Language selection

- Français fr

Medical Expenses 2023

From: Canada Revenue Agency

RC4065(E) 23

The CRA's publications and personalized correspondence are available in braille, large print, etext, or MP3. For more information, go to About multiple formats or call 1-800-959-8281 .

Find out if this guide is for you

This guide is for persons with medical expenses and their supporting family members. The guide gives information on eligible medical expenses you can claim on your tax return.

This guide uses plain language to explain the most common tax situations. The guide is for information only and does not replace the law.

General information

The medical expense tax credit is a non-refundable tax credit that you can use to reduce the tax that you paid or may have to pay. If you paid for healthcare expenses, you may be able to claim them as eligible medical expenses on your tax return. These expenses include a wide range of products, procedures and services, such as:

- medical supplies

- dental care

- travel expenses

Generally, you can claim all amounts paid, even if they were not paid in Canada.

You can only claim the part of an eligible expense for which you have not been or will not be reimbursed.

How to claim medical expenses

You can claim medical expenses on line 33099 or 33199 of your tax return under Step 5 – Federal tax.

Line 33099 – You can claim the total eligible medical expenses you or your spouse or common-law partner paid for any of the following persons:

- your spouse or common-law partner

- your or your spouse’s or common-law partner’s children who were under 18 years of age at the end of the tax year

Line 33199 – You can claim the part of eligible medical expenses you or your spouse or common-law partner paid for any of the following persons who depended on you for support:

- your or your spouse’s or common-law partner’s children who were 18 years of age or older at the end of the tax year, or grandchildren

- your or your spouse’s or common-law partner’s parents, grandparents, brothers, sisters, uncles, aunts, nephews, or nieces who were residents of Canada at any time in the year

You have to calculate, for each dependant, the medical expenses that you are claiming on line 33199.

Amounts you can claim

Line 33099 – You can claim the total of the eligible expenses minus the lesser of the following amounts:

- 3% of your net income ( line 23600 of your tax return)

Line 33199 – You can claim the total of the eligible expenses minus the lesser of the following amounts:

- 3% of your dependant's net income (line 23600 of their tax return)

The maximum provincial or territorial amount you can claim for medical expenses may differ depending on where you live. For more information, see the information guide for your province or territory of residence in your income tax package. If you live in Quebec, visit Revenu Québec .

Period for which you can claim these expenses

You can claim eligible medical expenses paid in any 12-month period ending in 2023 and not claimed by you or anyone else in 2022. For a person who died in 2023 , a claim can be made for expenses paid in any 24-month period that includes the date of death if the expenses were not claimed for any other year.

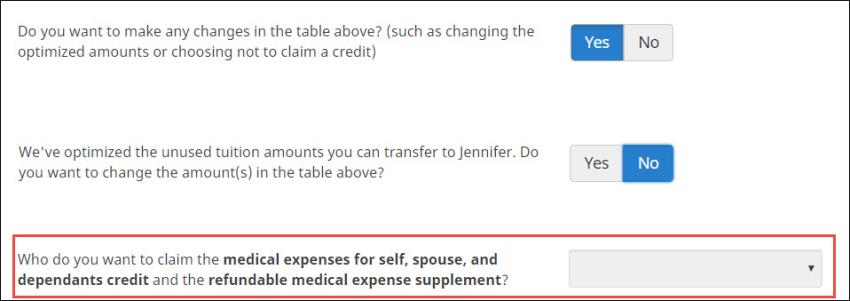

Richard and Pauline have two children, Jen and Rob. They have reviewed their medical expenses and decided that the 12-month period ending in 2023 they will use to calculate their claim is July 1, 2022 to June 30, 2023 . They had the following expenses:

Since Jen is under 18, Richard and Pauline can combine her medical expenses with theirs, for a total of $4,300. Either Richard or Pauline can claim this amount on line 33099 of their tax return (Step 5 – Federal tax). Since Rob is over 18 , his medical expenses should be claimed on line 33199.

Pauline’s net income (on line 23600 of her return) is $32,000. She calculates 3% of that amount, which is $960. Because the result is less than $2,635, she subtracts $960 from $4,300. The difference is $3,340, which is the amount she could claim on her tax return.

Richard’s net income is $48,000. He calculates 3% of that amount, which is $1,440. Because the result is less than $2,635, he subtracts $1,440 from $4,300. The difference is $2,860, which is the amount he could claim on his tax return. In this case, it is better for Pauline to claim all the expenses for Richard, herself, and their daughter Jen on line 33099.

To decide who should claim the medical expenses for Rob on line 33199 , Richard and Pauline will have to make the same calculation using Rob’s net income.

Credits or deductions related to medical expenses

Refundable medical expense supplement.

The refundable medical expense supplement is a refundable tax credit available to working individuals with low incomes and high medical expenses. You may be able to claim this credit if all of the following conditions apply:

- You made a claim for medical expenses on line 33200 of your tax return (Step 5 – Federal tax) or for the disability supports deduction on line 21500 of your tax return.

- You were resident in Canada throughout 2023.

- You were 18 years of age or older at the end of 2023.

You must also meet the criteria related to income.

For more information, go to line 45200 – Refundable medical expense supplement .

Disability supports deduction

The person with the impairment in physical or mental functions may be able to claim some medical expenses as a disability supports deduction. They can claim these expenses on either line 21500 or line 33099 , or split the claim between these two lines, as long as the total of the amounts claimed is not more than the expenses paid.

For the eligibility criteria, the list of the eligible expenses, or more information, see Guide RC4064, Disability-Related Information .

Certain medical expenses require a certification

In this guide, the CRA identifies the medical expenses that have to be certified by a medical practitioner. Medical practitioners include a wide range of health professionals, such as doctors, pharmacists, and nurses. To view the list of practitioners who can certify medical expenses, go to Authorized medical practitioners for the purposes of the medical expense tax credit .

Common medical expenses you can claim

You can claim the following items medical expenses on line 33099 or use them to calculate an amount on line 33199 . Any certification needed is specified. This list is not complete.

For more information, see Income Tax Folio S1-F1-C1, Medical Expense Tax Credit .

Attendant care and care in a facility

Attendant care is care given by an attendant who does personal tasks which a person cannot do for themselves. Attendant care can be received in certain types of facilities.

You can claim amounts paid to an attendant only if the attendant was not your spouse or common-law partner and was 18 years of age or older when the amounts were paid.

If an individual issues a receipt for attendant care services, the receipt must include their social insurance number.

Who can claim these expenses

You can claim as medical expenses the amounts you or your spouse or common-law partner paid for attendant care or care in a facility. The expenses must have been paid for the care of any of the following persons:

- a dependant

A dependant is someone who depended on you for support and is any of the following persons:

- your or your spouse’s or common-law partner’s child or grandchild

- your or your spouse’s or common-law partner’s parent, grandparent, brother, sister, uncle, aunt, nephew, or niece who lived in Canada at any time in the year

Amounts you can claim as medical expenses

Full-time care or specialized care.

Generally, you can claim the entire amount you paid for care at any of the following facilities:

- nursing homes (full-time care)

- schools, institutions, or other places (providing care or care and training)

The care is condifered to be full-time care when a person needs constant care and attendance.

Other places could include an outpatient clinic, such as a detoxification clinic; however, they do not include a recreational facility, such as a residential summer camp, even if it caters to persons with disabilities.

Generally, you cannot claim the entire amount you paid for a retirement home or a home for seniors. However, you can claim salaries and wages for care in such facilities if the care recipient qualifies for the disability tax credit (see Salaries and wages ).

What is meant by nursing home – A nursing home is generally considered to be a facility that gives full-time care, including 24-hour nursing care, to individuals who are unable to care for themselves. Any facility could be considered a nursing home if it has the same features and characteristics as a nursing home.

All regular fees paid for full-time care in a nursing home or for specialized care or training in an institution are eligible as medical expenses, including fees for all of the following:

- accommodation

- nursing care

- administration fees

- maintenance fees

- social programming and activities fees

However, extra personal expenses (such as hairdresser fees) are not eligible.

