manufacturer’s warranty expires is still a universal mystery. This benefit extends the manufacturer’s warranty on eligible items for 24 months. The benefit is valid on items with a manufacturer’s warranty of 5 years or less. Coverage is limited to $10,000 per item.

The Citi Premier card with its lower annual fee, waived the first year, is a good alternative to the high-end travel rewards cards. You’re not getting that complimentary lounge access or hotel elite status but you’re not paying that higher annual fee, either.

The card delivers a nice combination of bonus rewards earning opportunities for purchases travelers make most and plenty of flexible options to redeem those points for good value.

Keep in mind that Citi does not provide the travel protections and benefits that other travel rewards card may offer .

With that said, when it comes to earning and redeeming points, the Citi Premier is a good choice.

Frequently Asked Questions

If the citi premier card worth it.

Yes. If you’re spending money on travel and want a card that will earn on those purchases plus offer plenty of flexible redemption options, the Citi Premier card is worth it.

The annual fee is waived the first year on the card so you can try the card out for a year to see if it is a fit.

With a nice welcome bonus after meeting a minimum spending requirement in the first 3 months after card approval, and elevated earnings on travel, entertainment and dining purchases, you’ll earn hundreds of dollars worth of travel in just the first year.

How do ThankYou Points work?

ThankYou Points are earned on purchases made with your Citi Premier card.

Every purchase you make with your card will earn at least 1 ThankYou Point per dollar spent. However, certain categories of purchases earn multiple ThankYou Points per dollar spent.

With the Citi Premier card, you’ll earn 3 points per dollar spent on all airfare and hotel purchases, gas stations, dining, and supermarket purchases.

The points you earn are deposited into your ThankYou account after each statement period. You can sign in to your Citi Premier account online and access your ThankYou account when you’re ready to redeem your points.

You can redeem your points for travel, gift cards, pay your mortgage, get cash back, and more.

Can I transfer ThankYou Points to airlines?

Yes, ThankYou Points are transferable to 15 airline partners and it’s an easy transaction.

Just log in to your Citi Premier account online and select Rewards and Benefits, then ThankYou Rewards. You’ll then see a list of all the available redemption options, and there are many.

Under the Travel tab, you’ll see the Transfer option. Select the transfer option and you’ll see a list of airlines.

Prior to transferring your ThankYou Points, you’ll need to have a frequent flyer account established with the airline you’re transferring to so make sure you’ve set one up in advance and have the account number handy.

Many transfers happen nearly instantly, others can take 1-2 days.

How much are ThankYou Points worth?

ThankYou Points vary in value depending on the redemption option but generally you’ll find their worth to be between 1/2 cent per point and 5 to 6 cents per point.

For example, if you redeem your ThankYou Points for a statement credit, you’ll receive just 1/2 cent per ThankYou Point.

If you transfer your ThankYou Points to airline partners, it is possible to receive 5 to 6 cents per point when redeeming for award flights.

A redemption that yields less than 1 cent per ThankYou Point is not good value.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![citi premier mastercard travel insurance Citi Prestige Card — Full Review [2023]](https://upgradedpoints.com/wp-content/uploads/2016/07/Citi_ThankYou_Rewards_Prestige_Credit_Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Ultimate guide to the Citi travel portal

Editor's Note

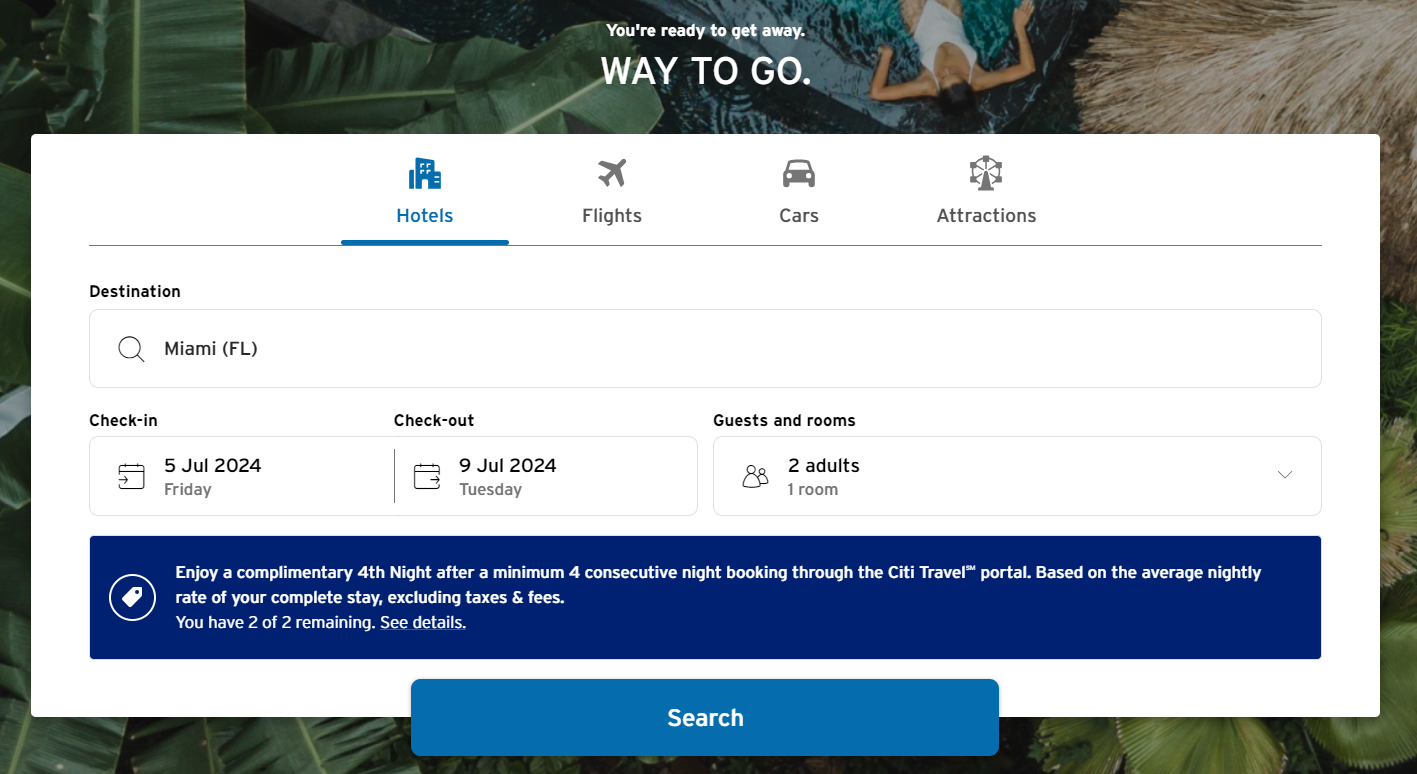

The new Citi travel portal launched earlier this year , offering an enhanced user experience, more hotel options and a new feature for booking activities and attractions. Citi Travel with Booking.com is powered by Rocket Travel by Agoda, utilizing the features and booking availability of Booking.com's brands.

In this article, we will explore the functionality of the new Citi travel portal, discuss any potential drawbacks and clarify who can access this booking engine. Additionally, we will provide a step-by-step guide on using the portal to book your desired travel experiences and explain how to pay using your ThankYou points.

What is the Citi travel portal?

There are four main selling points for using Citi Travel with Booking.com.

First, it provides a one-stop shop for travel that you can pay for with your Citi ThankYou points while booking multiple elements of a trip simultaneously. This can be simpler than transferring points to separate airline or hotel partners and booking your trip piece by piece — and you can even use as many or as few points as you want. The downside is that you might achieve less value from your points to gain simplicity.

Second, the portal allows you to use points to pay for travel beyond flights and hotels, such as guided tours and theme park tickets. You can't do this with Citi's list of transfer partners, and you may achieve better value paying for travel with points in Citi's portal than you would by cashing out your points .

Third, certain card benefits require using the Citi travel portal. This is true of hotel benefits built into the Citi Prestige® Card (no longer open to new applicants) and Citi Premier® Card (see rates and fees ). We'll explore those below.

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Lastly, if you're paying for travel (and not using points), you may be interested in the bonus points available when using Citi Travel with Booking.com. Competitors like the Chase Ultimate Rewards travel portal , American Express Travel and Capital One Travel offer higher earn rates (depending on which credit cards you have) when booking your travel in the bank's portal rather than directly.

Through June 30, 2024, Citi cardholders can earn bonus points as follows:

- 10 points per dollar on reservations for hotels, rental cars and eligible attractions with the Citi Prestige® Card (no longer open to new applicants) and the Citi Premier® Card

Through December 31, 2025, Citi cardholders can earn bonus points as follows:

- 5 points per dollar on these same bookings with the Citi ThankYou® Preferred Card (no longer open to new applicants) and the Citi Rewards+® Card (see rates and fees )

The information for the Citi ThankYou Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

The fact that Citi's portal provides a one-stop shop for your vacation is its main strength. The ability to book hotels, rental cars and even entrance tickets to tourist attractions in one place (and even pay for these with your points) provides great simplicity.

Related: The ultimate guide to Citi ThankYou Rewards

How to use the Citi travel portal

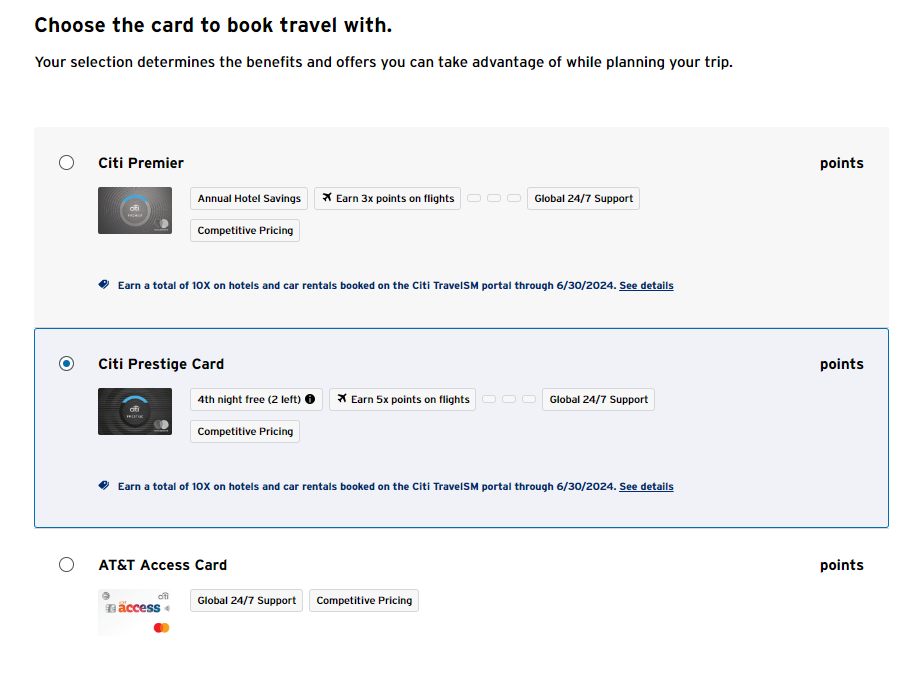

Citi's portal sets itself apart from competitors by being available to anyone with a credit card earning Citi ThankYou points . For comparison, some travel portals reserve their best features for cardholders with expensive premium credit cards . Thus, you can access the portal with the $495-a-year Citi Prestige Card and the no-annual-fee Citi Rewards+ Card .

