SafetyWing Review: Medical & Travel Insurance for Long-Term Travelers

If you’re a digital nomad fortunate enough to be working in the ‘Gig Economy’, then it’s likely that you have the opportunity to blend your working endeavors alongside frequent travel. If this sounds like you, and you find yourself moving from country-to-country, then it’s crucial that you plan for the unexpected.

By this, we mean arranging a comprehensive travel medical insurance plan that will protect you in the event that you require medical assistance. Failure to do so could result in significantly high medical bills – something that, depending on the severity of the issue, you might not be able to cover.

With that being said, the likes of SafetyWing tailor its travel medical insurance package to those that live the nomad lifestyle . With a headline pricing structure of $68/4 weeks for travels within the US, and $37/4 weeks for everywhere else, we sought to explore whether or not SafetyWing is a notable option for your travel medical insurance needs.

As such, if you’re thinking about using SafetyWing, be sure to read our comprehensive review. Within it, we cover everything from fees, what you are covered for, who is suitable, and more.

Visit SafetyWing

Coronavirus Update:

Table of Contents

As of August 1st, Nomad Insurance covers Coronavirus Disease (COVID-19)! Coverage works the same as any other illness as long as it was not contracted before your coverage start date, and does not fall under any other policy exclusion or limitation.

Testing for COVID-19 will only be covered if deemed medically necessary by a physician. The antibody test is not covered, as it is not medically necessary.

What is SafetyWing?

In its most basic form, SafetyWing is a travel medical insurance provider that is suited for those living the digital nomad lifestyle. With the provider recognizing that freelancers based in locations other than their home country will often fail to obtain the required medical insurance, SafetyWing targets its coverage specifically to this niche area.

Take note, you don’t need to be a freelance worker per-say to consider obtaining cover from SafetyWing, as the provider is still suitable if you’re simply living abroad.

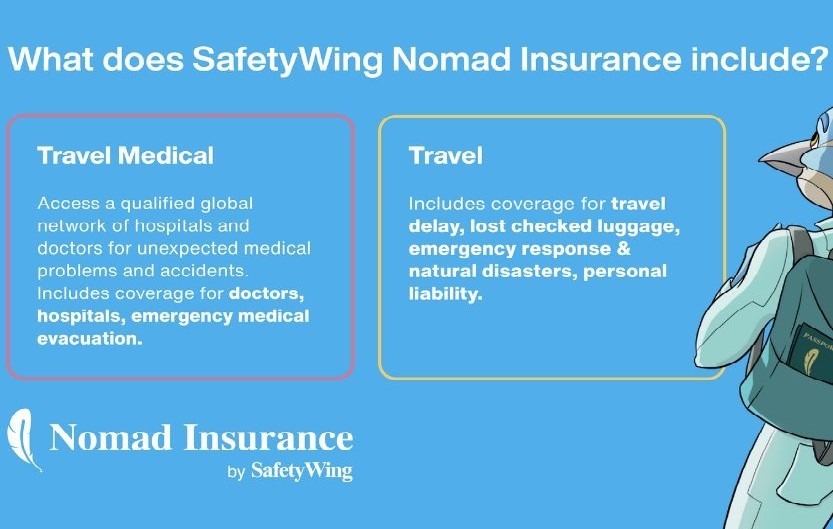

Nevertheless, on top of offering medical insurance, SafetyWing also covers a number of other travel-related events. This covers unfortunate events such as long travel delays, lost luggage, evacuation requirements linked to political unrest or terrorism, and more.

As we will discuss in more detail further down, SafetyWing has grown in popularity since its inception in 2017 due to its super-competitive pricing structure. When you first head over to the provider’s website, you’ll instantly be presented with its proprietary offer of $37/4 weeks, or $68/weeks if your travel plans includes the US.

Ultimately, the overarching selling point from the team at SafetyWing is to provide its customers with travel medical insurance that is reliable, flexible, and perhaps most importantly – affordable.

So now that you have an overview of what SafetyWing is, in the next section of our review we are going to explore what the provider covers in more detail.

Get a Quote from Safetywing

You can use our widget to get a direct quote from Safetywing for your required insurance.

What Does SafetyWing Cover?

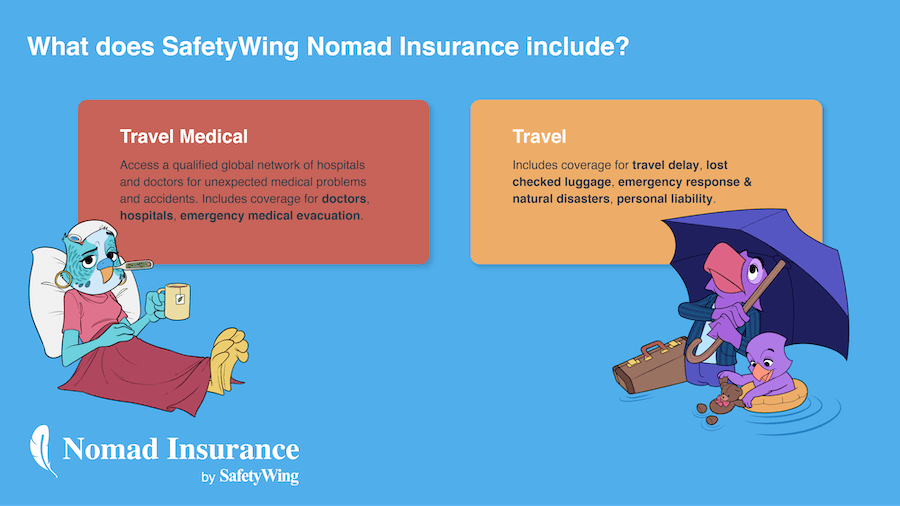

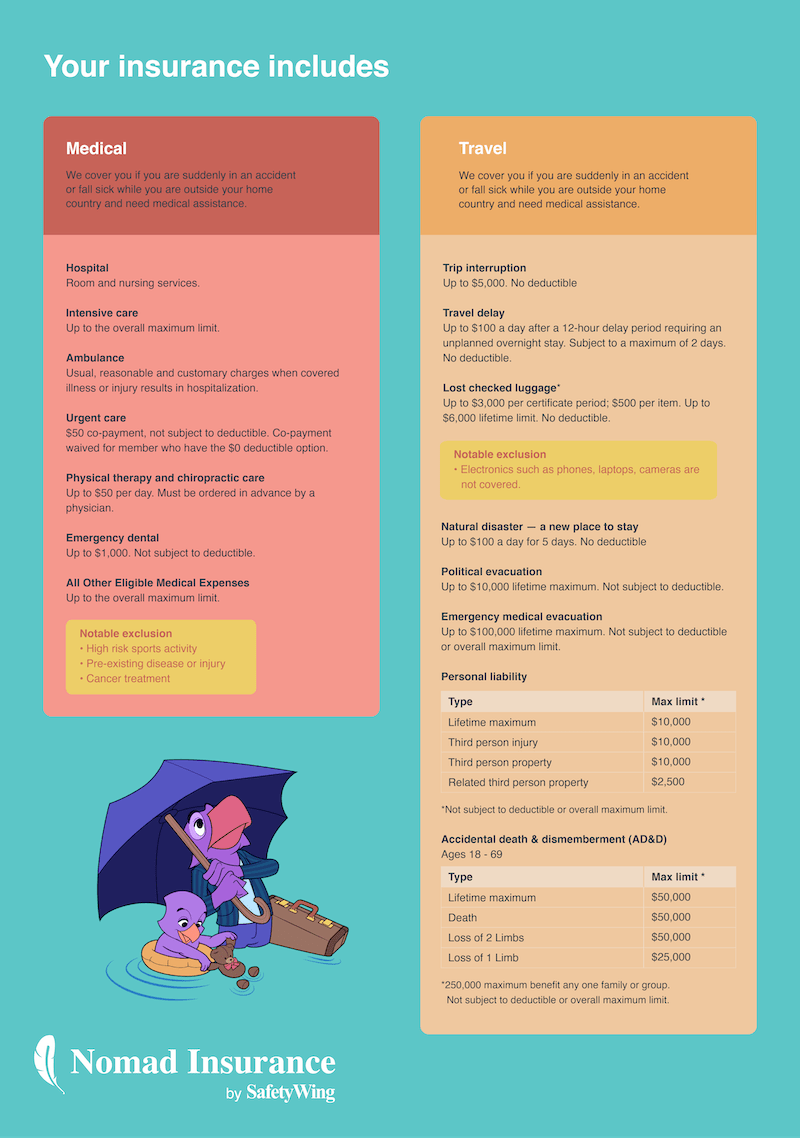

SafetyWing offers ‘Travel Medical Insurance’ , meaning that it provides both medical cover and travel cover. In order to understand how the two differ, we have broken down the most pertinent points below.

Medical Cover

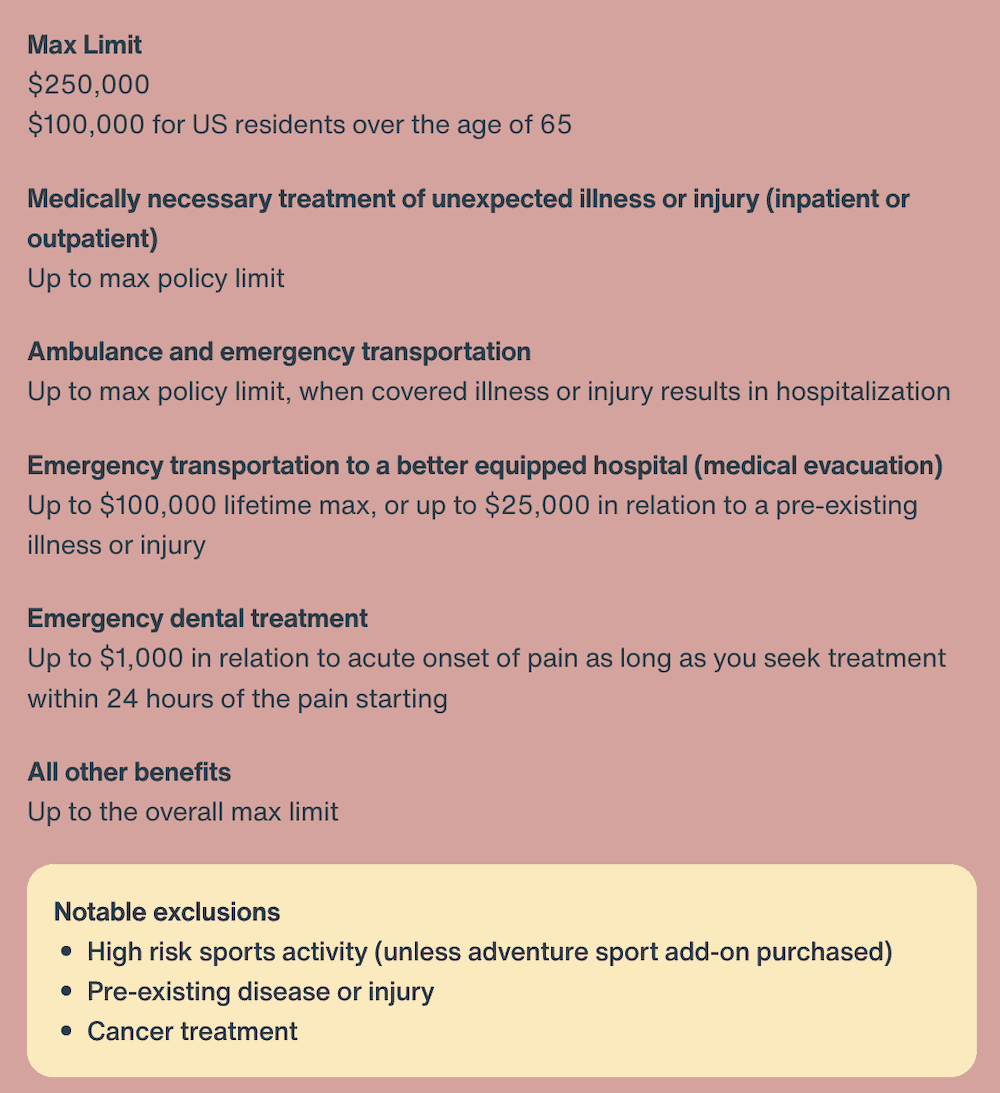

In a nutshell, SafetyWing will cover you in the event that you fall sick, or are involved in an accident, when you are outside of your home nation. This will include the costs related to hospital visits, such as nursing services and the room/bed itself, as well as intensive care.

