- Best Credit Cards

- Lifetime Free

- Forex Credit Cards

- RuPay Credit Cards

- International Travel

- Railway Lounge

- Credit Card Guides

- Credit Card News

- Offers & Rewards

- Credit Score Guide

- Credit Card Limit

- Lounge Access

SBI Credit Cards For Airport Lounge Access

SBI Card, the financial services company owned by the largest bank in India, is the most trusted credit card issuer in the country. Along with offering a wide range of cards from basic to the super-premium category, it aims to provide its customers with the best and most rewarding experiences. With SBI Credit Cards, you don’t just get a credit limit to spend but also a lot of benefits and privileges across different categories, including travel, shopping, fuel, lifestyle, and many more. Among all of these, travel-based credit cards are considered the most rewarding ones as these cards allow you to save a lot on your travel spends. Some super-premium travel credit cards come with high annual fees and great privileges, whereas others offer decent privileges with lower annual fees.

SBI Card offers some of the top travel credit cards in the Indian market, and most of these cards are popular due to the complimentary lounge access they offer. Some SBI Credit Cards offer domestic as well as international lounge access. However, some of them only allow free access to domestic airport lounges. Different cards target different segments of individuals, and that is why their features and benefits vary along with their membership charges. If you are looking for some of the best SBI Credit Cards for airport lounge access, this article has all the information you need. You can check the features and benefits of different SBI Credit Cards in the travel category and go for one that suits your requirements:

Table of Contents

BPCL SBI Card Octane

Sbi prime credit card, sbi card pulse, sbi elite credit card, club vistara sbi card prime, reliance sbi card prime, club vistara sbi credit card, etihad guest sbi premier credit card, etihad guest sbi credit card, sbi aurum credit card.

Add to Compare

Joining Fee

Renewal fee, best suited for, reward type.

Reward Points

Welcome Benefits

Best SBI Lounge Access Credit Cards

With a wide range of SBI Credit Cards available in the Indian market, it becomes a bit challenging task to filter out the credit cards with free airport lounge access. Even if you find the list somewhere, you might still have so much confusion about which card would be the best for you. To help you choose the best Credit Card for yourself, we are here with the list of all SBI Credit Cards along with their travel benefits and other necessary information:

SBI Credit Cards With Both Domestic and International Lounge Access

As mentioned earlier, some premium SBI Credit Cards offer both complimentary domestic and international lounge access. However, the number of complimentary visits might differ from card to card. Also, some of these cards have a very high annual fee, whereas others come with affordable annual charges. Refer to the following information for further details:

SBI Aurum Credit Card

The Aurum Credit Card offered by SBI Card is the most premium offering by the card issuer. It comes with a joining and annual fee of Rs. 10,000, which is quite high but totally worth it for those who believe in having a luxurious lifestyle. Along with a great reward rate and a number of additional benefits across different categories, the card offers complimentary lounge access as follows:

– 16 complimentary domestic lounge access every year (maximum 4 per quarter).

– Unlimited complimentary international lounge access.

SBI Card Elite

The SBI Elite Credit Card is the second-most premium card offered by SBI. It comes with an annual fee of Rs. 5,000, which you can get waived by spending Rs. 10 lakhs or more in the previous year. You can earn up to 10 Reward Points on every spend of Rs. 100 with this card and other privileges offered by the card include exciting welcome benefits, dining & movie discounts, and complimentary lounge access as mentioned below:

– 8 complimentary domestic lounge access every year (maximum 2 per quarter).

– 6 international lounge access every year (maximum two each quarter).

SBI Card Prime

The SBI Prime Credit Card is one of the most popular cards in the country. It comes with an annual fee of Rs. 2,999, which might seem to be high but is worth it if you are wise enough to maximise the benefits of your card. The card offers a fantastic reward rate across all the categories and a wide range of deals and discounts across other lifestyle categories. Talking about its travel privileges, you get Complimentary Trident Privilege Red Tier Membership, Complimentary Club Vistara Silver membership, and free lounge visits as listed below:

– 4 international lounge access every year (1 each quarter).

Club Vistara SBI Card Prime

The Club Vistara SBI Prime Credit Card is a co-branded travel card offered by SBI in partnership with Vistara Airlines. The card comes with a joining and annual membership fee of Rs. 2,999. The card rewards you in the form of CV Points that can be used against travel-related bookings with Vistara Airlines. Other benefits of this card include additional privileges across Vistara airlines, discounts & deals on other categories, and complimentary airport lounge access as mentioned below:

Etihad Guest SBI Premier Card

The Etihad Guest SBI Prime Card is another co-branded travel card issued by SBI in collaboration with Etihad Airways. The cardholders get a complimentary Etihad Guest Gold tier, and they get rewarded in the form of Etihad Guest miles on all their spends. Along with lots of privileges across different categories, you also get complimentary lounge access as follows:

– 8 complimentary domestic lounge access every year (capped at 2 per quarter).

– 4 international lounge access every year (1 per quarter).

SBI Credit Cards With Free Domestic Lounge Access

Sbi card pulse.

SBI Card Pulse is among the newly added cards to the SBI Card’s portfolio. It comes with an annual fee of Rs. 1,499 and is one of the best lifestyle cards in the Indian market. Along with attractive welcome privileges, the card offers a great reward rate of up to 10 Reward Points on every spend of Rs. 100. Talking about its lounge benefits, it only offers complimentary domestic lounge access as mentioned below:

The BPCL SBI Card Octane is the upgraded version of the BPCL SBI Credit Card. At a low joining fee of Rs. 1499, you can save a lot on transactions made on fuel. With this credit card, you would get 25 Reward Points on each Rs. 100 spent on BPCL petrol station. You can also save on movie tickets and get complimentary domestic lounge access with this credit card.

-4 complimentary access to domestic lounges every year (1 per quarter).

Etihad Guest SBI Card

The Etihad Guest SBI Credit Card is another Etihad co-branded credit card offered by SBI. The annual fee of this card is also Rs. 1,499, which is quite affordable for a lot of individuals. They can avail of exciting deals and discounts on travel booking, and the cardholders also get exclusive Etihad Guest Silver tier status. The airport lounge access offered with this card is mentioned below:

– 8 complimentary domestic lounge access every year (maximum 2 per quarter).

Club Vistara SBI Card

The Club Vistara SBI Card comes with an annual fee of Rs. 1,499 and is a great travel category in the basic category. Being a Vistara co-branded credit card, it offers additional discounts on the Vistara airlines and a lot more travel privileges, including free lounge visits as follows:

– 4 complimentary domestic lounge visits per year.

SBI Credit Cards Visa Lounge Access List

Most of the SBI Credit Cards are issued on the Visa card network, which is among the most popular card networks in the country, along with MasterCard. If you have an SBI Visa Credit Card with airport lounge access, you can access the following airport lounges using your credit card:

For the complete list of lounges that are accessible using SBI Credit Cards on the Visa network, you can check this page .

SBI Credit Cards MasterCard Lounge Access List

If you have an SBI MasterCard Credit Card with airport lounge access, you can access various airport lounges using your credit card, as MasterCard is also a popular card network in the country. The list of MasterCard Lounge Access is given below:

For the complete list of lounges that are accessible using SBI Credit Cards on the MasterCard network, you can check this page .

Bottom Line

SBI Card offers a wide range of credit cards in the travel category, and almost all of them offer complimentary airport lounges to domestic or international lounges. Free airport lounge visits are considered the most exclusive travel privileges offered by credit cards as it doesn’t only allow you to avoid the noisy environment at the airports. Still, you can also avail of all the lounge benefits without paying a single penny. However, it is quite essential for you to analyse your requirements and spending habits properly before you choose a travel credit card, as one can maximise credit card benefits only by choosing the right one.

Find the perfect credit card in India by comparing the most rewarding options in one place!

- Privacy Policy

- Terms & Conditions

Contact Info

© Copyright 2024 Card Insider

Made With ❤ in India.

Type above and press Enter to search. Press Esc to cancel.

Credit Cards

- Axis Bank Credit Card

Axis Bank Kwik Rupay Credit Card

Axis bank my zone credit card, axis bank select credit card, indianoil axis bank credit card, axis bank magnus credit card, flipkart axis bank credit card, axis bank vistara credit card, axis bank rewards credit card, axis bank vistara infinite credit card, axis bank neo credit card, samsung axis bank signature credit card, axis bank aura credit card, axis bank vistara signature credit card, axis bank privilege credit card, samsung axis bank infinite credit card, axis bank reserve credit card, axis bank airtel credit card, axis bank insta easy credit card, axis bank freecharge credit card, axis bank forex card, axis bank rupay credit card, axis bank burgundy private credit card, axis bank credit card interest rates, axis bank credit card pin generation, axis bank credit card offers, axis bank credit card types.