Salaries and wages

You may be able to claim the fees for salaries and wages paid for attendant care services or care or supervision in any of the following facilities:

- self-contained domestic establishments (such as your private home)

- retirement homes, homes for seniors, or other institutions that typically provide part-time attendant care

- group homes in Canada

- nursing homes (special rules apply to this type of facility; see the chart )

Eligibility for the disability tax credit may be a requirement to claim fees for salaries and wages as medical expenses. See the reference to Form T2201, Disability Tax Credit Certificate, in the chart .

Expenses you can claim – You may be able to claim as medical expenses the salaries and wages paid to all employees who do the following tasks or services:

- food preparation

- housekeeping services for a resident’s personal living space

- laundry services for a resident’s personal items

- health care (registered nurse, practical nurse, certified health care aide, personal support worker)

- activities (social programmer)

- salon services (hairdresser, manicurist, pedicurist) if included in the monthly fee

- transportation (driver)

- security for a secured unit

If you are receiving attendant care services in your home, you can only claim for the period when you are at home and need care or help. For an expense to be eligible as a medical expense, you must either:

- be eligible for the disability tax credit

- have a written certification from a medical practitioner that states the services are necessary

Expenses you cannot claim – You cannot claim the cost of any of the following:

- rent (except the part of rent for services that help a person with daily tasks, such as laundry and housekeeping)

- cleaning supplies

- other operating costs (such as the maintenance of common areas and outside grounds)

- salaries and wages paid to employees such as administrators, receptionists, groundskeepers, janitors (for common areas), and maintenance staff

Sample statement for attendant care expenses

To claim attendant care expenses paid to a facility such as a retirement home, you have to send the CRA a detailed breakdown from the facility.

The breakdown must clearly show the amounts paid for staff salaries that apply to the tasks and services listed under Expenses you can claim . The breakdown should also take into account any subsidies that reduce the attendant care expenses (unless the subsidy is included in income and is not deductible from income).

The following sample statements show the detailed information the CRA needs.

Based on the above statement, Stephen’s eligible attendant care expenses are $8,893.

Based on the above statement, Jamie’s eligible attendant care expenses are $5,877. The amount of eligible expenses that Jamie can claim was reduced because of the subsidies received.

Special rules when claiming the disability amount

There are special rules when claiming the disability amount and attendant care as medical expenses. For information on claiming attendant care and the disability amount, see the chart below.

Type of certification needed when claiming both attendant care as medical expenses and the disability amount

The following chart shows the certification you need to claim attendant care as a medical expenses on line 33099 or 33199 of your tax return (Step 5 – Federal tax) and if you can also claim the disability amount on line 31600 or line 31800 .

In all cases , for you to claim the disability amount, the CRA has to approve Form T2201, Disability Tax Credit Certificate. Part A of Form T2201 can be completed using the digital form, by phone, or by paper form. For more information on Form T2201, the disability tax credit, and the disability amount, go to Disability tax credit .

Calculate your net federal tax by completing Step 5 of your tax return to find out what is more beneficial for you. You can also see the examples below.

If you claim the fees paid to a nursing home for full-time care as a medical expense on line 33099 or 33199 of your tax return (Step 5 – Federal tax), no one (including yourself) can claim the disability amount for the same person.

You can claim the disability amount together with the portion of the nursing home fees that relate only to salaries and wages for attendant care (up to the limit indicated in the chart above). However, you must provide a breakdown of the amounts charged by the nursing home showing the portion of payments that relate to attendant care.

Choosing what is more beneficial

The following examples show two ways to calculate your net federal tax using Step 5 – Federal tax of your tax return, in order to determine what is more beneficial for you.

Dali is 38 years old and lives in their own home. Dali's only income is a disability pension of $32,000. Dali's doctor has certified in writing that they are dependent on others for their own personal need because of a physical impairment. The Canada Revenue Agency (CRA) has approved Form T2201 for Dali. Dali pays their 43-year-old neighbour, Marge, $14,000 each year to look after them full-time. Dali can claim the amounts they pay Marge for attendant care as a medical expense.

Dali has a choice to make. See the examples of Dali's tax return for a breakdown of their claims on their tax return using both options.

Dali's first option is to claim $10,000 of their attendant care expenses as a medical expense on line 33099 and claim the disability amount of $9,428 on line 31600 . Under this option, Dali would have no federal tax to pay.

Dali's second option is to claim all $14,000 of their attendant care expenses as a medical expense, but then they would not be able to claim the disability amount. Dali's federal tax would be $294.00.

For Dali, the first option is better since it reduces their basic federal tax to zero.

Judy is a 57-year-old who earned $40,000 of pension income last year. She was seriously injured in a car accident a few years ago and now needs full-time attendant care. The CRA has approved Form T2201 for her. Last year, Judy paid $32,000 to a retirement home. Of that amount, $21,000 was her share of the salaries and wages paid to staff for full-time attendant care.

Judy has a choice to make. See the examples of Judy’s tax return for a breakdown of her claims on her tax return using both options.

Her first option is to claim $10,000 of her share of the salaries and wages as medical expenses on line 33099 and claim the disability amount of $9,428 on line 31600. Under this option, she would have to pay $715.80 in federal tax.

Her second option is to claim all of her share of salaries and wages ($21,000) as a medical expense, but then she would not be allowed to claim the disability amount. Judy's federal tax would be $480.00.

For Judy, the second option is better since it reduces her basic federal tax to $480.00.

Care, treatment, and training

This section identifies most types of care, treatment and training you can claim as medical expenses.

Bone marrow transplant – reasonable amounts paid to find a compatible donor, to arrange the transplant including legal fees and insurance premiums, and reasonable travel, board and lodging expenses for the patient, the donor, and their respective attendants.

Cancer treatment in or outside Canada, given by a medical practitioner or a public or licensed private hospital.

Cosmetic surgery – generally, expenses solely for cosmetic procedures are not eligible.

An expense for a cosmetic procedure qulifies as an eligible medical expense if it is necessary for medical or reconstructive purposes, such as surgery to address a deformity related to a congenital abnormality, a personal injury resulting from an accident or trauma, or a disfiguring disease. For more information, see Common medical expenses you cannot claim .

Egg and sperm freezing and storage – to preserve one's ova (eggs) or sperm for the purpose of conceiving a child in the future.

Fertility-related procedures – amounts paid to a medical practitioner or a public or licensed private hospital to conceive a child. Under proposed changes, certain expenses paid in respect of a surrogate mother or a donor (for example, a donor or sperm, ova, or embryos) may be eligible as of 2022 if they are incured in Canada and are of a type that would be otherwise permitted as medical expenses of the individual. See also In vitro fertility program .

Group home – see Attendant care and care in a facility .

In vitro fertility program – the amount paid to a medical practitioner or a public or licensed private hospital. Under proposed changes, fees and other amounts paid to a fertility clinic or donor bank in Canada to obtain sperm or ova (eggs) may be eligible as of 2022. The amounts must be paid to enable the conception of a child by the individual, the individual's spouse or common-law partner, or a surrogate mother on behalf of the individuals. See also Fertility-related procedures .

Laser eye surgery – the amount paid to a medical practitioner or a public or licensed private hospital.

Nursing home – see Attendant care and care in a facility .

Organ transplant – reasonable amounts paid to find a compatible donor, to arrange the transplant including legal fees and insurance premiums, and reasonable travel, board and lodging expenses for the patient, the donor, and their respective attendants.

Personalized therapy plan – the salaries and wages paid for designing a personalized therapy plan are eligible medical expenses if certain conditions are met.

The plan has to be designed for a person who is eligible for the disability tax credit (DTC) and paid to someone who is in the business of providing such services to unrelated persons.

The therapy has to be prescribed and supervised by one of the following practitioners:

- a psychologist, a medical doctor, or a nurse practitioner (for expenses incurred after September 7, 2017) for a mental impairment

- an occupational therapist, a medical doctor, or a nurse practitioner (for expenses incurred after September 7, 2017) for a physical impairment

The plan has to meet one of the following conditions:

- be needed to get public funding for specialized therapy

- be prescribed by a psychologist, a medical doctor, or a nurse practitioner (for expenses incurred after September 7, 2017 ) for a mental impairment

- be prescribed by an occupational therapist medical doctor, or a nurse practitioner (for expenses incurred after September 7, 2017) for a physical impairment

For more information about the DTC, see Guide RC4064, Disability-Related Information .