Moreover, SafetyWing will also cover the costs if you are charged for utilizing an ambulance in your respective location, albeit, the provider does state that this needs to be “Usual, reasonable and customary charges when covered illness or injury results in hospitalization.”

If you require care from a chiropractic specialist or a physician, SafetyWing will cover you up to the first $50 per day. Furthermore, if you are required to seek emergency dental care, your SafetyWing plan should cover you up to the first $1,000.

In terms of notable exclusions, you won’t be covered if you engage in high-risk sporting activities. This would include the likes of freestyle skiing, advanced hiking, or street lugeing. It is also important to note that you won’t be covered on any pre-existing injuries or conditions, which is industry standard anyway. Finally, cancer treatment will not be covered by SafetyWing.

Travel Cover

On top of covering sickness and injury-related expenses, SafetyWing also offers comprehensive coverage on a range of travel-related costs. First and foremost, if you experience a travel delay that exceeds 12-hours – and you require an unplanned overnight stay, then your SafetyWing insurance will cover you up to $100 per day. Take note, this can only be claimed for a maximum of two days, which is reasonable.

If you are unable to leave your current location due to a natural disaster and thus – require a new place to stay, then you can claim up to $100 per – for a maximum of 5 days. On the other hand, you will be accustomed to higher limits if you are required to leave your current location due to a political evacuation, which amounts to a lifetime limit of $10,000.

When it comes to lost luggage that was checked-in with your respective airline, the SafetyWing plan offers up to $3,000 per certificate period. This amounts to a maximum of $500 per lost item, with consumers restricted to a lifetime limit of $6,000. However, the lifetime limit is per person meaning that if you are covered on a family or group basis, the lifetime limit extends to $250,000.

In terms of the fundamentals, you will not be able to claim electronic items, which includes cameras, laptops, and phones. This is somewhat frustrating, as it is likely that these items, in particular, will yield the greatest loss of value.

If you are ever in the need to claim for personal liability, then the maximum limits will depend on the specific circumstances. For example, while related-third-person property claims are capped at $2,500 – third-person property and third-party injury claims will yield a maximum limit of $25,000. Moreover, when it comes to accidental death or a loss of two limbs, SafetyWing covers up to $50,000. A loss of one limb comes with a limit of $25,000.

How Much Does SafetyWing Cost? Is it Worth the Money?

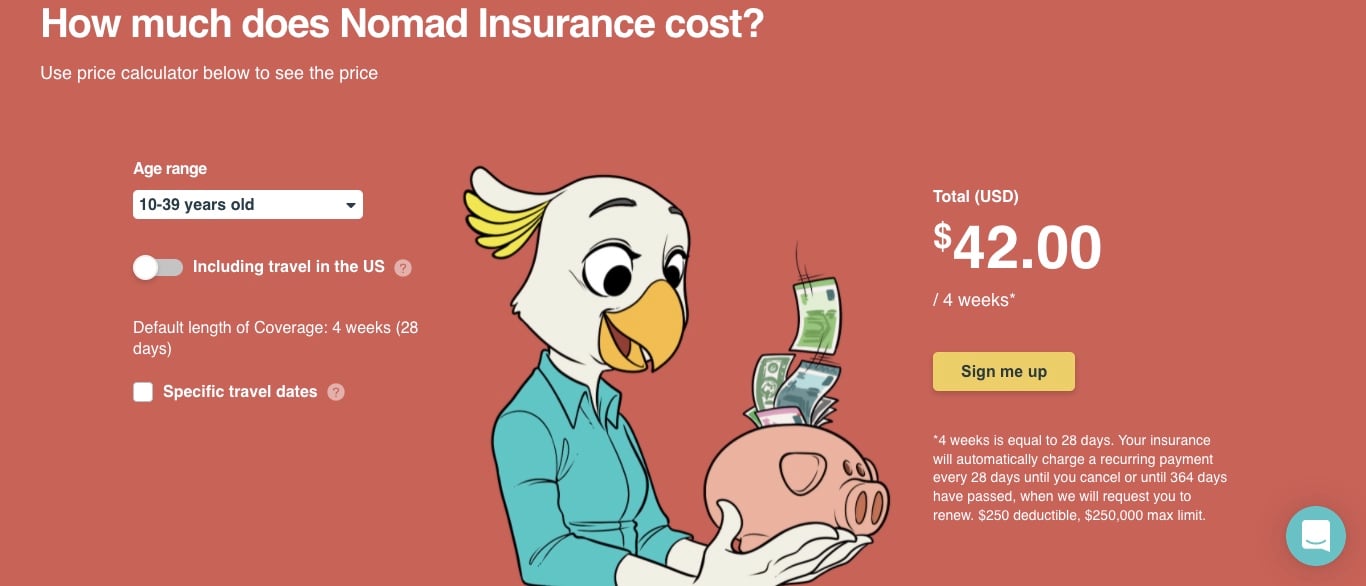

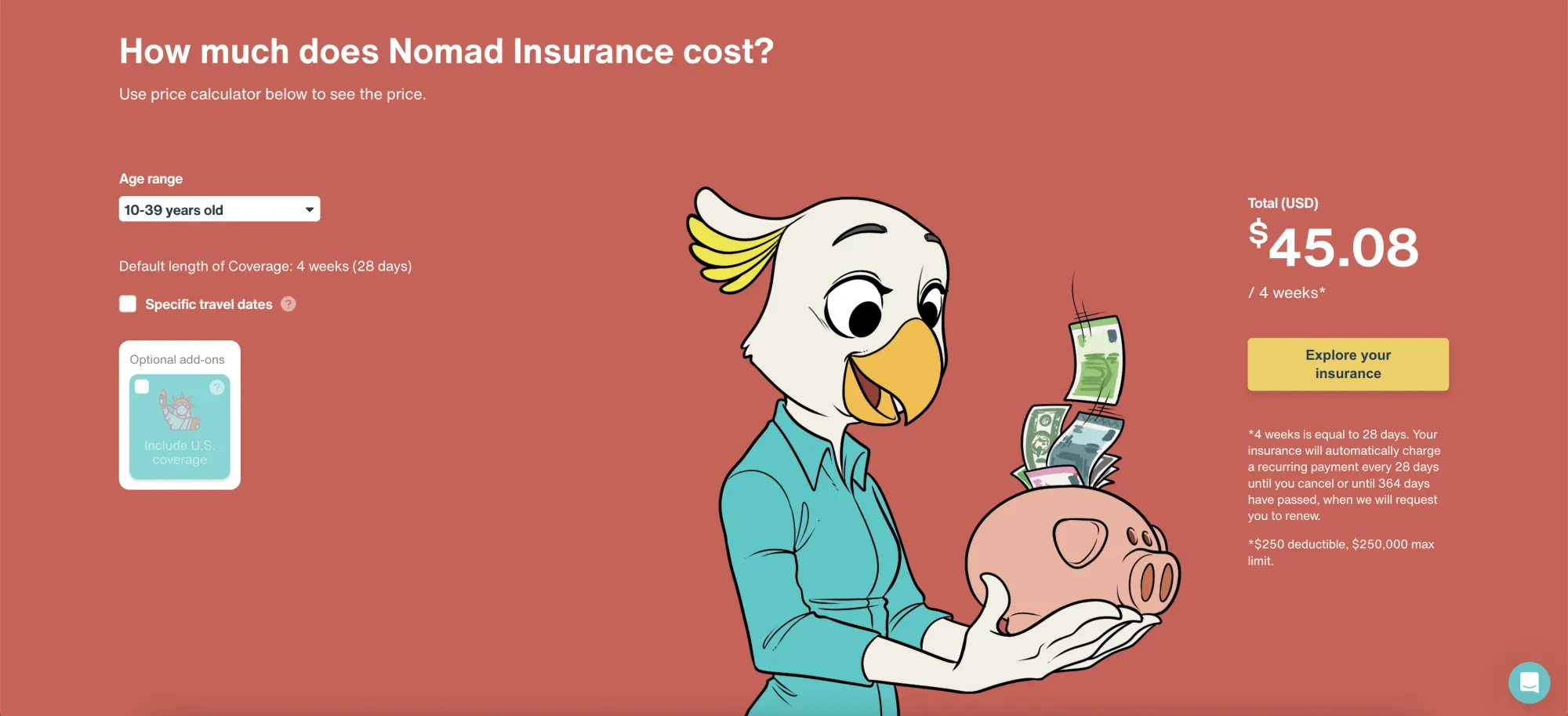

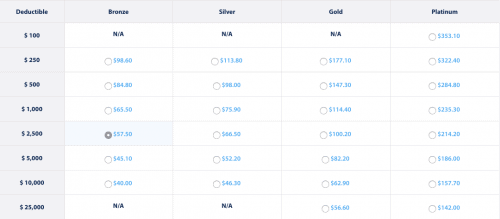

Although we have already presented the SafetyWing headline offer that is displayed across its homepage, it is important to note that the specific cost can vary depending on your age group.

As such, let’s breakdown the fundamentals in more detail. To clarify, the below prices are based on 4 weeks, which amounts to 28 full days of cover.

All Travel is Outside of the US

- Aged between 10-39: $36.96/4 weeks

- Aged between 40-49: $59.92/4 weeks

- Aged between 50-59: $94.08/4 weeks

- Aged between 60-69: $127.68/4 weeks

Travel includes the US

- Aged between 10-39: $67.76/4 weeks

- Aged between 40-49: $111.44/4 weeks

- Aged between 50-59: $183.68/4 weeks

- Aged between 60-69: $250.60/4 weeks

As you will see from the above figures, there is quite a premium if you are planning to travel to the US. The overarching reason for this is that medical care in the US is typically much higher than the rest of the world.

Nevertheless, the good news is that irrespective of where you are traveling, those aged 10 years old or below will be covered at no extra cost. This will only be the case if the respective child is traveling with an adult, or with a group.

Take note, you can only benefit from the $0 under-10 offer up to a maximum of two children. As such, if you require cover for three or more children under the age of 10, each subsequent child will revert to the regular price for 10-39 year old’s. Finally – it is important to note that children aged under 15 days will not be covered by SafetyWing.

In terms of the plan itself, SafetyWing will automatically renew the 28-day coverage until you cancel it. This is actually beneficial if you are based abroad or you are traveling overseas for a long period of time.

This auto-renewal option takes away the risk of forgetting to extend or renew your policy and accidentally finding yourself without coverage, which can be an issue with other travel insurances

Specific Travel Dates

If you don’t want to take out the 28-day recurring plan with SafetyWing, the provider also offers a tailor-made package that covers specific travel dates. For example, if you were looking to travel to South East Asia for 13 days, there would be no point in taking out the full 28-day plan.

If you do opt for this route, then you can take a plan out from just 5 days, up to a maximum of 364 days.

Does SafetyWing Have any Country Restrictions?

First and foremost, if you get sick or injured in your home country, it is important to clarify that you will only be able to claim on your SafetyWing coverage plan if the accident happened ‘incidentally’.

For example, if you were to pick up a serious injury while traveling and then came home with the specific purpose of receiving treatment domestically, you would not be able to claim your costs back from SafetyWing.

On the contrary, if you were traveling home to visit, and you became sick or encountered an accident, then this might be covered. However, you will only be covered in your home country for 30 days every 90 days of insurance cover – or 15 days for every 90 days of insurance cover if your home country is the US.

Nevertheless, you can travel with SafetyWing insurance anywhere in the world apart from Cuba, Iran, and North Korea. We should also note that kidnapping-related cover cannot be claimed if the incident started in Afghanistan, Iraq, Nigeria, Pakistan, Somalia, or Venezuela.