- HDFC Credit Card

HDFC Freedom Credit Card

Hdfc indian oil credit card, hdfc moneyback credit card, hdfc infinia credit card, hdfc diners club black credit card, hdfc swiggy credit card, hdfc regalia credit card, hdfc millennia credit card, hdfc business moneyback credit card, hdfc regalia gold credit card, hdfc regalia first credit card, hdfc upi rupay credit card, paytm hdfc bank credit card, hdfc moneyback+ credit card, tata neu plus hdfc bank credit card, shoppers stop hdfc bank credit card, flipkart wholesale hdfc bank credit card, 6e rewards indigo credit card, hdfc bank corporate platinum credit card, hdfc rupay credit cards, hdfc forex cards, hdfc virtual credit card, best hdfc credit cards, sbi credit card.

- SBI Prime Credit Card

- SBI Simply Click Credit Card

- SBI Elite Credit Card

SBI IRCTC Platinum Credit Card

- SBI Simply Save Credit Card

SBI Cashback Credit Card

Idfc first bank credit card, idfc millennia credit card, idfc classic credit card, idfc wealth credit card, idfc wow credit card, idfc select credit card, au bank credit card, au bank zenith credit card, au bank vetta credit card, au bank altura plus credit card, au bank altura credit card, au bank lit credit card, au bank credit card eligibility, au bank credit card customer care number, au bank credit card net banking, au bank credit card bill payment, american express credit card, amex membership rewards credit card, amex platinum reserve credit card, american express platinum charge card, amex smartearn credit card, american express gold charge card, amex platinum travel credit card, amex payback credit card, hsbc credit card, hsbc smart value credit card, hsbc visa platinum credit card, hsbc premier credit card, hsbc cashback credit card, hsbc lifetime free credit card, hsbc bank credit card statement, hsbc credit card reward points, hsbc credit card application status, hsbc credit card bill payment, standard chartered credit card, standard chartered smart credit card, standard chartered manhattan platinum credit card, standard chartered platinum rewards credit card, standard chartered easemytrip credit card, standard chartered credit card login, standard chartered credit card customer care, standard chartered credit card bill payment, standard chartered bank credit card statement.

- Yes Bank Credit Card

Yes Prosperity Rewards Plus Credit Card

Yes prosperity edge credit card, yes premia credit card, yes bank byoc credit card, yes first exclusive credit card, yes bank wellness credit card, yes bank rupay credit card, yes bank lifetime free credit card, close yes bank credit card.

- Kotak Credit Card

Urbane Gold Credit Card

Royale signature credit card, league platinum credit card, lic credit card, lic idfc credit cards, lic idfc classic credit card, lic idfc select credit card, axis bank lic credit card, lic axis platinum credit card, lic axis signature credit card, scapia credit card, rupicard credit card, personal loan, hdfc personal loan, idfc first bank personal loan, moneyview personal loan, kreditbee loan, privo personal loan, kotak personal loan, bajaj finserv personal loan, tata capital personal loan, yes bank personal loan, l&t finance consumer loan, instant loan apps, 5 lakh loan, 10 lakh loan, 15 lakh loan, 20 lakh loan, instant loan without cibil, best banks for personal loan, lowest personal loan interest rates, moneytap loan, finnable loan, incred loan, personal loan application status, 20000 loan on aadhaar card, smartcoin loan, loantap personal loan, business loan, kreditbee business loan, moneyview business loan, prefr credit business loan, lendingkart business loan, protium business loan, iifl business loan, sbi business loan, bank of baroda business loan, kotak business loan, icici bank business loan, neogrowth business loan, women business loans, unsecured business loans, working capital loan, cgtmse scheme, psb loans in 59 minutes, sbi e mudra loan, startup business loan, saksham yuva yojana, bank of baroda msme loan, home loan interest rates, best home loan interest rates, hdfc home loan, dda housing scheme 2024, pnb housing finance, kotak mahindra bank home loan, idfc first home loan, bajaj finserv home loan, 5 crore home loan emi, 2 crore home loan emi, 1 crore home loan emi, 70 lakh home loan emi, 50 lakh home loan, 45 lakh home loan emi, 40 lakh home loan, home loan in delhi, home loan in mumbai, pradhan mantri awas yojana, home loan balance transfer, home loan balance transfer interest rates, hdfc home loan balance transfer, kotak home loan balance transfer, pnb home loan balance transfer, home first home loan balance transfer, canara bank home loan balance transfer, loan against property, loan against property interest rate, hdfc loan against property, federal bank loan against property, kotak loan against property, idfc first loan against property, sbi loan against property, home first loan against property, pnb housing loan against property, bajaj finance loan against property, loan against property without income proof, sbi loan against property interest rates, loan against property eligibility, bank of baroda loan against property, canara bank loan against property, lic loan against property, gold loan interest rates, rupeek gold loan, muthoot fincorp gold loan, dbs gold loan, indiagold loan, oro gold loan, iifl gold loan, sbi gold loan, icici gold loan, canara gold loan, financial tools, emi calculator, home loan emi calculator, sbi home loan emi calculator, icici home loan emi calculator, hdfc home loan emi calculator, pnb home loan emi calculator, navi home loan emi calculator, lic home loan emi calculator, can fin home loan emi calculator, personal loan emi calculator, sbi personal loan emi calculator, hdfc personal loan emi calculator, icici bank personal loan emi calculator, idfc personal loan emi calculator, navi personal loan emi calculator, business loan emi calculator, loan against property emi calculator, sbi loan against property emi calculator, hdfc loan against property emi calculator, icici loan against property emi calculator, pnb hosuing loan against property emi calculator, compound interest calculator, loan prepayment calculator, rd calculator, fd calculator, fixed deposit, fixed deposit interest rates, credit card against fd, banking full form, imps full form, upi full form, acf full form, noc full form, icici full form, hdfc full form, credit card customer care number.

- HDFC Credit Card Customer Care

Axis Bank Credit Card Customer Care Number

- SBI Credit Card Customer Care

American Express Credit Card Customer Care

Standard chartered credit card customer care number.

- Yes Bank Credit Card Customer Care

IDFC Credit Card Customer Care Number

- HSBC Credit Card Customer Care

Credit Card IFSC Code

Hdfc credit card ifsc code, axis bank credit card ifsc code, yes bank credit card ifsc code, amex credit card ifsc code, credit card types, best fuel credit card, best shopping credit card, best student credit card, best lifetime free credit card, best cashback credit cards, best travel credit card, best reward credit card, airport lounge access credit cards, hdfc credit card airport lounge access, sbi credit card airport lounge access, axis bank credit card airport lounge access, hsbc credit card airport lounge access, flipkart axis bank credit card lounge access, yes bank credit card lounge access, axis bank my zone credit card lounge access, epf passbook, uan member portal, epf claim status, ppf interest rates, ppf withdrawal, uan activation, epf balance check, epf withdrawal rules, sbi ppf account, hdfc ppf account, icici ppf account, aadhaar card, aadhaar card status, aadhaar card download, aadhaar card update, pan aadhaar link, link aadhar to mobile number, personal loan customer care, bajaj finance personal loan customer care, sbi personal loan customer care, indiabulls personal loan customer care, kotak bank personal loan customer care, hdfc personal loan customer care, moneytap customer care, money view customer care, mpokket loan customer care, cashe customer care, hdb personal loan customer care, iifl personal loan customer care, home loan customer care, sbi home loan customer care, hdfc home loan customer care number, lic home loan customer care, pnb housing finance customer care, bank of baroda home loan customer care, dhfl home loan customer care, indiabulls home loan customer care, dsa registration, dsa full form, sbi dsa registration, hdfc dsa registration, icici bank dsa registration, axis bank dsa registration, dsa loan agent registration, credit card dsa registration, nbfc dsa registration online, health insurance, life insurance.

Whether you are a frequent flier or an occasional traveler, there is always a way to turn your air travel into a luxurious and relaxing experience with SBI Credit Card Airport Lounge Access. You get access to exclusive airport lounges around the globe with SBI Credit Card Lounge Access . Let’s explore the features and privileges of these credit cards.