Pre-natal and post-natal treatments paid to a medical practitioner or a public or licensed private hospital.

Rehabilitative therapy including lip reading and sign language training to adjust to a person’s loss of hearing or speech loss.

Respite care expenses – see Attendant care and care in a facility .

School for persons with a mental or physical impairment – an appropriately qualified person, such as a medical practitioner or the principal or head of the school, must certify in writing that the equipment, facilities, or staff specially provided by that school are needed because of the person’s physical or mental impairment.

Therapy – the salary and wages paid for the therapy given to a person who is eligible for the disability tax credit (DTC). The person giving the therapy must not be your spouse or common-law partner and must be 18 years of age or older when the amounts are paid.

- an occupational therapist, a medical doctor, or a nurse practitioner (for expenses incurred after September 7, 2017) for a physical impairment

Training – reasonable amounts paid for you or a relative to learn to care for a relative with a mental or physical impairment who lives with you or depends on you for support. The amount has to be paid to someone who is not your spouse or common-law partner and who was 18 years of age or older when the amounts were paid.

Treatment centre for a person addicted to drugs, alcohol, or gambling. A medical practitioner must certify in writing that the person needs the specialized equipment, facilities, or staff.

Whirlpool bath treatments – the amount paid to a medical practitioner for these treatments. A hot tub that you install in your home, even if prescribed by a medical practitioner, is not eligible.

Construction and renovation

This section identifies the fees related to the changes made to a home that you can claim as medical expenses.

Driveway access – reasonable amounts paid to alter the driveway of the main place of residence of a person who has a severe and prolonged mobility impairment, to ease access to a bus.

Furnace – the amount paid for an electric or sealed combustion furnace bought to replace a furnace that is neither of these, where the replacement is necessary because of a person’s severe chronic respiratory ailment or immune system disorder – prescription needed.

Renovation or construction expenses – the amounts paid for changes that give a person access to (or greater mobility or functioning within) their home because they have a severe and prolonged mobility impairment or lack normal physical development.

Costs for renovating or altering an existing home or the incremental costs in building the person’s main place of residence may be incurred. These amounts paid minus any related rebates, such as the goods and services tax/harmonized sales tax (GST/HST), can be claimed.

Renovation or construction expenses have to be reasonable and meet both of the following conditions:

- They would not normally be expected to increase the value of the home.

- They would not normally be incurred by persons who have normal physical development or who do not have a severe and prolonged mobility impairment.

Make sure you get a breakdown of the costs. Costs could include expenses such as:

- buying and installing outdoor or indoor ramps if the person cannot use stairs

- enlarging halls and doorways to give the person access to the various rooms of their home

- lowering kitchen or bathroom cabinets so the person can use them

While these costs to renovate or alter a home to accommodate the use of a wheelchair may qualify as medical expenses under the conditions described above, these types of expenses related to other types of impairment may also qualify. In all cases, you must keep receipts and any other related documents to support your claim. Also, you must be able to show that the person’s particular circumstances and the expenses meet all of the conditions.

If the renovation expenses qualify for the home accessibility tax credit (HATC), you could claim both the HATC and the medical expenses tax credit for these expenses. For more information about the HATC, see Guide RC4064, Disability-Related Information .

Devices, equipment, and supplies

This section identifies health-related devices, equipment, and supplies you can claim as medical expenses.

Acoustic coupler – prescription required.

Air conditioner – $1,000 or 50% of the amount paid for the air conditioner, whichever is less , for a person with a severe chronic ailment, disease, or disorder – prescription needed.

Air filter, cleaner, or purifier used by a person to cope with or overcome a severe chronic respiratory ailment, or a severe chronic immune system disorder – prescription needed.

Altered auditory feedback devices for treating a speech disorder – prescription needed.

Artificial eye or limb

Assisted breathing devices that give air to the lungs under pressure, such as:

- a continuous positive airway pressure (CPAP) machine – prescription needed

- a mechanical ventilator

Audible signal devices including large bells, loud ringing bells, single stroke bells, vibrating bells, horns, and visible signals – prescription needed.

Baby breathing monitor – designed to be attached to an infant to sound an alarm if the infant stops breathing. A medical practitioner must certify in writing that the infant is at risk of sudden infant death syndrome – prescription needed.

Bathroom aids to help a person get in or out of a bathtub or shower or to get on or off a toilet – prescription needed.

Bliss symbol boards or similar devices used by a person who has a speech impairment to help the person communicate by choosing the symbols or spelling out words – prescription needed.

Blood coagulation monitors – the amount paid, including disposable peripherals such as pricking devices, lancets, and test strips, for a person who needs anti-coagulation therapy – prescription needed.

Bone conduction receiver

Braces for a limb including custom-made woven or elasticized stockings, walking casts, and boots or shoes that have braces built into them to allow a person to walk.

Braille note-taker devices used to allow a person who is blind to take notes (that can be read back to them, printed, or displayed in braille) with the help of a keyboard – prescription needed.

Braille printers, synthetic speech systems, large print-on-screen devices , and other devices designed only to help a person who is blind to use a computer – prescription needed.

Breast prosthesis because of a mastectomy – prescription needed.

Catheters, catheter trays, tubing , or other products needed for incontinence caused by illness, injury, or affliction.

Chair – power-operated guided chair to be used in a stairway, including installation – prescription needed.

Cochlear implant

Computer peripherals designed only to help a person who is blind to use a computer – prescription needed.

Dentures and dental implants

Devices or software designed to allow a person who is blind or has a severe learning disability to read print – prescription needed.

Diapers or disposable briefs for a person who is incontinent because of an illness, injury or affliction.

Elastic support hose designed only to relieve swelling caused by chronic lymphedema – prescription needed.

Electronic bone healing device – prescription needed.

Electronic speech synthesizers that allow a person who is unable to speak to communicate using a portable keyboard – prescription needed.

Electrotherapy devices for the treatment of a medical condition or a severe mobility impairment. These can include devices for transcutaneous electrical nerve stimulation, electrical muscle stimulation, and iontophoresis – prescription needed.

Environmental control system (computerized or electronic) including the basic computer system used by a person with a severe and prolonged mobility impairment – prescription needed.

Extremity pump for a person diagnosed with chronic lymphedema – prescription needed.

Hearing aids or personal assistive listening devices including repairs and batteries.

Heart monitoring devices including repairs and batteries – prescription needed.

Hospital bed including attachments – prescription needed.

Ileostomy and colostomy pads including pouches and adhesives.

Infusion pump including disposable peripherals used in treating diabetes, or a device designed to allow a person with diabetes to measure their blood sugar levels – prescription needed.

Injection pens designed to be used to give an injection, such as an insulin pen – prescription needed.

Kidney machine (dialysis) – the cost of the machine and related expenses, such as:

- repairs, maintenance, and supplies

- additions, renovations, or alterations to a home (the hospital official who installed the machine must certify in writing that they were necessary for installation)

- the part of the operating costs of the home that relate to the machine (excluding mortgage interest and capital cost allowance)

- a telephone extension in the dialysis room and all long distance calls to a hospital for advice or to obtain repairs

- necessary and unavoidable costs to transport supplies

Large print-on-screen devices designed to help a person who is blind to use a computer – prescription needed.

Laryngeal speaking aids

Lift or transportation equipment (power-operated) designed only to be used by a person with a disability to help them access different areas of a building, enter or leave a vehicle, or place a wheelchair on or in a vehicle – prescription needed.

Needles and syringes – prescription needed.

Optical scanners or similar devices designed to allow a person who is blind to read print– prescription needed.

Orthopaedic shoes, boots, and inserts – prescription needed.

Osteogenesis stimulator (inductive coupling) for treating non-union of fractures or aiding in bone fusion – prescription needed.

Oxygen and oxygen tent or other equipment necessary to administer oxygen – prescription needed.

Oxygen concentrator – amounts paid to buy, use and maintain an oxygen concentrator including electricity.

Pacemakers – prescription needed.

