Convert Your Unused Rewards Into Real Money

Trade Miles Effortlessly with the Industry Leader: Cash Out or Top Up for Your Next Journey!

How does it work?

Trusted by over 25,000+ customers

Don't take our word for it. Here's what other people are saying about us...

4.8 out of 5 based on 700+ reviews

Unlock the value of your miles/points

Your miles and points lose on average 15% of their value each year. If you’ve got unused air miles or credit card points, you could be losing out on their worth. Our job is to find the best offer available, so you can maximize the value of your points.

Seamless Mileage Trading: Buy or Convert to Cash

Whether you're buying or selling, we're here to ensure a swift and secure transaction process.

Recent Blog

Buying airline miles: how major airlines are enhancing their programs, why every business owner should leverage points and miles for profit, understanding the fine print: expirations and cancellations of points, frequently asked questions (faqs).

The Miles Market is the best place to buy and sell airline miles, hotel points and credit card rewards

Buy or Sell Airline Miles and Credit Card Reward Points Instantly

Looking to sell your airline miles or credit card points? With Miles Buyer, you can sell your airline miles and credit card points quickly, simply, and safely. Enjoy the experience of selling your airline miles with the Best Online Mileage Broker of 2024 based on customer reviews. Sell your airline miles and get cash for your miles today!

Get a free quote & sell your miles for cash today!

- Your Name *

- Type of miles * Type of miles/points* Air Canada Aeroplan Air France/KLM Flying Blue Alaska Airlines American Airlines American Express Membership Rewards All Nippon Airways British Airways/avios Cathay Pacific Asia miles Capital One Miles Citi Thank You Points Delta Skymiles Etihad Emirates Skywards Hilton Honors Hyatt Jet Blue True Blue Lufthansha Miles and More Marriott Southwest Rapid Rewards SPG- Starwood Preferred Guest Spirit Airlines United Turkish Airlines Qantas Wells Fargo rewards Others

- Quantity * Please enter a value greater than or equal to 50000 .

- Email This field is for validation purposes and should be left unchanged.

1-800-511-0315

How Miles Buyer Works?

01. request a free quote.

Choose the type of mileage program that matches the miles you want to sell and fill out our form to request a free quote or contact us via phone or email. Once you fill out the form mileage brokers will contact you quickly with a quote.

02. We verify your miles

Once you accept the quote for selling your miles, we finalize the process by verifying your points, safely & securely.

03. You get paid

Once we verify your miles, we will immediately make you a secure payment for the agreed quote to your verified PayPal account. You get paid before you transfer your points.

04. Points Transfer

The last step of selling your points is transferring your points to us once you receive the payment, and you enjoy the extra cash in your pocket 100% customer satisfaction guaranteed.

Watch our promotional movie – sell miles and credit card rewards

We value your privacy

Your satisfaction is important to us, we only use secure and safe methods of payments to ensure your privacy and security. Sell your airline miles and points with MilesBuyer for a secure and fast transaction – we will complete your transaction within 15 minutes. Your privacy is our number one priority. We never share your data with 3 rd party applications. All transactions are completed through a secure prepayment via PayPal.

Sell Airline Miles with the Best Online Mileage Broker

Selling airline miles has never been easier! For too long, travelers have been letting their airline points go to waste- with MilesBuyer.com, this is a thing of the past. Here’s how it works: first, use one of our online channels to submit information on the points you’d like to sell. You’ll receive an offer within minutes, and you’ll get paid via PayPal as soon as you accept. Finally, one of our mileage brokers will walk you through the process of transferring your points. Simple! Contact our mileage brokers and get cash for miles today!

Southwest Rapid Rewards

Buy Airline Miles

Buying airline miles can help you get started on your next adventure. Learn more

About Miles Buyer

MilesBuyer.com is the internet’s number one most reputable site for buying and selling airline miles. We offer you the opportunity to sell airline miles that you don’t use- miles that the airline companies want you to let go to waste. We’re also the number one source for buying American Airline miles, as well as nearly every other major airline. Whether you need cash in your pocket or miles to book that last-minute Parisian getaway, MilesBuyer.com is your one-stop-shop for taking advantage of your airline miles.

Did you know that airline miles can be bought and sold? That’s right – if you have extra airline miles that you acquired on your credit cards, you can sell us your airline miles right now, and we will buy your airline miles in return for money. Use your frequent flier miles to get some extra cash. We offer money for airline miles at very good rates. Additionally, we will sell your extra airline miles, this way you can get cheaper flights, and upgrade to first class or business class tickets for lower than standard fare. Buying airline miles is an easy way to upgrade to a much better ticket. We buy and sell miles from: Delta , United , American Airlines, British Airways , Avios , Lufthansa , KrisFlyer Singapore Airlines, Emirates Skywards , and any other major airline!

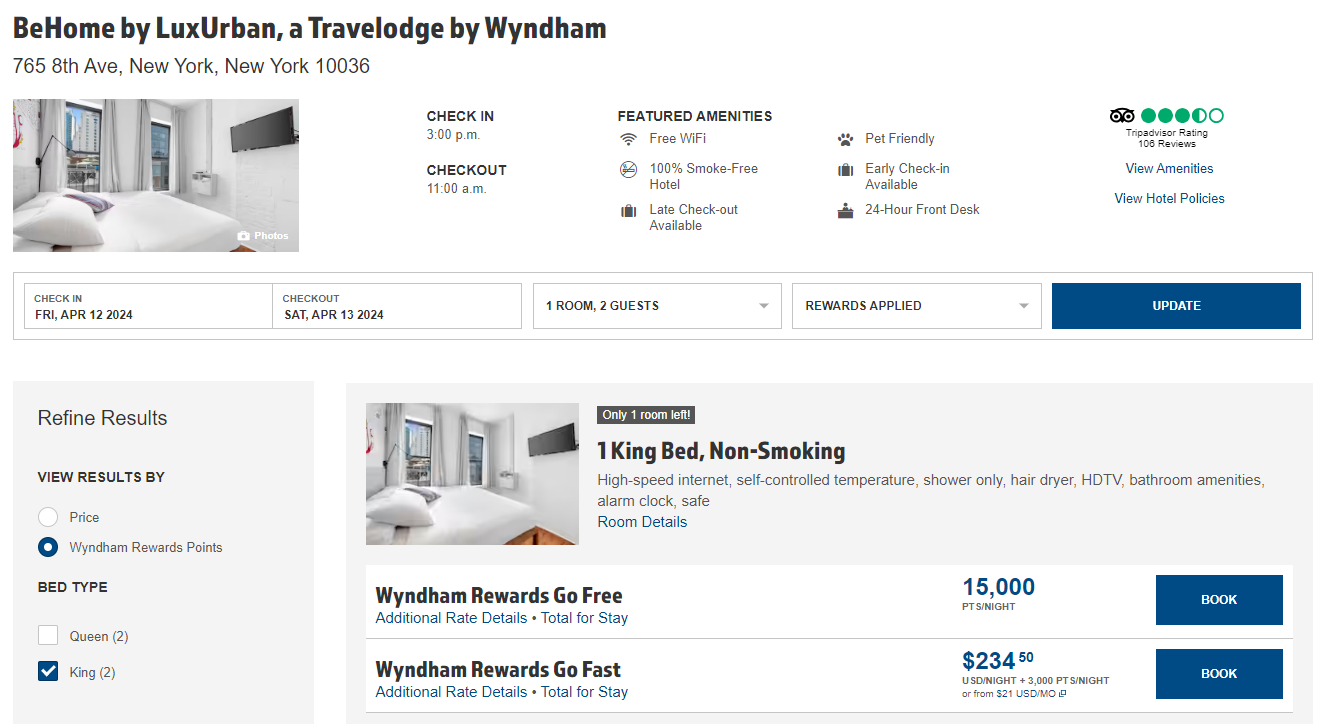

Have you accrued many credit card reward points? Don’t know what to do with them? No problem. We will buy your credit card points at very good rates – instead of letting your points go to waste, we will give you money in return. Also, if you are looking to buy, we will sell you credit card reward points . Get in touch with us to find out our competitive rates, and we’ll make it happen today! We offer deals for all major credit card companies, and will buy and sell Amex points , American Express, Chase Ultimate Rewards , Citi Thank You points , , DVC points , Wyndham points , IHG , and much more! Fill out a contact form to get a quote immediately from our mileage brokers, and we will get you the best deal available.

We work with

Business Owners

Small business owners have a unique advantage of accruing miles just through day-to-day business operations. By buying materials, inventory, or other services necessary to running a business, you unknowingly gather hundreds of thousands of miles. Make the most of these miles by reselling them or becoming a Miles Buyer partner, which will guarantee partial reimbursement for your business expenses.

Business Travelers

If you love to explore the world or you visit family and friends far from home often, you rack up miles quickly that may often go to waste. Luckily, with Miles Buyer, frequent flyers who travel regularly can sell these accrued points to get extra cash. There’s nothing better than enjoying a trip while knowing you’ll get some of your money back, perhaps to use toward the next adventure.

Frequent Flyers

Making sales or attending meetings on the road doesn’t have to just be work. It can also be an easy way for you score some extra income without putting in overtime. Work with Miles Buyer and cash in on your business travel by selling your miles, turning your flights into a little extra money.

Trusted by tens of thousands of people

Selling chase ultimate reward points – wilson.

"Made selling my chase ultimate reward point super easy. Best thing was that they paid me first. Thanks miles buyer!"

Selling Miles with Miles Buyer – Peng

"This is the third time I had business with Mile Buyer and they responded to my email and processed my request very fast. The customer service is very friendly and the service is always prompt. I have no problem with the payment method and I was glad with the rate they have paid for me. I will continue my business relationship with them and would like to recommend Mile Buyer to my friends!"

Testimonial 04

"I was very happy with the services provided by milesbuyer.com. I had large accounts with Air Canada and Lufthansa that were just sitting idle for years. Eli from Milesbuyer.com made the transaction go as smooth as could be."

Testimonial 03

"I spoke to several companies before deciding to go with MilesBuyer.com as they were the most responsive by far. It almost felt like a computer answered me back but it was a real human being!"

Testimonial 02

"Milesbuyer.com purchases all of my American Express points on a monthly basis. Every month, my business spends approximately $500k on inventory and supplies, so it's quite nice to get that extra cash."

Testimonial 01

"MilesBuyer has been great to work with. I needed to move quickly to free up some cash and the transaction went incredibly smooth."

Be notified about interesting updates

We will not spam you, we promise.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

The Points King

Can I trade my airline miles?

It is possible to trade airline miles for various other services and rewards, such as hotel bookings, car rentals, and gift cards.

While airlines forbid the barter or trade of airline miles, there are still plenty of opportunities to trade your miles and points. First of all, it is NOT illegal to sell airline miles in the United States, it is considered a violation of the loyalty program’s terms and conditions.

If you don’t want to sell miles for cash , you can trade them for hotel stays, car rentals, and more!

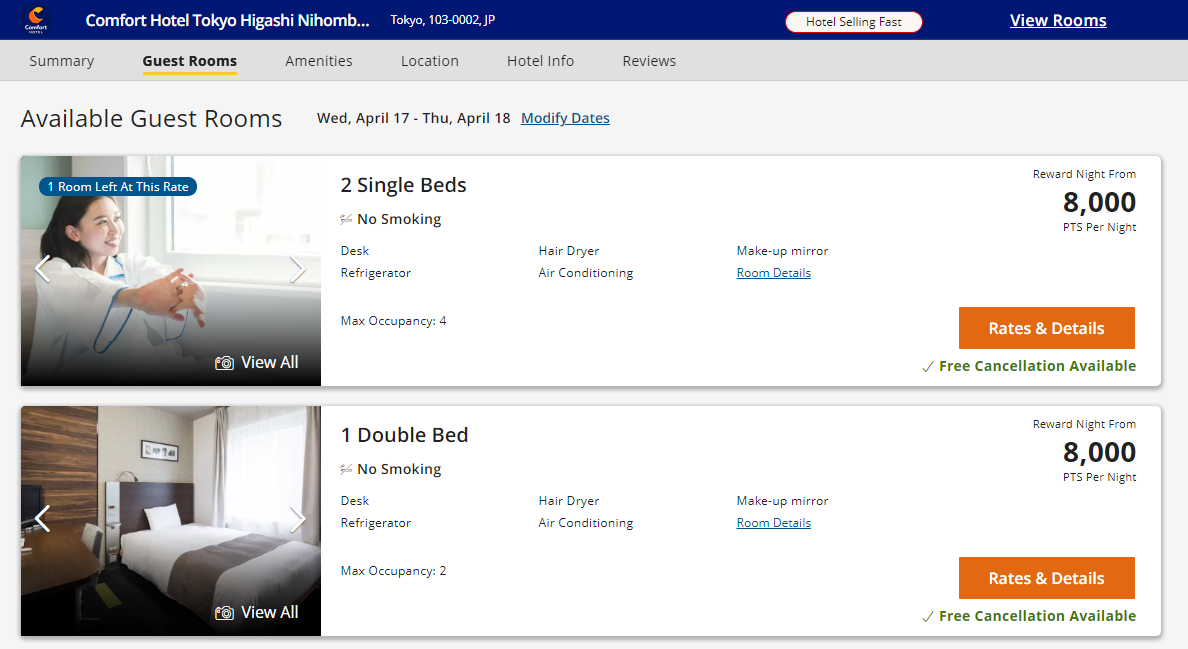

Can I trade airline miles for hotel bookings?