Choosing the Best SBI Credit Card Lounge Access

SBI, one of India's leading banks, offers a range of credit cards with airport lounge access as a prominent feature. These SBI credit card lounge access cards are designed to cater to the needs of frequent travelers, providing them with a comfortable and luxurious atmosphere while waiting for their flights. With these SBI credit cards , you can bid farewell to crowded airport terminals and embrace the tranquility of airport lounges.

Table of Contents: SBI Credit Card Airport Lounge Access[ Hide ]

Benefits of sbi airport lounge access credit cards, comparing best sbi credit card lounge access list, sbi card prime, air india sbi signature credit card, club vistara sbi card, etihad guest sbi card, final word on sbi cards with airport benefits, access to exclusive lounges:.

SBI Airport Lounge Access Credit Cards grant you access to a network of exclusive lounges at various domestic and international airports. These lounges offer a serene and sophisticated ambiance, away from the hustle and bustle of the terminal. You can unwind in comfortable seating, enjoy complimentary refreshments, access high-speed Wi-Fi, and even catch up on work in a peaceful environment.

Complimentary Refreshments and Amenities:

One of the most appealing features of SBI Credit Card Free Airport Lounge Access is the provision of complimentary food and beverages. Whether you're in the mood for a quick snack, a refreshing beverage, or a full-course meal, these lounges have you covered. Indulge in a delectable range of cuisines and quench your thirst with a wide selection of beverages, all on the house.

Priority Pass Membership:

Many SBI Airport Lounge Access Credit Cards come bundled with a Priority Pass membership. This prestigious membership allows you access to a vast network of lounges worldwide, regardless of the airline or class of service you are flying. Whether you're traveling for business or leisure, the Priority Pass membership ensures a comfortable experience, regardless of your travel plans.

Concierge Services:

In addition to lounge access, SBI Airport Lounge Access Credit Cards often provide access to concierge services. These dedicated professionals can assist you with various travel-related tasks, such as booking tickets, making hotel reservations, arranging ground transportation, and providing information on local attractions. With their expertise at your disposal, you can experience seamless travel arrangements, leaving you free to focus on your journey.

Also Check: SBI Lifetime Free Credit Card

Each of these SBI Credit Card Lounge Access comes with unique features and benefits, allowing individuals to choose the card that aligns with their travel preferences and lifestyle. These cards not only offer access to exclusive lounges but also provide additional rewards, privileges, and insurance coverage, making them comprehensive solutions for frequent travelers.

Let's delve deeper into the features and benefits of the individual SBI Airport Lounge Access Credit Cards mentioned in the comparative table below:

The SBI Elite Credit Card offers a host of benefits, including complimentary Priority Pass Membership. With this membership, cardholders can enjoy access to over 1,000 airport lounges worldwide, regardless of the airline or class of service they are flying. The annual fee for this card is Rs. 4,999, and it comes with additional privileges such as milestone rewards, accelerated reward points on select categories, and travel insurance coverage.

Also Check: SBI Simply Save Credit Card

The SBI Card PRIME caters to the needs of frequent flyers by offering four complimentary domestic lounge visits per quarter. Cardholders can relax and rejuvenate in partner lounges across India, making their travel experience more comfortable. In addition to lounge access, this card provides rewards on dining, groceries, and utility bill payments. The annual fee for this card is Rs 2,999, and it also includes benefits such as milestone rewards, fuel surcharge waivers, and accelerated reward points.

Designed for Air India frequent flyers, the Air India SBI Signature Credit Card offers complimentary domestic lounge visits. Cardholders can enjoy access to select lounges at major airports in India, enhancing their travel experience. Along with lounge benefits, this card provides accelerated reward points on Air India spends, complimentary membership to the Air India Frequent Flyer program, and additional travel benefits. The annual fee for this card is Rs. 4,999.

Also check: SBI Simply Click Credit Card

The Club Vistara SBI Card provides four complimentary domestic lounge visits per year, allowing cardholders to relax and unwind before their flights. This card is designed for online shoppers, offering accelerated rewards on online spending, including categories such as online retail, travel, dining, and more. With an annual fee of Rs.1499, the Club Vistara SBI Card provides a convenient way to enjoy lounge access along with rewards for frequent online shoppers.

This Etihad guest SBI credit card is designed to provide a range of benefits and rewards for frequent travelers and Etihad Airways customers. Cardholders can enjoy various travel-related perks, such as complimentary access to airport lounges, discounts on flight bookings, bonus Etihad Guest Miles on eligible transactions, and priority check-in and boarding. The card also offers accelerated rewards on everyday spending, enabling users to earn Etihad Guest Miles faster, which can be redeemed for flights, upgrades, hotel stays, and other travel-related experiences.

Also Check: SBI Pulse Credit Card

SBI Credit Cards with airport privileges offer an unparalleled travel experience, giving you access to exclusive lounges and a host of premium services. These credit cards not only elevate your airport experience but also provide additional benefits such as reward points, travel insurance, and special privileges with partner airlines. If you are a frequent traveler who values comfort and luxury, an SBI Airport Lounge Access Credit Card is your key to unlocking a world of convenience and relaxation at airports worldwide. Upgrade your travel experience today!

Also Read: How to Close SBI Credit Card?

Popular Credit Card Offers

- Amazon voucher (worth INR500)

- 3 complimentary airport lounge access

Annual fee : ₹ Zero

Joining fee : ₹ zero, save more on : rewards, axis bank indianoil credit card.

- 1 Edge Rewards Points*per Rs.100 spent on online shopping

- Up to Rs.250 cashback* on first fuel transaction

Annual fee : ₹ 500 + GST

Joining fee : ₹ 500 + gst, save more on : fuel, lic idfc credit card.

- High rewards on LIC premium payments

- Supersized rewards on everyday spending

Save more on : Shopping

American express american express® payback credit card.

- Earn 2 Reward points for every spent Rs 100.

- Up to 20% discounts at dine-ins at select restaurants

Annual fee : ₹ 1500 + GST

Joining fee : ₹ 750 + gst, hsbc hsbc premier credit card.

- EazyDiner Prime Annual Membership

- Unlimited Airport Lounge Access in India

Annual fee : ₹ 20000 + GST

Joining fee : ₹ 12000 + gst, save more on : lifestyle, au small finance bank lit credit card.

- Earn 5X/10X Reward Points

- 1% fuel surcharge waiver

- Rewards on LIC Premium Payments

- Rewards on International Spends

Rupicard rupicard

- No annual or joining fees

- Instant online issuance

AU Small Finance Bank Altura Credit Cards

- 5% cashback on retail spends of ₹2500

- 2 complimentary lounges accesses per quarter

Annual fee : ₹ 199 + GST

Joining fee : ₹ 199 + gst, sbi credit card rewards.

Get exclusive welcome benefits, rewards & cashback with SBI Card. Select a well suited card as per your requirement and apply!

Related Blogs

SBI Credit Card Reward Points Convert to Cash

State bank of india — one of the largest public sector banks with its headquarters in mu....

5 Best SBI Credit Cards with Their Features and Benefits

A credit card has become a necessity for most of us now. the reason why a lot of us have....

How to Activate SBI Credit Card? – All You Need to Know

The state bank of india is one of the most reputed banks globally that provides safe and....

Top 10 Credit Cards to Get Airport Lounge Access

Travelling can often prove to be an exhausting affair in itself. add to it, hours of wai....

10 Best International Credit Cards in India for 2024

The ever rising popularity of credit cards can be attributed to the various benefits it ..., sbi credit card airport lounge access faqs, which sbi credit card has airport lounge access.

There are some credit cards by SBI which offer airport lounge access. They are SBI Elite, SBI Card PRIME, Air India SBI Signature Credit Card, Club Vistara SBI Card and Etihad Guest SBI Card to name a few.

Is SBI Visa Platinum Card eligible for airport lounge access?

No, the SBI Visa Platinum Card does not typically provide complimentary airport lounge access as a standard benefit. The Visa Platinum variant of the SBI credit card may focus on offering other features and benefits, but lounge access is usually not included.

Is SBI Prime card eligible for lounge access?

Yes, SBI Prime card offers 8 complimentary domestic and 4 international lounge access every year. With a nominal annual fee this is one of the most sought after SBI credit cards.

Does SBI Simply Click Credit Card provide lounge access?

No, with SBI simply click credit card lounge access is not available. Although this particular card has a fair share of benefits like rewards and offers to name a few.

Does SBI Platinum Credit Card have lounge access?

Yes, this card is a result of co-branding between South Indian Bank and SBI. With this SBI Platinum credit card you get 8 complimentary airport lounge access in a year.