Page turner devices to help a person turn the pages of a book or other bound document when they have a severe and prolonged impairment that markedly restricts the person’s ability to use their arms or hands – prescription needed.

Phototherapy equipment for treating psoriasis or other skin disorders. You can claim the amount paid to buy, use, and maintain this equipment.

Pressure pulse therapy devices for treating a balance disorder – prescription needed.

Real-time captioning used by a person with a speech or hearing impairment and paid to someone in the business of providing these services.

Scooter – the amount paid for a scooter that is used instead of a wheelchair.

Spinal brace

Standing devices for standing therapy in the treatment of a severe mobility impairment – prescription needed.

Talking textbooks related to enrolment at a secondary school in Canada or a designated educational institution for a person who has a perceptual disability. A medical practitioner must certify in writing that the expense is necessary – prescription needed.

Teletypewriters or similar devices that allow a person who is deaf or unable to speak to make and receive phone calls – prescription needed.

Television closed caption decoders for a person who is deaf – prescription needed.

Truss for hernia

Van – 20% of the amount paid for a van that has been previously adapted, or is adapted within 6 months after the van was bought (minus the cost of adapting the van), to transport a person who needs to use a wheelchair, to a limit of $5,000 (for residents of Ontario, the provincial limit is $8,204).

Vehicle device designed only to allow a person with a mobility impairment to drive the vehicle – prescription needed.

Vision devices – including eyeglasses, contact lenses and prescription swimming goggles to correct eyesight – prescription needed.

Visual or vibratory signalling device used by a person with a hearing impairment – prescription needed.

Voice recognition software used by a person who has an impairment in physical functions. A medical practitioner must certify in writing that the software is necessary.

Volume control feature (additional) used by a person who has a hearing impairment – prescription needed.

Walking aids – the amount paid for devices designed only to help a person who has a mobility impairment – prescription needed.

Water filter, cleaner, or purifier used by a person to cope with or overcome a severe chronic respiratory ailment, or a severe chronic immune system disorder – prescription needed.

Wheelchairs and wheelchair carriers

Wigs – the amount paid for a person who has suffered abnormal hair loss because of a disease, accident, or medical treatment – prescription needed.

Gluten-free food products

Persons with celiac disease can claim the incremental costs associated with buying gluten-free food products as a medical expense.

Incremental cost of gluten-free products

The incremental cost of buying gluten-free food products is the cost of gluten-free product minus the cost of similar products with gluten.

Eligible food products

Generally, the food products are limited to those produced and marketed specifically for gluten-free diets, such as gluten-free bread.

Other products can also be eligible if they are used by the person with celiac disease to make gluten-free products for their own use. This includes, but is not limited to, rice flour and gluten-free spices.

If several people eat the product, only the costs related to the part of the product that is eaten by the person with celiac disease may be claimed as a medical expense.

Documents you need to keep

Do not send your supporting documents. Keep them in case the CRA asks to see them later. You will need to keep all of the following documents:

- a letter from a medical practitioner that certifies that the person has celiac disease and needs a gluten-free diet

- receipts for each gluten-free food product that is claimed

- a summary of each food product that was bought during the 12-month period for which the expenses are being claimed

Prescribed drugs, medications, and other substances

This section identifies prescribed drugs, medications, and other substances you can claim as medical expenses.

Drugs and medical devices bought under Health Canada’s Special Access Program – the amounts paid for drugs and medical devices that have not been approved for use in Canada, if they were purchased under this program. For more information, visit Health Canada .

Insulin or substitutes – prescription needed.

Liver extract injections for a person with pernicious anaemia – prescription needed.

Medical cannabis (marihuana) – the amounts paid for cannabis, cannabis oil, cannabis plant seeds, or cannabis products purchased for medical purposes from a holder of a licence for sale (as defined in subsection 264(1) of the Cannabis Regulations ). The patient must be a holder of a medical document (as defined in subsection 264(1) of the Cannabis Regulations). The Cannabis Regulations require that the patient be registered as a client of the holder of a licence for sale and require the patient to make their purchases from the holder they are registered with.

Where a patient has a registration certificate that allows them to legally produce a limited amount of cannabis for their own medical purposes, the cost of growing and producing cannabis for medical purposes (other than the cost of cannabis plant seeds and cannabis), such as pots, soil, nutrients, and lights, is not an eligible medical expense.

Prescription drugs and medications that can lawfully be obtained for use by the person only if prescribed by a medical practitioner. Also, the drugs or medications must be recorded by a pharmacist. You cannot claim over-the-counter medications, vitamins, or supplements, even if prescribed by a medical practitioner (except vitamin B12 ).

Vaccines – prescription needed.

Vitamin B12 therapy for a person with pernicious anaemia (either by injections, pills, or other methods) – prescription needed.

Service animals

The cost of a specially trained animal to assist in coping with an impairment for a person who is in any of the following situations. The person:

- is profoundly deaf

- has a severe and prolonged physical impairment that markedly restricts the use of their arms or legs

- is severely affected by autism or epilepsy

- has severe diabetes (for expenses incurred after 2013)

- has a severe mental impairment (for expenses incurred after 2017). The animal must be specially trained to perform specific tasks that assist the person in coping with the impairment. An animal that only provides emotional support is not considered to be specially trained for a specific task

In addition to the cost of the animal, the care and maintenance (including food and veterinarian care) are eligible expenses.

Reasonable travel expenses for the person to go to a school, institution, or other place that trains them in handling such an animal (including reasonable board and lodging for full-time attendance at the school) are eligible expenses. The training of such animals has to be one of the main purposes of the person or organization that provides the animal.

Services and fees

This section identifies the services and fees you can claim as medical expenses.

Ambulance service to or from a public or licensed private hospital.

Certificates – the amount paid to a medical practitioner for filling out and providing more information for Form T2201 and other certificates.

Deaf-blind intervening services used by a person who is blind and profoundly deaf when paid to someone in the business of providing these services.

Dental services – paid to a medical practitioner or a dentist. Expenses for purely cosmetic procedures are not eligible. For more information, see Common medical expenses you cannot claim .

Electrolysis – only amounts paid to a qualified medical practitioner. Expenses for purely cosmetic procedures are not eligible. For more information, see Common medical expenses you cannot claim .

Hospital services – public or private, that are licensed as hospitals by the province, territory, or jurisdiction they are located in.

Laboratory procedures or services including necessary interpretations – prescription needed.

COVID-19 tests, such as those for travel, would still need a prescription, even if they are mandatory.

Medical services by medical practitioners – to verify if a specific profession is recognized by a province or territory for the purposes of claiming medical expenses, go to Authorized medical practitioners for the purposes of the medical expense tax credit .

Medical services outside of Canada – if you travel outside Canada to get medical services, you can claim the amounts you paid to a medical practitioner and a public or licensed private hospital. A "licensed private hospital" is a hospital licensed by the jurisdiction that it operates in.

Moving expenses – reasonable moving expenses (that have not been claimed as moving expenses on anyone’s tax return) to move a person who has a severe and prolonged mobility impairment, or who lacks normal physical development, to housing that is more accessible to the person or in which the person is more mobile or functional, to a limit of $2,000 (for residents of Ontario, the provincial limit is $3,282).

Note-taking services used by a person with an impairment in physical or mental functions and paid to someone in the business of providing these services. A medical practitioner must certify in writing that these services are needed.

Nurse – the amount paid for services of an authorized nurse.

Orthodontic work including braces paid to a medical practitioner or a dentist. Expenses for purely cosmetic procedures are not eligible. For more information, see Common medical expenses you cannot claim .

Premiums paid to private health services plans including medical, dental, and hospitalization plans. They can be claimed as a medical expense, as long as 90% or more of the premiums paid under the plan are for eligible medical expenses.

Reading services used by a person who is blind or has a severe learning disability and paid to someone in the business of providing these services. A medical practitioner must certify in writing that these services are needed.

Sign language interpretation services used by a person with a speech or hearing impairment and paid to someone in the business of providing these services.

Tests – the cost of medical tests such as electrocardiographs, electrocardiograms, metabolism tests, radiological services or procedures, spinal fluid tests, stool examinations, sugar content tests, urine analysis, and x-ray services. Also, you can claim the cost of any related interpretation or diagnosis – prescription needed.

