Start Every Journey with Priority Pass

For the occasional Traveller

Standard plus, for the regular traveller, for the frequent traveller, priority pass excellence awards winners.

Celebrating outstanding airport lounge and travel experience partners in the Priority Pass global network. Discover the winners of this year’s awards.

PRE-BOOK YOUR LOUNGE NOW

Access to lounges is subject to space availability. Pre-book is available at select locations for a small fee. Log in to reserve your space in the lounge.

Unlock More with Priority Pass

Beyond premium lounges, explore a world of exclusive advantages. Refuel, relax and unwind with a variety of additional benefits to enhance your experience both within and beyond the airport.

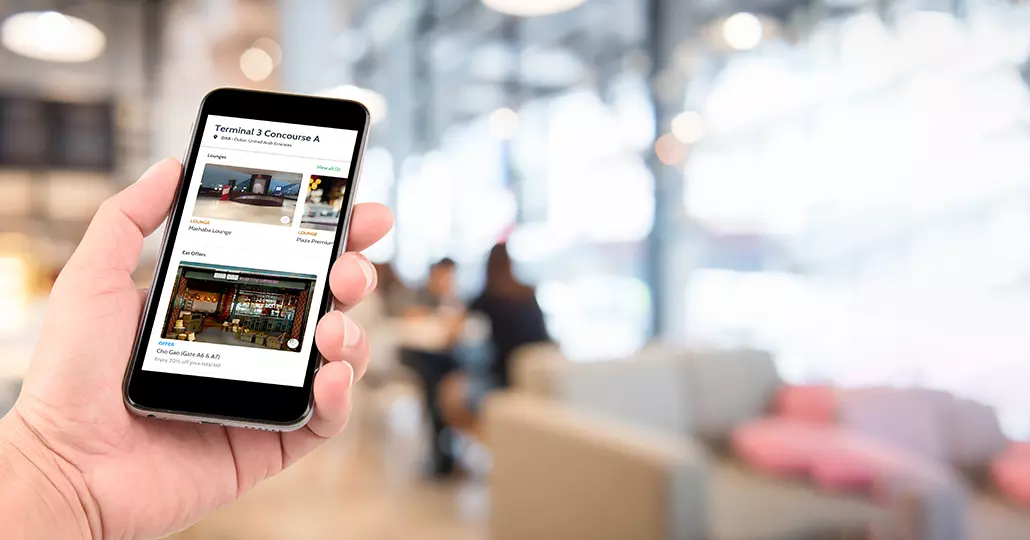

ENRICH YOUR AIRPORT EXPERIENCE WITH THE PRIORITY PASS APP

Download the app to help you find and access lounges and experiences, navigate airports, manage your account and much more.

Priority Pass Airport Guides

Enhance your airport experience using our bespoke airport guides.

The Benefits of Priority Pass

YOUR MEMBERSHIP BENEFITS

WORTH ARRIVING EARLY

WHEREVER YOUR TRAVEL TAKES YOU

Recently added.

Belfast George Best City

Belfast, northern ireland.

ASPIRE LOUNGE

Rio de Janeiro Galeao International, Terminal 2

Rio de janeiro, brazil.

GOL SMILES (INTERNATIONAL)

Kuala Lumpur Intl, KLIA Terminal 1 (Satellite)

Kuala lumpur, malaysia.

TRAVEL CLUB LOUNGE

Washington DC Dulles International, Concourse A

Washington dc, usa.

VIRGIN ATLANTIC CLUBHOUSE

Please upgrade your browser

To have the best experience using our site, please upgrade to one of the latest browsers.

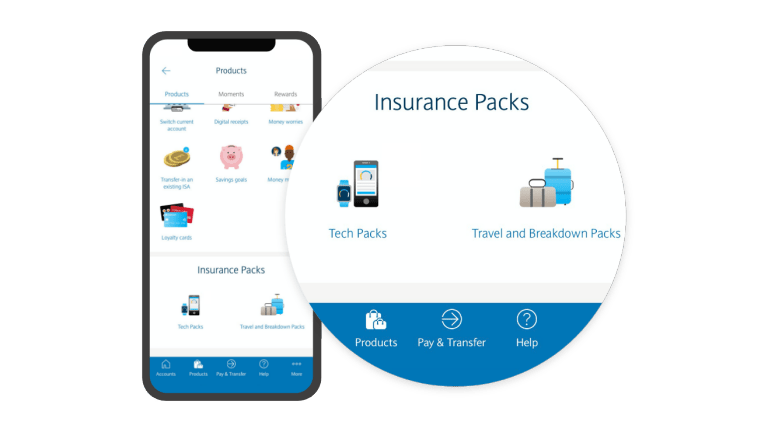

- Barclays insurance

- Barclays travel and breakdown insurance

Travel Plus Pack

Holiday cover with extras for £22.50 a month

Enjoy quality worldwide travel protection as well as exciting extras to help you make the most out of your travels

Six-month minimum term – terms and conditions apply.

Worldwide and UK multi-trip cover

Cover for you and your family, with optional cover for medical conditions

Complete breakdown cover in UK and Europe.

Unlimited callouts in UK, plus cover for you as a driver or passenger when travelling

Relax with 24/7 concierge service

From booking flights and hotels to accessing exclusive discounts, events and restaurants, Ten’s concierge service can help you with all your lifestyle needs.

Stress-free travels with DragonPass Premier+ app

Relax in a lounge, skip security queues or make use of dining discounts with the DragonPass Premier+ app.

If you’ve got a Barclaycard Avios Plus credit card, you can access airport lounges around the world for £18.50 per person. To compare the full features and benefits of our Travel Plus Pack and Barclaycard Avios Plus credit card, visit the Barclaycard website .

What does our Travel Plus Pack cover?

Eligibility criteria To apply for cover, you’ll need to:

- Live in the UK for at least 183 days a year

- Be registered with a UK doctor.

Who’s covered

If you’re eligible for travel insurance, Aviva will cover:

- You and your partner who lives with you up to the age of 79 at the start of your trip

- Your children (including step- and foster children) who travel with you and are under 23.

If you’re eligible for RAC breakdown cover, airport lounge access and concierge benefits, our providers will cover:

- You, as the pack holder

- Anyone who lives at the same address as you, if you add them to your cover when you buy your pack

Travel insurance by Aviva

We made some changes to our Travel Plus Pack terms and conditions on 24 April 2023. If you bought your pack before this date, your terms and conditions haven’t changed and you can find them in ‘Statements and documents’ in the Barclays app.

What’s covered

Multi-trip travel insurance underwritten by Aviva Insurance Limited. You’ll get:

Trips abroad and in the UK for up to 31 days. For UK trips, you’ll need to be away from home for at least two consecutive nights in pre-booked holiday accommodation

Winter sports, cruises and business trips outside the UK for non-manual work, like meetings and conferences

Up to £10 million worth of emergency medical treatment for sudden illness or injuries

Up to £10,000 per person for cancelled trips if you need to come home early

Unexpected travel costs – up to £10,000 for additional travel and accommodation costs if your plans are disrupted, and up to £250 if your pre-booked transport is delayed for longer than 12 hours

Protection for your belongings – up to £1,500 if your personal belongings are lost, stolen or damaged during your trip.

What’s not covered

Travel delays where your travel is delayed by less than 12 hours

Costs you can recover from your travel or accommodation provider, your debit or credit card company, PayPal, ABTA, ATOL or similar organisations

Any incident that happens after 31 days of your holiday, unless you have a longer trip upgrade

Anything that already happened before you bought this pack or booked your trip (whichever is later). For example, an airport strike that's been reported in the media

Any claim if you don’t follow the advice of local authorities

Claims if you travel against the advice of a doctor

Travels to get medical advice or treatment

Trips if you’re travelling with a terminal prognosis

Claims for cancellation or coming home early if you travel against advice or measures that were already announced when you bought your pack or booked your trip (whichever is later).

