Blog & Travel News

Disney thrills: Beyond castles and fairy tales

May 8, 2024

Walt Disney World is often synonymous with princesses, castles, and fun for the whole family rides. But what about the thrill-seekers? Fear not,...

Cruising is More Fun Together

Mar 15, 2024

Grab your friends and hit the gangplank to set sail for fun and adventure with your group. No matter if it is a large family reunion, your annual...

Adventures by Disney in Italy

Feb 28, 2024

Italy is one of the most requested travel destinations in the world and it's not hard to see why. This exquisite country boasts a long history, a...

The Journey to Universal Orlando Resort’s Epic Universe Begins Now

Feb 14, 2024

In 2025, Universal Orlando Resort will unveil its next game-changer for theme park entertainment with the debut of its most ambitious theme park...

Top-10 Tips to Pack Like a Pro

Feb 8, 2024

Bon voyage! Your exciting adventure awaits, but before you jet off, let's ensure your journey starts stress-free with expert packing tips. Through...

Animal Kingdom Lodge: A Serene Retreat after a busy Park Day

Jan 31, 2024

Dreaming of a Disney vacation that's both magical and majestic? Look no further than Animal Kingdom Lodge, a breathtaking resort nestled within the...

How to Choose the Perfect All Inclusive For Your Next Vacation

Jan 24, 2024

Picking the right resort for your next vacation can be a daunting task - where in the world? What resort brand? What inclusions? Do we want a ton of...

Unveiling the Allure of Luxury Cruising

Jan 17, 2024

Ditch the buffets and crowds! Discover the world of luxury cruising, where Michelin-starred chefs, private beaches, and exclusive shore excursions...

Aulani: A Celebration of Hawaiian Culture and Tradition Infused With Disney Magic

Jan 10, 2024

Aloha! Calling all adventurers, sun-seekers, and families craving an unforgettable vacation. Pack your pareos and plumerias, because today we're...

Get Daily Travel Tips & Deals!

By proceeding, you agree to our Privacy Policy and Terms of Use .

8 Travel Luxuries Even Cheap People Should Splurge On

Sarah Schlichter

Deputy Executive Editor Sarah Schlichter's idea of a perfect trip includes spotting exotic animals, hiking through pristine landscapes, exploring new neighborhoods on foot, and soaking up as much art as she can. She often attempts to recreate recipes from her international travels after she gets home (which has twice resulted in accidental kitchen fires—no humans or animals were harmed).

Sarah joined the SmarterTravel team in 2017 after more than a decade at the helm of IndependentTraveler.com. Sarah's practical travel advice has been featured in dozens of news outlets including the New York Times, the Chicago Tribune, USA Today, Budget Travel, and Peter Greenberg Worldwide Radio. Follow her on Twitter @TravelEditor .

The Handy Item I Always Pack: "A journal. Even years later, reading my notes from a trip can bring back incredibly vivid memories."

Ultimate Bucket List Experience: "Road tripping and hiking through the rugged mountains of Patagonia."

Travel Motto: "'To awaken quite alone in a strange town is one of the pleasantest sensations in the world.'—Freya Stark"

Aisle, Window, or Middle Seat: "Aisle. I get restless on long flights and like to be able to move around without disturbing anyone else."

Email Sarah at [email protected] .

Travel Smarter! Sign up for our free newsletter.

I’m not ashamed to admit it. When it comes to travel—and life in general—I’m cheap. I drive a 10-year-old Corolla (which I bought used), I’ve never even considered paying for an airline upgrade, and I’ve been using the same, somewhat battered toiletry bag for nearly 20 years. After all, the more frugal I am, the more travel I can afford. But I’m old enough to have discovered a few travel luxuries that I am willing to spend my hard-earned money on.

Which Travel Luxuries Are Worth Paying For?

Every traveler has their own priorities and their own idea of which “travel luxuries” are worthwhile. For some, that might be spa visits or hotel upgrades. For me, the most important travel luxuries are those that keep me comfortable, ensure that my vacation goes smoothly, and preserve my trip memories for years to come.

A Good Carry-on

When the handle of my last carry-on , which I purchased for less than $40, stopped retracting after only a couple of years of use, I decided it was finally time for an upgrade. I generally don’t check a bag, so my carry-on has to be roomy enough to hold everything I’m bringing on my trip and sturdy enough to get me through multiple flights a year. This time I’ve invested in the Eagle Creek Expanse , which is made with high-quality materials and has a lifetime warranty.

Nonstop Flights

Am I willing to shell out an extra $1,000 to fly in business class? No way. But if I have a choice between a connecting flight or a nonstop, I’ll pay an extra hundred or two to get where I’m going more efficiently. Airport connections add stress and uncertainty to a trip, and I’d rather spend the extra time exploring a new place.

High-Quality Hiking Boots

It doesn’t matter how stunning a landscape you’re hiking through; if your feet hurt, you’re not going to enjoy it. High-quality hiking boots are pricey, but they’re also built to last. Look for options with good arch support and a waterproof coating; I prefer a higher-cut boot that supports my ankles as well.

Reliable brands include Vasque and Timberland , but it’s worth shopping around and test-driving multiple boots to find the one that works best for your feet.

Global Entry

Several years ago, a U.S. immigration official asked me what I did for a living as he was checking my passport. When I told him I was a travel writer, he raised his eyebrows.”Why don’t you have Global Entry ?” he asked. Why, indeed?

A year later I enrolled in the program, and now every time I step into an expedited security lane or bypass a snaking immigration line after a long international flight, I consider it the best $100 I ever spent. (Membership lasts five years.) Even better, some travelers may be able to get Global Entry for free .

Waterproof Clothing

It only takes one rainy hike in New Zealand (or Ireland, or Alaska…) to learn the difference between clothes that are water-resistant and those that are waterproof. Water-resistant clothes are fine if you’re dashing between buildings on a drizzly day—but not so much if you’re doing extended outdoor activities like hiking or biking in a climate prone to downpours.

As the old saying goes, “There’s no bad weather, only bad clothing.” Stock up on waterproof pants and jackets before such trips.

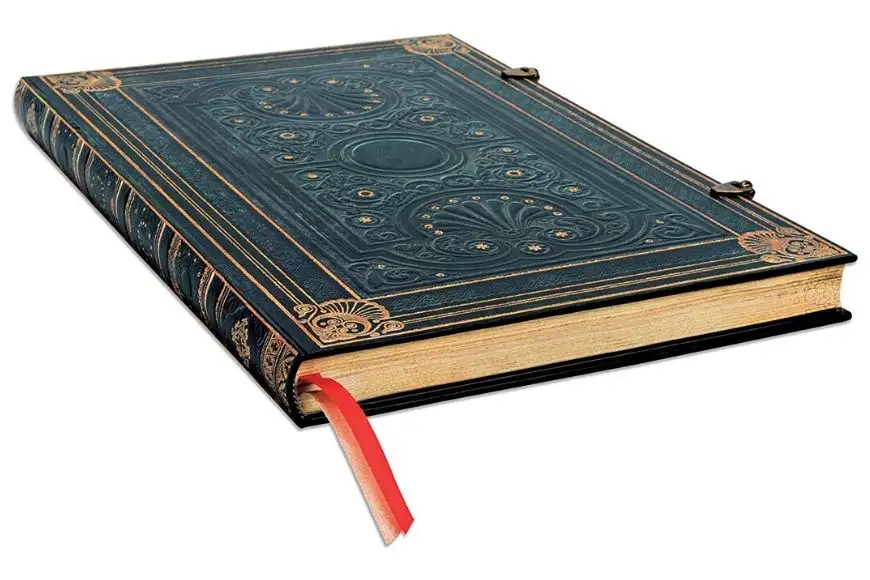

A Beautiful Travel Journal

Documenting the day’s experiences each night at my hotel is as vital a part of a vacation to me as trying new foods and exploring neighborhoods on foot. While I could easily scribble my thoughts in a two-dollar notebook from Target, my travel memories are precious, and I’d rather have them preserved in a more attractive place—like these gorgeous journals from Paperblanks .

