We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here . By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service .

Member Sign In

Don't Know Your Password?

- Zacks #1 Rank

- Zacks Industry Rank

- Zacks Sector Rank

- Equity Research

- Mutual Funds

- Mutual Fund Screener

- ETF Screener

- Earnings Calendar

- Earnings Releases

- Earnings ESP

- Earnings ESP Filter

- Stock Screener

- Premium Screens

- Basic Screens

- Research Wizard

- Personal Finance

- Money Managing

- Real Estate

- Retirement Planning

- Tax Information

- My Portfolio

- Create Portfolio

- Style Scores

- Testimonials

- Zacks.com Tutorial

Services Overview

- Zacks Ultimate

- Zacks Investor Collection

- Zacks Premium

Investor Services

- ETF Investor

- Home Run Investor

- Income Investor

- Stocks Under $10

- Value Investor

- Top 10 Stocks

Other Services

- Method for Trading

- Zacks Confidential

Trading Services

- Black Box Trader

- Counterstrike

- Headline Trader

- Insider Trader

- Large-Cap Trader

- Options Trader

- Short Sell List

- Surprise Trader

- Alternative Energy

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK . If you do not, click Cancel.

Carnival (CCL)

(delayed data from nyse).

-0.08 (-0.49%)

Updated Apr 1, 2024 04:00 PM ET

After-Market: $16.23 -0.03 (-0.18%) 7:58 PM ET

Add to portfolio

This is our short term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months. How good is it? See rankings and related performance below.

Zacks Rank Education - Learn about the Zacks Rank

Zacks Rank Home - Zacks Rank resources in one place

Zacks Premium - The only way to fully access the Zacks Rank

3-Hold of 5 3

The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style.

The scores are based on the trading styles of Value, Growth, and Momentum. There's also a VGM Score ('V' for Value, 'G' for Growth and 'M' for Momentum), which combines the weighted average of the individual style scores into one score.

Within each Score, stocks are graded into five groups: A, B, C, D and F. As you might remember from your school days, an A, is better than a B; a B is better than a C; a C is better than a D; and a D is better than an F.

As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style.

Zacks Style Scores Education - Learn more about the Zacks Style Scores

A Value | A Growth | D Momentum | A VGM

The Zacks Industry Rank assigns a rating to each of the 265 X (Expanded) Industries based on their average Zacks Rank.

An industry with a larger percentage of Zacks Rank #1's and #2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4's and #5's.

The industry with the best average Zacks Rank would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%.

Zacks Rank Education -- Learn more about the Zacks Rank Zacks Industry Rank Education -- Learn more about the Zacks Industry Rank

Top 36% (90 out of 252)

Industry: Leisure and Recreation Services

Key Expected Earnings Data

Earnings summary, earnings history.

The Zacks Equity Research reports , or ZER for short, are our in-house, independently produced research reports.

The ever popular one-page Snapshot reports are generated for virtually every single Zacks Ranked stock. It's packed with all of the company's key stats and salient decision making information. Including the Zacks Rank, Zacks Industry Rank, Style Scores, the Price, Consensus & Surprise chart, graphical estimate analysis and how a stocks stacks up to its peers.

The detailed multi-page Analyst report does an even deeper dive on the company's vital statistics. In addition to all of the proprietary analysis in the Snapshot, the report also visually displays the four components of the Zacks Rank (Agreement, Magnitude, Upside and Surprise); provides a comprehensive overview of the company business drivers, complete with earnings and sales charts; a recap of their last earnings report; and a bulleted list of reasons to buy or sell the stock. It also includes an industry comparison table to see how your stock compares to its expanded industry, and the S&P 500.

Researching stocks has never been so easy or insightful as with the ZER Analyst and Snapshot reports.

Learn more about Zacks Equity Research reports

See more Zacks Equity Research reports

- Transcripts

Price & Consensus

Zacks news for ccl, stock market news for mar 28, 2024, carnival (ccl) reports q1 loss, tops revenue estimates, ccl: what are zacks experts saying now.

Zacks Private Portfolio Services

Carnival (CCL) Q1 Earnings Surpass Estimates, Increase Y/Y

Compared to estimates, carnival (ccl) q1 earnings: a look at key metrics, the progressive and take-two interactive software have been highlighted as zacks bull and bear of the day.

This file is used for Yahoo remarketing pixel add

Due to inactivity, you will be signed out in approximately:

Carnival rides on record cruise demand to lift annual profit forecast

The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here.

Reporting by Granth Vanaik in Bengaluru and Doyinsola Oladipo in New York; Editing by Sriraj Kalluvila

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Thomson Reuters

Granth reports on the North American Consumer and Retail sector, covering a broad range of companies from consumer packaged goods and restaurants to department stores and apparel retailers. Granth's work on the website usually appears on the Retail & Consumer page of Reuters Business section. He holds a post-graduate degree in international relations and area studies and has previously worked as a research analyst.

Dollar ascendant as Fed cut bets pared, jawboning props up yen

The U.S. dollar hovered near a 4-1/2-month high against major peers on Tuesday as traders rushed to push back bets for the Federal Reserve's first interest rate cut this year.

- Search Search Please fill out this field.

- Company News

- Earnings Reports and News

Carnival Q2 FY2022 Earnings Report Recap

Carnival missed on earnings, revenue, and room occupancy rates

:max_bytes(150000):strip_icc():format(webp)/reiff_headshot-5bfc2a60c9e77c00519a70bd.jpg)

Key Takeaways

- Carnival's room occupancy rate of 69% improved significantly year over year (YOY) but failed to meet analyst predictions.

- The company's room occupancy rate is a measure of how well it utilizes its total customer capacity.

- Booking volumes for future sailing were close to double those of Q1 FY 2022 and reached the highest levels since the start of the pandemic.

Source: Predictions based on analysts' consensus from Visible Alpha

Carnival (CCL) Financial Results: Analysis

Carnival Corporation & plc ( CCL ) reported Q2 FY 2022 earnings that fell short of analysts' expectations across the board. Adjusted losses per share came in below predictions at -$1.61. Although revenue increased nearly 50% on a sequential basis, at $2.4 billion for the quarter, it nonetheless also missed analyst expectations. Carnival's Q2 FY 2022 ended May 31.

Carnival Room Occupancy Rate

Carnival's room occupancy rate for Q2 FY 2022 was 69%. This also fell short of analyst predictions, although it marked a strong improvement on a YOY basis as the company has resumed most of its operations following the pandemic-related shutdown. Carnival president and CEO Arnold Donald said that Carnival Cruise Line, the company's largest brand, expected occupancy to approach 110% during the company's Q3.

The occupancy rate provides a measure of how well a cruise line is utilizing its total passenger capacity. It is calculated by dividing the number of passengers during the relevant period by total passenger capacity over the same period. Passenger capacity assumes that each cabin accommodates two passengers, which means that an occupancy rate in excess of 100% is an indication that some cabins are filled with more than two passengers.

Carnival's Stock Performance and Next Earnings Report

Immediately following the earnings release, Carnival stock was trading up about 0.8% in after-hours trading . The company's shares have significantly underperformed the broader market in the past year. As of June 24, Carnival stock has provided a one-year trailing total return of -64.9% as compared with -11.0% for the S&P 500.