Tutoring services that are additional to the primary education of a person with a learning disability or an impairment in mental functions, and paid to a person in the business of providing these services to individuals who are not related to the person. A medical practitioner must certify in writing that these services are needed.

Travel expenses

This section explains which travel expenses you can claim as medical expenses.

Expenses you can claim

To claim transportation and travel expenses, all of the following conditions must be met:

- Substantially equivalent medical services were not available near your home.

- You took a reasonably direct travelling route.

- It is reasonable, under the circumstances, for you to have travelled to that place for those medical services.

If a medical practitioner certifies in writing that you were not able to travel alone to get medical services, you can also claim the transportation and travel expenses of an attendant.

If you have travel expenses related to medical services and you also qualify for northern residents deductions (line 25500 of your tax return), you may be able to choose how to claim your expenses. For more information, see Form T2222, Northern Residents Deductions .

At least 40 kilometres

If you had to travel at least 40 kilometres (one way) from your home to get medical services, you may be able to claim the public transportation expenses you paid (for example, taxis, bus, or train) as medical expenses. Where public transportation is not readily available, you may be able to claim vehicle expenses.

At least 80 kilometres

If you had to travel at least 80 kilometres (one way) from your home to get medical services, you may be able to claim accommodation, meal, and parking expenses in addition to your transportation expenses as medical expenses. This may include travelling outside Canada.

Meal and vehicle expenses

You can choose to use the detailed or simplified method for calculating meal and vehicle expenses. If you use the detailed method, you have to keep all receipts and records for your 12-month period.

For more information and to find out about the rates used to calculate these travel expenses, go to Meal and vehicle rates used to calculate travel expenses or call the CRA's Tax Information Phone Service at 1-800-267-6999 .

Accommodations

You must keep receipts for all accommodation expenses and you must be able to show that the amount paid for accommodation is necessary because of the distance travelled and your medical condition. Claim the amount for accommodation as shown on your receipts.

Expenses you cannot claim

If you traveled less than 40 kilometres from your home to get medical services, you cannot claim travel expenses as medical expenses. You also cannot claim travel expenses if you travel only to pick up a device or medication.

Paul lives in St-Hyacinthe and had to travel over 40 kilometres one way (but less than 80 kilometres) to Montréal to get medical services because similar services were not available within 40 kilometres of his home. He had to use his vehicle because no public transportation was readily available.

Paul can claim his vehicle expenses. He can choose the detailed or simplified method to calculate the amount to claim on his tax return.

Maria had to travel with her son Michael from Sydney to Halifax (over 80 kilometres one way) to get medical services for herself. Maria’s doctor gave her a letter certifying that she was not able to travel without an attendant.

Since similar medical services were not available near her home, Maria took a direct travelling route, and it was reasonable, under the circumstances, for her to travel to Halifax to get medical services.

The day after they arrived in Halifax, Maria checked into the hospital for surgery and had to stay for two weeks .

Michael stayed in a hotel nearby and during the day, helped her with meals and personal care at the hospital. Michael drove his mother back to Sydney afterwards.

Maria can claim all reasonable travel expenses for herself and her son while en route, to and from Halifax and for the two-week period of medical services in Halifax.

Jennifer had to travel from Prince Rupert to Vancouver (over 80 kilometres one way) to get medical services. Her husband Stephen drove her there. Jennifer stayed in the hospital in Vancouver for three weeks but Stephen drove back to Prince Rupert after dropping her off at the hospital. Jennifer’s doctor gave her a letter certifying that she was not able to travel without an attendant.

Since similar medical services were not available near her home, Jennifer took a direct travelling route, and it was reasonable, under the circumstances, for her to travel to Vancouver to get medical services.

Stephen came to visit Jennifer once during her three-week stay in the hospital. When Jennifer was ready to go home, Stephen drove to Vancouver to take her home.

Jennifer can claim reasonable travel expenses for herself and her husband for the trip from Prince Rupert to Vancouver and then for the drive back home. However, neither Jennifer nor Stephen can claim any expenses for the trip Stephen made to visit Jennifer in the hospital.

John had to travel from Winnipeg to Germany (over 80 kilometres one way) to get medical services. He flew there and back, and stayed at a hotel for one week while he received the services from a medical practitioner.

Since similar medical services were not available near his home, John took a direct travelling route, and it was reasonable, under the circumstances, for him to travel to Germany to get medical services.

John can claim all reasonable travel expenses for himself while en route, to and from Germany and for the one week period of medical services in Germany.

Common medical expenses you cannot claim

There are some expenses that are commonly claimed as medical expenses in error. The expenses you cannot claim include the following:

- athletic or fitness club fees

- birth control devices (non-prescription)

- blood pressure monitors

- liposuction

- hair replacement procedures

- filler injections (for removing wrinkles)

- teeth whitening

A cosmetic surgery expense may qualify as a medical expense if it is necessary for medical or reconstructive purposes, such as surgery to address a deformity related to a congenital abnormality, a personal injury resulting from an accident or trauma, or a disfiguring disease;

- diaper services

- health plan premiums paid by an employer and not included in your income

- liquid meal replacement products

- mobile applications that help a person manage their blood glucose level (without actually measuring it)

- nebulizer to turn liquid medicine into a fine mist that can be inhaled

- organic food

- over-the-counter medications, vitamins, and supplements, even if prescribed by a medical practitioner (except vitamin B12 )

- personal response systems such as Lifeline and Health Line Services

- provincial and territorial plans such as the Alberta Health Care Insurance Plan and the Ontario Health Insurance Plan (for a complete list of non-eligible plans, go to Lines 33099 and 33199 – Eligible medical expenses you can claim on your return )

- radon testing (for example, a radon test kit or the services of a radon measurement professional) or a radon mitigation treatment system (including installation)

- the part of medical expenses (including travel expenses) for which you can get reimbursed, such as reimbursements from a private insurance

If you are filing your tax return electronically or on paper, do not send any supporting documents. Keep them in case the CRA asks to see them later.

Receipts must show the name of the company or individual to whom an expense was paid. Receipts for attendant care or therapy paid to an individual should also show the individual’s social insurance number.

Receipts should also show the purpose of the payment, the date of payment, the name of the patient, and, if applicable, the medical practitioner who prescribed the purchase or gave the service.

In addition to receipts, the CRA may ask to see proof of payment, such as bank or credit card statements. If you are claiming amounts for a dependant who is 18 or older, the CRA may ask you for proof of support, such as a lease agreement or grocery receipts.

Digital services for individuals

The CRA’s digital services are fast, easy, and secure!

My Account lets you view and manage your personal income tax and benefit information online. Use My Account throughout the year to:

- view your benefit and credit information and apply for certain benefits

- view your notice of assessment or reassessment

- view uncashed cheques and request a replacement payment

- change your address, phone numbers, direct deposit information, marital status, and information about children in your care

- manage notification preferences and receive email notifications when important changes are made to your account

- check your tax-free savings account (TFSA) contribution room, your registered retirement savings plan (RRSP) deduction limit, and your first home savings account (FHSA) participation room

- track the progress of certain files you have submitted to the CRA

- make a payment online to the CRA with the My Payment service, create a pre-authorized debit (PAD) agreement, or create a QR code to pay in person at Canada Post for a fee. For more information on how to make a payment, go to Payments to the CRA

- view and print your proof of income statement

- manage authorized representatives and authorization requests

- submit documents to the CRA

- submit an audit enquiry

- link between your CRA My Account and Employment and Social Development Canada (ESDC) My Service Canada Account

- manage Multi-factor authentification settings

To sign in to or register for the CRA's digital services, go to:

- My Account if you are an individual

- Represent a Client if you are an authorized representative

Receive your CRA mail online

Set your correspondence preference to "Electronic mail" to receive email notifications when CRA mail, like your notice of assessment, is available in your account.

For more information, go to Email notifications from the CRA .

For more information

If you need help.

If you need more information after reading this guide, go to Eligible medical expenses you can claim on your tax return or call 1-800-959-8281 .

Direct deposit

Direct deposit is a fast, convenient, and secure way to receive your CRA payments directly into your account at a financial institution in Canada. For more information and ways to enrol, go to Direct deposit or contact your financial institution.