A Versatile Coat

Unless you make every vacation a beach vacation, you’re going to need a good coat when you’re out exploring. I prefer investing in versatile jackets with multiple layers you can customize to suit the day’s weather. Examples include Columbia’s Whirlibird IV Insulated Interchange for men and the Bugaboo II Fleece Interchange for women. Both have a lightweight waterproof outer shell as well as a warm and cozy liner. You can combine them for maximum warmth or wear the shell or liner on its own.

While these coats aren’t cheap, the price is easier to stomach when you remind yourself that you’re basically getting three jackets in one.

Photo Books

It’s all too easy to share a few snaps from your trip on Instagram and then leave the rest of your travel photos to linger, unorganized and neglected, on your phone or computer for years on end. But as with my journals, I prefer to spend a little money to preserve my travel memories in a more visually appealing way.

After every trip, I create a photo book with Shutterfly . The service lets you customize photo layouts, backgrounds, cropping, and more. Other popular photo book providers include Snapfish and Blurb .

Which travel luxuries are most important to you?

More from SmarterTravel:

- 11 Ways to Upgrade Your Next Trip for $100 or Less

- 11 Travel Tools You Won’t Regret Splurging On

- 9 Travel Products That Take the Stress Out of Your Trip

Follow Sarah Schlichter on Twitter @TravelEditor for more travel tips and inspiration.

Editor’s note: This story was originally published in 2018. It has been updated to reflect the most current information.

We hand-pick everything we recommend and select items through testing and reviews. Some products are sent to us free of charge with no incentive to offer a favorable review. We offer our unbiased opinions and do not accept compensation to review products. All items are in stock and prices are accurate at the time of publication. If you buy something through our links, we may earn a commission.

Top Fares From

Don't see a fare you like? View all flight deals from your city.

Today's top travel deals.

Brought to you by ShermansTravel

Southwest Ireland: 8-Night Trip, Incl. Guinness...

Specialized Travel Services

Barcelona to Rome: 7-Nt Mediterranean Cruise...

Princess Cruises

Ohio: Daily Car Rentals from Cincinnati

Trending on SmarterTravel

Become a Member for as little as $4/mo and enjoy unlimited reading of TSLL blog.

“True luxury doesn’t land in our lap, pre-packaged, but rather through conscious living, self-awareness followed by an appreciation for quality, not quantity. Your luxuries will be different than someone else’s if you are wholly aware of your full potential and true self .” — Shannon Ables, blog post “A Simple Life Lived Well IS Luxurious Living, Let Me Explain . . .”

To gently wake in the morning to birdsong as your body and mind are roused to consciousness to begin the day, or nudged by the soft melodies of a pastoral composition played in a nearby radio, such simple occurrences exemplify luxuries that elevate the quality of the day’s unfoldings.

In last Friday’s weekly newsletter sent to subscribers, I suggested treating ourselves to a simply luxury, and while going back through TSLL’s Archives to find posts sharing ideas and inspiration, it came to my attention that I actually only have one post titled “Simple Luxuries” . Rest assured I have oodles of posts titled Petit Plaisirs which are essentially the same thing ( find hundreds of them here ), and in fact, the two terms here on TSLL are interchangeable, meaning an idea to make the everyday all the more enjoyable, to elevate our lives and help us savor the present moment. Simple luxuries and petit plaisirs need not be of great expense and sometimes are absolutely priceless.

As we begin June, in many ways a month that ushers in a shift from full schedules to more leisure and less structure or at least fewer demands on our time, I wanted to bring a post that reminded us to take a deep breath, exhale completely and prioritize the quality of our everydays ensuring we have intentionally included simple luxuries. And as we put them into place with June’s arrival, hopefully by the time September rolls around, we will realize how the enjoyment and thereby quality of our days has increased and be encouraged to both remember and prioritize continuing to include them in our daily lives as they really do provide a richness leaving us each all the more nourished and thus bring a more grounded, kind and clear-eyed, responsive self to every situation.

So, let’s get started and take a look at 20 ways we can incorporate simple luxuries into our daily life.

1.A well-made (but need not be expensive) teapot that doesn’t drip while pouring

~( Brown Betty’ s are a dependable, classic choice as are Amsterdam teapots – only $12!)

2. Fresh lemons

For a hot cup of lemon water to begin the day, a squeeze of juice over a favorite fish dish and so much more. Oh! And yep, a squeeze over freshly sliced avocados as seen in the top photo – yum!

One of my favorite treats for a morning when I have fresh bread in the house – Avocado spread , and yep, a squeeze of lemon is a necessary ingredient!

3. A rich, anti-aging hand cream that soothes after a day of work in the garden or being outside or just because

~ Here is a list of 10 to choose from based on needs and budget.

4. Home delivery of your favorite weekly news publications.

I so delight in walking out on to my front porch Sunday morning and seeing the newspaper plopped on the sidewalk ready to be explored. Grateful to the consistent delivery driver who no matter what the weather, it arrives each week.

5. Seeing and remaining still to watch the morning sunrise or evening sunset.

Paired with a hot cuppa or a glass of something delicious depending on which end of the day you find yourself.

6. Savon de Marseille soaps

Simply made with 100% all-natural ingredients, primarily olive oil, La Savonnerie de la Licorne is my go-to Marseille based soap maker who has been making these reliably wonderful-on-your-skin soaps for over 100 years. Using no animal products, nor artificial fragrances, or coloring, or preservatives, once I began using them, they have become all I use for bathing and cleansing.

7. The scent of fresh flowers – whether cut for a boutique in the house or grown in the garden

8. A soothing, rich foot lotion to apply each night before bed for tired feet

L’Occitane’s Shea Butter Intensive Foot Balm does the trick.

9. An herbal tea or tisane to end the day made from clippings found in the garden

From rosemary to sage or lemon verbena and of course, chamomile, being able to snip a few (or just one) sprig or leaf from these herbs grown at home provides a relaxing end to the day, as well as offers a variety of health benefits.

10. Sitting down to enjoy a cosy British or French mystery (ad-free) and a place to put up the feet and relax

– Here are more than a few of my favorites and recommended series from readers for British series and this post includes many ideas for French series.