SBI Credit Card Related Pages

- How to Close SBI Credit Card

- SBI Credit Card Application Status

- SBI Credit Card Statement

- SBI Credit Card Eligibility Criteria

- SBI Credit Card Bill Payment

- SBI Credit Card Loan

- SBI Credit Card Type

Other Banks Credit Card

- UNI Credit Cards

Popular SBI Credit Cards

- IRCTC SBI Platinum Credit Card

- SBI Yatra Credit Card

Credit Card Customer Care

- ICICI Credit Card Customer Care

Top 10 debit cards with airport lounge access in India

From exclusive benefits to enhanced travel experiences, explore debit cards with airport lounge access. ditch the chaos and travel in comfort.

- " class="general-icons icon-sq-whatsapp">

- " class="general-icons icon-sq-googleplus popup">

Debit cards with airport lounge access

Axis priority debit card, related stories, top 10 credit cards for airport lounge access in india.

Visa on arrival countries for Indian passport holders in 2024

Countries that give visa-free access to Indians

- 25 percent off on movie tickets purchased on BookMyShow

- 20 percent off on dining at the bank’s partner restaurants

- Insurance coverage up to Rs10 lakhs

- Fuel surcharge waiver up to Rs200/month

- Waiver on card issuance and annual fee

SBI Platinum International Debit Card

- The card networks (RuPay/ Visa/ MasterCard) govern the lounge access facilities.

- The lounges are available across the world depending on the network provider.

- Two SBI reward points for every Rs200 spent on shopping, dining, fuel, travel, or online payment

- 200 bonus points on the first three purchases with this debit card in the first month

- All rewards earned in the birthday month get doubled

IDFC First Bank Visa Signature Debit Card

- Two complimentary access per quarter.

- Can bring more guests at an additional cost.

- The airport lounges accessible using this debit card can be checked here .

- Discounts on food & beverages, spa & gym subscriptions, pharmacies, etc.

- Personal accident insurance coverage up to Rs35,00,000

Axis Bank Prestige Debit Card

- One complimentary lounge access per quarter.

- Check out the available lounges here .

- Three percent cash back on travel bookings

- Two percent cash back on purchases at select merchant categories

- One percent cashback on fuel purchases across any fuel stations

- Complimentary INOX movie tickets

- Special insurance cover of Rs10 lakhs for the cardholder and family

HDFC Bank Millennia Debit Card

- One complimentary lounge access per quarter, subject to a minimum spend of Rs5,000 on the card in the previous quarter.

- Holders of this debit card can avail entry at selected airport lounges in India .

- Accidental insurance coverage up to Rs10 lakhs

- Up to Rs4800 cashback every year

- 5 percent cashback points on shopping via PayZapp and SmartBuy

- 2.5 percent cashback points on all online spending

- One percent cashback points on all offline spends and wallet reloads

YES Prosperity Platinum Debit Card

- One complimentary access per quarter to domestic airport lounges.

- Check out the lounge list here .

- Fuel surcharge waiver on a purchase of fuel at any petrol pump

- Exclusive offers on dining, shopping, travel, entertainment and more

- Assured reward points on every transaction

- Personal accident insurance up to Rs5,00,000

ICICI Bank Coral Paywave Contactless Debit Card

- 25 percent off on movie tickets purchased at INOX Movies multiplexes

- Fuel surcharge waiver at select petrol pumps

- Two ICICI Bank reward points on domestic and four on international transactions for every Rs200 spent using this debit card

HDFC EasyShop Platinum Debit Card

- Two complimentary lounge access per quarter, subject to a minimum spend of Rs5,000 on the card in the previous quarter.

- Holders of this debit card can avail entry at selected airport lounges across India .

- One cashback point for every Rs100 spent on telecom and utilities

- One cashback point for every Rs200 spent on groceries & supermarkets, restaurants, apparel, and entertainment

- No cost Equated Monthly Instalment (EMI) on leading electronics, furniture, apparel, and phone brands

- Insurance coverages

ICICI Bank Sapphiro Debit Card

- Fuel surcharge waiver at select petrol pumps.

- Four ICICI Bank reward points on domestic and eight on international transactions for every Rs200 spent using this debit card.

Kotak Privy League Signature Debit Card

- One free access per calendar quarter

- Access to over 1000 of the most luxurious VIP airport lounges in more than 130 countries and 500 cities worldwide.

- The lounges available using this airport lounge access debit card are here .

- Fuel Surcharge waiver of up to Rs30,000 in a month

- Offers and discounts at merchant outlets in categories such as fine dining, lifestyle, travel, and health

- Personal accidental death insurance up to Rs15,00,000

- " class="general-icons icon-sq-youtube">

Photo of the day: Gajon festival in Bengal

From the struggles of Indian students to IPL still charming sponsors, our top stories of the week

Tandem heatwaves, storm surges increasingly batter coasts: study

Write angry thoughts down and shred them, Japan study advises

Legendary restaurant elBulli will host two guests for one special night

India has what it takes to become a global semiconductor powerhouse: Qualcomm's Rahul Patel

Circle Introduces Smart Contract Functionality for BlackRock's BUIDL

Photo of the day: Ready for Lok Sabha Elections 2024

Estimating the value of intangible investments: A new approach

All We Imagine As Light: Indian film to compete for Palme d'Or at the Cannes Film Festival

Through the IPL, brands have started to speak to the many Indias: Nikhil Bardia

Inside Vasant 'Vas' Narasimhan's transformation of Novartis, and more

Why Adidas is betting big on Indian cricket

Video games top source for TV inspiration, says Jonathan Nolan

Photo of the day: Eid Mubarak

Best credit cards for cheap airport lounge access in April 2024

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Free airport lounge access has become an increasingly rare and elusive perk. These days, it feels like you either need diamond-level status with the airline, a credit card with a sky-high annual fee or A-list celebrity status to breeze through the entryway and grab a cabernet before your flight.

Or do you?

To find out, Fortune Recommends conducted research to find what–if any–credit cards still include airport lounge access for a reasonable annual fee in 2024. The good news is that there are several, and each of them has far more to offer frequent flyers than just a pair of lounge coupons. From free checked bags to welcome bonuses worth $750 or more, here are the best credit cards for affordable lounge access in 2024.

The best credit cards for cheap lounge access in April 2024

Best overall: u.s. bank altitude connect, best for checked bags: united sm explorer card.

- Best for CLEAR Plus: American Express® Green Card

Best value premium card: Capital One Venture X Rewards Credit Card

The U.S. Bank Altitude Connect Visa Signature Card includes a complimentary Priority Pass Select membership with four free passes each year to over 1,500 lounge locations worldwide. That–combined with a 50,000-point welcome bonus worth $500 and no annual fee for the first year–made it an easy pick for the best overall card for affordable lounge access in 2024.

U.S. Bank Altitude Connect

Intro bonus.

Rewards Rates

- 5x 5X points on prepaid hotels and car rentals booked directly in the Altitude Rewards Center

- 4x 4X points on travel, at gas stations and EV charging stations

- 2x 2X points at grocery stores, grocery delivery, dining and streaming services

- 1x 1X on all other purchases

- High earnings on travel

- No annual fee the first year

- 4 Priority Pass lounge visits per year

- Points not transferable to travel partners

- Additional perks: Cell phone protection, Trip cancellation/interruption, TSA/Global Entry fee rebate

- Foreign transaction fee: None

Why we like this card: Similar to how Pepsi challenges Coke, the U.S. Bank Altitude Connect Visa Signature Card seems poised to keep the reigning Chase Sapphire Preferred ® Card on its toes when it comes to stellar value in a mid-tier travel card package.

The Connect charges an annual fee of $0 the first year, then $95—and provides complimentary Priority Pass Select membership with four free passes each year and an up to $100 statement credit toward TSA PreCheck or Global Entry. Its welcome bonus is 50,000 points after spending $2,000 in the first 120 days.

But the buck doesn’t stop there. You’ll also get free travel insurance (Trip Cancelation/Interruption, Trip Delay Reimbursement and SmartDelay), no foreign transaction fees and rewards rates of up to 5X on prepaid hotels/car rentals and 4X on travel/gas. Did we mention that it charges no annual fee for the first year, either?

So if free PreCheck and lounge access with a $0 upfront commitment sounds good to you, check out the U.S. Bank Altitude Connect card.

The United SM Explorer Card card may only offer two United Club passes per year, but it more than makes up for it with a free checked bag for you and a companion, priority boarding, a $100 Global Entry/PreCheck/NEXUS fee credit and a 50,000-point welcome bonus. Plus, it even waives its $95 annual fee for the first year.

