Wise Travel Debit Card Review: Fees, Exchange Rates, Limits and How to Use It

There are many things you need to keep track of as a digital nomad, such as visas , travel documents, and accommodation , to name a few.

But one of the most important things to work out is your finances. As a digital nomad, you are likely constantly moving between countries and switching currencies, so having a travel debit card is imperative .

The Wise debit card is an easy financial solution for frequent travelers, digital nomads, and expats . So, what is the fuss about this Wise travel card? How does it work? And most importantly, should you hop on the bandwagon and sign up for it?

I have been using the Wise Travel Card for quite some time now and, in this article, I will give you my honest opinion about it.

What is a Wise Travel Debit Card?

If you travel often, you have probably used or at least heard of Wise (formerly Transfer Wise) .

This UK-based tech company was founded in 2011 by Estonian businessmen Kristo Käärmann and Taavet Hinrikus on the principle of providing fast and fair exchange rates for international transfers without any sneaky fees or below-par exchange rates.

I have been personally using their Wise multi-currency account for years now, and it is still the primary way I transfer money abroad. But, I recently started using the Wise travel card , which added an entirely new dimension to my travels.

Can I Use The Wise Card For Traveling Abroad?

The Wise travel card it's not a credit card and functions pretty much like a regular debit card. You simply add funds to the account and insert, swipe, or tap to pay for items.

The main difference? With Wise, you can hold money in more than 40 different currencies and pay like a local for items in more than 160 countries worldwide without having to worry about hefty fees or markups on conversion rates.

Your Wise Travel Card is connected directly to your Wise account, so you can spend funds from your balances.

Who is the Wise Travel Card for?

Obviously, this is a “travel” card, so its primary purpose is for spending abroad while traveling . That said, you could totally use this for your day-to-day expenses. Traditional banks aren’t really designed to cater to frequent travelers or digital nomads , and the Wise Travel Card fills this gap.

For example, my wages are paid from the US, but I live abroad permanently, so I can easily transfer from my US-based bank to Wise and then simply use my Wise card for most of my daily expenses.

You should consider using the Wise Travel Card if one or more of the following applies to you:

- You frequently transfer funds from another country that uses a different currency.

- You travel internationally often and need a card with low currency conversion fees.

- You often shop online with international retailers that sell their products in a foreign currency.

- You own a business and need a card for international expenses.

- Your current bank card has high currency conversion fees and you want to get away from a traditional bank account

- Your current bank card has high fees for using international ATMs.

Wise Card Features for Traveling Abroad

If you have used a travel prepaid card like Revolut , Chime , or Monzo in the past, you can expect similar features from the Wise Travel Card. Let's see which ones are those:

- Low fees on conversions with the mid-market exchange rate

- Hold, spend, and exchange more than 40 different currencies in your Wise account

- Available to citizens and residents of more than 30 countries , including the UK, Canada, EU, USA, and Australia

- Manage, top up, freeze, and view your card balance in the Wise App

- Use at over 2 million ATMs with free monthly withdrawals up to certain limits.

- Create up to 3 digital virtual cards for free

- Auto currency convert feature to automatically convert your funds at your set rate

- Ability to make Contactless payments

- Connect to most popular eWallets like Google Pay, Apple Pay, and more

- Free spending of any currency you hold in your Wise account

- Biodegradable and eco-friendly card design

Pros and Cons of the Wise Debit Card for Travel

When I first started my digital nomad journey, I quickly came to a rude awakening when I found that my bank was charging exorbitant markups on foreign exchange and fees for ATM withdrawals .

If the same is happening to you, you’ll want to get your hands on this gem of a travel card . But before you sign up, let’s go over some of the upsides and downsides of the Wise Travel Card.

Pros and cons:

What to love about the wise debit card.

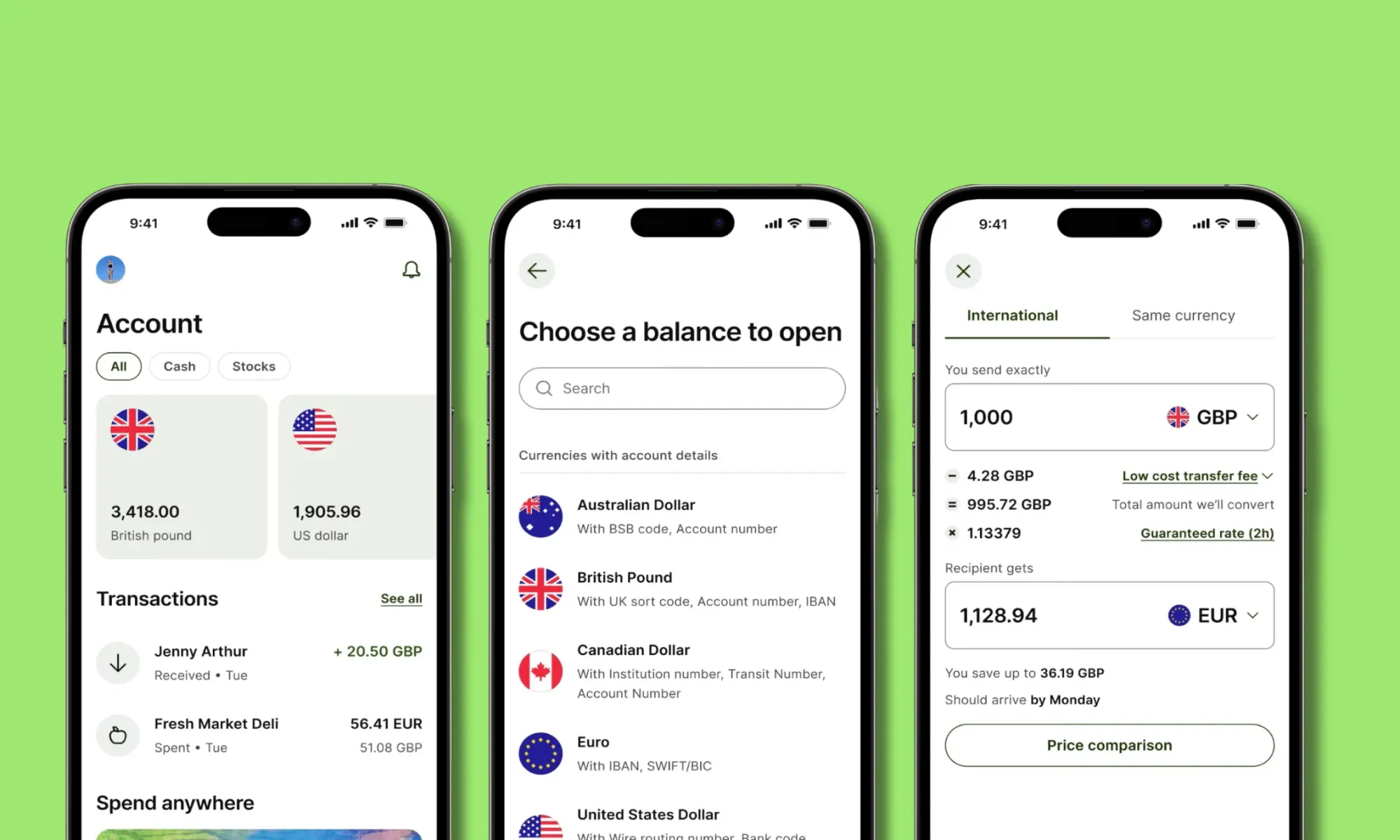

For me, the Wise card's standout features are the app's user-friendliness , the multi-currency account , and the low markup on exchange rates .

Being able to hold more than 40 currencies is a game changer. Transferring funds to different currencies in their app when I travel abroad is super easy. To give you an example, I spend quite a bit of time in Europe, the USA, and New Zealand. And with Wise , I can have separate accounts for USD, EUR, and NZD, which makes my life SO much more manageable when traveling to these countries!

On top of that, while there is a small markup fee on currency exchange, it is extremely minimal compared to other banks I have used .

What Could Be Improved About the Wise Debit Card?

The obvious downsides of the Wise Travel Card lie with ATM withdrawal limits , longer card delivery timeframes , and the lack of a premium option .

I am based in the USA, and my card took more than 2 weeks to arrive. Most digital nomads don’t spend too much time in each place, so this can make it difficult to receive your card initially if you are a frequent traveler .

Also, while card transactions are becoming the norm in many countries, cash is still king in several countries I have traveled to in the past few years. The Wise card is NOT exactly the ideal card for withdrawing cash . You’ll only get two transactions for free , and then you’ll be paying a usage fee as well as a 1.75% to 2% markup . This definitely isn’t a dealbreaker, but I hope Wise will improve this in the future.

What Currencies Can You Use With the Wise Travel Card?

One of the main reasons Wise has kept me on board as a customer all these years is their multi-currency account . This is truly the crown jewel of all of Wise’s features.

You can store 40+ currencies in various wallets in your Wise account , but this doesn’t mean you are limited to spending in those currencies. In fact, you can use the Wise debit card in more than 160+ countries ! If the currency you are spending in doesn’t have a wallet option, the Wise card will simply exchange the money into the payment currency at the time of your purchase .

For example, I was recently in Guatemala, and, unfortunately, I was not able to store Quetzal (the local currency) in my multi-currency account. But when I bought something, my funds were automatically converted from USD to Quetzal at the mid-market rate (plus 0.5%).