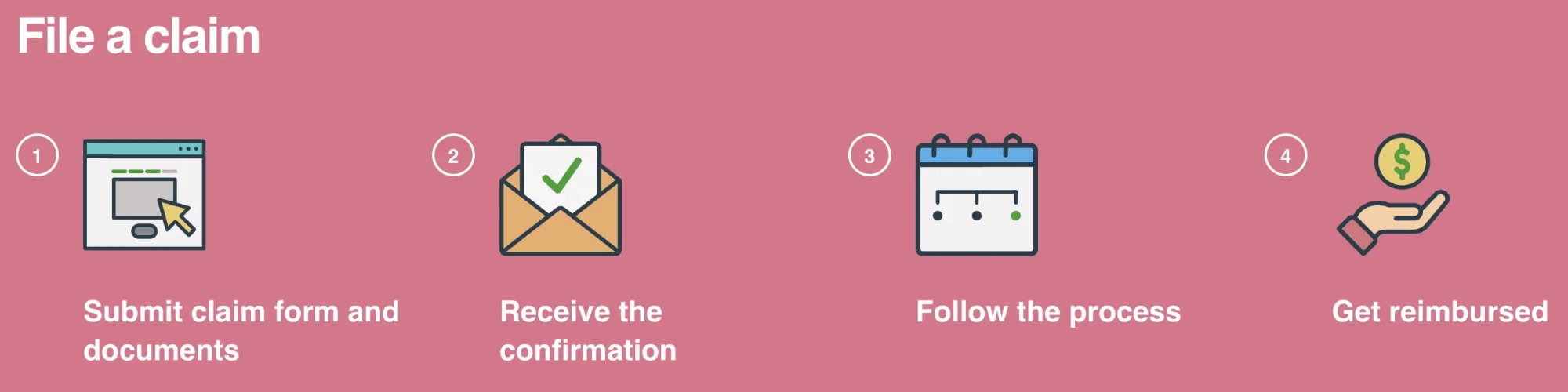

How Does the Medical Claim Process Work?

The claim process at SafetyWing works largely the same way as any other insurance provider. With that being said, here’s a quick breakdown of the key points that you need to be aware of.

Step 1: Is it an Emergency?

Firstly, if your sickness or injury is of a serious nature, you should proceed to call the emergency services as per the country you are based in.

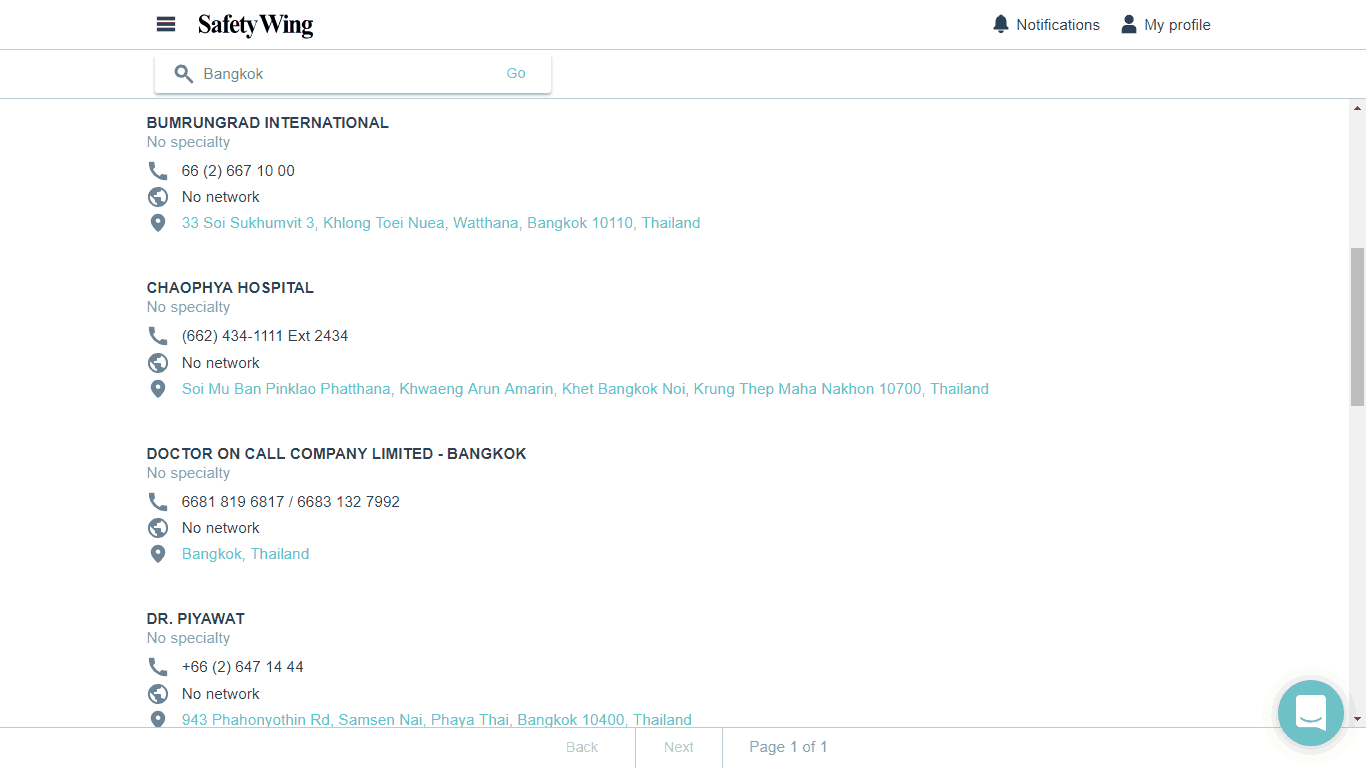

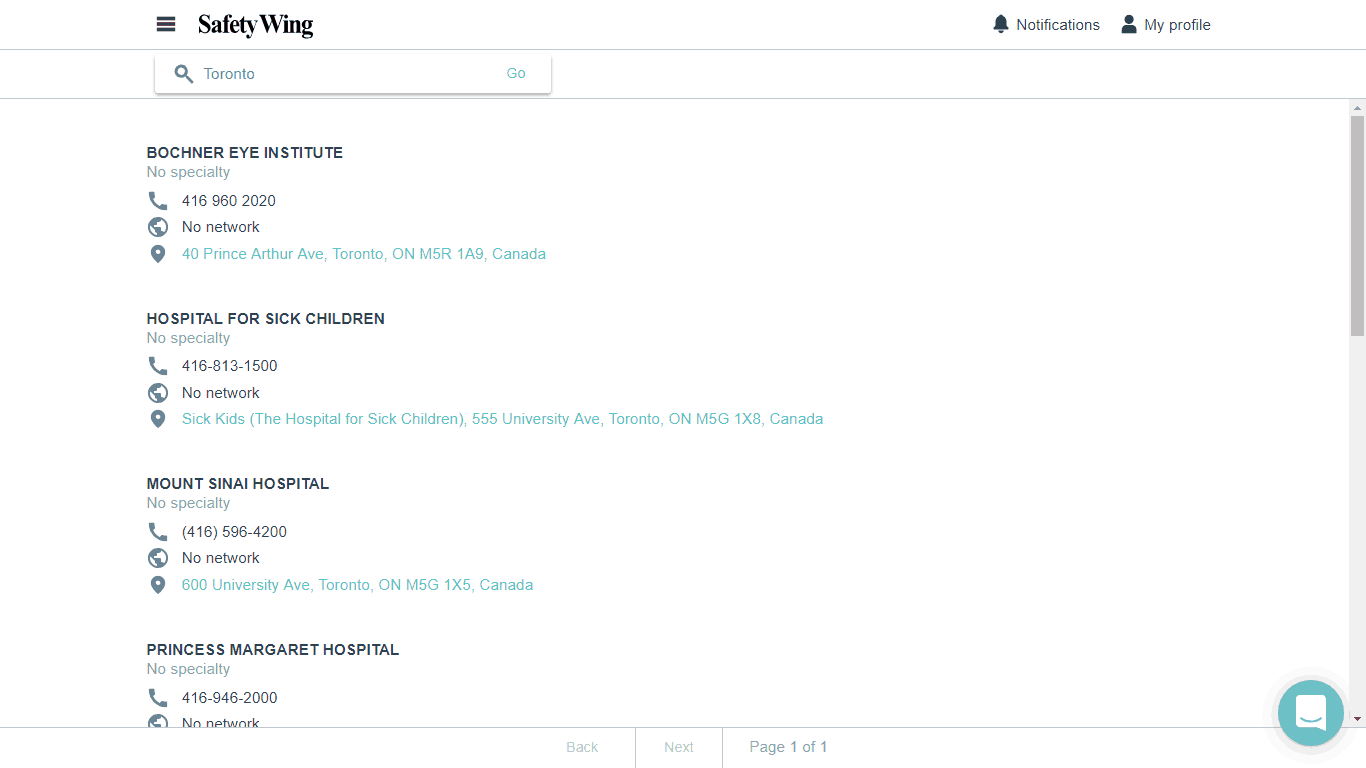

If it is not a serious injury and thus – you are able to walk into your nearest medical center or hospital, then you should log into your SafetyWing account and use the “Find a Hospital” option.

The provider has a global network of hospitals, doctors, and even medical specialists (such as physicians) within its database. As such, simply enter your exact location and the SafetyWing system will point you in the direction of the nearest center.

If for some reason the system is unable to locate a suitable hospital or doctor, you should proceed to use the nearest center that you can find. Failing that, you can contact SafetyWing directly via their telephone hotline.

Step 2: Show Your SafetyWing Card

When you arrive at the hospital or medical center, you should present your SafetyWing card at the earliest possible opportunity. While it is unlikely that the medical provider will have heard of SafetyWing, it will at the very least indicate that you have the required medical travel insurance in place to pay for your treatment.

This is a further reminder that you should always carry your SafetyWing card with you. Always prepare for the unexpected!

Step 3: Ask the Medical Provider About Payment

In some cases you can inquire whether or not the medical provider is able to take up payment with SafetyWing directly. This will depend on a range of factors, such as the respective country, whether you are at a hospital or medical center, and the type of treatment you have undergone.

In an ideal world, the provider will take the claim up directly with SafetyWing, meaning that you won’t be required to pay for it out of your own pocket. You can find doctors with direct payment in their database when you look for “direct bill”, only then it is possible. Alternatively, if you are required to pay for the bill yourself before leaving, you will have no option but to do this.

Step 4: Submitting the Claim to SafetyWing

If you have paid for the treatment yourself, you will then need to file a claim directly with SafetyWing. You can send an email directly to the claim team at [email protected], which needs to outline details of the treatment, alongside screenshots of the itemized bill, as well as any payment receipts.

Ease of Use

Customer support.

- Excellent Pricing

- Unlimited Travel

- Home Country Coverage

- Subscription Model

- No Trip Cancellation Coverage

Kane holds a Bachelor's Degree in Accounting and Finance, a Master's Degree in Financial Investigation and he is currently engaged in a Doctorate - researching financial crime in the virtual economy. With a keen passion for research, he currently writes for a variety of publications within the Financial and Cryptocurrency industries. [email protected]

Related Posts

Aawp review: the best amazon affiliate plugin for wordpress, lasso review: wordpress affiliate plugin to earn you more commissions, meet cleo app review: your own chat bot ai-powered financial assistant, xe money transfer review: send money internationally.

Comments are closed.

Type above and press Enter to search. Press Esc to cancel.

We’re in Myanmar right now and it’s SO epic… click here to follow along on Instagram.

- Meet the Team

- Work with Us

- Czech Republic

- Netherlands

- Switzerland

- Scandinavia

- Philippines

- South Korea

- New Zealand

- South Africa

- Budget Travel

- Work & Travel

- The Broke Backpacker Manifesto

- Travel Resources

- How to Travel on $10/day

Home » Budget Travel » Is SafetyWing The Best Travel Insurance For Long Term Travellers? Updated For 2024

Is SafetyWing The Best Travel Insurance For Long Term Travellers? Updated For 2024

“The worst can happen and does happen…so you had better make sure you’re Insured” – Fargo Season 1.

Usually, whenever I buy something I like to get my money’s worth and use it as much as possible. Take for example those Levi jeans that I wore everyday for a year until the knees wore out. Or take my trusty MacBook Pro which I use to beat out at least 10,000 words a day.

Travel Insurance on the other hand, is one of those rare things in life whereby you pay for it, and yet you hope that you never ever need to use it. But whenever you hit the road and head out on an adventure, it’s very important to get travel insurance. Whether you’re headed to Prague for a boozy weekend, or to Southeast Asia to spend 6 months finding yourself, disaster could be waiting for you at any point.

So here we run down what SafetyWing insurance offers and how they stack up against the competition. So with that, here’s our SafetyWing insurance review!