Carnival's next earnings report (for Q3 FY 2022) is expected to be released on Sept. 29, 2022.

Carnival Corp. " Carnival Corporation & PLC Provides Second Quarter 2022 Business Update ."

TradingView. " Price Chart: CCL and S&P 500 ."

MarketScreener. " Carnival Corporation (CCL) ."

:max_bytes(150000):strip_icc():format(webp)/cruise-masks-cdc-CRUISE0521-2000-c3db4158b8714162b5cf00a96536c873.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Carnival-stock

- News for Carnival

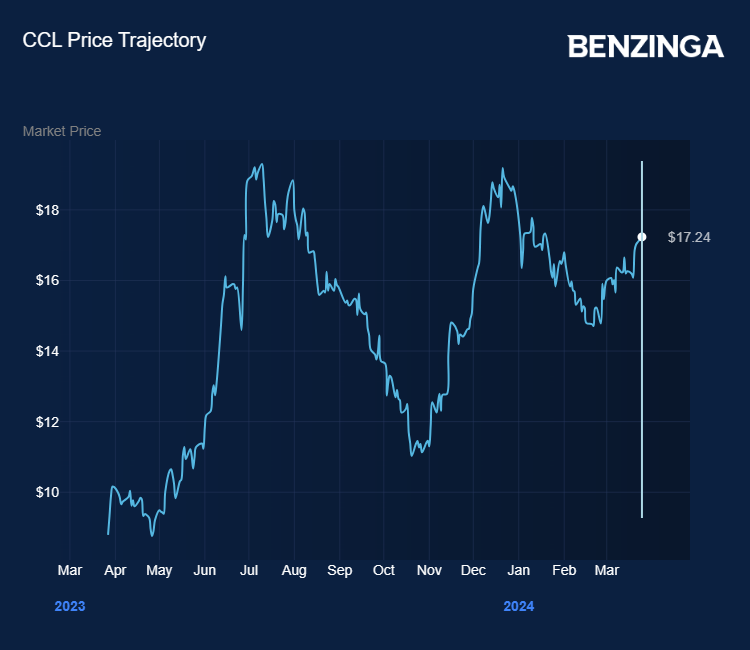

Can Carnival Stock Cruise Higher After Q1 Earnings?

Carnival Corp (NYSE:CCL) will report its first-quarter earnings on Wednesday, March 27, and while the company hasn’t yet fully recovered from the effects of the COVID-19 pandemic, like its sector rivals, Carnival is seeing strong growth in demand.

Carnival stock navigated extremely rough waters in the past four years, but revenues are rising and losses are easing.

The company said in its 2023 annual report that full-year revenues hit a record $21.6 billion and that it entered 2024 with its “best-booked position on record” for both price and occupancy.

Read Also: Norwegian Cruise Line Sets Sail For Stellar Outlook; Stock Jumps

However, the company is still struggling for profitability as its costs have risen and it repays the large debt pile accumulated during the pandemic. While operating profit rose significantly to $1.91 billion, it recorded a net loss of $74 million — although this was massively reduced from the net loss of $6 billion from the year before.

When Carnival reports its December-February quarter earnings on Wednesday, the company is expected to post $5.4 billion in revenues, up 22% from the same quarter last year, and a loss of $0.17 per share, an improvement of 69%.

Royal Caribbean, Norwegian Cruise Line Results Impress

Rival Royal Caribbean Group Ltd. (NYSE:RCL) recovered strongly since the pandemic. After reporting last month annual revenues of $13.9 billion and net income of $1.7 billion for its full year the company said “2023 was an exceptional year” and added it expected record earnings in 2024.

Just a couple of days later Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) was also upbeat about its 2024 prospects after reporting forecast beat fourth-quarter revenues.

Shares in Carnival are down about 1% in 2024, but have risen 16% over the past four weeks. Royal Caribbean shares are up 5.5% on the year, and up nearly 19% in the past four weeks since it raised its 2024 outlook. Norwegian Cruise Line is up fractionally on the year, but has soared nearly 30% since its Q4 results and outlook.

Analyst Update

“With Royal Caribbean raising its full-year 2024 outlook in late February, the bar is set high for Carnival,” said Christopher Stathoulopoulos , analyst at Susquehanna Financial Group.

He added: “Ahead of Carnival’s first-quarter results this Wednesday, we are updating our estimates for FY24 & FY25, with our FY24 estimates for earnings reflecting the impact of the rerouting and cancellation of certain itineraries around the Red Sea,” estimated at $0.075 in adjusted earnings per share, or $95 million adjusted net income, “and what we believe will be outperformance in unit revenue.”

While cruise operators have enjoyed a resurgence in recent months, the exchange-traded fund that tracks them, as well as hotels and airlines, failed to fully take off as troubles with Boeing Co (NYSE:BA) jets have hampered the performance of airline stocks. Indeed, Southwest Airlines Company (NYSE:LUV) is the worst-performing stock on the S&P 500 over the past month, down 17%.

The Defiance Hotel, Airline, and Cruise ETF (NYSE:CRUZ) gained 3.7% during 2024.

Now Read: The Carnival Is Not Over: A Remarkable Bounceback For Cruise Industry After Punishing 2 Years

Photo: Viola from Pixabay

Boeing News MORE

Related stocks.

Carnival Reports Smaller Loss but Bridge Collapse Will Hurt Earnings

C arnival has underperformed its peers in 2024, and hopes that it might catch up following its fiscal first-quarter earnings appear to be fading.

The cruise operator had a good quarter, posting a narrower-than-expected loss. Booking volumes hit a record level.

The company also raised its forecast for full-year adjusted profit to 98 cents per share. That is up from its December call of 93 cents but below the Wall Street consensus call of $1 per share.

On the negative side, Carnival said Tuesday’s collapse of the Francis Scott Key Bridge in Baltimore will hurt its net profit by as much as $10 million—a forecast it said isn’t reflected in the company’s overall financial guidance.

Attacks on merchant ships in the Red Sea by Yemen’s Houthi rebels, which have forced Carnival to reroute some vessels, will reduce earnings by 9 cents a share for the year through November, the company said. Adjusted earnings before interest, taxes, depreciation, and amortization are expected to be $5.63 billion, a 30% increase from 2023 and better than management forecast in December.

The stock was up 1.2% Wednesday, while Royal Caribbean shares were 1.4% higher and Norwegian Cruise Line Holdings rose 4.5%.

Carnival posted an adjusted loss of 14 cents per share on revenue of $5.41 billion—record sales for the company in the first quarter. Analysts were expecting an adjusted loss of 18 cents per share on revenue of $5.42 billion. Carnival’s own guidance was for a loss of 22 cents per share.

Carnival stock has fallen 6.9% so far in 2024, compared with a 7.3% climb for Royal Caribbean and a 5.1% rise for Norwegian Cruise Line Holdings. Those two both signaled surging demand and strong pricing when they reported their fourth-quarter earnings last month.

Carnival, meanwhile, said in January that its position in terms of bookings for the rest of 2024 was the best on record. Pricing and occupancy were above last year’s levels.