There are also 11 currencies for which you get account details to make bank transfers . This means you can transfer funds in the following currency balances directly from your Wise account to another bank account.

This is a feature of Wise that I use often. If I need to transfer funds from my US bank account to one in another country, I almost always use Wise as a “middleman” in order to avoid unexpected transfer fees .

While you won’t be able to make bank transfers in other currencies, you can hold them in your Wise account and spend with your travel card.

How Does the Wise Card Exactly Work?

As you can see, the Wise Travel Card is a wise decision for any traveler (see what I did there?), but how does it exactly work?

As with any new bank account or credit card, there is a bit of a learning curve when first using your Wise travel card . That said, using this card isn’t rocket science, so you’ll be saving money on exchange fees in no time!

How to Use the Wise Travel Card Abroad

The Wise travel card is specifically designed for spending money outside of your home country, so as you would expect, it is pretty easy to use abroad.

All you need to do is order your card , activate it, create a PIN, add money to your account, and you will be all set to use the card in a different country!

The Wise App

There is nothing more annoying than an app that is built for developers and not for the general public. Your banking and financial app should be easy to navigate and access.

I personally find the Wise app to be extremely user-friendly and intuitive . All features are easy to find, and when navigating through the app, I rarely got stuck or failed to find a setting.

I was easily able to change personal settings, connect bank accounts, exchange money, and send transfers from the app.

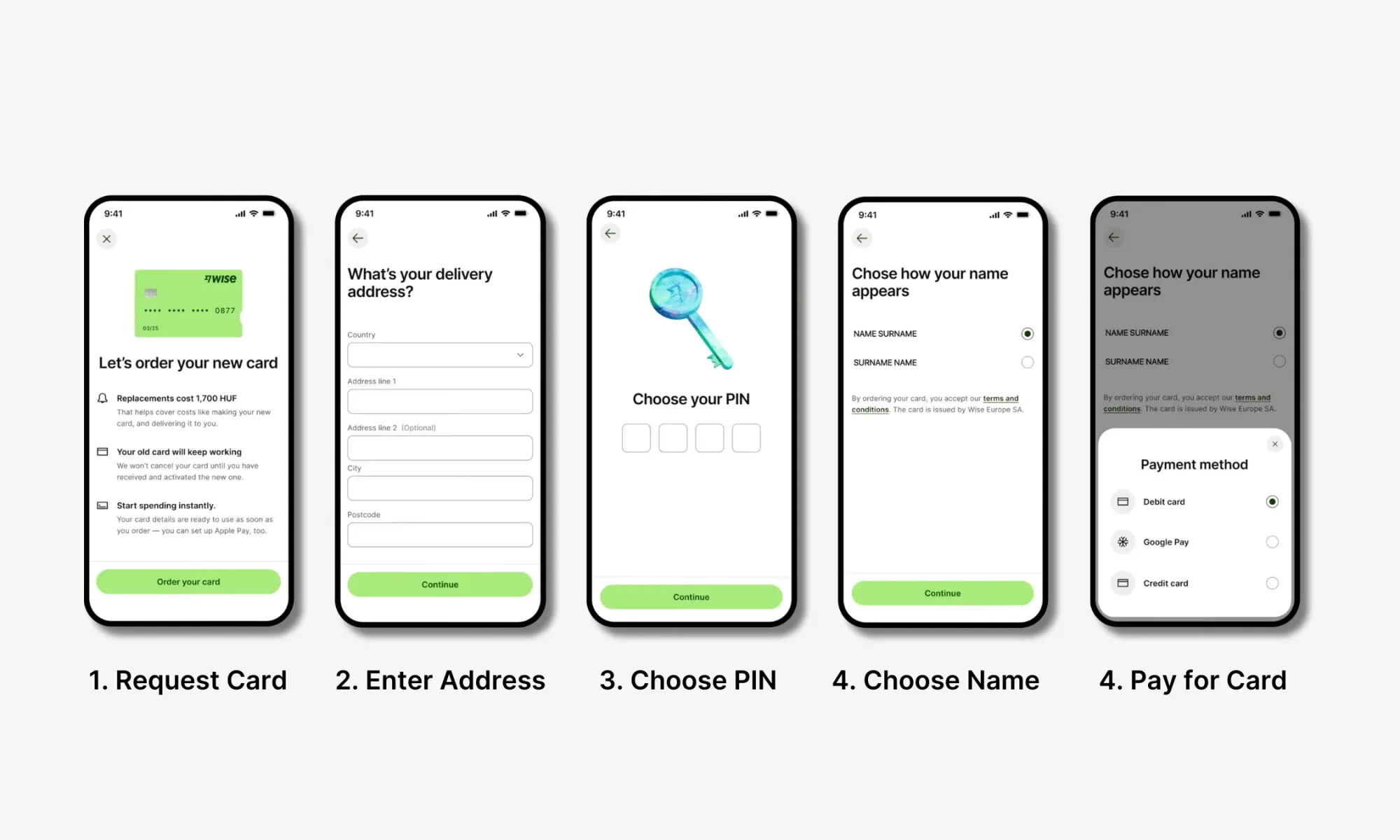

How to Order Your Wise Travel Card

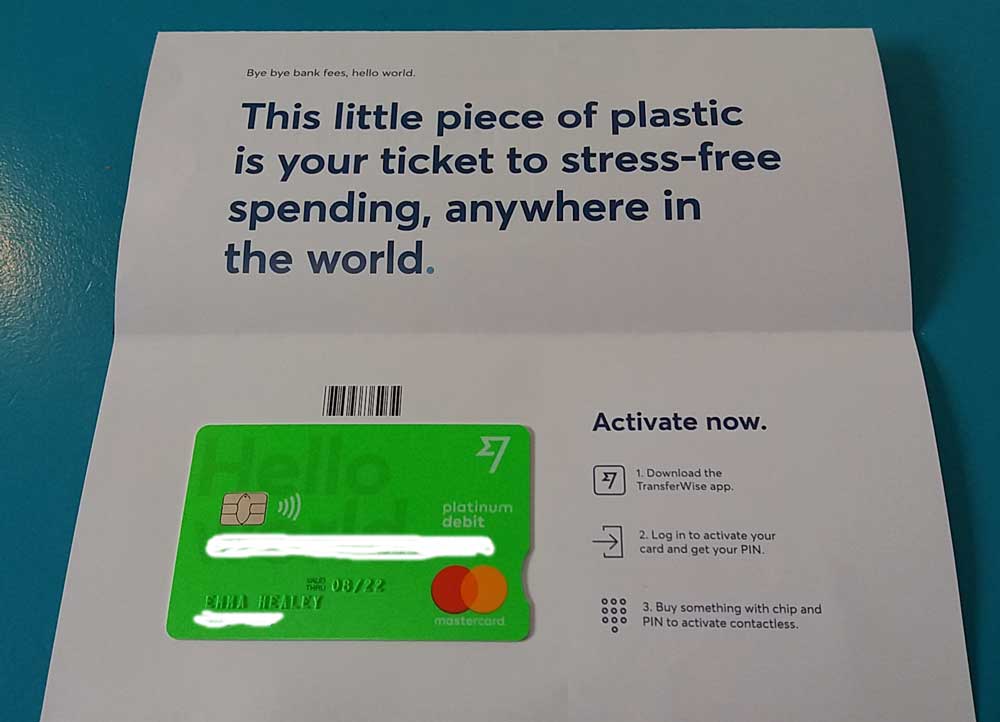

Ordering your Wise Travel Card can take some time (mine took more than 2 weeks to arrive), so I recommend getting on this as soon as possible to ensure you have the card for your next trip!

These are the 3 simple steps you will need to go through:

Step 1: Create a Multi-Currency Account

If you don’t have one already, your first step will be to sign up for a Multi-Currency Account with Wise

Step 2: Start Using Your Virtual Card Immediately

After making an account and verifying your details, you will then be directed to choose a digital/virtual card or a physical card . Digital cards are free and can be added to Google/Apple Pay or used for online payments immediately!

Step 3: Order a Wise Debit Card (Recommended)

If you want instead a physical card, you can do so by clicking on the “Card” tab on the main page and then click on “ Order a Debit Card ”. Physical cards cost a one-off fee of 7 GBP/7 EUR/10 USD , and it will take 7 to 21 business days for the card to arrive, based on your location.

If you'd like to visualise the entire process, watch the instructional video below:

How to Activate Your Wise Card

Once your Wise travel card arrives, it is time to activate it and start spending ! Luckily, for most Wise account holders, you won’t need to take any steps to activate the card, simply make a chip and PIN payment, and the card is ready to go !

Activate Your Wise Card (for US and Japan Customers Only)

As I mentioned above, Wise customers in the USA or Japan must activate the card separately . This isn’t too much of a headache, just don’t forget you need to be in your home country .

Here is a step-by-step breakdown of activating your card if you are a US and Japan customer.

- Log into the Wise app and tap on “ Card ”.

- Then tap on “ Activate Card ”.

- You’ll then be prompted to enter a 6-digit code that you’ll find on your card.

- After entering the code, you’ll create your PIN .

If you'd like to visualise the steps to activate your Wise card for your region, watch the instructional video below:

How to Change the PIN for Your Wise Card

Did you forget your PIN? Don’t worry, it happens to the best of us!

Luckily, if you are a US card holder, you can easily change your PIN in the Wise app :

- Tap on “ Card ” in the Wise app

- Select “ Change PIN ”

- Enter your new PIN 2 times, and you are all set!