United SM Explorer Card

- 2x 2x miles on dining (including eligible delivery services), hotel stays, and United® purchases (including tickets, inflight food, beverages and Wi-Fi, Economy Plus® and more)

- 1x 1x miles on all other purchases

- Free first checked bag benefit.

- Expanded award availability on United Saver flights.

- No foreign transaction fee.

- $0 introductory annual fee for the first year (then $95) annual fee

- Subject to Chase 5/24 rule.

- United perks: 25% back on in-flight purchases checked bag benefit, expanded Saver award ticket availability

- Travel perks: TSA/Global Entry credit, trip cancellation and interruption protection

Why we like this card: While the United Explorer card by Chase only offers two lounge passes per year, we thought it deserved a space on this list given how much cheaper–and smoother–it makes virtually every other step of your flight experience.

Starting at check-in, you’ll get a free checked bag for yourself and one companion. Then, you’ll scoot through security a little faster thanks to the $100 statement credit for Global Entry, TSA PreCheck or NEXUS. After cashing in your lounge passes, you’ll be able to board a little early thanks to priority boarding. Lastly, even after takeoff you’ll enjoy 25% off all in-flight food, beverages and Wi-Fi packages.

The caveat, of course, is most of these perks only apply to United flights so you’ll need to show some brand loyalty to maximize the United Explorer card’s benefits. But if you’re already a fan of United—and you’d finally like to experience the United Club on your next trip—it’s an obvious choice.

Best for CLEAR Plus: American Express Green

For a modest $150 annual fee, the American Express® Green Card includes up to $100 LoungeBuddy statement credit, up to $189 credit toward cost of CLEAR® Plus per calendar year and 3X on travel/transit/dining. All things considered, it’s a solid and well-rounded travel companion.

American Express® Green Card

Intro bonus, reward rates.

- 3x Earn 3X Membership Rewards points in expanded travel categories

- 1x Earn 3X points on eligible purchases at restaurants worldwide (including takeout and delivery in the U.S)

- All information about the American Express® Green Card has been collected independently by Fortune Recommends™.

- High earnings on travel and dining

- Membership Rewards points are valuable and flexible

- CLEAR Plus credit

- High annual fee for a mid-level travel card

- No trip cancelation insurance

- Additional benefits include a $100 LoungeBuddy benefit, trip delay and secondary car rental insurance

Why we like this card: If you like the idea of flying through security quickly and arriving at the lounge mere minutes after you enter the airport, the American Express Green card may be your ticket to that fantasy.

That’s because the Amex Green comes with a handy pair of credits for both CLEAR Plus and LoungeBuddy. For the uninitiated, CLEAR Plus allows you to move faster through security by scanning your eyes and/or fingerprints in a dedicated CLEAR Lane, and LoungeBuddy allows you to pre-book lounge access worldwide starting at $25 per visit.

The Amex Green also offers a 40,000-point welcome bonus worth up to $400 in travel or gift cards (earned after spending $3,000 within six months) plus 3X on travel/transit dining, making it a rewarding card to take on the go. Even better, those points are Membership Rewards points which can have even more value when transferred to partners.

All information about the American Express® Green Card has been collected independently by Fortune Recommends™ .

The Capital One Venture X Rewards Credit Card quickly justifies its $395 annual fee by offering a $300 travel credit, $100 TSA PreCheck/Global Entry credit, 75,000-mile welcome bonus and perhaps best of all, unlimited airport lounge access for you and up to two guests. Not only that, authorized users are free and can each get their own memberships. So while the Venture X certainly isn’t cheap, the value proposition earns it a place on the list.

Capital One Venture X Rewards Credit Card

- 10X 10x miles on hotels and rental cars booked through Capital One Travel

- 5X 5x miles on flights booked through Capital One Travel

- 2X 2x miles on everyday purchases

- Annual $300 travel credit and 10,000 Miles upon card anniversary make up for the annual fee

- Airport lounge access

- Capital One Miles require effort to maximize

- Limited cash redemption options

Other benefits

- Travel protections including car rental insurance, trip cancellation/interruption and travel delay protection

- Consumer protections including extended warranty and return protection

Why we like this card: While it may be a stretch to say that a card charging $395 a year provides “affordable” anything, consider this: the Capital One Venture X also comes with a 75,000 bonus miles after spending $4,000 on purchases within the first 3 months from account opening, an annual $300 back annually for bookings made through Capital One Travel and a 10,000-mile Anniversary Bonus. This means that while you’re technically paying a $395 fee each year, you’re getting $400 in travel credit right back.

That’s not to mention the card’s marquis benefit for frequent flyers: unlimited airport lounge access for you and up to two guests at any Capital One, Priority Pass or Plaza Premium Group location. The pampering doesn’t end there, either, since you’ll also be treated to instant Hertz President’s Circle status (until Jan. 1, 2025), a $100 experience credit at the Premier Collection of hotels and more.

So if you’re looking for a premium travel card with easy-to-use benefits and unlimited lounge access, your search may end with the Capital One Venture X.

Frequently asked questions

Which card offers free lounge access for no annual fee .

At the time of this writing, there are no rewards cards offering airport lounge access for a $0 annual fee. However, both the U.S. Bank Altitude Connect and the United Explorer card offer airport lounge access for a $0 annual fee for the first year and $95 per year thereafter.

What’s the best card offering airport lounge access for an annual fee below $100?

Our pick for the best card offering airport lounge access under $100 is the U.S. Bank Altitude Connect card. The card comes with a welcome bonus worth $500, complimentary Priority Pass Select membership with four lounge passes per year and charges no annual fee for the first year ($95 thereafter).

Is lounge access free on Amex rewards cards?

Complimentary lounge access is a perk of the Amex Green (up to $100 per year) and Platinum cards.

Which airline rewards cards include lounge access for under $100?

The United Explorer card, Miles & More World Elite Mastercard (Lufthansa), and SKYPASS Visa Signature cards (Korean Air) all include two complimentary lounge passes per year for an annual fee under $100.

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefits guide for more details. Underwritten by Amex Assurance Company.

EDITORIAL DISCLOSURE : The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends ™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

Guide to travel rewards credit cards

Best travel credit cards of april 2024, luxury travel for less: your guide to free airport lounge passes, 10 credit card tips to help you avoid disaster when traveling abroad, how credit card travel insurance works—and what it doesn’t cover, insure your adventures: the ultimate guide to credit cards offering travel insurance, how credit card rental car insurance saves money on every rental, chase lga lounge review: luxury at laguardia, chase beefs up new york profile with a new jfk sapphire lounge—here's what you need to know, biggest-ever amex centurion lounge opens in atlanta — with outdoor terraces and bars for both whiskey and smoothies, amex centurion lounge atlanta: what to expect now that it’s open, how to use your credit card to save on travel as airline costs soar, do you have travel rewards saved up these are the best ways to use them, 5 ways your credit card can help you save on spring break travel costs, best no annual fee travel credit cards of april 2024, capital one lounge: what you need to know, how i travel with my wife for less than a date night.

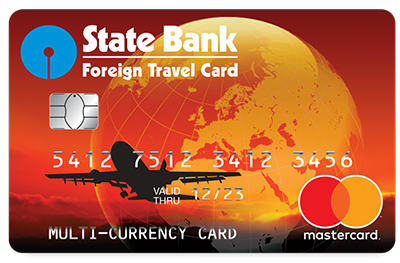

State Bank Multi-currency Foreign Travel Card

Chip & PIN Protected Prepaid Card. All your travel currency on one card.

You can easily reload your State Bank Multi-Currency Foreign Travel Card ++ with more funds ahead of your next trip, until the Card expiry date. Simply take your State Bank Multi-Currency Foreign Travel Card, valid passport and Form A2 (available at branches) and top up at FTC issuing branches of State Bank of India – subject to FEMA guidelines and other regulations. Click here for a detailed list of branches.

Reloadable until expiry date on the Card - within the limits of the Card ++

++ Until Card expiry and subject to reload limits (see Fees and Limits table). Limits are subject to FEMA regulations, imposed by The Reserve Bank of India from time to time.