11. Taking a walk amongst Mother Nature, fresh, clean air and the music of the natural world

12. A teacup or coffee mug or breakfast cup that fits the hand ideally

~for me, this would be a breakfast cup with a thumb rest and enough cup capacity for just the ideal amount of tea, such as Gien’s Breakfast Cup & Saucer.

13. Time to do or be as you please

~a post to explore: How Our Quality of Being Determines Our Quality of Doing

14. An enjoyable book that has you eager to dive back into its pages since the last moment you placed the bookmark

Explore lists upon lists of TSLL’s Favorite books shared at the end of each year, and always remember, you can stop by each Friday for the regular This & That post when I share books just released that I think you will enjoy in all sorts of genres – explore archived T & T posts here , and be sure to peruse TSLL’s Shop in the menu bar – drop-down menu – then click books .

15. A great lipstick

One that both projects the person you want to present to the world and hydrates as well as lasts. I shared the one in May’s Ponderings . . . post that I love which while taking months (maybe years if I am being honest) to find, but found it I finally did!

16. Essential Lavender Oil from Haute-Provence P.D.O. (Protected Designation of Origin)

The only ingredient is lavender oil, and that is all that is needed, 3-5 drops on your pillowcase to welcome sleep swiftly. Shop L’Occitane’s essential lavender oil here .

9 Benefits of Getting A Good Night’s Sleep

17. Seasonally fresh produce picked up at the local market or farm stand

~speaking of a good book from point #14, I am thoroughly enjoying the last book in Jean Luc-Bannelac’s Brittany Mystery series – Death of a Master Chef (seen here)~

18. A go-to scarf for each season

A scarf that both flatters our skin tone, but also is made of texture that provides the level of warmth (wool or cashmere in winter vs linen in summer) that makes our chosen accessory feel part of our being and completely comfortable.

19. Listening to a favorite classical composition (or your music genre of choice)

For me, each time Eric Satie’s Gymnopedie #1 begins to play, I stop and just listen to all three+ minutes. The same with Camille Saint-Saens’ “ Le Cygne ” or Debussy’s Clair de Lune .

20. Always having available in the fridge a quality piece of dark chocolate, and then . . .

. . . when I know I will be savoring it that evening, leaving it out on the counter at room temperature so that the full flavor will be enjoyed when I sit down with my cuppa tea in the evening to begin to unwind.

I wanted to conclude with the final suggestion of savoring a piece of dark chocolate because from the beginning of TSLL it has been a hallmark in many ways of living simply luxuriously in my own life. Yes, from a health standpoint, having dark chocolate satiates my sweet tooth without being too sweet and eliminates nearly entirely (but not absolutely) the desire for sweet desserts. I began welcoming this ritual into my evenings each time I didn’t have dessert back in my late 20s, but it has become my preferred dessert of choice, and quite a fun exploration to welcome home new finds from different chocolatiers, savoring just a square (or two) each night which prolongs the enjoyment even more without too much expense.

My hope in writing today’s post, whether you are a long-time member of TSLL or a new reader, is to inspire you to find those little details, thus the descriptor of ‘simple’ that elevate both the precise moment you are partaking in using or enjoying them, but that also satisfy and nurture the life you love living, not as a indulgence that detracts from your priorities or values or in eating or living healthily or well. Such choices and selections are out there, and when you tailor them to your tastes, preferences and what delights your eye and being, each day becomes all the more rich and amazing.

Wishing you everydays full of simple luxuries to savor. Bonne journée.

Looking for 366 Petit Plaisirs, one for every day of the calendar year? Be sure to pick up TSLL’s third book, The Road to Le Papillon: Daily Meditations on True Contentment where concluding each entry of inspiration, a Petit Plaisir is shared. (Available in four formats: hardback, paperback, audio and e-book.)

SIMILAR POSTS YOU MIGHT ENJOY

Let’s Relax, A Simple 10-Step How-to Guide

episode #306, 25 British Petit Plaisirs

100+ Petit Plaisirs to Enjoy (four-part series)

Advertisements

32 thoughts on “ 20 Simple Luxuries to Welcome into Your Everyday ”

What a super post to start my week 🙂 I woke early so just enjoying my simple luxury – curled up with a cup of coffee listening to Debussy looking out over my garden before walking to work. I have recently started experimenting with making my own chocolate – it was a lot simpler than I imagined, just cocoa butter, raw cacao and maple syrup (or honey) and it is divine and now my evening luxury, paired with a pot of tea! Thanks as always for the inspiration!

That chocolate making idea does sound doable! And delicious. 🙂 Thank you for sharing. Your morning ritual of simple luxuries brought calm just reading it. 🙂 Thank you for sharing that as well. Wishing you a wonderful week!

Wow! Shannon, you really are the curator of all things wonderful…and I love that it so much about the little things. I do also love all the wonderful products and links you provide. I have been so busy that I am just catching up on your posts from the last few weeks. I already feel more inspired and centered. I am excited to learn more about the Contentment Masterclass. I really don’t know how you provide so much beautiful and inspiring content on a regular basis. You are amazing. Thanks for all you do. You make a difference to so many people.

Thank you for all that you have said. I am chuffed, and grateful to hear you enjoy what you discover here. One of the objectives of TSLL is consistency in both postings and content ethos, and to hear from readers that I am perhaps doing just that means a lot. Thank you. 🙂

Thank you, Shannon, these little reminders and nudges are so helpful. Can’t wait to browse les Petits Plaisirs for even more inspiration!

You are most welcome Melissa. 🙂 And enjoy perusing. 🙂

Posts like this are my favorite! Rituals and treats to implement into our day as a reminder to take advantage of little moments to improve upon the day to days.

The Gien’s Breakfast Cup & Saucer are lovely as well as reasonably priced.

I have not read in months and have truly missed it. A long-overdue epiphany occurred and I renewed my Audible subscription. Now, I get to enjoy books again while on my daily commute (except for the 1st & 3rd Wednesday, of course 😉) Although I prefer holding one in my hands and physically turning the pages, this will do in the meantime.

And thank you for reminding me to savor these little luxuries instead of just going through the motions out of habit.

Have a wonderful week.

Audible is such a great idea especially when we wish to read but have a full schedule. Tickled you enjoyed the post and may you find moments to wiggle simple luxuries into your day. 🙂 You are such a very conscious enjoyer of your days, so I have no doubt you will find many. 🙂

I most often wake, for the first time around 5:15 am. I recently read that robins are the first to rise and sing in the morning. What a sweet sound. They provide the background music for my day. While I don’t always jump up to begin my day at that time, I know that this is a luxury that retirement has provided, the option to take the time to listen. Each of your reminders provide an opportunity for us to explore our own lives for special moments or routines. I often remind myself that it’s the little things that provide the big moments in my life and I am more grateful than I can put into words. Have a lovely day everyone!

Lucy Augustine, I enjoyed reading your comment yesterday evening and thought of you this morning as I was hearing the first birds sing…now I know they are robins! Sounds like retirement suits you and you are soaking it up, enjoy!