Do SafetyWing Cover COVID?

Safetywing review, do you need travel insurance, breakdown of safetywing travel insurance, what travel insurance plans does safetywing offer, what’s covered by safetywing travel insurance, what’s not covered by safetywing, who is safetywing travel insurance suitable for.

- Who isn’t SafetyWing Travel Insurance Suitable For?

How Much Does SafetyWing Travel Insurance Cost?

Other travel insurance providers, when should you buy travel insurance, staying safe on your adventure, frequently asked questions about safetywing travel insurance, final thoughts on safetywing travel insurance.

When COVID-19 first rocked the world in 2020, most travel insurers were quick to invoke their cancellation clauses and pull all cover relating to either illness, cancellation or disruption caused by the pesky pandemic.

These days, most insurance providers are offering some form of COVID coverage included within their policies, but some are more useful than others. Whilst many now cover hospitalisation caused by COVID infections, fewer are offering any kind of cover for disruption or cancellation such as being refused boarding on a flight for displaying symptoms, or having to cancel your trip because of a positive test.

Whilst the pandemic has largely subsided , COVID is still able to severely disrupt travel plans. Therefore do consider paying close attention to the finer details of any insurers COVID-19 cover.

SafetyWing can offer COVID-19 coverage in their policies and may be able to cover you for illness, evacuation cancellation and interruption.

These days there are countless travel insurance providers out there and choosing between them can be overwhelming. Furthermore, some of these providers have better reputations than others and there are some very unfortunate instances of insurers not paying out on claims. Finally, deciphering between policies and reading their fine print can be exhausting. But we’re here to help.

In this SafetyWing Review, we’ll take a good, detailed look at SafetyWing and its travel insurance policy. We’ll run through the various types of cover they offer, look at what is and is not included in their policy, and we’ll assess their value for money. We’ll also have a quick look at some of their best competitors (including World Nomads insurance).

Need help deciding between Safety Wing or Hey Mondo ? Check out our helpful guide.

Do you really even need travel insurance ? It’s a fair question. After all, the vast majority of trips end happily and safely without incident.

We at the Broke Backpacker have probably spent a combined total of maybe 10 years on the road and have easily visited over 100 countries. During all of that travel, we’ve clocked up a fair few mishaps ranging from inflected legs that almost needed amputating, to the inevitable bike crashes, all the way to gun-point robberies. These incidents were all traumatic enough themselves leaving physical or mental scars.

But mercifully, we were all insured at the time meaning that were spared the further trauma of paying out $10,000 medical bills and emergency medical evacuation or having to find $700 for a new iPhone.

Basically, nobody ever thinks it will happen to them and yet, it has to happen to somebody. Besides that, the law of averages tells us that if you travel enough, something somewhere will eventually go wrong.

Furthermore, some countries do actually require you to obtain insurance before even letting your enter.

What Does Travel Insurance Cover?

In order for you to decide whether you really do need travel insurance, let’s look at some of the things it can help with, and where you would be without travel insurance coverage.

Lost Luggage

The aviation industry watchdog estimates that 5.73 items of luggage are lost for every 1000 passengers. This is not a bad statistic but it means that if you take 10 flights, there is a 5% chance of your luggage being lost forever. Also, note that some airlines and airports (the black hole of Charles De Gaulle anybody?) are a lot worse than others for this.

Lost luggage can easily mean your trip is ruined as you’re forced to walk around Ibiza for a week sweating your ass off in the same inappropriate jeans and jumper combo you left home in. Replacing everything you own though, can mean you then have to find $1000 to replenish your wardrobe, refill your toiletry shelf and get a new travel camera . Any good travel insurance policy, therefore, covers lost luggage, usually up to at least $1000.

We’ve tested countless backpacks over the years, but there’s one that has always been the best and remains the best buy for adventurers: the broke backpacker-approved Osprey Aether and Ariel series.

Want more deetz on why these packs are so damn perfect? Then read our comprehensive review for the inside scoop!

Medical Expenses

Medical expenses can be seriously expensive. For example a friend of mine was once hospitalised whilst volunteering in Costa Rica and ran up bills in excess of $10,000. He recently spent 1 night in a Thai hospital, was billed $1,000 and his passport was used as a ransom. Personally, I don’t have $10,000 to pay Costa Rican Doctors but I do have maybe $50 to get myself some comprehensive health insurance.

Coming from the UK where we (just about) have the NHS, the cost of medical care in some parts of the world is quite a revelation. If you are reading this in the US you already know all about health extortion but do remember that your domestic health insurance will not cover your medical expenses outside of the US.

Accidents happen without warning and ill health can strike at any time, anywhere. In fact, if you have experienced driving or hygiene standards in India, then you’ll probably agree that you’re actually at a much higher risk of coming to harm on the road than you are at home!

Travel Disruption

Travel disruption and trip interruption comes in all shapes and sizes but let’s take a classic, topical example. Every year a few airlines and travel agents go bust leaving passengers stranded. Booking flights home at short notice is expensive, but not getting home ASAP can mean getting fired from your job. Having to stay an extra few nights in a hotel can also put undue strain on an already tired travel budget.

Having travel insurance can therefore mean the difference between desperately raiding your overdraft to pay a hotel, or your travel insurance company covering a few extra nights at your destination free of charge! Trip interruption is upsetting enough without it costing a fortune!

Robbery

In many parts of the world, tourists are a target for thieves. I’ve had my phone stolen by knife-wielding bandits in Colombia and know people whose hotels have been raided leaving them without gold jewellery and laptops.

Getting jacked is scary, but having to find $700 for a new iPhone is seriously fucking depressing. Thankfully, many travel insurance companies cover it.

Stash your cash safely with this money belt. It will keep your valuables safely concealed, no matter where you go.

It looks exactly like a normal belt except for a SECRET interior pocket perfectly designed to hide a wad of cash, a passport photocopy or anything else you may wish to hide. Never get caught with your pants down again! (Unless you want to…)

Who Are SafetyWing?

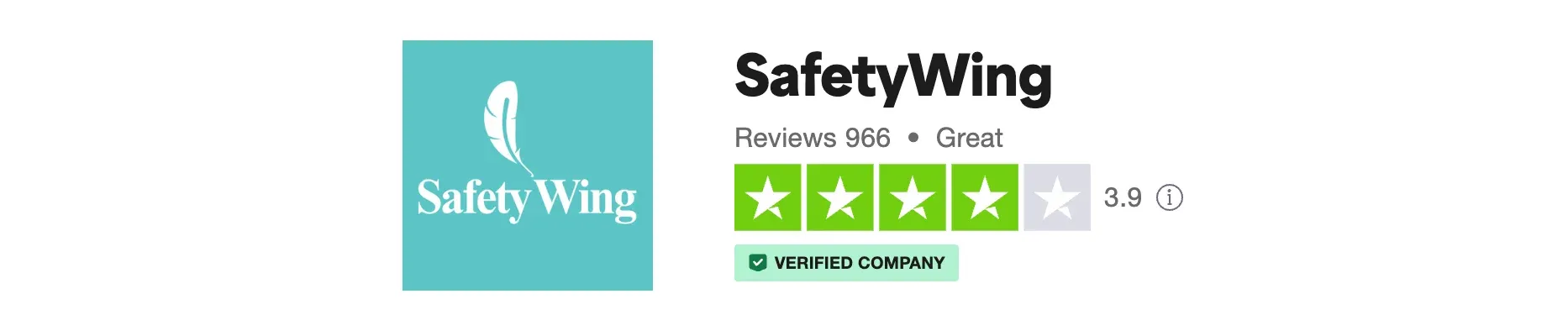

If you have never heard of SafetyWing, it’s probably because they are still a new company. Launched in 2018, founded by Norwegians and based in the US, SafetyWing is one of the newest travel insurance providers in the space.

In case you are nervous about entrusting your wellbeing to a baby company, don’t be. SafetyWing’s Insurance partner is Tokio Marine, one of the biggest and most established insurance companies in Japan, and the Insurance is underwritten by Lloyds. Furthermore, Insurers are required to go through a shed load of vetting and have erm, insurance, in place before they are even allowed to trade.

SafetyWing identifies as long-term travellers and digital nomads describing their mission as “insurance for nomads by nomads”. In practice, this means that they focus on long term travellers and digital nomads who are not served by other providers and can often fall between the cracks of healthcare systems.

SafetyWing is pretty unique in that they offer a kind of hybrid between travel insurance and health insurance. Their package is nowhere near as comprehensive as standard travel insurance as they have ripped out some of the features which are less likely to apply to digital nomads and long term travellers. This is reflected in the pricing which makes them one of the most reasonable and competitive travel insurance companies.

Whereas most travel insurance companies offer multiple different plans, SafetyWing insurance keeps things straightforward and offers one simple plan.

One Simple SafetyWing Plan

The headline is that SafetyWing plan may be able to cover you up to a maximum value of $250,000 per cover period with direct billing. The excess is $250 meaning that you must pay the first $250 of any claim yourself. For example, if you end up in hospital for stitches and the bill comes to $197, then unfortunately the entire bill comes out of your pocket and you cannot claim. That is however pretty standard across insurance cover.

In case you are in a hurry, the key points are set out below.

- Medical emergencies may be covered up to $250,000. This also includes emergency dental treatment up to $1,000 which is perfect if you fancy a bit of 2am gutter boxing!

- Medical Evacuation may be covered up to $100,000. Note that emergency medical evacuation means been transferred to a hospital in your home country and does not mean been rescued from a mountain after breaking your leg whilst trekking.

- Emergency evacuation in case of civil unrest or something may be covered up to $10,000.00. So, if London erupts into riotous, murderous, anarchy following Brexit, you can get yourself a flight either all the home, or simply to safety in Paris!

- In the event of a natural disaster , cover may be $100 per day for 5 days for accommodation costs.

- Whilst trip cancellation is not included, trip interruption up to $5,000.00 is included. This means that if you are forced to cut your trip short, you may receive up to $5,000 to help you get home.

- Lost Luggage may be covered up to $3,000. However, note that the maximum value per item is $500. Therefore, if you plan on checking-in that diamond necklace, you may wish to obtain different cover.

Please remember that international travel insurance coverage changes from time to time. It is important for you to read the policy yourself and make sure you understand it. If you are uncertain of anything, it is a good idea to speak with the provider for clarification especially when it comes to things like trip interruption and specific medical coverage.

