- Money Transfer

- Rate Alerts

What’s the Best Way to Exchange Your Currency for a Trip Abroad?

Got an international trip coming up? Need to make a currency exchange? Let us talk you through your options.

December 4, 2023 — 4 min read

When you’re preparing for an international vacation, there’s a lot you need to remember to bring. Between your passport, enough clothes, adapters, it’s easy to fill up a few bags with just the essentials.

However...it’s also important that you don’t forget to bring some money to use on your trip. Odds are, if you’re traveling internationally, you’ll need to make payments in a different currency. What’s the best way to get the money? When should you make the currency exchange?

You have a few different options for exchanging your currency. We’re going to run through your options and let you know what the best option is and what you should do your best to avoid.

4. Using ATMs and card payments

Technically, you don’t need to make any currency exchanges. If it comes down to it, you can just go to an ATM or use a debit or credit card to make your payments. But while this option might sound like the most convenient one (at least as far as your time is concerned), it’s far from the best option.

When you visit ATMs or use your card to make payments in another country (and currency), you’re going to be subjected to numerous service fees and transaction fees each time you withdraw cash or swipe your card. If you’re there for a short time and only plan on making one or two payments that might not be so bad, but if you’re planning on making numerous purchases, these fees can and will add up—fast.

3. Exchanging in person at your destination

Another common option is waiting until you enter the country, and exchanging your currency there. People typically do this at the airport or at a local bank or currency exchange store.

While this method will let you avoid the high transaction fees, it unfortunately will not protect you from unfavorable rates of exchange. These providers are free to set their own rates, and it is very likely (especially if you’re exchanging at an airport kiosk ) that the rates will give you much less for your money than if you transfer elsewhere.

And from a peace of mind perspective, wouldn’t it be nice to have your money taken care of before your arrival? That way, once you arrive, you’re free to start exploring or take a rest, without having to worry about getting money on top of wrangling your luggage and figuring out how to get to your lodgings.

2. Exchanging at the bank before your trip

As we mentioned in the previous section, it’s always nice to have your currency exchange taken care of before you reach your destination. It’s one less item to have on your to-do list when you arrive, and then if something happens upon arrival, you’ll already have the money that you need.

While banks are reliable, easily accessible, and can facilitate a currency exchange for you, they still aren’t the best option. While their rates will be better than those of airport kiosks, banks still come with a few drawbacks —namely, limited working hours, unfavorable exchange rates, and transaction fees.

So where does that leave us? Well...

1. Using money transfer to get currency before your trip

We promise we’re not biased—this really is the best option. Using an online money transfer service to exchange your currency before your trip will allow you to:

Avoid transaction and payment fees

Trust you’ll get a fair exchange rate

Take care of your currency exchange quickly and from your own home

Let you relax knowing that your currency exchange has already been handled.

It’s quick and easy to make an online money transfer. You don’t need to find a physical storefront and worry about business hours—you can initiate one on the go, 24/7, 365 days a year.

Haven’t made an online money transfer before? Here’s our step-by-step guide to the process. Or are you ready to get started now? Visit our Money Transfers page to learn more about Xe and how you can take care of your currency needs now, before you take on that upcoming trip.

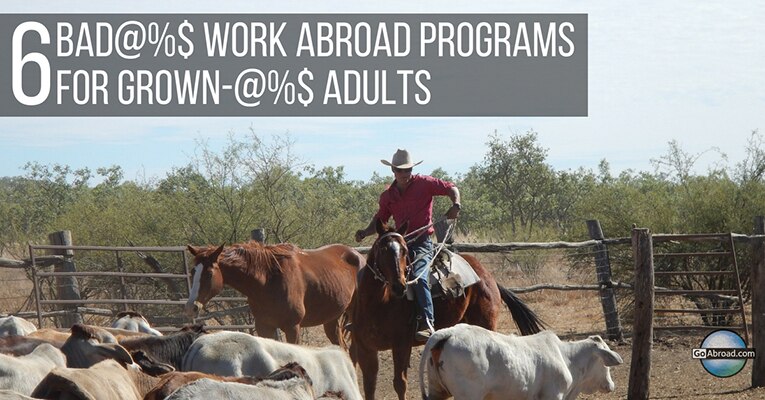

6 Bad@%$ Work Abroad Programs for Grown-@%$ Adults

by Steph Dyson - Last updated on June 5, 2017

- Before You Go

Let’s face it: while the bank of mom and dad was once an excellent option for an interest-free loan (*cough* handout *cough*) for traveling the globe, one day you’ve got to stand on your own two grown-up feet.

Ok, we know that all work and no play makes Jack (well, any traveler) a dull boy. Which is why there’s no better way than to fulfil wanderlust and calm those itchy feet than with paid work abroad programs . Yup, you read that correctly: it is possible to work and travel, all while leaving your parents busting with pride, your peers marvelling over your Insta-perfect photos, and your future employers swooning over the new skills etched onto your resume.

But how can you track down these barely believable workplace adventures, aka work abroad programs for adults? Well, my friend, I’m glad you asked. Let me introduce you to the land of work AND play, a place where novice skiers can transform to pros in a season and where a TEFL certificate can get you a teaching job in literally any part of the world.

[ Read the GoAbroad Top Travel Destinations Report for 2018 ]

Hand picked (and paid) work abroad programs.

While the experience you gain will be worth your weight (x100) in gold, it doesn’t hurt to earn some cash in exchange for putting all of those hours in. That’s why we’ve brought you this shortlist of paid work abroad programs, in Europe , Australia , and beyond.

1. Become a friend to the ocean and get paid to help with turtle conservation.

Try that whole “find-work-you-really-believe-in” thing by conserving marine life while you work abroad

Few paid work abroad programs are as turtley awesome as this one: working with the little critters on the enchanting shores of Cape Verde, a small archipelago of ten volcanic islands off the coast of West Africa.

Ideally, you should have previous experience and an insatiable passion for tagging, monitoring and practically living and breathing all things turtle. But if not, never fear; instead, check out these volunteering programs where you can lend a helping hand working with marine wildlife and quickly gain all the skills you need to apply.

Ultimately, this is a pretty niche job and one of the paid work abroad programs ideal for anyone with an undergrad in marine biology or an interest in moving into this field of work.

2. Get your hands dirty in the Australian outback.

Trade in your city life for the desert — you won’t regret it

News flash: it’s not just kids who get all the fun. No, while Australia might be top of the list of places for an adventure travel program abroad , grown-ups can go down under and learn what life’s really like in the outback with a rural work program in Australia.

Don’t worry, it’s unlikely you’ll find yourself reliving the reptile wrestling highlights of Crocodile Dundee; instead, you’re more likely to be working as a ranch hand, driving a tractor around the outback, or galloping through the red dusty lands of the Australian backwaters on your own horse.

This job probably isn’t for anyone who minds getting their hands a bit dirty and who isn’t so sure about getting a bit more up-close and personal with Australia’s frankly bonkers selection of mildly dangerous animals. But if you’ve got a sense of adventure and a desire to get off-the-beaten-track in one of the world’s most popular places for traveling, then this is the ultimate bada$$ work abroad program for you.

3. Say bonjour to a ski pass and a season cooking up a storm in Switzerland.

Get paid to work abroad and ski? Yes please.

For most wanting to learn how to work and travel, the hospitality industry is often the most obvious choice, particularly for those with little experience in other sectors and with a desire to work anywhere across the globe.