Of course, you can use airline miles for hotel bookings at participating partner hotels. Airline miles programs encourage customers to redeem their points for hotel bookings.

The airlines allow you to transfer the airline miles to hotel rewards programs through which you can book stays at their participating partner hotels.

Chase Sapphire, for example, lets you transfer loyalty points directly to a partner hotel’s rewards program and you can book from there.

Can I trade airline miles for gift cards?

Yes, there are certain websites such as points.com that allow people to trade their airline and hotel miles for gift cards. Exchanging points for gift cards is a good idea if you know you want to buy specific merchandise and you have unused points or the points are close to their expiration date.

Some airline miles programs like United’s Mileage Plus allow customers to redeem points for gift cards. For as little as 670 miles, you can claim a $25 gift card. There are over 100 retailers to choose from.

Can I trade airline miles for someone else?

Most frequent flyer programs allow users to transfer Airmiles points between accounts. However, the trading is limited. United, for example, only allows users to transfer a maximum of 15k points per year. As well, they charge a fee of 1.5 cents per mile plus a total service fee of $30+.

Can I trade airline miles for Robux?

Robux is a currency in the game called Roblox. Many people are trying to trade airline miles for Robux because they just don’t find the airline miles useful right now. With Robux, you can buy things in the game but also merchandise like hats and shirts.

Unfortunately, you can’t trade airline miles for Robux as of right now.

Can I trade airline miles for Smartpoints?

Smartpoints are a great way to book flights and hotel stays. You can use the Smartpoints to redeem flights on airlines such as Air Asia and stay at participating Tune Hotels.

However, you can’t turn your airline miles from other programs into Smartpoints. You must collect smartpoints from their official credit cards.

Can I trade airline miles for car rental?

If you’re an American Express Rewards member you can trade your airline miles for a car rental through the Pay with Points service. But don’t worry other loyalty programs let you trade miles for free car rentals too.

American Airlines partners with the major car rental companies and you need around 1000 AAdvantage points to redeem one car rental.

Delta, Hawaiian, Southwest, United, and other airlines offer this type of transfer. You can redeem points for car rentals across the United States.

The good news is that you can also use your cash back credit card miles and book car rentals. Simply use the cashback as the payment for your rental.

Can I trade airline miles for a charity donation?

If you’re feeling generous and want to help charities, the good news is that you can trade airline miles for charitable donations. The majority of airlines let you donate your miles and points to their partner charities such as the American Red Cross, Make-a-Wish, and more.

You can usually make the transfer from your frequent flyer account where you’ll see a list of partner charities and nonprofits.

Are you stockpiling lots of miles and points? If you have over 500k points, please contact us.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This website uses cookies to provide you with the best browsing experience.

Find out more or adjust your settings .

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

- Explore All Brands Opens a new window

- Our Credit Cards

About Marriott Bonvoy

- Marriott Bonvoy Overview

- Member Benefits

- How to Earn Points

- How to Use Points/Certificates

- Marriott Bonvoy Credit Card

- Marriott Bonvoy Moments Opens a new window

- Marriott Bonvoy Insiders Opens a new window

Join Marriott Bonvoy

- Enjoy our lowest rates, all the time

- Free in-room Wi-Fi

- Mobile check-in and more

Meetings & Events

- Meetings & Events Overview

- Business Meetings

- Social Events

- Group Travel

- Marriott Bonvoy Business® American Express® Card

Book a Meeting or Event

Innovative spaces. Inspired experiences. Personalized services.

Please select your preferred language

The americas, asia and oceania.

- Bahasa Indonesia

INTERNATIONAL

Marriott Bonvoy™ Credit Cards

Transfer Points to Miles

Transfer your Marriott Bonvoy® points to one of our partner programs.

Watch Your Points Take Off

Transfer your points to your frequent-flyer program*, and as a bonus, we’ll add 5,000** miles for every 60,000 points you transfer to frequent flyer miles. And if you’re a United MileagePlus® member, you’ll get 10,000 bonus miles for every 60,000 points you transfer.

Transfer points to miles*** at 3-to-1 ratio with most programs.

39 airlines participate

Transfer 3,000–240,000 points/day

*For most airline partners, your member name on the frequent flyer program account must match your Marriott Bonvoy™ first and last name.

**The offer does not apply to American Airlines AAdvantage, Avianca LifeMiles and Delta SkyMiles.

***Applies to miles, points, kilometers, and Avios earned through participating airline frequent-flyer programs unless otherwise indicated. Terms & Conditions.

10,000 Bonus Miles Await

You’ll get 10,000 bonus miles for every 60,000 points you transfer to United MileagePlus® award miles. That’s just one of the many benefits of the preferred partnership between Marriott Bonvoy and United MileagePlus.

Transfer Points on the Fly with More Airlines

** The offer of 5,000 bonus miles does not apply to these airlines.

Transfer Points to Miles Terms & Conditions

Contact Member Support

Need More Points?

You may purchase up to 100,000 points per calendar year for yourself or another member.

You may purchase up to 100,000 points per calendar.

- Edition Opens a new window

- The Ritz-Carlton Opens a new window

- The Luxury Collection Opens a new window

- W Hotels Opens a new window

- JW Marriott Opens a new window

- Marriott Hotels Resorts & Suites Opens a new window

- Sheraton Opens a new window

- MVC Opens a new window

- Delta Hotels Opens a new window

- Westin Opens a new window

- Le Meridien Opens a new window

- Renaissance Hotels Opens a new window

- Autograph Collection Opens a new window

- Tribute Portfolio Opens a new window

- Design Hotels Opens a new window

- Gaylord Hotels Opens a new window

- Max Opens a new window

- Courtyard Hotels Opens a new window

- Four Points Opens a new window

- Springhill Suites Opens a new window

- Fairfield Inn Opens a new window

- AC Hotels Opens a new window

- Aloft Opens a new window

- Moxy Opens a new window

- Protea Opens a new window

- City Express Opens a new window

- Four Points Express Opens a new window

LONGER STAYS

- Residence Inn Opens a new window

- TownePlace Suites Opens a new window

- Element Opens a new window

- HVMI Opens a new window

- Apartments by Mariott Bonvoy Opens a new window

- Marriott Executive Apartments Opens a new window

Marriott Bonvoy

- Earn Points

- Redeem Points

- Marriott Insiders Opens a new window

Deals & Packages

- Hotel & Flight Packages Opens a new window

- Cars, Tours, Activities Opens a new window

- All-Inclusive Resorts & Vacations Opens a new window

- Marriott Vacation Club Offers Opens a new window

- Travel Experiences

- The Ritz-Carlton Yacht Collection Opens a new window

- Marriott Bonvoy Traveler Opens a new window

Top Destinations

Our company.

© 1996 – 2024 Marriott International, Inc. All rights reserved. Marriott Proprietary Information

Points & Miles 101: A Beginner’s Guide to the Process

These days, there are a million and one ways to make budget travel a reality. From embracing the sharing economy to working overseas or volunteering abroad to hunting down cheap flights , traveling has never been easier or more affordable. Even with the pandemic-related price increases, travel is still relatively cheap and there are lots of deals out there to be found.

But the most incredible way to lower your costs even further? Points and miles .

It’s something I’ve been doing for years, which has enabled me to earn more free flights and free hotel stays than I can count. And if you’re not doing it, you’re leaving a lot of money on the table and paying way more for travel than you should be!

What are points and miles?

Collecting points and miles involves signing up for travel credit cards and collecting credit card points, hotel points, and/or airline miles you can cash in for free flights, flight upgrades, hotel stays, transportation, and much, much more.

While there are a ton of advanced tips and tricks to out there (and we go over a lot of them in my guide on the subject), many people don’t even know where to start. The process seems daunting because of all the programs and credit cards out there. Which card do you get? How do you know you’re maximizing your points? And just how do you redeem them for rewards?

It’s a lot to wrap your head around.

But it’s a lot easier than it seems. By just tweaking how you pay for groceries, gas, and dining out, you’ll be able to start earning points and miles toward free travel today .

In this points and miles 101 guide, I’ll explain the basics, so you can stop leaving money on the table and start making your travel dreams a reality.

Here is how you get started:

Step 1: Figure out your goal(s)

The first thing you want to do when it comes to points and miles is to figure out your goal(s). What are you looking to achieve?

Are you saving for a big family trip? Do you just want the odd free economy flight or hotel here and there? Or are you more interested in a huge first-class upgrade? Or are you an avid flyer who wants perks, like lounge access and free upgrades?

There’s no wrong answer, so spend some time pondering this. If you just go into points and miles without direction, you’re going to get lost.

You’ll need to do this because it will help you pick the cards and spending strategies that will get you closer to your goal(s). There are hundreds of travel credit cards to choose from, and they all have their own pros and cons.

For example, if you’re a loyal flier with American Airlines, the best cards to start off with would be those that are AA branded. That way, you can jump-start your point balance as well as get the perks that those cards come with (free checked bags, priority boarding, etc.).

If you’re looking to go to Europe on a United partner, you’ll want to apply for the cards that get you United or Star Alliance points.

Always like staying at a specific hotel chain? Get that particular brand’s card.

If you just want points to spend wherever you choose, get a Chase, Citi, Capital One, or American Express® Card, because you can use their points with a variety of travel companies.

Once you decide your goal(s), you can figure out the cards and programs that will get you there.

Step 2: Get a travel credit card

Once you know your goals to and what perks are important to you, you can start to browse for a credit card.

Note: Collecting points and miles is impossible without a credit card. You just cannot get enough points otherwise. Here’s everything you need to know about credit cards and why they aren’t as evil as society makes them out to be.

While many introductory cards are free, the best travel credit cards usually have an annual fee. You want to make sure you’re always getting more value out of the card than the annual fee. This isn’t hard to do if you’re a traveler, especially if you start with a low fee card. You can also often get the fee waived in subsequent years if you call and threaten to cancel the card. I do that often to avoid the fee.

Some things to remember before you apply for a card:

- There is no perfect card — each has its pros and cons based on your goals. Don’t listen to blogs touting some card as “the best.”

- Aim to get a card with a low annual fee and no foreign transaction fees (so you can use it abroad without paying extra).

- Make sure the welcome bonus is attainable (more on that below).

Remember that you need to pay off your monthly balances to make it worthwhile, so only apply for a card if you’re able to pay off your expenses each month.

Here’s what the ideal card should have:

- A huge welcome bonus – The best travel cards all offer a sizable introductory bonus. It will be these welcome points that jump-start your account and get you closer to a free flight or hotel stay. Typical travel credit card welcome bonuses range between 40,000 to 60,000 points, though sometimes they can be as high as 100,000. That’s why cards are so great: you get an instant balance of tens of thousands of points for very little work.

- A low spending minimum – Unfortunately, in order to get the great welcome bonuses these cards offer, there is usually a required spending minimum in the first few months. I typically sign up for cards with a minimum spending requirement of $3,000 USD in a three- to six-month period. While there are ways to temporarily boost your spending, it’s best to get the bonus using normal day-to-day spending. Only apply for a card or cards that you can meet the minimum spend(s) on to qualify for the welcome bonus(es). (More on minimum spending requirements in the next step.)

- An added category spending bonus – Most credit cards offer one point for every dollar spent. However, good credit cards will give you extra points when you shop at specific retailers, use their online portals, or, if it is a branded credit card, shop with a particular brand. This will help you earn points much more quickly.

- Special travel perks – All of these travel credit cards offer great perks. Many will give you a special elite loyalty status or other perks. Collecting points and miles is not just about just getting points and miles, it’s about what else comes with the card that makes your life easier!

- No foreign transaction fees – Credit cards are great to use overseas because you get the best possible exchange rate from them. But if you are paying a fee every time you use the card, then it’s less good. Nowadays there are so many cards offering no foreign transaction fees that you should never, ever, ever have to get one with a foreign transaction fee.

Step 3: Earn the welcome bonus

As mentioned, the most important part about signing up for a new credit card is to make sure you earn the welcome bonus. Most cards offer this bonus if you spend a set amount within the first few months of receiving a card (usually the first three months). These offers can be huge, often equal to the cost of a round-trip flight.

Obviously, it would be silly to pass up the chance at a free flight, so make sure you can meet the minimum spending requirement for the welcome bonus before you pick a card. If you can’t meet the spending requirement, there’s no point in signing up just yet.

That might mean waiting until your next big purchase (e.g., waiting until you need a new computer, a new couch, etc.) or waiting until a big holiday like Christmas or a loved one’s birthday, so you can earn more points than your normal spending.