Optional 12-month upgrades

For an extra one-off fee, you could get a:

Longer trip upgrade

Designed for trips longer than 31 days. This covers the entire trip for up to 120 days. You’ll need to buy this as soon as you book the trip.

Pre-existing conditions upgrade

We now cover more pre-existing medical conditions, some for free. You can add cover for other family members too. If you have a valid upgrade, you’ll be covered automatically for any new conditions that occur over 12 months. We’ll give you an upgrade quote when you buy your pack. This will be valid for 30 days, so you can decide if you want to buy the upgrade.

RAC breakdown cover in the UK and Europe

Get roadside assistance, national recovery and onward travel to anywhere in the UK, plus cover if your vehicle won’t start at home.

Personal vehicles, whether you’re the driver or the passenger

Electric cars

Unlimited callouts in the UK

Support on the myRAC app, where you can report your breakdown in 30 seconds

Transport to the nearest garage within 10 miles if we can’t repair your vehicle at the side of the road

A hire vehicle, alternative transport (for example, a train or plane) or overnight accommodation to help you complete your journey

Access to RAC Rewards for discounts and offers on all things motoring, plus discounts on days out, dining, holidays and gym memberships.

Terms and conditions apply for the myRAC app and RAC Rewards. For more information, register for the myRAC app or visit rewards.rac.co.uk/barclays/terms-and-conditions

Anyone other than your nominated partner or any other family members, such as your children

Vehicles used for business purposes

Company cars

Any breakdowns or accidents that happened before you bought this pack

Costs of any vehicle parts or repairs completed in a garage.

Terms and conditions

24/7 concierge service

Ten are here to help you plan unforgettable experiences with their digital concierge service.

Ten’s concierge service can help you:

Get priority access to top shows and music events at major venues and box offices worldwide

Enhance your plans with inspiration for travel and holiday bookings

Book adventures and get inspiration for unique days out with family and friends through the ‘Activities Hub’

Find reservations at premium restaurants around the world

Travel in comfort with luxury room upgrades, complimentary breakfast and discounted spa or dining – subject to availability

Get invitations to exclusive events with complimentary tickets.

Airport lounge access

Enhance your airport experience. Get free lounge passes, skip security queues and enjoy exclusive discounts at restaurants.

Get more out of your travels with the Dragonpass Premier+ app – unlock exclusive features to help improve your travels, including:

Six free visits to over 1,000 airport lounges

Discounted fast-track security at airports - pre-book online to skip queues and start your holidays stress free

Option to swap a free lounge visit for a £15 meal voucher at over 50 airport restaurants

Complimentary discounts of up to 25% off at selected airport restaurants.

Terms and conditions apply for the DragonPass Premier+ app and fast-track security. For more information, visit barclays.dragonpasspremierplus.com

Discounts on airport parking and hotels

With our Travel Plus Pack, you could get:

Up to 20% off on airport parking at major UK airports

Discounts for up to 18% off select hotel packages

Savings of up to 13% on all other participating hotels.

Don’t need airport lounge access?

Our Travel Pack offers worldwide travel insurance from Aviva with RAC complete breakdown cover for just £14.50 per month

Just need UK breakdown cover for roadside and at home?

Our Breakdown Cover Pack offers UK roadside and at-home rescue for £9 a month.

How to get our Travel Plus Pack

It only takes a few minutes to apply for our Travel Plus Pack in the Barclays app or Online Banking.

To apply for a pack, you’ll need to have an eligible current account with us.

Download the Barclays app to get our Travel Plus Pack

Tap the logo you need, and it’ll take you straight to the app in your app store.

- Important information

Travel Plus Pack Insurance Product Information Document (Travel IPID)

Travel Plus Pack Insurance Product Information Document (Breakdown Cover IPID)

Travel Plus Pack terms and conditions

Changes to terms and conditions

Our products

- Current accounts

- Credit cards

- Help & FAQs

- Money worries

- Report fraud or a scam

- Report card lost or stolen

Site information

- Accessibility

- Privacy policy

- Cookies policy

- Find Barclays

- Service status

Barclays Bank UK PLC and Barclays Bank PLC are each authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Barclays Insurance Services Company Limited and Barclays Investment Solutions Limited are each authorised and regulated by the Financial Conduct Authority.

Registered office for all: 1 Churchill Place, London E14 5HP

Complimentary airport lounge access

You’ll be pleased to know that if you're facing a flight delay of one or more hours, your Columbus Direct policy gives you free access to a network of over 1,000 airport lounges worldwide * The 1,000 lounges are available across 120 countries. Wherever you’re stranded, there's almost certainly a lounge waiting.

An oasis of calm

A flight delay can make stress levels rise, especially if it’s eating into your much anticipated holiday, or whether you’re returning home and you need to pick the car up at a specified time before further costs are incurred. Columbus Direct take away an element of that stress in the unfortunate event that your flight is delayed for more than an hour. This allows you to escape the crowded, noisy departure terminals and relax before boarding in an airport VIP lounge. At the lounge you can help yourself to a range of light refreshments and drinks, kick-back in comfortable seating, log on to Wi-Fi and enjoy the wait.

How to register

Once you’ve purchased your Columbus Direct policy, a confirmation email will be sent to your registered email address which will contain all your insurance documents. Within this email, you’ll also find the details of how to register for Airport Lounge Access, in case your flight is delayed.

How it works

If a delay of one hour or more is announced for your registered flight, we'll automatically send you a SMS message to inform you, and an email with a PDF file attached. There will be the same amount of PDF attachments as registered travel companions.

Within the PDF will be a unique LoungeKey barcode which will allow you, and your registered flight companions access into an available airport lounge*. You can enter the lounge when you like, so if you wanted to have a mooch around the duty-free first, you can forward each lounge voucher to members of your travelling party so they are able to access the lounge when they like, without you needing to be there.

Simply show your LoungeKey Barcode to a member of staff at a participating lounge and they'll scan your barcode to grant you access. The name on your LoungeKey barcode must exactly match the name which shows on your boarding pass. In the unlikely event that your voucher doesn’t work, or is invalid, please call our Customer Services team on 0800 068 0060 and they will be able to investigate this immediately for you.

For more information on our flight delay service, please see our FAQ’s page here , where we have complied a comprehensive list which will help you find the answers.

*Subject to availability .

- [email protected]

- +1.205.767.0507 | +44 (0) 20 3514 1337

- Travel Medical

- Trip Protection

- Annual Multi Trip

- Group Travel Benefits

- Warzone Cover: Ukraine

- Group Health Insurance

- Social Impact

- Broker Resources

- Podcast – The New Nomad

- Employer Login

Journey in Comfort: Our Lounge Access Benefit

1300+ airport lounges.

worldwide, included in all policies for 12 months

At Insured Nomads , we extend beyond premium travel and health insurance; our goal is to enrich your journey. As a part of our ongoing value addition, we are delighted to introduce an exclusive benefit: access to a broad network of airport lounges worldwide. With over 1300 lounges in more than 600 cities, our lounge access benefit turns waiting hours into moments of comfort and convenience, be it for relaxation or staying productive. This initiative embodies our dedication to enhancing your travel experience, every step of the way.

Members with Travel Insurance

If you purchased a World Explorer series travel insurance plan with Insured Nomads then you have this benefit for 12 months from the first activation date. You may be eligible to gain entrance into an airport lounges through their INC membership through our InstaPass℠ when a registered flight has been delayed by 2 hours . If access is granted then up to 3 friends can enter with you at no charge. Flights must be registered in advance of arriving at the airport.

1.Register your Trip

Click here to register your flight, up to 48 hours before departure, using your Travel Insurance policy number

2. Await Notification

If your flight is delayed by at least 2 hours then you will get notified with a lounge pass if there is a participating lounge available for you to relax in during the waiting time.

3. Enter a lounge

Present your digital lounge pass ( QR code ) at the lounge to recharge and wait away from the gate. Be aware that participating lounges may restrict entry due to demand at that time and other factors.