You can access Citi Travel with Booking.com by clicking this link and logging into your Citi account. If you have multiple Citi credit cards, you must select which card you want to use for booking travel.

Once you select a card, you're ready to start booking travel.

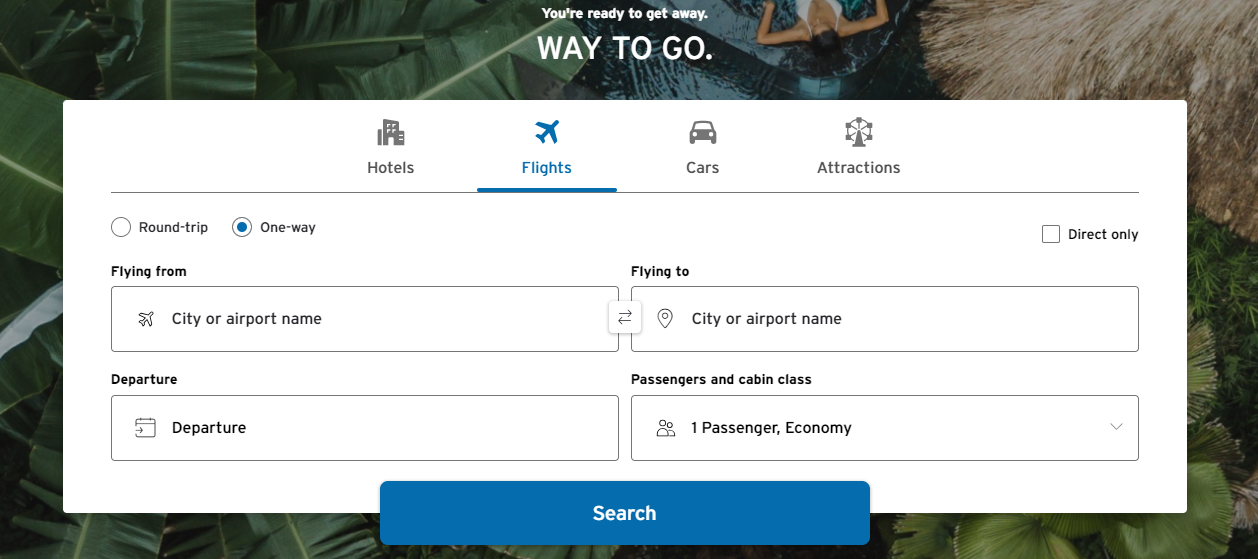

How to book flights using the Citi travel portal

Booking flights in Citi's portal functions similarly to other portals. You'll choose whether this is a one-way or round-trip flight and provide the route, number of passengers, dates and class of travel. Unfortunately, you can't book multi-city itineraries.

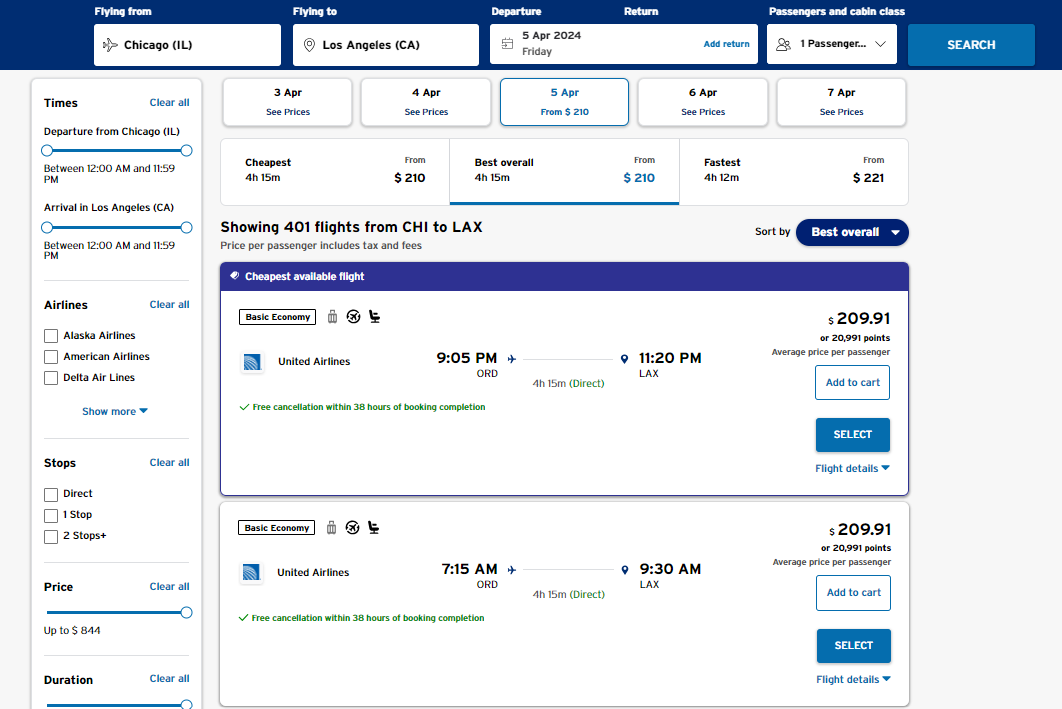

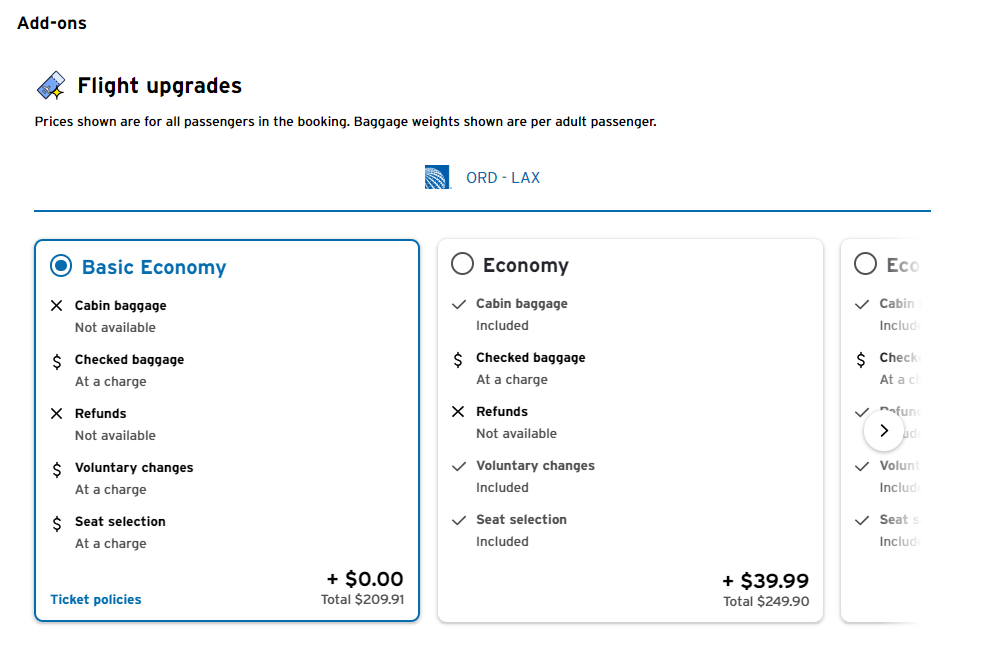

Here's an example search from Chicago to Los Angeles. Note that you can use cities for your search if you don't have a specific airport preference.

The Citi Travel portal offers many filters and sorting options to help you find the most suitable travel options. These filters allow you to refine your search based on price, duration, departure and arrival times, number of connections and even your preferred airline. Furthermore, you can sort the results using these options without losing any filtering choices.

To change the sorting order of the results, click on the "Best overall" drop-down menu on the right side above the price of the first result.

Once you have selected a flight, you will be prompted to provide passenger information, including names, dates of birth, frequent flyer numbers and known traveler numbers for TSA PreCheck and Global Entry (if applicable).

Additionally, before making your payment, you can upgrade to a higher class of travel if it is available. This is the first time you'll see the cost to book a main cabin fare instead of a basic economy fare.

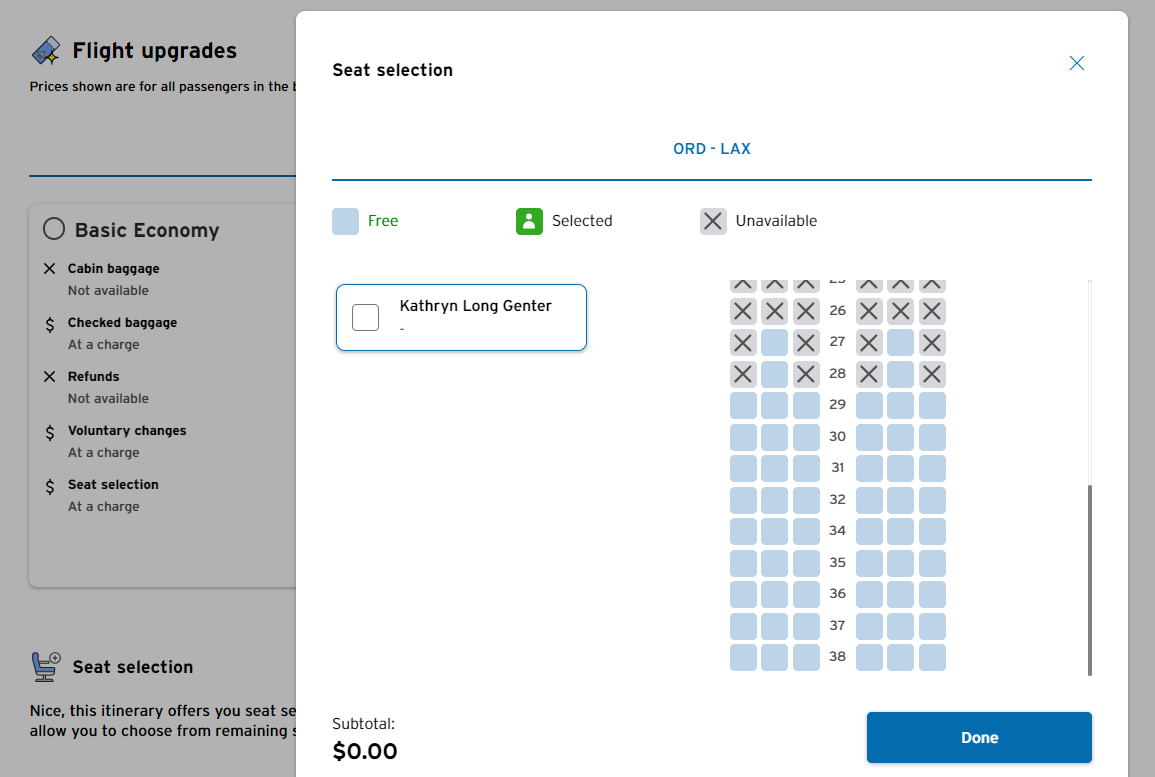

And if your fare class lets you select a seat, you can do so before heading to the payment page.