If you are a non-US Wise card holder , you cannot change your PIN in the app , unfortunately. Instead, you’ll need to change it using an ATM that supports PIN changes .

My best advice? Choose a PIN you’ll never forget, or keep it written down somewhere secure.

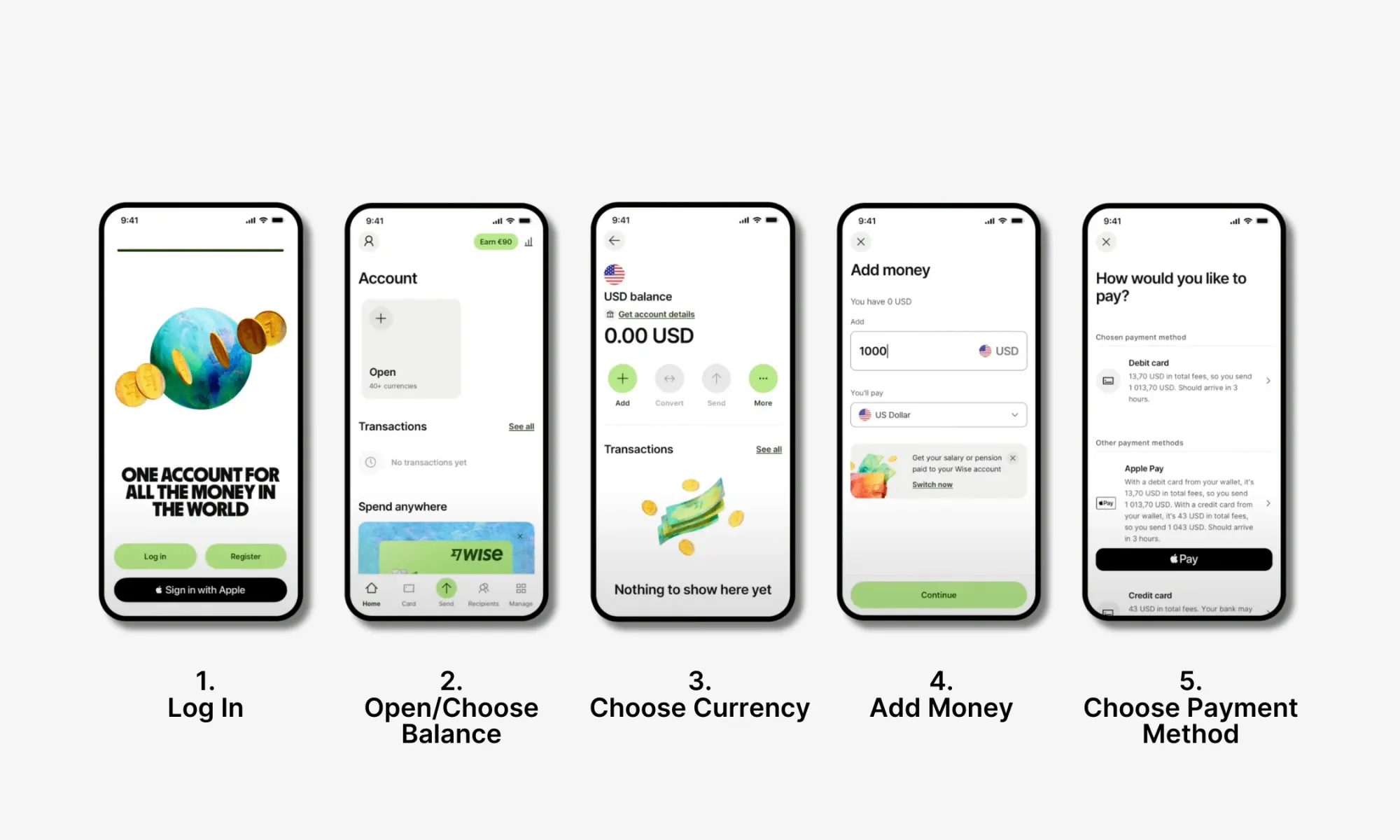

How to Add Money to Your Wise Travel Card

Your Wise travel card is linked to your Wise Multi-Currency account , so you’ll need to top up your Wise account with funds before using the card.

This is a pretty straightforward process:

- Logging into your account

- Choose which currency balance you want to add money to.

- Click “ Add ”.

- Choose which currency you want to use to top up the account.

- Type in the amount of money you want to add.

- Choose your payment method (bank transfer, debit card)

- Confirm the top-up and verify the money arrives in your balance.

Watch the instructional video below to visualise how to top up your Wise balance:

How to Freeze/Unfreeze Your Wise Card

One of the downsides of constant travel is that you put yourself at risk of fraud or losing your card. If you notice potential fraudulent transactions from your Wise card, or you believe your card is lost/stolen, you should freeze your card immediately . This way, you’ll avoid more fraud on your account.

Here are the steps to take to freeze your Wise Travel Card.

- After logging in to your Wise account, tap on “ Card .”

- Then simply click “ Freeze Card ”, or if you want to unfreeze, “ Unfreeze Card .”

- Fill out this transaction dispute form and contact customer support right away. They will be able to help you determine what to do next.

How to Replace a Lost or Stolen Wise Card

If you can confirm that your card has been lost or stolen, you’ll want to cancel the card and then order a new one.

- Log in to your Wise account and click on “ Card .”

- Tap “ Replace Card .”

- You’ll then be prompted to answer why you need a replacement card.

- Wait for the new card to arrive.

How to Use an ATM with Your Wise Travel Card

As mentioned above, ATM withdrawal is not the strongest feature with the Wise card, but you can definitely still use the card to take out cash. Spending with your Wise card is simple since the card can make contactless, chip, and swipe payments and is eligible for Google, Apple, Fitbit, and Garmin Pay. But how do you use an ATM with the Wise card?

Using an ATM with the Wise Travel Card is the same as using any other bank card. Simply insert your card into the machine, enter your PIN, determine how much cash you want to withdraw, and take your cash. Don’t forget to take your card back when you are done (I have made this mistake too many times…).

Wise Card ATM Limits

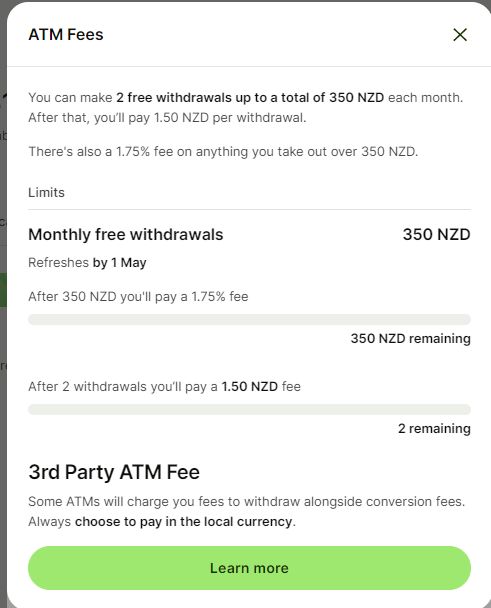

One of the biggest downsides with the Wise card is that you’ll have limited free ATM withdrawals. For all accounts, you’ll have 2 free ATM withdrawals each month, after which you will be charged an ATM usage fee and a percentage markup on the amount of cash you withdraw.

I use the Wise Travel Card for many of my day-to-day travel expenses, but I use my Charles Schwab Investor Checking account for ATMs. This card not only has a 0% ATM markup, but it also refunds any fees the ATM provider charges. This includes international withdrawals!

Wise Card Delivery Timeframe

Once you order your Wise Travel Card, you can expect it to take between 3 and 21 days to arrive, depending on your location. If you live in Singapore, you’ll get your card SUPER fast. Unfortunately for Americans like me, this isn’t the case.

Wise Travel Card Fees and Exchange Rates

One thing I really love is that using Wise itself is free, and you won’t have to pay an ongoing fee to Wise to use the card. In fact, there isn’t even a Premium account feature, so all users get 100% of the features for free. All this said, there are some charges and exchange rates you should know about before you start using the Wise Travel Card.

Comparison: How Does the Wise Card Holds Up Against Other Travel Cards?

Wise is a leader in the travel account realm, but it still has some major competitors. While all of these different companies vary, they all cater to digital nomads and frequent travelers. The table below will compare some key factors with Wise, Revolut, N26, and Chime.

You may also be interested in:

So, What Travel Card is the Best?

This is a close call and pretty dependent on where you are located. For example, N26 and Chime are awesome choices if you live in the EU or USA (respectively). But, with these options, you can’t hold different currencies like with Revolut and Wise.

For most digital nomads, Wise or Revolut will be the best option. You can hold a huge number of currencies, and they are available to many different nationalities. I have personally used both Wise and Revolut and can say they are both excellent options.

Spending Limits for the Wise Travel Card

The Wise Travel Card has set daily and monthly spending limits for all types of transactions. While these limits won’t be a deal breaker for the vast majority of users, they are still worth noting.

Keep in mind the above limits are for US Wise customers. The amounts will differ slightly for customers based in different regions.

Is It Safe to Use the Wise Travel Card?

Wise is a trusted and safe travel card provider, so you can rest assured that your funds will be protected when using the Wise Travel Card. A licensed and regulated financial institution, your funds are safeguarded in Wise. It is, however, worth noting that since Wise is not considered a bank, it is not FDIC insured. FDIC insures up to $250,000 of bank customer's money, but Wise works a bit differently. Wise safeguards users’ money and is required to ensure all customers have access to all of their funds.

