- NYC subway map

- New York City travel guide

New York City trip planner

Nycmoov.com is a free mapping and route planning service for getting around New York City. You can find the fastest route and compare trips in all modes of transport such as subway, metro, bus , ferry, bike, pedestrian, and car for all over New York City. You can also get in real time the subway and bus schedule as well as the alerts published by MTA.

">Getting around New York City

Trip planner, schedule & map, stations near me.

MTA subway trains, buses, metro and rails trains, and ferries

About the public transport in New York City

The New York City Subway is a metropolitan transportation system serving New York City in the United States. All public transportation infrastructure is owned by the City of New York, which has transferred the operation of the network to the Metropolitan Transportation Authority (MTA) .

With more than 5 million riders per weekday, the subway is the busiest means of public transport in the New York megalopolis. It has 425 stations with 472 stops on 24 lines spread over 236 miles, making it the world leader in terms of the number of lines and stations served. The lines are almost exclusively underground in Manhattan, while they are mostly overhead in the rest of the city.

The bus networks, the Metro-North Railroad, the Staten Island Railway and the Long Island Rail Road are also managed by MTA.

- Fares and Tolls

- Access-A-Ride Paratransit

- Accessibility

- About the MTA

- Give feedback

- Sign up for service alerts

- New York City Transit

- Bridges & Tunnels

- Long Island Rail Road

- Metro-North Railroad

- Other agencies and departments

- Planned Service Changes

- Elevator & Escalator Status

- Safety and Security

- Transparency

- Contact the MTA

- Media Relations

- Procurement and solicitations

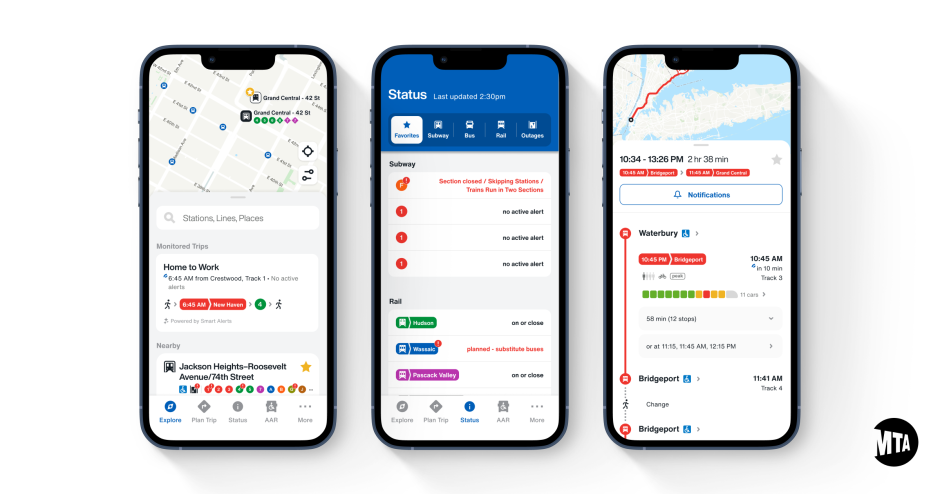

Our official apps: MYmta, TrainTime

About our apps.

Our flagship apps, MYmta and TrainTime, make it easy to find your best transit option, whether you’re traveling on the subway, bus, Long Island Rail Road, or Metro-North Railroad.

Our apps include tools that help you easily navigate your trip. You can plan and save trips, see real-time arrival and service status information, and get help right in the apps. With TrainTime, you can buy tickets for your LIRR and Metro-North trips.

Soon, we will replace MYmta with a new and improved MTA app. The new app is currently in beta, but you can download and start using it today. And we want to hear from you — your feedback will help us make improvements to the app for its wider release.

MTA app (beta)

The MTA app is the upcoming replacement for MYmta. It's a next-generation app designed with the rider in mind.

The new app has all of the real-time information that makes MYmta helpful with a new, streamlined interface to make that information easier to find. You can also sign up for Smart Alerts to get personalized travel recommendations and service alerts.

The MTA app is still in public beta. You can download it, but you'll need to go through some extra steps.

Sign up for the MTA app (beta)

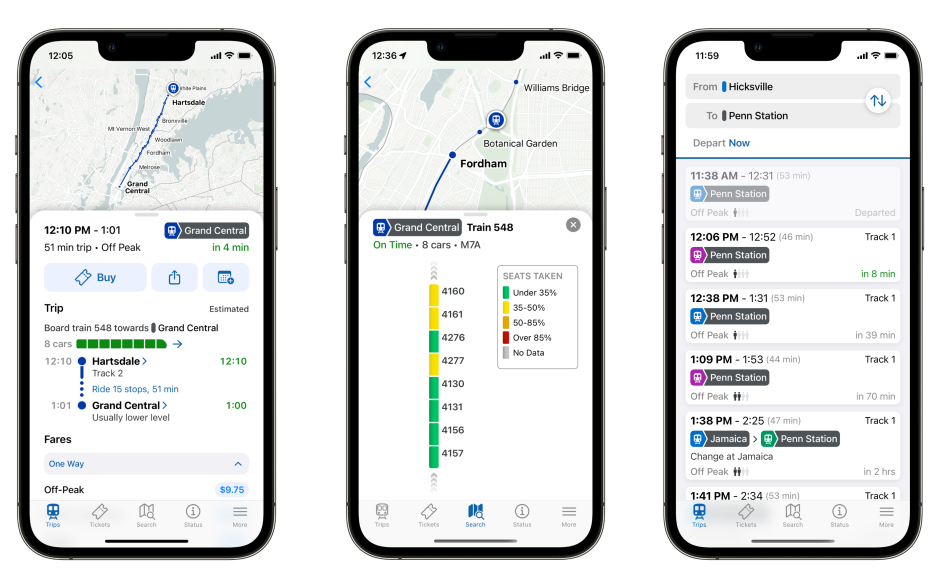

The TrainTime app provides a one-stop shop for Long Island Rail Road and Metro-North Railroad customers. With it, riders can buy and use tickets, plan their trips, track their trains, and more. Learn more about using TrainTime.