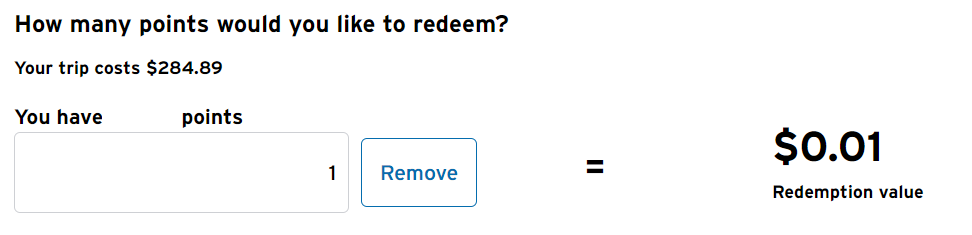

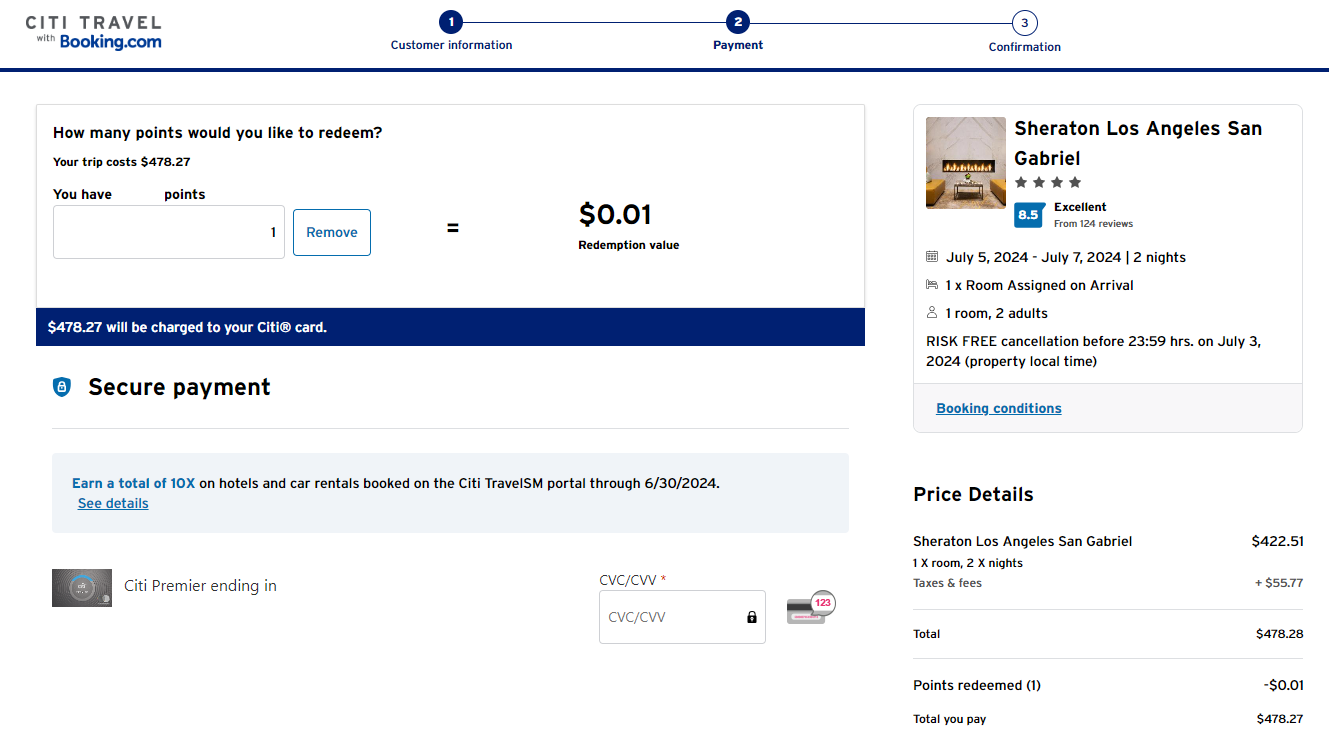

On the final page, you'll choose how you want to pay (with your points, credit card or a mix of the two) and complete your purchase. The redemption rate is an underwhelming 1 cent per point. For context, our valuations peg ThankYou points at 1.8 cents apiece, which you should be able to get by maximizing Citi's transfer partners .

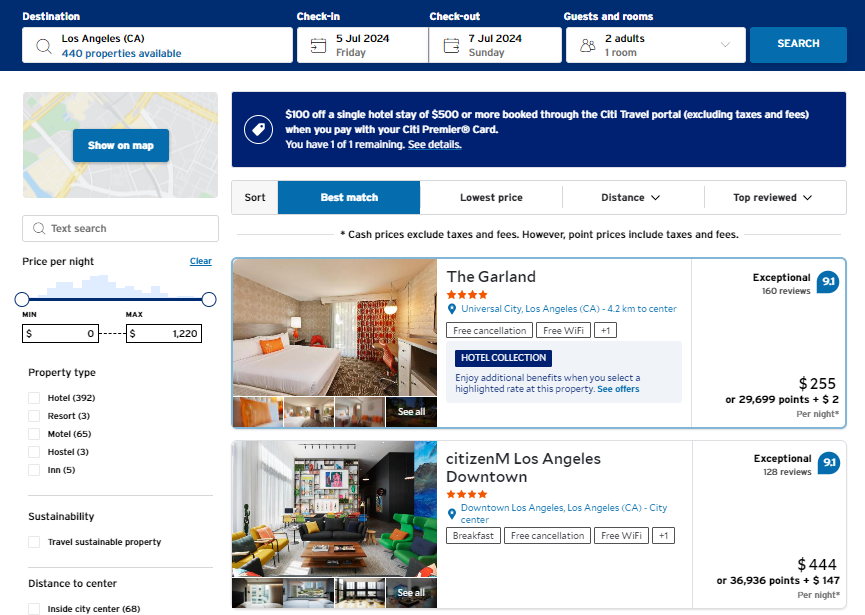

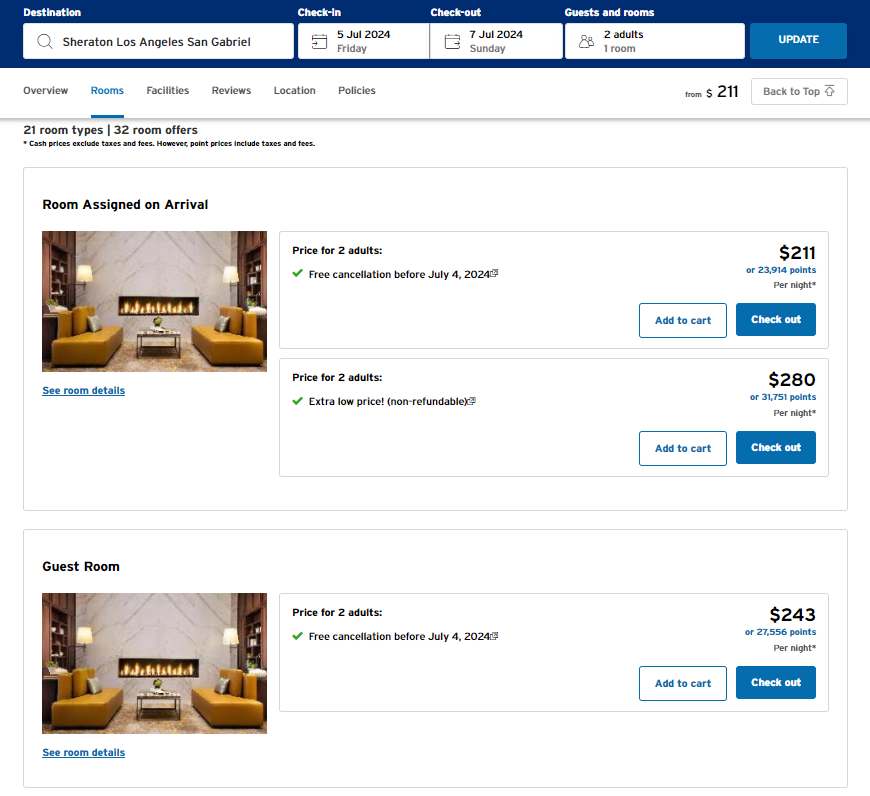

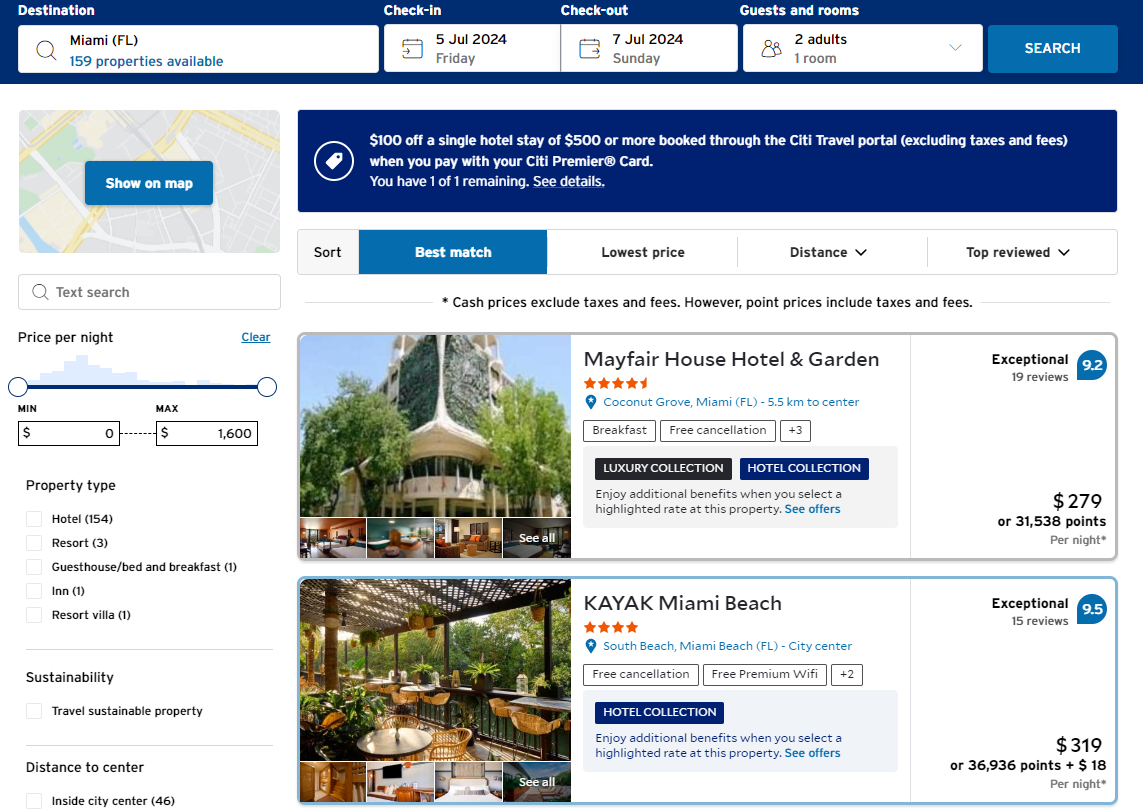

How to book hotels using the Citi travel portal

Booking hotels will feel familiar to those who have used other portals.