Members with Health Insurance

Health Insurance policy holders are eligible to gain entrance into the network of lounges via Priority Pass, entry is subject to availability and volume on the day of visit.

1. Activate your Membership

Click here to activate your membership at Priority Pass using your Health Insurance policy number

2. Download the App

Download the Priority Pass App and sign in with your membership to access your digital membership card

3. Enter a Lounge

Present your digital Priority Pass membership card (App) to recharge and wait away from the gate. Certain lounges may include free-of-charge access for children and guests.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

7 Ways to Access American Airlines Admirals Club Lounges

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

1. Buy an Admirals Club Day Pass

2. get the citi® / aadvantage® executive world elite mastercard®, 3. purchase an admirals club membership, 4. fly on a first class or business class ticket, 5. earn aadvantage elite status, 6. earn oneworld emerald or sapphire status, 7. use your military benefits, admirals clubs locations, other american airlines lounges and how to access them, final thoughts on accessing admirals clubs.

Lounge access before your flight or during a layover enhances your travel experience. You get free snacks and beverages, generally comfortable seating, high-speed Wi-Fi access and outlets to charge your devices. If you’re flying with American Airlines or any of its partners, you may be able to visit an Admirals Club, which is the airline’s airport lounge.

In addition to Admirals Clubs, customers can access partner lounges in airports American doesn’t fly to. There are currently almost 50 Admirals Club locations and more than 50 partner lounges in airports worldwide.

To enter the lounges, American Airlines requires travelers to present a same-day boarding pass on American or one of its partners. That's true for all passengers, regardless of status or flying class. Here are all the ways you can visit American Airlines Admirals Clubs.

Admirals Club in DCA airport. (Photo courtesy of American Airlines)

Day passes are available for purchase at select locations for $79 or 7,900 AAdvantage miles. The day pass includes access for you and up to three children (under age 18). You can log in to your AAdvantage account to purchase a pass or do so as a guest.

NerdWallet values American Airlines miles at 1.7 cents each. If you use your points to purchase a day pass, you’re only getting 1 cent per point. Based on the valuation, you’d be better off paying cash than using your points.

$79 per person is a steep price for visiting a lounge, so you’ll want to do the math on how much you could realistically save on food and drinks and whether you value the specific location’s amenities.

» Learn more: What's the value of American Airlines AAdvantage miles?

Only one credit card will get you into an American Airlines Admirals Club lounge.

The Citi® / AAdvantage® Executive World Elite Mastercard® includes an Admirals Club membership, allowing you to bring your immediate family or up to two guests and up to 10 authorized users with you. This card comes with the following sign-up bonus: Earn 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 within the first 3 months of account opening.

The card includes a $100 reimbursement every five years for Global Entry or TSA PreCheck, $120 Avis or Budget car rental credit every calendar year, $120 in Grubhub credits (up to $10 in statement credit on each monthly billing statement) and $120 in Lyft credits ($10 credit each month after taking three eligible rides).

When flying with American Airlines, you'll receive other benefits such as a free checked bag for you and up to eight travel companions as well as priority boarding, priority check-in and priority screening.

You will also earn:

4 miles for every $1 spent on eligible American purchases.

10 miles for every $1 spent on car rentals and hotels booked through aa.com.

1 Loyalty Point for every $1 spent, which counts towards elite status.

A 10,000 Loyalty Points bonus after you earn 50,000 Loyalty Points in a status qualification year. Plus, another opportunity to earn an extra 10,000 points if you reach 90,000 during the same time frame.

25% off on in-flight food and beverages purchases.

Although the card has a steep annual fee of $595 , as you’ll see below, that is still less than the cost of an annual Admirals Club membership. So, if you plan to visit Admirals Club lounges often, the card's cost along with all its perks, will be your best bet for getting access to the lounges.

Adding another person to your credit card account will cost $175 annually for the first three authorized users and $175 per additional user. It's important to note that authorized users on the credit card only get access to Admirals Clubs; they do not get access to other airline lounges or clubs that American Airlines has a lounge partnership with. Getting into partner lounges is a benefit solely reserved for the primary holder of the Citi® / AAdvantage® Executive World Elite Mastercard® .

» Learn more: Best credit card for Admirals Club access

Admirals Club annual membership rates vary depending on your frequent flyer status with American Airlines:

Non-elite AAdvantage members: $850 (new membership), $800 (renewal).

AAdvantage Gold members: $825 (new), $775 (renewal).

AAdvantage Platinum members: $800 (new), $750 (renewal).

AAdvantage Platinum Pro members: $775 (new), $725 (renewal).

AAdvantage Executive Platinum members: $750 (new), $700 (renewal).

With an annual membership, you can bring your immediate family (including spouse and children) or up to two guests. You can also buy a household membership for $1,550 to $1,650 (depending on your status level), which includes access for you and your spouse or domestic partner even when you’re not flying together.

You can access Admirals Club lounges if you fly first or business class on certain international, transcontinental and domestic routes. Those flying on American Airlines and on Oneworld partner airlines are eligible.

Qualifying international itineraries include flights between the U.S. and Asia, Australia, Canada, the Caribbean, Central and South America, Europe, Mexico, the Middle East and New Zealand. International first class customers can bring one guest, but other business class or first class domestic passengers will not have guest privileges.

Domestic flights with seats ticketed as Flagship for the following routes qualify:

New York-John F. Kennedy to/from San Francisco, Los Angeles or Orange County.

Los Angeles to/from Boston or Miami.

Dallas-Fort Worth to/from Honolulu, Kona or Maui.

Chicago-O’Hare to/from Honolulu.

Passengers on these tickets can also access American Airlines Flagship lounges (more details below).

AAdvantage members with Executive Platinum, Platinum Pro or Platinum status can access Admirals Club lounges when flying internationally on the routes and airlines mentioned above. The member can bring one guest (children above the age of two count as a guest) and the guest must be traveling on a departing or arriving Oneworld ticket.

» Learn more: Guide to American Airlines elite status

If you have Oneworld Emerald or Sapphire status, you can access Admirals Clubs and partner lounges with a qualifying itinerary for same-day travel on a Oneworld carrier. Elite status holders are allowed one guest each.

Alaska MVP Gold 75K and MVP Gold elites automatically received a status match to Oneworld Emerald and Sapphire, respectively, and can access Admirals lounges. Eligible flights include domestic and international routes mentioned above between the U.S. and Asia, Australia, Central America, Europe, Mexico City (MEX), New Zealand and South America.

» Learn more: Oneworld alliance: what you need to know

If you’re traveling in uniform, you can access domestic and international Admirals Club locations (except the JAL Sakura Lounge in Honolulu or the Airspace Lounge in San Diego) if space is available. You will need to present your military ID and a same-day boarding pass for a flight operated by American Airlines. Uniformed military personnel can also bring their immediate family members or up to two guests into the lounge.

» Learn more: 3 ways to score military travel discounts

There are nearly 50 Admirals Clubs and more than 60 partner lounges in domestic and international airports. In addition, American Airlines also has a network of more than 650 Oneworld lounges worldwide. Unfortunately, people with day passes and Citi® / AAdvantage® Executive World Elite Mastercard® authorized users do not get access to the partner lounges.

Atlanta (ATL).

Austin (AUS).

Boston (BOS).

Charlotte (CLT).

Chicago (ORD).

Dallas-Fort Worth (DFW).

Denver (DEN).

Honolulu (HNL).

Houston (IAH).

Los Angeles (LAX).

Miami (MIA).

Nashville (BNA).

New York (JFK and LGA).

Newark (EWR).

Orange County (SNA).

Orlando (MCO).

Philadelphia (PHL).

Phoenix (PHX).

Pittsburgh (PIT).

Raleigh-Durham (RDU).

San Francisco (SFO).

St. Louis (STL).

Tampa (TPA).

Washington D.C. (DCA).

Buenos Aires, Argentina (EZE).

London, England (LHR).

Mexico City, Mexico (MEX).

Paris, France (CDG).

Rio de Janeiro, Brazil (GIG).