- Multiple currencies on one Card

- Withdraw local currency at over 2 million ATMs worldwide, accepting Mastercard cards, or use your Card to pay directly for goods and services at 34.5 million merchants, wherever you see the Mastercard Acceptance Mark (other than in India, Nepal and Bhutan, or for payment of goods in Indian Rupees or the currencies of Nepal and Bhutan)

- Locking in the value of your Card balance, whenever you (re)load your State Bank Multi-Currency Foreign Travel Card, could help you to avoid exchange rate fluctuations and variances while you're abroad, and clear charges give you the control to manage your budget

- No bank account information is required to obtain and start using your State Bank Multi-Currency Foreign Travel Card

- Manage your Card online, with secure visibility of balances and transaction details, and services like an ATM locator

Your State Bank Multi-Currency Foreign Travel Card is not linked to your bank account and comes with 24/7 Global Assistance. If your State Bank Multi-Currency Foreign Travel Card is lost or stolen, please contact our Card Services team immediately, so that they can cancel it. If you have an additional Card, you can use it to access your funds. If both your Cards are lost or stolen, our Card Services team can offer assistance, including emergency cash replacement up to the available balance on your Cards (subject to availability in the relevant location).

- Chip and PIN protected

- Additional Card available for backup

- 24/7 Global Assistance, including free Card replacement if your Card is lost or stolen

- Peace of mind, as the Card is not linked to your bank account

Here's how it works...

State Bank Multi-Currency Foreign Travel Card ("Foreign Travel Card") is the smart way to carry your travel money. Simply load one or more of the following currencies- US Dollars, British Pounds, Euros, Singapore Dollars, Australian Dollars, Canadian Dollars and UAE Dirham to your State Bank Multi-Currency Foreign Travel Card and when you're travelling, use your Card to withdraw money from over 2 million ATMs worldwide accepting Mastercard® cards, or to pay for goods and services in shops, restaurants and hotels around the globe, displaying the Mastercard Acceptance Mark (other than in India, Nepal and Bhutan, or for payment of goods in Indian Rupees or the currencies of Nepal and Bhutan).

If you have insufficient funds in a transaction currency to pay for a transaction, the balance of the transaction will automatically be deducted from other available currency (ies) on your Card, in the following order of priority: USD, EUR, GBP, SGD, AUD, CAD and AED, subject to the applicable exchange rate and cross currency fee (see Fees and Limits Table).

With the State Bank Multi-currency Foreign Travel Card, you can lock in the exchange rates on your currencies each time you reload+. Simply visit FTC issuing branches of State Bank of India.

Looking for your nearest branch? Click here for a detailed list of branches.

+ Please note that any loads or reloads are made at the relevant exchange rate, applicable for Foreign Travel Card, on the day that the load is processed (this varies from day to day).

SIMPLY PREPAY AND GO!

State Bank Multi-Currency Foreign Travel Card is a prepaid currency card that can be pre-loaded with your spending money in up to seven Currencies and then used at ATMs and merchants abroad1, displaying the Mastercard® Acceptance Mark.

If you have insufficient funds in transaction currency to pay for a transaction, the balance of the transaction will automatically be deducted from any other available currencies on your Card, in the following order of priority: USD, GBP, EUR, SGD, AUD, CAD and AED, subject to the applicable exchange rate and Cross Currency fee (see Fees and Limits section of this website or the Fees and Limits Table in the Terms and Conditions).

1 Due to FEMA regulations, the State Bank Foreign Travel Card cannot be used at ATMs or merchants in India, Nepal and Bhutan, or for internet purchases where the website is registered in India, Nepal or Bhutan, or at websites accepting payment in Indian Rupees or the currencies of Nepal and Bhutan. In addition, there may be some other countries where usage of the Card is prohibited. Please click here to verify the list of prohibited countries.

Want to put more money onto your card.

Your State Bank Multi-Currency Foreign Travel Card can be reloaded, so you need never run short of money during your travels.

1. Return to any participating branch of State Bank of India, with your State Bank Multi-Currency Foreign Travel Card, valid passport and PAN Card. Fill in the prescribed application form and Form A2 (available at branches)

2. If you think you may need to have your State Bank Multi-Currency Foreign Travel Card reloaded whilst travelling overseas, you can leave a completed Form A2, a copy of your PAN Card and passport, plus a letter authorising a family member or friend in India to carry out the reload on your behalf. We may load the Card on receipt of the above documents from a family member or friend, along with a letter, signed by you. However, State Bank of India reserves every right in such cases, to verify that any person purporting to act on your behalf is so authorised and to identify and verify the identity of that person in accordance with the know-your-customer norms prescribed by The Reserve Bank of India.

- A reload fee applies to all reloads and may vary from time to time

- Reloads are made at the relevant exchange rates on the day that the reload is processed. The exchange rates for the available currencies will vary from day to day and may vary per reload location

DYNAMIC CURRENCY CONVERSION (DCC)

Dynamic Currency Conversion (DCC) is an optional service that is sometimes offered by retailers and ATM operators abroad, giving cardholders the choice of paying in either the currency of the country they are visiting or their own domestic currency. You should not use your Foreign Travel Card to make a purchase or ATM withdrawal in Indian Rupees (as you are prohibited from doing so by law) and you should choose to pay in the local currency. Please note that there will be an additional cost if the point of sale transaction or ATM withdrawal is in a currency other than the currencies on the card, or if more than one currency on your card is used to pay for the transaction. Please refer to the Fees and Limits Table for further information in the fees and limits section of this website or in the Terms and Conditions. Other benefits include:

- Multiple currencies on one card

- Card security (benefit of not being linked to a bank account)

- Access to worldwide ATM withdrawals

- 24/7 Global Assistance

- Additional Card to access the same funds

- Competitive exchange rates

RESTRICTIONS

Please note, due to FEMA regulations, the State Bank Foreign Travel Card cannot be used at ATMs or merchants in India, Nepal and Bhutan, or for internet purchases where the website is registered in India, Nepal or Bhutan, or at websites accepting payment in Indian Rupees or the currencies of Nepal and Bhutan.

There are a number of countries where the use of State Bank Foreign Travel Card is currently prohibited. If you attempt to withdraw cash from a cash machine, or use your Card at shops, restaurants, hotels and online in any of these countries, your request will be declined and the reason given as 'Decline, prohibited country'.

The countries currently affected are: Cuba, Iran, North Korea, Sudan and Syria

Card Security

WE'RE DEDICATED TO PROTECTING YOU Unfortunately, terms like 'ID theft' and 'fraud' are all too familiar nowadays. We are very aware of the threat and concerns you have regarding such issues, which is why fraud prevention is of paramount importance to us.

We know our customers. Every day we monitor transactions on our Cards, to detect unusual behaviour and if we spot something uncharacteristic, we'll contact you to verify your transactions. The State Bank Multi-Currency Foreign Travel Card is chip and PIN protected, with both cash withdrawals and purchases protected by PIN.

- Sign your Cards immediately when you receive them

- Check your transactions regularly and report anything unusual immediately to the 24/7 Card Services team

- If you print statements from the internet, keep them safe and shred them when you’ve finished using them

- Never give your personal details to someone who phones you claiming to be from a reputable company or even from MasterCard /SBI

- Don’t give out your details in response to unsolicited email

- Be wary of anyone who asks for common security details, like your mother’s maiden name, date of birth, or information about your work

- Never give your PIN to anyone, not even if they claim to be from State Bank of India

- Don’t let yourself get distracted when using ATMs – somebody may be trying to get to know your PIN

Never write down a PIN or keep it together with the Card. Be very alert when using ATMs, and ensure that:

- The machine has not been tampered with

- Nobody can watch you entering your PIN

- Card and cash are concealed and safe before you leave the machine

- You retain any printed records for safe disposal at a later time

- If your Card is retained, contact Card Services immediately for assistance

Always keep your Card in sight when making a purchase or it may get skimmed.

“Skimming” occurs when the genuine data on a card’s magnetic strip is electronically copied onto another card, allowing fraudsters to steal the funds on your card. This can happen at petrol stations, restaurants, bars and at ATMs. Skimmed card information is often sold on to organised crime groups.

Make sure that you're using a secure browser. A secure browser such as Microsoft Internet Explorer or Mozilla Firefox will indicate whether the website you are visiting is secure or not.

Broken key or padlock = unsecured Unbroken key or padlock = secured

These browsers scramble your personal data before sending it, so no one else can read it. Ensuring that your computer has up-to-date virus protection and a firewall will help protect you from attacks.

Key points when buying goods/services on the Internet:

- Know who you are dealing with. Use a reputable company and type its internet address into the browser yourself

- If the website gives you the option of using a secure checkout, opt for yes

- Just as you save till receipts, in case you need to return or exchange something, you need to keep a record of all transactions too. Print and save a copy of your completed order form and your order confirmation

“Phishing” is an attempt by fraudsters to “fish” for your card or account details. Phishing attempts usually appear as an email apparently from your bank or card issuer. Within the email, you are then encouraged to click on a link to a fraudulent log-in page, designed to capture your details.