Forms and publications

The CRA encourages you to file your return electronically. If you need a paper version of the CRA's forms and publications, go to Forms and publications or call 1-800-959-8281 .

Electronic mailing lists

The CRA can send you an email when new information on a subject of interest to you is available on the website. To subscribe to the electronic mailing lists, go to Electronic mailing lists .

Tax Information Phone Service (TIPS)

For tax information by telephone, use the CRA's automated service, TIPS, by calling 1-800-267-6999 .

Teletypewriter (TTY) users

If you use a TTY for a hearing or speech impairment, call 1-800-665-0354 .

If you use an operator-assisted relay service , call the CRA's regular telephone numbers instead of the TTY number.

Formal disputes (objections and appeals)

You have the right to file an objection if you disagree with an assessement, determination, or decision.

For more information about objections and related deadlines, go to File an objection .

CRA Service Feedback Program

Service complaints.

You can expect to be treated fairly under clear and established rules, and get a high level of service each time you deal with the CRA. For more information about the Taxpayer Bill of Rights, see the Taxpayer Bill of Rights .

You may provide compliments or suggestions, and if you are not satisfied with the service you received:

- Try to resolve the matter with the employee you have been dealing with or call the telephone number provided in the correspondence you received from the CRA. If you do not have contact information for the CRA, go to Contact information .

- If you have not been able to resolve your service-related issue, you can ask to discuss the matter with the employee’s supervisor.

- If the problem is still not resolved, you can file a service-related complaint by filling out Form RC193, Service Feedback . For more information on how to file a complaint, go to Submit a service feedback .

If you are not satisfied with how the CRA has handled your service related complaint, you can submit a complaint with the Office of the Taxpayers’ Ombudsperson .

Reprisal complaints

If you have received a response regarding a previously submitted service complaint or a formal review of a CRA decision and feel that you were treated impartially by a CRA employee, you can submit a reprisal complaint by filling out Form RC459, Reprisal Complaint .

For more information about complaints and disputes, go to Reprisal complaints .

Acoustic coupler

Air conditioner

Air filter, cleaner, or purifier

Altered auditory feedback devices

Ambulance service

Assisted breathing devices

Attendant care expenses

Audible signal devices

Baby breathing monitor

Bathroom aids

Bliss symbol boards

Blood coagulation monitors

Bone marrow transplant

Braces for a limb

Braille note-taker devices

Braille printers, synthetic speech systems, large print-on-screen devices

Breast prosthesis

Cancer treatment

Cannabis – see Medical cannabis (marihuana)

Catheters, catheter trays tubing

Certificates

Computer peripherals

Construction expenses – see Renovation or construction expenses

Cosmetic surgery

Deaf-blind intervening services

Dental services

Devices or software

Dialysis (kidney machine)

Diapers or disposable briefs

Driveway access

Drugs and medical devices bought under Health Canada’s Special Access Program

Egg and sperm freezing and storage

Elastic support hose

Electrolysis

Electronic bone healing device

Electronic speech synthesizers

Electrotherapy devices

Environmental control system (computerized or electronic)

Extremity pump

Fertility-related procedures

Glasses – see Vision devices

Group home – see Attendant care and care in a facility

Hearing aids

Heart monitoring devices

Hernia – see Truss for hernia

Hospital bed

Hospital services

Hot tub – see Whirlpool bath treatments

Ileostomy and colostomy pads

Infusion pump

Injection pens

Insulin or substitutes

In vitro fertility program

Kidney machine – see Dialysis (kidney machine)

Laboratory procedures or services

Large print-on-screen devices

Laser eye surgery

Lift or transportation equipment

Liver extract injections

Medical cannabis (marihuana)

Medical devices bought under Health Canada’s Special Access Program – see Drugs and medical devices bought under Health Canada’s Special Access Program

Medical services provided by qualified medical practitioners

Medical services provided outside of Canada

Moving expenses

Needles and syringes

Note-taking services

Nursing home – see Attendant care and care in a facility

Optical scanners

Organ transplant

Orthodontic work

Orthopaedic shoes, boots, and inserts

Osteogenesis stimulator (inductive coupling)

Ova – see In vitro fertility program

Ova freezing – see Egg and sperm freezing and storage

Oxygen and oxygen tent

Oxygen concentrator

Page turner devices

Personalized therapy plan

Phototherapy equipment

Premiums paid to private health services plans

Pre-natal and post-natal treatments

Prescription drugs and medications

Pressure pulse therapy devices

Radon testing

Reading services

Real-time captioning

Rehabilitative therapy

Renovation or construction expenses

Respite care expenses – see Attendant care and care in a facility

School for persons with an impairment in physical or mental functions

Sign-language interpretation services

Software – see Devices or software

Sperm – see In vitro fertility program

Sperm freezing – see Egg and sperm freezing and storage

Standing devices

Surrogate mother – see Fertility-related procedures

Syringes – see Needles and syringes

Talking textbooks

Teletypewriters

Television closed caption decoders

Transportation equipment – see Lift or transportation equipment

Treatment centre

Tutoring services

Vehicle device

Vision devices

Visual or vibratory signalling device

Vitamin B12

Voice recognition software

Volume control feature (additional)

Walking aids

Walking cast – see Braces for a limb

Water filter, cleaner or purifier

Whirlpool bath treatments

Page details

How to claim CRA medical travel expenses for 2023

The costs involved with traveling to receive medical attention can be significant when you factor in accommodation, meals, and related expenses.

Find out how to claim your CRA medical travel expenses.

IMPORTANT: All claims related to Medical Travel require documentation provided by the practitioner confirming your attendance (whether this be a receipt for services, or a letter signed by your service provider).