So, is Wise safe to use? Yes, absolutely! We don’t recommend keeping all of your money in Wise, but in general, it is a perfectly secure financial institution.

Additionally, the company uses several security features to protect your data, including HTTPS encryption, a two-step login process, and 24/7 fraud prevention.

What to Do If Your Wise Card Is Lost, Stolen, or Compromised

If you lose your Wise card or suspect it to be stolen or compromised, you’ll need to act quickly to prevent any further fraud. Below, we will go over a step-by-step process for what to do if your card is lost, stolen, or compromised.

- Freeze your card in the Wise app.

- Contact Wise support if you suspect the card to be compromised.

- Cancel the card in the app if you confirm the card is lost or stolen or if fraud charges have been made.

- Order a new card.

- Wait for the new Wise card to arrive.

Bottom Line: Is the Wise Travel Card Worth it?

Time for the 1 million dollar question: Should you get the Wise Travel Card?

If you are a frequent traveler like me and you don’t already have a solid travel card with fair exchange rates, low ATM fees the answer is a resounding yes !

The Wise Travel Card is one of the best cards for digital nomads and expats, as it allows you to seamlessly spend money, withdraw cash, and transfer funds from anywhere around the globe without having to worry about excessive fees. The best part? After paying a one-time card order fee, your Wise account is completely free to use!

Ready To Save Money Abroad with Wise?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

Sign up for our Newsletter

Receive nomad stories, tips, news, and resources every week!

100% free. No spam. Unsubscribe anytime.

You can also follow us on Instagram and join our Facebook Group if you want to get in touch with other members of our growing digital nomad community!

We'll see you there, Freaking Nomads!

Disclosure: Hey, just a heads up that some of the links in this article are affiliate links. This means that, if you buy through our links, we may earn a small commission that helps us create helpful content for the community. We only recommend products if we think they will add value, so thanks for supporting us!

How To Create a Healthy Work-Life Balance While Working Remotely

How to set up and manage an esim on iphone, digital nomad internet: best wifi options for remote work anywhere.

Wise Debit Card Review 2024: NZ’s Best Travel Money Card

Are you planning your next adventure overseas and wondering how to manage your travel money seamlessly? The Wise debit card is your ideal companion in this journey.

Formerly known as Transferwise, Wise is a popular money transfer platform that offers a travel money card specifically designed for travellers like you and me.

This travel card acts like a prepaid debit card that allows you to spend and send money globally using the real exchange rate.

You can eliminate confusing bank fees while withdrawing money from millions of ATMs worldwide, making payments in restaurants, and shops, and even booking your flights and accommodations.

The card takes the worry out of using ATMs overseas by allowing you to withdraw up to 350 NZD free of charge before incurring a small withdrawal fee.

With the Wise travel card in your wallet, you gain more control over your expenses, making it easier to stick to your budget while enjoying your trip.

You can get a Wise debit card for your travels using this link , and embrace the convenience of hassle-free transactions and massive savings wherever you go.

Wise Debit Card Overview

Table of Contents

Wise Multi-Currency Account

Physical and virtual card options, adding money to the account, converting currencies, spending money in new zealand and overseas, withdrawing cash, instant transaction notifications, wise virtual card, currency conversion fees, atm withdrawal fees, card issuing fees, transaction fees, wise card review: customer since the beginning, is it worth getting a wise card, can wise be used as a debit card, can i use a wise card in new zealand, what is the difference between a wise debit card and a credit card, can i get a wise card in nz, can i use a debit card on transferwise, is wise considered a bank in new zealand.

The Wise Debit Card is linked to a Wise Multi-Currency Account, designed to help you manage multiple currencies more efficiently than a traditional bank account.

The Wise Multi-Currency Account allows you to hold, receive and send money in over 50 currencies worldwide.

It simplifies your foreign transactions by offering real-time mid-market exchange rates, giving you more control over your finances and reducing hidden fees.

By opening a Wise account, you can access the following benefits:

- Hold money in 50+ currencies

- Send money to 70+ countries

- Convert money at real-time exchange rates

- Receive local account details, such as sort code, for major currencies

- No foreign transaction fees

Wise offers both physical and virtual card options when it comes to their debit cards.

This makes it ideal for travellers, allowing them to use the card in multiple locations without carrying cash or relying on bank accounts with higher fees.

The physical Wise Debit Card is accepted in over 150 countries, making it an excellent travel companion.

There are no foreign transaction fees, and the physical card allows you to withdraw up to 2 times for free at overseas ATMs per month, as long as you don’t exceed a combined $350 withdrawal.

The virtual card option is perfect for online purchases and subscriptions.

It eliminates the need for a physical card and can be used for hassle-free currency conversions without worrying about exchange rates or hidden fees.

The virtual card is a secure alternative to your traditional bank debit card, ideal for managing your finances in multiple currencies.

The Wise Debit Card provides a versatile and cost-effective solution for travellers and individuals managing multiple currencies.

With a Wise Multi-Currency Account, you can enjoy the benefits of real-time exchange rates, lower fees, and flexible card options, making your international spending experience more convenient and worry-free.

Using the Wise Debit Card

To begin using your Wise debit card, you must add money to your account.

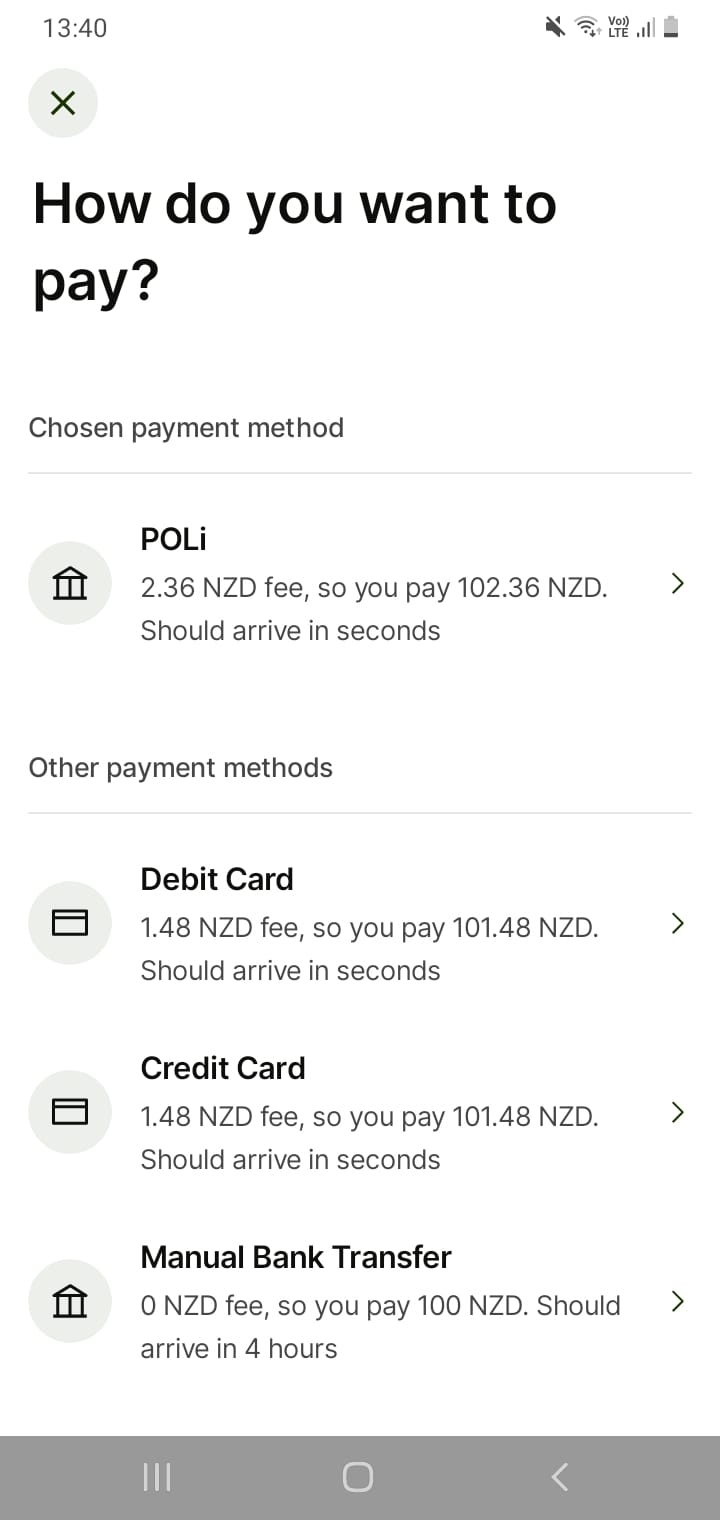

You can fund your account via bank transfer, POLI or credit or debit card.

As you can see from the screenshot above, with an example of depositing $100, depositing by Manual Bank Transfer is the cheapest but slowest way to add funds to your Wise account.

I recently added some funds from BNZ to Wise via Manual Bank Transfer, and it took 1.5 hours to arrive. Worth the time for the savings, though.

Once the money has been transferred, it will be available to use with your Wise debit card.

Ensure you have sufficient New Zealand Dollars (NZD) in your account to cover your intended transactions.

Wise offers low conversion fees and transparent pricing based on the mid-market rate.

To convert currencies, initiate an international money transfer through the Wise app or website.