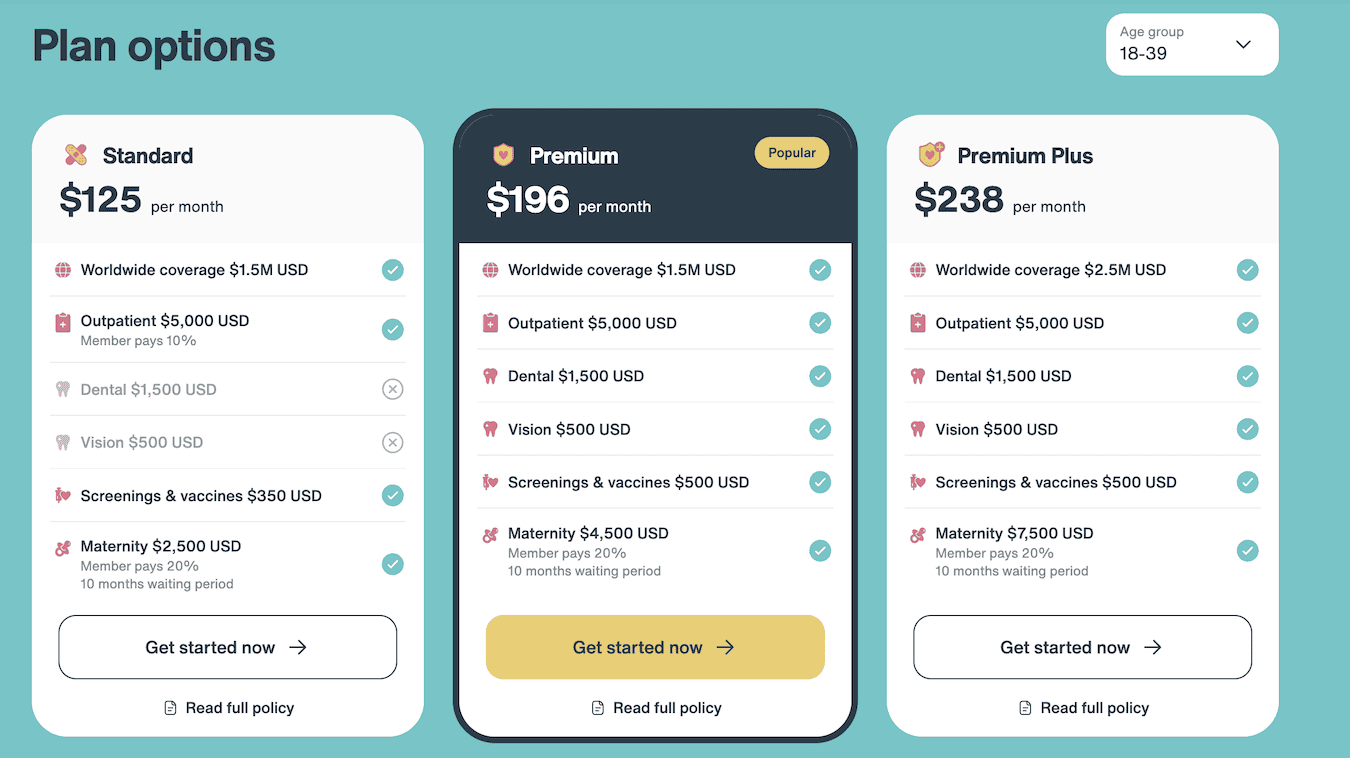

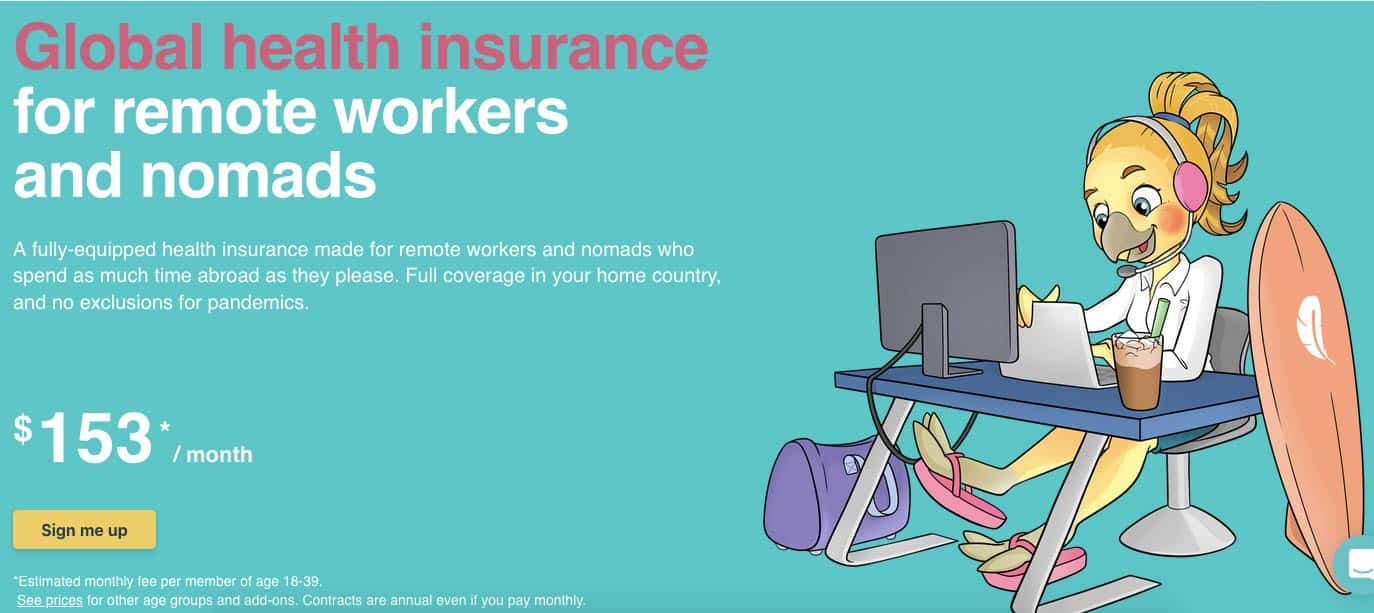

Remote Health

SafetyWing quite recently launched a second policy; Remote Health. Remote Health was initially designed to cover remote working teams and was a pioneering form of workplace health insurance for the age of the Digital Nomad.

However, SafetyWing has now evolved the concept and it is available for individuals. Remote Health differs from the standard policy in a number of ways offering a more robust cover. Crucially, it may be able to cover pandemics like the COVID-19 outbreak of 2020 and for this reason, appeals to a growing number of travellers. Not all insurance will cover Covid 19 so this is a great addition.

Remote Health is more expensive than the standard policy but may still be a good investment for those seeking stronger cover.

Emergency Accident & Sickness Medical Expenses

Got food poisoning in Delhi? Got hit by a moped in Bangkok? Or maybe you just slipped in the shower and broke your wrist at a hostel in Madrid ? These things can, and do happen and will all require emergency medical treatment. Being sick, infirm and unable to jerk yourself off is bad enough as it is, so the last thing you want is a hefty medical bill which you have to pay out of your own pocket.

Emergency accident, sickness and medical coverage is quite likely the most important aspect of any travel insurance plan – I certainly know it is for me. If you get ill, get hurt, or otherwise need medical attention, you may have medical coverage up to $250,000 and direct billing is available too.

If you need emergency dental care, you may be covered up to $1000.

Besides the above medical coverage, SafetyWing also offers a few additional benefits:

- Acute Onset of Pre-Existing Condition – If you have a pre-existing condition which suddenly, flares up, then you may be able to claim up to $250,000 of the maximum limit or $25,000 for medical emergency evacuation. If you do have a pre-existing conditions, please speak to the insurer about it to make sure you are covered.

- Outpatient Physical Therapy – You may be able to claim up to $50 per day if you ever need to see a physio or a chiropractor during your trip. This is very useful for when the dreaded, Digital Nomad bad-back strikes!

Emergency Evacuation and Repatriation

Medical Evacuation is when you need to be sent to your home country, or another country for further or continued medical treatment, and are too sick to travel home normally as a regular passenger. For example – when you are still stuck in a hospital bed with tubes coming stuck in you.

Repatriation means the cost of sending your dead body home. This is often overlooked by many travellers but it really is very important. The cost of flying bodies home is very expensive and I would hate for my family to ever be landed with this cost at such an awful time for them.

Accidental Death and Dismemberment

This applies in the very, very unlikely event that you have an accident and lose an arm or a foot. Or if you tragically arrive at your departing destination and then die.

This coverage is for the loss of life or limb as a result of an accidental injury occurring during the trip. The loss must occur within 365 days after the date of the accident causing the loss. Basically what this means is if you have an accident and are dying, if you die your family may be covered.

The same goes if you have something happen that results in your arm eventually being removed as a result of the accident.

We appreciate that this is pretty heavy going, grim stuff. But please persevere, these cover policies exist for a reason – the reason being that it is has happened to somebody before.

Things go wrong on the road ALL THE TIME. Be prepared for what life throws at you.

Buy an AMK Travel Medical Kit before you head out on your next adventure – don’t be daft!

Kidnapping is very rare but does happen so thankfully, SafetyWing’s Crisis Response coverage protects against this. If this happens, you may receive recompense for either your ransom or loss of personal belongings that occur during the kidnapping.

Note that crisis response does not apply in some “dangerous countries”. Examples are Iraq, Afghanistan, Pakistan, Nigeria, Somalia and Venezuela. Personally, I think it’s a bit harsh putting Pakistan on that list but there you go.

Incidentally, quite a few reputable travel insurance providers do not cover kidnapping at all.

Lost or Stolen Passport

Did you know that lost or stolen passport claims are amongst the most common ones made by travellers?! If your passport is lost or stolen, you may be able to claim up to $100 for a new one which I think, should cover it pretty much anywhere in the world.

Of course, in order to minimise the risk of this happening you should keep your passport securely locked in your hotel room or hostel locker. Even in countries that require foreigners to carry passports with them, a photo copy usually suffices.

When in transit, keep it near to you at all times and do not absent-mindedly put it down anywhere.

Personal Liability

Personal Liability indemnifies you in the event that your actions cause injury, harm or financial loss to another party. This includes vehicle accidents where you were found to be to blame.

Coverage also includes legal fees which can be harrowingly expensive.

Home Country Coverage

Somewhat unusually, SafetyWing even offers a level of coverage in your home country. This is because SafetyWing understands that long term travellers and Digital Nomads will go home once in a while, but that “the trip” is still not over. It’s great for popping home for Christmas or to attend your annoying cousin’s wedding.

The cover period is 30 days per every 90 day period (15 days in the US) .

We are not aware of any other travel insurance provider that offers anything like this.

To get the full measure of any travel insurance, it is important to look at what is not covered as well as what is covered.

In the case of SafetyWing, there are some very notable exclusions that you should carefully take into account before deciding whether it is the right cover for you.

Trip Cancellation

In case you get ill and have to cancel your trip, you cannot recover the costs of it. From what I can deduce, the rationale behind this is that for long term travellers and Digital Nomads, life is the trip! Therefore, you may be unlikely to ever even really need this.

Electronics

Expensive electronic equipment is not covered by the SafetyWing plan at all. At first, this may seem odd in a policy aimed at Digital Nomads . However, most Digital Nomads have separate, comprehensive gadget covers anyway. Most travel insurers who do cover gadgets only cover them up to $500 which is about one third the price of a MacBook.

I for one have a gadget cover that covers loss, theft, accidental damage and malfunction. After all, my livelihood depends on this little piece of overpriced silicon valley crap powering up each morning.

A new country, a new contract, a new piece of plastic – booooring. Instead, buy an eSIM!

An eSIM works just like an app: you buy it, you download it, and BOOM! You’re connected the minute you land. It’s that easy.

Is your phone eSIM ready? Read about how e-Sims work or click below to see one of the top eSIM providers on the market and ditch the plastic .

Theft or Loss

If you are robbed in Colombia, or you stupidly leave your Ombraz Armless sunglasses on an Indian bus, you are not covered. This is kind of unusual for travel insurance as both of these things do happen to travellers.

However, is this really such an issue? For example, in the case of your lost sunglasses, many insurers would try and wriggle out of paying that one anyway. Even if they did, you would have to pay the excess which could be anywhere between $50 – $250 (ie, more than the glasses are worth).

As for getting robbed, cash is generally not insured and any items are still subject to the excess. Therefore, the only thing you could realistically claim for is a stolen smartphone – see above re electronics.

Adrenaline Activities

SafetyWing does not certain adrenaline sports such as Quad Biking and Parachuting which is fair enough. However, somewhat surprisingly, football/soccer is not covered if you are playing as part of a regular team. Therefore, if you are a Digital Nomad thinking of joining the local 5 a side team in Budapest, think again! Trekking and mountaineering are covered up to an altitude of 4500 metres.

Sanctioned Countries

SafetyWing does not extend any coverage at all to Cuba, North Korea and Iran. This is presumably because the US’ draconian financial sanctions prevent them from doing so. Note that if you do wish to visit Iran, you will need travel insurance to enter so should find an alternate provider.

The kidnap or crisis coverage is not available in Iraq, Afghanistan, Pakistan, Nigeria, Somalia or Venezuela.

So what makes SafetyWing unique amongst other travel insurance providers, and who is there cover the perfect cover for?

SafetyWing understands that there is a lot more to travel than a 2-week trip. They appreciate that many of us set off with a one-way ticket, no itinerary, and have no idea when we will be coming back.

Therefore SafetyWing may be suitable for;

- Long Term Travellers – SafetyWing are pretty unique in that they offer open-ended travel insurance. You can bum around the world for years, and stay covered as long as you keep up your premiums.

- One Way Travellers – As I said, your trip doesn’t need to have a set end date in order for the cover to be valid!

- Digital Nomads – When you’re a digital nomad, you move from one destination to another working and hustling as you go. You can hustle around the world for years at a time with this policy. If you’re living as a digital nomad long term, there’s a pretty good chance that at some point you’re gonna need to see a Doctor about something.

- Travellers With Kids – This is another cool feature. The policy covers one young child per adult , up to 2 per family, age between 14 days and 10 years old. So, if both you and your partner take the cover, it’s 2 children for free as long as they are not over 10 years old! If your child is over the age of 10, you may wish to enquire about separate or additional cover for them.