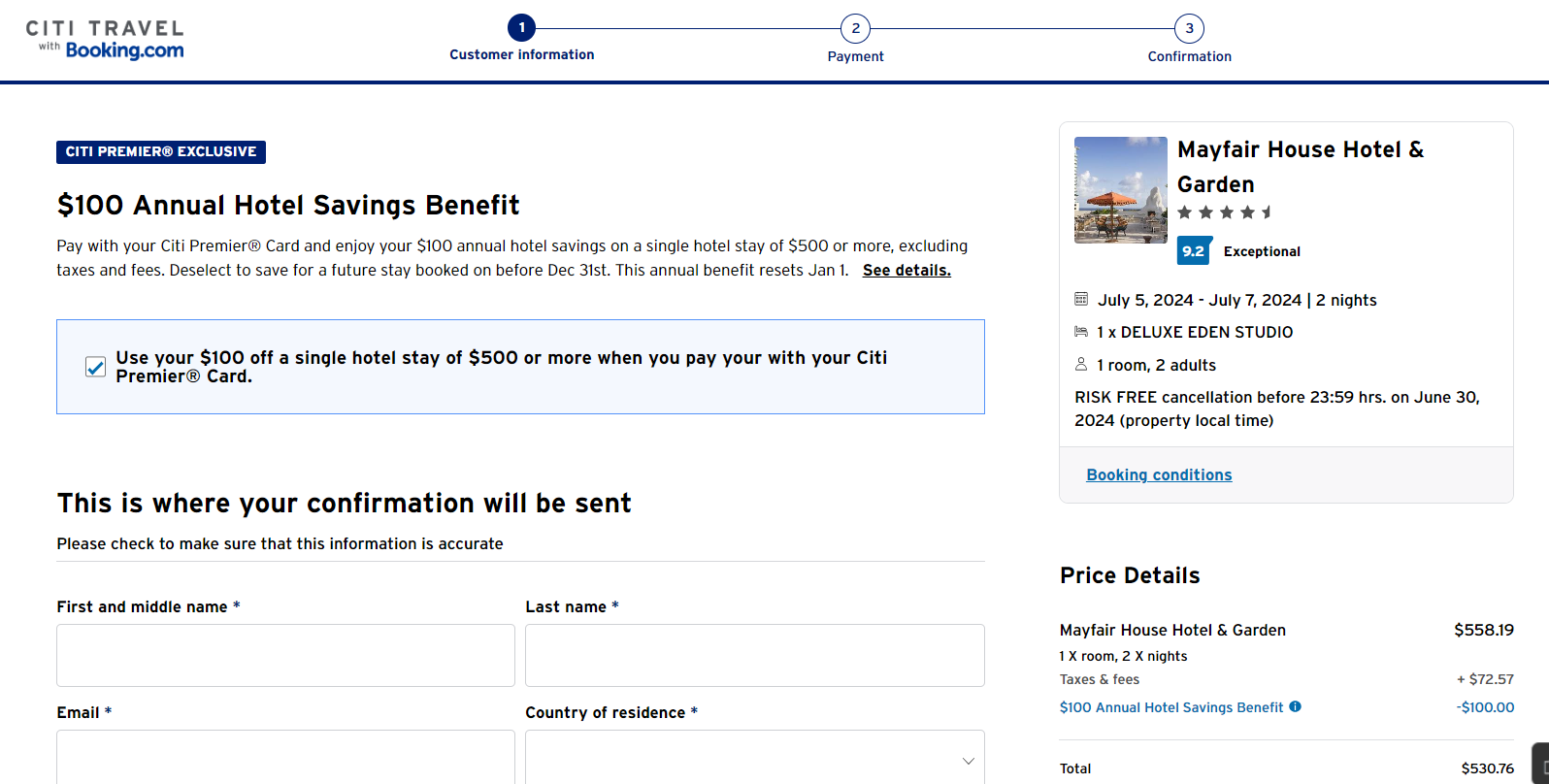

You should choose your Citi Premier or Citi Prestige card before beginning your hotel search if you intend to use those cards' benefits. Premier cardholders can use a $100 hotel credit each calendar year on a booking of $500 or more. In contrast, Prestige cardholders get a fourth night free on hotel bookings in the portal, available up to twice per calendar year.

From here, you can add filters to help you reduce your results, such as by price, neighborhood, star rating and nearby attractions.

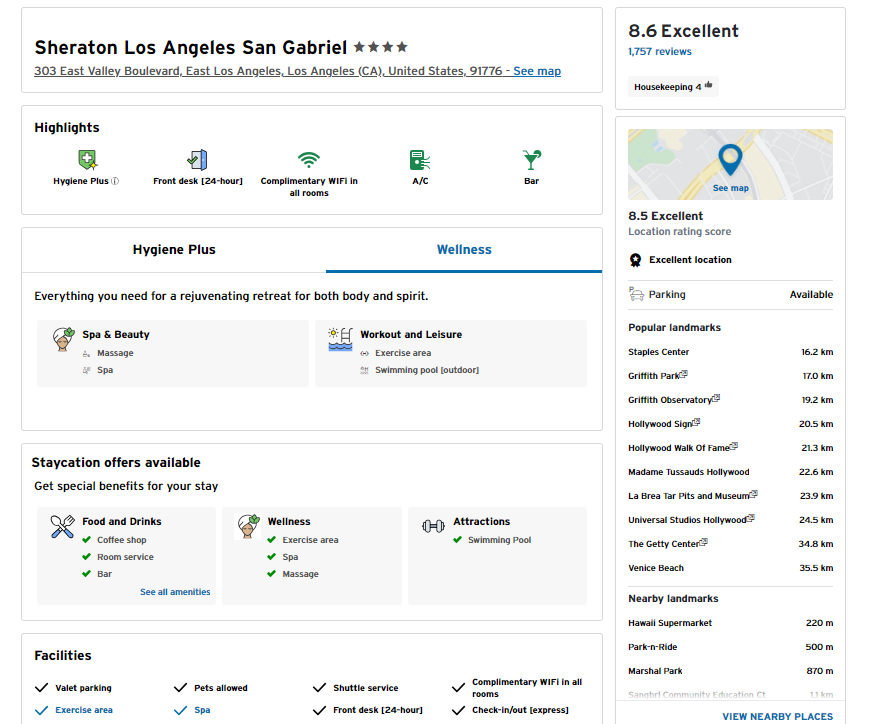

Once you pick a property, you'll see details on its amenities and features.

Then, you can select your desired room.

After choosing a room type, you can pay with points at checkout. Again, each point is worth a lackluster 1 cent.

You'll also have the option to view the cancellation policy before paying. Since policies can vary, ensure you know whether it's possible to change or cancel your booking before you make the final payment.

However, if you book a hotel that's part of a major loyalty program — like Hilton Honors or Marriott Bonvoy — through Citi, you likely won't earn points, nor will you enjoy any elite status perks on your reservation.

Hotel Collection and Luxury Collection properties

Alongside its revamped portal, Citi has introduced two new hotel programs, namely the Hotel Collection and the Luxury Collection. These programs offer similar advantages to other luxury hotel programs offered by credit cards .

Reservations through the Hotel and Luxury Collection have no minimum stay requirements. However, access to the Luxury Collection is exclusive to Citi Premier and Citi Prestige cardholders.

You will receive guaranteed benefits such as daily breakfast for two people and complimentary Wi-Fi for Hotel Collection bookings. In addition to these perks, the Luxury Collection offers a $100 on-property credit, which can be used based on the policies of each hotel. Both programs also provide other benefits, such as early check-in, late checkout and room upgrades (specifically for Luxury Collection bookings, subject to availability at check-in).

Unfortunately, you can't filter search results specifically for Hotel and Luxury collections properties. To identify these properties, you must look for a tag or description indicating their inclusion in your search results.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