If even that isn’t going to do the trick, you’ll need to get creative.

For example, when you go out for dinner, pay for the bill on your credit card and have everyone pay you back. That way, the cost will go toward your minimum spending requirement. Additionally, if any friends or family are planning big purchases, ask them if you can put them on your card so you can get the points. That’s another easy way to meet the minimum spend without having to shop til you drop.

Step 4: Maximize your category spending

Most travel credit cards offer category bonuses. That means that instead of getting just 1 point per every dollar spent, you might get 2 or 3 or even 10 when you shop in particular categories. Restaurants, supermarkets, and gas are three of the most common ones, but there are lots more too.

To maximize your points, always use the right card for each purchase.

If you just have one card to start, just put everything on that card to maximize your points. Once you start branching out and have a few cards, just keep track of the main category bonuses so you don’t miss out by using the wrong card. Earning double, triple, or even 10x the points can drastically speed up your earnings, so don’t skip out on the category bonuses!

Step 5: Redeem your points and miles

It’s time to cash those points in and make your travel dreams a reality! Depending on your spending and financial situation, maybe you’ve been able to save up enough in just a few months. Maybe it’s taken you a couple years. Either way, it’s time to reap the rewards! (If you want to learn more on how to do that, get this guide I wrote .)

FREQUENTLY ASKED QUESTIONS

Now that we’ve laid out the steps, I wanted to answer some common questions I get about collecting points and miles.

Can non-Americans collect points and miles? Yep! While the US definitely has the best travel cards, many other countries have similar cards too, including Canada, the UK, Australia, and most of Europe.

Start by checking with your local airline to see if it has a branded credit card. You can also check in with your bank and ask what cards are available. Every country is different, so you’ll need to ask around to get the ball rolling.

Here are some posts to help you get started:

- How to Collect Points & Miles in Canada

- How to Collect Points & Miles in Australia & New Zealand

- How to Collect Points & Miles in the UK

Do I need to pay off my bill every month if I want to do this? Yes. Credit cards charge huge interest fees, which will eat up whatever small benefit you get from the points.

Can you collect miles even if you have bad credit? Yep! You’ll likely need to start slow, with a card that doesn’t have amazing perks. However, over time, you can build your credit up as long as you’re paying off your bill every month. If you have bad credit, start with a prepaid or secured credit card to build back your credit.

Does opening a new card hurt my credit rating? Opening or closing a lot of credit cards at once can hurt your credit. However, applying for a few credit cards over a period of time won’t ruin your score. Sure, it will slightly dip every time there is an inquiry, whether for a credit card or home loan or car loan — that’s how the system is set up. But so long as you space out your applications and pay off your bills each month, you won’t find any long-term damage to your credit. I have dozens of cards and apply for and cancel them regularly, and my credit score is excellent.

Collecting points and miles can be intimidating, but it’s really just the art of being smart with your spending on the right one or two credit cards. You don’t really need to do more than that. While you can also dive much deeper in the game (some people really go down the rabbit hole on this!), it’s not all that necessary.

Don’t leave money on the table. Get a card, earn the welcome offer, maximize your points — and then do it all over again! Eventually — with no unnecessary spending — you’ll reach your goal and get to enjoy some awesome travel perks!

Book Your Trip: Logistical Tips and Tricks

Book Your Flight Find a cheap flight by using Skyscanner . It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation You can book your hostel with Hostelworld . If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

- SafetyWing (best for everyone)

- InsureMyTrip (for those 70 and over)

- Medjet (for additional evacuation coverage)

Want to Travel for Free? Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip? Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Got a comment on this article? Join the conversation on Facebook , Instagram , or Twitter and share your thoughts!

Disclosure: Please note that some of the links above may be affiliate links, and at no additional cost to you, I may earn a commission if you make a purchase. I only recommend products and companies I use. Opinions, reviews, analyses & recommendations are mine alone and have not been reviewed, endorsed, or approved by any of these entities. This page does not include all card companies or all available card offers.

Related Posts

GET YOUR FREE TRAVEL STARTER KIT

Enter your email and get planning cheatsheets including a step by step checklist, packing list, tips cheat sheet, and more so you can plan like a pro!

THE PO INTS TRADER

most trusted source to buy airline miles at a discount, frequently asked questions.