Download the TrainTime app for iOS or Android .

TrainTime features

- Buy tickets: All ticket types except UniTickets, Meadowlands tickets, group tickets, and MTA Away packages are available for purchase. Pay with Apple Pay, Google Pay, or credit/debit card. You can split payment between two cards.

- Plan trips: View Long Island Rail Road and Metro-North Railroad departure times and transfer details before you travel. You can also search for two origin and/or two destination stations at once.

- Save and share trips: Save your frequent trains for easy access. You can also share trips with family and friends so they know when to expect you.

- Track your train: Follow your trip with real-time GPS tracking, updated every few seconds. You can also see the layout of your train and how crowded each car is so you can position yourself on the platform before it arrives.

- View service status and alerts: See real-time arrival and status information, along with incidents on your branch or line.

- Chat with us: Text with a customer service representative for either LIRR or Metro-North within the app.

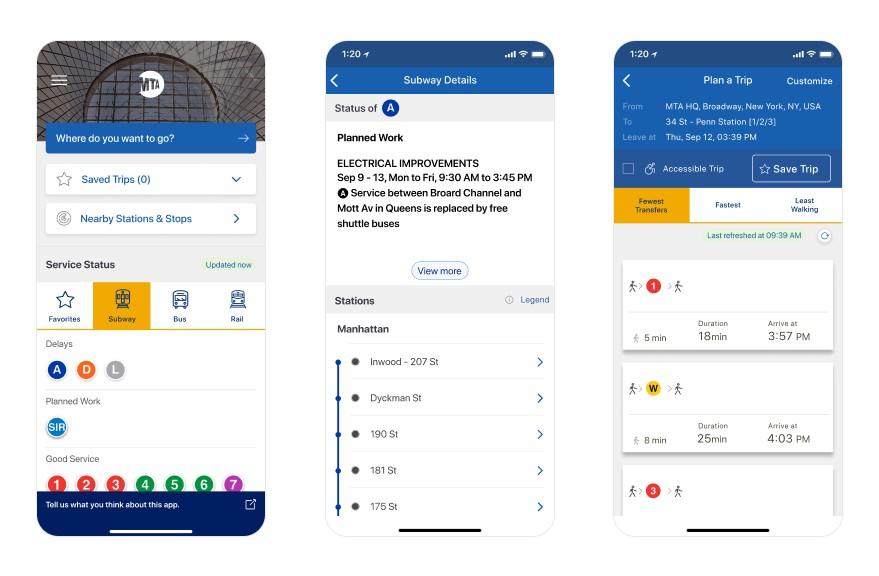

MYmta offers regionwide travel support, including real-time arrival and schedule information for subway, bus, Long Island Rail Road, and Metro-North service.

Download the MYmta app for iOS or Android .

MYmta features

- Plan your trip: Personalize subway, bus, or rail trips, and see trips with the fewest transfers, fastest time, or least time walking.

- Real-time service status: See real-time arrival information for subways, buses, and railroads.

- Save frequent trips: Bookmark your favorite subway, bus, or rail lines, or your frequently visited stations and stops. You can save your trips and view schedules to plan ahead.

- Nearby stations: View stations or stops near you on a map so you can find the MTA service closest to you, along with walking distances.

- Planned service changes: Look up planned service changes that will affect your travel.

- Elevator and escalator status: See which elevators and escalators throughout the MTA system are out of service.

- Fares and Tolls

- Access-A-Ride Paratransit

- Accessibility

- About the MTA

- Give feedback

- Sign up for service alerts

- New York City Transit

- Bridges & Tunnels

- Long Island Rail Road

- Metro-North Railroad

- Other agencies and departments

- Planned Service Changes

- Elevator & Escalator Status

- Safety and Security

- Transparency

- Contact the MTA

- Media Relations

- Procurement and solicitations

- Press Releases

MTA Unveils New All-In-One Mobile App for Trip Planning and Service Information

App includes schedules and service alerts for subways, buses, lirr and metro-north , public can sign up for app; currently in beta testing.

The Metropolitan Transportation Authority (MTA) today announced that its new MTA app is available for download. The app is currently in BETA testing and will eventually succeed the MYmta app. The app features schedules, service alerts and more for subways, buses, Long Island Rail Road and Metro-North Railroad all in one place. Users can also book Access-A-Ride trips and see elevator and escalator outages at stations throughout the subway system.

“If we want more customers to use public transit, providing travel tools that are easy and intuitive is key,” said MTA Acting Chief Customer Officer Shanifah Rieara . “The new MTA app accomplishes just that, connecting riders to the information they need in one or two taps.”

Additional features in the Beta version of the new MTA app include:

Plan a trip to see recommended routes and check schedules for subways, buses, Long Island Rail Road, Metro-North, PATH and AirTrain.

Get service alerts and see planned and unplanned service changes and best ways to get around.

Save favorite routes and stops for quick viewing of arrival times.

Live bus tracking to see where a bus is located that is approaching a stop, check when it will arrive, and follow it throughout its trip, including instant information on how many stops and minutes away a bus is.

Real-time on-board crowding for railroads.

Book Access-A-Ride trips, find pick up and drop off times for trips, and view trip history.

Improved search making it easier to see which search results are MTA stations and the services offered there at a glance.

Dynamic strip maps and station views indicate the service that is running at any given time.