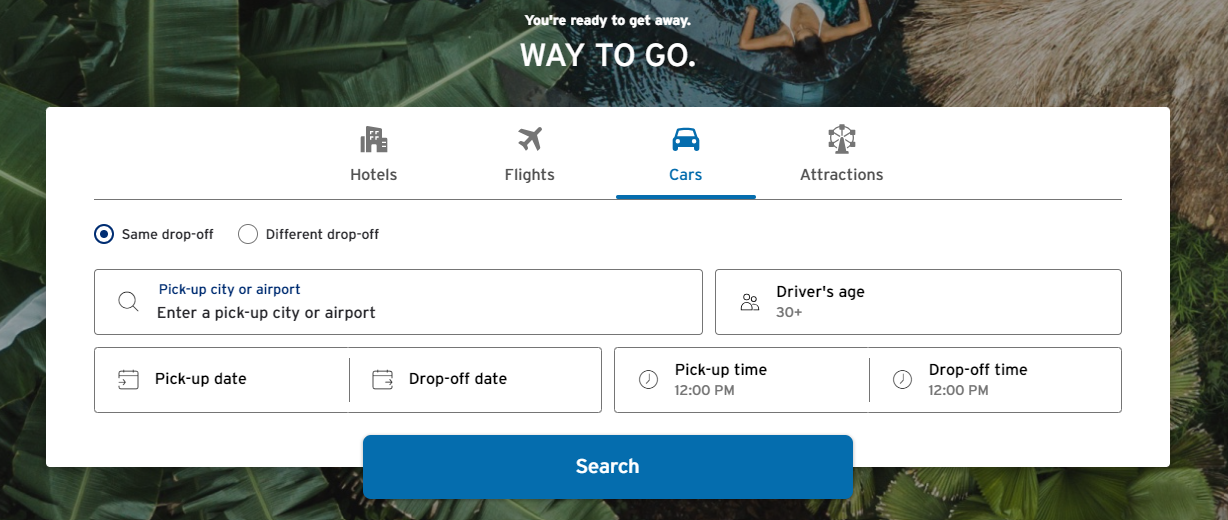

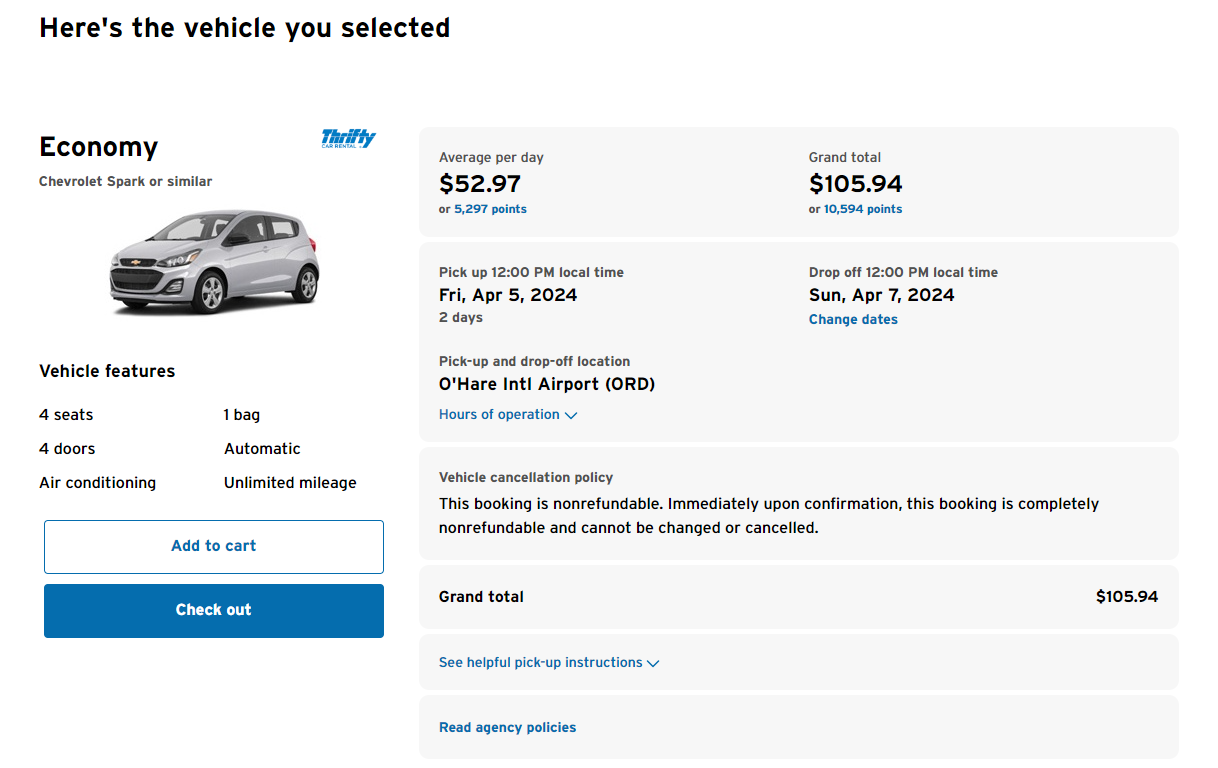

How to book rental cars using the Citi travel portal

Searching for rental cars feels familiar and works quickly.

After providing your location, dates, times and age, click "Search." From the available results, you can use the following filters:

- Vehicle type

- Rental company

- Free cancellation option availability

After choosing a car, you can see the full details and cancellation policy on the next page.

As with other items in Citi Travel with Booking.com , you can add your rental car to the shopping cart (if booking multiple travel elements) or go straight to check out to pay and reserve. Again, you can pay with points at a rate of 1 cent apiece.

How to book attractions using the Citi travel portal

One standout feature of Citi's travel portal is the ability to book attractions along with your hotels, flights and rental cars. This convenient option allows you to make a single transaction for all your travel needs, and you can even use your points to pay for them.

To access this feature, look for the "Attractions" option in the main search bar. However, depending on your location within the portal, you may need to click "More" in the drop-down menu and select "Attractions" from there.

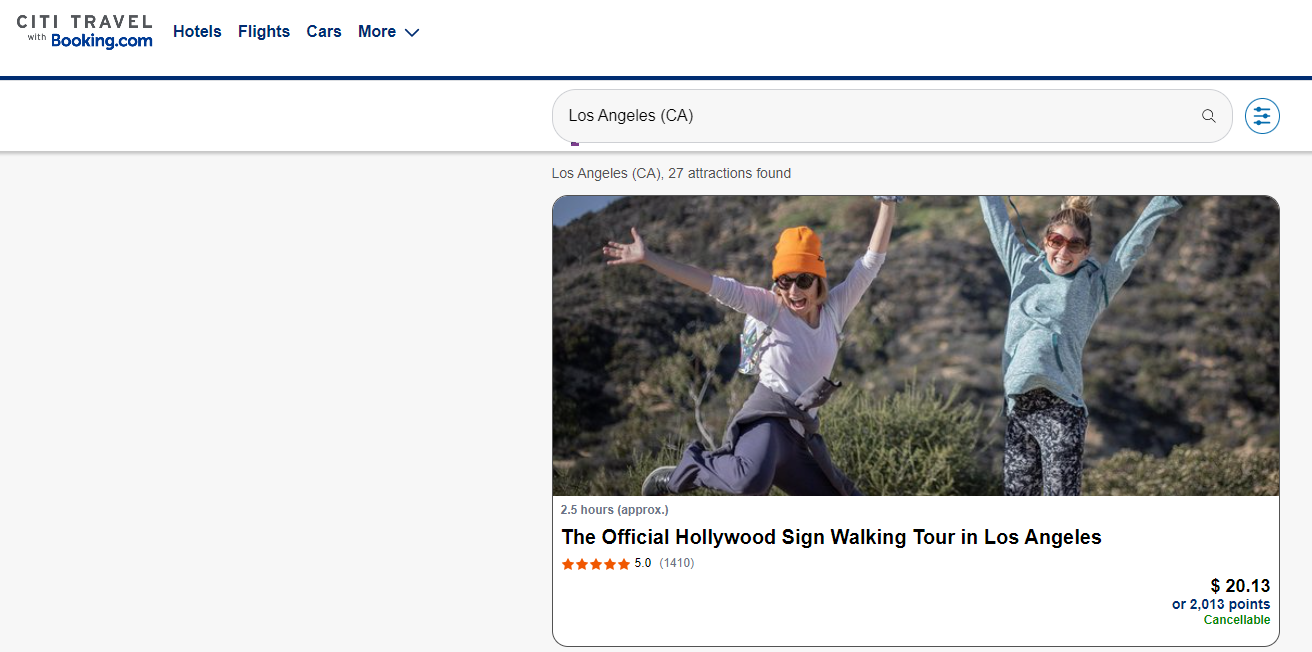

Once you search for a destination, you'll see all available options— from entrance tickets for tourist sights to guided tours. For example, you can book a guided walking tour of the Hollywood Sign.

When you see an activity or tickets you want to purchase, click on the tile. This will take you to a page with details about this offering and cancellation policies.

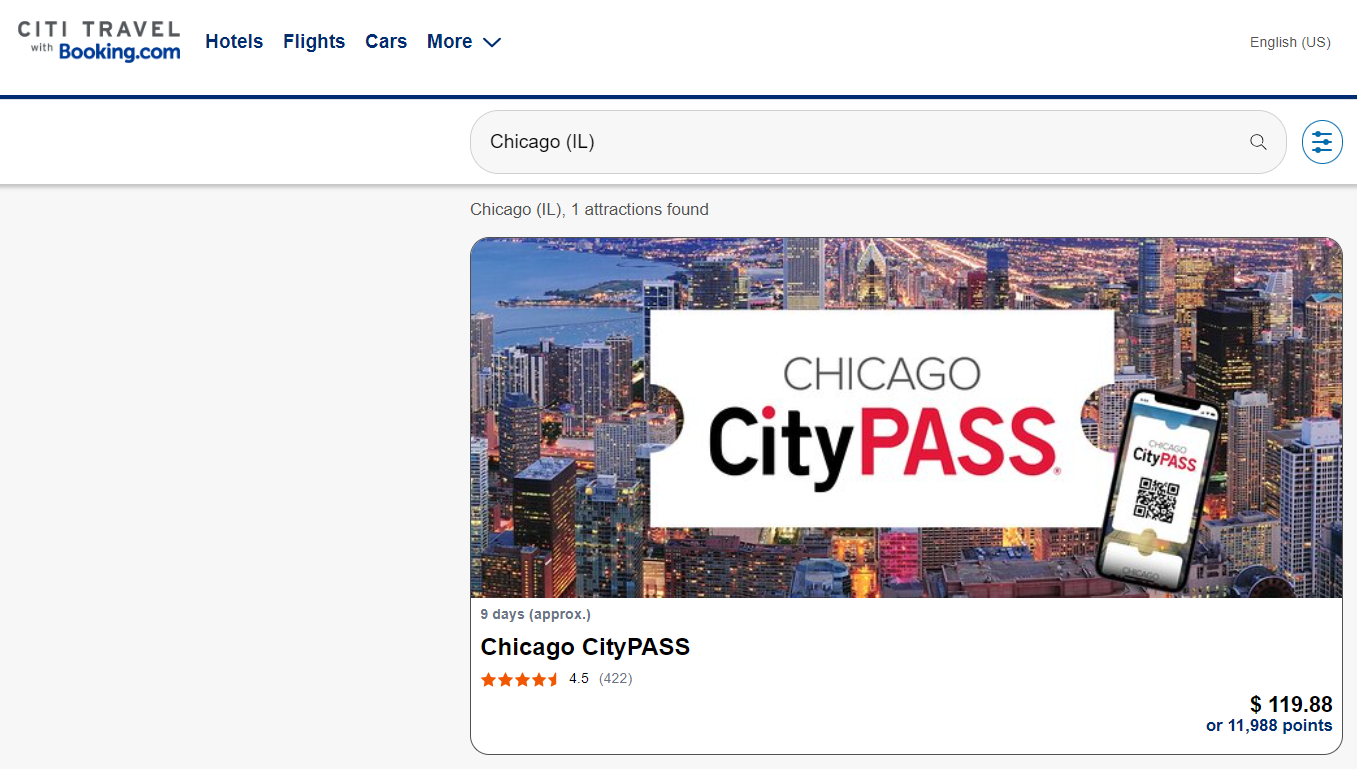

One noteworthy option is Chicago CityPASS tickets, including access to five popular attractions. Click on "Check availability" in the top right corner to choose your preferred date to find pricing and availability.

As with other elements of Citi's portal, you can pay for attraction bookings using ThankYou points with a value of 1 cent apiece.

More things to consider about the Citi travel portal

Now that you know how to use the Citi travel portal, here's some general guidance to maximize your experience.

As always, we recommend comparing prices. There is no guarantee that Citi Travel with Booking.com will offer the best price for your trip. It's recommended to compare the prices you see on the portal with prices available when booking directly with hotels, airlines, rental car companies or tour providers.

If you plan to pay with points, check if you can get better value by using fewer points with Citi's transfer partners . Transferring points to programs like Wyndham Rewards may let you get more value from your points. Check out our guide to redeeming Citi ThankYou points for high-value redemption ideas.

Also, if you book hotels or car rentals through Citi's travel portal, you may forfeit any elite status earnings and benefits. Many loyalty programs require direct bookings to recognize elite status and provide associated perks. Evaluate whether the benefits you would be giving up are worth it.

Finally, Citi Premier and Citi Prestige cardholders have exclusive benefits within the travel portal. Premier cardholders can enjoy $100 off a hotel stay of $500 or more once a calendar year, while Prestige cardholders can get a fourth night free on hotel stays of four nights or more twice a calendar year. If you're making an eligible hotel reservation, you'll see the option to use your available benefit on the payment screen.