1. Why should I buy freque nt flyer miles from The Points Trader?

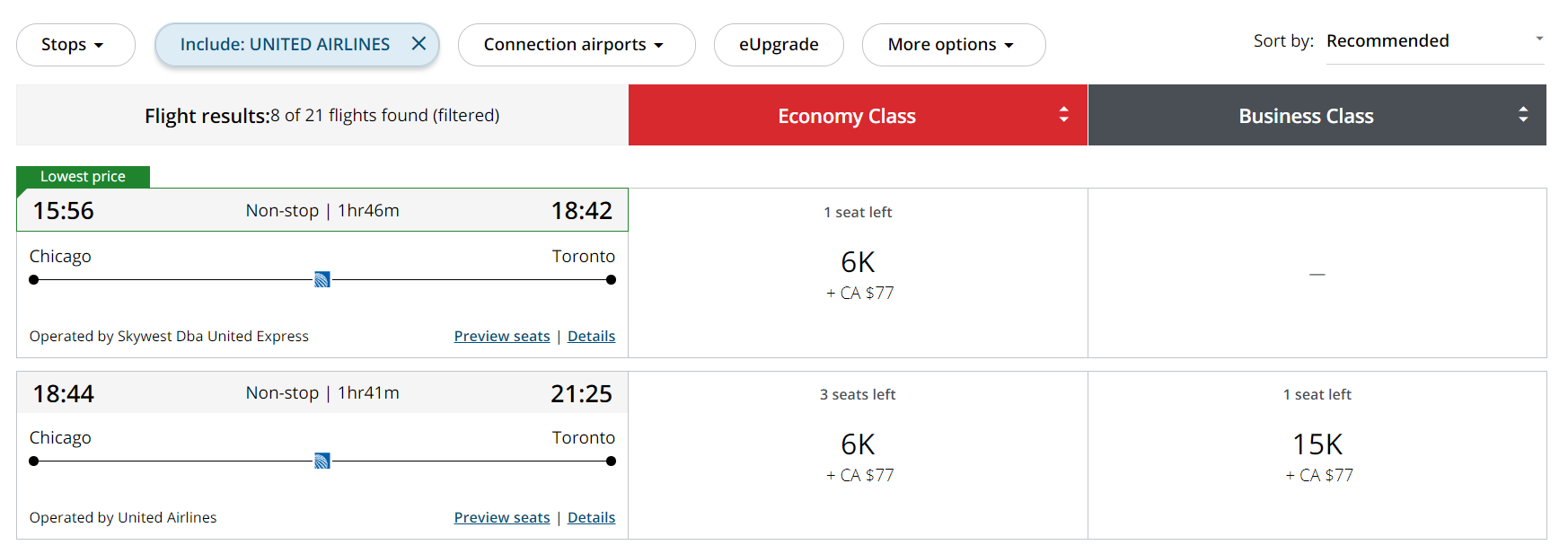

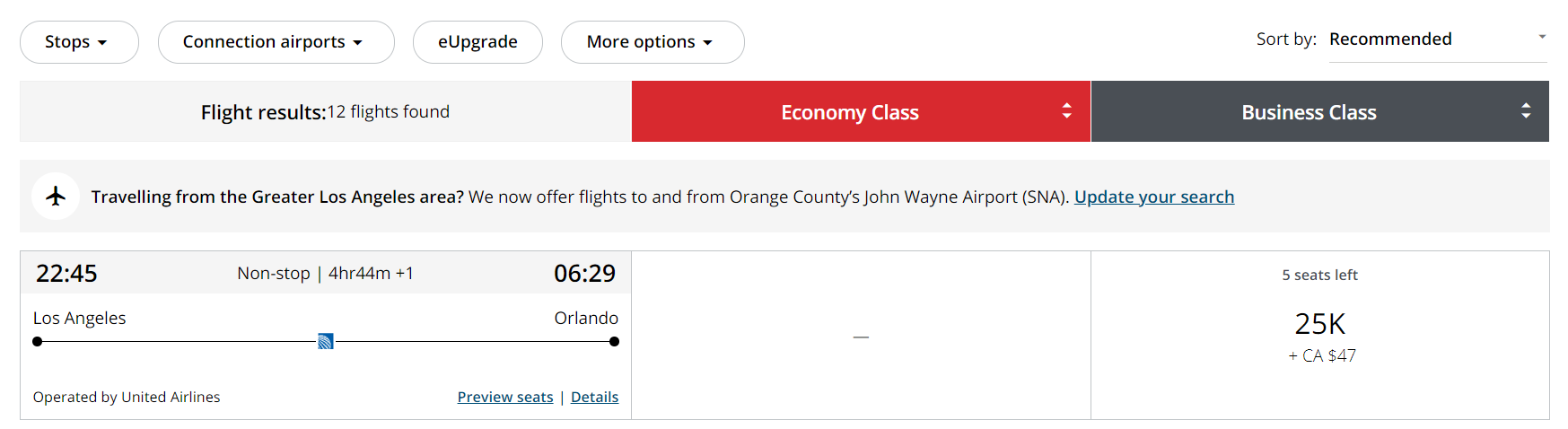

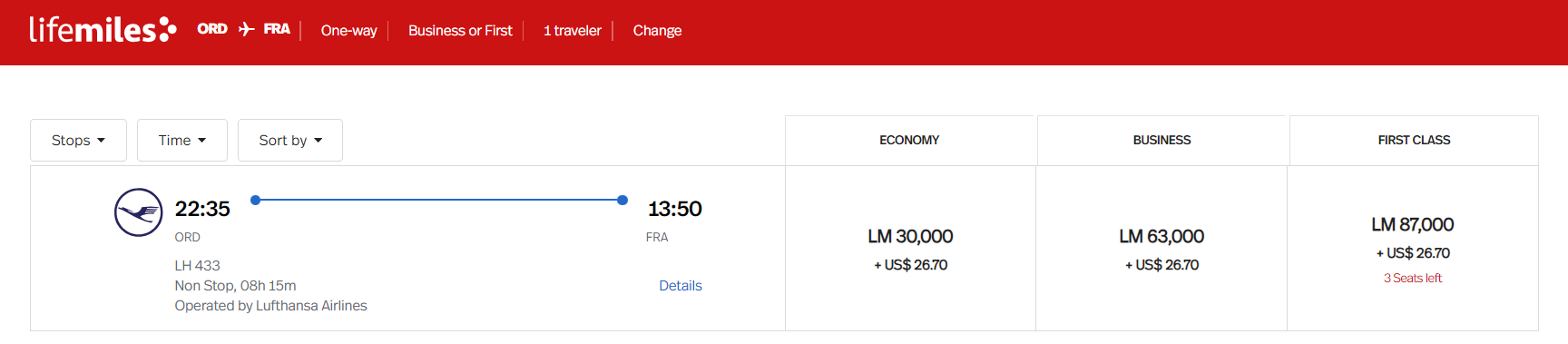

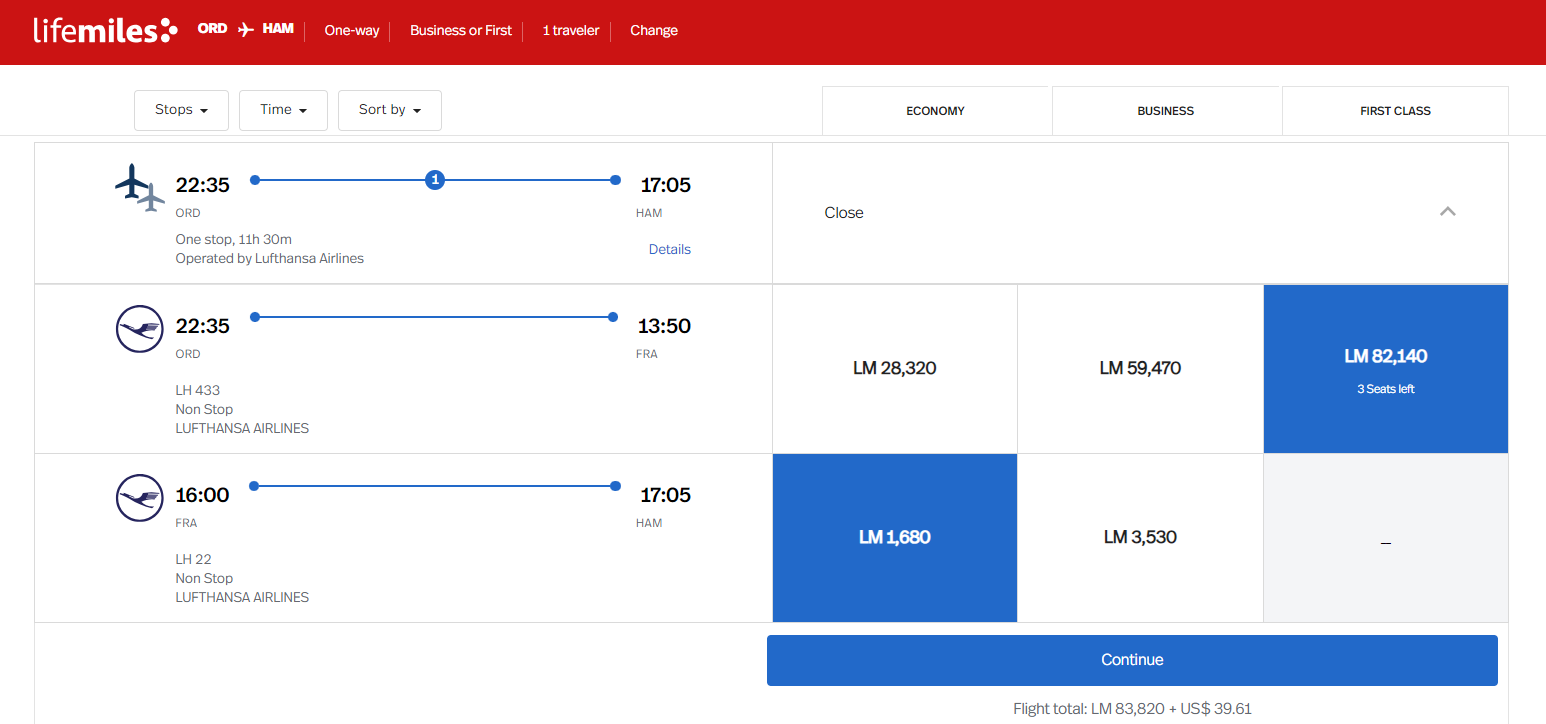

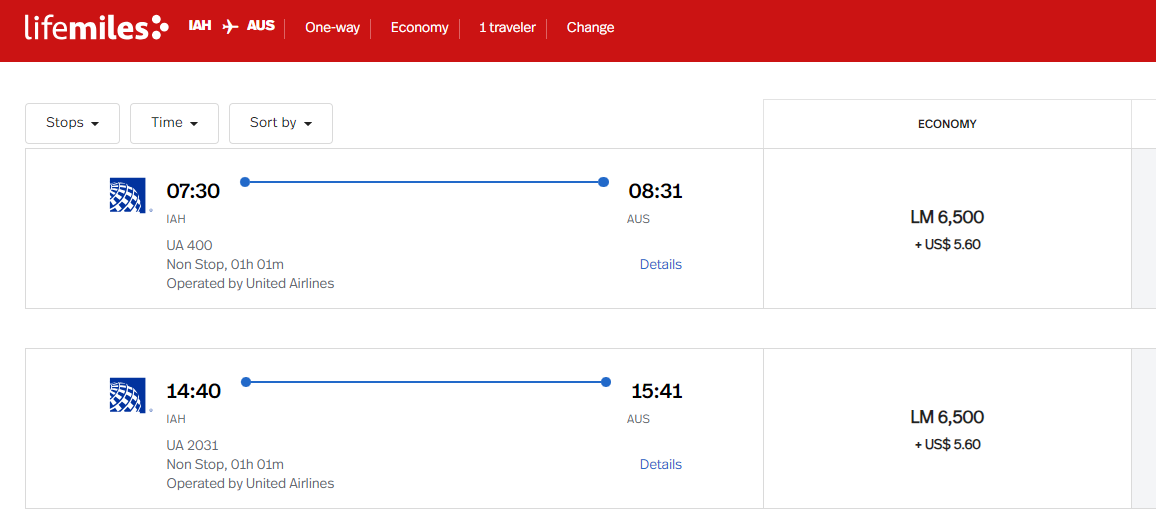

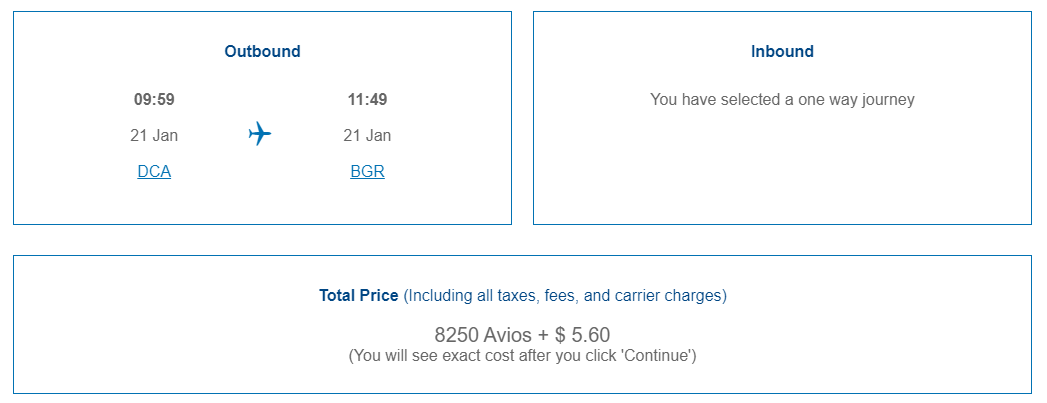

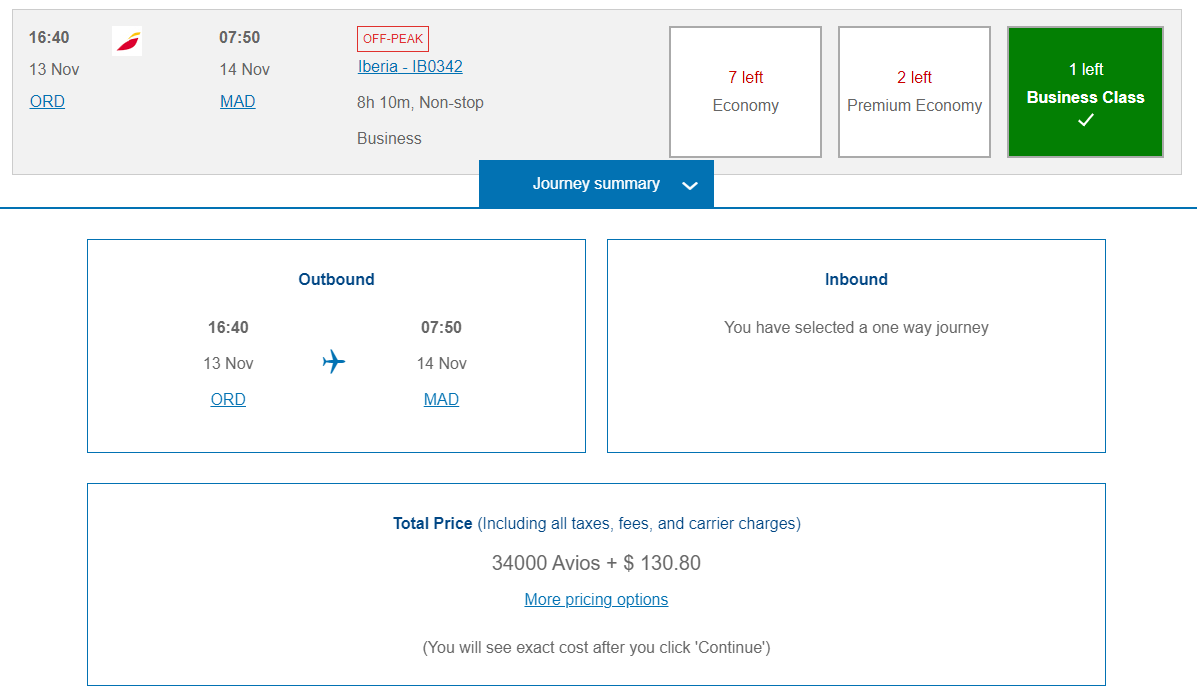

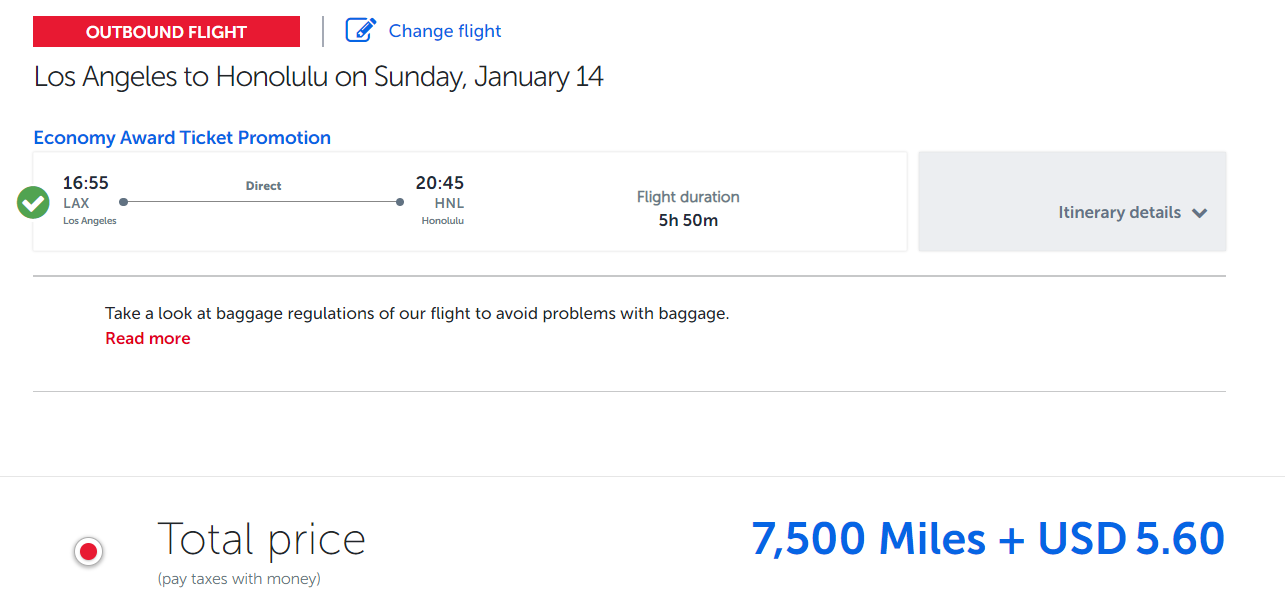

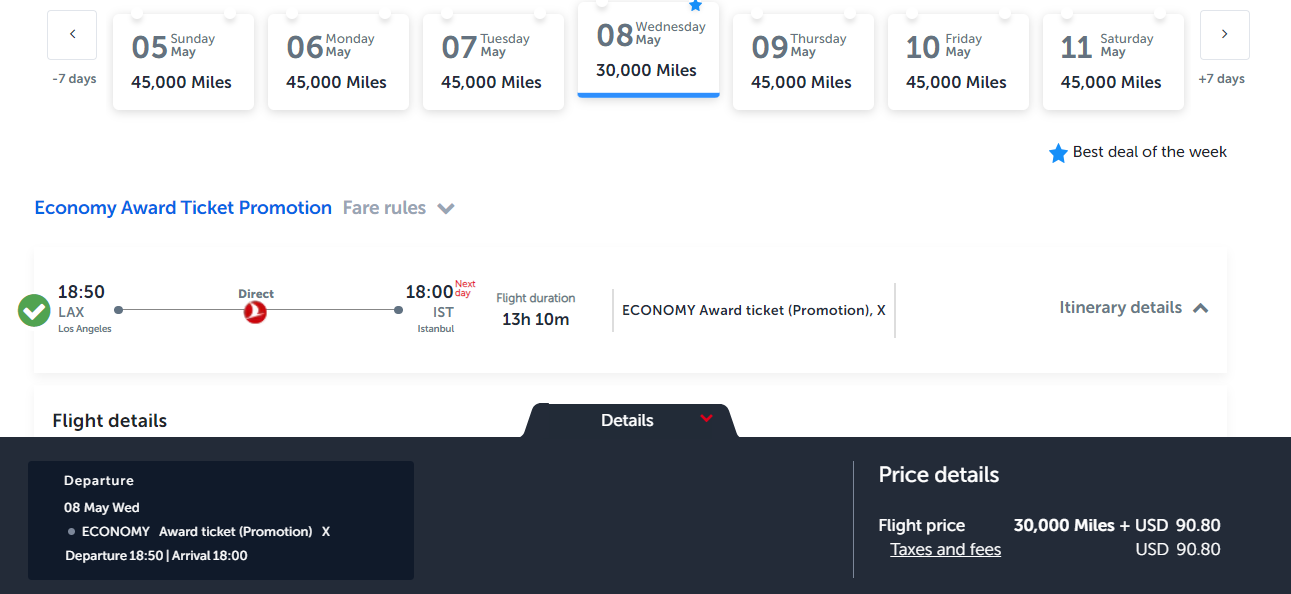

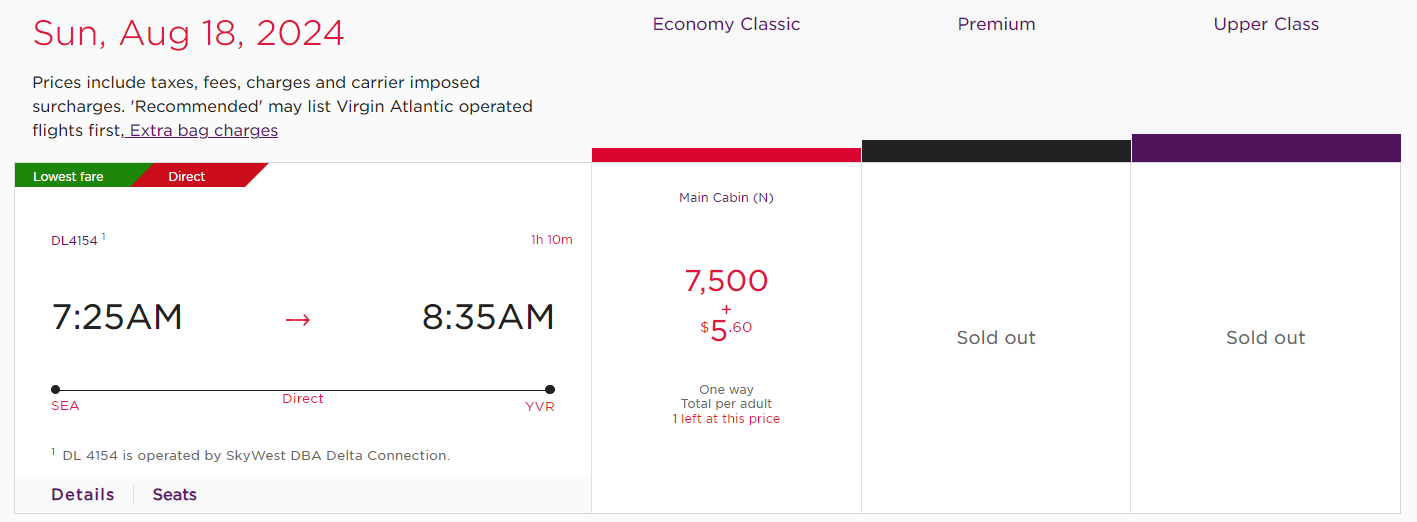

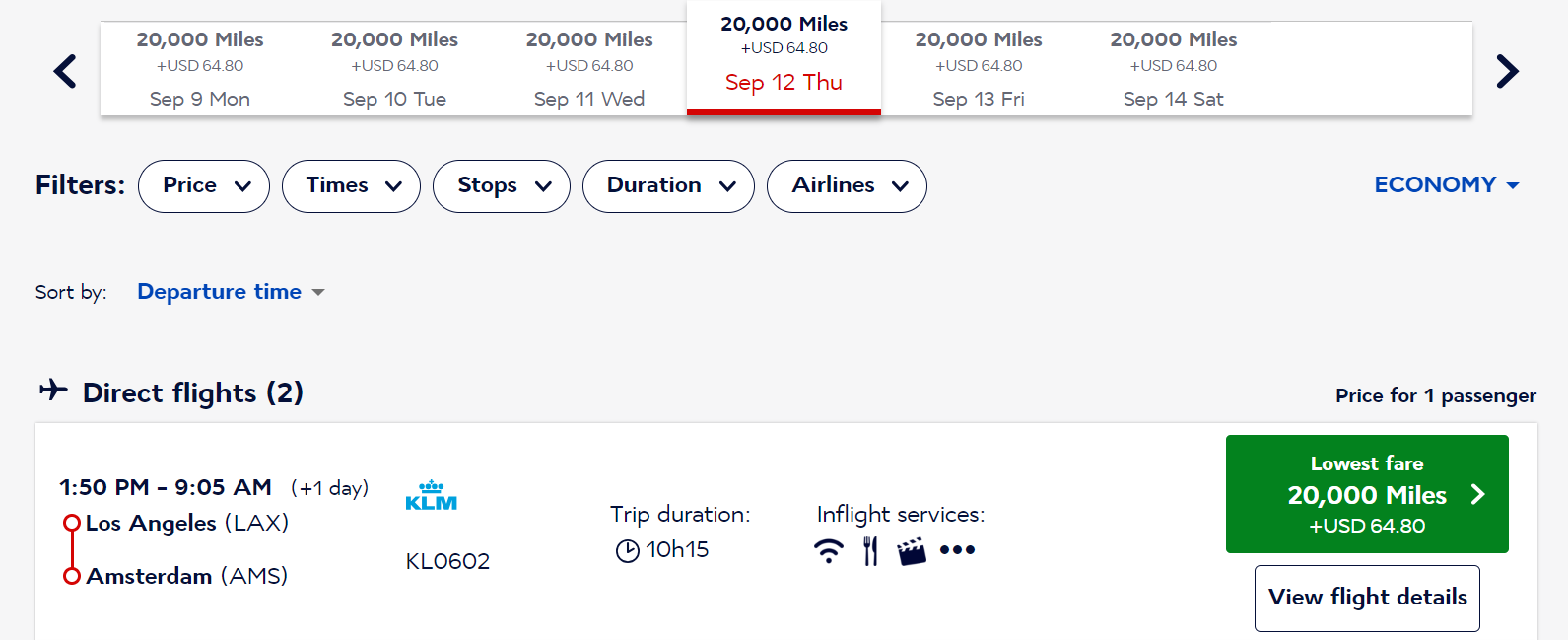

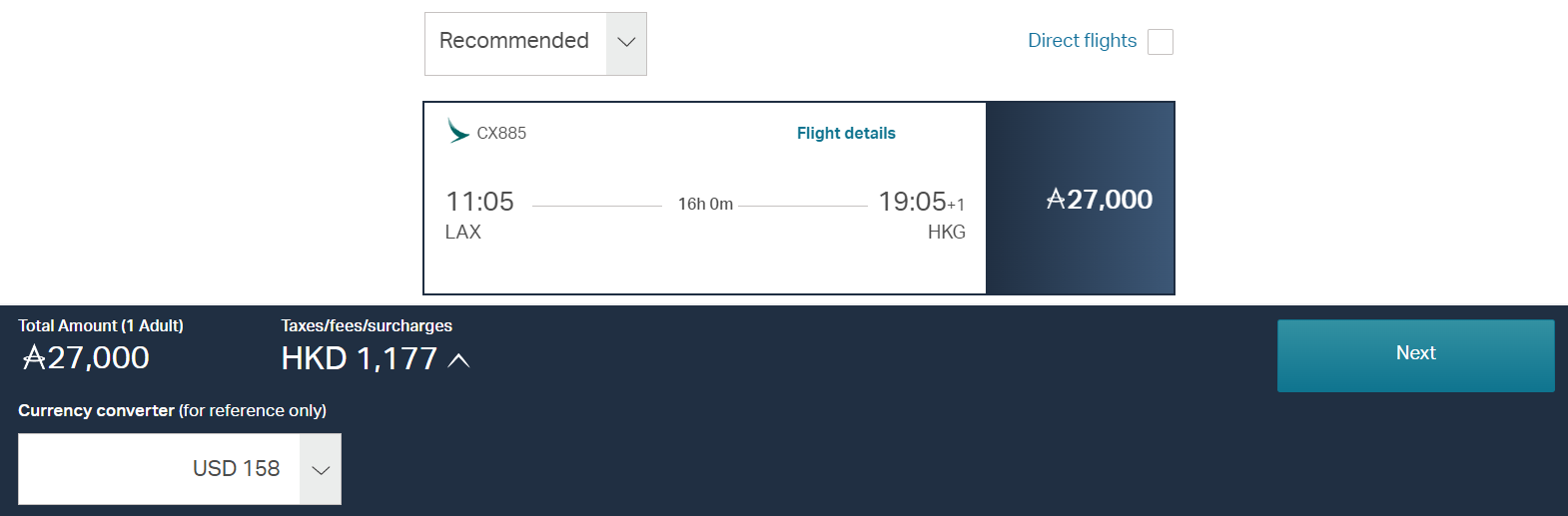

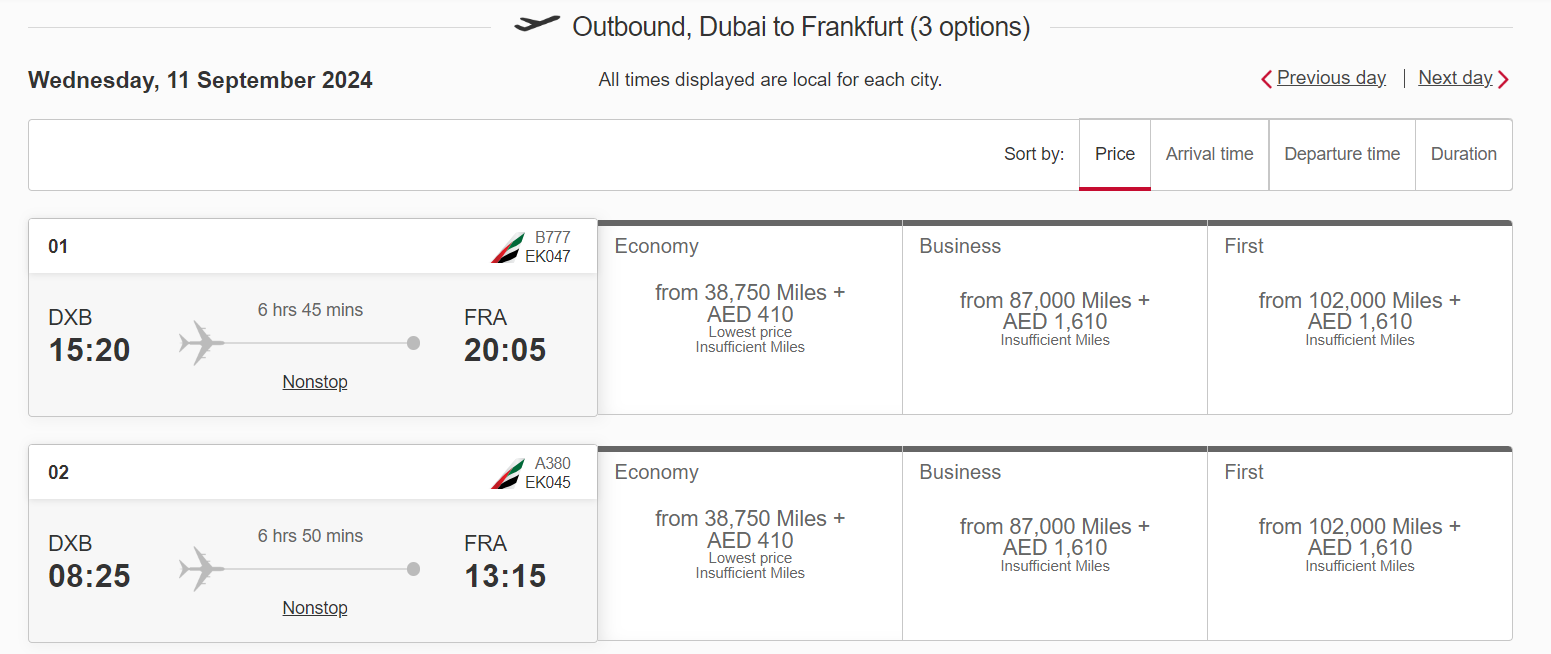

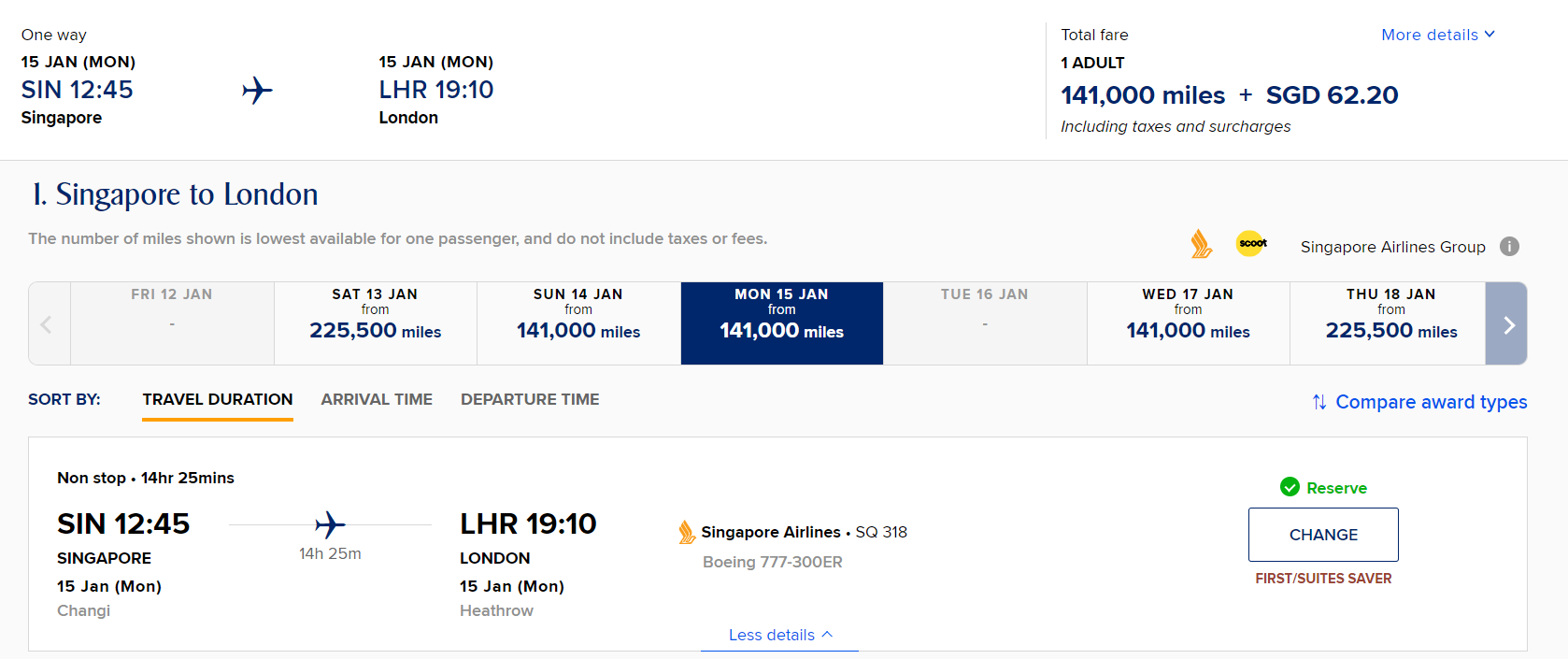

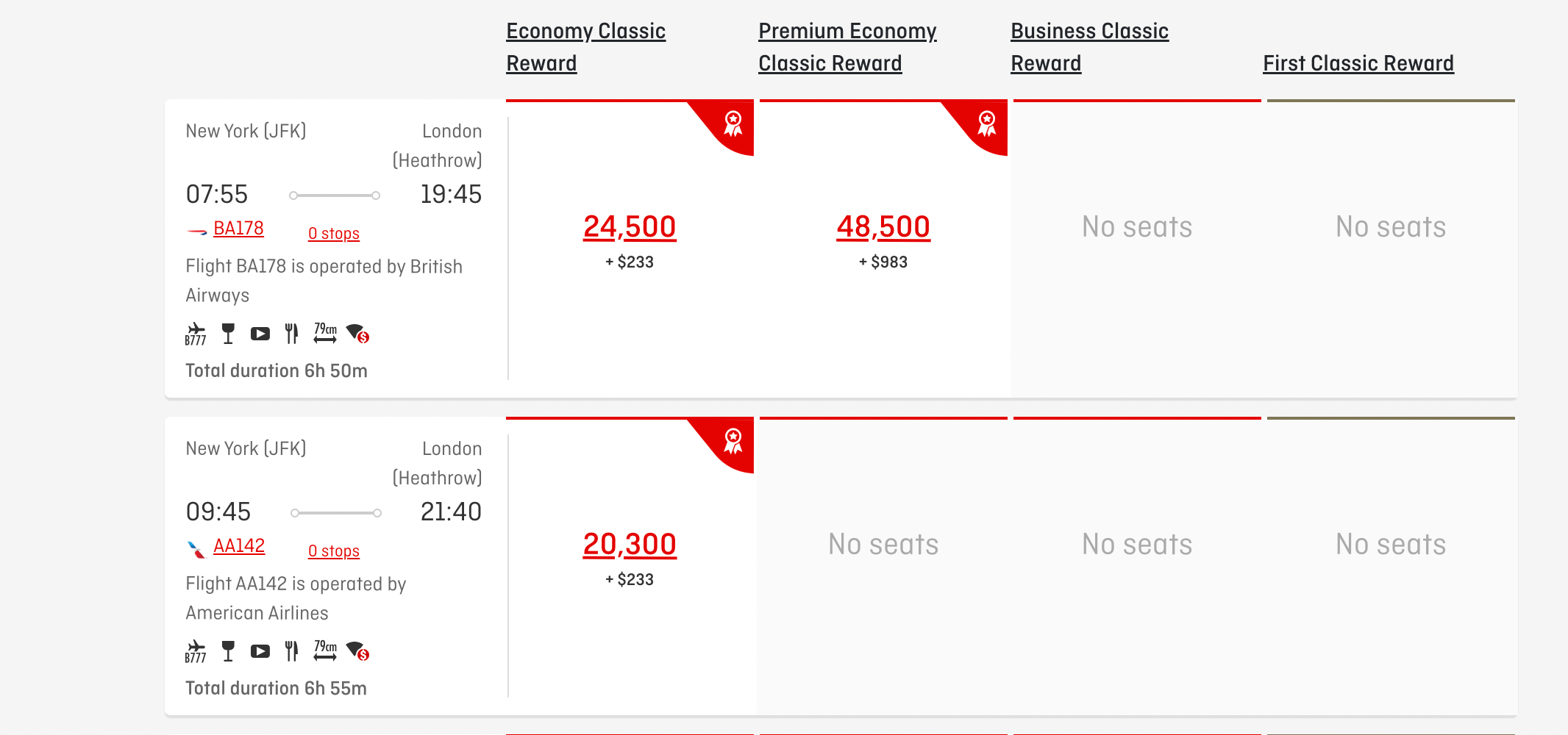

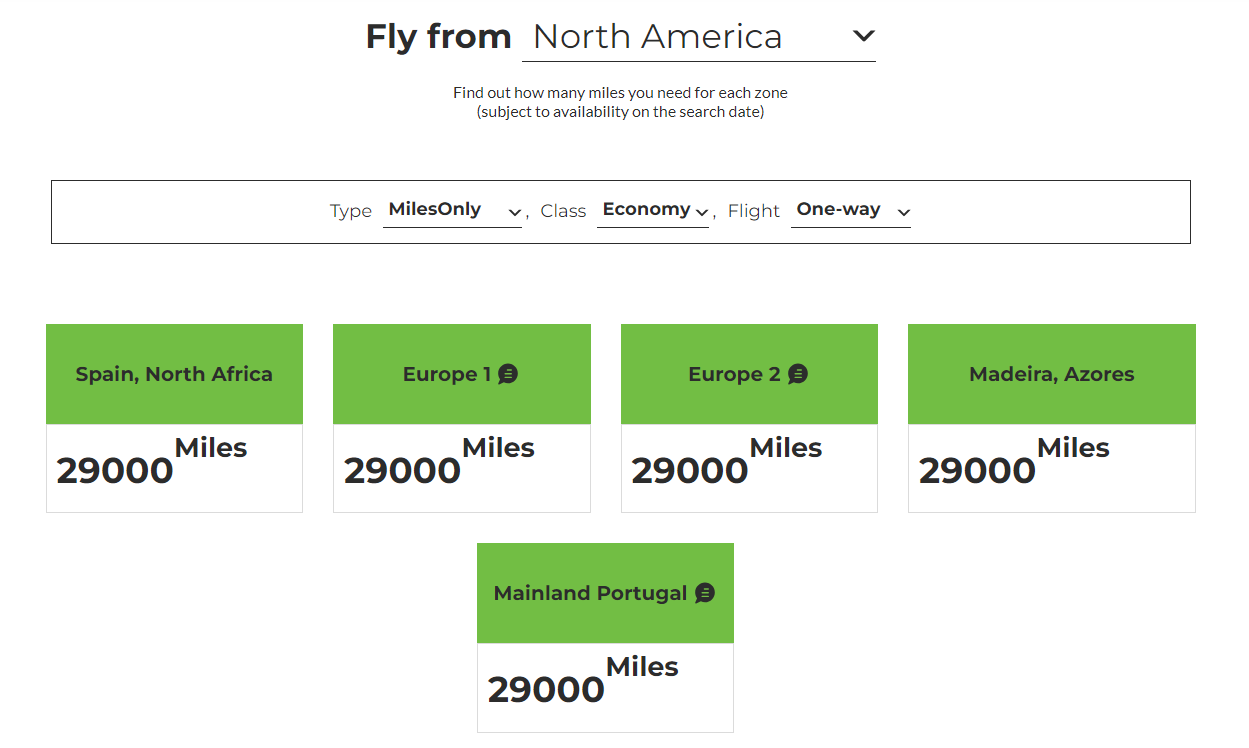

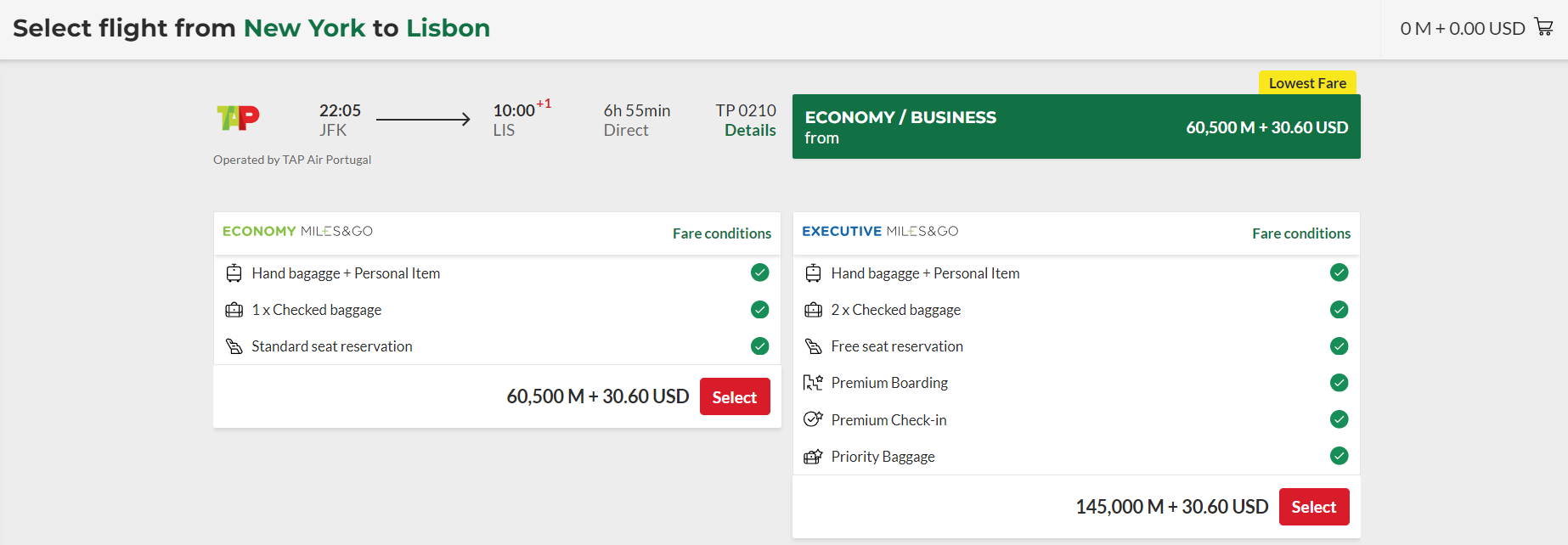

We constantly strive to provide the best prices compared to other mileage brokers. As you may know, you can often redeem your frequent flyer miles for an award ticket, usually with significant savings over their published cash fares! However, many people only have so much miles and often don't have enough to redeem that first or business class seats they are