Who isn’t SafetyWing Travel Insurance Suitable For?

SafetyWing specialises in travel insurance for long term backpackers and Digital Nomads. This is a sizeable and growing niche. However, this kind of cover isn’t necessarily right for everybody out there. SafetyWing is perhaps not the best travel insurance out therefor;

- Conventional Holidaymakers – If you are going on a classic, 2 weeks in the sun type holiday, then there will be plenty of travel insurance providers more suited to your needs, who can probably cover you cheaper than SafetyWing.

- Travellers Who Need Comprehensive Cover – Note that SafetyWing is a specialised cover but is not comprehensive. For example, trip cancellation cover is not included.

- Adrenaline Junkies – SafetyWing does not cover extreme sports such as white water rafting, running with the bulls or been fired from cannons. If you require this kind of cover, then perhaps consider another provider.

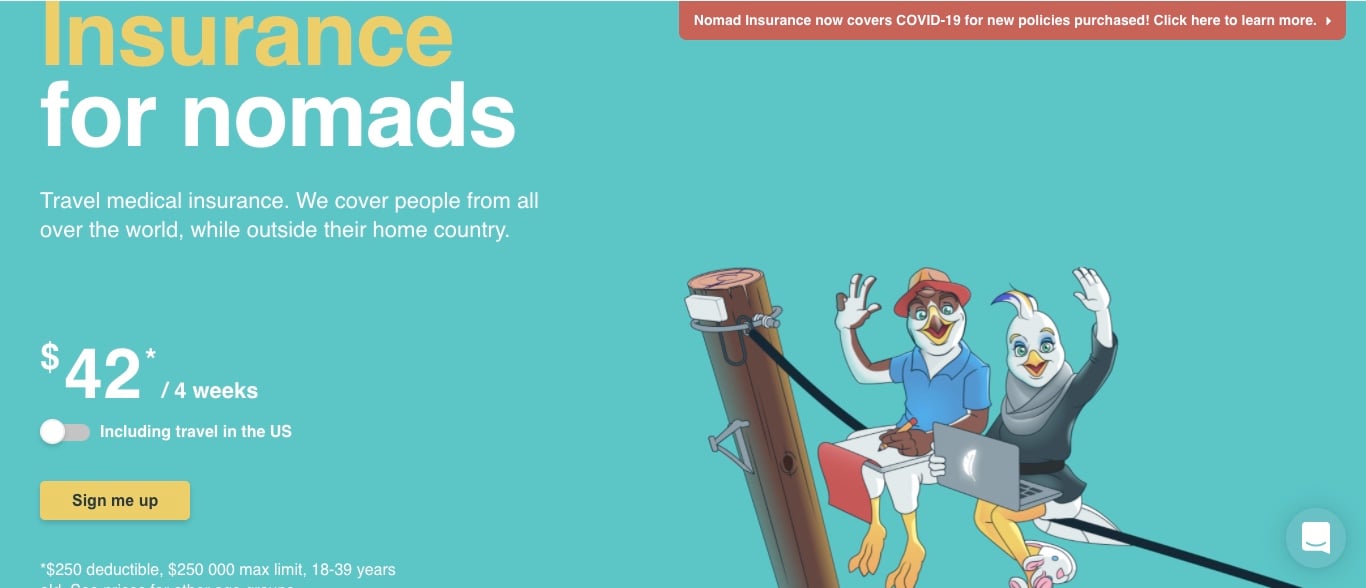

SafetyWing Travel Insurance can cost as little as $42 for 28 days. Compared to some private medical insurance policies, which can cost hundreds of dollars, this is great value. They also offer affordable monthly payment options.

SafetyWing’s monthly premium does vary depending on a number of factors, including the age of the applicant. A higher premium also applies if you intend to go backpacking in the USA (because of the expensive American healthcare system).

Not sure whether SafetyWing Travel Insurance is for you? Perhaps you feel you need a more comprehensive level of cover? Or maybe you are interested in SafetyWing but want to know what else is out there before you make a purchase?

There are loads of other travel insurance providers out there to choose from. In fact, there are possibly too many! In this section, we will take a quick look at some other leading, specialised travel insurance providers who we have also used and had positive experiences with.

World Nomads

World Nomads are by far, one of our favourite travel insurance providers. Like SafetyWing, they also offer backpacker insurance.

The cover levels for medical emergencies and evacuations are broadly speaking, very similar to SafetyWing. However, World Nomads do offer 2 separate plans depending on how much coverage you want and what exactly you intend to do. World Nomads do also include trip cancellation, electronic gadgets, rental car excess, and theft cover in the policies.

Word Nomads can cover over 100 countries. They can also cover a wide range of adventure sports which SafetyWing do not. However, they do not offer Home Country cover and do not offer open-ended cover.

ALWAYS sort out your backpacker insurance before your trip. There’s plenty to choose from in that department, but a good place to start is Safety Wing .

They offer month-to-month payments, no lock-in contracts, and require absolutely no itineraries: that’s the exact kind of insurance long-term travellers and digital nomads need.

SafetyWing is cheap, easy, and admin-free: just sign up lickety-split so you can get back to it!

Click the button below to learn more about SafetyWing’s setup or read our insider review for the full tasty scoop.

World Nomads’ cover appears a bit wider than SafetyWing but is also substantially more expensive. It is perhaps better suited to adventure travellers and more typical backpackers and less suited to Nomads.

For more information about World Nomads – check out our comprehensive World Nomads Review or just visit the site by hitting the button below.

Provided you’re still reading, I guess you have concluded that you do want travel insurance. Good decision. The next question is probably, when should you buy travel insurance?

Ideally, you should buy travel insurance before you start your trip and some providers may even insist on this. Note that if you do ever do make a claim on your travel insurance, they will probably ask for evidence of when your trip started in the form of an airline booking or flight ticket.

As a rule of thumb, I usually book my travel insurance the same day I book my flight. The only exception is if I have long term or annual cover in place at the time.

We hope you never have to claim on your travel insurance and wish you many long, happy, safe adventures. And in order to help you stay safe, we do have some top tips for you.

Firstly to make things far more difficult for potential thieves to take your money, pick yourself up a backpacker security belt to keep your cash safe & hidden on the road. Also, check out our Backpacker Safety 101 post for tips and tricks to stay safe whilst on your backpacking adventure.

For hiding bigger wads of cash, check out this post on ingenious ways to hide your money when travelling.

I strongly recommend travelling with a headlamp whilst backpacking anywhere in the world (every backpacker should have a good headtorch!) to prevent you from falling down a well on a dark night. In case you don’t have a head torch, check out this post for a breakdown of the best value headlamps to take backpacking.

These are some of the most commonly asked questions about SafetyWing that we received from you guys.

Do SafetyWing Insure Electronic Devices?

No. SafetyWing does not cover electronic devices. This is because most Digital Nomads usually have dedicated gadget insurance. If you have expensive electronic devices, I recommend getting decent cover for them.

What Countries Are Covered by SafetyWing?

SafetyWing can cover over 100 countries. They are not able to cover trips to North Korea, Iran or Cuba at all. The kidnap and crisis cover is not available in Iraq, Afghanistan, Somalia, Nigeria, Pakistan & Venezuela or any other country from where they are prohibited due to the US’ Financial Sanctions.

Is SafetyWing the Best Travel Insurance for Digital Nomads?

It is not possible to say which provider or cover is best. However, SafetyWing’s mission is to provide cover for nomads, by nomads. They certainly do provide dedicated, strong cover for Digital Nomads at a great price.

Is SafetyWing the Cheapest Travel Insurance on the Market?

SafetyWing is definitely amongst the cheapest travel insurance providers we have come across.

Whether you are planning to spend a month in Oz or to live in Southeast Asia as a freelancer, it really is a good idea to get yourself some insurance. Life is unpredictable and you never know when illness, accident or bad luck can strike. When it does, there is no worse feeling than being stuck with hefty expenses that could have easily been avoided.

I hope your future backpacking adventures fulfil all over your travel dreams and then some. Hopefully, the day will never ever come when you actually need to claim on your insurance.

But, if that dark day does arrive, SafetyWing travel insurance will help you out and you’ll be glad you made the investment.

A word on Travel Insurance. Please note that Insurance terms and conditions do vary and may change from time to time. The information provided here is for guidance purposes only. We recommend you check with your policy provider to ensure that you are fully covered before beginning your trip. Please read your policy terms and conditions very carefully.

And for transparency’s sake, please know that some of the links in our content are affiliate links . That means that if you book your accommodation, buy your gear, or sort your insurance through our link, we earn a small commission (at no extra cost to you). That said, we only link to the gear we trust and never recommend services we don’t believe are up to scratch. Again, thank you!

Aiden Freeborn

Share or save this post

Hi! We’re putting together a collection of reviews about Safetywing and would appreciate your input. We’re a high authority (Moz DA of 71, ahrefs DR of 62) website and can link back to you with a dofollow link below your review (can be just a few sentences long of unique content, but the more detail the better) if you submit one to us. We have a “submit review” page on our website otherwise you can email it to me. Let me know if you have any questions. Thank you!

We may well be able to provide an honest review of SafetyWing for you! I have contacted you by email.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of followup comments via e-mail.

Home » Digital Nomads » SafetyWing Travel Insurance Review 2024: Best Insurance for Digital Nomads

SafetyWing Travel Insurance Review 2024: Best Insurance for Digital Nomads

Safetywing review – travel insurance for long-term travellers, best travel insurance for digital nomads & remote workers.

I’ve recently come across a travel insurance product that I’m extremely excited about!

SafetyWing is the first medical travel insurance created specifically by nomads, for nomads . SafetyWing insurance company provides coverage (and peace of mind!) for people from all over the world while they are outside their home country.

And although their travel insurance is aimed at remote workers and digital nomads, it can be used by anyone who is traveling for extended periods of time.

Their plans are comprehensive, easy to understand, and they provide a variety of coverage options – there’s a travel insurance plan that will work for almost everybody!

And yes, they cover COVID-19 related occurrences (which can be difficult to find in other insurance policies).

You’ll find below my detailed SafetyWing travel insurance review, updated for 2022, that focuses on their different travel insurance offerings (Nomad + Remote Health Benefits) , the pros and cons of each, what exactly is covered, and how much they cost.

Quick Links – SAFETY WING TRAVEL INSURANCE:

- WHY IS SAFETYWING THE BEST TRAVEL INSURANCE OPTIONS FOR LONG-TERM TRAVELERS? (QUICK SUMMARY)

- WHAT IS INCLUDED IN SAFETYWING TRAVEL INSURANCE COVERAGE?

- WHERE CAN I TRAVEL WITH SAFETYWING NOMAD INSURANCE?

- WHAT IS COVERED WITH SAFETYWING NOMAD INSURANCE?

- WHAT ARE THE EXEMPTIONS AND LIMITATIONS?

- IS COVID-19 COVERED?

- WHEN DOES COVERAGE BEGIN?

- CAN I CHOOSE MY OWN HEALTHCARE PROVIDERS?

- HOW DO I FILE AN INSURANCE CLAIM?

- WHERE CAN I TRAVEL WITH SAFETYWING REMOTE HEALTH INSURANCE?

- WHAT IS COVERED WITH SAFETYWING REMOTE HEALTH INSURANCE?

- IS TRAVEL INSURANCE REALLY NECESSARY?

- IS IT DIFFICULT TO SIGN UP FOR TRAVEL INSURANCE?

- CAN I CANCEL MY INSURANCE POLICY WHEN I WANT TO?

- ARE MY ELECTRONIC DEVICES COVERED?

- IS SAFETYWING NOMAD INSURANCE THE CHEAPEST TRAVEL INSURANCE ON THE MARKET?

- IS SAFETYWING NOMAD INSURANCE THE BEST TRAVEL INSURANCE OPTION FOR DIGITAL NOMADS?

- DO I NEED TO HAVE A POLICE REPORT IF MY ITEMS WERE LOST OR STOLEN?

- DOES SAFETYWING COVER MY SPORT OR ACTIVITY?

- FINAL THOUGHTS ON SAFETYWING TRAVEL INSURANCE

- CHECK PRICES FOR SAFETYWING TRAVEL INSURANCE HERE

Why is SafetyWing the Best Travel Insurance Options for Long-Term Travelers?