You'll also see the benefit(s) highlighted on the hotel search page if you have one of these cards. This includes information on how many more times your benefit can be used.

If you don't see these benefits, check the top right corner of the portal and ensure your Premier or Prestige card is the active card for your searches.

Bottom line

Citi's revamped travel portal allows you to search and make travel reservations for flights, hotels, rental cars, and even tours and attractions. You can book travel up to a year in advance and pay using your Citi ThankYou points or any travel credit card .

Additionally, if you hold the Citi Premier or Citi Prestige, you can utilize your hotel benefits through the portal.

However, it's important to consider potential tradeoffs. Assess your elite status with hotel or rental car companies and determine if you might get better value by booking your travel through another platform. If convenience is your deciding factor, this user-friendly portal offers many results when planning your upcoming vacation.

Additional reporting by Kyle Olsen.

What You Need to Know About Credit Card Travel Insurance

What does credit card travel insurance cover how does it work and what are some credit cards that offer trip protection start to unravel the complexities in this beginner’s guide..

- Copy Link copied

Whether your flight was delayed or your trip was derailed by COVID, you could recoup some of your costs with insurance provided by travel credit cards.

Photo by Shutterstock

AFAR partners with CreditCards.com and may receive a commission from card issuers. This site does not include all financial companies or all available financial offers. Compensation may impact how an offer is presented. Our coverage is independent and objective, and has not been reviewed, approved, or endorsed by any of these entities. Opinions expressed here are entirely those of the AFAR editorial team.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

Travel can be fun and exciting, but many things can go wrong on a trip. There are flight cancellations and delays, lost luggage, and even the dreadful reality of contracting COVID away from home . Investing in travel insurance can alleviate the fear of such situations. But sometimes protections offered by travel insurance companies are ones that you already get for free from your credit card .

You read correctly. Just by charging travel to your credit card, you may be entitled to coverage that you never knew you had. As with third-party travel insurance—and basically any insurance for that matter—so many terms and conditions apply, there are rules after rules, and COVID reimbursements are a tricky topic.

The subject of credit card travel insurance is very complicated—way too complicated for a single article—yet the basics are worth knowing before booking your next trip.

What is travel protection on a credit card?

Most—but not all—credit cards provide several implicit travel insurances as benefits for being a cardholder. These insurances usually kick in when charging travel to the credit card or using points for travel through a credit card’s loyalty program. Said travel insurances are collectively referred to as travel protections in credit card literature. Typically, when searching for the travel coverages your credit card provides, you will find them lumped under a banner or heading labeled “Travel Protections.”

What does your credit card travel insurance cover?

Some of the best travel credit cards provide travel insurance as part of their regular benefits. Some do not. Depending on the credit card, you may be entitled to some compensation under the following insurances:

- Emergency Evacuation & Transportation: If you become ill on your trip and require medical evacuation and treatment

- Trip Interruption and Cancellation: If you need to cancel or cut short your trip due to specific unforeseen circumstances

- Emergency Medical and Dental Benefit: If you require emergency medical or dental services during a covered trip

- Trip Accident Insurance: If you are severely injured, maimed, or–eek–die on your trip

- Trip Delay: If your common carrier is delayed more than a specified number of hours

- Delayed Baggage: If your bags arrive late, beyond a specified number of hours

- Lost Baggage: If your bags are deemed lost for good

- Rental Car Insurance: If you rent a car more than a specified number of miles away from your domicile and experience theft or damage to the rental car that you did not cause

Again, it’s important to note that not all cards with travel insurance include all these coverages. Each is different. Moreover, if you buy third-party travel insurance , it may or may not include specific protections (and covered reasons) that you don’t already get with your credit card.

What credit cards come with travel insurance?

Remember those pamphlets that arrived in the mail when you received your credit card, the ones you threw in the recycling bin? Likely within that paperwork was a handy “Guide to Benefits” that detailed the travel insurances of your credit card. Thankfully, most of this information can still be retrieved online when logging into your credit card account or even doing a simple Google search.

In the most general sense, every credit card is unique in its benefits—and that includes travel insurances. Some cards like the Citi Premier® Card , which ranks best in class for extended warranty protection on shopping purchases and is great for earning points on travel, comes with zero travel protections. At the opposite end of the spectrum, Chase Sapphire Reserve® has the most comprehensive suite of travel protections, ranging from Medevac insurance to rental car insurance as primary coverage.

Below is a chart of six popular travel credit cards and the insurances they do and do not provide.

Within each box of this chart lies more layers of complexity. Often, you are entitled to itemized coverages only under specific circumstances known as “covered reasons.” Moreover, several cards may offer the same protection, say “Trip Delay Protection,” but each may define a delay differently (i.e., 6 hours vs. 12 hours) and then may cap reimbursements at different amounts. Similarly, while some rental car insurance policies like the Chase Sapphire Reserve offer primary coverage, others offer only secondary coverage (meaning, you’d need to go through your own regular car insurance first). On top of that, travel to specific countries may be excluded under some policies.

All this to say, read the fine print!

Where does COVID related coverage fit into credit card travel insurance?

To start, your credit card travel insurance is not an umbrella policy for COVID-related expenses. But you can find some COVID coverage within the Trip Cancellation & Interruption policies of select cards.

In the most general sense, if you decide to cancel your trip because of COVID (or civil unrest—another big topic nowadays), you will not be covered. Even the most generous of travel insurance-promoting credit cards, Chase Sapphire Reserve, states in its Guide to Benefits that “your disinclination to travel due to an epidemic or pandemic” is not covered by its Trip Cancellation & Interruption policies.

However, should you get sick while traveling, some coverage may kick in. Again, this will require reading through the fine print of your specific credit card’s Guide to Benefits. Within the Trip Cancellation & Interruption policies of Chase Sapphire Reserve, it states, “quarantine of you or your travel companion imposed by a physician or by a competent governmental authority having jurisdiction, due to health reasons,” is a covered event while the guide for The Platinum Card® from American Express (see rates and fees ) states, “quarantine imposed by a physician for health reasons” is also a covered event. What may be covered (if and when documented properly) is any prepaid trip expense charged to the credit card that you are unable to fulfill due to your illness. That means things like changing your flight home or a refund for the part of your trip/hotel stay missed after testing positive and having to quarantine. That said, neither card will pay for your expenses to stay in a hotel to recover from COVID.

Credit card travel insurance is complicated, and policies differ by card. However, it’s worth deciphering your card’s coverages to know exactly what you’re entitled to as a cardholder before booking your next trip–and to avoid redundant third-party travel insurance.

While the offers mentioned above are accurate at the time of publication, they are subject to change at any time, and may have changed or may no longer be available.

- Credit Cards

- ® " data-destinationurl="https://www.citibank.com.ph/citigold/?lid=PHENCBGCGMITLCitigold" href="https://www.citibank.com.ph/citigold/?lid=PHENCBGCGMITLCitigold" rel="" innerhtml="Citigold ® ">Citigold ®

- Citi Priority

- Personal Banking

- Investments

- Digital Services

- ATMS & BRANCHES

- Citi PremierMiles Mastercard

READY WHEN YOU ARE

Earn never-expiring miles with the Citi PremierMiles Mastercard.

No Citi credit card yet? Know more about our welcome gift here .

Key benefits of PremierMiles Card

1 PremierMile for every PHP30 spend

Convert your miles to redeem airline miles (1.6 PremierMiles = 1 mile) for your future travels or redeem cash credits (5 PremierMiles = 1 PHP) that you can use to offset your next purchase.

Never-expiring miles; use anytime you want

Citi PremierMiles Mastercard features

Use your Citi PremierMiles to pay for any purchase

Convert your big ticket purchase into small payments

Apply for cash in under a minute with the enhanced Citi Mobile App

Freedom to do more with the new citi mobile ® app "> freedom to do more with the new citi mobile ® app.

Everything at a glance

Activate a new card

Secure your transaction

Lock and unlock your card

Powerful features on demand

See your Citi PremierMiles balance

Citi PremierMiles ongoing promotions

ONLINE CARD FEATURES

Pay for your bills with Citi One Bill® and make payments usually paid through a local bank account with Citi PayAll.

Pay for your bills with Citi One Bill® and make payments usually paid through a local bank account with Citi PayAll.

DINE SO FINE

Dine from the comfort of your home by ordering take out or delivery from your favorite restaurants, plus pay a lot less.

LOVE TO CLICK

Enjoy exclusive online shopping deals with your Citi PremierMiles Card and have these delivered to you.

Your world of Citi PremierMiles in less than 15 minutes

Get a new Citi PremierMiles Mastercard ® from your mobile phone or computer in an easy, paperless signup process. A deposit account with Citi is not required.

Get a new Citi PremierMiles Mastercard ® from your mobile phone or computer in an easy, paperless signup process. A deposit account with Citi is not required.

Annual membership fee of PHP5,000. First year free.

Minimum income of PHP360,000 per year

Age 21 or older

Age 21 or older

Welcome gift of 30,000 never-expiring miles

Documents required to apply for a Citi PremierMiles Card

Required Documents: 1 photo-bearing government-issued ID ^

^ For resident foreigners, Foreign Government-issued passport and Alien Certificate of Registration issued by the Bureau of Immigration are acceptable IDs for resident foreigners and must be submitted with any of the following proofs of local residency: a. Immigrant Certificate of Residency (ICR) b. ACR-I-Card with Visa status "Permanent", otherwise, should be valid for more than 1 year c. Visa and Work Permit/Alien Employment Permit (AEP) with validity of more than 1 year d. Special Resident Investors Visa (SRIV) e. Special Resident Retirement Visa (SRRV) f. If employed with the Top 2000 companies, employment contract or letter from company HR printed on company letterhead with name, position and confirmation of term.

Note: valid TIN, SSS, GSIS or UMID number and active landline or mobile phone number are required.

^ For resident foreigners, Foreign Government-issued passport and Alien Certificate of Registration issued by the Bureau of Immigration are acceptable IDs for resident foreigners and must be submitted with any of the following proofs of local residency: a. Immigrant Certificate of Residency (ICR) b. ACR-I-Card with Visa status "Permanent", otherwise, should be valid for more than 1 year c. Visa and Work Permit/Alien Employment Permit (AEP) with validity of more than 1 year d. Special Resident Investors Visa (SRIV) e. Special Resident Retirement Visa (SRRV) f. If employed with the Top 2000 companies, employment contract or letter from company HR printed on company letterhead with name, position and confirmation of term.

Note: valid TIN, SSS, GSIS or UMID number and active landline or mobile phone number are required.