The app was co-developed with Axon Vibe, a smart mobility platform provider and former winner of the MTA’s Transit Tech Lab accelerator. Utilizing this smart transit technology MTA app users will also be able to opt into sharing their location data to receive smart, real-time, location-based notifications for their individual journey.

The aggregated data will be available to the MTA to better understand ridership and mobility patterns around the New York metropolitan area. This information will assist with improving transit operations to meet the needs of customers and developing innovative tools to help make it easier for riders to plan for transit and reduce greenhouse gas emissions. This effort was supported by the New York State Energy Research and Development Authority (NYSERDA).

“Axon Vibe is thrilled to continue supporting the MTA with our smart transit technology, aimed at promoting sustainable travel and increasing public transit ridership,” said Roman Oberli, CEO of Axon Vibe .

The app will replace MYmta when it becomes available in the Apple App Store and Google Play Store later this year. Riders will not need to download a new app as it will automatically update on a mobile device if MYmta is already installed.

Members of the public can sign up for access to the app here .

NYC Attractions & Landmarks

Top Things to Do in NYC

Free Things to Do in NYC

Beaches Near NYC

Best Museums in NYC

Theater in NYC

NYC's Best Live Music Venues

One Day in NYC: Itinerary

Day Trips From NYC

The Best Food to Try in NYC

Family-Friendly NYC Restaurants

NYC's Best Bars

Breweries in NYC

Weather & Climate

New York Airports

Neighborhoods to Know

Driving in NYC

NYC Public Transportation

Getting Around New York City: Guide to Public Transportation

Everything you need to know to get around New York City

Wikipedia Commons

The easiest, most affordable way to get around New York City is by public transportation. New York City mass transit generally falls into two categories: buses and subways. The city has 36 subway lines (that go to 472 stations) and 5,725 buses that can take you anywhere you want to go. Once you know how to use them, you'll find them efficient, reliable, and easy. The only problem is you must learn the system.

This guide will tell you everything you need to know about navigating your way around New York City's public transportation. You'll feel like a local in no time, maybe even venturing to far away places you never thought you would.

Watch Now: Riding the Subway in New York City

How to ride the new york city subway.

Most visitors will find themselves wanting to get around the city by subways. Subways serve most of Manhattan and the outer boroughs very well, and they take you directly to many popular tourist destinations.

- Before you ride the New York City subway you need to buy a MetroCard. You will swipe this card every time you enter a subway station at the turnstiles. MetroCards cost $1 to purchase. Once you buy your MetroCard you can add money to it.

- MetroCards may be purchased and refilled at subway station booths, MetroCard vending machines, and at other vendors . You can use cash, credit, or debit cards to make your purchase.

- New York City subway fares are $2.75 per trip. For visitors staying more than a couple of days you can buy a one week unlimited MetroCard for $33 or an unlimited monthly MetroCard for $127.00. People who are 65 or older or who have qualifying disabilities can get a reduced fare, which is half price. You must see an attendant at a station to purchase one.

- Because New York City has so many subway lines, it's impossible to memorize them all. Even locals have to look up directions on occasion. The best way to plan your trip is to consult Google Maps or the MTA website . There are also a variety of apps that you can download before your trip to easily look up subway directions. You simply type in your point of origin and your destination, and the app will tell you the route.

- New York City has some subways that run express. Your trip planning app will tell you exactly which line to take. If it tells you to take the 1, for example, don't get on the 2 or 3 even though it looks like it's going in the same direction. Those trains are express and won't stop at the station you need.

- The New York City subway operates 24 hours a day, but service is more sporadic between midnight and 6 am and on weekends. If you're traveling on the weekends or late at night, you should be aware of service interruptions that might impact your trip. Taking a few minutes to review the planned service changes can save you a ton of hassle. Trip Planning apps like Google Maps are aware of these disruptions and can help you plan your route.

- In every station there is an information booth where you can press the green button and talk to an attendant. If you are confused or need help it's a great tool to use.

- MTA has a list of accessible subway stations on its website.

Other Transit Options

Subways serve most of Manhattan and the outer boroughs very well, but in those areas where the subway service is not ideal there are buses, trains, bikes, and boats that can take you where you need to go.

New York City Buses

The city has around 5,000 buses, and you'll find they are particularly helpful when you need to travel to the far east or west portions of Manhattan.

New York City bus fare is $2.75 per trip. Be aware that buses only accept MetroCards or exact fare in coins—drivers cannot make change. There are also some buses along major routes in Manhattan & the Bronx that have you pay your fare before you board to speed the process of boarding. It's called "Select Bus Service" and the kiosk for pre-paying your fare is usually very obvious and easy to use.

Google Maps and MTA Trip Planner can tell you the best buses to take (and whether you should take one instead of the subway.) You can also look up New York City Bus schedules.

The NYC Ferry Service

In the past few years New York City has launched new ferry services taking commuters and visitors to Manhattan, Brooklyn, Queens, & Bronx. Ferries are particularly advisable if you are traveling to places along the water (perhaps you are going from the South Street Seaport to Brooklyn Bridge park.)

The ferries are fun to ride because they offer incredible views and refreshments on board (even local wine and beer!) During warmer seasons you can sit on the outer decks and enjoy the sunshine. They are also relatively inexpensive at $2.75 a ticket. You can look up routes and ticket information on the website.

Railroad Services

If you need to get to the suburbs or areas around New York City you might need to take railroads. Metro North trains take you to Connecticut and Westchester. They leave from Grand Central Station.

Long Island Railroad takes you into Manhattan, and New Jersey Transit takes you to New Jersey. Both train services leave from Penn Station. Google Maps will tell you which service to take.

All train services are reliable and run frequently, but they can get crowded at rush hour. Sometimes it's standing room only during morning and evening commutes. Avoid those times (8 a.m. to 10 a.m. and 5 p.m. to 7 p.m.) if possible.