Thank you for sharing this fact with us about Robins. It wouldn’t surprise me a bit. I so delight in my resident robins. 🙂

Thank you Lucy 🙂 It IS all the little things, isn’t it ? Sometimes ‘little things ‘are so much bigger than we think ! When we are aware, and appreciative , those moments are so special, and really do make a difference to our days . Daily Blessings.🦋 I’m rather late catching up with this post , but hope that you have had a lovely week, and will enjoy the coming weekend . Best wishes from the UK x Anne x

Lucy, I absolutely agree, SUCH a luxury to listen to the birdsong just after awakening. If I’m lucky enough, I am up before the dawn and the birds and it’s as if the day is suspended for just a breathless moment, waiting to spill its pockets of magic over us all. And if I’m really lucky, I already have a cup of coffee in my hands😄. And yes, all the moments, tiny and quiet to large and crackling, I am grateful for all. Hope your weekend is absolutely delightful.~Rona🐦💕

Loved the Post! Reminds me of some of the things I already do and more I need to add! Your reminders and sources, as well as new daily rituals of self care are much appreciated ! Having moved from a sunny hot climate, to Washington, I’ve found myself leaning even harder into each one. I now have Spring, Summer and Winter scarves . Thank you Shannon!

My pleasure! Happy to share and tickled you enjoyed the post. ☺️ Love reading that you too are finding various types of scarves to ensure you stay warm and can venture where you would like. 🙂 Enjoy your outings!

Shannon a delicious list of simple luxuries . I agree with Lucy that it’s the little things in our lives which count the most. Listening to birdsong or stopping to admire a beautiful rose is free but it’s our appreciation for them which nourishes the soul. I have two of mine to add. The first is crisp linen sheets and the second is a bottle of champagne is always chilling in my fridge. Extravagant I hear you say but it’s within my budget and I source mine from the small producers buying direct or at wine fairs. They don’t cost as much as some of the well known labels and are often better. I’d like to share this quote from the first Lady of Champagne- Madame Lily Bollinger. “I drink champagne when I’m happy and when I’m sad. Sometimes I drink it when I’m alone. When I have company I consider it obligatory. I trifle with it if I’m not hungry and drink it when I am. Otherwise I never touch it- unless I’m thirsty” France still holds the number one slot for its consumption. Have a great week enjoying all of life’s little luxuries. Kameela😊

Thank you Kameela! ☺️

Great quote Kameela 😂

Many years ago , when the UK was experiencing a drought, with water rationing ( I know this is not an unusual occurrence in France ! ) my youngest sister presented me with a white cotton drill apron , with a pink button fastening on the neck loop , and pink lettering which says …….

“ Save Water , Drink Champagne “

Every time I put on my apron , it makes me smile , and remember the many times we DID drink champagne together especially when we were visiting our other sister in the South of France .

Sadly, both of them have passed away in the last few years , but the memories and the laughter we shared will never be forgotten ❤️❤️🥂🍾

Crisp , freshly ironed sheets ….oh yes 😊 , and the fragrance of flowers , freesia , roses, wallflowers, pinks , lavender , honeysuckle and jasmine in particular, but so many more .

Both of my sisters ( and our Mother ) were at their happiest working in their beautiful gardens , and all of them had green fingers !

(and we often sipped champagne in the garden too 😊 )

Anne, I so loved reading about your beautiful memories of your Mother & sisters & you enjoying, well, each other and life together, thank you for sharing. I don’t have any champagne but I do have some chilled sparkling rosé and so this evening I will raise a glass of rosé in honor of their memory. Santé! Rona🥂💕

Ah, thank you so much Rona 💕 It wasn’t always champagne ( although it often was when we were celebrating being together ) Sparkling wines, Samur , and Cremante were equally enjoyed, , and the sister who lived in France lived in Provence, so much Rose was enjoyed as well , as that region is famous for its delicious rose ( apologies for the lack of the e acute accent ,cor the rose , I can’t make my keyboard speak in French 😂 Have a lovely weekend x

And you as well, Anne! (Tip: If you are using a Windows based computer, here’s a link on how to create accents for different languages using your keyboard: https://www.languagetesting.com/windows-alt-codes ) xx~R

Found it ! Rosé 🙂 Thank you for encouraging me to explore , I knew there must be a way x

Fabulous quote, Kameela, and now I am off to the market😉💕🥂

I loved this post – and all the comments. Luxuries do not have to cost a ton of money (or any money at all), and these lovely ideas are priceless. Thank you for starting my week out so positively.

This might be my favorite post ever!

Thank you for stopping by Julia 😌 Tickled you enjoyed the post!

Brilliant! Thank you, Shannon. Wonderful reminder of all the things we can relish on a daily basis. I don’t know to whom this is attributed, but, the phrase, “how you live your days is how you life your life,” always resonates. Days spent savoring simple luxuries and sharing our best selves with others are days well-lived. Thank you so very much.

Ah, yes, Annie Dillard’s famous words. A beauty truth to always hold with us. 😌 Thank you for stopping by Abigail.

Abigail, I love this quote by Annie Dillard from “The Writing Life”, not only is it a powerful reminder of our choices in life, but it is also a great defense of making a schedule!😄Enjoy your weekend! xx Rona

Fabulous list, Shannon, this is why I so love TSLL, you always manage to find and give us such lovely things to ponder and use and as you say,’SAVOR’. Mille mercis. ~Rona🙏🏼💕

I love these types of post Shannon. Especially enjoy your recommendations for products to try that you like! Sarah

I just have to swing back around, Shannon, and thank you for introducing WRTI (and thank you to whoever introduced you to it, I believe you mentioned a reader had). I have it on right now and so enjoy choosing jazz or classical anytime of day. This morning is a jazz cool blue morning! 😉 If I can make it up in time….I’ve come to adore the Sousalarm march at 7:15! I’ve actually marched around the house to it, does get the body going 😆. Fun fun. Thanks!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Host Agencies

- Accelerator Course

- Travel Jobs

- Travel Agent Chatter

- Etiquette & Rules

- Privacy Policy

Simple Luxuries Travel LLC

- Question & Answer

All Reviews

Exceptional Support and Unforgettable Experiences

First as a client and now an agent with Simple Luxuries Travel, I can confidently say that this company has exceeded all my expectations. From the moment I joined, I felt welcomed into a family that shares my passion for exploration, organizing and creating magical stress-free experiences for clients.

I am extremely thankful for both owners, for their knowledge and understanding of this industry. They are both very personable and approachable. They are always willing to work with you in a group setting or on an individual level as well. They have cultivated a family atmosphere where we work as a team, and that becomes extremely helpful during drop days or if you are on a personal trip.

Simple Luxuries Travel distinguishes itself with its unwavering commitment to providing exceptional support to its agents. The training program is comprehensive, equipping agents with the knowledge and tools needed to excel in the industry. Moreover, the support doesn't end after training. The team at Simple Luxuries Travel is always available to answer questions, provide guidance, and offer assistance whenever needed. Whether it's troubleshooting a booking issue or brainstorming ideas for a client's dream vacation, I have found the support system at Simple Luxuries Travel to be second to none.