Required Documents: 1. 1 photo-bearing government-issued ID ^   2. Proof of income   a. Latest one month pay slip, or   b. Latest income tax return (BIR 2316) with a BIR (Bureau of Internal Revenue) stamp or with a signature of your employer’s authorized representative, or   c. Original and signed Certificate of Employment that includes your status as an employee, length of service and compensation. 3. Bank statement of your Payroll Account showing your one-month salary

^ For resident foreigners, Foreign Government-issued passport and Alien Certificate of Registration issued by the Bureau of Immigration are acceptable IDs for resident foreigners and must be submitted with any of the following proofs of local residency: a. Immigrant Certificate of Residency (ICR) b. ACR-I-Card with Visa status "Permanent", otherwise, should be valid for more than 1 year c. Visa and Work Permit/Alien Employment Permit (AEP) with validity of more than 1 year d. Special Resident Investors Visa (SRIV) e. Special Resident Retirement Visa (SRRV) f. If employed with the Top 2000 companies, employment contract or letter from company HR printed on company letterhead with name, position and confirmation of term

Required Documents: 1. 1 photo-bearing government-issued ID ^ 2. Proof of income a. Latest one month pay slip, or b. Latest income tax return (BIR 2316) with a BIR (Bureau of Internal Revenue) stamp or with a signature of your employer’s authorized representative, or c. Original and signed Certificate of Employment that includes your status as an employee, length of service and compensation. 3. Bank statement of your Payroll Account showing your one-month salary

^ For resident foreigners, Foreign Government-issued passport and Alien Certificate of Registration issued by the Bureau of Immigration are acceptable IDs for resident foreigners and must be submitted with any of the following proofs of local residency: a. Immigrant Certificate of Residency (ICR) b. ACR-I-Card with Visa status "Permanent", otherwise, should be valid for more than 1 year c. Visa and Work Permit/Alien Employment Permit (AEP) with validity of more than 1 year d. Special Resident Investors Visa (SRIV) e. Special Resident Retirement Visa (SRRV) f. If employed with the Top 2000 companies, employment contract or letter from company HR printed on company letterhead with name, position and confirmation of term

Citibank, N.A., Philippine Branch, has transferred ownership of its consumer banking business to Union Bank of the Philippines with effect from August 1, 2022. The trademarks “Citi”, “Citibank”, “Citigroup”, the Arc design and all similar trademarks and derivations thereof are used temporarily under license by Union Bank of the Philippines from Citigroup Inc. and related group entities.

Citibank, N.A., Philippine Branch, has transferred ownership of its consumer banking business to Union Bank of the Philippines with effect from August 1, 2022. The trademarks “Citi”, “Citibank”, “Citigroup”, the Arc design and all similar trademarks and derivations thereof are used temporarily under license by Union Bank of the Philippines from Citigroup Inc. and related group entities.

Terms and Conditions

For any concerns, you may call us at (632) 8995-9999 or send us a message through www.citibank.com.ph . Citibank, N.A. Philippine Branch is regulated by Bangko Sentral ng Pilipinas with contact details at https://www.bsp.gov.ph.

Screens shown are for illustration purposes only. Please refer to the Citi Mobile® App for actual and accurate screens.

For any concerns, you may call us at (632) 8995-9999 or send us a message through www.citibank.com.ph . Citibank, N.A. Philippine Branch is regulated by Bangko Sentral ng Pilipinas with contact details at https://www.bsp.gov.ph.

Screens shown are for illustration purposes only. Please refer to the Citi Mobile® App for actual and accurate screens.

FREE 30,000 never-expiring miles

IMPORTANT NOTICE

Credit cards" data-destinationurl="https://www1.citibank.com.au/credit-cards?intcid=Meganav-CC" data-ctaposition="header:meganav" data-aria-label="Click here to view all Credit cards" href="https://www1.citibank.com.au/credit-cards?intcid=Meganav-CC" rel="" innerhtml="Credit cards">Credit cards

Features & Benefits

Citi rewards program, citi rewards program > citi rewards" data-destinationurl="https://www1.citibank.com.au/rewardsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to view the citi rewards program" href="https://www1.citibank.com.au/rewardsintcid=meganav-cc" rel="" innerhtml="citi rewards">citi rewards, citi rewards program >pay with points" data-destinationurl="https://www1.citibank.com.au/rewards/pay-with-pointsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to learn more about pay with points" target="_self" href="https://www1.citibank.com.au/rewards/pay-with-pointsintcid=meganav-cc" rel="" innerhtml="pay with points">pay with points, instalment plans" data-destinationurl="https://www1.citibank.com.au/credit-cards/instalment-plansintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to learn about citi instalment plans" target="_self" href="https://www1.citibank.com.au/credit-cards/instalment-plansintcid=meganav-cc" rel="" innerhtml="instalment plans">instalment plans, account information, account information > setting up repayments" data-destinationurl="https://www1.citibank.com.au/personal-loans/help-and-support/repaymentsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to setting up repayments" target="_self" href="https://www1.citibank.com.au/personal-loans/help-and-support/repaymentsintcid=meganav-cc" rel="" innerhtml="setting up repayments">setting up repayments, account information > useful forms and links" data-destinationurl="https://www1.citibank.com.au/help-and-support/useful-forms-and-links" data-ctaposition="header:meganav" data-aria-label="click here to view the useful forms and links page" target="_self" href="https://www1.citibank.com.au/help-and-support/useful-forms-and-links" rel="" innerhtml="useful forms and links">useful forms and links, calculators & tools" data-destinationurl="https://www1.citibank.com.au/credit-cards/calculatorsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to use our credit card calculators" target="_self" href="https://www1.citibank.com.au/credit-cards/calculatorsintcid=meganav-cc" rel="" innerhtml="calculators & tools">calculators & tools, loans" data-destinationurl="https://www1.citibank.com.au/personal-loansintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view our personal loans page" target="_self" href="https://www1.citibank.com.au/personal-loansintcid=meganav-pl" rel="" innerhtml="loans">loans, loans > citi ready credit" data-destinationurl="https://www1.citibank.com.au/personal-loans/ready-creditintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view citi ready credit page" target="_self" href="https://www1.citibank.com.au/personal-loans/ready-creditintcid=meganav-pl" rel="" innerhtml=" citi ready credit"> citi ready credit, loans > personal loan plus" data-destinationurl="https://www1.citibank.com.au/personal-loans/personal-loan-plusintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view citi personal loan plus page" target="_self" href="https://www1.citibank.com.au/personal-loans/personal-loan-plusintcid=meganav-pl" rel="" innerhtml=" personal loan plus"> personal loan plus, loans > help me choose" data-destinationurl="https://www1.citibank.com.au/personal-loans/help-me-chooseintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view the help me choose page" target="_self" href="https://www1.citibank.com.au/personal-loans/help-me-chooseintcid=meganav-pl" rel="" innerhtml="help me choose">help me choose, loans > compare loans" data-destinationurl="https://www1.citibank.com.au/personal-loans/compare-loansintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view the compare loans page" target="_self" href="https://www1.citibank.com.au/personal-loans/compare-loansintcid=meganav-pl" rel="" innerhtml="compare loans">compare loans, view all loans" data-destinationurl="https://www1.citibank.com.au/personal-loansintcid=meganav-pl-view-all" data-ctaposition="header:meganav" data-aria-label="click here to view all loans page" target="_self" href="https://www1.citibank.com.au/personal-loansintcid=meganav-pl-view-all" rel="" innerhtml=" view all loans > "> view all loans >, account information > how to use your account" data-destinationurl="https://www1.citibank.com.au/personal-loans/how-to-use-your-accountintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to learn how to use your citi lending account" target="_self" href="https://www1.citibank.com.au/personal-loans/how-to-use-your-accountintcid=meganav-pl" rel="" innerhtml="how to use your account">how to use your account, account information > how to manage your account" data-destinationurl="https://www1.citibank.com.au/personal-loans/how-to-manage-your-accountintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to learn how to manage your citi lending account" target="_self" href="https://www1.citibank.com.au/personal-loans/how-to-manage-your-accountintcid=meganav-pl" rel="" innerhtml="how to manage your account">how to manage your account, account information > setting up repayments" data-destinationurl="https://www1.citibank.com.au/personal-loans/help-and-support/repaymentsintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to learn how to make repayments to your personal loan account" target="_self" href="https://www1.citibank.com.au/personal-loans/help-and-support/repaymentsintcid=meganav-pl" rel="" innerhtml="setting up repayments">setting up repayments, account information > fees & charges" data-destinationurl="https://www1.citibank.com.au/personal-loans/fees-chargesintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view personal loans fees & charges" target="_self" href="https://www1.citibank.com.au/personal-loans/fees-chargesintcid=meganav-pl" rel="" innerhtml="fees & charges">fees & charges, account information > useful forms and links" data-destinationurl="https://www1.citibank.com.au/help-and-support/useful-forms-and-linkstab=lending&intcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view useful forms and links" target="_self" href="https://www1.citibank.com.au/help-and-support/useful-forms-and-linkstab=lending&intcid=meganav-pl" rel="" innerhtml="useful forms and links">useful forms and links, calculators & tools" data-destinationurl="https://www1.citibank.com.au/personal-loans/calculatorsintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view the calculators & tools" target="_self" href="https://www1.citibank.com.au/personal-loans/calculatorsintcid=meganav-pl" rel="" innerhtml="calculators & tools">calculators & tools, help with credit cards" data-destinationurl="" href="unsafe:javascript:void(0);" rel="" innerhtml=" help with credit cards"> help with credit cards, help with credit cards > check application status" data-destinationurl="https://www.citibank.com.au/global_docs/check_app_status.htm" data-ctaposition="header:meganav" data-aria-label="click here to check the status of your application" target="_self" href="https://www.citibank.com.au/global_docs/check_app_status.htm" rel="" innerhtml="check application status">check application status.