Carnival’s smaller-than-expected loss was the company’s sixth consecutive quarterly earnings beat. But that, and the increase to management’s financial guidance, didn’t appear to be enough for investors.

Truist analyst Patrick Scholes said that the effect of the Red Sea attacks of 9 cents per share was greater than the range of 6 cents to 7 cents management offered in January. And while Carnival’s comment about bookings and prices remained positive, management’s increased guidance remains short of what Wall Street had expected, Scholes said.

He maintained a Hold rating on the stock, with an $18 price target.

Wall Street had been turning more bullish on Carnival stock ahead of its earnings.

Stifel Research analyst Steven Wieczynski said before the numbers came out that he expected Carnival to raise its 2024 financial guidance Wednesday “based on continued strong demand and pricing.” He has a Buy rating on the stock and has a price target of $26, implying a gain of 52% from Tuesday’s closing level.

Wieczynski said that Carnival’s underperformance was partly because of fear over its problems in the Red Sea. A second issue is concern about the financial health of the European consumer, to which it has the greatest exposure among peers.

He said in a research note this month that many of the company’s challenges are reflected in its stock price. Earnings could be a trigger for gains, Wieczynski said at the time.

Mizuho analyst Ben Chaiken initiated coverage of Carnival with a Buy rating and a $21 price target Monday, implying a gain of 23% from Tuesday’s price. The company sold around 20% of its fleet while the cruise industry was shut down during the pandemic—a move that Chaiken said could help margins and earnings growth. Much of the capacity sold had lower margins, he said.

Chaiken maintained his Buy rating and price tag in a note after Carnival’s earnings Wednesday. He said Ebitda in the first quarter was better than expected, and that the cruise operator’s second-quarter Ebitda outlook for $1.05 billion was better than he had forecast.

Write to Callum Keown at [email protected]

Carnival Reports Q2 2023 Earnings

- June 26, 2023

Carnival Corporation has reported second quarter 2023 earnings and sets sights on 2026 SEA Change Program.

Highlights:

- U.S. GAAP net loss of $407 million, or $(0.32) diluted EPS, and adjusted net loss of $395 million, or $(0.31) adjusted EPS, above the better end of the March guidance range of $425 to $525 million net loss for the second quarter of 2023 (see “Non-GAAP Financial Measures” below).

- Adjusted EBITDA for the second quarter of 2023 was $681 million, at the high end of the March guidance range of $600 million to $700 million (see “Non-GAAP Financial Measures” below).

- Record second quarter revenue of $4.9 billion.

- The company saw continued acceleration of demand, with total bookings made during the quarter reaching a new all-time high for all future sailings.

- Total customer deposits reached an all-time high of $7.2 billion (as of May 31, 2023), surpassing the previous record of $6.0 billion (as of May 31, 2019) by over $1 billion, a 26% increase compared to the prior quarter.

- Cash from operations and adjusted free cash flow were positive in the second quarter of 2023. The company expects continued growth in adjusted free cash flow to be the driver for paying down debt over time (see “Non-GAAP Financial Measures” below).

- Second quarter 2023 ended with $7.3 billion of liquidity following the prepayment of over $1 billion in near term variable rate debt.

- The company is introducing its SEA Change Program, a set of key performance targets designed to achieve important strategic goals over a three-year period ending in 2026.

Carnival Corporation & plc’s Chief Executive Officer Josh Weinstein commented: “We reached a meaningful inflection point for revenue this quarter, with net yields surpassing 2019’s strong levels, and we achieved positive operating income, cash from operations and adjusted free cash flow.”

Weinstein continued: “We are already executing on our strategy to grow revenue by taking up ticket prices, even while maintaining record onboard spending levels, building occupancy and growing capacity. Based on continued strength in pricing, we delivered outperformance in the second quarter and raised our expectation for revenue in the second half, which coupled with the interest expense benefit we are capturing from deleveraging will bring another $275 million dollars to the bottom line for the year.”

Weinstein noted: “With bookings and customer deposits hitting all-time highs, we are clearly gaining momentum on an upward trajectory. We are focused on the durable revenue growth and margin improvement that will deliver on our SEA Change Program and propel us on the path to delivering and investment grade leverage metrics.”

Second Quarter 2023 Results and Statistical Information

- Operating income for the second quarter of 2023 was $120 million, turning positive for the first time since the resumption of guest cruise operations and marking a significant milestone.

- Adjusted EBITDA for the second quarter of 2023 was $681 million, at the high end of the March guidance range of $600 million to $700 million.

- While gross margin yields were down compared to 2019, the company achieved a significant milestone of net yields in constant currency surpassing 2019 levels, above March guidance by 3.2% in constant currency (see “Non-GAAP Financial Measures” below).

- Cruise costs per available lower berth day (“ALBD”) increased 8.3% as compared to the second quarter of 2019.

- In constant currency, adjusted cruise costs excluding fuel per ALBD (see “Non-GAAP Financial Measures” below) increased 13.5% compared to the second quarter of 2019 and were above the high end of March guidance primarily due to the timing of expenses between the quarters. Costs were higher as compared to 2019 as a result of higher dry-dock related expenses, higher advertising investments to drive revenue for 2023 and beyond, incentive compensation increases reflecting expected improvements in the company’s current and long-term performance, as well as partially mitigating the impacts of a high inflation environment.

- Total customer deposits reached an all-time high of $7.2 billion (as of May 31, 2023), surpassing the previous record of $6.0 billion (as of May 31, 2019) by over $1 billion, driven by strong demand, bundled package offerings and pre-cruise sales, and a 26% increase compared to the prior quarter.

According to a press release, company saw continued acceleration of demand, with total bookings made during the quarter reaching a new all-time high for all future sailings. Booking volumes for the second quarter exceeded the first quarter’s booking volumes, which was the previous record high, according tot he company.

Weinstein said: “Our momentous wave period, typically a first quarter event, started in record breaking fashion at the end of the fourth quarter, set a record in the first quarter, actually accelerated in the second quarter and has continued into the third quarter. Booking volumes have been tremendous and we are gaining momentum with favorable pricing trends, which reflects improved commercial execution and returns on our advertising investments. The booking lead times for our North America and Australia (“NAA”) segment are now further out than we have ever seen, while lead times for our Europe segment continue to lengthen and are now within 10 percent of 2019 levels, which is an improvement of 10 points from the last quarter. In fact, our European brands’ bookings taken this past quarter for second half 2023 sailings for European deployments achieved double digit percentage increases in both volume and price compared to 2019. Clearly the strength of our portfolio of world class brands is now shifting into high gear.”

The company’s cumulative advanced booked position for the remainder of 2023 is at higher ticket prices in constant currency, despite headwinds from the loss of St. Petersburg as a marquee destination due to the suspension of cruises to Russia (normalized for future cruise credits), as compared to strong 2019 pricing and a booked occupancy position that is near the high end of the historical range. (The company’s current booking trends are compared to booking trends for 2019 as it is the most recent full year of guest cruise operations.)

Aligned with the company’s yield management strategy, and while still early, the cumulative advanced booked position for full year 2024 is above the high end of the historical range at strong prices.