You can convert your New Zealand Dollars to various currencies before spending, ensuring you get the best exchange rate possible.

Your Wise debit card can be used for purchases in New Zealand and foreign countries.

This pre-paid debit card enables contactless payments and is also compatible with Google Pay and Apple Pay, making it convenient for shopping online and in-store.

The card transaction fees are usually low, allowing you to save money when using your Wise card compared to traditional bank cards.

To withdraw money, locate an ATM that accepts Mastercard and use your Wise debit card to access your funds.

Wise offers free ATM withdrawals in foreign currencies up to two times per month, after which a small fee applies.

Remember that some local ATM fees may still apply, so it’s best to research the specific charges beforehand to avoid surprises.

One of the benefits of using a Wise debit card is the instant transaction notifications feature.

You’ll receive real-time notifications on your phone or email when you spend money or withdraw cash.

This helps you keep track of your spending and monitor your account more closely.

By following these steps, you can make the most of your Wise debit card experience while travelling from New Zealand or using it domestically.

Wise virtual cards are available for the Wise Borderless Account on debit cards issued in New Zealand.

This makes it easy to shop online or make payments online or use contactless payment with your phone.

Using a digital card is a smart way to shop when you don’t trust a company with your details (I’m looking at you, Temu), as you can easily discard the virtual card details and generate a new one.

You can also use Apple Wallet and Google Pay with your Wise account.

Fees and Charges

When using the Wise Debit Card for your travels, you can expect transparency and convenience regarding fees.

This section outlines the various fees associated with the Wise Debit Card for travellers from New Zealand.

The primary reason for using the Wise Debit Card is to enjoy low currency conversion fees.

Wise uses the mid-market exchange rate without any hidden costs, ensuring that you can easily convert your New Zealand Dollars into foreign currency.

When you spend money in a currency you hold in your account or convert currencies in the Wise app, you’ll only pay a small fee based on the transaction amount.

The Wise Debit Card allows you to withdraw money from ATMs at low fees.

You can make up to two withdrawals for a total of $350 NZD each month for free.

After that, a 1.5 NZD fee per cash withdrawal applies. Additionally, there’s a 1.75% fee on any amount you withdraw above 350 NZD.

This is still a competitive fee compared to the main New Zealand banks as you can see from the table below, and as Wise’s exchange rates are the mid-market rates, you’ll probably still end up better off.

However, we personally try to withdraw just $350 per month in cash.

Getting the Wise debit card comes with no issuing fee or annual fees.

However, if you lose your card or need a replacement, there might be a small fee to cover the cost of producing and sending out a new card.

Check Wise’s pricing page for further details on card replacement fees.

Wise ensures that you only pay for what you use, and thus, transaction fees remain minimal.

When you use the Wise Debit Card for online payments , shopping online or in-store, or withdrawing money from your Wise account, you’ll find that the fees are significantly lower compared to traditional bank cards.

There are no hidden fees or monthly fees associated with the card.

In conclusion, the Wise Debit Card offers travellers from New Zealand a reliable and cost-effective solution for managing their finances, currency conversions, and transactions while travelling overseas.

By understanding the fees and charges involved, you can make the most of your Wise Debit Card experience and enjoy your travels without financial worries.

I feel uniquely qualified to do a Wise card review as a user since Wise (then Transferwise) introduced their debit card to the New Zealand market in 2019.

I have used my Wise card in the United States, United Kingdom, Ireland, Spain, Singapore, Malaysia, Thailand, Australia and, of course, New Zealand.

It is an essential tool in my travel kit and the primary way my husband and I spend money when we travel to keep currency conversion fees to a minimum.

The main benefits for us are the low currency conversion charges, transparent fees, and the ability to make international money transfers from within the Wise app easily.

I tend to hold funds in New Zealand Dollars (or United States Dollars as I am paid in USD), converting money as we reach a new country.

For example, when we travelled to Malaysia, I opened a new MYR (Malaysian Ringgit) wallet on Wise and transferred our monthly travel spending allocation over.

As we tend to stay longer when we travel, this works well for us as it allows us to track how much we are spending and in what categories.

The spending tracker is one of the Wise card features I like the most #personalfinancenerd.

I also find that Wise consistently has the cheapest conversion fee when it comes to sending money to family overseas.

Wise Debit Card Review: Frequently Asked Questions

Yes – absolutely! It’s the best travel money card available in New Zealand by a long shot.

The Wise card can save you money on exchange rates (they use the mid-market exchange rate) and foreign transaction fees and offers flexibility for international travellers to withdraw and pay in more than 50 currencies around the world,

Yes, Wise offers a debit card only. It must be linked to a Wise multi-currency account which is where you hold the New Zealand dollars you add to the card, as well as any foreign currency wallets you choose to open.

You can absolutely use your Wise card in New Zealand. This is a good way to use up any leftover foreign currency in your online wallet without massive currency conversion fees.

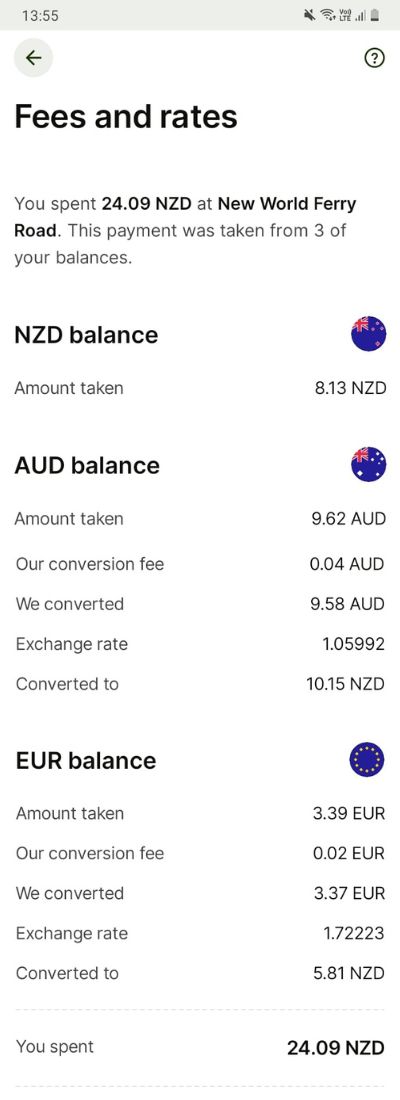

I recently spent $24.09 at New World, using small amounts left over in my multiple wallets, so the transaction was made up of NZD, AUD and EUR.

You can see how the different currencies were used up in the screenshot below.

According to Wise :

If you don’t have the currency you need in your account, you can still spend money. Our Smart Conversion technology will automatically convert the balance for you that has the lowest conversion fee. If the currencies that you hold in your account have the same conversion fees, we’ll use the one with the best exchange rate, so you get the most for your money.

Wise will always choose the option that saves you the most money, using up the local currency first.

The main difference between a Wise debit card and a credit card is that a debit card is linked to your Wise account and allows you to spend only the money you have in your account.

While a credit card allows you to borrow money up to a predetermined credit limit and is issued by a bank.

Wise does not offer credit cards. So there’s no chance of going into debt or overdraft with a Wise account.

It will simply decline the transaction if there is no money in the account.

Yes – to get a Wise debit card, you can sign up here . The card issuing fee is $14, and you can choose to pay for expedited shipping if you are in a rush.

Allow two weeks for the card to arrive after signup.

You can top up your Wise Card balance with a debit card.

No, Wise is not considered a bank in New Zealand. Wise Payments Ltd., which operates in New Zealand as a foreign entity, is not licensed by a New Zealand regulator to provide its services.

However, it is supervised by the Department of Internal Affairs (DIA) for anti-money laundering purposes.

If you have a borderless account with Wise, it is considered an electronic money account, which is different from a bank account.

Sign up for a Wise debit card for your travels using this link , to save on fees and get the best exchange rate wherever you go.

About Emma Healey

Emma is a recognised family finance and budgeting expert and founder of Mum's Money. Her advice has been featured in Stuff, NZHerald, Readers Digest, Yahoo Finance, Lifehacker, The Simple Dollar, MSN Money and more.

Wise Reviews

In the Financial Institution category

Visit this website

Company activity See all

Write a review

Reviews 4.3.

215,417 total

Most relevant

I’ve used Wise for almost everything…

I’ve used Wise for almost everything while travelling. It’s great! The exchange rates are always really close to mid-market. The fees are extremely transparent and low. The Visa card works almost everywhere. The caveat is that it’s technically a prepaid visa, so sometimes vendors won’t take it. This applies mainly to car rentals and Google Cloud. Otherwise, it works for purchases at shops, restaurants, hotels, and online. One great part is that if you have a currency account open (which is two clicks away) and you are holding USD, it will auto-convert from USD (or other currencies, like CAD) to that curreny for each transaction at the current rate.

Date of experience : 13 April 2024

Reliable and fast smooth transactions

Internet Service (NOT a bank), but guided and ruled by a bank's principles, with supervision by European banking autorities (thanks to HQ being in Belgium). Fast and reliable services, despite somewhat suspicious BIC/SWIFT accounts (from former banks, at e.g. NY). Service rates are definitely decent and grant users a fair exchange rate. I did several transactions and so far, everything was smoothless and to my great satisfaction. I want to emphasize the "Auto Conversion" service, which gives you a nice instrument to get the desired exchange rate from the markets. I may critizise the poor reachability from within Asia (other than doing USD to U.S.).