Sao Paulo, Brazil (GRU).

Toronto, Canada (YYZ).

In addition to Admirals Clubs, American Airlines has other lounges that passengers can visit if they have the right access.

Arrivals Lounge in London Heathrow

Shower suite in the Arrivals Lounge at London-Heathrow. (Photo courtesy of American Airlines)

If you’re flying into London’s Heathrow Airport, you can freshen up at the Arrivals Lounge when you land. To use that facility, you need to be flying in first or business class or have AAdvantage Executive Platinum, Platinum Pro or ConciergeKey status. Oneworld Emerald status and British Airways Premier status will also get you access.

» Learn more: British Airways First Class Lounge at Heathrow review

American Airlines Flagship lounges

Flagship Lounge at DFW. (Photo courtesy of American Airlines)

American Airlines also has Flagship lounges that offer premium sit-down dining, chef-inspired meals, cocktails, showers and much more. These lounges are located in Chicago (ORD), Dallas-Fort Worth (DFW), Los Angeles (LAX) and Miami (MIA) airports. A Flagship Lounge in Philadelphia will also be opening soon.

The following passengers can visit these lounges:

AAdvantage members with ConciergeKey status.

American Airlines Executive Platinum, Platinum Pro and Platinum elites.

Alaska MVP Gold 75K and MVP Gold elites.

Passengers flying on qualifying first and business class tickets (see qualifying routes here ).

Oneworld Emerald and Sapphire elites.

Single visit pass holders. Passes can be purchased for $150 or 15,000 American Airlines miles at the lounge. If you purchase a day pass, you cannot bring in guests.

» Learn more: How to access American Airlines Flagship lounges

International First Class lounge in London Heathrow

This exclusive lounge is available to those flying international first class or ConciergeKey, Oneworld Emerald, AAdvantage Executive Platinum and AAdvantage Platinum Pro elites (regardless of cabin class). Elites must show proof of a same-day flight operated by American or another Oneworld airline.

Flagship Lounge and British Airways partner lounges at JFK

Through a new partnership with British Airways, American Airlines opened three premium lounges in New York-John F. Kennedy airport that are available to certain passengers flying on American Airlines, British Airways or Oneworld tickets.

The Chelsea Lounge , Soho Lounge and Greenwich Lounge are the names of these new lounges.

Chelsea Lounge at New York-JFK. (Photo courtesy of JT Genter)

The Chelsea Lounge is the most exclusive. Access is granted to those flying in Flagship First or Flagship Business Plus on certain international and transcontinental routes. ConciergeKey members on qualifying routes on American Airlines and British Airways long-haul flights also get access.

Soho Lounge at JFK. (Photo courtesy of American Airlines)

Access to the Soho Lounge has more flexible entrance requirements, allowing the following passengers to visit:

Alaska’s MVP Gold 75K elites and AAdvantage Executive Platinum and Platinum Pro members who are flying on qualifying same-day international or long-haul routes operated by American or any Oneworld airline.

Any passengers flying on a Oneworld first class ticket between the U.S. and certain destinations.

Oneworld Emerald elites flying on any Oneworld flight.

ConciergeKey elites flying in any cabin on a Oneworld airline.

Next up is the Greenwich Lounge, which offers a cocktail bar, chef-inspired meals, showers, premium wine and more. Access is available to the following flyers:

Alaska’s MVP Gold and AAdvantage Platinum elites who are traveling on a certain same-day international flight operated by American or any Oneworld carrier.

Any passengers flying on a Oneworld business class ticket between the U.S. and certain destinations.

Oneworld Sapphire elites flying on any Oneworld flight.

Any passengers flying in business class on a Oneworld long-haul flight.

Lounge access can be the lynchpin between a good flight experience and a great one. There are several ways to access American Airlines Admirals Club lounges, from having the right credit card to earning elite status with the airline. If you want a taste of the comforts, consider purchasing a day pass during your next American flight.

You can access American Airlines lounges in several ways: buying a day pass or an Admirals Lounge Club membership; holding elite status with American Airlines, Cathay Pacific or British Airways; holding Oneworld Emerald or Sapphire status; traveling as a member of the military in uniform; flying on a business or first class ticket; or holding the Citi® / AAdvantage® Executive World Elite Mastercard® .

Yes, a one-day pass to American Airlines lounges can be purchased online or at select club locations for $79 or 7,900 AAdvantage miles.

Yes, passengers flying on American Airlines first class receive access to departure lounges around the world and the arrival lounge when landing at London-Heathrow.

You can access American Airlines lounges in several ways: buying a day pass or an Admirals Lounge Club membership; holding elite status with American Airlines, Cathay Pacific or British Airways; holding Oneworld Emerald or Sapphire status; traveling as a member of the military in uniform; flying on a business or first class ticket; or holding the

Citi® / AAdvantage® Executive World Elite Mastercard®

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Citibank's application

1x Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

70,000 Earn 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 within the first 3 months of account opening.

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

Best credit cards for airport lounge access in April 2024

If you want to enhance your next flight experience, consider our top picks for the best credit cards from our partners with airport lounge access. These clubs are great places to relax and recharge your devices before a flight and typically offer complimentary refreshments and private bathrooms — which can be a great perk when you find yourself on a long layover.

While you can pay for access to many lounges, it’s also a benefit on select credit cards.

In some cases, these cards will get you into airline-specific lounges — like Delta Air Lines’ Sky Clubs or American Airlines’ Admirals Clubs. Others include Plaza Premium access or a Priority Pass Select membership , granting you entry into curated collections of lounges worldwide. And issuers themselves have gotten into the game, with many American Express Centurion lounges, Capital One lounges and Chase Sapphire lounges opening their doors in recent years.

If you’re looking for a more relaxed experience than the hectic environment of an airport terminal, our team of experts has compiled the below list of the best credit cards with airport lounge access to elevate your experience ahead of your next flight.

- Capital One Venture X Rewards Credit Card : Best for premium travel

- The Platinum Card® from American Express : Best for airport lounge access

- Chase Sapphire Reserve® : Best for Priority Pass lounges and restaurants

- Delta SkyMiles® Reserve American Express Card : Best for Delta flyers

- The Business Platinum Card® from American Express : Best for businesses

- Delta SkyMiles® Reserve Business American Express Card : Best for Delta business travelers

Browse by card categories

Comparing the best credit cards, more details on the best credit cards, credit pointers with brian kelly, how to maximize credit cards with lounge access, how we rate cards, what is an airport lounge, how to choose the best airport lounge access credit card, ask our experts, frequently asked questions.

- No Annual Fee

Capital One Venture X Rewards Credit Card

If you can maximize the $300 annual credit towards bookings through Capital One Travel, the Venture X’s annual fee effectively comes down to $95, the same annual fee pegged to the Capital One Venture Rewards Credit Card (see rates and fees ). Add in a 10,000-mile bonus every account anniversary (worth $185, according to TPG valuations ), and the card may become the strongest option out there for a lot of travelers. Read our full review of the Capital One Venture X Rewards Credit Card.

- 75,000 bonus miles when you spend $4,000 on purchases in the first three months from account opening.

- 10,000 bonus miles every account anniversary

- $395 annual fee

- The $300 annual credit only applicable for bookings made through Capital One Travel portal

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

The Platinum Card® from American Express

The Amex Platinum is unmatched when it comes to travel perks and benefits. If lounge access, hotel elite status and annual statement credits are important to you, this card is well worth the high annual fee. Read our full review of the Amex Platinum card .

- The current welcome offer on this card is quite lucrative. TPG values it at $1,600.

- This card comes with a long list of benefits, including access to Centurion Lounges, complimentary elite status with Hilton and Marriott, and at least $500 in assorted annual statement credits and so much more (enrollment required).

- The Amex Platinum comes with access to a premium concierge service that can help you with everything from booking hard-to-get reservations to finding destination guides to help you plan out your next getaway.