2023 Outlook

For the full year 2023, the company expects:

- Includes approximately $0.5 billion unfavorable impact from fuel price and currency compared to 2019

- Continued sequential improvement in each quarter in adjusted EBITDA per ALBD as compared to 2019, driven by maintaining net per diems above 2019 levels while closing the gap in occupancy to 2019 levels (see “Non-GAAP Financial Measures” below)

- Occupancy of 100% or higher

- Net per diems of 5.5% to 6.5% (in constant currency) two and a half points higher than March guidance, based on the acceleration of its strong demand profile

- Adjusted cruise costs excluding fuel per ALBD (in constant currency) one and a half points higher than March guidance, due to a slower expected ramp down in inflationary pressures than previously estimated, incentive compensation increases reflecting expected improvements in the company’s current and long-term performance and continued increases in advertising investments

For the third quarter of 2023, the company expects:

- Adjusted EBITDA of $2.05 billion to $2.15 billion, a significant improvement compared to the second quarter of 2023 and adjusted net income of $0.95 billion to $1.05 billion

- Occupancy of 107% or higher

The company expects net yields compared to 2019 (in constant currency) to be positive for the second half of the year, despite the headwinds from the loss of St. Petersburg as a marquee destination due to the suspension of cruises to Russia.

See “Guidance” and “Reconciliation of Forecasted Data” for additional information on the company’s 2023 outlook.

SEA Change Program

Carnival Corporation & plc is introducing its SEA Change Program, a set of key performance targets designed to reflect the achievement of important strategic goals over a three-year period ending in 2026, including:

- S ustainability – More than 20% reduction in carbon intensity compared to 2019, improving upon the company’s industry leading fuel-efficiency and pulling forward its stated 2030 carbon intensity reduction goal by several years

- E BITDA – 50% increase in adjusted EBITDA per ALBD compared to 2023 June guidance, representing the highest level in almost two decades

- A djusted ROIC – 12% adjusted Return on Invested Capital (“ROIC”), more than doubling adjusted ROIC from 2023 to 2026, and representing the highest level in almost two decades. Adjusted ROIC excludes goodwill and intangibles to compare against historical performance (see “Non-GAAP Financial Measures” below)

By the end of 2026, the company is expecting to approach investment grade leverage metrics.

The company’s targets are built on measured net capacity growth of less than 2.5% compounded annually from 2023.

To achieve these three-year targets, the company will continue with its focus across the portfolio on a range of initiatives to drive net yield growth while maintaining its industry leading cost base and fuel efficiency to continue to improve margins and grow adjusted free cash flow, which the company believes will enable further debt reduction over time, the statement said.

Weinstein added: “These financial targets are anchored on optimizing capital allocation through measured capacity growth and will set our course back to strong profitability and investment grade leverage metrics. We are gaining momentum with continued strength in demand. We are excited about all the opportunities ahead and the potential to create outsized value for our shareholders as we work towards our 2026 targets.”

Financing and Capital Activity

Carnival Corporation Chief Financial Officer David Bernstein said: “We reached a meaningful turning point this quarter as we began deleveraging our balance sheet and are already $1.4 billion dollars off our peak debt. We believe with over $7 billion of liquidity, our improving EBITDA and our return to profitability in the second half of 2023, we are very well positioned to pay down debt maturities for the foreseeable future. We remain disciplined in making capital allocation decisions, and our lowest orderbook in decades provides a pathway for further deleveraging.”

Cash from operations and adjusted free cash flow were positive in the second quarter of 2023 and both are expected to be positive for the second half of the year. The company expects continued growth in adjusted free cash flow to be the driver for paying down debt over time.

The company has taken the following actions to address its debt portfolio since February 28, 2023:

- Opportunistically paid down over $1 billion of variable rate debt mostly with 2023 and 2024 maturities, that carried above average rates compared to the rest of its debt portfolio

- In June, paid down $300 million of 2024 maturities

- Aligned its interest coverage covenant at a ratio of not less than 2.0:1.0 for testing dates from May 31, 2024 until May 31, 2025, across substantially all its debt instruments with an interest coverage covenant

Following these actions, fixed rate debt now represents approximately 80% of the company’s debt portfolio, which provides protection from rising interest rates.

During the second quarter, the company repaid $1.8 billion of debt principal including the remaining $0.2 billion outstanding under its revolving credit facility. The company ended the second quarter of 2023 with $7.3 billion of liquidity, including cash and borrowings available under the revolving credit facility.

Simplifying Structure, Removing Senior Layers and Aligning Around Its Brands with Rejuvenated Leadership

The company continues its drive to return to strong profitability by optimizing its organizational and leadership structure to ensure continued momentum and to help expedite the achievement of its long-term goals.

The company realigned around a simplified structure that removes layers between Corporate and its brands.

The leadership of its six largest brands, representing over 90% of the company’s expected capacity at year-end, now report directly to Weinstein (up from one brand representing less than a third of the company’s capacity reporting directly to Weinstein), with three of the six brands continuing to support smaller-capacity brands for scale and efficiency.

The enhanced structure enables its brands to operate with greater speed and responsiveness to market demands and opportunities, the company said.

Additionally, building on the company’s leadership rejuvenation efforts, 7 of Weinstein’s 12 direct reports are new to the role (since the pause in guest cruise operations).

Cruise Industry News Email Alerts

- Breaking News

Get the latest breaking cruise news . Sign up.

54 Ships | 122,002 Berths | $36 Billion | View

- Mkt. Overview

- Record Year

- Refit Schedule

- PDF Download

- Order Today

- 2033 Industry Outlook

- All Operators

- Easy to Use

- Pre-Order Offer

- Advertising

- Cruise News

- Magazine Articles

- Quarterly Magazine

- Annual Report

- Email Newsletter

- Executive Guide

- Digital Reports

Privacy Overview

Carnival: Fiscal Q1 Earnings Snapshot

MIAMI — MIAMI — Carnival Corp. (CCL) on Wednesday reported a loss of $214 million in its fiscal first quarter.

On a per-share basis, the Miami-based company said it had a loss of 17 cents. Losses, adjusted to extinguish debt and for restructuring costs, were 14 cents per share.

The results surpassed Wall Street expectations. The average estimate of eight analysts surveyed by Zacks Investment Research was for a loss of 18 cents per share.

The cruise operator posted revenue of $5.41 billion in the period, which met Street forecasts.

Carnival shares have declined 8% since the beginning of the year, while the S&P’s 500 index has risen 9%. The stock has climbed 94% in the last 12 months.

This story was generated by Automated Insights (http://automatedinsights.com/ap) using data from Zacks Investment Research. Access a Zacks stock report on CCL at https://www.zacks.com/ap/CCL

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

CARNIVAL CORPORATION & PLC REPORTS RECORD FOURTH QUARTER AND FULL YEAR REVENUES WITH CONTINUED STRONG BOOKINGS AND EARNINGS MOMENTUM

Tracking ahead of SEA Change targets

MIAMI , Dec. 21, 2023 /PRNewswire/ -- Carnival Corporation & plc (NYSE/LSE: CCL; NYSE: CUK) reports fourth quarter and full year 2023 earnings and provides an outlook for the full year and first quarter 2024.