(quick summary).

In my opinion, these are the reasons SafetyWing is the best long-term traveler insurance option:

- No Limit on Duration of Travel – Yup, it’s true! Unlike other travel policies that will only cover you for two or three months maximum, SafetyWing has no limit on the duration of your travel that they will cover! After one full year, you will need to renew your travel insurance policy, but that’s it.

- SafetyWing Insurance Includes COVID-19 Coverage – As long as COVID-19 was not contracted before your coverage began, you’re covered for COVID-19 and quarantine-related expenses. More information on that is below! (This is rare with other travel health insurance companies).

- You Can Travel With a One-Way Ticket – If you travel without a return ticket like we often do, then this could be a good option for you. Unlike most other insurance companies, SafetyWing will cover you even if you don’t have a planned return ticket.

- Provides Some Coverage in Your Home Country – SafetyWing will provide limited coverage when you return to your home country, which is rare in travel insurance providers, as long as the visit is incidental. After being abroad for 90 days, you’ll retain your SafetyWing medical coverage for 30 days in your home country in a 90-day period (15 if your home country is the USA) if you decide to return to your home country and something happens while you are there. (Note that you cannot be traveling to your home country for the purpose of obtaining treatment for an illness or injury that happened while abroad)

- Worldwide Coverage is Included – If you’re planning on traveling around and planning as you go, this is perfect for you as SafetyWing provides worldwide coverage almost everywhere!

- Monthly Insurance Payments – You can pay your insurance premiums monthly with SafetyWing! Many of their competitors require upfront payment for the entire length of your trip, so this is a huge bonus for many.

- Purchase Your Insurance Policy While Traveling – If you’re already at your destination, you can purchase SafetyWing travel insurance, no problem. This is really rare with other travel insurance providers who require you to purchase your travel insurance before departing your home country! When we arrived in Mexico, my Canada insurance covered us for two months, then we switched to SafetyWing after that expired with no issues whatsoever.

- Coverage is Instant – Such a huge bonus! Some policies by travel insurance companies begin immediately after purchase, but some require longer to kick in.

- Direct Billing – Yep! Saves so much time.

- Your Adventure Activities Are Included – SafetyWing will cover you for activities that other insurance providers will not, such as riding a motorcycle or scooter, horseback riding, snowboarding or skiing, scuba diving, and bungee jumping. (However, extreme sports are not covered; learn more about exclusions here ).

- SafetyWing Insurance is Affordable – SafetyWing is able to keep their costs low by focusing on just the essentials needed by long-term travelers, such as emergency medical coverage, instead of trip cancellation and other costs that they’re not likely to need with their lifestyles. SafetyWing’s insurance options come at an affordable price – just $42/USD for four weeks of coverage. Compared to World Nomads, which costs about $120 for a standard plan and $210 for an upgraded plan, this is a steal of a deal.

- Simple and Clear Pricing – SafetyWing’s pricing structure is easy to understand, with no complicated quotes required or choosing between various “tiers” of coverage. This is definitely not true of the majority of travel insurance plans!

- No hidden costs – pricing is simply based on your age, and whether you include travel to the USA or not

- FREE Coverage for Your Kids – Coverage for up to two children under 10 years of age per family (one per each adult) is included for free.

- Travel Insurance Designed by Nomads, for Nomads – SafetyWing understands the needs of long-term travelers, remote workers, and digital nomads, and they’re consistently adapting their products to meet those needs.

What is included in SafetyWing Travel Insurance Coverage?

First things first, here is a high-level summary of what is covered by SafetyWing Travel Insurance:

Emergency Accident & Sickness Medical Expenses

Emergency accident and sickness coverage is usually the most important coverage of any travel insurance plan. If you become hurt, or sick, or require medical attention, your costs may be covered for these reasons up to $250,000. Some examples would be if you slip in the shower in your accomodation (just happened to a good friend of mine!), get food poisoning while traveling, find yourself in a car accident, etc. The last thing you want is a hefty medical bill. It’s incredibly important to make sure you’re covered for emergency accident and sickness expenses, as proper medical care can be very expensive around the world!

Coverage in Your Home Country

This is pretty rare with travel insurance companies, but SafetyWing even provides you with limited coverage while in your home country! SafetyWing was created by nomads for nomads and understands that these types of travelers will visit their home country once in a while, but that their travel is still not over. (I’m not aware of any other travel insurance providers who offer anything like this). (Note that home country coverage is incidental only. You cannot be traveling to your home country for the purpose of obtaining treatment for an illness or injury that happened while abroad. Coverage is only for a 30-day period in your home country in a 90-day period, or 15 days if your home country is the USA).

Emergency Evacuation & Repatriation

If it’s required for you to be sent home to your home country (or another country) for further or continued medical treatment, and are too sick to travel home normally as a regular passenger, SafetyWing will still cover you. This may be morbid (and often overlooked), but they also cover the repatriation of your dead body back home, which can be very expensive for your family.

Accidental Death and Dismemberment

If you are in an accident and lose a limb, or if you tragically arrive at your destination and then die, then SafetyWing will cover you. The loss must occur within 365 days after the accident date that caused the loss.

SafetyWing’s Crisis Response Coverage protects against the rare chance of kidnapping while traveling. You may receive recompense for either your ransom amount or for loss of personal belongings that occur during a kidnapping.

Please note that crisis response does not apply in some countries, such as Afghanistan, Iraq, Pakistan, Nigeria, and Somalia.

This type of coverage appears to be rare/overlooked with other travel insurance providers as well.

Stolen or Lost Passport

This is one of the most common claims made by travelers! If your passport ends up lost or stolen, SafetyWing will cover you up to $100 to replace it.

Personal Liability

Personal Liability Insurance indemnifies you in the rare event that your own actions cause an injury or financial loss to someone else. This could include a vehicle accident that you were found to be the cause of. Coverage also includes your legal fees, which can often be sky-high!

What are the different types of SafetyWing travel insurance?

Option 1 – safetywing nomad insurance – travel medical:.

Affordable travel medical insurance coverage for people from all over the world while outside their home country.

Who is Nomad Insurance for? This is a good option for people who are looking for a more simple, cost-effective medical health insurance policy while traveling for extended periods of time out of their home country. It’s the best long term for digital nomads, remote workers, long-term travel insurance for travelers, and anyone else planning to be out of their home country for a month or longer.

If you’re looking for a more inclusive insurance plan that covers extras such as dental care, vision care, health screenings, immunizations etc. then SafetyWing’s Remote Health Benefits Plan might be better suited for you!

Cost: Approx $42/USD per month on their subscription model ($77/USD per month if includes travel to USA) for ages 18-39 years old. See prices for other age groups here

Deductible: $250 deductible

Maximum Limit: $250 000 max limit

Where can I travel with SafetyWing Nomad Insurance?

You will be covered for travel anywhere in the world outside of your home country, except for the following: Cuba*, Iran, Syria, and North Korea.

* U.S. citizens with permission from the U.S. government may travel to Cuba.

What is covered with SafetyWing Nomad Insurance?

You’ll be covered for unexpected illness or injury, and medical emergencies, including expenses for hospital, doctor, and prescription drugs. If you become ill or injured, you’ll be covered for eligible medical expenses. It also provides emergency travel-related benefits, such as: emergency medical evacuation, bedside visits, travel delays, and lost checked baggage. During a natural disaster, Safety Wing covers a place for you to stay up to $100 a day for 5 days

For a complete list of exclusions and limitations please see this link: Description of Coverage .

What are the exemptions and limitations?

Exclusions for SafetyWing Nomad Insurance include:

- Cancer treatment

- Routine check-ups

- Pre-existing conditions (Limited coverage for acute onset of pre-existing conditions, but not chronic or congenital conditions)

Is COVID-19 covered?

Yes! SafetyWing’s Nomad travel insurance coverage works the same for COVID-19 related illnesses as any other illness, as long as you do not contract COVID-19 before your coverage start date, and that it does not fall under any other policy exclusion or limitation.

Testing for COVID-19 will only be covered if the test is deemed necessary by a physician. Antibody tests are not covered.

Quarantine is covered outside of your home country for up to $50/day for a maximum of 10 days, as long as you have been covered by Nomad Insurance for a minimum of 28 days and that your quarantine has been mandated by a physician or governmental authority, due to testing positive or you are symptomatic and waiting for test results.

When does coverage begin?

Your coverage begins immediately! As soon as your application is sent in and payment is made, if you’re submitting from outside your home country.

Can I choose my own health care providers?

Yes, as long as the incident happens outside of the USA.

Anywhere else in the world that is covered, you may select the hospital, physician, or other medical care service providers of your choice.

How do I file an insurance claim?

You file a claim simply by filling out a WorldTrips claims form and uploading it with photos or screenshots of receipts to the online portal. You can read about the entire SafetyWing claims process here .

Check SafetyWing NOMAD Insurance Prices Here:

Option 2 – safetywing remote health benefits:.

Fully-equipped global health insurance benefits for remote workers and digital nomads who spend plenty of time abroad. Also includes full coverage in your home country!

Who is Remote Health for? This is an excellent full health insurance benefit plan for remote workers and digital nomads who spend plenty of time abroad.

If you’re looking for a more simple, medical-only insurance plan, then SafetyWing’s Nomad Medical Insurance plan might be better suited for you!

Cost: Approx $206/USD * per month for ages 18-39 years old. The exact price will depend on factors such as your age, your company size (if a company plan), and what add-ons you choose. See prices for other age groups here

*Note: Taxes, location and other factors could affect price.

Deductible: $0 deductible

Maximum Limit: $1,500,000 USD annual maximum

Where can I travel with SafetyWing Remote Health Insurance?

Coverage is for all countries!*

*excluding USA, Hong Kong, and Singapore, where you’ll receive limited coverage for trips up to 30 days

What is covered with SafetyWing Remote Health Insurance?

So much is included with the Remote Health plan, such as dental coverage ($1000 USD), vision coverage ($500 US), health screenings and vaccines ($500 US), hospital treatment and accommodation, inpatient surgery, ICU, cancer tests and treatment, reconstructive surgery, renal failure and dialysis, inpatient prescription medication, emergency ground ambulance, organ transplants, surgeries both day and outpatient, rehab, palliative care, and more. For extreme sports, everything is covered without limitations (unless the sport is performed in a professional capacity).

Most of this is covered at 100% as well. (Full details of coverage here.)

For a complete list of exclusions and limitations please see this link: Remote Workers Policy Document.

- Active duty, war & disturbances

- Administrative & non-medical fees

- Aesthetic treatments

- Expenses covered by third parties

- Maternity or newborn complications

- Professional sports

- Routine exams

For a complete list of exclusions and limitations please see this link: Remote Workers Policy Document

The below is taken directly from page 24 of the Remote Health’s Policy as of January 2022. COVID-19 vaccines are also not included. For a current, updated list of exclusions, please see: Remote Workers Policy Document

Your coverage begins immediately, but some products may have a waiting period (such as a 9-month waiting period for Dental, and a 36-month waiting period for HIV-AIDS treatment).

Yes, you can seek treatment at any registered hospital in the world. Direct billing is also possible.

For hospitalizations and pre-planned treatment, payment for services can be pre-arranged directly with the hospital. For smaller unplanned treatments where you are not hospitalized, there is an online claims process. Reimbursement typically is within 15 days. Claims must be submitted within 180 days from the date of treatment for them to be eligible for coverage.

Get Great Hotel Discounts Using My Expedia Link:

Frequently Asked Questions – Safety Wing Travel Insurance

Here are the answers to some questions that are frequently asked by digital nomads and remote workers about travel insurance options:

Is travel insurance really necessary?

100%, completely, absolutely, yes. Unless you’re covered by some other provider (such as your credit card or employer), purchasing travel insurance is something I highly, highly recommend and cannot stress enough.

Is it difficult to sign up for SafetyWing Travel Insurance?

Absolutely not! It’s actually incredibly easy. First, you’ll create an account on SafetyWing’s website and choose an email address and password, or use your Facebook account to log in. After that, you’ll enter some details about yourself, such as your home country, your date of birth, and your mailing address.

When you’re ready to activate your insurance policy, you’ll simply choose your start date and specify whether you’ll be traveling to the United States or not. Here, you can also decide to add family members or friends to your travel insurance policy,

You can make your payment via credit card. You will be charged every 4 weeks as part of SafetyWing’s subscription model unless you decide to specify a specific start and end date for traveling and pay for it all upfront.