- The $695 annual fee is only worth it if you’re taking full advantage of the card’s benefits. Seldom travelers may not get enough value to warrant the cost

- Outside of the current welcome bonus, you’re only earning bonus rewards on specific airfare and hotel purchases, so it’s not a great card for other spending categories

- The annual airline fee credit can be complicated to take advantage of compared to the broader travel credits offered by competing premium cards

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card®. Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card®. Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®. Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card®. An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Chase Sapphire Reserve®

The Chase Sapphire Reserve is one of our top premium travel cards. With a $300 travel credit, generous points on dining and travel purchases and other benefits, you can get excellent value that far exceeds the annual fee on the card. Read our full review of the Chase Sapphire Reserve .

- $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year

- Access to Chase Ultimate Rewards hotel and airline travel partners

- 10x on hotels, car rentals and Chase Dining purchases through the Ultimate Rewards portal, 5x on flights booked through the Ultimate Rewards portal, 3x points on all other travel and dining, 1x on everything else

- 50% more value when you redeem your points for travel directly through Chase Ultimate Reward

- Steep initial $550 annual fee

- May not make sense for people that don't travel frequently

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- Member FDIC

Delta SkyMiles® Reserve American Express Card

The Delta SkyMiles Reserve American Express Card is the premier choice for Delta loyalists who value an accelerated path to elite status, Delta SkyClubs lounge access , an annual companion certificate and strong earning rates on Delta purchases. Read our full review of the Delta SkyMiles Reserve Amex Card .

- Up to $100 statement credit for Global Entry or TSA PreCheck

- Delta SkyClub access when flying Delta (Effective 2/1/25, Reserve Card Members will receive 15 Visits per year to the Delta Sky Club; to earn an unlimited number of Visits each year starting on 2/1/25, the total eligible purchases on the Card must equal $75,000 or more between 1/1/24 and 12/31/24, and each calendar year thereafter.)

- High annual fee of $650

- Lower fee Delta cobranded cards offer superior earning categories

- Earn 60,000 Bonus Miles after you spend $5,000 in purchases on your new Card in your first 6 months of Card Membership.

- Enjoy complimentary access to the Delta Sky Club® and bring up to two guests or immediate family members at a rate of $50 per person per visit when flying Delta. Effective 2/1/25, Reserve Card Members will receive 15 Visits per year to the Delta Sky Club; to earn an unlimited number of Visits each year starting on 2/1/25, the total eligible purchases on the Card must equal $75,000 or more between 1/1/24 and 12/31/24, and each calendar year thereafter.

- Receive four Delta Sky Club® One-Time Guest Passes each year when you fly together on Delta. After that, you may bring up to two guests at a per-visit rate of $50 per person, per location.

- Enjoy complimentary access to The Centurion® Lounge when you book a Delta flight with your Reserve Card.

- Receive $2,500 Medallion® Qualification Dollars each Medallion Qualification Year and get closer to Status with MQD Headstart.

- Earn $1 Medallion® Qualification Dollar for each $10 of purchases made on your Delta SkyMiles® Reserve American Express Card in a calendar year and get a boost toward achieving elevated Medallion Status for next Medallion Year.

- Receive a Companion Certificate on First Class, Delta Comfort+®, or Main Cabin domestic, Caribbean, or Central American roundtrip flights each year after renewal of your Card. The Companion Ticket requires payment of government-imposed taxes and fees of no more than $80 for roundtrip domestic flights and no more than $250 for roundtrip international flights (both for itineraries with up to four flight segments). Baggage charges and other restrictions apply. See terms and conditions for details.

- $240 Resy Credit: With the Delta SkyMiles® Reserve American Express Card Resy Credit, earn up to $20 per month in statement credits on eligible Resy purchases using your enrolled Card.

- $120 Rideshare Credit: You can earn up to $10 back in statement credits each month on U.S. rideshare purchases with select providers after you pay with your Delta SkyMiles® Reserve American Express Card. Enrollment Required.

- Delta SkyMiles® Reserve American Express Card Members get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. Discount not applicable to partner-operated flights or to taxes and fees.

- With your Card receive upgrade priority over other Medallion Members within the same Medallion level and fare class.

- Delta SkyMiles® Reserve American Express Card Members with an eligible ticket will be added to the Complimentary Upgrade list, after Delta SkyMiles Medallion Members.

- Earn 3X Miles on Delta purchases and earn 1X Miles on all other eligible purchases.

- No Foreign Transaction Fees.

- $650 Annual Fee.

- See Rates & Fees

The Business Platinum Card® from American Express

The Business Platinum Card from American Express is a great card for frequent travelers looking to add a touch of luxury to their business trips. While the card does come with a high annual fee, you’re also getting a ton of valuable benefits in return. They include generous annual travel credits, unparalleled lounge access that includes Amex Centurion Lounges and more. Read our full review of the Amex Business Platinum Card .

- Up to $100 credit for Global Entry or TSA PreCheck application fee every four to five years

- Up to $400 annual credit for eligible U.S. Dell purchases (enrollment required)

- Gold status at Marriott and Hilton hotels (enrollment required)

- Access to the Fine Hotels & Resorts program and Hotel Collection

- International Airline Program; and Cruise Privileges Program

- Steep $695 annual fee

- Difficulty meeting $15,000 welcome offer for smaller businesses

- Limited high bonus categories outside of travel

- Welcome Offer: Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of Card Membership.

- 5X Membership Rewards® points on flights and prepaid hotels on AmexTravel.com, and 1X points for each dollar you spend on eligible purchases.

- Earn 1.5X points (that's an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year.

- Unlock over $1,000 in annual statement credits on a curation of business purchases, including select purchases made with Dell Technologies, Indeed, Adobe, and U.S. wireless service providers.

- $200 Airline Fee Credit: Get up to $200 in statement credits per calendar year for incidental fees charged by your one selected, qualifying airline to your Card.

- $189 CLEAR® Plus Credit: Use your card and get up to $189 in statement credits per calendar year on your CLEAR® Plus Membership (subject to auto-renewal) when you use your Business Platinum Card®.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market as of 03/2023.

- $695 Annual Fee.

Delta SkyMiles® Reserve Business American Express Card

If you’re a high-budget business owner and fly Delta often, the Delta SkyMiles Reserve Business American Express Card is an elite airline card with a sleuth of benefits. While the card does come with a high annual fee, the impressive benefits including exclusive Delta SkyClub and Amex Centurion lounge access, airport, free checked bags, priority boarding and a fast track to Delta’s elite Medallion flying status by spending a considerable amount on the card. Read our full review of the Delta SkyMiles Reserve Business Amex Card . Effective 2/1/25, Reserve Card Members will receive 15 Visits per year to the Delta Sky Club; to earn an unlimited number of Visits each year starting on 2/1/25, the total eligible purchases on the Card must equal $75,000 or more between 1/1/24 and 12/31/24, and each calendar year thereafter.

- A companion certificate that can be used for a domestic, Caribbean or South American first-class, Delta Comfort+ or domestic main cabin round-trip flight

- Exclusive lounge access

- Steep $650 annual fee

- Limited reward earning rates outside of Delta purchases

- Welcome Offer: Earn 75,000 Bonus Miles after spending $10,000 in purchases on your new Card in your first 6 months of Card Membership.

- Enter Delta Sky Club® at no cost. Effective 2/1/25, Reserve Card Members will receive 15 Visits per year to the Delta Sky Club; to earn an unlimited number of Visits each year starting on 2/1/25, the total eligible purchases on the Card must equal $75,000 or more between 1/1/24 and 12/31/24, and each calendar year thereafter.

- Earn 3 miles per dollar on eligible Delta purchases.

- Get closer to elevated Status next Medallion® Year with MQD Headstart and MQD Boost: receive $2,500 Medallion Qualification Dollars each Medallion Qualification Year and earn $1 MQD for each $10 on purchases with your Delta SkyMiles® Reserve Business American Express Card.

- With the $240 Resy Credit, earn up to $20 per month in statement credits on eligible Resy purchases using your enrolled Card.