after. Buying that remaining airline miles that you need from us to top up your existing balance will allow you to travel in First and Business class on major airlines for half the price when buying directly with an airline for a full price.

2. How can I determine if buying miles is a good value for me?

The value of buying miles depends on several factors, including the cost of the miles, the redemption value of the miles, and the availability of travel options. To determine if buying miles is a good value for you, consider how much you would pay for the travel you want to book without using miles, and compare that to the cost of buying the necessary miles and redeeming them for the same travel. In general, it may be worth buying miles if you can redeem them for a high-value award ticket.

3. How do I trade points or miles with The Points Trader?

It’s simple. Request a free quote and one of our team member will come back to you within 24 hours with your request, pricing and detailed process. Be sure to check your spam folder!

4. Will the points I purchased be credited to my own frequent flyer account or will you give me someone else's frequent flyer account to redeem from?

We only offer transferable points/miles. All purchase you make will be credited to your own frequent flyer account for your own ease of use and management. Please be sure to provide us with accurate details of your frequent flyer account upon purchasing your miles.

5. How long will it take before my points or miles are credited to my account?

Our goal is to process your purchase as soon as possible. Since we deal world-wide, and there are time differences involved, please allow 1-2 business days for most purchase. Our team will specify explicitly if your purchase will need a longer processing time, depending on the mileage programs, market conditions and availability at the time, this could change.

6. Is trading points & miles legal ?

YES! There are no laws restricting the sale or barter of points or frequent flyer miles.

7. Is there a limit on how many Points I can trade?

There is no maximum of how much you can trade, we do however, have a minimum of 50,000 points/miles

per transaction for most program. Some program will have a different MOQ and it is listed on our quote form.