Taxis and Ride Shares

Many New Yorkers prefer to take taxis or private cars, especially late in the evening when subway service is more sporadic. Yellow taxis are the iconic New York City cars. You can flag them down when you need them. If you are in Brooklyn or another outer borough, the taxis are green.

New York City has a variety of ride-sharing apps. Uber and Lyft allow you to book a private car or share a car with passengers traveling in a similar direction. Both are reliable services and usually arrive very quickly.

One of the best ways to get around New York City is by Citi Bike, New York's bike share system. There are stations in Manhattan, Brooklyn, Queens & Jersey City where you can unlock a bike with your credit card and return it when you get to your destination. Download the Citi Bike app to find the docking stations closest to your location.

While many parts of the city have bike paths, be careful when riding bikes in the city. Lanes can get congested, and sometimes bike paths are close to speeding cars. Accidents happen regularly so vigilance is key.

Rental Cars

While New York City has ample car rental places, it's not advisable. It's difficult to drive in New York City. There is usually heavy traffic, and taxis are used to swirling in and out of lanes. Parking a car can also be difficult especially in Manhattan.

Tips for Getting Around New York City

- If you are traveling around Manhattan during the day, a subway is your best option.

- Between midnight and 6 am and on weekends check trip planning apps to determine how to travel to your destination. Routes and lines get changed during those times.

- Buses are your best option if you are traveling from East to West across the city.

- If it's a pleasant day try to rent a bike or ride a NYC ferry. You will see more of the city and have fun.

- NYC has many ride sharing options. If you are in a hurry choose a private car. If you have time and want to meet new people order a shared car. You never know who you will meet!

- Driving is tough in the city. It's also hard to park. Avoid a rental car if possible.

How to Travel from JFK Airport to Manhattan by Subway, Train, Taxi, and Shuttle

Getting To and From LaGuardia Airport in NYC

How to Travel From Newark Airport to Manhattan by Train, Bus, Car, and Shuttle

Using Public Transit Between JFK Airport and Manhattan

Getting Around Montreal: Guide to Public Transportation

New York City Guide: Planning Your Trip

Getting Around Bangkok: Guide to Public Transportation

Getting Around Pittsburgh: Guide to Public Transportation

Riding Buses in New York City

New Years in New York: How & Where to Get Your Free MetroCard, or $15 for a Cab

JFK Kennedy Transportation

How to Travel From Toronto to New York City by Train, Bus, Car, and Plane

Getting Around Mexico City: Guide to Public Transportation

The Coolest Bridges in New York City

How to Get to Brooklyn Bridge Park and DUMBO

18 Best Things to Do as a Solo Traveler in NYC

Trip Planner

Enter your "departing from" and "going to" destination and open your trip plan results in Google.

Try the new Trip Planner

Trip Planner tells you how long your trip will take and if there are any transfers involved.

View route schedules, get real-time Next Bus departures, and transit alerts on Trip Planner.

How to use new Trip Planner

Need help with using the new Trip Planner? Follow our step-by-step guides to understand how each feature can be used.

How To Use Trip Planner

How To Find Route Schedules

nysubway.com

New York City Subway System

New York City Subway Trip Planner

Plan your nyc trip with the new york subway route and trip planners.

You will need a subway trip planner to get around NYC on public transportation as it can be pretty complicated for the uninitiated. There are a number of tools out there to help you navigate and get you to your destination. You may expect that locals would never need a subway trip planner, but that’s not true because there are often train delays and reroutes on lines that mean that even locals have to use alternative subway and bus routes to get to their destination on time.

Online New York Subway Trip Planner and Navigation Tools :

- MTA Trip Planner Website Tool is a simple to use web service that allows you to plan all your impending trips from anywhere that is web connected. You can choose the time and date of travel and the site will give you a number of options to choose from. This service allows you to type in exact addresses, not just subway stations. The site will give you all the directions you need for navigating the bus, train and subway – allowing you to meticulously plan your trip. This is not a real time service, it gives you the route based on the scheduled subway train times – so it is necessary to check that the train is actually running.

- Google Transit is another easy to use website with similar functions to the MTA website. Both sites will display scheduled arrival and departure times of the trains allowing you to make plans with ease. The site has an “options” function that will allow you to customize your travel plan to your specific needs ie less walking, wheelchair accessible, best routes, fewer transfers etc.. Similar options are available on the MTA web site, however google maps has far more choices for travel options, but the MTA updates their website before google does.

There used to be online subway trip planner navigation tool called Hopstop, but Apple Inc. purchased the service in 2013 and rolled that technology into the iPhone Maps app (see below), before closing it down for good in October 2015.

Free Smartphone Mobile Apps available on iTunes and Google Play

As well as the online options there are also many free and paid apps for smartphones. The advantage to all the apps is that they can work offline, so when you are in the tunnel and you lose cell or wi-fi signal, they will still work providing you with information. The following apps will successfully guide you through the city. There is no official MTA app for navigating the subway system.

- New York Subway MTA App is a free App created by Mapway, a global company that provides public transportation apps for cities around the world. It is easy to use and that allows you to plan a trip by selecting a station from a drop down menu that also shows nearby or recently visited stations. The results can be viewed in a summary or a map form. The app also has MTA travel alerts and a New York city Guide.

- NYC Transit App Created by Transit Now Ltd, this app lets you select your departure and arrival destination from a map and will give clear basic maps and a trip planner that will provide you detailed train arrival times and real time information on delays and scheduled work.

- Maps On the iPhone This App by Apple Inc. only works on the iPhone and allows you to select a destination from the map and will give options for how to travel there, selecting the trains options will give you information on the subway lines. This incorporates the original hopstop data.