Sure, the old adage “if you can’t stand the heat, get out of the kitchen” is true; working in a professional kitchen is certainly not for the faint-hearted. But if you know your way around a stove and can identify a knuckle pounder from a mortar and pestle in a line up, a job as a chef at an international Swiss ski camp is not just a great way to grow your resume but gives you plenty of chances to hit the slopes and, well, cool down a little.

Not quite so comfortable in the kitchen? Call yourself “Soux” and get yourself a role as a hotel kitchen assistant . You won’t be getting rich quick, but with the wages enough to keep you in a ski pass and beer for the season - and plenty of free time to learn how to nollie and powder slash with the best of them – you’ll find that a job in the hospitality industry is one of the most ideal work abroad programs for adults.

But if you’re after more than just a slice of the adventure in the afternoons and weekend, instead hit the slopes for the season, with a season training at a world-class resort in Banff, Kelowna, Revelstoke or Vancouver to become snowboard level one coaching qualified.

While this does require some initial outlay to get you trained, it does come with a guaranteed job offer. So once you’re able to skim down those slopes with the elegance of a swan on skis (well, maybe better), you won’t be looking back!

4. Grab your pen and get copywriting in Peru.

Can you capture the essence of travel with the written word?

If you’re a bit more handy with, well, your hands and a pen, there are plenty of other work abroad programs to strike your fancy. Jet off to Peru for an entry level copywriter position where you’ll write content for various websites, all while attending Spanish classes and getting to know your way around South America’s most delectable culinary city, Lima.

You’ll also find that with weekends free to hop on a plane and head over to the grand Inca citadel, aka Machu Picchu in the south-east of the country or checking out the waves at Peru’s top beach resort, Mancora, you’ll hardly feel like you’re working.

5. Live in Europe’s most magical cities as a summer school director.

Trade in your silly songs and CTF for a much more epic summer camp experience

Culture vultures will want to sink their teeth into work and travel abroad programs that see you living in some of Europe’s most charming cities: Florence, Barcelona, Milan, or Rome.

Regardless of whether you’re a qualified teacher, graduate student or undergrad hoping to widen their skillset and live in some truly magical cities, this job is the way of spending summer abroad – and earning some cheeky euros along the way.

6. The most versatile work abroad program of them all: teach English anywhere in the world!

Teaching English is a popular and lucrative paid work abroad program

One of the most tried and tested ways of finding a paid work abroad program is through a TEFL course: aka a qualification for teaching English that proves you know your salt when it comes to irregular verbs, the tenses, and can at least start to explain why English spelling makes absolutely no sense.

The possibilities of spending a month or even more teaching English anywhere in the world are endless and open to applicants whether they’ve already studied for a TEFL certificate or not (If you’re the latter, check out our huge selection of accredited TEFL courses , read about these TEFL courses that practically guarantee you a job and how to ace those interviews for teaching English abroad ).

Expect to pay upwards of $1,000 to study abroad and then watch as the job offers rake in: whether teaching alongside the Pope (well, nearly) in the Vatican City or chowing down on bratwurst and a stein of local bier at any one of Germany’s most lively cities, such as Munich, Berlin, or Hamburg .

[ See ALL options for work abroad programs for adults ]

Make your dreams of working and traveling abroad come true.

We promise you: work and travel abroad are not just the stuff that warm, fuzzy dreams are made of - it is possible to make a wage and see the globe at its finest. But all the best work abroaders follow some simple slices of advice.

Program reviews matter.

The best work abroad experiences are those where the keen applicant has done his or her homework and so there aren’t any surprises when they arrive. This is where program reviews and chatting to previous participants come into play. Remember, working abroad isn’t just about you working for an employer, it’s the job itself working for both of you.

There are hundreds of reviews available about jobs abroad , so always be sure to check them out and don’t be shy to contact the program to ask to be put in touch with someone else who’s done the program before and can give you the lowdown.

Nail the application.

Firstly, applying for positions that suit your experiences or interests is a sure-fire way of making sure you make a good impression on your employers and enjoy every moment of your time abroad - not just those hours spent outside of work (Psst, you can sometimes even get a job overseas with no experience !).

Take it seriously.

Secondly, don’t be the person who treats a job abroad less seriously than one back in your home country. Prove you’ve mastered the art of adulting and be their star employee. Not only will you be guaranteed some stellar references, but it might even lead to you being asked to come back again next year.

Leave your preconceptions at home.

Finally, leave your preconceptions at home. Arriving with an open-mind to the cultural differences that you’ll no doubt encounter and behaving like an excitable sponge as you soak them all up is the magic sauce for a truly unforgettable experience working abroad.

We’re just getting started with paid work abroad programs! ?

After-work clinks to your amazing life abroad

Finding work abroad that can pay the bills and give you a wealth of experience might sound too good to be true, but lucky for you, those opportunities are out there. Be diligent in your hunt and match your skills to job availability. Most importantly, be flexible and adaptable — two key skills any expat can surely attest to the importance of. Life abroad doesn’t always go as planned (though we do our best to help plan for potential risks ), but it’s always worth the ride. Enjoy!

Feeling overwhelmed? We’ve got the personalized advice you need

Want to Get Matched with Programs?

Use MyGoAbroad to Save & Compare Programs!

Want to teach English online or abroad with the #1 TEFL School?

Related Articles

15 cheapest places for digital nomads, 5 advantages (and 5 disadvantages) of working abroad, how to live and work as a digital nomad, how to move to italy and get a job, what to know about living in china as an american, 10 best countries to work in the world in 2024, popular searches, recommended programs.

2565 reviews

International TEFL Academy

1107 reviews

Premier TEFL

INTERNeX Pacific

166 reviews

London College of Teachers and Trainers

For Travelers

Travel resources, for partners.

© Copyright 1998 - 2024 GoAbroad.com ®

- Study Abroad

- Volunteer Abroad

- Intern Abroad

- Teach Abroad

- TEFL Courses

- Degrees Abroad

- High School Abroad

- Language Schools

- Adventure Travel

- Jobs Abroad

- Online Study Abroad

- Online Volunteer Programs

- Online Internships

- Online Language Courses

- Online Teaching Jobs

- Online Jobs

- Online TEFL Courses

- Online Degree Programs

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Traveling Internationally? Order Foreign Currency Before You Go

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Upon landing in a foreign country, expect a lot of lines. There’s immigration, passport control and customs inspection. But there’s one line you can — and absolutely should — skip: the airport currency exchange.

Not only does the airport currency exchange counter’s line cut into precious time abroad, but it’s typically a terrible money move. Airport currency exchange rates are among the worst you’ll find.

It’s not uncommon to see airport exchanges charging 14% more than the current International Monetary Fund (IMF) exchange rate. NerdWallet even found some premiums exceeding 17%. Some also charge additional fees on top of the poor exchange rate.

So what do you do if you need cash upon arrival to order a cab or tip the bellhop? Consider ordering foreign currency before you fly.

Most banks allow you to order foreign currencies, which you can typically pick up at a local branch before your trip. Some banks offer to ship currencies to you, and sometimes they don’t even charge extra for postage if you order a certain amount.

Plus, the exchange rate can be good. For instance, at Bank of America, the exchange rates we checked in January 2024 average roughly 6% more than the IMF rates — and less than half of what the airport currency exchanges are charging.

» Learn more: The best travel credit cards right now

How to order foreign currency from your bank

While the exact process varies by bank, most major banks make it easy to order online.

Typically you can access the currency exchange webpage through your bank’s website or mobile app, or by phone. From there, you usually enter the currency you need, add the desired amount, select the pickup method and place your order.