We may contact you by email, but we will NEVER ask you to click on a link that directs you to enter or confirm your security details. If you are in any doubt about the authenticity of an email appearing to be from us, telephone Card Services immediately.

“Pharming” employs the same type of tricks as Phishing to lure you to a site address, but uses hidden software to redirect you from real websites to the fraudulent ones.

This is particularly clever, as it hijacks trusted brands of well-known banks, online retailers and card issuing companies and convinces you to respond under cover of trust to enter your personal details.

Just remember, if you are asked to type your PIN into a website along with your Card details, it is probably a fraudulent website, and you should close the browser and contact Card Services immediately.

If you lose your State Bank Multi-Currency Foreign Travel Card or it is stolen, reporting this to Card Services immediately will help protect the funds on the Card. Our dedicated team is on hand 24 hours a day, seven days a week, to help you get back to enjoying your travels.

Please click here for information on how to report your Card as lost or stolen.

Before you go

TRAVEL TIPS Some ATMs (cash machines) may charge a withdrawal fee, in addition to any fee associated with your State Bank Multi-Currency Foreign Travel Card. Some cardholders advise that they saved the free phone number for the country(-ies) they were travelling to in their mobile to check their Card balances, which is a quick and easy to use service (please note: calls from mobile phones are not free of charge). Cardholder feedback also suggests that some hotels may charge for calls made to free phone numbers, it is wise to check with your hotel beforehand.

PRE-AUTHORISATION It is not recommended that you use your State Bank Multi-Currency Foreign Travel Card as a guarantee of payment (usually for hotels, car hire and cruise lines). These companies may estimate the bill, and if you use your Card as a guarantee for the estimated amount, the funds will be temporarily unavailable to access or spend. You can, of course, use your State Bank Foreign Travel Card to settle your final bill.

When purchasing fuel, make sure you pay the cashier instead of using the ‘pay at pump’ option, to avoid a set amount (greater than your purchase amount) being ‘held’ until the final transaction settles (this principle applies to all payment cards; it is just more noticeable when using a prepaid card).

State Bank Multi-currency Foreign Travel Card is issued by State Bank of India, pursuant to license by Mastercard Asia/Pacific Pte. Ltd. Mastercard is a registered trademark of Mastercard International Incorporated.

- OTP has been introduced for making e-com transactions through INR Prepaid Cards. The OTP will be received on customer registered mobile number.

- The daily transaction limit on SBFTC are displayed on the first page after the Customer Login into the Prepaid portal

- Gift Card Issuance Charges waived till 31.03.2018

- EZ-PAY/IMPREST/SMART PAYOUT/XPRESS MONEY CARDS are enabled for cash withdrawls from NON SBI ATMs Charges Rs.20/- for each cash withdrawls and

- Rs 9/- for Balance enquiry

- *Gift Card issuance charges are waived since beginning of launching the product, currently waived till 31-03-2016, waiver is proposed to be continued till 31.12.2017.

- & **Nil load/reload charges are applicable through CINB/INB.

State Bank Foreign Travel Card

The Smartest way of Carrying Money Abroad.

State Bank Foreign Travel Card is a card in foreign currency that makes your foreign trip secure and convenient. It is a Chip based EMV compliant Card which stores encrypted and confidential information. It offers you a convenient and secure way to carry cash anywhere in the world (valid worldwide except in India, Nepal and Bhutan).. With State Bank Foreign Travel Card (SBFTC), you can shop, dine or visit places abroad without any worries of carrying or losing cash. It relieves you of the Annual fees, joining fees, credit limits, etc., usually associated with International Debit / Credit Cards. All you have to do is produce your 'State Bank Foreign Travel Card' and you will find making payments overseas easy. SBFTC is available as both Single Currency and Multicurrency Card. Single Currency Card Single Currency Card is available in eight foreign currencies viz. US Dollar (USD), Pound Sterling (GBP), Euro (EUR), Canadian Dollar (CAD), Australian Dollar (AUD), Japanese Yen (JPY), Saudi Riyal (SAR) and Singapore Dollar (SGD). Multicurrency Card Multicurrency SBFTC is available in 9 foreign currencies, viz. US Dollar (USD), Pound Sterling (GBP), Euro (EUR), Japanese Yen (JPY), Canadian Dollar (CAD), Australian Dollar (AUD), Saudi Riyal (SAR), Singapore Dollar (SGD) and UAE Dirham (AED).

- Cardholder has option to load all available currencies on a single card.

- Documentation

- FTC Selling Branch Address

Competitive exchange rates.

Reloadable any number of times..

Operatable by 4 digit PIN at ATMs and by PIN/Signature at Merchant Establishments.

SMS / E-Mail

Balance information after each transaction through SMS/e-mail.

Maximum amount of issue

As prescribed by the RBI/FEMA from time to time for the purpose of the visit abroad.

Balance Enquiry

Free balance enquiry at State Bank Group ATMs and VISA ATMs(at a charge).

Free balance enquiry and view / download details of transactions through https://prepaid.sbi/

Add-on-Cards

Add-on-cards not exceeding two in number to be used by the card holder in case of loss/misplacement/defacement of the card.

SMS/e-mail alerts for each transaction

*Disclaimer:The service is dependent on the infrastructure,connectivity and services provided by the service provider. State Bank of India will not be liable for any delay,inability or loss of information in the transmission of alerts.

A 24 x 7 call centre ( +91 18001234) to provide information and hot-list (block) the card in case of loss / misplacement.

Navigation Hindi

- Subsidiaries

- Corporate Governance

- Investor Relations

- SBI In the News

- Grahak Setu

Language Selector

- Customer Care

- Net Banking

State Bank Foreign Travel Card - Personal Banking

State bank foreign travel card.

- Eligibility

Required Document

How to apply, download section.

State Bank Foreign Travel Card, is a prepaid Foreign Currency card that makes your foreign trip trouble-free and convenient. It is a Chip based EMV compliant Card which stores encrypted and confidential information. It offers you a convenient and secure way to carry cash anywhere in the world (valid worldwide except in India, Nepal and Bhutan).

SBFTC is available in nine Foreign Currencies viz. US Dollars (USD), Pound Sterling (GBP), Euro (EUR), Canadian Dollar (CAD), Australian Dollar (AUD), Japanese Yen (YEN), Saudi Riyal (SAR), Singapore Dollar (SGD) and United Arab Emirates Dirham (AED).

- ISIC (International Student Identify Card) Membership (Valid upto Sep’2024)

- International SIM card with 28 days validity period and upto 5 GB of data (Valid upto 30.11.2024)

- Issued in association with VISA International and MasterCard Asia/Pacific Pte. Ltd.

- Accepted all over the world except in India, Nepal and Bhutan.

- Available for retail (students, tourists, pilgrims, medical needs, etc) and corporate customers (Companies, Government Departments, Public Sector Undertakings, etc.).

- Minimum amount of load/Re-load: USD 200/ GBP 120/ Euros 150/ CAD 200/ AUD 200 / YEN 15,800 / SAR 750 / SGD 250 / AED 750.

- Competitive exchange rates.

- Maximum amount of issue: As prescribed by Reserve Bank India (RBI) / Liberalised Remittance Scheme (LRS) / Foreign Exchange Management Act 1999 (FEMA) depending on the purpose of overseas visit. Presently, equivalent to USD 2,50,000.00 or equivalent per financial year for Education/ Employment/Medical/ Business Trip/Tourism/Pilgrimage.

- Reloadable any number of times, within the RBI / LRS / FEMA regulations cited above. Card can be reloaded at any authorised Branch.

- Operable by 4 digit PIN at ATMs and by PIN/Signature at Merchant Establishments.

- Free balance enquiry at State Bank Group ATMs in India and VISA /MasterCard ATMs overseas (at a charge).

- Free balance enquiry and view/download details of transactions through https://prepaid.sbi (VISA) or https://www.sbitravelcard.com (MasterCard).

- Add-on cards, not exceeding two (2) for VISA and one (1) for MasterCard, can be given for use of the card holder in case of loss / misplacement / defacement of the card.

- A 24 x 7 call centre to provide information and hot-listing (block) the card in case of loss / misplacement. Additionally, VISA SBFTC holder may block (temporary / permanent) online at https://prepaid.sbi

- Card can be used for online transaction (e-commerce) POS payment, ATM Cash withdrawal beside balance enquiry at ATM. Validation through VBV and use of CVV2 has been made mandatory in our system for performing e-commerce transaction for ensuring safety of the money of the cardholder. Ecommerce sites allowing transaction without validating VBV and CCV2 will be rejected by the bank.