Key Highlights

Full Year 2023

- Full year revenues hit an all-time high of $21.6 billion .

- Full year cash from operations was $4.3 billion and adjusted free cash flow was $2.1 billion (see "Non-GAAP Financial Measures" below).

- U.S. GAAP net loss of $74 million and positive adjusted net income of $1 million outperformed the September guidance range (see "Non-GAAP Financial Measures" below).

- The company made debt payments of $6 billion , reducing its debt balance by $4.6 billion from its peak in the first quarter of 2023 and ended the year with $5.4 billion of liquidity.

- The company entered 2024 with its best booked position on record, for both price and occupancy

Fourth Quarter 2023

- Record fourth quarter revenues of $5.4 billion with record net per diems (in constant currency) significantly exceeding 2019 levels and above the September guidance range and record net yields (in constant currency) (see "Non-GAAP Financial Measures" below).

- Booking volumes for the two weeks around Black Friday and Cyber Monday reached an all-time high for that period.

- Total customer deposits reached a fourth quarter record of $6.4 billion , surpassing the previous fourth quarter record of $5.1 billion (as of November 30, 2022 ), by 25 percent.

"We ended the year on a high note with another record-breaking quarter that exceeded expectations and achieved positive full year adjusted net income. In fact, we consistently outperformed in all four quarters of the year, buoyed by a strengthening demand environment across all our brands," commented Carnival Corporation & plc's Chief Executive Officer Josh Weinstein .

"Net yields for the fourth quarter continued on a positive trajectory, were significantly higher than a very strong 2019 and even higher than we had anticipated, enabling us to overcome four years of high cost inflation to deliver five percent higher per unit EBITDA than 2019 (holding fuel and currency constant)," Weinstein added.

"Thanks to a strong second half of 2023, we are already tracking ahead of our plan to achieve SEA Change, our three-year financial targets calling for the highest adjusted ROIC and adjusted EBITDA per ALBD in nearly two decades. Based on our 2024 guidance, we expect to deliver another big step forward, positioning us more than halfway toward realizing all our 2026 SEA Change targets. With nearly two-thirds of 2024 on the books already, we are well positioned to obtain another year of record revenues and adjusted EBITDA," Weinstein noted.

Fourth Quarter 2023 Results

- U.S. GAAP net loss of $48 million , or $(0.04) diluted EPS, and adjusted net loss of $90 million , or $(0.07) adjusted EPS, was above the better end of the September guidance range (see "Non-GAAP Financial Measures" below).

- Adjusted EBITDA of $946 million exceeded the September guidance range, driven by continued strength in demand, which is driving ticket prices higher (see "Non-GAAP Financial Measures" below).

- Record fourth quarter revenues of $5.4 billion , with record net per diems (in constant currency) significantly exceeding 2019 levels, and above the September guidance range and record net yields (in constant currency).

- Occupancy in the fourth quarter of 2023 was over 101 percent, in line with the company's expectations and historical levels.

- Gross margin per diems were down 2.3 percent compared to 2019, while net per diems (in constant currency) exceeded 2019 levels by over 10 percent and were three percentage points better than the midpoint of the September guidance range.

- Cruise costs per ALBD increased 12 percent as compared to the fourth quarter of 2019. Adjusted cruise costs excluding fuel per ALBD (in constant currency) increased 11 percent compared to the fourth quarter of 2019 and were in line with September guidance (see "Non-GAAP Financial Measures" below).

"We entered the year with the best booked position we have ever seen, and now have nearly two-thirds of our occupancy already on the books for 2024, at considerably higher prices (in constant currency). We continue to experience strong bookings momentum across the board, with our European brands showing remarkable strength during the quarter with booking volumes running up well into the double digits at considerably higher prices (in constant currency)," Weinstein noted.

Weinstein continued, "Our yield management strategy to base load bookings is clearly working as we pull forward booking volumes on strong pricing. We continue to build on that momentum with our ongoing advertising investments and lead generation efforts, increasing support from our trade partners, and the exceptional guest experiences our team members provide onboard every day, helping to deliver millions of cruising advocates."

Booking volumes during the fourth quarter continued at significantly elevated levels, above both prior year and 2019 comparable periods, while recent booking volumes for the two weeks around Black Friday and Cyber Monday reached an all-time high for that period. Pricing on bookings during the fourth quarter was considerably higher than prior year pricing (in constant currency).

The cumulative advanced booked position is at considerably higher prices (in constant currency) than 2023 levels, with each quarter of 2024 booked above the high end of the historical range.

2024 Outlook

For the full year 2024, the company expects:

- Adjusted EBITDA of approximately $5.6 billion , over 30 percent growth compared to 2023

- Net yields (in constant currency) up approximately 8.5 percent compared to 2023, with full year occupancy returning to historical levels and nicely higher net per diems (in constant currency) reflecting continued strength in pricing and onboard spending

- Adjusted cruise costs excluding fuel per ALBD (in constant currency) up approximately 4.5 percent compared to 2023

For the first quarter of 2024, the company expects:

- Adjusted EBITDA of approximately $0.8 billion , more than double the first quarter of 2023

- Net yields (in constant currency) up approximately 16.5 percent compared to the first quarter of 2023 with occupancy returning to historical levels as the company closes the remaining occupancy gap in the first half of the year

- Adjusted cruise costs excluding fuel per ALBD (in constant currency) up approximately 9.5 percent compared to the first quarter of 2023 primarily due to higher occupancy levels, the timing of advertising investments and dry-dock related expenses compared to the prior year

See "Guidance" and "Reconciliation of Forecasted Data" for additional information on the company's 2024 outlook.

Financing and Capital Activity

"During 2023, we made debt payments of $6 billion and ended the year with just over $30 billion of debt, which is $3 billion better than we forecasted just nine months ago during our March conference call and almost $5 billion off the first quarter peak," noted Carnival Corporation & plc Chief Financial Officer David Bernstein .

"And looking forward, we will continue to evaluate refinancing opportunities and opportunistically prepay additional debt. Furthermore, we expect durable revenue growth to drive increases in adjusted free cash flow in 2024 and beyond, which will be the primary driver for paying down our debt balances on our path back to investment grade," Bernstein added.

During 2023, the company generated cash from operations of $4.3 billion and adjusted free cash flow of $2.1 billion , making a significant contribution toward rebuilding the company's financial strength.

During the fourth quarter of 2023, the company reduced its debt by another $725 million and for the full year made debt payments of $6 billion while ending the fourth quarter with $5.4 billion of liquidity, including cash and borrowings available under the revolving credit facility. In addition, the company amended an agreement with one of its credit card processors and now expects an additional $800 million to be returned during the first quarter of 2024, representing substantially all of the credit card reserves balance as of November 30, 2023 .

Sustainability

The company continues to work aggressively towards its greenhouse gases ("GHG") emission reduction goals and ambitions through innovative projects aligned with its four-part emission reduction strategy: fleet optimization; energy efficiency; itinerary efficiency; and new technologies & alternative fuels. In 2023, the company:

- Reduced its absolute GHG emissions by over 10 percent as compared to its peak year of 2011, despite capacity growth of 30 percent over the same period.