While you can generally expect a solid exchange rate, use a trusted source such as Reuters or the International Monetary Fund to find current exchange rates and ensure you get a fair deal.

Additionally, understand all the fees involved. For example, Citi charges a $5 service fee for transactions under $1,000, though it’s waived for clients with premium bank accounts .

Or you might get charged a shipping fee. Bank of America’s standard shipping costs $7.50, but overnight shipping is $20. Sometimes you can avoid shipping fees by opting to pick up the cash at a local branch or by being a loyal customer. Bank of America Preferred Rewards program members get free standard shipping.

There’s also generally a minimum amount of foreign currency you can order ($100 or $200 is common) and a maximum ($10,000 within a 30-day period is common).

Other good ways to pay abroad

If it’s too late to order foreign currency from your bank, here are other ways to curtail currency fees :

Find an in-network ATM abroad

Major banks usually have branches abroad or partner with other banks to create a network. Using those ATMs often provides a decent exchange rate while eliminating out-of-network ATM fees.

If you end up using a non-network ATM, pay attention to ATM fees , which vary but usually run about $5 per transaction. Given that, consider limiting ATM debit transactions by withdrawing the amount you think you’ll need for the entire trip, or at least a large portion of it.

ATM availability is more common in some places than others. Macau has the highest number of ATMs per capita with 316 ATMs per 100,000 adults, based on 2021 data from the World Bank Group. Uruguay, Canada and Austria are other destinations with the most ATMs per capita.

But other countries tend to have far fewer. For example, Kenya had fewer than 7 ATMs per 100,000 adults and Nepal had only 20 ATMs per 100,000 adults, according to the same data.

Pay with a credit card that doesn’t charge foreign transaction fees

Depending on the card, you might get dinged with foreign transaction fees of 1%-3% when you make purchases at non-U.S. retailers abroad.

That’s why it’s wise to carry a no-foreign-transaction-fee credit card abroad.

on Chase's website

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠. .

Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel. .

Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening. .

» Learn more: The best no-foreign-transaction-fee cards

And more international merchants are taking plastic. This wider card acceptance and increased security are reasons travelers are ditching cash, according to the Visa Global Travel Intentions Study 2023, which polled more than 15,000 people in the Asian Pacific region between April and June 2023.

While this type of card won’t help you pay at cash-only businesses or get money for tips, it’s otherwise one of the smartest ways to pay internationally.

» Frequent travelers: Consider a multicurrency account

Try paying in cash dollars

If all else fails, offer to pay in U.S. dollars. In fact, some merchants or individuals accepting tips prefer it in certain countries. You might find vendors willing to give you an even better deal if you pay with U.S. dollars.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

What to know before exchanging currency for an international trip

Editor's Note

Whether you're making your way to Morocco or escaping everything in Thailand , successful globe-trotting requires a smart approach to avoiding extra fees when you make purchases. While you can make sure you have a card that does not charge foreign transaction fees, know that your card can't cover everything. Whether you find yourself in a hole-in-the-wall restaurant with no credit card payment terminal or you're hoping to tip the service staff at your hotel , you're going to need some cash. Here are four currency exchange tips to help you get the best deal on those dollars, yen, rand or whatever you're putting in your wallet.

1. Avoid airport kiosks

While exchanging currency at the airport is convenient, it comes with an extra cost. Those kiosks you see in high-profile locations in airport terminals pay huge rents and to make money they either charge you a significantly lower rate than the market rate or charge a sizable "transaction fee" — or both.

Multicurrency ATMs at U.K. airports that can dispense pounds, euro and U.S. dollars are also likely to give you an awful rate in exchange for this convenience.

If you do want to exchange cash before you leave, shop around for locations in towns and cities that are less convenient, but where there is more competition. A low-rent corner shop that advertises money exchange may be able to do a great rate for you. If you see a hole-in-the-wall exchange place with a queue down the road, they may have great rates too.

In general though, note that it is likely you will receive a better rate at your destination for your dollars even at an expensive but convenient airport kiosk. Ideally, try and find somewhere in a town or city at your destination rather than at an airport as they are likely to provide even better rates.

2. Plan ahead

If you are exchanging large amounts of money either before you go or at your destination, you may need to order it in advance. That booth on the high street may not have thousands of dollars of a certain currency on hand each day waiting for a big exchange to come in.

The more obscure the currency, the less actual currency the exchange operator is likely to have on hand. They might have thousands of U.S. dollars or euro, but New Zealand dollars or Mexican pesos may be required to be ordered.

For large amounts, especially if they are less common currencies, place an order at least a few days in advance to ensure you can pick up as much as you need. You'll probably be able to lock in the exchange rate then and there.

Related: How to avoid hidden costs when traveling

3. Your bank may reward you

If you want to exchange currency before a trip abroad, consider the rates at your local bank (though of course shop around, as discussed above). If you are comparing this to a high street exchange kiosk that has a slightly lower rate but does charge a transaction or service fee, you may still come out on top.

Related: Should you use a credit card to withdraw cash while traveling?

4. Know your ATM options

No matter how well you plan ahead, it's easy to find yourself in a cash crunch. If you do, don't just wander to the ATM on the next corner. Be prepared and know whether your bank has a network of partner institutions where you can save on costly ATM fees.

If you have an account with an international bank like HSBC or Santander, your account may be eligible for free ATM withdrawals in foreign currency at your bank's branded ATM anywhere in the world.

Just be absolutely sure you are aware of the fees and limits of this option before blindly withdrawing cash as you may be stung with multiple fees if you aren't certain of what you can do for free.

Bottom line

Exchanging cash before traveling can be a bit of a minefield with bad rates and high fees commonplace. Ideally use a no foreign transaction fee card to pay for purchases abroad as much as possible, so you don't have to exchange the cash in the first place or handle a foreign currency throughout your trip.

Where you must have cash, do your homework, shop around and try and get a rate as close to the market rate as possible.

Additional reporting by Ben Smithson.

Why you need currency exchange services

- How to find the best currency exchange

- Choosing a currency exchange service

- Online vs. physical services

- Exchange rate tips

- Currency exchange regulations

Preparing for currency exchange

How to find the best currency exchange near you.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate banking products to write unbiased product reviews.

- When travelling, you'll want to figure out what you're doing for currency exchange ahead of time.

- Local banks or credit unions may be the most convenient and affordable place to exchange currency.

- Make sure to check your institution's exchange rates and service fees to get the best trade.

Traveling abroad can be an exciting experience, but it also requires some planning. In addition to making sure your passport is up to date, you'll want to think through how you'll get the foreign currency you'll need while you're away. When it comes to exchanging currency, the goal is to get the best currency exchange rates with the lowest fees.

One of the most common reasons you might need to exchange currency is if you're planning on traveling to another country. It might be tempting to worry about travel money exchange later so you can focus on planning more exciting parts of the trip. Unfortunately, this could cause you to pay much more in fees and bad foreign currency exchange rates.

Before you go on your trip, think about how much money you might need so you can exchange currency while still in your home country. That way, you'll get a better rate, and you won't have to worry about finding a place to exchange currency in another, unfamiliar country.

Business transactions

Depending on who you're doing business with, you might need to make business transactions in currencies you're not familiar with. Knowing where to go to get the correct currency for your transactions will help them go smoothly.

Trading opportunities

If you've ever wondered what forex is , the answer is simple: Forex stands for the foreign exchange market, and it's the name people use to discuss the trade of foreign currencies.