Paid Smartphone Apps available on iTunes and Google Play:

Surprisingly enough, there are still paid smartphone apps out there and one of them is a New York Subway route planner and map:

NYC Subway 24-hour Kickmap This app costs $2.99 and is very similar to the other apps with the main difference being you can plan your travel without the distraction of advertisements. Another plus for this paid app is the function that shows the names of the neighborhoods which can be very helpful for visitors trying to maneuver the busy NYC subway system.

Conclusion: Our Top Picks For New York Subway Trip Planner and Navigation Tools :

As no one yet makes a subway trip planner that works in real-time (i.e. one that reroutes you based on service delays just like a car navigator), you can only use a service that just works based on the train schedule.

For someone planning a trip in advance with no constraints for time, either one of the online tools listed above would be a good option. As for the mobile apps it’s probably not necessary to pay to purchase an app unless the pop up advertisements are a major concern.

The free NYC Transit app by Transit Now Ltd. gives the best updates to show when your scheduled bus/train will arrive. It also tells you precisely how far/how long to walk and when the train is arriving. This app shows you nearby stops that you have used recently, just in case you need to run another errand while you are waiting for the service to arrive.

- Subway Train Service Guide →

New York Travellers

Your favourite NYC guide and blog

The complete New York City subway guide for beginners

If you are planning to go to NYC soon, then you have an important question to ask yourself! Do you know how the NYC subway works? If so, you’re very lucky. If not, you’re going to have some work to do! Because the New York subway is not really easy to use. Let me tell you a little anecdote….. After dropping off our luggage at the hotel on our first trip, we wanted to go to Times Square to fully immerse ourselves in the NYC vibes. We took the subway and…

From Chelsea, we visited all of southern Manhattan to Chinatown, before heading back in the right direction towards Times Square! So, to avoid wasting time while riding the subway, I suggest you to discover this special NYC subway guide ! You will find the main operating rules as well as some useful tips to avoid the pitfalls 🙂

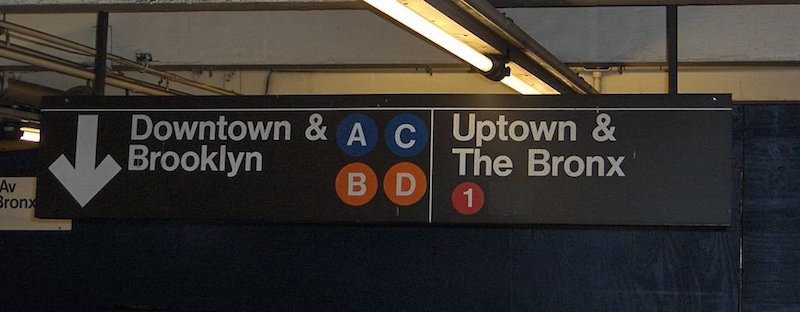

Riding the New York City subway : some rules to remember

➜ to identify the subway lines, we do not use the terminus station but the running direction (uptown or downtown)..

Uptown is indicated for lines going towards Upper Manhattan, the Bronx and Queens. Downtown is indicated for lines going towards Lower Manhattan and Brooklyn.

➜ The subway station you are entering doesn’t necessarily serve both directions.

Sometimes, you find a station for one direction (Uptown) and the other station across the street for the other direction (Downtown). There are also stations that serve both directions. In any case, this information is mentioned at the entrance of subway stations.

➜ Several subway lines run on the same platform.

This is the most common mistake! Remember to look at the subway number or letter when entering the platform to make sure that you get in the right one! Otherwise, you may run in the wrong way.

➜ Subways do not necessarily stop at all the stations they are supposed to serve.

I know, it’s getting a little bit complicated! Each line is served by two types of trains :

- The local train which stops at all stations of the subway line.

- The express train which only stops at the main stations of the subway line.

In general, there are more local trains than express trains, but don’t forget to pay attention to this detail! Express train is therefore faster than local train but you have to be sure it’ll stop at the station you want to go to.

To identify express trains and local trains :

- When entering the platform, a soundtrack informs passengers whether it is a local or an express train.

- The information is also visible on the display screens located on the platforms.

➜ During weekends, many subway lines are modified.

These changes affect both schedules and itineraries. It is not uncommon for some lines not to serve certain stations on weekends.Temporary line modifications are mentioned at stations and on platforms with posters (unfortunately not really visible!). If you notice a white poster filled with black text and the logo of some subway lines, I advise you to read it!

Are you ready to take the subway in NYC ?

Let’s check now if you have remembered these few rules 🙂

What information is displayed here ?

We will probably access two platforms:

- A first platform that serves A, C, B & D lines in the downtown direction.

- A second platform that serves the 1 line in the uptown direction.

- If you have to take the A line, remember to check the train you are getting on! Don’t forget that there are 3 other lines on this platform! Don’t either forget to check if it is an express or a local train.

NYC subway map

Honestly, it takes a few training trips to master the New York subway and not just enter the first subway! But once you understand how it works, the NYC metro is particularly effective. Take a look at the plan and see how many lines are in circulation!

There is also nothing to say about subway safety: even at the quietest hours of the night, the lines running in Manhattan are generally safe. During the day, some large stations are under police surveillance. Of course, as in all big cities, beware of pickpockets who can be anywhere!

Finally, while the overall aspect of the subway network is quite old, there is nevertheless wifi access in a very large number of stations.

Metrocards and fares

Subway tickets are called metrocards in New York City.

- Where to buy tickets? Metrocards can be purchased at ticket offices and distributors in metro stations.

- What are the different Metrocards? The standard ticket purchased by most tourists in New York is the 7-Day Unlimited Ride (or more if you stay longer).