- Achieved a 15.5 percent reduction in fuel consumption per ALBD compared to 2019 and expects another four percent reduction in fuel consumption per ALBD for full year 2024 compared to 2023.

- Now expects to achieve its 2030 GHG emission intensity reduction goal four years early, targeting more than a 20 percent reduction in emission intensity by the end of 2026 compared to 2019.

- Surpassed its 2030 goal to achieve shore power capability for 60 percent of its fleet, seven years ahead of schedule; now, 64 percent of the company's fleet has the capability to connect to shore power.

- Successfully piloted the use of biofuels as a replacement for fossil fuel on one additional ship, bringing its cumulative completed biofuel pilots to three ships.

- Delivered 38 percent reduction in food waste per person relative to its 2019 baseline, nearing its interim goal to reduce food waste by 40 percent per person by 2025, and on pace toward its 2030 goal of a 50 percent reduction.

Other Recent Highlights

- Carnival Corporation's brands launched advertising campaigns with Costa Cruises focusing on moments where guests are left speechless, P&O Cruises ( UK ) highlighting the unique experiences of a cruise holiday, AIDA Cruises inviting guests to experience oneself, and Holland America Line continuing its "Time of Your Life" campaign.

- Carnival Corporation was named one of the World's Top Female-Friendly Companies and one of the World's Best Employers of 2023 by Forbes, both for the third consecutive year.

- Carnival Cruise Line took delivery of Carnival Jubilee, offering an exciting mix of new entertainment, dining and fun to one of the line's most popular homeports, Galveston, Texas .

- Carnival Cruise Line announced hundreds of sailings to its new destination on Grand Bahama Island "Celebration Key" with 18 different ships departing from nine different homeports.

(See "Reconciliation of Forecasted Data")

Capital Expenditures

The company's annual capital expenditure forecast for 2024, is as follows:

Committed Ship Financings

Outstanding Debt Maturities

As of November 30, 2023 , the company's outstanding debt maturities are as follows:

Refer to Financial Information within the Investor Relations section of the corporate website for further details on the company's Debt Maturities: https://www.carnivalcorp.com/financial-information/supplemental-schedules

Conference Call

The company has scheduled a conference call with analysts at 10:00 a.m. EST ( 3:00 p.m. GMT ) today to discuss its earnings release. This call can be listened to live, and additional information can be obtained, via Carnival Corporation & plc's website at www.carnivalcorp.com and www.carnivalplc.com .

Carnival Corporation & plc is the largest global cruise company, and among the largest leisure travel companies, with a portfolio of world-class cruise lines – AIDA Cruises , Carnival Cruise Line , Costa Cruises , Cunard, Holland America Line , P&O Cruises ( Australia ), P&O Cruises ( UK ), Princess Cruises , and Seabourn.

Additional information can be found on www.carnivalcorp.com , www.aida.de , www.carnival.com , www.costacruise.com , www.cunard.com , www.hollandamerica.com , www.pocruises.com.au , www.pocruises.com , www.princess.com and www.seabourn.com . For more information on Carnival Corporation's industry-leading sustainability initiatives, visit www.carnivalsustainability.com .

Cautionary Note Concerning Factors That May Affect Future Results

Some of the statements, estimates or projections contained in this document are "forward-looking statements" that involve risks, uncertainties and assumptions with respect to us, including some statements concerning future results, operations, outlooks, plans, goals, reputation, cash flows, liquidity and other events which have not yet occurred. These statements are intended to qualify for the safe harbors from liability provided by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts are statements that could be deemed forward-looking. These statements are based on current expectations, estimates, forecasts and projections about our business and the industry in which we operate and the beliefs and assumptions of our management. We have tried, whenever possible, to identify these statements by using words like "will," "may," "could," "should," "would," "believe," "depends," "expect," "goal," "aspiration," "anticipate," "forecast," "project," "future," "intend," "plan," "estimate," "target," "indicate," "outlook," and similar expressions of future intent or the negative of such terms.

Forward-looking statements include those statements that relate to our outlook and financial position including, but not limited to, statements regarding:

Because forward-looking statements involve risks and uncertainties, there are many factors that could cause our actual results, performance or achievements to differ materially from those expressed or implied by our forward-looking statements. This note contains important cautionary statements of the known factors that we consider could materially affect the accuracy of our forward-looking statements and adversely affect our business, results of operations and financial position. Additionally, many of these risks and uncertainties are currently, and in the future may continue to be, amplified by our substantial debt balance incurred during the pause of our guest cruise operations. There may be additional risks that we consider immaterial or which are unknown. These factors include, but are not limited to, the following:

- Events and conditions around the world, including geopolitical uncertainty, war and other military actions, inflation, higher fuel prices, higher interest rates and other general concerns impacting the ability or desire of people to travel have led, and may in the future lead, to a decline in demand for cruises as well as negative impacts to our operating costs and profitability.

- Pandemics have in the past and may in the future have a significant negative impact on our financial condition and operations.

- Incidents concerning our ships, guests or the cruise industry have in the past and may, in the future, negatively impact the satisfaction of our guests and crew and lead to reputational damage.

- Changes in and non-compliance with laws and regulations under which we operate, such as those relating to health, environment, safety and security, data privacy and protection, anti-money laundering, anti-corruption, economic sanctions, trade protection, labor and employment, and tax may be costly and have in the past and may, in the future, lead to litigation, enforcement actions, fines, penalties and reputational damage.

- Factors associated with climate change, including evolving and increasing regulations, increasing global concern about climate change and the shift in climate conscious consumerism and stakeholder scrutiny, and increasing frequency and/or severity of adverse weather conditions could adversely affect our business.

- Inability to meet or achieve our targets, goals, aspirations, initiatives, and our public statements and disclosures regarding them, including those that are related to sustainability matters, may expose us to risks that may adversely impact our business.

- Breaches in data security and lapses in data privacy as well as disruptions and other damages to our principal offices, information technology operations and system networks and failure to keep pace with developments in technology may adversely impact our business operations, the satisfaction of our guests and crew and may lead to reputational damage.

- The loss of key team members, our inability to recruit or retain qualified shoreside and shipboard team members and increased labor costs could have an adverse effect on our business and results of operations.

- Increases in fuel prices, changes in the types of fuel consumed and availability of fuel supply may adversely impact our scheduled itineraries and costs.

- We rely on supply chain vendors who are integral to the operations of our businesses. These vendors and service providers may be unable to deliver on their commitments, which could negatively impact our business.

- Fluctuations in foreign currency exchange rates may adversely impact our financial results.

- Overcapacity and competition in the cruise and land-based vacation industry may negatively impact our cruise sales, pricing and destination options.

- Inability to implement our shipbuilding programs and ship repairs, maintenance and refurbishments may adversely impact our business operations and the satisfaction of our guests.

- We require a significant amount of cash to service our debt and sustain our operations. Our ability to generate cash depends on many factors, including those beyond our control, and we may not be able to generate cash required to service our debt and sustain our operations.

- Our substantial debt could adversely affect our financial health and operating flexibility.