Davide Accomazzo, an instructor of finance at Pepperdine Graziadio Business School , warns that buying and selling foreign currencies is very different from other types of investing or trading you might be used to.

"Currencies don't really have an expected positive rate of return," says Accomazzo. He says that this is different from something like mutual funds, where you're generally expected to receive some sort of profit over time. This can mean that currency exchange is a more volatile form of trading.

If you're interested in trading currencies, your best bet is to get an online brokerage account. You can also use brokerage accounts for things like stock trading and cryptocurrency exchange.

How to find the best currency exchange near you

Online search tools.

When trying to find a good place to exchange currency, something like a currency converter or an exchange rate calculator can give you an idea of what banks are generally trading these currencies for with each other. You can also check historical exchange rates to see how currencies have compared to each other over time. While this can be a good guide, Accomazzo warns that you probably won't find a bank willing to give you a rate that strong.

Many banks exchange foreign currency on a retail level, so make sure to check your bank's website and see if it offers exchange services for the currency you're interested in. Banks and credit unions tend to offer some of the best exchange rates, and most banks will give you the option of picking up your cash in a local branch or having it shipped to your home address.

Mobile apps

Google Maps can be helpful for finding currency exchange services with good reviews near you. If you use Google Maps, make sure to check if the bank has good reviews, does not charge service fees, and offers a competitive exchange rate.

If you're only looking for international money transfer, an online money exchange app might be a good option.

With one popular online money exchange site Wise , you can also hold money in over 50 currencies with just one account. Plus, you'll get a debit card with no foreign transaction fees and can make up to $100 in free ATM withdrawals per month.

If your bank has a mobile app, you can also check that and see if it allows you to exchange currency online.

Factors to consider when choosing a currency exchange

Exchange rates.

When exchanging currency, you'll want to keep in mind the exchange rate you're being offered. Exchange rates come in pairs (for example, United States dollars to British pounds), and they tell you how much of the new currency you'll get for your dollar. For example, if you're starting with USD, you might be able to get 0.8 pounds for every one U.S. dollar you trade.

Generally, these rates follow market trends. However, the exact exchange rate will depend on where you go, so make sure to check ahead of time whether the place you're going offers good rates.

Service fees

There are two types of fees you need to look out for when exchanging currency: service fees and foreign exchange fees.

Some banks, credit unions, and ATMs might charge you a service fee to exchange your funds. Always make sure to check what fees the institution you're working with charges ahead of time; even if one bank offers a better exchange rate than another bank, the deal might be worse overall because of high fees. Don't be afraid to ask for a fee breakdown before going through with the exchange, and keep an eye out for no fee currency exchange services.

These are different from foreign transaction fees , which are fees you'll pay if you use certain credit cards overseas. These are typically a percentage of the transaction you make with that card, and can build up over time. Make sure your card doesn't charge foreign transaction fees before you use it.

Location and convenience

While it's helpful to plan ahead of time for your trip, there are some options that allow you to exchange currency conveniently on the go without expensive fees.

Many travel-focused credit cards have no foreign transaction fees in addition to offering rewards for travel expenses, like airline tickets and hotel reservations.

If you already have a credit card that doesn't charge foreign transaction fees, this will usually be the simplest way for you to spend money abroad. There's no work to do ahead of time. You can just use your card as you normally would at home.

Also, some travel-friendly checking accounts may offer debit cards that have no foreign transaction fees.

You can also check to see if your bank has any ATMs in the country you'll be visiting. If you have to visit a nonbank ATM and you're given the option of processing the transaction in U.S. dollars or the foreign currency (called Dynamic Currency Conversion), choose the foreign currency. DCC exchange rates are often higher than the rates charged by card issuers themselves.

Online vs. physical currency exchange services

Pros and cons.

There are pros and cons to exchanging currency online and in person.

If you exchange funds online, you'll have access to a greater variety of places to exchange money from. That means you may be able to get a better exchange rate than if you stick to local places. However, you'll have to check how you'll get the money you've exchanged for: they might ship it to you, or they might have you pick the money up at a local branch. Either way, there's probably going to be some waiting involved.

If you exchange funds in-person, you'll be limited to places that have physical locations near you. You'll also want to call ahead to make sure the place you're trading with has the right currency in high enough amounts for your purposes. However, you'll have someone to walk you through the currency exchange process, and you'll be able to walk right out with the money you traded for.

Tips for getting the best exchange rates

There are three things to keep in mind when looking for the best exchange rates: plan and exchange currency before traveling, compare services to see which one offers the best rate, and keep an eye out for hidden service fees.

The No. 1 best way to get a good exchange rate is to exchange money before you start traveling. Currency exchanges near airports and hotels tend to give low exchange rates because they know you need the money immediately. By having a plan beforehand, you're already getting a better deal than you would otherwise.

Always make sure to compare services before you decide on one. Check the banks and credit unions around you to see if any of them offer good exchange rates, and see if you can get a travel credit card or debit card that won't charge you foreign transaction fees.

Finally, make sure you keep an eye out for hidden fees. Foreign transaction fees can add up, and high service fees might make a high exchange rate a worse deal.

Understanding currency exchange regulations

At a large-scale, interbank level, currency trading is "actually a relatively unregulated market," says Accomazzo. However, there's more regulation on a personal level because of anti-money laundering regulations. "There's a number of personal details that one has to reveal," Accomazzo says, "to make sure that it's not money laundering."

Check with the institution you're trading with ahead of time to see what requirements they have for currency trading, whether that's in the form of necessary identification, transaction limits, or otherwise.

Identification requirements

Most banks and credit unions will require some sort of identification from you to trade, such as a government-issued ID. Some might also require a proof of address. When you choose who you're trading with, make sure to call ahead and ask what you'll need to bring.

Transaction limits

Some banks and credit unions put limits on how much currency you can exchange at a time. If you're using an ATM, withdrawal fees might also limit how much you can withdraw.

If you're planning on exchanging a lot of currency, always call ahead to see if the bank is able to trade that much. And keep in mind that there are limits to how much physical currency you can bring into a country, if you're traveling.

"Every country is different, but you have a certain maximum amount that you can have in your pocket," Accomazzo says. "That does not apply to limits you have on a credit card, but in terms of actual physical cash, there are certain limits."

Check the laws of the country you're traveling to ahead of time to make sure you're not bringing too much money with you.

Currency Exchange FAQs

The best way to find a nearby currency exchange is by using online search tools like Google Maps or currency exchange locator websites. If you use a mobile app that's dedicated to currency exchange, it might also provide real-time information on exchange rates. Make sure to check customer reviews to make sure you choose a reputable service.

You can compare rates at different currency exchange services without making transactions to ensure you get the best exchange rate. Some locations might offer better exchange rates for larger transactions, so make sure to ask about available deals or discounts.

Yes, many currency exchange services charge fees or commissions. These can vary significantly between locations. Always ask for a fee breakdown before going through with the exchange.

Generally, you need to provide a valid government-issued ID, such as a passport or driver's license. Some exchange services might also require proof of address or other documentation, especially if you're planning on exchanging a large sum.

Yes, there are many services that offer online currency exchange. These platforms allow you to exchange money directly from your bank account. They will then send the foreign currency to your home or to a local bank branch for pickup. If you want to use one of these online services, keep in mind that they may offer different exchange rates than a physical location.

- Main content

Currency Experts

G - TMOZ - C&D Pizza Blog - Desktop Banner CTA (1).png

Why Travel Money

Here Are the Four Best Travel Money Cards in 2024

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

From the multitude of bank fees and ATM charges to hidden currency conversion fees, there's no question that spending your money abroad while travelling can be costly — and that's saying nothing about the cost of the holiday itself!

As you prepare for your trip abroad, the golden rule is that you'll save the most money by using the local currency of your destination. This means withdrawing local cash at foreign ATMs and using a debit card to pay directly in the local currency. For example, if you're from the UK, using your bank's debit card that accesses your British pounds will likely lose you money to hidden fees at ATMs abroad and at local merchants.

In general, we rate Revolut as the best travel card all around. Its versatile account and card can be used to spend like a local pretty much anywhere in the world. ✨ Get 3 months of free Revolut Premium as a Monito reader with our exclusive link .

If you're from the EU, UK, or US, here are a few more specific recommendations to explore:

- Best for travelling from the UK: Chase

- Best for travelling from the US: Chime ®

- Best for travelling from the Eurozone: N26

If it's not possible for you to spend in the local currency when travelling abroad, then spending in your home currency while using a card that doesn't charge any hidden exchange rate markups from your bank (e.g. only the VISA or Mastercard exchange rates to convert currency) is still a good bet for most people.

In this guide, we explore cards that waive or lower ATM fees and that hold multiple currencies. Spend on your holiday like a local and enjoy peace of mind after each tap and swipe!

Best Travel Cards (And More!) at a Glance

Best travel money cards.

- 01. What is the best best multi currency card? scroll down

- 02. Are prepaid currency cards really it? scroll down

- 03. Monito's best travel money card tips scroll down

- 04. FAQ about the best travel cards scroll down

Revolut: Best All-Rounder

Revolut is one of the most well-known fintechs in the world because it offers services across Europe, the Americas, Asia, and Oceania.

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

Revolut is available in many countries. You can double-check if it's available in yours below:

Here's an overview of Revolut's plans:

Revolut Ultra is currently only available in the UK and EU.

Like Wise, Revolut converts your currency to the local currency of your travel destination at an excellent exchange rate (called the 'Revolut Rate', which, on weekdays, is basically on par with the rate you see on Google), making it a good way to buy foreign currency before travelling abroad. As always though, bear in mind that Revolut's exchange rates might be subject to change.

Revolut's Standard Plan only allows currency exchange at the base mid-market exchange rate for transfers worth £1,000 per month. ATM withdrawals are also free for the first €200 (although third-party providers may charge a withdrawal fee, and weekend surcharges may also apply). These allowances can be waived by upgrading memberships.

N26: Good Bank For EU Travellers

One of the most well-known neobanks in Europe, N26 and its debit card operate in euros only. However, N26 is a partner with Wise and has fully integrated Wise's technology so that you never have to pay foreign transaction fees on your purchases outside of the eurozone. While N26 does not have multi-currency functionality, N26 will apply the real exchange rate on all your foreign purchases and will never charge a commission fee — making N26's card a powerful card for EU/EEA residents who travel across the globe.

- Trust & Credibility 7.9

- Service & Quality 8.0

- Fees & Exchange Rates 9.3

- Customer Satisfaction 8.1

These are the countries in which you can register for an N26 account:

And here is an overview of the various plans and account:

This low-fee option for banking is also ideal for travellers who do not belong to a European bank but frequent the Eurozone. For example, N26 is available for residents and citizens of Switzerland, Norway, and other European Economic Area countries that do not run on the Euro.

These citizens, who are in close proximity to the Eurozone, will save each time they spend with an N26 card while in Europe. N26 provides three free ATM withdrawals per month in euros but does charge a 1.7% fee per ATM withdrawal outside of Europe.

Take a look at our guide to the best travel cards for Europe to learn more.

Wise: Best For Multi-Currency Balances

Load up to 54 currencies onto this card at the real exchange rate, giving you access to truly global travel.

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

These are the countries in which you can order a Wise debit card:

Unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your home currency into up to 54 currencies. The live rate you see on Google or XE.com is the one you get with Wise.

An industry-low commission fee per transaction will range from 0.35% to 2.85%, depending on the currency.

Chase: Great UK Bank For Travel

A recent arrival from the USA, Chase is one of the UK’s newest digital challenger banks and comes with a rock-solid reputation and no monthly charges, no currency conversion charges, no withdrawal fees, and no other charges for everyday banking from Chase. It’s a simple, streamlined bank account with an excellent mobile banking app and a great cashback offer. However, it doesn’t yet offer more advanced features like international money transfers, joint accounts, business banking, overdrafts and loans, and teen or child accounts.

- Trust & Credibility 10

- Fees & Exchange Rates 10

- Customer Satisfaction 8.7

Chime: Great Account For US Travelers

Chime is a good debit card for international travel thanks to its no foreign transaction fees¹. Unlike multi-currency accounts like Revolut (which let you hold local currency), Chime uses the live exchange rate applied by VISA. This rate is close to the mid-market rate, and Chime does not add any extra markup to your purchases, although out-of-network ATM withdrawal and over-the-counter advance fees may still apply.

- Trust & Credibility 9.5

- Service & Quality 8.8

- Fees & Exchange Rates 9.8

While Chime waives ATM fees at all MoneyPass, AllPoint, and VISA Plus Alliance ATMs within the United States, this fee waiver does not extend to withdrawals made outside the country. For withdrawals abroad, Chime applies a $2.50 fee per transaction, with a daily withdrawal limit of $515 or its equivalent. This is in addition to any fees charged by the ATM owner. Therefore, we recommend Chime primarily for card purchases rather than relying on it for withdrawing cash while traveling internationally.

- No foreign transaction fees ¹;

- Uses VISA's exchange rate ( monitor here ):

- A $2.50 fee per ATM withdrawal made outside of the United States;

- More info: Read our Chime review or visit their website .

Best Travel Money Cards in 2024 Compared by Country

In the table below, see our comparison summary of the four best travel cards for 2024 by country:

Last updated: 8 January 2024

What's The Best Prepaid Card to Use Abroad?

Travel cards come in many varieties, such as standard credit cards or debit cards with no foreign transaction fees or cards that waive all foreign ATM withdrawal fees.

What is a Multi-Currency Card?

Multi-currency cards are a specific type of travel card that allows you to own all kinds of foreign currencies, which you can instantly access when you pay with your card abroad. By spending the local currency in the region of travel , you bypass poor foreign exchange rates. ATMs and cashless payment machines will treat your card like a local card.

We have already mentioned a few multi-currency cards in this review, but we will also introduce Travelex . Travelex's Money Card also allows you to top up several foreign currencies — albeit at exchange rates slightly poorer than the real mid-market rate .

Wise Account

Wise has one of the best multi-currency cards available on the market.

Read our full review for more details.

Revolut is impressive for its vast options in currencies and its additional services.

Our in-depth review explores Revolut's services in detail.

Travelex offers a prepaid travel money card that supports 10 currencies and waives all ATM withdrawal fees abroad.

- Trust & Credibility 9.0

- Service & Quality 5.8

- Fees & Exchange Rates 7.1

- Customer Satisfaction 9.3

Travelex charges fees, which fluctuate according to the exchange rates of the day, in order to convert your home currency into the currencies that it supports. But once the currency is on the card, you'll be able to spend like a local. Learn more with our full review .

Don’t Let Banks, Bureaux de Change, and ATMs Eat Your Lunch 🍕!

Are you withdrawing cash at an ATM in the streets of Paris? Exchanging currencies at Gatwick airport? Paying for a pizza with your card during a holiday in Milano? Every time you exchange currencies, you could lose between 2% to 20% of your money in hidden fees . Keep reading below to make sure you recognize and avoid them.

Currency Exchange Fees Eating My Lunch? What’s That?

You’re often charged a hidden fee in the form of an alarming exchange rate.

At any given time, there is a so-called “ mid-market exchange rate ” — this is the real exchange rate you can see on Google . However, the money transfer provider or bank you use to exchange currencies rarely offers this exchange rate. Instead, you will get a much worse exchange rate. They pocket this margin between the actual rate and the poor exchange rate they apply, allowing the bank or money transfer provider to profit from the currency exchange.

In other words, you or your recipient will receive less foreign currency for each unit of currency you exchange. All the while, the provider will claim that they charge zero commission or zero fees.

So the question now is… how can you avoid them? Thankfully, the best travel money cards will allow you to hold the local currency, which you can access instantly with a tap or swipe. Carrying the local currency avoids exchange rate margins on every purchase.

Top Travel Money Tips

- Avoid bureaux de change. They charge between 2.15% and 16.6% of the money exchanged.

- Always pay in the local currency and never accept the dynamic currency conversion .

- Don't use your ordinary debit or credit card unless it's specifically geared toward international use. Doing this will typically cost you between 1.75% and 4.25% per transaction. Instead, use one of the innovative travel money cards below.

By opting for a travel card without FX fees, you can freely swipe your card abroad without worrying about additional charges. However, saving money doesn't stop there. To make the most out of your travel budget, consider using Skyscanner , one of the most powerful flight search engines available that allows you to compare prices from various airlines and find the best deals.

With Skyscanner's user-friendly interface and comprehensive search options, you can discover cheap flights and enjoy your holidays with peace of mind and more money in your pocket.

Best Travel Money Card Tips

When you convert your home currency into a foreign currency, foreign exchange service providers will charge you two kinds of fees :

- Exchange Rate Margin: Providers apply an exchange rate that is poorer than the true "mid-market" exchange rate . They keep the difference, called an exchange rate margin .

- Commission Fee: This fee is usually a percentage of the amount converted, which is charged for the service provided.

With these facts in mind, let's see what practices are useful to avoid ATM fees, foreign transaction fees, and other charges you may encounter while on your travels.

Tip 1: While Traveling, Avoid Bureaux de Change At All Costs

Have you ever wondered how bureaux de change and currency exchange desks are able to secure prime real estate in tourist locations like the Champs-Élysées in Paris or Covent Carden in London while claiming to take no commission? It’s easy: they make (plenty of) money through hidden fees on the exchange rates they give you.

Our study shows that Bureaux de Change in Paris charges a margin ranging from 2.15% at CEN Change Dollar Boulevard de Strasbourg to 16.6% (!!) at Travelex Champs-Élysées when exchanging 500 US dollars into euros for example.

If you really want cash and can’t wait to withdraw it with a card at an ATM at your destination, ordering currencies online before your trip is usually cheaper than exchanging currencies at a bureau de change, but it’s still a very expensive way to get foreign currency which we, therefore, would not recommend.

Tip 2: Always Choose To Pay In the Local Currency

Don’t fall for the dynamic currency conversion trap! When using your card abroad to pay at a terminal or withdraw cash at an ATM, you’ve probably been asked whether you’d prefer to pay in your home currency instead of the local currency of the foreign country. This little trick is called dynamic currency conversion , and the right answer to this sneaky question will help you save big on currency exchange fees.

As a general rule, you always want to pay in the local currency (euros in Europe, sterling in the UK, kroner in Denmark, bahts in Thailand, etc.) when using your card abroad, instead of accepting the currency exchange and paying in your home currency.

This seems like a trick question - why not opt to pay in your home currency? On the plus side, you would know exactly what amount you would be paying in your home currency instead of accepting the unknown exchange rate determined by your card issuer a few days later.

What is a Dynamic Currency Conversion?

However, when choosing to pay in your home currency instead of the local one, you will carry out what’s called a “dynamic currency conversion”. This is just a complicated way of saying that you’re exchanging between the foreign currency and your home currency at the exact time you use your card to pay or withdraw cash in a foreign currency, and not a few days later. For this privilege, the local payment terminal or ATM will apply an exchange rate that is often significantly worse than even a traditional bank’s exchange rate (we’ve seen margins of up to 8%!), and of course, much worse than the exchange rate you would get by using an innovative multi-currency card (see tip #3).

In the vast majority of times, knowing with complete certainty what amount you will pay in your home currency is not worth the additional steep cost of the dynamic currency conversion, hence why we recommend always choosing to pay in the local currency.

Tip 3: Don't Use a Traditional Card To Pay in Foreign Currency/Withdraw Cash Abroad

As mentioned before, providers make money on foreign currency conversions by charging poor exchange rates — and pocketing the difference between that and the true mid-market rate. They also make money by charging commission fees, which can either come as flat fees or as a percentage of the transaction.

Have a look at traditional bank cards to see how much you can be charged in fees for spending or withdrawing $500 while on your holiday.

These fees can very quickly add up. For example, take a couple and a child travelling to the US on a two-week mid-range holiday. According to this study , the total cost of their holiday would amount to around $4200. If you withdraw $200 in cash four times and spend the rest with your card, you would pay $123 in hidden currency exchange and ATM withdrawal fees with HSBC or $110 with La Banque Postale. With this money, our travellers could pay for a nice dinner, the entrance fee to Yosemite Park, or many other priceless memories.

Thankfully, new innovative multi-currency cards will help you save a lot of money while travelling. Opening an N26 Classic account and using the N26 card during the same US holidays would only cost $13.60.

Need Foreign Cash Anyway?

In many countries, carrying a wad of banknotes is not only useful but necessary to pay your way since not every shop, market stall, or street vendor will accept card payments. In these cases you'll have two options to exchange foreign currency cheaply:

1. Withraw at an ATM

As we've explored in great depth in this article, withdrawing money from a foreign ATM will almost always come with fees — at the very least from the ATM itself, and so it's therefore the best strategy to use a travel debit card that doesn't charge in specific ATM withdraw fees on its own to add insult to injury. That said, if you need cash, we recommend making one large withdrawal rather than multiple smaller ones . This way, you'll be able to dodge the fees being incurred multiple times.

2. Buy Banknotes (at a Reasonable Rate!)

As we've also seen, buying foreign currency at the airport, at foreign bank branches, or in bureaux de change in tourist hotspots can be surprisingly expensive. Still, not all exchange offices are equally pricey . If you're looking for a well-priced way to exchange your cash into foreign currency banknotes before you travel, Change Group will let you order foreign currency online and pick them up at the airport, train station, or a Change Group branch just before you leave for your holiday. A few pick-up locations in the UK include:

- London centre (multiple locations),

- Glasgow centre,

- Oxford centre,

- Luton Airport,

- Gatwick Airport,

- St. Pancras Station.

(Note that Change Group also has locations in the USA, Australia, Germany, Spain, Sweden, Austria, and Finland!)

Although its exchange rates aren't quite as good as using a low-fee debit card like Revolut, Change Group's exchange rates between popular currencies tend to be between 2% to 3%, which is still a lot better than you'll get at the bank or at a touristy bureau de change in the middle or Paris or Prague!

FAQ About the Best Travel Money Cards

Having reviewed and compared several of the industry's leading neobanks, experts at Monito have found the Wise Account to offer the best multi-currency card in 2024.

In general, yes! You can get a much better deal with new innovative travel cards than traditional banks' debit/credit cards. However, not all cards are made equal, so make sure to compare the fees to withdraw cash abroad, the exchange rates and monthly fees to make sure you're getting the best deal possible.

- Sign up for a multi-currency account;

- Link your bank to the account and add your home currency;

- Convert amount to the local currency of holiday destination ( Wise and Revolut convert at the actual mid-market rate);

- Tap and swipe like a local when you pay at vendors.

Yes, the Wise Multi-Currency Card is uniquely worthwhile because it actually converts your home currency into foreign currency at the real mid-market exchange rate . Wise charges a transparent and industry-low commission fee for the service instead.

More traditional currency cards like the Travelex Money Card are good alternatives, but they will apply an exchange rate that is weaker than the mid-market rate.

The Wise Multi-Currency Card is the best money card for euros because unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your local currency into euros with them.

The live rate you see on Google or XE.com is the one you get with Wise . An industry-low commission fee will range from 0.35% to 2.85%. USD to EUR transfers generally incur a 1.6% fee.

Learn more about how to buy euros in the United States before your trip.

There are usually three types of travel cards, prepaid travel cards, debit travel cards and credit travel cards. Each have pros and cons, here's a short summary:

- Prepaid travel cards: You usually need to load cards with your home currency via a bank wire or credit/debit card top-up. You're then able to manage the balance from an attached mobile app and can use it to pay in foreign currencies or withdraw cash at an ATM abroad tapping into your home currency prepaid balance. With prepaid travel cards, as the name indicates, you can't spend more than what you've loaded before hand. Some prepaid card providers will provide ways to "auto top-up" when your balance reaches a certain level that you can customize. On Revolut for example, you can decide to top-up £100/£200/£500 from your debit card each time your balance reaches below £50.

- Debit travel cards: Some innovative digital banks, like N26 or Monzo, offer travel debit cards that have the same advantages than a Prepaid Travel Cards, except that they're debit card directly tapping into your current account balance. Like a Prepaid travel card, you can't spend more than the balance you have in your current account with N26 or Monzo, but you can activate an overdraft (between €1,000 or €10,000 for N26 or £1,000 for Monzo) if you need it, for a fee though.

Note that even if they're Prepaid or Debit cards, you can use them for Internet payments like a normal credit card.

- Credit travel cards: You can find credit cards made for international payments offering good exchange rates and low fees to withdraw money abroad, but you'll need to pay interests in your international payment if you don't pay in FULL at the end of every month and interest on your ATM withdrawals each day until you pay them back.

Why You Can Trust Monito

Our recommendations are built on rock-solid experience.

- We've reviewed 70+ digital finance apps and online banks

- We've made 100's of card transactions

- Our writers have been testing providers since 2013

Other Monito Guides and Reviews on Top Multi Currency Cards

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

Lufthansa agrees pay rise with flight attendants after strike

- Medium Text

Make sense of the latest ESG trends affecting companies and governments with the Reuters Sustainable Switch newsletter. Sign up here.

Reporting by Ilona Wissenbach, Editing by Rachel More

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Business Chevron

Bitcoin down by 7.9% to $61,842

Bitcoin fell 7.9% to $61,842 at 21:00 GMT on Saturday, losing $5,308 from its previous close.

Middle East latest: Israeli military say more than 200 drones and missiles launched by Iran in unprecedented attack

The IDF have said that a girl, 10, was injured during the Iranian attack, but did not confirm where. Meanwhile, Joe Biden is speaking to Benjamin Netanyahu following the attack.

Sunday 14 April 2024 02:43, UK

- Israel-Hamas war

Please use Chrome browser for a more accessible video player

- Iran launches drones at Israel and they'll arrive in hours - IDF

- Iran says it has also launched missiles as it retaliates for attack on Iranian consulate in Syria

- Sunak condemns Iran's 'reckless attack' in the 'strongest terms'

- Watch : Alistair Bunkall explains what this could mean for Middle East

- Mark Stone analysis : This is unprecedented

- Alex Rossi analysis : An extraordinarily dangerous moment

- Iran seizes Israeli-linked cargo ship with 25 crew on board

- Watch: Revolutionary Guards board vessel by helicopter

- Explained: Why is Iran attacking Israel?

- Live reporting by Jess Sharp and Lauren Russell

President Joe Biden is now speaking with Israeli Prime Minister Benjamin Netanyahu.

It comes after Mr Netanyahu convened his war cabinet earlier today and the US president cut a weekend trip short to return to Washington for a meeting with national security advisers.

Israeli media shared a photo of Mr Netanyahu during the conversation with Mr Biden.

Israel's defence secretary Yoav Gallant also posted on X saying he has spoken with his US counterpart, Lloyd Austin.

He said they discussed Israel's defensive operations in the face of Iran's attack, and went on to thank Mr Austin for "standing bolding with Israel".

Shortly after Iran confirmed that it had launched missiles and drones on Israel, numerous countries - including Israel - closed their airspace.

Jordan and Iraq also temporarily stopped all air traffic, while the attack was ongoing.

Real-time aircraft flight tracking information from Flightradar around the time the attack was reported shows planes avoiding countries surrounding Israel.

The Israeli military has said a "small number" of targets were hit in the Iranian attack, including an IDF base in southern Israel.

It said the base suffered minor damage was caused to the infrastructure.

The IDF said the majority of missiles were intercepted outside Israel's borders and were defended by the IDF aerial defence array before they crossed into Israeli territory.

Israel has requested that the United Nations Security Council to hold an emergency meeting to condemn Iran's attack.

Gilad Erdan, Israel's ambassador to the United Nations, wrote on X that the drone and missile launch was a "serious threat to global peace and security".

He urged the security council to "use every means to take concrete action against Iran" and designate the Iranian Revolutionary Guard as a "terror organisation".

According to a UN diplomat, the council is aiming to hold a meeting later today.

Earlier, United Nations secretary general Antonio Guterres, called for an immediate cessation of the hostilities.

He said he strongly condemns the attack by Iran on Israel.

The Israeli government have released footage of what it says are defence systems shooting down Iranian missiles over Jerusalem.

Earlier, the Israeli military said that more than 200 drones and missiles have been launched by Iran since yesterday.

A senior Israeli military official was quoted by Israeli state media that there would be a "significant response" to the Iranian attack - despite calls from the United Nations and Egypt to restrain from retaliation.

So how possible is an Israeli attack on Iran?

Harley Lippman, from the American Israeli Public Affairs Committee, told Sky News earlier that a "red line" between the two countries has now gone, paving the way for an Israeli attack on Iran.

"Since Israel was attacked and since there are no more red lines, Israel can attack Iran," he said.

"They may be surprised by the Iranian attack and they might not launch a major attack, but Israel has a lot of options.

"One is to do something immediately to show deterrence, some predict they will hit back ten times as hard or the window of opportunity to attack Iran's nuclear facilities is now open.

"I suspect that this is something that will be discussed in Israel. If I was living in an Iranian nuclear facility, I would be wearing a hard hat right now.

"I think Israel has to respond in a strong manner and they will."

There has been no official statement from the Israeli military on a retaliation.

Benjamin Netanyahu and Joe Biden are expected to speak shortly, according to Israeli media.

It comes after Israel's prime minister convened his war cabinet earlier today and the US president cut a weekend trip short to return to Washington for a meeting with national security advisers.

We'll bring you more on this as soon as we get it...

The United Nations secretary general has said he "strongly condemns" the "serious escalation" represented by the attack launched in Israel by Iran.

Posting a statement on X, Antonio Guterres called for an immediate cessation of the hostilities.

He also urged "maximum restraint" from all parties after the attack, which the Israeli military said involved more than 200 drones and missiles.

"I have repeatedly stressed that neither the region nor the world can afford another war," Mr Guterres said.

While the Israeli military has been giving an update on the Iranian attack launched earlier this evening, it has confirmed it is still intercepting incoming threats.

The Israel Defence Forces said "engagement has not ended".

In total, more than 200 drones and missiles have been launched so far, it added.

A girl has been wounded during the Iranian drone and missile attack, the Israel Defence Forces has said.

A military facility has also been lightly damaged, it added.

More than 200 drones and missiles were launched as part of the retaliatory strike, it said.

In total, Israeli warplanes intercepted more than 10 cruise missiles and dozens of drones outside the country's borders, it added.

It also confirmed Iran launched dozens of ground-to-ground missiles, most of which were intercepted.

Our international correspondent Alex Rossi has been speaking from Jerusalem this evening as sirens have sounded in the Israeli capital.

The Israel Defence Forces said that sirens in several other areas have also been set off including: southern Israel, the Shomron area, the area of the Dead Sea and northern Israel.

Watch the eyewitness report from Rossi as sirens, explosions and aircraft can be heard:

Be the first to get Breaking News

Install the Sky News app for free

Trump is coming back to the Lehigh Valley. Here’s how to see him and what to expect.

- Updated: Apr. 11, 2024, 12:30 p.m. |

- Published: Apr. 11, 2024, 10:53 a.m.

Supporters of President Donald Trump line Route 100 on May 14, 2020, ahead of his first visit to the Lehigh Valley. Sarah Cassi | For lehighvalleylive.com

- Rudy Miller | For lehighvalleylive.com

Former president Donald Trump is coming to the Lehigh Valley.

Thousands are expected to show up Saturday at the Schnecksville Fire Company fairgrounds in North Whitehall Township, according to Lehigh County Republican Committee Chairman Joe Vichot.

If you purchase a product or register for an account through a link on our site, we may receive compensation. By using this site, you consent to our User Agreement and agree that your clicks, interactions, and personal information may be collected, recorded, and/or stored by us and social media and other third-party partners in accordance with our Privacy Policy.

Watch CBS News

Biden is canceling $7.4 billion in student debt for 277,000 borrowers. Here's who is eligible.

By Aimee Picchi

Edited By Alain Sherter

Updated on: April 12, 2024 / 3:29 PM EDT / CBS News

The Biden administration on Friday said it's canceling $7.4 billion in student debt for 277,000 borrowers, with the recipients scheduled to receive emails today to alert them to their loan discharges.

The latest effort extends the debt relief provider under President Joe Biden after the Supreme Court last year blocked his administration's plan for broad-based student loan forgiveness. With the latest batch of loan cancellations, the White House said it has forgiven about $153 billion in debt for 4.3 million student borrowers.

Biden, who had made student loan relief a major campaign pledge, is tackling an issue that affects about 43 million Americans with a combined $1.7 trillion in student debt. It's a burden that some borrowers and their advocates say has harmed their ability to save for a home or achieve financial milestones, an issue that was echoed by Education Secretary Miguel Cardona in a conference call with reporters.

"I talked to a teacher in New York this week who took out a loan for $30,000," Cardona said Friday, "and after over a decade of paying and being a teacher the debt was $60,000, and she was saying that the interest was so high that the payments that she was making wasn't even touching her principal."

He added, "We are fixing a broken system. We're relentless and taking steps to transform a broken system into one that works people across the country."

Here's what to know about who is eligible for the latest round of forgiveness.

Who qualifies for the student loan forgiveness?

Three groups of people qualify under the latest round of debt relief, the White House said.

- $3.6 billion for 206,800 borrowers enrolled in the SAVE plan.

About $3.6 billion will be forgiven for nearly 207,000 borrowers enrolled in the Saving on a Valuable Education (SAVE) plan, an income-driven repayment program, or IDR, that the Biden administration created last year.

The White House said borrowers who are getting their debt discharged under SAVE had taken out smaller loans for their college studies. The plan allows people to receive forgiveness after they made at least 10 years of payments if they originally took out $12,000 or less in loans to pay for college; borrowers with larger loans are eligible after 20 or 25 years of repayment, depending on what types of loans they have.

"You sacrifice and you've saved for a decade or more to make your student loan payments, and you originally borrowed $12,000 or less, you're going to see relief," Cardona told reporters. "An overwhelming number of those who qualify for SAVE were eligible for Pell grants and come from low- and middle-income communities."

- $3.5 billion for 65,700 borrowers in income-repayment plans.

These borrowers will receive forgiveness through "administrative adjustments" to repayment plans where loan servicers had made it tougher for some borrowers to qualify for relief.

"These are people who paid for a long time but were being deprived of relief because of administrative and servicing failures," Cardona said. "These people met the contract of their loan" and will receive forgiveness.

- $300 million for 4,600 borrowers through Public Service Loan Forgiveness (PSLF).

The PSLF program is designed to help public servants like teachers and government employees achieve debt forgiveness after 10 years of repayment. It's a program that started in 2007 but had been plagued with complex rules that effectively hampered people from getting their debt discharged, with only 7,000 receiving loan forgiveness prior to the Biden administration.

With the latest round of discharges, the Biden administration has forgiven $62.8 billion in loans for 876,000 borrowers through PSLF.

Are there legal challenges to Biden's debt forgiveness plans?

In two separate lawsuits, Republican attorneys general in 18 states are pushing to have the SAVE plan tossed and to halt any further student debt cancellation. They say the SAVE plan oversteps Biden's authority and makes it harder for states to recruit employees. They also contend the plan undermines a separate cancellation program that encourages careers in public service.

It's unclear what the suits could mean for loans that have already been canceled. A court document filed by Kansas' attorney general says it's "unrealistic to think that any loan forgiveness that occurs during this litigation will ever be clawed back."

—With reporting by the Associated Press.

- Biden Administration

- Student Loan

Aimee Picchi is the associate managing editor for CBS MoneyWatch, where she covers business and personal finance. She previously worked at Bloomberg News and has written for national news outlets including USA Today and Consumer Reports.

More from CBS News

Maryland sportsbooks handle nearly $536M in March, $8.2M goes to state

Howard County Public School supporters stand up against potential budget cuts

Plans for flooding prevention underway in Annapolis after heavy rains

NTSB report on fatal I-695 crash reveals safety lapses; victims family lawyer demands action

IMAGES

COMMENTS

Military finance offices use the pay system exchange rate to convert the required amount of local currency (based on the OHA permitted) to U.S. dollars. Payments for OHA depend on dependency status, permanent duty station, grade, and rent payments for privately leased quarters. Service members can calculate their OHA by using the OHA Rate ...

This exclusive program's advantages include: $250 Instant Travel Benefit. Best Price Guarantee. Military Star Card Accepted. 25,000 Cruise Sailings Available. 250,000 Hotels, No Blackout Dates. 1000s of Luxury Resorts Around the Globe. Airfare and Car Rentals.

This date will be on your military orders. Refer to the Joint Travel Regulations (JTR) for more information. Check Your Voucher Status Online. There's an easy way to find out the status of your travel voucher! The tool provides travel payment status for Active duty Army PCS and active duty Army and National Guard. This is for non-DTS travel claims.