Account management

Account management > update contact details" data-destinationurl="https://www1.citibank.com.au/help-and-support/update-contact-detailsintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to update your contact details" target="_self" href="https://www1.citibank.com.au/help-and-support/update-contact-detailsintcid=meganav-hs" rel="" innerhtml="update contact details">update contact details, account management > travelling overseas" data-destinationurl="https://www1.citibank.com.au/help-and-support/travelling-overseasintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to view the travelling overseas page" target="_self" href="https://www1.citibank.com.au/help-and-support/travelling-overseasintcid=meganav-hs" rel="" innerhtml="travelling overseas">travelling overseas, account management > reset user id or password" data-destinationurl="https://www1.citibank.com.au/help-and-support/reset-passwordintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to reset your user id or password" target="_self" href="https://www1.citibank.com.au/help-and-support/reset-passwordintcid=meganav-hs" rel="" innerhtml="reset user id or password">reset user id or password, account management > document upload" data-destinationurl="https://www.citibank.com.au/aus/static/document_upload.htmintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to upload your forms and documents" target="_self" href="https://www.citibank.com.au/aus/static/document_upload.htmintcid=meganav-hs" rel="" innerhtml="document upload">document upload, account management > download citi mobile app" data-destinationurl="https://www1.citibank.com.au/citi-mobile-appintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about the citi mobile® app" target="_self" href="https://www1.citibank.com.au/citi-mobile-appintcid=meganav-hs" rel="" innerhtml="download citi mobile ®️ app">download citi mobile ®️ app, account management > deposit & home loan accounts" data-destinationurl="https://www1.citibank.com.au/nabintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about the move to nab" href="https://www1.citibank.com.au/nabintcid=meganav-hs" rel="" innerhtml="deposit & home loan accounts">deposit & home loan accounts, support > support services" data-destinationurl="https://www1.citibank.com.au/help-and-support/supporting-youintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about our support services" target="_self" href="https://www1.citibank.com.au/help-and-support/supporting-youintcid=meganav-hs" rel="" innerhtml="support services">support services, support > financial hardship" data-destinationurl="https://www1.citibank.com.au/help-and-support/financial-hardshipintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about financial hardship" target="_self" href="https://www1.citibank.com.au/help-and-support/financial-hardshipintcid=meganav-hs" rel="" innerhtml="financial hardship">financial hardship, support > disaster & crisis support" data-destinationurl="https://www1.citibank.com.au/help-and-support/disaster-and-crisis-supportintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about our disaster and crisis support" target="_self" href="https://www1.citibank.com.au/help-and-support/disaster-and-crisis-supportintcid=meganav-hs" rel="" innerhtml="disaster & crisis support">disaster & crisis support, support > scams" data-destinationurl="https://www1.citibank.com.au/help-and-support/scamsintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about scam prevention and reporting scams" target="_self" href="https://www1.citibank.com.au/help-and-support/scamsintcid=meganav-hs" rel="" innerhtml="scams">scams, support > dispute transactions" data-destinationurl="https://www1.citibank.com.au/help-and-support/dispute-transactionsintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn how to dispute a transaction" target="_self" href="https://www1.citibank.com.au/help-and-support/dispute-transactionsintcid=meganav-hs" rel="" innerhtml="dispute transactions">dispute transactions, support > banking code of practice" data-destinationurl="https://www1.citibank.com.au/help-and-support/banking-codeintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about the banking code of practice" target="_self" href="https://www1.citibank.com.au/help-and-support/banking-codeintcid=meganav-hs" rel="" innerhtml="banking code of practice">banking code of practice, support > data sharing consent (open banking)" data-destinationurl="https://www1.citibank.com.au/open-bankingintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about our data sharing consents and open banking" target="_self" href="https://www1.citibank.com.au/open-bankingintcid=meganav-hs" rel="" innerhtml=" ul.navbar-sub-menus {color: #002a54 important;} #signon {color: #ffffff important; border: 2px solid #002a54 important; background: #002a54 important; line-height: 3rem; padding-left: 3rem; padding-right: 3rem; border-radius: 0.6rem; box-shadow: none important; transform: none important; transition: none important; min-width: 10rem; min-height: 3rem;}.navigation-bar.bg-base.main-menu-font-size .container.navigation {line-height: 4rem;}.meganav-sec{display:flex;flex-direction:row;border-radius:8px;width:350px;align-items: center; background-color:#fde8cc important;}.megabox1{width:30%;}.megabox2{width:70%;background-color:#fde8cc important;border-radius: 0 8px 8px 0;padding:5px 10px}.megabox2 p {margin: 0 important;}@media only screen and (max-device-width : 768px){.meganav-sec{width:260px;}} data sharing consent (open banking)"> ul.navbar-sub-menus {color: #002a54 important;} #signon {color: #ffffff important; border: 2px solid #002a54 important; background: #002a54 important; line-height: 3rem; padding-left: 3rem; padding-right: 3rem; border-radius: 0.6rem; box-shadow: none important; transform: none important; transition: none important; min-width: 10rem; min-height: 3rem;}.navigation-bar.bg-base.main-menu-font-size .container.navigation {line-height: 4rem;}.meganav-sec{display:flex;flex-direction:row;border-radius:8px;width:350px;align-items: center; background-color:#fde8cc important;}.megabox1{width:30%;}.megabox2{width:70%;background-color:#fde8cc important;border-radius: 0 8px 8px 0;padding:5px 10px}.megabox2 p {margin: 0 important;}@media only screen and (max-device-width : 768px){.meganav-sec{width:260px;}} data sharing consent (open banking), the move to nab" data-destinationurl="https://www1.citibank.com.au/nabintcid=meganav-au" data-ctaposition="header:meganav" data-aria-label="click here to learn about the move to nab" target="_self" href="https://www1.citibank.com.au/nabintcid=meganav-au" rel="" innerhtml="the move to nab">the move to nab, sign into nab >" data-destinationurl="https://ib.nab.com.au/login" data-ctaposition="header:meganav" data-aria-label="click here to sign in to nab" target="_blank" href="https://ib.nab.com.au/login" rel="" innerhtml=" sign into nab > "> sign into nab >, report lost or stolen card" data-destinationurl="https://www1.citibank.com.au/help-and-support/lost-or-stolen-cardintcid=meganav-cu" data-ctaposition="header:meganav" data-aria-label="click here to report a lost or stolen card" target="_self" href="https://www1.citibank.com.au/help-and-support/lost-or-stolen-cardintcid=meganav-cu" rel="" innerhtml="report lost or stolen card">report lost or stolen card, report a scam" data-destinationurl="https://www1.citibank.com.au/help-and-support/scamsintcid=meganav-cu" data-ctaposition="header:meganav" data-aria-label="click here to report a scam" target="_self" href="https://www1.citibank.com.au/help-and-support/scamsintcid=meganav-cu" rel="" innerhtml="report a scam">report a scam.

- Help and Support

Complimentary Insurance

Many of our Citi credit card cardholders are eligible for complimentary insurance cover. Check below to see if your credit card provides any complimentary insurance covers.

If you need to make a travel claim, we encourage you to do so online . If you are looking for information about the impact of COVID-19 on travel insurance, please refer to our FAQs .

Our complimentary credit card insurance cover is issued and managed by AWP Australia Pty Limited (trading as Allianz Global Assistance) on behalf of the insurer Allianz Australia Insurance Limited.

For each complimentary insurance cover you are eligible for, please ensure you take the time to review the full terms and conditions. When you do, make sure you pay special attention to the benefits, eligibility and exclusions. It is particularly important to do this before travelling or purchasing goods as your cover may not be sufficient for your personal circumstances.

Citi Credit Cards Complimentary Insurance Policy Information Booklet

Note for Emirates Citi World Mastercard cardholders: Complimentary insurance covers associated with your card for travel and purchasing of goods will be honoured in accordance with the Citi Credit Cards Complimentary Insurance Policy Information Booklet provided you meet the eligibility requirements, and your account remains open at the time you make a claim. This means if you have purchased a return overseas travel ticket with your Emirates Citi World Mastercard and you became eligible for complimentary International Travel Insurance prior to 31 May 2023 but your travel commences after 31 May 2023, complimentary International Travel Insurance will still apply to that travel provided your account remains open.

Note for Emirates Citi World Mastercard cardholders: Complimentary insurance covers associated with your card for travel and purchasing of goods will be honoured in accordance with the Citi Credit Cards Complimentary Insurance Policy Information Booklet provided you meet the eligibility requirements, and your account remains open at the time you make a claim. This means if you have purchased a return overseas travel ticket with your Emirates Citi World Mastercard and you became eligible for complimentary International Travel Insurance prior to 31 May 2023 but your travel commences after 31 May 2023, complimentary International Travel Insurance will still apply to that travel provided your account remains open.

Additional Information

- PRESTIGE AND PREMIER

- SIMPLICITY & CLEAR

International Travel Insurance

Eligibility

Citi Prestige and Premier cardholders can access to up to 6 months complimentary International Travel Insurance cover when meeting the eligibility criteria as set out in the Citibank Credit Card Complimentary Insurance Policy including:

- spending at least $500 of prepaid travel costs on an eligible card or through a frequent flyer or travel program as outlined in the Policy Information Booklet

- holding a return overseas travel ticket before departing Australia

- you are aged under 81 years at the time you become eligible.

Your spouse and your dependants travelling with you may be covered by this policy. Eligibility criteria, terms, conditions, exclusions, limits and applicable sub-limits apply.

You can check your eligibility for International Travel Insurance and obtain a Letter of Eligibility by using the Allianz Global Assistance eligibility portal .

What is covered

The below information is a limited summary only and are subject to applicable terms, conditions, exclusions, limits, sub-limits and excesses that may apply.

For the full list of benefits and the terms, conditions, exclusions, limits, applicable sub-limits and excesses that apply, please read the Citi Credit Cards Complimentary Insurance Policy Information Booklet effective 1 November 2023.

- overseas emergency assistance

- overseas medical and dental expenses

- accidental death, permanent disability and loss of income

- cancellation

- travel delay and alternative transport expenses

- luggage and luggage delay

- rental vehicle excess cover for damage or theft of rental vehicle

- personal liability

A maximum $400 excess may apply for each claim made. No excess may apply to some claims, please refer to the Policy Information Booklet.

Citi Prestige and Premier cardholders can access to up to 6 months complimentary International Travel Insurance cover when meeting the eligibility criteria as set out in the Citibank Credit Card Complimentary Insurance Policy including:

For the full list of benefits and the terms, conditions, exclusions, limits, applicable sub-limits and excesses that apply, please read the Citi Credit Cards Complimentary Insurance Policy Information Booklet effective 1 November 2023.

Domestic Travel Insurance

Citi Prestige and Premier cardholders can access to up to 28 days complimentary Domestic Travel Insurance cover when meeting the eligibility criteria as set out in the Citi credit card complimentary insurance policy:

- the entire cost of your return domestic flight ticket is charged to the accountholder’s card account prior to commencing the journey; or

- before commencing your journey, you spend at least $250 on your prepaid travel costs and you charge these costs (e.g. cost of your return domestic travel ticket; and/or airport/departure taxes; and/or your prepaid domestic accommodation/travel; and/or your other prepaid domestic itinerary items) to the accountholder’s card account and you have a return domestic flight ticket prior to commencing the journey.

- flight delay

- additional expenses

- luggage delay

A maximum $75 excess may apply for each claim made. No excess may apply to some claims, please refer to the Policy Information Booklet.

Citi Prestige and Premier cardholders can access to up to 28 days complimentary Domestic Travel Insurance cover when meeting the eligibility criteria as set out in the Citi credit card complimentary insurance policy:

- the entire cost of your return domestic flight ticket is charged to the accountholder’s card account prior to commencing the journey; or

- before commencing your journey, you spend at least $250 on your prepaid travel costs and you charge these costs (e.g. cost of your return domestic travel ticket; and/or airport/departure taxes; and/or your prepaid domestic accommodation/travel; and/or your other prepaid domestic itinerary items) to the accountholder’s card account and you have a return domestic flight ticket prior to commencing the journey.

Rental Vehicle Excess Insurance in Australia

Citi Prestige and Premier cardholders are covered when the entire payment for the vehicle rental was charged to the accountholder's card account.

The cover available begins when you collect the rental vehicle from the rental vehicle company or agency you have entered into a rental vehicle agreement with and ends when you return the rental vehicle to the rental vehicle company or agency or at the expiry of the rental vehicle agreement, whichever occurs earlier.

The amount specified in your rental vehicle agreement up to the maximum total limit of $10,000 for all claims combined during the rental period.

An excess of $100 applies to each claim payable under Rental Vehicle Excess Insurance in Australia.

Purchase Protection Insurance

Citi Prestige and Premier cardholders are eligible for Purchase Protection Insurance for covered items or valuables:

- purchased anywhere in the world; or

- purchased and given as a gift to any permanent Australian resident,