- Earn up to $10 back each month after using your enrolled Delta SkyMiles® Reserve Business American Express Card for U.S. rideshare purchases with select providers.

- Save 15% when booking Award Travel on Delta flights. Not applicable to partner-operated flights or to taxes and fees.

- Not a Medallion Member? Card Members with an eligible ticket will be added to the Complimentary Upgrade list, after Delta SkyMiles Medallion Members.

- As a benefit of Card Membership, you can check your first bag free on Delta flights, saving up to $60 on a round-trip Delta flight per person. For a family of four that’s a potential savings of up to $240 per round-trip flight. When you purchase a Delta flight with your Delta SkyMiles Reserve Business Card, you will receive complimentary access to The Centurion® Lounge or Escape Lounge – The Centurion® Studio Partner.

- Receive Main Cabin 1 Priority Boarding on Delta flights; board early, stow your carry-on bag and settle in sooner.

- Elevate your travel experience with an annual statement credit of up to $250 after using your Delta Reserve Business American Express Card to book prepaid hotels or vacation rentals through Delta Stays on delta.com.

- Pay no foreign transaction fees when you travel overseas.

- Terms and limitations apply.

The Venture X packs a punch as a premium travel card, including extensive lounge access. There are now three Capital One Lounges open, featuring excellent amenities for U.S. travelers. In addition, the $300 annual credit through Capital One Travel — which effectively lowers the $395 annual fee to just $95 a year (see rates and fees ).

Anyone who wants to earn more than 1 mile per dollar on every purchase and travelers who value access to more than 1,300 airport lounges, travel credits and valuable transfer partners. The dedicated Capital One lounges accessible with this card may be all you need to know to decide.

“The Capital One Venture X Rewards Credit Card is the card that rewards me for every purchase I make with 2 miles per dollar spent that I can then use toward my travel goals. I also love how easy it is to earn and redeem my miles either through transferring to partners or erasing travel purchases, big or small” — Ashley Onadele , sponsored content writer

The Platinum Card® from American Express has more extensive airport lounge access and a longer list of benefits and perks that can easily offset the card's hefty $695 annual fee (see rates and fees ).

The Platinum Card is packed with a long list of benefits for anyone who loves traveling and shopping that justifies the annual fee every year. From access to more than 1,400 airport lounges worldwide to multiple elite hotel status, this card makes travel more comfortable, efficient and rewarding.

If you can take full advantage of up to $1,500 in annual statement credits, the Amex Platinum is one of the most compelling rewards cards. This is especially true if you travel enough to make the numerous hotel statuses and extensive worldwide airport lounge benefits useful.

“Whilst this card has a high annual fee, it more than justifies itself for frequent travelers like me. The lounge access options that come with the Platinum are unrivaled by competitors. I put all of my flights — whether bought with cash or points — on this card to earn 5 points per dollar spent and travel protections. I fully utilize the Uber, Saks Fifth Avenue, Hulu/Disney+ and Clear Plus credits (enrollment required for select benefits). And, honestly, pulling a Platinum card out of your wallet to pay for something does feel pretty fancy.” — Matt Moffitt, senior credit cards editor

If you want a slightly lower annual fee, try the Chase Sapphire Reserve® , which has a $550 annual fee but offers a $300 travel credit, Priority Pass lounge access and some of the best travel protections available.

From earning an impressive 10 points per dollar on hotels and car rentals booked through Chase Ultimate Rewards to the wide range of airline and hotel transfer partners, including World of Hyatt, the $300 annual travel credit and worldwide airport lounge access, the Chase Sapphire Reserve has long been one of our favorite premium credit cards.

Anyone with regular travel and dining expenses who wants unmatched flexibility to redeem points through travel partners or generous cash discounts through Chase Travel. This card also offers free entry to airport lounges and sizable discounts at restaurants in airports. The Chase Ultimate Rewards points earned from this card are hugely valuable because they are so easy to use.

“I've had the Sapphire Reserve for years, and it's going to stay in my wallet for the near future. I get $300 off travel every year, great earning rates on travel and dining (3 points per dollar), and varied travel protections that can reimburse me when things go wrong. And by leveraging other cards in the Ultimate Rewards ecosystem, I can maximize the earnings across all of my purchases.” — Nick Ewen, director of content

If you want a mid-tier card with a lower annual fee, the Chase Sapphire Preferred® Card is a good choice for earning Chase Ultimate Rewards points and has an annual fee of $95. You'll get numerous travel protections and access to all the same hotel and airline partners and lounge access benefits as you would with the Sapphire Reserve.

This card rewards anyone who flies Delta. As well as helping earn valuable elite Medallion status in the SkyMiles program, the card offers a generous three SkyMiles per dollar spent with Delta, an annual domestic, Caribbean or South American roundtrip companion certificate and SkyClub and Centurion airport lounge access.

Effective Feb. 1, 2025, Reserve cardmembers will receive 15 visits per year to the Delta Sky Club; to earn an unlimited number of visits each year starting on Feb. 1, 2025, the total eligible purchases on the card must equal $75,000 or more between Jan. 1, 2024, and Dec. 31, 2024, and each calendar year thereafter.

While plenty of travel credit cards provide airport lounge access, if you mainly fly with Delta, you'll want to get into its well-regarded Delta Sky Club lounges. Luckily, one of the primary benefits of this card is complimentary access to Delta Sky Clubs when flying Delta. If your home airport offers a Sky Club, this card could be a no-brainer to add to your wallet.

Delta Medallions spend a lot of time on Delta jets. The Delta Reserve card will help maintain status by offering a boost of 2,500 Medallion Qualification Dollars at the start of the year, plus the card's annual companion ticket is valid on first-class itineraries and can help offset the card's annual fee for multiple years.

If you're eligible for a business card, you might prefer the Delta SkyMiles® Reserve Business American Express Card . It has a lot of similarities to the consumer version, including lounge access, but with the option to put your business expenses on the card and potentially rack up more SkyMiles.

You can mix business with pleasure thanks to the Business Platinum’s long list of travel benefits and statement credits with can more than cover the annual fee. The numerous credits from Dell, Indeed, Adobe and more save money on regular business expenses, while the worldwide lounge access, CLEAR, TSA PreCheck and Global Entry credits save time at the airport, improve productivity and reduce the stress of each trip. Enrollment required for select benefits.

Frequent business travelers who value access to both Priority Pass and American Express Centurion lounges, as well as numerous credits and discounts to reduce their business expenses. Both business travel and personal travel can become more comfortable, convenient and affordable thanks to this card.

The annual perks and credits vastly outweigh the large annual fee. By accessing Priority Pass and Amex Centurion lounges, and maximizing the credits for airline incidentals and Clear Plus, you can get more value out of the card than it costs to keep it. Plus, it earns one of our favorite points currencies — American Express Membership Rewards points — at a rate of 5 points per dollar spent on flights and prepaid hotels booked on AmexTravel.com.

If you want a lower annual fee but higher earning rates, the American Express® Business Gold Card offers similar redemption options as the Business Platinum with an annual fee of $375 (see rates and fees ). The Amex Business Gold Card also earns 4 points per dollar on the two categories you spend the most on each month on the first $150,000 in combined purchase each year (then 1x).

The most premium Delta credit card offered to business owners, this card helps earn elite Medallion status in the SkyMiles program and offers Sky Club and Centurion airport lounge access. For regular Delta travelers, the additional perks of a free checked bag, Zone 1 priority boarding and 20% savings on inflight purchases are all valuable benefits offered by a single credit card.

Business owners who fly Delta regularly and would value Sky Club and Centurion lounge access. Also, those looking to reach elite Medallion status sooner with the help of a credit card that can provide perks like complimentary upgrades, priority airport services and additional baggage allowances.