The ordering of the risk factors set forth above is not intended to reflect our indication of priority or likelihood.

Forward-looking statements should not be relied upon as a prediction of actual results. Subject to any continuing obligations under applicable law or any relevant stock exchange rules, we expressly disclaim any obligation to disseminate, after the date of this document, any updates or revisions to any such forward-looking statements to reflect any change in expectations or events, conditions or circumstances on which any such statements are based.

Forward-looking and other statements in this document may also address our sustainability progress, plans, and goals (including climate change- and environmental-related matters). In addition, historical, current, and forward-looking sustainability- and climate-related statements may be based on standards and tools for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions and predictions that are subject to change in the future and may not be generally shared.

CARNIVAL CORPORATION & PLC NON-GAAP FINANCIAL MEASURES (CONTINUED)

Data in the below table is compared against 2019 as it is the most recent year of full operations due to the pause and resumption of guest cruise operations.

Gross margin per diems and net per diems were computed by dividing the gross margin and adjusted gross margin by PCDs. Gross margin yields and net yields were computed by dividing the gross margin and adjusted gross margin by ALBDs as follows:

Cruise costs per ALBD, adjusted cruise costs per ALBD and adjusted cruise costs excluding fuel per ALBD were computed by dividing cruise costs, adjusted cruise costs and adjusted cruise costs excluding fuel by ALBDs as follows:

Non-GAAP Financial Measures

We use non-GAAP financial measures and they are provided along with their most comparative U.S. GAAP financial measure:

The presentation of our non-GAAP financial information is not intended to be considered in isolation from, as a substitute for, or superior to the financial information prepared in accordance with U.S. GAAP. It is possible that our non-GAAP financial measures may not be exactly comparable to the like-kind information presented by other companies, which is a potential risk associated with using these measures to compare us to other companies.

Adjusted net income (loss) and adjusted earnings per share provide additional information to us and investors about our future earnings performance by excluding certain gains, losses and expenses that we believe are not part of our core operating business and are not an indication of our future earnings performance. We believe that gains and losses on ship sales, impairment charges, debt extinguishment and modification costs, restructuring costs and certain other gains and losses are not part of our core operating business and are not an indication of our future earnings performance.

Adjusted EBITDA provides additional information to us and investors about our core operating profitability by excluding certain gains, losses and expenses that we believe are not part of our core operating business and are not an indication of our future earnings performance as well as excluding interest, taxes and depreciation and amortization. In addition, we believe that the presentation of adjusted EBITDA provides additional information to us and investors about our ability to operate our business in compliance with the covenants set forth in our debt agreements. We define adjusted EBITDA as adjusted net income (loss) adjusted for (i) interest, (ii) taxes and (iii) depreciation and amortization. There are material limitations to using adjusted EBITDA. Adjusted EBITDA does not take into account certain significant items that directly affect our net income (loss). These limitations are best addressed by considering the economic effects of the excluded items independently and by considering adjusted EBITDA in conjunction with net income (loss) as calculated in accordance with U.S. GAAP.

Adjusted free cash flow provides additional information to us and investors to assess our ability to repay our debt after making the capital investments required to support ongoing business operations and value creation as well as the impact on the company's liquidity level. Adjusted free cash flow represents net cash provided by operating activities adjusted for capital expenditures (purchases of property and equipment) and proceeds from export credits that are provided for related capital expenditures. Adjusted free cash flow does not represent the residual cash flow available for discretionary expenditures as it excludes certain mandatory expenditures such as repayment of maturing debt.

Net per diems and net yields enable us and investors to measure the performance of our cruise segments on a per PCD and per ALBD basis. We use adjusted gross margin rather than gross margin to calculate net per diems and net yields. We believe that adjusted gross margin is a more meaningful measure in determining net per diems and net yields than gross margin because it reflects the cruise revenues earned net of only our most significant variable costs, which are travel agent commissions, cost of air and other transportation, certain other costs that are directly associated with onboard and other revenues and credit and debit card fees.

Adjusted cruise costs per ALBD and adjusted cruise costs excluding fuel per ALBD enable us and investors to separate the impact of predictable capacity or ALBD changes from price and other changes that affect our business. We believe these non-GAAP measures provide useful information to us and investors and expanded insight to measure our cost performance. Adjusted cruise costs per ALBD and adjusted cruise costs excluding fuel per ALBD are the measures we use to monitor our ability to control our cruise segments' costs rather than cruise costs per ALBD. We exclude gains and losses on ship sales, impairment charges, restructuring costs and certain other gains and losses that we believe are not part of our core operating business as well as excluding our most significant variable costs, which are travel agent commissions, cost of air and other transportation, certain other costs that are directly associated with onboard and other revenues and credit and debit card fees. We exclude fuel expense to calculate adjusted cruise costs excluding fuel. The price of fuel, over which we have no control, impacts the comparability of period-to-period cost performance. The adjustment to exclude fuel provides us and investors with supplemental information to understand and assess the company's non-fuel adjusted cruise cost performance. Substantially all of our adjusted cruise costs excluding fuel are largely fixed, except for the impact of changing prices once the number of ALBDs has been determined.

Adjusted ROIC provides additional information to us and investors about our operating performance relative to the capital we have invested in the company. We define adjusted ROIC as the twelve-month adjusted net income (loss) before interest expense and interest income divided by the monthly average of debt plus equity minus construction-in-progress, excess cash, goodwill and intangibles.

Reconciliation of Forecasted Data

We have not provided a reconciliation of forecasted non-GAAP financial measures to the most comparable U.S. GAAP financial measures because preparation of meaningful U.S. GAAP forecasts would require unreasonable effort. We are unable to predict, without unreasonable effort, the future movement of foreign exchange rates and fuel prices. We are unable to determine the future impact of gains and losses on ship sales, impairment charges, debt extinguishment and modification costs, restructuring costs and certain other non-core gains and losses.

Constant Currency

Our operations primarily utilize the U.S. dollar, Australian dollar, euro and sterling as functional currencies to measure results

and financial condition. Functional currencies other than the U.S. dollar subject us to foreign currency translational risk. Our operations also have revenues and expenses that are in currencies other than their functional currency, which subject us to foreign currency transactional risk.

Constant currency reporting removes the impact of changes in exchange rates on the translation of our operations plus the transactional impact of changes in exchange rates from revenues and expenses that are denominated in a currency other than the functional currency.

We report adjusted gross margin, net per diems, adjusted cruise costs excluding fuel and adjusted cruise costs excluding fuel per ALBD on a "constant currency" basis assuming the 2023 periods' currency exchange rates have remained constant with the 2019 periods' rates. These metrics facilitate a comparative view for the changes in our business in an environment with fluctuating exchange rates.

- The translation of our operations with functional currencies other than U.S. dollar to our U.S. dollar reporting currency results in decreases in reported U.S. dollar revenues and expenses if the U.S. dollar strengthens against these foreign currencies and increases in reported U.S. dollar revenues and expenses if the U.S. dollar weakens against these foreign currencies.

- Our operations have revenue and expense transactions in currencies other than their functional currency. If their functional currency strengthens against these other currencies, it reduces the functional currency revenues and expenses. If the functional currency weakens against these other currencies, it increases the functional currency revenues and expenses.