One of the most rewarding aspects of being an agent with Simple Luxuries Travel is the ability to curate truly unique and personalized experiences for clients. The company prioritizes understanding each client's preferences, interests, and budget, allowing agents the creative freedom to craft tailor-made itineraries that exceed expectations. Whether it's a luxury beach getaway, a magical theme park, or a cultural immersion in a vibrant city, Simple Luxuries Travel empowers agents to turn clients' travel dreams into reality.

In summary, Simple Luxuries Travel is more than just a travel agency – it's a family of passionate individuals dedicated to creating unforgettable travel experiences. With exceptional support, and personalized service, Simple Luxuries Travel sets the standard for excellence in the travel industry. I am proud to be a part of this incredible team and look forward to many more years of helping clients discover the world.

Sign up for a free account to submit reviews.

Jennifer Lalli - Simple Luxuries Travel

Location & hours.

Suggest an edit

Manassas, VA 20110

You Might Also Consider

Expedia Cruises in Falls Church

We are your neighborhood travel experts with the power of Expedia behind us! read more

in Travel Agents

CIRE Travel - Washington, DC

QuantStyle .. said "I'd give them six-stars if possible. They were very responsive to all my questions even before I paid them anything--before I even became a client. But here's something they don't advertise that is of GREAT VALUE: They can help you…" read more

in Travel Services

Dana B. said "Will and Kennedy are the only reason I still buy Away products. The service is impeccable and they are good people who truly care about the customer. I had an issue and both Kennedy and Will worked tirelessly until the found a…" read more

in Luggage, Travel Services, Airlines

Ask the Community

Ask a question

Yelp users haven’t asked any questions yet about Jennifer Lalli - Simple Luxuries Travel .

Recommended Reviews

- 1 star rating Not good

- 2 star rating Could’ve been better

- 3 star rating OK

- 4 star rating Good

- 5 star rating Great

Select your rating

People Also Viewed

Global Escape Travel

GTS Transportation

Warrenton-Fauquier Airport

Aviles Travel

All About You Limousines

Olazabal Travel Multi Service

The Best Vacation Awaits

Curious Tourist Travel

Horner Road Commuter Lot

Best of Manassas

Things to do in Manassas

Other Travel Agents Nearby

Find more Travel Agents near Jennifer Lalli - Simple Luxuries Travel

Related Cost Guides

Town Car Service

FREE SHIPPING AUSTRALIA WIDE ON ORDERS OVER $110

70 Ways To Add Simple Luxuries In Your Day

- SACRED RITUALS

- Simple Luxe Living

- SLOW LIVING

- STEEP THE SOUL

In the quiet, ordinary and everyday moments, we create the space to contemplate who we truly are and as a result our spirit blooms.

True contentment is found when we intentionally seek it in all that we do. Finding enjoyment in the everyday chores, seeing beauty in common places and seeking the extra-ordinary in the ordinary - this is the sacred art of living a life well lived.

It is our responsibility to see all the "common" beauty around us, to recognise its perfection, to be appreciative for the moment and then to savour it with every ounce of our being.

" l love that quiet time when nobody's up and the animals are all happy to see me" -Olivia Newton-John

How much does this quote from Olivia Newton-John make you smile. As I sit here at 4.30am writing this with my little rescued orphaned wombat crawling all over me - I couldn't think of a more perfect quote to start the day.

Don't you love those mornings when you get up early before the rest of the world has awoken and the quietness and stillness is so beautiful, calming yet brings with it an undercurrent of inspiration and opportunity.

In these mornings when you go outside the beauty of simplicity seems to amplify, whether your taking a morning walk, watering your garden or sipping your cup of tea on the front porch. The sweetness of the morning breath does something to the senses and the birds gently chattering seem truly relaxed to have you around.

It is in these simple moments that life is truly lived to its full potential, it is these simple luxuries that bring calm, inner peace and enthusiasm to our days.

Living a life embracing simple luxuries is a celebration of your senses while falling passionately in love with life despite all its complexities, compromises and contradictions. It is about finding beauty and awe in life, recipes, nature, chores, rituals, decorating, people and simplicity.

Simple luxuries bring beauty and grace no matter what your income, location or situation. The slow, yet simple life is something that we can all achieve. Choose to seek quality rather than quantity, personal style instead of trendy fashion, truth instead of expectation, knowledge and compassion instead of resentment, gratitude instead of suffering and homemade comforts rather than commercially mass produced goods.

Today I want to take you into your day [and your future days ahead] with a few of my favourite ways to add simple luxuries into everyday moments. Try a few yourself today or this weekend and notice how every day moments quickly become filled with a little more magic.

With this new-found appreciation for the simple the self lightens up a little -gifting you with a more light and breezy outlook on life.

Enjoy and savour these 70 Simple Luxuries that you can add to your every-day:

Join us and get nice things.

Free stuff and general goodness

*By completing this form you're signing up to receive our emails and can unsubscribe at any time.

14 best travel credit cards of June 2024

The best travel credit cards offer an array of premium perks and benefits . For both occasional travelers and frequent flyers, adding a travel credit card to your wallet is a great way to earn rewards and save money on every trip you take. At The Points Guy, our team has done the legwork and curated a selection of the best travel credit cards for any globe-trotter, whether you prefer to backpack through mountains or settle into a luxury villa for some relaxation. From generous travel credits to premium lounge access, we’ve chosen the cards packed with the best benefits to elevate your next travel experience.

Check out our list below and discover which travel credit card from our partners makes the best addition to your wallet for all of your adventures.

- Capital One Venture Rewards Credit Card : Best for earning miles

- Capital One Venture X Rewards Credit Card : Best for premium travel

- Chase Sapphire Preferred® Card : Best for beginner travelers

- Ink Business Preferred® Credit Card : Best for maximizing business purchases

- The Platinum Card® from American Express : Best for lounge access

- American Express® Gold Card : Best for dining at restaurants

- Capital One VentureOne Rewards Credit Card : Best for no annual fee

- The Business Platinum Card® from American Express : Best for business travel

- Wells Fargo Autograph Journey℠ Card : Best for unlimited point earning

- Chase Sapphire Reserve® : Best for travel credits

- Wells Fargo Autograph℠ Card : Best for variety of bonus categories

- American Express® Business Gold Card : Best for flexible rewards earning

- Bank of America® Travel Rewards credit card : Best for travel rewards beginners

- Alaska Airlines Visa Signature® credit card : Best for Alaska Airlines miles

Browse by card categories

Comparing the best credit cards, more details on the best credit cards, credit pointers with brian kelly, what is a travel credit card, helpful tools, how we rate cards, how to maximize travel credit cards, how to choose the best travel credit card, ask our experts, pros + cons of travel credit cards, frequently asked questions.

- Airport Lounge Access

Capital One Venture Rewards Credit Card

When it comes to simplicity and strong rewards, the Capital One Venture Rewards Credit Card is a solid choice for most travelers. You’ll earn earns 2 miles per dollar on every purchase with no bonus categories to memorize, making it an ideal card for those with busy lives. Read our full review of the Capital One Venture Rewards Credit Card .

- This flexible rewards card delivers a solid sign-up bonus of 75,000 miles, worth $1,388 based on TPG valuations and not provided by the issuer.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories.

- Rewards earned are versatile as they can be redeemed for any hotel or airline purchase for a statement credit or transferred to 15+ travel partners.