Date of experience : 12 April 2024

I had a fantastic experience with Wise

I had a fantastic experience with Wise! They made saving money a breeze. I was impressed by their good savings options, but what really stood out were the low fees. Unlike other financial institutions, Wise didn't bury me in hidden charges. Finally, the entire process, from set-up to transactions, was very fast. I would highly recommend them to anyone looking for a user-friendly and affordable way to transfer funds.

Date of experience : 08 April 2024

Quick, convenient, cheap

Significantly better than high street and other online banks. Easy and usually one of the cheapest to transfer money overseas. Great also when travelling. I like the investment/ save option too.

The way to go!

Love Wise’s service! Transparency on rates and fees is great and money arrived just as promised. When travelling, I sure don’t miss the old days of being “robbed” by banks on international transfers and credit card rates & fees!

Date of experience : 11 April 2024

I think you offer a good competitive…

I think you offer a good competitive service but the tracking leaves a lot to be desired. I couldn’t work it and was useless to me, I had to guess when the money might arrive in the foreign bank and was approx 24 hours after suggested.

It's so easy

The whole process from start to finish was very easy. I added two separate currencies to my card via bank transfer. The instructions were clear and easy to follow. I received confirmation from Wise within 2 hours of completing the bank transfer. It was as simple as that.

Date of experience : 10 April 2024

Super easy, super fast.

Good process for sending money once set up. Have used Transferwise for 5 years. Money appears in my overseas bank account almost instantaneously. Very attractive user-friendly website.

Effective, Quick and Easy

Simple, easy and quick to make transfers. The only reason I gave 4 stars was because Wise took away a transparent graph of Euros to Dollars over time and no longer list their fees when I run projections.

First time log in every single time???

Every time I try to log in it recognises me as a new customer and I have to reset my password every single time. I have a daughter in Vancouver and send her money and I have all the details present within the app so I find it frustrating when I need to send her money I have to start from scratch every time. Is this the same for every customer? Resetting password every time we use the app??? Other than that and once I get past that I find it very convenient and fast

made an appeal?

''If you've already made an appeal, our team will review your request and get back to you via email, ASAP.'' How its possible Wise to write me ASAP , and speak about checking something to my account ,almost 50 days you explain me how we proceed out issue . Then i receive from Obmudsman your mail to wrote you and its been 7 days since you just didnt answer me? ASAP=7 DAYS WISE?

Date of experience : 27 February 2024

read and earn money

the speed at which money is added to the card is astonishing, transition costs to countries such as Thailand and India are exceptionally low. and as a nice bonus, you can withdraw the first 200 euros abroad without costs.

The app is really clear and useful

The app is really clear and mostly intuitive. I set it up to receive payment abroad but found it’s great for foreign holidays too. I got the card for the security of having plastic but came to find phone payment was just so easy I rarely use itl.

Always so very quick with the transfers…

Always so very quick with the transfers and also very helpful especially after my husband passed, I have never known such kindness and patience from everyone that I spoke to, especially from such a big company. Thank you all. I certainly would recommend Wise .

Multicurency bank account

He wise Multicurency is working well. With a lot extra functions. Really helpful if you need travel as a travel money or help your family in home send for them money within a minutes.

Fast transfers with good exchange rates…

Fast transfers with good exchange rates and very competitive commissions. Since changing their website, I personally find it a bit more complicated to access the send/conversion page. Overall would recommend Wise every time.

Reliable, quick & easy and money arrived within minutes. Internal transfers with Wise are brilliant two. Have used several times to send money overseas.

Excellent solution for open bank accounts and for money transfer

I use Wise for bank accounts and international money transfer needs, and I am thoroughly impressed! The process was incredibly smooth, and the fees were transparent and much lower than traditional banks. Highly recommend Wise for anyone looking for a reliable and cost-effective money transfer service.

WISE the best money card for travelling

This is such an easy card to use world wide. I've have used it extensively on a recent 3 month holiday. I can also transferred money overseas easily and cheaply.

Date of experience : 18 September 2023

i am very disapionted from wise because…

i am very disapionted from wise because they closed my account without any reason and that wise was connected with my amazon account so now i need my account back or give me proper explanation thanks Regard...AMAZON M LLC

Date of experience : 03 April 2024

- Travel Money Cards

Wise: the Best Travel Money Card in New Zealand

Posted by Caitlin Bingham July 26, 2023

It’s fairly easy and convenient to get foreign currency, but it leaves you at the mercy of hidden fees and exchange rates. A quick trip to the ATM while abroad, or currency exchange at the airport, can leave your bank account hurting.

This is when a travel money card can be your friend. Such cards allow you to load up foreign currency, so you can enjoy your holiday without being stung by sky-high exchange rates and fees.

However, not all travel money cards offer the same features or charge the same conversion fees. So, while convenient, it pays to be aware of attached fees, or you might end up paying as much as you would with an FX operator.

As part of our mission to help consumers make the right choices, Canstar’s expert in-house researchers crunched the numbers on several travel money cards. And the winner is Wise, the recipient of our Travel Money Card | Outstanding Value Award 2023.

What is Wise?

Wise is more than just a simple travel money card.

Wise provides users with a single multi-currency account, that allows people in their increasingly global lives to pay, to get paid, and to spend, in any currency – wherever they are and whatever they’re doing.

Through your Wise account you can send, spend and receive foreign currencies, both online or via the Wise debit card.

All of these are done at the real market exchange rate, helping you retain as much value as possible. A single exchange fee is charged up-front, but there are no other hidden fees – you always see the total cost upfront.

What does Wise offer?

A wise account offers:.

- Account details: get account details in nine currencies (GBP, EUR, USD, AUD, NZD, SGD, CAD, HUF and TRY) in minutes, so you can pay and be paid like a local

- Direct debits: share your AU, EU and UK account details with merchants to conveniently automate and pay bills and subscriptions

- Payment methods: pay bills in NZ via a range of methods including cards, Apple Pay, bank transfer or BPay

- Manage your finances: keep track of payments and manage accounts via integration with accounting software like Quickbooks and Xero

- Saving jars: set money aside in individual Jars, for rainy days, vacations or anything else

- International money transfers: send money to over 75 countries at the real exchange rate. Money can be transferred instantly when using PayID

- Scheduled transfers: set up recurring transfers to automate the process of sending money abroad with Wise’s API

- Real-time tracking: transfer money and and view its progress in real-time

What does the Wise debit card offer?

- Spend: use the Wise debit card in over 200 countries and anywhere online

- Free to use: there are no monthly subscription, maintenance or transaction fees*

- Save money: spend at the real exchange rate, with no sneaky mark-ups

- Withdraw cash: withdraw up to NZ$350 per month for free (a small fee applies for withdrawals after the first $350)

- Security: set spending limits, freeze/unfreeze the card instantly in the app and get real-time notifications for every transactions

- Smart money-saving technology: automatically chooses the currency that offers the best conversion rate

- Virtual cards: No need to wait for your card to be delivered, your card details appear on your account as soon as your order, so you can start spending in store and online immediately, with Google or Apple Pay. Have up to three virtual cards at one time

*A small conversion fee is charged if you card doesn’t have the local currency pre-loaded, requiring currency conversion

Travel money cards: what other options do you have?

While Wise is our Travel Money Card | Outstand Value Award winner, our team crunched the numbers on four other travel money cards in this year’s award.

Air New Zealand OneSmart

Cash passport platinum mastercard, travelex money card.

- Load up to eight foreign currencies plus NZD at any one time (AUD, SGP, HKD, JPY, GBP, EUR, CAD and USD)

- Earn one Airpoints dollar for every NZD $100 spent overseas

- Earn one Airpoints dollar for every NZD $200 you spend domestically

- Use anywhere Mastercard is accepted

- Withdraw local currency from any ATM that accepts Mastercard

- Each month, your first three ATM withdrawals are free

- Load up to ten different currencies on one card (NZD, AUD, EUR, USD, GBP, JPY, CAD, HKD, SGD and AED)

- Lock in exchange rates each time you load and reload

- Manage and track your Cash Passport on the go via your mobile, tablet, laptop or PC

- Use your Cash Passport like you would a credit or debit card, except with your own prepaid funds. In-store, online or to withdraw local currency at ATMs

- Manage nine popular currencies on the go including: USD, AUD, EUR, GBP, CAD, SGD, JPY, HKD and NZD

- Zero ATM, Eftpos and online shopping fees

- Shop at millions of outlets wherever MasterCard is accepted

- Optional additional emergency card 24/7 global assistance

- Exclusive discounts with Mastercard Priceless Cities benefits

Westpac Global Currency Card

- Manage it online, anytime

- Lock in exchange rates with up to nine different currencies (AUD, USD, GBP, SGD, EUR, NZD, HKD, JPY, CAD)

- No purchase fee, no monthly fees and no bank transfer fees

- 24/7 assistance

Compare Travel Money Cards

Headed off overseas and looking for the best in money cards? Here’s a rundown of some of the most popular cards in New Zealand:

The display order does not reflect any ranking or rating by Canstar. This information is not an endorsement by Canstar of travel money cards or any specific provider. Information correct as of 20/09/23. For full pricing details see individual providers’ websites.

About the author of this page.

This report was written by Canstar Content Producer, Caitlin Bingham. Caitlin is an experienced writer whose passion for creativity led her to study communication and journalism. She began her career freelancing as a content writer, before joining the Canstar team.