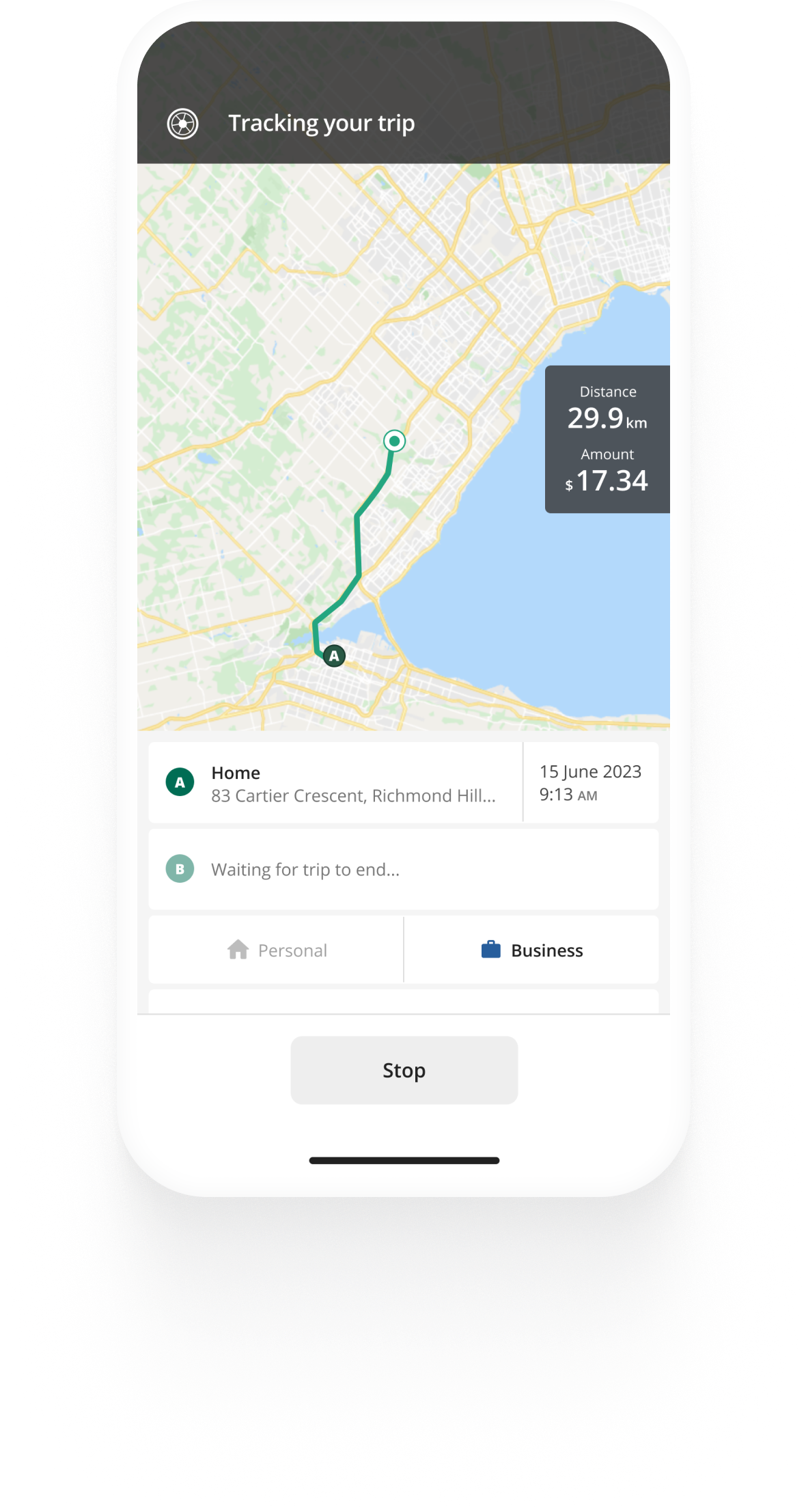

Claiming Mileage

There are two ways to claim transportation costs as a CRA travel medical expense but you have to travel at least 40 kilometers one way to obtain medical service that were not available locally.

Example: for trips to and from the hospital, clinic, or doctor’s office.

Record the distance of travel, calculate your mileage according to the province in which you reside. (2021 rates):

Example: 55¢ x 160km = $88.00; you may claim $88.00 as an eligible medical expense.

Vehicle expenses may be claimed as CRA medical travel expenses by submitting gas receipts for the date(s) of travel/service.

Claiming Meals, Accommodations and Parking

In addition to the transportation costs above, you may claim reasonable expenses during your trip for medical attention provided that you had to travel more than 80 kilometers to attend your appointment. The travel costs of one accompanying individual are also allowable, if it is deemed necessary to have a companion.

Meals can be claimed one of two ways: 1. Meal receipts can be submitted for reasonable costs for the patient and one attendant (alcoholic beverages will not be reimbursed) OR 2. A flat rate of $23 per meal may be claimed for the patient and one attendant up to a maximum of $69 per day per person.

Accommodations

Receipts must be enclosed for any reasonable accommodation fees that are being claimed (ie: hotel receipt). Coverage applies to the accommodations ONLY; telephone, movie charges and the like are not eligible for reimbursement.

Receipts must be enclosed for any parking lot fees incurred. Please refer to the CRA medical travel expenses website for further details

A farmer lives in rural Alberta. There is not much in the way of medical services, vision care, or therapeutic care, such as physiotherapy, available in this small town. Consequently, most treatment modalities require travelling to a center that has the appropriate medical facilities. The closest center is 44 kilometers from their home.

On a recent trip, they had chiropractic services performed and managed to visit the dentist for a check-up and teeth cleaning. They were eligible to be reimbursed for the cost of the travel between their home and where the services took place.

In Alberta, that amounts to 53 cents a kilometer – so they were also able to claim $46.64 for travel expenses (there and back). An alternative is to submit gas receipts for the dates of travel service.

On occasion, the same farmer requires a medical service that was only available on a timely basis in a major medical facility in the USA. This service was available in Canada but the wait time was over six months and the inconvenience to our customer as a result of their condition necessitated a faster remedy. They chose the US destination for the service.

As the travel distance now exceeded 80 Kilometers, in addition to the travel costs (economy class air fare), our customer can claim reimbursement for meals, accommodations, parking as well as the costs associated with a companion travelling with the patient if deemed necessary. An eligible travel expense claim of this magnitude represents a significant savings.

How to write off 100% your medical expenses

Are you an incorporated business owner with no arm's length employees? Learn how to use a Health Spending Account to pay for your medical expenses through your corporation:

Do you own a corporation with arm's length employees? Discover a tax deductible health and dental plan that has no premiums:

Write off 100% of your medical expenses

Are you an incorporated business owner with no employees? Learn how to use a Health Spending Account to pay for your medical expenses through your corporation:

Do you own a corporation with employees? Discover a tax deductible health and dental plan that has no premiums:

What's in this article

Subscribe to the blog

Discover more.

What is a health care spending account?

Health care spending accounts help business owners save on medical costs by turning after-tax...

By Alden Hui on December 8, 2020

What's covered in a Health Spending Account?

One of the great benefits of a Health Spending Account is the freedom it provides through an ...

By Alden Hui on October 15, 2019

7 Key Health Spending Account Rules that you should know

A Health Spending Account (HSA) is a tax-free benefit which allows small business owners and their...

By Alden Hui on April 25, 2019

This website stores cookies on your computer. To find out more about the cookies we use, see our Privacy Policy .

If devices mentioned above have not been purchased directly from a doctor, dentist, nurse or hospital , make sure you have something in writing from your medical practitioner to indicate that the device is medically required.

If you're not sure if your medical expense qualifies, follow the links below to Canada Revenue Agency information.

Cannabis as an Eligible Medical Expense

Income tax act s. 118.2(2)(u), cannabis regulations s. 264(1).

Previously, the cost of cannabis products could be eligible for the medical expense tax credit (METC) when they were purchased for a patient for medical purposes as per the Access to Cannabis for Medical Purposes Regulations , under the Controlled Drugs and Substances Act .

With the legalization of cannabis, as of October 17, 2018, eligible medical expenses include, for a patient who is the holder of an appropriate medical document , the cost of cannabis, cannabis oil, cannabis plant seeds or cannabis products purchased for medical purposes from a holder of a licence for sale for medical purposes of cannabis products. The individual purchasing the cannabis product must be registered as a client of the holder of a licence for sale. This measure was included in Bill C-97 which received Royal Assent in June 2019. See Licensed cultivators, processors and sellers of cannabis under the Cannabis Act .

Cannabis-related Definitions under the Cannabis Regulations s. 264(1):

Cosmetic procedures, taxtips.ca resources, canada revenue agency (cra) resources.

- Details of medical expenses

Meal and vehicle rates used to calculate travel expenses for medical travel for each province - 2022 rates will be available in 2023

Income Tax Folios:

Revised: March 22, 2024

Medical expenses you don’t want to forget to claim in 2022.

7 février 2022.

Medical expenses are one of the most (if not the most) overlooked non-refundable tax deductions. Most Canadians know that they can claim some of their medical expenses, but many are unsure of what and how much they can claim.

In this article, we’ll go over what medical expenses are tax deductible, common expenses you can claim, and who you can claim medical expenses for.

To jump ahead in this article, click on the section that you need:

What counts as a medical expense?

Common medical expenses.

Commonly missed medical expenses..

Who can you claim medical expenses for?

What counts as medical expenses for tax purposes?

When it comes to medical expenses you can claim, we understand this can be a confusing area. You can claim eligible medical expenses on your return if the expenses were:

- Paid by you or your spouse (common-law partners included).

- Paid in any 12-month period ending in 2021.

- Not claimed by you or by anyone else in 2020.

You can also claim all amounts paid, even if they weren’t paid in Canada. You can claim medical expenses for any 12-month period ending in 2021 and that you haven't already claimed in 2020. For example, for the 2021 tax year, you could claim expenses paid in 2020 and in 2021.

You can claim all or a portion of the medical expenses for which you’ve not been or will not be reimbursed . For example, let's say your health insurance plan reimbursed you for 80% of your medical expenses, you can only claim the remaining 20% on your return.

This brings us to the next question: what are eligible medical expenses? We’ll break this section down into two parts:

- Common medical expenses

- Commonly missed medical expenses

It’s important to make sure your expense is eligible in your province or territory. The Canada Revenue Agency (CRA) does admit that its list isn’t exhaustive.

To search a medical expense by name, or to see if you require a prescription, you can check out the CRA Medical Expense Chart .