Trip planner and schedules

If you need some help to plan your subway trips, the TripPlanner tool is made for you. Enter the starting point and the point of arrival and it will tell you what to do!

New York City’s subway schedule is extremely flexible : it never stops and runs 24 hours a day! In other words, if you go out late at night, you can return to the hotel at any time! Be careful: there are fewer trains at night than during the day, so travel times can be extended.

Useful links

➜ Website : Metropolitan Transportation Authority (MTA)

➜ App : New York Subway MTA Map (App Store)

➜ App : New York Subway MTA Map (Google Play)

I’m a french travel blogger, crazy about New York City! Since I discovered NYC in 2014, each trip is an opportunity to learn more about the secrets of this fantastic city. I wish you a pleasant visit on my blog, with I hope, a lot of beautiful discoveries!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

You should also read:

▷ How to plan a NYC trip? The complete guide

New York City neighborhoods guide: all you need to know

Is it legal to book an Airbnb in NYC? The rules for tourists and visitors

Trip Planner Download App

Download App

Metro's Trip Planner

Google Transit

PAL Trip Planner

Other Transit Tools

View Real-time Info

View Smart Traveler

View System Map

Download Schedules

Stop ID Lookup

Elevator and Escalator Status

Expedia Rewards is now One Key™

Elektrostal, visit elektrostal, check elektrostal hotel availability, popular places to visit.

- Electrostal History and Art Museum

You can spend time exploring the galleries in Electrostal History and Art Museum in Elektrostal. Take in the museums while you're in the area.

- Cities near Elektrostal

- Places of interest

- Yuri Gagarin Cosmonaut Training Center

- Central Museum of the Air Forces at Monino

- Peter the Great Military Academy

- Bykovo Manor

- Balashikha Arena

- Balashikha Museum of History and Local Lore

- Pekhorka Park

- Ramenskii History and Art Museum

- Malenky Puppet Theater

- Orekhovo Zuevsky City Exhibition Hall

- Noginsk Museum and Exhibition Center

- Saturn Stadium

Amtrak Booking: 14 Tips & Tricks To Know When Planning A Train Trip

- Research Amtrak routes, amenities, and prices to plan a comfortable trip and save money on tickets. Use the Amtrak Trip Map to understand the train's journey.

- Take advantage of Amtrak's everyday discounts for various groups, such as children, students, veterans, and people with disabilities. Check the "Everyday Discounts" page for eligibility.

- Look for time-sensitive deals on Amtrak's dedicated deals page. These deals offer discounts on tickets, double points, and special offers for specific destinations or times. Choose from a variety of deals to save money on ticket prices.

One of the finest ways to tour the United States is via Amtrak train. Whether seeing scenic views along the most beautiful Amtrak route or enjoying one of the many amazing Amtrak routes for foodies , passengers enjoy a greater standard of luxury than they would on a bus or some airlines.

There are a few things first-timers should be aware of with Amtrak if they are considering traveling in the United States by train. The following tips and tricks will help travelers book their Amtrak tickets in the easiest way at the most affordable price, as well as help them boost their comfort and convenience levels on their vacation. There's no better travel than via a train!

UPDATE: 2023/10/02 21:28 EST BY REENA JAIN

Four More Tips & Tricks For Amtrak Booking

Amtrak stands out as one of the more affordable modes of transportation, and there are a number of ways to save money while making reservations. In light of this, we have updated this list to include four more tips and tricks every passenger should be aware of before booking Amtrak tickets. Have fun, and enjoy the ride!

Related: California Zephyr Vs. Southwest Chief: Which Amtrak Train Route Is More Scenic?

Research For Amtrak Train Routes And Prices

Get a thorough understanding of Amtrak train routes and prices before purchasing a ticket. Discover how to take the train from the starting point to the destination by exploring the Amtrak Trip Map . Learn about the locations and cities the train will travel through. Also, acquire a full picture of the amenities and services offered at the stations, such as checked baggage, Wi-Fi, accessibility, and more, and become acquainted with them. This allows one to plan a comfortable trip while also saving money on tickets.

Check Out For Everyday Discounts

Another surefire way to save money on ticket prices is to take advantage of Amtrak's numerous discounts based on a passenger's age or for membership in different organizations. Child tickets, students, veterans, military people and their families, government employees, and Rail Passengers Association members are all eligible for discounts. People with disabilities are also eligible for discounts. People with disabilities also get discounts. So, passengers must check Amtrak's " Everyday Discounts " page before reserving their tickets to see if they are eligible for any discounts.

Look For Bargains On Dedicated Deals Page

Amtrak regularly posts time-sensitive bargains on its dedicated deals page . And, believe it or not, some of these bargains are simply superb! These deals are unquestionably the best way to save money on Amtrak ticket prices. Some of these deals include discounts on purchasing a good number of tickets; some offer double points on Amtrak Guest Rewards; and others offer discounts to a particular location or at a particular time. There are a great number of deals to choose from. Aren't these deals incredible?

Bring Own Food And Alcoholic Beverages

Many trains provide one or more onboard eating options. Plus, passengers who use their Amtrak Guest Rewards Preferred MasterCard to make food and beverage purchases onboard receive a 20% discount in the form of a statement credit. Thus, enjoying the onboard food is also rewarding. But those wishing to save money must bring their own food, water, and beverages (alcoholic stock as per Amtrak guidelines). Passengers can eat their food and non-alcoholic beverages in their seats, in their personal Sleeping Cars, and in the Sightseer Lounges. Nevertheless, they can only enjoy private stock in their Sleeping Car accommodations.

Book Amtrak Tickets In Advance & Purchase In The First "Buckets"

Amtrak offers a distinctive way to purchase train tickets that works well for early-bird tourists. Amtrak offers tickets in 'buckets,' with the lowest rates going on sale first, as opposed to the dynamic pricing matrix used by the majority of airlines. The next bucket, with a higher ticket price, is opened up after the allowed number of tickets for that price in the bucket has been sold out.