8. Is your trad ing process secure?

ABSOLUTELY! We work diligently in protecting your information by using cutting-edge technologies to secure our client's information that is entrusted to us. For more details, please contact us or visit our privacy policy page.

9. Is The Points Trader safe / legit?

COMPLETELY!! The Points Trader have been in business for years and have dealt with many clients worldwide, advising & consulting each client on the best uses of points and miles and how to maximize their values. We have hundreds of satisfied clients all over the globe with positive feedbacks commending our services. 85% of our clients are returning customers who continuously seeks our services and advice for their ongoing travel needs to save more money on their next luxury air travel. So in summary, The Points Trader is absolutely safe and established business.

Rapid Rewards

Buy, gift and transfer points

At Southwest®, we give you the power to control your Rapid Rewards® balance. If your balance needs a little love, you can buy Rapid Rewards points anytime. But it doesn’t stop there. You can gift or transfer your points to others, or donate them to charity—talk about making someone’s day!

Make the most of your points.

Short on points buy the points you need. 1.

Check now for points sale offers!

SHARE your points with other Rapid Rewards Members. 1

Purchase points for other rapid rewards members. 1, donate points to a charity. 2.

Learn more about these charities.

CLAIM points from a business or merchant.

If you're not a Member, enroll now and come back to claim your points.

Points SUBSCRIPTION

Enjoy our latest flight deals and partner promotions.

Buy Points FAQ

How do i purchase rapid rewards points for my rapid rewards account.

A few points shy of your next reward flight? No problem! You can purchase the points you need by logging into your account and clicking on Rapid Rewards at the top of the screen. Under Manage, select Buy or Transfer points. From here you can select the option you need. Points can also be purchased through the booking path when making a flight reservation.

How many points can I buy for my Rapid Rewards account?

Rapid Rewards points will be offered in increments of 1,000 during promotional periods and 500 when off promotion. The minimum purchase is 2,000 points and the daily maximum is 60,000 points for both personal and gift purchases.

Do Rapid Rewards points expire?

No, your Rapid Rewards points do not expire. However, if you choose to close your account, the points in your account will be terminated.

Do points claimed from a gift or via the Rapid Rewards Partnership Points program count toward A-List, A-List Preferred, or Companion Pass ® ?

From time to time, Southwest may offer a special promotion to purchase ‘tier qualifying points’, which count toward A-List status but are not redeemable. On the other hand, purchased ‘points’ do not count toward A-List, A-List Preferred, or Companion Pass, but they are redeemable.

How many points can I buy and gift to another Rapid Rewards Member?

You can buy up to 60,000 combined points per day for yourself or as a gift to another Member.

How does the recipient receive the gifted points I purchased for their account?

After entering the recipient's name and Rapid Rewards account number, the points will be deposited into the Member's Rapid Rewards account upon the completion of the transaction.

Can I buy points if I live in another country?

Yes. The purchase transaction must be completed with a credit card and will be subject to applicable taxes and fees (as defined by your financial institution), as well as the exchange rate associated with purchases made with a credit card issued through a foreign bank. They will be settled in USD.

How to earn Southwest Rapid Rewards points

Get points by flying with us, staying at your favorite hotel, & more.

Important information

1 Points conditions: Transactions are non-refundable and nonreversible. Please allow 72 hours for points to post to the applicable Rapid Rewards® account. Purchased, gifted, transferred, and donated points do not count toward A-List, A-List Preferred, or Companion Pass qualification. A valid credit card is required to complete point purchase, gift, and transfer transactions. Points can be bought for personal use, as a gift, or transferred in blocks of 1,000 during promotional periods and 500 when off promotion with an initial minimum purchase of 2,000 points and a daily combined maximum of 60,000 points. All Rapid Rewards rules and regulations apply and can be found at Southwest.com/rrterms . Southwest® reserves the right to amend, suspend, or change the Rapid Rewards program and/or Rapid Rewards program rules at any time without notice. Rapid Rewards Members do not acquire property rights in accrued points. The number of Rapid Rewards points needed for a particular Southwest flight is set by Southwest and will vary depending on destination, time, day of travel, demand, fare type, point redemption rate, and other factors, and is subject to change at any time until the booking is confirmed. 2 Points can be donated in blocks of 500 with a minimum donation of 500 points and a daily maximum of 60,000 points. Unless Southwest Airlines® and a charity jointly announce otherwise, no portion of the purchase price that a Passenger pays for a ticket is paid to any charity or may automatically generate Rapid Rewards points for any charity, even those Southwest Airlines preselects as eligible recipients of the Rapid Rewards donation program. Southwest Airlines reserves the right to change the charities that are eligible to participate in the Rapid Rewards donation program at any time without notice.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

Amex Membership Rewards Transfer Partners & How To Use Them [2024]

Jarrod West

Senior Content Contributor

460 Published Articles 1 Edited Article

Countries Visited: 21 U.S. States Visited: 24

Keri Stooksbury

Editor-in-Chief

48 Published Articles 3400 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

![trade travel points Amex Membership Rewards Transfer Partners & How To Use Them [2024]](https://upgradedpoints.com/wp-content/uploads/2019/10/Lufthansa_B748_First_Class_Seat_1A_Cherag_Dubash.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Key takeaways, airline transfer partners, hotel transfer partners, how to transfer membership rewards, transfer bonuses, earning amex membership rewards, booking travel with the amextravel.com portal, other ways to use your points, combining membership rewards from different accounts, redeeming membership rewards, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

- American Express Membership Rewards points transfer to numerous airline and hotel partners, typically at a 1:1 ratio, providing flexibility in redeeming points for travel.

- Popular airline partners include British Airways Executive Club, Delta SkyMiles, and Emirates Skywards.

- Hotel partners like Hilton Honors and Marriott Bonvoy allow points transfers for booking stays.

If you’re looking for a way to earn lots of points to redeem for some amazing travel, you can’t go wrong with American Express Membership Rewards credit cards. Amex provides a number of ways to earn Membership Rewards points and plenty of fun ways to redeem them for some great flights.

In this post, we’ll show you all of the American Express transfer partners, how to transfer Membership Rewards to these partners, and much more. With this guide in hand, you’ll be ready to book some amazing vacations!

The American Express Membership Rewards program has a ton of airline transfer partners.

Make sure you check the transfer rate (see below) since not all transfers are done at a 1:1 ratio.

Membership Rewards can also be transferred to 3 hotel rewards programs.

Like American Express airline partners, transfer ratios vary (see below), so make sure you check them before transferring.

Hot Tip: Use our transfer partner tool to see how many points you’ll get when you transfer your Amex Membership Rewards to their partner airlines and hotels!

With some Membership Rewards points in your account , it’s time to decide where you want to transfer your points so you can start traveling. Here are the simple steps to make the transfer process easy.

Step 1: Select Earn and Redeem from the menu.

Step 2: Select Transfer Points under Redeem .

Step 3: Choose your desired airline or hotel transfer partner and select Transfer Points . If you haven’t already, you will need to link your frequent flyer account to your Membership Rewards account. In the example below, we chose Delta Air Lines.

Step 4: Once you have linked your airline or hotel account to your Membership Rewards account, choose how many points you would like to transfer. Transfers must be made in increments of 1,000.

Step 5: Confirm the number of points you are transferring and complete the transfer.

Step 6: Head over to the appropriate airline or hotel program to book your award flight or award stay.

Bottom Line: Transferring Amex points to partners is easy. Just have your loyalty program numbers handy and your Amex card details, and you’ll be good to go!

Transferring your points when there is a bonus is an ideal situation. Getting the most value out of every point you have is the key to getting those high-level redemptions!

Amex has previously offered both public and targeted transfer bonus offers of 15% to 40%. For example, if you were to transfer 10,000 points when a particular partner is offering a 40% bonus offer, your points would be worth 14,000 points after transfer.

However, you shouldn’t transfer points JUST because there is a bonus. It’s best to keep your points in a transferable account (like Amex, Capital One, Chase, Citi, or Marriott Bonvoy) until you have a specific redemption in mind.

American Express provides tons of opportunities to earn Membership Rewards points . Pick the card or combination of cards that will help you earn the most points and get the benefits that matter to you.

Recommended American Express Cards (Personal)

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings through American Express Travel using your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card ® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $199 CLEAR ® Plus Credit: CLEAR ® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $199 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.¤

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

This is the best card for food lovers who dine out at restaurants (worldwide), order take-out and want big rewards at U.S. supermarkets!

The American Express ® Gold Card is a game-changer.

With this card, you can earn 4x Membership Rewards points at restaurants, up to $50,000 per calendar year, and you’ll also earn 4x Membership Rewards points at U.S. supermarkets on up to $25,000 per calendar year, then 1x.

There isn’t another card on the market that offers a 1-2 punch like this. Of course, there are several other benefits of the Gold Card as well, including extra monthly dining rewards and more.

- 4x points per dollar at restaurants worldwide, up to $50,000 per calendar year; then 1x thereafter

- 4x points per dollar at U.S. supermarkets, up to $25,000 per calendar year; then 1x thereafter

- 3x points per dollar on flights purchased directly from airlines or at AmexTravel.com

- $325 annual fee ( rates and fees )

- No lounge access

- Earn 60,000 Membership Rewards ® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Plus, receive 20% back in statement credits on eligible purchases made at restaurants worldwide within the first 6 months of Card Membership, up to $100 back. Limited time offer. Offer ends 11/6/24.

- Get the American Express ® Gold Card in either the Gold, Rose Gold or Limited-Edition White Gold metal design. White Gold design is only available while supplies last.

- Earn 4X Membership Rewards ® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards ® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards ® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards ® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards ® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express ® Gold Card at Dunkin' locations.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express ® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express ® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges with every booking of two nights or more through AmexTravel.com. Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

If you’re a business owner, see our list of the best Amex business credit cards .

A fun and easy way to boost your earning potential is to maximize Amex Offers , which grant additional Membership Rewards for your purchases at select merchants.

If you’re booking economy flights or hotels, don’t forget to check out AmexTravel.com , where you can book cash flights with points. Points are generally worth 1 cent each.

With The Business Platinum Card ® from American Express , each point is worth about 1.54 cents when booking on your preselected airline.

The boost is applied in the form of a 35% rebate , so you’ll still need the total points in your account at the time of booking. You can get up to 1 million points rebated per calendar year.

Let’s check out an example (below). If you have the Amex Business Platinum card and Delta Air Lines is your selected airline, this booking will cost 22,516 Membership Rewards points initially.

Once the rebate is applied, American Express will return 7,880 Membership Rewards to your account, which means this booking would actually cost you 14,636 points.

You might have noticed in the example above that the booking is a Membership Rewards Insider Fare .

This can make your bookings through AmexTravel.com even more valuable since American Express sometimes discounts flights if you pay entirely with points .

Should You Transfer or Book Through Amex?

Consider the flights we discussed above. Booking this itinerary through AmexTravel.com costs 14,636 Membership Rewards points, and the booking still earns Delta SkyMiles as a paid fare rather than an award ticket.

If you were to transfer Membership Rewards to Delta and book this same itinerary as an award ticket, you would have to transfer 25,000 points to your SkyMiles account to book it. In this case, booking through the portal would be a much better deal.

This is clearly a time to book through AmexTravel.com rather than transferring points. To ensure you get the most out of your points every time, it’s important to check both the portal and transfer options when booking economy class.

AmexTravel.com also allows you to book hotels at up to 1 cent per point in value through Fine Hotels & Resorts .

You can also redeem your points for gift cards to merchants like Nike, Saks Fifth Avenue , Walmart, or Amazon , or use your points to shop for items from the Membership Rewards site.

Unfortunately, these are generally terrible uses of your hard-earned Membership Rewards points. To get the most value out of them, stick with travel redemptions!

If you have multiple cards that earn Membership Rewards, they can each be linked to the same account so your points will automatically collect in one place.

Generally, when you apply for a new card that earns Membership Rewards points, it will automatically be linked to your account.

One downside is that points cannot be transferred to your spouse or significant other’s Membership Rewards account.

However, you can transfer points to a frequent flyer program owned by any authorized users on your account, as long as they have been an authorized user for at least 90 days .

While this isn’t a perfect solution, it still allows you to help friends and family book award flights.

Using your Membership Rewards points for travel is clearly the best way to use your points.

With so many airline transfer partners and tons of ways to redeem your points, it’s almost overwhelming!

To make the process a bit easier, we’ve compiled a list of the best ways to redeem your Membership Rewards for some amazing travel experiences.

American Express Membership Rewards points are tremendously useful if you want to travel. With so many ways to earn and redeem points, you can book award flights to just about anywhere in the world!

For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of the American Express ® Gold Card, click here . For rates and fees of The Business Platinum Card ® from American Express, click here .

Related Posts

![trade travel points 19 Best Ways To Earn Lots of American Express Membership Rewards Points [2024]](https://upgradedpoints.com/wp-content/uploads/2018/10/Amex-Gold-Upgraded-Points-LLC-12-Large.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Points & Miles 101: NerdWallet’s Quick Start Guide

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Table of Contents

Helpful lingo

The master list of travel loyalty programs, articles to get you started, next up — travel rewards credit cards 101, why you should listen to us.