- Highest bonus-earning categories only on travel booked via Capital One Travel

- Capital One airline partners do not include any large U.S. airlines.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

Capital One Venture X Rewards Credit Card

If you can maximize the $300 credit toward Capital One Travel, the Venture X’s annual fee effectively comes down to $95, the same annual fee pegged to the Capital One Venture Rewards Credit Card (see rates and fees ). Add in a 10,000-mile bonus every account anniversary (worth $185, according to TPG valuations ) and lounge access, and the card may become the strongest option out there for a lot of travelers. Read our full review of the Capital One Venture X Rewards Credit Card .

- 75,000 bonus miles when you spend $4,000 on purchases in the first three months from account opening.

- 10,000 bonus miles every account anniversary

- $395 annual fee

- $300 credit annually, only applicable for bookings made through Capital One Travel portal

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is one of the most popular travel rewards credit card on the market. Offering an excellent return on travel and dining purchases, the card packs a ton of value that easily offsets its $95 annual fee. Cardholders can redeem points at 1.25 cents each for travel booked through Chase or transfer points to one of Chase’s 14 valuable airline and hotel partners. Read our full review of the Chase Sapphire Preferred Card .

- You’ll earn 5 points per dollar on travel purchased through Chase Travel, 3 points per dollar on dining, select streaming services and online grocery store purchases, 2 points per dollar on all other travel and 1 point per dollar on everything else.

- Annual $50 Chase Travel Hotel Credit

- Premium travel protection benefits including trip cancellation insurance, primary car rental insurance and lost luggage insurance.

- The card comes with a $95 annual fee.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Ink Business Preferred® Credit Card

The Ink Business Preferred Credit Card’s sign-up bonus is among the highest we’ve seen from Chase. Plus earn points across the four bonus categories (travel, shipping, advertising and telecommunication providers) that are most popular with businesses. The card comes with travel protections, shopping protections and will also have primary coverage when renting a car for business purposes for you and your employees. Read our full review of the Ink Business Preferred Credit Card .

- One of the highest sign-up bonuses we’ve seen — 100,000 bonus points after $8,000 worth of spend in the first three months after card opening.

- Access to the Chase Ultimate Rewards portal for points redemption.

- Reasonable $95 annual fee.

- Bonus categories that are most relevant to business owners; primary car insurance.

- Perks including cellphone and purchase protection; extended warranty; trip cancellation/interruption insurance; trip delay reimbursement.

- Yearly cap on bonus categories.

- No travel perks.

- Subject to Chase's 5/24 rule on card applications.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

The Platinum Card® from American Express

The Amex Platinum is unmatched when it comes to travel perks and benefits. If lounge access, hotel elite status and annual statement credits are important to you, this card is well worth the high annual fee. Read our full review of the Platinum Card from American Express .

- The current welcome offer on this card is quite lucrative. TPG values it at $1,600.

- This card comes with a long list of benefits, including access to Centurion Lounges, complimentary elite status with Hilton and Marriott, and more than $1,400 in assorted annual statement credits and so much more. (enrollment required)

- The Amex Platinum comes with access to a premium concierge service that can help you with everything from booking hard-to-get reservations to finding destination guides to help you plan out your next getaway.

- The $695 annual fee is only worth it if you’re taking full advantage of the card’s benefits. Seldom travelers may not get enough value to warrant the cost.

- Outside of the current welcome bonus, you’re only earning bonus rewards on specific airfare and hotel purchases, so it’s not a great card for other spending categories.

- The annual airline fee credit and other monthly statement credits can be complicated to take advantage of compared to the broader travel credits offered by competing premium cards.

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR® Plus Credit: CLEAR® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck® application fee for a 5-year plan only (through a TSA PreCheck® official enrollment provider), when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- See Rates & Fees

American Express® Gold Card

This isn’t just a card that’s nice to look at. It packs a real punch, offering 4 points per dollar on dining at restaurants and U.S. supermarkets (on the first $25,000 in purchases per calendar year; then 1 point per dollar). There’s also an up to $120 annual dining credit at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com , Milk Bar, and select Shake Shack locations, plus it added an up to $120 annually ($10 per month) in Uber Cash, which can be used on Uber Eats orders or Uber rides in the U.S. All this make it a very strong contender for all food purchases, which has become a popular spending category. Enrollment is required for select benefits. Read our full review of the Amex Gold .

- 4 points per dollar on dining at restaurants and U.S. supermarkets (on the first $25,000 in purchases per calendar year; then 1 point per dollar)

- 3 points per dollar on flights booked directly with the airline or with Amex Travel.

- Welcome bonus of 60,000 points after spending $6,000 in the first six months of account opening.

- Weak on travel and everyday spending bonus categories.

- Not as effective for those living outside the U.S.

- Some may have trouble using Uber/food credits.

- Few travel perks and protections.

- Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

Capital One VentureOne Rewards Credit Card

If you’re looking to dip your toes into the world of travel rewards, the Capital One VentureOne Rewards Credit Card is a great way to get started. With no annual fee and a simple 1.25 miles per dollar on all your purchases, you won’t have to keep up with multiple bonus categories — just earn rewards on everything you purchase! Coupled with the 20,000-mile sign-up bonus, you can use your rewards to book travel, transfer to Capital One’s loyalty partners and more. Read our full review of the Capital One VentureOne Rewards Credit Card .

- No annual fee.

- Earn a bonus of 20,000 bonus miles once you spend $500 within the first three months from account opening.

- Use your miles to book or pay for travel at a 1-cent value, or transfer your miles to loyalty programs to gain potentially even greater value for your rewards.

- Earn 1.25 miles per dollar on all purchases.

- No foreign transaction fees.

- Other credit cards can offer you higher rewards for your common purchase categories.

- Capital One airline transfer partners do not include any large U.S. airlines.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies

The Business Platinum Card® from American Express

The Business Platinum Card from American Express is a great card for frequent travelers looking to add a touch of luxury to their business trips. While the card does come with a high annual fee, you’re also getting a ton of valuable benefits in return. They include generous annual travel credits, unparalleled lounge access that includes Amex Centurion Lounges and more. Read our full review on The Business Platinum Card from American Express .

- Up to $100 statement credit for Global Entry every 4 years or $85 TSA PreCheck credit every 4.5 years (enrollment is required)

- Up to $400 annual statement credit for U.S. Dell purchases (enrollment required)

- Gold status at Marriott and Hilton hotels; access to the Fine Hotels & Resorts program and Hotel Collection (enrollment required)

- Steep $695 annual fee.

- High spend needed for welcome offer.

- Limited high bonus categories outside of travel.

- Welcome Offer: Earn 150,000 Membership Rewards® points after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership.

- 5X Membership Rewards® points on flights and prepaid hotels on AmexTravel.com, and 1X points for each dollar you spend on eligible purchases.

- Earn 1.5X points (that’s an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year.

- Unlock over $1,000 in statement credits on select purchases, including tech, recruiting and wireless in the first year of membership with the Business Platinum Card®. Enrollment required. See how you can unlock over $1,000 annually in credits on select purchases with the Business Platinum Card®, here.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to the Card.