It is also preferable to schedule a trip as soon as travelers can because inexpensive tickets on busy days sell out the quickest (this is especially true for the most popular and busiest Amtrak routes ). Amtrak even offers discounts for travel up to two weeks in advance. If travelers make their reservations 14 days in advance, they may still be able to save up to 25% on their Amtrak fare.

An Amtrak rail ticket can be booked up to 11 months in advance.

Opt For The Best Days Of The Week To Book An Amtrak Ticket

Amtrak Train has special offers every week ; it is recommended to check to see what sales are being offered by the company on Tuesdays and Fridays. However, according to Money Saving Expert , purchasing train tickets 12 weeks before the departure date can potentially result in further savings.

Therefore, travelers are recommended to continuously check the offers and ticket prices to get the cheapest tickets!

- Cheapest days to book Amtrak: Tuesday and Friday

Be Flexible When Buying Amtrak Tickets

Similarly to other means of travel, flexibility is necessary if travelers are looking for the lowest fares. Sometimes, buying an Amtrak ticket on a certain day can cost them additional fees than the day before or after.

Consequently, if travelers are not limited by time and can postpone or schedule their trips earlier, it is guaranteed that their flexibility will pay off and save them some money.

Related: Empire Builder: What Makes This Amtrak Route One Of The Most Scenic In The U.S.

Book Tickets On The Official Amtrak Website Or App

One of the many things to know about Amtrak is that the easiest way to buy a train ticket is online at Amtrak.com . Travelers can also use their Amtrak mobile app. If they are old school or just like speaking to real people and find it easier, they may still buy their tickets at the ticket counter at any Amtrak station.

Also, not only is it easier to buy Amtrak tickets online or via the app, but it's also cheaper since travelers normally get the best rates. In addition, passengers can sometimes avail of discounts and special deals when they use the official Amtrak website and Amtrak app. Waiting until one gets to the station typically entails paying the highest price since Amtrak tickets increase in cost as seats are booked and the departure date gets closer.

Study All Amtrak Seating Options Before Purchasing A Ticket

Travelers may choose from a variety of seating arrangements while traveling by Amtrak train. Additionally, there are several alternatives for sleeping cars. They can select a Roomette, a Bedroom, an Accessible Bedroom, a Bedroom Suite, or a Family Bedroom according to the train they are on.

Travelers may also browse images and the specifications of each seat or sleeper car on the Amtrak official website to know more about their seating options.

- Some seat types on Amtrak trains: First Class, Business, Coach, and Sleeper Cars

Book The Appropriate Trip Duration When Buying An Amtrak Ticket

When travelers buy their tickets, they have a lot of various scheduling options accessible to them. One train, for instance, may go to its final station in just ten hours and without any stops. However, there may also be a few different itineraries that take 15 to 20 hours and have layovers.

Therefore, Amtrak riders should decide on the destinations they would like to visit before booking their tickets. That way, they can make a sightseeing vacation out of their train journey. Alternatively, if they want to get straight to their destination, booking an Amtrak train with minimal stops is better.

Related: The Joy Of Train Travel: Unwind & Relax With These Top 10 Amtrak Sleeper Train Routes

Download The Amtrak App

If travelers want to make their trip more efficient, they can install the Amtrak application on their smartphones. It is a useful tool for booking an Amtrak ticket and later showing it instead of printing it, finding a station at a certain location, and checking the status of a train.

Additionally, travelers will never need to be concerned about losing out on crucial information.

- Mobile operating systems: The Amtrak app is compatible with Android, Windows, and iPhone.

Participate In The Amtrak Guest Rewards Program

A terrific method to get free class upgrades, hotel and rental car savings, and access to travel bargains is through Amtrak's free rewards program. Getting started with the program is free and just takes a few minutes.

Even if travelers do not book a trip frequently, it is a good idea to join up for Amtrak Guest Rewards since any points they earn are valid for two years as long as there is activity on their account.

Know Amtrak Baggage Limits

Before travelers get to the train station to book a ticket and board, it is crucial to be aware of how much luggage they may carry. In this manner, they steer clear of snags and unanticipated costs. There are baggage allowances of two personal items and two carry-on bags per Amtrak traveler.

Each traveler is also permitted to carry up to 4 checked baggage with them . The first two items are free with the purchase of admission. However, any extra bag after that will cost extra fees.

- Amtrak Baggage Cost: $20 per additional bag

Choose An Amtrak Sleeper Bedroom Or Roomette For The Most Comfortable Experience

Although there are several booking options, as mentioned earlier, the most comfortable way to travel on long-distance trains is to reserve an Amtrak Roomette or Bedroom (and there are differences between the two) .

Travelers should know that all dining car meals, free bottles of water, hot showers, soft drinks with ice, and hot coffee are all included in their reservations. A special sleeping car attendant will also be assigned to them.

Travelers should make sure to tip the sleeping car attendant.

IMAGES

VIDEO

COMMENTS

Trip planner | MTA. Schedules Maps Fares & Tolls Planned Work. We have detected you are using an out-of-date browser.

Transparency Our leadership, performance, budgets, financial and investor information, and more. Careers at the MTA Job postings, how to apply, employee benefits, and more. Safety and security Our safety procedures, how to report an incident, and tips for having a pleasant trip. Climate Learn how we're making transit even more sustainable and ...

MTA. The latest version of the MTA app (formerly known as MYmta) makes it easier than ever to get details on subway, bus, and railroad service—straight from the source. You can plan a trip, see your train's arrival time, get service alerts for your route, or find your bus in real time. And important station information, like planned work or ...