Can I cancel my insurance policy when I want to?

Yes, it’s also very simple to cancel your travel insurance policy at any time with SafetyWing. It just takes one single click, and you will still remain insured until the last day that you’ve paid for.

Are my electronic devices covered?

SafetyWing does not cover electronic devices. Most remote workers will have dedicated electronic devices insurance to cover their computers, cameras, hard drives, etc. If you have expensive electronic devices, I highly recommend finding comprehensive insurance coverage for them. My devices are insured as business items with my TD Bank insurance, but you will want to do lots of research and find the provider that works best for you and your situaiton.

Is SafetyWing Nomad insurance the cheapest travel Insurance on the market?

From my research so far, SafetyWing’s Nomad plan is indeed by far one of the most affordable long-term travel insurance options on the market today.

Is SafetyWing Insurance the best travel insurance option for digital nomads?

It’s impossible to say which travel insurance provider is the “best” overall, as it comes down to your own individual needs and situation. However, SafetyWing was created by nomads for nomads, so they definitely know what is important for long-term travelers when it comes to their travel insurance needs. Their customer service team is responsive, their plans are comprehensive and easy to understand, and the price point is wonderful.

Do I need to have a police report if my items were lost or stolen?

Yes, like most travel insurance providers, Safety Wing requires you to file an official police report in the instance of lost or stolen items.

Does SafetyWing Travel Insurance cover my sport or activity?

Travel insurance by SafetyWing does cover a wide range of sports and activities. They do not cover organized athletics or sports or activities performed professionally. They do cover for classes that you sign yourself up for at the gym, lessons with a personal trainer, and sporting activities performed with friends who get together regularly, as long as it is not “organized athletics”.

If you’re a professional athlete or instructor, you’re unfortunately not covered while performing your sport. You’ll be able to find other types of insurance to cover you in these instances.

- Biking – includes touring and organized tours

- Bungee jumping

- Bushwalking up to 4,500 meters

- Camel riding/trekking

- Camping under 4,500 meters

- Canyon swing

- Capoeira dancing

- Clay pigeon shooting

- Cycling under 4,500 meters

- Deep-sea fishing

- Dirt boarding

- Dog sledding (not racing or competing)

- Fell running / walking

- Flying as a passenger

- Football (Soccer)

- Glacier walking up to 4,500 meters

- Gymnastics (only as exercise or for fun; not competitive or organized)

- Hiking up to 4,500 meters

- Horse riding

- Hot air ballooning as a passenger

- Hunting (excluding big game)

- Ice skating (indoor or outdoor)

- Ice climbing up to 4,500 meters

- Jet boating

- Land surfing

- Moped biking except as excluded below

- Motorbiking except as excluded below

- Mountain biking up to 4,500 meters

- Orienteering

- Outdoor endurance except as excluded below

- Paintballing

- Rap jumping

- Rifle range shooting

- Rollerblading

- Roller skating

- Rowing / sculling

- Safari tours

- Sandboarding

- Scuba diving (sub Aqua Pursuits involving underwater breathing apparatus) as long as you are PADI/NAUI/SSI certified, or if you are not certified you are covered for up to 10 meters when accompanied by a certified instructor.

- Sea canoeing

- Sea kayaking

- Skateboarding

- Skiing (only covered for recreational skiing. No cover provided while skiing away from prepared and marked in-bound territories (off piste) and/or against the advice of the local ski school or local authoritative body)

- Sleigh rides

- Snorkelling except as excluded below

- Snow rafting

- Snowboarding (only covered for recreational snowboarding skiing. No cover provided while skiing away from prepared and marked in-bound territories (off piste) and/or against the advice of the local ski school or local authoritative body)

- Soccer (Football)

- Speed boating

- Stand up paddle surfing

- Stilt walking

- Surfing except as excluded below

- Table tennis

- Ten pin bowling

- Trail bike riding

- Trekking up to 4,500 meters

- Tubing on snow

- Ultimate frisbee

- Via ferrata up to 4,500 meters

- Wake skating

- Wakeboarding

- Water skiing

- Weightlifting, cardio and classes at the gym (note that training for or attending a powerlifting competition is excluded.)

- Windsurfing

- Yachting (coastal waters only)

- Yachting (outside coastal waters)

- Yoga (in class or alone)

- All-Terrain Vehicles

- American Football

- Aussie Rules Football

- Aviation (except when traveling solely as a passenger in a commercial aircraft)

- Base Jumping

- Big Game Hunting

- Cave Diving

- Cliff Jumping

- Heli-Skiing

- Heli-gliding

- Hot Air Ballooning as a Pilot

- Kite-Surfing

- Martial Arts

- Motorized Dirt Bikes

- Mountaineering at elevations of 4,500 meters or higher

- Outdoor Endurance Events

- Parachuting

- Parasailing

- Powerlifting (lifting at max weight with the intention of attending a competition)

- Quad Biking

- Racing by any Animal, Motorized Vehicle, or BMX, and Speed Trials and Speedway

- Running with the Bulls

- Skiing off piste (outside prepared and marked in-bound territories) and/or against or against the advice of the local ski school or local authoritative body

- Snowboarding off piste (outside prepared and marked in-bound territories)and/or against or against the advice of the local ski school or local authoritative body

- Sky Surfing

- Snow Mobile

- Sub Aqua Pursuits involving underwater breathing apparatus (unless accompanied by a certified instructor at depths less than 10m, or PADI/NAUI/SSI certified)

- Whitewater Rafting

Final Thoughts on SafetyWing Travel Insurance

Life is truly unpredictable. You’ll never know when you end up sick, have an accident, or bad luck simply strikes. When the worst does happen, it’s a terrible feeling to realize you’re not covered and unprepared to pay for the costs required to seek treatment or help – especially costs that could easily have been avoided with the quick, easy and affordable purchase of travel insurance (such as Nomad Insurance or Remote Benefits by SafetyWing).

Purchasing peace of mind with travel insurance is so very important, whether you’re moving to a new country, working remotely as a freelancer, moving around the world as a digital nomad, or simply spending an extended amount of time abroad.

I hope your future travels are fulfilling, and I hope you’ll never see the day when you actually need to make a claim using your travel insurance!

PIN FOR LATER

Disclaimer: This blog post may include affiliate links. At absolutely no extra cost to you, I may receive a small commission for any purchase made through these links. Any commissions received are very much appreciated, as they help me to be able to continue posting travel blog content free of charge to my lovely readers. Of course, all recommendations are unbiased, and I will always only recommend products and services that I truly believe in. Thank you for your support!

Do you have questions for me about safetywing travel insurance, travel insurance in general, or have feedback on this blog post please feel free to shoot me a comment below; i would love to hear from you.

Learn More About Me

email Newsletter

Subscribe to my exclusive email list to receive giveaways, discounts, free travel guides, new blog posts & more!

Your privacy will always be respected; unsubscribe anytime.

First Name:

featured From The Blog

Instagram feed

You might also like....

Complete Guide to Working Remotely in Another Country

The Best and Worst Things about Life as a Digital Nomad

How to Upload Video to Instagram from PC or Mac

Freelance Job Ideas – The Best, High-Paying Freelance Job Ideas for 2023

Safest Places to Live in Mexico: Complete Guide for Expats

The Best Health Insurance for Travel to USA

Why Goose Travel Insurance?

Work from Home Jobs Using Just Your Cell Phone

Stay In Touch

Email newsletter.

Be the first to find out about new blogs, course offerings, travel guides, giveaways and freebies. I will always respect your privacy – unsubscribe anytime.

Yes! I wish to receive email from Jenn Explores.

leave me a comment

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

SafetyWing Travel Insurance Review: The Best Travel Insurance for Digital Nomads?

Travel insurance is always worth the money, but SafetyWing has a unique offering. In this SafetyWing review, let’s take a look at whether or not this could be the travel insurance coverage for you.

No matter where you plan to go in the world, it’s important to always travel with travel insurance. But when it comes to finding the right policy, it might be challenging to choose between the different travel insurance companies out there. That’s why this SafetyWing travel insurance review will help you to figure out if SafetyWing is the right company for you.

As a newcomer in the travel insurance industry, SafetyWing provides medical and travel insurance for many types of travelers. Whether you’re looking for coverage overseas or back in your home country, SafetyWing might be the best option for your trip.

And if you feel that another travel insurance company would be better suited for you, then we’ll help you decide which one! To compare travel insurance plans, just fill out the form below with the details from your upcoming trip.

Is Travel Insurance Worth it?

When it comes to planning a trip, you might be wondering, “ is travel insurance worth it? ”

Maybe you’ve never gotten sick or had something valuable stolen on vacation, like your passport or smartphone. Or perhaps it’s hard to justify the extra cost of travel insurance on top of already expensive flights and hotels.

Sure, most trips go off without a hitch. But if something does go wrong, you could be stuck paying for thousands of dollars in medical bills or even return flights to get you back home.

The truth is, just because something hasn’t happened in the past doesn’t mean it can’t happen in the future. Accidents can happen anywhere, even for the most experienced of travelers.

And unless you are willing to pay the money to dig yourself out of these accidents, travel insurance is really worth it.

As a rule of thumb, if you can’t afford travel insurance, you can’t afford to travel. So before you step on the plane, make sure you’re protected with a good travel insurance policy!

When to Purchase Travel Insurance

We recommend purchasing travel insurance as soon as you finalize your travel plans. But, generally speaking, you can buy a travel insurance policy anywhere from a few days to a few months before your trip starts.

Some travel insurance policies include trip cancellation coverage, which protects your losses if you can no longer go on your trip. To take advantage of this benefit, you should purchase a plan right after you make your first payment for your flight or hotel. That way, you’ll be fully covered if anything arises before your trip starts.

And if you forget to purchase travel insurance before you leave, then there are a few companies that let you take out a policy once you’re already on the road. SafetyWing , for example, lets you purchase a policy while you’re already traveling.

Who Is SafetyWing?

Before we dive into the specifics in this SafetyWing travel insurance review, let’s take a closer look at this up-and-coming company.

Founded in 2019, Norwegian travelers and entrepreneurs started SafetyWing in the Y Combinator accelerator program. As digital nomads themselves, SafetyWing’s co-founders wanted to create a policy that met the needs of like-minded travelers.

SafetyWing’s primary goal is to provide affordable travel and medical coverage for freelancers, digital nomads and long-term travelers, no matter where they are in the world.

And although SafetyWing is a relatively new company, it still has a reliable reputation. Tokio Marine, one of the largest insurance companies in Japan, backs and handles all claims.

Who Is SafetyWing Travel Insurance for?

SafetyWing is an affordable option for travelers who need emergency services abroad. As part of this SafetyWing travel insurance review, we’ll cover the types of travelers that would benefit most from this policy.

- Budget Long-Term Travelers: Unlike other insurance providers, SafetyWing allows you to travel for as long as you want. You can move around for one or two years and still have complete protection no matter where you go.

- Travelers with an Open Plan: You don’t need to specify the duration of your trip upfront, which makes it ideal for travelers who don’t know how long they’ll be on the road. And besides a few high-risk areas, your one SafetyWing policy covers you in over 180 countries.

- Travelers with Young Children: Your SafetyWing plan includes coverage for one child between the ages of 14 days and 10 years at no additional cost. If your policy includes two adults, then coverage for two children is included.

Who Isn’t SafetyWing Travel Insurance for?

Although there are many benefits to a SafetyWing travel insurance plan, it might not fit the needs for every type of traveler. And as part of this SafetyWing travel insurance review, we believe it’s essential to mention the people who might not benefit from the insurance.

- Travelers Wanting Full Trip Coverage: While SafetyWing includes trip delay, trip interruption and lost checked baggage coverage, it’s missing a few essential travel benefits. This is most noticeably trip cancellation coverage. If you can no longer go on your trip due to an illness or death in the family, you won’t be reimbursed for your flight or accommodation. For expensive vacations or longer trips, this can be a significant disadvantage.

- Travelers with Expensive Electronics: Expensive equipment like laptops, cameras and smartphones are not insured under the SafetyWing policy. If you want to make sure your equipment is protected on your trip, consider a supplemental coverage plan with InsureMyEquipment .