SOURCE Carnival Corporation & plc

In This Story

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

IMAGES

COMMENTS

Look out for CCL's next earnings release expected on June 24, 2024. For the next earning release, we expect the company to report earnings of -$0.01 per share, reflecting a year-over-year increase ...

Carnival Co. & last announced its quarterly earnings results on March 27th, 2024. The reported ($0.14) earnings per share for the quarter, topping the consensus estimate of ($0.18) by $0.04. The business earned $5.41 billion during the quarter, compared to analysts' expectations of $5.42 billion. Its revenue was up 22.0% on a year-over-year basis.

Carnival Corporation & plc First Quarter Report 2024 on Form 10-Q 464.5 KB. 2023. Quarter Title; Q4: ... Carnival Corporation & plc Reports Record Second Quarter Earnings And Additional $1 Billion Share Repurchase Authorization. ... Carnival Cruise Line, also known as America's Cruise Line, is a leader in contemporary cruising and operates a ...

Find annual and quearterly earnings data for Carnival Corporation Common Stock (CCL) including earnings per share, earnings forecasts at Nasdaq.com.

Carnival Corporation & plc (NYSE/LSE: CCL; NYSE: CUK) reports fourth quarter and full year 2023 earnings and provides an outlook for the full year and first quarter 2024.

MIAMI, Sept. 29, 2023 /PRNewswire/ -- Carnival Corporation & plc (NYSE/LSE: CCL; NYSE: CUK) reports third quarter 2023 earnings and provides an outlook for the full year and fourth quarter 2023 ...

Carnival Corporation has reported fourth quarter and full year 2023 earnings and provided an outlook for the full year and first quarter 2024. Full Year 2023 Full year revenues hit an all-time high of $21.6 billion. Full year cash from operations was $4.3 billion and adjusted free cash flow was…

Zacks Consensus Estimate. This cruise operator is expected to post quarterly earnings of $0.75 per share in its upcoming report, which represents a year-over-year change of +229.3%. Revenues are ...

Carnival Corporation announced financial results for the first quarter 2024 and provided an outlook for the full year and second quarter 2024. Record first quarter revenues of $5.4 billion with record net yields (in constant currency) and record net per diems (in constant currency) both significantly exceeding 2023 levels.

New-to-cruise customers surged more than 30% year-over-year, Carnival said. Adjusted cruise costs, excluding fuel in constant currency, were up 7.3% in the first quarter from a year earlier, but 2 ...

Carnival Corporation & plc (NYSE:CCL) Q4 2023 Earnings Conference Call December 21, 2023 10:00 AM ETCompany Participants. Beth Roberts - SVP of IR Josh Weinstein - CEO David Bernstein - CFO ...

Company's earnings for a period net of operating costs, taxes, and interest. -48.00M. 97.00%. Net profit margin. Measures how much net income or profit is generated as a percentage of revenue ...

It does not store any personal data. Carnival Corporation has reported third quarter 2023 earnings and provides an outlook for the full year and fourth quarter 2023. Highlights: U.S. GAAP net income of $1.07 billion, or $0.79 diluted EPS, and adjusted net income of $1.18 billion, or $0.86 adjusted EPS, exceeded the June guidance range.

Carnival's next earnings report (for Q3 FY 2022) is expected to be released on Sept. 29, 2022. ... Royal Caribbean Cruises Q1 2022 Earnings Report Recap.

Carnival Corporation & plc To Hold Conference Call on 2024 1Q Earnings. Mar 27, 2024 at 10:00 AM EDT. First Quarter 2024 Earnings Presentation 4.3 MB. Fourth Quarter 2023 Earnings Presentation 6.7 MB. ... Carnival Cruise Line, also known as America's Cruise Line, is a leader in contemporary cruising and operates a fleet of ships designed to ...

Carnival Corporation continues to expand next generation internet across its fleet with the installation of SpaceX's Starlink on Costa Cruises, Cunard and P&O Cruises (UK) ships, with plans for ...

Over the next five years, Carnival sales are expected to grow 11% annually, while its earnings rise more than double to $2.53 per share.Granted, debt is still a problem -- Carnival owes $29.5 ...

Carnival Corporation & plc CCL is scheduled to report its first-quarter fiscal 2024 results on Mar 27, 2024, before the opening bell.In the last reported quarter, the company delivered an earnings ...

When Carnival reports its December-February quarter earnings on Wednesday, the company is expected to post $5.4 billion in revenues, up 22% from the same quarter last year, and a loss of $0.17 per ...

March 22, 2024 — 10:42 am EDT. Written by Zacks Equity Research for Zacks ->. Carnival Corporation & plc CCL is scheduled to report its first-quarter fiscal 2024 results on Mar 27, 2024, before ...

The stock was up 1.2% Wednesday, while Royal Caribbean shares were 1.4% higher and Norwegian Cruise Line Holdings rose 4.5%. Carnival posted an adjusted loss of 14 cents per share on revenue of $5 ...

Carnival Corporation has reported second quarter 2023 earnings and sets sights on 2026 SEA Change Program. Highlights: U.S. GAAP net loss of $407 million, or $ (0.32) diluted EPS, and adjusted net loss of $395 million, or $ (0.31) adjusted EPS, above the better end of the March guidance range of $425 to $525 million net loss for the second ...

The cruise operator posted revenue of $5.41 billion in the period, which met Street forecasts. Carnival shares have declined 8% since the beginning of the year, while the S&P's 500 index has ...

Tracking ahead of SEA Change targets. MIAMI, Dec. 21, 2023 /PRNewswire/ -- Carnival Corporation & plc (NYSE/LSE: CCL; NYSE: CUK) reports fourth quarter and full year 2023 earnings and provides an outlook for the full year and first quarter 2024.. Key Highlights . Full Year 2023 . Full year revenues hit an all-time high of $21.6 billion.; Full year cash from operations was $4.3 billion and ...

Carnival's Q1 2024 earnings report states the cruise operator made $5.4 billion in revenue with record net yields due to "all-time high" bookings and ticket prices. Onboard sales also ...

--Carnival Corporation& plc reports fourth quarter and full year 2023 earnings and provides an outlook for the full year and first quarter 2024.. Full year revenues hit an all-time high of $21.6 ...

Carnival Reports Smaller Loss but Bridge Collapse Will Hurt Earnings By Callum Keown Updated March 27, 2024, 12:43 pm EDT / Original March 26, 2024, 4:30 pm EDT

Cruise ship company Carnival (NYSE:CCL) will be announcing earnings results tomorrow before market open. Here's what investors should know. Last quarter Carnival reported revenues of $5.40 billion ...

Analysts believe Carnival will earn $1.00 per share this year and $1.37 next year. That's a nice year-over-year jump in earnings, but it's coming from a far lower base number than it once was.

Home of the smile, AIDA Cruises is the epitome of a premium-quality, relaxing cruise and operates one of the world's most state-of-the-art fleets. Carnival Cruise Line, also known as America's Cruise Line, is a leader in contemporary cruising and operates a fleet of ships designed to provide fun and memorable vacation experiences at a great ...