New York City trip planner. Nycmoov.com is a free mapping and route planning service for getting around New York City. You can find the fastest route and compare trips in all modes of transport such as subway, metro, bus , ferry, bike, pedestrian, and car for all over New York City. You can also get in real time the subway and bus schedule as ...

MYmta features. Plan your trip: Personalize subway, bus, or rail trips, and see trips with the fewest transfers, fastest time, or least time walking. Real-time service status: See real-time arrival information for subways, buses, and railroads. Save frequent trips: Bookmark your favorite subway, bus, or rail lines, or your frequently visited stations and stops.

Plan a trip to see recommended routes and check schedules for subways, buses, Long Island Rail Road, Metro-North, PATH and AirTrain. ... transit operations to meet the needs of customers and developing innovative tools to help make it easier for riders to plan for transit and reduce greenhouse gas emissions. This effort was supported by the New ...

New York City subway fares are $2.75 per trip. For visitors staying more than a couple of days you can buy a one week unlimited MetroCard for $33 or an unlimited monthly MetroCard for $127.00. ... Trip Planning apps like Google Maps are aware of these disruptions and can help you plan your route. In every station there is an information booth ...

New York City's digital subway map. See real-time, nighttime, and weekend subway routes, train arrival times, service alerts, emergency updates, accessible stations, and more.

New York Subway system transports over 5 million passengers every weekday (3 million on the weekend). This site has the official subway maps, line maps, train and station information, MTA Twitter Feed, MTA contact information, Metrocards, subway safety and popular tourist destinations.

Trip Planner tells you how long your trip will take and if there are any transfers involved. View route schedules, get real-time Next Bus departures, and transit alerts on Trip Planner. Go to Trip Planner. How to use new Trip Planner. Need help with using the new Trip Planner? Follow our step-by-step guides to understand how each feature can be ...

New York Subway MTA App is a free App created by Mapway, a global company that provides public transportation apps for cities around the world. It is easy to use and that allows you to plan a trip by selecting a station from a drop down menu that also shows nearby or recently visited stations. The results can be viewed in a summary or a map form.

The standard ticket purchased by most tourists in New York is the 7-Day Unlimited Ride (or more if you stay longer). Single Ride Ticket. $3.00. 7-Day Unlimited Ride. $32.00. 30-Day Unlimited Ride. $121.00. Reduced Fares (apply to seniors 65 or older and customers with disabilities) 7-Day Unlimited Ride : $16.00.

Our subway system is the largest and busiest in North America. There are 472 stations on 25 routes, spread along 665 miles of track. The subway operates 24 hours a day, 7 days a week, 365 days a year. ... Download the MTA app for trip planning, maps, arrival times, real-time service status, station information, and more. Paying the subway fare

Freeway Service Patrol. Rideshare. Fares. Prices. Prices are for a one-way trip on Metro bus and rail and include 2 hours of FREE transfers. Regular Ride. $1.75/Ride. Learn More.

Plan my trip. No trips available. We were unable to plan atrip between thoselocations. Try adjustingyour trip settings. Youcan also contact TransitInformation for help byphone at 612-373-3333. Edit my trip/ Start over. *Trips shown are based on default settings tailored for optimal results.

NFTA-Metro | 181 Ellicott St. | Buffalo, New York 14203 NFTA-Metro Customer Care 716-855-7211 | TTY/Relay 711 or 800-662-1220

Plan Your Trip Transit Services Bus Schedules, Trolley, Rapid, Access, Transit Parking Getting Around Maps & Schedules, Trip Planner, Departures & Real-Time, Alerts & Detours, Service Notices, Airport

A mix of the charming, modern, and tried and true. See all. Apelsin Hotel. 43. from $48/night. Apart Hotel Yantar. 2. from $28/night. Elektrostal Hotel.

Things to Do in Elektrostal. 1. Park of Culture and Leisure. 2. Electrostal History and Art Museum. 3. Statue of Lenin. 4. Museum and Exhibition Center.

Our system includes: 6,553 subway cars, which collectively traveled 355.5 million miles in 2023. 472 subway stations. 665 miles of track. 5,800 buses, which collectively traveled 152 million miles in 2023. 238 local bus routes, 20 Select Bus Service routes, and 75 express bus routes in the five boroughs.

Things to Do in Elektrostal, Russia: See Tripadvisor's 803 traveller reviews and photos of Elektrostal tourist attractions. Find what to do today, this weekend, or in July. We have reviews of the best places to see in Elektrostal. Visit top-rated & must-see attractions.

Plan Your Trip Transit Services Bus Schedules, Trolley, Rapid, Access, Transit Parking Getting Around Maps & Schedules, Trip Planner, Departures & Real-Time, Alerts & Detours, Service Notices, Airport

Plan your trip. Hotels in Elektrostal Vacation Rentals in Elektrostal Flights to Elektrostal Car Rentals in Elektrostal Elektrostal Vacation Packages. Elektrostal. Travel Guide. Check-in. Check-out. Guests. Search. Explore map. Visit Elektrostal. Things to do. Check Elektrostal hotel availability.

In the six years since the first Fleet of the Future train first went into service, the new trains have gone from a surprising sight for riders to an everyday part of their trip. The legacy fleet was officially retired in April with a fond send off, but the fact is the new trains took over the system by replacing the old cars for all scheduled ...

Research Amtrak routes, amenities, and prices to plan a comfortable trip and save money on tickets. Use the Amtrak Trip Map to understand the train's journey.

Look up current and future subway, bus, Long Island Rail Road, and Metro-North Railroad planned service changes that may affect your travel. Search Routes. Select Routes. Select Date. Get information on planned service changes for the MTA's subways, buses, Metro-North Railroad, Long Island Rail Road, and Bridges & Tunnels.