“The Delta SkyMiles Reserve Business Amex helped me attain airline status without actually having status. As a newbie Delta flyer, I wanted to have a credit card that would make my overall travel experience better. Access to the Delta Sky Club and Centurion lounges when flying Delta are massive perks. The ability to earn triple miles when making Delta purchases, an annual companion pass and a 15% discount when using my SkyMiles to book award travel make the high annual fee on this card worth it.” — Hannah Streck, senior SEO manager

If you want a Delta card with a lower annual fee (see rates and fees ), the Delta SkyMiles® Platinum Business American Express Card offers Delta perks like an annual companion certificate and a faster path to elite status that could be a better fit for regular Delta travelers.

Understand lounge access eligibility

To maximize your airport lounge experience and avoid disappointment, it's worth doing a little homework before setting off on your travels.

Most airport lounges, regardless of whether they are run by the airline or are independent, will require a same-day boarding pass. Some may allow access on arrival at your destination, while most will only permit access if your boarding pass is for onward travel. Airline-run lounges may limit access to those with a boarding pass for a flight operated by or marketed by that airline or a partner airline, such as an airline in the same alliance.

Opening hours of lounges vary, with most opening early in the morning and closing late at night, though some are open 24 hours a day, seven days a week. You can check the opening hours of the lounge you plan to visit on the lounge’s or airline’s website. Access is usually limited to within two or three hours of departure, so don’t arrive first thing in the morning if your flight does not depart until the evening if you are looking for lounge access.

Guest allowances vary from program to program and airline to airline. Many airlines allow you to bring a guest provided they have a boarding pass for the same flight, and children under a certain age may also be permitted when they are on the same flight. It’s worth checking the guest allowances before you reach the airport so there are no nasty surprises at the desk and you’re not stuck waiting in the terminal because one group member can’t access the lounge.

Ensure the airports you visit have eligible lounges

Some airports may not be large enough to have any lounges, so no card issuer or airline could offer lounge access at these airports even if they wanted to. Where only one lounge is available, check it is in the same terminal you are departing from, and that the opening hours align with the time of your visit.

In large airports, you might have access to multiple lounges. Generally, the lounges run by credit card issuers, like American Express , Capital One and Chase , and ones run by airlines will usually be of superior quality to those run by independent lounge operators like Aspire and No1 Lounges.

Don’t forget the card's other perks

While airport lounge access is a hugely valuable benefit for regular travelers, some of the best cards for lounge access also come with many other travel benefits that shouldn’t be overlooked. These can include hotel elite status , offering you early check-in, late checkout, space-available room upgrades, welcome amenities, additional points and even free breakfast.

Other card perks could include travel credits; cash back with popular retailers; purchase protections; reimbursement for TSA PreCheck , Global Entry and Clear Plus ; and 24-hour concierge services.

An airport lounge is a dedicated space within an airport that offers amenities and services to enhance the travel experience for eligible passengers. These lounges are typically operated by airlines, independent companies or credit card companies and provide a more comfortable and exclusive environment than the busy terminal.

Airport lounges often offer comfortable seating, quiet areas, Wi-Fi access, charging stations, workstations, complimentary food and beverages (including some alcoholic drinks), newspapers, magazines, and sometimes even spa facilities, showers and sleep pods.

Types of airport lounges

Many full-service airlines operate their own lounges at hub locations as well as important outstations.

These lounges may be reserved for premium-class passengers and those with elite status; however, some offer access to those with the right credit card or lounge membership.

Related: The best lounges at London Heathrow — and how to get inside

Amex's Centurion lounges are among the most exclusive in the issuer’s Global Lounge Collection .

Centurion lounges outshine most other airport lounges in several ways. For example, American Express Centurion lounges typically offer seasonally inspired food curated by renowned local chefs, signature and sometimes location-specific cocktails, premium spirits, and curated wine lists. Some Centurion lounges even offer spa services, wine tastings and family rooms.

They tend to be significantly better than your average Priority Pass lounge.

More than a dozen U.S. airports have an American Express Centurion lounge.

Capital One’s impressive airport lounges have begun opening in multiple locations across the United States.

In addition to the traditional airport lounge features, Capital One lounges offer a premium dining experience with seasonal menus and regionally sourced ingredients.

Ready-to-eat food stations feature grab-and-go snacks, including salads, fresh fruits, juice shots and rotating warm selections like breakfast sandwiches in the mornings or fresh-from-the-oven cookies in the afternoons.

For those who have the opportunity to take a seat and relax before their flight, other catering highlights include craft cocktails on tap, local beers and regional wines, dining stations (with vegetarian, vegan and gluten-free options) and a full-service coffee and espresso bar from La Colombe.

All Capital One lounge visitors must present a boarding pass for a departing flight. Access is available up to three hours before departing or connecting same-day flights. Guests can't enter with boarding passes for arriving flights that don't have an onward connection.

Related: A complete guide to Capital One’s airport lounges

Chase Sapphire Reserve® cardholders get access to Chase Sapphire lounges, which have broad dining options, including locally inspired dishes by award-winning chefs like James Beard Award finalist Douglass Williams. Beverage options include local draft beers, craft cocktails, curated wine lists, and local coffee with a selection of teas.

Complimentary Wi-Fi, nursing rooms, private bathrooms and space for working or relaxing are also features.

Related: Complete guide to Chase Sapphire airport lounges — and how to get access

Priority Pass is a network of airport lounges, minisuites and even airport restaurants. It boasts 1,400 eligible locations in over 600 cities in almost 150 countries. Although those numbers are impressive, many lounges are located outside the U.S.

So, while the network is large, there's no guarantee you'll have access to a lounge on every trip. However, Priority Pass can help you on many of your trips.

Priority Pass also has a partnership with some airport restaurants, Minute Suites and similar facilities, allowing members to enjoy perks at locations that don't have a traditional lounge or the chance to eat at a restaurant rather than an airport lounge for a change.

Only select cards like the Chase Sapphire Reserve® offer credits at non-lounge locations.

The amount of the Priority Pass restaurant credit varies, but it averages $28 per person. Some restaurants also cap the number of guests. If you have one member and one included guest on your membership, then you can enjoy $56 worth of food and drinks for your table by swiping your Priority Pass card from an eligible credit card.

At bars and restaurants, gratuity is not included, so add a tip for your server where it is customary. Many locations do not allow you to take items to go, so it might not be the best option if you are in a rush.

Priority Pass also has some less conventional airport options. For example, the PGA MSP Lounge at Minneapolis-St. Paul International Airport (MSP) offers free access to a putting green, along with golf lessons and a golf simulator available for a fee. This lounge also offers a $15 credit that can be applied toward food and drinks or to a golf experience.

Related: Everything you need to know about the Priority Pass airport lounge program

What are the benefits of airport lounges?

Complimentary food and beverages.

Airport lounges usually have a wide range of unlimited complimentary food available, which changes throughout the day. The cuisine options will vary from lounge to lounge, though guests may enjoy both light snacks such as fruit, cold cuts, cheese, nuts and crisps, and heartier dishes like salads, hot meals, pasta, curries and desserts.

Water, coffee, tea, juices and soft drinks are usually complimentary. Some lounges provide a wide range of alcoholic beverages, including beers, wine and spirits, at no cost. At the same time, some will charge for alcoholic drinks but may provide a limited selection of basic options at no extra cost.

Quiet spaces to work or relax

Unlimited Wi-Fi will usually be provided at no extra cost, so look around at the lounge’s entrance to see if a password is displayed; otherwise, you may be able to access the network (or the general airport's network) without a password.

Airport lounges feature various places to work or relax, including a business center with desks, phone booths to take a private call and sofas to watch television or entertainment on your own devices. Just remember to use headphones so you don’t disturb other lounge guests.

Charging stations and outlets

If your devices run low before a long-haul flight, do a full lap of the airport lounge when you enter. There will usually be charging points available next to seating areas, as well as in dining or relaxation areas. If you need help finding a place to charge your devices, ask the staff if they can locate any available points.

- 1 Lounge network coverage Look for a credit card that provides access to a wide network of airport lounges that align with your travel habits and destinations.