- SMS/e-mails alerts for each transaction*.

- *Disclaimer: The service is dependent on the infrastructure, connectivity and services provided by the service provider. State Bank of India will not be liable for any delay, inability or loss of information in the transmission of alerts.

Variants :

A. On VISA platform , SBFTC is available as both Multicurrency and Single Currency Card.

Multicurrency Card

- Multi-Currency SBFTC is available in 9 foreign currencies, viz. US Dollar (USD), Pound Sterling (GBP), Euro (EUR), Japanese Yen (JPY), Canadian Dollar (CAD), Australian Dollar (AUD), Saudi Riyal (SAR), Singapore Dollar (SGD) and UAE Dirham (AED).

- Cardholder has option to load all available currencies on a single card.

Single Currency Card

- Single currency card in eight foreign currencies viz. US Dollar (USD), Pound Sterling (GBP), Euro (EUR), Canadian Dollar (CAD), Australian Dollar (AUD), Japanese Yen (JPY), Saudi Riyal (SAR) and Singapore Dollar (SGD).

For more details, please refer to user guide, FAQ, Schedule of charges etc at website– https://prepaid.sbi

B. On MasterCard platform, SBFTC is available as Multi Currency card in seven foreign currencies viz. US Dollar (USD), Pound Sterling (GBP), Euro (EUR), Canadian Dollar (CAD), Australian Dollar (AUD), Singapore Dollar (SGD) and UAE Dirham (AED).

For more details, please refer to user guide, FAQ, Schedule of charges etc at website – https://www.sbitravelcard.com

- Any resident individual {as per definition of FEMA, 1999 Section 2 (V)}, who plans to travel abroad except Nepal and Bhutan.

- Corporates for their employees whom they plan to send abroad for official purpose subject to completion of KYC norms.

- Parents/sponsors of the students going abroad for higher studies, in student’s name and can be subsequently reloaded up to the statutory ceiling, prescribed from time to time under FEMA guidelines 1999 and subsequent amendments.

- Foreign Nationals residing in India, subject to completion of KYC/FEMA norms.

- Signed application-cum-agreement form.

- Copy of valid Passport.

- Copy of valid PAN card.

- Document confirming intended foreign travel like VISA, Ticket, Proof of admission to a foreign university / institute or any other document.

- Proof of residence in case the address is different from that appearing on passport.

All eligible customers have two options to apply for SBFTC:

Option1: Online Application: You can apply for SBFTC Application through RINB ( https://www.onlinesbi.sbi/ ). Path to apply is ‘e-Services >> e-Cards >> Apply State Bank Foreign Travel Card’. A reference number is generated. Please take a printout of online application, and along with required KYC documents and papers visit any Authorised Branch for further processing for issuance of SBFTC.

Option2: Apply at Branch: Please visit any Authorised Branch, fill the application form and submit along with the required KYC documents and papers.

- List of Branches Selling FTC

- Frequently Asked Questions (FAQs)

- SBFTC Application Form

Last Updated On : Monday, 12-02-2024

- Interest Rates

8.50%* p.a. onwards

w.e.f. 05.04.2024

*T&C Apply.

11.15% p.a.*

less than Rs.10 Cr. w.e.f 15.10.22

Rs.10 Cr. and above w.e.f 15.10.22

Starts From 8.75%*

SBI Realty Gold Loan

SBI Gold Loan

*T & C Apply

Starts From 7.90%

SBI Personal Gold Loan

Loan amount up to Rs. 3 lakhs

> Rs. 3 lakhs & up to Rs. 5 lakhs

Balance below Rs. 10 crs

Balance Rs. 10 crores and above

8.15% p.a.*

(On Applying through YONO)

2 years to less than 3 year

5 years and up to 10 years

Quick Links

- Doorstep Banking Services

- Tools & Calculators

- Unauthorized Digital Transaction Reporting

Prepaid Card

Gifting Convenince

More Informartion

Periodic payments made easy

More Information

Convenient & Safe foreign travel

Instant Gratification

SBI NMRC City1 Card

Nagpur Metro Maha Card

SBI MMRDA Mumbai1 Card

SINGARA CHENNAI CARD

SBI GOSMART KANPUR METRO CARD

NCMC Prepaid Card

- Terms and Conditions

SIA is Typing...

character(s) remaining

Was this helpful ?

Thank you for sharing your feedback!

Your feedback matters.

(Please enter your 10 digit Indian mobile Number)

- Get In Touch

Manage your account on the go with the SBI Card Mobile App

- New User? Register Now

Track Application

- Investor Relations

- Analyst Investor Meeting

- Annual Report

- Business Presentations

- Financial Results

- General Meeting Information

- Investor Contact Points

- Other Disclosures

- Policies and Codes

- Corporate Announcements

- '+citiesDetail[i].name+'

- Annual Fee : Rs. 1499 + applicable taxes

- Renewal Fee (per annum): Rs. 1499 + applicable taxes

- Add-on Fee (per annum): Nil

Club Vistara SBI Card

Privileges on club vistara sbi card.

Know about the privileges on your Club Vistara SBI Card

Welcome Gift

- Get 1 Economy class ticket as an E-Gift Voucher on payment of Annual / Renewal fee.

- E-Gift voucher will be sent via E-mail to your registered e-mail address within 30 working days post payment of Annual Fee. T&C apply.

Reward Benefits

- Earn 3 CV Points (per Rs. 200 spent) on all your spends

- S pends include all retail spend categories including fuel

Comprehensive Insurance Cover

- Up to 4 cancellations per year, each limited to Rs. 3,500

- Lost card liability cover up to Rs. 1 lakh

- Air Accident Cover up to Rs 50 lakhs

- Loss of check in baggage up to Rs 72,000

- Delay of check in baggage Rs 7,500

- Loss of travel documents up to Rs 12,500

- Baggage Damage- Cover up to Rs. 2500

Milestone Benefits

- Spend Rs. 50,000 within 90 days of card issuance and get 1000 bonus CV Points

- Get 1 Economy class ticket each on annual spends of Rs. 1.25 lakhs, Rs. 2.5 lakhs & Rs. 5 lakhs

- Get 1 Hotel E-Voucher from Yatra worth Rs. 5000 on reaching annual spends of Rs. 5 lakhs

- Bonus CV Points will be credited to the Club Vistara Membership Account within 15 working days of reaching the spends threshold. T&C apply.

Domestic Airport Lounge access

- Enjoy 4 complimentary visits per year to Domestic Airport lounges (subject to a max of 1 per quarter)

- Cardholder’s are entitled for one (1) free Domestic visit in a quarter. Unutilized access will lapse at the end of quarter and cannot be carried to next quarter.

- In case a Cardholder accesses the airport lounge beyond complimentary visits, he/she will be charged as per the regular access rates prescribed by the lounge.

- Any accompanying guests (including children) with the Cardholder will be subject to a charge which will be made at the time of entry to the Cardholder

Complimentary Priority Pass Membership

- Enjoy complimentary priority pass membership worth USD 99 for 24 months from the date of issue of priority pass membership.

International Lounge Access

- Standard membership of Priority pass program is complimentary for 24 months. Usage fee of USD 27+applicable taxes will be charged on your Club Vistara SBI card for visit to the priority pass membership lounge.

- To apply for Priority Pass Card, pls visit sbicard.com

Club Vistara SBI Card Features

Know everything about your Club Vistara SBI Card

Fees and Charges

Terms and conditions.

- For detailed Terms and Conditions and Usage Directions, click here

- Download Brochure

Reward Point

- Earn 3 CV Points on every Rs. 200 that you spend using the Club Vistara SBI Card

- Use your CV Points on your CV Account to redeem on Air Vistara and Partner Airlines

- Click here to browse through our Club Vistara CV Points redemption page

Contactless Advantage

- Daily purchases now made easy with Club Vistara SBI Card. Simply wave your card at a secure reader to transact

- Fast & convenient: No need to hand over your card or look for cash /coins for everyday small ticket purchases

- Security: The card never leaves your hand during a Contactless transaction, significantly reducing the risk of card loss and fraud due to skimming (counterfeit). Even if the card is waved multiple times at the reader, the unique security key feature of Mastercard payWave or Visa payWave will ensure that only one transaction goes through, thus making it more secure

- Please click here to download the FAQ’s