- $189 CLEAR® Plus Credit: Use your card and get up to $189 in statement credits per calendar year on your CLEAR® Plus Membership (subject to auto-renewal) when you use the Business Platinum Card®.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market as of 03/2023.

- $695 Annual Fee.

Wells Fargo Autograph Journey℠ Card

The Wells Fargo Autograph Journey credit card offers healthy reward earning rates on top of uncapped point-earning meaning the sky's the limit — especially if you strategize and spend in popular categories.

- No foreign transaction fees

- Uncapped earning potential

- $50 annual statement credit

- Solid point earning rates in popular categories

- This card features an annual fee

- Select “Apply Now” to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn 60,000 bonus points when you spend $4,000 in purchases in the first 3 months – that’s $600 toward your next trip.

- Earn unlimited 5X points on hotels, 4X points on airlines, 3X points on other travel and restaurants, and 1X points on other purchases.

- $95 annual fee.

- Book your travel with the Autograph Journey Card and enjoy Travel Accident Insurance, Lost Baggage Reimbursement, Trip Cancellation and Interruption Protection and Auto Rental Collision Damage Waiver.

- Earn a $50 annual statement credit with $50 minimum airline purchase.

- Up to $1,000 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

Chase Sapphire Reserve®

The Chase Sapphire Reserve is one of our top premium travel cards. With a $300 travel credit, bonus points on dining and travel purchases and other benefits, you can get excellent value that far exceeds the annual fee on the card. Read our full review of the Chase Sapphire Reserve card .

- $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Access to Chase Travel hotel and airline travel partners.

- 10 points per dollar on hotels and car rentals through Chase Travel, 10 points per dollar on Chase Dining purchases through the Ultimate Rewards portal, 5 points per dollar on flights booked through the Chase Travel portal, 3 points per dollar on all other travel and dining, 1 point per dollar on everything else

- 50% more value when you redeem your points for travel directly through Chase Travel

- Steep initial $550 annual fee.

- May not make sense for people that don't travel frequently.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

Wells Fargo Autograph℠ Card

The Wells Fargo Autograph card packs a punch for a no-annual-fee product, with an array of bonus categories plus solid perks and straightforward redemption options. Read our full review of the Wells Fargo Autograph here .

- This card offers 3 points per dollar on various everyday purchases with no annual fee. It also comes with a 20,000-point welcome bonus and an introductory APR offer on purchases. Plus, you'll enjoy up to $600 in cellphone protection when you pay your monthly bill with the card. Subject to a $25 deductible.

- Despite the lucrative earning structure, Wells Fargo doesn't offer any ways to maximize your redemptions — you're limited to fixed-value rewards like gift cards and statement credits.

- Select "Apply Now" to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months - that's a $200 cash redemption value.

- Earn unlimited 3X points on the things that really add up - like restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Plus, earn 1X points on other purchases.

- $0 annual fee.

- 0% intro APR for 12 months from account opening on purchases. 20.24%, 25.24%, or 29.99% variable APR thereafter.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Redeem your rewards points for travel, gift cards, or statement credits. Or shop at millions of online stores and redeem your rewards when you check out with PayPal.

American Express® Business Gold Card

The Amex Business Gold card is a solid choice for high-spending small businesses with the flexibility to earn 4 points per dollar in the two categories where you spend the most. The card is ideal for businesses who value simplicity above all. Read our full review of the American Express Business Gold Card .

- You'll earn 4 Membership Rewards points per dollar in the top 2 spending categories each month (on the first $150,000 in combined purchases each calendar year).

- Hefty $375 annual fee.

- There may be better options for small businesses who don't spend a lot.

- Welcome Offer: Earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.*

- Earn 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle from 6 eligible categories. While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter). Only the top 2 categories each billing cycle will count towards the $150,000 cap.

- Earn 3X Membership Rewards® points on flights and prepaid hotels booked on amextravel.com using your Business Gold Card.

- Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment required.

- Get up to a $12.95** statement credit back each month after you pay for a monthly Walmart+ membership (subject to auto-renewal) with your Business Gold Card. **Up to $12.95 plus applicable taxes on one membership fee.

- Your Card – Your Choice. Choose from Gold or Rose Gold.

- *Terms Apply

Bank of America® Travel Rewards credit card

The Bank of America Travel Rewards credit card is a great starter card thanks to its no annual fee and no foreign transaction fees when you travel internationally. Earning and redeeming is effortless, with no confusing bonus categories to keep track of and the ability to redeem your points for all of your travel needs. Read our full review of the Bank of America Travel Rewards card.

- 1.5 points per dollar on all purchases

- No annual fee

- Bank of America does not offer airline or hotel transfer partners like other banks such as American Express, Chase or Capital One.

- No travel and purchase protections.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 19.24% - 29.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

Alaska Airlines Visa Signature® credit card

There’s a lot to love about the Alaska Airlines credit card, in part due to its highly valuable loyalty program: Alaska Airlines MileagePlan. Whether you’re a loyal Alaska flyer or a points maximizer looking to diversify your rewards portfolio, this card has a lot to offer. For starters, you’ll receive Alaska’s Famous Companion Pass each year from $122 ($99 fare plus taxes and fees from $23) each account anniversary after you spend $6,000 or more on purchases within the prior anniversary year, free checked bags for you and up to six guests on your itinerary, 20% back on in-flight purchases and more. Plus, Alaska has joined the oneworld alliance, opening up endless redemption opportunities. Read our full review of the Alaska Airline credit card.

- Free checked bag for you and up to six guests on your reservation.

- Alaska discounts, including 20% back on in-flight purchases.

- Limited Time Online Offer—60,000 Bonus Miles!

- Get 60,000 bonus miles plus Alaska's Famous Companion Fare™ ($99 fare plus taxes and fees from $23) with this offer. To qualify, make $3,000 or more in purchases within the first 90 days of opening your account.

- Get Alaska’s Famous Companion Fare™ ($99 fare plus taxes and fees from $23) each account anniversary after you spend $6,000 or more on purchases within the prior anniversary year. Valid on all Alaska Airlines flights booked on alaskaair.com.

- Earn unlimited 3 miles for every $1 spent on eligible Alaska Airlines purchases. Earn unlimited 2 miles for every $1 spent on eligible gas, EV charging station, cable, streaming services and local transit (including ride share) purchases. And earn unlimited 1 mile per $1 spent on all other purchases. And, your miles don’t expire on active accounts.

- Earn a 10% rewards bonus on all miles earned from card purchases if you have an eligible Bank of America® account.

- Free checked bag and enjoy priority boarding for you and up to 6 guests on the same reservation, when you pay for your flight with your card — Also available for authorized users when they book a reservation too!

- With oneworld® Alliance member airlines and Alaska’s Global Partners, Alaska has expanded their global reach to over 1,000 destinations worldwide bringing more airline partners and more ways to earn and redeem miles.

- Plus, no foreign transaction fees and a low $95 annual fee.

- This online only offer may not be available elsewhere if you leave this page. You can take advantage of this offer when you apply now.