- 2 Eligibility requirements Understand the eligibility criteria for accessing the lounges with the credit card, which may include flying on a specific airline or alliance, having status in an airline loyalty program, or meeting a minimum spending requirement.

- 3 Guest access Having guest access can be beneficial if you frequently travel with a companion. If the card does not allow guest access, your travel companion may consider getting their own card with lounge access.

Mastercard Airport Experiences

Provided by loungekey.

Turn the airport into a destination

Over 1,400 lounges await

Turn the airport experience from an endurance to an indulgence, with complimentary food, drink and much more.

Locate dining, shopping, and spa offers

From duty-free shops to designer boutiques. From sushi restaurants to spas.

On the go? Download the app to locate lounges and offers.

404 Not found

Banking that makes a statement

Turn heads with our white metal card and enjoy peace of mind with worldwide phone and travel insurance, interest and much more.

£ 15 per month

6 month minimum • Must be aged 18-69 • Ts&Cs apply

Protection for your prized possession

Phone insurance that covers theft, loss, accidental damage, even cracked screens. Learn more about the phone insurance.

For phones worth up to £2,000 (including VAT) and accessories up to £300, like headphones and chargers. With £75 excess. Exclusions apply.

Provided by Assurant

Worldwide family travel insurance

Stress-free travel with insurance that covers cancellation up to £5,000, medical bills up to £10m, lost valuables up to £750, winter sports and more. Worth £143 a year on average.

Multi-trip cover for you, your partner, and family. By "family", Zurich means partners and dependent children up to 19 years old (21 if in full-time education). Your family is covered when they're travelling with you.

Cover anywhere in the world, including the US.

There's a £50 excess for every successful claim.

Learn more about our travel insurance to see the full Zurich terms and conditions , including general and coronavirus exclusions.

Provided by Zurich, powered by Qover

Your money makes you money

Earn an exclusive rate of 4.60% AER (variable) on Instant Access Savings Pots and an Instant Access Cash ISA (instead of 4.10% AER with a regular Monzo account). We’ll pay interest monthly.

See Amex and other accounts, in Monzo

Get a clear view of your finances by adding your other bank accounts and credit cards to Monzo. See your balances and transactions, and move money around with easy bank transfers. Ts&Cs apply.

Earn interest on your money

Discounted airport lounge access.

Get discounted lounge access to over 1,100 airport lounges.

£600 fee-free withdrawals abroad

Unlimited in the UK and EEA, and £600 fee-free per month elsewhere. Afterwards we'll charge a 3% fee per withdrawal.

Advanced roundups

Automatically put aside 2, 5 or 10 times as much spare change every time you spend.

Stay safe with virtual cards

We're all shopping online more, so it's important to be extra careful. Keep your physical card details safe by using virtual cards for online payments.

Protect your physical card

Use your virtual cards’ unique details online instead of the ones on your physical card.

Manage online subscriptions

Avoid updating your payment details everywhere because your physical card got lost or stolen.

Have up to 5 at any time

Personalise your cards by giving them names and picking from a range of colours.

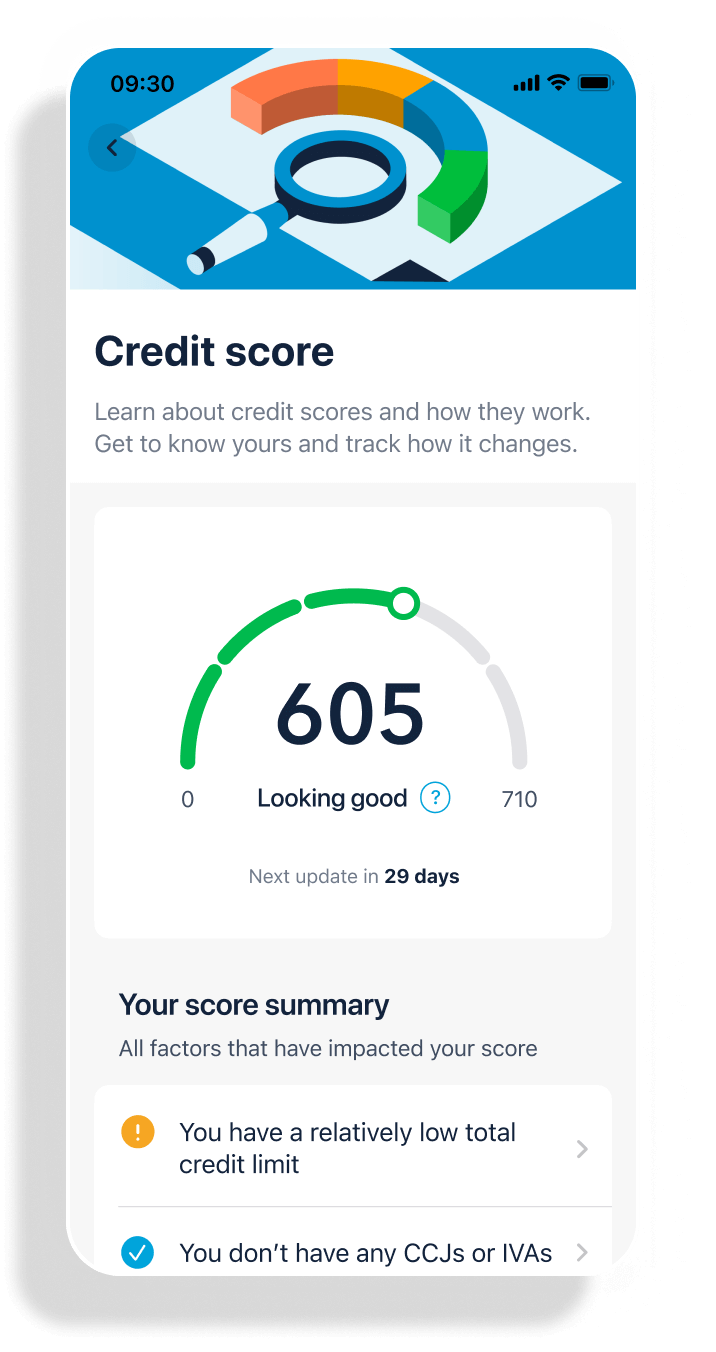

Track your credit health

See your credit score in the app and track how it changes each month.

With helpful guides on how credit scores work and tips on ways you could improve yours.

Provided by TransUnion. Ts&Cs apply

Treat yourself

Laka : 15% off cycle insurance every month for a year for new Laka customers

Patch : 15% off plant and plant pot orders over £50. Available for both new and existing Patch customers.

Naked Wines : Over 50% off 6 bottles of wine when you sign up. Available for new Naked Wines customers only.

Fiit : 25% off a home workout membership. Available for new FiiT customers only.

And more. See them all in the app : These may change over time, go to the app to see the latest offer available. Conditions apply

Packed with the best of Monzo

A UK current account

We're a fully licensed UK bank, which means we're authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority

Protection for your money

Your eligible deposits in Monzo are protected by The Financial Services Compensation Scheme (FSCS) up to a value of £85,000 per person.

A new way to bank

With features like instant spending notifications, simple ways to send money, Pots for separating it and monthly spending summaries.

Friendly support

Got a problem? We're here to help. Just message us in the app.

Loans and overdrafts

We offer loans up to £25,000 and overdrafts up to £2,000. See if you're eligible without impacting your credit score. Our representative APR for loans of more than £10,000 and up to £25,000 is 13.8% APR. For loans up to £10,000 it’s 25.2% APR. For overdrafts, it’s 39% APR/AER representative (variable). Our representative APR is 39.0% APR. You can use the APR to compare the cost of different credit products.

Interest on your savings

Pick an account.

We're making money work for everyone, so we have different accounts for different needs.

With savings, borrowing and overdrafts

Your money is protected by the FSCS

Your eligible deposits are protected by the FSCS up to a value of £85,000 per person

4.10% AER interest (variable)

Across Monzo Instant Access Savings Pots and Cash ISA

Fee-free UK bank transfers

Send money to any UK bank for free