Enjoy reading this article?

Sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article

Travel money cards allow travellers to access pre-loaded money throughout the world. Find the best-value travel money card for your next trip

View latest Travel Money Cards Star Ratings

View winner of Travel Money Card of the Year Award 2023

Reciprocal Health Agreements - What Do They Cover?

Can I Use My NZ Driver Licence in Australia?

What is Revolut?

Quick Links

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

The 3 Best Prepaid Travel Cards for New Zealanders in 2023

Here is a list of the 3 best prepaid cards you can take with you on your travels and the positives and negatives for each one:

- Wise - best overall for low fees and the Google exchange rate

- Travelex Money Card - best for getting your hands on a card instantly

- Westpac Travel Money Card - best for no fees to load by bank transfer

Wise - our pick for prepaid travel card

- Top up for free in NZD using Apple Pay, card or bank transfer

- No annual fee, hidden transaction fees or exchange rate markups

- No minimum balance requirements

- Allows you to make payments and withdrawals wherever you are in the world in over 40 currencies

- Local bank account details covering Australia (AUD), the UK (GBP), the USA (USD), Europe (EUR), Canada (CAD) and of course New Zealand (NZD)

- Available in the US, UK, Europe, Australia, Singapore, Japan and New Zealand

Find out more about the Wise card.

With this card:

- It's very easy to set up and order

- Available as a virtual card

- You can receive foreign currency into a free multi-currency account linked to the card

- Pay with your Wise card in most places overseas where debit cards are accepted

- You can transfer money to a bank account overseas

It's not all good news though

- There is a 2% ATM withdrawal fee when you withdraw over NZ$200 during a month

- It takes up to three weeks for delivery

Go to Wise or read our review .

Travelex Money card - get this card instantly

- Order online and collect next day in store - or get one instantly in a Travelex branch

- Hold and convert up to 8 currencies including AUD, USD, GBP and EUR

- No fee to get a card, or to replace it upon expiry

- No Travelex international ATM fees

- Competitive exchange rates which are likely to include a small markup on the Google rate

- Available to eligible customers who can present a passport or driving licence

Find out more about the Travelex card .

- Travelex has a massive network of stores and pick-up locations making it easy to order online and collect later

- They do not charge any commissions or fees (may charge fees for credit card payments)

- Order online 24/7

- Card handling fees if you want to buy currency using a credit card

- 3-5 business day wait for online orders

Go to Travelex or read our review .

Westpac Travel Money Card - no fees to load by bank transfer

- Up to 9 currencies supported for loading and exchange

- Free to top up from your bank account, or load with debit card for a fee

- Lock in exchange rates at the time you top up to help you budget

- No fee to spend currencies you hold on the card

- Withdraw your unspent funds back to your Westpac account easily

Find out more about Westpac Travel Money card .

- Hold and exchange 9 popular currencies

- Add funds from your Westpac account with no extra fee

- Use for spending and withdrawals anywhere Mastercard is accepted

- 24/7 global emergency assistance if something goes wrong

- 4 NZD domestic ATM withdrawal fee

- Debit card top ups cost 1.5% of the load value

- 5 - 10 day delivery time

What are Prepaid Travel Cards?

Prepaid travel cards are a good alternative to carrying cash. They look like credit or debit cards, but they function differently.

You're able to load the card with a set amount of money in the currency you need and can use it to make purchases online, in stores and to withdraw money at ATMs.

Most travel cards allow for multiple currencies to be loaded onto the card. So it's important to know what currency you'll be using on your travels. Airlines also offer prepaid cards so the money you spend can earn you reward points.

Looking for something different?

Read our guides on:

- The Best Travel Cards For Kiwis to Use in the USA

- The best travel cards for Europe

- The Best Ways to Take Travel Money to Canada

- Find the Cheapest Way to Transfer Money to New Zealand

- International edition

- Australia edition

- Europe edition

New Zealand tightens visa rules after migration hits ‘unsustainable’ levels

Net migration to New Zealand hit a near record high in 2023 after a new temporary work visa was introduced after the pandemic

New Zealand will tighten its visa rules for some migrants as the coalition government moves to overhaul the immigration system it says has led to “unsustainable” levels of migration.

Last year, annual net migration to New Zealand hit a near record high of more than 173,000 non-New Zealand citizens in the year to December, Stats NZ reported .

Immigration minister Erica Stanford announced on Sunday changes to the accredited employer worker visa (AEWV), the main temporary work visa, which was introduced in mid-2022 to help fill workforce shortages after the pandemic.

The government’s changes to the scheme would include introducing English-language requirements for low-skilled jobs and setting a minimum skills and work experience threshold for most employer work visas. The maximum continuous stay for most low-skilled roles will also be reduced to three years from five years.

The changes would be immediate, she said.

“The government is focused on attracting and retaining the highly skilled migrants such as secondary teachers, where there is a skill shortage,” Stanford said in a statement. “At the same time we need to ensure that New Zealanders are put to the front of the line for jobs where there are no skills shortages.”

New Zealand, which has a population of about 5.1 million, has seen a rapid growth in migrant numbers since the end of the pandemic, raising concerns last year that it was fanning inflation. A Reserve Bank-commissioned report released last month into the possible links between migration levels and inflation was inconclusive.

Stanford said the changes would also reduce the vulnerability of migrants to exploitation.

In February, the Public Service Commission released its review of the AEWV scheme, which former immigration minister Andrew Little ordered after complaints of exploitation. The commission found that a small number of “unscrupulous employers” targeted the scheme and took payments from people wanting to move to New Zealand.

“By having an English-language requirement migrants will be better able to understand their rights or raise concerns about an employer early,” Stanford said.

The government had scrapped plans to add 11 new roles to the Green List – a list of highly skilled roles that New Zealand is struggling to fill – including welders, and fitters and turners.

Neighbouring Australia, which has also seen a big increase in migration, has said it would halve its migrant intake over the next two years.

- New Zealand

- Asia Pacific

Most viewed

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards > Reviews

Breeze Easy Visa Credit Card review 2024: Money-saving perks for fans of the startup carrier

Stella Shon

Allie Johnson

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Grace Pilling

Published 6:07 a.m. UTC April 10, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Breeze Airways remains relatively unknown, but this startup airline is a breath of fresh air for travelers in underserved areas. The airline offers nonstop routes from smaller airports to popular U.S. destinations, allowing flyers to skip connecting through busy airports.

Now, the low-cost airline is launching its first credit card, the Breeze Easy™ Visa® Credit Card * The information for the Breeze Easy™ Visa® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. . Cardholders can earn BreezePoints on Breeze flights and everyday expenses and redeem them for flights, bags, seat assignments, and more.

Here’s our full Breeze Easy Visa Credit Card review and our take on whether frequent Breeze flyers should take a closer look.

Breeze Easy Visa Credit Card basics

- Annual fee: $89.

- Welcome bonus: 50,000 BreezePoints after spending $2,000 in the first 90 days of account opening.

- Rewards: Earn up to 10 points per $1 on Nicer Bundles, Nicest Bundles and trip add-ons (5 points per $1 when the flight is purchased, plus 5 points per $1 once the flight is completed), up to 4 points per $1 on Nice Bundles (2 points per $1 when the flight is purchased, plus 2 points per $1 when flight is completed), 2 points per $1 on eligible grocery store and restaurant purchases (including inflight food and beverages and 1 point per $1 on other purchases.

- APR: 21.24% to 29.99% variable.

- Recommended credit score: Good to excellent.

- Does the card offer preapproval? No.

- Other benefits: Points never expire with the card, Group 1 Priority boarding, complimentary inflight Wi-Fi on Breeze Airbus fleet, 7,500-anniversary points after spending $10,000 in a year and no foreign transaction fees.

Breeze Easy Visa Credit Card review

A loyalty program is key to repeat business, and Breeze is offering its frequent flyers even more with the debut of a new travel rewards credit card. While the Breeze Easy Visa Credit Card isn’t for everyone, it provides plenty of value for the right cardholder.

You can earn up to 10 points per $1 on Nicer Bundles, Nicest Bundles and trip add-ons (5 points per $1 when the flight is purchased, plus 5 points per $1 once the flight is completed), up to 4 points per $1 on Nice Bundles (2 points per $1 when the flight is purchased, plus 2 points per $1 when flight is completed), 2 points per $1 on eligible grocery store and restaurant purchases (including inflight food and beverages and 1 point per $1 on other purchases.

In other words, you can get up to a 10% return on eligible Breeze purchases.

Your BreezePoints never expire as long as you have the card, and you can redeem them at a flat 1-cent-per-point rate for flights and other traveler extras such as checked bags and seat assignments.

But with an $89 annual fee, you’ll need to crunch the numbers to see if the card will provide enough value to justify the cost.

The card offers benefits you’d expect from any airline credit card , such as access to priority boarding for the cardholder and companions on the same reservation. And cardholders get free inflight Wi-Fi, saving $8 each way. (By the end of the year, Breeze plans to become a fleet of all Airbus A220s, one of the most comfortable regional jets to fly.)

In sum, Breeze offers an economical way to fly to dozens of U.S. destinations, and its new credit card is a natural fit for frequent Breeze travelers.

- Elevated points spent on Breeze flights and trip add-ons: That’s one of the best rewards rates on any airline credit card, giving flyers a generous haul of points for booking Breeze flights.