Perhaps you’re wondering why your friends race to foot the bill for after group dinners out. Or maybe you’re tired of being the only team member who doesn’t get bumped up to a premium class on work trips. Or maybe even you can’t knowingly pass up a deal, even if it’s a small one.

Welcome to Points and Miles 101, the official NerdWallet quick start guide for aspiring travel hackers. Here, we nerd out about all things points and miles.

Rewards travel has a language all of its own, and getting a grasp of the general concepts will improve your foray into the points and miles pool. Know words like:

Award charts. Certain airlines and hotels offer award charts to define the costs of bookings in points and/or miles. This is often done in contrast to dynamic award pricing.

Award travel. Award travel refers to flights, hotel stays, vacation packages or other travel-related expenses booked by redeeming travel rewards.

Bank programs/credit card rewards program. Some financial institutions, like Chase or Capital One, run loyalty programs associated with specific credit cards. Members typically are cardholders that earn flexible points that may be used to book flights and hotels through the program’s travel portal or transferred to other loyalty programs.

Dynamic award pricing. Dynamic award pricing means that a company ties the cost of a specific booking to the cash price. This is a pricing structure used instead of an award chart.

Loyalty programs. Loyalty programs are run by a travel corporation and exist to encourage customers to repeatedly fly or stay with the corporation’s brands. Examples include World of Hyatt and Delta SkyMiles. You can find loyalty programs offered by non-travel entities, too (but for the purposes of this guide, we'll focus on the travel-related ones).

Miles. In this context, miles are a type of travel reward earned with an airline loyalty program. They are typically earned by flying or spending on an airline credit card. You can think of miles as airline points. Whether they are called miles or points varies depending on the loyalty program — for example, United Airlines, American Airlines and Alaska Airlines use the term miles, but Southwest Airlines members earn Rapid Rewards points.

Points/travel rewards/rewards currencies/miles. Travel rewards are a virtual currency that go by many names. They are earned by charging eligible purchases to a credit card, flying, spending with partners or staying in hotels.

Redemptions. When points and miles collectors can use their earned travel rewards to pay for award travel or some other benefit/reward.

Transferable currencies. Rather than being tied to an individual brand, transferable currencies are designed to transfer to several hotels and airlines for a variety of redemptions. These are often offered by bank programs/credit card rewards programs.

Travel credit cards/rewards credit cards. Travel rewards credit cards are a type of credit card that earn points, miles or travel rewards that cardholders can redeem for award travel. Airline and hotel credit cards are a type of travel credit card, technically, but usually the term travel credit card refers to a more general card that earns a transferable currency in a bank program/credit card rewards program.

Valuations. NerdWallet’s annual analyses to figure out how much each loyalty program’s miles or points can be worth in cash when used for award travel. These values can help you determine when to pay in cash versus points.

Travel loyalty programs come in a variety of shapes and sizes. The most common are hotel rewards programs, airline frequent flyer programs and bank programs. Online travel agencies, such as Hotels.com or Expedia, also run their own loyalty programs. All of these programs are similar to non-travel loyalty programs that you might already be a part of, like Target, Old Navy or Starbucks.

Here’s an overview of your travel loyalty program options, broken down by type.

Credit card rewards programs

General credit cards rewards programs — also known as bank programs that earn transferable currencies — are the bread and butter of many points and miles strategies. Their inherent flexibility (since they aren't tied to a single travel company) make them attractive to individuals who aren’t “all in” on a single program. These include:

Chase Ultimate Rewards® .

American Express Membership Rewards .

Citi ThankYou Points .

Capital One Miles .

Airline frequent flyer programs

If you live near an airport that is serviced by multiple carriers, you have your work cut out for you. You can choose between several major airlines’ rewards programs. Travelers who fly out of smaller airports may have a more clear-cut option as to which airline they'll likely use most frequently.

Domestic airline loyalty programs include:

Alaska Airlines Mileage Plan .

American Airlines AAdvantage .

Delta Air Lines SkyMiles .

Frontier Miles .

Hawaiian Airlines HawaiianMiles .

JetBlue TrueBlue .

Southwest Airlines Rapid Rewards .

Spirit Airlines Free Spirit .

United Airlines MileagePlus .

Here's a smattering of popular international airline loyalty programs:

Air Canada Aeroplan .

Air France/KLM Flying Blue .

ANA Mileage Club .

British Airways Avios .

Emirates Skywards .

Virgin Atlantic Flying Club .

Hotel loyalty programs

Travelers can book regular stays within a specific hotel portfolio and earn rewards. Here’s a sampling of hotel rewards programs to shop and consider.

IHG Rewards .

World of Hyatt .

Choice Hotels .

Marriott Bonvoy .

Wyndham Rewards .

Hilton Honors .

Best Western Rewards .

Red Roof Inn RediRewards .

Consider this section “Required Reading” to develop a firm foundation in your points and miles knowledge.

1. The Beginner's Guide to Points and Miles

For an ultra-comprehensive overview of the travel rewards universe, start here, with our Beginner’s Guide to Points and Miles . This article covers the basics and then some, helping readers think through esoteric and practical topics alike.

What are your points and miles goals?

Are you ready to pay off your credit card bills in full each month?

Does a general travel credit or a co-branded credit card make more sense?

2. Why Do Travel Points Matter?

While we live and die by points and miles (we’re nerds, remember?), we also know that plenty of travelers forgo loyalty program membership and still have enjoyable vacations, flights and hotel stays.

Even so, using points can still be useful to save money on travel. You don’t actually have to spend 50 nights per year in hotels or fly somewhere every other weekend to reap the benefits. With a well-planned strategy and without spending extra money, you can earn almost-free hotel nights and flights, plus fringe benefits like complimentary checked bags, airport lounge access or late check-outs.

Points values vary from loyalty program to loyalty program, and understanding the entire landscape can get overwhelming quickly. Explore the topic deeper in our article, Why do travel points matter?

3. How Much are Points and Miles Worth?

Points values vary from loyalty program to loyalty program and even booking to booking.

Some programs have a fixed value for their points. For example, Southwest Rapid Rewards points rarely deviate from the value of 1.5 cents each. If you want to buy a $100 flight with your Rapid Rewards points, it’ll likely cost you about 6,667 points ($100 flight / 1.5 cents value = 6,667 points). If you wanted to buy a $200 flight, it would probably cost you double the points as well ( 1.5 cents value x 13,333 points = $200 flight).

Similarly, many credit card rewards programs have a fixed value unless they are transferred to a partner. One Capital One mile is worth 1 cent.

Other programs may use dynamic pricing or an award chart, which can make the valuations fluctuate across bookings. For example, one night at a Marriott hotel might cost $550 in cash or 60,000 points ($550 / 60,000 points = 0.91 cent valuation). Meanwhile, a different booking at another Marriott property might cost $350 in cash or 60,000 points ($350 / 65,000 points = 0.58 cent valuation).

Because point values vary so much, it’s helpful to know an average value to target when making award bookings. If the booking gets you less than the average value of your points, you should probably just pay in cash instead.

But figuring out the average value is no easy task. That’s where we come in. We collect and analyze hundreds of real-world award booking costs to determine the average value of different rewards currencies. With these in hand, you’ll be able to quickly determine whether or not an individual booking is a good deal. See the value of your preferred loyalty program or browse options with our deep dive: What Are Points and Miles Worth This Year?

4. How to Get Started with Travel Rewards

Are you ready to jump in and take up the travel hacking hobby as one of your own? We’re so glad to have you. We’ve broken it down into five easy steps.

1. Pick a rewards card.

2. Select your priority loyalty programs.

3. Work toward elite status.

4. Learn the rules.

5. Find high-value redemptions.

Get more advice: 5 steps to getting started with rewards travel .

Now that you have a solid understanding of points and miles, the next step is to expand your knowledge of what travel rewards credit cards are out there.

To help you make the best possible credit card choice for your budget, financial goals and travel desires, we’ve put together another quick start guide: Travel Rewards Credit Cards 101 .

We’re die-hard nerds who felt motivated to lessen the financial sting of our favorite activity — traveling — by learning the tricks of the points-and-miles trade. Our editors and writers boast over 40 years of experience in the travel industry, and our travel rewards redemptions range from business class tickets to Japan to mattress runs in Vegas.

Our editorial guidelines outline the integrity we strive to maintain in every word we write and every recommendation we make.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

Ultimate guide to Capital One airline and hotel transfer partners: How to maximize your miles

Editor's Note

Historically, you could only redeem Capital One miles at a fixed value . But in 2018, Capital One added transfer partners as an additional redemption option for some of its cards. Capital One has since added new transfer partners at mostly a 1:1 transfer ratio.

Capital One currently has more than 15 airline and hotel transfer partners. In this guide, we'll discuss how to earn Capital One miles and then walk through each Capital One transfer partner so you can decide which ones to learn more about.

How to earn Capital One miles

Some, but not all, Capital One credit cards earn Capital One miles. Here's a list of some currently available consumer cards that earn transferable Capital One miles :

- Capital One Venture X Rewards Credit Card : Earn 10 miles per dollar on hotels and rental cars booked through Capital One Travel, 5 miles per dollar on flights booked through Capital One Travel and 2 miles per dollar on other purchases. Plus, you can earn 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening; $395 annual fee (see rates and fees ).

- Capital One Venture Rewards Credit Card : Earn 5 miles per dollar on hotels and rental cars booked through Capital One Travel and 2 miles per dollar on other purchases. Plus, you can earn 75,000 bonus miles when you spend $4,000 on purchases within the first three months from account opening; $95 annual fee (see rates and fees ).

- Capital One VentureOne Rewards Credit Card : Earn 5 miles per dollar on hotels and rental cars booked through Capital One Travel and 1.25 miles per dollar on other purchases. Plus, you can earn 20,000 bonus miles once you spend $500 on purchases within the first three months from account opening; $0 annual fee (see rates and fees ).

If you're looking for a business card, here are some options that earn Capital One miles:

- Capital One Venture X Business : Earn 10 miles per dollar on hotels and rental cars booked through Capital One Travel, 5 miles per dollar on flights booked through Capital One Travel and 2 miles per dollar on other purchases. Plus, you can earn 150,000 bonus miles after spending $30,000 in the first three months from account opening; $395 annual fee (see rates and fees ).

- Capital One Spark Miles for Business : Earn 5 miles per dollar on hotels and rental cars booked through Capital One Travel and 2 miles per dollar on other purchases. Plus, you can earn a one-time bonus of 50,000 miles once you spend $4,500 on purchases within the first three months of account opening; $0 introductory annual fee for the first year, then $95 after (see rates and fees ).

- Capital One Spark Miles Select for Business : Earn 1.5 miles per dollar on purchases. Plus, you can earn a one-time bonus of 50,000 miles once you spend $4,500 on purchases within the first three months from account opening; $0 annual fee.

The information for the Capital One Spark Miles Select has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

You'll need at least one of the above cards to earn Capital One miles. But, once you have a card that earns Capital One miles, you can convert cash back from your other Capital One cards into miles . So, it might be worth pairing one of the above cards with some of our favorite Capital One cash-back cards, such as the Capital One SavorOne Cash Rewards Credit Card , if you're looking to boost your stash of Capital One miles.

Related: Chase Sapphire Preferred vs. Capital One Venture Rewards: Which $95 card should you get?

Capital One transfer partners overview

As mentioned above, Capital One has more than 15 transfer partners. Here's each of the Capital One transfer partners and the ratio at which you can transfer Capital One miles to each partner:

- Aeromexico Rewards : 1:1 transfer ratio

- Air Canada Aeroplan : 1:1 transfer ratio

- Air France-KLM Flying Blue : 1:1 transfer ratio

- Accor Live Limitless : 2:1 transfer ratio

- Avianca LifeMiles : 1:1 transfer ratio

- British Airways Executive Club : 1:1 transfer ratio

- Cathay Pacific Asia Miles : 1:1 transfer ratio

- Choice Privileges (only U.S.-based accounts) : 1:1 transfer ratio

- Emirates Skywards : 1:1 transfer ratio

- Etihad Airways Guest : 1:1 transfer ratio

- EVA Airways Infinity MileageLands : 4:3 transfer ratio

- Finnair Plus : 1:1 transfer ratio

- Qantas Frequent Flyer : 1:1 transfer ratio

- Singapore Airlines KrisFlyer : 1:1 transfer ratio

- TAP Air Portugal Miles&Go : 1:1 transfer ratio

- Turkish Airlines Miles&Smiles : 1:1 transfer ratio

- Virgin Red : 1:1 transfer ratio

- Wyndham Rewards : 1:1 transfer ratio

Not all of these transfers will occur immediately. So, check out our guide to Capital One transfer times to see how long transfers to each partner usually take.

Related: Tips and tricks to get maximum value from your Capital One miles

Best Capital One transfer partners