With the Capital One Venture, you’re earning 2 miles per dollar on every purchase, which makes it easy to rack up rewards without having to juggle different bonus categories or spending caps. And with flexible redemption options and a manageable annual fee, this card is an excellent choice if you’re looking to keep just one credit card in your wallet for all spending.

Those looking to earn flexible rewards should use the Capital One Venture card as it allows you to redeem miles for a fixed value or transfer the miles you earn to 15+ airline and hotel transfer partners , including Avianca, Etihad Airways, Turkish Airlines and Singapore Airlines.

“The Capital One Venture is a great card that can add value to pretty much anyone’s wallet. I use it to earn 2 miles per dollar on the purchases that fall outside of my other cards’ bonus categories. The annual fee is low, Capital One miles are easy to redeem and the card does come with a few nice perks — including TSA PreCheck/Global Entry application fee reimbursement.” — Madison Blancaflor , senior content operations editor

Even if you’re a casual traveler, consider jumping to the Capital One Venture X Rewards Credit Card (see rates and fees ). The card’s up to $300 annual credit for purchases made with Capital One Travel immediately covers the higher annual fee — and that’s not even considering the added perks you’ll enjoy.

At $395 per year (see rates and fees ), this premium card is cheaper than all of its competitors without sacrificing the breadth of valuable perks it includes. Cardholders will get unlimited visits to Capital One’s premium network of lounges and 1,300-plus Priority Pass lounges worldwide and able to bring up to two guests for no additional charge.

For frequent travelers, the Capital One Venture X is a must-have and is well worth the $395 annual fee. If you travel frequently with your significant other, family or friends, you can even add some authorized users for no additional cost. This will grant them their own lounge access (and the ability to bring up to two guests for no fee), among many other benefits, making this a huge cost-saver for those who travel in groups.

“With an annual fee that is $300 less than The Platinum Card® from American Express (see Amex Platinum rates and fees ), the Capital One Venture X card is my favorite travel credit card. The card comes with an annual $300 Capital One Travel credit, which I use to book flights. That effectively brings the annual fee down to $95 per year (see rates and fees ). Cardholders enjoy a Priority Pass Select membership. Authorized users — you geta number of them at no cost — also enjoy their own Priority Pass Select membership. I use my Venture X card to earn 2 miles per dollar (a 3.7% return at TPG’s valuations ) in spending categories where most cards would only accrue 1 mile — like auto maintenance, pharmacies and medical bills.” — Kyle Olsen , former points and miles reporter

Those turned off by the Venture X’s annual fee could opt for the Capital One Venture Rewards Credit Card , which has a $95 annual fee (see rates and fees ), identical sign-up bonus and similar earning and redemption options.

You’ll earn a solid return on dining and travel (6% back and 4% back, respectively, based on TPG valuations ) on top of your generous sign-up bonus, and you also have access to some of the best travel protections offered by any travel rewards credit card.

We’ve long suggested the Chase Sapphire Preferred Card as an excellent option for those who are new to earning travel rewards because it lets you earn valuable, transferable points with strong bonus categories and a reasonable annual fee.

“The Chase Sapphire Preferred has remained a top card in my wallet for years. Between the consistently strong sign-up bonus, low annual fee and continual improvements that have been made over the years, it’s hard for any other mid-tier rewards card to compare. I love that I can earn bonus rewards on travel, dining, streaming and online grocery purchases — all with just one card. Plus, Chase Ultimate Rewards points are valuable and easy to use whether you’re new to points and miles or an expert.” — Madison Blancaflor , senior content operations editor

To add more luxury to your travel experience, consider the Chase Sapphire Reserve® . Though it comes with a higher annual fee, you’ll enjoy Priority Pass lounge access plus a $300 annual travel credit.

The Ink Business Preferred earns 3 points per dollar on the first $150,000 in combined travel, shipping, internet, cable, phone services and advertising purchases made on social media sites and search engines each account anniversary year. TPG’s most recent valuations peg the value of Chase Ultimate Rewards points at 2 cents apiece, so you’ll get a fantastic return of 6% on purchases in these categories.

If you spend a lot on business travel or social media advertising, you’ll be able to earn significant points using the Ink Business Preferred card .

“I originally signed up for the Ink Business Preferred primarily for its sign-up bonus. But, over the last year, I’ve found myself making it my go-to card when booking travel. After all, the Ink Business Preferred earns 3 points per dollar spent on travel and provides excellent travel protections, including trip delay protection and rental car insurance.” — Katie Genter , senior writer

If you don’t want to worry about maximizing specific purchases and are looking for a lower spending requirement to earn a sign-up bonus, consider the Ink Business Unlimited® Credit Card , which offers 1.5% cash back on all purchases and carries no annual fee.

The Amex Platinum is a stellar premium travel card that can provide amazing redemptions . Besides the welcome offer, it comes with more than $1,400 in credits each year and various lounge access options. Enrollment is required for select benefits.

Anyone looking for luxury travel benefits will find that the ton of annual statement credits make the annual fee worth it. Plus, you’ll get unparalleled lounge access , automatic Gold status with Hilton and Marriott, and extra perks with Avis Preferred , Hertz Gold Plus Rewards and National Car Rental Emerald Club . Enrollment is required for select benefits.

“While this card has a high annual fee, it more than justifies itself for frequent travelers like me. The lounge access options that come with the Platinum are unrivaled by competitors. I put all of my flights on this card to earn 5 points per dollar spent and trip protection insurance. I make sure to take full advantage of the Uber, Saks Fifth Avenue, Hulu/Disney+ and Clear credits (enrollment is required). And, honestly, pulling a Platinum card out of your wallet to pay for something does feel pretty fancy.” — Matt Moffitt , senior credit cards editor

The Capital One Venture X Rewards Credit Card can be a great alternative to the Amex Platinum, with a notably lower annual fee, similar perks and a more rewarding earning rate on everyday purchases.

The Amex Gold earns 4 points per dollar on dining at restaurants, with no foreign transaction fees (see rates and fees ), meaning you’ll get an 8% return on purchases (based on TPG’s valuations ). While a few other cards temporarily offer higher return rates on dining, this is the best option for long-term spending, making it one of the best dining cards and best rewards cards .

Those looking for a great return on dining and purchases at U.S. supermarkets will get a lot of value from this card.

“Groceries and dining at restaurants are two of my top spending categories, and I love that the Amex Gold rewards those purchases with 4 points per dollar. When you factor in the $10 dining credit and $10 in Uber Cash each month, the $250 annual fee is a net cost of $10.” — Senitra Horbrook , former credit cards editor

For those who dine out a lot and also want additional bonus categories and other valuable perks for a lower annual fee, consider the Chase Sapphire Preferred® Card .

The no-annual-fee Capital One VentureOne Rewards Credit Card (see rates and fees ) has the same redemption options as its sibling card (the Venture Rewards card) but with a lower rewards rate and fewer perks. The miles earned on the card can also be transferred to airline and hotel partners, a benefit not usually seen with a no-annual-fee card.

The VentureOne is a strong card to have in your arsenal and great if you are budgeting. After all, there aren’t many no-annual-fee cards with the ability to transfer points and miles directly to travel partners, so it’s a big bonus that this card offers that (see rates and fees ).