Some common medical expenses can include:

- Prescription medication and drugs, although this doesn’t include over-the-counter medication.

- Amounts charged by medical practitioners (although the types of medical practitioners that qualify will vary depending on your province or territory, so double check on the CRA website ).

- Bathroom aids (grab bars, grips, and rails).

- Hearing aids.

- Hospital care.

- Travel expenses to receive medical care outside your community if you travel more than 40 kilometres and the medical services are not available where you live.

- Insulin, needles, syringes to treat diabetes.

- Contact lenses, including equipment and materials for using contacts.

- Private health insurance premiums for medical care coverage.

- Medical Cannabis (the amounts paid for cannabis, cannabis oil, cannabis plant seeds, or cannabis products) if registered with a licensed supplier.

- Service animal costs which can include including food and veterinarian care.

- Ambulance service to or from a public or licensed private hospital.

It’s worth noting that you’ll need to hold on to your receipts when you claim these costs. If you file a paper return, you’ll have to attach your receipts. But it’s also good practice to save all your receipts if you file electronically in case the CRA requests them at a later date.

Now, we get that understanding which medical expenses are eligible in the eyes of the CRA isn’t easy. Some medical expenses that improve the life of someone living with a medical condition can qualify as a valid expense for tax purposes. But bear in mind that some of these might require a doctor’s prescription.

Such expenses can include:

- Birth control pills prescribed by a doctor.

- Renovation or construction costs to help with access or greater mobility within one’s home, but certain conditions apply.

- Cosmetic and plastic surgery that is reconstructive or medical in nature (for example, artificial teeth, nose reconstructive surgery if resulting from an accident or disfiguring disease).

- Appliances like a furnace or air conditioner where it is prescribed because of a severe chronic respiratory ailment or immune system disorder.

- Gluten-free products for those with celiac disease.

- Tutoring for children with disabilities.

- Prescription sunglasses.

The same rules about holding on to your receipts would apply here too. So, unless you’re filing a paper return (in which you would have to attach all your receipts), hold on to any receipt in case the CRA requests to review them.

Who can I claim medical expenses for?

You can claim medical expenses for:

- Your spouse or common-law partner or

- Your or your spouse’s children under the age of 18

- Other relatives who depend on you for support (such as your or your spouse’s child or grandchild over 18, parent, grandparent, brother, sister, uncle, aunt, niece, or nephew) – these are claimed under the dependant’s section in H&R Block’s tax software. Refer to our online Help Centre article for more information on claiming medical expenses for other dependants.

Still have a few more questions about how to claim medical expenses, or who should claim medical expenses and more? Check out our Help Article on medical expenses for more details!

Still have a couple of questions about medical expenses or feeling ready to file your return? H&R Block is here to help you get the most out of your return in whichever way is most comfortable for you. Choose from one of four convenient ways to file: File in an Office , Drop-off at an Office , Remote Tax Expert , or Do It Yourself Tax Software .

Partager cet article

Articles connexes, getting into the weeds – claiming cannabis on your tax return., 28 janvier 2019, filing taxes for a senior 7 things you can do to maximize their return., 18 janvier 2017, 6 things to know about childcare expenses., 16 février 2022, weirdest things canadians have tried to claim on their taxes., 12 décembre 2018, obtenir notre infolettre..

Nous l'envoyons une fois par semaine, avec uniquement le meilleur contenu.

Don’t fill this out if you’re human:

En cliquant sur le bouton Soumettre ci-dessous, vous consentez à recevoir des messages électroniques de H&R Block Canada au sujet des offres de produits, conseils d’impôt et matériel promotionnel. Vous pouvez retirer votre consentement n’importe quand en nous envoyant un courriel à [email protected] .

Track mileage automatically

Medical travel expenses, in this article, medical travel expenses you can claim, how to claim medical mileage from the cra.

You can claim a range of expenses for medical-related costs from the CRA. An important cost you can deduct on your tax return is medical travel expenses when you drive or use public transport to reach a medical centre that provides the medical care you need.

Track business driving with ease

Trusted by millions of drivers

You can claim medical mileage from the CRA if you travel over 40 kilometres in one direction in order to receive medical attention. In order for your mileage to qualify, you must observe the following rules from the CRA:

- You weren’t able to receive the medical care you needed near your home

- You took a reasonably direct route to the medical facility

- It was reasonable for you to travel to the specific medical facility in order to receive the needed medical service

You can claim mileage with your own car or a rented one, as well as any public transport costs such as bus, taxi and train fares if that was your mode of transportation.

The CRA provides two methods with which you can claim medical travel expenses - the simplified and detailed methods.

With the simplified method , you can use a flat per-kilometre rate to claim medical travel expenses. Each province and territory has a different cents per kilometre rate. With the detailed method, you can claim your actual medical travel expenses.

You can only use one method during a tax year.

If you use the simplified method for claiming medical travel expenses, it is highly recommended that you keep track of your medical mileage, as the CRA may ask for proof of your claim.

If you decide to use the detailed method in order to claim medical travel expenses, you will need to keep all receipts related to your medical mileage. These can include gas, fuel, oil, tyres, insurance, maintenance and repairs receipts for your vehicle, and bus, taxi and train tickets. You also need to keep track of your mileage, including your total mileage and mileage related to medical purposes.

If you use your vehicle to travel for medical purposes, you can find the percentage of medical mileage by dividing your medical travel by the total travel for the year. You will be able to claim a percentage of your fixed and variable costs to maintain and drive your vehicle equal to the percentage of medical travel you had during the year. For example, if 3% of your total kilometres were for medical purposes, you will be able to claim 3% of your vehicle expenses during the year.

Learn more about medical travel and other medical expenses you can claim and see the flat per-kilometre rates for the simplified method.

Do you also use your vehicle for work-related travel? See our CRA guide on mileage allowance and deductions where you’ll learn how to claim work-related travel and what records you need to keep.

How to automate your mileage logbook

Automate your logbook

Related posts, per diem allowance.

In Canada, Per diem often refers to a meal or travel allowance. The CRA doesn’t set fixed rates, so what is a fair rate, and what about tax?

CRA Mileage Rate 2024

The CRA announces 2024 rates for vehicle allowance: From January 1st, 2024, per kilometre rates will increase 2 cents over 2023.

Company Cars vs Car Allowance: Which Is Best for Your Company?

See the pros and cons of company cars and car allowances in Canada and decide which is right for your company - make the best choice for your business & employees.

Choose your Country or region

This browser is not supported. Please use another browser to view this site.

- Credit cards

- Newcomers to Canada

- ETF finder tool

- Best crypto

- Couch potato

- Fixed rates

- Variable rates

- Mortgage payment calculator

- Income property

- Renovations + maintenance

- Compound interest calculator

- Household finances

- Find a Qualified Advisor Tool

- Monthly budget template

- ETF Finder Tool

- Student money

- First-time home buyers

- A Guide For New Immigrants

- Best dividend stocks

- Best online brokers

- Where to buy real estate

- Best robo-advisors

- Making sense of the markets

Ask a Planner

- A Rich Life

- Interviews + profiles

- Retired Money

Advertisement

By Jason Heath, CFP on February 23, 2021 Estimated reading time: 3 minutes

You may be able to claim these commonly overlooked medical expenses on your tax return

Several medical expenses are eligible for a tax credit. Here are a few Canadians should consider at tax time.

Whether you do your own taxes or enlist professional help, you want to avoid leaving money on the proverbial table. Yet, a number of medical expenses are commonly overlooked by taxpayers when filing their tax returns.

Medical expenses may be eligible for a federal non-refundable tax credit on your tax return. To be eligible, expenses must exceed a limit of 3% of your net income, subject to a maximum threshold of $2,397 for 2020 (applies to income of $79,900 and above). Provincial and territorial non-refundable tax credits have maximum thresholds ranging from $1,637 to $2,503.

Here are some common medical expenses you may be able to claim on your 2020 income tax return:

Health plans

Premiums you pay for medical and dental plans, as well as the out-of-pocket (co-pay) portion of medical expenses submitted to the plan are eligible. Premiums paid by payroll deduction may be reported on your T4 slip in the “other information” section in box 85 or on your final pay stub for the year.