- Complimentary Wi-Fi for all travelers on the same reservation: You won’t have to pay for internet connectivity, saving you $8 on every one-way flight.

- BreezePoints won’t expire : BreezePoints normally expire after 24 months, but the card will extend their shelf life for as long as your account remains open.

- Anniversary bonus: You’ll get a 7,500-point bonus every account anniversary, worth $75 for Breeze flights and more, if you spend at least $10,000 on the card each year.

- No free bags: Airline credit cards typically come with a free checked bag, but this card does not waive the cost of checked bags.

- BreezePoints are worth 1 cent apiece: While Breezy Rewards is a straightforward program, there’s no opportunity for outsized value, as with other frequent flyer program currencies.

- Full rewards only after your flight : With the card’s earning rate, you’ll earn half of the BreezePoints when purchasing the flight and the other half after the flight is complete.

Breeze Easy Visa Credit Card rewards

Perhaps the most eye-catching feature of Breeze’s first-ever credit card is the ability to earn huge rewards on eligible Breeze Airways purchases. Let’s take a closer look at how the rewards break down:

Cardholders can earn up to 10 points per $1 on Nicer Bundles, Nicest Bundles and trip add-ons (5 points per $1 when the flight is purchased, plus 5 points per $1 once the flight is completed), up to 4 points per $1 on Nice Bundles (2 points per $1 when the flight is purchased, plus 2 points per $1 when flight is completed), 2 points per $1 on eligible grocery store and restaurant purchases (including inflight food and beverages and 1 point per $1 on other purchases.

New applicants can also earn 50,000 BreezePoints after spending $2,000 in the first 90 days of account opening.

Using government data and other publicly available information, we estimate that a household in the U.S. that would be in the market for this card has around $25,087 in annual expenses that can be charged to a credit card.

We assumed the example cardholder purchased flights at the base-level ticket (Nice fare class). Here’s how our sample household’s rewards could break down:

Cardholders will earn BreezePoints through the Breezy Rewards program. In this example, the cardholder earned 37,119 points from card purchases, worth $371.19 for Breeze flights, baggage fees, seat assignments, and more.

Breeze Airways is not part of an airline alliance, nor does it have any partnerships, except with new partner Priceline. You can only redeem your points for Breeze-related purchases, meaning there’s no opportunity to maximize rewards on other airlines. This is a key consideration if you want to apply for the Breeze card.

Breeze Easy Visa Credit Card perks

An airline credit card is best suited to those who fly almost exclusively with the carrier, and the Breeze Easy Visa is no exception. Cardholders get the major advantage of free inflight Wi-Fi, saving them and companions on the same reservation $8 each way.

Furthermore, cardholders and their travel companions on the same reservation get Group 1 priority boarding. That means you’ll have first dibs on precious overhead bin space. The more you fly, the more value you’ll get from these benefits.

In addition, cardholders get the chance to earn 7,500 bonus points each anniversary year after spending $10,000 in purchases. Those BreezePoints are worth $75 — nearly the cost of the annual fee — adding even more ongoing value.

Although the airline has no international flights, the Breeze Easy card is a keeper for traveling abroad because there are no foreign transaction fees. It’s a Visa Signature card, which comes with complimentary travel insurance perks such as trip cancellation and interruption insurance, baggage delay coverage and more.

Breeze Easy Visa Credit Card drawbacks

One crucial feature the card is missing: a free bag benefit. Most airline credit cards will waive the cost of the first checked bag as a cardholder-exclusive perk. This could be a dealbreaker for some travelers.

At the lowest fare classes, Breeze only allows for one free personal item that must fit under the seat. The airline also operates on a dynamic bag pricing model, so the cost of a carry-on and checked bag will vary slightly depending on your flight route.

While this may disappoint, remember that BreezePoints can be redeemed for extra charges, including bag fees. For instance, you can use 3,500 BreezePoints to wipe out a $35 carry-on bag charge. And, if you’ve booked a higher fare class (Nicer or Nicest), the cost of bags is included in the ticket bundle.

How the Breeze Easy Visa Credit Card compares to other travel cards

Breeze easy visa credit card vs. chase sapphire preferred® card.

The Chase Sapphire Preferred Card , which has a $95 annual fee, is ideal for travelers looking to earn bonus points on travel and everyday purchases. You’ll earn 5 points per $1 on travel purchased through Chase Travel℠, 3 points per $1 on dining, select streaming services, and online grocery purchases (excluding Walmart, Target and wholesale clubs), 2 points per $1 on all other travel purchases and 1 point per $1 on all other purchases.

Chase Ultimate Rewards® has an enticing list of transfer partners, including United and Southwest. Cardholders can redeem miles at an elevated 1.25-cent rate for travel purchases via the Chase travel portal. Unfortunately, you can’t book Breeze Airways flights on Chase Travel, so this isn’t a fit if you want to redeem points for Breeze flights.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

Chase Sapphire Preferred® Card

Welcome bonus.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s Take

- Flexible points that can be transferred to 14 travel partners or redeemed through Chase Travel℠ at 1.25 cents each.

- $50 annual statement credit toward Chase Travel hotel bookings.

- Valuable travel protections.

- $95 annual fee.

- Category bonuses are limited and not competitive against other travel cards.

- Transfer partner list is limited compared to programs like Amex Membership ® Rewards and Citi ThankYou ® .

Card Details

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Breeze Easy Visa Credit Card vs. Capital One Venture Rewards Credit Card * The information for the Capital One Venture Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

The Capital One Venture Rewards Credit Card also has a $95 annual fee and offers the benefit of simplicity with 5 miles per $1 on hotels and rental cars booked through Capital One Travel and purchases through Capital One Entertainment and 2 miles per $1 on other purchases. You can redeem Capital One miles as a statement credit for any travel purchases made within the past 90 days at a rate of 1 cent apiece. This rewards flexibility is a big plus.

It’s also possible to outsize those rewards with Capital One’s airline and hotel transfer partner roster, especially for international flights. You’ll also benefit from a Global Entry/TSA PreCheck application fee credit (up to $100), a nice added travel perk.

Breeze Easy Visa Credit Card vs. JetBlue Plus Card * The information for the JetBlue Plus Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

We’d be remiss not to offer a comparison to the JetBlue Plus card to see how the Breeze Easy card stacks up. The JetBlue Plus Card has a slightly higher $99 annual fee. It’s also issued by Barclays and offers similar earnings: 6 points per $1 on eligible JetBlue purchases, 2 points per $1 at restaurants and eligible grocery stores and 1 point per $1 on all other purchases.

You’ll earn TrueBlue points, which can be redeemed for flights on the airline or partner carriers such as Qatar Airways or Hawaiian Airlines. The JetBlue Plus card offers a free first checked bag. This benefit provides at least $35 in savings each way, which helps offset the annual fee.

Is the Breeze Easy Visa Credit Card worth it?

Between the card’s welcome bonus and ongoing rewards rates, there’s a lot of potential to stockpile BreezePoints. But unless you exclusively fly with the airline, it’s worth shopping around to see if another travel credit card will serve you better in the long term, especially if your goal is to save money on flights with a range of carriers, rather than just Breeze Airways.

Breeze Easy Visa Credit Card is right for you if:

- You frequently fly out of the airline’s main hubs .

- You want to earn rewards to save money on Breeze flights and travel purchases.

- You want to save money onboard Breeze flights with the card’s complimentary Wi-Fi.

Frequently asked questions (FAQs)

Airline credit cards, such as the new Breeze Easy card, offer ways for the most loyal flyers to save money on travel. This card is no exception, with plenty of ways to earn BreezePoints, free Wi-Fi and more for ultra-loyal Breeze passengers.

The Breeze Easy card costs $89 per year. This fee is in line with competing travel cards, which you might also want to consider for more flexible rewards earning, redemption and perks.

While the issuing bank, Barclays, does not disclose a specific credit score requirement, you’ll want to have good to excellent credit to increase your chances of qualifying for most travel credit cards.

Breeze Airways does not offer a true business-class product, but the airline has a spacious recliner seat called “Ascent class” on its Airbus A220 fleet, and extra legroom seats.

*The information for the Breeze Easy™ Visa® Credit Card, Capital One Venture Rewards Credit Card and JetBlue Plus Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Stella Shon is a freelance writer that connects the dots between personal finance and travel. Her work has appeared in The Points Guy, ValuePenguin and MoneyUnder30, and she's been interviewed by The New York Times, CNBC and more.

Allie is a journalist with a passion for money tips and advice. She's been writing about personal finance since the Great Recession for online publications such as Bankrate, CreditCards.com, MyWalletJoy and ValuePenguin. She's also written personal finance content for Discover, First Horizon Bank, The Hartford, Travelers and Synovus.

Grace Pilling is a deputy editor for credit cards at USA TODAY Blueprint. She believes credit cards are the ultimate choose-your-own-adventure tools of the financial world and gets excited about helping people discover the best credit card strategy for their unique goals. Prior to joining Blueprint, Grace worked on and led personal finance teams at Bankrate, CreditCards.com, MoneyUnder30 and MoneyGeek. She has a bachelor’s degree in English and writing and a diploma in editing and publishing.

How to do a balance transfer with Discover

Credit Cards Louis DeNicola

9 ways to maximize the Citi Custom Cash card’s 5% cash-back categories

Credit Cards Lee Huffman

American Express Business Platinum benefits guide 2024

Credit Cards Chris Dong

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Credit Cards Jason Steele

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson