Please Note: JavaScript is not enabled in your web browser. In order to enjoy the full experience of the Discover website, please turn JavaScript on. If JavaScript is disabled, some of the functionality on our website will not work, such as the display of rates and APRs.

- Card Help Center

- Credit Resource Center

- Banking Help Center

- Home Loans Help Center

- Student Loans Help

- Personal Loans Help

- Gift Card Help

- Log In Opens modal dialog

Secure Account Log In

Please complete all fields below

- Forgot User ID/Password?

- Activate Credit Card

- Register Your Account

You're logged out

You're now securely logged out. We hope to see you again soon.

We'll Be Right Back!

How to Set Up Credit Card Travel Notifications

Putting a travel notification on your credit card may prevent a major travel headache.

Set Up Credit Card Travel Notifications

Getty Images

Travel notifications prevent a credit card issuer from flagging a purchase you make out of the country as fraudulent.

You might be ready for an upcoming trip, but is your credit card? Depending on your card issuer, you might need to set up a travel notification for your account.

Adding a card travel notification is easy. For most credit cards, you'll follow these steps:

- Call your credit card company, log in to its website or access its app.

- Share your travel dates and locations, if applicable.

- Submit and verify your travel notification.

This will help you avoid potential hassles and embarrassing situations when you're away.

What Are Travel Notifications?

A travel notification is essentially a setting you activate on your credit card account. "Basically, you're just telling the credit card issuer you're going to be using the card outside of the normal places you (use it). That way, they don't think someone stole your credit card," says Simon Zhen, research analyst at personal finance website MyBankTracker.com.

If you're on a road trip, you could make a card purchase in one town and then try to shop in another distant location but have your card rejected. Dan Hanks, senior vice president of credit card loyalty and servicing at PNC Bank, says if a transaction appears to be fraudulent, it may be declined, even if it is a legitimate purchase. Purchase location is just one factor credit card companies consider when flagging fraudulent transactions .

"If a customer suddenly starts using a card in a place they've never been, especially in another country, it doesn't mean we'll decline them, but it increases the chance we might stop the transaction if we think it's fraud," Hanks says.

Transactions may be marked as fraudulent and your card deactivated as a precaution, particularly if your issuer can't reach you to confirm them. If you only bring one credit card on your trip, you may have a major problem on your hands. Luckily, setting up a travel notification before you leave is an easy solution.

How to Set Up Travel Notifications

A travel notification usually requires you to provide your planned destinations and trip dates to your credit card issuer. With that information, the issuer has more knowledge to weed out fraudulent transactions from legitimate ones.

You usually have a few options to set up a travel notification. First, you can call the card issuer. "Look on the back of the card, and you can find the phone number to call. You just tell the customer service rep that you'll be traveling," Zhen says. If you prefer digital communication, you can typically set up a travel notification through the credit card company's website or app.

Each credit card company has its own travel notification policies. While many companies allow you to set up travel notifications, others may not need you to tell them about your travel plans. Below are the policies of major credit card issuers:

American Express does not request travel notifications, citing industry-leading fraud detection capabilities.

Bank of America allows you to create a travel notice up to 60 days before your trip, and it can last up to 90 days from the first day of your excursion. With one travel notice, you can set up multiple itineraries for various cards. You must provide Bank of America a contact number for when you're away from home. You can also supply details about where you'll be staying, any planned layovers and other information that may help the company monitor your account for fraud while you're traveling.

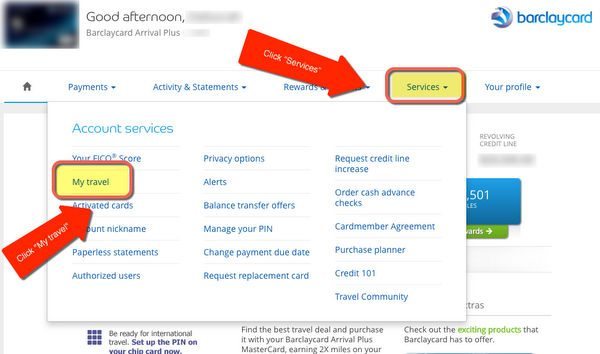

According to Barclays , a travel notification is not mandatory, but it could be wise to avoid declined purchases simply because you are traveling abroad or to a different part of the U.S. Contact the bank by phone, or access your account online or with the Barclays app to set up a notification. If you will be traveling for more than 365 days, connect with the bank by phone to set up a notification.

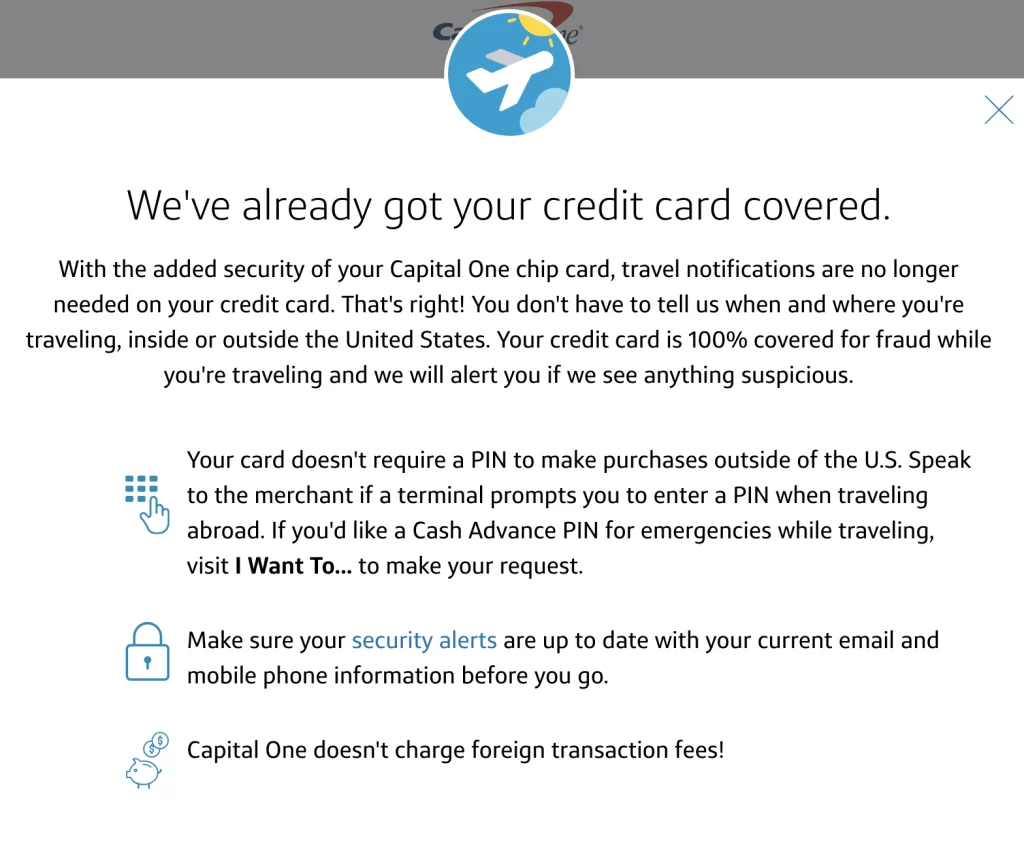

Capital One doesn't need notification of travel plans because of the added security of the bank's chip cards.

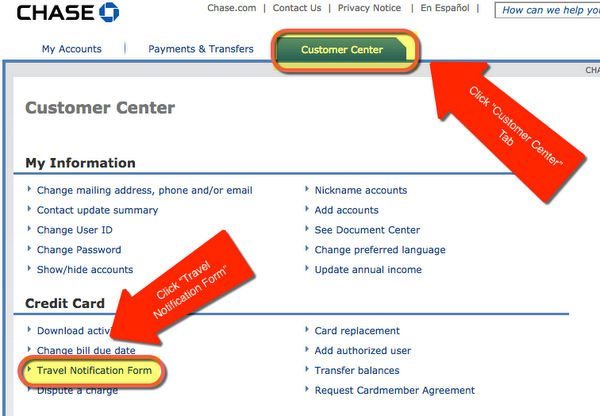

Chase lets you set up a travel notification up to a year before your trip. The notification can last up to 90 days. You can apply the notification to multiple cards simultaneously and list multiple destinations.

Citi permits you to add a travel notification up to 180 days before your journey and up to 89 days after your trip begins. You can set the notification for more than one card and report several destinations with one travel notification.

Discover advises setting up a notification before you embark on a trip abroad. Your travel start date can be up to 24 months in the future, and travel notifications can last up to 24 months.

PNC Bank suggests notifying it of the locations and dates of your planned travel to help eliminate phone calls to confirm your account activities. You can create travel notifications up to two years before you depart, and notifications can last up to 30 days. If your travel plans exceed 30 days, you can set up more than one travel alert.

USAA recommends a travel notification to reduce the chance of your card being blocked or flagged for unusual activity. You can set up a notification up to one year before your trip, and the notification will last up to one year from your departure. USAA does not request travel destinations.

U.S. Bank allows you to establish a travel notification for any trip within the next 90 days. Notifications can last up to 90 days. If your travel plans exceed 90 days, you can set up an additional notification at a later date.

Wells Fargo favors notification of when and where you plan to travel. Wells Fargo's travel notifications do not have any time-based restrictions, so you can set up your travel alert for as long as you'll be away and not have to set up subsequent ones.

Overall, setting up a travel notification doesn't have a downside for the customer, Hanks says. Making travel notifications easy to activate is in a credit card company's best interest. And notifications reduce the chance that a real transaction may be classified as fraudulent, which makes everyone happier.

Don't Forget About Debit Cards

"Some people set up a travel notification on a credit card but forget to set one up on their debit card," Zhen says.

While credit cards offer many protections that can be useful when traveling, especially abroad, some people may still plan to use their debit cards. If you do, make sure you set up a travel notification on your debit cards, too, so your purchases on those cards don't get flagged as fraudulent transactions when you're on your next trip.

Tags: credit cards

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

How to Set a Travel Notice for Your Credit Cards

Susan Shain

Susan is a freelance writer who specializes in turning complex financial topics into engaging and accessible articles. She's been writing about personal finance for six years, and was previously the senior writer at The Penny Hoarder and a staff writer at Student Loan Hero. Her personal finance writing has also appeared in publications like MarketWatch and Lifehacker.

When I worked at a ski rental shop in Breckenridge, Colorado, I witnessed many international (and some out-of-state) customers’ credit cards get declined.

Not because their credit limits were too low or because they were purchasing too much — but because they failed to set up travel notifications with their card issuers.

So now, any time I travel to a foreign country, I always set up a travel notice on my credit card beforehand.

Since I travel with the Chase Sapphire Reserve® (Review), I create a Chase travel notice, but you can take this step with most major credit or debit cards. Here’s how.

What Is a Credit Card Travel Notice?

As a way to prevent fraud , your credit card issuer monitors your spending activity. If it notices a suspicious purchase — in an unusually large amount, or from a new location — it may decline the transaction. This could be more likely in countries where fraud is a bigger problem.

Which is why the answer to the question “Should I notify my credit card company when traveling?” is usually yes.

Although you can often get away with shopping in another state without triggering a red flag, international travel is another story.

By notifying your credit card of your travel plans, you’ll reduce the chances of getting your transaction declined in the checkout line — which, trust me, is never fun — and having to call your card issuer to verify your purchases. It’s still possible to have your purchases declined after setting a travel notice, but it’s much less likely.

How to Set Up Travel Notices for 8 Major Credit Card Issuers

Ready to create your first travel alert? While you could call your card issuer, it’s easier to do it online.

Here’s how to set up travel notices with eight different credit card issuers.

When you visit MoneyTips, we want you to know that you can trust what’s in front of you. We are an authoritative source of accurate and relevant financial guidance. When MoneyTips content contains a link to partner or sponsor affiliated content, we’ll clearly indicate where that happens. Any opinions, analyses, reviews or recommendations expressed in our content are of the author alone, and have not been reviewed, approved or otherwise endorsed by the advertiser.

We make every effort to provide up-to-date information; however, we do not guarantee the accuracy of the information presented. Consumers should verify terms and conditions with the institution providing the products. Some articles may contain sponsored content, content about affiliated entities or content about clients in the network. While reasonable efforts are made to maintain accurate information, the information is presented without warranty.

Chase travel notice

Because of the company’s abundant travel perks and partnership with the Visa network — which is widely accepted worldwide — Chase cards are a favorite among globetrotters.

You can create Chase travel notifications up to a year in advance for credit cards, and up to 14 days for debit cards. Your travel dates can span an entire year — if you’re away for longer, you’ll simply have to adjust your dates once you’re on the road. Chase will have your request on file within 24 hours from the time you submit.

To set up Chase travel notifications, you’ll need to log in to your account and click on the credit card you plan to use. Under the “Things you can do” dropdown menu on the right, you’ll see the “Travel notification” option. That will take you to your “Profile & Settings” page, where you’ll be able to create a travel alert.

Insider tip

Depending on the type of Chase account you have, the process may be slightly different for you. In any case, just look for your “Profile & Settings” page, and then look for a button to set a travel notice.

Alternatively, if you’re already outside the country, you can call Chase collect at 1-302-594-8200 to alert the issuer of your travel plans.

Setting up a travel notice with the Chase bank app

After logging in to the Chase mobile app, tap the profile icon (this should appear as the outline of a person) and select “My settings.” Choose “Travel” within the settings menu and tap “Update” near any credit or debit card products you’ll be taking.

This will allow you to enter the details for your upcoming trip, which can be edited at a later time. Saving this information will successfully set up a travel notice.

Our favorite Chase travel card: While many Chase credit cards are adventure-ready, we’d recommend the Chase Sapphire Preferred® Card for new travelers. Not only does it earn 2X Chase Ultimate Rewards points per dollar on travel, but you’ll also get a great introductory bonus: 60,000 bonus points after spending $4,000 on purchases in the first 3 months. You’ll also earn 5X Ultimate Rewards points per dollar on Lyft rides and travel purchased through Chase Ultimate Rewards. You can transfer the points you earn to a variety of airline and hotel loyalty programs. The Sapphire Preferred has a $95 annual fee.

American Express travel notice

Surprise! You actually can’t create an Amex travel notice.

On its site, the issuer says it uses “industry-leading fraud detection capabilities” that help it recognize when you’re on the road, thereby eliminating the need to create an American Express travel notification.

The issuer does recommend you update your contact information, so it can reach you in case of any complications, and download the Amex app, so you can manage your account on the go.

Note that Amex credit cards aren’t as widely accepted across the globe. If you’re a frequent international traveler, we’d recommend looking for a card with a Visa or Mastercard logo instead because they’re accepted by most merchants.

Our favorite American Express travel card: For its $695 Rates & Fees annual fee, The Platinum Card® from American Express offers a slew of travel perks. They include extensive airport lounge access; 5X Membership Rewards points per dollar on eligible flights and hotels (starting 1/1/21, on up to $500,000 spent per calendar year); and up to $200 in Uber credits per year. Its introductory bonus is Earn 100,000 Membership Rewards® points after you spend $6,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu..

Capital One travel notice

As with Amex, there’s no need to set a travel notice for Capital One credit cards.

If you log in and click “Set Travel Notification,” you’ll be greeted by this window:

The issuer, long popular with international travelers for its lack of foreign transaction fees, says: “With the added security of your Capital One chip card, travel notifications are no longer needed on your credit card.”

It notes Capital One will cover you with its $0 fraud liability policy, and will also be on the lookout for any suspicious activity.

Our favorite Capital One travel card: The Capital One Venture Rewards Credit Card is a fantastic, easy-to-use travel rewards card, offering 2X Venture miles per dollar on everything. The introductory bonus is 60,000 bonus miles for spending $3,000 in the first 3 months. It comes with a $95 annual fee.

Bank of America travel notice

Ready to travel with your Bank of America card? Log in to your account, and in the menu at the top right, you’ll see “Help & Support.”

Hover over those words, and a drop-down menu will appear. Click on “Set Travel Notice” — and voila! You’ll be able to add your travel dates and destinations, as well as extra details about your trip, like any planned layovers.

Setting a travel notice with Bank of America.

Bank of America cards allow you to set travel notices up to 60 days in advance, and they can last for up to 90 days. If you’ll be traveling longer than that you’ll need to adjust your travel notice later on.

Our favorite Bank of America travel credit card: If you don’t want to pay an annual fee, the Bank of America® Travel Rewards Credit Card might work for you. You’ll earn 3X points per dollar at the Bank of America travel center and 1.5X points on everything else. After you make $1,000 in purchases in the first 90 days, you’ll earn 25,000 points — enough for a $250 statement credit toward travel purchases.

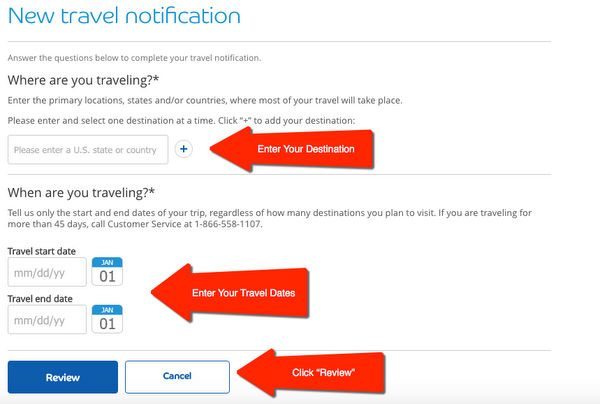

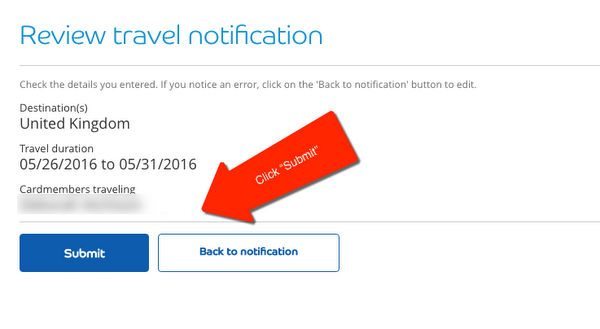

Citi travel notice

If you have a Citi credit card, the first step is to log in to your account.

Then you should hover over the “Services” button in the menu, and then select “Travel Services.” Next you can select “Manage Travel Notices,” before selecting the card for which you want to set a notice. Unlike some other issuers, you’ll need to set a separate notice for each card you plan to travel with.

Citi advises making sure your contact information is up to date before traveling, and also to download the Citi Mobile App to more easily monitor your account.

Here’s what setting a Citi travel notice looks like:

Setting a travel notice with Citi.

Then, once you fill out your destination and dates and verify your info, you’ll be good to go!

Our favorite Citi travel credit card: The offers a generous 3X ThankYou points per dollar on air travel and at gas stations, restaurants, supermarkets, and hotels. You can earn None. There’s a None annual fee to pay for this card.

Discover travel notice

Although Discover credit cards aren’t the best for traveling internationally, as they aren’t accepted as widely as Visa or Mastercard, you should still set up a travel notice if you bring your Discover card overseas.

You can do this from your online account by selecting “Manage” at the top of your screen, then clicking “Manage Cards” and then “Register Travel.”

Setting a travel notice with Discover.

Our favorite Discover travel card: For a card with no annual fee, the Discover it® Miles isn’t a bad choice. You’ll get 1.5X miles per dollar spent on everything, with double your miles at the end of your first cardholder year.

PNC travel notice

If you have a PNC credit or debit card, the bank recommends you set up a travel notice, explaining: “You typically use your card at local merchants and online, but suddenly you’re buying tapas in Madrid or sushi in Tokyo. This unexpected activity is what triggers the alert. Although less likely, this kind of predicament also can happen when traveling domestically.”

To notify PNC, you can either call the financial institution at 1-888-PNC-BANK or set up an alert online. After logging in to your account, you’ll select: “Customer Service” –> “Account Services” –> “Debit/ATM Card Services” –> “Edit/View Preferences.”

Then, in the bottom right corner of your screen, you’ll see an option to “Notify PNC of Foreign Travel.” After filling it out with your dates, destinations, and phone number, you’ll be ready to go.

Recommended PNC travel credit card: Like the BofA card, the PNC Premier Traveler® Visa Signature® isn’t the best option out there — but it’s fine for PNC loyalists. It offers a 30,000-mile introductory bonus when you spend $3,000 in the first three billing cycles, and 2X miles per dollar spent on everything. Its $85 annual fee is waived the first year.

Wells Fargo travel notice

If you’d like to tell Wells Fargo of your travel plans, you can either call the number on the back of your card, use the bank’s mobile app, or log in to your online account.

If you choose the latter method, you’ll hover over the “Accounts” dropdown menu, then click on “Manage Cards” –> “Manage Travel Plans.” As with the other issuers, you’ll enter your dates and destinations before submitting.

Recommended Wells Fargo travel credit card: There aren’t any Wells Fargo travel cards at the moment.

If you’d prefer a Visa card from Wells Fargo for traveling, consider the Wells Fargo Active Cash℠ Card . It offers 2% cash back on everything you buy, with a solid introductory bonus, but it also has a foreign transaction fee.

4 Things to Consider When Choosing a Travel Credit Card

If you’re looking for another piece of plastic to add to your wallet, here are four things to consider when choosing the best travel rewards credit card:

- Foreign transaction fees: Some credit cards charge a 3% fee for making purchases in a foreign currency. If you plan to travel abroad, make sure your chosen card has no foreign transaction fees.

- Annual fees: Many of the top-tier travel rewards credit cards have hefty annual fees. But before getting scared off, see if the card offers any credits or benifits that offset it. For example, while the Chase Sapphire Reserve® has a $550 annual fee, it also offers a $300 annual travel credit that applies toward flights, car rentals, and even Lyft rides.

- Rewards and perks: One of the most compelling reasons to get a travel credit card is the opportunity to earn points and miles that you can exchange for free travel. So take a look at your potential card’s introductory bonus and earning ability. You should also read the fine print to learn all about its travel perks, which might include airport lounge access or travel insurance.

- Loyalty programs: The majority of hotel chains and airlines have co-branded cards that earn additional rewards when you spend money with them. So if you are loyal to a particular brand, it’s wise to consider the co-branded options. For hotel cards, examples include the IHG® Rewards Club Premier Credit Card, Marriott Bonvoy Boundless™ Credit Card, and The World of Hyatt Credit Card. For airline cards, you can choose from options like the United℠ Explorer Card or Southwest Rapid Rewards® Plus Credit Card.

Whichever card you choose, be sure to set a travel notice before you board your next train or cruise or flight — and then enjoy your vacation free of worries!

You don’t have to stick to “travel credit cards” just because you want to, you know, travel with your credit card. As long as you set up a travel notification when you go, you can use any card you’d like. So, in case they’re a better fit, here are links to the best cash back, balance transfer, and 0% intro APR credit cards.

Share Article

On This Page Jump to Close

You should also check out….

Ascent/PKS Media Inc./Getty Images

Advertiser Disclosure

Can you use a Discover card for international travel?

Yes, you can – and may even be surprised by the perks of doing so

Published: February 14, 2022

Author: Erica Lamberg

Editor: Grace Pilling

Reviewer: Barri Segal

Why trust us?

Discover card holders can use their card at more than 44 million merchants in more than 190 countries and territories, and Discover’s international acceptance continues to grow.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

Discover issues some of the most popular cash back credit cards in the U.S., but the issuer might not be at the top of your mind when you think of international travel. You may be surprised to learn that, though the Discover network doesn’t have the vast international reach of Mastercard or Visa, your Discover card can be a good travel companion.

Discover card holders can use their cards at more than 44 million merchants in more than 190 countries and territories, and Discover’s international acceptance continues to grow. Furthermore, Discover has good perks for travelers, including generous cash back rewards, introductory APR offers, no annual fees and – especially useful for traveling outside the U.S. – no foreign transaction fees .

Read on to learn more about where Discover cards are accepted internationally, plus some tips for using a Discover card for international travel.

The best Discover card for international travel

Where is discover card accepted.

Before you embark on your trip, you should check Discover’s online map to see if your card will be accepted where you are traveling. Discover card acceptance varies widely between countries – even those within the same continent.

Discover card in North America

Discover has the widest acceptance within its home base, the United States. However, you may have trouble using your Discover card in Canada, since acceptance is more limited there.

Discover card in Central America

In Central America, Discover card acceptance is high in Belize, but more limited in most countries.

Discover card in South America

On the other hand, you’ll have an easier time using your Discover card for travel in South America. The acceptance rate is high in many countries there, including popular destinations, Argentina, Brazil, Chile and Peru.

Discover card in Europe

Unfortunately, using your Discover card can be hit or miss in Europe. While acceptance is high in a few countries, such as Austria and Switzerland, it’s more limited in many popular destinations. France, in particular, has a low acceptance rate.

Discover card in Asia

While using a Discover card is likely to be difficult in most of Asia, acceptance is high in a handful of Asian countries. Discover has a partnership with UnionPay in China and JCB in Japan. These alliances have boosted acceptance rates in those two regions. Discover card is also highly accepted in Israel, India and South Korea.

Discover card in Africa

Acceptance is limited in most of Africa, with the exception of two popular tourist destinations: Kenya and Morocco.

Other countries that accept Discover

Acceptance is limited in most spots in Oceania and the Pacific. However, the Caribbean is a hot spot for using your Discover card – acceptance is high in most of the islands there.

Tips for using your Discover card internationally

Laks Vasudevan, senior vice president of consumer card product management at Discover, offers the following tips when using Discover or any credit card:

- Report a lost or missing credit card . In case your Discover card is lost or stolen while traveling, you can use Discover’s Freeze it feature to lock your account in seconds by calling Discover or logging into your account. You can unfreeze your account just as quickly.

- Make sure you’re not liable for fraud . In case someone steals your credit card information, report it right away to your credit card issuer and check your account frequently for fraudulent activity. At Discover, customers are never responsible for unauthorized credit card, debit card, online, or mobile banking transactions on their accounts.

- Register your travel plans with Discover . Notify Discover online, via the mobile app or over the phone (1-800 DISCOVER) to help ensure uninterrupted use of your card.

- Look for the Discover and Diners Club International acceptance logos at merchants . This will show you where you can use your Discover card. Note that there are a few exceptions to this guideline, including Japan (JCB), China (UnionPay) and India (RuPay). Check Discover’s website for a full list of its affiliated networks.

- Make copies of the front and back of your credit card . Keep these in a separate place in case your card is lost or stolen.

- Understand that individual vendors may not accept the card . Even in countries where Discover card acceptance is high, it won’t be universal. Tourist hotspots like hotels, restaurants or stores are more likely to take Discover. Outside of tourist zones, you may have a hard time using your Discover card. Be sure to have either a Mastercard or Visa card (and some cash) on hand.

Bottom line

Before departing for your international trip, it’s important to consider if your Discover card will be widely accepted in the country you’ll be visiting. Although Discover is growing in popularity and is well-accepted internationally, prudent planning is still important.

This advice applies to any card you choose to bring on your travels: Be sure to bring at least two credit cards – and inform both issuers that you’ll be traveling – to save yourself from being caught empty-handed.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Erica Lamberg is a business, and travel writer whose work also appears in Gannett, US News & World Report, MSN, The Ladders, Reader’s Digest and NBC News. She is based in suburban Philadelphia.

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week.

By providing my email address, I agree to CreditCards.com’s Privacy Policy

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Learn more about Card advice

Is the Discover it Student Cash Back worth it?

College students have plenty of cards from which to choose if they want to build credit. How does the Discover it Student Cash Back card compare?

Activate Discover bonus categories for Q3 2023

Discover has added a few new bonus categories in 2022, including gyms, fitness clubs and digital wallets.

Is the Discover it Cash Back worth it?

Activate Discover bonus categories for Q2 2023

Guide to Discover it Cash Back rewards and benefits

How to maximize Discover it Cash Back's benefits

Explore more categories

- Credit management

- To Her Credit

Questions or comments?

Editorial corrections policies

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe.

Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Our top goal is simple: We want to help you narrow down your search so you don’t have to stress about finding your next credit card. Every day, we strive to bring you peace-of-mind as you work toward your financial goals.

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience.

Editorial integrity is central to every article we publish. Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com , email Lance Davis, VP of Content, at [email protected] .

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My watchlist

- Stock market

- Biden economy

- Personal finance

- Stocks: most active

- Stocks: gainers

- Stocks: losers

- Trending tickers

- World indices

- US Treasury bonds

- Top mutual funds

- Highest open interest

- Highest implied volatility

- Currency converter

- Basic materials

- Communication services

- Consumer cyclical

- Consumer defensive

- Financial services

- Industrials

- Real estate

- Mutual funds

- Credit cards

- Credit card rates

- Balance transfer credit cards

- Business credit cards

- Cash back credit cards

- Rewards credit cards

- Travel credit cards

- Checking accounts

- Online checking accounts

- High-yield savings accounts

- Money market accounts

- Personal loans

- Student loans

- Car insurance

- Home buying

- Options pit

- Investment ideas

- Research reports

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

How to Set Up Credit Card Travel Notifications

You might be ready for an upcoming trip, but is your credit card? Depending on your card issuer, you might need to set up a travel notification for your account.

Adding a card travel notification is easy. For most credit cards, you'll follow these steps:

-- Call your credit card company, log in to its website or access its app.

-- Share your travel dates and locations, if applicable.

-- Submit and verify your travel notification.

This will help you avoid potential hassles and embarrassing situations when you're away.

[ Read: Best Travel Rewards Credit Cards. ]

What Are Travel Notifications?

A travel notification is essentially a setting you activate on your credit card account. "Basically, you're just telling the credit card issuer you're going to be using the card outside of the normal places you (use it). That way, they don't think someone stole your credit card," says Simon Zhen, research analyst at personal finance website MyBankTracker.com.

If you're on a road trip, you could make a card purchase in one town and then try to shop in another distant location but have your card rejected. Dan Hanks, senior vice president of credit card loyalty and servicing at PNC Bank, says if a transaction appears to be fraudulent, it may be declined, even if it is a legitimate purchase. Purchase location is just one factor credit card companies consider when flagging fraudulent transactions .

"If a customer suddenly starts using a card in a place they've never been, especially in another country, it doesn't mean we'll decline them, but it increases the chance we might stop the transaction if we think it's fraud," Hanks says.

Transactions may be marked as fraudulent and your card deactivated as a precaution, particularly if your issuer can't reach you to confirm them. If you only bring one credit card on your trip, you may have a major problem on your hands. Luckily, setting up a travel notification before you leave is an easy solution.

How to Set Up Travel Notifications

A travel notification usually requires you to provide your planned destinations and trip dates to your credit card issuer. With that information, the issuer has more knowledge to weed out fraudulent transactions from legitimate ones.

You usually have a few options to set up a travel notification. First, you can call the card issuer. "Look on the back of the card, and you can find the phone number to call. You just tell the customer service rep that you'll be traveling," Zhen says. If you prefer digital communication, you can typically set up a travel notification through the credit card company's website or app.

[ Read: Best Airline Credit Cards. ]

Each credit card company has its own travel notification policies. While many companies allow you to set up travel notifications, others may not need you to tell them about your travel plans. Below are the policies of major credit card issuers:

American Express does not request travel notifications, citing industry-leading fraud detection capabilities.

Bank of America allows you to create a travel notice up to 60 days before your trip, and it can last up to 90 days from the first day of your excursion. With one travel notice, you can set up multiple itineraries for various cards. You must provide Bank of America a contact number for when you're away from home. You can also supply details about where you'll be staying, any planned layovers and other information that may help the company monitor your account for fraud while you're traveling.

According to Barclays , a travel notification is not mandatory, but it could be wise to avoid declined purchases simply because you are traveling abroad or to a different part of the U.S. Contact the bank by phone, or access your account online or with the Barclays app to set up a notification. If you will be traveling for more than 365 days, connect with the bank by phone to set up a notification.

Capital One doesn't need notification of travel plans because of the added security of the bank's chip cards.

Chase lets you set up a travel notification up to a year before your trip. The notification can last up to 90 days. You can apply the notification to multiple cards simultaneously and list multiple destinations.

Citi permits you to add a travel notification up to 180 days before your journey and up to 89 days after your trip begins. You can set the notification for more than one card and report several destinations with one travel notification.

Discover advises setting up a notification before you embark on a trip abroad. Your travel start date can be up to 24 months in the future, and travel notifications can last up to 24 months.

PNC Bank suggests notifying it of the locations and dates of your planned travel to help eliminate phone calls to confirm your account activities. You can create travel notifications up to two years before you depart, and notifications can last up to 30 days. If your travel plans exceed 30 days, you can set up more than one travel alert.

[ Read: Best Hotel Credit Cards. ]

USAA recommends a travel notification to reduce the chance of your card being blocked or flagged for unusual activity. You can set up a notification up to one year before your trip, and the notification will last up to one year from your departure. USAA does not request travel destinations.

U.S. Bank allows you to establish a travel notification for any trip within the next 90 days. Notifications can last up to 90 days. If your travel plans exceed 90 days, you can set up an additional notification at a later date.

Wells Fargo favors notification of when and where you plan to travel. Wells Fargo's travel notifications do not have any time-based restrictions, so you can set up your travel alert for as long as you'll be away and not have to set up subsequent ones.

Overall, setting up a travel notification doesn't have a downside for the customer, Hanks says. Making travel notifications easy to activate is in a credit card company's best interest. And notifications reduce the chance that a real transaction may be classified as fraudulent, which makes everyone happier.

Don't Forget About Debit Cards

"Some people set up a travel notification on a credit card but forget to set one up on their debit card," Zhen says.

While credit cards offer many protections that can be useful when traveling, especially abroad, some people may still plan to use their debit cards. If you do, make sure you set up a travel notification on your debit cards, too, so your purchases on those cards don't get flagged as fraudulent transactions when you're on your next trip.

Recommended Stories

Conor mcgregor displays concerning behavior with twitches, difficulty speaking in interview.

McGregor's "Road House" hit Prime Video this week.

Dodgers' reported reaction to Shohei Ohtani's $680 million deferral request: 'Holy f***'

Andrew Friedman reacted like the rest of us when he heard Shohei Ohtani's contract proposal.

NFL mock draft: A top QB prospect falls amid trades galore in the top 10

Charles McDonald and Nate Tice's latest mock draft has five quarterbacks off the board in the top 13, a big-time weapon for Aaron Rodgers and some steals in the second half of the first round.

March Madness: Auburn's Chad Baker-Mazara ejected less than 5 minutes into Tigers' upset loss to Yale

Baker-Mazara was tossed after he was called for a flagrant 2 foul.

Texas is refusing to register kei trucks, and owners are fighting back

"The Autopian" reports that owners of kei trucks are running into more problems registering their vehicles, and an organization formed to fight back.

Boeing targets a culprit of 737 MAX production woes: 'Traveled work'

Boeing's CFO today outlined the steps the company is taking to address a series of issues affecting the safety and reliability of its planes (not to mention the company’s reputation).

Report: Chiefs CB L'Jarius Sneed to be traded to Titans

The Chiefs gave L'Jarius Sneed the franchise tag this offseason.

These Patagonia jackets are a steal right now at REI at almost $250 off

Combine these deals for a cold-weather system that'll keep you warm and dry for years to come for nearly $250 off the MSRP

NBA's G League Ignite will no longer exist after this season

Jalen Green, Jonathan Kuminga and Scoot Henderson are notable G League Ignite alum.

Pass or Fail: Houston Texans show off new road uniforms after Reddit leak

Texans CEO and Chairman Cal McNair took to Reddit to show off one of the team's new uniform combinations in response to a leak.

Newly hired Michigan defensive line coach resigns after OWI arrest

Greg Scruggs was hired earlier in March after he coached at Wisconsin in 2023.

NFL free agency good, bad and ugly: How has your favorite team done so far?

Which teams should be most excited after a week of NFL free agency?

Kyle Richards loves snacking on this low-sugar, high-protein cinnamon cereal

The 'Real Housewives' star has been prioritizing her health, and Three Wishes is high on her list of hunger-curbing treats.

Dodgers' Mookie Betts hits MLB's first home run of 2024, wins himself a car

Betts hit a career-high 39 home runs in 2023 and finished second in NL MVP voting.

A 15-year problem that has plagued corporate America is finally turning around

Productivity is rebounding after 15 years of no gains. That could help drive stocks higher.

2025 Ram 1500's 'Hurricane' I6 tops V8 in fuel economy

2025 Ram 1500 full-size pickup truck now has fuel economy numbers, and the Hurricane inline-six delivers better numbers than the V8 it replaces.

NL Central season preview: What's in store for Cardinals, Cubs, Brewers, Reds and Pirates in 2024?

The Cubs and Cardinals are expected to contend, with the Brewers and Reds right on their tails, in what could be baseball's most competitive division.

2024 Fantasy Baseball: 12 sleeper pitchers not getting enough love in drafts

Fantasy baseball analyst Dalton Del Don wraps up his positional sleeper series with the pitchers!

Caleb Williams flashes more than trademark arm talent to Bears, Commanders and Patriots at his pro day

Even in a scripted setting like Wednesday's, there are going to be hiccups. How Williams handled them gave teams a glimpse into more than just his ability to throw the football.

Shohei Ohtani's reps request law enforcement investigation of alleged theft by fired interpreter, per report

We have a new explanation for the change in Ohtani's story: No one actually talked to Ohtani.

Credit Card Travel Alerts: How to Set Them (and Why You Might Not Need To)

When you’re planning for a trip, especially an international one, you already have a huge to-do list.

You need to confirm your hotel plans, pack, check-in for your flight, and plan your activities for once you land.

The last thing that you want to happen when you arrive is to have your credit card declined.

Card issuers are constantly watching for fraud and taking steps to block scammers from using your card without your permission.

One common tactic is watching for unexpected changes in the location where you use your card. If you travel somewhere and use your credit card, your card issuer could decline it because they think s fraudster stole your card info.

Is there anything that you should do or a way to tell your card issuer when you’re traveling to make sure they don’t block your credit card?

What Are Credit Card Travel Notifications?

You can give your card issuer a credit card travel notification to help avoid having your card declined.

You’re telling your card issuer that you have travel plans, so it knows not to decline your card during your trip.

For example, if you live in Colorado and plan to fly to England, you’ll contact your card issuer and tell them when you plan to leave and when you plan to return. If the card issuer sees charges from stores in England during your travel dates, it will know they’re legitimate.

Some card issuers let you provide travel notifications through your account portal on the issuer’s website.

Usually, you’ll find the option somewhere in your account settings or personal information page.

However, things have changed:

Many card issuers don’t request, require, or even accept travel notifications anymore.

They rely on other methods to anticipate upcoming travel plans.

Why You Might Not Need to Set Them Anymore

Card issuers use multiple strategies to figure out when your traveling, even without providing a notification.

You booked travel on the card

One way that card issuers can tell if you’re planning to travel is based on your shopping habits.

If you book tickets for a flight using your credit card, your card issuer already knows that you have travel plans.

This is also true if you use your credit card rewards points to book your trip.

Since your card issuer can tell that you have travel plans based on your purchases, you don’t need to tell them about your trip.

The location of your card activity

A more subtle way for the card issuers to figure out your travel plans is based on other purchases you make.

You buy something at the airport just before you leave, your card issuer can probably guess that you’re about to get on a flight.

If your shopping habits change to include shopping at stores that people frequently use to prep for a trip that can also tip off your card issuer.

You're a frequent traveler

Card issuers also use your long-term purchase and travel history.

As a frequent flier, your card issuers probably expect you to travel on a regular basis and won’t worry about charges popping up from around the globe.

Travel Alerts for Top U.S. Card Issuers

Here are how some of the top card issuers in the US let you set travel notifications.

American Express

American Express doesn’t require travel notifications.

You don’t have to contact the company before you travel, but if you want to, you can do so by calling the number on the back of your credit card.

Bank of America

Bank of American doesn’t require travel notifications.

The bank does offer a set of advice for people travelling internationally on its website.

If you want to notify Bank of America of your travel anyway, you can do so by calling the number on the back of your card.

Capital One

Capital One says that you do not need to inform the company of travel plans because it now issues chip-based credit cards.

If you still want to let the company know, you can call the number on the back of your card.

Chase accepts travel notifications from its cardholders through its website .

You can set the notification up to a year in advance, making it easy to set the notification when you book your flights.

To set your travel notification:

- Sign in to your account and open the menu on the left side of the screen.

- Open your profile and settings

- Select more settings, then travel

- Click update

- Provide information about your destination, departure date, and return date

You can also call the company to set up your travel alert.

Citi lets you set up travel notifications through your online portal .

To set the alert:

- Visit the travel alert page

- Click Set Up/Manage and sign in to your account

- Select your card and click “add a travel notification”

- Tell Citi who will be using the card, where they’re going, and the dates of travel

You can also reach out to Citi by calling the number on the back of your card.

Discover does not require travel alerts from its customers, but you can always call the number on your card to let them know anyway.

Make Sure Your Contact Info is Up to Date

While it’s always important to make sure that your card issuer has your contact information, keeping your contact info up to date is doubly important when you’re traveling.

Your credit card issuer might not contact you frequently, but one of the times that they’ll want to reach out is when they’re trying to verify whether a purchase is legitimate or not.

If you’re traveling and your card is declined, you may receive a call from your card issuer asking you whether you tried to make the purchase.

If you say yes, they can unblock your card instantly -- letting you complete the transaction.

This can save a lot of time compared to you having to call the card issuer, navigate a phone tree, wait on hold, and explain that you were the one trying to make the purchase rather than a fraudster.

Taking a few minutes to update your contact info with all your card issuers before you travel can save you some headaches down the road.

It’s also a good way to make sure that your contact info is current so your card issuers can reach you, even when you aren’t traveling.

You might also like

Advertiser Disclosure:

We believe by providing tools and education we can help people optimize their finances to regain control of their future. While our articles may include or feature select companies, vendors, and products, our approach to compiling such is equitable and unbiased. The content that we create is free and independently-sourced, devoid of any paid-for promotion.

This content is not provided or commissioned by the bank advertiser. Opinions expressed here are author’s alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

MyBankTracker generates revenue through our relationships with our partners and affiliates. We may mention or include reviews of their products, at times, but it does not affect our recommendations, which are completely based on the research and work of our editorial team. We are not contractually obligated in any way to offer positive or recommendatory reviews of their services. View our list of partners.

MyBankTracker has partnered with CardRatings for our coverage of credit card products. MyBankTracker and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Do you need to set up travel alerts on your credit cards?

Whether you have two or 22 travel rewards credit cards in your wallet, chances are you enjoy hitting the road. Unfortunately, it can be extremely frustrating when your card gets flagged while traveling, and you're suddenly unable to use it. While it's great when an issuer correctly flags unauthorized account activity as fraudulent, the opposite is true when the issuer inadvertently prevents you from swiping a card.

Thankfully, most major issuers no longer require users to set travel alerts ahead of time.

In this guide, we'll walk through the details for different cards so you know what to expect before your trip.

What is a travel alert?

Before diving into issuer-specific guidelines, let's start with a quick overview of what a travel alert is and why this is important.

Most of today's credit cards have mechanisms to prevent fraud and abuse. When an issuer notices unusual account activity, it may flag it as potentially fraudulent. This happened to me when an unauthorized individual called Chase and inputted the full 16-digit account number of my Chase Freedom Unlimited. I immediately requested a new card, preventing the thief from actually using the compromised card number — a minor inconvenience but not a significant hassle.

However, this protection can also kick in if you try to use a card abroad or in an area of the U.S. that's far from your primary residence. Suppose you've spent months (or even years) swiping a card solely within a specific area and then you suddenly try to use it in another state or country. In that case, this activity might get flagged — and it could be a substantial roadblock to continuing your trip. If you haven't set up your cellphone to work abroad — or if you're in an area with limited service — there may be no quick way to let the issuer know that the purchase is (in fact) valid and authorized.

If you notify the issuer ahead of time, a sudden charge in another part of the country or the world (one that you specifically said you'd be visiting during the given time period) won't be flagged. This allows you to continue swiping your card and — most importantly — keep enjoying your trip.

So, how exactly do you do this? As noted above, many major credit card issuers no longer require proactive travel alerts ahead of time — but let's go through some of the largest ones.

Related: Best credit cards with no foreign transaction fees

How to set American Express travel alerts

Amex doesn't require you to set up travel alerts. In fact, if you log in to your account at AmericanExpress.com, you won't even see this as an option. Here's the rationale, per the issuer's FAQ page on the topic:

We use industry-leading fraud detection capabilities that help us recognize when our card members are traveling, so you don't need to notify us before you travel.

It does suggest that you keep updated contact information on your account and download the Amex app before your trip. However, you shouldn't have any trouble using your cards when traveling.

Applicable cards include: American Express® Gold Card , The Platinum Card® from American Express , Marriott Bonvoy Brilliant® American Express® Card , The Business Platinum® Card from American Express .

How to set Bank of America travel alerts

Like Amex, Bank of America no longer requires travel alerts ahead of time. If you search in the Help & Support center, you'll see the following message:

You no longer need to let us know when you travel. We monitor your accounts and will send automatic alerts if we detect suspicious activity. Should you need us while traveling, call the number on the back of your card anytime.

TIP: It's important that your email address and mobile phone number are up to date on your account profile, so we can notify you quickly about unusual activity.

Note that this applies to both credit and debit cards associated with your Bank of America login, which can be nice if you're planning to withdraw money from an ATM using your debit card.

Applicable cards include : Alaska Airlines Visa® credit card , Bank of America® Premium Rewards® credit card .

How to set Capital One travel alerts

Capital One uses the same approach as American Express — you don't need to set these up in advance. When you log in to your Capital One account and click on the "I Want To…" button, you'll see what appears to be an option to set a travel notification. However, when you click on it, you'll receive the following message:

With the added security of your Capital One chip card, travel notifications are no longer needed on your credit card. That's right! You don't have to tell us when and where you're traveling, inside or outside the United States. Your credit card is 100% covered for fraud while you're traveling and we will alert you if we see anything suspicious.

You're covered by $0 Fraud Liability on unauthorized charges. Remember that none of Capital One's credit cards impose foreign transaction fees for purchases made abroad.

Applicable cards: Capital One Venture X Rewards Credit Card (see rates and fees ), Capital One Venture Rewards Credit Card (see rates and fees ), Capital One SavorOne Cash Rewards Credit Card (see rates and fees ), Capital One Spark Miles for Business (see rates and fees ).

How to set Chase travel alerts

Chase offers a wide variety of valuable credit cards, including many that you may want to use when traveling. Like previous issuers on the list, you no longer need to proactively set up travel notifications ahead of your trip. When you log in to your Chase account, you'll still see the "Travel notification" option under account services, but here's the message you'll find there:

We've got you covered! With our enhanced security measures:

- You don't need to set up travel notifications anymore.

- We'll send you fraud alerts if we see any possible identity theft.

- We'll alert you if we notice any suspicious behavior on your account.

Applicable cards include: Chase Sapphire Reserve , Chase Sapphire Preferred Card , World of Hyatt Credit Card , United Explorer Card , Aeroplan Credit Card , Ink Business Preferred Credit Card .

How to set Citi travel alerts

Unlike previous issuers, Citi still allows you to set up travel notifications on your credit cards. Here's how to do so:

- Log in to your account at citi.com.

- Hover over "Services" at the top, then click on "Travel Services."

- Click on "Add a Travel Notice."

- Select the applicable cardholders, enter your dates, then click "Next."

- Review the details, then click "Confirm."

Note that you don't even need to select the individual destination (or destinations) you're visiting. The only required pieces of information are the cardholders who'll be on the trip (including authorized users ) and the dates of the trip.

Applicable cards include: Citi Premier® Card (see rates and fees ), Citi Rewards+® Card (see rates and fees ), Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees ).

What if a travel alert doesn't work?

Unfortunately, even the advanced technology credit card issuers use nowadays isn't guaranteed. There may be certain instances where a legitimate transaction is flagged as potentially fraudulent, especially when traveling. Alternatively, an issuer may require an extra verification step before approving a purchase instead of being declined immediately. This especially applies to many online transactions thanks to 3D card security measures .

This is one reason why it's critical to have updated contact information on file with your card issuers and a working mobile phone when you're outside the country. This ensures that you can complete any verification requests in a timely fashion.

It's also critical to always have at least one backup credit card in your wallet when traveling (or load alternate options into your mobile wallet ). Ideally, this card would be from a different card issuer and work with a different payment network, which minimizes the chance that neither card will work.

Related: Best travel credit cards

Bottom line

From full flights to weather delays to traffic, travel can be stressful — and that's without any financial issues. Fortunately, most major credit card issuers no longer require advance travel notices on your accounts. However, you should still carry at least one backup payment method in case your primary card is declined. It's also critical to have a working phone number to receive email or text notifications when things go wrong.

If you want to maintain your ability to swipe your favorite travel rewards credit cards on your next trip, follow these instructions before you depart.

Additional reporting by Ryan Wilcox and Madison Blancaflor.

How to Set Up A Travel Notification for 9 Major Credit Cards

- Updated May 18, 2023

- Posted in Travel Planning

- Tagged as Travel Hacks and Tips , Travel Planning

A travel notification can prevent credit cards from declining charges due to suspected fraudulent activity.

Being stranded in a foreign country without a credit card is a nightmare.

Do you agree?

Thankfully, this is avoidable.

We have compiled step-by-step instructions for how how set up travel notifications for major credit card carriers.

Due to evolving security features, some credit cards do not recommend or require travel notifications. I, however, still like to notify my credit card prior to a trip for peace of mind!

Setting Up A Travel Notification: A Step-by-Step Guide

American express.

American Express does not require or recommend you set a travel notification. They feel confident in their security measures because of the fraud detection practices implemented. Actually, there is not even an option online to create a travel notification.

American Express recommends that you keep your contact information updated in case they need to reach you during your travels.

Fun Fact : Amex credit cards are not as widely accepted globally. So if you are a frequent international traveler, it may be wise to look for a credit card with a Mastercard or Visa logo as they are more widely accepted among merchants across seas.

Bank Of America

Bank of America lets you set a travel notice online, through the mobile app, or by phone at (800) 432-1000 .

According to Bank of America, a travel notice can be set no more than 60 days prior to departure and last up to 90 days from the first day of your trip. You can only have one travel notice set at a time.

How To Set A BoA Travel Notification

Step 1: Log into your bankofamerica.com account.

Step 2: Hover over “Help & Support” tab.

Step 3: Click on “Set Travel Notice” in the drop-down menu.

Step 4: Complete the Travel Notification Form and submit!

As you complete the travel notification form, enter your destination(s), travel dates, contact number(s), and card(s) you’re taking with you.

Barclaycard

You can set a travel notice for Barclays credit cards online or by phone at 1-866-928-8598.

How To Set a Barclaycard Travel Notification

Step 1: log into your barclaycard account or on the mobile app, step 2: select the “tools” tab and click “my travel”, step 3: enter your travel dates and destinations.

If you choose to set a travel notification by phone, call the toll free number listed above. You will need to enter your card number and ask to speak with a representative regarding a travel notice.

Capital One

Surprise! Like American Express, there is no need to set a travel notice for Capital One credit cards. You still, however, have the option to set a travel notice.

If you log into your capitalone.com account and click “Set Travel Notification,” you will get this window:

To notify Chase of travel plans, you can do this through your online account, by calling the number on the back of your card, or through their mobile app.

According to Chase, a travel notice can be set up to 1 year prior to departure and last up to 1 year from the first day of your trip.

If you will be gone for longer than this period of time, you will just need to let Chase know at some point to extend the travel notice.

How to set a Chase travel notification

Step 1: Log into your Chase.com account.

Step 2: Click on the menu icon in the left hand corner.

Step 3: Click on “Profile & Settings” in the drop-down menu.

Step 4: Click on “Travel” (located under “more settings”)

Step 5: Click “Update” on the right side of the screen (Located next to the credit card section).

Step 6: Finally, you will be able to enter your travel information. Here you should enter your destination(s) and travel date(s). Click Save!

Already out of the country? No problem! You can call Chase collect at 1-302-594-8200 to alert the issuer of your travel plans.

Citibank also lets you easily set up a travel notice online.

How to set a Citibank travel notification

Step 1: Sign into your Citi.com account.

Step 2: Click on “Services” and then “Travel Services.”

Step 3: Select “Add a Travel Notice.”

Step 4: Enter your destination(s) and travel date(s).

Step 5: Verify the phone number and email address that Citi has on file to ensure they are up to date.

To set a travel notice for Discover, you can do this by logging into your online account or by calling Discover customer service at 1-800-347-2683.

How to set a Discover travel notification

Online Instructions:

Step 1: Log into your discover.com account.

Step 2: select the card you will be taking with you on your trip., step 3: click on the “manage” tab at the top of your screen., step 4: click on “register travel” under the “manage cards” section., step 5: enter your destination(s) and travel date(s)..

F un Fact: Like Amex, Discover credit cards are not the best when traveling internationally because they are not as widely accepted.

Wells Fargo

If trying to notify Wells Fargo of your travel plans, you can do this online, through their mobile app, or by calling the number on the back of your card.

How to set a Wells Fargo travel notification

To do this online:

Step 1: Log into your wellsfargo.com bank account.

Step 2: hover over the “accounts” drop-down menu that is located at the top of the screen., step 3: click on “manage travel plans” (located under the “manage cards” section)., step 4: enter your destination(s) and travel date(s).

Unfortunately, U.S. Bank does not allow you to set up a travel notification through your online account. You will have to contact its customer service team directly.

Why is it Important to Set up a Travel Notification?

Avoid fraudulent activity.

When you travel, especially to a different country or region, your credit card transactions may appear suspicious to the card issuer. They might flag these transactions as potentially fraud and take measures to protect your account, such as freezing it temporarily. By setting up a travel notification, you inform your credit card company about your travel plans in advance, reducing the likelihood of your legitimate transactions being blocked.

Enhanced Security

Travel notifications act as an additional layer of security for your credit card. When you notify your credit card issuer about your travel plans, they can monitor your account more closely during that period. If they notice any unusual activity, they can reach out to you to verify its authenticity or take appropriate action to protect your account.

Convenience

Without a travel notification, your credit card company might see foreign transactions as suspicious and decline them. This can be inconvenient when you’re traveling and relying on your credit card for expenses. By notifying your credit card company in advance, you can ensure uninterrupted access to your funds and enjoy a hassle-free travel experience.

Preventing Account Lockouts

Some credit card issuers have strict security measures in place, and if they detect unusual activity, they may freeze your account for your protection. While this is done to prevent fraudulent charges, it can be frustrating and time-consuming to resolve the issue while you’re away. By setting up a travel notification, you reduce the chances of your account being locked due to your legitimate transactions.

Assistance in Emergencies

In case of an emergency, having a travel notification in place allows your credit card company to better assist you. If you encounter any issues with your card while traveling, such as loss, theft, or unauthorized transactions, notifying your credit card company beforehand ensures they can provide immediate support and guidance.

To enjoy a smooth and secure experience while using your credit cards during your travels, it’s highly recommended to set up travel notifications. The process is typically straightforward and can usually be done through your credit card company’s website, mobile app, or by calling their customer service.

We know the challenges with traveling and hope that this guide will answer any questions regarding travel notifications. Our goal is to make travel simple, easier, and more fun for you!

Until next time!

xxx Sara + Josh

Travel Notification FAQ’s

What are travel notifications, how do you tell your bank you're traveling chase, how do i notify bank of america that i am traveling, how do i set up a travel notice with citibank, need more travel tips.

10 Travel Hacks For Stress Free Adventure

How To Make Planning Your Next Trip Easier

And please do me a little favor and share this article with others, for there’s a good chance that it will help them with their travels!

Share my adventures Share this content

- Opens in a new window X

- Opens in a new window Facebook

- Opens in a new window Pinterest

Sara & Josh

You might also like.

How To Hold Your Mail When You’re On Vacation

13 Popular Vacation Planning Apps: Revolutionize The Way You Travel!

TSA Pre✓ vs. Global Entry: Which is Better for Your Travels?

Leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. Many, but not all, of the offers and clickable hyperlinks (such as a “Next” button) that appear on this site are from companies that compensate us. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site. And the advertised offers may be subject to additional terms and conditions of the advertiser. All information is presented without any warranty or guarantee to you.

This page may include: credit card ads that we may be paid for (“advertiser listing”); and general information about credit card products (“editorial content”). Many, but not all, of the offers and clickable hyperlinks (such as a “Apply Now” button or “Learn More” button) that appear on this site are from companies that compensate us. When you click on that hyperlink or button, you may be directed to the credit card issuer’s website where you can review the terms and conditions for your selected offer. Each advertiser is responsible for the accuracy and availability of its ad offer details, but we attempt to verify those offer details. We have partnerships with advertisers such as Brex, Capital One, Chase, Citi, Wells Fargo and Discover. We also include editorial content to educate consumers about financial products and services. Some of that content may also contain ads, including links to advertisers’ sites, and we may be paid on those ads or links.

For more information, please see How we make money .

How & Why to Notify Credit Cards When You Travel Abroad

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money .

Have an overseas trip coming up? Make sure to tell your credit card issuers you’ll be traveling!

I’ll explain why this is important. And show you the different ways to set travel alerts!

Set Travel Alerts for Your Credit Cards When Traveling Abroad

Setting travel notifications is important because credit card issuers will often block a card if they think there’s suspicious activity. And you don’t want the headache of having a charge declined while on vacation!

Also, don’t forget to use a card that does not charge foreign transaction fees when traveling outside the US . Because fees usually negate the value of miles & points you’re earning!

My favorite no foreign transaction fee card is the Chase Sapphire Preferred which earns 2X points for travel (airfare, hotel, car rental, etc) and dining. Because that’s what vacation is for, right? To explore and eat good food! 🙂

The Barclaycard Arrival Plus World Elite Mastercard and Citi Prestige cards do not charge foreign transaction fees either.

How to Set Travel Notifications

Of course, you can always call the number on the back of your card to notify your credit card company about a trip.

And with the Chase Sapphire Preferred card, you’ll even get a real person on the other end of the line right away ! But with other cards you might have to go through an automated program, which can be a pain.

The good news is some cards let you set travel alerts online, in case you can’t or don’t want to talk.

Chase has a “ Travel Notification Form” online . Just login and go to the “Customer Center” tab. Then click the “Travel Notification Form.”

With the Barclaycard Arrival Plus card, it’s also easy to set up travel alerts online.

When you log-in to your account, click the “Services” drop-down tab. Then select “My travel.”

Then enter your trip information, like where you’re traveling and the dates you’ll be gone.

You’ll be able to review the details of your travel alert, and then submit the form!

Once you’ve submitted the travel notification, you shouldn’t have any issues using your card.

The Barclaycard Arrival Plus card is also particularly useful overseas because you can use it with a PIN at automated vending machines . Like those that sell train tickets or gas station kiosks.

My Arrival Plus card definitely came in handy during my trip in Iceland !

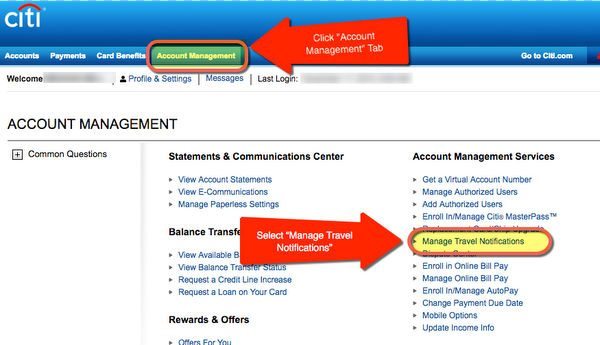

For cards issued by Citi, like the Citi Prestige , you also have the option to set-up trip alerts online . Although Citi claims it isn’t actually necessary when traveling.

Citi’s travel notification form can be found under the “Account Management” tab after logging-in to your account.

Bottom Line

If you’re traveling abroad, don’t forget to set-up a travel alert with your credit card issuer. Because often times they’ll disable your card if they suspect fraudulent activity.

You can always call the number on the back of the card to set up a trip notification, but some cards will let you submit an alert online!

And remember to use a card with no foreign transaction fees, like the Chase Sapphire Preferred or Barclaycard Arrival Plus !

More Topics

Credit Cards

Join the Discussion!

You May Also Like

BonusTracker: Best credit card bonus offers

June 14, 2021 4

Best Hilton credit cards: Improved weekend night certificates, earning rates and more

June 12, 2021 2

Our Favorite Partner Cards

Popular posts.

Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Do i need to notify a credit card company when traveling.

If you have planned travel coming up, alerting your credit card issuers about your vacation plans can help to ensure that your charges aren't declined when you arrive. Here's how you can prepare yourself and your credit card for your next trip.

What is a credit card travel notice?

A travel notice is an alert to your credit card issuer that you'll be going on a trip to a different location. By giving this notice in advance, you're letting your credit card company know that you may be making charges from a different state or country.

Why should you notify your credit card company of travel?

Credit card companies check cardholders' accounts for any unusual or suspicious activity when a transaction occurs. If your company sees a charge from a location away from home, your issuer may think this is suspicious activity and decline the charge. If you're visiting a country or location where fraudulent charges occur more often, the chances of your credit card getting declined are higher when you don't alert your credit card issuer about your travel.

Do you need to notify your credit card company?